Gold World News Flash |

- Is Gold Still a Good Investment? David Morgan on Prudent Money

- Gold Daily and Silver Weekly Charts – A Little Flight to Safety

- Silver Bulls Turn Red?

- John Williams - We’re Coming to the End Game

- SILVER MYTHS SMASHED, Part 3: The Silliest Question You Could Possibly Ask about Silver

- Here Is Yet Another Frightening Prediction To End 2014

- After Central Bank Financial Bubbles, Comes Liquidation And Industrial Deflation

- Gold stubs Swiss National Bank's toe, and the Financial Times says 'ouch!'

- 12 Charts That Show The Permanent Damage That Has Been Done To The US Economy

- Oil price dip is Saudi bow to China, Leeb tells King World News

- The Gold Price Rose 0.35 Percent Closing at $1,233.60

- Fighting back, First Majestic delays sale of silver amid price weakness

- George Soros Bought $10.5 Million of Silver Wheaton Corp.; Should You Buy, Too?

- Don’t Miss Your Chance to Profit from the “End of OPEC”

- Gold Daily and Silver Weekly Charts - The Almighty Dollar

- Here Is China’s Stunning Master Plan For Gold, Silver & Oil

- A Win-Win Scenario for Gold Investors

- Silver price-fixing lawsuits consolidated in Manhattan federal court

- 3 Ways to Protect Yourself (and Profit) from Cyberattacks

- Gold Surges While Stock Markets Implode

- Gold Prices Rally Strongly amid Falling Equities

- Ted Butler’s Silver Price Outlook – Why This Time Could Be Different

- Building an Ark: How to Protect Public Revenues From the Next Financial Meltdown

- Peter Schiff - China's Boom and Lust for Gold - Video

- Silver, Warfare and Welfare

- Swiss Gold Referendum “Propaganda War†Begins

- South Africa's gold CEOs ready for mergers as prices decline

- JPMorgan sets aside $1 billion for forex-rigging penalty

- 2014 The Last Economic Crash

- U.S. Dollar Sea Change

- Inflation, Deflation, and Our Very Confident Bet in T-Bonds

- John Kaiser's Tips for Escaping the Resource Sector Swamp Alive

- Silver, Warfare and Welfare

- End of U.S. Dollar Hegemony - Not

| Is Gold Still a Good Investment? David Morgan on Prudent Money Posted: 15 Oct 2014 12:30 AM PDT from silver investor.com: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts – A Little Flight to Safety Posted: 14 Oct 2014 11:00 PM PDT from Jesse's Café Américain:

Silver cannot seem to get out of its own way, but managed to post a little gain in the aftermarket. As a reminder, this Friday is a stock option expiration, so let’s be on the lookout for the games Wall Street people play. There was no real economic news in the US for Columbus Day holiday, but we have some news later this week, and as always earnings reports. I don’t know if it is the November elections effect or what, but the commentary on American television is going from silly to absurd. The Very Serious People in New York and Washington must be living in some alternate universe. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Oct 2014 10:30 PM PDT from AltInvestorshangout: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| John Williams - We’re Coming to the End Game Posted: 14 Oct 2014 10:04 PM PDT John Williams, founder of ShadowStats.com, says, "The big factor here is the U.S. dollar and all sorts of things that impact that. The economy is probably the biggest. You also have the Fed policy. Right now, there is the presumption that the easing is over and they are going to raise... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SILVER MYTHS SMASHED, Part 3: The Silliest Question You Could Possibly Ask about Silver Posted: 14 Oct 2014 09:35 PM PDT So Many Myths, So Little Time from The Wealth Watchman:

No, the most difficult part is actually choosing which lie to crack open next! There are just so many of these chuckle-inducing myths, that it feels like being a little kid in a toy store. Do I take home the train set or the Batcave? No no, wait! This! A thousand times this!

Great job, kiddo! You'll be carving up all those silver lies, like delicious Thanksgiving turkeys, in no time! Valuable life lesson: it doesn't matter what the problem was, as the light saber is usually the solution(rock on, little shield brother!). Just like the Truth, come to think of it! No matter what the problem is, truth stands ever-ready to bridge the gap. The evil in our world can plot and scheme all they like. Most of the time, there's not much you can do about it. They're just gonna do what they do, and that's how it is. But, most folks forget the other part of the equation: that those men cannot keep all of you from doing your thing! That's a fact. They can't stop you from spreading truths like hundreds of contagious brush-fires. They can't stop you from peeling back all their lies, which took them so many years to construct. They can't stop you from thinking for yourself, or for distrusting everything that proceeds from their political and media mouth-pieces. Most importantly, though, they can't stop you from buying real, honest-to-goodness, silver! Don't concentrate on their power, concentrate on yours. You may think you're powerless, but you're the furthest thing from powerless that you can imagine. Again, turn their crimes against them, and make gravity your ally. Use your great resolve to stick to your guns. If that little devil on your shoulder appears to you, and asks if you're really making the right decision, just send the little guy on a mission to renew your driver's license at the DMV. That oughta keep him busy for awhile! Another Silver Myth Silver warriors, ya know that mechanism deep inside of you, that all-important filter, if you will, which keeps your most private thoughts…..private? That marvelous fishnet which scoops up the worst musings within all of us, and provides us the great security of capturing and killing those thoughts before they can ever, ever escape from our mouths into wide, open spaces? Ahh, it's wonderful isn't it? The very thing which keeps us all from going up to a strange woman, and asking: "Excuse me, but I was just curious, how much do you weigh?" Or: "Why would you do that to your hair?" Or: "What's the most embarrassing thing that's ever happened to you?" Seriously, dude, it's probably being questioned by you. Yes, we all know those questions are a bad idea, and yet so many people still ask those same types of questions about silver. Don't believe me? I'm about to prove it to you with a question so terrible, it's scarcely to be believed. In fact, it is so cringe-worthy, that I almost hesitate to type it out… But. I. Must. Ok, silver trolls, you owe me big time. This public service announcement goes out to all those 'special' people who sadly turned that inner filter off, a long time ago. Alright, focus Watchman. You can do this! Whew…. Here goes… "Man, with the Dow starting to trade like a penny stock, and Europe's economies being sucked into a black hole, I'm simply gonna increase my silver-buying here at sub $18 prices!" "Watchman, sometimes I just don't get you at all. What's with all the silver-buying? I mean, what good is silver…" *cringes* "If you can't eat it?" I mean, wha… I don't even…. How do they… *sigh* The Watchman isn't often rendered speechless, but a question like this, will do it nearly every time. I can't believe any silver stacker has even had to address something so…infantile. Yet we have! In fact, inexplicably, some of us have had to deal with this grey-cell-numbing question numerous times. I've finally had enough of it! As hard as it is, this one must be put to sleep, so let's help that puppy get through his "Swamp of Sadness", and just get this over with. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Here Is Yet Another Frightening Prediction To End 2014 Posted: 14 Oct 2014 09:01 PM PDT  Today King World News interviewed a 60-year market veteran who made some absolutely frightening predictions as we head into the end of 2014. He discussed what to expect in the major markets, including stocks and gold, and he warned that despite the propaganda and recent stock market action, the West is literally "destroying" itself. Below is six-decade market veteran Ron Rosen's remarkable interview. Today King World News interviewed a 60-year market veteran who made some absolutely frightening predictions as we head into the end of 2014. He discussed what to expect in the major markets, including stocks and gold, and he warned that despite the propaganda and recent stock market action, the West is literally "destroying" itself. Below is six-decade market veteran Ron Rosen's remarkable interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After Central Bank Financial Bubbles, Comes Liquidation And Industrial Deflation Posted: 14 Oct 2014 06:02 PM PDT Submitted by David Stockman via Contra Corner blog, Nearly two decades of central bank financial repression have created huge distortions and imbalances in the world economy. Now they are coming home to roost as the impossibility of ZIRP forever dawns on even our mad money printers. Having created yet another round of ebullient financial bubbles, they are now getting palpably nervous. Even the lady with the perpetual tan and unfailing call for “moar” monetary and fiscal stimulus, IMF head Christine Lagarde, said something sensible over the weekend:

She got the “too much financial risk-taking” part right, but here’s the thing. The apparatus of state policy—-fiscal borrowing and central bank money printing—-can not cause enterprise to flourish. Free market capitalism is the milieu in which business enterprise, invention, risk-taking and labor productivity thrive best. So, yes, reducing market impairments—such as tax rates on production and capital which are too high or regulations, protectionist laws and subsidies which are too onerous—-is always helpful. These latter steps are now coming into fashion under the heading “structural reform” and they make sense as far as they go. But central bankers like Draghi and international monetary bureaucrats like Lagarde pushing this agenda fail to recognize that their own policies on the fiscal and monetary side currently dwarf the ill-effects of, for instance, over-zealous EPA regulation in the US or protectionist labor laws in Europe. In fact, long-standing financial repression and absurdly low interest rates have generated malinvestments and debt burdens that are crushing enterprise and true economic risk-taking throughout the world economy. In the DM (developed market economies), the resulting malady is consumer balance sheets that are bloated with debt; and in the EM (emerging markets) the ill takes the form of vastly bloated industrial capacity and public infrastructure. So if there were ever a case of “physician, heal thyself”, this is it. Indeed, the current spectacle of Europe’s monetary arsonist, Mario Draghi, telling Italy’s most recently installed double-talking politician, Prime Minister Renzi, to change the nation’s labor laws so that employers can more easily fire redundant workers says it all. Of course this should be done—Italy can’t thrive in a global economy based on 1960s communist union theories that were invalidated the moment that the comrades in Beijing swapped Mao’s little red book for the printing presses of red capitalism. Still, the redundant labor and resulting economic inefficiency in Italy’s few remaining large-scale industrial plants is trivial compared to the burden of nearly $3 trillion of public debt—a figure that amounts to 130% of GDP and continues to mount.

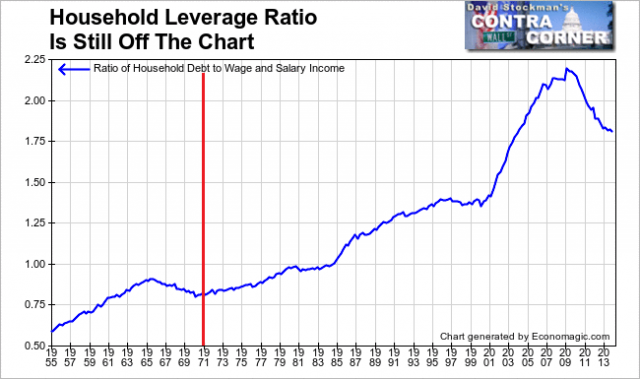

By his ill-considered and undeliverable pledge to do “whatever it takes”, and the phony peripheral bond rally it elicited, Draghi has destroyed any semblance of political will in Italy to tackle its 130% of GDP public debt. Instead, based on the blatant scheming now underway in Italy’s parliament, it is already evident that the “labor reform” that Renzi is talking up amounts to statutory legerdemain that will make almost no difference in the domestic jobs market for years to come. Yet, it will provide the pretext for a return to out-and-out fiscal profligacy in Italy next year—-as Italy’s politicians are already making evident in an openly public manner. So what’s going on is Keynesian central bankers are looking for a scapegoat, and have found exactly the right word cloud to define it—-that is, “structural reform”. And the politicians are grabbing the bait, knowing that infinitely malleable enabling acts can be made to sound constructive upon parliamentary approval, even as they permit real policy change to be buried in regulatory wrangling and judicial review for years to come. At the same time, the politicians’ pound of flesh in this emerging scam is more pork barrel spending and fiscal stimulus in the guise of “public investment”. But the litmus test on that proposition is quite simple: Are the proposed public “investment” projects being funded with higher user fees and taxes or general government borrowing? It goes without saying that it is the latter. Yet with DM governments at peak public debt ratios nearly everywhere (i.e. 100% of GDP and higher), borrowing even more money to fund public projects which for the most part are not needed, and will not contribute to improved economic efficiency, is a little more than a recipe for higher taxes and more economic stagnation down the road. So the new consensus coming out of this weekend’s IMF meeting is just a smokescreen. What ails the global economy can not be remedied by toothless “structural reforms” or wasteful “public investments”. What is urgently needed, instead, is an end to central bank financial repression and rapid return to normalized interest rates and budget surpluses that can pay down unsustainable public debt burdens that have built up over the past few decades. Yes, that would cause the boys & girls and robo-traders on Wall Street to throw one hellacious hissy fit. But there’s no getting around it. Current money pumping policies by the major central banks are just inflating financial bubbles to ever more treacherous heights, guaranteeing that the eventual day of reckoning will be all the more traumatic. And yet the central bankers are reluctant to allow interest rates to escape from the zero bound and begin their flight upward toward “normalization” because they are wedded to the Keynesian fallacy that a weak economy is evidence of insufficient “aggregate demand”. Therefore, monetary “accommodation”—even when it reaches the lunatic extent of recent years— is purportedly needed to goose households and businesses into more spending. In the DM world, however, the credit transmission channel of monetary policy is broken and done. Real interest rates for maturities up to five years have been negative in real terms for most of this century. Not surprisingly, main street households have smothered themselves in debt, and have thereby, ironically, reduced the efficacy of Keynesian stimulus policies practically to zero. The reason is that during the decades after the demise of Bretton Woods in 1971, public and private balance sheets were consistently and drastically levered-up on a one-time basis. The resulting credit-fueled consumption binge in DM economies added to measured GDP, but not to true, sustainable wealth gains. It was a one-time parlor trick that has now left them with contractually fixed public and private debts ranging from 350-500% of GDP—– off-set by stagnant incomes and unsustainable mark-to-market asset values that are vastly inflated by the long years of bubble finance. So the DM world has now reached the limits of “peak debt”, even with the ZIRP enabled ultra-low “carry” cost on these towering obligations. In this regard, the US and Spanish ratio patterns are typical. But in either case, Keynesian monetary stimulus is simply pushing on a string, as is reflected by slowly falling debt ratios since the 2007-2008 peak. Stated differently, there has been no escape velocity owing to Keynesian stimulus. Massive central bank liquidity injections have remained in the canyons of Wall Street and other major financial markets where they have enabled endless free money funding of speculation and carry trades, but have contributed virtually nothing to spending by debt-saturated main street households.

At the same time, central bank financial repression has made capital inordinately cheap and has thereby caused fantastic over-investment in the EM world. The current disastrous overcapacity in China’s steel industry is a case in point. Between the year 2000 and 2010 its steel industry grew from 150 million tons of annual capacity to 750 million tons—a rate of heavy industry growth never before witnessed anywhere. Yet as shown below, the flood of cheap money from the Peoples’ Printing Press of China in response to the Great Recession only stimulated a further round of even more fantastic steel capacity growth. The 300 million tons or 40% gain since 2010 is a striking measure of the current global derangement. China’s steel capacity expansion in just the last four years exceeds the combined capacity of the entire steel industry of Europe and North America combined. Yet China’s sustainable domestic need is arguably less than 500 million tons per year—once its spree of constructing empty apartment buildings, unpopulated cities, redundant highways, bridges, airports and high speed railroads and unneeded industrial capacity comes to an end—as it surely must and will. Even the comrades in Beijing are signaling a resignation to that unavoidable outcome. Already, the inevitable collapse is becoming visible. Prices are plunging, inventories are soaring, and profits in the steel industry have virtually disappeared. As detailed in the attached story from Bloomberg, the inexorable consequence will be a flood of cheap exports on the world market.

Indeed, the real problem is that once this immense capacity was brought into being, it was not going to go quietly into the night. China’s true excess capacity now amounts to upwards of 50% of steel production in the rest of the world. Consequently, when China’s domestic consumption is sharply curtailed as the world’s greatest historical building boom winds down, the flow of excess plate and sheet and rebar and structural products into the world steel markets will have a relentless shocking impact. Prices and profits will be crushed everywhere; and protectionist policies not seen since the 1930s are likely to be kindled. After all, it only need be recalled that 85% of all the growth in global steel production since the year 2000 has been attributable to China. In the rest of the world, steel production during the last 14 years has barely inched forward—growing at just 1.1% per annum owing to a tepid level of end demand. So when the flood of dumped still comes flooding in from China, it is evident that the absorption capacity is next to zero. And steel is just the most advanced case. A huge wave of industrial deflation is virtually guaranteed in the food chain of materials extraction, production and fabrication.

Today’s Bloomberg story on China’s growing steel industry crisis notes that “China steel now as cheap as cabbage.” Perhaps that is a foretaste of things to come! In any event, the stunning collapse of steel prices and the soaring inventories of iron ore in China are a reminder that cheap capital artificially provisioned by central banks can lead to an enormous boom of malinvestment. But ultimately the laws of economics will out and a relentless deflationary correction ensues. It would appear that the global steel industry, among others, is soon to find out about the crack-up part which inexorably follows the boom.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold stubs Swiss National Bank's toe, and the Financial Times says 'ouch!' Posted: 14 Oct 2014 05:13 PM PDT On its own hook the FT's "news" story accuses the Swiss gold initiative of "absurdities," mockery the newspaper has yet to hurl against central banks even as they intervene openly in every market and resort to "negative interest rates." Yes, in the FT's view only gold as money can be "absurd." And largely surreptitious control of the valuation of all capital, labor, goods, and services in the world by an unelected, supra-national elite isn't totalitarian -- it's good government! Central banking, heil! * * * Swiss Fight to Block Public Gold Vote By Delphine Strauss http://www.ft.com/intl/cms/s/0/a886cb26-53b4-11e4-8285-00144feab7de.html Switzerland's central bank is flexing its muscles to defend its cap on the Swiss franc. Its battle to fend off deflation -- in which it sees the exchange rate as its chief weapon -- is already complicated by the slide in the euro that followed European Central Bank easing. Now the SNB is fighting on a new front: to block a populist motion that would force it to almost treble the proportion of reserves held in gold. At the end of November, Swiss citizens will vote on an initiative that calls on the central bank to hold at least 20 per cent of its assets in gold; to repatriate any gold stored abroad; and to refrain from selling any gold in future. ... Dispatch continues below ... ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. The "Save our Swiss Gold" initiative -- launched by members of the ultra-conservative Swiss People's Party -- seeks to tap into a current of Swiss public opinion that is fiercely proud of the country's independence, and unsettled by the economic struggles of its neighbours. But it has drawn criticism from across the political spectrum. The government has rejected the idea, saying last year that "gold no longer has any meaning for monetary policy." Parliament voted against it by a large majority. For the central bank, the measures are not merely an anachronism: they pose an immediate threat. Since September 2011, when it promised to buy as much foreign currency as needed to stop the Swiss franc strengthening past SFr1.20 to the euro, the SNB's foreign currency holdings have ballooned -- rising from about SFr204bn at the end of 2010 to SFr470bn in August. Despite the difficulty of managing such a rapid increase, the SNB says the minimum exchange rate is still "the key instrument to avoid an undesirable tightening of monetary conditions." The gold initiative could, if it passed, blow a hole in this policy. Jean-Pierre Danthine, vice-chairman of the SNB's governing board, said last week that the central demand, to hold 20 per cent of assets in gold, "would severely restrict the conduct of monetary policy." If this limit had existed when the SNB first enforced its minimum exchange rate, he argued, the central bank would have had to buy gold in huge quantities as well as euro -- "which would almost certainly have caused the foreign exchange markets to doubt our resolve to enforce the rate." It is rare for the SNB to take such a stance on what is purportedly a political issue, so these comments show how sensitive policy makers are when it comes to the credibility of their policy on the franc. Thomas Jordan, chairman, said in September the SNB had not had to intervene to enforce the policy since 2012. But the Swiss franc is still trading close to SFr1.20 to the euro -- with the euro's weakness and renewed global risk aversion keeping it under upward pressure. There is continued speculation that the SNB may eventually resort to negative deposit rates -- as the ECB has done -- to keep the currency in check. The central bank is also deeply concerned about its ability to manage its vast reserves. Mr Danthine pointed out that a ban on gold sales could mean that gold eventually accounted for the bulk of the SNB's assets -- it would be obliged to buy gold every time its balance sheet expanded and to sell euro every time it contracted. He also noted that gold holdings would not earn interest or dividends, and underlined other absurdities inherent in the initiative, such as repatriating gold stored in the UK or Canada, where it could most easily be sold if needed, or stipulating that reserves meant for use in emergencies could not be sold at all. It is not yet clear whether the measures stand any real prospect of becoming law. Population growth and mass communication have made it easier to gather the 100,000 signatures needed to put initiatives to a public vote in Switzerland, but only 10 of 66 initiatives that have gone to referenda since 2000 have passed. Opinion polls will not appear until later this month, and have proved unreliable before previous votes. But Scotland's independence referendum last month was a reminder of how rapidly political risks can come to the fore in currency markets. Analysts at Nomura warn that speculators may test the exchange rate floor if initial polling results were to show support for the public vote in coming weeks. The vote warrants close attention, says Derek Halpenny, a strategist at Bank of Tokyo Mitsubishi. He thinks the SNB could -- given a long enough lead-in time -- both increase its gold holdings to the level the initiative requires, and maintain its minimum exchange rate. This could have knock-on effects in forex markets, because it would need to convert euro into dollars to fund gold purchases. Analysts say the other logical possibility -- meeting the 20 per cent criterion by shrinking foreign exchange reserves -- would make it impossible to enforce the cap on the franc. In the long term, though, Mr Halpenny argues that "a shift back towards much larger gold holdings would only help reinforce the franc's safe-haven status. ... The imposition of a limit would be seen as reducing the ability of the authorities to devalue the franc in order to lift inflation." Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 12 Charts That Show The Permanent Damage That Has Been Done To The US Economy Posted: 14 Oct 2014 05:03 PM PDT Submitted by Michael Snyder via The Economic Collapse blog, Most people that discuss the "economic collapse" focus on what is coming in the future. And without a doubt, we are on the verge of some incredibly hard times. But what often gets neglected is the immense permanent damage that has been done to the U.S. economy by the long-term economic collapse that we are already experiencing. In this article I am going to share with you 12 economic charts that show that we are in much, much worse shape than we were five or ten years ago. The long-term problems that are eating away at the foundations of our economy like cancer have not been fixed. In fact, many of them continue to get even worse year after year. But because unprecedented levels of government debt and reckless money printing by the Federal Reserve have bought us a very short window of relative stability, most Americans don't seem too concerned about our long-term problems. They seem to have faith that our "leaders" will be able to find a way to muddle through whatever challenges are ahead. Hopefully this article will be a wake up call. The last major wave of the economic collapse did a colossal amount of damage to our economic foundations, and now the next major wave of the economic collapse is rapidly approaching. #1 Employment The mainstream media is constantly telling us about the "employment recovery" that is happening in the United States, but the truth is that it is just an illusion. As the chart below demonstrates, just prior to the last recession about 63 percent of all working age Americans had a job. During the last wave of the economic collapse, that number dropped to below 59 percent and stayed there for a very long time. In the past few months we have finally seen the employment-population ratio tick back up to 59 percent, but we are still far, far below where we used to be. To call the tiny little bump at the end of this chart a "recovery" is really an insult to our intelligence...

#2 The Labor Force Participation Rate The percentage of Americans that are either employed or currently looking for a job started to fall during the last recession and it has not stopped falling since then. The labor force participation rate has now fallen to a 36 year low, and this is a sign of a very, very sick economy...

#3 The Inactivity Rate For Men In Their Prime Years Some blame the decline in the labor force participation rate on the aging of our population. But it isn't just elderly people that are dropping out of the labor force. In fact, the inactivity rate for men in their prime working years (25 to 54) continues to rise and is now at the highest level that has ever been recorded...

#4 Manufacturing Employees Once upon a time in America, anyone that was reliable and willing to work hard could easily find a manufacturing job somewhere. But we have stood by and allowed millions upon millions of good paying manufacturing jobs to be shipped out of the country, and now many of our formerly great manufacturing cities have been transformed into ghost towns. Over the past few years, there has been a slight "recovery", but we are still well below where we were at just previous to the last recession...

#5 Our Current Account Balance As a nation, we buy far more from the rest of the world than they buy from us. In other words, we perpetually consume far more wealth than we produce. This is a recipe for national economic suicide. Our current account balance soared to obscene levels just prior to the last recession, and now we have almost gotten back to those levels...

#6 Existing Home Sales Our economy has never fully recovered from the housing crash of 2007-2008. As you can see from the chart below, the number of existing home sales is still far below the level that we hit back in 2006. At this point we are just getting back to the level we were at in 2000, but our population today is far larger than it was back then...

#7 New Home Sales Things are even more dramatic when you look at new home sales. This is an industry that have been absolutely emasculated. The number of new home sales in the United States is just a little more than half of what it was back in 2000, and it isn't even worth comparing to what we experienced during the peak of 2006.

#8 The Monetary Base In a desperate attempt to get the economy going again, the Federal Reserve has been wildly printing money. It has been so reckless that it is hard to put it into words. When I look at this chart, the phrase "Weimar Republic" comes to mind...

#9 Food Inflation Thankfully, much of the money that the Federal Reserve has been injecting into the system has not made it into the real economy. But enough of it has gotten into the system to force food prices significantly higher. For example, my wife went to the store today and paid just a shade under 10 bucks for just four pieces of chicken. And as you can see from the chart below, food prices have been steadily going up in America for a very long time...

#10 The Velocity Of Money One of the reasons why we have not seen even more inflation is because the velocity of money is extraordinarily low. In general, when an economy is healthy money tends to flow through the system rapidly. People are buying and selling and money changes hands frequently. But when an economy is sick, money tends to stagnate. And that is exactly what is happening in the United States right now. In fact, at this point the velocity of the M2 money stock has dropped to the lowest level ever recorded...

#11 The National Debt As our economic fundamentals have deteriorated, our politicians have attempted to prop up our standard of living by borrowing from the future. The U.S. national debt is on pace to approximately double during the Obama years, and it increased by more than a trillion dollars in fiscal year 2014 alone. Despite assurances that "the deficit is under control", the federal government borrows about a trillion dollars a year to fund new spending in addition to borrowing about 7 trillion dollars to pay off old debt that is coming due. What we are doing to future generations of Americans is absolutely criminal, and it is just a matter of time before this Ponzi scheme totally collapses...

#12 Total Debt Of course it is not just the federal government that is gorging on debt. When you add up all forms of debt in our society (government, business, consumer, etc.) it comes to a grand total of more than 57 trillion dollars. This total has more than doubled since the year 2000... If you know anyone that believes that we are in good economic shape, just show them these charts. The numbers do not lie. Our economy is sick and it is getting sicker by the day. And of course the next major financial crisis could strike at any time. U.S. stocks just experienced their worst week in three years, and if cases of Ebola start popping up around the country the fear that would cause could collapse our economy all by itself. The debt-fueled prosperity that we are enjoying today is not real. We are living on the fumes of our past, and every single day our long-term problems get even worse. Anyone with half a brain should be able to see what is coming. Sadly, most Americans will continue to deny the truth until it is far too late. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oil price dip is Saudi bow to China, Leeb tells King World News Posted: 14 Oct 2014 04:51 PM PDT 7:50p ET Tuesday, October 14, 2014 Dear Friend of GATA and Gold: Fund manager Stephen Leeb tonight tells King World News that the decline in oil prices may be part of a scheme between Saudi Arabia and China to facilitate their trade as Saudi Arabia moves out of the United States' political orbit. An excerpt from the interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/10/14_H... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 BullionStar is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. BullionStar's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in BullionStar's bullion vault, which is integrated with BullionStar's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Rose 0.35 Percent Closing at $1,233.60 Posted: 14 Oct 2014 04:48 PM PDT

The GOLD PRICE is knocking at the ceiling of $1,237, knocking, knocking, but hasn't yet broken through. The SILVER PRICE is knocking at the $17.60 ceiling, but so far has only bloodied its knuckles. Slowing down here is poor form. Silver has yet to climb above its 20 DMA (17.51). Action of the last four weeks still looks like a bottom, but silver needs to prove itself soon. Advance is getting bogged down. Silver is liable to break through $18.00 suddenly and not look back. Markets today: Stocks climbed on a ledge and stopped plunging over that waterfall today, but the damage has already been done. Yesterday both the Dow and the S&P500 broke their August lows, further confirming a down trend. S&P500 also broke its uptrend line from March 2009 when the bull phase began. Both also crashed through their bottom channel lines, which might signal a pause or an acceleration of the fall. Dow lost 5.88 (0.04%) to 16,315.19. S&P added 2.96 (0.16% to 1,877.70. Break yesterday below 1,900 is liable to demoralize stock investors pretty badly. Dow in silver bounced up at day's end, up 0.6% to $1,213.71 silver dollars (938.73 oz). It spent 16 months forming a big wedge, broke above the top limit in September, and today plunked down against it. Dow in Silver ought to fly like a man jumping off the Yazoo River bridge with an anvil tied to each ankle. Dow in gold hooked up today, 0.33% to G$273.69 gold dollars (13.24 oz). Still in freefall below the 20 and 50 DMA with all indicators pointing down. US dollar index rose 0.45% (39 basis points) to 85.92. Question is not whether it is correcting, but how far it will fall. Investors must be POURING out of stocks into bonds. Ten year bond yield today gapped down mightily to 2.206%. Clearly the flight into treasury bonds is on. Yet it didn't depress the yen too much. It lost 0.17% to close at 93.42 cents/Y100, but is steady rallying. Euro fell back 0.75% to $1.2660. Having a hard time getting off the ground. I believe, by the way, that my wife has prepared a pullet pot pie for supper tonight. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fighting back, First Majestic delays sale of silver amid price weakness Posted: 14 Oct 2014 04:38 PM PDT 7:42p ET Tuesday, October 14, 2014 Dear Friend of GATA and Gold: Ninety-nine point nine percent of gold and silver mining companies and their executives are brain-dead, merely geologists and accountants, unaware of the monetary nature of their product and how their product is priced by surreptitious market intervention by central banks. But here and there certain companies and their executives have a clue, and First Majestic Silver Corp. today again proclaimed itself to have far more than a clue. First Majestic announced that it won't sell its metal into the recent weakness in the silver futures markets. In a statement the company said: "Silver prices declined 19 percent in the third quarter, representing the second largest quarterly decline since the financial crisis in 2008. As a result of this weakness, the company decided to temporarily suspend silver sales in an attempt to maximize future profits. This suspension of sales will result in lower revenues and earnings for the third quarter. However, it is likely that these inventories of unsold ounces will instead be sold in the fourth quarter. As of September 30, 2014, approximately 934,000 ounces of silver were held in inventory." This isn't the first time that First Majestic has withheld production amid price weakness. The company and its chief executive officer, Keith Neumeyer, long have acknowledged that the monetary metals are monetary and subject to attack by issuers of other forms of money. Unlike most other gold and silver mining companies, First Majestic is not inclined to cooperate with such attacks. It even mints its own silver rounds, bars, and ingots and sells them directly to the public: https://www.store.firstmajestic.com/ First Majestic's statement is posted at the company's Internet site here: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| George Soros Bought $10.5 Million of Silver Wheaton Corp.; Should You Buy, Too? Posted: 14 Oct 2014 03:26 PM PDT It’s my favourite way to invest in precious metals, and apparently George Soros agrees with me. The stock is Silver Wheaton Corp. (TSX: SLW)(NYSE: SLW). Originally, the company was a small division of mining giant Goldcorp Inc., until it was spun off in 2004. But over the next 10 years, Silver Wheaton has grown into one of the largest players in the mining sector. It’s an odd bet. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Don’t Miss Your Chance to Profit from the “End of OPEC” Posted: 14 Oct 2014 02:24 PM PDT Is it 2008 all over again? Heh, if you're the Saudis it is! Saudi Arabia and Iran rushing to lower oil prices? Wow! Certainly not a sight you'll see every day… Saudi Arabia just slashed prices for their Arab Light crude oil to prices not seen since December 2008. A decade ago would you ever imagine that a U.S.-led oil boom would cause a panic amongst OPEC nations? Well, my friend, it's happening right in front of our eyes. Notably, it's a tough time to rejoice with many of our favorite oil and gas stocks heading lower on lower energy prices and a general market pullback. But, really, you've got to sit back and really enjoy being an American in today's energy market. It's not just Saudi Arabia rushing to lower oil prices either. "State-run National Iranian Oil Co." Bloomberg reports, "cut official selling prices of its crude to buyers in Asia for November." Saudi Arabia and Iran rushing to lower oil prices? Wow! Certainly not a sight you'll see every day… Or even every decade! Other OPEC nations will likely follow too. Nigeria? Angola? The whole "end of OPEC" dialogue you've heard murmuring in the background since 2008's budding shale boom is really happening right in front of our eyes. And you won't see me tearing up over it, either. Today we live in a new oil world — one where there’s pressure on OPEC and potential in America. And I'm not all smiles around the office these days. At I type, WTI crude oil trades hands at $84 a barrel. Brent crude for December delivery is $89. "Price Drop Tests Oil Drillers" the B-section of today's Wall Street Journal reports. So while lower oil prices are good for you, me and millions of U.S. drivers (heck, I got gasoline last week for $2.94 a gallon) — the same feel good story isn't being felt in Houston boardrooms. The pullback in shale producer prices is truly warranted. It's not easy to say, that's for sure. But with ambiguity in the future price of oil — or at least in analysts' minds — there's plenty of reason why traders are shying away from America's shale players. That's all well and good in the short term. But this pullback won't last. While the globe figures out new supply and demand dynamics for oil, we'll come to a new support level for prices. Remember, although we're seeing a fortuitous burp of extra oil these days, there's plenty of long-term support for prices. …today's well-run shale oil producers are plenty economic around $85 oil. That said, oil prices will level out (likely around $85) in due time. Maybe a week or maybe a few months. But when they do it will be brilliantly clear that today's well-run shale oil producers are plenty economic around $85 oil. You see, the market is treating many of these shale players like they are "marginal" oil producers (you know, companies that are on the cusp of profitability that live and die with a dollar change in the price of oil.) That's simply not the case. Break even prices in the sweetspots are closer to $50. So you tell me if producers can still make a buck at $85. This is a high conviction idea on my part. I know that the shale industry is here to stay… and thrive. But with oil prices feeling the heat it's not time to back up the truck just yet. Once we see oil prices level out I promise you a fistful of opportunities. Keep your boots muddy, Matt Insley P.S. The U.S. oil boom is minting millionaires as we speak. And if you think that’s going to slow down… think again. There is still plenty of money to be made in this sector. And I can help position you to make the most gains out of this ongoing story. Click here now to sign up for my Daily Resource Hunter e-letter, for FREE, and learn how you can get in on the ground floor of the next great U.S. energy investment. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - The Almighty Dollar Posted: 14 Oct 2014 01:14 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Here Is China’s Stunning Master Plan For Gold, Silver & Oil Posted: 14 Oct 2014 01:13 PM PDT  Today an acclaimed money manager spoke with King World News about China's stunning master plan for gold, silver, and oil. Stephen Leeb also spoke about the big picture for resource wars, fracking, Russia, the United States, and Saudi Arabia. Today an acclaimed money manager spoke with King World News about China's stunning master plan for gold, silver, and oil. Stephen Leeb also spoke about the big picture for resource wars, fracking, Russia, the United States, and Saudi Arabia.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Win-Win Scenario for Gold Investors Posted: 14 Oct 2014 01:00 PM PDT Volatility and price drops may be nerve wracking, but the bull market in gold is far from over. In fact, it has barely begun. To understand why, it helps to look at two prior episodes in the relationship of gold and money that are most relevant to today. These episodes were a period of extreme deflation, the 1930s, and a period of extreme inflation, the 1970s. History shows that gold does well in both conditions. …neither the inflation nor the gold price spike happened overnight. It took 15 years to play out from start to finish. Commentators frequently observe that we are experiencing "price stability" or "low inflation" based on the fact that the consumer price index has averaged 2% over the past 12 months. However, this average hides more that it reveals. The economy is experiencing strong deflationary forces as a result of weak employment and deleveraging associated with the depression that began in 2007. Simultaneously the economy is experiencing strong inflationary forces as a result of Fed money printing. The deflationary and inflationary forces offset each other to produce a seemingly benign average. But below the surface the forces struggle to prevail with some likelihood that one or the other will emerge victorious sooner than later. Inflationary forces often appear only with significant lags relative to the expansion of the money supply. This was the case in the late 1960s and early 1970s. The Fed began to expand the money supply to pay for Lyndon Johnson's "guns and butter" policy in 1965. The first sign of trouble was when inflation increased from 3.1% in 1967 to 5.5% in 1969. But there was worse to come. Inflation rose further to 11% in 1974 and then topped off at 11.3% in 1979, 13.5% in 1980 and 10.3% in 1981, an astounding 35% cumulative inflation in three years. During this time period, gold rose from $35 per ounce to over $800 per ounce, a 2,300% increase. The point is that neither the inflation nor the gold price spike happened overnight. It took 15 years to play out from start to finish. The Fed's current experiments in extreme money printing only began in 2008. Given the lags in monetary policy and the offsetting deflationary forces, we should not be surprised if it takes another year or two for serious inflation to appear on the scene. Another instructive episode is the Great Depression. The problem then was not inflation but deflation. It first appeared in 1927 but really took hold in 1930. From 1930-1933, cumulative deflation was 26%. The U.S. became desperate for inflation. It could not cheapen its currency because other countries were cheapening their currencies even faster in the "beggar-thy-neighbor" currency wars of the time. Finally, the U.S. decided to devalue the dollar against gold. In 1933, the price of gold in dollars was increased from $20 per ounce to $35 dollar per ounce, a 75% increase at a time when all other prices were decreasing. This shock therapy for the dollar worked, and by 1934 inflation was back at 3.1%, a massive turnaround from the 5.1% deflation of 1933. In short, when all other methods fail to defeat deflation, devaluing the dollar against gold works without fail because gold can't fight back. It is unclear if the world will tip into inflation or deflation, but one or the other is almost certain. It is unclear if the world will tip into inflation or deflation, but one or the other is almost certain. The good news for gold investors is that gold goes up in either case as shown in the 1930s and 1970s. Yet patience is required. These trends take years to play out and policies work with a lag. Meanwhile, investors can use recent setbacks to acquire gold at more attractive prices while waiting for the inevitable price increase to occur. Regards, James Rickards Ed. Note: Warren Buffett and China are hedging against the dollar. China's using gold… while Buffett's going outside of the box. What could be next for the yellow metal? James Rickards has a few thoughts in this exclusive Daily Reckoning video: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver price-fixing lawsuits consolidated in Manhattan federal court Posted: 14 Oct 2014 12:20 PM PDT By Brendan Pierson NEW YORK -- Litigation alleging that Deutsche Bank, Bank of Nova Scotia, and HSBC illegally fixed the price of silver has been centralized in Manhattan federal court. Lawsuits filed by investors since July over the alleged price-fixing were consolidated on Tuesday in the U.S. District Court for the Southern District of New York, following an order issued last Thursday by the U.S. Judicial Panel on Multidistrict Litigation, a special body of federal judges that decides when and where to consolidate related lawsuits. The panel ruled that the cases should be handled by U.S. District Judge Valerie Caproni in Manhattan, who is already overseeing similar litigation over alleged gold price-fixing. ... For the remainder of the report: http://www.reuters.com/article/2014/10/14/antitrust-silver-idUSL2N0S91QO... ADVERTISEMENT Sinclair's Next Market Seminar Is Nov. 15 in San Francisco Mining entrepreneur and gold advocate Jim Sinclair will hold his next market seminar from 10 a.m. to 3 p.m. on Saturday, November 15, at the Holiday Inn at San Francisco International Airport in South San Francisco, California. Admission will be $100. For more information and to register, please visit: http://www.jsmineset.com/2014/10/10/san-francisco-qa-session-announced/ Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 Ways to Protect Yourself (and Profit) from Cyberattacks Posted: 14 Oct 2014 12:17 PM PDT Were you a victim of the terrifying cyber-attack that occurred at the start of this month? If not, consider yourself lucky… 76 million households and 7 million small businesses were hacked. If you've ever used Chase or JPMorgan's websites or apps, online criminals now have your name, address, phone number, and email. If you receive an email asking for personal information like your social security number, don't respond. Nine other financial institutions were infiltrated, too — all by criminals who seem to be based in Russia. As one of the most serious online thefts ever perpetrated, the Treasury, the Secret Service and the F.B.I. have all gotten involved. But there's a silver lining to this debacle… And it could mean big gains for early investors. Today we'll do three things for you:

So let's dive in… First of all, there are basic steps you should always take to protect yourself online: For example, review transactions on your banking statement each month, and check your credit reports once a year (it's free) at AnnualCreditReport.com. And here are three ways to be even more cautious. 1. If you receive an email asking for personal information like your social security number, don't respond. Banks and credit card companies never ask for personal info like this over email. 2. Did you know that 860 million cases of identity theft have been reported? To avoid becoming part of this statistic, you can do what's called a security freeze. A security freeze stops the credit bureaus from releasing your credit reports. This single step ensures that no fake accounts get set up in your name. 3. Install sophisticated privacy software on your computer, your tablet, and your mobile device. And this is where a new start-up we've discovered can help… As my colleague Wayne wrote about a couple months ago, Cybercrime is big business: It costs U.S. corporations $250 billion annually. Globally, the figure is closer to $1 trillion. But as Wayne said, "Where there's chaos, there's opportunity." One company taking advantage of this opportunity is called SnoopWall. SnoopWall is a security and privacy software company. They build tools that detect and block malicious activity. As investors, we like the big, fast-growing market they're going after — and we like the quality of their team, too. Their founder, Gary Miliefsky, is a founding member of the US Department of Homeland Security. Gary's advised two White House administrations (Bill Clinton and George W. Bush) on cyber security. In the past, his technology innovations have been acquired by McAfee, a top software security company, and been licensed to companies including IBM. Let's take a look at what Gary and his team are building and patenting… SnoopWall's expertise is in what's called counterveillance. SnoopWall's technology makes your computer and other devices invisible. To explain what this term means, consider the Stealth Bomber — the B-2. The B-2 is so powerful because it's invisible to radar. Its outer layer is a form of counterveillance technology. In other words, it counters any surveillance. SnoopWall is taking the same approach, but for the war against cybercrime. Their technology makes your computer and other devices invisible. This way, cyber criminals won't be able to find you. And none of your private information or data can be stolen. Senator Markey, a member of the Senate Commerce Committee, said "the data breach at JPMorgan Chase is yet another example of how Americans' most sensitive personal information is in danger." After the breach at JP Morgan, and after attacks on household names like Target and Home Depot, the real question is: who'll be next? Regards, Matthew Milner Ed. Note: Counterveillance technology may be the next major trend to emerge from the cybersecurity sector. That’s why readers of today’s issue of the FREE Tomorrow in Review e-letter saw a link that allowed them to directly invest in SnoopWall. And that’s not all… In addition, readers were shown 3 other specific chances to discover real, actionable profit opportunities (in a variety of different sectors). It’s just a small benefit of being a loyal Tomorrow in Review reader. Don’t miss another issue or profit opportunity. Click here now to sign up for Tomorrow in Review — completely FREE of charge — and see for yourself. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Surges While Stock Markets Implode Posted: 14 Oct 2014 09:02 AM PDT Graceland Update | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Prices Rally Strongly amid Falling Equities Posted: 14 Oct 2014 08:25 AM PDT The price of gold rebounded from its 15-month low last week to see its biggest weekly gain in four months. After failing to break below a key support level at $1180 an ounce the price of gold rallied higher for the first time in a long while last week, with gold bouncing $32 (2.7%) to close out the week at $1223 an ounce. The price of the yellow metal has begun this week on a firmer note as prices extend last weeks' gains. At the time of writing the price of spot gold was trading at $1233 an ounce after pushing through $1230 an ounce on Monday and hitting a four-week high as traders covered short positions while some bargain hunters stepped in to buy at the current low levels. Meanwhile global equities have fallen. The Standard & Poor's 500 Index experienced its worst three-day loss since 2011 as it fell an additional 1.6% on Monday to 1,874.82 at 4 p.m. in New York, the lowest since May and closing below its 200-day moving average for the first time since 2012. The Dow Jones Industrial Average lost 1.4% to a six-month low. Brent crude tumbled 1.5% after sliding into a bear market last week. The dollar weakened against most of its 16 major counterparts and gold gained 0.7%. The S&P 500 has fallen 6.8% from its Sept. 18 record as the Fed contemplates when to raise interest rates. The index is down 4.8% over three days, the most since November 2011. The International Monetary Fund cut its forecast for global growth last week and said the euro area faces the risk of a recession. The IMF now expects world growth to register at 3.3% in 2014, down 0.1% from its forecast in July. For 2015, it also slashed its forecast by 0.2% to 3.8%. The organization, which represents 188 countries, now expects world growth to come in at 3.3% in 2014, down 0.1% from its forecast in July. While in 2015, it expects growth of 3.8%, down 0.2% from earlier expectations. It comes less than a month after the Organisation for Economic Co-operation and Development (OECD) slashed its expectations for the global economy because of concerns about a stuttering recovery in the U.S. and the continued fragility of the euro zone. Speaking as the IMF’s World Economic Outlook was released on Tuesday, Research Director Olivier Blanchard said the world’s economic recovery was “weak and uneven,” and highlighted countries’ “very different evolutions.” “Growth is uneven and still weak overall and remains susceptible to many downside risks,” the IMF’s report said. Following the report the price of gold rebounded by 1.3%, its biggest one-day advance in two months. The IMF also warned of bubbles building in financial assets. "Downside risks related to an equity price correction in 2014 have also risen, consistent with the notion that some valuations could be frothy," it said. Also comments from some of the top U.S Fed policy makers expressed increasing concern about weakening world economies, were deemed a bit dovish by the market place. Last week, Chinese traders returned to the market following their Golden Week holiday. Bullion dealers cited solid demand for kilo bars and domestic demand for gold jewellery was strong leading manufacturers to order more of the yellow metal. In Hangzhou, retailers saw gold jewellery sales jump 106%, while stores in Tianjin saw gold and silver jewellery sales rise by more than 40%, according to a statement from the ministry of commerce earlier this week. Demand has also been increasing in India, the second biggest consumer, helped by the festival and wedding season. Indian gold premium increased to $12-$15 an ounce last week from $7 two weeks ago, dealers said. This month, India will celebrate the festivals of Dhanteras and Diwali and both are considered auspicious times for buying gold jewellery, coins or bars. As the wedding season approaches, demand for gold is expected to increase. Gifts of gold are an important part of Indian weddings. “Gold demand in the physical market has increased and is likely to remain firm until early next year because of festivals and the wedding season. Gold jewellery remains in demand during the marriage season as it is mandatory for Indian households to gift gold,” said Yash Zaveri, director of retailer Zaveri & Co. The big news of the week, which went unnoticed by mainstream media was the launch of the new gold kilo bar contract by the Singapore Exchange. The new Singapore Kilobar Gold contract is for 25 kilograms of 99.99% pure gold and began trading on the Singapore Exchange (SGX) at 8:15 a.m. on Oct. 13, introducing centralized trading and clearing of a physically-delivered gold contract in Singapore. The contract is the result of a collaboration between International Enterprise (IE) Singapore, Singapore Bullion Market Association (SBMA), Singapore Exchange (SGX) and the World Gold Council. Commenting on the significance of the announcement, Singapore's Minister of Trade and Industry Lim stated, "With our close proximity to both demand and supply in Asia, I believe that Singapore is well-placed to support the bullion industry, with substantive mutual benefits." Asia's incessant demand for physical gold is the biggest driver for the implementation of a new gold contract trade on the Singapore Exchange. "Our vision is that Asia can be a driving force to continue the growth of the bullion industry, and be a global leader in areas fundamental to the demand and trade in this region," he added. The move comes after in 2012 the Singapore Government exempted investment in precious metals (IPM) from a 7% Goods and Services levy. "The global gold market continues to shift from west to east and Singapore's ambitions to become a gold hub reflect this trend. Since its inception, the World Gold Council has worked with key market participants to drive the development of this market," said Albert Cheng, Far East Managing Director at the World Gold Council. Brink's Singapore Pte Ltd has been appointed as an Approved Vault Operator and its approved vault is at The Singapore Freeport. Banks supporting the development of the contract include JPMorgan Chase Bank, Standard Bank Plc Singapore Branch, Standard Chartered Bank and The Bank of Nova Scotia. Muthukrishnan Ramaswami, President, SGX stated, "SGX is pleased to support the consortium's efforts to develop Singapore as a global trading hub for gold. SGX's market place will enable the trading and clearing of the Singapore Kilobar Gold Contract and establish a fully transparent price discovery mechanism for gold in this region." The Shanghai Gold Exchange was launched in September inside the city’s free-trade zone, offering yuan-denominated contracts backed by gold held in Shanghai. China is now the world’s largest producer and consumer of gold, and the biggest importer, as domestic demand has outstripped supply. India also is a major buyer and importer. Two-thirds of global gold purchases come from Asia. With such demand for physical gold, it is obvious that there is a complete disconnect between the current price of gold and the real value of gold. This price suppression has been the result of the activities of the CME Group, together with major banks. By using paper contracts on Comex, these institutions are causing severe dislocations in the real world and the scam can't continue indefinitely and will cause its own demise by how it distorts the real world of supply and demand. Furthermore, the recent rally in the U.S. dollar is unjustified by the economic fundamentals and will not be sustainable in the long-term. Gold therefore remains a crucial portfolio diversifier for the potential dangers ahead. Technical picture

Gold prices have rebounded strongly from recent lows and are likely to climb higher and re-test resistance at around $1270 an ounce. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ted Butler’s Silver Price Outlook – Why This Time Could Be Different Posted: 14 Oct 2014 07:29 AM PDT The Commitment of Traders Report, for positions held at the close of Comex trading on Tuesday October 7th 2014, did not change much compared to a week earlier. The reporting week included October 3d on which silver was trading at its absolute lows. According to Ted Butler these lows didn’t mean much, as there was so little volume associated with them, that they were more fishing expeditions by JPMorgan and their High Frequency Trading buddies, than anything else. The powerful rallies [with high volume] off those lows pretty much negated any improvements in the COT Report that would have shown up if those rallies hadn’t occurred. Ed Steer analyzes in his daily gold and silver newsletter the COT report (www.caseyresearch.com/gsd) for the reporting week in which silver reached $16.70 and gold $1185:

What do we make out of the current gold and silver futures positions? One thing is clear, as both Butler and Steer have reiterated, the rate of accumulation in short positions of commercial traders (read: JP Morgan) during the next rally will determine to which extent the rally will run. So far, after the silver price peak in 2011, all rallies have been capped by aggressive shorting by commercials. Is there a reason to believe this time will be different? Although hesitant, COT analyst Ted Butler believes there are reasons to believe that it could be different with the next precious metals rally. From Ted Butler’s latest premium update on www.butlerresearch.com:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Building an Ark: How to Protect Public Revenues From the Next Financial Meltdown Posted: 14 Oct 2014 06:36 AM PDT Concerns are growing that we are heading for another banking crisis, one that could be far worse than in 2008. But this time, there will be no government bailouts. Instead, per the Dodd-Frank Act, bankrupt banks will be confiscating (or “bailing in”) their customers’ deposits. That includes local government deposits. The fact that public funds are secured with collateral may not protect them, as explained earlier here. Derivative claims now get paid first in a bank bankruptcy; and derivative losses could be huge, wiping out the collateral for other claims. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peter Schiff - China's Boom and Lust for Gold - Video Posted: 14 Oct 2014 06:19 AM PDT Synopsis: With the launch of the iPhone 6, Americans now wait in line for hours to sell wealthy Chinese the smartphones at 10X the price. How did we become the waiters and they the big spenders? Peter explains China's ongoing boom and what it means for their favorite commodity - gold. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Oct 2014 06:15 AM PDT US policies that promote warfare and welfare have produced massively increased debt, much higher consumer prices, larger government, and more central bank intrusion into the markets. And yes, higher silver and gold prices also resulted from these policies. Fifty years ago we were bombing North Vietnam "back into the stone age" while also declaring a "war on poverty." The consequences of both "wars" have not been encouraging. Since then we have created considerable indebtedness by promoting such questionable ideas as a war on Iraq, a war on drugs and a war on terrorism. Future uses of national income and more debt could include a war on ebola, war on ISIS, and many other "wars." | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Swiss Gold Referendum “Propaganda War†Begins Posted: 14 Oct 2014 06:03 AM PDT The referendum for the Swiss Gold Initiative is scheduled for November 30th and the propaganda war - between the Swiss National Bank (SNB) and the Swiss Parliament on one side and the Swiss People's Party (SVP) on the other - has begun and we expect it to escalate as the day draws nearer. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| South Africa's gold CEOs ready for mergers as prices decline Posted: 14 Oct 2014 05:20 AM PDT By Kevin Crowley JOHANNESBURG, South Africa -- South Africa's gold miners are ready for mergers and acquisitions as the falling price of bullion forces companies to cut costs and repay debt. "Maybe there's some smart consolidation that can take place on a regional basis," Sibanye Gold Ltd. Chief Executive Officer Neal Froneman said last week. "I think there will be. I think it's the right time. I think it's necessary. I don't think my counterparts in the industry are on completely different pages either." The company is the country's biggest producer of the metal. Gold's 27 percent drop since the start of last year has prompted executives to consider deals as a way of cutting costs in South Africa's aging mines and insulating investors from risks such as labor strikes in the country that's the world's sixth-biggest producer of the metal. AngloGold Ashanti Ltd. failed in its attempt last month to split its local mines from its international operations only because investors balked at the accompanying $2.1 billion share sale. "We're probably a good target right now," Graham Briggs, CEO of Harmony Gold Mining Co., South Africa's third-largest bullion producer, said in an interview last week. "A low share price, we're fairly good with our cost control. If we had bigger management fees to take out, it would be even more of an advantage. We have low debt." ... For the remainder of the report: http://www.bloomberg.com/news/2014-10-13/south-africa-gold-ceos-ready-fo... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JPMorgan sets aside $1 billion for forex-rigging penalty Posted: 14 Oct 2014 05:06 AM PDT By Tom Braithwaite and Martin Arnold JPMorganChase set aside $1 billion in legal reserves, depressing third-quarter results, as the largest US bank by assets prepares to pay big penalties over allegations it manipulated the foreign exchange market. The bank has paid billions of dollars in penalties over regulatory violations and lawsuits in the past two years -- ranging from the "London whale" trading fiasco to mis-selling mortgage-backed securities. Bulking up its reserves by $1 billion was more than analysts expected and took the bank's profits for the three months to the end of September below expectations, at $5.6 billion. It is a sign, according to people familiar with the matter, that JPMorgan is close to settling enforcement action, which is being led by authorities in the UK and US, and affects several of the world's biggest currency trading banks. ... ... For the remainder of the report: http://www.ft.com/intl/cms/s/0/01f4693c-5380-11e4-929b-00144feab7de.html ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Oct 2014 04:46 AM PDT The coming bond market crash. And what happens when there is no more gold. [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Oct 2014 03:44 AM PDT You don’t need a weatherman To know which way the wind blows. â€" Bob Dylan, “Subterranean Homesick Blues,†1965 Full fathom five thy father lies. Of his bones are coral made. Those are pearls that were his eyes. Nothing of him that doth fade, But doth suffer a sea-change Into something rich and strange. â€" William Shakespeare, The Tempest | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||