saveyourassetsfirst3 |

- Moscow Just Took a Quantum Leap Into the Future

- $1,000 gold could be coming. Here’s what resource investors need to know.

- What Will the End of QE Mean for the Precious Metals?

- Gold quiet on Monday waiting for FOMC and next short term cycle to Nov 7th

- Bullish Silver Stealth Buying

- Land of the Free – 1 in 3 Americans Are on File with the FBI in the U.S. Police State

- An Ebola Armageddon Could Trigger a Rebirth in Gold and Silver Prices: Eric Sprott

- Soybean Meal Continues Pulling the Grain Floor Higher

- The Countdown to Truth

- Picking Up Where We Left Off

- Prepare for Global Gold Confiscation and Orwell’s 1984, Warns Rickards

- Tahoe Resources COO is a silver miner to his very core

- Gold and silver jewelry still hot in India

- Indian gold bar imports surge in September

- Gold Or Crushing Paper Debt?

- Crude Oil Weakness Continuing

- Jim Willie: Shanghai Shock to Shatter the Gold Market!

- China gold imports rise to five-month high

- Gold ETF sales back in consolidation mode

- Gold prices stagnant, investors look to end of QE3

- Oliver Gross Says Peak Gold Is Here to Stay

- Big falls likely in Brazilian financial markets as Dilma Rousseff wins re-election

- What the Swiss Gold Referendum Means for Central Banks

- OCTOBER SILVER EAGLE SALES BEST EVER…. And With A Whole Week Remaining!

- Metals & Markets- Silver Miner Fights Back, Takes on the Bankster Cartel!

- How Will The Stock Market React To The End Of Quantitative Easing?

- Federal Reserve to Markets: You’re Too Easy!

- Heads up… The last time this happened, it marked a MAJOR bottom in the price of gold

| Moscow Just Took a Quantum Leap Into the Future Posted: 27 Oct 2014 01:00 PM PDT BRICS Rising There can be no doubt that an alliance, called the BRICS, is positioning itself to be the new anti-globalist, anti-Western central banking force in the world. In fact, there are well-respected voices within the Kremlin, who've now called upon the leaders of the East to step up the game-plan of the BRICS, and turn it from a mere trade […] The post Moscow Just Took a Quantum Leap Into the Future appeared first on Silver Doctors. |

| $1,000 gold could be coming. Here’s what resource investors need to know. Posted: 27 Oct 2014 12:48 PM PDT From The Gold Report: The wave of zero-interest liquidity washing over the financial world could result in a short-term gold bottom of $1,000 per ounce, reports Oliver Gross of Der Rohstoff-Anleger (The Resource Investor). The good news is that Peak Gold is here to stay, which means that midtier producers will soon be desperate to buy low-cost, high-quality deposits. In this interview with The Gold Report, Gross argues that this could be the opportunity of a lifetime for contrarian investors, and suggests a half-dozen best bets to be taken out. The Gold Report:Earlier this month, the broader equities markets suffered huge losses as gold made significant gains. Then, after the broader markets recovered, gold fell. Is there now an inverse relationship between the health of the broader markets and the price of gold? Oliver Gross: This kind of inverse relationship between gold and the broader equity markets isn’t really new. It has been observed since fall 2011, when the price of gold peaked. Since then, gold has fallen more than 35%, while the S&P 500 has risen 70%. The current situation resembles the early 2000s, when the broader equity markets were in the final phase of the dot-com bubble, while gold traded as low as $340 per ounce ($340/oz). Then, of course, the broader equities markets collapsed, while gold rose above $1,900/oz. TGR: Some analysts believe that the broader equities market is dangerously overvalued. To give one example, Netflix was recently trading at 144 times earnings. What do you think? OG: After a 5+-year bull run leading to new all-time highs in the broader equity markets, there are many signs of bubble formations in the Internet, high-tech and biotechnology sectors. Again, this feels like the early 2000s. The extremely high price-to-earnings ratios in stocks such as Netflix indicate investor euphoria and huge amounts of speculative capital provided by the central banks. It is shocking to compare valuations in the broader sectors of the equity markets to valuations in the precious metals space. Alibaba (BABA:NYSE) has a market valuation of more than $220 billion ($220B). This company, with sales of less than $10B, is now worth far more than the 10 largest gold and silver producers put together. We see similar speculative booms with Facebook, Amazon, Tesla, and Apple. TGR: How should investors react to this bubble? OG: Speaking for myself, as one who follows an anticyclical strategy, I like to invest when there is blood in the streets, and that is certainly what is happening with precious metal equities. Today, investors can buy gold and silver stocks at decade-low valuations and historically low bullion-to-equity valuations. Nobody cares about precious metals equities today, but when the bubble in the broader markets bursts, we will see a massive shift in market sentiment and in the behavior of investors. That said, investors must stick to best-in-class stories and must demonstrate constancy and patience. TGR: Could the collapse of the bubble lead to a crisis similar to that which occurred in 2007–2008? OG: Yes, the possibility of another Lehman Brothers event is there. When the largest and most influential players in the financial industry want to exit this market, we could see a 2008-like selloff very, very fast. I also think that it is only a matter of time before a further big player in our financial industry will go the same way as Lehman. TGR: Geopolitical turmoil today is greater now than it has been for quite some time: Gaza, ISIS, Ukraine and now Ebola. Traditionally, this would have resulted in a significantly higher gold price, which has not happened. Is what we have seen this year an anomaly, or is the price of gold no longer affected by external events? OG: That is a question not easily answered. Traditionally, gold has been regarded as the ultimate crisis protection, so geopolitical turmoil usually resulted in a higher gold price. What has changed is the incredible power of the central banks. They have changed the rules of the game. This is a major financial experiment with no historical precedent. The combination of unlimited liquidity, historically low interest rates and historically high debt levels has, for the moment, mitigated geopolitical risk factors and guaranteed faith in the U.S. dollar as the world’s reserve currency. Gold has fought incredible odds since fall 2011. It is the most hated asset class, the official enemy of the U.S. dollar reserve and our global monetary system. And so the biggest financial institutions have no interest in higher gold prices. They still control the gold futures and the paper-gold market, so it is easy for them to attack the gold price. But this can’t continue forever, and it’s just a matter of time before all the money created since 2008 will no longer simply inflate asset bubbles. Inflation will return, and gold will again respond positively to external crises. TGR: Where do you see gold and silver prices going in the short term? OG: I see a 50% chance of a final panic selloff across the gold and silver space. In this scenario, gold could fall to $1,000/oz, and silver could fall as low as $12/oz. TGR: Wouldn’t such prices lead to widespread curtailment of bullion production? OG: The current all-in costs of gold producers are now above $1,150/oz, even after massive cost reductions and a focus on higher-grade mining. Such expedients can have only a temporary effect. At a gold price of $1,000/oz, there will be many shutdowns. We need a gold price of at least $1,400/oz to support sustainable production, and that number will rise, as early as 2015 or 2016. We have reached Peak Gold, and it’s here to stay. The highest-grade and most-profitable deposits are gone. The bear market in the gold mining space has been so long and painful that the major producers have their backs to the wall. Barrick Gold Corp. (ABX:TSX; ABX:NYSE), Newmont Mining Corp. (NEM:NYSE), Goldcorp Inc. (G:TSX; GG:NYSE), AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) and Kinross Gold Corp. (K:TSX; KGC:NYSE) have dramatically cut exploration and development budgets. Most discoveries of the last five years need a far higher gold price to be mined. In addition, many recent discoveries are located in jurisdictions with high country or environmental risks and lack infrastructure, resulting in multibillion-dollar capital expenditures (capexes). TGR: As a result of the factors you’ve mentioned, can we now expect a big increase in mergers and acquisitions (M&As)? OG: Not so much among the majors. Most of them have weak balance sheets and too many in-house projects to risk expensive and dilutive takeovers. I see only Goldcorp and Newmont as potential bidders among the majors. Goldcorp lost the Osisko takeover battle to Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE) and Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), while Newmont refused to merge its Nevada operations with Barrick’s. So Goldcorp and Newmont might attempt different takeovers when the time is right. TGR: What are the attributes possessed by those companies likely to be taken out? OG: When the influential players in the gold mining space think that the gold price bottom is in, and a new bull market is likely, M&A interest will grow big time. Such a consolidation could create a perfect storm for the strongest junior gold producers and quality gold developers with robust, competitive projects. Specifically, takeover targets will have financeable mine capexes with a good relation to the discounted net present value (NPV) of their projects. They will be profitable with gold at $1,100/oz, and at least break even at $1,000/oz. Their projects will be in pro-mining jurisdictions with stable laws, the sustainable support of regional and local communities, and solid infrastructure. TGR: What about management? OG: Takeover targets must have managements with strong track records, or, failing that, existing investment from the larger precious metals companies or previously successful strategic investors. And, of course, healthy financials. There are many evaluations to be made, and there aren’t any “no brainers” here. Due diligence and continuous research are critical. When you think you haven’t spotted any weaknesses, you’ve likely missed something. TGR: Which gold junior or mid-cap gold producer is your current favorite? OG: I like B2Gold Corp. (BTG:NYSE; BTO:TSX; B2G:NSX) at this price level for many reasons. First, I like its takeover of Papillion Resources and its Fekola project in Mali. Fekola will be a very large and very profitable gold mine. Second, I like its CEO Clive Johnson, whose team has built one of the fastest-growing gold producers in one of the toughest environments ever. Third, B2Gold has three operating mines: two in Nicaragua, which are running smoothly, and one in the Philippines. Fourth, it has a diversified portfolio of attractive gold projects with massive growth potential. B2Gold has proved it can succeed in difficult regions and, despite the collapse of the gold price, has maintained strong cash flow and a strong balance sheet. Its gold production has grown from 158,000 oz (158 Koz) in 2012 to about 400 Koz this year, with operating costs of around $680/oz and all-in sustaining costs of $1,025–1,125/oz. After its Otjikoto Mine in Namibia ramps up, production should hit 580 Koz in 2016, and after Fekola ramps up, production could reach an amazing 900 Koz in 2017. B2Gold is on the verge of becoming a major gold producer and a lucrative takeover target. TGR: As you mentioned, B2Gold has two operating mines in Nicaragua. Can we expect further success stories from that country? OG: Nicaragua has huge potential. Gold is already its most important export, and the government intends to be a growing producer. One company I follow is Calibre Mining Corp. (CXB:TSX.V), which has generated much interest this year after good assay results, and because 11% was bought by the legendary Pierre Lassonde, founder of Franco-Nevada Corp. (FNV:TSX; FNV:NYSE). I like Calibre’s business model: attracting partners to spend exploration capital. It has optioned a part of its large project portfolio to IAMGOLD Corp. (IMG:TSX; IAG:NYSE), which will invest $5 million ($5M) over three years, and has formed a joint venture with B2Gold to explore a huge land package with many promising gold targets. Calibre has the potential to found an entire gold camp. TGR: Which companies do you like in South America? OG: I closely track Columbus Gold Corp. (CGT:TSX.V; CBGDF:OTCQX) and its 4.3 Moz Paul Isnard project in French Guiana. This is another company with strong investors. A prominent private U.S. investor bought 9.9% of the company in September, and the major Russian gold producer Nordgold N.V. (NORD:LSE), which has the option to buy 50.01% of Paul Isnard, bought 9% of Columbus in October. TGR: Why did Nordgold make a direct investment in Columbus? OG: I expect to protect itself from a lowball takeover offer from another gold producer, as Columbus is indeed a very attractive takeover target. I met Columbus’ CEO Robert Giustra in Paris this year. He is committed to dramatic and dynamic expansion. The company will finalize an extensive drilling program this quarter, which should lead to an increase in the quantity and quality of identified gold resources. A preliminary economic assessment (PEA) is scheduled for Q1/15. In addition, Columbus will undertake a significant drilling program at its Eastside gold and silver project in Nevada. This could become a company-maker in its own right. TGR: You have a particular interest in Colombia. Which companies do you like there? OG: I like two junior gold companies in the Antioquia Department: Red Eagle Mining Corp. (RD:TSX.V) and Continental Gold Ltd. (CNL:TSX; CGOOF:OTCQX). Red Eagle’s key deposit, San Ramon at its large Santa Rosa gold project, has amazing economics. Its September feasibility study outlines average production of 50 Koz gold per year over eight years with operating cash costs of only $596/oz and all-in costs of $763/oz. Positive economics include cash flow of $132M, an NPV of $104M and an internal rate of return of 53%. The capex is only $75M, and the payback period is just 1.3 years. Red Eagle needs one more permit to build one of the world’s most profitable gold mines. What is really important to understand here is that this smaller-scale underground operation is only a starter point, and Red Eagle has clear plans to significantly expand gold production in the future. I visited San Ramon this year, and it exceeded my already high expectations. It has great infrastructure and exploration potential, great management and project team, and almost peerless community relations. I completely trust in the skills and visions of Red Eagle’s CEO, Ian Slater, as well. TGR: What impresses you about Continental? OG: Its Buriticá gold project is already world-class, and could be a cornerstone asset for any large gold producer. The deposit has grown from 3 Moz in 2011 to 7 Moz in 2014, with grades higher than 9 grams per ton (9 g/t). The company intends to begin underground production in 2017, with the goal of outlining 10+ Moz. Its next big milestone will be its PEA, which should be completed by the end of this quarter. The permitting process in Colombia is challenging, but it helps that Continental’s largest shareholder is one of Colombia’s leading mining entrepreneurs. And the company has more than $80M in cash. TGR: What else do you like in South America? OG: My favorite gold story in Brazil is Brazil Resources Inc. (BRI:TSX.V; BRIZF:OTCQX). TGR: Didn’t its share price take a huge hit this month? OG: The last weeks have been very tough, yes, but the company will weather the storm. I am greatly impressed by Brazil Resources’ founding chairman, Amir Adnani. Both prudent and vigorous, he has acquired a large project portfolio with a multimillion-ounce gold resource. At its current valuation, Brazil Resources offers excellent leverage on the gold price, and it is backed by first-class, financially sound investors. TGR: Which Nevada gold companies are your favorites? OG: In Nevada, I like Gold Standard Ventures Corp. (GSV:TSX.V; GSV:NYSE) and its Railroad-Pinion gold project in Nevada. The company has successfully consolidated a large land package and proved close to 1.5 Moz in very lucrative, exposed oxide deposits. This deposit is open in multiple directions and is located in an active gold mining camp next to Newmont. This should be a straightforward heap-leach gold mine with low capital intensity, and represents another takeover target. A company both in Nevada and Turkey is Pilot Gold Inc. (PLG:TSX). Its Kinsley Mountain project in Nevada contains a high-grade and promising discovery. In Turkey, the company is successfully exploring and developing the TV Tower project with Teck Resources Ltd. (TCK:TSX; TCK:NYSE). TV Tower could become an entire mining district, containing several gold, copper and silver deposits. Pilot’s managers and geologists are some of the best in the industry, and both Teck and Newmont are strategic shareholders. TGR: And which gold companies do you fancy elsewhere in the world? OG: In Burkina Faso, there’s True Gold Mining Inc. (TGM:TSX.V), which is led by the same people who masterminded Pilot Gold. Founding Chairman Mark O’Dea plans to grow True Gold into a midtier gold producer. Its flagship project, Karma in Burkina Faso, already contains a multimillion-ounce gold resource and still has outstanding exploration potential. Investors have to love True Gold’s fundamentals. It belongs to a small and very exclusive circle of gold developers, those that own a fully permitted and fully financed high-margin gold project. Construction has begun, and gold should be produced by the end of 2015. True Gold will be one of the world’s profitable gold producers. Mark O’Dea is also a director of Pure Gold Mining Inc. (PGM:TSX.V), which has consolidated a large land package in Ontario’s Red Lake District, the highest-grade gold mining district in the world. Pure Gold now controls 100% of the Madsen gold project, which contains a high-grade gold mine with historic production of 2 Moz. I see the potential to discover a high-grade, multimillion-ounce resource in the next few years. This could lead to a takeover by a larger gold producer, such as Goldcorp, the major Red Lake player. My favorite gold play in Europe is Dalradian Resources Inc. (DNA:TSX), which owns the Curraghinalt gold project in Northern Ireland. It has 3.5 Moz already at 10+ g/t, with great exploration potential and compelling economics. In my opinion, Dalradian could become a high-margin gold producer. This is another attractive takeover target for any midtier gold producer. Sprott is now a large shareholder and funded this story until the prefeasibility study, which is scheduled in 2015. Dalradian did an impressive financing of $27M+ at $0.90/share, but investors can buy it now for less than $0.70. TGR: Moving on to copper, we’ve seen three companies with advanced projects taken out this year: Lumina Copper Corp., Augusta Resource Corp. and Curis Resources Ltd. Who’s next? OG: There aren’t many attractive copper projects left that are controlled by junior miners. I’ll name two. The first is Reservoir Minerals Inc.’s (RMC:TSX.V) Timok project in Serbia. This contains a large deposit with extremely high copper and gold grades, so much so that copper major Freeport-McMoRan Copper & Gold Inc. (FCX:NYSE) will pay for Timok all the way to a bankable feasibility study in exchange for 75%. That means zero cost for Reservoir with unlimited exploration and development potential. As Reservoir owns a very large, diversified and promising project portfolio next to many active mines in Serbia, and Freeport always targets large world-class deposits with attractive locations, I think it’s more than obvious that Reservoir will be taken over by Freeport, perhaps sooner than later. The second junior copper company with takeover potential is Excelsior Mining Corp. (MIN:TSX.V), with its Gunnison in-situ project in Arizona. The company released a stunning prefeasibility study in early 2014 with industry-leading economics. More than 25% of the company is now owned by Greenstone Resources, a solid London private equity fund. At its current share price, Excelsior offers fantastic leverage on the copper price. TGR: You are now more bullish on uranium companies, correct? OG: Uranium prices have just enjoyed their first recovery in years. We may have seen the bottom here, so I think investors should put uranium stocks back on their watchlists. In my opinion, the most attractive discovery story in the global uranium space in view of grade, size and quality is Fission Uranium Corp. (FCU:TSX) and its outstanding discovery at its Patterson Lake South (PLS) project in Saskatchewan’s Athabasca Basin. What is really awesome is that Fission is still achieving a very successful drilling rate. I think it’s clear that PLS will be taken over, and this might happen after the release of the first |

| What Will the End of QE Mean for the Precious Metals? Posted: 27 Oct 2014 12:28 PM PDT Submitted by Money Metals Exchange. This fall, the Federal Reserve is expected to finally wind down its latest monthly bond-buying program known as Quantitative Easing. What will the end of this $4 trillion (and counting) debacle mean for precious metals markets? The answer may be, not much. That's not to say that gold and silver prices won't move following the Fed's final taper. But it is to say that widespread anticipation of QE's end has already been priced into the markets. Metals Markets Often Move Counter to Popular ExpectationsIt's worth recalling what happened when the current cycle of Quantitative Easing (officially, "QE3") was announced in back September 2012. At the time, many analysts assumed that QE3 would provide an immediate boost to gold and silver prices. Instead, the metals markets responded counterintuitively. They declined for several months following the Fed's announcement. Fast forward to October 2014, and almost nobody expects the end of QE to be bullish for precious metals. In fact, speculative interest in gold and silver sits at multi-year lows. Hedge funds are collectively showing one of their lowest net long positions in the silver market on record. The Fed's final termination of QE won't make the hot money crowd suddenly turn even more bearish on metals. That crowd has already positioned itself in anticipation of such an announcement. When the announcement comes, it could be a non-event for precious metals markets.

At the same time, it could spark a revolt against the U.S. stock and bond markets, which have heretofore been floating on a rising sea of Fed liquidity. Previous cessations of Federal Reserve stimulus programs have led to significant corrections in equity markets. When the Fed Finally Hikes Rates, It Will Probably Be Chasing Inflation HigherOf course, the Fed has no immediate plans to unload the more than $4 trillion in bonds it has accumulated on its balance sheet. Nor has it yet committed itself to actually raising its benchmark Federal funds rate, despite widespread expectations that it will do so by mid 2015. Fed chair Janet Yellen stated recently, "The appropriate path of policy, the timing and pace of interest rate increases ought to — and I believe will — respond to unfolding economic developments. If those were to prove faster than the committee expects, it would be logical to expect a more rapid increase in the Fed funds rate. But the opposite also holds true." That means the Federal Reserve may not raise rates until inflation begins spiraling out of control. In a Wall Street Journal survey of 30 economists, all but three expect the Fed to wait too long before raising short-term rates rather than move too soon.

The Fed doesn't directly control whether long-term or even short-term rates are positive or negative in real terms. Negative real interest rates, which refer to rates that sit below the inflation rate, are generally bullish for precious metals. Negative real interest rates can persist or even become more deeply negative while the Fed is raising the short-term rate. Mike Gleason, a Director at Money Metals Exchange, noted in one of our weekly audio podcasts this summer, "During the great gold and silver bull run of the late 1970s, the Fed wasn't slashing rates. It was doing the opposite. The Fed kept raising rates, but it didn't get out ahead of inflation until [then-Fed Chairman] Paul Volcker stepped in and jacked rates up to punishing double-digit levels." Market Conditions Remain Favorable for AccumulationThere is a widespread misconception that only rate cuts or more QE would be bullish for gold and silver. To the contrary, if rising inflation pressures force the Fed to raise rates, that would potentially be quite bullish for gold and silver as well. Instead of fearing rate hikes, metals investors should actually look forward to the next rate-raising cycle. That's when the biggest gains in gold and silver could come. At some point, yes, real interest rates may turn positive and precious metals prices may get overextended to the upside. But neither situation exists under current market conditions. Now remains a favorable period for savvy investors to accumulate physical precious metals while the herd isn't paying attention, premiums on common bullion products are low, and spot prices remain significantly discounted from their highs of three years ago.

By Stefan Gleason, President of Money Metals Exchange, a national precious metals deal with over 35,000 customers. Mr. Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC, and his writings have appeared in hundreds of publications such as the Wall Street Journal, Washington Times, and National Review.

|

| Gold quiet on Monday waiting for FOMC and next short term cycle to Nov 7th Posted: 27 Oct 2014 12:18 PM PDT Commodity Trader |

| Posted: 27 Oct 2014 11:55 AM PDT Battered silver remains deeply out of favor, recently plumbing miserable new lows after drifting sideways for most of 2014. This metal's relentless and oppressive weakness continues to break the wills of long-suffering contrarians. But professional investors are taking advantage of the epically-bearish psychology plaguing silver. They've been steadily accumulating positions all year long in massive […] The post Bullish Silver Stealth Buying appeared first on Silver Doctors. |

| Land of the Free – 1 in 3 Americans Are on File with the FBI in the U.S. Police State Posted: 27 Oct 2014 10:45 AM PDT The sickening transformation of these United States into an authoritarian police state with an incarceration rate that would make Joseph Stalin blush, has long been a key theme here. As a result of our insane societal obsession with authority and disproportionate punishment, the WSJ reports that "nearly one out of every three American adults are […] The post Land of the Free – 1 in 3 Americans Are on File with the FBI in the U.S. Police State appeared first on Silver Doctors. |

| An Ebola Armageddon Could Trigger a Rebirth in Gold and Silver Prices: Eric Sprott Posted: 27 Oct 2014 10:45 AM PDT Could an infectious disease kill the monster that has been choking gold and silver prices for more than a year? On the heels of a lively Sprott Precious Metals Roundtable discussion, The Gold Report caught up with investor Eric Sprott to ask how a tragedy in Africa could impact the price of precious metals and mining stocks. […] The post An Ebola Armageddon Could Trigger a Rebirth in Gold and Silver Prices: Eric Sprott appeared first on Silver Doctors. |

| Soybean Meal Continues Pulling the Grain Floor Higher Posted: 27 Oct 2014 10:28 AM PDT Last week it was the 100 day moving average in the meal that was the talk of the town. Today, and this week, it is the 200 day moving average. Meal has now taken both of them out and has set in motion a blast of buying by hedge funds in spite of the fundamentals associated with improving harvest progress and soon to be hedge pressure. Farmers watching the rally are sitting tight on sales of new crop ( (which is a mistake in my opinion ) as most of them now want to see how high the rally in the beans and in the corn will go before they let go of their newly harvested crop. The problem with such thinking is that it essentially turns the farmer into a speculator. Rallies that fly in the face of fundamentals are bewildering but they can flame out faster than they began leaving a lot of people holding the bag at the highs wondering what they did wrong. My suggestion to farmers who think higher prices are yet to come is to not hold off on selling any new crop but to sell a portion of it and replace that with call options if you think you can fetch more down the road. What you do not want to do is to end up selling at the same time all of the hedge funds do as well! Once processors have new crop supplies of beans flowing into the pipeline, especially in the Eastern Belt, basis is going to move swiftly lower in my view. The buying frenzy that has been seen in the meal will then become a selling frenzy. Again, I have no idea when that will occur nor from what level it will take place but I am watching several key technical levels to get a sense of when the hedge funds will have awakened the big commercial hedge pressure machine. For now, it is the funds in the driver's seat. Meal stalled out last week at EXACTLY the 50% Fibonacci retracement level of the collapse from the May high near $412. It flew through that level this morning and is now threatening the 61.8% level near $368. Quite frankly, I am going to be stunned if it can succeed in clearing that level although with the Dollar showing some weakness today and the macro boys buying into commodities as a result, anything is possible. If it does, we could see this thing run all the way to $380 before reality sets in. Meal had traded in a range between $360 and $340 for nearly two months ( July-Sep) before it broke down in the face of the massive bean crop expected. That it has not only returned to this former "value zone" but has exceeded it, is something that I never expected to see and I have seen a lot of weird things in the bean market over the years. There is some chatter occurring that late rains in Brazil have turned some farmers there away from beans and towards cotton but one has to be careful with such unconfirmed rumors. More often than not, these sorts of stories arise when people are trying to come up with some sort of fundamental reason to explain inexplicable technical price action. The technical price action has many analysts now confidently predicting a harvest bottom has been forged and that the grains are going to work higher from here. Put me in the disbeliever camp but until I see some signs that these funds are through playing "chase prices higher and move more demand to S. America" I am very careful. Those computers are unacquainted with "value" and will press in the direction that they are programmed to go until something halts them and makes them reverse. This afternoon we'll get an update from USDA on the harvest progress. |

| Posted: 27 Oct 2014 09:45 AM PDT The black swan that sends the world's financial, currency systems into a black hole will be the shot heard round the world. But the timing and the path toward that end is unknown. In the end, silver is a physical reality. Price is openly manipulated by the banks that make a profit while fulfilling the […] The post The Countdown to Truth appeared first on Silver Doctors. |

| Posted: 27 Oct 2014 08:52 AM PDT A new week begins nearly the same as the old week ended with gold stuck in a tight range. With another set of "Fedlines" due in 50 hours, something tells me we won't be stuck in this range for much longer. |

| Prepare for Global Gold Confiscation and Orwell’s 1984, Warns Rickards Posted: 27 Oct 2014 08:45 AM PDT In the year 2024, capitalism and markets will have been abolished in favor of a marxist dystopia managed by the “New World Order. The savings and assets of the middle classes will have been annihilated. This unfolds through a series of panics and shocks to the markets and hyper-inflation. As the hyperinflation takes hold there is a mass […] The post Prepare for Global Gold Confiscation and Orwell’s 1984, Warns Rickards appeared first on Silver Doctors. |

| Tahoe Resources COO is a silver miner to his very core Posted: 27 Oct 2014 08:25 AM PDT This year's "Silver Bull of the Year" Ron Clayton has devoted more than 30 years of his life to mining, especially operating underground silver mines. |

| Gold and silver jewelry still hot in India Posted: 27 Oct 2014 07:42 AM PDT The silver jewelry exports from India recorded significant surge of 66.76% year-on-year to $253.69 million in September this year. |

| Indian gold bar imports surge in September Posted: 27 Oct 2014 07:11 AM PDT The Gems and Jewelry Export Promotion Council has released data showing that the gold bar imports during September this year witnessed sharp rise of 35.74% over the previous year. |

| Posted: 27 Oct 2014 07:00 AM PDT Gold will survive as a store of value far longer than any government, fiat currency, or debt-based paper investment. Submitted by Deviant Investor: A Yahoo headline: Pentagon Readying For Long War in Iraq, Syria. More war means more debt and higher inflation. Increasing national debt is as certain as death and taxes. Increasing consumer prices follow. […] The post Gold Or Crushing Paper Debt? appeared first on Silver Doctors. |

| Posted: 27 Oct 2014 06:53 AM PDT Two weeks ago during the trading session, crude oil briefly dipped below the $80/barrel level. It did not stay there long however. This morning, crude has revisited the sub $80 level. This is something that we should monitor closely. We will want to see how this market closes today as it has not had a close below $80 since 2012. Weak crude prices, while generally good for the consumer ( cheaper energy costs ) and some business interests ( transportation related), are a sign of sluggish economic growth generating insufficient demand to keep up with available supply. Equity markets are lower as I type these comments as well with the Yen higher and the bonds higher. More safe haven plays are in vogue at this point. Deflationary pressures are back once more on the minds of traders it would seem. Gold is getting tugged between being a safe haven and the general trend lower across the commodity spectrum. Macro trades are on display once again. |

| Jim Willie: Shanghai Shock to Shatter the Gold Market! Posted: 27 Oct 2014 06:00 AM PDT The pattern of central bank covering the debt is clear. The lesson is that central banks can apply paper patches to the failed banks, and buy more time, then repeat the process on the next failed bank event. No limit to their bank patches seems to be in force. The banker cabal can continue […] The post Jim Willie: Shanghai Shock to Shatter the Gold Market! appeared first on Silver Doctors. |

| China gold imports rise to five-month high Posted: 27 Oct 2014 05:57 AM PDT Imports rose in September as retailers and fabricators boosted purchases ahead of a holiday sales season. |

| Gold ETF sales back in consolidation mode Posted: 27 Oct 2014 04:40 AM PDT If these sales halt, the support for the gold price remains strong, says Julian Phillips. |

| Gold prices stagnant, investors look to end of QE3 Posted: 27 Oct 2014 04:34 AM PDT The focus has shifted to the FOMC meeting this week, which is widely tipped to signal the end of QE3. |

| Oliver Gross Says Peak Gold Is Here to Stay Posted: 27 Oct 2014 01:00 AM PDT |

| Big falls likely in Brazilian financial markets as Dilma Rousseff wins re-election Posted: 27 Oct 2014 12:13 AM PDT It’s not looking good for the BRICS these days. The emerging market currencies are all wilting under the heat of the rising dollar with additional problems from the Ukraine crisis fall-out to the second term for Dilma Rouseff in Brazil. Sacha Tihanyi, Senior Currency Strategist at Scotiabank, explains his bearish outlook for Brazil’s financial markets after the re-election of President Dilma Rousseff… |

| What the Swiss Gold Referendum Means for Central Banks Posted: 26 Oct 2014 09:33 PM PDT Unlike the rest of us, the lucky Swiss get to go to the polls next month and tell their central bank what to do about gold. A yes-vote will send shock waves through the gold market and shake central banks around the world at their foundations. Read….. What the Swiss Gold Referendum Means for Central Banks |

| OCTOBER SILVER EAGLE SALES BEST EVER…. And With A Whole Week Remaining! Posted: 26 Oct 2014 09:00 PM PDT The US Mint just sold another 715,000 Silver Eagles over the weekend, bringing October Silver Eagle sales to an all-time monthly record- with a whole week remaining! Submitted by Steve St. Angelo, SRSRocco Report: While the Fed and Western Central Banks continue to prop up the entire market, investors took advantage of the manipulated low […] The post OCTOBER SILVER EAGLE SALES BEST EVER…. And With A Whole Week Remaining! appeared first on Silver Doctors. |

| Metals & Markets- Silver Miner Fights Back, Takes on the Bankster Cartel! Posted: 26 Oct 2014 08:30 PM PDT In this week’s Metals & Markets, The Doc & Eric Dubin break down the week’s action discussing: First Majestic Silver takes on the cartel- holds back 35% of Q3 silver production- CEO Keith Neumeyer issues call for silver miners to form their own cartel to put an end once and for all to paper manipulation Russian/ […] The post Metals & Markets- Silver Miner Fights Back, Takes on the Bankster Cartel! appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| How Will The Stock Market React To The End Of Quantitative Easing? Posted: 26 Oct 2014 04:19 PM PDT

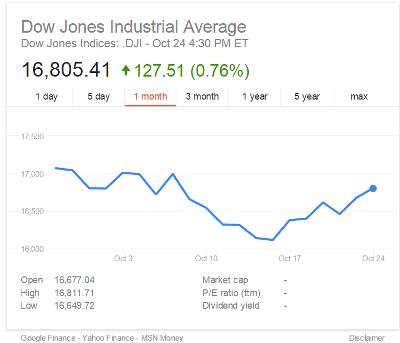

After all this time, many Americans still don't understand what quantitative easing actually is. Since the end of 2008, the Federal Reserve has injected approximately 3.5 trillion dollars into the financial system. Of course the Federal Reserve didn't actually have 3.5 trillion dollars. The Fed created all of this money out of thin air and used it to buy government bonds and mortgage-backed securities. If that sounds like "cheating" to you, that is because it is cheating. If you or I tried to print money, we would be put in prison. When the Federal Reserve does it, it is called "economic stimulus". But the overall economy has not been helped much at all. If you doubt this, just look at these charts. Instead, what all of this "easy money" has done is fuel the greatest stock market bubble in history. As you can see from the chart below, every round of quantitative easing has driven the S&P 500 much higher. And when each round of quantitative easing has finally ended, stocks have declined substantially... And of course the chart above tells only part of the story. Since April 2013, the S&P 500 has gone much higher... If someone from another planet looked at that chart, they would be tempted to think that the U.S. economy must be expanding like crazy. But of course that is not happening. This market binge has been solely fueled by reckless money printing by the Federal Reserve. It is not backed up by economic fundamentals in any way, shape or form. And now that quantitative easing is ending, many are wondering if the party is over. For example, just check out what CNN is saying about the matter...

Everyone knows that quantitative easing was a massive gift to those that own stocks. So how will the stock market respond now that the monetary heroin is ending? We shall see. Meanwhile, deflationary pressures are already starting to take hold around the rest of the globe. The following is an excerpt from a recent Reuters report...

If the Federal Reserve and other global central banks were not printing money like mad, the global economy would have almost certainly entered a deflationary depression by now. But all the Federal Reserve and other global central banks have done is put off the inevitable and make our long-term problems even worse. Instead of fixing the fundamental problems that caused the great financial crash of 2008, the central bankers decided to try to paper over our problems instead. They flooded the global financial system with easy money, but today our financial system is shakier than ever. In fact, we just learned that 10 percent of the biggest banks in Europe have failed their stress tests and must raise more capital...

Most people do not realize how vulnerable our financial system truly is. It is essentially a pyramid of debt and credit that could fall apart at any time. Right now, the "too big to fail" banks account for 42 percent of all loans and 67 percent of all banking assets in the United States. Without those banks, we essentially do not have an economy. But instead of being careful, those banks have taken recklessness to unprecedented heights. At this moment, five of the "too big to fail" banks each have more than 40 trillion dollars of exposure to derivatives. Most Americans don't even understand what derivatives are, but when the next great financial crisis strikes we are going to be hearing a whole lot about them. The big banks have transformed Wall Street into the biggest casino in the history of the planet, and there is no way that this is going to end well. A great collapse is coming. It is just a matter of time. |

| Federal Reserve to Markets: You’re Too Easy! Posted: 26 Oct 2014 03:09 PM PDT As the end of the latest quantitative easing program approached, everyone was wondering if history would repeat in the form of a stock market correction that terrified the government into another round of debt monetization. And right on cue, volatility surged in late September, sending US stocks down by about 6% by mid-October. And even that tepid bit of excitement was enough to send the Fed’s spinners into action:

That was literally all it took. No concrete action, no pulling out the bazooka, just some regional Fed chair whom 99.9% of Americans have never heard of speculating that maybe the end of tapering should be delayed by few months. And the markets went volatile on the upside, recouping most of the previous couple of weeks’ losses in a few days. Somewhere out there a bunch of Fed suits are sitting around a conference table laughing about how easy it is to manipulate today’s “investors”. After a decade of artificially-low interest rates, massive debt monetization, trillion-dollar bank bailouts and who knows what other kinds of secret interventions in what used to be free markets, the leveraged speculating community no longer cares about fundamentals. Instead it’s all about the flow of newly created-currency from the world’s central banks. When the spigot is on, buy. When it’s off, sell. This has turned out to be one of the easiest periods in financial history for the folks running money on the “don’t fight the Fed” system. So now what? Another burst of asset price inflation that takes small cap equities and junk bonds to the moon? Maybe. The new money has to flow somewhere, and with Europe joining the debt monetization party there might soon be a lot of money indeed sloshing around a global financial system with relatively few attractive choices. But there’s a reason that unlimited money creation has never been an easy path to affluence: It only works for a short while and is inevitably followed by a period of chaos as all the malinvestment generated when money was too easy causes various kinds of crises. In any event, the question that should be on everyone’s mind isn’t whether the Fed will keep QE going, but why, after five years of epic debt monetization and record low interest rates, inflation expectations are, as Ballard notes, plunging. The Keynesian answer is that $30 trillion (or whatever the true number turns out to be) wasn’t enough. $50 trillion, they assert, would have returned the world to steady, sustainable growth. For lack of another politically-marketable policy option, the “more is better” crowd will get what they want in 2015, when something will happen somewhere to scare the world’s central banks into a coordinated attempt to inflate away their past mistakes. |

| Heads up… The last time this happened, it marked a MAJOR bottom in the price of gold Posted: 24 Oct 2014 10:20 AM PDT From Dave Forest at Pierce Points: Things have changed a lot in the gold market − in a very short period of time. And news this week suggests that further structural changes are coming to the market. The kind we haven’t seen in over 15 years. Specifically when it comes to gold hedging, the practice of forward-selling bullion in order to lock in a fixed price. With gold rising over a good part of the last decade, investors wanted as much exposure as possible to prices. With buyers betting that prices would continue to rise − generating increasing profits for companies that produce bullion. That led to a decrease in hedging − with gold producers sometimes paying billions of dollars to “unwind” their hedges. And regain complete exposure to market prices. But a survey released on Wednesday suggests that gold companies are now going the exact opposite direction. Increasing their hedges − by a significant amount. The study’s authors − gold market experts GFMS along with Societe Generale − said they expect total hedging in the gold industry to rise to 40 tonnes of metal in 2014. A mark that would be the highest yearly figure since 1999. There’s reason to believe the prediction. In the second quarter alone, total hedging across the gold industry jumped 61% as compared to the year-ago period. Suggesting that producers are indeed returning to hedges in a big way. The strategy makes sense in light of recent market activity. With gold prices having once again dipped below $1,200 per ounce over the last several weeks, producers are anxious about further declines. And therefore want to lock in prices in order to protect against further falls. The 40 tonnes of total hedging predicted by GFMS this year is of course not huge in a historical perspective. Given that the previous high in 1999 was over 500 tonnes. But it’s interesting to note that the 1999 high in hedging activity coincided exactly with a multi-year low point for the gold price − when bullion dropped to $250 per ounce. After which the market rose steadily and significantly for several years. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment