Gold World News Flash |

- Gold And Silver Jump On Bullish Price Action

- Silver Update — Disconnect Starting [Part 2]

- David Stockman On Monetary Breakdown & Skyrocketing Gold

- NASA warns: Global groundwater crisis could lead to food supply collapse

- Would You Buy An ISIS Gold Coin?

- In The News Today

- Koos Jansen: Who's feeding China's gold hunger?

- A Call to the Swiss

- Gold jumps $40/oz

- And The Biggest Winner From The Oil Price Plunge Is...

- Marc Faber on Gold, the US Dollar, China and the Swiss Gold Referendum

- Gold Capitulation? Not Likely

- Potential Owners Per Ounce of Registered Comex Gold Back Over 50

- The Desperate Suicide of Competitive Devaluation.....

- This Country Will Collapse & Destabilize The Entire World

- Swiss Central Bank Admits Buying Shares of Stock Market! Preventing Deflation Collapse!

- Turk says mining shares have never been been cheaper, mining executives are clueless

- Weekend Update November 14

- Swiss central bank could nullify gold initiative with overnight gold swaps

- Gold Investors Weekly Review – November 14th

- Gold And Silver Jump On Bullish Price Action

- Coast To Coast AM - November 14, 2014 The Zodiac Killer

- Iran said to open refinery as 'resistance,' doubling annual gold production

- Gold And Silver – A Change In Suppressed Down Trend?

- A Change Underway In The Suppressed Gold And Silver Down Trend?

| Gold And Silver Jump On Bullish Price Action Posted: 16 Nov 2014 12:00 AM PST from Gold Silver Worlds:

Let's look at the Gold ETF, GLD. What dominates this chart is a bearish reverse flag formation. However, rather than executing with a breakdown below the flag, it broke out above the flag. When you see a bullish outcome to a bearish technical pattern it is a sign of positive momentum. This is confirmed by the Price Momentum Oscillator (PMO) which bottomed. A PMO bottom in oversold territory is generally a good set up. |

| Silver Update — Disconnect Starting [Part 2] Posted: 15 Nov 2014 09:34 PM PST from BrotherJohnF: posted for subs on 11/7/14 |

| David Stockman On Monetary Breakdown & Skyrocketing Gold Posted: 15 Nov 2014 09:30 PM PST from KingWorldNews:

Stockman: "Yes. It's leading to a breakdown of the monetary system, not to the classic hyperinflation which causes a flight to gold in the initial instance. However, as it becomes clear that the central banks have lost control, that there is an out-and-out currency war underway, that the global economy is cooling rapidly — that's the only way you can explain oil at $75 a barrel — once that becomes clear, I think there is going to be a great shock to confidence in the central banks.” |

| NASA warns: Global groundwater crisis could lead to food supply collapse Posted: 15 Nov 2014 08:30 PM PST by J. D. Heyes, Natural News:

The impact has already been felt, primarily in California. Data obtained form the Gravity Recovery And Climate Experiment (GRACE) reveal that there, Californians in the Sacramento and San Joaquin river basins have lost approximately 15 cubic kilometers (4 cubic miles) of total water every year since 2011, which is more water than all 38 million Californians combined use on an annual basis for both municipal and domestic purposes. More than half of that use is linked to Central Valley groundwater pumping.(1) |

| Would You Buy An ISIS Gold Coin? Posted: 15 Nov 2014 08:00 PM PST from morningmayan: |

| Posted: 15 Nov 2014 07:37 PM PST Jim Sinclair’s Commentary The latest from John Williams’ www.ShadowStats.com. - October RetailSales Were Near Consensus, with Minimal Revisions and A Sharply-Slowing Pace of Fourth-Quarter 2014 Growth - Negative Surpriseson the Economy and in the Political Arena Are Among Imminent Top Threats to U.S. Dollar "No. 673: October Retail Sales, Consumer Liquidity, Updated Hyperinflation and DollarRisks"... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| Koos Jansen: Who's feeding China's gold hunger? Posted: 15 Nov 2014 06:28 PM PST 9:29p ET Saturday, November 15, 2014 Dear Friend of GATA and Gold: Bullion Star market analyst Koos Jansen, a GATA consultant, tonight reviews figures for gold exports to China on a nation-by-nation basis. He concludes that demand for gold in China remains strong and is running at more than twice the amount reported by the World Gold Council. Jansen's commentary is headlined "Who's Feeding China's Gold Hunger?" and it's posted at Bullion Star here: https://www.bullionstar.com/blog/koos-jansen/who-is-feeding-chinas-gold-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 15 Nov 2014 06:00 PM PST by Andrew Hoffman, Miles Franklin:

|

| Posted: 15 Nov 2014 05:00 PM PST Weakening dollar, anticipation of Swiss vote on gold, appear to be pushing the price of gold higher. by Kip Keen, MineWeb.com

The price of gold – which has suffered severely in recent weeks – ticked up on short covering, a weakening dollar and mounting expectations over a possible “Yes” vote in a Swiss referendum, analysts said. The vote could very well force the country’s central bank to buy some 7% of the world’s yearly gold demand. |

| And The Biggest Winner From The Oil Price Plunge Is... Posted: 15 Nov 2014 04:51 PM PST "The Chinese, among others, seem to be responding to the lower oil price with additional demand," notes one tanker executive as Bloomberg reports the number of supertankers sailing toward China's ports matched a record on Oct. 17 and is still close to that level now. The plunge in price has enabled China to add 35 million barrels to its inventories in the past three months as the nation fills its strategic petroleum reserves, OPEC said yesterday. Furthermore, though the oil slide is hurting nations from Venezuela to Iran - that depend on energy for revenues - ship owners serving the industry's benchmark Middle East-to-Asia trade routes are reaping the best returns from charters in years as the slump drives down the industry's single biggest expense. As one analyst notes, "we've seen the Chinese buying a lot from the Middle East and that's really let rates cook." So it appears the Chinese, in the face of the worst growth and economy in years, are rational enough to buy more at lower prices (as opposed to the buy-more-because-stocks-are-at-all-time-highs Western investors).

A near-record 113 tankers are destined for China...

* * * * * * The biggest concern, of course, is that this burst of activity is interpreted by the all-knowing-ones as some sustainable pick up in aggregate demand that "means" growth is back baby... and thus begins another mini cycle of mal-investment. |

| Marc Faber on Gold, the US Dollar, China and the Swiss Gold Referendum Posted: 15 Nov 2014 04:00 PM PST GoldBroker |

| Posted: 15 Nov 2014 04:00 PM PST USAGold |

| Potential Owners Per Ounce of Registered Comex Gold Back Over 50 Posted: 15 Nov 2014 03:01 PM PST |

| The Desperate Suicide of Competitive Devaluation..... Posted: 15 Nov 2014 02:04 PM PST

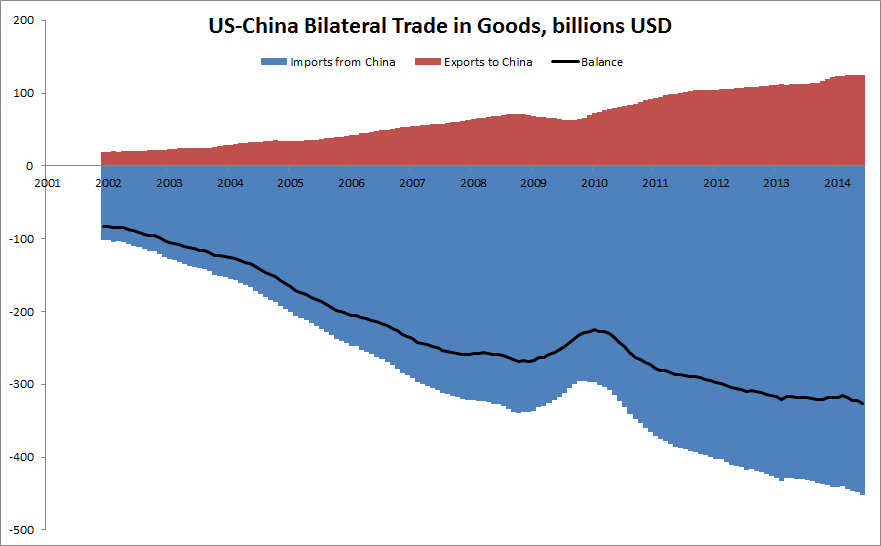

Courtesy of the StealthFlation BlogThe zero sum game of competitive global currency devaluations is on like Donkey Kong. Anyone still sleeping comfortably, confident that all will end well, best brace themselves for a resounding wake up call. Be alarmed, Japan just jacked the joint, and the jerry rigged monetary jig is up. Moving forward, all the other Asian export economies will promptly be forced to keep up with their FUBAR neighbor, the utterly juiced Japanese Joneses. Each Nation State in the Far East is now completely compelled to competitively devalue in tandem, in order to maintain export market share, in a desperate attempt to avert their outbound container super ship cargoes from running westwards on empty. Throughout the new millennium, China has made great technological strides, repositioning itself away from a predominantly low tech manufacturing economy, towards a value added high tech producing exporter. In this capacity it has converged with Japan. The Japanese, on the other hand, over the same time period, have seen both the Chinese, Koreans and the other Asian Tigers ravenously devour more and more Hamachi and California rolls, promptly snatched from their stale sushi shop lunch box. Take one quick look at the above chart, and you tell me why Mr. Xi nearly gagged when shaking hands with Mr. Abe the other day.

The following excerpt from a Bloomberg article titled; Japan's Export Reach Three Year Low as Recession Looms, published shortly before Abe's December 2012 election, clearly outlined the sagging soggy sushi state of affairs:

No wonder the hapless Captain Abe, slipping on his sinking sashimi ship, immediately pulled the ripcord releasing the emergency currency life boat, in a desperate effort to rapidly inflate the fiat rescue raft with fresh Yen air. Can you really blame him? After all, the Chinese have been buying a gazillion dollars' worth of U.S. treasuries in order to suppress the value of their own Yuan for years now. It was all good while Uncle Sam's force fed extreme global trade imbalances were rocking and rolling on seemingly endless cheap U.S. credit, but that free ride has been bouncing along the bottom of the ocean these days, and may well be about to hit some very jagged rocks. Be assured, extreme trade imbalances are not a good thing. As Aristotle once said; Extremes are bad". The massive capital and current account imbalances that global trading partners have been irresponsibly running over the past 25 years are coming home to roost. The end result will be nothing short of shock and awe. Ok, so we get the picture, all the nations on the Pacific rim side of the Globe are now locked into a monumental mortal martial arts fiat food fight for the ages. As world's GDP continues to falter, the gloves will come off, plates will start to fly, and eventually the zero sum situation will end up in crazed Kamikaze currency raids battling for each others industrial export capacity. The trouble with all of this, of course, is that for the overall world economy it's nothing short of committing Hari Kari. Let's move on to the west, and check in overthere, shall we. Europe is certainly mired in what can only be viewed as a structurally cemented recession. And guess what, the largest economic block on the planet exports a ton of stuff around the world. So, like China, they too will get swamped by Admiral Abe's crushing counterfeit currency wave. In fact, the Eurozone actually exports more to the USA than China does. Last year, the EU sent us a whopping total of just under $600 billion worth of merchandise, whereas the Chinese came in at a distant $440 billion. Make no mistake, as the Pacific rim fake fiat food fight heats up, you can bet your bottom EURO that the Frogs and assorted Eurotrash will join right in, heaving their devalued moldy Camembert and debased wienerschnitzel right over the counter towards the others.

