Gold World News Flash |

- Date of Swiss Gold Initiative Vote Inches Closer

- Still Worried About The Gold & Silver Smash - Just Read This

- Top Cyclical Forecaster: “Yes, A Mad Max Event Is Possible”

- Upside Down and Backwards: Here We Go Again

- Market Report: Market Turbulence

- Harvey Organ's Gold and Silver Blog Has Been 'Deleted by Court Order'

- An Ebola Outbreak Would Be Advantageous For Globalists

- The Real Great Rotation: Bond Funds Have Biggest Inflow On Record

- Gold and Silver Getting a Temporary Reprieve

- The Gold Price Rose $28.80 this Week or 2.4 Percent to Close at $1,221

- The Calm Before The Storm In The Gold Market

- A Brief Visual History Of Metals

- Gold Daily And Silver Weekly Charts - His Mills Grind Slow, But Exceedingly Fine

- Survive Ebola: Become a “White Blood Cell” For Mankind

- Why the Fed Will Continue to Print Money in 2015

- Central Bank Gold Agreement No.4

- Ditch Dollars, Buy Gold. For Now

- Chinese gold buying picks up after holiday and premiums rise

- Total Systemic Collapse, The Destruction Of Money & War

- 5 Reasons Why The Gold Price Could Have Bottomed at $1,180

- US Dollar Super Overbought

- John Embry -- Something Seriously Wrong With Financial System

- Gold, Stocks Market Turbulence

- Goldcorp CEO visits Australia and predicts 'peak gold' next year

- Alasdair Macleod: A market reset is due

- Soft Money Paradigm Breaking

- COT Data Show a Bottom for Copper

- The Stronger Dollar = Stealth QE

- Weekday Wrap-Up: Bitcoins and Goldbugs, Q3 Earnings Signals, $40 Oil, and Geopolitical Feedback Loops

- In Modi's Wake

| Date of Swiss Gold Initiative Vote Inches Closer Posted: 10 Oct 2014 09:20 PM PDT from TF Metals Report:

Will November 30, 2014 be a seminal day in the fight to return the world to a system of sound money? Maybe. But only if the good people of Switzerland ignore their devious central bankers and sycophant media. Regular readers of this site know that we’ve been all over this story for months. As the date of the Swiss national referendum approaches, you can be assured that many more updates will follow. For today, just a recap. To begin with, please read this: http://www.tfmetalsreport.com/blog/5731/turdville-love-open-letter-good-people-switzerland Then follow that up with this: http://www.tfmetalsreport.com/blog/6065/swiss-gold-initiative Why am I bringing this up again today? Because earlier this week, the Swiss National Bank (SNB) put out an opinion piece that was clearly designed to frighten the Swiss people into voting “NO” on The Initiative. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Still Worried About The Gold & Silver Smash - Just Read This Posted: 10 Oct 2014 09:01 PM PDT  Today King World News is featuring a piece by a man whose recently released masterpiece has been praised around the world, and also recognized as some of the most unique work in the gold market. Below is the latest exclusive KWN piece by Ronald-Peter Stoferle of Incrementum AG out of Liechtenstein. Today King World News is featuring a piece by a man whose recently released masterpiece has been praised around the world, and also recognized as some of the most unique work in the gold market. Below is the latest exclusive KWN piece by Ronald-Peter Stoferle of Incrementum AG out of Liechtenstein.This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Top Cyclical Forecaster: “Yes, A Mad Max Event Is Possible” Posted: 10 Oct 2014 09:00 PM PDT by Mac Slavo, SHTFPlan:

The destruction of the Russian ruble in the 1990′s, the rise and fall of the dot.com bubble, and the collapse of the U.S. economy in 2007-2008 were all verified predictions that he made well in advance of the events happening. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Upside Down and Backwards: Here We Go Again Posted: 10 Oct 2014 07:27 PM PDT “There are some ideas so wrong that only a very intelligent person could believe in them.” -George Orwell from Silver-coin-investor:

Cohen paints the portrait of a bond market panic; the very sort that could easily trigger the type of crash that could “get away” from policy makers and morph into a full blown currency crisis. And it then proceeds to miss the entire point all together. It’s no wonder they are called the Associated Press.

