saveyourassetsfirst3 |

- YOU ARE 100% RIGHT ABOUT SILVER — The Wealth Watchman

- Warning: Gold avalanche continues

- Popular Movement in Switzerland Looks to Repatriate Gold and Increase Reserves

- SILVER SQUELCHERS PART 3: Their Interesting Associates

- Resource master Rick Rule: This is a “very, very bullish sign” for junior gold stocks

- BO POLNY: Triple Bottom a Prelude to Runaway Gold & Silver Bull Markets

- Gold 1240 Lines Up as Resistance

- Is this the end for gold?

- Legendary Gold Trader: This Will Drive the Gold Trolls Wild- Gold Will Trade at New Highs Above $1900

- T. Ferguson: 12 Charts That Show a Deflationary Crash is Dead Ahead!

- Legendary Gold Trader: This Will Drive the Gold Trolls Wild- Gold Will Trade at New Highs Above $1900

- Gold hovers, looks for way out

- Gold is Making a Dramatic Comeback in the Financial System

- Rebounding gold supported by weak stocks, dollar index

- India as the 'jeweller to the world'?

- Metals market update for October 7

- Shackling SNB to gold bad idea - Swiss Minister

- New Gold Tourism Circuit in India to boost jewelry production

- Stewart Thomson: Deflation Is Bullish For Gold Stocks

- Silver “Particularly Cheap” as “Blood On The Commodity Streets”

- Gold investors await China to return from holiday

- Silver “Particularly Cheap” as “Blood On The Commodity Streets”

- Gold vs S&P 500: Insights From The 25-Year Chart

- Gold Threatens Two-Month Down Trend, SPX 500 Rebound Thwarted

- When Will Gold Rally? Watch The Yen

- The Best Offense Remains a Good Defense: M Partners' Derek Macpherson

- To buy or not to buy

- Gold Price Support At $1,180/oz and $1,161/oz, Then At $1,000/oz

- Tocqueville’s Hathaway: China Has It Right About Gold and The Dollar

- Surging dollar may be triple whammy for U.S. earnings

- Rick Rule on Junior Gold Miners -- Continued

- India should aim $40 billion gold jewellery exports by 2020: World Gold Council

- 'India needs more world-class gold refineries to attract foreign direct investment'

- Durga puja festivities ring in golden splendour in India

- India’s jewellery market

- Gold Import Zoomed to 131 Tonnes Ahead of Festival

- Scotiabank confirms Jansen: China gold demand far greater than World Gold Council says

- Koos Jansen: China's gold demand remains strong, silver remains scarce

- Robin Bromby in The Australian: Shanghai gold surprise in store

- Tocqueville's Hathaway: China has it right about gold and the dollar

- Gold Bars Worldwide

- Memories Of The Souk Al Manakh

- Bitcoin speculators being crushed will they now move into silver?

- Only a minor perfect storm brewing in global financial markets?

- The Second Worst Hyperinflation

- Real Interest Rates and Recent Decline in the Price of Gold

- Oct 6/No change in gold inventory at the GLD/no change in silver inventory at SLV/huge demand for physical gold from China this week at 46 tonnes/Silver still in backwardation in Shanghai but inventory rises to 3.038 million oz/ gold and silver rise today

- Record September Gold Eagle Sales…A Big Price Move Coming?

- Gold Price vs U.S. Debt Ratio In 2014: A Major Disconnect

- $1180 : Is A Major Low Ahead For Gold And Silver?

| YOU ARE 100% RIGHT ABOUT SILVER — The Wealth Watchman Posted: 07 Oct 2014 01:00 PM PDT Despite the cartel's vicious, criminal paper games, Silver & Gold demand has EXPLODED and Western demand is back with a vengeance. Judging by the past week of Silver Eagle sales from the US Mint the big players, the smartest guys in the room were busy buying nearly 24 tonnes of silver from the U.S. Mint! So […] The post YOU ARE 100% RIGHT ABOUT SILVER — The Wealth Watchman appeared first on Silver Doctors. |

| Warning: Gold avalanche continues Posted: 07 Oct 2014 12:10 PM PDT With a strong dollar currently depressing the precious metals prices, M Partners Mining Analyst Derek Macpherson believes that fundamentals will kick in eventually and bring prices back up. |

| Popular Movement in Switzerland Looks to Repatriate Gold and Increase Reserves Posted: 07 Oct 2014 11:47 AM PDT There is a peoples’ movement in Switzerland to repatriate their gold and increase the percentage of gold reserves. This story has received very little attention in the media, even within the precious metals community. It could have significant ramifications for the gold market, increasing central bank demand and putting upward pressure on the gold price. This […] |

| SILVER SQUELCHERS PART 3: Their Interesting Associates Posted: 07 Oct 2014 11:45 AM PDT We all know that the end of COMEX price rat-holing of gold and especially silver has a more limited life now than ever before. Have you wondered what will be the response of the President and Treasury Secretary might be to a silver default? By Charles Savoie, SRSRoccoReport: In the last century we've seen the […] The post SILVER SQUELCHERS PART 3: Their Interesting Associates appeared first on Silver Doctors. |

| Resource master Rick Rule: This is a “very, very bullish sign” for junior gold stocks Posted: 07 Oct 2014 11:36 AM PDT From Sprott’s Thoughts: During a time in which few investors are considering the possibility of a recovery in natural resources, Rick Rule, Chairman of Sprott U.S. Holdings was kind enough to share a few comments. Speaking towards the overall market Rick noted that, “The market itself is very healthy. You are seeing a transition…a transition that doesn’t suggest, but rather screams that [junior resource issues are] under accumulation—which is a very, very bullish sign.” When asked if the current recovery might outperform the early 2000′s recovery, Rick indicated that, “[S]tatistically, this market shows it can be done because the bear market that preceded this bull market was a bear market that was more severe… bear markets are the authors of bull markets, and the recoveries in some way, shape, or form are related to the declines.” Here are his full interview comments with Sprott Global Resource Investment’s Tekoa Da Silva: Tekoa Da Silva: Rick, we had a meeting at our offices here recently, in which all our brokers, money managers, geologists, sat down around a table for what was a fascinating discussion on the resource markets. You commented at one point during that meeting that we’re beginning to see a stair step formation building in the charts of the resource market; a series of higher highs and higher lows, suggesting a move of paper from weak hands to strong. Can you talk about that for our readers? Rick Rule: Sure. I’m not a technical analyst but I have some friends who I think are fairly adept at this, [so I'll say that], the chart pattern we’re seeing in the junior mining market in particular (but in the precious metals markets as well) is sort of a saucer-shaped recovery that is a slow, gradual recovery featuring higher highs and higher lows. It’s important to note that the advances then consolidate—and that’s very important. The advances that don’t consolidate tend to [later] consolidate or fall off very rapidly. So what we’re seeing is a market that will advance by 10% or 12%, and then decline by 5% or 6%. This is unnerving for people who can’t stomach volatility, people who have too much margin in their account, or people who are simply unrealistically impatient with regards to markets. But the fact that it’s frustrating doesn’t have anything to do with the market. The market itself is very healthy. You are seeing a transition in the better stocks of the GDXJ—a transition that doesn’t suggest, but rather screams that they’re under accumulation which is a very, very bullish sign. The slowness of the recovery suggests that the recovery is not fragile or over-extended at all. It’s very powerful and very deliberate. So I’m extremely encouraged by that. Most people of course, most speculators, want the later stages of a recovery, the “J curve.” Unfortunately for them, most speculators when they get excited, they buy. So when that J curve takes place, when the strong upward right momentum starts to build in a chart, that’s the time when one should be selling, not buying. TD: Rick, are there other technical indications that you’re seeing now which suggest the juniors are being aggressively accumulated? RR: Well, the chart shows just what I’ve described. If you [use] the base of a hundred, the chart would run to 112 or 113 and then consolidate back to 105 and then run to 120 or 121 and consolidate back to 109 or 110…then run to 127 or 130 and consolidate back to 115. [So] that’s precisely what we’re seeing. It’s interesting that we aren’t seeing extraordinary volumes, just like we didn’t see extraordinary volumes in June, July and August of 2013 which [marked] the bottom. We saw a situation then where the buyers were exhausted but there was some residual selling. So you had a down to flat market on no volume. Now you have a situation where the sellers are exhausted. It’s going up on limited volume but the buyers have the predominance. The market will move from this recovery phase to a bull market phase, and exceeding expectations in this market is absolutely inevitable because the expectations for the sector are so low that they can’t help but be exceeded. TD: Rick, could you comment on your expectations for the strength of this recovery, and do you feel it may be more intense than what we saw in the early 2000s? RR: That would be difficult. The recovery we saw from the bottom in 2000 through the beginnings of the bull market in 2004 and then through the top of the bull market in 2007 were extraordinarily powerful. That was the best period of performance in my career albeit from a small base. So outperforming that recovery would be difficult. Now statistically, this market shows it can be done because the bear market that preceded this bull market was a bear market that was more severe. The TSX Venture fell by 75% percent from its top in early 2011 to its bottom in late 2013 and we have seen in a very rough sense that bear markets are the authors of bull markets, and the recoveries in some way, shape, or form are related to the declines. So from a statistical or empirical sense, I think that what you say could come true. From a practical sense, the recovery from the 2000 bear market was so kind to me personally that it seems disingenuous to expect a replay. TD: Rick, I was reading the annual statement put together by Ned Goodman at Dundee Corporation − who you’ve noted to be a mentor of yours over the years − and he indicated that he has learned that you don’t make money when everyone is running into stocks. You make money when no one wants to buy. Despite that statement—few people seem to be interested in investing in resources. What are your thoughts? RR: It’s common at a bear market bottom that while people empirically understand the goods are on sale and they’re going to make money, that their recent experience has been so bad that they won’t allow themselves to reenter the market until they have confirmation from the market itself that it’s safe and attractive to do so. It’s amusing to me that you point out Ned Goodman. I remember a speech that he gave at the Prospectors and Developers Association of Canada in 1999 basically saying that the pivot point was in, and the bear market was over. I would suspect that Ned was within three or four months of being right. I don’t really consider Ned to be a market timer but what he is, is a 76-year-old guy who has been in resource markets for 50 years, and right now, people are saying to Ned with regards to his bullishness on the market that, “Well, Ned has been saying that for a year and a half. Why would anybody possibly listen to him?” Well, how about the fact that he’s a self-made billionaire? That might be a reason. How about the fact that he was stupendously right in the 1998-2000 bull market? How about the fact that when he spun Dundee Corp. out of Corona in the early 90s bear market, the stock of Dundee went from $.80 cents to $42 in the ensuing bull market? I’m one of those who believe that past is prologue, and I am one of those who believe that self-made billionaires who are still active in the market are people worth listening to. So I think that Ned may be anecdotal data, but I think he’s very, very good anecdotal data. Of course it doesn’t hurt that his conclusions are very similar to my own. TD: I’d like to ask you about the idea of pyramid portfolio allocation. I remember you noting it could be a rewarding strategy for an interested speculator. What are your thoughts on how one could construct a pyramid portfolio in the resource space? RR: With regards to the precious metals, I think that an investor needs to ask himself or herself first of all if they believe in the precious metals thesis, and if they believe that there is a place in their portfolio for precious metals and precious metals equities; A, because they’re unloved, and B, because they’re traditional antidotes for popular instruments like the U.S. 10-year treasury. If the answer is yes, then investors and speculators need to ask themselves whether the precious metals they have in their portfolio are sufficient or whether they need to add more. We have found that most general market investors are under-invested in precious metals from our own point of view. If the investor agrees with that statement, they need to decide further whether they want to hold their precious metals in physical form or in the form of ETFs or trusts. I have chosen (not surprisingly) to hold most of my precious metals in the form of the Sprott Physical Trusts; the Physical Gold Trust, the Physical Silver Trust, and the Physical Platinum and Palladium Trust. One reason is because it’s a hassle to hold physical precious metals − although I do hold some − and another is because the ease with which one can buy and sell on the New York Stock Exchange (as opposed to a coin dealer), favors particularly for an older person like me, a certificated product. So the first thing that one needs to do is decide whether or not their precious metals holdings are sufficient and two, in what form they wish to own them. The second decision then if you buy the precious metals argument after having achieved the beta of the metals with physical precious metals holdings is—do you want to chase alpha? In other words, do you want the leveraged performance that a precious metals bull market would generate in the equities? If that’s the case, how do you want to do it? With regards to the big companies, I am increasingly convinced that investors should not be buying the market, or a market cap weighted ETF like the GDX which rewards size, but rather through buying very high quality individual companies or an ETF that concentrates on qualitative rather than size selective measures. A key problem in the gold business is cash flow generation because the industry as a whole doesn’t generate much cash even at higher gold prices, but individual companies such as Franco-Nevada, Goldcorp, or Royal Gold generate substantial cash. So I would suggest that if somebody wants to capture alpha that they first start with the major mining companies. The high quality major mining companies will be the first to move in the event that the metals prices go up. Then at the top of the triangle are the speculative juniors that we at Sprott Global are so well-known for and there are two different ways to play those. You can play the after market in those stocks which are free trading shares on the exchange (the higher quality ones of course), and then there’s the tippy top of the pyramid for those investors who are accredited investors. By that I mean participating in private placements in the junior sector. The attractiveness of that is if the private placement is intelligently constructed, you get “warrants” which are the right but not the obligation to buy more stock at a fixed price over time, which you can exercise if the company generates value internally or if the market itself recovers. TD: Rick, Warren Buffett is known for having said that a bull market is like sex in that it feels the best right before it ends. I asked you back in January, your thoughts on the general equities market. I’d like to ask again: When you look at the strength of the S&P 500, reaching all-time highs—what are your thoughts? RR: Well Tekoa, with the caveat that I’m not a general market securities analyst, and also with the caveat that I’m not an economist—I’m a credit analyst—the sentiment associated with the broad market seems too strong to me. I own some general market securities and I have some money managed by others in the broad market, but I have to say I’m nervous. I’m nervous because [the market strength] presupposes that the North American economy (at least) is in recovery and I see no particular evidence of that recovery, although I will say that over the last quarter, there are signs that the biggest companies in the United States are beginning to invest in property, plant and equipment—which is a useful sign. But I’m not seeing much by way of increased worker’s incomes outside of the oil and gas industry in the United States, so it’s difficult for me to see a recovery happening without rising real wages in the middle class. If we began to see rising wages, then we would see a consumer cycle where the North American auto fleet and North American durable goods, things like refrigerators and washing machines (consumer durables), begin to get bought because the used inventory – in terms of its age, is at an all-time high. If we had real growth in workers’ incomes, we would be replacing the auto fleet and we would be replacing our durable goods inventories. If we saw that, then we would begin to see greater property, plant, and equipment investments by major companies in the United States. That increased capital employed by workers would continue to increase real workers’ wages. It seems to me like the strength we’re seeing in the S&P 500 presupposes that this is going to happen, and if that’s true, the S&P 500 isn’t expensive. I just don’t know that it’s true. The second thing that’s worrying to me is that the debt and equity markets rally we’re in is surely the stuff of very, very low interest rates. I talk to investors every day whose behavior is being determined by the very low return that they’re getting on savings. Investors are getting forced into riskier and riskier activities. They’re going further out the yield curve to increase their income, and remember that debt instrument pricing is set by the delta between their yield and the yield on the U.S. 10-year treasury. As an example, in the junk debt markets (which more and more people are being forced into), if the median yield is 7%, and the yield on the U.S. 10-year treasury is 2.7%, the delta is 4.3%, something like that. If the yield on the U.S. 10-year treasury were to go from 2.7% to 3.5%, the delta (which is what the pricing is based on) would decline by about 25% or 30%, and it wouldn’t surprise me to see a commensurate impact on the debt markets, meaning a pretty ugly decline, and I could see that spilling over into the equities markets. So I would tell readers with regard to the general securities markets, please don’t buy the entire market. Buy individual securities where you believe the business will grow of its own volition for old-fashioned reasons, like the company servicing its customers well and as a consequence of that, beating its competitors well. Don’t buy the market. Buy individual stocks. TD: Rick, in wrapping up, is there anything else you think we may have missed? RR: No, I think we’ve asked people to understand an awful lot Tekoa. I would ask the readers that if they agree with this way of thinking, that they reach out to us. I espouse what I of course believe to be correct and we would welcome the opportunity to do business with like-minded people. TD: Rick Rule, chairman of Sprott U.S. Holdings, thank you for sharing your comments. RR: Thank you Tekoa. |

| BO POLNY: Triple Bottom a Prelude to Runaway Gold & Silver Bull Markets Posted: 07 Oct 2014 10:30 AM PDT Gold has placed a triple 2-year chart bottom at $1180 and will NOT break. Gold sits on the rising support line from back from 2000 – 2001 when the Bull Market began. Buying Gold today in the very low $1200 range is equivalent to buying Gold back in 2001 when it was $255. All truth […] The post BO POLNY: Triple Bottom a Prelude to Runaway Gold & Silver Bull Markets appeared first on Silver Doctors. |

| Gold 1240 Lines Up as Resistance Posted: 07 Oct 2014 10:17 AM PDT |

| Posted: 07 Oct 2014 09:57 AM PDT The precious metals market finally rallied yesterday. |

| Posted: 07 Oct 2014 09:30 AM PDT Gold expert Jim Sinclair, the man who called the 1980′s gold bull market top to the day, and predicted gold’s rise to over $1650 an ounce in the current bull run nearly a decade ago, has sent a MUST READ alert to subscribers regarding the latest gold and silver take-down. Sinclair urges PM investors to […] The post Legendary Gold Trader: This Will Drive the Gold Trolls Wild- Gold Will Trade at New Highs Above $1900 appeared first on Silver Doctors. |

| T. Ferguson: 12 Charts That Show a Deflationary Crash is Dead Ahead! Posted: 07 Oct 2014 09:15 AM PDT IF I’M RIGHT ABOUT THIS, things are going to get even worse before they get better. Why? Because hardly anyone else is talking about it! By the time the world outside of SD finally figures out what’s going on, the stock market will be crashing, crude will be near $80 and the metals will be even lower, particularly silver. As […] The post T. Ferguson: 12 Charts That Show a Deflationary Crash is Dead Ahead! appeared first on Silver Doctors. |

| Posted: 07 Oct 2014 08:47 AM PDT

|

| Gold hovers, looks for way out Posted: 07 Oct 2014 08:40 AM PDT There is widespread evidence of strong physical demand for gold around the $1,200/oz level. |

| Gold is Making a Dramatic Comeback in the Financial System Posted: 07 Oct 2014 08:00 AM PDT Change is never easy. People don't like it, and will resist change even if their current situations are terrible. Inertia is the most powerful force in the universe after all. Desirable or not, it's happening. The US dollar's days are numbered. Now, gold, with its millennia-long history is making a comeback. We're not just talking […] The post Gold is Making a Dramatic Comeback in the Financial System appeared first on Silver Doctors. |

| Rebounding gold supported by weak stocks, dollar index Posted: 07 Oct 2014 07:49 AM PDT Gold prices saw a good bounce today as stocks were weaker. |

| India as the 'jeweller to the world'? Posted: 07 Oct 2014 07:23 AM PDT The World Gold Council has called upon India to put hoards of idle gold lying with households and temples into use. |

| Metals market update for October 7 Posted: 07 Oct 2014 07:14 AM PDT Gold climbed $15.20 or 1.28% to $1,207.00 per ounce and silver soared $0.50, nearly 3% to $17.31 per ounce yesterday. |

| Shackling SNB to gold bad idea - Swiss Minister Posted: 07 Oct 2014 06:52 AM PDT The government says asking the Swiss National Bank to hold a fixed portion of its assets in gold will hinder monetary policy. |

| New Gold Tourism Circuit in India to boost jewelry production Posted: 07 Oct 2014 06:31 AM PDT The jewellers in India have extended strong support to World Gold Council's (WGC) proposal to set up 'Gold Tourism Circuit' in the country. |

| Stewart Thomson: Deflation Is Bullish For Gold Stocks Posted: 07 Oct 2014 06:30 AM PDT A major decline in oil prices that causes a collapse in global stock markets while Indian gold demand surges, is likely to entice those money managers to recommend gold stocks to their clients. As the dollar has rallied, the price of silver has declined significantly, and the gold to silver ratio has soared to the […] The post Stewart Thomson: Deflation Is Bullish For Gold Stocks appeared first on Silver Doctors. |

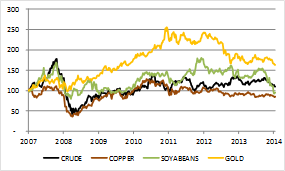

| Silver “Particularly Cheap” as “Blood On The Commodity Streets” Posted: 07 Oct 2014 04:44 AM PDT Relative to stock market indices, broad commodity indices are now at their lowest levels since the late-1990s dot com boom. But key commodity price ratios, such as those between precious and industrial metals, are already at levels associated with financial crises such as that of 2008. In other words, there is already 'blood on the commodity streets', presenting investors and commodity traders with potentially attractive opportunities. Some of our long standing clients, particularly more liquid HNW clients, are adding to allocations and see this latest sell off as an opportunity. New business is also coming from existing gold and silver investors and owners as we are seeing flows from ETF and other bank vaulted gold and silver into our allocated storage in Zurich and Singapore.

With few exceptions, commodity prices have fallen sharply in recent months, to their lowest levels in over a year.

Relative to stock market indices, broad commodity indices are now at their lowest levels since the late-1990s dot com boom. But key commodity price ratios, such as those between precious and industrial metals, are already at levels associated with financial crises such as that of 2008. In other words, there is already 'blood on the commodity streets', presenting investors and commodity traders with potentially attractive opportunities. COMMODITY PRICES, RATIOS, WARNINGS Source: Bloomberg, CME Many commentators at the time argued that soaring commodity prices were indicative of a so-called 'supercycle' driven by soaring demand from emerging economies such as China, India and Brazil. Growth in these countries was indeed rapid in the decade leading to 2008. But commodity supply was nevertheless rising to meet demand and it has continued to do so. Following a sharp correction lower during the global financial crisis of 2008, commodity prices recovered in 2009-11, only to re-enter a downtrend which has continued to this day. Some argue that this is but a normal cyclical correction due to slowing global demand. Others believe it implies that the 'supercycle' is over. In a previous report, I used commodity price ratios to argue against the 'supercycle' explanation for the boom (or bust) of commodity prices in recent years, pointing out that growth-oriented commodity prices, such as those for copper or crude oil, had not risen materially relative to those for non-industrial commodities, such as gold.[1] Were the 'supercycle' for real, this would not have been the case. Thus it is my view that the sharp downtrend in commodity prices in recent months is primarily a cyclical phenomenon indicative of sharply weaker global industrial demand, combined with a stronger dollar.[2] There is some support for this view in that global leading indicators have declined in recent months. In many cases, commodity prices and price ratios have fallen to levels not seen since the depths of the global financial crisis of 2008. COMMODITIES LEFT FAR BEHIND IN THE RALLY Source: Bloomberg, Standard and Poor's Does this imply that a crisis is imminent? Perhaps not, but it does highlight the fact that, notwithstanding a modest correction of late, equity and risky asset prices generally remain elevated and could well experience a major correction lower. Commodities, by contrast, are almost as cheap as during the 2008 crisis and thus it would appear prudent to take profits, rotating out of the former and into the latter. SLOWING PRODUCTIVITY AND STAGFLATION In another recent report I focused on stagflation, including the financial market consequences: Stocks might be able to outperform bonds in stagflation but, when adjusted for the inflation, in real terms they can still lose value. Indeed, in the 1970s, stock market valuations failed to keep pace with the accelerating inflation. Cash, in other words, was the better 'investment' option and, naturally, a far less volatile one. Best of all, however, would have been to avoid financial assets and cash altogether and instead to accumulate real assets, such as gold and oil…[3] A persuasive case can be made that the potential for gold, oil and other commodity prices to outperform stocks and bonds is higher today than it was in the mid-1970s. Monetary policies around the world are generally more expansionary. Government debt burdens and deficits are far larger. If Keynesian policies caused the 1970s stagflation, then the steroid injection of aggressive Keynesian policies post-2008 should eventually result in something even more spectacular. This combination of low commodity prices, both outright and relative to those for equities and other risky assets, and weak productivity growth implying a period of stagflation ahead, is both highly unusual and, from the perspective of an opportunistic investor, highly attractive. Perhaps not since the 1970s—perhaps not even since the early 1930s—has there been such a good opportunity in which to accumulate and overweight real assets in a portfolio.[4] PASSIVE AND ACTIVE TECHNIQUES FOR COMMODITIES INVESTING Those inclined to take a more active approach should consider overweighting specifically those commodities which appear to have attracted speculative selling of late. Here at Amphora, we advise clients on commodities markets and also trade on our own behalf. Our investment process begins with a proprietary tool we call our 'heat map'. This is a visual representation of statistically-normalised commodity price ratios, arranged in a matrix. Those price ratios at statistical extremes appear in red; those within normal ranges are shown in white. The amount of red relative to the amount of white thus indicates to what extent commodity price ratios, in general, are out of line with historical averages. At present, those commodities appearing particularly cheap on key ratios would include silver, wheat and soybeans. Crude oil and copper prices have also fallen sharply but not to the same degree against their key ratios. Thinking fundamentally, it is also unlikely that industrial commodity prices will rise in the event that equity markets meaningfully correct to the downside in the coming months. SILVER, WHEAT and SOYABEANS ARE PARTICULARLY CHEAP AT PRESENT Source: Bloomberg, CME (Sept 12 = 100) On the other side, there are a handful of commodities that have bucked the downtrend, but all of these can be explained with reference to extreme weather patterns or other unusual factors. Coffee, the year's top performer, remains elevated in price due to poor rainfall in the Brazilian Highlands, the world's top-producing region. Cocoa prices are elevated in part due to concerns that the tragic West African Ebola outbreak will complicate this year's harvest (which appears quite large). Cattle prices have soared in recent months as seasonal rains have failed to arrive in key ranching areas of the Western US. (That said, the sharp decline in hog prices in recent months could contribute to lower cattle prices if and when consumer substitution effects begin to kick in.) Strength in these commodity prices in no way contradicts the general weakness or the view that global industrial production has slowed sharply. COFFEE AND CATTLE PRICES ARE COMMODITY OUTLIERS AT MULTI-YEAR HIGHS Source: Bloomberg, CME, ICE SHADOW BANKING, MONEY AND GOLD There is widespread evidence of strong physical demand around this level, which I believe is long-term and strategic in nature, associated with official institutions, such as emerging economy central banks, and wealthy investors seeking a hedge against a future financial crisis. That said, a new forward hedging programme on the part of major gold mining firms could send the price lower. Once this was completed, however, I am confident prices would recover quickly to above $1,200 again. The flow of produced (or forward-hedged) gold is tiny relative to the strong underlying physical demand over a multi-month or longer horizon. GOLD CONSISTENTLY FINDS SUPPORT AROUND $1,200/OZ AS THE S&P500 CATCHES UP Source: Bloomberg, CME Fundamentally, the arguments in favour of a substantially higher gold price remain intact. The global money supply continues to increase at a historically elevated rate. Bank credit concerns faded for a time but have recently returned to the fore, a source of concern for the safety of bank deposits, especially in the euro-area. In this context, in the event the Fed, ECB or other major central banks indicate they are concerned by growing signs of economic weakness and declining rates of consumer price inflation, the gold price is likely to re-enter an uptrend that could continue for some time. As the IMF recently observed,[6] the global 'shadow banking system' has been growing rapidly, fuelled by rapid money supply and credit growth, and has again become a potential source of systemic risk, as it also was back in 2007-8. By the time the IMF makes such observations, prepares a report, approves it for publication and makes it available for external distribution, you can be rather certain that the developments in question have long since rung the alarm bells in the hallowed halls of that esteemed supranational financial regulatory institution. The Bank for International Settlements published a report expressing similar concerns over the summer.[7] Longer-term, with economic officials stubbornly clinging to worn-out monetary stimulus measures that have lost most if not all their effectiveness due to excessive debts, public and private, and with an equal reluctance to implement any meaningful structural reforms to encourage sustainable business investment and boost productivity, there is simply no where for the gold price to go but up as the effective purchasing power of fiat currencies goes down. There is also the possibility that, when investors least expect it, certain currencies, perhaps even major ones, suffer sudden crises of confidence in which the threat of devaluation looms. The dollar itself is not immune, given that the US possesses the world's largest cumulative external trade deficit. Indeed, I have long predicted an eventual loss of pre-eminent reserve status for the dollar, something that would send the greenback lower and dollar interest rates higher when it occurs. Gold is a form of insurance against this eventuality or against currency crises more generally, as indeed it always has been. For those so concerned, the ideal time to add to such insurance is when it is temporarily 'on-sale', as it is today at just under $1,200/oz. [1] Please see COMMON COMMODITY MISCONCEPTIONS, Amphora Report vol. 5 (June 2014). The link is here.

GOLDCORE MARKET UPDATE Gold in Dollars, 5 Years (Thomson Reuters) Gold climbed $15.20 or 1.28% to $1,207.00 per ounce and silver soared $0.50, nearly 3% to $17.31 per ounce yesterday. Gold in Singapore ticked marginally higher from $1,204 per ounce to near $1,210 per ounce. Gold continued marginally higher in early London trading prior to slight falls. Premiums for gold in Asia were quoted at $1.20 to $1.60 an ounce to the spot London prices, unchanged from last week. In Tokyo, sellers pushed up premiums for gold bars to 25 cents to spot prices from zero last week. The price fall attracted physical buyers and bargain hunters for gold yesterday, boosting prices. Gold imports into Turkey rose sharply in September to 12.599 tonnes, their highest this year and more than double last September’s total of 4.843 tonnes, data from the Istanbul Gold Exchange shows. Turkish gold bullion imports climbed to 12.6 tonnes in September, verses 2 tonnes in August, data published from Borsa Istanbul showed. Total gold imports in the first three quarters, at 65.577 tonnes, are sharply down on the 235.4 T imported in the first nine months of last year (a record year for gold imports). Gold in Euros, 5 Years (Thomson Reuters) Bullion demand has picked up but remains anemic and we are seeing only quite a small amount of new clients despite huge engagement with our emailed research and social media community. Some of our long standing clients, particularly more liquid HNW clients, are adding to allocations and see this latest sell off as an opportunity. New business is also coming from existing gold and silver investors and owners as we are seeing flows from ETF and other bank vaulted gold and silver into our allocated storage in Zurich and Singapore. Sentiment is as bad as I have seen it and reminiscent of the 2003 to 2007 period. We believe that the poor sentiment is quite bullish from a contrarian perspective. |

| Gold investors await China to return from holiday Posted: 07 Oct 2014 04:09 AM PDT Gold traded little changed above this year's low as investors awaited Asian buyers to return from a holiday. |

| Silver “Particularly Cheap” as “Blood On The Commodity Streets” Posted: 07 Oct 2014 04:02 AM PDT gold.ie |

| Gold vs S&P 500: Insights From The 25-Year Chart Posted: 07 Oct 2014 02:38 AM PDT This article is submitted by Gary Christenson, author of the new book “Gold Value and Gold Prices From 1971 – 2021.” The US national debt in 1989 was about $2.8 Trillion. Twenty Five years later, in 2014, that debt had increased by a factor of about 6.3 to $17.8 Trillion. For many decades the US piled on more debt, increased the currency in circulation much more rapidly than the economy grew, and of course, caused consumer prices to increase substantially. Naturally the S&P 500 Index increased, as did the price of gold, since each dollar was worth less. Consider the graph of the SUM of the S&P 500 Index and the price of gold. Debt increased, prices increased, and the dollar purchased less. Now consider the RATIO, as shown in this graph of gold divided by the S&P 500.

The ratio at the gold peak in 1980 was about 8. You can see that the ratio was trending downward from 1980 (graph shows since 1989) to about 2001. Subsequent to the stock market crash of 2000, 9-11, and the massive increase in spending and debt, the ratio now trends upward. We know that the official national debt is increasing about a $Trillion per year. Graph 1 shows that as debt increases, so does the sum of the S&P and gold. Graph 2 shows that gold increased relative to the S&P from about 2001 to 2011, and then fell. Gold is now deeply oversold compared to the S&P and ready to rally, unless you believe that the US national debt will start decreasing (not likely) or that the S&P will continue skyward for the foreseeable future (not likely). Will gold reverse tomorrow, next week, next month, or next year? Good luck with that question! My guess is very soon, but the high-frequency-traders, central bankers, and politicians seem to be more influential than physical supply and demand. Regardless, the critical points are:

Additional Reading Bill Holter It's all a financial mirage

Gary Christenson | The Deviant Investor | GEChristenson.com

|

| Gold Threatens Two-Month Down Trend, SPX 500 Rebound Thwarted Posted: 07 Oct 2014 01:10 AM PDT dailyfx |

| When Will Gold Rally? Watch The Yen Posted: 07 Oct 2014 01:05 AM PDT investing |

| The Best Offense Remains a Good Defense: M Partners' Derek Macpherson Posted: 07 Oct 2014 01:00 AM PDT |

| Posted: 07 Oct 2014 12:06 AM PDT I recall walking through an antique store in Centerville Indiana in 2001 and noticing that one dealer had hundreds of silver coins in cardboard holders on the table top for folks to look through, unwatched by security or anyone except the cashier about 30 feet away who was often distracted ringing people up. At $4.75 per ounce, the shoplifters were after better stuff. |

| Gold Price Support At $1,180/oz and $1,161/oz, Then At $1,000/oz Posted: 06 Oct 2014 11:30 PM PDT marketoracle |

| Tocqueville’s Hathaway: China Has It Right About Gold and The Dollar Posted: 06 Oct 2014 11:27 PM PDT "What 'da boyz' painted yesterday was a picture-perfect key reversal to the upside" ¤ Yesterday In Gold & SilverThe gold price got sold down the second that trading began in New York at 6 p.m. EDT on Sunday evening---and new low tick for this move down came at, or minutes after 9:00 a.m. Tokyo time, which was 8:00 a.m. in Hong Kong on their Monday morning. But once that engineered sell-off was out of the way, the price rallied in fits and starts for the remainder of the Monday session---culminating in a vertical spike at 1 p.m. EDT. That got dealt with instantly---and the gold price traded mostly flat for the remainder of the New York session. The low and high tick were posted by the CME Group as $1,183.30 and $1,209.90 in the December contract. Gold closed on Monday at $1,206.80 spot, up $16.10 from Friday's close---and considering the fact that there was such a huge swing in prices, net volume was only 143,000 contracts, which I consider to be reasonably light considering the price action. Well over 30,000 of those contracts were traded before London opened. Silver, of course, got smacked in the usual way at the open in New York on Sunday evening---and da boyz also took silver to a new low minutes after 8 a.m. Hong Kong time as well. The price recovered a bit from there, but traded mostly flat until around 2 p.m. Hong Kong time---and an hour before London opened. Then away it went to the upside, hitting its high price tick of the day in the New York Access Market about an hour before the 5:15 p.m. close of electronic trading. The low and high prices were recorded as $16.66 and $17.36 in the December contract. Silver finished the Monday session in New York at $17.35 spot, up 49 cents on the day---and about 70 cents off its low. Like gold, net volume wasn't overly heavy considering the price action, as only 38,000 contracts were traded---and about a third of that traded before London opened. Of course, platinum and palladium weren't spared, as the HFT boyz and their algorithms set new lows in both metals at the exact same time as gold and silver, in the very thinly traded Far East market on their Monday morning as their trading day started. Platinum traded in a $63 price range in the January 2015 contract yesterday, with volume north of 23,000 contracts---and palladium traded a dime short of $34 in the December contract in its low/high price swing. Platinum closed up $18---and palladium was up $7---impressive closes considering the depths that JPMorgan et al drove them at 8 a.m. Hong Kong time. Here are the charts. The dollar index closed at 86.65 in New York late on their Friday afternoon---and didn't do much of anything all morning long in Far East trading on their Monday. But late during the Hong Kong lunch hour the index began to fade---and this phenomenon continued right up until the decline became far more serious in mid-afternoon trading in New York. And at around 3:40 p.m. EDT the 85.70 low tick was in---as someone was there to catch the proverbial falling knife. After that the index rallied a small handful of basis points into the close, finished the day at 85.77. You'll carefully note that the simultaneous engineered price declines in all four precious metals had zero to do with what was going on in the currency markets at the time. But the main stream press uses this old canard anytime they can---and its all such bulls hit. This was a hardball in-your-face "up yours" run-the-sell-stops-across-the-board in all four---and da boyz didn't give a flying %&$# what anyone thought, as there was nobody out there to stop them, or raise a finger in protest. Here's the 3-day chart starting at 2 p.m. EDT on Sunday afternoon---and running until 3:00 a.m. EDT this morning. The gold stocks opened up on the day---and then chopped higher in a rather uninspiring way for the remainder of the New York trading session---and the HUI closed up 1.96%. The chart for the silver equities was very similar to the gold chart, except that the silver shares dipped into negative territory for a brief period just before lunch EDT. Nick Laird's Intraday Silver Sentiment Index closed up an even 2.00%. The CME Daily Delivery Report showed that 7 gold and 77 silver contracts were posted for delivery within the Comex-approved depositories on Wednesday. In silver, the only short/issuer was Jefferies. They also stopped 36 of their own contracts---and Canada's Scotiabank stopped another 32 contracts. The link to yesterday's Issuers and Stoppers Report is here. The CME Preliminary Report for the Monday trading session showed that gold open interest in October dropped by 321 contracts---and there are now only 1,592 contracts left often. Silver's October open interest sits at 287 contracts, down 4 contracts from Friday. There were no reported changes in GLD yesterday, but SLV had a withdrawal of 862,936 troy ounces. The U.S. Mint had a sales report yesterday---which I triple checked to make sure that I wasn't seeing things. Their gold eagles sales exploded from the 5,000 troy ounces reported last Thursday, up to 18,000 troy ounces---and their 1-ounce 24K gold buffalo sales jumped from 2,500 troy ounces, up to 7,000 troy ounces. Since they don't make this many gold bullion coins in one day, they were obviously bought from existing inventory---and probably by one buyer, as retail sales in North America are lacklustre at the moment---and that's being generous. Silver eagle sales were more modest, as they reported selling 125,000 of them. With the return of the 'mystery buyer' in silver eagles, I am more than sensitive to the fact that this 'mystery buyer' has now shown up in the gold bullion coin sales as well. What do they know that we don't----yet? There was a decent amount of gold reported received at the Comex-approved depositories on Friday, as 34,250 troy ounces were reported received by Canada's Scotiabank---and 4 kilobars were shipped out. The link to that activity is here. Of course it should come as no surprise that it was another huge day in silver, as 998,783 troy ounces were reported received---and 444,116 troy ounces were shipped out the door. The big action was at Brink's, Inc. and HSBC USA. The link to that is here. I have quite a few charts for you today---and here are four of them---and I've posted two others in The Wrap section as well. The first two shows the intraday average price movements of both gold and silver averaged out over all business days during the month of September---and as you can see, there's a definite pattern to the month. The 'high' in gold---if you wish to dignify it with that name---came at noon in Hong Kong---and negative London bias began about 30 minutes before the London a.m. fix---with the engineered price decline continuing in New York after the 11 a.m. EDT London close---and with the bottom coming minutes after trading began in Hong Kong the following day. The intraday silver chart for September looks almost identical to the intraday gold chart above, but the low tick in that metal came about an hour later. The beauty of these charts is that it takes out all the daily 'noise'---and strips the background base price pattern bare for all to see. With some exceptions, the 5-year intraday charts look very similar. The negative 'London Bias' has become an almost permanent fixture on the gold scene for the last two generations, going all the way back to January 1975. This is the real 'price fixing' mechanism. The next chart shows the weekly withdrawals from the Shanghai Gold Exchange. For the week ending September 26, it was 46.309 metric tonnes. I have the Koos Jansen take on this in the Critical Reads section, but if you don't want to scroll down---it's linked here. The last of the four charts, also courtesy of Nick Laird, shows just how rotten the sentiment is in the precious metals at the moment, as Central Fund of Canada, which has been around for 53 years, is currently selling at -7.74% NAV---and is back to the premium it was selling for in 2001. Buy with both hands, dear reader! Since today is Tuesday, I have a lot of stories today---and I'm sure there are a few in here that you'll find worth your while. ¤ Critical ReadsSurging dollar may be triple whammy for U.S. earningsThe suddenly unstoppable U.S. dollar is posing a triple threat to American companies' profits: driving up the costs of doing business overseas, suppressing the value of non-U.S. sales and, perhaps most worryingly, signaling weak international demand. The dollar has been on a tear, with an index tracking it against six other major currencies notching roughly an 8 percent gain since the end of June. Few analysts see its breakout performance stalling out anytime soon since the U.S. economy stands on much firmer footing than most others around the world, Europe's in particular. For companies in the benchmark S&P 500, that's a big headwind because so many are multinationals, and as a group they derive almost half of their revenue from international markets. No surprises in this Reuters story that was reposted on the news.yahoo.com Internet site at 8:04 a.m. EDT on Sunday morning---and I thank Brian Farmer for today's first story. American Banks Stockpile Treasuries as Deposits Top LoansAmerican banks are loading up on U.S. government debt, a sign they remain cautious on the economy even with the jobless rate at a six-year low and corporations at their healthiest in a generation. Commercial lenders increased their holdings of Treasuries and debt from federal agencies in September by $54 billion to an unprecedented $1.99 trillion, data from the Federal Reserve show. Banks have now been net buyers for 12 straight months. Bank of America Corp. and Citigroup Inc. are among the lenders adding government bonds this year as loan growth fails to keep up with record deposits and banks prepare for rules that take effect in January requiring them to hold more high-quality assets. While companies in the Standard & Poor’s 500 Index are earning more than ever and carrying the lowest debt burdens in at least 24 years, the buying suggests that loan officers are less sanguine over the outlook for the U.S. economy. This Bloomberg article, filed from New York, was posted on their website at 10:00 a.m. MDT yesterday morning---and I thank Howard Wiener for bringing it to our attention. 'Russians' Behind Huge JPMorgan CyberattackU.S. officials are far more concerned than they are publicly acknowledging about the gigantic cyberattack against JPMorgan that affected as many as 76 million households. And they believe Russians with at least loose connections to the country's government are behind the attack, according to a new report from The New York Times. JP Morgan revealed Thursday that as many as 76 million households and 7 million small businesses may have had private data compromised in the breach, one of the largest and most serious into a U.S. corporation. Data that may have been compromised in the breach include contact information and "internal JPMorgan Chase information" relating to the users, according to an SEC filing from the company. If the Russians really want to bring JPMorgan to its knees, all they would have to do is announce that they were withdrawing their precious metals production from world markets until JPMorgan et al removed their presence from the Comex futures market. That would pretty much do it. This story appeared on the Business Insider website at 8:20 a.m. EDT on Saturday morning---and it was picked up by the finance.yahoo.com Internet site---and it's courtesy of Brad Robertson. Jim Rickards: CIA and financial warfareAuthor and economist Jim Rickards tells Erin how the CIA and U.S. government should prepare for financial warfare. This 2:46 minute video clip showed up on the Russia Today website on Sunday---and is now posted over at the youtube.com Internet site. It's worth watching---and I thank Harold Jacobsen for digging it up for us. New York's Waldorf Astoria to be sold for $1.95 billion to Chinese insurance companyHilton Worldwide is selling the Waldorf Astoria New York to Chinese insurance company Anbang Insurance Group Co. for $1.95 billion. Hilton Worldwide will continue to manage the storied hotel for the next 100 years as part of an agreement with Anbang. The Waldorf Astoria New York has restaurants including Peacock Alley, Bull and Bear Prime Steakhouse and Oscar's. The companies said Monday that the property will undergo a major renovation. In March 1893, millionaire William Waldorf Astor opened the 13-story Waldorf Hotel. The Astoria Hotel opened four years later. The Waldorf Astoria New York, on Park Avenue in Manhattan, opened in 1931, according to the company's website. At the time it was the largest hotel in the world. The hotel became an official New York City landmark in 1993. This AP story showed up on the Times of India website at 7:43 p.m. IST on their Monday evening---and I thank reader M.A. for sharing it with us. Lloyds Cutting Thousands of Jobs as CEO Pares CostsLloyds Banking Group Plc, Britain’s largest mortgage provider, is poised to eliminate thousands of jobs in what may be the biggest round of cuts since at least 2011, a person familiar with the matter said. The bank will shut branches as part of efforts to automate its entire business, with job cuts expected in areas such as mortgage processing and new account opening, said the person, who asked not to be identified because the strategy isn’t finalized. Some people may be able to assume new roles in the revamp instead of losing their jobs, the person said. Lloyds Chief Executive Officer Antonio Horta-Osorio, 50, has been seeking ways to bolster earnings growth to help return the lender to full private ownership. The bank has eliminated more than 37,000 jobs in the aftermath of its government bailout in 2008, according to data compiled by Bloomberg, with some 15,000 cuts announced in 2011 as part of an effort to lower costs by 1.5 billion pounds ($2.4 billion). This Bloomberg offering, filed from London, showed up on their Internet site at 5:55 a.m. Denver time yesterday morning---and I thank West Virginia reader Elliot Simon for sending it our way. ECB's treatment of Ireland and Italy is a constitutional scandal, yet nobody held to accountSo the truth comes out at last. The EU/IMF Troika – actually the ECB – compelled the Irish state to take on the vast liabilities of Anglo-Irish and other banks in the white heat of the financial crisis. It threatened to pull the plug on ECB support for the Irish banking system, in breach of its own core duty to act as a lender-of-last resort, unless the Irish taxpayer took the full losses. This protected bondholders from their condign fate, even though these creditors were fully complicit in Ireland’s credit bubble. Indeed, they helped to cause it, along with the ECB’s ultra-loose monetary policy and negative real rates (set for German needs) during the boom. Even the riskiest tranches of junior bank debt were deemed off limits. Working class youths in Cork, Limerick, and Dublin will have to service a very high public debt -- currently 124pc of GDP, up from 25pc in 2007 -- for a very long time. This very interesting, but not surprising news showed up under Ambrose Evans-Pritchard's banner a The Telegraph last Friday---and it's the first contribution of the day from Roy Stephens. It's definitely worth reading. Hans-Werner Sinn: eurozone doomed to 'decade of crises'The eurozone is doomed to a decade or more of economic stagnation and civil unrest that could destroy the single currency if countries such as France do not implement vital reforms, according to one of Europe’s most influential economists. Hans-Werner Sinn, the president of Germany’s Ifo Institute for Economic Research think-tank, said policymakers would continue to misuse capital to finance the higher living standards unlocked by joining the euro, while dragging their heels on reform. “My prediction is not that the euro will fall apart, but that it leads to a stagnation and animosity even more than we see today among the people of Europe,” he said. “You see |

| Surging dollar may be triple whammy for U.S. earnings Posted: 06 Oct 2014 11:27 PM PDT The suddenly unstoppable U.S. dollar is posing a triple threat to American companies' profits: driving up the costs of doing business overseas, suppressing the value of non-U.S. sales and, perhaps most worryingly, signaling weak international demand. The dollar has been on a tear, with an index tracking it against six other major currencies notching roughly an 8 percent gain since the end of June. Few analysts see its breakout performance stalling out anytime soon since the U.S. economy stands on much firmer footing than most others around the world, Europe's in particular. For companies in the benchmark S&P 500, that's a big headwind because so many are multinationals, and as a group they derive almost half of their revenue from international markets. No surprises in this Reuters story that was reposted on the news.yahoo.com Internet site at 8:04 a.m. EDT on Sunday morning---and I thank Brian Farmer for today's first story. |

| Rick Rule on Junior Gold Miners -- Continued Posted: 06 Oct 2014 11:27 PM PDT It’s common at a bear market bottom that while people empirically understand the goods are on sale and they’re going to make money, that their recent experience has been so bad that they won’t allow themselves to reenter the market until they have confirmation from the market itself that it’s safe and attractive to do so. It’s amusing to me that you point out Ned Goodman. I remember a speech that he gave at the Prospectors and Developers Association of Canada in 1999 basically saying that the pivot point was in, and the bear market was over. I would suspect that Ned was within three or four months of being right. I don’t really consider Ned to be a market timer but what he is, is a 76-year-old guy who has been in resource markets for 50 years, and right now, people are saying to Ned with regards to his bullishness on the market that, “Well, Ned has been saying that for a year and a half. Why would anybody possibly listen to him?” Well, how about the fact that he’s a self-made billionaire? That might be a reason. How about the fact that he was stupendously right in the 1998-2000 bull market? How about the fact that when he spun Dundee Corp. out of Corona in the early 90s bear market, the stock of Dundee went from $0.80 to $42 in the ensuing bull market? This longish interview with Tekoa Da Silva appeared on the sprottglobal.com Internet site on Monday. |

| India should aim $40 billion gold jewellery exports by 2020: World Gold Council Posted: 06 Oct 2014 11:27 PM PDT India, the world's largest gold consumer, should target five-folds increase in gold jewellery exports to US$40 billion by 2020 from the current level of US$8 billion, according to the World Gold Council (WGC). The country should also put to use about 22,000 tonnes of gold lying idle with households and temples and reduce its dependence on imports in the next five years, it said. "Our vision for gold is that it should be put to work for the economy, creating jobs, developing skills, generating exports and revenues - an essential part of the financial, economic and social structure of the country," WGC said in its Vision 2020 for the country. WGC said that the country should meet 40 per cent of gold demand from its domestic stocks and the rest 60 per cent through imports and mining. When the World Gold Council says that a program is in the best interests of India, you can be equally sure that it won't be in the best interests of its citizens. This program just reeks of that. This gold-related news item appeared on the Economic Times of India website at 5:56 p.m. IST on their Saturday afternoon---and my thanks go out to reader U.M. for sharing it with us. |

| 'India needs more world-class gold refineries to attract foreign direct investment' Posted: 06 Oct 2014 11:27 PM PDT Indian household, which has total holding of around 25,000 tonnes of gold, needs more gold refineries for monetising and attracting foreign direct investment (FDI) in the sector, according to industry experts. "India's households have a total holding of around 25,000 tonnes of gold which needs to be monetised. Even if we target one per cent of gold for monetising, the quantity will come to around 250 tonnes which MMTC-PAMP cannot handle alone. Therefore, we need to have more world-class refineries through FDI investment in India," MMTC-PAMP managing director Rajesh Khosla said at the two-day seminar organised by the India Bullion and Jewellers Association (IBJA) here. MMTC-PAMP is the first and the only London Bullion Markets Association accredited gold and silver refinery in the country. A joint venture between state-owned MMTC and Switzerland-based PAMP SA, has set up its refinery near Gurgaon. This is another gold-related news item from the Economic Times of India, this one from early afternoon on Sunday IST. It's the second story in a row from reader U.M. |

| Durga puja festivities ring in golden splendour in India Posted: 06 Oct 2014 11:27 PM PDT It is the time to splurge in India, and when it comes to appeasing the Gods, no expense is spared. The country is in the midst of the Durga Puja celebrations, where the ceremonial worship of the Mother Goddess is under way. One of the most important festivals of India, the event is also an occasion for reunion and rejuvenation, and a celebration of traditional culture and customs. However, in most small lanes across the country, it is just an excuse for mainline jewellery brands to deck up some of the idols of the Goddess installed atop various small stages, or pandals. And gold traders with an eye on the declining price of the metal might be hoping for an uptick in price as devotees’ passions eat into global gold supplies. This interesting article, filed from Mumbai, appeared on the mineweb.com Internet site yesterday sometime---and it's three in a row from reader U.M. |

| Posted: 06 Oct 2014 11:27 PM PDT Dhanteras, the first day of Diwali, is a day for celebrating wealth. Devotees light the first lamps of the festival of lights to welcome Lakshmi, the goddess of prosperity, into their houses to bless them with fortune for the year ahead. Usually falling between mid-October and mid-November, Diwali is one of the most important dates in the Indian calendar, and as they celebrate, Indians buy gold. Today, India is one of the largest markets for gold jewellery, which has a complex but central role in the country’s cultures. In India, gold jewellery is a store of value, a symbol of wealth and status and a fundamental part of many rituals. In the last decade, 75 per cent of gold demand in India has taken the form of jewellery. More than two-thirds of that demand comes from the country’s rural population, where a deep affinity for gold goes hand in hand with practical considerations of the portability and security of jewellery as an investment. This, in part, explains how India’s appetite for gold defies market conditions: despite a 400 per cent rise in the rupee gold price over the last decade, gold demand from Indian consumers continues to grow. This must read story was posted on the World Gold Council's website, but there's no dateline, however, it's probably very recent. There's some nice 'eye candy' in here, although the pictures are rather small. I thank reader U.M. for her fourth contribution in a row to today's column. |

| Gold Import Zoomed to 131 Tonnes Ahead of Festival Posted: 06 Oct 2014 11:27 PM PDT The festival season in India has already kick-started with speck of positivism this year. Traders opted for further imports of gold on the enthusiasm of the festival buying. The September month figure for gold imports in India was shot up to 131 tons, a 110% increment from the August figure of 63 tons. Last year on September gold import saw a drastic reduction and came down to a mere 11tons due to the strict import restrictions. The Government of India had come out with the clear circular of 80:20 on August 14, 2013 that stated for every 100 tons import, one has to provide 20 tons for export purpose. In the first eight months of 2014, India imported 418 tons of gold, which translates into average 50 tons a month. The sharp increase in import in September is indicating demand is coming back to market on account of marriage and festival and of course, comparably lower price of gold. Gold has breached decisive support of $1200/oz in London. It appears now gold could easily come down to $1130/oz or lower level. Rupee has lost some ground against US dollar. That would remain deterrent to price fall of gold in local market. However, since gold is available at sub Rs.27,000/10gm and festival and marriage season is around, demand is expected to remain robust. The above three paragraphs are all there is to this short story filed from Bangalore, India yesterday. It was posted on the bullionbulletin.in website on Monday IST---and I'll be very happy if/when this rather enormous import number is confirmed elsewhere---and the sooner the better. I thank reader U.M. for her final offering in today's column. |

| Scotiabank confirms Jansen: China gold demand far greater than World Gold Council says Posted: 06 Oct 2014 11:27 PM PDT Gold researcher and GATA consultant Koos Jansen detailed on Saturday how a gold market analyst for Scotiabank has confirmed Jansen's interpretation of Chinese gold demand and the workings of the Shanghai Gold Exchange, concluding that Chinese demand is far greater than reported by the World Gold Council, and, crucially, that the People's Bank of China obtains its gold through other means, not through the exchange, signifying that Chinese demand is higher still. The links to the Scotiabank analysis---and Jansen's commentary---were posted on the gata.org Internet site on the weekend. |

| Koos Jansen: China's gold demand remains strong, silver remains scarce Posted: 06 Oct 2014 11:27 PM PDT Gold researcher and GATA consultant Koos Jansen reported that the latest figures from the Shanghai Gold Exchange show that Chinese gold demand remains strong. Jansen adds that while silver inventory on the Shanghai Futures Exchange has increased markedly after having been dramatically drawn down, silver remains scarce in Shanghai. Jansen's report was posted on the bullionstar.com Internet site at 2:23 a.m. Singapore time on their Sunday morning---and I found 'all of the above' in a GATA release yesterday morning. It's worth skimming. |

| Robin Bromby in The Australian: Shanghai gold surprise in store Posted: 06 Oct 2014 11:27 PM PDT If you want to know what China will do in the future, it's usually a good thing to look at its past. Don't trust us --- listen to the late Chinese communist leader, Zhou Enlai. "Past experience, if not forgotten, is a guide to the future," he said in 1972. He was talking about the relationship between China and Japan, but let's take another example, this time gold, which tumbled again to close the week at US$1,191 an ounce. Keith Goode, probably Australia's most experienced gold analyst, now running his own outfit at Eagle Research, was struck by what the Chinese are doing in Shanghai. This article that comments on my headline story in Saturday's edition of the Gold and Silver Daily---and was posted on theaustralian.com.au Internet site on Monday local time 'down under'. The complete article is posted in the clear in another GATA release from yesterday. It's worth your time as well. |

| Tocqueville's Hathaway: China has it right about gold and the dollar Posted: 06 Oct 2014 11:27 PM PDT Tocqueville Gold Fund manager John Hathaway's third-quarter letter to investors details how the fundamentals for a much stronger gold price remain in place, and he cites many of the developments to which GATA has called attention in recent weeks. Hathaway's letter concludes: "We take comfort that our positive view of the future dollar gold price is shared by those who understand the difference between synthetic and physical metal and who regard the real substance as a matter of strategic imperative, not as a plaything for macro traders. We believe that China's negative assessment of the future prospects for the U.S. dollar is correct and that our investment strategy of investing in the shares of value-creating gold miners offers sensible and dynamic exposure to the inevitable repricing of gold in U.S. dollars." This copy of the report was posted on the gata.org Internet site on Saturday---and definitely falls into the must read category. |

| Posted: 06 Oct 2014 11:00 PM PDT Gold Bars worldwide |

| Memories Of The Souk Al Manakh Posted: 06 Oct 2014 10:30 PM PDT Gold Newsletter |

| Bitcoin speculators being crushed will they now move into silver? Posted: 06 Oct 2014 09:35 PM PDT Every market has its favorite speculative asset and for the past few years the electronic funny money Bitcoin has ruled this roost. Yesterday Bitcoin rebounded from a 20 per cent sell-off over the weekend. But year-to-date speculators in this novel specie have lost 40 per cent of their money in dollar terms. These are the same mad speculators who drove the silver price up to nearly $50 three years ago. Since then the shiniest of metals has crashed back to earth and now stands at an alluring $17 an ounce, precisely the point at which it previously began its almost 300 per cent price surge. Silver surges Yesterday silver bounced strongly back from a sell-off that took it to the bottom of its fibbonnacci sequence range at the end of last week. This all absolutely stinks of market manipulation by the bullion banks but they also make money by exaggerating the ups and downs of silver, and will know a bottom when they see one. Time to pile in then for the speculators burnt by Bitcoin? Moving out of a losing asset class and into the next winner is clearly a good trade. Some will get it. Others will gradually see their losses multiply on Bitcoin which is a money without any backing, no central bank to prop it up and no precious metals to prop up the central bank. Exactly why Bitcoin prices have flopped is open to debate. The threat of regulations like the proposed by New York's Department of Financial Services may limit the free-wheeling nature of the currency and be a concern to holders. Then again the increased use of Bitcoin by retailers may have actually hurt its value because Bitcoin payments have to be converted into dollars and that drives down its price. ArabianMoney sees Bitcoin as just a classic speculative bubble with nothing to support it. Speculative times Those with an eye for the next big speculation will undoubtedly now be looking at silver. The long-term chart shows a massive uptrend at hand if gold prices do finally hit the roof, and even houses like Goldman Sachs who think gold will sink to $1,050 this year see it as still having another burst of strength when the US economy finally grows into a more inflationary stage. That might prove wishful thinking. There are other reasons to believe in gold as a safe haven asset in another major global financial crisis led this time by China and Japan. Silver is always leveraged to the gold price so speculators might want to get in now rather than wait for the storm. With their Bitcoins in dire distress and falling like a stone why would they wait any longer to make the shift into silver? |

| Only a minor perfect storm brewing in global financial markets? Posted: 06 Oct 2014 08:57 PM PDT US stocks resumed their downward slide yesterday and gold and particularly silver bounced back. Long-time bulls are beginning to concede that this might be the start of a ‘minor storm’ for global financial markets. Did they not say the same in 2007? Robert Pavlik, chief market strategist at Banyan Partners, says US equitie investors are worried about various events like unrest in Hong Kong and domestic Ebola fears… He’s forgeting the commodities downturn, overmighty US dollar, impact of the Ukraine crisis on the eurozone, Japan’s economic suicide and last but not least the Chinese economic slowdown, otherwise he has a point… |

| The Second Worst Hyperinflation Posted: 06 Oct 2014 06:27 PM PDT This very short piece was written back in 2006 for my first book, Understanding Money, and though correct at the time, today would be considered mistitled. Just two years after this was written the Zimbabwe hyperinflation would overtake both Yugoslavia's, and the previous record holder, Hungary's, to take the number one spot as the worst hyperinflation in history. I have decided however, to leave it titled as originally written. You'll have to imagine you are reading this in the context of a book, and my sarcastic remarks in parenthesis refer to the same stupid things that have been tried over and over throughout history and that I had described in previous chapters. For example, Venezuela is in the beginning stages of an economic collapse right now and unfortunately, you can insert "Venezuela" for "Yugoslavia" in the article below and most of the story will still be true. Many of the things in this article have already happened in Venezuela, many are happening now, and many have yet to happen… but they absolutely will occur. I hope by now you have learned that economic history is a great predictor of the future. Enjoy Mike |

| Real Interest Rates and Recent Decline in the Price of Gold Posted: 06 Oct 2014 05:50 PM PDT SunshineProfits |

| Posted: 06 Oct 2014 03:26 PM PDT |

| Record September Gold Eagle Sales…A Big Price Move Coming? Posted: 06 Oct 2014 03:00 PM PDT Something is brewing in the gold market… From the SRSRocco Report: Something is brewing in the gold market as U.S. Gold Eagle sales hit a record this month. This is a very interesting trend change as sales of Gold Eagles were sluggish for most of the year. Matter-a-fact, Gold Eagle sales in September are the […] The post Record September Gold Eagle Sales…A Big Price Move Coming? appeared first on Silver Doctors. |

| Gold Price vs U.S. Debt Ratio In 2014: A Major Disconnect Posted: 06 Oct 2014 02:38 PM PDT As the chart below shows, gold has tracked the expansion in US debt pretty handily. The correlation between the two is +0.86..

You can see in 2011, the rise in the gold price became overextended relative to the rise in US debt. Then it decoupled and went in the opposite direction.

A second rationale for holding gold takes into account the balance sheet expansion of central banks: If one accepts that gold is not merely an industrial commodity but an alternative form of money, then it clearly makes sense to favor a money whose supply is growing at 1.5% per annum over monies whose supply is growing up to 20% per annum. A third rationale for owning gold is best summed in perhaps the most damning statement to capture our modern financial tragedy. "We all know what to do, we just don't know how to get re-elected after we've done it." This is from Jean-Claude Juncker, former Prime Minister of Luxembourg and current President-Elect of the European Commission. It's clear there is a vacuum where bold political action should reside. Elected leaders continue to kick the can down the road and ignore dangers to the system. And in this vacuum, central bankers have stepped in to fill the void via bond yields that are below the rate of inflation. They say that to a man with a hammer, everything looks like a nail. To a central banker facing the prospect of outright deflation, the answer to everything is the printing of ex nihilo money and the manipulation of financial asset prices. This makes it incredibly difficult to shake off the suspicion that navigating the bond markets over the coming months will require almost supernatural powers in second-guessing both central banks and one's peers. For what it's worth this is a game we won't even bother playing. Our pursuit of the rational alternative – proper forms of money and compelling deep value in equity markets – continues. More to follow on this.

From Sovereignman.com. If you liked this post, please click the box below. You can Download our Free 17 page Report The 6 Pillars of Self Reliance. |

| $1180 : Is A Major Low Ahead For Gold And Silver? Posted: 06 Oct 2014 02:35 PM PDT investing |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment