Gold World News Flash |

- What The Last 14 Years Have Taught Me About Gold & Markets

- Rule gives KWN alternative arguments for resource investing

- Financial Times: Banks plan to write off derivatives when a counterparty fails

- China, Russia, Saudi Arabia, Oil, Gold, Silver & Global Conflict

- The SILVER Price Beat Down, the CHARADE of the Chicago CME & PAPER HFT: It COSTS Around $24 To Pull PHYSICAL SILVER Out of the Ground — V The Guerrilla Economist

- China is maneuvering to get its currency included in IMF's super-currency

- Gold initiative would hamper policy, Swiss government says

- Replace These People with an App Already

- Inside September's "Born Again" Jobs Report

- The Gold Price Closed $5.00 Higher Closing on the Comex at $1,211.70

- China wants say in 'price discovery' in everything

- Russia, South Africa in talks to support platinum price

- The Death of the Dollar Has Been Greatly Exaggerated

- Submit Your Questions To These Precious Metals Experts

- Gold vs Silver Investment Demand In 2014 – Spot The Difference

- Gold Daily and Silver Weekly Charts - Leveling Up

- China, Russia, Saudi Arabia, Oil, Gold, Silver & Global Conflict

- Jim’s Mailbox

- Richard Russell - We Just Saw Ultimate Bottom In Gold & Silver

- Obama Abandoning the Saudis for Iran and Dooming the Petrodollar - Video

- Gold and the S&P 500 Index: Sum and Ratio

- Huge Reversal in USD and Gold - Finally!

- NYTimes: Big banks face another round of U.S. charges over currency market rigging

- Silver “Particularly Cheap†as “Blood On The Commodity Streetsâ€

- Deflation Is Bullish For Gold Stocks

- Gold vs S&P 500: Insights From The 25-Year Chart

- The Best Offense Remains a Good Defense: M Partners' Derek Macpherson

- Gold and the S&P 500 Index: Sum and Ratio

- Volatility Returning to Currency Markets

| What The Last 14 Years Have Taught Me About Gold & Markets Posted: 07 Oct 2014 09:01 PM PDT  Today one of the wealthiest people in the financial world spoke with King World News about the incredible lessons the last 14 years has taught him about gold and the major markets. Rick Rule, who is business partners with Eric Sprott, also discussed why he is so bullish going forward. Today one of the wealthiest people in the financial world spoke with King World News about the incredible lessons the last 14 years has taught him about gold and the major markets. Rick Rule, who is business partners with Eric Sprott, also discussed why he is so bullish going forward.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rule gives KWN alternative arguments for resource investing Posted: 07 Oct 2014 08:44 PM PDT 11:40p ET Tuesday, October 7, 2014 Dear Friend of GATA and Gold: Sprott Asset Management's Rick Rule, interviewed today by King World News, makes alternative arguments for investing in the resource sector and invites people to take their choice. First, Rule says, the sector seems to be as unloved as it could get and likely close to a bottom. Second, Rule says, if you believe the U.S. government that the economy is recovering, resources should recover with it. Of course Rule is talking his book but one of those arguments may make sense. The interview is excerpted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/10/8_Wh... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Times: Banks plan to write off derivatives when a counterparty fails Posted: 07 Oct 2014 08:06 PM PDT Banks Rewrite Derivatives Rules to Cope with Future Crisis By Tom Braithwaite and Tracy Alloway http://www.ft.com/intl/cms/s/0/aeb57e26-4e6d-11e4-bfda-00144feab7de.html NEW YORK -- The world's biggest banks have agreed to tear up the rulebook on derivatives to make it easier to resolve a future failing institution like Lehman Brothers. People familiar with the matter said 18 bank "dealers," ranging from Credit Suisse to Goldman Sachs, have agreed to give up the right to pull the plug on derivatives contracts with a crisis-stricken institution. ... Dispatch continues below ... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 BullionStar is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. BullionStar's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in BullionStar's bullion vault, which is integrated with BullionStar's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Several months of complex talks involved regulators and asset managers but were led by dealers under the umbrella of the International Swaps and Derivatives Association. US regulators, who have previously condemned the industry's crisis planning as inadequate, had demanded banks come up with a plan to stop their counterparties terminating derivatives contracts in the event of a crisis. The banks portrayed the success of the talks as a rare positive example of industry collaboration. ISDA is due to announce the agreement to change its "protocols," which govern the $700 trillion market, in the next few days. They will take effect from January 1, 2015. According to a report from the US Government Accountability Office, 80 per cent of Lehman's derivatives counterparties closed out their deals with the bank within five weeks of its bankruptcy filing. That, in theory, helped the companies mitigate their counterparty risk with the failed bank but it also meant that Lehman's estate had to spend years in court trying to claw back collateral from its partners. "One of the problems with Lehman was when there was a failure of one subsidiary clients of derivatives trades took funding away and took business away, adding to market instability," said one bank negotiator. This also made it harder to find buyers for the rump of Lehman. The current thinking among regulators is that the core of a failing institution should be preserved. Although shareholders would be likely to be wiped out, the operating company would be recapitalised or sold to mitigate the shock to the broader financial system. "You have the financial sector absorb the losses but you have the company stay in business," said another industry negotiator. "Assuming it gets signed up, it's a very important step in ending 'too big to fail.'" The concept of "too big to fail" has become hugely controversial since the financial crisis when AIG was bailed out by the US government because of fear of the consequences of its failure. Regulators have been struggling to come up with a viable system to avoid a repeat of the expensive bailout of AIG or the damaging failure of Lehman. The Dodd-Frank financial reforms in the US and parallel reforms in Europe instituted new procedures to "resolve" a failing institution but many believed these were unworkable without changes to derivatives contracts. The vast majority of derivatives contracts will be covered by the agreement to change the ISDA protocols, according to banks, but there are several elements yet to settle. One of the most important is that large institutional investors such as BlackRock would not be covered by the changes, particularly if they are cross-border counterparties. Regulators are working to compel asset managers and hedge funds to accept the new protocols. Some of them argue they cannot voluntarily give up the right to cut off business with a failing bank because of a fiduciary duty to protect their investors' interests. Another element that is not finalised is how the system would work in the event of a US company going through bankruptcy in the courts rather than the new resolution regime. Participants in the ISDA talks said the industry had come to agreement and "prewired" the way this would work but it required regulation to make it effective. The overhaul has drawn criticism from some who think that regulators may have made a mistake in asking the industry to update the derivatives documents voluntarily. Some market participants had suggested that regulators introduce incentives, such as preferential capital margin treatment, to speed negotiations. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China, Russia, Saudi Arabia, Oil, Gold, Silver & Global Conflict Posted: 07 Oct 2014 08:00 PM PDT from KingWorldNews:

It could be that the Saudis are trying to put a little pressure on Russia. Interestingly, in the United States there are reports everywhere saying that we are becoming the largest producer of oil in the world. There are also claims that fracking is a technological marvel and we are going to continue to increase oil production. The part about the oil production is true but I have serious issues with fracking being a technological marvel. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Oct 2014 07:25 PM PDT [Ed. Note: The action, particularly in regard to silver, begins around 14:10] from Hagmann & Hagmann, via Before Its News: The on Hagmann And Hagmann Report: V, the Guerrilla Economist, walks us through the labyrinth of the current economic crisis – yes, there is one, and gives us possible dominoes that might fall first, an event or series of events that will ultimately bring down the U.S. Dollar.The Guerrilla Economist, who has a proven near perfect accuracy rate, is the founder and operator of his website, Rogue Money at www.RogueMoney.net. We'll explore the proxy war going on between Russia (and China) versus the United States, and how this proxy war is laying the groundwork for a potential shooting war, or WW III. Sound ominous? It is, more than most people realize. The Guerrilla Economist will also discuss the Silver and Gold manipulation, and where both metals are expected to be trading in the next 3, 6, 12 and 18 months. Also, Mike Rosecliff will be interviewed with the Guerrilla. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China is maneuvering to get its currency included in IMF's super-currency Posted: 07 Oct 2014 06:10 PM PDT China Currency Push Takes Aim at Dollar By David Marsh http://www.usatoday.com/story/money/business/2014/10/07/china-currency-p... Protests over democracy in Hong Kong may be preoccupying the Chinese leadership, but a subject of still greater international importance is being played out this week behind closed doors in Washington. China is bidding to enter the heart of global finance by establishing its currency, the renminbi, as part of an ubiquitous monetary unit used in official transactions around the world. ... Dispatch continues below ... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: The issue of whether the Chinese should be part of the International Monetary Fund's Special Drawing Right, the composite reserve currency used in official financing, is highly technocratic, but the political questions at stake go to the core of world money and power -- and will be discussed, in the background, at the annual meetings of the IMF and World Bank in Washington this week. The decision on a new SDR structure, to be made in the next 15 months, will influence how China and its currency can play a bigger part in driving world trade, investment, and capital flows. The renminbi eventually could challenge the dollar and its pivotal position in world money -- which is why the U.S. government and Federal Reserve are examining this with intense interest. China is unlikely to mount an open campaign to enter the SDR, grouping the main reserve currencies, the dollar, the euro (linking countries in European monetary union led by Germany and France), the Japanese yen, and British pound, and is valued at around $1.5. Beijing would prefer the question of recalculating the composition of the SDR, which comes up for review in 2015, to follow market developments, reflecting a big increase in demand for renminbi financing from private banks, central banks, traders, corporations, and asset managers. Many hurdles remain. These include the renminbi's lack of formal convertibility for transactions that shift capital inside and outside the country, where Beijing is reluctant to abolish all controls. In addition, China still has to release more statistics to the fund about its monetary reserves and other matters. However, Chinese measures over the past three years to liberalize and internationalize its currency, and a big increase in financial market interest in China, are pointing toward a broadening of the SDR's composition from January 2016. An additional factor is China's own action to galvanize emerging market economies toward reforming word monetary arrangements. This includes the five-nation Brics group's decision to set up the New Development Bank in Shanghai, potentially challenging the IMF and the World Bank. As the world's No. 2 economy after the U.S., China believes it is close to earning the status of a reserve money, the first time that an emerging market currency would attain this position. Chinese entry into the "magic circle" has been advanced by the British government's September decision to issue renminbi-denominated bonds, the first big government to take such a step, and allow the proceeds to be held as reserves by the Bank of England. The main conditions for the renminbi to pass the SDR test are that it should be widely used in trade and be "freely usable" in international payments and asset management. Although a long way behind the dollar, the renminbi has made impressive strides recently and is challenging the euro in several key fields. Next year's planned review also will touch on the opportunity for the SDR to play a greater role on financial markets -- for example in denominating bond issues. The SDR has lost ground as a financial vehicle in the past two decades, reflecting the surging importance of international private-sector capital markets. But with the addition of the renminbi, it may be about to make a comeback. ----- David Marsh is managing director of the Official Monetary and Financial Institutions Forum, a London study organization. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold initiative would hamper policy, Swiss government says Posted: 07 Oct 2014 05:39 PM PDT Yes, guys, that's the point, in case you didn't notice. * * * By Catherine Bosley http://www.bloomberg.com/news/2014-10-07/swiss-gold-initiative-would-ham... ZURICH, Switzerland -- Asking the Swiss National Bank to hold a fixed portion of its assets in gold would hinder monetary policy, the government said today. On Nov. 30 Switzerland will vote on the initiative "Save Our Swiss Gold," which would force the central bank to hold at least 20 percent of its assets in gold. It would also forbid the sale of any such holdings and require all the gold be held in Switzerland. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata "A rigid and unsaleable minimum gold holding would make it difficult for the SNB to fulfill its mandate to ensure price stability and to contribute to the stable development of the economy," Finance Minister Eveline Widmer-Schlumpf said at a press briefing in Bern today. Both parliament and the government have already recommended that voters reject the initiative. Opinion polls will be published this month. The SNB's balance sheet ballooned in the wake of the currency interventions it waged to defend the minimum exchange rate of 1.20 per euro set in 2011. The SNB held foreign-exchange reserves of 462.2 billion francs ($481 billion) at the end of September, with total assets of about 522 billion francs. Initiatives are a key element of Switzerland's direct democracy. The gold initiative was started by several members of the Swiss People's Party (SVP), who collected the requisite 100,000 signatures for the measure. SNB President Thomas Jordan has on several occasions urged its rejection, saying it would make it difficult to fulfill the institution's mandate for price stability. "The initiative has the potential to limit the central bank's ability to act," he told Frankfurter Allgemeine Zeitung in an Oct. 1 interview. According to Beat Siegenthaler, currency strategist at UBS AG in Zurich, the SNB would be forced to buy about 1,500 tons of gold over five years to meet the required 20 percent threshold. As of the end of June, the central bank, based in Zurich and Bern, owned 1,040 tons of the precious metal. Its gold holdings have made the SNB dependent on market developments. It was forced to scrap its dividend and its annual payment to the government and the cantons last year after it suffered a 9.1 billion-franc loss after the price of gold experienced its biggest plunge since 1981. "The initiative demands that the central bank engages in an investment adventure," Peter Hegglin, who heads the conference of finance director of the Swiss cantons, said at the Bern press briefing. "A gold supply that can't be touched isn't an emergency supply." The SNB said in April 2013 that about 20 percent of its gold was with the Bank of England and 10 percent at the Bank of Canada, with the remainder stored in Switzerland.

Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Replace These People with an App Already Posted: 07 Oct 2014 05:35 PM PDT By: Chris Tell at http://capitalistexploits.at/ I spent a recent weekend looking at some real estate. It used to be a favourite way for me to spend time and I realized how much I really miss it. I was reminded of how 99% of real estate agents are completely useless. No, I mean not just incompetent but really useless and thick... really thick. Sometimes it's easy to tell thick people apart. You can ask them random questions or just initiate conversation, and when their knowledge fails to extend beyond what's on TV and the weather, you've probably got yourself a thickie. Alternatively, you can measure the distance between their eyes, measure their arm length to height ratio, count the number of times they repeat the same meaningless words such as "fab" or "retro" when trying in vain to describe a crappy box of a house, or you can leave them in a room full of banana skins and see what happens. I say this because it's important to try to steer clear of thick people. Your sanity demands it. To be fair, I had one great experience amongst 4 dismal ones. Pareto's law seems to run true. Normally, I don't pay a heck of a lot of attention to peoples attire, what car they drive or such things, just ask my wife. That said, some things stand out, and like a goat in a fish tank you can't help but notice. The first agent I met for the day was such a "goat". He arrived 20 minutes late, pulled up in a 20 year old Ford Falcon complete with a purple sparkly paint job, lowered suspension, darkened windows and a Fatboy number plate. I was immediately worried. The car screamed "I want to be a Fatboy but can't afford a Ferrari and I have no style." Of course, driving around in a Ferrari for work as a real estate agent, selling anything other than multi-million dollar mansions screams, "I am a shark" and would probably distract clients from the houses they're meant to be buying, while they instead glare at the car thinking ill thoughts about the agent. Let's just say that as a salesperson's appearance matters. When it comes to looking at the property, whether it be land or buildings, any monkey can look around and see what there is to see. What an agent needs to be able to do is to explain what can't be seen by the naked eye. In this instance any modicum of knowledge outside of "there is the dishwasher" would have been useful. Clearly my expectations were too high. I looked at 4 properties, all in the same area, and asked the 4 different agents the same questions:

I'd done a bit of research prior to stepping out the door. I referred to this earlier in "6 Ways to Improve Decision Making". I hate wasting time so I'm not going to bother looking at something which I haven't got at least some level of knowledge about. As such I could have answered all of the 3 questions above but wanted to use them as a starting point to find out more. Alas, I completely flummoxed all 4 of these "experts". It would have come as a gigantic surprise that a 14 ha development was already underway for a very exclusive private school just 2 kilometers away. A simple Google search would reveal this but that might interrupt getting Facebook updates. Growth rates in the area have been off the charts for the last 10 years and employment opportunities have been opening up causing demand growth. Anyone living in the region should have some level of knowledge of this but don't go expecting to be educated by most real estate agents. This is far from my first encounter with real estate agents and it is not unique. What this means is that the buyer has to do the work themselves. This is a good thing really for the buyer, especially if you're an educated buyer and know what you want. I recall for example buying a property some years back. I wanted to put a contract to the vendor and the agent was unaware how to proceed. I walked out to my car, and 5 minutes later came back with a signed contract. I always used to keep a few copies complete with the relevant clauses I needed. The agent, a middle-aged woman, obviously completely in a flap as to what she was meant to be doing, began recoiling and actually trying to dissuade me from buying. She'd probably never had a sale before and had no idea what to do. I helped her out in a big way. I explained to her how difficult it would be to drive home without legs and that, unless she took my contract to the buyer immediately, that was the only way she'd be traveling. Back to my weekend fun. The absolute best agent by far was a woman who clearly was running multiple things in her life. Namely being a mum as well as selling real estate. How do I know this? Well she drove one of those chest freezers on wheels as the car salesmen call it. People mover. The only reason anyone would drive such a horrible box is to transport screaming, messy kids around. I know, trust me. This woman was awesome. She knew the demographic because she lived in the area and her kids went to local schools, she also knew about the new school coming in, she knew what arterial roads bordered the property she was showing me, she knew what traffic was like, what demographic was living in the area, what zoning existed and where, she knew that 80% of people living in this area were home owners not renters, she knew what the typical yield on properties was, what it had been in the past and how cap rates have collapsed, and she had a list of recent comparable sales drawn up to provide me. Hallelujah, I was in love! What then is the solution? Well, I propose using technology. Everywhere I look people are far more engaged with their phones than with real people. Let's further this trend and profit from it. Heck, why fight the trend?

Let's develop an app for real estate buyers. At the push of a button we can find out area details, historic growth rates, median incomes, median sales prices, strategic plans such as highways being built etc. In short, let's take that wonderful woman, driver of the chest freezer, and put her onto your smart phone. We could even use her voice to guide you through the topics you browse. That will take care of the generic statistic driven data. Then what we'll do is combine that technology with another technology which is far from fictitious and a company we have invested in via our Seraph private syndicate. This technology is augmented reality. Check it out here. Now imagine for a minute what can be done with this technology. In the real estate space you could "virtually" walk through that property you want to view while augmenting yourself into the picture, or perhaps augmenting your furniture in the lounge, your dog chasing the cat in the garden. I'm sure you can think of a number of amazing uses yourself. Let's get it done before Google snaps up this company making shareholders, yours truly included, very happy indeed. Most importantly we'll do away with countless unnecessary real estate agents and we'll have our own virtual agent at our fingertips. Like it or not, this is coming. Based on my weekend experience I can't wait.

"Any sufficiently advanced technology is indistinguishable from magic." - Arthur C Clarke | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

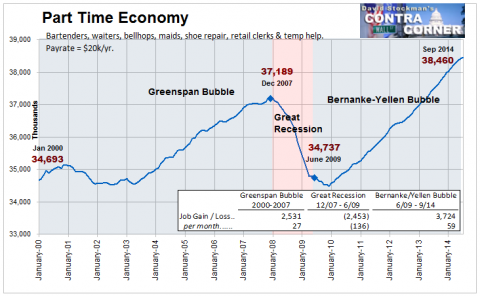

| Inside September's "Born Again" Jobs Report Posted: 07 Oct 2014 04:44 PM PDT Submitted by David Stockman via Contra Corner blog, The September jobs report was greeted by a flurry of robo-trader exuberance because another print well above 200k purportedly signals that growth is underway and profits will remain in high cotton as far as the eye can see. But how many years can this Charlie Brown and Lucy charade be taken seriously—-even by the headline stalking talking heads who inhabit bubblevision? For the entirety of this century they have actually been gumming about little more than “born again” jobs, not real expansion of labor inputs to the faltering US economy. In effect, some macroeconomic Lucy periodically removes the jobs football, but after ritual hand-wringing during the recession the charade starts all over again. That is, Wall Street and the financial media resume what amounts to a monthly jobs telethon around the BLS’s massaged, imputed, seasonally maladjusted and incessantly revised establishment payroll guesstimates. But try the trend of aggregate labor hours. instead. That’s also contained in the BLS report, but it is never cited in context—-only as a meaningless point comparison with the prior month. The better angle, of course, is spans of years and decades because that captures trends and the real course of economic history, not monthly noise and revisions. Here’s what the trend of labor hours used to look like. Notwithstanding five recessions between 1964 and mid-2000, labor hours grew at 2.1% annually between 1964 and 1980, and 1.8% per year between 1980 and 2000. Throw in a point or two for productivity, and you had 3-4 percent real GDP growth.