Early in, he frames a difference -mainstream investors who "poured trillions into the bond market over the last 5 years. This is opposed to the “fund managers and regulators” who are fretting over there not being enough buyers when everyone decides to sell at once. It implies responsibility of the mainstream investor versus the prudent manager and regulator. He describes a situation known as “liquidity risk” and some bond pros are scrambling to prepare for it. Portfolio managers are hoarding cash. BlackRock, the world’s largest fund manager, is suggesting regulators consider new fees for investors pulling out of funds. That distinction is a crucial one. Modern propaganda is most effective because it uses our natural deference to authority – the more obscure the better. The flip slide to that authority is our inferiority – the more obscure the subject. Finance is the perfect example. Most average people are quick to claim ignorance; while they defer to the most powerful who paint it as some massively complicated mathematical science. When in fact, while finance is an attempt at science, it is beholden to basic behavioral principles that are quickly reduced to “common sense” or basic civility. This one is especially rich: Mohamed El-Erian, former CEO of bond fund giant Pimco, thinks ordinary investors are too blasé about the flaws in the trading system. "Investors today are like homeowners who only discover there’s a clog under the sink when it’s too late and they’re staring at a mess." “It’s only when you try to put a lot of things through the pipes that you realize you’ve got a problem", says El-Erian, now Chief Economic Adviser to global insurer Allianz. “You get an enormous backup.” The key above is that investors – “who have poured into bonds” – are “like” homeowners. The Fed Risk “Now the U.S. central bank, which has done so much to lift prices, is threatening to knock the market from its perch. The Fed plans to end its own bond buying program after its next meeting in October, and is widely expected to raise short-term interest rates it controls next year. Bond investors have occasionally sold in a panic when these rates have risen in the past. Today the Fed is telegraphing its every move. Most investors think it will raise rates in slow and predictable increments. And all that cash that fund managers hold will help, too. Cash comprised 8.8 percent of assets in August, versus 6.3 percent before last year’s sell-off in May, according to the Investment Company Institute. The Fed is ending QE because, as the TBAC warned, it was competing (buying up “good” collateral) with REPO and clogging overnight liquidity – the mainline leverage conduit… The Feds were already well on their way to creating the next liquidity crisis. They had no choice to slow down QE to free up collateral. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market Report: Market Turbulence Posted: 10 Oct 2014 07:20 PM PDT from Silver Doctors:

