saveyourassetsfirst3 |

- Lois Lerner’s Revenge: Anti-Obamacare Filmaker is Hit with IRS Audit

- Silver Myths Smashed: The Most Commonly Spoken Silver Lie Today

- What’s behind the Swiss gold referendum?

- This chart could be GREAT news for resource investors

- Technical Outlook: Gold and Silver

- Date of Swiss Gold Initiative Vote Inches Closer

- Gold – Takes a Breather Below $1225

- Gold Bounce May Be Fizzling As SPX Threatens Key Trend

- Gold Trading Levels at 1206 and 1240

- Marshall Swing: It is Time to BUY, BUY, BUY Physical Silver With Every Fiat Dollar You Have!

- Silver Eagle Sales Hit A One Day Record Two Days In A Row

- Metals market update for October 10

- Further softening of gold prices to be expected

- He’s one of the world’s smartest gold analysts. You probably won’t believe what he’s doing now.

- David Morgan’s Secret to Being Grateful, Even at $17 Silver

- 5 Reasons Why The Gold Price Could Have Bottomed at $1,180

- “Non-Official Cover” – Respected German Journalist Blows Whistle on How the CIA Controls the Media

- Gold bullion sold to cover equity losses

- Global Equity Shock as “Captured” System Starts to Crack

- Global Equity Shock as "Captured" System Starts to Crack

- Caviar for Apple but the Irish Poor Must Pay Yet Again for Water

- Labour first

- Silver in supply deficit but price unmoved so far

- The Fourth Central Bank Gold Agreement - what gives?

- Gold Loses Steam Around $1235

- Silver price saw the ‘most intense’ manipulation ever this September says Bill Murphy

- Silver - Technical Report

- The Gold Dollar

- Schizo Market Has Biggest Plunge in 6 Months Following Most Euphoric Surge Since 2011

- Former Fed Chair Bernanke takes stand, underscores need for 2008 AIG bailout

- Draghi Policies Blunted in Berlin as German Protests Grow

- Festive buying of gold starts in UAE but lags in India

- Lawrence Williams: World top 15 gold producers - output still rising but peaking this year

- Lawrence Williams: World Top 15 Gold Producers—Output Still Rising, But Peaking This Year

- Gold Exposed As USD Revived By Safe-Haven Demand

- Gold & Silver: The Final Breakdown?

- Golden Secrets (III) Yamashita’s Gold

- Legendary Gold Trader: This Will Drive the Gold Trolls Wild- Gold Will Trade at New Highs Above $1900

- Oct 9/ no change in gold inventory at the GLD/no change in silver inventory at the SLV/gold and silver rise/Dow plummets by 334 points/Ebola scare intensifies!

- Gold Price – A Significant Bounce Off Support

- YOU ARE 100% RIGHT ABOUT SILVER — The Wealth Watchman

- The Current Au to Ag Ratio Tells the Story Very Clearly…

- Cartel Water-boarding PM Investors

- Global Equity Market Review

- Gold Trading Levels at 1206 and 1240

| Lois Lerner’s Revenge: Anti-Obamacare Filmaker is Hit with IRS Audit Posted: 10 Oct 2014 12:00 PM PDT There are many systemic reasons why America continues to circle the toilet bowl toward a full fledged oligarchic Banana Republic. I've spent the last couple of years highlighting many of them here on these pages. Nevertheless, all of them pale in comparison with the disappearance of the rule of law. When the rule of law ceases to […] The post Lois Lerner's Revenge: Anti-Obamacare Filmaker is Hit with IRS Audit appeared first on Silver Doctors. |

| Silver Myths Smashed: The Most Commonly Spoken Silver Lie Today Posted: 10 Oct 2014 10:30 AM PDT Wicked Men Hate Truth "Truth is treason in the empire of lies." Submitted by The Wealth Watchman: The powerful quote above is most often attributed to Dr. Ron Paul. Though I've never seen this attribution verified beyond any doubt, it is fitting that he should be credited with it, even if he wasn't the first to say it. My […] The post Silver Myths Smashed: The Most Commonly Spoken Silver Lie Today appeared first on Silver Doctors. |

| What’s behind the Swiss gold referendum? Posted: 10 Oct 2014 10:04 AM PDT The Swiss people have looked at the current financial situation of the world, and they want to go back to a gold standard. |

| This chart could be GREAT news for resource investors Posted: 10 Oct 2014 09:57 AM PDT From Tom McClellan’s Chart in Focus:

Last week I pointed out how the Commitment of Traders (COT) Report data for currencies were pointing to a big topping condition for the dollar. That top appears to have arrived, and if the dollar heads downward then that should provide a boost to prices for all sorts of commodities. A similar message comes from the COT data on copper futures, where we find that the commercial (big, smart money) traders are net long in a huge way. That means as a group they are positioned for a big rally in copper prices. They are often early in adopting a big skewed position, but nearly always right in the end. So to summarize, the smart money traders are betting on both a dollar decline, and a copper price rebound. Those two bets are actually the same thing, if we assume that a falling dollar happens, and that it causes commodities prices to rise. From a price standpoint alone, copper has broken out above the declining tops line which dates all the way back to 2011. But that breakout never went anywhere, and copper prices have since retraced back downward to rest upon the top side of that broken trendline. Pulling back to test a broken resistance agent like that is actually fairly typical behavior, and ultimately bullish as long as the declining tops line now holds as a support agent. With the commercial traders already at a huge net long position, it is more difficult for the bearish forces to break down through any significant support agent. Instead, copper is likely to move upward from here, with that rally fueled by the short-covering of the speculators who have been shorting it, and fueled as well by the unwinding of the dollar’s blowoff top. Other metals should presumably move higher as well. |

| Technical Outlook: Gold and Silver Posted: 10 Oct 2014 09:55 AM PDT actionforex |

| Date of Swiss Gold Initiative Vote Inches Closer Posted: 10 Oct 2014 09:52 AM PDT Will November 30, 2014 be a seminal day in the fight to return the world to a system of sound money? Maybe. But only if the good people of Switzerland ignore their devious central bankers and sycophant media. |

| Gold – Takes a Breather Below $1225 Posted: 10 Oct 2014 09:50 AM PDT marketpulse |

| Gold Bounce May Be Fizzling As SPX Threatens Key Trend Posted: 10 Oct 2014 09:50 AM PDT investing |

| Gold Trading Levels at 1206 and 1240 Posted: 10 Oct 2014 09:50 AM PDT dailyfx |

| Marshall Swing: It is Time to BUY, BUY, BUY Physical Silver With Every Fiat Dollar You Have! Posted: 10 Oct 2014 09:01 AM PDT What you see on the chart on this past Friday into Sunday/Monday has all the markings of a classic commercial short covering price raid but that is the subject of next week's report after the numbers come out… That $16 handle came and went quickly, did it not? It is still time to BUY, BUY, […] The post Marshall Swing: It is Time to BUY, BUY, BUY Physical Silver With Every Fiat Dollar You Have! appeared first on Silver Doctors. |