By contrast, here’s the trend during the years of maniacal money printing since the year 2000. That’s when Greenspan panicked after the dotcom bust and cut interest rates several dozen times between 2000 and 2003, dropping the cost of money to just 1%. That policy did self-evidently levitate the price of risk assets, but no such thing can be said about aggregate units of labor employed in the private economy. On a peak-to-peak basis during the 81 months of the Greenspan housing bubble of 2001-2007, labor hour grew at only 0.5% per year—-or by just one-quarter of their historic rate. And during the 81 months of the Bernanke-Yellen bubble since the 2007 peak, labor hours have hardly advanced at all, creeping higher at just a 0.2% annual rate. Stated differently, a tsunami of money has generated but a trickle of employment—-that is, a growth rate of labor hours over nearly a seven year stretch that is just one-tenth of the pre-2000 trend.

In this context, it is also well to recall that while September’s report represented month #81 since the pre-recession peak, there has been no documented act of god abolishing the business cycle during the interim. So given this late stage of the business cycle, it would make sense to look at the cyclical trend, not the monthly delta—even on a gross job count basis including the ones with big pay, little pay and fleeting pay. Indeed, after 81 months the only relevant metric is the trend: each BLS report is now effectively on borrowed time. Based on the empirically evident condition of the world economy—-Japan’s government is about to concede it is in a new recession, Europe never got out of recession notwithstanding its ECB fueled bond bubble and the China house of cards is hitting the skids harder by the day—it is hard to contend that the US economy is heading for a permanent berth in the nirvana of Keynesian full-employment. Could anyone still believe in the Great Moderation or that the Fed can deflate the giant bond, stock and real estate bubbles evident everywhere without perturbing the business cycle? So the 81 month test is more than a fair measure of the “progress” that has actually been made since the printing presses were put on open-throttle in September 2008. The graph below shows the establishment survey jobs count after the cyclical peak in June 1990. As can be seen, 81 month later in March 1997, the job count had risen from 110 million to 122 million. These 12 million new jobs represented a 11% gain from the prior peak.

During the 81 months between the February 2001 peak and November 2007—–the point, incidentally that the S&P 500 peaked last time around—-the gain was not so robust. Still, the pick-up in the gross job count from 132.8 million to 138.4 million amounted to 5.5 million jobs or 4.1%. So now the trend was fading, especially in view of the unsustainable housing bubble jobs contained within the November 2007 total.

Then we get to month 81 of the current cycle. It is evident that the White House’s 10 million jobs claim is blatant propaganda. About 90% of those “new” jobs are actually “born again” jobs—-the same ones that were “created” during the Greenspan housing bubble and endlessly taken credit for by the Bush White House and GOP fiscal derelicts on Capitol Hill. In truth, the 139.4 payroll jobs reported for September amounted to an 81-month gain of just 1.09 million or 0.7%. That’s right—since the last peak, the US economy has only generated 13,000 genuinely new jobs per month. And that’s before any consideration is given to quality measures such as hours per week and average pay.

In this context, the “deep” recession argument cuts no slack. If the American economy were actually healthy, or if the Fed’s furious money printing was actually boosting the main street economy, the rebound from the deep 2009 bottom would have been robust, not languid. In fact, here is the 81 month rebound from the deep recession of 1981—–the downturn most similar to the Great Recession of 2008-2009. As can be seen, the 5 million jobs lost during the deep downturn of 1981-1982 were recovered within two years of the prior peak, and the overall gain over 81 months was nearly 10 million jobs or 13 %. Needless, to say that’s what a conventional recovery from a deep recession looks like. By contrast, what has occurred in this cycle is in different ballpark altogether.

Moreover, all of the above is about the raw jobs count. Yet whereas “one man, one vote” is an admirable principle as it pertains to political democracy, it is utterly irrelevant in economics. A 15-hour per week job at McDonald’s counts as one job in the BLS establishment survey, but the pay rate amounts to just 12% of the median full-time job on an annualized basis. Hackneyed as it sounds, the jobs market is increasingly populated by hamburger flippers, barhops, shoe clerks and bed pan changers. These jobs are almost never full-time, and as a result average weekly hours have been sinking for decades. Accordingly, the 9 million new jobs created during the Reagan era recovery represented far more than 9X the embedded economic output in the 1 million jobs gained during the Bush-Obama cycle.

So the point is simple. The headline jobs number so breathlessly reported each month tells almost nothing about the true employment situation—and most certainly is not a signal to buy, buy, buy an already stupendously inflated stock market. Indeed, when the internals of the jobs count are carefully examined, the story is not about recovery and growth at all; it’s about a continuous deterioration in the mix of jobs reported and the economic value added and income they represent. The starting point remains “breadwinner jobs” in construction, manufacturing, the white collar professions, business management, FIRE, distribution and transportation and core government excluding education—jobs which generate upwards of 40 hours per week of work and $50K per year of gross pay. As I have previously indicated, we are not even close to recovery of the breadwinner jobs lost during the Great Recession, or since the 2000-2001 peak for that matter. Specifically, the Great Recession resulted in the loss of 5.7 million or 8% of all breadwinner jobs in the US economy. As is evident in the graph below, all of the gains since the recession ended in June 2009 are born-again jobs, representing barely half of the original loss. The truth is, the American economy still had nearly 3 million fewer breadwinner jobs in September than it had at the 2007 peak and almost 4 million fewer than the high water mark back in 2001. A decade and one-half of rampant money printing—-during which the Fed’s balance sheet exploded from $500 billion to nearly $4.5 trillion or 9X—-has thus been no blessing whatsoever for main street households, even as Wall Street has been gifted with opportunities to scalp prodigious windfalls from two giant financial bubbles. What the monthly jobs telethon is actually counting for the most part is part-time jobs in retail, lodging, restaurants and temp agencies which are dumped unceremoniously during the downturn (i.e. without severance) and then are steadily reborn as incomes recover in the upper end of the household distribution.Thus, unlike breadwinner jobs where only 50% of the recession loss has been recovered to date, the 7% decline in part-time jobs was recovered by early 2013. Accordingly, the count of part-time jobs now stands 1.4 million or nearly 4% above the 2007 peak. Unfortunately, the average annualized pay rate for jobs in this category is about $20,000 or just 40% of breadwinner job pay. Not only does this knock the idea of headline job equivalence into a cocked-hat, but even here it can not even be said that America has a part-time jobs machine. When the Fed’s boom-bust cycles hit their hard-landing phase, the job loss is so severe that the trend never catches up. Since Bill Clinton exited the Oval Office in January 2000, therefore, the average gain in part-time jobs has only been 22,000 per month. At 40% pay rates, that’s a drop in the bucket compared to 150,000 per month of labor force entrants who could work full time and would surely covet an opportunity for full pay. In truth, even these modest gains in part-time jobs may not be all they appear to be. Fully 3 million of the 4 million job gains in the part-time economy since 2000 have been in restaurants, bars, hotels, stadiums and other places of entertainment. These are the jobs with the absolute lowest pay, fewest hours, barest benefits and least security within the part-time world. Moreover, to some substantial degree they represent merely the monetization of what used to be unpaid and uncounted household hours in the home kitchen. By contrast, in the goods producing economy the US lost 3.6 million jobs during the Great Recession—- or one-seventh of all jobs in construction, manufacturing and mining/energy production. As shown below, only 21 percent of those lost jobs have been “born again”. Indeed, the 19.2 million goods producing jobs are still 5.5 million or 22% lower than they were at the turn of the century. Needless to say, jobs in this sector do generate something which approximates a living wage. According to the BLS, the typical position here generates about 40 hours per week at an average rate of $25 per hour—the equivalent of $50k per year on a run rate basis. It is also the case that these higher paying goods-producing jobs help pull the freight in the US economy because they add to exports or reduce imports. Notwithstanding the Keynesian delusion that we can borrow from the rest of the world indefinitely, the fact is we import $2.5 trillion worth of goods and services from the rest of the world annually—-and sooner or latter the half trillion shortfall after exports must be paid for. That obviously can’t be accomplished by the one sector of the job market that has actually been growing since the turn of the century–namely, the HES Complex (health,education and social services). As shown below, the HES Complex generated 51,000 jobs per month during 2000-2007 cycle and even 43,000 per month during the Great Recession. The problem is that the HES Complex is almost entirely fiscally dependent. That is, it’s fueled by about $1.5 trillion per year of government spending for health care through Medicare, Medicaid and related programs and more than $1 trillion per year for education at all levels. Even employer paid health care is heavily dependent upon upwards of $200 billion per year in tax benefits and subsidies. The obvious fact of fiscal life, however, is that governments at all levels are broke and freighted down with debilitating debt burdens that will increasingly put the squeeze on HES funding, and therefore hiring. In that respect, the slight easing of the Federal deficit during year six of the business recovery is no consolation whatsoever. Uncle Sam’s annual deficit will soar back across the trillion dollar level with the next recession, and there surely will be one not too far down the road. So rather than put their fiscal houses in order by paying-down their recession swollen debt loads, governments from city hall to Washington have continued to pile it on. Accordingly, they head into the next recession with $18 trillion of Federal debt plus upwards of $4 trillion at lower levels of government. That totals to 130% of GDP. It thus constitu | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Closed $5.00 Higher Closing on the Comex at $1,211.70 Posted: 07 Oct 2014 04:40 PM PDT

Both silver and gold prices gave us a key reversal's second half, a higher close today. The GOLD PRICE now must climb through that 20 DMA above at $1,220.89, but in fact needs to close above $1,224, the last high, and $1,237, the high before that. The great barrier in front of gold is $1,300. The SILVER PRICE today traded up to the downtrend line (from the end-August high) but stopped there. MACD indicator is about to turn up. Silver must keep on progressing, moving through $17.75 then $18.00. The white metals are also rallying with us. Platinum made a key reversal yesterday and today, and added 1.12% today for a $1,260.70 close. Palladium made a key reversal and rose 2.51% today to $787.30. Both platinum and palladium had collapsed after September 1, and both fell through their 200 DMAs. It strengthens the case for silver and gold to have the white metals rallying, too. So far, so good, but a mere common correction might do all this, especially after as long as metals have been oversold. They need to keep making steady progress. 'Twould be a good idea to buy some here. ALSO, if you are ever going to swap gold for silver, now is the time. Okay, we got the signals we needed. We're on the road, pot-holed though it be. US dollar index, scrofulous parasite on world prosperity, dropped 12 basis points (0.14%) to 85.76. This ain't as much as I'd like, but it is a lower close, and that's all that's needed. The lethargic euro rose 0.13% to $1.2670, and looks none too pert still. 20 DMA floats above at $1.2783. Yen, on the other hand, burst through its 20 DMA (92.20) and added 0.57% for a close at 92.47 cents/Y100. Yen appears to be rallying seriously. Euro appears to be cataleptic or deeply depressed. Fear sent investors racing out of stocks and into US bonds, driving the price up and the yield down. 10 year treasury note yield fell 3.09% to 2.350%. Put on black and weep and mourn, stocks! Another triple digit down day for the Dow, its fifth out of eight triple digit days since the 19 September high. Dow dove 272.52 (1.6%) to 16,719.39. S&P500 plunged 29.62 (1.51%) and perched on the low at 1,935.10. For both indices, this is the lowest close, but not the lowest price, for this move. They left their 20 and 50 day moving averages behind so long ago there's no point in mentioning them. All indicators are working for Sir Isaac Newton -- gravity-ward. Dow in Gold and Dow in Silver are feeding my fire. Dow in gold ended the day at G$285.89 gold dollars (13.83 oz.), below the 20 DMA at 13.96 and down a choking 1.72%! All indicators down, all systems go for "a stock top and gold and silver bottom behind us." Yet humility and the still-remembered bruises of earlier episodes constrain me to await more confirmation. Dow in silver fell 0.69% to S$1,258.63 silver dollars (973.47 oz), lower than the last low. Also, the MACD turned down today. Rate of change has crashed. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China wants say in 'price discovery' in everything Posted: 07 Oct 2014 04:38 PM PDT Time to Focus on Chinese Derivatives By William Barkshire http://www.ft.com/intl/cms/s/0/5514b5dc-4e02-11e4-adfe-00144feab7de.html There have been many false dawns in the progress to open up China's participation in global capital markets. That has led to the loss of interest by some overseas investors and in some cases retrenchment. However, under Xi Jinping's leadership market liberalisation is now gathering a real pace and international players should start paying more attention to concrete evidence of development. ... Dispatch continues below ... ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank The announcement in April by the central government of the Hong Kong Exchanges and Clearing and Shanghai Stock Exchange Stock Connect link underpins this tangible change. Set to go live later this month, it is likely to see interest from funds that do not currently have access to China via the qualified foreign institutional investor quota schemes seeking either yield pick-up or to trade the valuation differential between stocks listed in both Hong Kong and Shanghai. While this project is significant, it will be eclipsed in the long term by the scale and scope of other projects. The key policy focus in Beijing is on developing those markets that can assist China in its economic development, or what might be termed its "real" economy rather than just the financial services sector. Central to this is the move toward market-based pricing in commodities, where China is the major global consumer. Here the political desire is for price discovery to take place in Asia and not just in London, New York, and Chicago. State-owned enterprises are poised to be allowed to increase their hedging practices in a wide range of commodity futures and options markets. As a result they are actively seeking to increase the sophistication of their risk management practices both domestically and in international markets. The launch in the past two months of over-the-counter commodities clearing in iron ore and coal by Shanghai Clearing House and the international board of Shanghai Gold Exchange -- a spot and forward market -- are significant developments and should be more closely watched. The Shanghai Gold Exchange is particularly relevant, as while heavily controlled, it offers fully fungible access to onshore liquidity in precious metals for international companies. It will also offer access to a highly interesting arbitrage between global and domestic demand-driven prices. By the end of this year, OTC commodities trading and clearing will be extended to other products, including copper in both spot and forward markets in the Shanghai free-trade zone. It is interesting to note that both the Shanghai Clearing House and Shanghai Gold Exchange are regulated by the People's Bank of China, which seems to be at the forefront of implementing these important market reforms. There are also expectations that we will finally see the launch of the Shanghai Energy Exchange in the Shanghai free-trade zone by the end of the year -- a very significant market development as it will allow remote market access from equivalent regimes recognised by the China Securities Regulatory Commission. The launch of exchange-traded options on the highly-liquid CSI futures contract operated by the China Financial Futures Exchange will come next year. Initially it will be a restricted market, but in due course it could set a new global benchmark in options liquidity. Many industry veterans have become wary of investing in market development initiatives in China -- the guiding principle for many Western firms has also traditionally been to put your costs into China but not your revenue line. Economic development, including the introduction of efficient market-based structures, is core to maintaining the primacy of the Chinese Communist Party. Recent events in Hong Kong mask that economic prosperity remains central to political stability well ahead of any calls for democratic reform. China is also increasingly aware of its increased interdependency with the rest of the world and a need for more balanced commercial relationships that are mutually beneficial. In short, those market infrastructure providers specialising in trading, clearing, and collateral management need to focus on these real market developments now as the time between the final announcement of the launch date and going live is notoriously short in China. This pace is going to quicken. For those that begin planning now and building key relationships, the opportunities in derivatives will be a once-in-a-lifetime development. ----- William Barkshire is managing director of Agora Partners, based in Hong Kong and Shanghai.

Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Russia, South Africa in talks to support platinum price Posted: 07 Oct 2014 04:20 PM PDT Why not? OPEC itself was formed in part to counter Western control of the currency markets, one cartel giving rise to a counter-cartel. * * * By Yuliya Fedorinova and Andre Janse van Vuuren http://www.bloomberg.com/news/2014-10-07/russia-south-africa-seek-to-sup... Russia and South Africa, together holding about 80 percent of the world's platinum-group metal reserves, will meet to discuss ways to buoy slumping prices. Officials from Russias central bank and OAO GMK Norilsk Nickel, the world's biggest producer of palladium, which is part of the precious-metal group, will attend the meeting next month, according to Natural Resources Minister Sergei Donskoi. "This won't be a trading agreement, but the main aim of this cooperation is to put together the interests of the two countries in this field," Donskoi said in an interview last week at Bloomberg's Moscow office. One option is for the central banks to boost purchases of platinum and palladium, he said. ... Dispatch continues below ... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Platinum prices have tumbled about 20 percent since Russia and South Africa agreed on a plan in March 2013 to set up a bloc to coordinate exports. While palladium is little changed in that period, both metals are down more than 10 percent since August. Platinum rose 1 percent to $1,258.56 an ounce by 12:51 p.m. in London, while palladium gained 0.4 percent to $770.75. South Africa mines about 70 percent of the world's platinum and Russia 40 percent of its palladium. South Africa's central bank and Ministry of Mineral Resources didn't immediately respond to e-mails seeking comment. The country's Chamber of Mines isn't aware of the talks, spokesman Vusi Mabena said. Norilsk has also suggested buying stockpiles and including those reserves in agreements between the five BRICS nations, Brazil, Russia, India, China, and South Africa, Donskoi said. Technological exchange may also be part of the pact, he said. Norilsk and a group of banks and private investors are raising funds to buy palladium stockpiles from Russia's central bank, the company said Sept. 24. The Norilsk and Russian central bank's press offices declined to comment on Donskoi's remarks. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

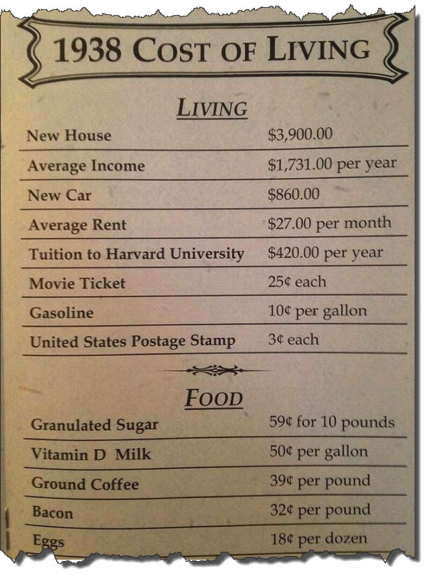

| The Death of the Dollar Has Been Greatly Exaggerated Posted: 07 Oct 2014 03:08 PM PDT To recast Mark Twain's famous quote, the death of the dollar has been greatly exaggerated. Despite all the hand-wringing over "money printing," the old greenback surged in Q3. What it means for you and your portfolio is the subject of today's alert. First, let me frame the rally, which has been historic. The U.S. dollar index measures the dollar against a basket of currencies such as the euro and the yen. It was up 7.7% in the third quarter. Outside of the third quarter of 2008 — when the financial crisis was in full fury and the dollar was a favorite safe haven — you have to roll back to 1992 to find a quarterly gain bigger than the one we just saw. That strength continued into the fourth quarter as the dollar index notched its 12th consecutive weekly gain — the longest on record (which goes back to 1973). One effect of the strong dollar seems to be a lower gold price. Gold hit its lowest point in 2014 last week. It's down for the year. This is after falling 28% last year. Gold hasn't been this low since the middle of 2010. I'll just say that if I saw a stock go down for 44 years, I wouldn't draw the conclusion that it will go up. I don't have a strong opinion on gold. It could go to $800. It could go to $2,000. I don't know. But I don't think fear of "money printing" is a good reason to own gold. There's been a lot of money printing going on since 1980. Yet the price of gold would have to get over $2,000 an ounce just to match its 1980 price in inflation-adjusted terms. That's 34 years and counting of not keeping up with inflation. Even if you think that start date is unfair — since 1980 was a peak for gold — it doesn't get better if you roll back further. According to an article at Zero Hedge, gold was $35 an ounce in 1970… and would have to be priced at over $4,000 an ounce just to equal its 1970 purchasing power. That's 44 years of losing. Of course, Zero Hedge uses this as a reason to be bullish. The implication being that it will get to its inflation-adjusted high. But there is no reason gold has to do so. It might, it might not. I'll just say that if I saw a stock go down for 44 years, I wouldn't draw the conclusion that it will go up. Commodities in general will have a tough time in the face of a strong dollar. We've seen this with oil, which has its own supply and demand dynamics acting unfavorably on prices. (That's a fancy way of saying there is too much oil.) Even so, commodity producers can be a good bet even if the commodity goes nowhere. And you are patient. Consider the energy sector. The sell-off in energy names in the last few weeks has been something to behold. Here I think there is good value. I recently spoke with David Neuhauser at Livermore Partners, who gave us two bargains: Zargon Oil & Gas and Long Run Exploration. These are cash-spinning assets even at lower oil prices. Both pay around 10%. I've spoken with David recently, and he's still buying both. And two weeks ago, I was up in Sprott's office talking to Steve Yuzpe. He heads up Sprott's publicly listed private equity firm, called Sprott Resource Corp. Steve recently bought a producer of met coal called Corsa Coal. (It trades in Toronto.) Met coal prices are down 50% in the last few years. But clearly, some companies can still make good money at today's prices (or even lower prices). Yuzpe thinks Corsa is one of them. As for stocks more generally, it's hard to say what a strong dollar means. Ben Levisohn's column in Barron's over the weekend pointed out that it doesn't mean stocks have to go down:

The market doesn't care about history, though. The S&P 500, a proxy for the U.S. stock market, is full of multinational companies that get significant earnings from overseas operations. With the dollar taking a big jump, the value of those earnings falls. It also makes their goods more expensive to overseas buyers. So expect a ding to the earnings of U.S. companies selling stuff overseas. But since this market doesn't seem to care about earnings, maybe it won't matter. (I'm joking. I think it could be an ugly quarter when earnings roll in. We'll see.) What I really think is that you should not worry much about the U.S. dollar's strength or weakness. This is not to say it doesn't have effects. Of course it does. I say you shouldn't worry about it because you can't predict what's going to happen next. The dollar is strong, for now. How long it is is anybody's guess. In any case, the long-term bet is that the dollar will, in general, buy less in the future than it can today. I share here a graphic from Zero Hedge: It's safe to say we can all share such stories. ("Golly, I remember when…") And our children and grandchildren will have their own such tales to tell. I spend most of my time looking for good value in names that can create wealth for us in a variety of scenarios over time. Ideally, these would be rich in catalysts — such as a potential spinoff or buyout — that will make things happen. That's where my focus is. Regards, Chris Mayer Ed. Note: Finding sound investments — regardless of the relative strength of the U.S. dollar — is what Chris specializes in. He’s found a method of navigating the markets that boils down every investment to just four major factors… which then determine whether or not you should invest… or pass. To be able to access Chris’ most up-to-date research and recommendations, sign up for the FREE Daily Reckoning email edition. Once inside, you’ll get regular chances to discover real, actionable investment opportunities you won’t find anywhere else. Click here now to get in for FREE, before you do anything else today. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Submit Your Questions To These Precious Metals Experts Posted: 07 Oct 2014 02:20 PM PDT TheDailyCoin is setting up an internet radio show in which he will be interviewing four precious metals experts. You can participate by submitting questions for these gentlemen:

Questions accepted through Wednesday October 8. The internet radio show will be released on Saturday October 11. Just leave your question in the comment section of this article (bottom of this page) and we will pass them on to TheDailyCoin.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold vs Silver Investment Demand In 2014 – Spot The Difference Posted: 07 Oct 2014 01:47 PM PDT Record high net silver short positions by technical funds in the futures market, close to record low sentiment, technically record oversold indicators, and a four year price low. That is where we stand in silver. The picture in gold is more or less comparable, although we would use the word “record” slightly less. Logically, investment interest in the metals should be trending lower. That appears to be partly right. As the following charts show, interest in gold investments as evidenced by gold ETF’s (the most popular Western gold investment vehicles) has been trending lower along with a drop in the gold price. However, the opposite trend has been observed in silver. As the first of the two charts shows, silver demand as evidenced by silver ETF’s has been trending higher. This is yet another sign of a major disconnect in silver, which comes on top of what we discussed yesterday Silver Price Falls Amid A Strengthening Physical Market although we firstly analyzed this a year ago in The Great Disconnect Between Paper & Physical Silver.

The silver price has been trending lower but demand for silver ETF’s has been going up. A surprising disconnect.