On the news front, the S&P rating agency reminded us that Greece is likely to default, Germany released some horrible industrial production numbers, and the Federal Open Market Committee unexpectedly released dovish minutes. So what’s it all about? This week more than any other it became clear that the global economy is stalling, with the threat of outright recession in the Eurozone and Japan affecting other economies. And in the US, while much is made of an improving jobs scene, the fact remains that in relation to the size of the workforce there is a greater percentage of working-age people not employed since the 50's era of the male dominated workplace. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Harvey Organ's Gold and Silver Blog Has Been 'Deleted by Court Order' Posted: 10 Oct 2014 07:19 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| An Ebola Outbreak Would Be Advantageous For Globalists Posted: 10 Oct 2014 07:09 PM PDT Submitted by Brandon Smith of Alt-Market blog, It's sad to say with such finality, but a universal fact of existence is that most of the people you meet in this life are fundamentally and functionally ignorant. Not necessarily stupid, but certainly ignorant. Ignorance comes not from a lack of intelligence, but from a denial of knowledge and truth. That is to say, ignorance takes hold when people decide to act as though they know and understand a thing, even if they do not. Ignorance prevails when a society or nation chooses to value the appearance of expertise, to value the theater of overconfidence, and to cheer for the bluster of morons rather than admit that they have unanswered questions on subjects they do not yet grasp. For nothing is worse for the self absorbed than to acknowledge that they do not know. Entire nations have fallen throughout history because of this terrible weakness... By extension, such ignorance is not just an inherent disease but also an easily exploitable disease. When we refuse to think critically and examine our surroundings thoroughly, we become like grazing gazelles oblivious to the predators encircling us in the tall grass. And, just as there are predatory individuals that hide amongst us, there are are also predatory oligarchs that camouflage themselves as benevolent politicos and financial professionals standing above us. Normal predators we fear, establishment predators we invite into our homes as protectors, saviors, and partners. The disease of ignorance leaves us vulnerable to many other plagues, including literal plagues like the Ebola virus. When we take the establishment at its word concerning the threat of Ebola outbreak, we make ourselves vulnerable. When people assume that the worst could never happen to them, history shows us that it inevitably does. The recent discovery of an Ebola infected patient in Dallas, Texas has led to reasonable concern from the general population, but mainstream media efforts along with CDC and White House spin have subdued any practical response by the citizenry. The constant droning voice of the establishment claims there is nothing to be worried about; that even if there was an outbreak in the U.S., it would be quickly squashed by highly prepared medical response teams. First and foremost, the existence of just one Ebola infected person within America's borders indicates a likelihood of others, or the possibility of others in the near future unless policies and procedures are changed. As far as I can tell, the government has no intention of introducing rational fail-safes such as requiring mandatory quarantine for those seeking to reenter the U.S. from known outbreak regions, shutting down unrestricted travel into the country from countries with Ebola, training hospitals properly in the identification of the disease, or committing mass resources to quelling Ebola in hot zones before it reaches our shores, at least not in time to make a difference. Secondly, the establishment also has no intention of giving the general public accurate information as to the behavior and dangers of Ebola. Those I have spoken with in the medical field including some who work within major city hospitals have related to me that the CDC has not been honest in its assessment of the probability of outbreak. For example, the CDC is consistently reminding the public that Ebola is not an “airborn” disease, and this is technically true as far as the science indicates. However, they forget to mention that it is indeed a “droplet born” disease, meaning, it can travel through the air carried in an infected cough or sneeze. The tight quarters of an airplane make for a perfect petri dish, with droplets and particulates passing back and forth through the same space and oxygen for hours at a time. The spread of Ebola is nowhere near as containable as the CDC claims. I have been told that most hospitals are completely unprepared to fend off an outbreak of a virus as destructive as Ebola. Little to no standardized training has taken place, and some facilities are only now putting together a list of emergency procedures. Human error within the chain of care also occurs often, as we saw in Dallas, Texas, and these errors can lead to greater infection in a hospital environment. CDC and WHO efforts in countries like Liberia have been so ineffective and halfhearted it leads one to question why their budgets are in the billions of dollars? Where is all their capital and their resources going if not to bring an unprecedented hammer down on a clearly dangerous outbreak of Ebola? Why is the virus being allowed to flourish rather than being destroyed right where it started? Where has the full force of the CDC been for the past several months while death gestates in Africa? The one legitimate function of government, any government, is to protect the right of the people to pursue their own life, liberty, and happiness. I think stopping the invasion of mortal viruses would fall into this category. The one job our government is MANDATED to do, and it refuses to do it. Why? I have made the point many times in the past and I'll make it here again; when a catastrophe takes place, or a crisis is imminent, ask yourself, who ultimately benefits? I believe that the lack of strong prevention response from our government, an inadequacy which is obvious to all of the health care workers I have talked with and to anyone who has the sense to do their own research, could be absolutely deliberate. I believe the spread of Ebola may be desired by certain power brokers, and here is why: The Perfect Cover Event I have been warning for quite some time that the banking establishment in particular is well aware that an economic collapse of incredible proportions is coming. In fact, they have done everything in their power to make one possible. This collapse, according to my research, is designed to clear the way through monetary carpet bombing for a new international Bretton Woods-style agreement which will plant the foundation of a truly global economic system centralized and controlled by a highly select few elites. Needless to say, the internationalists would prefer not to take the blame for such a calamity. Regional or widespread war, terrorism, cyber attacks, etc, are all useful vehicles to conjure mass confusion, and can also be used as scapegoats for the eventual downfall of our economy. That said, a viral pandemic truly surpasses them all in effectiveness. All other tragedies could easily be tied to the first “domino” or “linchpin” (as Rand Corporation calls it) of Ebola transmission, but the strategy goes deeper than this... An Act Of Nature Even though most people are well aware of the fact that governments have been engineering biological weapons for decades, few people think political leadership would ever use them at all, let alone use them on the people they are tasked to protect. Even with the complacency and inaction of our government in terms of the response to Ebola, the general assumption by most of the American population will be that any viral outbreak is a product of nature, not of men. Acts of nature are not things that the common man can easily rebel against. People rebel against governments and corrupt despots all the time, but not the plague. If a viral pandemic strikes, nearly everything a government does after the fact, no matter how corrupt or destructive, can be rationalized as necessary for the greater good of the greater number. If anyone does rebel, they will be labeled as pure evil, for they are now disrupting the government's ability to stop the pandemic from spreading, and thus, are partly responsible for the mass deaths that follow. During a viral outbreak, government becomes mother, father, nurse and protector. No matter how abusive they are, most people will still look to them for safety and guidance, primarily because they have no knowledge of disease. What they do not understand, they will fear, and fear always drives the ignorant into the arms of tyrants. One should also take into consideration the fact that most globalists lean towards the ideology of eugenics and promote the concept of population reduction. A pandemic would fulfill this desire nicely... Rationalized Economic Collapse Who would question the event of an economic collapse in the wake of an Ebola soaked nightmare? Who would want to buy or sell? Who would want to come in contact with strangers to generate a transaction? Who would even leave their house? Ebola treatment in first world nations has advantages of finance and a cleaner overall health environment, but what if economic downturn happens simultaneously? America could experience third world status very quickly, and with it, all the unsanitary conditions that result in an exponential Ebola death rate. The treasury, labor department, and private Federal Reserve have gone to vast lengths to skew statistics and rig markets with trillions in fiat dollars. Despite historic numbers of Americans falling off unemployment rolls, imploding shipping and manufacturing statistics, and the U.S. teetering on the edge of global “de-dollarization”, a large portion of the citizenry has been led to believe that economic recovery is assured. What they do not understand is that fiscal implosion is unavoidable, and the whole bull market is a circus designed to distract. Amidst even a moderate or controlled viral scenario, stocks and bonds will undoubtedly crash, a crash that was going to happen anyway. The international banks who created the mess get off blameless, while Ebola, an act of nature, becomes the ultimate scapegoat for every disaster that follows. Rationalized Travel Restrictions If you want to lock down the movement of a population to prevent the spread of dissenting groups or ideas, I can't think of a better way than to claim it is to prevent the spread of a deadly virus. Our government and world health officials are approaching Ebola with an attitude of nonchalance right now, because prevention is NOT part of the plan. When Ebola strikes hard within our country, that is when they will finally decide that strict measures are needed. Suddenly, those borders that they could never secure before will become impassable for you and I. And traveling between states or perhaps even counties may be extraordinarily difficult. “Papers please...” will become the new mantra of petty authority. Forced Health Measures Do not be surprised if an Ebola vaccine of some kind suddenly appears on the market just as the situation begins to turn tragic. And, do not be surprised if said vaccine is a total sham that ends up making more people sick. Expect that forced vaccinations will take place, especially as a prerequisite for receiving treatment from CDC or FEMA hazmat facilities. Expect that these facilities will become nothing more than obscure prisons for the sick where people quietly die. Expect that every American will be required to be tested and screened, with biometric data carefully stored, beginning with airport travel (once the virus is already entrenched). The options are endless for abuse in terms of totalitarian health laws when the public thinks they could end up bleeding from every orifice and dying of liver failure. Rationalized Martial Law Imagine if some Americans decide they don't like being poked, prodded, tagged and bagged by the establishment. Imagine they decide to fight back, Ebola be damned. An already uphill battle becomes an epic struggle when a large percentage of the population thinks you are a monster that wants to hasten the spread of Ebola. Not that the ignorant count for much in the grand scheme of history, but waking at least some of them up in the future to the bigger threat (the globalists) is hard to do when all they can see is devilish microbes. Those who plan to combat the rise of the internationalists, as I plan to, should accept now the likelihood that the only people we will have on our side tomorrow are the people we have been able to wake up today. Martial law will be welcomed by the rest. International Response An international response is almost guaranteed during a major pandemic. Sovereignty will be tossed in the dirt. UN and WHO teams and perhaps even troops could accompany an aid package to the U.S. Think of the glorious propaganda, as globalists tell stories of how they “saved humanity” by surpassing the barbaric practices of national and individual sovereignty, defeated the Ebola virus (after millions of deaths, of course), and out of the ashes, the “phoenix” of global governance was born. If they succeed, imagine what the history books will say for the next several centuries. What Do We Do? There are no silver bullet solutions. There never have been and there never will be. People looking for them will be sorely disappointed and ill prepared after wasting so much time searching for an easy out. The only answer is for communities of people to take their own survival into their own hands and become as self sufficient as possible. This means that neighborhoods, towns, and counties will have to take precautions now to steel themselves for a pandemic event, instead of simply sitting on their hands and expecting government officials to save them. The treatments for Ebola in most cases involve nothing more than the steady replacement of vital fluids, electrolytes and plasma until the patient's body can build up an immunity to the virus. Those with stronger immune systems before contraction are more likely to survive and beat back the disease. Government care, for the most part, is NOT going to save many people either way. That is to say, your survival will depend on you and your immune system, not them. Communities that make efforts to prevent contact and that strengthen individual immunity will have a better chance of survival than going into any government run hazmat facility. Government is not needed, and will often end up being more of a threat than the virus itself. Groups I work closely with and talk with, many with their own doctors and nurses, are already setting prevention guidelines in motion. If you can prove you don't need the system to save you, their rationale for attempting to control you is weakened. The ignorant will still try to demonize us for our efforts, but self sufficiency is all we have in the face of this kind of storm. If we can lead by example with our own successful health standards while saving people where the establishment could not, perhaps we can turn the tide. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Real Great Rotation: Bond Funds Have Biggest Inflow On Record Posted: 10 Oct 2014 06:38 PM PDT Investors worldwide poured a net $15.8 billion into bond funds in the week ended Oct. 8. As Reuters reports, this is the biggest inflows in dollar terms since records began in 2001, according to EPFR Global. Money market funds also saw the biggest inflow since October 2013 as it appears the real great rotation is from stocks (biggest outflows in 9 weeks) into 'safe' assets.

The up-in-quality, and up-in-capital-structure trade is alive and well, as BofA notes, investment grade inflows exploded as high-yield spreads widened further - now at one-year wides (despite small inflows).

"Money is flowing out of PIMCO," warned one analyst but as BofA notes, PIMCO flows are reported monthly and so it is unclear as to the extent these flows are "overstated." | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver Getting a Temporary Reprieve Posted: 10 Oct 2014 05:45 PM PDT Gold closed last week below $1200 for the first time but has since rebounded from support at $1180. Silver has also rebounded but only after declining in 11 of the past 12 weeks. Precious Metals endured a very rough September and became very oversold. With Gold near its daily low and the gold miners (HUI, GDX) near their December lows, a rebound was probable. Precious metals bulls need to stay patient and disciplined as we believe this is an oversold bounce in a sharp downtrend until proven otherwise. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Rose $28.80 this Week or 2.4 Percent to Close at $1,221 Posted: 10 Oct 2014 05:15 PM PDT

All right! On the weekly chart the GOLD PRICE poked its head above the downtrend line and closed there. 'Tis interesting as well that the Gold/Philadelphia Bank Index spread gapped up this week, indicating that confidence in financial markets is waning & turning to gold. Gold has crossed above its 20 DMA, the first hurdle of a rally, but needs now to beat that last high at $1,237.00. Gold made a key reversal on Monday, then confirmed it on Tuesday, Wednesday, and Thursday by closing higher. Resistance above stands at $1,300, then $1,325, but the test will come at $1,350. There gold must prove whether it means business or not. The SILVER PRICE had been trading down to the downtrend line on a weekly chart, hit it last week & bounced up this week. Silver's goals now are (1) close above the downtrend line from the end-August high about 1750c. Above that next big resistance is 1875c, but 1900c also stands in the way. At 2153c, the last high, silver faces its last high, but the year's high has been 2218c, so silver must swing over that. Two interpretations are possible: the washout low last week exhausted and ended the precious metals correction that has lasted since 2011, and they will slowly advance & resume their primary uptrend from here. Alternatively, we will see a vigorous rally, but that will fail and take metals to one last low. Of the two I favor the first, but no one can tell until we see what gold does at $1,350. Watch for higher silver & gold prices next week. GOLD/SILVER RATIO remains high and it is time to swap gold for silver. It seems the waterfall has begun in stocks. They had a frightful week. Here are some statistics: Dow, loss since last high, 4.6%; loss this week 2.7%; below 200 DMA S&P500, loss since last high, 5.6%; loss this week, 3.1%; barely above 200 DMA Nasdaq Comp, loss since last high, 7.3%; loss this week, 4.5%; below 200 DMA Nasdaq 100, Loss since last high, 6.0%; loss this week, 3.9%; still above 200 DMA Russell 2000, loss since last high, 13.2%; loss this week, 4.7%; below 200 DMA Wilshire 5000, loss since last high, 6.3%; loss this week, 3.6%; below 200 DMA NYSE, loss since last high, 7.3%; loss this week, 3.2%; below 200 DMA In the arbitrary and goofy way the media do things, they now claim that 10% is a "correction." You can see all these indices pushing toward that mark, and the Russell 2000 well past it. Most significant is sinking below the 200 DMA. Markets often reach toward the 200 DMA in a correction, and when an upmarket touches it, that's a pretty good place to buy a correction. However, remember that by definition a bull or rising market is generally rising, so generally above its 200 day moving average, and vice versa for a falling market, that usually stays below its 200 day moving average. So that 200 DMA is a meaningful milestone. This is about as bad as a correction gets, but 'twill get worse yet. And although it has been terribly steep, it won't prove stock markets saw their ultimate top on 19 September until we see further confirmations. That is a good first approximation, though. Most of these indices (except for the S&P500 & N-100) have broken their uptrend lines from 2009, when the uptrend began. The S&P500 stands right at it (1906.13 vs. 1905.22) and the N-100 (3870.85 today vs. 3761.05). Hard for me to overstate the importance of breaking that uptrend line. Of course, markets often do that & recover, but seldom after a five year advance. It was the worst week for the S&P500 since May 2012. So far the Dow in Gold & Dow in Silver are pinpointing the downturn in stocks & upturn in metals. I know that mathematically they are bound to do that, but I mean that when they speak, they speak not with forkéd-tongue but reliably. Dow in gold fell 0.64% to G$279.48 gold dollars (13.52 oz). Already way below its 20 DMA, it stands only G$1.24 above the 50 DMA at G$278.24 (13.46 oz). This is free fall. Dow in Silver hath piercéd its 20 DMA (S$1,224.22 silver dollars or 964.86 oz) and today lost 0.95% to close at $1,230.39 (951.63 oz). The DIS lost 5.4% in one week. For both the DiG & DiS all indicators point down, calling for the move to continue. Like a kid stealing cookies who aims one eye always on the door watching for his mom, I have one eye peeled for the US dollar index. That rascal's liable to come back and lay a baseball bat over our head when we're not looking. It peaked this week with a high at 86.87, but sank and cut into its 20 DMA. Rallied back 28 basis points (0.33%) today and ended at 86.06. This calleth not the peak into question, but seem no more than ordinary up and down action. Indicators still call loudly for lower prices. That sorry euro touched its 20 DMA yesterday and it scared it so bad that today it fell back 0.53% to $1.2623. It helped not the euro (or US Stocks) that S&P today announced it was downgrading France's credit outlook as its budget & spending portended fatter deficits. Over in Japan, now in the sights of a super-typhoon, has a yen at least wanting to rise. Yen climbed 0.16% today and has begun a rally. Where it goes and how quickly the BOJ tries to kill it, we'll see. Y'all enjoy your weekend! Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

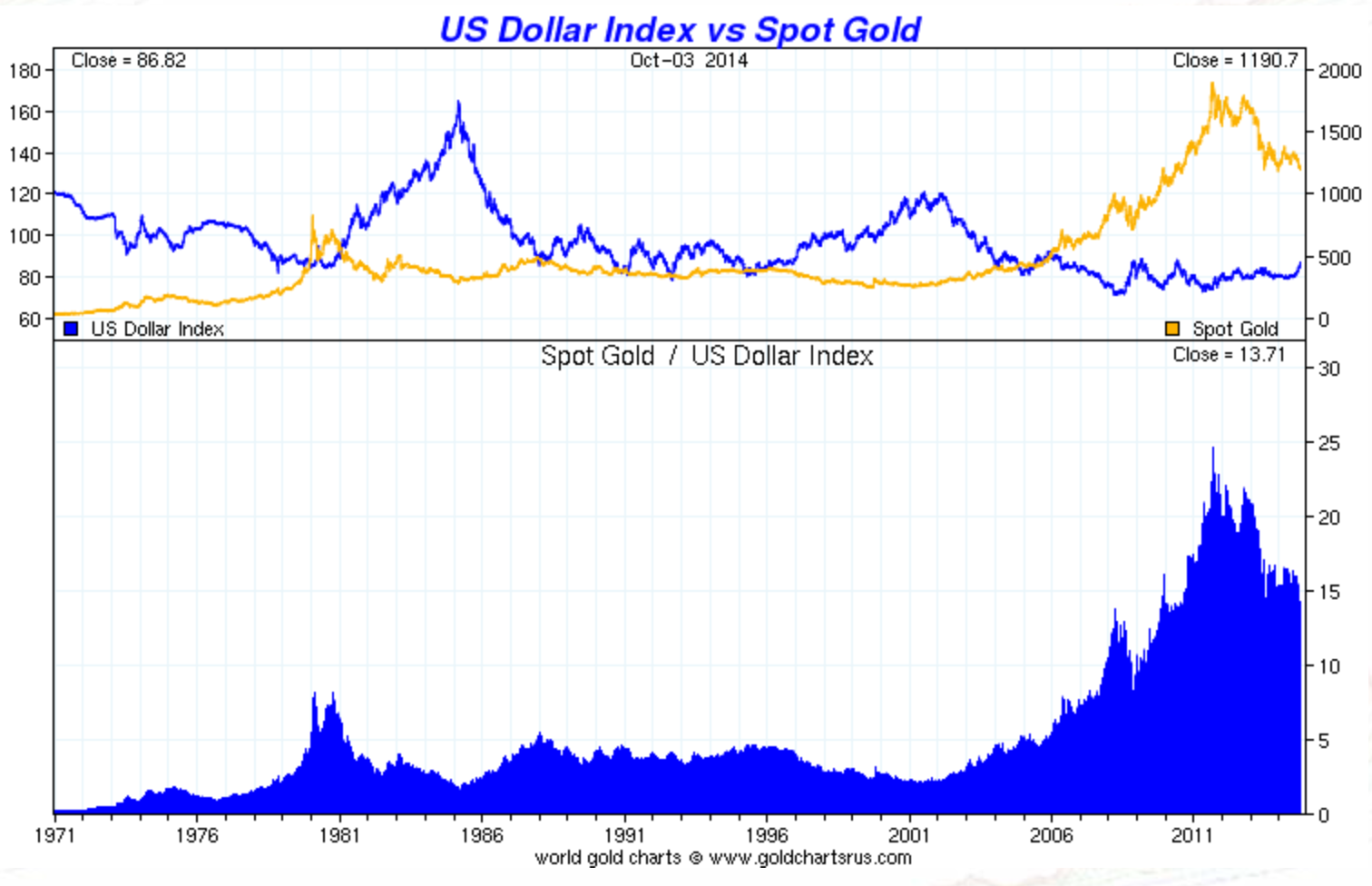

| The Calm Before The Storm In The Gold Market Posted: 10 Oct 2014 04:43 PM PDT Submitted by Dan Popescu via Goldbroker.com, US Dollar Index vs Spot Gold

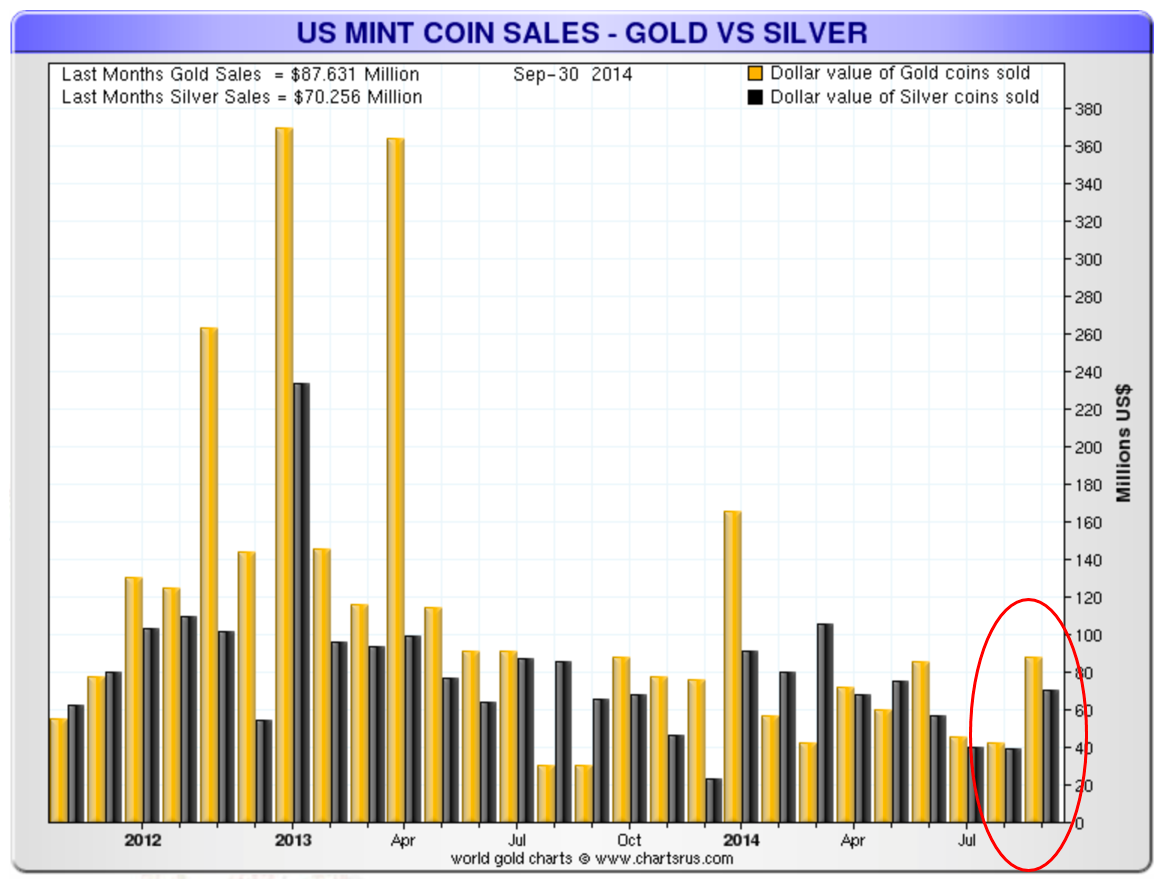

Again this week the gold price tested the $1,200 level dropping below it on higher US dollar against most fiat currencies. It is assumed that a stronger US dollar against the euro and other fiat currencies is also negative for the price of gold. However gold is not a hedge against the US dollar but rather against all fiat currencies. Even though gold’s price has been falling, in India and China gold premiums have increased signifying a rising demand. We have also seen a substantial increase in silver and gold coin sales in the US. Actually gold coin sales doubled in September compared to August.

