Gold World News Flash |

- Here Is The Most Frightening Prediction To End 2014

- US Dollar is Extreme

- This one chart shows exactly how undervalued gold is right now…

- Why NED Davis is Dead Wrong About Gold Price Falling to $660

- Everyone’s Shorting Gold; Due For A Rally

- Let’s Watch as the Big Bank “Fixers†Scramble and Flee

- War, Peace, and Financial Fireworks

- The only public North America company in Cambodia — Angkor Gold

- The Peter Schiff Show Podcast #5

- This One Chart Shows Exactly How Undervalued Gold Is Right Now…

- YOU ARE 100% RIGHT ABOUT SILVER — The Wealth Watchman

- More tape painting in gold by the central planners, Turk tells KWN

- Desperate West Using Psychological Warfare Against Investors

- This One Chart Shows Exactly How Undervalued Gold Is Right Now...

- Divergence In Gold and Silver Open Interest

- Will Gold Crash With The Dow... Or Soar?

- Gold Price Sprang Up $14.50 or 1.19% Percent to $1,206.70

- Crony Capitalism Is Kryptonite To Democracy And The Real Economy

- Gold Price vs U.S. Debt Ratio In 2014: A Major Disconnect

- Financial letter writer Ron Rosen takes gold price suppression for granted

- Jim Rickards : Obama Ending Alliance with Saudi Arabia and Killing the Petrodollar

- Gold Daily and Silver Weekly Charts - Peak Empire, In Time of Plague

- Sprott, Rule, Embry discuss metals' prospects and you can join them

- Gold Price $1400 In 2015 According To Sterne Agee

- At KWN, Embry dissects phony U.S. job report

- Silver’s Disconnect: Silver Price Falls Amid A Strengthening Physical Market

- Gold And Silver Divergence: Enter the Dragon

- Here Is The Most Frightening Prediction To End 2014

- 3 Insider Secrets to Self-Publishing Success

- China/India Gold Demand: 2013 Déjà Vu

- Koos Jansen: China's gold demand remains strong, silver remains scarce

- GBP Still Trading Under Pressure:Â Can This Continue?

- Gold Price Support At $1,180/oz and $1,161/oz, Then At $1,000/oz

- Cerulean Dollars - Go Deep or Go Home

- Instead of Puking, Do This

- Ron Paul - The Real Status of U.S. Forces in Afghanistan and Iraq

- The Soaring U.S. Dollar Debate: Good, Bad, Ugly

- Catalyst Check: Natural Resources Watchlist at Three Months

- Fed May Hold Off Raising Interest Rates If Strong Dollar Continues

- Technician: More Weakness Ahead for Stocks; Dollar Could Be Entering "New Structural Bull Market"

| Here Is The Most Frightening Prediction To End 2014 Posted: 07 Oct 2014 01:00 AM PDT from KingWorldNews:

The global stock markets will top out at the time gold bottoms at the of the trendline shown on the multi-decade chart you see above. This is the crossroads where the bull market in gold is going to reassert itself. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Oct 2014 12:34 AM PDT Using Tom McCellan’s article discussing a “blow off” move in the US dollar and its very bearish net short position by commercial traders as a starting point, I would like to talk about the USD and gold and how they each fit in to the global macro backdrop. We could add silver into the mix as well because its failure in relation to gold (ref. the gold-silver ratio’s breakout last week) is the other horseman (joining Uncle Buck) that would indicate a changing macro. Here’s the McClellan piece: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This one chart shows exactly how undervalued gold is right now… Posted: 07 Oct 2014 12:30 AM PDT from Sovereign Man:

This was deliriously tacky behavior from within a normally staid backwater of the financial markets. Some financial media reported this as a 'David vs Goliath' story; in reality it is anything but. The story can be more accurately summarized as 'Bond fund manager leaves gigantic asset gatherer for other gigantic asset gatherer' (Janus Capital's $178 billion in client capital being hardly small potatoes). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why NED Davis is Dead Wrong About Gold Price Falling to $660 Posted: 07 Oct 2014 12:20 AM PDT John LaForge, commodities strategist at Ned Davis Research says gold is going to $660 an ounce. In an appearance on CNBC on Thursday, LaForge said that the end of the current “supercycle” for gold could push the precious metal down to $660 an ounce, or about 40% lower than where it is currently trading. LaForge said that in the 1980s, the price of gold fell about 65% from peak-to-trough as the precious metal endured a 20-year bear market. And after hitting $1900 an ounce in 2011, gold should see a similar peak-to-trough decline in the current cycle. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Everyone’s Shorting Gold; Due For A Rally Posted: 07 Oct 2014 12:00 AM PDT from KitcoNews: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Let’s Watch as the Big Bank “Fixers†Scramble and Flee Posted: 06 Oct 2014 11:43 PM PDT Shah Gilani writes: If you can’t beat ‘em (or manipulate ‘em), then don’t join ‘em. That’s the new Wall Street mantra, as evidenced by happenings in the “fixing” world. Talk about irony. “Fixing” or “fix” are Wall Street terms used to describe how benchmarks are priced on hundreds of instruments, from the Libor and other foreign currency exchange rates to gold, silver and swaps. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| War, Peace, and Financial Fireworks Posted: 06 Oct 2014 11:20 PM PDT Politics has long been a driver of international markets and fickle financial systems alike. Everything is connected. Here are some voices from the just-concluded Casey Research Fall Summit talking about cause, effect, and war. James Rickards, senior managing director with Tangent Capital Partners and an audience favorite at investment conferences, says the Middle East, Russia, and China are all working against the US dollar and for gold. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The only public North America company in Cambodia — Angkor Gold Posted: 06 Oct 2014 11:00 PM PDT from cambridgehouseintl: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Peter Schiff Show Podcast #5 Posted: 06 Oct 2014 10:00 PM PDT from Peter Schiff: 2:55 – The numbers behind the weekly economic data | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This One Chart Shows Exactly How Undervalued Gold Is Right Now… Posted: 06 Oct 2014 09:51 PM PDT from ZeroHedge:

The integrity of markets is clearly at risk. And we have long sought alternatives that offer much lower credit and counterparty risk. The time-honored alternative has been gold. As the chart below shows, gold has tracked the expansion in US debt pretty handily (the correlation between the two is a strong +0.86) and if one expects that relationship to resume (we do), then gold looks anomalously cheap relative to the rising level of US debt. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YOU ARE 100% RIGHT ABOUT SILVER — The Wealth Watchman Posted: 06 Oct 2014 09:33 PM PDT

As The Wealth Watchman notes, despite the cartel’s vicious, criminal paper games, Silver & Gold demand has EXPLODED and Western demand is back with a vengeance. Judging by the past week of Silver Eagle sales from the US Mint the big players, the smartest guys in the room were busy buying nearly 24 tonnes of silver from the U.S. Mint! So the cartel can continue slaughtering the paper silver market, but they do so at their own peril as the inverse reaction to their criminality is a RUN ON PHYSICAL precious metals in the United States and abroad. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| More tape painting in gold by the central planners, Turk tells KWN Posted: 06 Oct 2014 09:17 PM PDT 12:16a ET Tuesday, October 7, 2014 Dear Friend of GATA and Gold: Friday's smash of the gold futures price, GoldMoney founder and GATA consultant James Turk tells King World News, was another typical tape-painting operation by the central planners for short-term psychological purposes. An excerpt from the interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/10/7_De... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Desperate West Using Psychological Warfare Against Investors Posted: 06 Oct 2014 09:01 PM PDT  With the Dow still trading close to 17,000 and the U.S. Dollar Index near 86, today James Turk told King World News that the West is now using psychological warfare against investors in the gold and silver markets. Turk also included a key chart that looks at the psychological games Western central planners are now employing. With the Dow still trading close to 17,000 and the U.S. Dollar Index near 86, today James Turk told King World News that the West is now using psychological warfare against investors in the gold and silver markets. Turk also included a key chart that looks at the psychological games Western central planners are now employing.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This One Chart Shows Exactly How Undervalued Gold Is Right Now... Posted: 06 Oct 2014 07:31 PM PDT Submitted by Tim Price via Sovereign Man blog,

We discussed this last week, highlighting this seeming anomaly that even as there has never been so much debt in the history of the world, it has also never been so expensive. This puts the integrity of markets clearly at risk. And we have long sought alternatives that offer much lower credit and counterparty risk. The time-honored alternative has been gold. In fact, as the chart below shows, gold has tracked the expansion in US debt pretty handily (editor’s note: the correlation between the two is a strong +0.86). You can see in 2011, the rise in the gold price became overextended relative to the rise in US debt. Then it decoupled and went in the opposite direction. This is a similar trend to what occurred in the early 1980s. And if one expects that relationship to resume (we do), then gold looks anomalously cheap relative to the rising level of US debt. A second rationale for holding gold takes into account the balance sheet expansion of central banks: If one accepts that gold is not merely an industrial commodity but an alternative form of money, then it clearly makes sense to favor a money whose supply is growing at 1.5% per annum over monies whose supply is growing up to 20% per annum. A third rationale for owning gold is best summed in perhaps the most damning statement to capture our modern financial tragedy.

This is from Jean-Claude Juncker, former Prime Minister of Luxembourg and current President-Elect of the European Commission. It’s clear there is a vacuum where bold political action should reside. Elected leaders continue to kick the can down the road and ignore dangers to the system. And in this vacuum, central bankers have stepped in to fill the void via bond yields that are below the rate of inflation. They say that to a man with a hammer, everything looks like a nail. To a central banker facing the prospect of outright deflation, the answer to everything is the printing of ex nihilo money and the manipulation of financial asset prices. This makes it incredibly difficult to shake off the suspicion that navigating the bond markets over the coming months will require almost supernatural powers in second-guessing both central banks and one’s peers. For what it’s worth this is a game we won’t even bother playing. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Divergence In Gold and Silver Open Interest Posted: 06 Oct 2014 07:21 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will Gold Crash With The Dow... Or Soar? Posted: 06 Oct 2014 05:40 PM PDT Submitted by Jeff Thomas via Doug Casey's International Man blog, In 2008, we projected that the crash in the market was in fact a mini-crash and that the day would come when a more major crash would occur - one that reflected the level of debt. In recent months, this prognostication has been gaining traction - that a second, more severe crash is inevitable. There are two primary camps amongst economists with regard to the economic direction that a crash will generate: inflationists and deflationists.

The argument goes back and forth, yet there seems to be the misconception that one must be either an inflationist or deflationist. This is not at all the case. Recently, there have been vehement arguments from some very notable people in the deflationist camp that we shall soon see major drops in the Dow—first to 6000, then to 3300. They feel that, as this occurs, there will be a further real estate crash, gold will sink to $750, and unemployment will go through the roof. Inflationists will inevitably reply that, in the event of a crash, the central governments will print money like never before, as soon as there is even a whiff of deflation. (Their argument is strongly supported by the repeated confirmations by the previous chairman of the US Federal Reserve, Ben Bernanke, that no deflation will be acceptable to the Fed, that they will indeed print as much as it takes to counteract any possible deflation.) However, each camp is overlooking a significant factor. The deflationist reasoning tends to lead up to the occurrence of deflation… and then stops. They rarely comment on what happens next: the influx of newly-created currency units. The inflationists overlook the fact that, when a major crash occurs, it happens suddenly and when it occurs, it carries other markets with it. No amount of monetary printing can react quickly enough to simply cancel out the precipitous deflationary force of a crash. All that can be hoped for by the Fed and others in their situation is that they “play catch-up” as quickly as possible—injecting money into general circulation (not just crediting it to the banks, as they are now doing) to reverse the deflation and to hopefully return to “controlled” inflation. Are we headed for a crash in the stock market? Almost certainly, and probably a more severe one than in 2008. Are we headed for dramatic inflation or even hyperinflation? Again, almost certainly. So what will this look like? How will it play out? Consider the following as an order of immediate events (in brief form):