Where's the end game in all of this you ask? Well, so far, the USD seems to have dodged the flying currency cup cakes. The strict adult monitor in the mess hall is not partaking in the flying fiat food fest. As such, many macro mavens are touting the second coming of king dollar as a sure sign of the rebirth of the renown American exceptionalismwhich has brought about yet another economic renaissance, fantastically fueled by an endless reservoir of ingenious technology and new found shale energy. Myself, I wouldn't break out the pompoms quite so fast. The last thing the U.S. needs is more hot money capital piling into the dollar from overseas, and the last thing faltering overseas economies need is massive capital flight due to the unwind of the gratuitous carry trade racket. Talk about the potential for an out of control capital flow velocity vortex. These thing have a tendency to pick up intense momentum all at once as they unwind themselves from years of being systematically methodically built up over time. Think of it as the mad rush for the exits of a packed MLB stadium right after the opposing team hits a grand slam, tacking on another 4 runs in the top of the Ninth having already led the game 3 - 0. An appreciating dollar has several very serious unintended consequences. Clearly, one issue is that it will create headwinds for the newly revitalized export sector which had been one of the substantive bright spot for the U.S. economy over the past few years. Another, conundrum is that as the devalued overseas capital flows seek refuge in the USD from the deliberate debasement abroad, it will serve to only exacerbate the already frothy asset bubbles which have been steadily forming in most asset classes (Stocks, Bonds, Real Estate, Art, Collectibles....etc). Finally, and most importantly, it will create a massive deflationary wave, which is the last thing the largest debtor Nation in the history of the planet needs. In fact, this is the Fed's worst nightmare, as not only does it increase the real cost of our external sovereign debt loads, but also, the strong dollar deflation will further depress the velocity of money which already sits at historic lows. And therein lies the rub. How is the Fed going to achieve its wet dream of 2% inflation that it deems to be so crucial to generating the escape velocity that is essential for self sustaining economic growth? I'm afraid, my friends, that the only answer the FED has in store for us will be more of the same. Can you say QE 4.0? Welcome to the Keynesian circle jerk end game. Picture a dog chasing its own tail until it finally drops from exhaustion, let's call our dog "Fido Fed". Les jeux sont fait, let the games begin. Got Gold?  |

| This Country Will Collapse & Destabilize The Entire World Posted: 15 Nov 2014 12:18 PM PST  On the heels of a large surge in gold and silver prices, today Michael Pento warned King World News that a major nation is now close to collapse and their collapse is going to destabilize the entire global financial system. This is an incredibly powerful piece from Pento. On the heels of a large surge in gold and silver prices, today Michael Pento warned King World News that a major nation is now close to collapse and their collapse is going to destabilize the entire global financial system. This is an incredibly powerful piece from Pento.This posting includes an audio/video/photo media file: Download Now |

| Swiss Central Bank Admits Buying Shares of Stock Market! Preventing Deflation Collapse! Posted: 15 Nov 2014 11:21 AM PST Central banks around the world are printing currency out of thin air and buying shares of their stock markets! There is now public evidence of this being a global mandate in order to keep the markets continuing higher. Low interest rates and trillions of QE aren't enough. Every central bank... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Turk says mining shares have never been been cheaper, mining executives are clueless Posted: 15 Nov 2014 10:42 AM PST 1:45p ET Saturday, November 15, 2014 Dear Friend of GATA and Gold: In an hour-long interview with the TF Metals Report's Turd Ferguson, GoldMoney founder and GATA consultant James Turk says, among other things: -- Shares of monetary metals mining companies have never been cheaper. -- Gold backwardation has never been as severe, indicating massive intervention by central banks against gold. -- The World Gold Council and most monetary metals mining companies are not defending gold's role as money, nor defending the industry itself, as most mining company executives are clueless about the nature of the monetary metals. -- Central banks are destroying the world's market economies. -- And the Swiss Gold Initiative has a chance. The interview is an hour long and can be heard at the TF Metals Report here: http://www.tfmetalsreport.com/podcast/6357/conversation-james-turk CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 15 Nov 2014 10:25 AM PST By Everett Millman, head content writer at Gainesville Coins, a leading gold and silver distributor. ABSTRACT: The markets were mostly a mixed bag this week, with stocks and precious metals... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} |

| Swiss central bank could nullify gold initiative with overnight gold swaps Posted: 15 Nov 2014 09:55 AM PST 12:58p ET Saturday, November 15, 2014 Dear Friend of GATA and Gold: Zero Hedge reports today that a market analyst for Deutsche Bank has figured out an easy way for the Swiss National Bank to nullify the Swiss Gold Initiative if it is approved at Switzerland's national referendum on November 30. The referendum would require the central bank to increase its gold reserves, and the Deutsche Bank analyst, Robin Winkler, writes that rather than purchase more reserves, the bank could just pretend to have them for one day each month, the day of the bank's monthly report, a bookkeeping pretense accomplished with an overnight gold swap, reversed the following day. Of course such evasion and deception would be perfectly in the spirit of central banking, though it might tend to remind people that central banking has become worse than the disease it purports to cure. As was confirmed by the secret March 1999 report of the staff of the International Monetary Fund, gold swaps and loans are primary mechanisms of surreptitious manipulation of markets by central banks: http://www.gata.org/node/12016 http://www.gata.org/files/IMFGoldDataMemo--3-10-1999.pdf Zero Hedge's report is headlined "How Central Banks Use Gold Swaps To 'Boost' Their Gold Holdings" and it's posted here: http://www.zerohedge.com/news/2014-11-15/how-central-banks-use-gold-swap... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT USAGold: Coins and bullion since 1973 USAGold, well known for its Internet site, USAGold.com, offers contemporary bullion coins and bullion-related historic gold coins for delivery to private investors in the United States, Europe, Canada, Australia, and New Zealand. It is one of the oldest and most respected names in the gold industry, with thousands of clients and an approach to investment that emphasizes guidance and individual needs over high-pressure sales tactics. The firm's zero-complaint record at the Better Business Bureau makes it an ideal match for the conservative, long-term investor looking for a reliable contact in the gold business. Please call 1-800-869-5115x100 and ask for the trading desk, or visit USAGold.com. USAGold: Great prices, quick delivery -- all the time. Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold Investors Weekly Review – November 14th Posted: 15 Nov 2014 09:35 AM PST In his weekly market review, Frank Holmes of the USFunds.com summarizes this week's strengths, weaknesses, opportunities and threats in the gold market for gold investors. Gold closed the week at $1,189.01 up $11.03 per ounce (0.94%). Gold stocks, as measured by the NYSE Arca Gold Miners Index, rose 2.94%. The U.S. Trade-Weighted Dollar Index fell 0.13% for the week. Gold Market StrengthsOn Tuesday, gold futures jumped higher after a report showed that U.S. jobless claims increased more than forecast last week. Gold prices rallied on Friday as more than 10,000 contracts for December delivery were traded, pushing the gold price up 1.5 percent within six minutes. Moreover, the one-, two-, three- and six-month gold forward offered rates turned negative, signaling increased physical demand in a tightening market. Robin Winkler of Deutsche Bank wrote that current polling on the referendum in Switzerland (to require its national bank to hold 20 percent of its reserves in gold) was now leading in the polls. Gold traders turned bullish for the first time in three weeks as prices neared four-year lows. Additionally, this month U.S. Mint gold coin sales are already more than half of what they were in October, which was the strongest month since January. Austria Mint sales are up 40 percent from October. Gold Market WeaknessesThe World Gold Council announced that gold demand fell to the lowest level in almost five years in the third quarter as bar, coin and jewelry purchases slowed. Silver shorts are at record highs as the market remains negative on the precious metals sector due to the strong U.S. dollar. Fund shorts account for 39 percent and 54 percent of total open interest for Comex silver and Nymex platinum, respectively. Switzerland's regulator charged UBS AG employees with front-running in precious metals trading, particularly in silver, as part of its review of the bank's foreign-exchange business. The Swiss regulator and those in the U.S. and the U.K. ordered UBS and four other banks to pay about $3.3 billion to settle a probe into the rigging of foreign-exchange rates. Gold Market OpportunitiesThe UBS commodity strategy team published a contrarian report stating that liquidity will run dry well before the Federal Reserve has a chance to increase the Fed Funds rate, according to the research firm's Proprietary U.S. Liquidity Indicator. As a consequence, they believe the next significant action of the Fed will be an attempt to reflate the U.S. economy, not rein it in. This leads to a bullish outlook on both dollar cash and gold equities.

The same UBS report delineates that gold stocks will outperform bullion as the Fed likely reflates the economy. The research firm’s Fed Action Model predicts when the Federal Reserve is likely to act when the reading falls below zero. Furthermore, their reasoning for gold stocks outperforming bullion is a result of two types of gold rallies. The first is a reflationary boom scenario where bullion outperforms gold stocks as commodity appreciation causes costs to rise. This leads miners to low grade operations and undertake high-cost expansions and M&As. That was the case in 2004 -2007 and 2009-2011. The second type of rally is characterized by risk aversion flows out of credit and equity and into treasuries. Costs at the mine fall as commodity currencies decline. Miners cut costs and restructure. With gold in a bear market, the stocks are financially and operationally geared. This was the case in 2001-2002 and during the last four months of 2008. This is the scenario the UBS team sees presently unfolding.

Gold Market ThreatsIndia, the world's biggest gold user after China, announced it will review bullion import rules after purchases in October jumped to the highest level this fiscal year. Though no indication has been given, any import restrictions could be a headwind for gold prices. The labor movement in South Africa has been thrown into turmoil after the November 8 decision by the Congress of South African Trade Unions to expel the National Union of Metalworkers of South Africa. The decision was opposed by seven of the 20 other affiliates and sets the stage for a fight over loyalty and membership dues of the remaining 1.85 million members. South Africa's labor relations are the most hostile of 144 countries, according to the World Economic Forum, and the country had 114 strikes last year that resulted in 6.7 billion rand ($597 million) in lost wages. UBS cut its one-month gold target from $1,250 per ounce to $1,180 per ounce citing weak sentiment, light positioning and an extreme amount of shorts.

|

| Gold And Silver Jump On Bullish Price Action Posted: 15 Nov 2014 08:15 AM PST This is an excerpt from the daily StockCharts.com newsletter to premium subscribers, which offers daily a detailed market analysis (recommended service).

Metals had a healthy day, as did other natural resource ETFs. I’ve highlighted notable ETFs right from our DecisionPoint ETF Tracker Report found in the DP Tracker Blog. This displays only a small portion of the ETFs we cover in the Tracker Report and only the section that sorts by the day’s percentage change. I’ve selected some of the charts for analysis. Let’s look at the Gold ETF, GLD. What dominates this chart is a bearish reverse flag formation. However, rather than executing with a breakdown below the flag, it broke out above the flag. When you see a bullish outcome to a bearish technical pattern it is a sign of positive momentum. This is confirmed by the Price Momentum Oscillator (PMO) which bottomed. A PMO bottom in oversold territory is generally a good set up. The Silver iShares ETF, SLV looks very similar to GLD. There is a reverse flag which is considered bearish, but instead of breaking down, price broke out. The PMO is very close to a positive crossover its 10-EMA which would generate a PMO Crossover BUY signal. The Gold Miners ETF is sending us mixed messages. On the one hand there is a bearish reverse flag formation while on the other hand, the PMO just crossed over its EMA generating a PMO BUY signal.

I encourage you to go to our DP ETF Tracker, find an ETF on a line of the report that interests you and click on it. The chart will come up and you can analyze and annotate it just as I did above. To access the reportyou do need to be a StockCharts.com member. |

| Coast To Coast AM - November 14, 2014 The Zodiac Killer Posted: 15 Nov 2014 07:08 AM PST Coast To Coast AM - November 14, 2014 The Zodiac Killer The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Iran said to open refinery as 'resistance,' doubling annual gold production Posted: 15 Nov 2014 06:31 AM PST From The Associated Press http://abcnews.go.com/International/wireStory/report-iran-opens-gold-pla... Iranian state television is reporting that the country has inaugurated a new gold-processing plant that will double the country's annual production to 6 tons. The report says First Vice President Ishaq Jahangiri attended the inauguration Saturday of the plant near Takab in northwestern Iran. It says the new processing facility, built next to Iran's Zarshouran gold mine, also will produce an estimated 2.5 tons of silver and 1 ton of mercury a year. State television says Iran previously produced an estimated 3 tons of gold a year. This is part of Iran's "economy of resistance" to counter sanctions imposed over Tehran's contested nuclear program. The Islamic Republic is currently negotiating a final deal over its atomic program with world powers. ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold And Silver – A Change In Suppressed Down Trend? Posted: 15 Nov 2014 06:16 AM PST Until there is a clear break of elite’s central banking dominance over the gold and silver markets, there will be no dramatic recovery reflective of where the true price for both metals should be. Whether it is $5,000 or $10,000 for gold or $100 or $200 for silver [the ounce], the current distorted pricing, as dictated by the paper derivative market and not actual physical metal, will prevail demonstrating the power the elites exert at will. The probability of the elites being “all in” has not even reached the stretching point, yet, although it may be getting there. All that remains, really, is to wait and let events take the unnatural course they have been on for several decades. The undoing of too many decades of gold/silver manipulation/suppression will not be accomplished in a single year, as it has not been over the past few years, and there is no way of knowing the time factor for change in the year[s] ahead. |

| A Change Underway In The Suppressed Gold And Silver Down Trend? Posted: 15 Nov 2014 02:45 AM PST Until there is a clear break of elite's central banking dominance over the gold and silver markets, there will be no dramatic recovery reflective of where the true price for both metals should be. Whether it is $5,000 or $10,000 for gold or $100 or $200 for silver [the ounce], the current distorted pricing, as dictated by the paper derivative market and not actual physical metal, will prevail demonstrating the power the elites exert at will. The probability of the elites being "all in" has not even reached the stretching point, yet, although it may be getting there. All that remains, really, is to wait and let events take the unnatural course they have been on for several decades. The undoing of too many decades of gold/silver manipulation/suppression will not be accomplished in a single year, as it has not been over the past few years, and there is no way of knowing the time factor for change in the year[s] ahead. We have said on several occasions, the elites think in terms of decades, while most people have trouble planning a year in advance. Back in 1988, the Economist, [A Rothschild- backed publication, certainly in terms of content], published an article, "Get Ready For A World Currency By 2018." Here is a 30 year plan as evidence of how the elites work, and there was surely years of planning involved before the article was even published. The new world currency was to be administered by the International Monetary Fund. It could only work if nations gave up their sovereignty [Hello, European Union], and all currency control to the IMF, as it was imagined back then. Greece, Cyprus, Ireland, Spain, etc, etc, and more to follow, have virtually given up their sovereignty in favor of increased debt "bail-outs" to "cure" the excessive debt under which each country was already buried. There is no one who would agree that increased doses of heroin will "cure" an addict, or increased whiskey or vodka will "cure" an alcoholic, yet the Western banking elites have sold the notion that the only way to save a financially destitute country is to take on even more debt as a "cure," and the masses continue to buy into it. There is one thing upon which almost all can agree as a certainty: the paper fiat currency scheme, as it exists today, is near its end, inevitably doomed to failure. Consider a few related circumstances. Seven years ago, the Fed's balance sheet was 6.3% of the U S economy. Today, it is over 25% of Gross Domestic Product. During that time span, the Fed's balance sheet grew 5 times larger while the actual economy was up about 20%. All that the Quantitative Easings have done is shore up the entire underwater banking system while the US economy has been purposely gutted in the process. In the 10 year period prior to 2007, $13.88 of new GDP was created for every new Federal Reserve Dollar printed by the Fed. From 2007 through the first half of 2014, only 81.8 cents of new GDP was created for every fiat Federal Reserve Note. This is but one example of how the elites are destroying the Federal Reserve Dollar, gutting the economy, and propping up their precious "Do Not Disturb" fiat debt enslavement Ponzi scheme. Most Americans remain in a comatose state of [un]awareness when it comes to understanding how the fiat monetary system [does not] works. The G-20 met in Australia last week, and guess what has been announced as a part of their agenda? The G-20 has vowed to focus on a plan to add $2 trillion to world GDP. This kind of economic insanity has no limits for the elite's New World Order, to be controlled by a single IMF currency. Can it be any clearer why gold and silver are being suppressed in order to serve the greater NWO good? We mentioned the importance of the Swiss referendum requiring the Swiss National Bank to maintain a 20% gold reserve requirement, from the current 8%, and it also prohibits the Swiss central bank from ever selling any Swiss gold. What is of great interest is the ability of the elite's central bankers possibly preventing the Swiss referendum from passing. Should it pass, despite both Swiss government and banking pressure against it, the question then becomes, what will the payback consequences be against the Swiss for fighting the elite's system of controlled debt. All Western politicians are controlled by the Rothschild central banking system, and all Western governments are subservient to these banking interests. While it may appear that China and Russia, along with the other BRICS nations, have banded together to put an end to the elite-controlled fiat currency system led by the once "almighty dollar,' now in rapid decline, appearances are never what they seem to be, on purpose. What is not clear is the extent to which the elite's central banking system has control over both the Chinese and Russian governments. The United States, as a world-dominating power, fades with each passing month. This country is done, finished, and is running on its remaining military might. The US has no viable means of sustaining itself. There is no manufacturing base, there are no savings in plant and equipment from which to rebuild. Cities, even states, are facing bankruptcy, burdened by decades of public pension promises that can no longer be met, along with diminishing tax revenues. Which country will take over? Both Russia and China have a host of issues that preclude them from implementing a workable world-serving financial currency/system. It is not clear that China even has the capacity