Gold World News Flash |

- Systemic Global MELTDOWN Happening RIGHT NOW!

- How China & Gold Will Shape The Future

- ALERT: Gold & Silver Derivatives Gutted, Rigging Henchmen Being Suicided As End Of The World As We Know It Arrives

- DEAD BANKSTERS & CHINA’S 30,000 TONS OF GOLD — Alasdair Macleod

- Are We Ready For The Fall Of Baghdad?

- Societal Collapse Will Reveal the Best & Worst in Humanity

- How China & Gold Will Shape The Future

- As gold smuggling rises, India's tax office calls for lower import duty

- Federal Reserve to Markets: You’re Too Easy!

- Another Deutsche Banker And Former SEC Enforcement Attorney Commits Suicide

- Gold price suppression documents cited in debate at New Orleans conference

- Dollar Losing Reserve Currency Status, Central Bankers Preparing A Major Conflict

- Weimar Germany, Global Bank Takeover, Gold, Silver & Oil

- Systemic Global MELTDOWN Happening RIGHT NOW!

- Mining CEO Calls on Fellow Miners to Halt Physical Silver Sales to End the Paper Manipulation

- Events Impacting The Gold And Silver Price In The Week Of October 27th

- Gold Investors Weekly Review – October 24th

| Systemic Global MELTDOWN Happening RIGHT NOW! Posted: 26 Oct 2014 10:00 PM PDT from The Money GPS: | ||||

| How China & Gold Will Shape The Future Posted: 26 Oct 2014 09:15 PM PDT 25:47 – Gold and Silver rising over the next few years? $2,000 gold by 2015, $3,000-4000 by 2020. Silver – $50-75 2015/2016. $100 or more per ounce before 2020. from ZeroHedge:

Willem Middlekoop, author of The Big Reset – The War On Gold And The Financial Endgame, believes the current international monetary system has entered its last term and is up for a reset. Having predicted the collapse of the real estate market in 2006, (while Ben Bernanke didn’t), Middlekoop asks (rhetorically) – can the global credit expansion ‘experiment’ from 2002 – 2008, which Bernanke completely underestimated, be compared to the global QE ‘experiment’ from 2008 – present? – the answer is worrisome. In the following presentation he shares his thoughts on the future of the global monetary system; and how gold, the US and China are paramount for its outcome. | ||||

| Posted: 26 Oct 2014 08:45 PM PDT by Bix Weir, Road To Roota:

News coming out this weekend that a MAJOR, MAJOR player in this “Mafia-Like” banking cabal has been found dead in the midst of the chaos. Check this out: Deutsche Bank Lawyer Found Dead by Suicide in New York

Yes – this likely part of the Gambino crime family is knee deep in gold and silver derivatives…surprise! The Gambino family found out long ago that a life of crime in the Stock Market is much cleaner and much easier than the ways of their ancestors! The “Good Guys run” Zerohedge (of course), put two and two together with the previous suicide of Deutsche Bank’s William Broeksmit back in January… Another Deutsche Banker And Former SEC Enforcement Attorney Commits Suicide http://www.zerohedge.com/news/2014-10-25/deutsche-bank-lawyer-and-former-sec-enforcement-attorney-found-dead-apparent-suicide From Zero Hedge:

So here’s what we have to look forward to next week… - Breaking stories of the largest derivative holder in the world, Deutsche Bank, having derivative problems in their quarterly report to be released on the 29th. - News over the weekend of at least two newly suicided banksters that dealt in complicated derivative transactions…potentially more on the way. - Ebola outbreaks in New York City as fear spreads throughout the subway every time someone sneezes. - The long term manipulation of the stock market bubbling up to it’s all time highs. and… - With physical Gold and Silver demand at ALL TIME HIGHS the manipulated prices are at 5 year lows… What could go wrong?! Strap in my friends. May the Road you choose be the Right Road. Bix Weir PS – Hundreds of trillions in derivative transactions going sideways might sound bad for the Banks but it’s 100x worse for the Average Joe who saved his whole life and put his money into their system for retirement. Sean and I have tried to spread the truth and we are closing in on 200,000 views of this explosive interview: The Shocking Truth the History Channel Can’t Tell You! | ||||

| DEAD BANKSTERS & CHINA’S 30,000 TONS OF GOLD — Alasdair Macleod Posted: 26 Oct 2014 07:42 PM PDT

