Gold World News Flash |

- YOUR FRIENDLY NEIGHBORHOOD CRIMINAL BANK: Excerpts Prove FOREX Traders COLLUDED in Transactions With Colleagues at Other Banks.

- Putin Is About To Rock The Gold, Oil & Currency Markets

- Swiss Regulator Fines UBS for Silver Price Manipulation so This is Now a Matter of Fact Not Speculation

- Putin's trump card is to refuse dollars for Russian energy, Sperandeo tells KWN

- United States: Voters Know Better than Economists

- The Economic End Game Explained

- Here’s what I think the financial system will look like in the future

- The Economic End Game Explained

- War-Making And Class-Conflict

- Kiev Preparing For An All Out Offensive Which Will Lead To War

- Did The BoJ Quietly Peg The Yen To Gold?

- Coast To Coast AM - November 11, 2014 The Nature of Angels

- 24 Reasons Why Millennials Are Screaming Mad About America's "Unfair" Economy

- Gold has never been so much in backwardation, Turk tells King World News

- Bud Conrad: 'Paper gold' and its effect on the gold price

- The Federal Reserve Is a Cartel - G. Edward Griffin

- The Gold Price Closed at $1,158.90 Down $3.90

- Brazil Builds Its Own Fiber-Optic Network... To Avoid The NSA

- The 1937 Recession

- Yra Harris On Official Swiss Objections To the Gold Referendum

- The Number One Misconception About the Banking System — and Why You Should Care

- Why the Dollar’s Reserve Currency Status is America’s “Achilles Heel”

- Gold Daily and Silver Weekly Charts - Agents of Misfortune

- Good News for Gold Bulls from the LBMA's Near Bears

- The Remarkable Chart Every Gold & Silver Investor Must See

- Today's market-rigging disclosures only hint at far greater offenses

- Silver and Gold Producers – a CALL TO ARMS!

- Would you die on your feet or your knees -- or even win?

- 3 Things Central Banks Will Do to “Save the Economy”

- GOLD IS CURRENCY -- Dave Kranzler

- Dr. Bill Deagle - Marked For Extermination

- 7 Ways to Play the Post-Election Resource Market

- The U.S. Dollar’s Crucial Role in the Commodity Cycle

- Swiss Regulator: “Clear Attempt To Manipulate Precious Metals †… “Particularly Silverâ€

- Attention Preppers: Here is the One Prepper Asset That Trumps All Others

- Currency War Begins - Russia Detaches From The Dollar/Euro Currency Peg

- IAMGold lays off 40% of management and quits World Gold Council

- Swiss regulator says UBS tried to manipulate monetary metals fixes

- Fines bring bank currency-rigging settlement to $4.3 billion

- Wednesday Morning Links

- “Paper Gold” and Its Effect on the Gold Price

- James Turk -- Dollar Will Eventually Go Over the Cliff

- Rocks to Riches with Thomas Schuster

- “Paper Gold” and Its Effect on the Gold Price

| Posted: 12 Nov 2014 11:00 PM PST from The Point:

Transcript excerpts of conversations released Wednesday by the Commodity Futures Trading Commission show traders from U.S. banks Citibank (C) and JPMorgan Chase (JPM), coordinated their currency trades with colleagues at Swiss banking giant UBS (UBS), London-based HSBC (HSBC) and other financial institutions. The cryptic chats feature references to “cable” trades – shorthand for transactions involving the British Pound/U.S. Dollar exchange rate. The excerpts also show the traders often colluded to focus their moves on the daily 4 p.m. London time market “fix” – the most widely referenced time when world foreign exchange benchmarks are set. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Putin Is About To Rock The Gold, Oil & Currency Markets Posted: 12 Nov 2014 09:01 PM PST  Today a legendary trader and investor, who recently called the bottom in the U.S. stock market with remarkable precision, gave King World News a stunning interview where he laid out exactly how Russian leader Vladimir Putin is about to rock the gold, oil, and currency markets. Victor Sperandeo has been in the business 45 years, and has worked with famous individuals such as Leon Cooperman and George Soros. Below are the warnings and predictions issued by Sperandeo. Today a legendary trader and investor, who recently called the bottom in the U.S. stock market with remarkable precision, gave King World News a stunning interview where he laid out exactly how Russian leader Vladimir Putin is about to rock the gold, oil, and currency markets. Victor Sperandeo has been in the business 45 years, and has worked with famous individuals such as Leon Cooperman and George Soros. Below are the warnings and predictions issued by Sperandeo.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 12 Nov 2014 08:40 PM PST by Peter Cooper, Arabian Money:

Like forex manipulation 'The behavior patterns in precious metals were somewhat similar to the behavior patterns in foreign exchange,' said Mark Branson, Finma CEO. 'We have also seen clear attempts to manipulate fixes in the precious metals markets.' | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Putin's trump card is to refuse dollars for Russian energy, Sperandeo tells KWN Posted: 12 Nov 2014 08:23 PM PST 11:20p ET Wednesday, November 12, 2014 Dear Friend of GATA and Gold: Picking up a theme long expressed by fund manager and geopolitical strategist James G. Rickards, market analyst Victor Sperandeo tonight tells King World News that all Russian President Vladimir Putin has to do to control the currency, energy, and commodity markets is to ban acceptance of U.S. dollars for purchase of Russian oil and gas. Timing such a move with the arrival of cold weather would make it even more effective, Sperandeo says. An excerpt from the interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/11/13_P... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| United States: Voters Know Better than Economists Posted: 12 Nov 2014 08:20 PM PST by Philippe Herlin, Gold Broker:

There is nothing unfair in these results. On the contrary, they simply show that manipulating statistics has its limits. The American people, unlike "economists", columnists and political leaders, know that unemployment is being grossly under-estimated, namely because millions of discouraged unemployed workers are not accounted for in the statistics. People also realise that the Fed's monetary printing experiment has created a "wealth effect" (QE is good for stocks and shareholders) generating a little growth, but that this growth remains fragile and bubble-like. The American people, in general, are not faring better since the 2008 crisis and there is no real economic recovery: they just let it be known to the politicians in place. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Economic End Game Explained Posted: 12 Nov 2014 07:22 PM PST Submitted by Brandon Smith via Alt-Market.com, Throughout history, in most cases of economic collapse the societies in question believed they were financially invincible just before their disastrous fall. Rarely does anyone see the edge of the cliff or even the bottom of the abyss before it has swallowed a nation whole. This lack of foresight, however, is not entirely the fault of the public. It is, rather, a consequence caused by the manipulation of the fundamental information available to the public by governments and social gatekeepers. In the years leading up to the Great Depression, numerous mainstream “experts” and politicians were quick to discount the idea of economic collapse, and most people were more than ready to believe them. Equities markets were, of course, the primary tool used to falsely elicit popular optimism. When markets rose, even in spite of other very negative fiscal indicators, the masses were satisfied. In this way, stock markets have become a kind of dopamine switch financial elites can push at any given time to juice the citizenry and distract them from the greater perils of their economic future. During every upswing of stocks, the elites argued that the “corner had been turned,” when in reality the crisis had just begun. Nothing has changed since the crash of 1929. Just look at some of these quotes and decide if the rhetoric sounds familiar today:

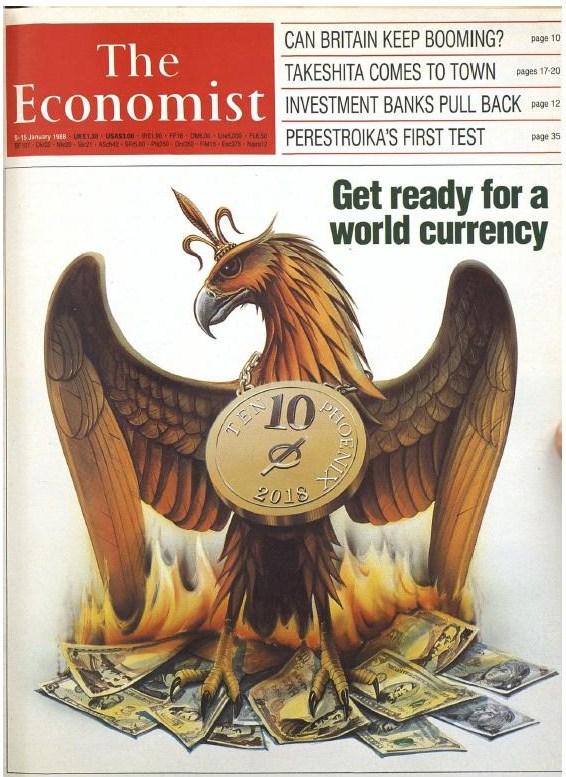

I hear nearly identical statements from pro-mainstream, pro-dollar skeptics all the time. And all of their assertions rest solely on the illusion of the Dow and the dollar index, not to mention statistics that are sourced from the very government that has much to gain by fooling the public into believing all is well. In 2009, Paul Krugman, perhaps the worst and most famous economist of our age, lamented on the fact that no one in mainstream finance saw the derivatives and credit crash coming. Yet it is the same kinds of manipulative policies that Krugman champions that caused this collective ignorance in mainstream circles to begin with. What the past proves, time and time again, is that establishment trained and educated economists are perhaps the most useless of all analysts. They are perpetually wrong. Only independent analysts have ever been able to predict anything of value as far as our economic future — not because they are psychic, but because they have the advantage of standing outside the foggy propaganda of brainwashed financial academia. It also proves that the appearance of prosperity means nothing if the fundamentals do not support the optimism. That is to say, a bullish stock market, a high dollar index and a low unemployment percentage mean nothing if such stats are generated by false methods and fiat. The fundamentals ALWAYS matter. As we saw during the Great Depression, the markets cannot hide from reality forever. I relate these points because the future I am about to suggest here might sound outlandish to some, because it is so contrary to the “official” accounting of our current financial world. It is important to remember that the mainstream, the majority, is almost always wrong and that the truth is very rarely accepted broadly until calamity has already fallen. I outlined the hard facts behind the reality of economic downturn in my article “We Have Just Witnessed The Last Gasp Of The Global Economy.” The bottom line is that the stock market, the greatest false indicator of all time, is on the verge of implosion; and the banking elites are positioning themselves to avoid blame for this implosion while the rest of us are being sold on the most elaborate recovery con-game ever conceived. But what is the purpose behind this con-game? Lies are generally only told by those who hope to gain something through deception. What do the elites hope to gain by creating a facade of recovery? They have openly admitted to the public on numerous occasions EXACTLY what they want — namely, the institution of a truly global and centralized economic system revolving around a highly controlled world currency framework and dominated by a select cult of banking oligarchs. Anyone who claims that this is not the goal is either a liar or an uneducated fool. I have covered the evidence supporting this program many times in the past, but it would seem with the precariously surreal nature of our world today that much needs repeating. In 1988, the financial magazine 'The Economist' published an article titled “Get ready for a world currency by 2018,” in which it outlined the framework for a global currency system called the “Phoenix” (a hypothetical title), administered by the International Monetary Fund by the year 2018, which would erase all national economic sovereignty and require governments to borrow from the world central banking authority, rather than print, in order to finance their infrastructure programs. This would mean total control by the IMF over member nations as they beg and plead for more capital under the global currency umbrella.

If this sounds familiar, it is because I have been warning about the IMF takeover of the global monetary system for at least six years. The Economist actually admits that the Phoenix system would start out in the format of the Special Drawing Rights basket currency:

The plan is to introduce a basket currency system as an alternative to the dollar as world reserve, then slowly but surely phase out all sovereign currencies until the basket becomes a currency itself - the ONLY currency. Former World Bank Chief Economist Justin Yifu Lin seems to agree with this ideology, arguing that national currencies must be replaced with a supranational currency, and pointing out that no single currency has the strength to stand alone as world reserve:

I would mention that a "Phoenix" rises from the ashes of calamity reborn. What ashes are the elites expecting the new global currency to rise from? It is important to note that 'The Economist' is not just any random financial publication; it is in large part owned by the Rothschild banking family and is based out of the London financial center, meaning, The Economist does not have to “guess” on the economic developments of the future; it has an inside track on exactly what is planned to occur. You can see my more recent analysis on the IMF global currency scheme here. A plan for global governance has also been touted by international elites over the years, the roots of which would supposedly begin around 2015. The Gorbachev Foundation, which boasts many American elites as members, has long predicted the rise of a global government. In 1995, the executive director of the foundation, Jim Garrison, had this to say to the San Francisco Weekly:

At the Gorbachev-led State of the World Forum in 1995, Council On Foreign Relations member Zbigniew Brzezinski had this to say:

Regionalization is already occurring as the BRIC nations form their own bilateral trade agreements and their own global bank, and this is by design. The catalyst to trigger the end of the dollar and the dominance of a global currency system, I believe, will be the false East/West paradigm. I have seen an incredible array of analytic interpretations of the macro-economy by multiple mainstream and independent financial writers, but very few of them recognize that the conflict between the West and the eastern BRICS is nothing more than a farce. I have compiled a considerable profile of evidence on the reality that governments like Russia and China are actually complicit in the formation of a global currency and global government controlled by the IMF. You can see that evidence here, here and here. China in particular has loudly pronounced a need for a global currency system to replace the dollar, and they have suggested that this system be controlled by the IMF:

China is NOT anti-establishment or anti-new world order, nor is Russia. Eastern opposition to the NWO is a lie. Period. In fact, the BRICS have argued only for greater inclusion in the IMF system and have no intention of developing a legitimate alternative to “Western” globalization. If you do not understand that the BRICS are part of the NWO, not opposed to it, then you do not understand a thing. With the BRICS on board with the plan for global currency, what is likely to happen over the course of the next few years if the schedule for an economic reset is on track for 2018? As I outlined in my last article, the U.S. in particular has been prepped like a sacrificial lamb, with the populace for the most part oblivious to the extent of the threat. Middle-class wealth is being driven into bonds and will be driven more so by market declines, which will progress over the next few months. This “herding” of capital into bonds is only in preparation for the death of the dollar’s world reserve status, thus erasing what little savings were left among the common citizenry. The ceremony initiating our nation’s fiscal destruction will likely take place in the near term. To achieve global centralization by 2018, the elites would need a serious crisis soon in order to provide the proper collective panic required to generate public consent for global economic governance in four years’ time. The first, most important factor to consider is the fake conflict between the IMF and the U.S. Congress over the approval of IMF policy changes agreed upon in 2010. The U.S. has yet to officially sign off on the IMF policy measures that would bring more “inclusiveness” for developing nations like Russia and China, and this has led the IMF to assert that a move forward without the U.S. is necessary. IMF head Christine Lagarde is now demanding that Congress pass the reforms of 2010; but with the election of a predominantly Republican government, those reforms have little or no chance of being approved. Lagarde recently joked that she would be willing to "belly dance" to get IMF reforms passed (I would pass them just to avoid the gut churning image of that belly dance), but the joke will ultimately be on the U.S. as IMF heads suggest that if the current Congress does not pass reforms by the end of this year, they will be forced to apply a "Plan B". The details of this Plan B are not public. It is now highly likely that the IMF will set policy WITHOUT the input of the U.S., as they have warned they would, crippling the assumptions by many that the IMF is somehow a “U.S.-owned institution.” It is actually the reverse; the IMF is setting the stage for ownership of the U.S. monetary structure, along with the Bank Of International Settlements, which appears to be the capstone of the NWO system. The next IMF meeting on SDR inclusion is not set, but will probably take place in early 2015. It is expected that China and the Yuan will be officially added to the SDR basket. Gold should also be watched carefully. There is a reason why the BRICS have been accumulating thousands of tons of the precious metal. The IMF introduction of gold into the SDR basket is inevitable, and a new Bretton Woods style-agreement has already been called for by a number of elites. The IMF has been openly discussing the ascension of the SDR to replace the dollar as the world reserve currency since at least 2011. With developing nations already asking for help from the IMF due to volatility caused by the Fed taper and the BRICS well into their own programs to remove the dollar as the world reserve, the only question left is: How will the banks be able to accomplish the currency reset without taking blame for the resulting catastrophe that will no doubt bury the majority of middle-class and poor? There is no way around it. The elites need a geopolitical disaster so overwhelming that all economic changes taking place in the background go completely unnoticed. They also need to set themselves up as the prognosticators and rescuing heroes in the midst of the coming chaos, as outlined in my last article. I do not know what that disaster will specifically look like, because there are too many possibilities to consider. Think about this honestly, 10 years ago, would you or your friends and family have ever thought that the U.S. would be at war in Syria with a terrorist organization we created ourselves out of thin air? That we would be immersed in renewed tensions and the possibility of economic warfare with Russia? That our presidency would have attempted and failed the initiation of socialized healthcare? That our military would be tapped as a possible response force for domestic unrest? That an outbreak of Ebola would be suggested as a trigger for medical martial law? How many conspiracies have been exposed in just the past few years? How many government crimes have hit the headlines and then disappeared? Benghazi, Fast and Furious, IRS targeting of activists, government-aided illegal immigration, etc. — a nonstop parade of corruption that few would have thought possible a decade ago. We are being boiled slowly, economically as well as politically. We are being conditioned to accept imminent crisis as a way of daily life, to become used to it and to blame these crises on hundreds of various scapegoats, but never the international banks. And while the Titanic sinks, the band plays on, as mainstream pundits and dupes accuse independent analysts of “crying wolf.” The economic endgame is not about collapse alone. Collapse is nothing more than a process that ends abruptly only when public faith is finally lost. The endgame is about acceptance — the acceptance by the masses of a “new normal” in which financial and political terror become the foundation of daily life. The endgame is, first and foremost, about the psyche of mankind and its mutation into something unrecognizable. This kind of pervasive conditioning requires immeasurable fear. Our economic philosophy of sovereign trade and identity cannot be erased without it. The elites have already given us their timeline. The crash of 2008 was only the beginning of the program, and 2014-2015 looks to be the next stage. I have written hundreds of articles on how to prepare and diffuse the dangers of the impending reset, but the most important issue of all is that people understand the threat is at their doorstep. It’s not a few years off or a decade away; it’s here now. We are right in the middle of collapse, even if many cannot see it. Watch global developments carefully, as market volatility increases and international conflicts escalate. Time is up. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Here’s what I think the financial system will look like in the future Posted: 12 Nov 2014 07:20 PM PST from Sovereign Man:

In the Pharaohs' day, gold was money. Today, it might be even more important than ever. As advanced as our modern civilization may be, we've been playing with fire for more than a century. Every single experiment with unbacked paper money throughout history failed. And though today's economists like to think that 'this time is different,' our own experiment with paper money will share the same fate. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Economic End Game Explained Posted: 12 Nov 2014 06:40 PM PST by Brandon Smith, Activist Post:

In the years leading up to the Great Depression, numerous mainstream "experts" and politicians were quick to discount the idea of economic collapse, and most people were more than ready to believe them. Equities markets were, of course, the primary tool used to falsely elicit popular optimism. When markets rose, even in spite of other very negative fiscal indicators, the masses were satisfied. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 12 Nov 2014 06:29 PM PST Submitted by Joseph Salerno via Ludwig von Mises Institute, All governments past and present, regardless of their formal organization, involve the rule of the many by the few. In other words, all governments are fundamentally oligarchic. The reasons are twofold.

The inherently nonproductive and oligarchic nature of government thus ensures that all nations under political rule are divided into two classes: a productive class and a parasitic class or, in the apt terminology of the American political theorist John C. Calhoun, "taxpayers" and "tax-consumers." The king and his court, elected politicians and their bureaucratic and special-interest allies, the dictator and his party apparatchiks — these are historically the tax-consumers and, not coincidentally, the war makers. War has a number of advantages for the ruling class.

