Gold World News Flash |

- Embry – World’s Most Undervalued Asset & A Global Collapse

- Weimar Germany, Global Bank Takeover, Gold, Silver & Oil

- DEAD BANKSTERS & CHINA’S 30,000 TONS OF GOLD — Alasdair Macleod

- Richard Russell - Here Is What I’ve Learned After 90 Years

- Bloomberg Claim: Deflation Is NOT Always Bad

- Volcanic Eruption of Gold and Silver Demand: Shanghai’s Blast

- A Storm of Global Events Is Threatening to Push Gold and Silver to Record Highs

- The Gold Price Lost $2.10 Closing at $1,229.10

- AHEAD: "False Flag" & Destruction of U.S. Dollar | Fabian Calvo

- America Secretly Recruited Thousands Of Nazis As Cold War "Assets"

- Unlike Ebola Patients, The Markets After QE Can't Be Quarantined

- A Tale of Two Cities

- Recovery impossible within the current monetary system, Embry tells KWN

- Australian scholar says futures markets suppress commodity prices, keep producing nations poor

- Chart Shows A Potential Double or Triple in the TSX Venture

- The Rise And The Fall Of The Bankster (Full Movie)

- Gold Daily and Silver Weekly Charts - Spooky Janet and the Zombies of the American MIddle Class

- Gold as Investment Insurance

- Why a Central Bank Can Never Run Out of Money

- Embry - World’s Most Undervalued Asset & A Global Collapse

- Strong economies correlate with sound money, not depreciating money, Turk tells KWN

- What Will the End of QE Mean for the Precious Metals?

- Bill Holter analyzes gold manipulation debate at New Orleans conference

- A Scary Story for Emerging Markets

- James Turk - 2 Key Charts, Gold & The Destruction Of Money

- Swiss gold initiative advocates professionalize their campaign and need your help

- GATA favorites will participate in eMoney Show, an Internet conference Nov. 12

- China launches direct trade between yuan, Singapore dollar, bypassing U.S. dollar

- Correction

- GoldInitiative: Egon von Greyerz on Swiss Referendum

- DEAD BANKSTERS & CHINA'S 30,000 TONS OF GOLD -- Alasdair Macleod

- Oliver Gross Says Peak Gold Is Here to Stay

- The “Save Our Swiss Gold” Initiative Is Incompatible With the EUR/CHF Peg

- Oil Breaks Below $80

- Geopolitical – Week of 10.26.14

| Embry – World’s Most Undervalued Asset & A Global Collapse Posted: 28 Oct 2014 01:00 AM PDT from KingWorldNews:

There can be no sustainable economic recovery given the massive quantity of leverage and debt in the financial system. If interest rates truly reflected the gravity of the debt crisis in the West and the inherent risk in debt-based paper instruments, the debt would not be serviceable and the West would simply default. Thus the Western central banks have maintained a zero-based interest rate policy which has staved off the inevitable collapse, but I can guarantee you it has just made the ultimate endgame materially worse. | ||||||||||||||||||||||||||||||||||||||||||||

| Weimar Germany, Global Bank Takeover, Gold, Silver & Oil Posted: 27 Oct 2014 09:40 PM PDT from KingWorldNews:

Monopoly is derived from Greek, and the word describes a situation where one person or entity is the sole supplier of a good or a service. Monopsony is another seldom seen term whereby an entity controls the market for a good or service. Our Federal Reserve and their brethren have nearly taken the throne of monopolists on the supply of capital and monopsonists in controlling markets. Annual savings and even tax revenues have become rounding errors compared to the tens of trillions of dollars of fiat money created out of thin air and then doled out behind the scenes to financial institutions, governments and favored corporations. | ||||||||||||||||||||||||||||||||||||||||||||

| DEAD BANKSTERS & CHINA’S 30,000 TONS OF GOLD — Alasdair Macleod Posted: 27 Oct 2014 09:05 PM PDT

In the first half of our new interview with GoldMoney’s Alasdair Macleod we discuss the latest banker “suicides” which have all of the hallmarks of intelligence agency ‘wet work’. And Alasdair explains how China could easily have acquired 20,000 tons of gold in recent decades – and as SRS Rocco recently pointed out, an additional 10,000 tons of gold in just the last three years. The second half of our nearly one hour long interview will post on Tuesday night. Thanks for tuning in. | ||||||||||||||||||||||||||||||||||||||||||||

| Richard Russell - Here Is What I’ve Learned After 90 Years Posted: 27 Oct 2014 09:01 PM PDT  Today the Godfather of newsletter writers, 90-year old Richard Russell, shares what he has learned after 90 years on this earth. The 60-year market veteran also covered gold, silver, deflation, Europe, Germany, the Fed, QE, the U.S. dollar and much more. Today the Godfather of newsletter writers, 90-year old Richard Russell, shares what he has learned after 90 years on this earth. The 60-year market veteran also covered gold, silver, deflation, Europe, Germany, the Fed, QE, the U.S. dollar and much more.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||

| Bloomberg Claim: Deflation Is NOT Always Bad Posted: 27 Oct 2014 08:20 PM PDT by Jeff Nielson, Bullion Bulls Canada:

This is the byproduct of serial lying. With any person/entity which spews enormous quantities of lies; it is logically inevitable that many of the newer lies will contradict many of the older lies. The latest example of this concerns the economic dynamic known as deflation. Those who regularly follow the fiction of the mainstream media will be familiar with its hysterical hyperbole concerning deflation: it is (according to these Liars) "the most destructive economic condition of all". It is a lie universally parroted throughout the Corporate media…until now. | ||||||||||||||||||||||||||||||||||||||||||||

| Volcanic Eruption of Gold and Silver Demand: Shanghai’s Blast Posted: 27 Oct 2014 08:01 PM PDT The BRICS Just Don't Stop from The Wealth Watchman:

As great as the demand figures were going into early October, they're even better now, and deserve another look. As I wrote before, the West's exchanges, specifically the Comex and LBMA, are the crooked mechanisms which control prices for silver and gold for the rest of the planet. Yet, the pricing power of those two crooked exchanges is not long for this world. Those wolverines are being de-fanged by the BRICS as we speak. It is not an easy process, nor is it a terribly quick one, as stackers well know, but once again, I urge those in our community to show the kind of self-assured patience that the Chinese and Indians nationals are showing.

Shanghai: A Black Hole for the World's Gold Not only have the Chinese kept up this brisk pace of gold-accumulation since late September, they've upped the ante several notches! Check out these withdrawals: Week 39: Demand was 45 tonnes. Week 41: Demand was over 68 metric tonnes! This is the 3rd-largest, weekly demand total on record for Shanghai Week 42: 51.5 tonnes of gold was withdrawn. Incredible. Look at this graph beneath, via Koos Jansen's abode: See that yellow line that represents the entirety of world gold mining supply? Now see the blood-red bar on the furthest right, slicing through the top of it like a lovely stream of magma from the exploding volcano, which we casually refer to as "Chinese gold demand"? Make no mistake about it, the Chinese appetite for gold is most definitely volcanic! | ||||||||||||||||||||||||||||||||||||||||||||

| A Storm of Global Events Is Threatening to Push Gold and Silver to Record Highs Posted: 27 Oct 2014 07:40 PM PDT by Joshua Krause, Activist Post:

It would show the phony paper market who's really in charge. With the price of 800 million ounces of physical silver being controlled by 1 billion ounces of paper stocks, a challenge like this could make stock prices tumble while the price of real silver goes through the roof. He suggested that they agree upon a month sometime in 2015. I'd be willing to bet that the anticipation of that event, would make silver prices go ballistic long before that month arrives. | ||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Lost $2.10 Closing at $1,229.10 Posted: 27 Oct 2014 06:24 PM PDT

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||

| AHEAD: "False Flag" & Destruction of U.S. Dollar | Fabian Calvo Posted: 27 Oct 2014 06:03 PM PDT IN THIS INTERVIEW:- The Federal Reserve to continue printing money ►0:34- Will inflation overwhelm precious metal price manipulation? ►4:45- What will indicate the next big leg down in the economy? ►6:19 [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||

| America Secretly Recruited Thousands Of Nazis As Cold War "Assets" Posted: 27 Oct 2014 04:29 PM PDT Winston Churchill once said that "You can always count on Americans to do the right thing - after they've tried everything else." By 'everything else' apparently he also meant hiring thousands of Nazis as Cold War spies and informants and, according to the NYT, "as recently as the 1990s, concealing the government's ties to some still living in America." Because remember when merely associating with Nazi war criminals was enough to get you thrown out of polite society in perpetuity and likely thrown in a US prison, or worse? Well, when the one doing the association is that creature of utmost "fluidity" when it comes to matters of morality, the US government, apparently preaching moral superiority while invading and targeting for extermination world "dictators" whose only crime is being "evil" according to the US government's pristine moral compass, then everything is forgiven. But before the truth is revealed there will be years of denying, misrepresenting the facts, and outright lying. So here, according to the NYT, are the facts about Uncle Sam's employment of Nazis for decades. "At the height of the Cold War in the 1950s, law enforcement and intelligence leaders like J. Edgar Hoover at the F.B.I. and Allen Dulles at the C.I.A. aggressively recruited onetime Nazis of all ranks as secret, anti-Soviet "assets," declassified records show." And while Germans justified their actions during World War II by merely following orders, how did the US seek to validate its grotesque actions? Here is the NYT with the winning phrase of the day, if not year:

And there it is: moral lapses. When the market crashes, and the US economy's long-deferred collapse is now a fact, prepare to hear much more about the so-called moral lapses of bankers, Federal Reserve officials, and tenured economist during the upcoming public tribunals. But back to America's double standard in purshing vs retaining Nazi criminals:

And here's why the US did everything in its power to keep the awful truth hidden: "Some spies for the United States had worked at the highest levels for the Nazis."

Anyone reading this with nothing but disgust would be delighted to know that Bolschwing's own son was stunned by the two-faced nature of the US government:

It went so far that America would do everything in its power to hide its pathological moral failure from even its closest of allies, the Israeli:

The shocking bottom line:

One can only speculate: by now most are either dead or "suicided" just like the Deutsche Bankers: "None of the spies are known to be alive today." And while none of this comes as a surprise, especially in the aftermath of the Snowden revelations, one wonders if the world have to wait another 50 or so years before it is declassified that the CIA has been the primary and instigator of every current conflict around the globe, from the Ukraine civil war to ISIS? | ||||||||||||||||||||||||||||||||||||||||||||

| Unlike Ebola Patients, The Markets After QE Can't Be Quarantined Posted: 27 Oct 2014 04:00 PM PDT Submitted by James H Kunstler via Kunstler.com, Oh, that sound you hear this morning is the distant roar of European equity markets puking after the latest round of phony bank "stress tests" — another exercise in pretend by financial authorities who understand, at least, the bottomless credulity of the news media and the complete mystification of the general public in monetary matters. I rather expect that roar to grow Niagara-like as US markets catch the urge to upchuck violently. Problem is, unlike Ebola victims, they can't be quarantined. The end of the "taper" is upon us like the night of the hunter, conveniently just a week before the US election. If the Federal Reserve is politicized, the indoctrination must have been conducted by the Three Stooges. America's central bank never did explain the difference between tapering and exiting their purchases of US treasury paper. I guess that's because it has other interventionary tricks up its sleeves. Three-card Monte with reverse repos... ventures into direct stock purchases... the setting up of new Maiden Lane type companies for scarfing up securities with that piquant dead carp aroma. Who knows what's next? It's amazing what you can do with money in a desperate polity with a few dozen lawyers. Of course, there is the solemn matter as to what happens now to the regularly issued treasury bonds and bills. Do they just sit in an accordian file on Jack Lew's desk next to his Barack Obama bobblehead. The Russians don't want them. The Chinese are already stuck with trillions they would like to unload for more gold. Frightened European one-percenters may want to park some cash in American paper to avoid bail-ins and other confiscations already rehearsed over there — but could that amount to more than a paltry few billion a month at the most? What do the stock markets do without up to $85 billion a month (peak QE) sloshing around looking for dark pools to settle in? Can US companies keep the markets levitated by buying back their own shares like snakes eating their tails? Isn't that basically over and done? And exactly how do interest rates stay suppressed when only a few French tax refugees want to buy American debt? I don't think anybody knows the answer to these questions and the scenarios are too abstruse for the people who get paid for supposedly writing learned commentary in the sclerotic remnants of the press. A few things are for sure, though they are sedulously kept out of the public discussion by interested gate-keepers. One is that the western economies have lost the ability to generate real new wealth of the type that their debt-based monetary systems require for ongoing operations (such as paying interest on old debt). Instead, we've entered a liminal era when fake wealth passes for wealth. Jive capital poses as capital. The main reason for this, of course, is the inability of world energy producers to meaningfully increase energy production in a way that does not suck more capital out of the system than the system can regenerate. But that conversation also has been outlawed from the public arena in "Saudi America." I suspect the subject will force itself on the national consciousness in the year ahead as one company after another in the shale oil regions craps out on a shortage of available investment capital. That's the inflection point where fake wealth is unmasked for what it really is: crippled capital formation. The disappointment from that looming event will thunder through our society. In the meantime, the distractions are many and powerful. Ebola may appear controlled for the moment in the USA, but the host countries in West Africa are virtually falling apart and the demographic movement out of failed economies like Liberia's would suggest an awful dynamic for the spread of that disease into new regions. ISIS (or whatever we call them) is putting on a diversionary show on the Turkish border, but the real action awaits in Baghdad, perhaps poignantly at Christmas time, when mortar rounds start falling on the US embassy in the Green Zone and the evacuations commence. | ||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Oct 2014 03:42 PM PDT This is a work of fiction with a few similarities to the reality we all know and trust, or … the reality that we think we know. City A in a Paper WorldA financial genius had a plan! He and his offspring implemented the plan over several hundred years.

City B in a Gold World

SummaryOur fictional City A might resemble some major cities in the western hemisphere. It is inhabited by regular people as well as politicians, rats, and central bankers. Currency units are digital, purchase less every year, and are created in large quantities every day. The political and financial elite control most of the government and the economy for their own benefit. Economic statistics and financial TV continually assure the people that "it's all good." The crashes of 2000, 2006, and 2008 caused many people to question the usual narrative. City B does not exist. Currency units are backed and redeemable with gold, the government runs a balanced budget, and politicians are not allowed to use tele-prompters. A reset seems inevitable and possibly imminent. As they say, the market always does what it is supposed to, but not when we expect it. The next crash could be rather severe, unless financial TV is right this time and it truly is all good………

This bit of fiction has been brought to you from somewhere near City A, where I encourage you to read:

Gary Christenson | The Deviant Investor | GEChristenson

| ||||||||||||||||||||||||||||||||||||||||||||

| Recovery impossible within the current monetary system, Embry tells KWN Posted: 27 Oct 2014 03:11 PM PDT 6:10p ET Monday, October 27, 2014 Dear Friend of GATA and Gold: Incomprehensible debt, derivatives, and algorithmic trading in financial instruments have made a worldwide economic recovery impossible within the current monetary system, Sprott Asset Management's John Embry tells King World News today: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/10/27_E... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers. (http://www.gata.org/node/173) To invest or learn more, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||

| Australian scholar says futures markets suppress commodity prices, keep producing nations poor Posted: 27 Oct 2014 03:00 PM PDT 5:58p ET Monday, October 27, 2014 Dear Friend of GATA and Gold: Fourteen years ago the British economist Peter Warburton wrote that Western central banks were using the futures and derivatives markets and intermediary investment banks to control commodity prices -- -- giving rise to the adage: "The futures markets aren't manipulated. The futures markets are the manipulation." Today MineWeb's Lawrence Williams interviews a mathematician and former stockbroker who holds a doctorate in math from the University of Melbourne, Australia, Fraser Murrell -- http://www.ms.unimelb.edu.au/~mscareer/index.php?page_ref_id=69 -- and who emphatically concurs, describing the futures markets as the mechanism by which the financially sophisticated West loots the developing world, which is dependent for its livelihood on the production of natural resources. The Western countries sustaining these futures markets, Murrell argues, thereby perpetuate poverty in the developing countries. Of course this has been GATA's complaint for many years, but nobody at GATA has a Ph.D., just tinfoil hats. Williams' interview with Murrell is headlined "Futures Markets Keep Precious Metals Prices Depressed" and it's posted at MineWeb here: http://www.mineweb.com/mineweb/content/en/mineweb-gold-news?oid=257914&s... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers. (http://www.gata.org/node/173) To invest or learn more, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||

| Chart Shows A Potential Double or Triple in the TSX Venture Posted: 27 Oct 2014 01:56 PM PDT Risk taking is a natural part of life, especially in the capitalist system where the greater the risk, the increased potential reward. The TSX Venture Index which is made of the Canadian start ups in junior mining and high tech is hitting lows not seen since 2002 and the 2008 Credit Crisis. Despite the record amount of global QE, investors are sitting in US dollars, treasuries and large caps rather than investing in new ideas especially in the resource arena. Higher risk capital entering start ups especially in junior mining has reached a new low as investors have been seeking liquidity and dividends. Clearly, the strong global economy purported on CNBC has not yet been reflected on the TSX Venture Exchange yet. However, that may change over the next 3-5 years and now may be the time to buy up the best resource assets at historic lows. Over the past decade, The TSX Venture has at least doubled or tripled from these historical low levels where it is currently trading. Major rallies over the past decade began when the Venture was trading below $1000. The Venture is trading at $790 as this is written. I wouldn’t be surprised to see a major bounce to the $2400 or $3400 level like it did back in 2009 and 2003. The Junior Gold Miner (GDXJ) ETF appears like it could be approaching a major bottom in the $29 zone and could form a double bottom with the December Low over the next couple of weeks. I just returned from the New Orleans Conference where I met with management of some exciting gold companies on the verge of major gains as they reach fundamental catalysts. 1)Pershing Gold (PGLC) just announced a financing with some of the most active and smartest US investors and now sits with over $20 million in cash, a fully permitted heap leach facility and an expanding gold resource base in Nevada. One of the insiders has been buying aggressively in the open markets which is a positive sign for a turn in the company. I expect Pershing to be uplisted to a major exchange such as the NYSE or Nasdaq in the near term. With the former Franco Nevada, Chief of US operations as its current CEO the weak junior mining environment could play into the advantage of cash rich and deep pocketed Pershing to pick up quality mining assets at a bargain to complement near term production at Relief Canyon. I am excited to see this company break out of its recent downtrend, get uplisted and become recognized by the institutions possibly by the end of 2014. 2)Red Eagle Mining (RD.V or RDEMF) just published a Definitive Feasibility Study showing some of the best economics in the business on their San Ramon Deposit in Colombia. All that they are waiting for is the final environmental permit which could come soon and really boost the value of this asset. Red Eagle has some strong shareholder support from Liberty Metals and is one permit away from building one of the world’s most economic mines. Don’t think the project is toosmall, there is a lot of room for growth and was drilled in a way to get it into production the most cost effective way. The CEO Ian Slater did an excellent job to advance this project to get to a construction decision without blowing out its share structure and minimizing dilution. 3)Canamex Resources (CSQ.V) is hitting arguably the best drill results in Nevada right now on a regular basis and have attracted investment dollars from two NYSE gold producers such as Hecla and Gold Resource Corp. There are assays pending from both the Penelas East Discovery and historic resource area. I first told you about Canamex back in 2013 and it is now up 130% in 2014 as they are making a great discovery in Nevada at their Bruner Project. Canamex just announced step out drill results at the far northern end of Penelas East over 100 meters away from the nearest neighbor drill result. They intersected 22.9 meters of 3.29 g/tonne, which means that the project remains wide open to the north. A second core hole was drilled and intersected the high grade target. Results should come out in early November. Canamex is pulling back to its 200 day moving average. It may be a good area of support to add as it is in a strong uptrend. Disclosure: I own all 3 companies and they are all website sponsors. Do your own due diligence before and during your investment. ___________________________________________________________________________ Sign up for my free newsletter by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… Accredited investors looking for relevant news click here… To send feedback or to contact me click here… Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin. | ||||||||||||||||||||||||||||||||||||||||||||

| The Rise And The Fall Of The Bankster (Full Movie) Posted: 27 Oct 2014 01:52 PM PDT The brittish empire didnt collapse, they just figured out they could control the world without a military through economics. Banksters wont collapse. They are stacking high at record lows getting ready for the new era and stripping us all of our assets and possessions while they hold the metals.... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Spooky Janet and the Zombies of the American MIddle Class Posted: 27 Oct 2014 01:35 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Oct 2014 01:30 PM PDT Just how much is enough? It depends on how you judge the risk of a serious stockmarket crash... YOU WAKE UP in the morning, turn on the news, and get a sick feeling in your stomach, writes Brian Hunt, editor-in-chief at Porter Stansberry's research group, Stansberry & Associates. The stock market is crashing again. Another big Wall Street bank has failed. Your 401(k) has lost another 25%. It's bleeding value every week. Your dream of early retirement is history. You've lost so much money in stocks that even a "regular" retirement is in jeopardy. If you live a long life, there's no way you'll have enough money. This is the financial disaster scenario that terrifies a lot of investors. It's what kept people up at night during the 2008 credit crisis. Could it happen again? Could another crisis cause the value of the US Dollar to collapse? Could the stock market suffer another epic decline? Many people say the answer to these questions is "yes". Fortunately, I don't need to know the answer to these questions...and neither do you. The good news is that it's very easy to buy insurance against financial disasters like these. I personally own this insurance. Many of the smartest, wealthiest people I know own it, too. It could mean the difference between a comfortable, early retirement...and just barely getting by. First, it's important to agree on what "insurance" is. In my book, buying insurance comes down to spending a little bit of money to hedge yourself against a disaster. Throughout our lives, we spend a little bit of money on insurance and hope we never have to use it. For example, home insurance costs a small fraction of your home's value. Buy it and hope you never have to use it. Same goes for car insurance. It costs a fraction of your car's value, so you buy it and hope you never have to use it. It's the same with investment insurance. You can buy "investment insurance" and hope to never have to use it. There are hundreds of wealth and investment insurance policies out there. They involve intricate details, lots of forms to sign, and payment of big fees to advisors and salesmen (which are often the same thing). I'd rather keep things simple and keep money in my pocket instead of a salesman's pocket. Here's how you can do it... Put a small portion of your wealth in gold bullion. That's it. That's all it takes to insure yourself against a financial disaster. No complicated insurance products. No big fees to pay. Just pay a small commission to a gold seller, store the gold in a safe place, and you're done. Here's why this "insurance" is important... Some popular market gurus are predicting a global depression, a collapse in the Dollar, and a huge increase in the price of gold. The chances of them being right are relatively slim. People have been predicting the "next depression" for 30 years. The world just has a way of not ending. However, the "doom and gloom" gurus bring up some good points. They aren't crazy. There are some big risks to our financial system. The US government is spending way too much money on wars, Obamacare, welfare, and other programs. Europe and China's economies could decline and trigger a global recession. These are all real risks to your retirement account. I'm no doom-and-gloomer. I think the economy will deal with these risks and keep growing. Again, the world just has a way of not ending like so many people believe it will. That's why I want to own stocks, bonds, and real estate. These assets will do well if the crap doesn't hit the fan. However, I also want insurance in case I'm wrong and the potential disaster that some are predicting takes place. People would likely flock to gold in a global financial disaster...and cause its price to soar. That's why it makes sense to buy gold as a form of insurance. The good news is that you don't have to buy a huge amount of gold to have a good insurance policy. You can place just 5% of your portfolio into gold. Let's say you have a $100,000 portfolio with 95% of it in blue-chip stocks and income-paying bonds. You place the remaining 5% of your portfolio into gold. This gives you $95,000 in stocks and bonds and $5,000 in gold. If the predicted financial disaster doesn't strike, your stocks and bonds will increase in value. Your gold will probably hold steady in price or decline a little. Since the bulk of your portfolio is in stocks and bonds, you'll do just fine. But what if the financial disaster strikes? I've heard some top financial analysts say gold could climb to $7,000 an ounce in the financial-disaster scenario. Let's say a financial disaster sends the value of your stocks and bonds down 50%. That would be a massive decline. Throughout history, only the worst, most severe bear markets sent stocks down this much. This epic financial disaster would cut your $95,000 stock and bond position by 50%, leaving you with $47,500. But let's say this disaster also causes gold to rise to $7,000 an ounce. Right now, gold is $1,230 per ounce. A rise to $7,000 would produce a more-than-fivefold increase in the value of your gold. It would cause the value of your $5,000 gold stake to rise to about $28,455. Post-financial disaster, you're left with $75,955 ($47,500 from stocks and bonds + $28,455 from gold). The disaster still hits you, but not nearly as hard. Your insurance played a big role in limiting the damage. But what if you think the chances of financial disaster are higher than "unlikely"? What if you're more worried than the average Joe? If you are, simply increase the "insurance" portion of your portfolio. Instead of a 5% position in gold, you could increase it to 20%. If the previously mentioned financial disaster were to strike your $100,000 portfolio weighted 80% in stocks/bonds and 20% in gold, the math works out like this: The 50% decline in your $80,000 stocks/bond position leaves you with $40,000. Gold's increase to $7,000 an ounce makes your $20,000 gold position increase to $113,821. Your large gold insurance position actually produces a net gain in this scenario. You're left with $153,821...an increase of more than 50%. As you can see, the larger your gold-insurance policy, the better you do in the financial-disaster scenario. But if the financial disaster doesn't strike, you won't benefit as much because you hold less money in stocks and bonds, which do well if the economy carries on. And keep in mind...it would take a serious financial disaster to send stocks down by 50% and gold to $7,000. Depending on what you think the chances of financial disaster are, you can adjust your gold-insurance policy. It all depends on your goals and beliefs. Think the chances of disaster are slim? Consider a gold-insurance policy equivalent to 1%-5% of your portfolio. Think the chances of disaster are high? Consider a gold-insurance policy equivalent to 20% of your portfolio. Are the "gloom and doom" gurus right? Is financial disaster around the corner? I don't know the answer. Nobody does. But if you buy some "investment insurance" in the form of gold, you don't need to know the answer. It's simple. It's easy. It's low-cost. You buy gold and hope to never have to use it. You'll do fine if things carry on. You'll do fine if the crap hits the fan. And the peace of mind you get from owning gold "insurance" is worth even more than the money it could save you. | ||||||||||||||||||||||||||||||||||||||||||||

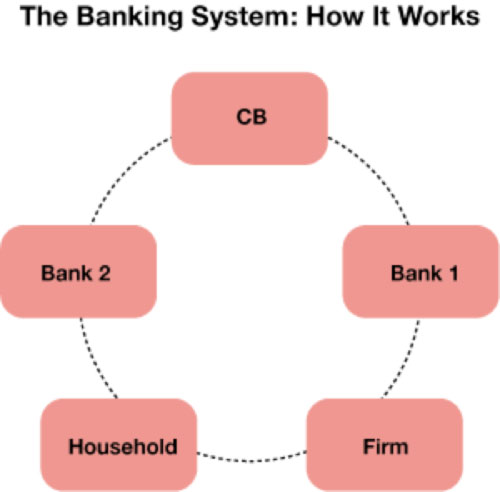

| Why a Central Bank Can Never Run Out of Money Posted: 27 Oct 2014 01:24 PM PDT This post Why a Central Bank Can Never Run Out of Money appeared first on Daily Reckoning. "We can't run out of money," economist L. Randall Wray said. The U.S. government spends through keystrokes that credit bank accounts, he continued. The money comes from nowhere. The government doesn't need to finance itself with taxes. And it doesn't borrow its own currency. It can afford all that is for sale in dollars. Despite laying out an incontrovertible set of facts, Wray's audience often is aghast. He says he gets four reactions when he tells people about how the government spends:

Wray is one of the architects of Modern Monetary Theory, or MMT. In essence, it is a description of how our monetary system works. The implications are profound. And Wray is very good at explaining it simply. Below are some notes from a talk he gave at the Post Keynesian Conference in Kansas City, which I attended. To begin, I like how Wray emphasized he's not really saying anything people at the Federal Reserve Bank don't already understand. First, there is a great quote from Ben Bernanke when, as Fed chief, he was on 60 Minutes:

Bernanke gets it. "The Fed can't run out of money," Wray said. "As long as someone at the Fed has a finger and they have a key to stroke, they can't possibly run out of money." Second, there is this statement from the St. Louis Fed: "As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational." And yet it is not uncommon to hear people say the U.S. is bankrupt or that the Fed itself is somehow in trouble. People on the inside know differently. As Wray emphasized: Government can never run out of dollars. It can never be forced to default. It can never be forced to miss a payment. It is never subject to whims of "bond vigilantes." Money… is simply the way we keep score in a modern economy. Banks are the scorekeepers. Thus, there is no need to balance the budget, heresy of heresies! As Wray says, "The necessity of balancing the budget is a myth, a superstition, the equivalent of old-time religion." "Whoa!" I hear you say. Let's back up. To understand how modern money works, it may be best to start with the banking system. Wray began with a simple model of a bank, a firm and a household. "So a firm approaches a bank and says it would like a loan," Wray says. "Where does the bank get the money?" It creates it out of thin air, out of nothing. It keystrokes it into existence. It creates a loan (an asset for the bank) and offsets it with a deposit (a liability for the bank). The firm gets a credit (an asset) and an offsetting debit (the loan). No prior deposits needed. As Wray says: "Loans create deposits. The bank lends its own IOUs. Can they run out? "Of course not. They can't run out of their own IOUs." This is important. If you don't get this, banking will forever remain a mystery to you. To get back to our example: The firm then takes the loan and uses the proceeds to hire people from our household. People then use the funds to buy the product from the firm, and the firm uses the money to repay the loan. It's a super-simple model. So let's add another bank and a central bank to make it more realistic. Now the firm and the household use different banks. The banks have to clear with one another. They do this through the central bank by using the IOUs of the central bank — called reserves. "What happens if Bank 1 is short reserves to clear the account?" Wray asked. "The central bank creates reserves so that Bank 1 can clear with Bank 2. "Can the central bank run out of reserves? The answer is no," Wray says. "Deposits create reserves. So the central bank will accommodate the demand for reserves by creating them in loans. Banks repay those loans to the central bank by returning the reserves to the central bank." (Much the same way as the firm repaid the bank in the simpler model with which we started.) Now, how about the government? The U.S. government spends it currency into existence. This is important, too. The government spends first and then collects taxes. (Logically, this is how it began, or else how would people get the money to pay taxes?) Taxes are what give the dollar value. As Alfred Mitchell-Innes, a diplomat and credit theorist, once put it: "A dollar of money is a dollar, not because of the material of which it is made, but because of the dollar of tax which is imposed to redeem it." In the old days, this was obvious. A government would, for example, raise a tally. It got a bunch of hazel wood sticks and made tallies and spent them. Or it stamped coins or printed notes. Then it collected taxes in whatever it claimed as money. Today, it is more complicated. …when someone says the country is bankrupt… you'll know that simply isn't true. The Treasury spends dollars into existence through the central bank. The central bank credits the accounts of banks, and banks credit whoever is getting paid. Taxes reverse the process. Banks then debit accounts, and the central bank debits the banks. The government cannot run out of credits. Money, then, is simply the way we keep score in a modern economy. Banks are the scorekeepers. They can no more run of credits than the Fenway scorekeeper can run out of runs. Taxes don't finance the government any more than taking runs off the scoreboard replenishes Fenway's scorekeeper. And the scorekeeper certainly doesn't need to borrow runs. True, there are operational constraints to how much the government can spend. There is the budgeting process, which is a real constraint. There are other technicalities that Wray says are not effective constraints. For example, technically, the Treasury must have the balance in their central bank account before they write a check, but practically, it makes no difference. This is because the central bank, Treasury and special private banks have always developed procedures to allow the Treasury to get deposits into the central bank before it writes the check. Another example is that the central bank can't buy Treasury securities directly from the Fed. But again, in practice, this makes no difference. There are special banks standing ready to buy new issues and then sell them to the central bank. To sum up MMT's findings: Government spending credits bank accounts. Taxes debit bank accounts. And deficits mean net credits to bank accounts. (If the government never ran a deficit, the nongovernment sector could not have a positive net balance of dollars.) The main conclusions to keep in mind are that the U.S. government cannot go bankrupt in its own currency. It can always afford to buy whatever is for sale in its own currency. And the only economic constraints it faces are full employment of existing resources and inflation (by spending too much). Other constraints are political. Wray ended with a slide about what he did not say since people are apt to jump to absurd conclusions:

Though called Modern Monetary Theory, economists have understood all of the above for a long time. Wray shared quotes from 1832 that showed a sound understanding of all these principles. And John Maynard Keynes pointed out that modern money, or the credit-based money we have today, is at least 4,000 years old. Now you have some understanding of modern money. And so when someone says the country is bankrupt or that it relies on the Chinese to finance it, you'll know that simply isn't true. Just these ideas alone put you ahead of most everyone else, including most professional economists. Regards, Chris Mayer P.S. So… Now you have a better understanding of what money really is… How do you use that to your advantage in the markets? Well… I recently wrote a FREE report — available to subscribers of The Daily Reckoning email edition — that reveals “The Hidden Investment that Quietly Pays You 5 Times Your Money.” Click here now to sign up for The Daily Reckoning, completely FREE of charge, and you’ll immediately gain access this report… and all the potential profits that come with it. The post Why a Central Bank Can Never Run Out of Money appeared first on Daily Reckoning. | ||||||||||||||||||||||||||||||||||||||||||||

| Embry - World’s Most Undervalued Asset & A Global Collapse Posted: 27 Oct 2014 01:01 PM PDT  Today a man who has been involved in the financial markets for 50 years warned King World News that we are nearing a violent change in the markets. John Embry, who is business partners with billionaire Eric Sprott, also discussed the endless stream of propaganda from the mainstream media. Today a man who has been involved in the financial markets for 50 years warned King World News that we are nearing a violent change in the markets. John Embry, who is business partners with billionaire Eric Sprott, also discussed the endless stream of propaganda from the mainstream media.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||

| Strong economies correlate with sound money, not depreciating money, Turk tells KWN Posted: 27 Oct 2014 12:47 PM PDT 3:42p ET Monday, October 27, 2014 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant James Turk today tells King World News that the referendum on the gold initiative in Switzerland is a contest between sound money and financial repression by central banks and that strong economies correlate with sound money, not with ever-depreciating money as central banks pretend. Turk's interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/10/27_J... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers. (http://www.gata.org/node/173) To invest or learn more, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||

| What Will the End of QE Mean for the Precious Metals? Posted: 27 Oct 2014 12:28 PM PDT Submitted by Money Metals Exchange. This fall, the Federal Reserve is expected to finally wind down its latest monthly bond-buying program known as Quantitative Easing. What will the end of this $4 trillion (and counting) debacle mean for precious metals markets? The answer may be, not much. That's not to say that gold and silver prices won't move following the Fed's final taper. But it is to say that widespread anticipation of QE's end has already been priced into the markets. Metals Markets Often Move Counter to Popular ExpectationsIt's worth recalling what happened when the current cycle of Quantitative Easing (officially, "QE3") was announced in back September 2012. At the time, many analysts assumed that QE3 would provide an immediate boost to gold and silver prices. Instead, the metals markets responded counterintuitively. They declined for several months following the Fed's announcement. Fast forward to October 2014, and almost nobody expects the end of QE to be bullish for precious metals. In fact, speculative interest in gold and silver sits at multi-year lows. Hedge funds are collectively showing one of their lowest net long positions in the silver market on record. The Fed's final termination of QE won't make the hot money crowd suddenly turn even more bearish on metals. That crowd has already positioned itself in anticipation of such an announcement. When the announcement comes, it could be a non-event for precious metals markets.

At the same time, it could spark a revolt against the U.S. stock and bond markets, which have heretofore been floating on a rising sea of Fed liquidity. Previous cessations of Federal Reserve stimulus programs have led to significant corrections in equity markets. When the Fed Finally Hikes Rates, It Will Probably Be Chasing Inflation HigherOf course, the Fed has no immediate plans to unload the more than $4 trillion in bonds it has accumulated on its balance sheet. Nor has it yet committed itself to actually raising its benchmark Federal funds rate, despite widespread expectations that it will do so by mid 2015. Fed chair Janet Yellen stated recently, "The appropriate path of policy, the timing and pace of interest rate increases ought to — and I believe will — respond to unfolding economic developments. If those were to prove faster than the committee expects, it would be logical to expect a more rapid increase in the Fed funds rate. But the opposite also holds true." That means the Federal Reserve may not raise rates until inflation begins spiraling out of control. In a Wall Street Journal survey of 30 economists, all but three expect the Fed to wait too long before raising short-term rates rather than move too soon.

The Fed doesn't directly control whether long-term or even short-term rates are positive or negative in real terms. Negative real interest rates, which refer to rates that sit below the inflation rate, are generally bullish for precious metals. Negative real interest rates can persist or even become more deeply negative while the Fed is raising the short-term rate. Mike Gleason, a Director at Money Metals Exchange, noted in one of our weekly audio podcasts this summer, "During the great gold and silver bull run of the late 1970s, the Fed wasn't slashing rates. It was doing the opposite. The Fed kept raising rates, but it didn't get out ahead of inflation until [then-Fed Chairman] Paul Volcker stepped in and jacked rates up to punishing double-digit levels." Market Conditions Remain Favorable for AccumulationThere is a widespread misconception that only rate cuts or more QE would be bullish for gold and silver. To the contrary, if rising inflation pressures force the Fed to raise rates, that would potentially be quite bullish for gold and silver as well. Instead of fearing rate hikes, metals investors should actually look forward to the next rate-raising cycle. That's when the biggest gains in gold and silver could come. At some point, yes, real interest rates may turn positive and precious metals prices may get overextended to the upside. But neither situation exists under current market conditions. Now remains a favorable period for savvy investors to accumulate physical precious metals while the herd isn't paying attention, premiums on common bullion products are low, and spot prices remain significantly discounted from their highs of three years ago.

By Stefan Gleason, President of Money Metals Exchange, a national precious metals deal with over 35,000 customers. Mr. Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC, and his writings have appeared in hundreds of publications such as the Wall Street Journal, Washington Times, and National Review.

| ||||||||||||||||||||||||||||||||||||||||||||

| Bill Holter analyzes gold manipulation debate at New Orleans conference Posted: 27 Oct 2014 11:52 AM PDT 2:51p ET Monday, October 27, 2014 Dear Friend of GATA and Gold: Market analyst Bill Holter, who writes for the Miles Franklin coin and bullion shop in Minnesota and GATA Chairman Bill Murphy's LeMetropoleCafe.com, today analyzes the gold manipulation debate between your secretary/treasurer and Doug Casey of Casey Research at the New Orleans Investment Conference last Thursday: http://blog.milesfranklin.com/the-debate-if-you-can-call-it-that CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||

| A Scary Story for Emerging Markets Posted: 27 Oct 2014 11:13 AM PDT The consequences of the coming bull market in the US dollar, which I’ve been predicting for a number of years, go far beyond suppression of commodity prices (which in general is a good thing for consumers â€" but could at some point threaten the US shale-oil boom). The all-too-predictable effects of a rising dollar on emerging markets that have been propped up by hot inflows and the dollar carry trade will spread far beyond the emerging markets themselves. This is another key aspect of the not-so-coincidental consequences that we will be exploring in our series on what I feel is a sea change in the global economic environment. | ||||||||||||||||||||||||||||||||||||||||||||

| James Turk - 2 Key Charts, Gold & The Destruction Of Money Posted: 27 Oct 2014 08:43 AM PDT  With continued uncertainty in global markets, today James Turk sent King World News two incredible charts that readers around the world must see, and he also discussed gold, the destruction of money and much more. Below is what Turk had to say in this timely and powerful interview. With continued uncertainty in global markets, today James Turk sent King World News two incredible charts that readers around the world must see, and he also discussed gold, the destruction of money and much more. Below is what Turk had to say in this timely and powerful interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||

| Swiss gold initiative advocates professionalize their campaign and need your help Posted: 27 Oct 2014 07:32 AM PDT 10:33a ET Monday, October 27, 2014 Dear Friend of GATA and Gold: The campaign in support of the gold referendum initiative in Switzerland on November 30 has been professionalized, erecting a comprehensive Internet site -- http://gold-initiative.ch/aktuell/ -- which, while in German, can be automatically translated into English if visited via a Google Chrome Internet browser. Donations in support of the campaign are being collected at the Gold Switzerland Internet site, operated by Matterhorn Asset Management, whose managing partner, Egon von Greyerz, is a primary proponent of the initiative: https://goldswitzerland.com/swiss-gold-initiative-2014/ The referendum proposal would bar the Swiss National Bank from selling the country's gold reserves; require the bank to repatriate Swiss gold reserves from foreign vaults and vault all the national gold reserves in Switzerland itself; and hold at least 20 percent of Switzerland's foreign exchange reserves in gold. Essentially the referendum proposal is a democratic revolt against unaccountable central banking and currency market rigging. The first national opinion poll on the referendum proposal found it leading by 45 to 39 percent -- http://www.gata.org/node/14594 -- but most financial institutions in Switzerland, parasitic dependents of the central bank, are likely to pour resources into the opposition campaign, so the proposal's advocates will need lots of support from Switzerland itself and from around the world. Switzerland imposes no limits on who can donate in support of national referendum campaigns, nor on how much they can donate -- and those allied with the central bank have access to infinite money. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Direct Ownership and Storage of Precious Metals Goldbroker.com is a precious metals investment company that enables investors to own and store gold directly in their own name (no mutualized ownership) in Zurich and Singapore. Goldbroker's clients are not exposed to any counterparty risks. They own gold and silver in their own names (the ownership certificate cites the name of the investor and serial number of his bars) and they have storage accounts opened in their own name as well. So Goldbroker.com's storage partner knows the exact identity of each investor. Goldbroker.com doesn't store in the name of its clients; rather, Goldbroker's clients store personally. All investors have direct access to their gold and silver bars. Goldbroker.com was launched in 2011 so that investors would avoid any counterparty risk when investing in physical gold and silver. Goldbroker.com is listed among GATA's recommended monetary metals dealers. (http://www.gata.org/node/173) To invest or learn more, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||

| GATA favorites will participate in eMoney Show, an Internet conference Nov. 12 Posted: 27 Oct 2014 07:10 AM PDT 10:10a ET Monday, October 27, 2014 Dear Friend of GATA and Gold: GATA favorites including Frank Holmes of U.S. Global Investors and Brien Lundin of Jefferson Financial will be participating in an Internet conference of financial expertise, the eMoney Show, to be held on Wednesday, November 12. The show will feature more than 20 experts in the monetary metals, resources, and energy. The eMoney Show aims to show investors how to tap into growth opportunities, identify companies poised to benefit from new technologies, and download reports, research, and investing tools in a virtual exhibit hall. Attendance is free and participants will be eligible for prizes, including computer tables, gift cards, and a $500 grand prize. To register for the eMoney Show, please visit: https://secure.moneyshow.com/eshow_reg/registration.asp?sid=E3MS14&scode... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||

| China launches direct trade between yuan, Singapore dollar, bypassing U.S. dollar Posted: 27 Oct 2014 06:27 AM PDT From Xinhua News Agency http://english.cntv.cn/2014/10/27/ARTI1414401659567921.shtml BEIJING -- China on Monday announced direct trading between the renminbi and Singapore dollar beginning Tuesday, marking another step toward internationalizing the Chinese currency. The announcement by China Foreign Exchange Trading System extended the yuan's list of direct onshore trade to more major currencies, including the U.S. dollar, the euro, British sterling, Japanese yen, Australian dollar, New Zealand dollar, Malaysian ringgit, and Russian ruble. ... Dispatch continues below ... ADVERTISEMENT Sinclair's Next Market Seminar Is Nov. 15 in San Francisco Mining entrepreneur and gold advocate Jim Sinclair will hold his next market seminar from 10 a.m. to 3 p.m. on Saturday, November 15, at the Holiday Inn at San Francisco International Airport in South San Francisco, California. Admission will be $100. For more information and to register, please visit: http://www.jsmineset.com/2014/10/10/san-francisco-qa-session-announced/ The move aims to boost bilateral trade and investment, facilitate the use of the two currencies in trade and investment settlement, and reduce exchange costs for market players, the foreign exchange trading system said in a statement. The move is also expected to help Singapore in its bid to become a renminbi offshore center. According to the arrangement, China's interbank foreign exchange market will kick off direct trading between the yuan and the Singapore dollar via spot, forward, and swap contracts. With direct trading of their currencies, China and Singapore will be less dependent on the U.S. dollar to settle bilateral trade and investment deals. Previously the exchange rate between the two currencies was calculated based on the yuan-U.S. dollar central parity rate and the Singapore dollar-U.S. dollar rate. Now that the two currencies can be directly traded, the yuan-Singapore dollar rate will be set based on the average prices offered by market makers before the opening of the interbank foreign exchange market. The foreign exchange trading system will publish its yuan/Singapore dollar central parity rate at 9:15 a.m. each trading day. The exchange rate on the spot market will be allowed to trade 3 percent higher or lower from parity. The People's Bank of China, the central bank, authorized and welcomed the announcement, saying it is an important measure between the Chinese and Singaporean governments to jointly push forward bilateral and economic relations. "The direct yuan-Singapore dollar trade is good for forming a direct exchange rate between the two currencies and reducing exchange costs," the PBOC said in a statement. Vowing to "actively support" yuan-Singapore dollar direct trade, the PBOC said the move will also help boost financial cooperation between the two countries. To boost the use of the yuan internationally, China has also signed multiple currency swap agreements totaling 2.9 trillion yuan (US$472 billion) with 26 overseas monetary authorities. The PBOC has also authorized offshore renminbi clearing and settlement arrangements in Singapore, London, Frankfurt, Seoul, Paris, and Luxembourg, as well as Taiwan, Hong Kong, and Macao. The Chinese government is gradually relaxing its hold over the yuan and making it a global reserve currency. China is also under pressure to diversify its foreign exchange reserves, which stood at US$3.89 trillion at the end of June. Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||

| Posted: 27 Oct 2014 03:53 AM PDT Dear Reader, Wall Street has found renewed optimism, with the Dow, Nasdaq, and S&P 500 all rebounding significantly last week. But is the correction of the last couple months really over, or is this a dead cat bounce? It’s hard to say, but the rebound followed remarks by some Fed talking heads suggesting that they might not wind QE down as quickly as planned, or at all, given the weakness in the stock market. It’s a perverse world in which good news is bad news; signs of economic strength are bad because they signal an end to the money printing, and stocks retreat. Bad news is good because more money printing creates an expectation, if not a self-fulfilling prophecy of higher share prices. I don’t honestly know what happens next, but I do know that this looking-glass economy central bankers imagine they control can’t go on ignoring reality forever. So, for any subscribers who missed The Casey Report special report last week, I strongly urge you to read it now, plan, and act accordingly. The link includes a quick video summary. But the broader market correction is not the correction I sat down to write about this week. What I want to say is that, as much as I enjoyed Bill Bonner’s book, Hormegeddon, calling it the “must-read” book of 2014 was a mistake, since the year isn’t over yet. I don’t take back anything else I said about the book, however; it’s a great read I still highly recommend. That said, there is a new book coming out next week that’s more deserving of the top “must read” title: Marin Katusa’s The Colder War. Why? Well, feel free to apply whatever discount you wish to my review below, since this is a Casey publication and it’s not unreasonable to assume I have a bias, but The Colder War is as important and well written and entertaining as my other favorite book of the year—and much more pressing, if not actually urgent. See below for details. First, some follow-up on the ongoing Ebola tragedy. There’s a lot of fear-mongering out there, even a rumor that Ebola-infected US troops will be sent to the VA hospital here in San Juan, Puerto Rico—and that the hospital’s requisition of HEPA filters means the disease must be airborne now. The latter point has become an urban legend you can see debunked at Snopes.com. Personally, I can’t imagine a hospital not wanting clean air. And it would be most ungracious of me to oppose soldiers who got sick fighting Ebola getting the best treatment possible, even if that brings them to my backyard. I know it’s alarming that doctors and nurses who wear protective gear are getting sick, but that doesn’t prove, or even imply, that this strain of Ebola has mutated into a superbug. Remember that none of the family of the Ebola patient who died in Dallas—who spent time in close proximity to him, completely unprotected—have been infected. A friend who’s in the field tells me that, despite the suits and masks, it’s actually quite difficult to avoid all contact with dangerous bodily fluids when treating a disease that produces a lot of them. Now, I distrust government as much as anyone you are likely to meet, and I don’t expect the full truth from officials who think they know what’s best for everyone, but spreading rumors is not helpful. We should all think carefully about what we say and do, focusing on the distinction between facts and fears, lest we make the problem worse than it has to be. Meanwhile, I’m sorry to say that I was right about Ebola spreading to Mali. I truly do hope the Malians will be able to contain the outbreak as the Nigerians appear to have done, but I’m skeptical, since the patient was a 2-year-old girl, and toddlers are not known for keeping bodily fluids to themselves under the best of conditions. The next country I see as being at highest risk is Côte d’Ivoire, and I do urge investors to get out of potential harm’s way there. As in all things, a reasoned, disciplined approach is what’s called for here. Sincerely, Louis James

A Work of GeniusLouis James, Chief Metals & Mining Investment Strategist I understand that calling Marin Katusa’s new book a work of genius puts my credibility at stake, since we are like family here at Casey Research. So let me start with a fact: I started reading The Colder War intending to skim it, as I did not actually expect to enjoy it. I wasn’t even sure I’d like it. I’m being blunt here because, while Marin is a very street-smart math genius who has taken to investing in the resource sector like a fish to water, he’s never been the strongest writer in our group. This goes all the way back to the very beginning of our association. Marin came to one of our first Casey summits and kept pestering me to look at some research he’d done on mineral exploration in Ecuador. He was like a kid pulling on the pant leg of a circus performer. I was busy, but he wouldn’t go away, so I had a look… and the data was astonishingly deep and compelling. The writing, however, was nothing to brag about. I decided to try Marin out as an assistant anyway, based on his manifest analytical abilities—and the rest is history. Flash forward almost a decade, and my “inner editor” still winces from time to time when I read Marin’s reports. So when I picked up The Colder War, I knew the data would be good, but I was frankly afraid the writing would be flawed, making it hard to say nice things about the book and still look myself in the mirror. The content did not disappoint, of course—but I’m delighted to report that the writing astounded me. In fact, it was hard to put the book down. I was on deadline, but the story kept me wanting to know what came next… In the end, I had to force myself to put it down and finish writing the dispatch I had to publish the next day. I should have known better than to underestimate Marin Katusa—won’t make that mistake again. The Colder War covers the latest developments in the global struggle among nations and leaders for advantage and dominance. This is an important topic that will impact everyone on our planet and obviously has important implications for investors. Unfortunately, this is a subject everyone has opinions about but few really understand. The average person is drowning in an ocean of disinformation, ill-informed pontification, and outright bullshytt—propaganda emitted by one side or another in the conflict. It’s vital to think clearly about the renewed conflict between East and West, and Marin’s analysis cuts through all the nonsense and biased coverage like a laser through fog. But here’s what was, for me, the reason I’m willing to call The Colder War a work of genius. Marin and I have both traveled extensively and spent a lot of time in former Soviet republics and China. We see many things the same way but have interpreted others differently. I am particularly sensitive to people who’ve never been to Ukraine trying to outdo each other in sensational interpretations of the facts on the ground. I disagree with some of Marin’s take on the Ukrainian situation. But… He made a good case, based on documented facts, forcing me to reconsider my own position. I’m human, and as fallible as any other, but it’s very, very rare that anyone can make me rethink a position like this, especially on one that I know I know more about than most people (outside of Ukraine). And—joy, oh joy!—the writing itself really is great. I started out noting a few clever turns of phrase and cutting insights, glad to have a few gems to quote, but quickly gave up. They came so fast and furious, I’d have ended up quoting most of the book. Another thing that struck me about this was how much history Marin managed to weave into his political and economic analysis. Many people try this, but the result is usually distracting, if not outright boring. Not The Colder War, which is a fascinating read. Here’s another shocker about Marin’s book, for an arrogant guy like me. I don’t often bother with more than skimming of many books, because they have nothing new to teach me. I’m usually quite happy and impressed if a book can contribute one or two genuinely new ideas, hopefully along with supporting facts and other useful information. But I can honestly say that I learned a lot reading Marin’s book. I found myself pausing more than once in almost every chapter, thinking: “Hm. I didn’t know that!” If the history books foisted upon me in school had been half as engaging as The Colder War, I might well have ended up being a historian. That’s how good this book is. I just wish it hadn’t ended where it did—there’s so much more to say, directions to go with the ideas. Fortunately, I get to read Marin’s work in his energy publications, so I know where to go to get more. I’ll let readers decide for themselves if that’s an option they want to pursue. For now, I’ll leave it with my recommendation to read The Colder War. I’m confident it will be time and money well spent—and enjoyed. | ||||||||||||||||||||||||||||||||||||||||||||

| GoldInitiative: Egon von Greyerz on Swiss Referendum Posted: 27 Oct 2014 03:30 AM PDT Dan Popescu interviews Egon von Greyerz – Oct 24 2014“A Swiss Gold Referendum YES Vote Will Be a Trendsetter for Central Banks”Interview section about the GoldInitiative starts at 2 min 35 sec into the video. | ||||||||||||||||||||||||||||||||||||||||||||

| DEAD BANKSTERS & CHINA'S 30,000 TONS OF GOLD -- Alasdair Macleod Posted: 27 Oct 2014 03:17 AM PDT In the first half of our new interview with GoldMoney's Alasdair Macleod we discuss the latest banker "suicides" which have all of the hallmarks of intelligence agency 'wet work'. And Alasdair explains how China could easily have acquired 20,000 tons of gold in recent decades - and as SRS Rocco... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||

| Oliver Gross Says Peak Gold Is Here to Stay Posted: 27 Oct 2014 01:00 AM PDT The wave of zero-interest liquidity washing over the financial world could result in a short-term gold bottom of $1,000 per ounce, reports Oliver Gross of Der Rohstoff-Anleger (The Resource Investor). The good news is that Peak Gold is here to stay, which means that midtier producers will soon be desperate to buy low-cost, high-quality deposits. In this interview with The Gold Report, Gross argues that this could be the opportunity of a lifetime for contrarian investors, and suggests a half-dozen best bets to be taken out. | ||||||||||||||||||||||||||||||||||||||||||||

| The “Save Our Swiss Gold” Initiative Is Incompatible With the EUR/CHF Peg Posted: 26 Oct 2014 05:00 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||

| Posted: 26 Oct 2014 05:00 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||

| Geopolitical – Week of 10.26.14 Posted: 26 Oct 2014 08:15 AM PDT ISIS and the New Horus Putin at Valdai Discussion Club 2014 |