In the first half of our new interview with GoldMoney’s Alasdair Macleod we discuss the latest banker “suicides” which have all of the hallmarks of intelligence agency ‘wet work’. And Alasdair explains how China could easily have acquired 20,000 tons of gold in recent decades – and as SRS Rocco recently pointed out, an additional 10,000 tons of gold in just the last three years. The second half of our nearly one hour long interview will post on Tuesday night. Thanks for tuning in. | ||||

| Are We Ready For The Fall Of Baghdad? Posted: 26 Oct 2014 07:15 PM PDT Submitted by Ron Holland via The Daily Bell, I recently was in Vietnam and spent some time in prosperous, capitalist Saigon, now called Ho Chi Minh City, and toured the American War Museum. I believe there are a number of parallels between the Vietnam and Iraq War and that history could repeat itself now in Baghdad. Who can forget the former Vietnamese supporters of America being left behind as the last helicopter left the roof of the US embassy? Today, America still has the strongest military in the world but our manufacturing capacity and financial situation shows the US is on a downhill slide like earlier over-extended and bankrupt empires throughout world history. We've already watched the frightening incompetence of the Obama Administration and the CDC in dealing with the Ebola virus. One would have to be blind not to see the petrodollar deathwatch as Russia, China and the BRIC countries build new trading alternatives to avoid using the dollar world reserve currency when trading energy and other financial dealings. This is simple payback for Washington's threats, banking fines and penalties against institutions and nations de jure that fail to march to the US tune of dictating trade and financial arrangements. The world is now ganging up on the United States because Washington has terrorized smaller nations around the world for decades as the big bully on the block. We've had the misfortune of watching ISIS – originally funded and equipped by the US, Saudi Arabia and other Persian Gulf allies, as was Bin Laden – turn on their benefactors out to destroy Assad in Syria because of a pipeline deal and take over much of Iraq. My point is just as the pro-US South Vietnamese government could not survive without major US forces, neither will the present government in Baghdad. So what could happen to the massive, fortified Baghdad US Embassy in the Green Zone that rivals the Vatican in size? What are the possible military objectives of the Islamic State fighters (ISIS) in regard to the Iraqi capitol? While the US media elites and the Air Force concentrates on a meaningless ISIS backwater diversionary attack on Kobane on the northern Syrian border with Turkey, their real target is Baghdad and this will likely become very apparent between now and the end of the year. Our military experts confidently state that ISIS does not have enough troops to take and hold Baghdad, a city of 7 to 9 million people. They are correct unless ISIS wants to destroy its forces like the German Wehrmacht squandered its strength fighting in Leningrad or Stalingrad. But they can win major PR victories without getting bogged down in street-to-street fighting in the Shiite areas in the north and east. Baghdad has been a city in transition since the Bush invasion created a power vacuum and endless violence in the capitol. Historically full of neighborhoods with a mix of Sunni and Shia, the population division is now almost complete with most Shia concentrated in the north and east of the river and most Sunni in the area stretching from the airport to the American Green Zone. Here lies the problem: The western Sunni neighborhoods are perfect cover for the Islamic fighters to slowly infiltrate the area around the Green Zone and embassy compound and mix in with the population. After all, this is a Sunni insurrection against the majority Shia government. Hence the ISIS advance in Anbar province to just outside the airport is a direct threat to the Green Zone because their forces will be moving through predominantly Sunni neighborhoods all the way east to the American embassy. They could but surprisingly have not attempted to shut down the airport and here is where the situation gets interesting. Late this week, the Iraq army leadership basically said that unless US forces arrive to help them defend the western approaches to the city, they will throw down their weapons and go home – and I believe they will. The scenario I see is the first attack will likely be against the most heavily defended target, the US embassy and the Green Zone. The ISIS fighters are not strong enough to take the heavily fortified green zone by direct assault and so it will probably fail. The US will then attempt to fly in reinforcements to the airport and this will be when ISIS will start mortar fire and attempt to close the Baghdad airport as well as attack any convoys through the Sunni neighborhoods heading to the Green Zone. They will likely be able to shut down the airport, thus forcing reinforcements and embassy staff leaving to use helicopters for transportation to airfields further south in Iraq or maybe even to Kuwait. Closing the airport will be a major public relations victory for ISIS. A siege of the Green Zone and American embassy will likely then take place and the US will be forced to destroy by air the Sunni neighborhoods surrounding the area from the zone west to the airport at a minimum resulting in heavy Sunni civilian causalities. Once again, more bad PR for the United States. Eventually, the US may well be forced to close the embassy and withdraw from the Green Zone, which will result in videos that remind the American public of the Saigon collapse back on April 30, 1975. This would be a tremendous PR victory for the extremists, resulting in more fighter recruits. Finally, if the US is forced to withdraw from their fortified embassy then, of course, ISIS will take over America's largest embassy in the world. Note, this embassy compound can hold 35,000 American personnel and is basically a small city-state within Baghdad that is massively defended. This, again, is another victory for ISIS. Finally, the US may well decide to destroy the entire Green Zone and embassy by air to prevent its occupation by the terrorists. This will provide yet more videos – the US destroying its biggest embassy in addition to our earlier air attacks directed at our own tanks and trucks taken by ISIS troops when the Iraq army ran away from Mosul and northern Iraq. Although the Bush invasion of Iraq has been a costly tragic mistake for all involved, we would do well to never again put US troops back on the ground there. Otherwise, our other economic and financial weaknesses and major threats to our national interests, including the end of the dollar as the world reserve currency, could happen far sooner when combined with a major military defeat and loss of prestige that does not have to take place. I will be writing more about what happens on the home front to private wealth, prosperity and property when empires collapse and why American investors should look now at possible safe haven opportunities and global investment alternatives to survive and prosper in the future. Remember, all empires die but – although seldom covered in the history books – it is never a pleasant experience for the citizenry. | ||||