We thus arrive at a universal, praxeological truth about war. War is the outcome of class conflict inherent in the political relationship — the relationship between ruler and ruled, parasite and producer, tax-consumer and taxpayer. The parasitic class makes war with purpose and deliberation in order to conceal and ratchet up their exploitation of the much larger productive class. It may also resort to war making to suppress growing dissension among members of the productive class (libertarians, anarchists, etc.) who have become aware of the fundamentally exploitative nature of the political relationship and become a greater threat to propagate this insight to the masses as the means of communication become cheaper and more accessible, e.g., desktop publishing, AM radio, cable television, the Internet, etc. Furthermore, the conflict between ruler and ruled is a permanent condition. This truth is reflected — perhaps half consciously — in the old saying that equates death and taxes as the two unavoidable features of the human condition. Thus, a permanent state of war or preparedness for war is optimal from the point of view of the ruling elite, especially one that controls a large and powerful state. Take the current US government as an example. It rules over a relatively populous, wealthy, and progressive economy from which it can extract ever larger boodles of loot without destroying the productive class. Nevertheless, it is subject to the real and abiding fear that sooner or later productive Americans will come to recognize the continually increasing burden of taxation, inflation, and regulation for what it really is — naked exploitation. So the US government, the most powerful mega-state in history, is driven by the very logic of the political relationship to pursue a policy of permanent war. From "The War to Make the World Safe for Democracy" to "The War to End All Wars" to "The Cold War" and on to the current "War on Terror," the wars fought by US rulers in the twentieth century have progressed from episodic wars restricted to well-defined theaters and enemies to a war without spatial or temporal bounds against an incorporeal enemy named "Terror." A more appropriate name for this neoconservative-contrived war would involve a simple change in the preposition to a "War of Terror" — because the American state is terrified of productive, work-a-day Americans, who may someday awaken and put an end to its massive predations on their lives and property and maybe to the American ruling class itself. In the meantime, the War on Terror is an open-ended imperialist war the likes of which were undreamt of by infamous war makers of yore from the Roman patricians to German National Socialists. The economist Joseph Schumpeter was one of the few non-Marxists to grasp that the primary stimulus for imperialist war is the inescapable clash of interests between rulers and ruled. Taking an early mega-state, Imperial Rome, as his example, Schumpeter wrote:

This lengthy quotation from Schumpeter vividly describes how the expropriation of peasants by the ruling aristocracy created a permanent and irreparable class division in Roman society that led to a policy of unrestrained imperialism and perpetual war. This policy was designed to submerge beneath a tide of national glory and war booty the deep-seated conflict of interests between expropriated proletarians and landed aristocracy. Democracy and Imperialist War Making Schumpeter's analysis explains the particularly strong propensity of democratic states to engage in imperialist war making and why the Age of Democracy has coincided with the Age of Imperialism. The term "democratic" is here being used in the broad sense that includes "totalitarian democracies" controlled by "parties" such as the Nationalist Socialist Workers Party in Germany and the Communist Party in the Soviet Union. These political parties, as opposed to purely ideological movements, came into being during the age of nationalist mass democracy that dawned in the late nineteenth century. Because the masses in a democratic polity are deeply imbued with the ideology of egalitarianism and the myth of majority rule, the ruling elites who control and benefit from the state recognize the utmost importance of concealing its oligarchic and exploitative nature from the masses. Continual war making against foreign enemies is a perfect way to disguise the naked clash of interests between the taxpaying and tax-consuming classes. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Kiev Preparing For An All Out Offensive Which Will Lead To War Posted: 12 Nov 2014 06:01 PM PST The people in the UK have had enough with austerity. Mortgage application plunge once again, which show Real Estate is in a death spiral. The Western countries are selling gold, meanwhile China and Russia are stockpiling gold. Obamacare was designed as a scam. Obama wants to regulate the... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Did The BoJ Quietly Peg The Yen To Gold? Posted: 12 Nov 2014 05:57 PM PST For 14 years, as Japan's economic demise grew more and more evident, its currency devalued relative to gold (the only non-fiat numeraire). When Abenomics began, the trend began to stabilize... but for the last year or so - as The Fed tapered - JPY and Gold have practically flatlined around 132,000 JPY per ounce. This 'odd' stability stands in strangely stark contrast to the volatility and trends in the USD, JPY, and Gold over this period. Even amid the collapse in JPY in recent weeks, it has remained firmly inside a 3% envelope of the 'peg'.

A long trend of JPY fiat devaluation as Japan's lost decades are priced in...

Then odd stability...

Of course, this is conjecture, but doesn't it seem a little odd that with all the hot money flows and violent swings in the last year around the world, that this relationship has been for all intent and purpose - flat and managed.

Charts: Bloomberg | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Coast To Coast AM - November 11, 2014 The Nature of Angels Posted: 12 Nov 2014 05:30 PM PST Coast To Coast AM - November 11, 2014 The Nature of Angels The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 24 Reasons Why Millennials Are Screaming Mad About America's "Unfair" Economy Posted: 12 Nov 2014 05:28 PM PST Submitted by Michael Snyder via The Economic Collapse blog, Do you want to know why Millennials seem so angry? We promised them that if they worked hard, stayed out of trouble and got good grades that they would be able to achieve the "American Dream". We told them not to worry about accumulating very high levels of student loan debt because there would be good jobs waiting for them at the end of the rainbow once they graduated. Well, it turns out that we lied to them. Nearly half of all Millennials are spending at least half of their paychecks to pay off debt, more than 30 percent of them are living with their parents because they can't find decent jobs, and this year the homeownership rate for Millennials sunk to a brand new all-time low. When you break U.S. adults down by age, our long-term economic decline has hit the Millennials the hardest by far. And yet somehow we expect them to bear the burden of providing Medicare, Social Security and other social welfare benefits to the rest of us as we get older. No wonder there is so much anger and frustration among our young people. The following are 24 reasons why Millennials are screaming mad about our unfair economy... #1 The current savings rate for Millennials is negative 2 percent. Yes, you read that correctly. Not only aren't Millennials saving any money, they are actually spending a good bit more than they are earning every month. #2 A survey conducted earlier this year found that 47 percent of all Millennials are using at least half of their paychecks to pay off debt. #3 For U.S. households that are headed up by someone under the age of 40, average wealth is still about 30 percent below where it was back in 2007. #4 In 2005, the homeownership rate for U.S. households headed up by someone under the age of 35 was approximately 43 percent. Today, it is sitting at about 36 percent. #5 One recent survey discovered that an astounding 31.1 percent of all U.S. adults in the 18 to 34-year-old age bracket are currently living with their parents. #6 At this point, the top 0.1 percent of all Americans have about as much wealth as the bottom 90 percent of all Americans combined. Needless to say, there aren't very many Millennials in that top 0.1 percent. #7 Since Barack Obama has been in the White House, close to 40 percent of all 27-year-olds have spent at least some time unemployed. #8 Only about one out of every five 27-year-olds owns a home at this point, and an astounding 80 percent of all 27-year-olds are paying off debt. #9 In 2013, the ratio of what men in the 18 to 29-year-old age bracket were earning compared to what the general population was earning reached an all-time low. #10 Back in the year 2000, 80 percent of all men in their late twenties had a full-time job. Today, only 65 percent do. #11 In 2012, one study found that U.S. families that have a head of household that is under the age of 30 have a poverty rate of 37 percent. #12 Another study released back in 2011 discovered that U.S. households led by someone 65 years of age or older are 47 times wealthier than U.S. households led by someone 35 years of age or younger. #13 Half of all college graduates in America are still financially dependent on their parents when they are two years out of college. #14 In 1994, less than half of all college graduates left school with student loan debt. Today, it is over 70 percent. #15 At this point, student loan debt has hit a grand total of 1.2 trillion dollars in the United States. That number has grown by about 84 percent just since 2008. #16 According to the Pew Research Center, nearly four out of every ten U.S. households that are led by someone under the age of 40 are currently paying off student loan debt. #17 In 2008, approximately 29 million Americans were paying off student loan debt. Today, that number has ballooned to 40 million. #18 Since 2005, student loan debt burdens have absolutely exploded while salaries for young college graduates have actually declined…

#19 According to CNN, 260,000 Americans with a college or professional degree made at or below the federal minimum wage last year. #20 Even after accounting for inflation, the cost of college tuition increased by 275 percent between 1970 and 2013. #21 In the years to come, much of the burden of paying for Medicare for our aging population will fall on Millennials. It is being projected that the number of Americans on Medicare will grow from 50.7 million in 2012 to 73.2 million in 2025. In addition, it has been estimated that Medicare is facing unfunded liabilities of more than 38 trillion dollars over the next 75 years. That comes to approximately $328,404 for every single household in the United States. #22 In the years to come, much of the burden of paying for our exploding Medicaid system will fall on Millennials. Today, more than 70 million Americans are on Medicaid, and it is being projected that Obamacare will add 16 million more Americans to the Medicaid rolls. #23 In the years to come, much of the burden of paying for our massive Ponzi scheme known as Social Security will fall on Millennials. Right now, there are more than 63 million Americans collecting Social Security benefits. By 2035, that number is projected to soar to an astounding 91 million. In 1945, there were 42 workers for every retiree receiving Social Security benefits. Today, that number has fallen to 2.5 workers, and if you eliminate all government workers, that leaves only 1.6 private sector workers for every retiree receiving Social Security benefits. #24 Our national debt is currently sitting at a grand total of $17,937,617,036,693.09. It is on pace to roughly double during the Obama years, and Millennials are expected to service that debt for the rest of their lives. Yes, there are certainly some Millennials that are flat broke because they are lazy and irresponsible. But there are many others that have tried to do everything right and still find that they can't get any breaks. For example, Bloomberg recently shared the story of a young couple named Jason and Jessica Alinen...

Can you identify with them? Most young Americans just want to work hard, buy a home and start a family. But for millions of them, that dream might as well be a million miles away right now. Unfortunately, most of them have absolutely no idea why this has happened. Many of them end up blaming themselves. Many of them think that they are not talented enough or that they didn't work hard enough or that they don't know the right people. What they don't know is that the truth is that decades of incredibly foolish decisions are starting to catch up with us in a major way, and they just happen to be caught in the crossfire. Sadly, instead of becoming informed about what is happening to our country, a very large percentage of our young people are absolutely addicted to entertainment instead. Below, I want to share with you a video that I recently came across. You can find it on YouTube right here. A student at Texas Tech University recently asked some of her classmates a series of questions. When they were asked about Brad Pitt or Jersey Shore they knew the answers right away. But when they were asked who won the Civil War or who the current Vice-President of the United States is, they deeply struggled. I think that this video says a lot about where we are as a society today...

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold has never been so much in backwardation, Turk tells King World News Posted: 12 Nov 2014 05:23 PM PST 8:25p ET Wednesday, November 12, 2014 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant tells King World News tonight that gold has never been as backwardated as it is now and that a rally in the gold price always follows backwardation. An excerpt from the interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/11/12_T... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit USAGold.com. USAGold: Great prices, quick delivery -- all the time. Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bud Conrad: 'Paper gold' and its effect on the gold price Posted: 12 Nov 2014 05:16 PM PST 8:16p ET Wednesday, November 12, 2014 Dear Friend of GATA and Gold: Casey Research's chief economist, Bud Conrad, reports today that the gold futures market on the New York Commodity Exchange is so concentrated that 98.5 percent of the gold delivered to the market last month came from only three banks -- Barclays, Bank of Nova Scotia, and HSBC -- and 98 percent of the deliveries were taken by just one bank, Barclays. "The opportunity for distorting the price of gold in an environment with so few players is obvious," Conrad writes. "Barclays knows 98 percent of the buyers and is supplying 35 percent of the gold." Of course the opportunity for gold market rigging is not yet obvious to the founder of Casey Research, Doug Casey, who argues that all markets are manipulated, that it's no big deal, that central banks have no interest in gold, and it wouldn't matter if they did have any interest because they're all irrelevant anyway. But then Conrad does the research at Casey Research and Casey merely supplies the ideology and opinions, and if the research doesn't fit the ideology and opinions, it's irrelevant too. Conrad's report is headlined "'Paper Gold' and Its Effect on the Gold Price" and it's posted at the Casey Research Internet site here: http://www.caseyresearch.com/articles/paper-gold-and-its-effect-on-the-g... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Federal Reserve Is a Cartel - G. Edward Griffin Posted: 12 Nov 2014 04:28 PM PST G. Edward Griffin discusses the trajectory of the US dollar and the country's political direction with Casey Research Chief Metals & Mining Strategist Louis James during the recently concluded conference, Navigating the Politicized Economy. The Financial Armageddon Economic Collapse Blog... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Closed at $1,158.90 Down $3.90 Posted: 12 Nov 2014 03:50 PM PST

The GOLD PRICE dropped $3.90 (0.28%) at $1,158.90; the SILVER PRICE fell 4.5 cents to $15.619. This won't do. Silver and GOLD PRICES are stalled here and if they can't get passed these recent highs at $1,170 - $1,172 and $15.88. Hanging around here only burns up purchasing power, morale, and enthusiasm. In markets as in life, if you're not moving forward you're falling behind. Silver coin premiums won't shut up and strongly shout for a rally. US and UK regulators have fined UBS, HSBC, Citigroup, JP Morgan Chase, and Royal Back of Scotland $3.4 billion (average $680 mn each) for "allegedly" manipulating currency markets. But if it's only "alleged," why did they agree to pay all that dough? I note that no one went to jail, nor were there any indictments. Don't y'all think that's odd, that none of the hanchos in these giant banks are ever brought up on criminal charges? I reckon there must be 2 sets of laws, one for them, and one for us peons. Stocks bounced off that overhead resistance today. Dow shrank back 2.7 (0.02%) to 17,612.20. S&P lost 0.07% (1.43) to 2,038.25. Watch for a sharp decline. US dollar index rose 29 basis points today after losing 29 basis points yesterday. Closed at 87.90. Still trending down. Euro lost 0.28% to $1.2436, wiping out yesterday's gains. Yen bounced up 0.22% and ended at 86.53. Sorry to leave y'all short tonight, but I must keep an appointment. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Brazil Builds Its Own Fiber-Optic Network... To Avoid The NSA Posted: 12 Nov 2014 03:28 PM PST Submitted by Simon Black via Sovereign Man blog, This past week Brazil announced that it will be building a 3,500-mile fiber-optic cable to Portugal in order to avoid the grip of the NSA. What’s more, they announced that not a penny of the $185 million expected to be spent on the project will go to American firms, simply because they don’t want to take any chances that the US government will tap the system. It’s incredible how far now individuals, corporations, and even governments are willing to go to protect themselves from the government of the Land of the Free. The German government, especially upset by the discovery of US spying within its borders, has come up with a range of unique methods to block out prying ears. They have even gone so far as to play classical music loudly over official meetings so as to obfuscate the conversation for any outside listeners. They’ve also seriously contemplated the idea of returning back to typewriters to eliminate the possibilities of computer surveillance. More practically, the government of Brazil has banned the use of Microsoft technologies in all government offices, something that was also done in China earlier this year. The Red, White, and Blue Scare has now replaced the Red Scare of the Cold War era. And it comes at serious cost. From Brazil’s rejection of American IT products alone, it is estimated that American firms will lose out on over $35 billion in revenue over the next two years. Thus, as the foundation of the country’s moral high-ground begins to falter, so does its economic strength. The irony should not be lost on anyone; on a day when Americans celebrate their veterans’ courage in fighting against the forces of tyranny in the world, we find yet another example of where the rest of the world sees the source of tyranny today. It’s amazing how much things have changed. In the past, the world trusted America with so much responsibility. The US dollar was the world’s reserve currency. The US banking system formed the foundation of the global banking system. US technology became the backbone of the global Internet. But the US government has been abusing this trust for decades. Today the rest of the world realizes they no longer need to rely on the US as they once did. And in light of so much abuse and mistrust, they’re eagerly creating their own solutions. Just imagine—if Brazil is building its own fiber optic cable to avoid the NSA, it stands to reason that they would create their own alternatives in the financial system to directly compete with the IMF and the US dollar. Oh wait, they’re already doing that too. Fool me twice, shame on me. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 12 Nov 2014 03:06 PM PST Submitted by Stephen Lewis of admisi The 1937 Recession The US Federal Reserve terminated its latest programme of bond purchases at the end of last month. Though Fed officials have been at pains to point out that this did not represent a tightening in monetary policy, but at most a halt in the supply of monetary stimulus, financial market participants are not wholly convinced. They fear the shift in Fed policy is occurring before US economic growth is firmly established. They worry that the US economy will slip back into recession from lack of adequate monetary support. Some of them cite the example of 1937-38 when the US suffered a severe downturn in business activity four years into its recovery from the Great Depression. This they attribute to an untimely tightening in the Fed's policy-stance. They argue that Ms Yellen and her colleagues could be repeating the mistake of their predecessors eighty years ago. Nowadays, events in the US economy in the 1930s are seen primarily through the prism of 'A Monetary History of the United States, 1867-1960' by Milton Friedman and Anna Schwartz. This is certainly a work that greatly influenced Mr Bernanke in his responses to the policy challenges he faced after 2008. The financial markets largely accept the Friedman/Schwartz view that the troubles of the Great Depression and its aftermath were the consequence of faulty monetary policies. However, we should remember that the Friedman/Schwartz work was not entirely objective; it was produced in support of their thesis that monetary variables are the key to short-term economic fluctuations. It is not surprising, then, that their account of the 1930s experience points to that conclusion. It attaches overwhelming weight to central bank monetary policy in generating and dampening these fluctuations, while overlooking what may be other significant influences. When, in 2008, the global economy plunged into a crisis widely acknowledged as the most dangerous since the 1930s, the Friedman/Schwartz analysis naturally gained influence, as a text relevant to such situations, and with that came the current assumption that central bank monetary policy sufficiently determines whether or not an economy will achieve sustained growth with stable prices. It also seems to many observers, especially in the financial markets where historical analyses are received second-hand, that central banks ought to be on guard to avoid repeating errors they are believed to have committed all those years ago. This is why there is now a strong focus on the Fed's supposed contribution in precipitating the severe recession of 1937/38. The setback to US economic activity in 1937-38 was no small matter. The unemployment rate rose from 14.3% to 19.0%, as manufacturing output suffered a peak-to-trough fall of 37% and personal incomes declined by 15%. By comparison, during the Great Depression in the USA, unemployment had risen from 3% to 21%, industrial production had dropped by 45% and personal incomes by 44%. (It is worth noting that the post-2008 downturn did not generate statistics anything like the order of magnitude of those relating to either of these episodes, except that labour-shedding was on roughly the same scale as in 1937-38). The monetarist analysis sees the 1937 downturn as a consequence of premature tightening in US central bank policy, starting in August 1936. In the previous year, the reserves held by banks had built up to more than twice the legal requirement, a circumstance that unsettled Marriner Eccles, then Fed Chairman. His concern and that of other Fed and US Treasury officials was that the reserves overhang could prove inflationary or result in asset bubbles, as it gave banks massive scope to step up their lending. Consequently, the Fed decided, over three stages, to double the level of the reserve requirements. This is the action that, according to the monetarist account, triggered the 1937-38 recession. To be sure, there was the appropriate temporal relationship between the Fed's move and the economic downturn, with the former coming before the latter. However, while the data is scanty, it does not appear that the tightening of reserve requirements was the decisive factor, since the lending behaviour of member banks after the policy-move was similar to that of unaffected non-member banks. If higher reserve requirements had made a substantial difference to banks' lending behaviour, member banks should have been more constrained than non-member banks. The monetarist account of these events is not all that persuasive. We should bear in mind that the financial structure in the mid-1930s was, in important respects, different from today's. One important difference lay in the relative importance of gold to the monetary system. The USA went off the gold standard in 1933 but under the Gold Reserve Act in January 1934, the Roosevelt Administration withdrew gold coin from circulation and fixed the US dollar price of gold at $35/oz. At that price, gold flooded into the USA from the increasingly troubled states of Europe, thereby increasing the US money supply. The rising liquidity in US capital markets boosted asset prices and encouraged speculative activity. As a result, there was widespread misallocation of capital. Belatedly, the US Treasury moved to sterilise the monetary effects of these inflows of gold. As the flow of liquidity to the markets was cut off, the unproductive character of much of the financial investment during the recovery years was made manifest. The economy thereupon peaked and went into a slide. This Austrian School interpretation of events fits the facts rather better than the monetarist account. The lesson for policymakers today is uncomfortable. For, on this view, if there is a parallel with the 1930s, the damage has already been done. It was done when the Fed allowed funds available for investment in capital markets to balloon, not this time through unsterilized gold inflows but through its QE experiment. There are, indeed, other factors that may have led to the 1937-38 recession. Contrary to popular belief, the Roosevelt fiscal policy up to 1937 was aimed at balance; only in response to the recession did the Administration resort to Keynesian pump-priming. Fiscal policy was far looser in the aftermath of the 2008 debacle than it was from 1933 onwards. This should warn us against assuming too close a parallel between the two periods. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yra Harris On Official Swiss Objections To the Gold Referendum Posted: 12 Nov 2014 03:00 PM PST Le Cafe Américain | ||||||||||||||||||||||||||||||||||||||||||||||||||||

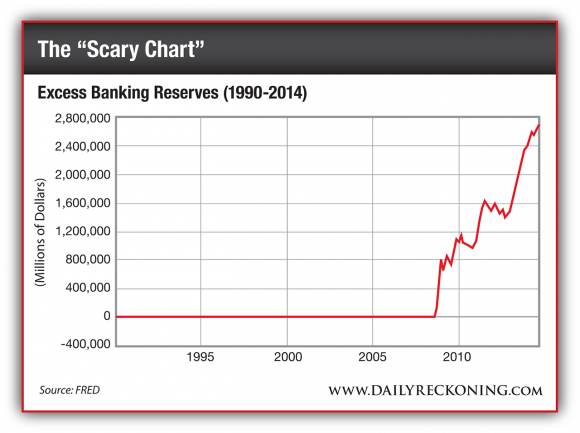

| The Number One Misconception About the Banking System — and Why You Should Care Posted: 12 Nov 2014 02:29 PM PST This post The Number One Misconception About the Banking System — and Why You Should Care appeared first on Daily Reckoning. Modern Monetary Theory, very simply, looks at how the government spends. How the government spends, how it interacts with the central bank. How the central bank interacts with the Treasury, interacts with the banking system. So the first part of MMT is really descriptive. It’s how the system actually works. In the second part of MMT, they have policy conclusions, which you can debate one way or the other, but the descriptive work is what I find most valuable. This is because for most people, the way they think the system works, it’s not the way the system actually works. So the classic example is QE, or quantitative easing, where the central bank is buying Treasury securities for example, and are replacing them with a deposit. If you look at what most people think about quantitative easing, is they immediately think that the government is printing a lot of money, and that this is inflationary. But if you actually look at the mechanics of how it works, what really happens is that QE, if anything if has a deflationary bias, and a contractionary bias. Because what it does is it deprives the private sector of a lot of interest income they would have earned otherwise. It’s, in effect, taking money that's in this savings account, and moving it into a checking account. Or instead of earning a higher yield of interest, you’re earning much less interest. That's one area where I think that it has been most helpful as an investor because most people are expecting that it will either lead to the dollar to collapse, or the lead to hyperinflation. If you look at the actual transactions and how they happen, you would come to the conclusion that's not possible. Everybody – our readers especially — have seen that chart, which shows the huge increase in excess reserves in the banking system since QE. And I thought the same, until sometime around early 2013, where I started to really revaluate everything that I thought about the banking system and how it worked. Because nothing that people were predicting would happen, happened. In fact, the opposite happened. Rates didn't go up, rates went down. Gold didn't go up, gold went down. Treasure yields are still falling at 2 percent. And the hyperinflation everyone thought was nowhere near. So I started to reexamine all those assumptions. And because of this reexamination, I think there are many things I’ve learned, but if I had to boil down the one thing I would tell you to remember is that loans create deposits. Banks don't lend deposits. On the macro view, when you’re looking at the macro economy, just because there are tremendous amount of excess reserves in the banking system, doesn't meant that those are going to leak out into the private sector. In fact, whether the excess reserves are there or not, it does not change the banking system's ability to make a new loan. It has no impact. So whether they had $3 trillion in excess reserves, or they had zero in excess reserves, it doesn't impact the banking system's ability to create new money and make new loans. And once you understand that, then you start to think: ah ha, this is why we’re not seeing that kind of hyperinflation that people might have expected with quantitative easing because it’s trapped up there in the banking system and there isn't a mechanism for it to get out. It’s not possible. [Ed. Note: For the last year or so, Chris Mayer has been extolling the virtues of the Modern Monetary Theory (MMT) -- and now it's your turn! We want to know: What's YOUR take on Modern Monetary Theory? Tell us in the comment section, below!] The post The Number One Misconception About the Banking System — and Why You Should Care appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why the Dollar’s Reserve Currency Status is America’s “Achilles Heel” Posted: 12 Nov 2014 01:39 PM PST This post Why the Dollar’s Reserve Currency Status is America’s “Achilles Heel” appeared first on Daily Reckoning. [Ed. Note: While most pundits and self-proclaimed experts herald modern central bankers as "saviors of the economy," there are a few dissenting voices who know better. We've featured many of them in the pages of the Daily Reckoning before. But below, Marc Faber quotes a rare member the mainstream financial sector who -- rather than being a cheerleader for the establishment -- isn't afraid to call out the Fed for its hazardous monetary policy. Read on...] Ned Goodman (born in 1937) is a successful entrepreneur (by background a geologist) and a philanthropist who also happens to be a billionaire, thanks to his Dundee Group of Financial, Resource and Real Estate Investments, which he founded in 1991. He is also a deep thinker, and a man with common sense and a vast knowledge. Every year, Goodman airs his insightful views in a lengthy paper (the 2013 write-up was over 90 pages) published as part of Dundee's annual report. In the 2013 report, he explains:

Of the US economy, which he calls (appropriately, in my view) the "Botox" economy, he writes:

Goodman then quoted libertarian Charles Goyette (who cooperates with Ron Paul and writes a newsletter entitled Charles Goyette's Freedom and Prosperity Letter.) According to Goyette:

I have quoted from Ned Goodman's contribution to the Dundee Group's annual report of 2013 because it is common for people in the financial sector to be central bank cheerleaders who applaud Keynesian interventions with fiscal measures (as long as they don't involve increasing taxes on the affluent members of society) and, in particular, with monetary policies as long as these are expansionary and lift financial asset prices. So, whereas I assume that Goodman is well aware that the 30-times increase in the market price of his company's stock over a 20-year period is partly due to central banks' expansionary monetary policies, he is nevertheless extremely critical of the current direction of economic policies, which have not been fully "thinking about the end before starting the beginning". Regards, Marc Faber Ed. Note: In addition to this commentary from Marc Faber (and Ned Goodman), today’s Daily Reckoning email edition contained an exclusive piece from Addison Wiggin continuing the discussion we’ve been having on Modern Monetary Theory (MMT). Not only that, but readers were also given a unique chance to learn more about how to use MMT to their advantage, and help them to better navigate the financial markets no matter what lies ahead. If you’re not getting The Daily Reckoning sent straight to your inbox, you’re missing the full story. Click here now to sign up for FREE. The post Why the Dollar’s Reserve Currency Status is America’s “Achilles Heel” appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Agents of Misfortune Posted: 12 Nov 2014 01:14 PM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Good News for Gold Bulls from the LBMA's Near Bears Posted: 12 Nov 2014 12:59 PM PST LBMA conference 2014's straw poll marks big change from lagging the bear market... GOOD news for gold bulls from the London Bullion Market Association's conference in Lima, writes Adrian Ash at BullionVault. Everyone was bearish! Or very nearly. As contrarian signals go, add this to the pile...growing taller every day. Sure, instead of sipping Pisco Sours in Peru, we're here sipping instant coffee with the same view of Hammersmith's A4 flyover in West London that we get every day. But friends and journalists who didn't think this year's conference too far to go report a stark, bearish tone to the chit-chat. We noted before last year's LBMA trip to Rome that the attendees...although "expert" industry insiders (like, umm, us)...have consistently called it wrong with their average 12-month forecast. As an average, the crowd was too timid when prices were rising, and then too confident when the bear began.  But where this unscientific poll has been consistently late, lagging the gold price up and down, it now forecasts next-to-no change in gold prices by the time of the next conference (Vienna 2015). This week in Lima, the smallest LBMA crowd since at least 2009 said gold will trade at $1200 per ounce one year from now. As a guide to sentiment, the LBMA delegates' average guess has shown just how wrong the crowd tends to be. And having lagged the turn in prices so badly since 2011, forecasting no change might be as close to bearish as it gets. When everyone's out...or at least miserable...there's only one way for prices to head. So says the "contrarian" school of long-term investing. Find an asset that's hated, and deeply oversold. Then fill your boots. Gold isn't quite there yet, perhaps. It's certainly a very long way from the hated, oversold wreck gold was at the turn of the century...dumped by central banks, investors and even Asian consumers. But with precious metals now the target of parliamentary hearings and heavy fines...and with bullion-bank traders facing personal charges of stiffing their clients...the wheel has turned full circle from the peak of the financial crisis. Instead of hedge funds and credit derivatives being the focus of lawsuits and new post-bubble rules, it's the turn of gold and silver. Coming at the same time as the "flight" or "exodus" from commodities investing (copyright, all headline writers today), some kind of low must be near. Near is a relative term, however. This choice cut of CNBC talking-head bearishness sees $1000 as a clear target. Other calls for $800 gold come from big-name fund managers and strategists are also much nearer now than they were. But that kind of wipe-out...clearing the last of the "momentum followers" who mistook gold for a bull market, rather than a flight from other, more typically profitable assets last decade...is still 30% below today. Three years after gold and silver peaked, such wipe-out forecasts might also simply reflect recent history too. Because after all, it was extrapolating the trend...just after the top in 2011 at $1900...which gave the world forecasts of $3000 gold...$5000 gold...even $10,000 gold. Such over-excited forecasts, unlike the anonymous, averaged guess from the LBMA conference floor, are of course looking for headlines. Who can forget Dow 36,000...? But even the mildest group-think cuts both ways, bullish and bearish. Because people tend to predict what they've just seen. Experts included. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Remarkable Chart Every Gold & Silver Investor Must See Posted: 12 Nov 2014 12:45 PM PST  With the war in gold and silver continuing to rage, today one of the most respected veterans in the gold world spoke with King World News about a remarkable chart that every gold and silver investor must see. Below is the extraordinary chart as well as James Turk's comments on the war in the gold market. With the war in gold and silver continuing to rage, today one of the most respected veterans in the gold world spoke with King World News about a remarkable chart that every gold and silver investor must see. Below is the extraordinary chart as well as James Turk's comments on the war in the gold market.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Today's market-rigging disclosures only hint at far greater offenses Posted: 12 Nov 2014 11:54 AM PST 2:54p ET Wednesday, November 12, 2014 Dear Friend of GATA and Gold: As much as we may claim some vindication from today's official confirmations of LIBOR and gold-market rigging -- http://www.gata.org/node/14706 http://www.gata.org/node/14707 -- they involve, after all, only the smaller participants, the investment banks that often function as agents for Western central banks. The much bigger issue is the surreptitious involvement of central banks in market rigging, and not just the rigging of the gold market but increasingly the rigging of all commodity markets, as indicated by the documents filed this year by futures exchange operator CME Group with the U.S. Commodity Futures Trading Commission and the Securities and Exchange Commission: http://www.gata.org/node/14385 http://www.gata.org/node/14411 This is an enormous story with consequences for everyone on the planet, signifying the destruction of democracy, markets, and human progress everywhere, as well as the vicious exploitation of the developing world and the transfer of its wealth to the developed world. But except for the story's political sensitivity, why can't it be reported by respectable financial news organizations? Today's disclosures are only the smallest start, by no means a conclusion. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers. (http://www.gata.org/node/173) To invest or learn more, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and Gold Producers – a CALL TO ARMS! Posted: 12 Nov 2014 11:43 AM PST How much longer are you going to let Wall Street determine the price you are permitted to charge for your product? How much longer will you stand by and watch as computer traders raise and mostly lower the price of your product, by selling contracts in the futures market for metal they do not own, and do not produce? (Bud Conrad at Caseyresearch.com has just written an excellent article, with a number of charts, on this subject titled: “Paper Gold and its effect on the Gold Price.”) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Would you die on your feet or your knees -- or even win? Posted: 12 Nov 2014 11:19 AM PST 2:21p ET Wednesday, November 12, 2014 Dear Friend of GATA and Gold: Gold mining companies that haven't already committed themselves to die quietly, and any of their shareholders who aren't completely demoralized and useless, might note what Bloomberg News was told by a market analyst in Geneva in regard to the huge fines announced today against the investment banks that were caught manipulating the LIBOR interest rate. "'Many will see this as drawing a line under this sad episode,' said Tim Dawson, an analyst at Helvea SA in Geneva who covers financial firms. 'We are less optimistic,' he said. The banks are 'likely to face a heavy burden of potential litigation in coming years.'" (See: http://www.bloomberg.com/news/2014-11-12/banks-to-pay-3-3-billion-in-fx-....) Since Switzerland's market regulatory agency announced today that it had caught Swiss banking giant UBS trying to manipulate the daily London gold fix -- http://www.gata.org/node/14707 -- and since Barclays Bank already has admitted and been fined for an incident of gold market rigging -- http://www.bloomberg.com/news/2014-05-23/barclays-fined-44-million-for-l... -- why shouldn't such litigation now become an avalanche against the bullion banks involved in the London fix and against the investment banks that have gotten anywhere near it? A class-action lawsuit is already under way against the London gold fix banks and its plaintiffs are looking for people to join their complaint. All people have to do is send an exploratory e-mail: http://www.gata.org/node/14674 Good weapons are at hand. Do you want to die on your feet or on your knees -- or would you even prefer to win? CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Own Allocated -- and Most Importantly -- Zurich, Switzerland, remains an extremely safe location for storing coins and bars of the monetary metals. If you do not own segregated physical coins and bars that you can visit, inspect, and take delivery of, you are vulnerable. International diversification remains vital to investors. GoldCore can accomplish this for you. Read GoldCore's "Essential Guide to Gold Storage In Switzerland" here: http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44 (0)203 086 9200 -- U.S.: +1-302-635-1160 -- International: +353 (0)1 632 5010 Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||