The gold price has been trending lower along with decreasing demand for gold ETF’s. Mind the disconnect with the trend in silver. Chart courtesy: Sharelynx. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Leveling Up Posted: 07 Oct 2014 01:15 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| China, Russia, Saudi Arabia, Oil, Gold, Silver & Global Conflict Posted: 07 Oct 2014 12:50 PM PDT  Today an acclaimed money manager spoke with King World News about China, Russia, Saudi Arabia, oil, gold, silver, and global conflict. Stephen Leeb also spoke about the bigg picture for fracking, geopolitics, and the metals markets in this fascinating interview. Today an acclaimed money manager spoke with King World News about China, Russia, Saudi Arabia, oil, gold, silver, and global conflict. Stephen Leeb also spoke about the bigg picture for fracking, geopolitics, and the metals markets in this fascinating interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 07 Oct 2014 10:44 AM PDT Jim, Richard feels the bottom is set and we should be getting ready for a rising market. CIGA Larry Richard Russell – We Just Saw Ultimate Bottom In Gold & Silver Today the Godfather of newsletter writers, 90-year old Richard Russell, said we have witnessed the "ultimate bottom" in the gold and silver markets. The... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Richard Russell - We Just Saw Ultimate Bottom In Gold & Silver Posted: 07 Oct 2014 08:22 AM PDT  Today the Godfather of newsletter writers, 90-year old Richard Russell, said we have witnessed the "ultimate bottom" in the gold and silver markets. The 60-year market veteran also warned that the world is going to see a new monetary system which will feature gold as the centerpiece. Today the Godfather of newsletter writers, 90-year old Richard Russell, said we have witnessed the "ultimate bottom" in the gold and silver markets. The 60-year market veteran also warned that the world is going to see a new monetary system which will feature gold as the centerpiece.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Obama Abandoning the Saudis for Iran and Dooming the Petrodollar - Video Posted: 07 Oct 2014 07:18 AM PDT By Alex Daley, Chief Technology Investment Strategist I sat down with Jim Rickards, author of many best-selling economics and investing books, including his latest, titled The Death of Money. In this exclusive interview, Jim shares his view on the changes in US foreign policyâ€"the newly announced partnership with Iran to help fight ISIS and recent moves away from the petrodollar deal with Saudi Arabiaâ€"and what they mean for the dollar, gold, and investment markets in general. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and the S&P 500 Index: Sum and Ratio Posted: 07 Oct 2014 07:09 AM PDT The US national debt in 1989 was about $2.8 Trillion. Twenty Five years later, in 2014, that debt had increased by a factor of about 6.3 to $17.8 Trillion. For many decades the US piled on more debt, increased the currency in circulation much more rapidly than the economy grew, and of course, caused consumer prices to increase substantially. Naturally the S&P 500 Index increased, as did the price of gold, since each dollar was worth less. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Huge Reversal in USD and Gold - Finally! Posted: 07 Oct 2014 07:00 AM PDT Briefly: In our opinion speculative long positions (full) in gold, silver and mining stocks are justified from the risk/reward perspective. The precious metals market finally rallied yesterday. Gold moved lower in the first hours of the session, getting very close to the Dec. 2013 low, but it rallied before the session was over, finally closing over $16 higher. Is the final bottom in? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NYTimes: Big banks face another round of U.S. charges over currency market rigging Posted: 07 Oct 2014 06:46 AM PDT By Ben Protess and Jessica Silver-Greenberg The Justice Department is preparing a fresh round of attacks on the world's biggest banks, again questioning Wall Street's role in a broad array of financial markets. With evidence mounting that a number of foreign and American banks colluded to alter the price of foreign currencies, the largest and least regulated financial market, prosecutors are aiming to file charges against at least one bank by the end of the year, according to interviews with lawyers briefed on the matter. Ultimately, several banks are expected to plead guilty. Interviews with more than a dozen lawyers who spoke on the condition of anonymity to discuss private negotiations open a window onto previously undisclosed aspects of an investigation that is unnerving Wall Street and the defense bar. While cases stemming from the financial crisis were aimed at institutions, prosecutors are planning to eventually indict individual bank employees over currency manipulation, using their instant messages as incriminating evidence. ... ... For the remainder of the report: http://dealbook.nytimes.com/2014/10/06/big-banks-face-another-round-of-u... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 BullionStar is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. BullionStar's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in BullionStar's bullion vault, which is integrated with BullionStar's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver “Particularly Cheap†as “Blood On The Commodity Streets†Posted: 07 Oct 2014 04:03 AM PDT With few exceptions, commodity prices have fallen sharply in recent months, to their lowest levels in over a year. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deflation Is Bullish For Gold Stocks Posted: 07 Oct 2014 03:25 AM PDT Graceland Update | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold vs S&P 500: Insights From The 25-Year Chart Posted: 07 Oct 2014 02:38 AM PDT This article is submitted by Gary Christenson, author of the new book “Gold Value and Gold Prices From 1971 – 2021.” The US national debt in 1989 was about $2.8 Trillion. Twenty Five years later, in 2014, that debt had increased by a factor of about 6.3 to $17.8 Trillion. For many decades the US piled on more debt, increased the currency in circulation much more rapidly than the economy grew, and of course, caused consumer prices to increase substantially. Naturally the S&P 500 Index increased, as did the price of gold, since each dollar was worth less. Consider the graph of the SUM of the S&P 500 Index and the price of gold. Debt increased, prices increased, and the dollar purchased less. Now consider the RATIO, as shown in this graph of gold divided by the S&P 500.

The ratio at the gold peak in 1980 was about 8. You can see that the ratio was trending downward from 1980 (graph shows since 1989) to about 2001. Subsequent to the stock market crash of 2000, 9-11, and the massive increase in spending and debt, the ratio now trends upward. We know that the official national debt is increasing about a $Trillion per year. Graph 1 shows that as debt increases, so does the sum of the S&P and gold. Graph 2 shows that gold increased relative to the S&P from about 2001 to 2011, and then fell. Gold is now deeply oversold compared to the S&P and ready to rally, unless you believe that the US national debt will start decreasing (not likely) or that the S&P will continue skyward for the foreseeable future (not likely). Will gold reverse tomorrow, next week, next month, or next year? Good luck with that question! My guess is very soon, but the high-frequency-traders, central bankers, and politicians seem to be more influential than physical supply and demand. Regardless, the critical points are:

Additional Reading Bill Holter It's all a financial mirage

Gary Christenson | The Deviant Investor | GEChristenson.com

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Best Offense Remains a Good Defense: M Partners' Derek Macpherson Posted: 07 Oct 2014 01:00 AM PDT With a strong dollar currently depressing the precious metals prices, M Partners Mining Analyst Derek Macpherson believes that fundamentals will kick in eventually and bring prices back up. In this interview with The Mining Report, he advises investors to look for low-risk companies on solid footing and discusses some of his favorite names that are poised to come out fighting. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and the S&P 500 Index: Sum and Ratio Posted: 06 Oct 2014 11:01 PM PDT The US national debt in 1989 was about $2.8 Trillion. Twenty Five years later, in 2014, that debt had increased by a factor of about 6.3 to $17.8 Trillion. For many decades the US piled on more... {This is a content summary only. Click on the blog title to continue reading this post, share your comments, browse the website, and more!} | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Volatility Returning to Currency Markets Posted: 06 Oct 2014 05:00 PM PDT |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The oil market has been coming down and coming down pretty hard in terms of price, not only in the U.S. but also in Europe. There is dissent in OPEC as some countries are questioning whether or not the Saudis are intentionally driving down the price of oil to help their U.S. ally in the war against the East.

The oil market has been coming down and coming down pretty hard in terms of price, not only in the U.S. but also in Europe. There is dissent in OPEC as some countries are questioning whether or not the Saudis are intentionally driving down the price of oil to help their U.S. ally in the war against the East.

No comments:

Post a Comment