| Societal Collapse Will Reveal the Best & Worst in Humanity Posted: 26 Oct 2014 07:15 PM PDT from DEMCAD: | ||||

| How China & Gold Will Shape The Future Posted: 26 Oct 2014 06:48 PM PDT Willem Middlekoop, author of The Big Reset – The War On Gold And The Financial Endgame, believes the current international monetary system has entered its last term and is up for a reset. Having predicted the collapse of the real estate market in 2006, (while Ben Bernanke didn't), Middlekoop asks (rhetorically) - can the global credit expansion 'experiment' from 2002 – 2008, which Bernanke completely underestimated, be compared to the global QE 'experiment' from 2008 – present? - the answer is worrisome. In the following presentation he shares his thoughts on the future of the global monetary system; and how gold, the US and China are paramount for its outcome.

Middlekoop predicts the real estate crash in 2006... (ensure English Subtitles - Closed Captions - are enabled)

Bernanke did not... (stunning!!)

So just how big an underestimation are central bankers making this time with their 'experimentation'... Willem Middelkoop On The Big Reset... (ensure English Subtitles - Closed Captions - are enabled) Source: Koos Jansen via BullionStar * * * And here is an in-depth interview with Middelkoop (in English) that summarizes "how the house of cards will come tumbling down"

FULL TRANSCRIPT OF THE INTERVIEW available at the website above. 02:11 - Live video of Willem Middelkoop from Amsterdam. 03:52 - The Next Reset 05:45 - Christine LaGarde - Reset, notes at Davos 07:37 - Asset backed currencies, SDR 09:03 - Bretton Woods - Gold backed dollar 09:41 - Germany gold repatriation - Fort Knox Gold 10:38 - Germany Bundesbank 12:15 - Central bankers and gold 12:26 - IMF double counting gold of member countries. 13:36 - Gold Certificates - Gold on Federal Reserve and Treasury balance sheets. 14:35 - Which countries have the most gold reserves 15:32 - Interest Rates - Negative Rates - Japan example for U.S. and E.U. 17:26 - Debt to GDP - Japan - Why we need a monetary reset - Debt restructurings 19:20 - Financial Reforms versus sovereign Debt Restructuring 20:05 - Debt Cancellation - Removing $2 trillion from Federal Reserve Balance Sheet - If the Federal Reserve and the U.S. Treasury reevaluate gold's price to $4,200 or $8,400 an ounce instead of $42 an ounce as it is currently. 22:08 - The Euro and the Global Currency Reset - Currency Devaluation, gold. Financial Reset - World Championship of Money Debasement 23:17 - Investing in paper currencies, what do you recommend? 24:29 - Other investments, real estate, tangible assets. Where and when to buy. 25:47 - Gold and Silver rising over the next few years? $2,000 gold by 2015, $3,000-4000 by 2020. Silver - $50-75 2015/2016. $100 or more per ounce before 2020. 27:04 Gold/Silver Ratio and $100 an ounce silver. Gold is reused, silver is used up, silver shortages coming. 29:11 Already a silver shortage here in the United States. 29:47 London Silver Fix Ending 30:50 China Official Gold Holdings, not updated since 2008. 31:46 - Koos Jansen http://ingoldwetrust.ch 32:44 - What kinds of gold should people get into, physical, mining, etf? What is the ideal portfolio? 34:08 - Pullback in precious metals, trading close to 2010 levels, how long can it last? 35:14 - Willem's fund CDFUND (Commodity Discovery Fund) performance. 35:53 - Quantative easing, can the U.S. stop or just taper? Russia and China stopped buying U.S. Treasuries 37:41 - How much can interest rates be raised? National debt of the U.S. why we need a reset of the system. It's in the interest of the U.S. to take the lead. 39:29 - How close are we to the reset? Will it be overnight like it's been historically or gradual? 41:14 - Now is the time to prepare for the reset - gold and silver correction 42:34 - War on Gold and the Financial Endgame - Gold is the natural enemy for the dollar, the U.S. and the system. European countries help the U.S. 43:52 - http://gata.org - They have done great research for the last 10 years. 44:19 - Contacting Willem Middelkoop - Commodity Discovery Fund | ||||

