saveyourassetsfirst3 |

- Gold Sector Review

- A Warning from the Watchman

- Foreshadowing...?

- Price Smashes: A Dream for Us, a Nightmare for these Guys!

- Ready to hit the eject button? Here are five places to start looking

- Michael Kosowan: I Think High-Quality Names Will Rebound With Force–They Have Assets The Industry Covets

- Ted Butler To Silver Miners: COMEX Is Responsible For Low Silver Prices

- Sunshine Profits’ Take on the Swiss Gold Referendum

- GLD and SLV Technical Picture for November 2014

- How Is Paper Gold Trading Affecting The Gold Price

- "Paper gold": What every investor should know

- Gold & Silver Trading Alert: Gold and Miners Soar on Huge Volume

- Rocks to riches: Gold's ready for a comeback

- What resource guru Frank Holmes is thinking now

- Zeal on The Fed, QE, & Stocks

- Central banks managing -- that is, rigging -- gold more actively, LBMA is told

- The Consequences of a Strengthening US Dollar

- World Gold Council Issues its Latest Report

- Signs of life detected in gold market

- Gold falls again on interest rate news

- Even More On The Gold-Yen Link

- Metals market update for November 13

- National Economic Suicide: The U.S. Trade Deficit With China Just Hit A New Record High

- India overtakes China as the world's largest gold consumer

- Burkina Faso uprising: What are the risks for gold miners?

- “Now Is A Good Time” To Buy Gold – Fidelity Investments

- "Now Is A Good Time" To Buy Gold - Fidelity Investments

- The Full Letter Written by the FBI to Martin Luther King Has Been Revealed

- Gold demand falls to 5-year low

- NUM says signed deal with Sibanye Gold softening job cuts

- India said to review gold policy

- Gold drops for second day

- New blog by an ex-RBA gold sale/leasing analyst

- New blog by an ex-RBA gold sale/leasing analyst

- Global demand for gold slips 2% in Q3 to 929 tonnes as Indian buying jumps 60% to compensate for Chinese slowdown

- Indian Jewellery Demand A Highlight In Subdued Q3 Gold Market â?? World Gold Council

- Buy Gold & Silver at a 10.6% Discount

- Gold Pulls A Rabbit Out Of A Hat

- Swiss Regulator: “Clear Attempt to Manipulate Precious Metals”—“Particularly Silver”

- Jim Willie: Chinese Have Acquired a Majority Controlling Interest in the Federal Reserve!

- Harvey Organ: Backwardation in Gold is Incompatible With Massive Raid on Gold!

- Silver prices doing ‘weird stuff’ and paper market set to fold in on itself predicts Silver Wheaton CEO

- Marshall Swing: PMs Will Not Be Allowed to Crash Until September 2015

- Obama’s Secret Treaty Would Be The Most Important Step Toward A One World Economic System

- This is the fraud that guarantees the end of America

| Posted: 13 Nov 2014 01:18 PM PST Biwii | ||||||||||||||

| Posted: 13 Nov 2014 01:00 PM PST What we'll likely face dead ahead, calls for an emergency post. Submitted by The Wealth Watchman: I've had such a strong foreboding feeling the last several days, that I feel I cannot ignore it. The last series had ended in a good place, anyway. So I'm going to pen a warning instead. What follows is a […] The post A Warning from the Watchman appeared first on Silver Doctors. | ||||||||||||||

| Posted: 13 Nov 2014 01:00 PM PST Some light musings on the usually incomprehensible economic prognostications of the Maestro, the notoriously fickle pronouncements of career politicians, and the direction of gold pricing in the near future. | ||||||||||||||

| Price Smashes: A Dream for Us, a Nightmare for these Guys! Posted: 13 Nov 2014 12:30 PM PST While the recent silver price smash is a dream for us stackers...it is a LIVING NIGHTMARE for these guys: Submitted by The Wealth Watchman: Once again, to demonstrate that I "walk the walk", and tread the warrior's path, I'll let you know that I decided to attack the enemy on Friday afternoon. This time, the price […] The post Price Smashes: A Dream for Us, a Nightmare for these Guys! appeared first on Silver Doctors. | ||||||||||||||

| Ready to hit the eject button? Here are five places to start looking Posted: 13 Nov 2014 12:22 PM PST Are you ready to hit the EJECT button on the increasingly fascist state known as the US of A? Submitted by Simon Black, Sovereign Man: As we talked about yesterday, moving abroad isn't as difficult as you think. Sure, it's not always cookies and cupcakes, but the benefits and opportunities of living abroad are often […] The post Ready to hit the eject button? Here are five places to start looking appeared first on Silver Doctors. | ||||||||||||||

| Posted: 13 Nov 2014 11:30 AM PST Following another few weeks of cascading metals and mining equity prices, Michael Kosowan, Investment Executive and Investment Advisor with Sprott Global Resource Investments and Sprott Private Wealth, was kind enough to share a few comments. Speaking towards to the psychological challenge resource investors face in this market, Michael noted, "It's uncomfortable swimming against the tides of uncertainty […] The post Michael Kosowan: I Think High-Quality Names Will Rebound With Force–They Have Assets The Industry Covets appeared first on Silver Doctors. | ||||||||||||||

| Ted Butler To Silver Miners: COMEX Is Responsible For Low Silver Prices Posted: 13 Nov 2014 11:26 AM PST This is an excerpt from Ed Steer’s daily gold and silver newsletter (recommended to subscribe): As usual, silver analyst Ted Butler came out with his mid-week commentary yesterday—and he had something to say to all the primary silver producers out there that are prepared to listen and save themselves before they go bankrupt—and take all their shareholders, including me, with them. I never asked his permission to reprint what he had to say, but I thought I’d include this lengthy commentary, so I’ll be ready for an ear full when I talk to him later today, but this is important enough that it should be posted in the public domain. I, like you you, have stuck by the silver miners through thick and thin, even though I’ve discovered over the years that these silver miners [along with their golden brethren] don’t give a flying #%@# about any of their stockholders – including you or me. As I’ve said before on several occasions, if I do manage to get to a position where I can sell their equities for the prices that they should be selling for, I’ll never own another mining share in my entire life – and for good reason. Here’s what Ted had to say:

[Note: the bolding and underlining is mine. - Ed] Please feel free to send Ted’s commentary to any silver mining company that you feel might be interested in higher silver prices. You should even send this to The Silver Institute, even though it will be for naught, as they are not at all interested in helping their members in this regard. Here’s the link to their “Contact Us” page. | ||||||||||||||

| Sunshine Profits’ Take on the Swiss Gold Referendum Posted: 13 Nov 2014 11:18 AM PST SunshineProfits | ||||||||||||||

| GLD and SLV Technical Picture for November 2014 Posted: 13 Nov 2014 11:17 AM PST This is an excerpt from the daily StockCharts.com newsletter to premium subscribers, which offers daily a detailed market analysis (recommended service).

The Gold SPDR (GLD) surged almost 3% on Friday, plunged over 2% on Monday and advanced 1.43% on Tuesday. There may be some support in the 110 area and the ETF is still quite oversold, but the bigger trend is down and this is the dominant force. I will leave first resistance in the 115 area.

| ||||||||||||||

| How Is Paper Gold Trading Affecting The Gold Price Posted: 13 Nov 2014 11:10 AM PST Gold dropped to new lows of $1,130 per ounce last week. This is surprising because it doesn't square with the fundamentals. China and India continue to exert strong demand on gold, and interest in bullion coins remains high. I explained in my October article in The Casey Report that the Comex futures market structure allows a few big banks to supply gold to keep its price contained. I call the gold futures market the "paper gold" market because very little gold actually changes hands. $360 billion of paper gold is traded per month, but only $279 million of physical gold is delivered. That's a 1,000-to-1 ratio:

We know that huge orders for paper gold can move the price by $20 in a second. These orders often exceed the CME stated limit of 6,000 contracts. Here's a close view from October 31, when the sale of 2,365 contracts caused the gold price to plummet and forced the exchange to close for 20 seconds:

Many argue that the net long-term effect of such orders is neutral, because every position taken must be removed before expiration. But that's actually not true. The big players can hold hundreds of contracts into expiration and deliver the gold instead of unwinding the trade. Net, big banks can drive down the price by delivering relatively small amounts of gold. A few large banks dominate the delivery process. I grouped the seven biggest players below to show that all the other sources are very small. Those seven banks have the opportunity to manage the gold price:

After gold's big drop in October, I analyzed the October delivery numbers. The concentration was even more severe than I expected:

This chart shows that an amazing 98.5% of the gold delivered to the Comex in October came from just three banks: Barclays; Bank of Nova Scotia; and HSBC. They delivered this gold from their in-house trading accounts. The concentration was even worse on the other side of the trade—the side taking delivery. Barclays took 98% of all deliveries for customers. It could be all one customer, but it's more likely that several customers used Barclays to clear their trades. Either way, notice that Barclays delivered 455 of those contracts from its house account to its own customers. The opportunity for distorting the price of gold in an environment with so few players is obvious. Barclays knows 98% of the buyers and is supplying 35% of the gold. That's highly concentrated, to say the least. And the amounts of gold we're talking about are small—a bank could tip the supply by 10% by adding just 100 contracts. That amounts to only 10,000 ounces, which is worth a little over $11 million—a rounding error to any of these banks. These numbers are trivial. Note that the big banks were delivering gold from their house accounts, meaning they were selling their own gold outright. In other words, they were not acting neutrally. These banks accounted for all but 19 of the contracts sold. That's a position of complete dominance. Actually, it's beyond dominance. These banks are the market. My point is that this market is much too easily rigged , and that the warnings about manipulation are valid. At some point, too many customers will demand physical delivery and there will be a big crash. Long contracts will be liquidated with cash payouts because there won't be enough gold to deliver. I saw a few squeezes in my 20 years trading futures, including gold. In my opinion, the futures market is not safe. The tougher question is: for how long will big banks' dominance continue to pressure gold down? Unfortunately, I don't know the answer. Vigilant regulators would help, but "futures market regulators" is almost an oxymoron. The actions of the CFTC and the Comex, not to mention how MF Global was handled, suggest that there has been little pressure on regulators to fix this obvious problem. This quote from a recent Financial Times article does give some reason for optimism, however: UBS is expected to strike a settlement over alleged trader misbehaviour at its precious metals desks with at least one authority as part of a group deal over forex with multiple regulators this week, two people close to the situation said. … The head of UBS's gold desk in Zurich, André Flotron, has been on leave since January for reasons unspecified by the lender…. The FCA fined Barclays £26m in May after an options trader was found to have manipulated the London gold fix. Germany's financial regulator BaFin has launched a formal investigation into the gold market and is probing Deutsche Bank, one of the former members of a tarnished gold fix panel that will soon be replaced by an electronic fixing. The latter two banks are involved with the Comex. Eventually, the physical gold market could overwhelm the smaller but more closely watched US futures delivery market. Traders are already moving to other markets like Shanghai, which could accelerate that process. You might recall that I wrote about JP Morgan (JPM) exiting the commodities business, which I thought might help bring some normalcy back to the gold futures markets. Unfortunately, other banks moved right in to pick up JPM's slack. Banks can't suppress gold forever. They need physical gold bullion to continue the scheme, and there's just not as much gold around as there used to be. Some big sources, like the Fed's stash and the London Bullion Market, are not available. The GLD inventory is declining.

If a big player like a central bank started to use the Comex to expand its gold holdings, it could overwhelm the Comex's relatively small inventories. Warehouse stocks registered for delivery on the Comex exchange have declined to only 870,000 ounces (8,700 contracts). Almost that much can be demanded in one month: 6,281 contracts were delivered in August. The big banks aren't stupid. They will see these problems coming and can probably induce some holders to add to the supplies, so I'm not predicting a crisis from too many speculators taking delivery. But a short squeeze could definitely lead to huge price spikes. It could even lead to a collapse in the confidence in the futures system, which would drive gold much higher. Signs of high physical demand from China, India, and small investors buying coins from the mint indicate that gold prices should be rising. The GOFO rate (London Gold Forward Offered rate) went negative, indicating tightness in the gold market. Concerns about China's central bank wanting to de-dollarize its holdings should be adding to the interest in gold. In other words, it doesn't add up. I fully expect currency debasement to drive gold higher, and I continue to own gold. I'm very confident that the fundamentals will drive gold much higher in the long term. But for now, I don't know when big banks will lose their ability to manage the futures market.

| ||||||||||||||

| "Paper gold": What every investor should know Posted: 13 Nov 2014 10:39 AM PST By Bud Conrad, Chief Economist, Casey Research:Gold dropped to new lows of $1,130 per ounce last week. This is surprising because it doesn't square with the fundamentals. China and India continue to exert strong demand on gold, and interest in bullion coins remains high. I explained in my October article in The Casey Report that the Comex futures market structure allows a few big banks to supply gold to keep its price contained. I call the gold futures market the "paper gold" market because very little gold actually changes hands. $360 billion of paper gold is traded per month, but only $279 million of physical gold is delivered. That's a 1,000-to-1 ratio:

We know that huge orders for paper gold can move the price by $20 in a second. These orders often exceed the CME stated limit of 6,000 contracts. Here's a close view from October 31, when the sale of 2,365 contracts caused the gold price to plummet and forced the exchange to close for 20 seconds:

Many argue that the net long-term effect of such orders is neutral, because every position taken must be removed before expiration. But that's actually not true. The big players can hold hundreds of contracts into expiration and deliver the gold instead of unwinding the trade. Net, big banks can drive down the price by delivering relatively small amounts of gold. A few large banks dominate the delivery process. I grouped the seven biggest players below to show that all the other sources are very small. Those seven banks have the opportunity to manage the gold price:

After gold's big drop in October, I analyzed the October delivery numbers. The concentration was even more severe than I expected:

This chart shows that an amazing 98.5% of the gold delivered to the Comex in October came from just three banks: Barclays; Bank of Nova Scotia; and HSBC. They delivered this gold from their in-house trading accounts. The concentration was even worse on the other side of the trade—the side taking delivery. Barclays took 98% of all deliveries for customers. It could be all one customer, but it's more likely that several customers used Barclays to clear their trades. Either way, notice that Barclays delivered 455 of those contracts from its house account to its own customers. The opportunity for distorting the price of gold in an environment with so few players is obvious. Barclays knows 98% of the buyers and is supplying 35% of the gold. That's highly concentrated, to say the least. And the amounts of gold we're talking about are small—a bank could tip the supply by 10% by adding just 100 contracts. That amounts to only 10,000 ounces, which is worth a little over $11 million—a rounding error to any of these banks. These numbers are trivial. Note that the big banks were delivering gold from their house accounts, meaning they were selling their own gold outright. In other words, they were not acting neutrally. These banks accounted for all but 19 of the contracts sold. That's a position of complete dominance. Actually, it's beyond dominance. These banks are the market. My point is that this market is much too easily rigged , and that the warnings about manipulation are valid. At some point, too many customers will demand physical delivery and there will be a big crash. Long contracts will be liquidated with cash payouts because there won't be enough gold to deliver. I saw a few squeezes in my 20 years trading futures, including gold. In my opinion, the futures market is not safe. The tougher question is: for how long will big banks' dominance continue to pressure gold down? Unfortunately, I don't know the answer. Vigilant regulators would help, but "futures market regulators" is almost an oxymoron. The actions of the CFTC and the Comex, not to mention how MF Global was handled, suggest that there has been little pressure on regulators to fix this obvious problem. This quote from a recent Financial Times article does give some reason for optimism, however: UBS is expected to strike a settlement over alleged trader misbehaviour at its precious metals desks with at least one authority as part of a group deal over forex with multiple regulators this week, two people close to the situation said. … The head of UBS's gold desk in Zurich, André Flotron, has been on leave since January for reasons unspecified by the lender…. The FCA fined Barclays £26m in May after an options trader was found to have manipulated the London gold fix. Germany's financial regulator BaFin has launched a formal investigation into the gold market and is probing Deutsche Bank, one of the former members of a tarnished gold fix panel that will soon be replaced by an electronic fixing. The latter two banks are involved with the Comex. Eventually, the physical gold market could overwhelm the smaller but more closely watched US futures delivery market. Traders are already moving to other markets like Shanghai, which could accelerate that process. You might recall that I wrote about JP Morgan (JPM) exiting the commodities business, which I thought might help bring some normalcy back to the gold futures markets. Unfortunately, other banks moved right in to pick up JPM's slack. Banks can't suppress gold forever. They need physical gold bullion to continue the scheme, and there's just not as much gold around as there used to be. Some big sources, like the Fed's stash and the London Bullion Market, are not available. The GLD inventory is declining.

If a big player like a central bank started to use the Comex to expand its gold holdings, it could overwhelm the Comex's relatively small inventories. Warehouse stocks registered for delivery on the Comex exchange have declined to only 870,000 ounces (8,700 contracts). Almost that much can be demanded in one month: 6,281 contracts were delivered in August. The big banks aren't stupid. They will see these problems coming and can probably induce some holders to add to the supplies, so I'm not predicting a crisis from too many speculators taking delivery. But a short squeeze could definitely lead to huge price spikes. It could even lead to a collapse in the confidence in the futures system, which would drive gold much higher. Signs of high physical demand from China, India, and small investors buying coins from the mint indicate that gold prices should be rising. The GOFO rate (London Gold Forward Offered rate) went negative, indicating tightness in the gold market. Concerns about China's central bank wanting to de-dollarize its holdings should be adding to the interest in gold. In other words, it doesn't add up. I fully expect currency debasement to drive gold higher, and I continue to own gold. I'm very confident that the fundamentals will drive gold much higher in the long term. But for now, I don't know when big banks will lose their ability to manage the futures market. Oddities in the gold market have been alleged by many for quite some time, but few know where to start looking, and even fewer have the patience to dig out the meaningful bits from the mountain of market data available. Casey Research Chief Economist Bud Conrad is one of those few—and he turns his keen eye to every sector in order to find the smart way to play it. This is the kind of analysis that's especially important in this period of uncertainty and volatility… and you can put Bud's expertise—along with the other skilled analysts' talents—to work for you by taking a risk-free test-drive of The Casey Report right now. The article "Paper Gold" and Its Effect on the Gold Price was originally published at caseyresearch.com. | ||||||||||||||

| Gold & Silver Trading Alert: Gold and Miners Soar on Huge Volume Posted: 13 Nov 2014 10:18 AM PST SunshineProfits | ||||||||||||||

| Rocks to riches: Gold's ready for a comeback Posted: 13 Nov 2014 10:09 AM PST The key to finding gold is understanding the rocks. Thomas Schuster is a geologist and mining analyst with a deep understanding of where the gold hides. In this interview with The Gold Report, he talks about a number of gold explorers whose rocks are starting to shine. And gold is... | ||||||||||||||

| What resource guru Frank Holmes is thinking now Posted: 13 Nov 2014 10:05 AM PST From The Gold Report: Frank Holmes’ advice to investors? Chill. In his interview with The Gold Report, the veteran commodities investor shared some strategies that help him “sit back and stay balanced,” namely by diversifying and following the money. Find out about the indicators Holmes watches to read the market’s pulse, and why a +/- 35% move for gold doesn’t keep him awake at night. Holmes also profiles his favorite mining stocks, including one that generates what could be the highest per-employee revenue in the world.

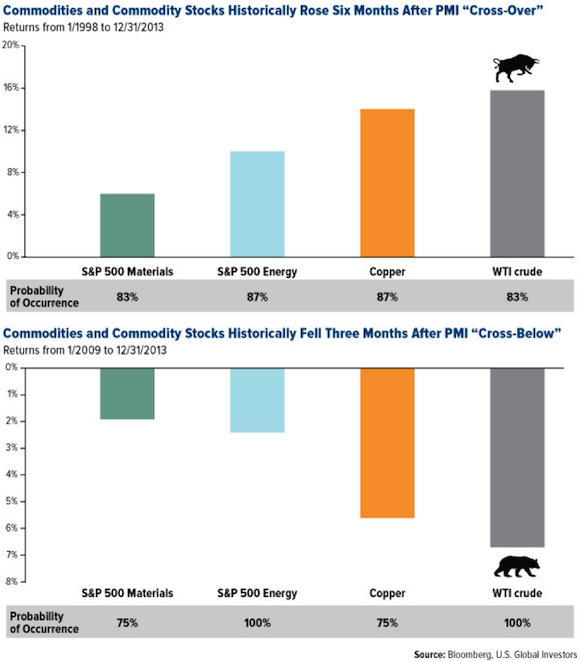

The Gold Report: Your talk at the New Orleans Investment Conference was titled “The Optimistic Investor in a Pessimistic World.” How do you stay so positive when gold falls 2% or even more in a day? Frank Holmes: The biggest thing when it comes to gold—something I’ve always advocated—is to maintain a 10% weighting, 5% in gold stocks and 5% in gold jewelry or coins, and to rebalance each year. That has been a wonderful way for investors to deal with the volatility of the capital markets and to sleep at night. TGR: What is happening in commodities? What are the most important indicators you’re watching? FH: If you’re really in tune to the stock and commodity markets day in and day out, it’s kind of similar to arriving at a party and being able to tell if there is good energy or if it’s not the place for you. There are these patterns you notice. When it comes to commodities, a magic number for looking toward the future is PMI, which stands for Purchasing Manufacturers Index. In America, it’s often called the ISM Manufacturing Index, which is exactly the same. J.P. Morgan publishes a global PMI every month, which surveys the major economies of the world, the G20 countries. I like to look at what happens when the one-month average of the world is above the three-month average, and what happens when it goes below. It’s remarkable to see the law of inertia take hold.

The global PMI was so very strong in 2003, 2004, 2005 and 2006. Europe, America and Asia were just roaring, and commodities were ripping. Since 2008, the patterns have changed. There are so many new fiscal rules, Federal Advisory Committee Act (FACA) rules, money movement rules, etc., that you can’t get the synchronized global PMI running in a very constructive way. But it’s important to look at what Europe is doing, because Europe is a bigger economic trading partner with China than America is. So when Europe slows down, that puts a real dent in China’s economic prosperity. But the real psychology in the stock market is Quantitative Easing 3 (QE3) ending.

TGR: Do you think the headlines about ending QE3 are a short-term pain for the commodities market, particularly precious metals? FH: The biggest thing that’s really hurting commodity markets, and gold in particular, is a stronger dollar. Whenever the real rates of return in America are negative, gold starts to rally, which it did for the first six months of this year. And now the rates have gone positive. So all of a sudden, gold starts taking it on the chin. But the positive note is that India has been buying gold and so has China—there has been record demand on the back of these selloffs. There is a slow tectonic shift taking place globally for this credible metal. TGR: Let’s talk about how the fundamentals vary among asset classes and whether the volatility we’re seeing right now is normal. FH: We did a special report in August/September, trying to explain this DNA of volatility. The piece was called “Managing Expectations: Anticipate Before You Participate.” Everything in life is about managing expectations. As Warren Buffett says, if you want to have a long-lasting marriage, have low expectations, and everything is on the upside. The same thing happens with earnings. Do you expect the PMI to be positive? Do you expect the earnings to be positive? What we have done in our research is look at all the asset classes, and we have noted that they each have different DNAs of volatility. When you look at gold and the stock market, it’s about the same. It’s a nonevent for gold to go +/-15%, and it’s normal for the S&P 500 to go +/-15%. But mining stocks, energy stocks, emerging markets and biotechnology have a DNA of volatility of +/-35%. If biotechnology is off 35%, it’s brutal feeling it as an investor, but it’s just normal. So right now, we have gold stocks off 35% over 12 months, and they’re down one standard deviation. Now, if gold falls 50%, that means the odds favor a reversal. Last year at Christmastime, we commented that gold stocks and bullion were down two standard deviations, and we were due for a big rally. And positive interest rates went negative until June. Over those six months, gold rallied right back to its mean. Everything reverts to this mean average, which is important for investors to recognize. So when you’re looking at the volatility, it shouldn’t frighten you. The only time you really lose on this is if you’re forced out of a holding. TGR: As we’re entering tax-loss selling season, what is your strategy for the end of the year? FH: I look for companies that are trading way below their book value and are candidates to be taken out. When you go down the junior spectrum, the question is how much cash does a company have, and can it survive for two years without any funding. If not, then there is dilution risk. I try to stay away from the micro-cap stocks, which often spend money faster than they’re able to get their per-share reserves or production up. TGR: You still have more than 80% of the Gold and Precious Metals Fund and more than 90% of the World Precious Minerals Fund in gold. What is your strategy there? What are your top performers? FH: I think royalty companies are the safest plays—Franco-Nevada Corp. (FNV:TSX; FNV:NYSE) , Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX) and Silver Wheaton Corp. (SLW:TSX; SLW:NYSE)—the three amigos. They have high-margin businesses and low cost of capital, and there are very smart people running these companies. When you take a look at a company like Silver Wheaton, 30 people are generating $500 million ($500M) in revenue. It’s probably the most profitable company per employee in the world. TGR: And lower risk. FH: Correct, much lower risk. Now, when it comes to the junior spectrum, we like the stock to have great management, have a wonderful footprint from a geological point of view, be increasing its production and be very conscientious of dilution. Klondex Mines Ltd. (KDX:TSX; KLNDF:OTCBB) is one of those companies that has done a great job of respecting value per share. When it comes to big caps, Randgold Resources Ltd. (GOLD:NASDAQ; RRS:LSE) is another company that’s conscientious about dilution and doing transactions that are extremely accretive. TGR: Klondex just reported some drill results at Fire Creek. Have you been happy with the progress it’s making? FH: Yes. We’re very happy with the company and management. It has a great track record. It has the sponsorship of Franco-Nevada. I think that’s an excellent company. Another royalty company we have is Virginia Mines Inc. (VGQ:TSX). It has a big, healthy balance sheet, lots of cash and the ability to grow over time. I think that stocks like that will be rerated on any bounce in gold. They will bounce more than the Market Vectors Junior Gold Miners ETF (GDXJ:NYSE.MKT) will. TGR: What silver companies in the fund are doing well? FH: The silver companies are having a more and more difficult time. The safe play for silver is Silver Wheaton. TGR: What about other companies active in Mexico? Ralph Aldis: MAG Silver Corp. (MAG:TSX; MVG:NYSE) has been advancing the Juanicipio project in Mexico. From what I understand on the ramp development at Juanicipio, MAG Silver has advanced the ramp to around 600 meters in length. The development has been slower in the upper portion of the ramp due to the more weathered nature of the rock and the occasional intersection of silicified zones, which requires additional efforts to work through. Now MAG Silver is in more of the fresh volcanic rocks and advancing at about 115 meters per month. Currently it is about one-third through the estimated 30-month timeframe to reach the vein. Fresnillo Plc (FRES:LSE), its partner, seems to be moving the process along at a “not-too-fast” rate. Fresnillo’s dilemma is that should it decide to buy out MAG Silver, it may have to pay a higher price once the Juanicipio is in production. The bigger issue, which could potentially move the share price of MAG Silver higher in the near term, would be a resolution to access to the Cinco de Mayo Zn-Pb-Au-Ag carbonate replacement deposit, after being expelled by a more radical landowner group in the area. I believe MAG Silver is making progress on resolving this issue. Hopefully we will get a positive update in the first quarter next year. TGR: Frank, you just won some awards for education. What is the role of education in your operation? FH: My blog goes out to tens of thousands of people in 193 countries, so it’s amazing to see the readership. We’ve won about 64 awards in the past seven years. This year it was a record 10. The one that gets the No. 1 e-letter is Investor Alert. That is written every Friday night. Many publications can’t produce a product like this because compliance is so rigorous, but we are able to get it out to shareholders for the weekend read. It’s written by our investment team. It assesses the strengths and weaknesses of the portfolio, presents an outlook for the following week and notes major opportunities and threats. The SWOT model always has three sentences for each section and usually a chart. The fact that it’s put together by the investment team makes it much more credible and timely, but it’s also succinct. TGR: Educate us. Give us something to be hopeful about. FH: We’re seeing record numbers of companies buying back more than 4% of their stock every year. Apple announced a 20% buyback and increased its dividend. I’ll give you a good data point: Ten years ago, you bought your first iPod. Facebook was just being created. Today, 10 years later, Facebook does about $12 billion ($12B) in revenue, and the iTunes component of iPod does $18B in revenue. What Apple is doing is creating products that are synchronized together, sort of a holistic ecosystem. There is wonderful innovation in America. These things are important for overall growth in the economy. Another positive note: There are lots of opportunities in basic materials and resources. While we’re talking, there are 7 billion people on Mother Earth. On the other side of the world, there are 100 million people having sex. And in nine months, there are going to be 1 million screaming babies, and that population growth is not going to stop. TGR: And you have a great chart (see beginning of interview) that shows how many resources that baby will use over his or her lifecycle. What are some of the highlights on the commodity side? FH: In 1972, China and India had no global footprint. They only had 2% of the world’s gross domestic product. Today, they’re 25% and 40% of the world’s population. Down the road, this is very positive for commodities. When these commodities turn and we finally get synchronized growth, then I think what’s going to happen is a streamlining of rules and regulations. Where you are getting the fastest growth is where there are tax breaks. TGR: Do you think the results of the recent midterm elections will be positive for this regulatory environment? FH: We’ll see what happens when it happens. The difficult part for the average investor is that the best the stock markets have been is with a Democratic president and a Republican Congress. That’s why we like to say that you should be diversified and follow the money. I’ve written about the fact that under Obama, there’s been a spectacular stock market run. It’s shocking. Why? Because so much capital has been injected into it. I think that one has to sit back and be balanced. One of the big things we told investors in New Orleans is that if you’re worried about all this volatility, then we have the no-drama fund, the Near-Term Tax Free Fund (NEARX). Morningstar has just given it a 5-Star Overall rating. Investors age 50–55 are about 15 years away from retirement. It’s not a good time to take big risks like putting all assets in the stock market. Witness the huge crash of 2008 when individuals about to retire lost their nest eggs. When you compare the growth of the Near-Term Tax Free Fund over 13–14 years with the S&P 500, you can see that the fund has grown with relatively low risk. The stock market had a wild ride, but earned only a tiny bit more.

TGR: Thanks for talking with us. FH: A pleasure, as always. Frank Holmes is CEO and chief investment officer at U.S. Global Investors Inc., which manages a diversified family of mutual funds and hedge funds specializing in natural resources, emerging markets and gold and precious metals. Holmes purchased a controlling interest in U.S. Global Investors in 1989 and became the firm’s chief investment officer in 1999. Under his guidance, the company’s funds have received numerous awards and honors including more than two dozen Lipper Fund Awards and certificates. In 2006, Holmes was selected mining fund manager of the year by the Mining Journal. He is also the co-author of “The Goldwatcher: Demystifying Gold Investing.” He is a member of the President’s Circle and on the investment committee of the International Crisis Group, which works to resolve global conflict, and is an adviser to the William J. Clinton Foundation on sustainable development in nations with resource-based economies. Holmes is a much sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg and Fox Business, and has been profiled by Fortune, Barron’s, The Financial Times and other publications. Ralph Aldis, CFA, rejoined U.S. Global Investors as senior mining analyst in November 2001. He is responsible for analyzing gold and precious metals stocks for the World Precious Minerals Fund (UNWPX) and the Gold and Precious Metals Fund (USERX). Aldis also works with the portfolio management team of the Global Resources Fund (PSPFX) to provide tactical analyses of base metal, paper, chemical, steel and non-ferrous industries. Aldis received a master’s degree in energy and mineral resources from the University of Texas at Austin in 1988 and a Bachelor of Science in geology, cum laude, in 1981, from Stephen F. Austin University. Aldis is a member of the CFA Society of San Antonio. | ||||||||||||||

| Posted: 13 Nov 2014 10:00 AM PST Americans spoke loudly and clearly at the polls this past week, repudiating Obama's and the Democrats' failed big-government policies. This huge Republican victory has serious implications for the Fed and US stock markets. Republican lawmakers have long opposed this easy Fed, and they will put great pressure on it to normalize its balance sheet and […] The post Zeal on The Fed, QE, & Stocks appeared first on Silver Doctors. | ||||||||||||||

| Central banks managing -- that is, rigging -- gold more actively, LBMA is told Posted: 13 Nov 2014 09:02 AM PST GATA | ||||||||||||||

| The Consequences of a Strengthening US Dollar Posted: 13 Nov 2014 08:47 AM PST A rising US dollar wreaks a greater amount of damage in the weaker periphery countries by sucking capital away from them (as dollar-denominated assets looks ‘safer’ to investors). As the currencies suffering outflows decline against the dollar, imports become more expensive and exports lose value when traded for dollars. It's a triple-whammy for emerging nations: their borrowing costs are soaring, the capital leaving to pay off dollar-denominate debt leaves them starved for investment capital, and their imports rise in cost as their exports earn less. If these countries start faltering, the risk of contagion to the wider global economy increases dramatically. | ||||||||||||||

| World Gold Council Issues its Latest Report Posted: 13 Nov 2014 08:44 AM PST I would urge my readers to take some time perusing the contents of the WGC's most recent report on supply and demand in the gold market. It is a most informative read. I wanted to pull a short extract from their section on ETF's as I found their analysis remarkably similar to mine when it comes to GLD for instance. From their GOLD DEMAND TRENDS, page 6: "ETF outflows were far smaller in scale than those in Q3 last year. As of end-September, ETF holdings have declined by a little under 84t, equivalent to just 12% of the outflows over the same period of 2013. This lends weight to our analysis - as laid out in previous research - that more tactical investors have largely exited and the remaining base of ETF positions are held as strategic investments. There was, however, little during the quarter to encourage fresh investment in ETFs as investors kept their gaze locked on the US economic scenario. The prospect of US interest rates remaining low 'for a considerable time' and the widely-anticipated end to quantitative easing( QE) by the Federal Reserve eclipsed all other considerations. The soundness of gold's underlying fundamentals was widely acknowledged, but in itself offered little fresh impetus to drive an increase in investor positions." Is this not exactly what I have been saying here? To launch gold into a soaring bull market, as the gold perma-bulls continue to assert it would be were it nor for constant price manipulation by banks acting as agents of the Fed, requires steady inflows of investment capital ( HOT MONEY). That requires a CHANGE IN SENTIMENT towards gold which currently is not there among the Western-based investment crowd. The continued drawdown in GLD is EVIDENCE of this lagging Western-based investment demand for the metal. Those types are moving money into equities where the big return on invested capital has been made this year. When the WGC speaks of "tactical investors", I substitute hedge funds. Those are short-term oriented, market timing and MOMENTUM-based trader/investors. They are simply not interested in the metal at this time. Many of those entities are selling their holdings in GLD, which are producing nothing in the way of gains and moving those funds into equities and putting the money to work there. That is simply smart money management. After all, hedge funds get paid to produce profits - not sit on invested monies which are going nowhere and potentially even losing! That is why you see them shorting the metal. The ones who are interested, as the report says, are more long term oriented investors who see gold as a strategic asset to hold in their portfolio. Many of us at this site fall into this category but we are with the "tactical investors" when it comes to reading the price charts and understanding the current rather poor sentiment towards gold among traders and short term oriented investors. Changing the theme slightly now, I am especially interested in the section on "hedging". I always find it fascinating to see how little downside protection most mining companies manage to put in place for themselves. Essentially they become businesses largely involved in speculation rather than mitigating risk and locking in profits. It is a strange business model that most commercial firms would have some real problems with. Perhaps that is one of the reasons that their stock price sink so rapidly. Investors realize that many have few, if any, strategies in place to mitigate price risk to the downside and will punish the share price mercilessly as a result. Here is the link to the report.... http://www.gold.org/supply-and-demand/gold-demand-trends | ||||||||||||||

| Signs of life detected in gold market Posted: 13 Nov 2014 08:41 AM PST Gold prices drifted lower today as stocks were quiet, crude oil fell and the dollar index rose. | ||||||||||||||

| Gold falls again on interest rate news Posted: 13 Nov 2014 08:12 AM PST Gold extended losses as the Federal Reserve prepares to raise interest rates next year while other central banks boost stimulus, strengthening the dollar. | ||||||||||||||

| Even More On The Gold-Yen Link Posted: 13 Nov 2014 08:11 AM PST As other outlets catch on to the gold--yen link, I thought we might discuss it a bit more today. | ||||||||||||||

| Metals market update for November 13 Posted: 13 Nov 2014 08:07 AM PST Gold for immediate delivery lost 0.1% to $1,162.60/oz in late morning trade in London. It reached $1,132.16 last Friday, November 7, the lowest since April 2010. | ||||||||||||||

| National Economic Suicide: The U.S. Trade Deficit With China Just Hit A New Record High Posted: 13 Nov 2014 07:00 AM PST Americans now buy nearly five times as much stuff from the Chinese as they buy from us. According to government numbers that were just released, we imported 44.9 billion dollars worth of goods from China in September but we only exported 9.3 billion dollars of goods to the Chinese. China is literally wiping the floor with us on the […] The post National Economic Suicide: The U.S. Trade Deficit With China Just Hit A New Record High appeared first on Silver Doctors. | ||||||||||||||

| India overtakes China as the world's largest gold consumer Posted: 13 Nov 2014 06:44 AM PST The Q3 Gold demand Trends Report published by the World Gold Council (WGC) for the third quarter of 2014 indicates that India has regained its position from China as the world's largest gold consumer. | ||||||||||||||

| Burkina Faso uprising: What are the risks for gold miners? Posted: 13 Nov 2014 05:56 AM PST For miners and exploration companies, stability is perhaps the single most important consideration to doing business in any country, writes Henry Bonner. | ||||||||||||||

| “Now Is A Good Time” To Buy Gold – Fidelity Investments Posted: 13 Nov 2014 05:27 AM PST Joe Wickwire, research analyst and portfolio manager at Fidelity investments, presented some very grounded, reasonable arguments as to why one should buy gold at the LBMA Precious Metals Conference in Lima, Peru which concluded on Tuesday.

Fidelity Investments are a largely family owned mutual fund and financial services company. It is one of the largest mutual fund and financial services groups in the world. Founded in 1946, the company has since served North American investors. This year they were voted best investment company in an online broker review by Stockbroker.com. They have gradually moved up in the rankings from eighth place in 2011. They currently manage a massive $2 trillion worth of assets. Gold is a diversification and makes up only a small proportion of their overall assets. Thus their pronouncements concerning gold can be regarded as independent. “I believe that now is a good time to take advantage of the negative sentiment short-term trading sentiment”, Wickwire said as reported by the Bullion Desk:

He emphasised that, while precious metals may respond to market volatility in the short term, in the longer term the fundamentals are sound. As many as 40% of mining companies cannot turn a profit with prices below $1250. We can extrapolate therefore that if prices do not rise from where they now languish ($1163) many mining companies will fold. This would lead to a supply crunch and consequent rising prices. Mr. Wickwire reviewed the conditions behind the surge in gold price from 2001 – 2008 and concluded that similar dynamics are currently in operation. “Today is quite similar – there are negative real interest rates, while countries are using currency as a policy tool to support nominal growth at the expense of real growth. And on top of that, supply from the gold industry is starting to come down.” He emphasised the importance of owning gold as a form of financial insurance and concluded We agree that in the long term gold acts as a counterbalance to and a hedge against market volatility. To fret over declines in price is to miss the point. Holding an allocation of physical gold as a proportion of one’s portfolio ensures that, if and when faith in paper and digital assets declines and counterparty and systemic risk returns, one is hedged and ones wealth is protected. This is the whole point of owning gold bullion. As always we advise owning gold in allocated gold accounts in vaults in the safest jurisdictions in the world such as Singapore and Switzerland. Get Breaking News and Updates on the Gold Market Here

MARKET UPDATE Gold for immediate delivery lost 0.1% to $1,162.60/oz in late morning trade in London. It reached $1,132.16 last Friday, November 7, the lowest since April 2010.

Futures trading volume was more than double the average for the past 100 days for this time of day, data compiled by Bloomberg show. Global bullion demand declined 2.5% from a year earlier to 929.3 metric tons in the third quarter, the lowest since the last quarter of 2009, the London-based World Gold Council said in a report today. Jewelry consumption slipped 4%, while bar and coin purchases dropped 21%, it said. Although questions are being asked about the Chinese demand data as it appears to only view Chinese demand through the rather narrow prism of Hong Kong exports to China. However, today China is importing huge volumes of gold bullion from all over the world and therefore deliveries on the Shanghai Gold Exchange are a much better benchmark of real Chinese demand. Holdings in gold exchange traded funds fell 4 tons to 1,620 tons yesterday, remaining at the lowest in more than five years due to poor sentiment and weak hand selling. Holdings in the world’s largest gold backed exchange-traded fund, SPDR Gold Shares, fell 1.8 tonnes to 722.67 tonnes on Wednesday. This is the seventh straight day of declines.

A small amount of the ETF liquidations are by investors concerned about the return of the Eurozone debt crisis, geopolitical risk and systemic risk and opting for the safety of allocated and segregated gold bullion coins and bars. Some support was offered by buying of physical gold bullion in China overnight, dealers told Reuters. Buy Gold Bars at the Lowest Prices and in the Safest Way Zero Premium Gold, a new low cost and safer gold investment, has been launched today. It allows investors internationally to invest in physical gold bars at the lowest prices in the market. Investors can now own gold bars at a record low premium of just 0% which is at the live market spot gold price. High charges or premiums for gold bars have made investors wary of physical gold bars in the past and led to the success of online gold account providers with pooled allocated accounts and gold exchange traded funds (ETFs). Zero Premium Gold is as cost effective as gold ETFs and other gold investment vehicles with the added security of outright ownership of the underlying physical asset. | ||||||||||||||

| "Now Is A Good Time" To Buy Gold - Fidelity Investments Posted: 13 Nov 2014 05:02 AM PST gold.ie | ||||||||||||||

| The Full Letter Written by the FBI to Martin Luther King Has Been Revealed Posted: 13 Nov 2014 05:00 AM PST Naturally, a man that utters truth to power and who also has a considerable following would not appeal to the thug in charge of the FBI at the time, J. Edgar Hoover. So what did Mr. Hoover do? He sent a letter to Dr. King, pretending to be a black person and implied that he should kill […] The post The Full Letter Written by the FBI to Martin Luther King Has Been Revealed appeared first on Silver Doctors. | ||||||||||||||

| Gold demand falls to 5-year low Posted: 13 Nov 2014 02:23 AM PST On less coin, jewelry buying. | ||||||||||||||

| NUM says signed deal with Sibanye Gold softening job cuts Posted: 13 Nov 2014 02:06 AM PST With provisions that include voluntary severance packages. | ||||||||||||||

| India said to review gold policy Posted: 13 Nov 2014 01:42 AM PST As imports surge in October. Demand in India surpassed China for the second straight quarter in the July-September period. | ||||||||||||||

| Posted: 13 Nov 2014 01:32 AM PST On dollar strength as demand contracts. | ||||||||||||||

| New blog by an ex-RBA gold sale/leasing analyst Posted: 13 Nov 2014 01:17 AM PST Perth Mint | ||||||||||||||

| New blog by an ex-RBA gold sale/leasing analyst Posted: 13 Nov 2014 12:47 AM PST Steve Ellis, a fund manager for Baker Steel Capital Managers, just let me know he has started a new blog Gold Market Macro which will focus on "gold lease rates, physical gold premiums and the phenomenon of backwardation in gold". Normally another blogger on gold would be a ho hum event, but given Steve "worked for the Reserve Bank of Australia (RBA) as a senior Bank Analyst and studied the sale and leasing of RBA's gold reserves" from 1996 to 1998, I think this blog is a must add to your watch list. While I doubt Steve will be able to give any direct comment on the RBA's sale of two thirds of Australia's gold reserves, which happened during his time there (given central bank employment confidentiality agreements are probably signed in blood or something) it will no doubt give him a unique perspective on the gold market and you never know, he might inadvertently let something slip. | ||||||||||||||

| Posted: 13 Nov 2014 12:17 AM PST India was back as the world’s largest consumer of gold in the third quarter with demand for jewellery up 60 per cent to 183 tonnes, according to the World Gold Council. This was almost enough to offset a 39 per cent slump in Chinese jewellery demand for gold to 147 tonnes as consumers cut back on luxuries. Total global demand for the precious metal was down two per cent to 929 tonnes. Russia emerged as the biggest gold buyer for its reserves, acquiring 55 tonnes, and has more than tripled its holdings to 1,150 tonnes over the past decade. Priced in US dollars its gold holdings are a hedge against the collapsing ruble which has lost 30 per cent of its value in dollar terms since the invasion of Crimea in March. Central bank buying Central banks are expected to add a total of 500 tonnes to their reserves this year by the WGC. They have not been deterred by a second year of falling gold prices. It’s been the holders of gold exchange traded products who have been dumping gold in favor of the soaring US stock market that posted fresh all-time highs this week. What will happen when the stock market turns down is a moot point. In October the S&P 500 dropped 9.7 per cent in a correction before heading back up again, and the gold price went up significantly. Some analysts think that could be an indication of what will happen if stocks take another tumble in the near future. Another round of international sanctions if Russia expands its aggression in the Ukraine could derail the fragile eurozone economy. Japan’s recent sharp devaluation of the yen may have set off a time bomb in Asian markets. Bullish Wall Street However, the bullish consensus on Wall Street is that nothing can go wrong. The weakest US economic recovery in history can support global economic expansion whatever happens. And interest rate rises ahead make gold an unattractive investment. What if instead they are wrong. The US economic recovery is not strong enough for the global economic headwinds. Interest rates not only don’t go up but go negative as they are in the eurozone and QE4 is launched. Then the global demand for gold will take off again and the price… | ||||||||||||||

| Indian Jewellery Demand A Highlight In Subdued Q3 Gold Market â?? World Gold Council Posted: 12 Nov 2014 11:05 PM PST Perth Mint Blog. | ||||||||||||||

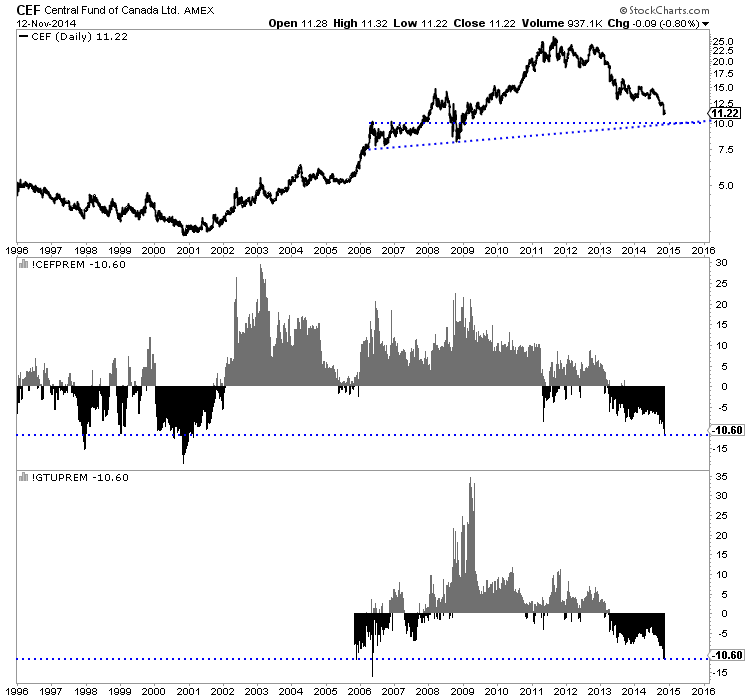

| Buy Gold & Silver at a 10.6% Discount Posted: 12 Nov 2014 11:03 PM PST CEF and GTU are ETFs backed by physical metal. CEF is comprised of Gold and Silver (slightly more Gold) while GTU holds Gold. Tracking the price of each relative to its net asset value provides us a useful sentiment indicator. This data is available on stockcharts.com. In the chart below we plot the price of CEF, its historical premium/discount to NAV and GTU’s historical premium/discount to NAV. Each security is currently trading at nearly an 11% discount to its NAV. For CEF, that is the largest discount in 12 and a half years. GTU began trading in late 2005 so it does not have as long of a history. Today’s discount of 10.6% to NAV would be the highest discount if not for a single data point in 2006.

The post Buy Gold & Silver at a 10.6% Discount appeared first on The Daily Gold. | ||||||||||||||

| Gold Pulls A Rabbit Out Of A Hat Posted: 12 Nov 2014 10:18 PM PST Precious Metals Stock Review | ||||||||||||||

| Posted: 12 Nov 2014 10:10 PM PST "The four PMs are still hugely oversold" ¤ Yesterday In Gold & SilverThe gold price traded a few dollar either side of unchanged on Wednesday during the Far East and early London trading session. The smallish rally that began 20 minutes before the Comex open ran into the usual not-for-profit sellers at 8:30 a.m. EST. It was all down hill from there, with the low tick of the day coming shortly after the 1:30 p.m. Comex close. The subsequent rally cut the COMEX loses in half. The high and low ticks were recorded by the CME Group as $1,169.40 and $1,156.50 in the December contract. Gold closed yesterday at $1,161.70 spot, down $1.20 from Tuesday's close. It would have performed better if JPMorgan et al hadn't put in an appearance at 8:30 a.m. EST yesterday morning. Gross volume was well in excess of 200,000 contracts, as we're well into roll-over process out of the December delivery month, but it all netted out to 127,000 contracts, with over a third of that amount coming before the London a.m. gold fix. After that, the net volume fell off to next to nothing. After the usual down tick at the New York open at 6 p.m. EST on Tuesday evening, the silver price didn't do much until shortly after 2 p.m. Hong Kong time, which may have been the high of the day. Then it chopped lower to its low tick, which appeared to come around 1 p.m. GMT---twenty minutes before the COMEX open. Silver managed to rally back to pennies above unchanged by 12:30 p.m. in New York, but then got sold down into the 1:30 p.m. COMEX close. After that it didn't do a thing. The low and high price ticks for silver were recorded as $15.545 and $15.765 in the December contract. Silver finished the Wednesday session at $15.665 spot, down 3.5 cents from Tuesday's close. Like gold, gross volume was pretty high, but it all netted out to only 20,500 contracts, with about 40 percent of that amount coming before the London a.m. gold fix, so there was no net volume worth mentioning after that. The platinum price action was very similar to both gold and silver---and platinum was closed well off its high once again, finishing the Wednesday session up 3 bucks. Palladium traded flat until around 1:30 p.m. Hong Kong time---and then rallied steadily until its high price spike which occurred shortly after the COMEX open. By the 1:30 p.m. EST COMEX close, the price had been sold back down to unchanged and, like silver, it traded ruler flat into the 5:15 p.m. electronic close---finishing the day up 2 whole dollars. The dollar index closed late on Tuesday afternoon at 87.59. It's low tick of 87.40 came minutes before the London open on their Wednesday morning---and the 87.89 high came five minutes or so after the 1:30 p.m. EDT COMEX close. From there it sold off a handful of basis points, closing at 87.85---up 26 basis points on the day. The gold stocks traded in positive territory up until minutes before 11:30 a.m. EST. From there they slid into the red, hitting their low around 1:35 p.m.---and minutes after the Comex close, at the same time that the dollar index hit its zenith. The gold stocks managed to eke out a tiny gain in the last few minutes of trading, as the HUI closed up 0.08%, which is basically unchanged. The silver equities had a chart pattern that was almost a carbon copy of what happened with the gold stocks, except they couldn't squeeze a positive close, as Nick Laird's Intraday Silver Sentiment Index closed lower by 0.69%. The CME Daily Delivery Report showed that zero gold and 31 silver contracts were posted for delivery within the COMEX-approved depositories on Friday. The short/issuer on all of them was Jefferies---and the long/stopper on all of them was Canada's Scotiabank. The CME Preliminary Report for the Wednesday trading session showed that there are 34 gold contracts still open in November, up 5 contracts from Tuesday's report. Silver's November o.i. is unchanged at 110 contracts---minus the 31 contracts to be delivered tomorrow that I mentioned in the previous paragraph. There was another withdrawal from GLD yesterday. This time an authorized participant took out 57,664 troy ounces. And as of 9:35 p.m. EST yesterday evening, there were no reported changes in SLV. The good folks over at the shortsqueeze.com Internet site finally got around to updating the short positions for both GLD and SLV---late, to be sure, but better late than never. This report is for the period October 16 to October 31. During that time, the short position in SLV declined by 1,795,000 shares/troy ounces, or 10.79%. The short position in GLD dropped as well---by 45,160 troy ounces---or 2.90%. For the second day in a row, there was no sales report from the U.S. Mint. And also for the second day in a row, there was little in/out activity at the Comex-approved depositories. In gold, nothing was reported received---and 3,225 troy ounces were shipped out. In silver, there was nothing received either---and only 185,515 troy ounces shipped out the door. No need to link this activity. I note that First Majestic Silver "Subsequent to quarter end, the Company sold all 934,000 ounces of silver that it held over from the third quarter for an average price of $17.29 per ounce increasing the cash balance by $16.1 million." I also note that Endeavour Silver who, along with First Majestic Silver, reported their less-than-stellar third quarter results the other day---mentioned that "Bullion inventory at quarter-end included 523,526 oz silver and 937 oz of gold." One has to wonder if they still hold this, or have they gone the First Majestic route as well? As usual, silver analyst Ted Butler came out with his mid-week commentary yesterday---and he had something to say to all the primary silver producers out there that are prepared to listen and save themselves before they go bankrupt---and take all their shareholders, including me, with them. I never asked his permission to reprint what he had to say, but after writing the comments about First Majestic and Endeavour above, I thought I'd include this lengthy commentary---so I'll be ready for an ear full when I talk to him later today, but this is important enough that it should be posted in the public domain. I, like you you, have stuck by the silver miners through thick and thin, even though I've discovered over the years that these silver miners [along with their golden brethren] don't give a flying #%@# about any of their stockholders---including you or me. As I've said before on several occasions, if I do manage to get to a position where I can sell their equities for the prices that they should be selling for, I'll never own another mining share in my entire life---and for good reason. Here's what Ted had to say--- "There does seem to be a budding reaction building among the leaders of the primary silver miners to the COMEX action of depressing silver prices, namely a recognition that the continued existence of their enterprises is threatened. This has long been recognized by the shareholders of mining stocks and is reflected in the prices of the shares. An intelligent reaction by the primary silver miners to the artificial price-setting on the COMEX could have a profound influence in hastening the coming resolution and in ending the continuing silver price suppression. But what’s the most intelligent reaction by the primary silver miners at this time? "While understandable, withholding production alone is not the best way of fighting back, simply because the extremely low price of silver is not caused by overproduction, but by COMEX dealings. And forget about any illegal cartel of silver miners. As I’ve suggested previously, the best thing for the primary silver miners to do, either individually or collectively, is to openly petition the regulators to address the price manipulation on the COMEX. But wait a minute – didn’t I just say that there would never be a regulatory resolution? Yes, I most certainly did and I still believe that to be true. Please hear me out. "The primary silver miners (the byproduct producers aren’t necessarily excluded either) have to go the regulators, even if the regulators will do nothing, because it’s the right thing to do. In fact it’s the only practical approach the miners can take. Petitioning the regulators is the only legitimate action the miners can take (although I am always open to other suggestions). Forget low-cost, my approach is no cost to the miners. Further, shareholders would applaud any mining leader who took this approach. "Most importantly, the miners have a responsibility to adopt such an approach for the simple reason that they have the most legitimate reason for complaining about the COMEX price setting. It is this legitimacy that makes the silver miners the perfect candidates to petition the regulators. Miners are not speculators or market analysts desirous of higher prices; they have a legal right to expect the level playing field of a non-manipulated price. Producers of every product hold important protections against dumping and artificial price restraints. "But why should the miners petition the regulators if the regulators will do nothing? Because of the message that will send to the rest of the world. Try to imagine the potential reaction in the investment world to news that a silver miner or group of miners asked the regulators to investigate evidence of manipulation? It is one thing for an Internet analyst (me) to make such allegations, but quite another for a legitimate producer to do the same. It’s all about legitimacy. It is well-known that in establishment media circles the allegations of a silver (and gold) manipulation is populated by conspiracy types and that’s a big reason the scam has lasted so long. But if a silver miner or miners the allegation, it just might prompt some of the establishment types to actually look at the evidence, something none have done to this point. "The only thing a silver miner must be careful about in adopting an approach of openly petitioning the regulators to address the goings on in COMEX dealings is to stick to the facts and don’t say anything wrong. Unfortunately, there are an incredible amount of misstatements of fact regarding the COMEX’s role in setting silver prices that a miner repeating them will reduce any petition to a fool’s errand. Ego aside, I don’t think I’ve ever made an error when petitioning the regulators and it is this careful approach that has made me immune from a counter reaction in calling JPMorgan and the CME market criminals. Of course, I would assist any miner desiring to petition the regulators. - Silver analyst Ted Butler: 12 November 2014 [Note: the bolding and underlining is mine. - Ed] Please feel free to send Ted's commentary to any silver mining company that you feel might be interested in higher silver prices. You should even send this to The Silver Institute, even though it will be for naught, as they are not at all interested in helping their members in this regard. Here's the link to their "Contact Us" page. I have very few stories for you today---and I'm quite happy about that. I hope you'll find one or two from the list below that are worth reading. ¤ Critical ReadsRussell Napier Declares November 16, 2014 The Day Money DiesOn Sunday in Brisbane the G20 will announce that [large] bank deposits are just part of commercial banks’ capital structure, and also that they are far from the most senior portion of that structure. With deposits then subjected to a decline in nominal value following a bank failure, it is self-evident that a bank deposit is no longer money in the way a banknote is. If a banknote cannot be subjected to a decline in nominal value, we need to ask whether banknotes can act as a superior store of value than bank deposits? If that is the case, will some investors prefer banknotes to bank deposits as a form of savings? Such a change in preference is known as a "bank run." Each country will introduce its own legislation to effect the ‘ bail-in’ agreed by the G20 this coming weekend. The consultation document from the UK’s Treasury lists the following bank creditors who will rank ABOVE depositors in a ‘failing’ financial institution. This commentary appeared on the Zero Hedge website at 12:09 p.m. on Wednesday---and I thank reader "Michael G" for sharing it with us. Gas to average under $3/gallon in 2015, government saysThe average price of gasoline will be below $3 a gallon in 2015, the Energy Department predicted Wednesday. If the sharply lower estimate holds true, U.S. consumers will save $61 billion on gas compared with this year. Economists say lower gasoline prices act like a tax cut, leaving more money for consumers to spend on other things. Consumer spending is 70 percent of the U.S. economy. The department's Energy Information Administration predicted in its most recent short-term energy outlook that drivers will pay $2.94 per gallon on average in 2015, 45 cents lower than this year. This AP story was picked up by the msn.com Internet site yesterday---and it's courtesy of West Virginia reader Elliot Simon. Forex scandal: How to rig the marketThe foreign exchange market is not easy to manipulate. So how do you make currency prices change in the way you want? Traders can affect market prices by submitting a rush of orders during the window when the fix is set. This can skew the market's impression of supply and demand, so changing the price. This might be where traders obtain confidential information about something that is about to happen and could change prices. For example, some traders shared internal information about their clients' orders and trading positions. The traders could then place their own orders or sales in order to profit from the subsequent movement in prices. This article appeared on the bbc.com Internet site at 9:30 a.m. EST yesterday---and it's courtesy of South African reader B.V. Ukraine out in the cold this winter without coal from Russia, Donbass – Energy MinisterUkraine doesn’t see other options than to buy gas from Russia, or coal from the self-proclaimed Donetsk People’s Republic, to keep the country warm this winter, said Yury Prodan Ukrainian Energy and Coal Industry Minister. "South Africa has refused to maintain further deliveries of coal to us. A new contract can be signed in at least a month and a half. We have no other choice but to turn to Russian suppliers and purchase their coal. The situation with coal supply is threatening. Energy security is at risk," said Prodan at a government session Wednesday. Ukraine now has just 1.7 million tonnes of coal reserves, which is critically low. “There is a risk we won’t pull through the autumn and winter, but we continue to look for a way out,” he said. This news item put in an appearance on the Russia Today website at 5:06 p.m. Moscow time on their Wednesday afternoon, which was 9:06 a.m. EST. It's the first contribution of the day from Roy Stephens---and it's worth your while. Donetsk Won't Supply Coal to Ukraine Until Shelling EndsThe administration of the self-proclaimed Donetsk People's Republic says it will not supply coal to Kiev until it stops its military operations in the republic, the Energy Minister of the republic told journalists on Wednesday. “There is an ongoing war and we cannot supply coal to those who are shelling us,” said the minister. Besides, he added, Kiev has blocked the accounts of the state mines within the republic and has not paid miners’ salaries since July. “Let them unblock the accounts first and pay off all the debts and then we will start talking,” he added. I don't know how you feel about it, but this sounds reasonable enough to me, dear reader. This brief news item appeared on the sputniknews.com Internet site at 6:11 p.m. Moscow time yesterday evening---and it's certainly worth reading as well. I thank Roy Stephens for this article. Moscow slams NATO's accusations of invasion in Ukraine as groundlessRussia has denied NATO claims that its army has crossed into eastern Ukraine in the past few days, calling them groundless, the Defense Ministry said. “We have stopped paying attention to the groundless accusations made by NATO’s Supreme Allied Commander in Europe, US General Philip Breedlove, of the ‘observed’ Russian military columns allegedly invading Ukraine,” said Defense Ministry of | ||||||||||||||

| Jim Willie: Chinese Have Acquired a Majority Controlling Interest in the Federal Reserve! Posted: 12 Nov 2014 08:00 PM PST In this MUST LISTEN interview, Hat Trick Letter Editor Jim Willie discusses the coming COMPLETE COLLAPSE of the US economy, & whether the Federal Reserve intends to buy up assets for pennies on the dollar in the aftermath of the collapse. Willie also discusses’ China’s recent acquisition of JPM’s HQ at 1 Chase Manhattan Plaza, […] The post Jim Willie: Chinese Have Acquired a Majority Controlling Interest in the Federal Reserve! appeared first on Silver Doctors. | ||||||||||||||

| Harvey Organ: Backwardation in Gold is Incompatible With Massive Raid on Gold! Posted: 12 Nov 2014 07:43 PM PST The 6th month GOFO rate has entered backwardation. The backwardation in gold is incompatible with the raid on gold . It does not make any economic sense. Lets head immediately to see what the data has in store for us today: The Perfect Holiday Gift for 2014: Royal Canadian Mint Holiday Snowman Submitted by […] The post Harvey Organ: Backwardation in Gold is Incompatible With Massive Raid on Gold! appeared first on Silver Doctors. | ||||||||||||||

| Posted: 12 Nov 2014 07:15 PM PST There’s been some ‘weird stuff’ going on in the paper market for silver this CNBC interview reminds us today as prices hover near four-year lows. Silver Wheaton president and CEO Randy Smallwood predicts that the silver paper market will be ‘folding in on itself’ sending prices much higher. His company is set to benefit with an average silver production cost of $4.50 so he is already making a 70 per cent profit margin on every ounce sold… | ||||||||||||||

| Marshall Swing: PMs Will Not Be Allowed to Crash Until September 2015 Posted: 12 Nov 2014 07:00 PM PST All speculators should cover all the shorts they have right now to secure MASSIVE profits! But they won't. Why? The speculators really believe they can force the Commercials hand and pin their positions on them but that is not mathematically possible. They sense and even smell the blood of far lower spot prices in the future and they […] The post Marshall Swing: PMs Will Not Be Allowed to Crash Until September 2015 appeared first on Silver Doctors. | ||||||||||||||

| Obama’s Secret Treaty Would Be The Most Important Step Toward A One World Economic System Posted: 12 Nov 2014 06:37 PM PST

Even though Congress is not being allowed to see what is in the treaty, Barack Obama wants Congress to give him fast track negotiating authority. What that means is that Congress would essentially trust Obama to negotiate a good treaty for us. Congress could vote the treaty up or down, but would not be able to amend or filibuster it. Of course now the Republicans control both houses of Congress. If they are foolish enough to blindly give Barack Obama so much power, they should all immediately resign. And it is critical that people understand that this is not just an economic treaty. It is basically a gigantic end run around Congress. Thanks to leaks, we have learned that so many of the things that Obama has deeply wanted for years are in this treaty. If adopted, this treaty will fundamentally change our laws regarding Internet freedom, healthcare, copyright and patent protection, food safety, environmental standards, civil liberties and so much more. This treaty includes many of the rules that alarmed Internet activists so much when SOPA was being debated, it would essentially ban all "Buy American" laws, it would give Wall Street banks much more freedom to trade risky derivatives and it would force even more domestic manufacturing offshore. In other words, it is the treaty from hell. In addition to imposing Obama's vision for the world on 40 percent of the global population, it is also being described as a "Christmas wish-list for major corporations". Of the 29 chapters in the treaty, only five of them actually deal with economic issues. The rest of the treaty deals with a whole host of other issues of great importance to the global elite. The following list of issues addressed by this treaty is from a Malaysian news source...

Why can't we get this type of reporting in the United States? And if this treaty is ultimately approved by Congress, we will essentially be stuck with it forever. This treaty is written in such a way that the United States will be permanently bound by all of the provisions and will never be able to alter them unless all of the other countries agree. Are you starting to understand why this treaty is so dangerous? This treaty is the key to Obama's "legacy". He wants to impose his will upon 40 percent of the global population in a way that will never be able to be overturned. Of course Obama is touting this treaty as the path to economic recovery. He promises that it will greatly increase global trade, decrease tariffs and create more jobs for American workers. But instead, it would be a major step toward destroying what is left of the U.S. economy. Over the past several decades, every time a major trade agreement has been signed we have seen even more good jobs leave the United States. And it doesn't take a genius to figure out why this is happening. If corporations can move jobs to the other side of the planet to nations where it is legal to pay slave labor wages, they will make larger profits. Just think about it. If you were running a corporation and you had the choice of paying workers ten dollars an hour or one dollar an hour, which would you choose? Plus there are so many other costs, taxes and paperwork hassles when you deal with American workers. For example, big corporations will not have to provide Obamacare for their foreign workers. That alone will represent a huge savings. Any basic course in economics will teach you that labor flows from markets where labor costs are high to markets where labor costs are lower. And at this point it costs less to make almost everything overseas. As a result, we have already lost millions upon millions of good jobs, and countless small and mid-size U.S. companies have been forced to shut down because they cannot compete with foreign manufacturers. Later this month, consumers will flock to retail stores for "Black Friday" deals. But if you look carefully at those products, you will find that almost all of them are made overseas. We buy far, far more from the rest of the world than they buy from us, and that is a recipe for national economic suicide. We consume far more wealth that we produce, and anyone with half a brain can see that is not sustainable in the long run. The only way that we have been able to maintain our high standard of living is by going into insane amounts of debt. We are currently living in the largest debt bubble in the history of the planet, and at some point the party is going to end. Please share this article with as many people as you can. We need to inform people about what Obama is trying to do. If Obama is successful in ramming this secret treaty through, it is going to do incalculable damage to what is left of the once great U.S. economy. | ||||||||||||||