saveyourassetsfirst3 |

- Our friend James Altucher is giving away 29 of his favorite books. Here’s how you can get them for FREE.

- How to survive in the gold market

- Silver Myths Smashed, Pt. 2: The Surprising Lie that some Gold Lovers Repeat

- Toxic Mix Blows up: Oil Price Collapse & Junk Bond Insanity

- Precious Metals Video Market Update

- Meet the Pied-à-Terre Levy – The Proposed Tax that Could Crush High End NYC Real Estate

- This is the Best Currency to Hold for Now (You May Be Surprised)

- Dr. Copper Succumbing to Deflationary Pressures

- S&P 500 to test Important Support

- Dollar plunges after weak U.S. data signal delayed Fed rate hike

- Argonaut Gold Announces Q3 Production of 32,122 Oz Au-eq

- Stewart Thomson: Gold Surges While Stock Markets Implode

- A secret scheme to manipulate silver prices?

- 9 Ominous Signals Coming From The Financial Markets That We Have Not Seen In Years

- Controversial post: This could mean 10 years of stock market losses ahead

- 10-year T-bond yields drop below 2% as stock sell-off continues

- Three Strikes and You're Out

- Metals market update for October 15

- Gold and silver rise again as US stocks slump and Citi warns of more severe corrections

- Asian gold demand fading above $1,230

- Skyrocketing gold and silver imports double India's trade deficit

- Sri Lankan military uncovers gold from battle sites

- The Heart Of The Ponzi

- First Majestic defers Q3 silver deliveries; looks for better prices

- “Secret Scheme To Manipulate The Price Of Silver” - Lawsuits Against Banks Proceed

- Harvey Organ’s Gold & Silver Update: We Are Moving Closer to Backwardation!

- SNB fights to block public gold vote

- Fresnillo looks to hedge some gold output

- Where is the gold price heading to now?

- NBC Correspondent Quarantined for Ebola is Spotted Going Out in New Jersey Anyway

- GOLD Likely TO Heal Lower As Sellers In Control

- “Secret Scheme To Manipulate The Price Of Silver” – Lawsuits Against Banks Proceed

- SA Mint releases new gold coin

- Wolf Richter: Toxic Mix for Fracking – Oil Price Collapse & Junk Bond Insanity

- Gold imports soar 450% in India

- Gold, silver doldrums to continue in 2015 - Natixis

- US Dollar Index (DX) Futures Technical Analysis – October 15, 2014 Forecast

- Gold Witnesses Corrective Advance

- Gold – Eases Away from Resistance at $1240

- US Fed rate hike will not affect India if Modi govt delivers key economic reforms

- Gold Faces Mixed Cues Ahead of US Data

- H.C. Wainwright Analyst Jeff Wright Names Three Companies that Could Turn the Gold Trend Upside Down

- Bond market crash is the biggest worry for the Bank of International Settlements

- Gold Stubs Swiss National Bank’s Toe, and the Financial Times Says ‘Ouch!’

- Too-Big-to-Fail Banks Face Up to $870 Billion Capital Gap

- Saudis Deploy the Oil Price Weapon Against Syria, Iran, Russia, and the U.S.

- Silver price-fixing lawsuits consolidated in Manhattan federal court

- Fighting back, First Majestic delays sale of silver amid price weakness

- Mark O'Byrne: Swiss Gold Referendum “Propaganda War” Begins

- Gold stubs Swiss National Bank's toe, and the Financial Times says 'ouch!'

| Posted: 15 Oct 2014 12:31 PM PDT From James Altucher:

“Why are you even doing this podcast?” Dave asked me. “Because I love my guests. I get to pick up the phone and call them and ask them anything I want.” From Peter Thiel to Mark Cuban to Coolio to Marni Kirnys, I simply love them. And maybe Coolio would never talk to me unless I had something called a “podcast.” I don’t even know what that stupid word means. Am I sitting in some sort of “pod” like Major Tom. Is ground control listening to me talk to Arianna Huffington? One person said to me: “But there’s no theme. You talk to entrepreneurs, rappers, random writers… JUST WHAT IS YOUR THEME?” He really wanted to know. Humans are NOT themes. Coolio was talking to me about the value of the U.S. dollar. Mark Cuban telling me what he was doing the second he became a billionaire. Geoffrey Miller telling me about the evolution of sex. Humans aren’t themes. Humans want to reach out and touch each other. They want to connect. They want to have something they leave behind. I open the door and say, you can come over here and leave something behind that hopefully people will listen to and enjoy for years. Yesterday, I read a book that was a page-turner. I was on a train from Baltimore to New York. It was a book about nothing to do with anything I’ve ever read before. I noticed the author has another book coming out in November. He has 10 or so New York Times Bestsellers behind him. As soon as I was done with the book, I wrote to him and said, “Can I talk to you?” And he wrote write back and said, “Yes!” And I said to myself “Yay!” I know the more times a day I say “YAY!” the longer I will live. Please, please, please promise me you will say “Yay!” a lot today. It might not work for you. But you can tell me later. We can play chess in the park when we are 100 years old and our backs hurt and we hold each other up when the day ends and the pieces are scattered by the wind, the game unfinished. By the time this post ends, I am going make you say “Yay!” Because I love my guests so much, and I love them because I mostly love their books, I want you to love them as much as I do and I want you have their books. I’ve picked out 29 of the books of my guests, some of them haven’t even appeared on the show yet. I want you to have them. All 29. I will pay for them. I gain nothing by doing this. You can have them in any form you want. I can’t give all 29 books to all the people who read this, but I can give them to some people. See the bottom of this post (and then you can say “Yay!”) Here are the books I’m giving out: (By the way, for those who wonder why I would do this, I have no clue. Maybe you can give me an answer why I would do this. I just want to run into you in the street and then we can all talk about the books we love. Yay!)

Here’s the link if you want to sign up for my giveaway. I think it’s about $400-500 in value, but I haven’t added it up. Maybe it’s more. There’s also ways to increase the chances of getting all of the books. I describe in the link. http://www.jamesaltucher.com/giveaways/james-altuchers-book-giveaway/ I charge nothing. I want nothing. I just want to run into you and we can say, “We both loved these books.” YAY! | ||||||||||||||||||||||||||

| How to survive in the gold market Posted: 15 Oct 2014 12:17 PM PDT Fans of gold have been following Federal Reserve Board announcements for any sign of relief, but H.C. Wainwright & Co. Analyst Jeff Wright says change may be a long time coming. | ||||||||||||||||||||||||||

| Silver Myths Smashed, Pt. 2: The Surprising Lie that some Gold Lovers Repeat Posted: 15 Oct 2014 12:00 PM PDT Silver investment demand has rocketed from less than 10% of industrial silver demand's size, to nearly 50% of its size in just 6 short years. This is historic. And it spells biiiiiiiig problems for the "biiiiiiig players". Submitted by The Wealth Watchman: Truth Gives You Such a High! Well, that was fun! In fact, smashing silver myths […] The post Silver Myths Smashed, Pt. 2: The Surprising Lie that some Gold Lovers Repeat appeared first on Silver Doctors. | ||||||||||||||||||||||||||

| Toxic Mix Blows up: Oil Price Collapse & Junk Bond Insanity Posted: 15 Oct 2014 11:38 AM PDT Theories abound why this is suddenly happening, after years of deceptive calm. Read….. Toxic Mix Blows up: Oil Price Collapse & Junk Bond Insanity | ||||||||||||||||||||||||||

| Precious Metals Video Market Update Posted: 15 Oct 2014 11:22 AM PDT Here is our brief analysis of Gold, Silver and the HUI Gold Bugs Index….