| As gold smuggling rises, India's tax office calls for lower import duty Posted: 26 Oct 2014 03:57 PM PDT By Shruti Srivastava http://indianexpress.com/article/business/business-others/as-gold-smuggl... NEW DELHI, India -- Seizures of smuggled gold by the directorate of revenue intelligence has risen by an unprecedented 330 per cent during the April-September period as compared to last year, prompting the directorate to call on the finance ministry to bring down the import duty on the yellow metal and make smuggling less lucrative. This development comes even as gold imports have jumped by around 450 per cent year-on-year in September touching $3.75 billion, which calls into question the effectiveness of the high import duty of 10 per cent. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Experts say that import duty has failed to as a deterrent and demand for gold has only gone up. "There were 2,150 seizures of gold made by the DRI across the country worth over Rs 600 crore in the last six months. This is huge when compared to 500 seizures worth Rs 150 crore made last year during the same period," a government official told The Indian Express on the condition of anonymity. According to a report by the DRI, gold seizures made up for 24.58 per cent of the total seizures last year compared to 8 per cent of the total seizures in 2012-13. It seized 1,267.26 kg gold in 2013, 200.75 kg in 2012 and 153.26 kg in 2011, according to available figures. "DRI director general Najib Shah has written to revenue secretary Shaktikanta Das pointing out that the imports have gone up drastically despite high duty. Gold smuggling has emerged as a huge menace for the country. In view of the current situation, the finance ministry should take some decision on the high duty rate. Also, it is resulting in huge foreign exchange outgo," the official added. In the budget for 2014-15, the government did not reduce the import duty on gold despite the current account deficit coming down to 1.7 per cent in 2013-14 from a high of 4.8 per cent in 2012-13. Last year the government had taken a slew of measures, including raising the import duty to 10 per cent in phases and restrictions on import, to cut down gold imports. However, the measures led to a rise in smuggling. Ajay Sahai, director general, Federation of Indian Exports Organisations, said that smuggling is on the rise due to the high duty and not supply shortages."Availability and price are the two factors which contribute to gold smuggling. Clearly, there is no supply shortage as evident by high imports in the last few months. High duty is now becoming counterproductive. "Availability and price are the two factors which contribute to gold smuggling. Clearly, there is no supply shortage as evident by high imports in the last few months. High duty is now becoming counterproductive. "It is alarming, even if it is a 50 per cent rise in import of the metal month-on-month. If the government brings down the duty, smuggling will come down," he added. The current account deficit during the first quarter of the current fiscal narrowed to 1.7 per cent of GDP from 4.8 per cent of GDP during the same period last fiscal. This was largely helped by a steep decline of 52.7 per cent in gold imports during the first quarter. Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||

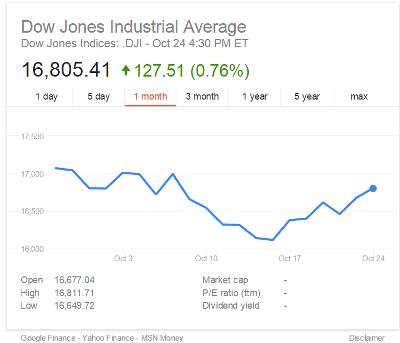

| Federal Reserve to Markets: You’re Too Easy! Posted: 26 Oct 2014 03:09 PM PDT As the end of the latest quantitative easing program approached, everyone was wondering if history would repeat in the form of a stock market correction that terrified the government into another round of debt monetization. And right on cue, volatility surged in late September, sending US stocks down by about 6% by mid-October. And even that tepid bit of excitement was enough to send the Fed’s spinners into action:

That was literally all it took. No concrete action, no pulling out the bazooka, just some regional Fed chair whom 99.9% of Americans have never heard of speculating that maybe the end of tapering should be delayed by few months. And the markets went volatile on the upside, recouping most of the previous couple of weeks’ losses in a few days. Somewhere out there a bunch of Fed suits are sitting around a conference table laughing about how easy it is to manipulate today’s “investors”. After a decade of artificially-low interest rates, massive debt monetization, trillion-dollar bank bailouts and who knows what other kinds of secret interventions in what used to be free markets, the leveraged speculating community no longer cares about fundamentals. Instead it’s all about the flow of newly created-currency from the world’s central banks. When the spigot is on, buy. When it’s off, sell. This has turned out to be one of the easiest periods in financial history for the folks running money on the “don’t fight the Fed” system. So now what? Another burst of asset price inflation that takes small cap equities and junk bonds to the moon? Maybe. The new money has to flow somewhere, and with Europe joining the debt monetization party there might soon be a lot of money indeed sloshing around a global financial system with relatively few attractive choices. But there’s a reason that unlimited money creation has never been an easy path to affluence: It only works for a short while and is inevitably followed by a period of chaos as all the malinvestment generated when money was too easy causes various kinds of crises. In any event, the question that should be on everyone’s mind isn’t whether the Fed will keep QE going, but why, after five years of epic debt monetization and record low interest rates, inflation expectations are, as Ballard notes, plunging. The Keynesian answer is that $30 trillion (or whatever the true number turns out to be) wasn’t enough. $50 trillion, they assert, would have returned the world to steady, sustainable growth. For lack of another politically-marketable policy option, the “more is better” crowd will get what they want in 2015, when something will happen somewhere to scare the world’s central banks into a coordinated attempt to inflate away their past mistakes. | ||||

| Another Deutsche Banker And Former SEC Enforcement Attorney Commits Suicide Posted: 26 Oct 2014 02:52 PM PDT Back on January 26, a 58-year-old former senior executive at German investment bank behemoth Deutsche Bank, William Broeksmit, was found dead after hanging himself at his London home, and with that, set off an unprecedented series of banker suicides throughout the year which included former Fed officials and numerous JPMorgan traders. Following a brief late summer spell in which there was little if any news of bankers taking their lives, as reported previously, the banker suicides returned with a bang when none other than the hedge fund partner of infamous former IMF head Dominique Strauss-Khan, Thierry Leyne, a French-Israeli entrepreneur, was found dead after jumping off the 23rd floor of one of the Yoo towers, a prestigious residential complex in Tel Aviv. Just a few brief hours later the WSJ reported that yet another Deutsche Bank veteran has committed suicide, and not just anyone but the bank's associate general counsel, 41 year old Calogero "Charlie" Gambino, who was found on the morning of Oct. 20, having also hung himself by the neck from a stairway banister, which according to the New York Police Department was the cause of death. We assume that any relationship to the famous Italian family carrying that last name is purely accidental. Here is his bio from a recent conference which he attended:

As a reminder, the other Deutsche Bank-er who was found dead earlier in the year, William Broeksmit, was involved in the bank's risk function and advised the firm's senior leadership; he was "anxious about various authorities investigating areas of the bank where he worked," according to written evidence from his psychologist, given Tuesday at an inquest at London's Royal Courts of Justice. And now that an almost identical suicide by hanging has taken place at Europe's most systemically important bank, and by a person who worked in a nearly identical function - to shield the bank from regulators and prosecutors and cover up its allegedly illegal activities with settlements and fines - is surely bound to raise many questions. The WSJ reports that Mr. Gambino had been "closely involved in negotiating legal issues for Deutsche Bank, including the prolonged probe into manipulation of the London interbank offered rate, or Libor, and ongoing investigations into manipulation of currencies markets, according to people familiar with his role at the bank." He previously was an associate at a private law firm and a regulatory enforcement lawyer from 1997 to 1999, according to his online LinkedIn profile and biographies for conferences where he spoke. But most notably, as his LinkedIn profile below shows, like many other Wall Street revolving door regulators, he started his career at the SEC itself where he worked from 1997 to 1999. "Charlie was a beloved and respected colleague who we will miss. Our thoughts and sympathy are with his friends and family," Deutsche Bank said in a statement. Going back to the previous suicide by a DB executive, the bank said at the time of the inquest that Mr. Broeksmit "was not under suspicion of wrongdoing in any matter." At the time of Mr. Broeksmit's death, Deutsche Bank executives sent a memo to bank staff saying Mr. Broeksmit "was considered by many of his peers to be among the finest minds in the fields of risk and capital management." Mr. Broeksmit had left a senior role at Deutsche Bank's investment bank in February 2013, but he remained an adviser until the end of 2013. His most recent title was the investment bank's head of capital and risk-optimization, which included evaluating risks related to complicated transactions. A thread connecting Broeksmit to wrongdoing, however, was uncovered earlier this summer when Wall Street on Parade referenced his name in relation to the notorious at the time strategy provided by Deutsche Bank and others to allow hedge funds to avoid paying short-term capital gains taxes known as MAPS (see How RenTec Made More Than $34 Billion In Profits Since 1998: "Fictional Derivatives") From Wall Street on Parade:

It would appear that with just months until the regulatory crackdown and Congressional kangaroo circus, Broeksmit knew what was about to pass and being deeply implicated in such a scheme, preferred to take the painless way out. The question then is just what major regulatory revelation is just over the horizon for Deutsche Bank if yet another banker had to take his life to avoid being cross-examined by Congress under oath? For a hint we go back to another report, this time by the FT, which yesterday noted that Deutsche Bank will set aside just under €1bn towards the numerous legal and regulatory issues it faces in its third quarter results next week, the bank confirmed on Friday.

Clearly Deutsche Bank is slowly becoming Europe's own JPMorgan - a criminal bank whose past is finally catching up to it, and where legal fine after legal fine are only now starting to slam the banking behemoth. We will find out just what the nature of the latest litigation charge is next week when Deutsche Bank reports, but one thing is clear: in addition to mortgage, Libor and FX settlements, one should also add gold. Recall from around the time when the first DB banker hung himself: it was then that Elke Koenig, the president of Germany's top financial regulator, Bafin, said that in addition to currency rates, manipulation of precious metals "is worse than the Libor-rigging scandal." It remains to be seen if Calogero's death was also related to precious metals rigging although it certainly would not be surprising. What is surprising, is that slowly things are starting to fall apart at the one bank which as we won't tire of highlighting, has a bigger pyramid of notional derivatives on its balance sheet than even JPMorgan, amounting to 20 times more than the GDP of Germany itself, and where if any internal investigation ever goes to the very top, then Europe itself, and thus the world, would be in jeopardy.

At this point it is probably worth reminding to what great lengths regulators would go just to make sure that Deutsche Bank would never be dragged into a major litigation scandal: recall that the chief enforcer of the SEC during the most critical period following the great crash of 2008, Robert Khuzami, worked previously from 2002 to 2009 at, drumroll, Deutsche Bank most recently as its General Counsel (see "Robert Khuzami Stands To Lose Up To $250,000 If He Pursues Action Against Deutsche Bank" and "Circle Jerk 101: The SEC's Robert Khuzami Oversaw Deutsche Bank's CDO, Has Recused Himself Of DB-Related Matters"). The same Khuzami who just landed a $5 million per year contract (with a 2 year guarantee) with yet another "law firm", Kirkland and Ellis. One wonders: if and when the hammer falls on Deutsche Bank, will it perchance be defended by the same K&E and its latest prominent hire, Robert Khuzami himself? But usually it is best to just avoid litigation altogether. Which is why perhaps sometimes it is easiest if the weakest links, those whose knowledge can implicate the people all the way at the top, quietly commit suicide in the middle of the night... | ||||

| Gold price suppression documents cited in debate at New Orleans conference Posted: 26 Oct 2014 02:32 PM PDT 6:20p ET Sunday, October 26, 2014 Dear Friend of GATA and Gold: Documents that were included in a PowerPoint presentation by your secretary/treasurer during his debate with Doug Casey of Casey Research on Thursday, October 23, at the New Orleans Investment Conference -- a debate whose proposition was "Gold Manpulation: Real or Imagined?," with your secretary/treasurer arguing that it is real -- are cited below, though, because of lack of time, not all of them were reviewed during the debate. The PowerPoint presentation, showing images of the documents, is posted at GATA's Internet site here: http://www.gata.org/files/GATA-NOLA-PowellDebateDocs.pdf Many more documents confirming gold price suppression by Western central banks can be found in GATA's "Documentation" archive here: http://www.gata.org/taxonomy/term/21 Summaries of the Western central bank gold price suppression scheme -- its history, purposes, and methods -- can be found in the section titled "The Basics" at GATA's Internet site here: http://www.gata.org/taxonomy/term/23 CHRIS POWELL, Secretary/Treasurer * * * The fourth installment of the European Central Bank Gold Agreement, announced in May 2014, asserting that the central banks will continue to conspire to coordinate their interventions in the gold market: http://www.ecb.europa.eu/press/pr/date/2014/html/pr140519.en.html The 2013 annual report of the Bank for International Settlements, asserting that the bank trades gold and gold derivatives for its member central banks: http://www.gata.org/files/BISAnnualReport-06-23-2013.pdf ... Dispatch continues below ... ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank The 2008 PowerPoint presentation by the Bank for International Settlements advertising secret gold market interventions as being among the bank's services to its members: http://www.gata.org/files/BISAdvertisesGoldInterventions.pdf The June 2005 speech by Bank for International Settlements official William R. White asserting that gold market intervention is a primary purpose of international central bank cooperation: http://www.gata.org/files/BIS-WhiteSpeechCentralBankCooperation-June2005... The minutes of the April 1997 meeting of the G-10 Gold and Foreign Exchange Committee, showing central bank and treasury officials conspiring to coordinate their gold market policies: http://www.gata.org/files/FedMemoG-10Gold&FXCommittee-4-29-1997.pdf Federal Reserve Chairman Alan Greenspan's testimony to Congress in July 1998, in which he asserted that central banks lease gold to suppress its price: http://www.federalreserve.gov/boarddocs/testimony/1998/19980724.htm The secret March 1999 staff report of the International Monetary Fund noting that central banks oppose reporting their gold swaps and leases because doing so would impair their secret interventions in the gold and currency markets: http://www.gata.org/files/IMFGoldDataMemo--3-10-1999.pdf The speech by Banque de France official Alexandre Gautier to the London Bullion Market Association meeting in Rome in September 2013, asserting that the French central bank trades gold for its own account "nearly on a daily basis" and is "active in the gold market for central banks and official institutions": http://www.gata.org/files/BanqueDeFrance.pdf Federal Reserve Governor Kevin M. Warsh's acknowledgment in September 2009 that the Fed has secret gold swap arrangements with foreign banks: http://www.gata.org/files/GATAFedResponse-09-17-2009.pdf The U.S. Treasury Department's explanation of its Exchange Stabilization Fund as having the power to intervene secretly not only in the gold market but any market: http://www.treasury.gov/resource-center/international/ESF/Pages/esf-inde... A statement by the Bank of England in 2011 that the gold swap and lease transactions undertaken by the bank are "market-sensitive" and the public must not be allowed to know about them: http://www.gata.org/files/BankOfEngland-GoldSwaps&Leases-10-24-2011.pdf A January 2014 letter from the CME Group, operator of the major U.S. futures market exchanges, informing the U.S. Commodity Futures Trading Commission that central banks are receiving discounts for trading futures in all major U.S. markets: http://www.gata.org/files/CMEGlobexCentralBankIncentiveProgram.pdf The CME Group's 10-k filing with the U.S. Securities and Exchange Commission for 2014 disclosing that its clients include central banks and governments: http://www.gata.org/files/CMEGroup-10K-03-03-2014.pdf The CME Group's August 2014 letter to the U.S. Commodity Futures Trading Commission acknowledging market-rigging practices on CME Group exchanges: http://www.gata.org/files/CMEGroupManipulativePractices-08-28-2014.pdf The study of the relationship of gold's price and interest rates written by Harvard economics professor Lawrence Summers and University of Michigan economics professor Robert Barsky and published by the National Bureau of Economic Research in August 1985, titled "Gibson's Paradox and the Gold Standard": http://www.gata.org/files/GibsonsParadox-OriginalVersion.pdf Cables from U.S. embassy in Beijing to the U.S. State Department in Washington signifying the Chinese government's awareness of gold price suppression by Western central banks: http://www.gata.org/node/10380 http://www.gata.org/node/10416 The minutes of the April 1974 meeting at the U.S. State Department of Secretary of State Henry Kissinger and Assistant Secretary Thomas Enders, in which they discuss the objective of the U.S. government to control the gold price: http://history.state.gov/historicaldocuments/frus1969-76v31/d63 Federal Reserve Chairman Arthur Burns' letter to President Ford in June 1975 explaining a secret agreement with the government of Germany to obstruct a free market in gold: http://www.gata.org/files/ArthurBurnsLetterToPresidentFord-June1975.pdf The March 1974 memo from the U.S. State Department's deputy assistant secretary for international finance and development, Sidney Weintraub, to Undersecretary of State for Monetary Affairs Paul Volcker, describing the U.S. government's objective of removing gold from the international monetary system: http://history.state.gov/historicaldocuments/frus1969-76v31/d61 Federal Reserve Chairman William McChesney Martin's secret 1961 plan for rigging all markets to support the U.S. dollar: http://fraser.stlouisfed.org/docs/historical/martin/23_06_19610405.pdf Federal Reserve Board of Governors member Kevin M. Warsh's commentary in The Wall Street Journal in December 2011 acknowledging that "financial repression" has been undertaken by government policy makers to "obscure market prices and prevent informed judgments": http://www.gata.org/node/10839 The transmission in May 2011 by the Board of Governors of the Federal Reserve System to GATA of a penalty in court costs for the Fed's illegally withholding gold-related records: http://www.gata.org/files/FedLetterLegalCosts.jpg http://www.gata.org/files/FedCheckLegalCosts.jpg Join GATA here: Mines and Money London http://www.minesandmoney.com/london/ Vancouver Resource Investment Conference http://cambridgehouse.com/event/33/vancouver-resource-investment-confere... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit:

This posting includes an audio/video/photo media file: Download Now | ||||

| Dollar Losing Reserve Currency Status, Central Bankers Preparing A Major Conflict Posted: 26 Oct 2014 01:59 PM PDT UK growth falls .7%. Frances unemployment is at an all time high. Unilever sales down because of economy. U.S. Government revises house data to make it look like housing is in a recovery.China launches the BRICS bank. Shooting in Washington state to push gun bills. Mali has first case of Ebola as... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Weimar Germany, Global Bank Takeover, Gold, Silver & Oil Posted: 26 Oct 2014 01:25 PM PDT  As the world continues to move into uncharted territory, today a 40-year market veteran sent King World News a fantastic piece covering everything from Weimar Germany to banks taking over the world. He also discusses gold, silver, oil, and what investors should be doing in this dangerous environment. Below is what Robert Fitzwilson, founder of The Portola Group, had to say in this exclusive piece for King World News. As the world continues to move into uncharted territory, today a 40-year market veteran sent King World News a fantastic piece covering everything from Weimar Germany to banks taking over the world. He also discusses gold, silver, oil, and what investors should be doing in this dangerous environment. Below is what Robert Fitzwilson, founder of The Portola Group, had to say in this exclusive piece for King World News.This posting includes an audio/video/photo media file: Download Now | ||||

| Systemic Global MELTDOWN Happening RIGHT NOW! Posted: 26 Oct 2014 01:13 PM PDT In the New World, economic DISASTER is our fate we can't avoid. The global controllers have decided that we must be punished under their heavy hand, squeezing us into dust. As poverty and unemployment increase, more and more denial exists in the public and they effectively bring upon their normalcy... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||

| Mining CEO Calls on Fellow Miners to Halt Physical Silver Sales to End the Paper Manipulation Posted: 26 Oct 2014 04:20 AM PDT I have always been in favor of mining companies holding back the sale of a portion of their metals when prices dip. Furthermore, they should hold reserves beyond the amount needed to run daily operations in gold and silver, not fiat cash. It can always be converted if and when necessary. Lastly, offer an option to pay dividends in physical metal, cutting out the middlemen. Keith Neumeyer of First Majestic Silver was one of the first mining CEOs to do this and I applaud his actions. In the latest quarter, First Majestic held back 35% of their production, rather than selling it at deeply discounted paper prices. | ||||

| Events Impacting The Gold And Silver Price In The Week Of October 27th Posted: 26 Oct 2014 01:10 AM PDT In this article, we summarize the key events of the running week that could have an impact on the price of gold and silver price because of trading in COMEX futures. Over the last week, between October 20th and 25th, both gold and silver remained somehow stable. There was no specific event driven price change. Gold and silver are still moving at a key juncture. Silver has broken long time support and seems to be moving to the resistance line (see more in Michael Noonan’s latest chart analysis). Gold, on the other hand, is still above critical support but is not yet moving any sign of significant demand. Gold bulls should be able not to let prices go lower from here, at least not on a sustained basis, to avoid a break through critical support. One negative for the precious metals complex is that gold stocks have been sold off heavily during the week. As miners are mostly leading the metals, this is not a sign of health in the sector. On the other hand, gold is increasingly behaving as a safe haven in a world which is becoming more and more uncertain. For the week commencing October 27th, there are some key economic data coming mainly from the U.S. and European Union. There are no formal Central Bank statements expected. Mainly the data on Thursday and Friday have the potential to cause some moves in the markets and metals, although our expectation is that such moves will not be aggressive. Below is a more detailed calendar of key economic data in key markets. They are not necessarily driving gold and silver prices, but could cause price volatility:

Note: The primary focus of our website is to report on the different aspects of the gold market: fundamentals, economic and monetary analysis, basic technical analysis. Our view on the real price setting in the gold and silver market differs from the mainstream view. Price changes happen to coincide with events or announcements; mainstream media are used to report a relationship between both. However, we believe that the real price setting for the time being is taking place in the COMEX futures market. Market expert Ted Butler does an outstanding job analyzing the weekly evolution in the COMEX market and how it affects price setting. | ||||

| Gold Investors Weekly Review – October 24th Posted: 26 Oct 2014 12:48 AM PDT In his weekly market review, Frank Holmes of the USFunds.com summarizes this week's strengths, weaknesses, opportunities and threats in the gold market for gold investors. Gold closed the week at $1,230.39 down $7.93 per ounce (-0.64%). Gold stocks, as measured by the NYSE Arca Gold Miners Index, fell 1.31%. The U.S. Trade-Weighted Dollar Index rebounded 0.71% for the week. Gold Market StrengthsThe primary driver for the recent positive sentiment on gold is higher expected demand, particularly from China and India. Gold imports into India last month rose by roughly four times to 95 metric tons compared to 15 to 20 tons in September of last year. Festival season in India, as well as the deregulation of the Chinese gold market, has given a substantial boost to global gold demand. Gold analysts and traders are bullish on gold for the fourth-straight week, the longest streak since February. Bloomberg survey results for next week showed 11 out of 21 traders holding a bullish outlook for gold. Fear and uncertainty in the global economy is stimulating gold demand as well. This month the International Monetary Fund (IMF) downgraded its outlook for global growth, increasing the attractiveness of gold as a safe haven. Furthermore, the more dovish mentality from the Federal Reserve has been a big tailwind for gold, which has been depressed by expectations of rate increases. Gold Market WeaknessesSPDR Gold Trust holdings were reduced to their lowest level in a year on Monday. This decline in gold assets is concerning given that gold prices have recently rebounded. JP Morgan reduced its gold price forecast for 2015 and 2016 this week. The bank sees gold prices declining to $1,220 per ounce and $1,200 per ounce in 2015 and 2016, respectively.

Gold Market OpportunitiesThe first opinion poll pertaining to the Swiss gold referendum revealed stronger support for the policy than against. The referendum would require the Swiss National Bank to hold at least 20 percent of its reserves in gold. As it currently stands, the Swiss National bank has only 7 percent of its reserves in gold. The cost to reach the 20 percent mark would amount to roughly $70 billion of additional gold purchases.

Gold Market ThreatsPaul Tudor Jones, a world renowned macro trader, said that commodities as a whole will be ugly until at least 2020. Jones argues that having reached the peak a few years ago, commodities still have a long way to go before the bottom is reached. Severe droughts in the western United States may weigh heavily on mining companies operating in the region. In 2013, mining companies around the world spent $12 billion on water infrastructure, a 275 percent increase from 2009. The extra costs incurred by maintaining water quality and quantity are problematic for the industry.

|

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

I have been warning everyone that the gold and silver derivative markets were being “set ablaze” for the last few months and that the backrooms of these major participants (Deutsche Bank, JP Morgan, Citibank, HSBC, et al) are being gutted. These banks are not long for this world.

I have been warning everyone that the gold and silver derivative markets were being “set ablaze” for the last few months and that the backrooms of these major participants (Deutsche Bank, JP Morgan, Citibank, HSBC, et al) are being gutted. These banks are not long for this world.

No comments:

Post a Comment