This is the deflationist argument and it is a logical one. (Popular estimates for the gold price are between $1000 and $750 as a potential floor.) But this scenario rings true only if all those who hold gold are forced to sell. What could actually happen might be similar to what we have seen with the unravelling of paper gold - that the development only serves to encourage those who understand gold to buy all they can. This serves to create a floor for the gold price. There may well be sudden downward spikes that would tend to prove deflationists right, but as we now live in an electronic age, the turnaround by purchasers will be almost as quick as the crashes themselves. It may be that we will see sudden precipitous drops in gold, followed by immediate rises in purchasing - a real rodeo ride. It is entirely possible that gold stocks will stay down longer than the gold price, and some (otherwise viable) companies may even go into liquidation. However, gold itself will not drop to $750 and stay there, as deflationists imply. More to the point, its recovery may be quite swift. The market is experiencing a divide that didn’t exist before. Until recently, there have been many people (millions) who misunderstood gold, treating it like a stock. Many of those people are disappearing from the market (having been washed out by the paper gold failure), and soon, most of those who are still in gold will be those who understand it. The higher the percentage of gold ownership that is in their hands, the more solid the floor. Whatever that floor may prove to be, gold will stabilise. Then, inevitable inflation will cause renewed interest in gold by the misinformed, as it begins its inflationary rise. By the time gold passes $2000, the misinformed will be falling all over each other to get back in—still not understanding gold, but desperate to ride the coattails of “a winner.” It would be at this point that we would go into a period of dramatic inflation, with a concurrent gold mania. Whatever level of drop gold experiences as a result of deflation, gold will rise up from it like a phoenix - long before other asset classes rise. In fact, it will lead the pack. The question for the investor should not be whether we shall see inflation or deflation. We shall see both. The rodeo is underway and we are, whether we wish to be or not, in the saddle of the bronc. Soon, the chute will open and he’ll start bucking for all he’s worth. When he does, it will matter little whether he bucks to the left or to the right. The only objective should be to ride it out. In investment terms, what this means is that we need to have avoided those investments that are most greatly at risk and have chosen instead those investments that are likely to be intact when the ride is over. If we have loaded up on precious metals, in truth, it matters little if gold drops to $1000 or (gulp) to $750 as deflationists have predicted. All that will matter is whether we have had the fortitude to stay in the saddle until the ride comes to an end. Editor’s Note: Gold is inherently an international asset because it is disconnected from any government and its value is universally recognized everywhere in the world. Buying some is perhaps the easiest step you can take toward internationalizing your savings. The next step is to store your gold in a safe foreign jurisdiction. Perhaps one of the easiest and most convenient ways to own physical gold offshore is with the Hard Assets Alliance. To get a free report on how you can internationally diversify your physical gold see here. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Sprang Up $14.50 or 1.19% Percent to $1,206.70 Posted: 06 Oct 2014 05:01 PM PDT

Both planted the clear first half of a key reversal, viz., a break into new low ground with a higher close for the day. That first half is useless and a liar unless followed by the 2nd half, a higher close tomorrow. Third day's higher close offers more proof still. Look at the changes inside silver and GOLD PRICES. Silver came out of an oversold fever that began 10 September. Other indicators have turned up. The downtrend line from the end-August high lies above at $17.65, and silver's high today reached $17.36. If fuelled by short-covering, silver could o'erleap that tomorrow. As yet this turn is no more than a small cloud on the horizon, but it has all the elements of a turnaround -- except confirmation, which only tomorrow can give. Zut alors! Donnerwetter! Gold's low today -- really over the weekend -- came at $1,183.30, pennies above the June and December 2013 low. Observe that the ever-more-volatile silver cracked those lows ($18.60) while gold has not. That would be typical behavior, with silver always weaker on the downswing but often outpacing gold on the upswing.

That argues that the recent highs in the ratio also mark the lows in silver and gold prices. THAT ALSO IMPLIES THAT IF YOU WANT TO SWAP GOLD FOR SILVER, YOU HAVE YOUR SIGNAL TO DO IT FAST. What next? The gold price must close -- not tomorrow, but soon -- above $1,225, then $1,237. then $1,237. $1,300 is the first big goal. The SILVER PRICE needs to climb above $18, then $18.75 where it fell down. In the aftermarket silver was trading at $17.36, 18 cents above its close, a sign that shorts are covering. Platinum and palladium also shot up. Call me a nat'ral born durned fool from Tennessee, but I bought silver and gold today. I'll buy more if it keeps rising, though I am careful to note that it must keep rising or gainsay today's signal. US dollar index lost 92 basis points of that 107 bp it won on Friday, leaving today looking a lot like a key reversal, only because its 86.85 high lacked 2 bps of Fridays. Nonetheless, a follow-through tomorrow will confirm the dollar's reversal. Closed at 85.89, and fell off its grotesquely overbought condition (RSI now 64.64, i.e., below overbought 70 line). I saw an article today by Clive Maund which credited unrest/potential war in Ukraine, Hong Kong, and the Middle East with sending investors, especially non-US investors, into the US dollar. In other words, it's a flight to safety. Add momentum following hedge funds to that and he's likely correct. Dollar's stumble was health and well-being to the yen and euro. Euro found a ladder and climbed 1.14% to $1.2657. This means little until the Euro crosses that 20 DMA (now $1.2797), but it did carry the euro up out of oversold territory. Yen rallied Wednesday and Thursday, crashed Friday, then bounced back today, up 0.92% to 91.95. Clearly above oversold. Ten year treasury note yield fell along with the dollar, and has sunk below its 50 day moving average. Suddenly all the certainty that Mother Yellum "must" raise interest rates evaporated. All the stock indices I watch stumbled today: Nasdaq, N-100, Russell 200, Wilshire 5000, Dow, S&P500. Ain't that what they call "across the board"? Dow lost 17.78 (0.1%), not much but enough to crack the 17,000 level upon which investor moral hangeth. S&P500 lost 3.08 (0.16%) to 1,964.82. Owch. Dow reached up and punched its 20 DMA today, but fell back. S&P500 didn't do that well and ended below its FIFTY day moving average. Durn! Did I forget to remind y'all the Dow is trading BELOW its uptrend line from March 2009? I did, didn't I. Dow in gold jerked back Friday's gains and fell to 14.07 (G$290.85 gold dollars). That's below the previous (19 September) high at 14.20 oz (G$293.54). Looks like that and Friday have left a double top, but that will not be confirmed until the DiG again closes below its 20 DMA, now 13.95 oz (G$288.37). Too early to declare certainly, but that 19 September peak in stocks may have been the Big One. Dow in Silver has also left a double peak, 30 September at S$1,298.86 silver dollars (1,004.59 troy ounces) and 3 October at S$1,305.57 (1,009.78 oz.). Today the DiS lost S$38.23 (29.57 oz or 2.93%) and ended at S$1,267.34 (980.21 oz). Needs to fall through the 20 DMA at S$1,231.35 (952.37 oz) to confirm reversal, but presumption already lies with gravity. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Crony Capitalism Is Kryptonite To Democracy And The Real Economy Posted: 06 Oct 2014 04:51 PM PDT Submitted by Charles Hugh-Smith of OfTwoMinds blog, When the machinery of governance is ruled by the highest bidders, democracy is dead. Last week I described the sources of America's America's terminal political dysfunction. The engine of this terminal dysfunction is crony capitalism, the incestuous and oh-so-profitable marriage of the Central State and monied Elites. Gordon T. Long and I continue our discussion of the perverse incentives and consequences of crony capitalism in a 25-minute video program. Gordon argues that America's Crony Capitalism closely resembles the Roman Tribute System, an arrangement that skims wealth and concentrates it at the top of the power pyramid. Vast financial crimes are met with fines. Guilty parties do not go to jail but rather the corporation pays a fine. Billion-dollar crimes are assessed million-dollar fines-- a percentage that closely mirrors a Tribute System. The government makes money through enforcement but not prevention. Corporations make illicit fortunes with the confidence that the government will settle for a small slice of the wealth stripmined from the people. The fines for financial skimming operations act as a form of tribute to the Central State: the State and its corrupt elected officials and regulators turn a blind eye to the pillage of the citizenry via financialization schemes, and then skim a tribute via fines and campaign contributions. Everybody in the inner circle wins: the finance perps collect their millions in bonuses, the legislators collect their millions in campaign contributions, and the regulators (who managed to do nothing in the way of prevention) get to declare a toothless victory in announcing wrist-slap fines. I have covered this dynamic many times: The Mafia State of Mind (February 6, 2014) This cozy arrangement might seem benign, but it's actually deadly to democracy and the real economy. Let's call crony capitalism what it really is: Kryptonite to democracy and the real economy. Concentrated wealth and State power form a self-reinforcing feedback loop that destroys democracy. The more profitable buying influence and the revolving door between corporations and regulators becomes, the more money the corporations have to spend on lobbying, which serves to further protect their profits. The more money political toadies collect, the more beholden they are to entrenched interests. This feedback loop rewards crony capitalism and limits classical capitalism’s key features: transparent markets and competition. An economy dominated by crony capitalism stagnates as competition is suppressed and government enriches those who are “more equal than others” (to borrow a phrase from Orwell). Money that might have once been invested in research and development is now devoted to bribing politicos, lawsuits defending corporate turf and wrist-slap fines/Tribute to the State that enables and protects crony skimming operations. When the machinery of governance is ruled by the highest bidders, democracy is dead.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price vs U.S. Debt Ratio In 2014: A Major Disconnect Posted: 06 Oct 2014 02:38 PM PDT As the chart below shows, gold has tracked the expansion in US debt pretty handily. The correlation between the two is +0.86..

You can see in 2011, the rise in the gold price became overextended relative to the rise in US debt. Then it decoupled and went in the opposite direction.

A second rationale for holding gold takes into account the balance sheet expansion of central banks: If one accepts that gold is not merely an industrial commodity but an alternative form of money, then it clearly makes sense to favor a money whose supply is growing at 1.5% per annum over monies whose supply is growing up to 20% per annum. A third rationale for owning gold is best summed in perhaps the most damning statement to capture our modern financial tragedy. "We all know what to do, we just don't know how to get re-elected after we've done it." This is from Jean-Claude Juncker, former Prime Minister of Luxembourg and current President-Elect of the European Commission. It's clear there is a vacuum where bold political action should reside. Elected leaders continue to kick the can down the road and ignore dangers to the system. And in this vacuum, central bankers have stepped in to fill the void via bond yields that are below the rate of inflation. They say that to a man with a hammer, everything looks like a nail. To a central banker facing the prospect of outright deflation, the answer to everything is the printing of ex nihilo money and the manipulation of financial asset prices. This makes it incredibly difficult to shake off the suspicion that navigating the bond markets over the coming months will require almost supernatural powers in second-guessing both central banks and one's peers. For what it's worth this is a game we won't even bother playing. Our pursuit of the rational alternative – proper forms of money and compelling deep value in equity markets – continues. More to follow on this.

From Sovereignman.com. If you liked this post, please click the box below. You can Download our Free 17 page Report The 6 Pillars of Self Reliance. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial letter writer Ron Rosen takes gold price suppression for granted Posted: 06 Oct 2014 02:14 PM PDT 5:10p ET Monday, October 6, 2014 Dear Friend of GATA and Gold: Financial letter writer Ron Rosen, interviewed today by King World News, takes for granted that central banks are striving to suppress the price of gold but believes that they won't be able to get away with it much longer. Let's hope Rosen is right, but GATA is not yet planning the victory party. Rosen's interview is excerpted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/10/6_He... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Rickards : Obama Ending Alliance with Saudi Arabia and Killing the Petrodollar Posted: 06 Oct 2014 01:52 PM PDT At the San Antonio Casey Research Summit, Jim Rickards sat down with Alex Daley to talk about the pain ahead for the US Dollar, why we'll soon see SDRs, and other harbingers of the Death of Money. [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Peak Empire, In Time of Plague Posted: 06 Oct 2014 01:34 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sprott, Rule, Embry discuss metals' prospects and you can join them Posted: 06 Oct 2014 01:22 PM PDT 4:20p ET Monday, October 6, 2014 Dear Friend of GATA and Gold: Sprott Asset Management's Eric Sprott, Rick Rule, and John Embry will get together for an hour at 2 p.m. ET Tuesday to discuss the prospects for the precious metals, and you can join them via the Internet. Just register here: https://event.on24.com/eventRegistration/EventLobbyServlet?target=reg20.... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price $1400 In 2015 According To Sterne Agee Posted: 06 Oct 2014 01:22 PM PDT In a precious metals update, analysts Michael Dudas and Satyadeep Jain from the investment bank Sterne Agee, forecasted that both gold and silver prices will trend higher in 2015. According to their report, there are three key reasons at the center of their thinking:

The analysts expect the gold price in 2015 to average $1,400. For the year after, in 2016, they believe the gold price will trade at $1,450 on average. Silver should follow gold higher. The analysts expect a silver price of $19 in 2015 and $21 in 2016. For gold stock investors, the analysts suggested looking at these senior gold miners: Newmont Mining, Agnico-Eagle Mines, Coeur Mining and Gold Resources. Dudas and Jain write:

Source: Barron’s | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| At KWN, Embry dissects phony U.S. job report Posted: 06 Oct 2014 01:01 PM PDT 4p ET Monday, October 6, 2014 Dear Friend of GATA and Gold: Sprott Asset Management's John Embry today tells King World News about the phoniness and contrivances of the latest U.S. jobs report and says the data manipulation is part of a scheme to support the U.S. dollar and the U.S. stock market. An excerpt from Embry's commentary is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/10/6_Jo... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver’s Disconnect: Silver Price Falls Amid A Strengthening Physical Market Posted: 06 Oct 2014 12:57 PM PDT Chartwise, gold and silver do not look very constructive. As we have detailed in the last couple of weeks here, here and here, there is a high probability that the silver and gold price decline are not over. In this article, Jeff Clark’s from Casey Research describes the huge disconnect developing in the silver market as we speak. In his new Big Gold report he describes the potential catalysts that could spark a turnaround in this market. He correctly points out that we are living in a central bank-controlled world. However, the odds of central planners steering us out of the corner they've painted us all into are remote. “The math just doesn't work, and history has demonstrated the outcome of such fiscal, monetary, and economic foolishness numerous times.” The price of all precious metals have dropped. However, the silver price has suffered the most. As a monetary metal, it seems to defy logic that silver has plummeted while debt levels have soared, money printing is at historic levels, and fiscal deficits remain stubbornly high in spite of record federal tax revenue. But the disconnect is bigger than just the price vs. silver's monetary role. Look at the following facts and figures which are provided by Jeff Clark’s. Note that we wrote already last year about the Great Disconnect Between Paper & Physical Silver. The Big Disconnect In The Silver MarketWhile all precious metals have dropped, the silver price has suffered the most. As a monetary metal, it seems to defy logic that silver has plummeted while debt levels have soared, money printing is at historic levels, and fiscal deficits remain stubbornly high in spite of record federal tax revenue. But the disconnect is bigger than just the price vs. silver's monetary role. Consider the following aspects of the silver market that are rising:

The following aspects of the silver market are falling:

It's honestly hard to find a more distorted market anywhere else in the world today. At some point, this disconnect must be rectified. But the disconnect is worse than that…

In other words, SLV has never been this oversold. This doesn't mean the silver price can't fall further, nor that if it bounces from such oversold levels it will be sustainable. But it does mean the rubber band is more stretched than at any other time we know of. The disconnect is worse still. We all know that silver is more volatile than gold, so it's not surprising that it has sold off more than gold in this recent downdraft. But…

Last, silver is closing in on its longest bear market in modern history… This updated snapshot shows six decades of bear markets. The black line represents silver's decline from April 2011 through October 3, 2014.

The disconnect between the silver price and its fundamentals is greater than ever.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold And Silver Divergence: Enter the Dragon Posted: 06 Oct 2014 12:37 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Here Is The Most Frightening Prediction To End 2014 Posted: 06 Oct 2014 12:11 PM PDT  Today King World News interviewed a 60-year market veteran who made some absolutely frightening predictions as we head into the end of 2014. He discussed what to expect in the major markets, including stocks and gold, and he warned that despite the propaganda and recent stock market action, the West is literally "destroying" itself. Below is six-decade market veteran Ron Rosen's remarkable interview. Today King World News interviewed a 60-year market veteran who made some absolutely frightening predictions as we head into the end of 2014. He discussed what to expect in the major markets, including stocks and gold, and he warned that despite the propaganda and recent stock market action, the West is literally "destroying" itself. Below is six-decade market veteran Ron Rosen's remarkable interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 Insider Secrets to Self-Publishing Success Posted: 06 Oct 2014 11:43 AM PDT The first thing you should know about self-publishing is this: These days, people don't care if your book is self-published or not. So don't worry too much about that. Unlike in the olden days, a self-published book can be just as good as a traditionally published one. Provided, of course, they follow a few basic rules…

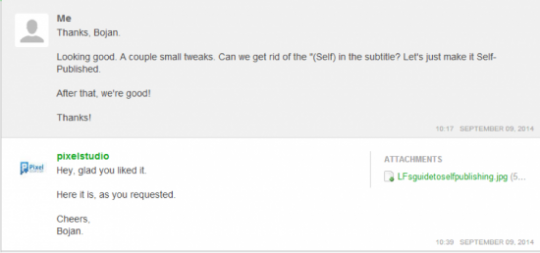

Also, you really need to put yourself in the buyer's shoes. Is it interesting? Is it timely? Would you buy your book if you stumbled across it? Be honest. If the answer is no, you need to restructure it before you go any further. If you're positive you have a hit, though, read on… Today, you're going to learn three instantly actionable steps you can take, no matter what stage you're at with your book… One, how to get a professional-looking cover for as little as $5. Two, how to format your book to get people to love it and buy your next one… Three, how to market your book to hundreds of thousands of people — absolutely free… Let's get started. How to get a professional cover for as little as five bucks… As mentioned a couple weeks ago, we had the following cover made for only $10… With more time, we could've made this for free. Only the free option will take a little experience with a photo manipulator. You have three options for creating your cover for free or on the cheap… Keep in mind, though, potential readers WILL judge your book by its cover. It's the first impression. And it's crucial. So make sure it looks professional and pleasing to the eye. If this takes spending a bit more money, so be it. It'll be worth it. To get some ideas, go to Amazon and look at the best-sellers in your genre. Then look at the crappiest. You'll probably notice a trend as far as what works and what doesn't. Here are your free (and one cheap) book cover options…

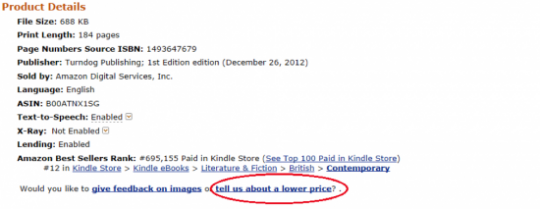

Here's how you create your free cover from scratch… First, you'll need a good picture for your cover. One website that offers royalty-free photos is Flickr. Just go on their website and search for images that are within what's called "Creative Commons." When a photo is in Creative Commons, you're free to use it for commercial purposes as long as you provide proper attribution (unless otherwise stated). You can also Google "free for commercial use images" or something to that effect to find other places that offer free photos. Just make sure to provide a small attribution for the owner of the photo on your copyright page. Go ahead and copy and paste the following into a document. You can use it as a template for your copyright page: Copyright [enter year] [enter your name] [Enter title of your book] Take that picture and use a photo manipulator like Gimp… Gimp is a 100% free photo manipulation program. And aside from being free, it does have a few advantages over Photoshop. One, it's a smaller program, which makes it faster and more stable, especially if you have an older computer. Two, it's more intuitive and easier to use than Photoshop in many ways. Three, there are many excellent tutorials on how to use Gimp, also free. Here are a couple links to get you started… Option No. 2: Use CreateSpace's Cover Creator… CreateSpace is Amazon's print-on-demand self-publishing platform. With it, you can not only self-publish your book — but also create the cover (and both for free). CreateSpace makes money by taking a cut from each book sold on Amazon.com. Use CreateSpace if you want to sell physical copies. For e-books, use Kindle's KDP program. (More on that in a bit…) CreateSpace's cover creator is fast. Simple to use. And all of it is free. Here's the tutorial for their cover creator. Finally, here's how we had our cover created for only $10… I've mentioned this website before in my FREE Laissez Faire Today e-letter… The website is called Fiverr. It's a platform that allows users to offer their services for as little as $5 to as much as $1,000. There are hundreds of small book cover design companies that will create your cover for as little as $5. Many of them, of course, have shoddy work and little experience. But there's one in particular I'm extremely impressed by. It's called Pixel Studio. They're a professional graphic design studio located in Banja Luka, Bosnia and Herzegovina. Much of their work comes from Fiverr. And I haven't seen one disappointed review on the platform yet. In fact, they have a five-star rating from 2,224 buyers. They worked on our self-publishing cover. And they kept editing it until I was completely satisfied (and I was pretty particular). Here's a snippet of the tail end of our conversation early last month… Here's how the pricing works… They'll design a $5 cover for you if you provide the picture. For $10, which is the option we chose, they'll buy a premium photo for you. And you can choose it yourself before they buy it. It's a great service, and I can't recommend them enough. Click the graphic below to see for yourself. [To be clear, I'm not getting any kickbacks from Pixel Studio. In fact, they're not even aware I'm writing about them. I just think they're great.] Here's the second "secret": How to format your book to make people love it and want to buy your next one. It boils down to this… The power of a "freemium" and why splitting your book into chunks will make you more money. A lot of the most successful indie authors are publishing their books in episodes. I'll show you an example of what I mean in a moment… They'll split the entire book into chunks of 50-200 pages and publish them as standalone products. Think of a successful TV series in which each episode leaves with a cliffhanger, making the viewers excited to come back next week and tune in. Here's why this is brilliant… With this method, you can make your first "episode" of your book free. You can cut that episode off with a killer cliffhanger and show them where to buy the next episode, or the complete "set" for a lower price overall. For example, here's how you can structure it… Part One: Free That's just one option. It's always good to play around with pricing to see how much you can charge at a psychologically valuable selling price (meaning, the reader feels like he or she is getting more than they are paying for). Here's a good example of how this works, from author David Wright with his book Yesterday's Gone… Season One: Free Inside this series, you'll notice, each season consists of several episodes (chapters) to give it more of a TV feel… but you can break it up however you'd like. One problem: Amazon doesn't allow you to price your first "episode" for free through their Kindle Direct Publishing program (KDP)… Not at first, at least. But here's one clever loophole: Use Amazon's price-match guarantee against them. So here's what you do: Publish your e-book on Amazon for 99 cents (and don't enroll this one into the KDP program… more on that in a moment). Then, publish it on another self-publishing site that does allow you to offer it for free (such as Smashwords) and set the price at zero. Then, once published on both sites, go to your book's Amazon page and look for the "tell us about a lower price" link… Click it and send them the link to your free e-book on Smashwords. Encourage your friends and family to do the same. If they get enough requests, they'll change it to free. And also, as a side note: In your first free episode, give your readers an opportunity to follow you. Your first book should have a way for readers to get into contact with you, and you with them. You'll want to build a list of followers. That way, when you release your second, you can let them know. And if they loved the first "set," they'll probably buy it. Moving on, here's the third "secret" in our arsenal… This is one you'll want to use once your book is published and ready to roll. It's the best way to market your book to thousands of people for free. First, you're going to want to get the rest of your episodes in Amazon's Kindle Direct Publishing Select program. Remember, don't enroll your first book in the Select program. That one is the "taster." What's the Select program? When you enroll into this program, you're committing to sell the e-book ONLY in the Kindle format. Don't worry. You can unenroll your book after 90 days. If you do, though, you won't receive the perks of KDP Select. Which is why I recommend signing up for KDP Select first before anything. Let me explain… The biggest perk of KDP is that you can offer your episodes for FREE on Amazon for up to five days every three months… Use this program to offer your second episode for free for five days. Why would you want to do that? It's very simple. Enter what's called "pulsing." Each time you offer your book for free, hundreds, maybe thousands, of people will download it. That's a good thing. Depending on how well you market it (I'll get to that) your book will skyrocket on Amazon's popularity list, exposing you to hundreds of thousands of potential buyers. Amazon's popularity list is where most of your readers will discover you… Not necessarily on the best-seller list. Why? That's what Kindle readers are fed each day. That list is also weighted so that higher-priced books move up the list faster. Meaning, a higher price for your second book will help you get noticed. Here's why… Most new e-book sellers, following the latest trend, are currently pricing their books at 99 cents… This cuts into Amazon's bottom line. To combat that, they're currently giving higher prices the advantage. This is why I recommended pricing Part Two at a higher price than others — and the box set at only a dollar or so more. So when you offer your second episode for free, you'll have the usual price ($3.99) and the limited-time freebie going for you. With Amazon's KDP Select, you can choose which days you're going to offer your episode for free. In the days leading up to that freebie launch, here's what you do… You're going to want to tell the world your book will be free. Luckily, there are hundreds of places full of eager readers where you can do that. Here are three of the best resources to get you started… A quick tutorial on the best practices. Author Marketing Club's free submission tool. And a list of 100-plus websites to submit your free e-book. That's all we have for you today. More information on the book to come. Stay tuned. Regards, Chris Campbell Ed. Note: These are only three of the many secrets on self-publishing Chris Campbell will be leaking out to his Laissez Faire Today readers over the next few weeks. If you're writing a book, you can't afford not to see what he'll share next. Best part? Signing up is 100% free: Click here now to get started. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China/India Gold Demand: 2013 Déjà Vu Posted: 06 Oct 2014 11:06 AM PDT In 2013; a chain of events led to what was (at the time) the greatest stampede into gold in human history. It began with the Cyprus Steal, the West's first "bail-in". This led to the realization (by the Smart Money) that no paper assets were safe any longer, within any Western financial institution or market. In turn, this led to an unprecedented stampede out of the banksters' paper-called-gold "products", primarily their ultra-fraudulent bullion-ETF's. With the paper-called-gold market being 100 times larger than the real (physical) gold market; this naturally caused a plunge in the official price of gold. It was at this point that the stampede into (physical) gold began. Some of this demand was from the West: sellers of these vast quantities of paper-called-gold suddenly saw the wisdom in holding real bullion: having physical custody of their asset, and thus zero counterparty risk. Most of the demand, however, came from the East. With the price of gold falling roughly 30%, from already depressed levels; this was nothing less than a "dinner chime" for Pavlov's dogs. Unlike the serf-populations of Western nations; appreciation (and understanding) of precious metals has not been blunted by roughly 30 years of relentless anti-gold (and anti-silver) propaganda. With this Eastern understanding; the world had already been witnessing a relentless transfer of the world's bullion holdings from West to East. Thus like women flocking to a shoe-store sale; this "30% off" on the price of gold in 2013 led to a spike in Asian demand beyond anything previously seen. As indicated in a previous commentary in June of last year; at that time both China and India were on a pace to import roughly 2,000 tonnes of gold – surpassing any previous total for either nation. China, indeed, ended 2013 with net imports exceeding 2,000 tonnes, according to gold analyst (and China specialist) Koos Jansen. Gold demand in India was temporarily derailed, however; as India imposed (what was at one point) a near-total embargo on (legal) gold imports into that nation. This draconian measure was a capitulation to blackmail from the One Bank, which had caused a "currency crisis" in India by attacking the value of the rupee in (rigged) global FX markets. The bankers made it explicitly clear that nothing less than a dramatic drop in gold imports would/could rescue the rupee from these currency market attacks. Official imports into India plunged dramatically, and India ended the year having imported considerably less than 2,000 tonnes. A precise number is not possible; as the legal restrictions on gold imports into India reignited gold smuggling into that country. Indeed, the Indian government had spent years previously "liberalizing" its gold market, precisely in order to stem blackmarket flows across its porous borders. As gold-smuggling exploded, and it became more and more obvious that a legal ban on importing gold could not stop the flow of bullion into that nation; the bankers themselves capitulated, and allowed India's government to restore official gold imports to somewhere close to "normal" (i.e. pre-2013 levels). However, making it easier to legally import gold into India has not resulted in a drop-off in smuggling. Indeed, recent reports indicate that gold-smuggling into India is accelerating further. Now, as more bankster manipulation has caused a (relatively) modest further retreat in bullion prices (roughly a 5% recent drop in the price of gold, and 10% for silver); we see indications of gold demand into China and India returning to that torrid pace of 2013 – just as the beginning of the seven-month "gold season" in India looms before us. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Koos Jansen: China's gold demand remains strong, silver remains scarce Posted: 06 Oct 2014 09:37 AM PDT 12:35p ET Monday, October 6, 2014 Dear Friend of GATA and Gold: Gold researcher and GATA consultant Koos Jansen reports today that the latest figures from the Shanghai Gold Exchange show that Chinese gold demand remains strong. Jansen adds that while silver inventory on the Shanghai Futures Exchange has increased markedly after having been dramatically drawn down, silver remains scarce in Shanghai. Jansen's report is posted at Bullion Star here: https://www.bullionstar.com/article/china%20buys%2045t%20of%20gold%20ahe... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 BullionStar is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. BullionStar's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in BullionStar's bullion vault, which is integrated with BullionStar's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GBP Still Trading Under Pressure:Â Can This Continue? Posted: 06 Oct 2014 06:26 AM PDT Dollar strength continues to dominate, so if there is any way to characterize the overall behavior in forex markets for the final portion of the summer, it would be done using the pronounced bullish moves that have been see against the Euro and Pound. Most of this positive activity in the greenback has been supported by risk aversion and geopolitical tensions (which were present in several major economic regions around the world). This sent the PowerShares DB US Dollar Index Bullish ETF (NYSE: UUP) to new highs, and this strength came at the expense of both the Euro and British Pound (GBP), which are both trading at some of their lowest levels of the year. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Support At $1,180/oz and $1,161/oz, Then At $1,000/oz Posted: 06 Oct 2014 06:16 AM PDT Gold had a torrid September and suffered further losses last week of 2.2%. Gold in U.S. Dollars, 5 Years (Thomson Reuters) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cerulean Dollars - Go Deep or Go Home Posted: 06 Oct 2014 05:25 AM PDT “We have deep depth.”-Yoga Berra The dollar institution is much larger than the Fed, the Treasury or the entire basket of FOREX that derives relative values of backless currencies. Market action makes market commentary. Few question price discovery -- instead they spend precious time trying to make the fundamentals fit the price. A backwards endeavour. We need to go deeper. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Oct 2014 04:43 AM PDT Dear Reader, I’m coming to you from East Africa, having just survived a hair-raising ride in a battered old Soviet helicopter to inspect some of the highest-grade copper deposits I’ve ever seen. I’ve got lots of notes to compile, so I’ll go ahead and turn this week’s column over to Jeff Clark, who tackles last week’s alarming—or electrifying, depending on your point of view—decline in our market sector, head on. Before I go, however, I’ll mention that Jeff has joined Twitter. Catch him there, if you’d like to get his gold market updates: @biggolddude. You can also follow my rock-kicking adventures on Twitter: @duediligenceguy. We look forward to hearing from you. Sincerely, Louis James

Instead of Puking, Do ThisJeff Clark, Senior Precious Metals Analyst The sure sign of a market in capitulation is when those who are long feel like puking. With gold and silver prices in what certainly feels like capitulation mode, pat yourself on the back if you didn’t succumb to the pressure and sell. Actually, pat your future self on the back, because it’s that person who will realize the benefits of your discipline today. In the short-term, though, the bad news is that the decline is probably not over. Gold’s low of $1,180 is likely to be tested and possibly breached. Silver’s previous low was broken weeks ago. It all seems like a huge disconnect to the realities we can all see with our own eyes. As just one example, the mainstream applauded the lower unemployment number last Friday—but the labor participation rate fell to a 36-year low, with a record 92.6 million Americans no longer in the workforce. And the stock market soared on the news. I don’t think I’m just being stubborn because I’m sure that, at some point, disconnects in data like that will matter. We’re living in a central bank-controlled world more than ever before, but the odds of central planners steering us out of the corner they’ve painted us all into are remote. The math just doesn’t work, and history has demonstrated the outcome of such fiscal, monetary, and economic foolishness numerous times. The Biggest DisconnectWhile all precious metals have dropped, the silver price has suffered the most. As a monetary metal, it seems to defy logic that silver has plummeted while debt levels have soared, money printing is at historic levels, and fiscal deficits remain stubbornly high in spite of record federal tax revenue. But the disconnect is bigger than just the price vs. silver’s monetary role. Consider the following aspects of the silver market that are rising:

The following aspects of the silver market are falling:

It’s honestly hard to find a more distorted market anywhere else in the world today. At some point, this disconnect must be rectified. But the disconnect is worse than that…

In other words, SLV has never been this oversold. This doesn’t mean the silver price can’t fall further, nor that if it bounces from such oversold levels it will be sustainable. But it does mean the rubber band is more stretched than at any other time we know of. The disconnect is worse still. We all know that silver is more volatile than gold, so it’s not surprising that it has sold off more than gold in this recent downdraft. But…

Last, silver is closing in on its longest bear market in modern history… This updated snapshot shows six decades of bear markets. The black line represents silver’s decline from April 2011 through October 3, 2014. The disconnect between the silver price and its fundamentals is greater than ever. Instead of Puking, Here’s What I’m Doing About It…First, I can’t let this grossly overdone decline go by without taking advantage of it. I contacted one of our recommended bullion dealers and asked them if they could give us a discount on premiums. They can, and so I will be offering BIG GOLD subscribers two discounts on bullion in tomorrow’s issue: one on silver and one on gold, both with discounted premiums you can’t get elsewhere. Combine the low premiums with the recent selloff and this is a remarkable opportunity to add more ounces to our portfolio for the same dollar amount than we’ve been able to do in four years. That’s exactly how a contrarian should look at it—and in this market, you’re a contrarian or a victim. Second, because many related stocks have fallen off the proverbial cliff, some are now at a point where a double or triple is not unreasonable to expect once the market turns around. The selloff in one of our gold stocks, however, is so over overdone that our analysis shows it could be a five-bagger from current prices. I plan to buy this stock after waiting two days for subscribers to do so first, but to capture that return you must buy it now, before any bounce can occur. Third, my introduction tomorrow will show why owning gold right now is more critical than ever. I ask 14 questions that shed light on the multitude of risks we’re exposed to right now—and then ask five pointed questions to determine if you are using gold and gold stocks in the most optimal way for the current environment. The perspective you’ll gain from this view could make you think more constructively about your gold investments, or in the least, reinforce your outlook. It has for me. That’s what I’m doing. As our profitable “gold insurance” recommendations that have profited from falling gold prices show, this is not just stubborn gold bug talk, or pride—or even stupidity. It’s that I don’t believe in free lunches and I do believe that sooner or later the economic realities we all see will impact our market strongly and positively. If you want to join me and others at Casey Research and capitalize on what we think will be a fleeting opportunity, start here before Tuesday’s issue is released. You can get started by reading the September issue; it comes with a list of catalysts that could spark a turnaround in this market, well worth 10 minutes of your time. I hope you’ll join us, but either way, don’t give up the ghost… or the food in your stomach. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ron Paul - The Real Status of U.S. Forces in Afghanistan and Iraq Posted: 06 Oct 2014 04:12 AM PDT After 13 years of war in Afghanistan - the longest in US history - the US government has achieved no victory. Afghanistan is in chaos and would collapse completely without regular infusions of US money. The war has been a failure, but Washington will not admit it. More than 2,000 US fighters have been killed in the 13 year Afghan war. More than 20,000 Afghan civilians were also killed. According to a study last year by a Harvard University researcher, the wars in Iraq and Afghanistan will cost in total between four and six trillion dollars. There is no way of looking at the US invasion of Afghanistan and seeing a success. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Soaring U.S. Dollar Debate: Good, Bad, Ugly Posted: 06 Oct 2014 03:52 AM PDT The dollar is on a tear. And the world is scrambling to figure out what it means. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Catalyst Check: Natural Resources Watchlist at Three Months Posted: 06 Oct 2014 01:00 AM PDT At the Cambridge House Canadian Investment Conference in June, The Gold Report Publisher Jason Mallin asked a panel of experts picking a portfolio of stocks with upside potential for the 2014 Streetwise Reports Natural Resources Watchlist what they wanted to see in an equity. As always, Sprott US Holdings Inc. CEO Rick Rule, summed up the ideal beautifully. "We like reality at a discount," he said. Now that three months have passed, we decided to check in with Rick and co-panelists Joe Mazumdar from Canaccord Genuity and Keith Schaefer from Oil & Gas Investments Bulletin to see how that reality is playing out. You can always check the portfolio in real time at the Portfolio Tracker. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fed May Hold Off Raising Interest Rates If Strong Dollar Continues Posted: 05 Oct 2014 05:00 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Technician: More Weakness Ahead for Stocks; Dollar Could Be Entering "New Structural Bull Market" Posted: 05 Oct 2014 05:00 PM PDT Near-term caution on the market was echoed again by our most recent technician on the show, Louise Yamada, as the major indexes attempt to stabilize. She sees "continued deterioration" in a number of key indicators beyond what we've seen so far this year and believes this may be the start of a cyclical correction of around 10%. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

We are very close to where the upside explosion in gold is going to begin. There are millions of despondent gold holders right now but if they look at the quarterly chart below they will see that we are just a few bucks away from the end of what has been a brutal bear market ($1,160 on the trendline below).

We are very close to where the upside explosion in gold is going to begin. There are millions of despondent gold holders right now but if they look at the quarterly chart below they will see that we are just a few bucks away from the end of what has been a brutal bear market ($1,160 on the trendline below). For the benefit of anyone living under a rock these past weeks, Bill Gross, the so-called "Bond King" and manager of the world's largest bond fund (PIMCO), jumped ship before he could be shoved overboard. PIMCO's owners, Allianz, must surely regret having allowed so much power to be centralized in the form of one single 'star' manager. In a messy transfer in which nobody came out of well, Janus Capital announced that Bill Gross would be joining to run a start- up bond fund, before he had even announced his resignation from PIMCO (but then again Janus was a two-faced god).

For the benefit of anyone living under a rock these past weeks, Bill Gross, the so-called "Bond King" and manager of the world's largest bond fund (PIMCO), jumped ship before he could be shoved overboard. PIMCO's owners, Allianz, must surely regret having allowed so much power to be centralized in the form of one single 'star' manager. In a messy transfer in which nobody came out of well, Janus Capital announced that Bill Gross would be joining to run a start- up bond fund, before he had even announced his resignation from PIMCO (but then again Janus was a two-faced god).

from

from

International Speculator

International Speculator

No comments:

Post a Comment