to become the next world powerhouse. Russia does not. Yet both nations have expressed support of a currency system run by the IMF, the elite-controlled mechanism for running its New World Order agenda. Why would they say that? The elite-dominance of its fiat paper dynasty has ruled the world for a few centuries. Money is least understood by the masses, yet it is the greatest controlling influence by a small group pulling the strings by which the Western world operates. Does that small but most powerful group extend its control over China and Russia? While the thinking is that both countries will "reset" the price of gold and silver as the fiat system of the Western world is toppled, who knows if the elites are simply changing horses, as it were, and will eventually be running China and Russia as it has the US/UK/EU? There are so many unanswered [unanswerable?] questions, beyond when will gold and silver "take off?" As to the latter, the charts still say "No time soon." While this is true as the way things stand now, change can occur at any time, but that is future, and all we is address what is actually known in the present tense. Yes, last Friday was the best for silver in a single day in over two years, but that does not materially change anything. Three weeks ago there was a S/D [Supply over Demand], two day move lower when the recent 16.60 support area was broken. The decline started from the 17.20 level, so resistance is defined by that range. Last Friday was an attempt to begin an assault on this immediate overhead resistance. Friday was a D/S bar, [Demand overcoming Supply]. Combining the last two Fridays, we are starting to see a change in the character of market behavior where the strongest bars in the down trend are to the upside. For next week, it is important to see if there will be any upside follow-through, and to what extent, given the overall layers of resistance, and also the way in which Friday's rally bar is retested. An example of a positive retest is what occurred two Fridays ago when price moved in a sideways manner for four trading days, maintain the gains. Once a pattern of gains being able to hold emerges, it will lead to a trend change. When last Friday's impressive rally is incorporated into the weekly chart, the response is not as enthusiastic for its impact. There will be an increasing number of articles declaring silver is on its way, probably from the same writers that said the same thing over the past several months. Glance back at the low for 2010, and you can see how after an initial rally, price moved sideways for about five months. It does not mean a similar pattern develops here, just that it can take some time for a trend to change course, and being first in is not always the best situation. Waiting for an upside breakout of the 5 month pattern brought more immediate results, so it pays to be more select in one's timing, at least for futures. Gold's pattern is more stable than silver's, even though silver outperformed gold last week on a relative price relationship basis. The previous two swing bottoms in 2013 and almost 2014 did not lead to sustained rallies, and there is zero available evidence that says a new bull move will commence, presuming the recent low holds as a swing low. Let the market prove itself first. You can see how the general level of volume has picked up in the month of November. The fact that the volume increase is occurring at the lows, if they hold, usually indicates a change from weak hands into strong. Keep in mind, it takes time to turn around a trend, and the down trend can change into a sideways move before an up trend occurs, so patience has merit for not "jumping the gun," which often means a false start. Note the combined volume of the last 10 TDs [Trading Days]. In total, it still has not led a price move over the single down day and its volume from 31 October. It shows the difficulty of effort required of buyers to overcome sellers in a down trend. It also suggests the volume and price behavior is more in the form of short-covering as opposed to new longs being established. Gold has dropped 770 dollars from its highs. A rally of 55 dollars should not be viewed as game-changing. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Metals had a healthy day, as did other natural resource ETFs. I've highlighted notable ETFs right from our

Metals had a healthy day, as did other natural resource ETFs. I've highlighted notable ETFs right from our  Eric King: "David, you're thoughts on the gold market as there is all of this massive money printing all over the world. It really is unprecedented."

Eric King: "David, you're thoughts on the gold market as there is all of this massive money printing all over the world. It really is unprecedented." Shocking findings reported by NASA show that the problem of diminishing groundwater is poised to lead to the collapse of the food supply, where there could be devastating consequences.

Shocking findings reported by NASA show that the problem of diminishing groundwater is poised to lead to the collapse of the food supply, where there could be devastating consequences. I simply cannot underestimate the message of last month's "

I simply cannot underestimate the message of last month's " The price of gold made a strong showing Friday, jumping over 3 percent in the span of five hours up about $40/oz to $1,189.70 at presstime.

The price of gold made a strong showing Friday, jumping over 3 percent in the span of five hours up about $40/oz to $1,189.70 at presstime.

No comments:

Post a Comment