| Silver Eagle Sales Hit A One Day Record Two Days In A Row Posted: 10 Oct 2014 09:00 AM PDT The last day of September, the U.S. mint reported silver eagle sales of 750,000 coins. One day later, they reported another 1.65 million. Both were one day records. The two-day total – 2.35 million – was more than the entire months of August and July: Submitted by PM Fund Manager Dave Kranzler, Investment Research […] The post Silver Eagle Sales Hit A One Day Record Two Days In A Row appeared first on Silver Doctors. |

| Metals market update for October 10 Posted: 10 Oct 2014 08:46 AM PDT Gold climbed $1.20 or 0.1% to $1,223.70 per ounce and silver fell $0.05 or 0.29% to $17.35 per ounce yesterday. |

| Further softening of gold prices to be expected Posted: 10 Oct 2014 08:24 AM PDT The CARE Ratings' report on gold released yesterday predicts gold prices to hover around $1,200 per oz, with a downward bias for the rest of the year. |

| He’s one of the world’s smartest gold analysts. You probably won’t believe what he’s doing now. Posted: 10 Oct 2014 08:00 AM PDT From Frank Curzio, editor, Small Stock Specialist: One of the world’s smartest gold analysts is making a big bet on gold. If you’re interested in making money from precious metals, you should consider doing the same… On Wednesday, I spoke with John Doody on my S&A Investor Radio podcast. (You can listen to my entire conversation with John for free right here.) John has been studying and analyzing gold stocks for more than 40 years. Today, John writes the excellent Gold Stock Analyst newsletter. His opinion on gold stocks is so respected, he has been quoted in Barron’s, The Financial Times, the Washington Post, and the Wall Street Journal. And he told me that nearly his entire $12 million fortune is now invested in gold today. This might sound crazy… The price of gold has gotten crushed over the past few years. The metal is down more than 20% since the start of 2012. And gold stocks have fared even worse. The benchmark gold-stocks fund, the Market Vectors Gold Miners Fund (GDX), is down more than 55% since January 2012. For comparison, the S&P 500 is up more than 55%.

Most investors have given up on the sector. But John says this has created an enormous opportunity for investors to buy gold today. You see, there are several catalysts that should push gold and gold stocks higher in the months ahead. For starters, Europe’s economy is going through a sharp slowdown. The latest economic figures show many European nations could fall into a recession. Because of this, John says the European Central Bank (ECB) is likely to announce several more plans to stimulate the economy by printing money and keeping interest rates low – just like the U.S. has been doing. The ECB has already cut interest rates twice since June. It also announced it would be buying covered bonds and bundled bank loans. But more aggressive measures are likely on the way. This will create a huge amount of cheap money that will eventually result in higher inflation. And even the hint of higher inflation could push gold prices – and gold stocks – higher as investors, worried about the devaluation of their money, pour into these assets. History also shows gold prices should jump higher soon. Earlier this month, gold prices fell to around $1,200 per ounce. Since June 2013, gold prices have fallen to around $1,200 an ounce three times. The last two times gold prices tested these levels, they jumped higher in the months ahead. You can see this in the chart below…

As you can see, gold tested the $1,200 level in June 2013. The metal then soared 17% in three months. The same thing happened in December 2013. After falling below $1,200 per ounce, gold rallied 15% in three months. We could see something similar happen this time around. You see, gold prices HAVE to rise for gold companies to remain profitable. John says the average breakeven cost for gold companies is roughly $1,250 an ounce – higher than the current price of gold. That means gold producers are losing money right now. If gold prices remain below – or fall further below – the breakeven cost, some companies will go out of business or take supply off the market. Lower supply – while demand remains steady – will ultimately result in higher gold prices. And John says there’s another catalyst that means we could see lower supply soon… On November 30, Switzerland will vote on whether the Swiss National Bank will be required to hold at least 20% of its assets in gold. In 2000, Switzerland changed from a gold-backed currency to a euro- and U.S. dollar-backed one. The Swiss National Bank went from holding at least 30% of its assets in gold in 2000 to just 8% today. If the referendum passes, the Swiss National Bank will be forced to bring its percentage of assets backed by gold up to 20%. John says this will amount to it purchasing 50 million ounces of gold (equal to roughly half the annual mine supply) over the next few years. This would result in a tremendous amount of gold coming off the world market – which would push gold prices and gold stocks higher. Even if just one of these catalysts takes shape, it should be enough to push gold prices higher over the next few months from these depressed levels. So I suggest following John’s lead and adding a few gold stocks to your portfolio today. P.S. Back in 2009 – after gold fell double digits – John locked in gains of 979% and 1,013% on two gold trades. He made these big profits using just one simple strategy… a strategy that has made him nearly $12 million altogether. And today, John has agreed to share his secret. To learn more about John’s strategy – and how you can use it to profit from gold today – click here. |

| David Morgan’s Secret to Being Grateful, Even at $17 Silver Posted: 10 Oct 2014 08:00 AM PDT Manipulation and apathy can’t keep silver prices down forever; there is too much demand and too much money sitting on the sidelines. In this interview with The Gold Report, Silver-Investor.com Editor David Morgan tells us why he is grateful for his balanced approach to investing and life. He also explains why he is still excited […] The post David Morgan’s Secret to Being Grateful, Even at $17 Silver appeared first on Silver Doctors. |

| 5 Reasons Why The Gold Price Could Have Bottomed at $1,180 Posted: 10 Oct 2014 07:28 AM PDT The yellow metal has fallen nearly 40% from its 2011 high above 1900 to trade below 1200 at the start of this week, mirroring Columbus's own fall from grace as more of his transgressions have been brought to light. We want to highlight five reasons that gold may not be irreparably damaged: 1) Strong Previous Support at 1180 The first and most obvious reason that gold may bounce from here is that it tested strong previous support at 1180 earlier this week. This support level put a floor under the metal's price in both June and December of 2013, leading to a 200 point rally in each case. While gold has been putting in a series of lower highs over the last few years, a bounce back toward at least 1300 is possible off this key floor. 2) Bullish Gartley Pattern Projects a Rally off 1180 In addition to representing a key level of previous support, the 1180 level also marks the completion of a multi-month Bullish Gartley "222" pattern. For the uninitiated, this formation is named after the author (H.M. Gartley) and page number (222) of the first book to describe it (Profits in the Stock Market) way back in 1935. In essence, it helps traders identify higher-probability turning points in the market from the confluence of multiple Fibonacci levels. In this case, the 100% retracement of XA, 161.8% Fibonacci extension of BC, and ABCD pattern (where the AB leg is the same length as the BC leg) all converge at 1180 (see chart below). When multiple different support levels converge, the probability of a rally from that floor is increased. 3) Weekly Bullish Candlestick Pattern On a shorter-term basis, this week's price action off the 1180 level has been convincingly bullish. Gold prices are on track to complete a bullish Piercing Candle* formation this week, signaling a shift from selling to buying pressure and marking a possible bottom in the chart. A Piercing Candle is formed when a candle trades below the previous candle’s low, but buyers step in and push rates up to close in the upper half of the previous candle’s range. It suggests a potential bullish trend reversal. 4) Slow Stochastics Turning Higher from Oversold Territory In addition to the bullish price action and converging support levels at 1180, the Slow Stochastics indicator also shows that gold is oversold. As we go to press, the indicator is turning higher and about to cross back above both its signal line and the 20 level, suggesting that an oversold bounce is more likely. This mirrors the movement that we saw in the indicator the last two times gold tested 1180 support. 5) Gold Catching a Bid on Global Risk Aversion Finally, gold is also catching a bid on global risk aversion. Fears about a global Ebola epidemic, falling global growth estimates, the end of QE and increasing geopolitical uncertainty are all contributing to the risk-off move, which has driven cash flows into gold, a traditional safe haven. If traders remain on edge over the next couple of weeks, gold should continue to enjoy a bullish tailwind from safe haven flows. To the topside, bulls may look to target the Fibonacci retracements of the entire ABCD pattern in the coming weeks. The first hurdle could be the 38.2% Fibonacci retracement at 1263, followed by the 61.8% Fib level near 1310. Of course, if the bears are able to regain the upper hand next week, a drop through 1180 support would herald another leg lower, in line with the longer-term downtrend.

You can find more of FOREX.com's research at http://www.forex.com/latest-forex-research.html

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions. Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that FOREX.com is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. FOREX.com is regulated by the Commodity Futures Trading Commission (CFTC) in the US, by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investment Commission (ASIC) in Australia, and the Financial Services Agency (FSA) in Japan. Please read Characteristics and Risks of Standardized Options. |

| “Non-Official Cover” – Respected German Journalist Blows Whistle on How the CIA Controls the Media Posted: 10 Oct 2014 07:00 AM PDT "I was bribed by billionaires, I was bribed by the Americans to report…not exactly the truth." - Udo Ulfkotte, former editor of one of Germany's main daily publications, Frankfurter Allgemeine Zeitung Whether you want to admit it or not, CIA control of the media in the U.S. and abroad is not conspiracy theory, it is conspiracy fact. Submitted by […] The post "Non-Official Cover" – Respected German Journalist Blows Whistle on How the CIA Controls the Media appeared first on Silver Doctors. |

| Gold bullion sold to cover equity losses Posted: 10 Oct 2014 06:25 AM PDT Some large funds and traders cashed in positions to cover the large losses incurred in oil and stocks. |

| Global Equity Shock as “Captured” System Starts to Crack Posted: 10 Oct 2014 05:08 AM PDT Many commentators believe that the central banks and regulators have become captive to political and specific industry interests, we would agree. What is even more troubling is the degree to which the markets themselves have become centralised in their outlook. For example, In the last number of years an enormous amount of the world’s capital market asset basis is increasingly be managed by ONE single company and or directed by the services provided by Blackrock's "Alladin" system. Indeed The Economist magazine believes that "Alladin" monitors and supports upwards of 30,000 investment portfolios and assists in the direction of over 17 Trillion dollars in assets. That is 7% of the worlds total. This is sheer lunacy.

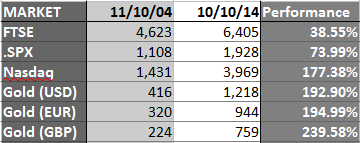

This week has seen some market volatility (see VIX Chart) reminiscent of the functioning market from days of old. The markets are spooked, bad news is overtaking good news and bearish views are becoming vogue. We are seeing a titanic battle taking place between the various bull and bear camps and they are starting to unleash some serious firepower. The sleepy volumes of late have ticked up appreciably, and small investors are shifting in their seats nervously. The secret that no one really wants to admit (especially while they are making money) is that the recent stock market rally is a gargantous fraud. It has very shaky foundations indeed, propped up on pillars of monetary jelly. At its core is a massive money creation machine which is utterly unaccountable and unelected and a very select credit distribution system. Market Volatility Index – 1989 to October 9, 2014 (Thomson Reuters) You have heard the arguments regarding growing mountains of debt, the risk of inflation and stagflation, overvalued stock markets, property markets, massive derivative positions etc etc etc. Perhaps you have become a little desensitized to these risks, because the party still seems to be going on, and no one is panicking. Yes we have had a few bumps in the economic road to date but they have been explained away. But far more has happened on your watch then you may be aware and it might all becoming to a head very, very shortly. What has happened is that the entire capital market complex has become “managed” and captured by a few very powerful institutions. What this means is that we have moved from a market based global economy – which matches buyer against seller in an efficient price discovery mechanism, to a planned global economy, where intervention is the norm and the views of those in leveraged command matter more. The markets are, and have been for the past 10 to 15 years, transfixed on the policy decisions of the U.S. Federal Reserve Bank, and all other global central banks are transfixed on the policy decisions of the Federal Reserve too. The power that this one institution has been given is staggering. They can, without any recourse, to elected officials, initiate policy that can send the global economy into a tailspin. Their policies can push millions if not billions of Emerging Economy citizens into destitution or transform them from impoverished to empowered. The market gyrations we are seeing this week are multi-faceted. At their heart is a game of chicken between what the markets say they need and what the Federal Reserve is willing to give them. It all comes down to the terms by which credit is released and managed and how productive those in receipt of money can be with the credit. There is also another battle being waged, those that wish to print money to stimulate and those that wish to manage government expenditures in order to balance the fiscal books. The market assumptions regarding Germany and its economy are being found to be false, the growth assumptions for the global economy are being found to be false, these falsehoods are now being priced into expected returns, and as such current valuations are being seen as being shaky. Many commentators believe that the central banks and regulators have become captive to political and specific industry interests, we would agree. What is even more troubling is the degree to which the markets themselves have become centralised in their outlook. For example, In the last number of years an enormous amount of the world’s capital market asset basis is increasingly be managed by ONE single company and or directed by the services provided by Blackrock's "Alladin" system. Indeed The Economist magazine believes that "Alladin" monitors and supports upwards of 30,000 investment portfolios and assists in the direction of over 17 Trillion dollars in assets. That is 7% of the worlds total. This is sheer lunacy. What if the Federal Reserve makes a bad call, what if the Alladin misses it, what then? Too much power vested in two few is a recipe for disaster. Truly we have put a fox in charge of our hen house. Gold has started to grab attention as concerned money seeks a safe haven. Interestingly over the last 10 years gold has risen in most currencies and far outperformed the equity markets. See GoldCore's 'Gold Important Diversification As Living In One Greatest Financial Bubbles Ever' Webinar Here RECEIVE BREAKING NEWS AND UPDATES HERE 9TH OF OCTOBER – THOMSON REUTERS INTERVIEW GOLDCORE'S MARK O'BYRNE FOR THOMSON REUTERS GLOBAL GOLD FORUM Jan Harvey thomsonreuters.com I’m joined in the Forum now by Mark O’Byrne, research director at GoldCore, who’s agreed to talk us through his view of the market. Welcome, Mark! Jan Harvey thomsonreuters.com Glad to have you. So — gold’s had a bit of a rollercoaster time of it recently, with prices falling back below $1,200/oz earlier this week. What sort of reaction did you see to that decline from consumers? Jan Harvey thomsonreuters.com Are potential buyers still attracted to gold at lower price levels? Or are there some concerns that it could have further to fall? Mark O'Byrne goldcore.com So repeat business is key with clients either reallocating to gold if they previously had liquidated – we advised caution when gold prices surged over $1600 back in 2011 – or clients increasing allocations due to concerns about various risks. Some good HNW and family office business too and a desire for storage in Singapore and Zurich. Mark O'Byrne goldcore.com Bit of both really. Think majority concerned about further falls but quite a large percentage of our clients see the price weakness as a buying opportunity. Think retail investors as a whole would be very concerned of further price falls as there is still a lot of risk appetite in the world and investors are favouring stocks and property over gold … for now Jan Harvey thomsonreuters.com What do you think we would need to see before we saw a stronger return to buying among retail investors? Mark O'Byrne goldcore.com I believe we need a period of rising gold prices and retail investors tend to be trend followers. We also probably need heightened concern about markets and about the financial system and global economy. A resumption of the Eurozone debt crisis, a U.S. recession, a global recession and major War in the Middle East and other risks of today… Mark O'Byrne goldcore.com have the potential to lead to a period of risk aversion which may see stocks, bonds and property come under pressure. This would greatly benefit gold and should see higher prices and retail investors allocate to gold again. Unfortunately for investors they tend to forget the most important rule in investing which is … Mark O'Byrne goldcore.com … DIVERSIFICATION. Irrational exuberance and complacency is rife again today — but for how long and how sustainable – are important questions Mark O'Byrne goldcore.com We advise dollar, pound or euro cost averaging into gold. This protects from volatility and short term price risk. Jan Harvey thomsonreuters.com Has there been a change in the kind of volumes, or products, favoured by retail investors this year over last? Mark O'Byrne goldcore.com Not for us. We tend to deal with investors who wish to accumulate physical gold in the cheapest ways possible. Therefore, we always offer cost effective bullion formats. If we are offering American eagles at very low premiums they will buy them, if we have Gold bars (1 oz) they will go for them. Mark O'Byrne goldcore.com We are offering kilo bars in volume at near 1% premiums currently, if the client buys a minumim of 4 kilo bars for storage in London, Zurich, Singapore or Hong Kong. Because we are so competitive on the premium, we are attracting some flows from the gold ETFs and some flows from banks unallocated gold accounts. Jan Harvey thomsonreuters.com What has interest been like in silver, compared to gold? Mark O'Byrne goldcore.com Thus, much of our business is not new gold buyers but rather from existing gold buyers who are looking to own segreated and allocated coins and bars Mark O'Byrne goldcore.com Quite similar. Although there is the silver stacker phenomenon of those who believe silver will either outperform gold or will be a better protection from a systemic or currency collapse or both … Mark O'Byrne goldcore.com … they buy silver consistently whenever they have disposable income and have been a constant for years. Their demand can be seen in the data as well. The VAT on silver in the UK and Europe can lead to less demand for silver for delivery but for our Secure Storage we see similar demand for silver as we see for gold – everything from 1,000 oz bars to silver eagles and maples and a combination thereof Jan Harvey thomsonreuters.com Do you think demand for silver has been affected by the hefty price swings of recent years (which have been even more pronounced for silver than for gold)? Mark O'Byrne goldcore.com Silver looks unvervalued when compared to stocks and many assets today and there is some merit to their line of thought Mark O'Byrne goldcore.com Yes the volatility has put off most of the retail investment marketplace. This means that silver remains the preserve of a minority of hard money types and those who are concerned about the financial and monetary system … Mark O'Byrne goldcore.com Although silver has been volatile – it is important to put that volatility into context. Silver is less volatile than many “blue chip” shares and many of the tech share darlings of today. Yet you rarely hear experts caution people from buying individual shares … Mark O'Byrne goldcore.com It is interesting there is a cross over of bitcoin advocates and early adopters and both share similar concerns about the monetary system … Mark O'Byrne goldcore.com Our positon on silver is similar to that on gold. It has a place in a diversifed portfolio. Somewhere between 5% to 10% for gold and 5% to 10% for silver. This means that an investor would have some 10% to 20% in precious metals … Mark O'Byrne goldcore.com This would be considered high but we believe that the financial, economic, monetary and indeed geopolitical backdrop merits higher allocations to precious metals today – especially due to their undervaluation versus stocks, bonds and property – all of which are at record highs. Jan Harvey thomsonreuters.com Thanks Mark. And thanks for joining us today! GOLDCORE MARKET UPDATE Gold climbed $1.20 or 0.1% to $1,223.70 per ounce and silver fell $0.05 or 0.29% to $17.35 per ounce yesterday. Gold in Singapore remained firm at $1,224.06 an ounce by 0035 GMT, after climbing for four straight sessions. Gold's safe haven status has been ignited on poor economic news from the eurozone's biggest economy, Germany, a weaker dollar, and IMF's weaker growth expectations for Japan and Brazil. In London, gold pulled back on Friday, ending four days of gains as the dollar climbed against a basket of currencies. |

| Global Equity Shock as "Captured" System Starts to Crack Posted: 10 Oct 2014 05:02 AM PDT gold.ie |

| Caviar for Apple but the Irish Poor Must Pay Yet Again for Water Posted: 10 Oct 2014 04:55 AM PDT  Oct 11th at 2 pm, Irish people are set to march in their thousands on O’Connell Street Like springs and wells bubbling up from the subterranean aquifer that is Ireland, finally grief and desperation driven resistance is springing up all over the country in the form of the Irish Water Meter Protests. Poor and working people are sore because they already pay for water through central taxation and they do not want to pay Irish Water, a Private Company Limited by Shares, a second time for this service. The impact of the charges incurred will be like ten austerity budgets in one. To add insult to injury this company wants the people’s PPS social security numbers so they can add it as an asset on their balance sheet. The incorporation of this company leaves it clear for corporate privatization two years hence. The banksters have their greedy eyes on Ireland’s Blue Gold. Tomorrow, Oct 11th at 2 pm, Irish people are set to march in their thousands on O’Connell Street. With Troika demanded water metering in process, Irish citizen’s last 50 Euro (p.m.) is set to be swallowed up by the voracious appetite of the controlling bankster elite and their cronies. The impact of the charges incurred will be like ten austerity budgets in one. The so called ‘recovery’ is only for the top earners and the other foreign, tax avoiding, corporations. Like springs and wells bubbling up from the subterranean aquifer that is Ireland, finally grief and desperation driven resistance is springing up all over the country in the form of the Irish Water Meter Protests. Poor and working people are sore because they already pay for water through central taxation and they do not want to pay Irish Water, a Private Company Limited by Shares, a second time for this service. To add insult to injury this company wants the people’s PPS social security numbers so they can add it as an asset on their balance sheet. The incorporation of this company leaves it clear for privatization two years hence. The banksters have their greedy eyes on Ireland’s Blue Gold. Water charges: Concern at 'excessive Garda force' The government is PPS-ing all over us Social media reacts angrily to Joan Burton’s ‘expensive phones’ comment Revealed: cut to top rate of tax on table in Budget Ireland mount strong tax regime defence Company Printout cro.ie Shares Irish Government 51% Ervia 49%

|

| Posted: 10 Oct 2014 03:57 AM PDT Sibanye Gold and Royal Bafokeng Platinum prioritise employee needs. |

| Silver in supply deficit but price unmoved so far Posted: 10 Oct 2014 01:50 AM PDT Silver has been the worst performing of the precious metals over the past year, but a continuing supply deficit suggests better things ahead. |

| The Fourth Central Bank Gold Agreement - what gives? Posted: 10 Oct 2014 01:43 AM PDT The signatories of the fourth CBGA do not have any plans to sell significant amounts of gold. |

| Posted: 10 Oct 2014 01:10 AM PDT dailyforex |

| Silver price saw the ‘most intense’ manipulation ever this September says Bill Murphy Posted: 10 Oct 2014 01:04 AM PDT The silver market saw the ‘most intense’ manipulation ever in September, according to founder of the Gold Anti Trust Action Committee Bill Murphy who spoke to Cambridge House host Vanessa Collette at the Canadian Investor Conference in Toronto. Is this the last gasp for desperate manipulators led by the central banks? Or is this a price manipulation that nothing can stop? Is the ’silver fix’ still a reality? How is China influencing the market? |

| Posted: 10 Oct 2014 12:15 AM PDT investing |

| Posted: 10 Oct 2014 12:07 AM PDT Charleston Voice |

| Schizo Market Has Biggest Plunge in 6 Months Following Most Euphoric Surge Since 2011 Posted: 09 Oct 2014 11:16 PM PDT Wednesday's panic buying vertical ramp in stocks - decoupling from everything but the trusty partners VIX and AUD/JPY - has been entirely unwound as The Dow drops over 300 points (nearly unchanged for 2014), Trannies tumble and Small Caps slump. Stocks all closed significantly lower - despite a late-day effort to lift - ending the day down from pre-FOMC Minutes. Treasuries closed 0-2bps higher in yield but had ignored equity exuberance and provided the reality check by the close. Real trading volatility ranges are surging in the major indices which historically has not been a good sign. The US$ retraced some of the FOMC losses as Draghi chatter pushed EUR higher. Oil prices cratered under $85 as gold and silver rose (despite US$ strength). Following yesterday's biggest intraday swing since Nov 2011, the Russell 2000 saw its worst day in 6 months. This Zero Hedge story is wall-to-wall charts---and they're worth skimming. It's the second offering in a row from Joe Nordgaard. |

| Former Fed Chair Bernanke takes stand, underscores need for 2008 AIG bailout Posted: 09 Oct 2014 11:16 PM PDT Former Federal Reserve Chairman Ben Bernanke testified in federal court Thursday that insurance giant American Group Inc. had to be rescued by the government in 2008 to avert global catastrophe. Bernanke took the stand at a trial of a lawsuit brought by former AIG Chairman and CEO Maurice Greenberg, who is suing the government over its handling of AIG's bailout loan. Bernanke was one of the key decision makers on the bailout, which began with an $85 billion rescue loan from the New York Federal Reserve in September 2008 and grew to nearly $185 billion in federal aid. In early questioning, Bernanke kept his answers terse when asked about the potential damage an AIG collapse might inflict. "Certainly there was an enormous amount of stress on financial institutions" in the fall of 2008 after mortgage financiers Fannie Mae and Freddie Mac had been taken over by the government and fear cascaded through financial markets, Bernanke said. I'm sure he lied when he had to, which would have probably been most of the time. However, it would be a tie as to which one was the biggest crook---as Greenberg has an ugly past. This AP story put in an appearance on their Internet site at 3:36 p.m. EDT yesterday---and I thank West Virginia reader Elliot Simon for sending it our way. |

| Draghi Policies Blunted in Berlin as German Protests Grow Posted: 09 Oct 2014 11:16 PM PDT The European Central Bank president has stopped short of large-scale sovereign-bond purchases as efforts to mollify Germany’s political elite do little to silence criticism of his ever-more expansionary measures. Support for anti-euro groups such as Alternative for Germany has risen and the ECB’s latest plan to buy assets sparked an outcry within all major parties. “German public opinion matters an awful lot,” said Anatoli Annenkov, senior economist at Societe Generale SA in London. “Draghi wants the ECB to be a central bank like any other, one that can go and buy government debt. But he’s perfectly aware of Germany’s opposition, and the storm now is a clear signal that it’ll be much more difficult.” Draghi, who [spoke at the Brookings Institution in Washington yesterday], may be pressured at this week’s International Monetary Fund meetings in the city to take further measures to revive the 18-nation currency bloc’s recovery. That won’t be easy in the face of a German aversion to quantitative easing that is rooted in the 1920s, when money-printing laid the foundation for a society that still fears rising prices more than deflation. Well, dear reader, all that central banks have to do is reprice their gold---and that would fix a lot of things, but it would cause a lot of problems as well. This Bloomberg article, filed from Frankfurt, showed up on their website at 3:47 a.m. Denver time on Thursday morning---and I thank Manitoba reader U.M. for her first contribution to today's column. |

| Festive buying of gold starts in UAE but lags in India Posted: 09 Oct 2014 11:16 PM PDT Indian expats in the UAE (and the Gulf) have gotten around to making their gold and jewellery purchases during the festive season of Diwali, aiming to make full use of the soft pricing for the metal. But their counterparts in India are yet to get into the full swing of it, according to a leading retailer. That the current government in India — which took over the reins in May — would bring down import duties, currently at 10 per cent, has come to naught. It means that, on average, buying gold in India is costlier by Dh15 or so on a per gram basis compared to what it would be in Dubai. And each time there are fluctuations in the rupee versus the dollar, there are those benefits to be had from buying here. “Gold retail sales in India are yet to see that pick up in demand typically expected ahead of Diwali,” said Joy Alukkas of Joyalukkas Group, which has an extensive network in southern India apart from what it has in the Gulf. “In comparison, there’s been an definite pick-up in volumes in the Gulf and across the board — what has helped is that Indian customs has turned more lenient in what travellers to India can bring into the country. This brief gold-related news item, filed from Dubai, put in an appearance on the gulfnews.com Internet site at 4:29 p.m. Gulf Standard Time [GMT +4] yesterday, which was 7:29 a.m. EDT. It's the second offering of the day from reader U.M. |

| Lawrence Williams: World top 15 gold producers - output still rising but peaking this year Posted: 09 Oct 2014 11:16 PM PDT According to the latest research report from London-based precious metals analysts – Metals Focus – global mined gold output is still on the increase this year, despite the much lower gold price prevailing. This is primarily due to the build-up to full production of a number of major new gold mining operations which came on stream in 2013, while the start-ups at Kibali in the DRC, Aykem in Ghana and Tropicana in Australia added a further 21 tonnes in the first half of the current year. The increased mine production in the first half of the year, however, was at least in part countered by a continuing decline in scrap sales – indeed the consultancy is forecasting a fall in global gold supply for the full year due to a predicted double digit drop in scrap supply. Overall Metals Focus is forecasting a global gold supply figure down 2% at 139 million ounces (4,323 tonnes) for the full year, with supply and demand in predicted balance. Looking ahead to 2015, though, there is a forecast further fall in scrap sales due to a likelihood of a continuation of low gold prices. If this is coupled with the beginnings of a decline in global mine production as the low gold price further impacts the sector with uneconomic mines no longer being able to be kept open then fundamentals may improve again. Even so, prices are seen as remaining relatively depressed, although a pick-up is seen as the year progresses. This commentary from Lawrie, which falls into the must read category, was posted on the mineweb.com Internet site yesterday---and it's the third and final offering from reader U.M., for which I thank her. |

| Lawrence Williams: World Top 15 Gold Producers—Output Still Rising, But Peaking This Year Posted: 09 Oct 2014 11:16 PM PDT "It was disheartening, but not surprising, to see JPMorgan et al show up" ¤ Yesterday In Gold & SilverThe gold price didn't do much in Far East trading yesterday---and the only rally worthy of the name began once the London a.m. gold fix was done for the day at 10:30 a.m. BST, which was 5:30 a.m. EDT. Gold rallied until 8:10 a.m. EDT---about ten minutes before the Comex open---and at that point someone hit the 'Buy the dollar index/Sell the precious metals" button. The low came a minute or so after 12 o'clock noon in New York---when the dollar 'rally' ended at precisely the same moment---and the precious metal traded sideways from there into the 5:15 p.m. EDT electronic close. The high and low ticks were recorded as $1,234.00 and $1,219.30 in the December contract. Gold closed in new York yesterday afternoon at $1,223.60 spot, up $2.10 from Wednesday's close. Net volume was very decent at 159,000 contracts Silver, of course, got sold down at the 6 p.m. Wednesday evening open in New York, but rallied back into positive territory around 11 a.m. Hong Kong time. At that point it traded sideways for a few hours, before beginning to rally anew an hour before London opened. Like gold, the rally got cut off at the knees a few minutes after 8 a.m. EDT---and spent the next forty-five minutes or so heading lower. Then the silver price had the audacity to rally anew---and hit its high tick of the day shortly before 10:30 a.m. EDT. At that point the HFT boys and their algorithms showed up---and by noon they had the price back to unchanged and, like gold, silver traded basically flat from there for the remainder of the New York session. The low and high price ticks were reported by the CME Group as $17.325 and $17.72 in the December contract. Silver finished the Tuesday session at $17.35 spot, down 3 cents from Wednesday's close. Platinum and palladium traded similarly, as both had their London rallies capped a few minutes after 1 p.m. BST/8:00 a.m. in New York. After that they continued to get sold down right into the 5:15 p.m. electronic close. Both were closed down 8 bucks on the day. Here are the charts. The dollar index closed late on Wednesday afternoon in New York at 85.32. From there it began to chop quietly lower, dipping a few basis points below the 85.00 mark on two occasions---with the last time coming about 12:40 p.m. BST in London. Then minutes after 1 p.m. BST/8 a.m. in New York, someone hit the "Buy the dollar index/Sell the Precious Metals" button. The 85.63 high tick came about 12:15 p.m. EDT---and the index shed a handful of basis points going into the close. It finished at 85.55---which was up 33 basis points from its Wednesday close. The co-relation between the beginning and end of the dollar 'rally'---and the beginning and end of the sell-offs in all four precious metals [gold and silver in particular]---was hardly coincidental. It looked totally engineered to me. But you're free to make up your own mind on this. The gold stocks opened down a hair---and never looked back until the 3:00 p.m EDT low tick. After that they rallied fairly sharply into the close. The HUI finished down 'only' 3.54%---but it was down a bit over 5 percent at its low. The silver equities followed a similar path as the gold stocks---and even though the silver price only closed lower by 3 cents, their shares got body slammed to the downside to the tune of 5.19%. The CME Daily Delivery Report showed that zero gold and 4 silver contracts were posted for delivery within the Comex-approved depositories on Monday. Nothing to see here. The CME Preliminary Report for the Thursday trading session was a no-show. When I checked their website at 3:30 a.m. EDT this morning, they had the final trading data posted for September 30. I'm sure that this will be fixed when the CME office opens in Chicago later this morning. There were no reported changes in GLD yesterday, but 1,438,131 troy ounces of silver were withdrawn from SLV. It's hard to say whether that was a 'plain vanilla' withdrawal because of price action---or whether the silver was more desperately needed elsewhere. While on the subject of SLV---Joshua Gibbons, the "Guru of the SLV Bar List," updated his website with what was happening over at the iShares.com Internet site with regards to silver as of the end of trading on Wednesday. This is what he had to report: "Analysis of the 08 October 2014 bar list, and comparison to the previous week's list -- 695,726.3 troy ounces were removed (all from Brinks London) and 3,756,699.6 troy ounces were added (all to Brinks London). No bars had a serial number change." "The bars removed were from: Britannia Refined Metals (0.3M oz), Handy Harman (0.1M oz), and 13 others." "The bars added were from: Solar Applied Materials (1.6M oz), Degussa (0.6M oz), Handy Harman (0.5M oz), Britannia Refined Metals(0.4M oz), and 24 others." "As of the time that the bar list was produced, it was overallocated 244.6 oz. All daily changes are reflected on the bar list. Again, about 3.7M oz of the deposits appear to be fresh bars (never in SLV before)." The link to Joshua's website is here. I also noted that the good folks over at the shortsqueeze.com Internet site updated their short interest data for GLD and SLV as of the last trading day in September---and this is what they had to say: In SLV, the short interest increased by 9.37 percent, from 13.73 million shares/troy ounces up to 15.02 million shares/troy ounces. I would assume, maybe wrongly, that this was 'normal' shorting of the shares. This is naked shorting because the short seller never had to deposit any physical metal to back it up. There are now two owners of the same shares, but only one has real silver backing it. In GLD, the numbers went the opposite way, as the short interest in that ETF declined by 5.32 percent, from 1.55 million troy ounces, down to 1.47 million ounces. There was no sales report from the U.S. Mint. Over at the Comex approved depositories on Wednesday, there was a decent withdrawal in gold, as 96,750 troy ounces were shipped out---and 4,179 troy ounces were reported received. Virtually all the activity was at Canada's Scotiabank---and the link to that is here. The in/out activity in silver was much quieter than normal, as only 207,500 troy ounces were received---and 4,987 troy ounces were shipped out that door. The link to that action is here. Here are a couple of charts Nick sent out to all and sundry last night. The first shows the weekly and cumulative withdrawals from the Shanghai Gold Exchange for each year going back to 2008---and the second is just the total yearly chart, with the last bars in both charts being the "Withdrawn-to-Date" total. Both show precisely the same data, but presented differently. The first one shows the intra-year trend, which is slightly different for each year. I doubt if it means much, but it does give a birds-eye view over time. I have very few stories today, so few in fact that I had to check around the Internet to see if anything had been missed. It was just a very slow news day. However, having said that, there are some must reads in here that you should find the time for. ¤ Critical ReadsCarl Icahn Is Hedging, Warns a Big Correction is "Definitely Coming"While he still holds many stocks, Billionaire investor Carl Icahn joins the ranks of many of his billionaire market-watchers and is "hedging with S&P Puts," because he is "concerned about the whole economy." As he explains in this brief clip, "you can't keep an economy up just from The Fed," and with The Fed withdrawing from its money-printing largesse, Icahn concludes, a big correction "is definitely coming, it's just a matter of when." There's a 2:38 minute CNBC video clip embedded in this Zero Hedge piece from 6:04 p.m. EDT yesterday evening---and it's worth watching. I thank reader Joe Nordgaard for today's first story. Schizo Market Has Biggest Plunge in 6 Months Following Most Euphoric Surge Since 2011Wednesday's panic buying vertical ramp in stocks - decoupling from everything but the trusty partners VIX and AUD/JPY - has been entirely unwound as The Dow drops over 300 points (nearly unchanged for 2014), Trannies tumble and Small Caps slump. Stocks all closed significantly lower - despite a late-day effort to lift - ending the day down from pre-FOMC Minutes. Treasuries closed 0-2bps higher in yield but had ignored equity exuberance and provided the reality check by the close. Real trading volatility ranges are surging in the major indices which historically has not been a good sign. The US$ retraced some of the FOMC losses as Draghi chatter pushed EUR higher. Oil prices cratered under $85 as gold and silver rose (despite US$ strength). Following yesterday's biggest intraday swing since Nov 2011, the Russell 2000 saw its worst day in 6 months. This Zero Hedge story is wall-to-wall charts---and they're worth skimming. It's the second offering in a row from Joe Nordgaard. Sears Tumbles as Vendor Reportedly Halts ShipmentsSears Holding Corp. shares fell sharply Wednesday morning after a media report said a vendor halted shipments to the department-store chain. The move comes as suppliers are growing increasingly concerned about Sears’s finances ahead of the crucial holiday shopping season. Shares slumped as much as 17% to $25.05 on heavy trading volume. The stock has lost about half its value over the past 12 months. This news item appeared on The Wall Street Journal website at 11:12 a.m. EDT on Wednesday morning---and I found it in yesterday's edition of the King Report. Former Fed Chair Bernanke takes stand, underscores need for 2008 AIG bailoutFormer Federal Reserve Chairman Ben Bernanke testified in federal court Thursday that insurance giant American Group Inc. had to be rescued by the government in 2008 to avert global catastrophe. Bernanke took the stand at a trial of a lawsuit brought by former AIG Chairman and CEO Maurice Greenberg, who is suing the government over its handling of AIG's bailout loan. Bernanke was one of the key decision makers on the bailout, which began with an $85 billion rescue loan from the New York Federal Reserve in September 2008 and grew to nearly $185 billion in federal aid. In early questioning, Bernanke kept his answers terse when asked about the potential damage an AIG collapse might inflict. "Certainly there was an enormous amount of stress on financial institutions" in the fall of 2008 after mortgage financiers Fannie Mae and Freddie Mac had been taken over by the government and fear cascaded through financial markets, Bernanke said. I'm sure he lied when he had to, which would have probably been most of the time. However, it would be a tie as to which one was the biggest crook---as Greenberg has an ugly past. This AP story put in an appearance on their Internet site at 3:36 p.m. EDT yesterday---and I thank West Virginia reader Elliot Simon for sending it our way. Barclays to pay $20 million to settle U.S. class action over LiborBarclays Plc has agreed to pay nearly $20 million (£12.43 million) to resolve a U.S. class action lawsuit accusing the British bank of manipulating the Libor benchmark interest rate, according to court papers filed Wednesday. The proposed deal, disclosed in court papers filed in federal court in New York, is the first such settlement of private litigation in the United States against various banks accused of manipulating the London interbank offered rate. The deal, which must be approved by a federal judge, follows earlier agreements by Barclays in 2012 to pay $453 million to settle investigations by U.S. and British authorities related to Libor. As part of the $19.98 million settlement, on behalf of futures contract traders, Barclays has agreed to cooperate with the plaintiffs, who hope documents and information the banks provides will aid in resolving claims against other banks. This isn't even coffee money, let alone a licensing fee---and nobody goes to jail once again. This Reuters story, filed from New York, was posted on the uk.reuters.com Internet site at 9:19 p.m. BST on their Wednesday evening, which was 4:19 p.m. EDT. I thank reader Victor George for sharing it with us. U.K.'s Treasury hires banks to run first renminbi bond sale by a Western stateThe government has today hired three banks to help the UK become the first Western state to issue bonds in the Chinese currency renminbi. The Treasury has appointed HSBC, Standard Chartered and the state-owned Bank of China to run the sale. The new bonds will help to diversify the UK’s public reserves, which are currently held in US and Canadian dollars, euro and yen. Chancellor George Osborne said the sale is “another step in cementing Britain’s position as the centre of global finance”. The Treasury said the issue would be “benchmark-sized”, which typically means in excess of $500m (£308.6m) to allow future issuers to price themselves based on the benchmark's performance in the market. This news item appeared on the telegraph.co.uk Internet site at 1:40 p.m. BST yesterday afternoon---and I found it all by myself. Draghi Policies Blunted in Berlin as German Protests GrowThe European Central Bank president has stopped short of large-scale sovereign-bond purchases as efforts to mollify Germany’s political elite do little to silence criticism of his ever-more expansionary measures. Support for anti-euro groups such as Alternative for Germany has risen and the ECB’s latest plan to buy assets sparked an outcry within all major parties. “German public opinion matters an awful lot,” said Anatoli Annenkov, senior economist at Societe Generale SA in London. “Draghi wants the ECB to be a central bank like any other, one that can go and buy government debt. But he’s perfectly aware of Germany’s opposition, and the storm now is a clear signal that it’ll be much more difficult.” Draghi, who [spoke at the Brookings Institution in Washington yesterday], may be pressured at this week’s International Monetary Fund meetings in the city to take further measures to revive the 18-nation currency bloc’s recovery. That won’t be easy in the face of a German aversion to quantitative easing that is rooted in the 1920s, when money-printing laid the foundation for a society that still fears rising prices more than deflation. Well, dear reader, all that central banks have to do is reprice their gold---and that would fix a lot of things, but it would cause a lot of problems as well. This Bloomberg article, filed from Frankfurt, showed up on their website at 3:47 a.m. Denver time on Thursday morning---and I thank Manitoba reader U.M. for her first contribution to today's column. IMF chief: eurozone showing symptoms of Japan's chronic economic illsChristine Lagarde, the head of the International Monetary Fund, has warned that the eurozone is displaying the symptoms of Japan’s longstanding economic problems and needs fresh moves to avert the threat of recession. With the IMF’s annual meeting in Washington likely to be dominated by the failure of Europe to emerge from the financial crisis of six years ago, Lagarde dropped a broad hint that she wanted Germany to run down its budget surplus to boost growth. She said there was a “serious risk” of a recession in the eurozone if nothing was done to avert a new downturn. Her comments came after bad economic news from Germany and as the UK chancellor, George Osborne, said the stalling of the eurozone economy was already having an adverse impact on Britain. Asked if the eurozone was the new Japan, a country that has never fully recovered from the financial crash at the end of the 1980s, Lagarde said: “We have alerted to the risks of persistently low inflation, which was one of the attributes of Japan.” This news story, filed from Washington, was posted on theguardian.com Internet site at 5:48 p.m BST yesterday afternoon---and I thank S |

| Gold Exposed As USD Revived By Safe-Haven Demand Posted: 09 Oct 2014 11:00 PM PDT dailyfx |

| Gold & Silver: The Final Breakdown? Posted: 09 Oct 2014 10:00 PM PDT bullionvault |

| Golden Secrets (III) Yamashita’s Gold Posted: 09 Oct 2014 04:00 PM PDT Bix Weir |

| Posted: 09 Oct 2014 03:30 PM PDT Gold expert Jim Sinclair, the man who called the 1980′s gold bull market top to the day, and predicted gold’s rise to over $1650 an ounce in the current bull run nearly a decade ago, has sent a MUST READ alert to subscribers regarding the latest gold and silver take-down. Sinclair urges PM investors to […] The post Legendary Gold Trader: This Will Drive the Gold Trolls Wild- Gold Will Trade at New Highs Above $1900 appeared first on Silver Doctors. |

| Posted: 09 Oct 2014 03:16 PM PDT |

| Gold Price – A Significant Bounce Off Support Posted: 09 Oct 2014 02:54 PM PDT This is an excerpt from the daily StockCharts.com newsletter to premium subscribers, which offers daily a detailed market analysis (recommended service).

In our article on September 23 we postulated that gold seemed to be setting up for a triple bottom, but it was too soon to tell for sure. As of this week gold has reached the level of support drawn from the two previous bottoms, and it has bounced off that support. It is not yet a robust bounce, but it is at least a first small sign that a long-term bottom may be forming. In the chart below we can see the three bottoms that have formed at about the 1180 level. The recent bottom is not very prominent, but it hints at the possibility of a continued rally, and shows a window of opportunity beginning to open for gold bulls. The negative part of this picture is that the support line is part of a consolidation that is called a continuation pattern, which implies that it is just a pause before the preceding decline continues. The indicator at the bottom of the chart shows that sentiment for gold is still negative. Central Gold Trust (GTU) is a closed-end fund that owns gold, and, because it is closed-end, its shares which trade like a stock, can trade at a discount or premium to the actual value of the assets the fund owns. Because GTU is selling at a heavy discount to net asset value, we know that traders are not at all anxious to own gold. What we want to see is for GTU shares to start selling at a premium, because that will help confirm that any rally has market sentiment on its side and is likely to persist. Essential to the continued strength of gold is the continued weakness of the dollar. The next chart shows that the dollar, which experienced an unusually sharp advance, has begun to break down.

However, the weekly chart shows that this weakness may only be a technical pullback after a long-term breakout. Conclusion: Thanks to a sharp pullback by the dollar gold has managed to bounce off an important support line, and offers the possibility that another rally is beginning, a rally that could end the long decline from all-time highs. It is a time for increased attention for those who want to catch the next gold rally. |

| YOU ARE 100% RIGHT ABOUT SILVER — The Wealth Watchman Posted: 09 Oct 2014 02:03 PM PDT Despite the cartel's vicious, criminal paper games, Silver & Gold demand has EXPLODED and Western demand is back with a vengeance. Judging by the past week of Silver Eagle sales from the US Mint the big players, the smartest guys in the room were busy buying nearly 24 tonnes of silver from the U.S. Mint! So […] The post YOU ARE 100% RIGHT ABOUT SILVER — The Wealth Watchman appeared first on Silver Doctors. |

| The Current Au to Ag Ratio Tells the Story Very Clearly… Posted: 09 Oct 2014 01:35 PM PDT The current Au to Ag ratio tells the story very clearly … one would think that a blind man could see it. Submitted by Dr. Jeffrey Lewis, Silver-Coin-Investor: But the truth of the matter is this … Main Street got raped by Wall Street, Wall Street sleeps the FED and gets all […] The post The Current Au to Ag Ratio Tells the Story Very Clearly… appeared first on Silver Doctors. |

| Cartel Water-boarding PM Investors Posted: 09 Oct 2014 01:30 PM PDT After silver topped $30, I realized I needed more, that my purchases at $24 were rather insignificant. I often sang that refrain: "How I wish I had bought it cheaper." The rest is history—especially the part where I loaded the boat with a credit card at over $40 per ounce. So here we are with $17 […] The post Cartel Water-boarding PM Investors appeared first on Silver Doctors. |

| Posted: 09 Oct 2014 01:20 PM PDT Source: Short Side of Long Blog We have all been watching a correction unfold in global stock markets. Everyone is wounding whether or not it is a sign of something more worrisome to come. Depending on regions and sectors, the correction started in either middle of June or middle of September and global equity markets have been impacted with varying results. Some are down only a few percent while others have reached and bypassed a correction territory (10% or more on the downside). Chart 1: Global stock market indices have been quite weak as of late! Source: Short Side of Long

Breadth has weakened meaningfully around the world. As of last Friday, we had less then 30% of important global stock markets trade above their respective 200 day moving average. MSCI World Index has only 37% of its components trade above their respective 200 MAs, while Europe has actually become extremely oversold at only 12%. It seems majority of the weakness is coming from foreign stock markets, as the recent US Dollar rally has put a decent amount of selling pressure on various stocks. However, bullish sentiment on the US Dollar is now at nosebleed levels so it would not surprise me one bit to see a pullback here. This could give global markets a bit of a relief.

Chart 2: S&P together with many other markets put in a strong reversal Source: Bar Chart (edited by Short Side of Long)

It seems to have started yesterday with S&P 500, together with the rest of the global stock markets, putting in a very strong reversal. As we can clearly see from both Chart 2 and Chart 3, US large cap equities continue to outperform the rest of the world, by trading above both the 200 MA as well as remaining above its rising trend line. Finally, while volatility is showing an uptick in recent weeks, so far it has been contained and compressed. If it does breakout, bears might finally be taking charge of the trend. Let us remember that this is an important juncture as Fed policy is changing and there is possible room for much higher volatility if markets throw a tantrum. Chart 3: US stocks still in uptrend, with volatility compressed for now… Source: Short Side of Long

So how important was last nights reversal in equities? I am not 100% sure as it is extremely hard to predict the future in the short term with high accuracy. Obviously, stock markets became oversold (look at the breadth readings in links again) so it is not surprising that we now attempting to rebound. We have to let the rally unfold a little and judge its breadth and price character, together with the way various stocks markets around the world perform. This would give us more information as to whether we should position for the bullish or the bearish trend.

Chart 4: US, Eurozone & Emerging Markets have diverging stock cycles Source: Short Side of Long

Bulls will claim that the US equity market trend remains in place and the yesterdays reversal is yet another buying opportunity signal. If bulls are correct and if I was bullish, I wouldn't be necessarily buying US equities here as they remain on the very expensive side. Maybe one could do better in GEM equities, which have overwhelmingly under-performed the world index. This is even more true if you believe the Dollar has topped out for awhile and could pullback, giving foreign equites a chance to rebound. On the other hand, bears will claim that global stock markets are starting to break down as the 2 year uptrend finally comes to an end. They would view yesterdays price reversal as a temporary rebound from oversold conditions, before another leg down. If bears are correct and if I was bearish, I would be looking to short the stock markets showing most technical damage and breadth deterioration.

The post Global Equity Market Review appeared first on The Daily Gold. |

| Gold Trading Levels at 1206 and 1240 Posted: 09 Oct 2014 12:01 PM PDT |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment