Gold World News Flash |

- The Consequences of a Strengthening US Dollar

- Marc Faber on Gold, the US Dollar, China and the Swiss Gold Referendum

- Jesse Ventura: America Now Represents Nazi Germany

- ISIS Minting Gold and Silver Coins to Avoid “Satanic Usury” of Illuminati Banking System

- Celente – Russia’s Gold & The End Of The American Empire

- David Stockman On Monetary Breakdown & Skyrocketing Gold

- Just six powerful corporations control almost all the information you see and hear

- Russia And Egypt Are Proposing Peace In Syria, Central Bankers Want War

- Confidence in central banks is fading and markets will rediscover gold, Stockman says

- Here Is What The Insiders Are Doing In The Gold Market

- The End of the Gold Trade?

- Gold Market Capitulation? Not Likely

- Gold’s Support at $1000/Oz

- Depression-Level Collapse In Demand: In Historic First, Glencore Shuts Coal Mines For 3 Weeks

- Image Claims to Show Ukrainian Fighter Jet Shooting Down MH17

- Gold is part of Russia's defense against U.S., Celente tells KWN

- Coast To Coast AM - November 13, 2014 Giants & the Nephilim

- Oil price slump to trigger new US debt default crisis as OPEC waits

- Axel Merk: Why The Swiss Should Vote "Yes" On The Gold Initiative

- Jonathan Kosares: Gold capitulation? Not likely

- Russia Is Preparing For A "Catastrophic" Oil Price Collapse

- Gold Price Closed Up $23.90 or 2.1 Percent to $1,185.00, Silver Price Outshone Rising 69.3 cents or 4.64 Percent

- ISIS Minting Gold and Silver Coins to Avoid “Satanic Usury” of Illuminati Banking System

- Gold Daily and Silver Weekly Charts - He Dwelleth In This Land

- The Alex Jones Show(VIDEO Commercial Free) Friday November 14 2014: Ben Fuchs

- ObamaCare’s Architect Confesses to Fraud

- Celente - Russia’s Gold & The End Of The American Empire

- Stock Market S&P Megaphone Top, Huge Volume Bullish Reversal in Junior Gold Miners?

- Gold Stocks Apocalypse

- 2 Simple Ways to Spot Hidden, Undervalued Biotech Stocks

- Stealth QE4 - Operation Tokyo Twist as Japan Sacrifices Pensions Funds

- Ronan Manly: Swiss gold shenanigans intensify prior to Nov. 30 vote

- Shocking Facts About China, Russia & End Of Gold Bear Market

- The Government Does Not Want You To See This Letter

- Gold/Silver Ratio 2015: Can Silver Rise When Gold Falls?

- Make 20% Investing in Retail Stocks This Holiday Season

- TF Metals Report: More on the gold-yen link

- Gold & Silver Prices Jump on "Short Squeeze" as Dollar Slides, "Bout of Physical Tightness" Hits London Bullion Market

- Here Is What The Insiders Are Doing In The Gold Market

- David Icke : 'They Live' Was Telling The Truth

- Bill Maher: Council on Foreign Relations Secretly Controls the World

- My Secret Gold Strike Investing Strategy

- Friday Morning Links

- The Return of the U.S. Dollar

- ISIS To Mint Gold Coins - Irony of them Leading Honesty

- Gold/Silver Ratio 2015: Can Silver Rise When Gold Falls?

- China's REE Dominance Challenged

- Dr. Richard Alan Miller - Breakthroughs In Nanotechnology

| The Consequences of a Strengthening US Dollar Posted: 14 Nov 2014 11:00 PM PST from ChrisMartensondotcom | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Marc Faber on Gold, the US Dollar, China and the Swiss Gold Referendum Posted: 14 Nov 2014 11:00 PM PST GoldBroker | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jesse Ventura: America Now Represents Nazi Germany Posted: 14 Nov 2014 10:01 PM PST Alex Jones talks with Jesse Ventura about what the United States of America has become and why it has become what it is. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ISIS Minting Gold and Silver Coins to Avoid “Satanic Usury” of Illuminati Banking System Posted: 14 Nov 2014 09:40 PM PST from Mark Dice: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Celente – Russia’s Gold & The End Of The American Empire Posted: 14 Nov 2014 09:20 PM PST from KingWorldNews:

When you read the comments from Russia's economic advisor, Sergey Glazyev, he makes it very clear. He said, 'All freely convertible currencies are today under American control.' And he's making it clear that this isn't a good situation. Why should they be under American control? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| David Stockman On Monetary Breakdown & Skyrocketing Gold Posted: 14 Nov 2014 09:01 PM PST  Today David Stockman warned King World News that the global monetary breakdown is going to intensify and this will lead to a skyrocketing gold price. KWN takes Stockman's warnings very seriously because he is the man former President Reagan called on in 1981, during that crisis, to become Director of the Office of Management and Budget and help save the United States from collapse. Below is what Stockman, author of the website contracorner, had to say in his powerful interview. Today David Stockman warned King World News that the global monetary breakdown is going to intensify and this will lead to a skyrocketing gold price. KWN takes Stockman's warnings very seriously because he is the man former President Reagan called on in 1981, during that crisis, to become Director of the Office of Management and Budget and help save the United States from collapse. Below is what Stockman, author of the website contracorner, had to say in his powerful interview.This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Just six powerful corporations control almost all the information you see and hear Posted: 14 Nov 2014 08:00 PM PST by J. D. Heyes, Natural News:

In a word, that’s pretty scary. As observed by The Economic Collapse blog: These corporate behemoths control most of what we watch, hear and read every single day. They own television networks, cable channels, movie studios, newspapers, magazines, publishing houses, music labels and even many of our favorite websites. Sadly, most Americans don’t even stop to think about who is feeding them the endless hours of news and entertainment that they constantly ingest. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Russia And Egypt Are Proposing Peace In Syria, Central Bankers Want War Posted: 14 Nov 2014 07:37 PM PST Greece now has the fastest growing economy, or is it manipulated to look that way. UK is in a middle of a housing crisis. Retail sales plummet once again, even with gas prices falling. Russia prepares for economic war by purchasing 55 tonnes of gold. Sweden confirms sub in its water but does not... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Confidence in central banks is fading and markets will rediscover gold, Stockman says Posted: 14 Nov 2014 07:27 PM PST 10:28p ET Friday, November 14, 2014 Dear Friend of GATA and Gold: Former U.S. budget director David Stockman tells King World News tonight that central banks are losing the confidence of the markets and eventually the markets will rediscover a currency more reliable than anything printed by central banks -- gold. An excerpt from the interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/11/15_D... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers. (http://www.gata.org/node/173) To invest or learn more, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Here Is What The Insiders Are Doing In The Gold Market Posted: 14 Nov 2014 07:20 PM PST from KingWorldNews:

Buy Inflections are instances of concentrated and accelerated buying activity by insiders. While there were reasons to cast suspicions on that signal, mainly a reduced level of volume, stocks are indeed higher after suffering some short-term weakness. The Buy Inflection from insiders gave more credence to the idea that the mini-panic readings in mid-October were likely "it" for this sentiment cycle. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Nov 2014 07:00 PM PST from CrushTheStreet: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Market Capitulation? Not Likely Posted: 14 Nov 2014 06:44 PM PST If you’re waiting for capitulation in the gold market, don’t hold your breath – An argument for why the bottom in gold will come with a whimper, not a bang and why the mainstream media might be looking for capitulation in the wrong place. ca·pit·u·la·tion noun \kə-ˌpi-chə-ˈlā-shən\ When investors give up any previous gains in stock price by selling equities in an effort to get out of the market and into less risky investments. True capitulation involves extremely high volume and sharp declines. It usually is indicated by panic selling. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Nov 2014 06:40 PM PST by Jordan Roy-Byrne, TheDailyGold:

The chart below shows the weekly Gold close since 1980 and the net non-commercial (speculative) position as a percentage of open interest. From this chart we can deduce the two most important levels: $720/oz and $1000/oz. Give or take $5/oz, $720/oz was the secondary peak in 1980, the peak in 2006, small resistance in 2007 and major support in 2008. Gold's bottom in 2008 wasn't random. It bottomed at an important pivot point around $700/oz. Today, Gold is in a downtrend without any major support until the $1000/oz level. That level marked important support and resistance from 2008 to 2010 and is the next major support. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Depression-Level Collapse In Demand: In Historic First, Glencore Shuts Coal Mines For 3 Weeks Posted: 14 Nov 2014 06:25 PM PST In a historic move showing just how profound the collapse in global commodity demand and trade is, earlier today the Sydney Morning Herald reported that Australia's biggest coal exporter Glencore, which last year concluded its merger with miner Xstrata creating the world's fourth largest mining company and world's biggest commodity trader, will suspend its Australian coal business for three weeks "in a move never before seen in the Australian market, to avoid pumping tonnes into a heavily oversupplied market at depressed prices." Putting this shocking move in context, it is something that was avoided even during the depths of the global depression in the aftermath of Lehman's collapse, and takes place at a time when the punditry will have you believe that the US will decouple from the rest of the world and grow at 3% in the current quarter and in 2015. "This is a considered management decision given the current oversupply situation and reduces the need to push incremental sales into an already weak pricing environment," the company said.

For those who don't recall some of the more paradoxical moves in the Australian commodity space in recent months, Glencore is not only the dominant coal exporter in the global coal market, but one which has continued to raise its thermal coal output in Australia and push its coal business towards a new production record this year, even as prices for the commodity crashed to five-year lows. Thermal coal is selling for about $65 a, about half of the $120 price from three years ago. Said oterhwise, Glencore took the first and only page out of Amazon's playbook and has been pumping excess production in hopes of crushing marginal prices to the point where its competition goes out of business. Unfortunately, things are not working out as expected and earlier today Glencore surprised the market by saying it would shut its Australian coal business for three weeks, starting mid-December, shaving about 5 million tonnes of output. As SMH notes, "while it is understood Glencore's overall Australian coal business is the black, the size and length of the shutdown is unprecedented and suggests a level of financial distress at some of its mines."

So in a completely unshocking turn of events, rushing to create the biggest loss possible finally backfired on the company itself. Staff will be forced to take three weeks paid annual leave as a result of the suspension. Glencore has 13 Australian mine complexes, including about 20 mines and employs about 8000 staff. Still, in a world in which non-GAAP appearances are all that matter, Glencore was quick to put some lipstick on this historic pig:

Odd how it is always about the "medium run" where companies are optimistic, never the short run, especially when they suddenly find themselves in what can only be classified as a global depression in commodity demand. And now that Glencore is finally facing the music, the question is whether the other two majors who also took the beggar-thy-competitor route to prosperity, BHP Billiton and Rio Tinto, who Glencore chief Ivan Glasenberg "has attacked for dramatically expanding production in the face of falling iron ore prices" will follow suit or merely double down making Glencore's pain that much more acute.

The rest of the story is familiar: crush the competition by flooding the market with ever cheaper commodities:

And therein lies the paradox: by adopting what is ultimately a self-destructive practice, the iron-ore majors, facing crumbling global demand, are merely accelerating the deflationary pressures facing not only iron but all other commodities, as they seek to flood the world with excess production and put producers who cost of production is below the margin price out of business. Something which Saudi Arabia is also allegedly doing to its US shale-based competition. The only thing that is certain is that absent some massive global reflationary spark, many companies are about to go out of business. And should it be someone as massive and prominent as Glencore, the global deflationary wave will only acclerate further, leading to an even faster slow down in global growth, until finally decades of excess capacity and production find their new equilibrium with an epic slam, one which may involve yet another round of global taxpayer-funded bailouts. For now, however, keep a close eye on Glencore, which may just be the canary in the coalmine. No pun intended. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Image Claims to Show Ukrainian Fighter Jet Shooting Down MH17 Posted: 14 Nov 2014 06:00 PM PST A television news channel in Russia has released an image of what it claims shows a Ukrainian fighter jet shooting a missile towards Malaysia Airlines Flight 17. Skeptics are questioning the legitimacy of the image. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold is part of Russia's defense against U.S., Celente tells KWN Posted: 14 Nov 2014 05:36 PM PST 8:37p ET Friday, November 14, 2014 Dear Friend of GATA and Gold: Russia's steady acquisition of gold is part of the nation's defense in the international currency war, where, in the Russian view, "all freely convertible currencies are today under American control." That's the outlook of trends forecaster Gerald Celente's new interview with King World News, posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/11/14_C... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Own Allocated -- and Most Importantly -- Zurich, Switzerland, remains an extremely safe location for storing coins and bars of the monetary metals. If you do not own segregated physical coins and bars that you can visit, inspect, and take delivery of, you are vulnerable. International diversification remains vital to investors. GoldCore can accomplish this for you. Read GoldCore's "Essential Guide to Gold Storage In Switzerland" here: http://info.goldcore.com/essential-guide-to-storing-gold-in-switzerland Email the GoldCore team at info@goldcore.com or call our trading desk: UK: +44 (0)203 086 9200 -- U.S.: +1-302-635-1160 -- International: +353 (0)1 632 5010 Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Coast To Coast AM - November 13, 2014 Giants & the Nephilim Posted: 14 Nov 2014 05:30 PM PST Coast To Coast AM - November 13, 2014 Giants & the Nephilim The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oil price slump to trigger new US debt default crisis as OPEC waits Posted: 14 Nov 2014 05:30 PM PST By Andrew Critchlow Remember the global financial crisis, triggered six years ago when billions of dollars of dodgy loans -- doled out by banks to subprime borrowers and then resold numerous times on international debt markets -- began to unravel and default? Stock markets plunged, banks collapsed, and the entire global financial system teetered on the brink of catastrophe. Well, a similarly chilling economic scenario could be set off by the current collapse in oil prices. Based on recent stress tests of subprime borrowers in the energy sector in the US produced by Deutsche Bank, should the price of US crude fall by a further 20 percent to $60 per barrel, it could result in up to a 30 percent default rate among B- and CCC-rated high-yield US borrowers in the industry. West Texas Intermediate crude is currently trading at multi-year lows of around $75 per barrel, down from $107 per barrel in June. "A shock of that magnitude could be sufficient to trigger a broader high-yield market default cycle, if materialised," warn Deutsche strategists Oleg Melentyev and Daniel Sorid in their report. ... ... For the remainder of the story: http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/1123138... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 BullionStar is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. BullionStar's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in BullionStar's bullion vault, which is integrated with BullionStar's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

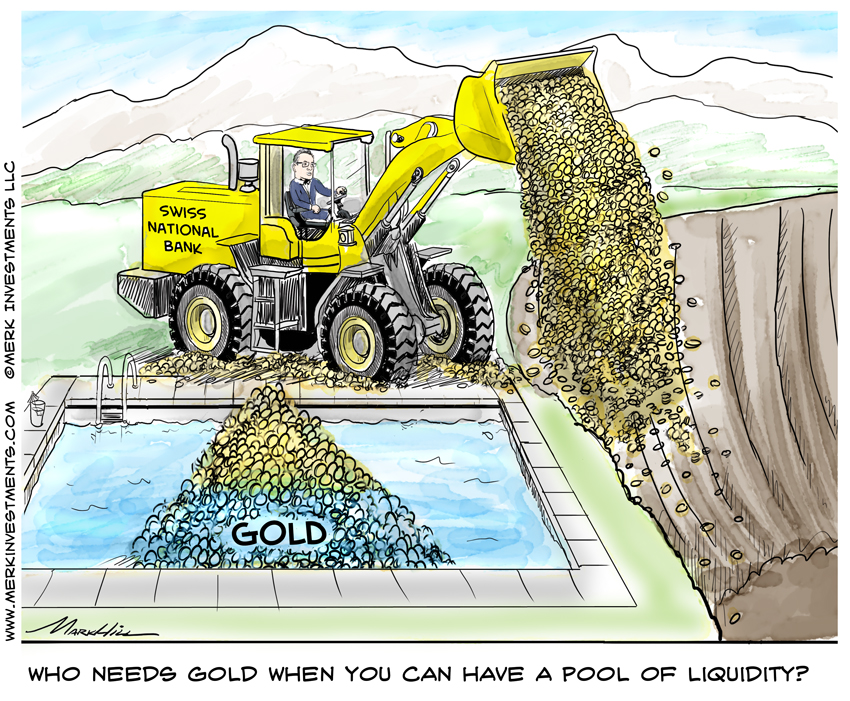

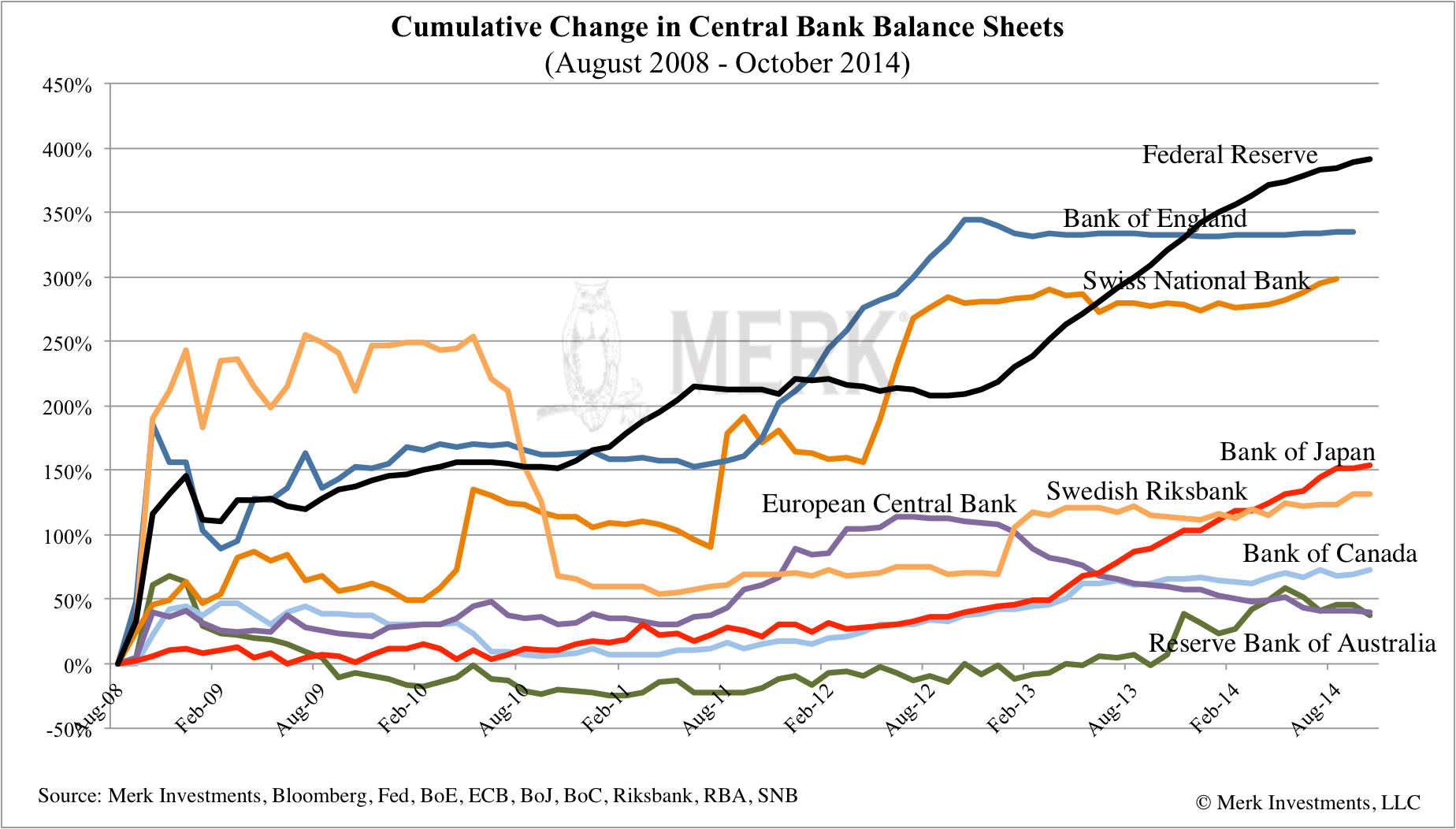

| Axel Merk: Why The Swiss Should Vote "Yes" On The Gold Initiative Posted: 14 Nov 2014 05:25 PM PST With gold already moving today on rumors of an increasingly positive tone towards Switzerland's referendum on the Gold Initiative, Axel Merk notes that it appears widely misunderstood and discusses implications for gold, the Swiss franc and Switzerland as a whole.

Authored by Axel Merk of Merk Investments, On November 30th, the Swiss are voting whether to amend their country’s constitution on an initiative entitled ‘Save our Swiss Gold.’ The motivation The initiators of the gold initiative appeal to Swiss citizens desire not to sell out the ‘family silver.’ In the late 90’s, the Swiss National Bank (SNB) owned 2,590 tons of gold; since then 1,550 tons have been sold at prices far lower than today’s prices. While the Swiss might like their gold, they are fiercely independent. That’s relevant because by imposing a ceiling of the Swiss franc versus the euro, the SNB has de facto imposed the euro on Switzerland, a step closer to joining the euro – something many Swiss object to. More importantly, many Swiss may find it inappropriate for what is supposed to be an apolitical body like the SNB to impose policies with major political ramifications. Not surprisingly, the Swiss government – which opposes the initiative - does not frame the discussion this way, but instead talks about the flexibility the SNB needs to implement its policies. It also points to the ‘losses’ incurred in 2013 when the price of gold fell. Let’s look at the initiative and arguments in more detail. The initiative would amend Switzerland’s constitution such that:

As transitional measures:

Central bank independence The Swiss government states the SNB’s independence would be at risk if the initiative passed. Former Federal Reserve Chair Alan Greenspan had this to say about central bank independence: “I never said the central bank is independent.” He did not imply the government tells the Fed where to set policy on a daily basis, but made it clear that it is the government that sets the rules. He fought back against accusations that the Fed finances huge government deficits, arguing critics have it backwards, as the Fed merely goes along. He then added that the Fed’s policies are driven by ‘culture rather than economics.’ It should not be surprising that the Swiss government is against any outside restrictions imposed on the SNB, but not because it jeopardizes central bank independence, but because it reduces the flexibility the government has. But that, of course, is precisely the purpose of constitutional initiatives available in Switzerland. Gold a risk for the SNB? The Swiss government claims that the sharp drop in gold prices in 2013 lead to heavy losses at the SNB. It’s sad when the official pamphlet representing the government’s view resorts to polemics. Let’s get a few things straight about central bank accounting:

Gold sales needed in times of crises? The Swiss government argues a central bank must be able to sell its gold in times of crisis. Let’s think about this: such a ‘crisis’ might occur when a bank is over-leveraged and must be rescued. To facilitate a ‘rescue’, the SNB is likely to provide “liquidity” (money printing with the promise that it’s only for the short-term). If a bank is insolvent rather than illiquid, it might require a capital injection. That capital has to come from somewhere. If gold is sold for this purpose, it is the people’s gold that’s being sold. The government likes to keep an option open to socialize losses. We would argue that the very reason “too big to fail” exists is because governments play rescuers that are all too willing to sacrifice the wealth of the public. They say such measures are for the common good – because depositors might lose their money in a bank. Indeed, when a bank collapses, it is the savers that lose out, as the savers are the folks that have loaned money to the bank. The way to protect savers, though, is through prudent policies that require those that take risks to be responsible for losses. Gold is the people’s money Gold is the people’s money, not the government’s money to splurge. If a currency is backed by gold, then the currency represents the gold. It’s not for the government to give away: that’s why the initiative argues against selling any of the gold, ever. It’s for that reason as well that the gold does not need to be kept abroad: gold is a store of value that ought to back the currency in circulation. 20% minimum backing of reserves Marc Faber, for example, says he has been asked to publicly support the initiative, but has so far declined to do so because he argues it is a haphazard solution; only 100% backing would be worth supporting publicly. In our assessment, Marc is too quick in discarding the merits of the initiative. Combined with the requirement that the SNB will never, ever, be allowed to sell gold, there are major ramifications:

Competitive Swiss franc? The Swiss government argues that the strong Swiss franc is a concern to exporters. No kidding. Other concerns are competitors – maybe we should get rid of those, too. And those pesky customers that don’t always feel like buying gadgets and services that are Swiss made. Kidding aside, we would argue that it is impossible for an advanced economy to compete on price. An advanced economy has to compete on value. Very few low-end consumer goods are exported from advanced economies. Look at beer, as the one area where low advanced economies have tried to compete with what might be considered as a low-end product: first, beer is branded as a premium product these days. In order to have pricing power there has been massive consolidation in the brewing sector over recent decades in much of Europe; Switzerland has been left behind in this trend – but note that these are trends that have been firmly in place well before the financial crisis. A weaker Swiss franc wouldn’t fix these challenges. The alternative to scale is to then try to be profitable at the local level; indeed, microbreweries with no export market have succeeded in many high cost areas. Swiss multi-nationals have long learned to have natural hedges in place, matching revenue and expenses in their export markets. Switzerland usually retains the headquarters, possibly R&D. Switzerland has lots of seasonal workers; policy makers should think out of the box, such as paying seasonal workers in euros. It may be far better to pay workers in a depreciating currency than to throw away one’s gold reserves in order to attract more seasonal workers… Switzerland has always had a tough market. It is said that because of how critical Swiss consumers are, that if someone can have a product succeed in Switzerland, it can succeed anywhere. We live in a world drowning in debt. The U.S., European Union, Japan, to name a few, cannot afford to pay all the promises they have made. As Alan Greenspan recently said, a welfare state cannot support a gold standard. These other countries will debase their currencies over time in an effort to make their liabilities more affordable. It won’t be easy to sell to countries that have put policies in place that we believe may impoverish their middle class. The solution, however, is not to impoverish Switzerland. It won’t be easy, but the sooner Switzerland embraces the reality that competitive devaluation is not in its interest, the better. Back to reality Having made the case for Switzerland’s gold initiative, note that passing the initiative would only be a first step. Unless policy makers embrace the spirit rather than the letter of the law, it may be an uphill battle. We have already received research reports how the SNB could circumvent its obligations by spinning off assets. The SNB might also engage in derivatives to undermine the spirit of the initiative should it pass. Let’s also keep in mind that the SNB has five years to implement the 20% backing of its reserves by gold. That should allow the SNB to conduct purchases without disrupting markets. In the short-term, the signaling effect might be the most powerful one: the ceiling of the Swiss franc versus the euro may well get tested. Such ceilings are enforceable only when they represent an unconditional commitment. As soon as someone blinks, the market will test the resolve of policy makers. The passing of such tests may well qualify as resolve. The SNB may be well served to start buying gold from day one if they accelerate their purchases of euros. Ultimately, people should never rely on their government to pursue a gold standard, but consider pursuing their own, personal gold standard. On that note, we will expand on our discussion of Switzerland’s vote to force the Swiss National Bank to hold a minimum of 20% of its reserves in our upcoming Webinar (click here to register), on November 20, 2014. As part of the webinar, we will also discuss how investors can build their personal gold standard. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jonathan Kosares: Gold capitulation? Not likely Posted: 14 Nov 2014 05:20 PM PST 8:21p ET November 14, 2014 Dear Friend of GATA and Gold: USAGold's Jonathan Kosares argues tonight that any "capitulation" in the gold market is more likely to occur with the paper shorts than with the metal longs, because the "herd money" is on the short side. Kosares' commentary is headlined "Gold Capitulation? Not Likely" and it's posted at USAGold here: http://www.usagold.com/publications/Nov2014R&Ocapitjk.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Russia Is Preparing For A "Catastrophic" Oil Price Collapse Posted: 14 Nov 2014 05:19 PM PST Vladimir Putin told the state-run TASS news agency that Russia's economy faces a potential "catastrophic" slump in oil prices, saying, as Bloomberg reports, such a scenario is "entirely possible, and we admit it." However, Putin reassures that with reserves at more than $400 billion, the country will weather such a turn of events because "we handle our gold and currency reserves and government reserves sparingly."

* * * | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Nov 2014 04:06 PM PST

No sooner did I demand it than silver and GOLD PRICES broke out upside, after a frustrating do-nothing week. The gold price leapt $23.90 (2.1%) to $1,185.00. Silver outshone, rising 69.3 cents (4.64%) to $16.31. Yesterday I said silver and gold needed to climb through $16.00 and $1,185.00, and they promptly did. Believe it or not, in the midst of all this gloom, the gold price has actually risen for the past two weeks. Bottom came at $1,130.40 (intraday) last Friday, 7 November. Today gold acted as if it wanted to drop but caught hold and levitated straight up to close Comex at $1,185 and end the day about $1,190. Why is $1,180 such strong resistance? Because for 16 months it formed the stout floor for gold. Today the GOLD PRICE touched the 20 DMA ($1,192.83). This only begins a rally. Next gold must climb over $1,200, then $1,225 where it began to fall off. Above that comes the test at the last high, $1,255.60. The chart has formed what might turn out to be an upside-down head and shoulders pattern. That means we can expect a rise toward $1,255.6 where the neckline is, then a drop back for a test of $1,180, the bottom of the left shoulder, for a rally from there up through the neckline. The SILVER PRICE reached up and nearly touched the 20 DMA at $16.40 (the high was $16.38), and it closed near there. Next week it should jump through the 20 DMA and press on toward $17.82, the last high. Silver's chart, too, shows a potential upside-down HandS. Silver needs to throw a leg over $17.00 where its waterfall began. Momentum indicators have all turned up, so they are confirming this breakout as genuine. I bought silver today. GOLD/SILVER RATIO dropped to 72.655 today. If you ever want to swap gold for silver near this ratio level, you ought to jump soon. Stocks spent the week millimetering higher, for the fourth straight up-week. Dollar finally faltered for a correction today. Platinum and palladium seem to have found bottoms. Dow faltered today, losing 18.05 (0.1%) to 17,634.74. S&P500 technically rose, 0.49 or 0.2% to 2,039.82. Disagreement shows confusion, confusion lack of confidence. May go marginally higher next week, but the time bomb is ticking for a slippery slide. (I'm giving y'all two metaphors for the price of one). Cycles point to a peak soon but also gauges of inward weakness are showing. Add to that knocking on the upper boundary line on declining volume. Not a good cocktail. Dow in metals plunged. Dow in gold lost 2.11% to end at G$307.39 gold dollars (14.87 oz), falling back below the channel line it had thrown over. Good start. Dow in silver dove for the bottom, ending at $1,397.60 silver dollars (1,080.96 oz). Now back within the up channel. Too soon to tell us whether this is a permanent turn. US dollar index made the first half of a key reversal with a new intraday high at 88.36, but a lower close for the day. Ended at 87.58, down 25 basis points or 0.28%. A lower close on Monday will send the dollar index into a weighty correction, swimming like a man in concrete overshoes. Euro finally made something resembling a turnaround. Reached up for the 20 DMA at $1.2524, up 0.39%. Could run fast toward $1.2900. Yen confirmed nosedive with a gap down today an a 0.41% drop to 85.99. Y'all enjoy your weekend! Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ISIS Minting Gold and Silver Coins to Avoid “Satanic Usury” of Illuminati Banking System Posted: 14 Nov 2014 02:52 PM PST SIS Minting Gold and Silver Coins to Avoid "Satanic Usury" of Illuminati Banking System. *SUBSCRIBE* for more great videos! Click "Like" "Favorite" and sound off in the comments. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - He Dwelleth In This Land Posted: 14 Nov 2014 02:02 PM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Alex Jones Show(VIDEO Commercial Free) Friday November 14 2014: Ben Fuchs Posted: 14 Nov 2014 01:18 PM PST On the Friday, November 14 edition of the Alex Jones Show, Jones delves into the latest on the giant health care swindle that is Obamacare, and provides an update on how Obama's contentious promise to grant amnesty to millions of illegals can only hasten America's economic collapse. Jones also... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ObamaCare’s Architect Confesses to Fraud Posted: 14 Nov 2014 01:04 PM PST MIT Professor admitted health law's passage relied on "stupidity of American voters" The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Celente - Russia’s Gold & The End Of The American Empire Posted: 14 Nov 2014 12:24 PM PST  On the heels of a massive rally in the gold and silver markets, today the top trends forecaster spoke with King World News about Russia's stunning moves in the gold market, and why this spells the end of America's dominance of the world. Below is what Gerald Celente, who is founder of Trends Research and the man considered to be the top trends forecaster in the world, had to say in his fascinating interview. On the heels of a massive rally in the gold and silver markets, today the top trends forecaster spoke with King World News about Russia's stunning moves in the gold market, and why this spells the end of America's dominance of the world. Below is what Gerald Celente, who is founder of Trends Research and the man considered to be the top trends forecaster in the world, had to say in his fascinating interview.This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock Market S&P Megaphone Top, Huge Volume Bullish Reversal in Junior Gold Miners? Posted: 14 Nov 2014 12:19 PM PST In a recent landslide election, Republicans took back control of the Senate and House. President Obama’s approval rating is very low. Although there a few making money in the stock market, the majority of the American people are fed up with close to 100 million people not working. Welfare and entitlement spending is out of control. The debt is still soaring close to $20 trillion and the dollar is rising making it even harder for politicians and banks to avoid default. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Nov 2014 12:09 PM PST This latest capitulation by gold-stock investors has left this hated sector at truly apocalyptic lows. Bearish consensus is so extreme that pretty much everyone believes the gold miners are doomed to spiral lower forever. But today’s horrendous gold-stock price levels aren’t righteous, they’re a temporary emotional fiction conjured by epic fear. Trading at fundamentally-absurd levels, gold stocks are due to mean revert far higher. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2 Simple Ways to Spot Hidden, Undervalued Biotech Stocks Posted: 14 Nov 2014 12:05 PM PST This post 2 Simple Ways to Spot Hidden, Undervalued Biotech Stocks appeared first on Daily Reckoning. [Ed. Note: We've shared several stories recently about the upcoming bull market in biotech stocks. From a practical side, as well as a technical side... But there's still a stigma around this market, that's it's too risky to bet on, right now. Below, Thompson Clark describes two simple ways to find great, hidden value in this market before it takes off.] Last week, I attended a fairly exclusive investing conference. And while there, I had a fascinating one-on-one conversation with a whip-smart CEO of a biotech company. He has his Ph.D. in mechanical engineering. So you know this guy knows what he's talking about. He gave me two ideas that might generate some big biotech profit opportunities in the coming months. What he said really kicked my brain into gear. Let me explain why… See, the crazy thing is this CEO considers himself a value investor. Now, if you know much about biotech investors, that sounds ridiculous. Biotech stocks can swing wildly — anywhere from 25-75% overnight. You take some big gambles. More often than not, Phase 3 drugs sell for Phase 1 prices. But value investing is the opposite. Value investors like us find hidden treasure in the stock market. They find million-dollar houses selling for half off. So how could this CEO consider himself a value investor? That's exactly what I asked myself. As we talked more, it started to come together for me… a light bulb went off in my head. It has to do with how people misprice the value of drugs getting FDA approval. A company goes through four phases with the FDA to get drug approval. It's during these phases researchers prove the drug works. Each phase is harder and harder to pass. The goal is to pass all the steps and get FDA approval. Once approved, the company can sell the drug and get rich! The further along the company is in these phases, the more it should be worth. But here's the kicker. More often than not, Phase 3 drugs sell for Phase 1 prices. Now, my CEO friend gave me the rundown on these phases. What you need to know is once a company reaches Phase 3, as he explained, approval is almost guaranteed. But unbelievably, the market sometimes fails to account for this. The stock could be in Phase 3 — yet "valued" like it's in Phase 1! In other words, we're buying a potential bar of gold for the price of a lump of coal. Now, that's exactly the type of opportunity I'm on the lookout for. But this guy gave me another idea that really set my wheels in motion. He explained that there are plenty of cases where a few different companies are researching the same drug, trying to solve the same problem. Company A could trade at $100 million, while Company B could trade at $1 billion. And yet they're solving the same problem. This is a textbook example of market inefficiency. And as it turns out just a little bit of research can help sort this out. What if Company A has worse results in drug studies? Then the gap might make sense. Or what if Company A is in Phase 1 with the FDA, while Company B is in Phase 3? The price gap would make sense as well. However, there are many cases where it's the exact opposite. Company A — the cheaper of the two — will have a better drug and higher degrees of FDA approval. But it will trade at a huge discount to Company B. How's this possible? …a lot of these Phase 3 companies slip completely off everyone's radar… Most stock buyers don't understand how to value a biotech company. So the companies that promote themselves can do really well at first, while the quieter, science-based companies are hidden treasures Wall Street doesn't have on its radar. Basically, after a company is approved for Phase 3, you'd think everyone would be excited. But the truth is a lot of these Phase 3 companies slip completely off everyone's radar because they don't have a slick-talking CEO to promote them. And that's great news for us. Situations like this can hand us enormous profits — safely. We'll want to invest with the smart guys and avoid the promoters. This gives us limited downside and potentially unlimited upside. And you can take this to the bank — I'll be spending a lot of time sniffing out these opportunities for you in the months ahead. I'll keep you in the loop as I do my detective work. Regards, Thompson Clark Ed Note. In today’s issue of The Daily Reckoning email edition, Thompson opened the doors to his elite research service… But he only opened it a crack… allowing only a handful of lucky readers in for a very limited time. If you’d like the opportunity to get in on incredible services like Thompson’s, you have to sign up for The Daily Reckoning, for FREE, right here. The post 2 Simple Ways to Spot Hidden, Undervalued Biotech Stocks appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stealth QE4 - Operation Tokyo Twist as Japan Sacrifices Pensions Funds Posted: 14 Nov 2014 11:55 AM PST Simply put, QE can never be halted or even slowed. The USFed is in a corner, with no policy options, facing collapse, with no ability whatsoever to halt the systemic failure in progress. It can only rely on hidden machinery and profound lies, against a background of constant economic propaganda. The central bank franchise system wrapped around the fiat paper currency regime has failed. They cannot stop it, not even with endless bond fraud and endless war, the new twin towers of the fascist state legacy. The entire financial structures have become fully dependent on easy money and debt financed by a printing press, buttressed by derivative machinery. The Uncle Sam bearing the USDollar emblem is like a pathetic heroin addict brandishing a modern howitzer. The USDollar is fast losing its integrity, during a dangerous global rejection episode. Therefore, QE must be exported, the easy candidate Japan. Call it Operation Tokyo Twist. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ronan Manly: Swiss gold shenanigans intensify prior to Nov. 30 vote Posted: 14 Nov 2014 11:49 AM PST 2:50p ET Friday, November 14, 2014 Dear Friend of GATA and Gold: The Swiss National Bank's long transition from an independent holder and advocate of gold reserves to a mere branch of the U.S. Federal Reserve is described in today's commentary at GoldCore by the firm's market analyst, Ronan Manly, a GATA consultant. Manly's commentary is headlined "'Gold Wars' -- Swiss Gold Shenanigans Intensify Prior To November 30 Vote" and it's posted here: http://www.goldcore.com/goldcore_blog/Gold_Wars_Swiss_Gold_Shenanigans_I... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shocking Facts About China, Russia & End Of Gold Bear Market Posted: 14 Nov 2014 10:20 AM PST  Today a legend who was recently asked by the Chinese government to give a speech to government officials in China spoke with King World News about the end of the gold bear market as well as shocking facts about China and Russia. John Ing, who has been in the business for 43 years, also spoke about the action we are seeing in the gold market and what to expect going forward. Today a legend who was recently asked by the Chinese government to give a speech to government officials in China spoke with King World News about the end of the gold bear market as well as shocking facts about China and Russia. John Ing, who has been in the business for 43 years, also spoke about the action we are seeing in the gold market and what to expect going forward.This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Government Does Not Want You To See This Letter Posted: 14 Nov 2014 09:27 AM PST In this video Luke Rudkowski breaks down the latest redacted letter that was sent by the FBI to MLK. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers and many more [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold/Silver Ratio 2015: Can Silver Rise When Gold Falls? Posted: 14 Nov 2014 08:48 AM PST Bullion Vault | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

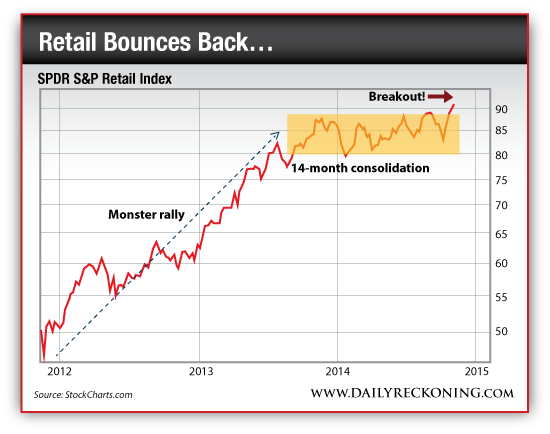

| Make 20% Investing in Retail Stocks This Holiday Season Posted: 14 Nov 2014 08:46 AM PST This post Make 20% Investing in Retail Stocks This Holiday Season appeared first on Daily Reckoning. [Ed. Note: Back in May, Greg Guenthner said to stay away from retail stocks. Now he's singing a different tune, as retail stocks are beginning a major breakout. Don't let this market pass you buy. Read below for his full assessment...] Black Friday approaches… No, I'm not talking about a market meltdown. I mean America's unofficial busiest shopping day of the year. And instead of getting trampled to death fighting over a cheap flat screen TV at Best Buy the day after Thanksgiving, you should stay at home eating leftover turkey and buying retail stocks instead. That's right — the retail sector is back in action after riding the pine for the better part of the past year. And you're looking at gains of 20% if you get in now. I'll show you the best way to do it in a minute… First, check out the challenges retail stocks have faced this year. Five months into 2014, retail stocks were falling into the meat grinder. The entire sector — minus a few names like Tiffany and Co. that cater to the one-percenters — was getting ground into mince meat. Now, after a furious rally, retailers are coming on like gangbusters… As of late May, the S&P Retail Index was down 7% on the year. It managed to fight back above breakeven twice — once in July and again in August. But retail stocks continued to lag behind the market for the rest of the year…until just two weeks ago. Now, after a furious rally, retailers are coming on like gangbusters… Back in May, I told you to avoid this sector. After all, the popular, middle-of-the-road and discount retailers were getting slapped silly. Walmart cratered after reporting a lackluster first quarter. Dick’s Sporting Goods fell 18% after it warned of weak sales. Staples dropped more than 12% after missing analyst forecasts. Not a pretty picture. At the time, energy stocks were rocketing higher almost every single day. That was the easy trade during the first half of the year. But now that oil has fallen off a cliff, the board has tilted in favor of retail once again. This is the time of year when the talking heads on TV are going to be asking all the analysts about holiday shopping projections and how Tickle Me Elmo sales will boost stocks. That's all garbage. Let me spare you the agony — holiday shopping isn't rocket science. People spend money this time of year, and they might spend a little more than expected this year because they're saving a bit on gas. Like I said, it ain't rocket science… The average price of a gallon of gas is at $2.99, down from $3.70 in late June, according to AAA. That's a huge discount that will help consumers save billions. Oh, and oil is in the gutter again. Crude dropped nearly 4% yet again yesterday afternoon… All of this adds up to some pretty impressive rallies throughout the retail sector. Don’t believe me? Just check out your favorite (or least favorite) retailer. Its share price has probably jumped sharply over the past couple of weeks… Walmart jumped more than 4% yesterday alone on its third quarter earnings report. Same-store sales, an important retail metric, rose for the first time in seven quarters. That's just the boost it needed heading into the holidays… Despite stiff competition from online price matching, I still think stocks like Walmart can outperform heading into 2015. Regards, Greg Guenthner P.S. The S&P Retail Index is up 13% over the past four weeks. And it looks like Target and Walmart are no longer struggling with weak sales. Heck, they might even beat expectations this season. If you want to cash in on the biggest profits this market has to offer, sign up for my Rude Awakening e-letter, for FREE, right here. I’ll be tracking the sector very closely, and sharing ally my findings — including huge potential winners — with my readers. Don’t miss out. Click here now to sign up for FREE. The post Make 20% Investing in Retail Stocks This Holiday Season appeared first on Daily Reckoning. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TF Metals Report: More on the gold-yen link Posted: 14 Nov 2014 08:41 AM PST 11:40a ET Friday, November 14, 2014 Dear Friend of GATA and Gold: The TF Metals Report's Turd Ferguson today speculates on a seeming correlation between the price of gold and the Japanese yen, a correlation that became almost exact starting in June this year, with both the yen and gold declining sharply. But Ferguson thinks a limit to the correlation may be approaching because the physical gold market will break from the paper gold market if the paper price keeps falling. Ferguson's commentary is headlined "Even More on the Gold-Yen Link" and it's posted at the TF Metals Report here: http://www.tfmetalsreport.com/blog/6346/even-more-gold-yen-link CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sinclair's Next Market Seminar Is Nov. 15 in San Francisco Mining entrepreneur and gold advocate Jim Sinclair will hold his next market seminar from 10 a.m. to 3 p.m. on Saturday, November 15, at the Holiday Inn at San Francisco International Airport in South San Francisco, California. Admission will be $100. For more information and to register, please visit: http://www.jsmineset.com/2014/10/10/san-francisco-qa-session-announced/ Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing recordings of the proceedings of the 2014 New Orleans Investment Conference: https://jeffersoncompanies.com/landing/2014-av-powell Or by purchasing DVDs of GATA's London conference in August 2011 or GATA's Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Nov 2014 08:11 AM PST GOLD and silver prices leapt in late London trade Friday, erasing earlier losses in what traders called a "short squeeze" to stand unchanged on the week as crude oil also bounced from 4-year lows. After new US data put consumer confidence at the best level in 7 years, the Dollar suddenly fell hard on the currency market, dropping 1 cent against the Euro after trading near last week's 2-year highs. Silver prices leapt 4.3% over the next two hours, touching a 7-session high at $15.94 per ounce. Gold meantime gained 2.2% to recover $1175 after earlier sliding below $1150, a new 4.5-year low when first hit last week. Betting against gold and silver prices has this month reached multi-year records on the latest data from US regulator the CFTC. Data compiled by Reuters this morning showed open interest in US gold options was heaviest in "put" contracts – set to profit if gold falls – at target prices of $1100-1200 for both December and January. "The gold price has increasingly become a function of the strength of the US Dollar in recent weeks," says a note from the commodity analysts at Standard Bank, saying that gold is "acting as a pseudo-currency." "Precious metals," says Sean Corrigan at Diapason Commodities in Switzerland, "are only currently finding support from a bout of physical tightness in gold," as shown by a rising cost to borrow gold through London's wholesale market. The annualized interest rate on bullion demanded by would-be gold lenders for 1-month swaps has risen since the start of November to 0.27%, steadily reaching the highest level since dramatic spikes to 0.5% and 4% in 2001 and 1999, caused by a rush to cover short positions taken by bearish traders. "So far," says Bernard Dahdah at French investment and bullion bank Natixis, "rises in lease rates have reflected the difficulty of transforming [large] Western-held bullion bars to kilo bars [for Asian investors]. "But at some point, this may become more a question of the absolute volumes of gold still held in Western vaults." With London the centre of world bullion dealing, net gold exports from the UK have now totalled 1,680 tonnes since the start of 2013 according to BullionVault analysis. That equals more than 60% of total net imports – primarily held for investors in London's specialist vaults – over the previous five years. Now the world's largest importer and mining producer, China currently has no "bullion banking" market, and the bulk of metal in private hands is held by consumers as jewelry or investors as kilobars. Shanghai officials told the Reuters newswire last month they would like to enable miner hedging as well as speculative trading in physical gold through the launch of forwards and options contracts. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Here Is What The Insiders Are Doing In The Gold Market Posted: 14 Nov 2014 08:10 AM PST  After some wild trading in the gold market, everyone wants to know what's next for gold and the mining shares? To help answer that question, today King World News is pleased to share a key portion of the internationally acclaimed work from Jason Goepert, founder of SentimenTrader, including a fascinating chart on insider buying. After some wild trading in the gold market, everyone wants to know what's next for gold and the mining shares? To help answer that question, today King World News is pleased to share a key portion of the internationally acclaimed work from Jason Goepert, founder of SentimenTrader, including a fascinating chart on insider buying. This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| David Icke : 'They Live' Was Telling The Truth Posted: 14 Nov 2014 07:35 AM PST Full title: The David Icke Videocast: Parliament protests, McCain the warmonger and politicians don't run the world The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers , Whistelblowers , truthers... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bill Maher: Council on Foreign Relations Secretly Controls the World Posted: 14 Nov 2014 07:23 AM PST Bill Maher Joked that Council on Foreign Relations Secretly Controls the World and an Ear to Ear Grin Emerged on CFR President Richard Haas. The Financial Armageddon Economic Collapse Blog tracks trends and forecasts , futurists , visionaries , free investigative journalists , researchers ,... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| My Secret Gold Strike Investing Strategy Posted: 14 Nov 2014 05:47 AM PST Keith Fitz-Gerald writes: Gold has taken a tremendous beating in recent weeks and is now tumbling along at four-year lows of $1,160/ounce. Things are so bad that you can actually buy the Central Fund of Canada Ltd. (NYSEMKT:CEF) – a popular gold and silver bullion investment vehicle – at a 10%-11% discount to the price of gold, because traders think the price of gold will drop even lower. Frankly, I think that’s fantastic news. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Nov 2014 05:25 AM PST MUST READS Volcker at Odds With Fed Policy – WSJ Moscow gives France warship delivery deadline – The Local Putin Hoards Gold, Rattles Sabers – What's Next? – Fiscal Times IEA sees new era, no quick rebound in oil prices – Reuters Oil Price Slide – No Good Way Out – Our Finite World How Low Can the Price of Oil [...] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Nov 2014 05:16 AM PST Two years ago, my friend Mohamed El-Erian and I were on the stage at my Strategic Investment Conference. Naturally we were discussing currencies in the global economy, and I asked him about currency wars. He smiled and said to me, “John, we don’t talk about currency wars in polite circles. More like currency disagreements†(or some word to that effect). | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ISIS To Mint Gold Coins - Irony of them Leading Honesty Posted: 14 Nov 2014 05:10 AM PST http://www.presstv.ir/detail/2014/11/... The ISIL Takfiri terrorist group says it is planning to create its own currency in coins, prompting speculations on whether the move is viable. The terrorist group said in a statement on Thursday that the currency will be in the form of two gold, three... [[ This is a content summary only. Visit http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold/Silver Ratio 2015: Can Silver Rise When Gold Falls? Posted: 14 Nov 2014 04:47 AM PST The Gold/Silver Ratio has hit 5-year highs. Analysts say that makes silver cheap... SILVER looks cheap right now, and not only because it has dropped 70% in Dollar terms over the last three-and-half years, writes Adrian Ash at BullionVault. That, says Yahoo Finance, is the view of smaller private investors, apparently "wedded to [the] idea that the Fed is going to destroy the Dollar" even as QE ends and rate-hikes are next. But a growing number of professional analysts also say silver is cheap, and very cheap compared to gold. Cheap enough to make buying it over the heavier metal – or even "ratio trading" the precious pair, shorting gold and going long silver – an attractive play. The core idea is that the long history of gold and silver as monetary metals still lingers, and their prices still track each other very closely today. So first up, UK consultancy Capital Economics. The drop in both precious metals is overdone, they think, but the Gold/Silver Ratio is really out of whack. Because as both metals have sunk in price, silver has fallen too fast, sending the relative value of gold to 5-year highs near 75 ounces of silver per 1 ounce of gold. What Capital Economics calls the more "normal" ratio of 60 would, on flat gold prices, take silver back up to $20 per ounce by end-2015 as gold rallies to $1200 on their forecast. Because silver is primarily an industrial metal, it could then rise again to $23 in 2016 on "any economic recovery". But gold, being relatively useless to industry while loved by consumers and investors, is seen trading shy of $1400 two years from now. Trouble is, that "normal" level of 60 is an average of only the last 20 years. Longer-term averages in the Gold/Silver Ratio are lower – much lower. So either silver is deeply undervalued against gold today, or the underlying trend in the Gold/Silver Ratio points higher because the world is choosing to price gold more highly over time. Physically, the earth's crust contains perhaps 20 times as much silver as gold. Global mine output last year was at a ratio of 8-to-1. But at market prices, here's how the Gold/Silver Ratio has moved in the last 100 years.  Further back, and starting from around 10 ounces of silver per 1 ounce of gold in early medieval Venice, the Gold/Silver Ratio was set around 15.2-to-1 by Sir Isaac Newton when he established what then became the Sterling Gold Standard at the start of the 1700s. A century later, the young United States ran a "bimetallic" standard at 15.5-to-1, but after the Gold Standard went global, and pushed silver out of the world's monetary system, the heavier metal's relative value rose again in the early 20th century, peaking around 100 during the Great Depression. Gold prices were fixed at $35 per ounce after WWII, with private ownership and trading banned to maintain that peg. But monetary inflation rose sharply, inviting higher prices in freely traded silver, and driving a slump in the Gold/Silver Ratio below 20 until gold was de-linked from the US Dollar – and shot higher – during the 1970s. Over the next 40 years, the Gold/Silver Ratio repeated that surge and fall. It has averaged 60 over the last two years. To push back to that level in 2015, silver could gain 12% in Dollar terms, even with gold holding flat near today's four-and-half-year lows of $1150 per ounce. Starting from today's 5-year low in silver's relative value to gold, it's not only Capital Economics who think the cheaper metal could "potentially outperform gold by a very large margin." Investment bank J.P.Morgan just revised its gold and silver forecasts for 2015. Its new forecasts put the average Gold/Silver Ratio back down at 66 from today's 74 level. Dutch bank ABN Amro meanwhile urges investors not to buy gold – calling it a "falling knife" – but also says silver prices will recover. The table at the end of this note shows that ABN expects silver to rise in nominal Dollar terms next year, recovering to $18 per ounce by the end of 2015. With gold prices down at $800 per ounce, that would squash gold's relative value from 75 to 44 ounces of the white metal. But really? That's some forecast. The 44 level has only been seen in the Gold/Silver Ratio four times in the last three decades, and only when silver prices have reached a marked peak. And could silver rise so sharply when gold prices fall? The post-WWII restrictions on gold trading began to unravel in 1968. Since then, and looking at all 12-month periods, gold and silver have moved in the same direction some 75% of the time. Gold rose while silver fell 17% of the time, but silver rose as gold fell only 7% of the time – and almost half of those times came during Warren Buffett's concerted silver purchases (some might say "corner") of the late 1990s. Berkshire Hathaway came to own 130 million ounces, then equal to around one-sixth of the world's entire annual silver mining output. That wasn't quite as much as Texas oil barons the Hunt brothers tried to corner in the late 1970s, but for silver to end its current slump and turn higher, one leading analyst has said it would need an uber-rich "sponsor" again. So history says silver can go up as gold falls. But such an event is rare. If silver is to rise 50% by end-2016, as Capital Economics' two-year forecast of $23 per ounce suggests, then the historical record says it's highly likely gold will have risen too. Out of all trading days since 1970, silver has stood 50% higher or more from two years earlier some 22% of the time (London Fix data). Gold has always been higher as well. Always. And where silver has stood 45-55% higher from two years before (roughly 1 day in 30 over the last 11,270) then gold has always been higher as well, gaining 40% on average. So, silver up but gold down? For a while perhaps. But through 2015 and on to end-2016...? Don't bet on it. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||