The post Precious Metals Video Market Update appeared first on The Daily Gold. | ||||||||||||||||||||||||||

| Meet the Pied-à-Terre Levy – The Proposed Tax that Could Crush High End NYC Real Estate Posted: 15 Oct 2014 10:58 AM PDT For quite some time, I have pointed out that many oligarchs will ultimately rue the day they made these investments in ghost skyscrapers. It always seemed obvious to me that once the billionaires had their fill, they would become a captive milk cow for local governments. When you buy a $20 million dollar home in NYC, and the market starts to cool even a little, there is no getting out. You are completely stuck and then it will be time to come collect. No one will feel sorry for you. No one will care. If you are an oligarch and you didn't see this coming, I don't know what to tell you. The pied-à-terre tax is now on the agenda in New York City… Read the rest here. | ||||||||||||||||||||||||||

| This is the Best Currency to Hold for Now (You May Be Surprised) Posted: 15 Oct 2014 10:45 AM PDT Surprisingly, this currency currently pegged to the dollar is likely the best currency to currently hold… Submitted by Simon Black, Sovereign Man: I just got off a two-hour conference call with the board of directors of our agricultural investment company. I'm fortunate that our board is comprised of some incredibly smart people, including a senior […] The post This is the Best Currency to Hold for Now (You May Be Surprised) appeared first on Silver Doctors. | ||||||||||||||||||||||||||

| Dr. Copper Succumbing to Deflationary Pressures Posted: 15 Oct 2014 10:44 AM PDT Even the sharp fall in the US Dollar today has not been enough to keep copper from falling sharply. It is currently down over $.08 as I type these comments, some 2.65% on the day. The fall in the red metal has completely erased the gains made on Monday and Tuesday of this week as well as those made late last week when it bounced away from the psychological $3.00 mark. It is threatening to sink below that once more. The meddle of the bulls is going to be severely tested here. If copper falls below the lows made last week and CLOSES below $3.00, I think we all had better pay attention as that would be a horrendous signal that the fall in stocks could become even more serious than it already is. Dr. Copper would be signaling a sharper contraction in the overall global economy and would bring into serious challenge the idea of "buy the dip" in stocks which has been the featured sentiment for longer than I can remember now. If the equity market sentiment shifts towards one of "sell the rally", look out! Speaking of equities, let me post up a quick chart of the Russell 2000 index. That is about as broad a basket of stocks as you can get. Two things to note. First - the highs near 1213 are now confirmed as a Double Top on the chart. The reason? Because support zone down near 1080-1075 has failed to hold. Bulls still have a chance to end the week back above that level in the last two trading days but the current negative sentiment seems quite strong for now. Secondly - the market has officially entered "CORRECTION" territory - which is defined as a move of 10% + off the peak high. Notice however that for the market to be declared officially a "BEAR", it would have to fall to near the 975 level and collapse through that level, preferably on strong volume. Thus, even though the selloff is incredibly violent at the moment, the market is undergoing a correction and has not yet, from a technical analysis standpoint, entered become a Bear. In other words, the Bull is wounded but not dead yet. Take a look at the S&P 500. It is quite different from the Russell. The index is flirting ever so dangerously with entering "CORRECTION" territory in today's session. Note how far down below the current price level it would have to drop to turn the BULL into a Bear. Stay tuned... as usual, time will make things clear for us but for now, the Bears have the upper hand but the Market is moving to levels that might shake the bulls out of their stupor. What is also rather interesting on a day like this is that while the Dollar has been getting shellacked, on the chart, it is still just bouncing up and down like a ping pong ball going nowhere. It is still stuck in a range between 87 on the top and 85 on the bottom. It did violate the bottom of the range early in the session but has rebounded and move back within the "box". Cattle are all over the place today. First they sold off quite sharply across the Board. Then the two front months began to move up and turned positive. Then the sellers came back in again and back down they went. The big fund long contingent in this market is fighting for dear life NOT to be flushed. Right now it looks as if they are losing the battle but the close is about 20 minutes off so anything is possible. It is amazing watching the amount of money some players will spend in an attempt to defend a position. Gold thus far has been able to shrug off the selling pressure coming in from those selling it to cover losses in stocks but is having some difficulty getting through the $1250 level. Silver is being drug lower by copper but getting some buying related to gold's good showing. I fear that if copper cracks $3.00 decisively, silver is going to fall. With the current equity weakness, unless we get some dose of economic data that is surprisingly strong ( say a jobs number ) instead of the surprisingly weak data we have been getting, gold is drawing support from ideas that any notion of the Fed raising interest rates soon is effectively DOA for the time being. What a day... I am already ready for Friday afternoon and it is only Wednesday! | ||||||||||||||||||||||||||

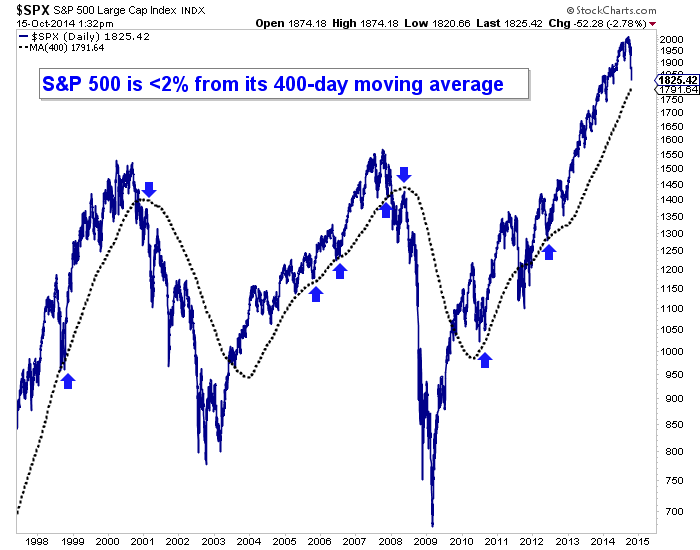

| S&P 500 to test Important Support Posted: 15 Oct 2014 10:40 AM PDT The 400-day moving average has been a very important pivot point over the past 20 years for the S&P 500. It has helped to mark bull and bear markets by way of marking support and resistance. The S&P 500 is now less than 2% from testing its 400-day moving average. It has been 2+ years since the S&P 500 tested its 400-dma. Note that from 1998 to 2000 the S&P did not test its 400-dma and for almost 18 months (mid 2006 to end of 2007) the S&P did not test its 400-dma. The bottom line is if the S&P 500 falls below its 400-dma, it will have fallen into a bear market.

The post S&P 500 to test Important Support appeared first on The Daily Gold. | ||||||||||||||||||||||||||

| Dollar plunges after weak U.S. data signal delayed Fed rate hike Posted: 15 Oct 2014 10:12 AM PDT The U.S. dollar hit a three-week low against the euro and a more than one-month low against the yen on Wednesday after weak U.S. economic data on retail sales and producer prices heightened concerns that the Federal Reserve would delay its first rate hike... Read | ||||||||||||||||||||||||||

| Argonaut Gold Announces Q3 Production of 32,122 Oz Au-eq Posted: 15 Oct 2014 10:01 AM PDT Toronto, Ontario – (October 15, 2014) Argonaut Gold Inc. ("Argonaut", "Argonaut Gold" or the "Company"; TSX: AR), announced today that the Company produced 32,122 gold equivalent ounces ("GEOs" or "GEO") during the third quarter ("Q3") ended September 30, 2014. This included 22,980 GEOs at its 100% owned El Castillo Mine ("El Castillo") located in Durango, Mexico and 9,142 GEOs at its 100% owned La Colorada Mine ("La Colorada") located near Hermosillo, Mexico. Additionally, the Company reported record GEOs loaded to the pads in Q3, which will be reflected in the fourth quarter ("Q4") production numbers.

1 GEOs are based on conversion ratio of 55:1 for silver to gold and is the referenced ratio throughout this release. THIRD QUARTER 2014 HIGHLIGHTS: Click Here for the Full Release The post Argonaut Gold Announces Q3 Production of 32,122 Oz Au-eq appeared first on The Daily Gold. | ||||||||||||||||||||||||||

| Stewart Thomson: Gold Surges While Stock Markets Implode Posted: 15 Oct 2014 09:15 AM PDT In late 2013, I predicted the Fed would taper all the way to zero in 2014, and suggested that taper would turn the Dow into a "wet noodle", while creating a rally in gold prices. That's the opposite of what most analysts thought would happen in 2014, and it's exactly what has transpired. The risk […] The post Stewart Thomson: Gold Surges While Stock Markets Implode appeared first on Silver Doctors. | ||||||||||||||||||||||||||

| A secret scheme to manipulate silver prices? Posted: 15 Oct 2014 08:23 AM PDT The lawsuits against banks that alleges they engaged in a secret scheme to manipulate the price of silver bullion is proceeding. | ||||||||||||||||||||||||||

| 9 Ominous Signals Coming From The Financial Markets That We Have Not Seen In Years Posted: 15 Oct 2014 08:00 AM PDT Is the stock market about to crash? Without a doubt we have been living through one of the greatest financial bubbles in U.S. history, and the markets are absolutely primed for a full-blown crash. We are starting to see some ominous things happen in the financial world that we have not seen happen in a very […] The post 9 Ominous Signals Coming From The Financial Markets That We Have Not Seen In Years appeared first on Silver Doctors. | ||||||||||||||||||||||||||

| Controversial post: This could mean 10 years of stock market losses ahead Posted: 15 Oct 2014 08:00 AM PDT From Bill Bonner, Chairman, Bonner & Partners: New England is stunning this time of year. Just what you’d expect. The leaves turn brown, yellow, and red, putting on their best outfits and strutting their stuff in the cool autumn air. Autumn, especially in New England, is the loveliest time of the year. The sun barely clears the tops of the trees, even at noon. The light, filtered through the colored leaves, gives the earth the rich and heavy air of a funeral parlor. Perhaps that is why there are market crashes in the fall. Investors feel the approach of death… Inflated by Debt Last week, we talked about the increase in volatility. Our friend and former World Bank economist Richard Duncan predicted this would happen. As the Fed’s QE comes to an end, he said, so will the EZ money supporting the stock market. Shrewd investors are looking ahead. Without the Fed behind it, what is the likely return from the U.S. stock market over the next 10 years? “Negative,” says equity analyst Stephen Jones. Stock prices are high. From these heights, stocks typically fall more than they rise – even without the withdrawal of QE. That’s because stock prices regress to the mean. This could bring 10 years of losses for stock market investors. Wait a minute, you might say, these prices are supported by earnings. But Stephen insists that corporate earnings have been inflated by debt. The money had to come from somewhere. And it could only have come from debt. So if the credit expansion stops, those earnings will deflate. That’s why the feds are so desperate to keep interest rates low and liquidity high. When rates rise, the jig is up. Earnings will fall. Stocks will fall. Credit will contract… and the economy with it. Tax revenues will shrink. Bonds will crash. Have we forgotten anything? Oh, yes… the entire model of modern government and finance will collapse, too. In fact, it will be the end of the world as we have known it. Drooping Leaves We (your editor is speaking for himself) were born at the beginning of the biggest boom in history. In Phase I, that boom was fueled by output – of babies, autos, TVs, and genuine economic growth. But in Phase II, it was fueled by credit. From 1964 to 2014, credit in the U.S. increased 50 times, as the economy shifted from manufacturing to finance – that is from making things to buying them with borrowed money. Now, 66 years later, the leaves are beginning to droop on the whole shebang. Last week, the IMF announced that the Chinese economy is now larger than that of the U.S., on a purchasing-power parity basis. In U.S. dollar terms, Chinese output may still be below the U.S. But when you adjust for what the local currency will buy, China is bigger… and getting bigger all the time. Another interesting feature of the report: Since the beginning of the financial crisis in 2008, the Chinese economy has grown not twice as fast as the US, but nine times as fast. But China is not immune to the seasons either. From Chongqing province comes the following news, via the Wall Street Journal: About 1,000 workers at a Foxconn plant in southwest China assembling printers and computers for companies went on strike for several hours this week demanding higher pay. The Taiwan-based company, formally known as Hon Hai Precision Industry Co., said the workers walked off the job for four hours Wednesday at its production site in Chongqing. About 20 workers went on strike Thursday morning but further details on that stoppage weren’t available. Foxconn is working with its labor union and workers to resolve the dispute, the company said Thursday in a statement. The company said the strikes didn’t disrupt production. Why is this important? It’s another leaf turning yellow, says former Reagan budget adviser David Stockman. Chongqing is on the western edge of China’s productive landmass and population centers. Go further west and you run into the Gobi Desert – lots of sand but few people. If China is running out of cheap labor there, it’s running out everywhere. Last of the Summer Wine A key component of Phase II of the great credit expansion was the entry of about 500 million workers into the international labor pool. Gradually, as American shoppers went to Walmart, they found more and more “Made in China” labels and “Everyday Low Prices.” This phenomenon largely offset the Fed’s inflation. In short, the U.S. found that it could inflate credit all it wanted without causing an alarming rise in prices or interest rates. But now, the summer is over. The strikes in Chongqing suggest that, even on the furthest fringes of China, bargaining power is shifting to workers. The well of cheap labor from impoverished Chinese peasants has been pumped dry. If that is so, labor rates will rise in China… and prices won’t be far behind. Don’t expect an immediate markup of flat-screen TV prices. This is a big boat the Chinese are turning. It will take years to manifest. Besides, it is just October. There are still November and December ahead. And don’t be surprised if stock market volatility spooks the Fed so that it goes back into QE mode – or worse. Relax. Enjoy the season. Leaves – like wine and women – can be at their best just as they begin their decline. And as a passenger on the Titanic was heard to remark after the ship hit an iceberg, “the band never sounded better.” Regards,

Bill Crux note: Bonner & Partners senior analyst Braden Copeland is urging all readers to prepare for a serious stock market correction… or worse. In his special report, “Open in Case of Emergency,” he lays out a step-by-step plan to protect your wealth before, during, and after a market crash. (HINT: It doesn’t involve selling your stocks or moving entirely into cash.) Find out how to get your own copy for FREE right here. | ||||||||||||||||||||||||||

| 10-year T-bond yields drop below 2% as stock sell-off continues Posted: 15 Oct 2014 07:35 AM PDT CNBC’s Rick Santelli reports on the major action in bonds, after the 10-Year yield fell below two per cent. Is this a capitulation bottom for yields before the bond market really blows up? These are dangerous times for what should be the safest of investment assets. No wonder gold and silver prices are going up… | ||||||||||||||||||||||||||

| Posted: 15 Oct 2014 07:15 AM PDT and no, I am not talking about the baseball playoffs but rather the triple whammy that completely obliterated both the US equity markets and the US Dollar this morning. The New York Fed released its business conditions index and it was scary; spooky scary. The index fell to - hold onto your hat - from 27.54 in September to 6.17 in October. Most analysts had been expecting a decline but a more modest one to near 20. This index is a reading of manufacturing activity. If the reading comes in above zero, it indicates expansion but come on already, a plunge of that magnitude is hardly reassuring if one is trying to find a healthy economy! That was strike one... Strike two - falling retail sales. They dropped 0.3% in September. Retail sales have been rising since January - albeit not at a breakneck speed but this is the first drop since then. Again, analysts had been expecting a fall but only a meager 0.1%. Strike three - a fall in the PPI or producer price index. It fell 0.1% in September. That was the first fall in a year! STocks plunged and so did the Dollar but what is breathtaking is the action in the long bond. The thing SOARED and was up over 4 points in early action. It has subsequently settled down to being up a mere 2 points ( note - this is sarcasm). Yields on the Ten Year just now fell BELOW 2% hitting a low, thus far, of 1.868%. Can anyone say DEFLATION! If that were not enough bad news for one day, yet another hospital worker has sadly contracted the Ebola virus. People are getting scared as they know full well that Mr. Happy Face, the current propaganda in chief from the CDC, has been lying to them about the mode of transmission. Let's see - we have a deadly disease in Africa that is threatening to become a world-wide epidemic, a group of grotesquely barbaric terrorists on the rampage through Mesopotamia and an economy that is looking more and more like it is running out of juice to sustain it - and NO, I am not talking about the bubonic plague, the Ottoman empire Turks and the mess in Europe during the Middle Ages but rather the 21th century. The more things change, the more they become the same. "That which has been is that which will be so that there is nothing new under the sun, " echoed the wisest man of a former age, one named Solomon in the book of Ecclesiastes. I will try to get some charts up a bit later. The long bond chart is breathtaking. By the way, the sinking Dollar is having a profound impact on gold as it moved strongly higher. However, there are two schools of thought out there right now impacting the yellow metal. The first is gold is a safe haven. The second is that it is liquid and can be sold to cover losses in equities ( margin related) and could very well sink along with the crude oil and rest of the commodity complex. IT looks as if the former is winning at the moment. Soybeans are still being squeezed by whomever it is that has decided to go after the shorts. The excuse this time around is the falling Dollar will make US beans more competitive on the global export markets. I am very concerned however about almost all of the commodities because if indeed this market selloff is the start of something more serious on the economic front, it is hardly going to be conducive to higher grain and bean prices. Even cattle, that stalwart of the commodity sector is succumbing. That has me sitting up and taking serious notice. Can beans be far behind? We'll see. Traders - be so very careful in these markets right now. They can run you over in mere seconds. | ||||||||||||||||||||||||||

| Metals market update for October 15 Posted: 15 Oct 2014 07:11 AM PDT Gold climbed $0.70 or 0.06% to $1,233.40 per ounce and silver slipped $0.05 or 0.29% to $17.40 per ounce yesterday. | ||||||||||||||||||||||||||

| Gold and silver rise again as US stocks slump and Citi warns of more severe corrections Posted: 15 Oct 2014 07:05 AM PDT Gold and silver retraced recent losses and moved forward again as the main US stock markets resumed their downward tumble. It is already getting hard to keep pace with this swiftly evolving picture but the trend is clearly towards lower equity prices and higher bond and precious metal prices. The traditional safe havens are back in fashion. Citi Private Bank Global chief strategist Steven Wieting discusses the economy and his outlook for the quickly deteriorating markets on ‘Bloomberg Surveillance’… | ||||||||||||||||||||||||||

| Asian gold demand fading above $1,230 Posted: 15 Oct 2014 07:05 AM PDT Asia demand waned but is expected to come back in full force on the fall in gold price, explains Julian Phillips. | ||||||||||||||||||||||||||

| Skyrocketing gold and silver imports double India's trade deficit Posted: 15 Oct 2014 07:04 AM PDT India's trade deficit doubled during September, thanks to sharp rise in gold and silver imports. | ||||||||||||||||||||||||||

| Sri Lankan military uncovers gold from battle sites Posted: 15 Oct 2014 07:00 AM PDT The Sri Lankan military has decided to hand over unspecified quantities of gold jewelry recovered from a battle site to Central Bank vaults. | ||||||||||||||||||||||||||

| Posted: 15 Oct 2014 06:45 AM PDT The Federal Reserve created false demand for real debt created by the Treasury…and now the Federal Reserve wants to pretend it can step aside for a real buyer somewhere out there for all this debt. Got Gold? Submitted by Chris Hamilton, SRSRocco Report: Given the Fed will complete its "taper" shortly…the topic of who has […] The post The Heart Of The Ponzi appeared first on Silver Doctors. | ||||||||||||||||||||||||||

| First Majestic defers Q3 silver deliveries; looks for better prices Posted: 15 Oct 2014 06:31 AM PDT GATA's Powell: '99.9% of gold and silver mining companies and their execs are brain-dead'. | ||||||||||||||||||||||||||

| “Secret Scheme To Manipulate The Price Of Silver” - Lawsuits Against Banks Proceed Posted: 15 Oct 2014 06:16 AM PDT gold.ie | ||||||||||||||||||||||||||

| Harvey Organ’s Gold & Silver Update: We Are Moving Closer to Backwardation! Posted: 15 Oct 2014 06:00 AM PDT Let’s head immediately to see what the data has in store for us today. First: GOFO rates: We are moving closer and closer to backwardation!! Submitted by Harvey Organ: Gold: 1233.60 up 4.30 Silver: 17.35 up 6 cents In the access market: Gold 1233.00 silver 17.40 The gold comex again had […] The post Harvey Organ’s Gold & Silver Update: We Are Moving Closer to Backwardation! appeared first on Silver Doctors. | ||||||||||||||||||||||||||

| SNB fights to block public gold vote Posted: 15 Oct 2014 05:51 AM PDT Swiss citizens will soon vote on an initiative that calls on the central bank to hold at least 20% its assets in gold. | ||||||||||||||||||||||||||

| Fresnillo looks to hedge some gold output Posted: 15 Oct 2014 05:47 AM PDT The miner has won shareholder approval to hedge up to 44% of the output from the Herradura project. | ||||||||||||||||||||||||||

| Where is the gold price heading to now? Posted: 15 Oct 2014 05:30 AM PDT moneyweek | ||||||||||||||||||||||||||

| NBC Correspondent Quarantined for Ebola is Spotted Going Out in New Jersey Anyway Posted: 15 Oct 2014 05:00 AM PDT NBC Chief Medical Correspondent Nancy Snyderman was part of a film crew that worked with freelance cameraman Ashoka Mukpo covering the ebola virus in Monrovia, Liberia. After it was discovered that Mr. Mukpo had come down with the virus, Dr. Snyderman agreed to quarantine herself for 21 days as part of a voluntary arrangement with the Centers […] The post NBC Correspondent Quarantined for Ebola is Spotted Going Out in New Jersey Anyway appeared first on Silver Doctors. | ||||||||||||||||||||||||||

| GOLD Likely TO Heal Lower As Sellers In Control Posted: 15 Oct 2014 05:00 AM PDT countingpips | ||||||||||||||||||||||||||

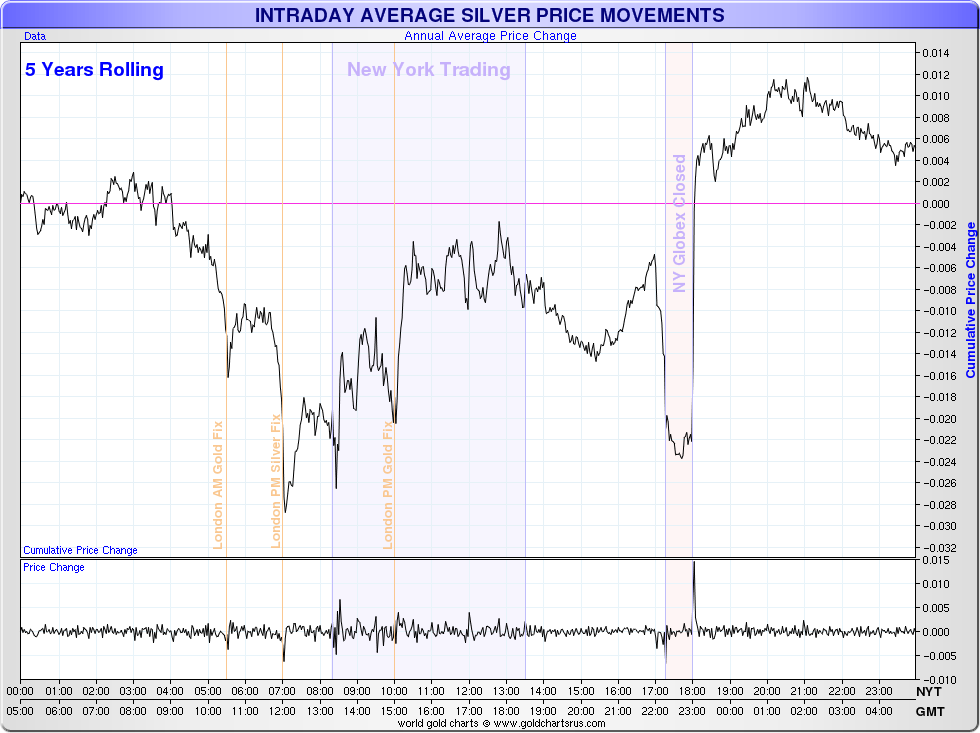

| “Secret Scheme To Manipulate The Price Of Silver” – Lawsuits Against Banks Proceed Posted: 15 Oct 2014 04:32 AM PDT "Secret Scheme To Manipulate The Price Of Silver" – Lawsuits Against Banks ProceedThe lawsuits against banks that alleges they engaged in a secret scheme to manipulate the price of silver bullion is proceeding.

Manipulation of the silver market was covered in a recently released 'Get REAL' Special on Silver presented by Jan Skoyles. Mark O’Byrne of Goldcore.com was interviewed and the interview was an in depth look at this silver market today. Litigation alleging that Deutsche Bank, Bank of Nova Scotia and HSBC Plc illegally fixed the price of silver were centralised in a Manhattan federal court yesterday. The banks have been accused of rigging the price of billions of dollars in silver to the detriment of investors globally. Lawsuits filed by investors since July over the allegations were consolidated yesterday in the U.S. District Court for the Southern District of New York, following an order issued last Thursday by the U.S. Judicial Panel on Multidistrict Litigation, a special body of federal judges that decides when and where to consolidate related lawsuits. The banks abused their position of controlling the daily silver fix to reap illegitimate profit from trading, hurting other investors in the silver market who use the benchmark in billions of dollars of transactions, according to the suit. Investors claim, the banks unlawfully manipulated silver and silver futures. The U.S. Judicial Panel on Multidistrict Litigation ruled that the cases should be handled by U.S. District Judge Valerie Caproni in Manhattan, who is already overseeing similar litigation over alleged gold price fixing. Three lawsuits were originally filed in Manhattan, and two were filed in Brooklyn. The plaintiffs in the Brooklyn lawsuits had sought to have the litigation consolidated there. The banks had also asked that the litigation be consolidated in Brooklyn, in the Eastern District of New York. However, the multidistrict litigation panel said Manhattan made more sense because the defendants all had corporate offices there and also because the cases involved issues similar to the gold litigation. The plaintiffs allege that the banks abused their power as participants in the silver fix, a London based benchmark pricing method dating back to the Victorian era, in which banks fixed silver prices once a day by phone. In August, the system was replaced by a new benchmark system administered by the CME (Chicago Mercantile Exchange) and Thomson Reuters. HSBC spokesman Neil Brazil declined to comment and representatives of the other banks did not immediately respond to requests for comment. This follows the initiation of similar actions against some bullion banks for alleged gold price manipulation earlier this year. The three named banks, Deutsche Bank, Bank of Nova Scotia, and HSBC are alleged to have abused their position at the LBMA to profit from inside knowledge. The fixing of the price of silver is a daily operation where banks on the panel of the LBMA agree on a price for the precious metals which are then used throughout the financial, jewellery and mining industries throughout the day. It is alleged that some of the banks who fix the price, position themselves advantageously in the silver market before the price is made public. “Defendants have a strong financial incentive to establish positions in both physical silver and silver derivatives prior to the public release of silver fixing results, allowing them to reap large illegitimate profits,” plaintiff Scott Nicholson told the AFP. Separately, Bullion Desk reported yesterday that JPMorgan Chase Bank is now the fifth accredited member of the silver pricing benchmark, the LBMA has confirmed, with others parties "in the pipeline", a spokesman said. A spokesperson said they had completed "strict regulatory controls" for accredited members.. JP Morgan becomes the fifth member, alongside HSBC Bank USA, Mitsui & Co Precious Metals, the Bank of Nova Scotia – ScotiaMocatta and UBS AG. It will be interesting to see if Chinese banks partake in the new fix process as the concern is that the fixes remain the play things of certain western banks and are not representative of global physical demand and supply of actual gold and silver bullion. Manipulation of the silver market was covered in a recently released 'Get REAL' Special on Silver presented by Jan Skoyles. Mark O’Byrne of Goldcore.com was interviewed and the interview was an in depth look at this silver market today. See Video here Gold climbed $0.70 or 0.06% to $1,233.40 per ounce and silver slipped $0.05 or 0.29% to $17.40 per ounce yesterday. Silver in U.S. Dollars – 1984 to October 14, 2014 (Thomson Reuters) Gold in Singapore fell 0.3% to $1,222.10 an ounce. The metal hit a four week high of $1,237.90 on Tuesday, before pulling back to close 0.4% lower. Silver for immediate delivery or Swiss storage fell 1.4% to $17.19 an ounce in London. Palladium dropped 1.6% to $782.10 an ounce. Platinum lost 1% to $1,254 an ounce. Gold fell on low volume again and futures trading volume was 40% below the average for the past 100 days for this time of day, data compiled by Bloomberg show. Volumes for the benchmark spot contract on the Shanghai Gold Exchange are about 33% lower than in late September, the latest data show however physical deliveries remain very high and are headed for 2,000 tonnes again in 2014. See Essential Guide To Gold and Silver Storage In Switzerland | ||||||||||||||||||||||||||

| SA Mint releases new gold coin Posted: 15 Oct 2014 03:46 AM PDT The Mint will make a contribution to the conservation of the Cape Mountain Leopard, an endangered species. | ||||||||||||||||||||||||||

| Wolf Richter: Toxic Mix for Fracking – Oil Price Collapse & Junk Bond Insanity Posted: 15 Oct 2014 03:31 AM PDT Yves here. As oil prices have collapsed, the fundamentals of fracking, which was overhyped given the short productive life of individual wells, now looks even more dubious at current energy price levels. And given how risky the sector has become, cheap debt, even in this time of ZIRP, is no longer freely available either. | ||||||||||||||||||||||||||

| Gold imports soar 450% in India Posted: 15 Oct 2014 02:24 AM PDT Imports at a new high; September trade deficit widens on gold imports. | ||||||||||||||||||||||||||

| Gold, silver doldrums to continue in 2015 - Natixis Posted: 15 Oct 2014 02:24 AM PDT Natixis forecasts declines in copper, gold and silver prices along with increases in lead, nickel, platinum, palladium, and zinc prices. | ||||||||||||||||||||||||||

| US Dollar Index (DX) Futures Technical Analysis – October 15, 2014 Forecast Posted: 15 Oct 2014 01:35 AM PDT fxempire | ||||||||||||||||||||||||||

| Gold Witnesses Corrective Advance Posted: 15 Oct 2014 01:25 AM PDT investing | ||||||||||||||||||||||||||

| Gold – Eases Away from Resistance at $1240 Posted: 15 Oct 2014 01:15 AM PDT marketpulse | ||||||||||||||||||||||||||

| US Fed rate hike will not affect India if Modi govt delivers key economic reforms Posted: 15 Oct 2014 01:08 AM PDT For the first time in two decades, the developed nations on both sides of the Atlantic may be decoupling on interest rates. The US, the supplier of cheap money across the world, is poised to make the dollar more expensive, while the European Central Bank and the Bank of Japan have promised to run their printing presses for an indefinite period. Read | ||||||||||||||||||||||||||

| Gold Faces Mixed Cues Ahead of US Data Posted: 15 Oct 2014 01:00 AM PDT dailyfx | ||||||||||||||||||||||||||

| H.C. Wainwright Analyst Jeff Wright Names Three Companies that Could Turn the Gold Trend Upside Down Posted: 15 Oct 2014 01:00 AM PDT | ||||||||||||||||||||||||||

| Bond market crash is the biggest worry for the Bank of International Settlements Posted: 15 Oct 2014 12:08 AM PDT A sudden and precipitous fall in the bond market is the biggest worry at the Bank of International Settlements, the central bank for the central banks based in Basel, according to Guy Debelle, head of the BIS's market committee. Speaking in Sydney and cited in The Daily Telegraph today, he said: ‘The sell-off, particularly in fixed income, could be relatively violent when it comes. There are a number of investors buying assets on the presumption of a level of liquidity which is not there. This is not evident when positions are being put on, but will become readily apparent when investors attempt to exit their positions. The exits tend to get jammed unexpectedly and rapidly.’ True believers Mr. Debelle thought it strange that bond market participants seemed to always believe what central banks told them: ‘I find it somewhat surprising that the market is willing to accept the central banks at their word, and not think so much for themselves…That is a point we haven't started from before. There are undoubtedly positions out there which are dependent on (close to) zero funding costs. When funding costs are no longer close to zero, these positions will blow up.’ Many firms have also left the bond market leaving it particularly vulnerable in a sell-off, he noted: ‘Market liquidity is structurally lower now than it was in the past. The question today is whether there is too little capacity. When volatility returns, it may well rise quite rapidly.’ Mr. Debelle pointed back to the US treasury bond crash of 1994, but warned that it could be even more violent this time with a ‘fair chance that volatility will feed on itself.’ What would this mean for global investors? If history if any guide then when bond markets blow-up precious metals are usually the only asset class left that investors trust. The rotation is first into gold and silver, and because of supply constraints the impact on their price is dramatic. Investment implications The price of real estate and stocks will crash too because the cost of money suddenly becomes dramatically more expensive and that upsets many business models and bankruptcy and bank failures follow. Eventually prices will stabilize and look attractive to those owning precious metals and the cycle can begin again. Bond markets are like any other and rise from one extreme to another before falling. What is different this time as Mr. Debelle highlights is the degree of exaggeration due to central bank interventions since the global financial crisis. If he’s right this is about to blow-up in their faces as the most dramatic policy failure of all time. The BIS is hardly a fringe newsletter writer trying to generate an audience. It’s perhaps the last bastion of commonsense in a world gone mad. | ||||||||||||||||||||||||||

| Gold Stubs Swiss National Bank’s Toe, and the Financial Times Says ‘Ouch!’ Posted: 14 Oct 2014 11:24 PM PDT "West Texas Intermediate hit a new low for this move down" ¤ Yesterday In Gold & SilverThe gold price got sold down a few dollars starting at the 6 p.m. EDT open in New York on Monday evening---and from there it traded sideways in a very tight range, but began to rally once the noon London silver fix was done for the day. 'Da boyz' put an end to that at the 8:20 a.m. EDT Comex open fifty minutes later---and it was all down hill into the close. The lows and highs aren't worth mentioning. Gold finished the Tuesday session in New York at $1,232.20 spot, down $4.90 from Monday. Net volume was reasonably light at 111,000 contracts, a few thousand contracts less than Monday's volume. Silver also got sold down at the open as per usual on Monday evening---and then pretty much followed the gold price path for the remainder of the Tuesday session. The high and low are barely worth looking up, but the CME Group recorded them as $17.57 and $17.325 in the December contract. Silver was closed down 11 cents yesterday to $17.39 spot. Net volume was pretty light at only 24,500 contracts. Platinum rallied a bit in the early going in Far East trading on their Tuesday, with the high tick coming about 1:30 p.m. Hong Kong time. By noon in Zurich, it was back to about unchanged on the day---and didn't do much after that, finishing the day up 4 dollars. Palladium rallied about ten bucks by 2 p.m. Hong Kong time---and then chopped around from there, closing up 7 bucks. The dollar index closed in New York late on Monday afternoon EDT at 85.22---and continued its rally that began off the 85.09 low that began around 5:05 p.m. just before Monday's close. Most of the indexes gains yesterday were in by 11 a.m. BST in London---and the index crawled higher from there, closing at 85.88---up 66 basis points, which was everything it lost during the Monday trading session. Forgive me for mentioning this, but it appeared that, once again, a buyer of last resort showed up to catch the proverbial falling dollar index knife at 5:05 p.m. EDT on Monday, as it was about to slice through the 85.00 mark. Here's the 3-day chart so you can see this rally from its beginnings late on Monday afternoon EDT. The gold stocks opened in the black---and rallied to their highs at exactly 11 a.m. EDT. From there they chopped lower, as the HUI gave up a large portion of its earlier gains, finishing the day up 1.05%. It was about the same for silver equities, but they rallied much more vigorously---and also sold off much more vigorously as well, as Nick Laird's Intraday Silver Sentiment Index finished up only 1.07%. At its high, the index was up 3.5%. The CME Daily Delivery Report showed that zero gold and 10 silver contracts were posted for delivery within the Comex-approved depositories on Monday. The short/issuer in silver was Jefferies once again. The CME Preliminary Report for Tuesday showed that gold's open interest in October dropped by 72 contracts down to 987 contracts---and in silver, the o.i. for October declined by 11---down to 183 contracts. There were no reported changes in GLD yesterday---and as of 9:45 p.m. yesterday evening, there were no reported changes in SLV, either. Earlier this morning Europe time, the good folks over at Switzerland's Zürcher Kantonalbank updated their gold and silver ETFs for the week ending on Friday, October 10---and this is what they had to report: Their gold ETF declined by 11,571 troy ounces, but their silver ETF actually rose by 25,505 troy ounces. The U.S. Mint had a very decent sales report yesterday. They sold 3,500 troy ounces of gold eagles---4,000 one-ounce 24K gold buffaloes---and 430,000 silver eagles. There wasn't much in/out activity in gold at the Comex-approved depositories on Monday, as only 9,645 ounces were reported received---and one kilobar was shipped out. The link to that activity is here. And, much to my amazement, there was no in/out activity in silver at all. It's been a while since I've seen that. I have a decent number of stories for you again today---and I hope you have the time to read the most important ones. ¤ Critical ReadsMore Q.E. would be appropriate if U.S. economy faltered - Fed's WilliamsA bellwether Federal Reserve policymaker on Tuesday downplayed concerns about weakness in the global economy, saying the U.S. central bank should only delay an interest rate hike next year if inflation or wages fail to perk up. John Williams, president of the San Francisco Fed, said in an interview with Reuters that the first line of defense at the central bank, if needed, would be to telegraph that U.S. rates would stay near zero for longer than mid-2015, when he currently expects them to rise. If the outlook changes "significantly," with inflation showing little sign of returning to the central bank's 2-percent target, he said he would even be open to another round of asset purchases. Jim Rickards was right---QE4 in 2015---watch for it! This Reuters story, filed from Washington, was posted on their website at 3:54 p.m. EDT yesterday afternoon---and falls in to the absolute must read category. You'll note that the 'Thought Police' at Reuters changed the headline to a far softer sounding "Exclusive: Fed's Williams downplays global risks, eyes U.S. inflation". Today's first story is courtesy of Manitoba reader U.M. The $11 Trillion Advantage That Shields U.S. From TurmoilCall it America’s $11 trillion advantage: Consumer spending is likely to steer the U.S. economy safely through the shoals of deteriorating global growth and turbulent financial markets. The combination of more jobs, falling gasoline prices and low borrowing costs will help lift household purchases. Such tailwinds probably matter more than Europe’s struggles or the slackening in emerging markets that caused the Dow Jones Industrial Average last week to erase its gains for the year. Household purchases make up almost 70 percent of the $16.8 trillion U.S. economy and have climbed an average 2 percent in the recovery that’s now in its sixth year. Spending growth will accelerate to 2.7 percent next year after 2.3 percent in 2014, according to the latest Bloomberg survey of economists. “We’ve got a lot of things working in favor of the consumer right now,” said Nariman Behravesh, chief economist in Lexington, Massachusetts, at IHS Inc. “To have that kind of strength is the biggest asset for the U.S. It’s a pretty rock solid footing.” As we know already, consumer 'confidence' can vanish in an instant if given the right/wrong circumstances, as we've seen it before. This Bloomberg news/propaganda item was posted on their website at 8:01 Denver time yesterday morning---and I thank Howard Wiener for sharing it with us. JPMorgan sets aside $1 billion for forex-rigging penaltyJPMorgan Chase set aside $1 billion in legal reserves, depressing third-quarter results, as the largest U.S. bank by assets prepares to pay big penalties over allegations it manipulated the foreign exchange market. The bank has paid billions of dollars in penalties over regulatory violations and lawsuits in the past two years -- ranging from the "London whale" trading fiasco to mis-selling mortgage-backed securities. Bulking up its reserves by $1 billion was more than analysts expected and took the bank's profits for the three months to the end of September below expectations, at $5.6 billion. It is a sign, according to people familiar with the matter, that JPMorgan is close to settling enforcement action, which is being led by authorities in the U.K. and U.S., and affects several of the worlds biggest currency trading banks. Another licensing fee---and nobody goes to jail. Just the cost of doing business. This news item appeared on the Financial Times website yesterday---and it's posted in the clear in this GATA release. All That is Broken With the U.S. Financial System in One ChartWe have shown this chart before. We will show it again because, to nobody's surprise, nothing has changed since then. The chart in question, which we believe demonstrates all that is wrong with the US financial and banking system, shows JPM's quarterly deposits, which in Q3 just hit a new all time record of $1.335 trillion, and its loans, which despite the much hyped rebound in Q2, once again declined to $743 billion from $747 billion in Q2 (so much for that lending-driven recovery?) leading to a new record low Loan-to-Deposit ratio of 56%. So while deposits are obviously hitting new record nominal highs quarter after quarter, when was the last time JPM's loans printed at all time highs? The answer: just as Lehman filed for bankruptcy, when the number was $761 billion. This brief Zero Hedge piece appeared on their website at 10:54 a.m. EDT yesterday morning---and I thank Manitoba reader U.M. for her second offering of the day. It's worth reading. This Time is Different—–For the First Time in 25 Years the Wall Street Gamblers are Home AloneExcept this time is indeed different, but not in a good way. When Bernanke & Co. stalled off the August 2007 correction for nearly a year, they still had plenty of dry powder. The federal funds rate was 5.25% and the Fed’s balance sheet was only $850 billion. But now, however, we are on the far side of the great monetary experiment known as ZIRP and QE. The money market rate is at the zero bound and has been pinned there for 69 months running—a stretch never before experienced even during the Great Depression. Likewise, the Fed’s balance sheet has grown by 5X to nearly $4.5 trillion—again a previously unimaginable eruption. But what is profoundly different this time is that the Fed is out of dry powder. Its can’t slash the discount rate as Bernanke did in August 2007 or continuously reduce it federal funds target on a trip from 6% all the way down to zero. Nor can it resort to massive balance sheet expansion. That card has been played and a replay would only spook the market even more. So this time is different. The gamblers are scampering around the casino fixing to buy the dip as soon as white smoke wafts from the Eccles Building. But none is coming. For the first time in 25 years, the Wall Street gamblers are home alone. This commentary by David Stockman appeared on his Internet site yesterday---and Roy Stephens sent it to me in the wee hours of this morning. It's a longish read, but well worth it if you have the time. Americans face post-foreclosure hell as wages garnished, assets seizedMany thousands of Americans who lost their homes in the housing bust, but have since begun to rebuild their finances, are suddenly facing a new foreclosure nightmare: debt collectors are chasing them down for the money they still owe by freezing their bank accounts, garnishing their wages and seizing their assets. By now, banks have usually sold the houses. But the proceeds of those sales were often not enough to cover the amount of the loan, plus penalties, legal bills and fees. The two big government-controlled housing finance companies, Fannie Mae and Freddie Mac, as well as other mortgage players, are increasingly pressing borrowers to pay whatever they still owe on mortgages they defaulted on years ago. Using a legal tool known as a "deficiency judgment," lenders can ensure that borrowers are haunted by these zombie-like debts for years, and sometimes decades, to come. Before the housing bubble, banks often refrained from seeking deficiency judgments, which were seen as costly and an invitation for bad publicity. Some of the biggest banks still feel that way. But the housing crisis saddled lenders with more than $1 trillion of foreclosed loans, leading to unprecedented losses. Now, at least some large lenders want their money back, and they figure it’s the perfect time to pursue borrowers: many of those who went through foreclosure have gotten new jobs, paid off old debts and even, in some cases, bought new homes. This Reuters story, filed from New York, showed up on their website at 3:35 a.m. EDT on Tuesday---and I thank reader 'h c' for sending it along. Citigroup to Exit Retail Banking in 11 MarketsCitigroup customers across Central America and parts of Eastern Europe will be looking for a new place to bank next year. Citigroup said Tuesday that it will bow out of the retail banking business in 11 markets, part of its ongoing effort since the financial crisis to restructure and slim down. The news came as the bank announced third-quarter earnings. Citi said the impact would primarily be smaller countries in Latin America: Costa Rica, El Salvador, Guatemala, Nicaragua, Panama and Peru. It will also exit consumer banking in Egypt, Japan, the Czech Republic, Hungary and Guam. The bank is exiting those areas to focus on market share and growth potential in places where it believes it can be competitive, Citigroup CEO Michael Corbat said in a statement. It will still have institutional banking operations in these areas. This AP story appeared on the abcnews.go.com Internet site at 3:00 p.m. EDT on Tuesday---and I thank West Virginia reader Elliot Simon for finding it for us. Too-Big-to-Fail Banks Face Up to $870 Billion Capital GapToo big to fail is likely to prove a costly epithet for the world’s biggest banks as regulators demand they increase holdings of debt securities to cover losses should they collapse. The shortfall facing lenders from JPMorgan Chase & Co. to HSBC Holdings Plc could be as much as $870 billion, according to estimates from AllianceBernstein Ltd., or as little as $237 billion forecast by Barclays Plc. The range is so wide because proposals from the Basel-based Financial Stability Board outline various possibilities for the amount lenders need to have available as a portion of risk-weighted assets. With those holdings in excess of $21 trillion at the lenders most directly affected, small changes to assumptions translate into big numbers. This Bloomberg article, filed from London, showed up on their website in the wee hours of yesterday morning MDT---and its another contribution from reader U.M. It's definitely worth your time. Richest 1% own 50 percent of world wealth - Credit Suisse reportWorld wealth has reached a record $263 trillion but is concentrated in fewer hands. The richest 1 percent have accumulated more wealth, and own almost 50 percent of it, which could trigger recession, according to a new report by Credit Suisse. The Credit Suisse Global Wealth Report, released Tuesday warns that the “abnormally high wealth income ratios” may spark a recession, as high disparity leads to economic friction. Global wealth has grown to a record $263 trillion in mid-2014, $20.1 trillion more, and an 8.3 percent increase, over mid-2013. Household wealth has more than doubled since 2000, when the same report calculated it at $117 trillion. Leading the money trail is the United States, dubbed 'Land of Fortunes' by the report, which again boasts the highest average wealth. It is home to 34.7 percent ($91 trillion) of global wealth. Europe’s portion comes in a close second with 32.4 percent, followed by India and China’s 23.7 percent share, and then the 18.9 percent concentrated in the Asia-Pacific region. This rather short story appeared on the Russia Today website at 2:36 p.m. yesterday afternoon Moscow time, which was 6:36 a.m. EDT in New York. I thank Harry Grant for sending it along in the wee hours of this morning. It's worth skimming---and the embedded chart is certainly worth a look, even if you don't want to read the whole thing. Sprott Money Weekly Wrap UpJeff Rutherford interviews Eric Sprott---and he shares his views on the European and U.S. economy, the Ebola outbreak, and the set-up in the precious metals market. It runs for 7:59 minutes---and it was posted on the sprottmoney.com Internet site on Monday. Economics Nobel laureate tells France to 'downsize the state'Speaking on FRANCE 24, French economist Jean Tirole advocated Scandinavian-style labour market policies and government reform as a way of preserving France’s social model. Hours after he won the economics Nobel Prize, Tirole said he felt “sad” the French economy was experien | ||||||||||||||||||||||||||

| Too-Big-to-Fail Banks Face Up to $870 Billion Capital Gap Posted: 14 Oct 2014 11:24 PM PDT Too big to fail is likely to prove a costly epithet for the world’s biggest banks as regulators demand they increase holdings of debt securities to cover losses should they collapse. The shortfall facing lenders from JPMorgan Chase & Co. to HSBC Holdings Plc could be as much as $870 billion, according to estimates from AllianceBernstein Ltd., or as little as $237 billion forecast by Barclays Plc. The range is so wide because proposals from the Basel-based Financial Stability Board outline various possibilities for the amount lenders need to have available as a portion of risk-weighted assets. With those holdings in excess of $21 trillion at the lenders most directly affected, small changes to assumptions translate into big numbers. This Bloomberg article, filed from London, showed up on their website in the wee hours of yesterday morning MDT---and its another contribution from reader U.M. It's definitely worth your time. | ||||||||||||||||||||||||||

| Saudis Deploy the Oil Price Weapon Against Syria, Iran, Russia, and the U.S. Posted: 14 Oct 2014 11:24 PM PDT Asian stock markets continued to fall today, propelled at least in part by the adverse reaction to the Saudi announcement yesterday that they would let oil prices fall to $80 a barrel. And further reports indicate that the Saudis intend to keep oil prices low enough to force a realignment of prices not just among various grades of crude, but also for intermediate and long-term substitutes. It is critical to remember that the Saudis have no compunction about imposing costs on other nations to maximize the value of their oil resource long term and hence the power they derive from it. The 1970s oil shock produced a nasty recession in the US and most other advanced economies and gave a further impetus to inflation, which was already hard to manage and dampened growth by discouraging investment. The current alignment of factors gives the Saudis the opportunity to make life miserable for a long list of parties they would like to discipline, including the US. The sharp rise in the dollar means that lowering the price of oil in dollar terms is unlikely to leave the desert kingdom worse off in local currency terms. But it undermines US energy development, both fracking and development in the Bakken, as well as more development by the majors, who were regularly criticized by analysts for how much they were spending on exploration when the math didn’t pencil out well at over $100 a barrel. Countries whose oil is output is mainly heavy, sour crude, like Iran and Venezuela, find it hard to sell their oil when prices are below $100 a barrel (or at least when the dollar was weaker, but the $80 price point, even with a strong dollar, may be low enough to cause discomfort). In other words, this is a classic case of predatory pricing: set your price low enough long enough to do real damage to competitors, and reduce their market share, not just immediately, but in the middle to long term. This amazing commentary appeared on the nakedcapitalism.com Internet site yesterday---and it falls into the absolute must read category. My thanks got out to reader U.M. for bringing it to our attention. | ||||||||||||||||||||||||||

| Silver price-fixing lawsuits consolidated in Manhattan federal court Posted: 14 Oct 2014 11:24 PM PDT Litigation alleging that Deutsche Bank, Bank of Nova Scotia, and HSBC illegally fixed the price of silver has been centralized in Manhattan federal court. Lawsuits filed by investors since July over the alleged price-fixing were consolidated on Tuesday in the U.S. District Court for the Southern District of New York, following an order issued last Thursday by the U.S. Judicial Panel on Multidistrict Litigation, a special body of federal judges that decides when and where to consolidate related lawsuits. The panel ruled that the cases should be handled by U.S. District Judge Valerie Caproni in Manhattan, who is already overseeing similar litigation over alleged gold price-fixing. This Reuters story appeared on their Internet site at 2:26 p.m. EDT on Tuesday afternoon---and I found it over at the gata.org Internet site. | ||||||||||||||||||||||||||

| Fighting back, First Majestic delays sale of silver amid price weakness Posted: 14 Oct 2014 11:24 PM PDT Ninety-nine point nine percent of gold and silver mining companies and their executives are brain-dead, merely geologists and accountants, unaware of the monetary nature of their product and how their product is priced by surreptitious market intervention by central banks. But here and there certain companies and their executives have a clue, and First Majestic Silver Corp. today again proclaimed itself to have far more than a clue. First Majestic announced that it won't sell its metal into the recent weakness in the silver futures markets. In a statement the company said: "Silver prices declined 19 percent in the third quarter, representing the second largest quarterly decline since the financial crisis in 2008. As a result of this weakness, the company decided to temporarily suspend silver sales in an attempt to maximize future profits. This suspension of sales will result in lower revenues and earnings for the third quarter. However, it is likely that these inventories of unsold ounces will instead be sold in the fourth quarter. As of September 30, 2014, approximately 934,000 ounces of silver were held in inventory." CEO Keith Neumeyer and his company First Majestic Silver, not being a member of The Silver Institute, can do what he wants---not like the other bought and paid for companies that are listed as members. I'm a shareholder in this company---and have been for almost as long as it has been around. I applaud this move---and so should you, as it takes real courage to lead in times like this. I just hope that there's no surprise blowback from left field in the near future. This GATA release is definitely worth reading. | ||||||||||||||||||||||||||

| Mark O'Byrne: Swiss Gold Referendum “Propaganda War” Begins Posted: 14 Oct 2014 11:24 PM PDT The referendum for the Swiss Gold Initiative is scheduled for November 30th and the propaganda war - between the Swiss National Bank (SNB) and the Swiss Parliament on one side and the Swiss People's Party (SVP) on the other - has begun and we expect it to escalate as the day draws nearer. The SNB, who oppose the initiative, has warned that a 'yes' vote would severely hamper the ability of the central bank to conduct its business. A proposal that the SNB should hold a fifth of its assets in gold and be prohibited from selling the precious metal in the future would severely restrict its ability to conduct monetary policy, Vice President, Jean-Pierre Danthine, told the Wall Street Journal. The gold referendum was proposed by the SVP and backed by the necessary 100,000 signatures required the put an issue to referendum in Switzerland. The SVP is one of the largest political parties in Switzerland. The party is the largest party in the Swiss Federal Assembly, with 54 members of the National Council and 5 of the Council of States. This indicates a degree of popular support for the measure and all eyes are on November 30th. If the referendum is passed, it would result in the following--- This Tuesday commentary by Mark was posted on the goldcore.com Internet site yesterday morning BST---and is worth your time. I thank reader M.A. for sending it our way. | ||||||||||||||||||||||||||

| Gold stubs Swiss National Bank's toe, and the Financial Times says 'ouch!' Posted: 14 Oct 2014 11:24 PM PDT On its own hook this Financial Times "news" story accuses the Swiss gold initiative of "absurdities," mockery the newspaper has yet to hurl against central banks even as they intervene openly in every market and resort to "negative interest rates." Yes, in the FT's view only gold as money can be "absurd." And largely surreptitious control of the valuation of all capital, labor, goods, and services in the world by an unelected, supra-national elite isn't totalitarian -- it's good government! Central banking, heil! This must read story appeared on the Financial Times website yesterday---and is posted in the clear in this GATA release. The actual headline to the story reads "Swiss Fight to Block Public Gold Vote". | ||||||||||||||||||||||||||

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment