Gold World News Flash |

- Stockman - This Will Dislocate Every Market In The World

- ISIS Unveils Its New Gold-Backed Currency To Remove Itself From “The Oppressors’ Money System”

- Putin “Prepares For Economic War”, Buys Whopping 55 Tonnes Of Gold In Q3

- Obama’s Secret Treaty Would Be The Most Important Step Toward A One World Economic System

- Ted Butler urges silver miners to stand up and fight market rigging

- Currency market suspects that Swiss Gold Initiative could win, von Greyerz says

- And The Nation That Increased Prosperity The Most In The Last 5 Years Is...

- Adrian Ash: Good news for gold bulls from the near-bears of the LBMA

- "Paper Gold" And Its Effect On The Gold Price

- Is the FED private? How the government & FED secretly steal your money.

- Will the Dollar Bull Market Catch You by Surprise?

- Silver and Gold Prices Moved Sideways Today with the Gold Price Ending at $1,161.10

- Coast To Coast AM - November 12, 2014 Children's Evolution & The Culture of Numbers

- Good News for Gold Bulls from the LBMAs Near Bears

- A Massive Debt Bubble Waiting to Be Flattened

- Silver and Gold Producers a CALL TO ARMS!

- Beware the Money Illusion Coming to Destroy Your Wealth

- US and Brussels target at least 12 banks over forex

- Gold Daily and Silver Weekly Charts - La Douleur Exquise du Monde

- Recordings of New Orleans proceedings, from Greenspan to GATA, are on sale

- Swiss Gold Initiative continues to frighten Financial Times

- ISIS is going on The Gold Standard

- Gold Sector Review - Inflation, Fundamentals, Psychology/Sentiment and Technicals

- Gold Three Steps Forward, Two Steps Back

- “Paper Gold†and Its Effect on the Gold Price

- Record Volume In GDXJ Junior Gold Miners Could Indicate a Bottom

- Wrong Then, Wrong Now

- Ted Butler To Silver Miners: COMEX Is Responsible For Low Silver Prices

- GLD and SLV Technical Picture for November 2014

- How Is Paper Gold Trading Affecting The Gold Price

- Our Take on the Swiss Gold Referendum

- Now Is A Good Time To Buy Gold Says Fidelity Investments

- Worried About Gold / Silver Action - Just Read This

- Central banks 'managing' -- that is, rigging -- gold 'more actively,' LBMA is told

- Russia Continues to Buy Gold

- Gold Videocast: Exclusive Interview with Axel Merk

- Living with Ebola in Liberia

- America Funded ISIS/ISIL; Russia Turned Them Against Us

- In The News Today

- Jim’s Mailbox

- India to review gold policy after surge in imports

- Putin stockpiles gold as Russia prepares for economic war

- Thursday Morning Links

- Gold's Smoking Gun

- Gold Long Short GDXJ, DGZ ETF Technical Analysis

- Gold: Winter is Coming

- Time to Short Amazon?; and Apple Grabbing Back Market Share

| Stockman - This Will Dislocate Every Market In The World Posted: 13 Nov 2014 10:19 PM PST  Today David Stockman warned King World News about what he says will dislocate every market in the world, including stocks, bonds, commodities, and real estate. KWN takes Stockman's warnings very seriously because he is the man former President Reagan called on in 1981, during that crisis, to become Director of the Office of Management and Budget and help save the United States from collapse. Below is what Stockman, author of the website contracorner, had to say in his powerful interview. Today David Stockman warned King World News about what he says will dislocate every market in the world, including stocks, bonds, commodities, and real estate. KWN takes Stockman's warnings very seriously because he is the man former President Reagan called on in 1981, during that crisis, to become Director of the Office of Management and Budget and help save the United States from collapse. Below is what Stockman, author of the website contracorner, had to say in his powerful interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ISIS Unveils Its New Gold-Backed Currency To Remove Itself From “The Oppressors’ Money System” Posted: 13 Nov 2014 09:11 PM PST from ZeroHedge:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Putin “Prepares For Economic War”, Buys Whopping 55 Tonnes Of Gold In Q3 Posted: 13 Nov 2014 09:08 PM PST from ZeroHedge:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Obama’s Secret Treaty Would Be The Most Important Step Toward A One World Economic System Posted: 13 Nov 2014 08:55 PM PST by Michael Snyder, The Economic Collapse Blog:

Even though Congress is not being allowed to see what is in the treaty, Barack Obama wants Congress to give him fast track negotiating authority. What that means is that Congress would essentially trust Obama to negotiate a good treaty for us. Congress could vote the treaty up or down, but would not be able to amend or filibuster it. Of course now the Republicans control both houses of Congress. If they are foolish enough to blindly give Barack Obama so much power, they should all immediately resign. And it is critical that people understand that this is not just an economic treaty. It is basically a gigantic end run around Congress. Thanks to leaks, we have learned that so many of the things that Obama has deeply wanted for years are in this treaty. If adopted, this treaty will fundamentally change our laws regarding Internet freedom, healthcare, copyright and patent protection, food safety, environmental standards, civil liberties and so much more. This treaty includes many of the rules that alarmed Internet activists so much when SOPA was being debated, it would essentially ban all “Buy American” laws, it would give Wall Street banks much more freedom to trade risky derivatives and it would force even more domestic manufacturing offshore. In other words, it is the treaty from hell. In addition to imposing Obama’s vision for the world on 40 percent of the global population, it is also being described as a “Christmas wish-list for major corporations”. Of the 29 chapters in the treaty, only five of them actually deal with economic issues. The rest of the treaty deals with a whole host of other issues of great importance to the global elite. The following list of issues addressed by this treaty is from a Malaysian news source…

Why can’t we get this type of reporting in the United States? And if this treaty is ultimately approved by Congress, we will essentially be stuck with it forever. This treaty is written in such a way that the United States will be permanently bound by all of the provisions and will never be able to alter them unless all of the other countries agree. Are you starting to understand why this treaty is so dangerous? This treaty is the key to Obama’s “legacy”. He wants to impose his will upon 40 percent of the global population in a way that will never be able to be overturned. Of course Obama is touting this treaty as the path to economic recovery. He promises that it will greatly increase global trade, decrease tariffs and create more jobs for American workers. But instead, it would be a major step toward destroying what is left of the U.S. economy. Over the past several decades, every time a major trade agreement has been signed we have seen even more good jobs leave the United States. And it doesn’t take a genius to figure out why this is happening. If corporations can move jobs to the other side of the planet to nations where it is legal to pay slave labor wages, they will make larger profits. Just think about it. If you were running a corporation and you had the choice of paying workers ten dollars an hour or one dollar an hour, which would you choose? Plus there are so many other costs, taxes and paperwork hassles when you deal with American workers. For example, big corporations will not have to provide Obamacare for their foreign workers. That alone will represent a huge savings. Any basic course in economics will teach you that labor flows from markets where labor costs are high to markets where labor costs are lower. And at this point it costs less to make almost everything overseas. As a result, we have already lost millions upon millions of good jobs, and countless small and mid-size U.S. companies have been forced to shut down because they cannot compete with foreign manufacturers. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ted Butler urges silver miners to stand up and fight market rigging Posted: 13 Nov 2014 08:07 PM PST 11:08p ET Thursday, November 13, 2014 Dear Friend of GATA and Gold: Silver market analyst Ted Butler, the original exposer of metals market rigging, is urging silver mining companies to complain to market regulators in the United States, not in any expectation of regulatory action but rather to send a signal to the rest of the world. Butler's appeal, made in his proprietary newsletter -- https://www.butlerresearch.com/ -- is excerpted in the clear in today's edition of GATA board member Ed Steer's Gold and Silver Daily letter at Casey Research: http://www.caseyresearch.com/gsd/edition/swiss-regulator-clear-attempt-t... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Currency market suspects that Swiss Gold Initiative could win, von Greyerz says Posted: 13 Nov 2014 06:18 PM PST 9:21p ET Thursday, November 13, 2014 Dear Friend of GATA and Gold: Fines against the major investment banks for their currency market rigging are trivial compared to the profits the banks made from their misconduct, just a small cost of doing crooked business, Swiss gold fund manager Egon von Greyerz tells King World News tonight. He adds that the currency market seems to be pricing the Swiss franc as if the Swiss Gold Initiative could be approved at referendum on November 30. An excerpt from von Greyerz's interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/11/13_S... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit USAGold.com. USAGold: Great prices, quick delivery -- all the time. Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| And The Nation That Increased Prosperity The Most In The Last 5 Years Is... Posted: 13 Nov 2014 06:16 PM PST ...Rwanda.

And the biggest collapse in prosperity since 2009 has occurred in Greece - stunningly outpacing war torn, sanctioned Syria to the downside.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adrian Ash: Good news for gold bulls from the near-bears of the LBMA Posted: 13 Nov 2014 06:09 PM PST 9:10p ET Thursday, November 13, 2014 Dear Friend of GATA and Gold: Bullion Vault research director Adrian Ash remarks tonight on the pervasive bearishness reported from the London Bullion Market Association conference in Lima, Peru. "When everyone's out, or at least miserable," Ash writes, "there's only one way for prices to head. So says the 'contrarian' school of long-term investing. Find an asset that's hated and deeply oversold. Then fill your boots." He adds pretty sagely, "People tend to predict what they've just seen." Ash's commentary is headlined "Good News for Gold Bulls from the LBMA's Near-Bears" and it's posted at Bullion Vault here: https://www.bullionvault.com/gold-news/gold-bears-111220142 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| "Paper Gold" And Its Effect On The Gold Price Posted: 13 Nov 2014 05:48 PM PST Submitted by Bud Conrad via Casey Research, Gold dropped to new lows of $1,130 per ounce last week. This is surprising because it doesn’t square with the fundamentals. China and India continue to exert strong demand on gold, and interest in bullion coins remains high. I explained in my October article in The Casey Report that the Comex futures market structure allows a few big banks to supply gold to keep its price contained. I call the gold futures market the “paper gold” market because very little gold actually changes hands. $360 billion of paper gold is traded per month, but only $279 million of physical gold is delivered. That’s a 1,000-to-1 ratio:

We know that huge orders for paper gold can move the price by $20 in a second. These orders often exceed the CME stated limit of 6,000 contracts. Here’s a close view from October 31, when the sale of 2,365 contracts caused the gold price to plummet and forced the exchange to close for 20 seconds:

Many argue that the net long-term effect of such orders is neutral, because every position taken must be removed before expiration. But that’s actually not true. The big players can hold hundreds of contracts into expiration and deliver the gold instead of unwinding the trade. Net, big banks can drive down the price by delivering relatively small amounts of gold. A few large banks dominate the delivery process. I grouped the seven biggest players below to show that all the other sources are very small. Those seven banks have the opportunity to manage the gold price:

After gold’s big drop in October, I analyzed the October delivery numbers. The concentration was even more severe than I expected:

This chart shows that an amazing 98.5% of the gold delivered to the Comex in October came from just three banks: Barclays; Bank of Nova Scotia; and HSBC. They delivered this gold from their in-house trading accounts. The concentration was even worse on the other side of the trade—the side taking delivery. Barclays took 98% of all deliveries for customers. It could be all one customer, but it’s more likely that several customers used Barclays to clear their trades. Either way, notice that Barclays delivered 455 of those contracts from its house account to its own customers. The opportunity for distorting the price of gold in an environment with so few players is obvious. Barclays knows 98% of the buyers and is supplying 35% of the gold. That’s highly concentrated, to say the least. And the amounts of gold we’re talking about are small—a bank could tip the supply by 10% by adding just 100 contracts. That amounts to only 10,000 ounces, which is worth a little over $11 million—a rounding error to any of these banks. These numbers are trivial. Note that the big banks were delivering gold from their house accounts, meaning they were selling their own gold outright. In other words, they were not acting neutrally. These banks accounted for all but 19 of the contracts sold. That’s a position of complete dominance. Actually, it’s beyond dominance. These banks are the market. My point is that this market is much too easily rigged , and that the warnings about manipulation are valid. At some point, too many customers will demand physical delivery and there will be a big crash. Long contracts will be liquidated with cash payouts because there won’t be enough gold to deliver. I saw a few squeezes in my 20 years trading futures, including gold. In my opinion, the futures market is not safe. The tougher question is: for how long will big banks’ dominance continue to pressure gold down? Unfortunately, I don’t know the answer. Vigilant regulators would help, but “futures market regulators” is almost an oxymoron. The actions of the CFTC and the Comex, not to mention how MF Global was handled, suggest that there has been little pressure on regulators to fix this obvious problem. This quote from a recent Financial Times article does give some reason for optimism, however: UBS is expected to strike a settlement over alleged trader misbehaviour at its precious metals desks with at least one authority as part of a group deal over forex with multiple regulators this week, two people close to the situation said. … The head of UBS’s gold desk in Zurich, André Flotron, has been on leave since January for reasons unspecified by the lender…. The FCA fined Barclays £26m in May after an options trader was found to have manipulated the London gold fix. Germany’s financial regulator BaFin has launched a formal investigation into the gold market and is probing Deutsche Bank, one of the former members of a tarnished gold fix panel that will soon be replaced by an electronic fixing. The latter two banks are involved with the Comex. Eventually, the physical gold market could overwhelm the smaller but more closely watched US futures delivery market. Traders are already moving to other markets like Shanghai, which could accelerate that process. You might recall that I wrote about JP Morgan (JPM) exiting the commodities business, which I thought might help bring some normalcy back to the gold futures markets. Unfortunately, other banks moved right in to pick up JPM’s slack. Banks can’t suppress gold forever. They need physical gold bullion to continue the scheme, and there’s just not as much gold around as there used to be. Some big sources, like the Fed’s stash and the London Bullion Market, are not available. The GLD inventory is declining.

If a big player like a central bank started to use the Comex to expand its gold holdings, it could overwhelm the Comex’s relatively small inventories. Warehouse stocks registered for delivery on the Comex exchange have declined to only 870,000 ounces (8,700 contracts). Almost that much can be demanded in one month: 6,281 contracts were delivered in August. The big banks aren’t stupid. They will see these problems coming and can probably induce some holders to add to the supplies, so I’m not predicting a crisis from too many speculators taking delivery. But a short squeeze could definitely lead to huge price spikes. It could even lead to a collapse in the confidence in the futures system, which would drive gold much higher. Signs of high physical demand from China, India, and small investors buying coins from the mint indicate that gold prices should be rising. The GOFO rate (London Gold Forward Offered rate) went negative, indicating tightness in the gold market. Concerns about China’s central bank wanting to de-dollarize its holdings should be adding to the interest in gold. In other words, it doesn’t add up. I fully expect currency debasement to drive gold higher, and I continue to own gold. I’m very confident that the fundamentals will drive gold much higher in the long term. But for now, I don’t know when big banks will lose their ability to manage the futures market. Oddities in the gold market have been alleged by many for quite some time, but few know where to start looking, and even fewer have the patience to dig out the meaningful bits from the mountain of market data available. * * * Casey Research Chief Economist Bud Conrad is one of those few—and he turns his keen eye to every sector in order to find the smart way to play it. This is the kind of analysis that’s especially important in this period of uncertainty and volatility… and you can put Bud’s expertise—along with the other skilled analysts’ talents—to work for you by taking a risk-free test-drive of The Casey Report right now. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is the FED private? How the government & FED secretly steal your money. Posted: 13 Nov 2014 05:30 PM PST Ron Paul (1988) Is the FED private? How the government secretly steals your money with help from the FED. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will the Dollar Bull Market Catch You by Surprise? Posted: 13 Nov 2014 05:23 PM PST By: Brad at www.CapitalistExploits.at A bull market in the US Dollar is underway and its magnitude and duration are likely to catch everyone by surprise. I believe it isn't out of the question for the USD Index to advance by at least 50% within the next 5 years. If this forecast proves correct, there will be profound ramifications for the global economy and many financial markets, particularly emerging markets. The Dollar Index has advanced by about 10% in the last 6 months, which is quite a sizeable move. However, if one takes a long-term view this isn't a large move. What I am interested in is the USD trading sideways for the last 7 years. Usually when a market has been locked in a trading range for a long period of time a breakout to the upside signals the start of a long-term bull trend. Note the long-term chart of the Dollar Index below - the bull markets in the early 1980s and late 1990s occurred after long periods of sideways movements. After some 7 years of "oscillating" around the 80 level it is about due for an extended period of upward movement. This isn't hard to work out. It is the "collateral damage" of an extended bull market in the dollar that will be difficult to estimate!

A rising dollar is indicating the relative strength of the US economy relative to other economies and it will no doubt be a leading indicator of rising interest rates. Given that very few are expecting or positioned for higher rates in the future, this will have very important ramifications for many financial markets. This has already started to play out in a number of markets, particularly commodity markets. Although a number of commodity prices have fallen quite significantly from their highs of 2011, if the behavior of the CRB Index below is anything to go by, we may well see the average commodity price fall by another 50% within the next 5 years!

Even if I am wrong and commodity prices only fall another 25% it would still take the CRB Index back to its GFC lows of about 350 and this will have a profound effect on emerging markets. This is where we need to tread carefully - the two previous US dollar bull markets have seen dramatic collapses in emerging market economies and financial markets. The early 1980s saw the Latin American shock. The 1995-2001 bull market brought down Asia and Russia with the Asian Tiger Crisis (1997) and the LTCM crisis (1998) respectively, one could also include the Argentine default in late 2001 as well! In short - extended periods of USD strength are associated with emerging markets financial crisis! It has been a while since we have witnessed an emerging market centric crisis. One of the most dramatic was the "Asian tiger" crisis of 1997. During this time many emerging market currencies fell by some 50% against the USD. Note behavior of the JPMorgan Asian Dollar Index (Asian currencies against the USD) below. This index was trending down well before the crisis hit in October 1997, the crisis didn't occur without a long period of warning! Also note the trading range with which it has been locked in for the last 4 years - the next move will be big and by all accounts it does appear to be to the downside!

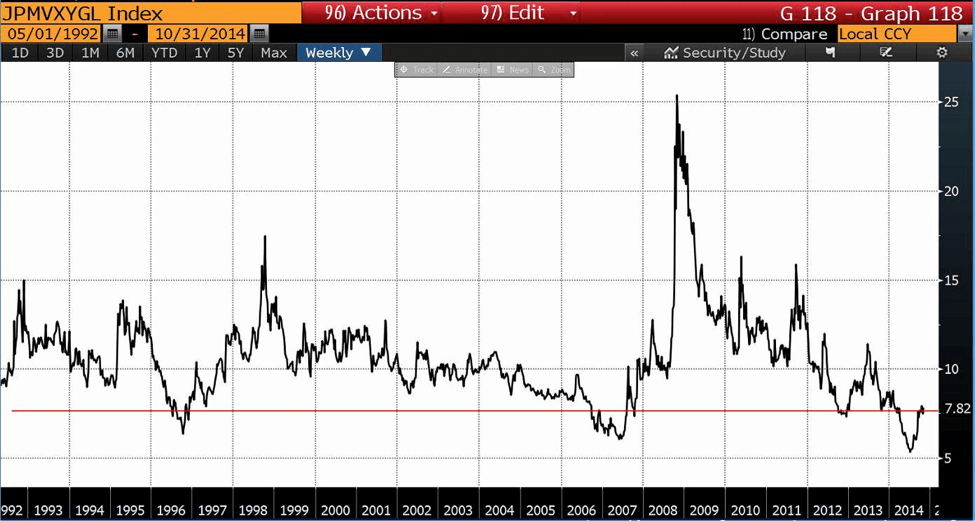

From great lows in volatility come great highs - or something like that. In July this year something occurred in currency markets that we haven't experienced in at least a generation - "record" lows in implied volatility. Below is the JPMorgan Global Implied Volatility Index (think of it as the VIX of currency markets). It got to a record low in July.

This index only goes back to 1992. So it is a "record" as from 1992. However, if the index did go back another 20 years I find it doubtful it would have registered any lower readings. What is the big deal here, you might ask. Never before have currency traders have currency traders been so unanimous in their belief that the USD would trade in such a narrow trading range - i.e. not move at all over the coming months. There could be a number of reasons for this but as far as I am concerned they are somewhat inconsequential! I am a great believer in "contrarianism". Contrarians live by the saying "when everyone thinks alike the opposite is most likely to happen". Why does this happen? Well, when everyone thinks alike there isn't anyone left to think alike so by default the opposite must occur. That is easy. The hardest part is in being able to identify the extent to which everyone thinks alike. However, it is somewhat of a dead giveaway that everyone is thinking alike when a record low in implied volatility occurs! So from a behavioral perspective currency markets are entering a period of increasing volatility, extreme lows in volatility usually lead to extreme highs so get ready for the ride! The current level of implied volatility isn't high by historical standards. This means that if someone wants to express a bullish view on the USD the most efficient way to do it is via long-term options. Fundamentally - what supports a bull market in the USD and an eventual crisis in emerging markets? I previously touched upon this in my writings on the Singapore dollar and the Chinese renminbi, but in essence it is the "unwind" of the carry trade. We would be delusional to imagine that the capital flows that have poured into emerging market real estate, local currency bond and equity markets will be immune to an appreciating US dollar and some rise in US interest rates. I will quote Ambrose Evans-Pritchard's latest article in the Daily Telegraph to shed light on the carry trade:

Let us not forget that the US Dollar was in a bear market for some 10 years (from 2001 to 2011). Yes, one could argue over a year or two but at the end of the day the USD has been out of favour for a very long period of time. Given all the "death of the USD" commentary that was being bantered about up until a couple of months ago, it is hardly surprising that a huge complacency grew towards a multi-year bull market in the USD. Therefore, the magnitude of the carry trade "unwind" is likely to be way underappreciated. Holders of long term call options on the USD against emerging market currencies are likely to be pleasantly surprised over the coming months. - Brad

"The chart of the US dollar is by far and away the most important chart on earth." - Raoul Pal | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and Gold Prices Moved Sideways Today with the Gold Price Ending at $1,161.10 Posted: 13 Nov 2014 05:03 PM PST

The metals' breaks below 15 month support levels has, on one hand, wrecked the picture technically. On the other hand, it means that the end of the correction draweth nigh -- but how nigh? US dollar today lost 7 basis points but the daily chart was flat. As long as the dollar and stocks are rising hand in hand, silver and gold will remain red-headed stepchildren. Chart says the US dollar index could rise to 89, maybe to 92. A rising dollar alone is not necessarily strychnine for gold and silver, not if stocks break, but if the Dow breaks through here, why, we're looking at another 6-8 months or more of this misery. Silver and GOLD PRICES today moved sideways in a narrow range. To break out the first step for gold is a close above $1,180, and for the SILVER PRICE it's $16.00. Short of that, they're just marking time for another fall. Don't shoot the messenger, I'm just reporting what I see. This has been an awfully sleepy week, which always leaves me suspicious and flinching.. Stocks have ground to higher highs the way you'd grind corn with quern-stone, little by little. Dow reached a new high today at 17,652.79, up another 40.59 or 0.23%. However, the S&P500 stalled and rose only 1.08 (0.05%) to 2,039.33. Any time now. I note in passing that one may draw an uptrend line from the April 2009 low in the Dow that riseth until this day. On 22 September the Dow broke down through that line and dropped like your grade average after you picked up beer drinking in college. Last three days it has been bumping up against that line. Markets frequently break out, move, then trade back to the breakout line for one last kiss good-bye. Analogous break in the S&P500 came 13 October, but it only traded below that line six days. S&P500 is now bumping against another overhead resistance line. MACD and Stochastics are at highest levels seen during this bull move. I don't know - maybe it can go on forever. Dow in gold and Dow in silver are vibrating up and down in tiny zigzags. After their parabolic moves up, they look like they are quivering to begin what always happens after a parabolic up move: a concrete-block drop. DiG today rose 0.23% to 15.19 oz or G$314.00 gold dollars. Dow in Silver rose 0.23%, too, to 1,128.33 oz or $1,458.85. Both have thrown-over resistance lines above, so are ripe for a fall. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Coast To Coast AM - November 12, 2014 Children's Evolution & The Culture of Numbers Posted: 13 Nov 2014 04:24 PM PST Coast To Coast AM - November 12, 2014 Children's Evolution & The Culture of Numbers The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Good News for Gold Bulls from the LBMAs Near Bears Posted: 13 Nov 2014 03:18 PM PST Bullion Vault | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Massive Debt Bubble Waiting to Be Flattened Posted: 13 Nov 2014 03:16 PM PST This post A Massive Debt Bubble Waiting to Be Flattened appeared first on Daily Reckoning. Not much market action yesterday. The Dow was flat. Gold was flat. TV screens are flat. Some singers are flat. Cakes come out flat. Tires go flat. Prizefighters are laid out flat. Dead men, too. Sooner or later, we all go flat. One of our favorite columnists, Thomas Friedman, wrote a book about it, The World Is Flat. …superficial thinking… [is] the unleaded gas that purposeful jackasses put in their tanks. You can count on Friedman. He's bound to have something to say on almost any subject. He has so many thoughts because they come so cheaply to him. He is not a deep thinker. He is in over his head in a parking lot puddle. But we have no quarrel with superficial thoughts. They are better in many ways. Easier to understand and repeat at dinner parties. And much more easily put to service by men of action. That's the real benefit of all superficial thinking: It's the unleaded gas that purposeful jackasses put in their tanks. Forget the nuances. Ignore the paradoxes. Don't overthink it. Give them a simple idea, and they can use it to make a grand mess of anything. Friedman is a world improver. Not in a way that would make things better. If he wanted to do that he could paint his windows, pick up trash on the sidewalk and flirt with the fat meter maid. No. He insists on telling other people what to do. He is not a real doer; he is a real pain in the derriere. He has a plan for every situation and a fix for every problem. In every case, he claims to be able to look into the future and make it better before it happens. Remember our dictum: People who try to force others to abide by their ideas are always the same people whose ideas are moronic. You can quote us on that. Years after publication, Friedman explained what he had in mind in his 1993 book:

Friedman was right. Globalization, under the umbrella of Pax Americana, was a trend. He spotted it. He teased it out. And he wrote a book about it that was a bestseller. But there was much more to globalization than new technology and American capitalism. Importantly, it was financed by a corrupt new money system. Under the postwar Bretton Woods agreement, foreign nations linked their currencies to the US dollar… and the dollar was linked to gold at a fixed rate. Over centuries, gold had proven useful. It may not be perfect money. But it was the best yet discovered. Some crypto currency, such as Bitcoin, may eventually prove more useful. But that is for the future to decide. For us, for now, gold works. "Fiat," or paper money, does not. Since the supply of gold is limited, consumer prices tend to remain stable. The supply of credit is also limited, because the currency is limited. When demand for credit increases, the price of it (interest rates) goes up. And the credit-fueled boom comes to an end. Back in the 1960s, President Johnson pursued an expensive, hopeless war in Vietnam and an ambitious giveaway program at home. "Guns and butter" — he wanted it all. As the bills came due, the financial whizzes in Washington had a simpleminded idea: "Rather than pay up in gold, as is customary (and statutory), let's change the system so we can pay our debts in IOUs — just green pieces of paper that we'll call dollars." "Wait a minute," more thoughtful people objected. "A purely fiat money system has never worked. If you could create real money just by printing up pieces of green paper, everyone would do it." Determined not to overthink it, the authorities applauded the benefits of this new "flexible" currency. In 1968, Johnson asked Congress to remove the requirement that the dollar be backed by gold. Then in 1971, his successor, Richard Nixon, ended the direct convertibility of the dollar to gold. Thus, the US abandoned gold and took the lid off the money pot. Now, there was almost no limit to how much cash could be created… how much credit could be boiled up… or how many bubbles could come rising from the hot, open crock. The world was not so much flattened as hammered into a grotesque new shape by US monetary policy. Now, people could buy things they couldn't afford and probably didn't need with money they didn't have. Credit cards, lines of credit, mortgages and their derivatives! Without gold, the feedback looped around in the wrong direction. American consumers bought — on credit — Chinese goods. Dollars went to China. And to keep its currency from appreciating versus the dollar, the Chinese government had to create renminbi to buy up the dollars from private holders. This caused a boom in China, which added extra capacity to China's export machine and pinched off more and more of America's industrial output. Then what could China do with all these dollars? It had to invest them back into the US. So it bought US Treasury debt. This helped push down US interest rates, stimulating more credit-fueled buying. The world was not so much flattened as hammered into a grotesque new shape by US monetary policy. The Chinese produced too much. The Americans consumed too much. And all over the world, a huge debt bubble got bigger and bigger — waiting to be flattened. Regards, Bill Bonner Ed. Note: Bill Bonner co-founded The Daily Reckoning with fellow New York Times bestselling author Addison Wiggin over ten years ago. And since its inception it has been one of the most informative and entertaining reads you can find anywhere in the world. And right now, you can get The Daily Reckoning sent straight to your email inbox, absolutely FREE. Click here now to sign up and discover all the unique benefits the Daily Reckoning email has to offer. This article originally appeared in Bill Bonner’s Diary of a Rogue Economist, here. The post A Massive Debt Bubble Waiting to Be Flattened appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and Gold Producers a CALL TO ARMS! Posted: 13 Nov 2014 02:09 PM PST Peter Degraaf | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Beware the Money Illusion Coming to Destroy Your Wealth Posted: 13 Nov 2014 01:42 PM PST This post Beware the Money Illusion Coming to Destroy Your Wealth appeared first on Daily Reckoning. A money illusion sounds like something a prestidigitator performs by pulling $100 bills from a hat shown to be empty moments before. In fact, money illusion is a longstanding concept in economics that has enormous significance for you if you're a saver, investor or entrepreneur. Money illusion is a trick, but it is not one performed on stage. It is a ruse performed by central banks that can distort the economy and destroy your wealth. …that people prefer a raise over a pay cut while ignoring inflation is the essence of money illusion. The money illusion is a tendency of individuals to confuse real and nominal prices. It boils down to the fact that people ignore inflation when deciding if they are better off. Examples are everywhere. Assume you are a building engineer working for a property management company making $100,000 per year. You get a 2% raise, so now you are making $102,000 per year. Most people would say they are better off after the raise. But if inflation is 3%, the $102,000 salary is worth only $98,940 in purchasing power relative to where you started. You got a $2,000 raise in nominal terms but you suffered a $1,060 pay cut in real terms. Most people would say you're better off because of the raise, but you're actually worse off because you've lost purchasing power. The difference between your perception and reality is money illusion. The impact of money illusion is not limited to wages and prices. It can apply to any cash flow including dividends and interest. It can apply to the asset prices of stocks and bonds. Any nominal increase has to be adjusted for inflation in order to see past the money illusion. The concept of money illusion as a subject of economic study and policy is not new. Irving Fisher, one of the most famous economists of the 20th century, wrote a book called The Money Illusion in 1928. The idea of money illusion can be traced back to Richard Cantillon's Essay on Economic Theory of 1730, although Cantillon did not use that exact phrase. Economists argue that money illusion does not exist. Instead, they say, you make decisions based upon "rational expectations." That means once you perceive inflation or expect it in future, you will discount the value of your money and invest or spend it according to its expected intrinsic value. In effect, inflation is a hidden tax used to transfer wealth from savers to debtors… Like much of modern economics, this view works better in the classroom than in the real world. Experiments by behaviorists show that people think a 2% cut in wages with no change in the price level is "unfair." Meanwhile, they think a 2% raise with 4% inflation is "fair." In fact, the two outcomes are economically identical in terms of purchasing power. The fact, however, that people prefer a raise over a pay cut while ignoring inflation is the essence of money illusion. The importance of money illusion goes far beyond academics and social science experiments. Central bankers use money illusion to transfer wealth from you — a saver and investor — to debtors. They do this when the economy isn't growing because there's too much debt. Central bankers try to use inflation to reduce the real value of the debt to give debtors some relief in the hope that they might spend more and help the economy get moving again. Of course, this form of relief comes at the expense of savers and investors like you who see the value of your assets decline. Again a simple example makes the point. Assume a debtor bought a $250,000 home in 2007 with a $50,000 down payment and a $200,000 mortgage with a low teaser rate. Today, the home is worth $190,000, a 24% decline in value, but the mortgage is still $200,000 because the teaser rate did not provide for amortization. This homeowner is "underwater" — the value of his home is worth less than the mortgage he's paying — and he's slashed his spending in response. In this scenario, assume there is another individual, a saver, with no mortgage and $100,000 in the bank who receives no interest under the Fed's zero interest rate policy. Suppose a politician came along who proposed that the government confiscate $15,000 from the saver to be handed to the debtor to pay down his mortgage. Now the saver has only $85,000 in the bank, but the debtor has a $190,000 house with a $185,000 mortgage, bringing the debtor's home above water and a giving him a brighter outlook. The saver is worse off and the debtor is better off, each because of the $15,000 transfer payment. Americans would consider this kind of confiscation to be grossly unfair, and the politician would be run out of town on a rail. Now assume the same scenario, except this time, the Federal Reserve engineers 3% inflation for five years, for a total of 15% inflation. The saver still has $100,000 in the bank, but it is worth only $85,000 in purchasing power due to inflation. The borrower would still owe $200,000 on the mortgage, but the debt burden would be only $170,000 in real terms after inflation. Better yet, the house value might rise by $28,000 if it keeps pace with inflation, making the house worth $218,000 and giving the debtor positive home equity again. The two cases are economically the same. In the first case, the wealth transfer is achieved by confiscation, and in the second case, the wealth transfer is achieved by inflation. The saver is worse off and the debtor is better off in both cases. But confiscation is politically unacceptable, while inflation of 3% per year is barely noticed. In effect, inflation is a hidden tax used to transfer wealth from savers to debtors without causing the political headaches of a real tax increase. Why do central banks such as the Fed pursue money illusion policies? The answer involves another academic theory that doesn't work in the real world. The Fed believes that underwater debtors are from a lower income tier than savers and investors. This means the debtors have what's called higher marginal propensity to consume, or MPC. The MPC measures how much you spend out of each dollar of wealth you gain. If you gained $1,000 and decided to spend $50, your MPC would be 5%. If you spent nothing after getting an additional $1,000, your MPC would be 0%. Academic theory says that poorer debtors have a higher MPC than wealthier savers. This means that if inflation transfers wealth from savers to debtors, total spending will go up because the debtors will spend more of the money than the savers would have. This is said to benefit debtors and savers, because debtors gain from the increased wealth, while savers gain from more overall spending in the form of jobs, business revenues and stock prices. This makes inflation a win-win. If your savings are eroded by inflation, the pain is real and your spending may be cut. This theory sounds neat and tidy, but it has serious flaws. By lumping all savers together, the theory fails to distinguish between truly wealthy savers and middle-class savers. It may be true that if you're a very wealthy saver, you have a low MPC. If you are spending a certain amount on vacations and fine wine and the Fed steals some of your savings through inflation, you will probably spend just as much on vacations and fine wine. But if you're part of the middle class who is struggling with an unemployed spouse, children's tuition, elderly parents' health care and higher property taxes, your savings and investments are a lifeline you cannot afford to lose. If your savings are eroded by inflation, the pain is real and your spending may be cut. There is no free lunch. Cantillon in the 1730s suggested an even more insidious flaw in the central bank's reasoning. He said that inflation does not move uniformly through an economy. It moves with lags, something Milton Friedman also said in the 1970s. Inflation, according to Cantillon, moves in concentric circles from a small core of people to an ever widening group of affected individuals. Think of the way ripples spread out when you drop a pebble in a pond. Cantillon said that the rich and powerful are in the inner circle and see the inflation first. This gives them time to prepare. The middle class are in the outer circles and see the inflation last. They are the victims of lost purchasing power. This Cantillon Effect may explain why wealthy investors such as Warren Buffett are buying hard assets like railroads, oil and natural gas that will retain value when inflation hits. Official measures of inflation are low today but those in the inner circle already see it coming first, just as Cantillon suggested. If you're in the wider circles, however, you may stay in conventional stock and bond portfolios too long and will see the value of your assets diluted by inflation. You may not realize it until it's too late, either. The money illusion deceives everyday investors. If you own hard assets prior to stage three, you'll be spared. But if you don't, it will be too late… Money illusion has four stages. In stage one, the groundwork for inflation is laid by central banks but is not yet apparent to most investors. This is the "feel good" stage where people are counting their nominal gains but don't see through the illusion. Stage two is when inflation becomes more obvious. Investors still value their nominal gains and assume inflation is temporary and the central banks "have it under control." Stage three is when inflation begins to run away and central banks lose control. Now the illusion wears off. Savings and other fixed-income cash flows such as insurance, annuities and retirement checks rapidly lose value. If you own hard assets prior to stage three, you'll be spared. But if you don't, it will be too late because the prices of hard assets will gap up before the money illusion wears off. Finally, stage four can take one of two paths. The first path is hyperinflation, such as Weimar Germany or Zimbabwe. In that case, all paper money and cash flows are destroyed and a new currency arises from the ashes of the old. The alternative is shock therapy of the kind Paul Volcker imposed in 1980. In that case, interest rates are hiked as high as 20% to kill inflation… but nearly kill the economy in the process. Right now, we are in late stage one, getting closer to stage two. Inflation is here in small doses and people barely notice. Savings are being slowly confiscated by inflation, but investors are still comforted by asset bubbles in stocks and real estate. Be nimble and begin to buy some inflation insurance in the form of hard assets before the Stage Three super-spike puts the price of those assets out of reach. Regards, Jim Rickards Ed. Note: "Wiped-out savers broke out in money riots," Jim wrote in his dystopian account of life in the U.S. 10 years from now "but were quickly suppressed by militarized police who used drones, night-vision technology, body armor and electronic surveillance. Highway tollbooth digital scanners were used to spot and interdict those who tried to flee by car…" Spooky stuff. And it only gets scarier from there… Don’t miss you chance to access to the full account of the dangerous trends Mr. Rickards already sees in place today. Click here now to sign up for The Daily Reckoning email edition, completely free of charge. The post Beware the Money Illusion Coming to Destroy Your Wealth appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US and Brussels target at least 12 banks over forex Posted: 13 Nov 2014 01:21 PM PST Kara Scannell and Alex Barker Six banks agreed a $4.3 billion settlement with UK, US, and Swiss regulators on Wednesday for allegedly attempting to manipulate the foreign exchange market. But for them and at least half a dozen other banks and their legal and public relations, the exposure is far from over as US and European investigators continue to pursue cases. The US Department of Justice is investigating numerous banks, former traders, and salesmen for allegedly manipulating the $5.3 trillion forex market and overcharging customers, while evidence obtained by Europe's top competition authority, people close to the probe said, is of "startling quality." The investigations, which are expected to play out over the next year or longer, will probably result in large fines and criminal findings from the DoJ, these people say. ... ... For the remainder of the report: http://www.ft.com/intl/cms/s/0/3f33027a-6b51-11e4-9337-00144feabdc0.html... ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers. (http://www.gata.org/node/173) To invest or learn more, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - La Douleur Exquise du Monde Posted: 13 Nov 2014 01:17 PM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Recordings of New Orleans proceedings, from Greenspan to GATA, are on sale Posted: 13 Nov 2014 01:06 PM PST 4:09p ET Thursday, November 13, 2014 Dear Friend of GATA and Gold: The entire proceedings of last month's New Orleans Investment Conference, from the interviews with former Federal Reserve Chairman Alan Greenspan to the presentations of GATA Chairman Bill Murphy and your secretary/treasurer, including the latter's debate with Casey Research founder Doug Casey about gold price suppression, are now available for purchase on compact disc, DVDs, and streaming video. Not only that, but you can choose to buy the whole works or just the presentations of special interest to you -- and the conference has generously offered to share with GATA the revenue generated by purchases by GATA supporters. To learn more and to help GATA earn a little money here, please use this Internet link: https://jeffersoncompanies.com/landing/2014-av-powell CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Own Allocated -- and Most Importantly -- Zurich, Switzerland, remains an extremely safe location for storing coins and bars of the monetary metals. If you do not own segregated physical coins and bars that you can visit, inspect, and take delivery of, you are vulnerable. International diversification remains vital to investors. GoldCore can accomplish this for you. Read GoldCore's "Essential Guide to Gold Storage In Switzerland" here: http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44 (0)203 086 9200 -- U.S.: +1-302-635-1160 -- International: +353 (0)1 632 5010 Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Swiss Gold Initiative continues to frighten Financial Times Posted: 13 Nov 2014 12:51 PM PST Anxious Gold Bugs Swarm Switzerland's Central Bank By James Shotter ZURICH, Switzerland -- From rescuing Switzerland's biggest bank during the financial crisis to stemming a dramatic appreciation of the franc, the Swiss National Bank has faced its fair share of challenges in recent years. Now another is looming: "Save Our Swiss Gold." That is the name of a radical initiative that the Swiss public will vote on November 30 that would drastically change how the central bank functions. If accepted, it would force the SNB to hold at least 20 per cent of its assets in gold; ban it from ever selling the metal; and require all its gold to be stored in Switzerland. The initiative is the latest in a string of proposals fuelled by mounting popular anxiety in Switzerland about the 8 million-strong nation's ability to control its affairs in a turbulent world. ... ... For the remainder of the report: http://www.ft.com/cms/s/0/218f6cec-6a1e-11e4-9f65-00144feabdc0.html#axzz... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 BullionStar is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. BullionStar's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in BullionStar's bullion vault, which is integrated with BullionStar's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ISIS is going on The Gold Standard Posted: 13 Nov 2014 12:48 PM PST Terrorists Love Silver! And Gold! ISIS wants Silver and Gold! So does China... Russia... India... All of you and now even Alan Greenspan himself! The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Sector Review - Inflation, Fundamentals, Psychology/Sentiment and Technicals Posted: 13 Nov 2014 12:46 PM PST Below is a summary of some of the aspects we follow in NFTRH to gauge a future investment stance on the gold sector. It is much more complex than simply hearing dogma that seems to make sense and then holding on for dear life… Inflation The hype is dying. 10 years of inflation hysterics have gone down the drain even as global policy makers pull out inflationary bazookas and use them at the slightest hint of economic trouble. The BoJ’s recent action was just the latest and most striking in its timing. Global markets were bouncing within correction mode and the Yen had just pinged a key resistance level. The BoJ then blew the Yen up with policy designed to at once reward risk takers and asset holders and mercilessly punish the Japanese people, renowned for the ethic of saving. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Three Steps Forward, Two Steps Back Posted: 13 Nov 2014 12:35 PM PST Jared Dillian writes: I have been a gold bull, unrelentingly, since 2005. It has been quite an adventure. Nine years ago, I was 31â€"still pretty young. I hadn’t read enough Austrian economics to even understand why I should like gold, but I did nonetheless. Besides, it was going up. And coincidentally, the folks at State Street had just come out with GLD, the SPDR Gold Shares ETF, and I was a market maker in it. Without GLD to invest in, I wonder if I would have had the inclination to learn about investing in gold futures or physical gold. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| “Paper Gold†and Its Effect on the Gold Price Posted: 13 Nov 2014 12:23 PM PST By Bud Conrad, Chief Economist Gold dropped to new lows of $1,130 per ounce last week. This is surprising because it doesn’t square with the fundamentals. China and India continue to exert strong demand on gold, and interest in bullion coins remains high. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Record Volume In GDXJ Junior Gold Miners Could Indicate a Bottom Posted: 13 Nov 2014 12:10 PM PST In a recent landslide election, Republicans took back control of the Senate and House. President Obama’s approval rating is very low. Although there a few making money in the stock market, the majority of the American people are fed up with close to 100 million people not working. Welfare and entitlement spending is out of control. The debt is still soaring close to $20 trillion and the dollar is rising making it even harder for politicians and banks to avoid default. Somehow irrationally despite billions of dollars being printed under the guise of QE, the US dollar is rising. The question I ask is how long do you really believe this dead cat bounce in the US dollar will last? It may be just a bounce in a long term downtrend and is only relative to the other fiat currencies in fast decline. Smart investors should be accumulating gold and silver coins and high quality junior mining stocks trading now at historic lows. It should be noted that coin sales are picking up especially mint grade numismatics. Avoid the large cap equities like the S&P500 making a classic megaphone top, US dollar and long term treasuries as these are markets overbought and where the fundamentals do not justify the current valuation. I am very concerned about the exuberance in banking and real estate as the numbers of unemployed in America are still at record levels. Avoid “fairy tale” sectors which try to say that Price Earning Ratios do not matter or that we are in a new era which justifies obscene valuations. The Middle East Arab Spring has turned into an Islamic Winter. Black swans could still be on the horizon. Now the US is looking to team up with Iran to fight ISIS and possibly ignoring the threat of Iran’s nuclear ambitions. Russia just stated What we are seeing with the rise of the dollar and decline in commodities may be part of the war no longer fought with bullets and missiles but with foreign exchange rates. The ruble is collapsing along with the Russian Economy. China and Russia may begin to look to trade in Yuan to avoid the negative consequences of currency wars. Those with US dollars are able to purchase gold and silver at low prices despite record demand. The US Mint is showing record sales. Many have asked how is gold and silver going down in price when demand is at record levels? The only answer is that some games are being played in the paper market. This week the regulators just fined the major banks for manipulating exchange rates. Investors may be just beginning to lose faith in the manipulated paper markets and are just buying physical coins. Some numismatics such as Mint Grade Morgan and Peace Silver dollars have had a nice rise this past year despite a decline in gold and silver prices. The junior gold miners (GDXJ) are hitting record volumes which indicates massive capitulation. The bear may be getting exhausted. We know that bear markets end in panic and many bail at the low. This time of the year the San Francisco Resource Conference was a main gathering for junior mining investors for many years. Now it is cancelled. This indicates to me that the public investor has panicked out chasing the bull market in US large caps, the dollar and long term treasuries. When the retail investor is gone, the smart money accumulates. Don’t rush, there may be retests of this bottom and long term resource investors should look to add to high quality position on weakness. Remember that bear market bottoms are the best times to buy. Notice the increase in recent M&A deals such as the acquisitions of Brigus, Rainy River, Cayden, Prodigy, Osisko, Bayfield and Scorpio. I expect the junior mining sector to get leaner and meaner with larger, stronger and consolidated stories. One of my favorite takeout targets in the gold space is Integra Gold (ICG.V or ICGQF) who owns the Lamaque South Gold Project and the Sigma Lamaque Milling Complex. The Abitibi Greenstone Belt is one of the areas where the majors are looking to expand. Yamana, Agnico, and Goldcorp are all looking to expand their footprint in this highly profitable region. Integra owns one of the highest grade and most advanced mines in Quebec, possibly one of the best mining jurisdictions in the world and a mill in an area with infrastructure and a skilled labor force. Integra has hit some really high grade in its Parallel and Triangle Zone. They recently acquired the Sigma mill which is only 500 meters from the Parallel Zone. Its a fully permitted, 2,200 ton per day mill and investors should realize that this acquisition moves Integra closer to production and cash flow. Integra announced a major permitting update due to the mill acquisition which shortens the timeline to production. Integra has been informed that they will not require a Federal Environmental Assessment for the combined mine and mill. Permitting timelines are crucial to majors who may be following Integra and waiting for its upcoming Preliminary Economic Assessment due shortly which is going to include 40,000 meters of additional drilling. Integra President and CEO Stephen de Jong said in the recent news, ”From a time value perspective to cash flow, this ruling should save an estimated 6 to 12 months as we progress towards a production decision, in addition to the positive timeline implications stemming from the infrastructure obtained in the acquisition.” See the full news release by clicking here… Recently Integra was heavily sold by panic sellers who had a margin call. I expect tax loss selling to also be in play with recent weakness. Nevertheless, Integra should be considered as a high grade and economic junior which has some of best chances of getting into production. It could be considered a takeout target especially after the PEA is announced which will take into account all the additional drilling and the Sigma Mill acquisition. See my recent interview with Integra CEO Stephen de Jong by clicking here… Disclosure: I own Integra Gold and the company is a website sponsor. ___________________________________________________________________________ Sign up for my free newsletter by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… Accredited investors looking for relevant news click here… To send feedback or to contact me click here… Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 13 Nov 2014 11:57 AM PST Some politicians and big businessmen say that the EU is vital to our prosperity. Sound familiar? Let's remind ourselves what they said about the euro. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ted Butler To Silver Miners: COMEX Is Responsible For Low Silver Prices Posted: 13 Nov 2014 11:26 AM PST This is an excerpt from Ed Steer’s daily gold and silver newsletter (recommended to subscribe): As usual, silver analyst Ted Butler came out with his mid-week commentary yesterday—and he had something to say to all the primary silver producers out there that are prepared to listen and save themselves before they go bankrupt—and take all their shareholders, including me, with them. I never asked his permission to reprint what he had to say, but I thought I’d include this lengthy commentary, so I’ll be ready for an ear full when I talk to him later today, but this is important enough that it should be posted in the public domain. I, like you you, have stuck by the silver miners through thick and thin, even though I’ve discovered over the years that these silver miners [along with their golden brethren] don’t give a flying #%@# about any of their stockholders – including you or me. As I’ve said before on several occasions, if I do manage to get to a position where I can sell their equities for the prices that they should be selling for, I’ll never own another mining share in my entire life – and for good reason. Here’s what Ted had to say:

[Note: the bolding and underlining is mine. - Ed] Please feel free to send Ted’s commentary to any silver mining company that you feel might be interested in higher silver prices. You should even send this to The Silver Institute, even though it will be for naught, as they are not at all interested in helping their members in this regard. Here’s the link to their “Contact Us” page. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GLD and SLV Technical Picture for November 2014 Posted: 13 Nov 2014 11:17 AM PST This is an excerpt from the daily StockCharts.com newsletter to premium subscribers, which offers daily a detailed market analysis (recommended service).

The Gold SPDR (GLD) surged almost 3% on Friday, plunged over 2% on Monday and advanced 1.43% on Tuesday. There may be some support in the 110 area and the ETF is still quite oversold, but the bigger trend is down and this is the dominant force. I will leave first resistance in the 115 area.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Is Paper Gold Trading Affecting The Gold Price Posted: 13 Nov 2014 11:10 AM PST Gold dropped to new lows of $1,130 per ounce last week. This is surprising because it doesn't square with the fundamentals. China and India continue to exert strong demand on gold, and interest in bullion coins remains high. I explained in my October article in The Casey Report that the Comex futures market structure allows a few big banks to supply gold to keep its price contained. I call the gold futures market the "paper gold" market because very little gold actually changes hands. $360 billion of paper gold is traded per month, but only $279 million of physical gold is delivered. That's a 1,000-to-1 ratio:

We know that huge orders for paper gold can move the price by $20 in a second. These orders often exceed the CME stated limit of 6,000 contracts. Here's a close view from October 31, when the sale of 2,365 contracts caused the gold price to plummet and forced the exchange to close for 20 seconds:

Many argue that the net long-term effect of such orders is neutral, because every position taken must be removed before expiration. But that's actually not true. The big players can hold hundreds of contracts into expiration and deliver the gold instead of unwinding the trade. Net, big banks can drive down the price by delivering relatively small amounts of gold. A few large banks dominate the delivery process. I grouped the seven biggest players below to show that all the other sources are very small. Those seven banks have the opportunity to manage the gold price:

After gold's big drop in October, I analyzed the October delivery numbers. The concentration was even more severe than I expected:

This chart shows that an amazing 98.5% of the gold delivered to the Comex in October came from just three banks: Barclays; Bank of Nova Scotia; and HSBC. They delivered this gold from their in-house trading accounts. The concentration was even worse on the other side of the trade—the side taking delivery. Barclays took 98% of all deliveries for customers. It could be all one customer, but it's more likely that several customers used Barclays to clear their trades. Either way, notice that Barclays delivered 455 of those contracts from its house account to its own customers. The opportunity for distorting the price of gold in an environment with so few players is obvious. Barclays knows 98% of the buyers and is supplying 35% of the gold. That's highly concentrated, to say the least. And the amounts of gold we're talking about are small—a bank could tip the supply by 10% by adding just 100 contracts. That amounts to only 10,000 ounces, which is worth a little over $11 million—a rounding error to any of these banks. These numbers are trivial. Note that the big banks were delivering gold from their house accounts, meaning they were selling their own gold outright. In other words, they were not acting neutrally. These banks accounted for all but 19 of the contracts sold. That's a position of complete dominance. Actually, it's beyond dominance. These banks are the market. My point is that this market is much too easily rigged , and that the warnings about manipulation are valid. At some point, too many customers will demand physical delivery and there will be a big crash. Long contracts will be liquidated with cash payouts because there won't be enough gold to deliver. I saw a few squeezes in my 20 years trading futures, including gold. In my opinion, the futures market is not safe. The tougher question is: for how long will big banks' dominance continue to pressure gold down? Unfortunately, I don't know the answer. Vigilant regulators would help, but "futures market regulators" is almost an oxymoron. The actions of the CFTC and the Comex, not to mention how MF Global was handled, suggest that there has been little pressure on regulators to fix this obvious problem. This quote from a recent Financial Times article does give some reason for optimism, however: UBS is expected to strike a settlement over alleged trader misbehaviour at its precious metals desks with at least one authority as part of a group deal over forex with multiple regulators this week, two people close to the situation said. … The head of UBS's gold desk in Zurich, André Flotron, has been on leave since January for reasons unspecified by the lender…. The FCA fined Barclays £26m in May after an options trader was found to have manipulated the London gold fix. Germany's financial regulator BaFin has launched a formal investigation into the gold market and is probing Deutsche Bank, one of the former members of a tarnished gold fix panel that will soon be replaced by an electronic fixing. The latter two banks are involved with the Comex. Eventually, the physical gold market could overwhelm the smaller but more closely watched US futures delivery market. Traders are already moving to other markets like Shanghai, which could accelerate that process. You might recall that I wrote about JP Morgan (JPM) exiting the commodities business, which I thought might help bring some normalcy back to the gold futures markets. Unfortunately, other banks moved right in to pick up JPM's slack. Banks can't suppress gold forever. They need physical gold bullion to continue the scheme, and there's just not as much gold around as there used to be. Some big sources, like the Fed's stash and the London Bullion Market, are not available. The GLD inventory is declining.