US Mint Gold Coin Sales – Gold and Silver

With sentiment at historic low as I explained in my previous article Gold Sentiment, $1,200 and more specifically $1,180 is more a correction within a secular bull market than a pause in a larger bear market. With more and more articles coming out with titles like “Gold Dies”, I am more convinced than ever that we are seeing a major bottom being crated. Eastern central banks are still buying massively and Western central banks are holding on to their stock. This doesn’t look to me as a continuation of a downtrend. On November 30, Swiss citizens will go to the polls to vote on three areas; whether or not the Swiss National Bank should increase its gold reserves to 20%, that the central bank should stop selling its gold and that all its gold should be held within the country. If by any chance the Swiss people votes in favor I expect major tremors in the gold market. Just the fact that Switzerland will have to buy a large amount of gold to reach the 20% will have a major psychological effect on the gold market not to mention also the snowball effect it will have on other countries. Switzerland is a very small country but with a long history of gold ownership. A vote in favor in the Swiss Gold Initiative referendum would mean that Switzerland would have to buy 1,700 tonnes of gold. This represents 70% of annual world gold production. The Swiss National Bank has 5 years to acquire the 1,700 tonnes if the initiative passes. Gold as a hard currency is also influenced by geopolitics. But for gold to go up you need not just a local crisis but a crisis that has global impact. Other ways it only increases in price locally in the conflict area with temporary impact on global price. With the Crimean annexation by Russia the world has switched from a détente and disarmament environment to a new cold war and rearmament. Local conflicts are appearing everywhere with potential of escalating into a global conflict. The Middle East and in particular the Iraq/Syria region has become a stateless land where ISIS is trying to expand its influence and destabilize the entire region. Libya, an oil rich country is still in chaos and now social unrest in Hong Kong is threatening stability in China. Let’s not forget the recent unrest in the US with the Ferguson riots, a suburb of St. Louis, Missouri. The US is not used to having social unrest on its own territory. Home grown terrorism spurred by economic hardship has not happened in the US since the 60s. There is a believe in the US that trouble can only come from the outside forgetting even the recent Oklahoma City bombing by a good American boy named Timothy McVeigh. In Europe high unemployment, the rise of the extreme right and secessionist movements (Scotland, Catalonia, etc.) threaten the European Union. The currency wars are still alive and contrary to the G8 agreement not to manipulate their exchange rates, this is what is actually happening. The US dollar going up against the euro is a stated desire of the European Central Bank. But there is no reason why gold should move with the euro. Gold is the anti-fiat hard currency not just the anti US dollar. Gold has risen as much in all paper currencies in the last 15 years not just against the US dollar. In the most recent Fekete Research Gold Basis Service, Sandeep Jaitly states that “December silver remains in backwardation and December gold is soon to join it”. In a recent article in the London Financial Times, John Dizard mentioned an increase in gold’s “popularity as a medium of exchange for international transactions has been soaring, particularly in the past few months as the impact of US government sanctions on non-compliant banks has become severe.” And that, despite gold being “the most expensive and least convenient of all of the monetary alternatives to the dollar.” I emphasize the words “medium of exchange” and “soaring” because if we believe the mainstream media nobody wants to use gold as money because it is expensive and least convenient. I mentioned it in a previous article on gold sentiment but I wanted to mention it again because I think it is a very important piece of information. Physical gold is being accumulated and used in exchanges but very discretely as of now. In a recent report mentioned in the UK Telegraph it is revealed that a record number of super-rich elite are buying gold bullion bars weighting 12.5 Kg. The report says “The gold buying secrets of the UK come as it was recently revealed the number of 12.5kg gold bars being bought by wealthy customers has increased 243% so far this year, when compared to the same period last year.” The geopolitical and economic environment in the last few months was in my view the calm before the storm. All the economic issues both in Europe and the US and all the geopolitical conflicts I mentioned above, or a combination of them have the potential to degenerate “unexpectedly”. Both the economic and political environments are uncertain and will surprise the complacent markets. More and more the current environment reminds me of the Citigroup president’s statement to the Financial Times before the 2008 crisis. CEO Chuck Prince made clear that he was aware of the risks his company was taking but said “When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing,” An unexpected precipitating event like a black swan event in this uncertain environment will push gold and silver up with a quantum leap with gold leading.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Brief Visual History Of Metals Posted: 10 Oct 2014 02:55 PM PDT We have documented the history if individual metals before and we have also visualized their annual production. However, we have not seen all of the metals on one timeline before such as in this infographic. Worth noting is gold's prominence ever since the beginning of history. Because the yellow metal is one of the rare elements that can be found in native form (such as nuggets), it was used by the earliest of our ancestors. Comparatively, it is only recently that the technology has advanced to allow us to discover or extract the rest of the metals on today's periodic table. For example, even though we knew of titanium as early as 1791, it was relatively useless all the way up until the 1940?s because of its metallurgy. In the 20th century, scientists advanced a way to remove the impurities, making it possible to get the strong and hard titanium we know today. Another standout fact is that it took all the way until the early 19th century for two very important elements to be discovered. Both are not found free in nature very often and thus slipped detection for many centuries. Silicon, which actually makes up 26% of the earth's crust, was discovered in 1823. Then in 1827, aluminum was discovered – we now know today that it is the most common metal in the earth's crust (it's actually 1200X more abundant than copper).

Courtesy of: Visual Capitalist | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily And Silver Weekly Charts - His Mills Grind Slow, But Exceedingly Fine Posted: 10 Oct 2014 01:27 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Survive Ebola: Become a “White Blood Cell” For Mankind Posted: 10 Oct 2014 12:30 PM PDT Please share this episode far and wide… The information provided below could save your life in the event of an all-out pandemic. It will also show you how the world's governments and health officials aren't reacting appropriately to this crisis… and why you shouldn't depend on them to save you. Toward the end of today's episode, you'll learn what you can do to help weaken the virus (and have a much better chance of surviving) if the Battle of Ebola comes to your hometown. If you've arrived here as a result of a friend or family member sharing this issue with you, you can click here to sign up for my FREE Laissez Faire Today e-letter for further updates. We have lots to cover today, so let's begin… "I am sick of the jibber jabber about Ebola," our in-house tech maven Stephen Petranek wrote yesterday to his Breakthrough Technology Alert readers. "The focus on how many people a foreigner has touched, the incredible naivete we are seeing in the reporting about the disease that simply is not helpful or informative or smart and the unfocused hysteria. "We're in far more danger than the pundits can even guess. "…if the outbreak is not stopped now, we could be looking at hundreds of thousands of people infected…" "So much so that the time has come to start thinking about what you will do if a major Ebola virus outbreak occurs in the United States. That's not because there's a case in Dallas or that the person infected may have come in contact with 100 different people. "It's because Ebola is out of control, and the significance of the numbers behind it is not being reported. "When President Barack Obama committed 3,000 U.S. troops on Sept. 15 to help contain Ebola in West Africa, he was on the right track. "At a press conference, he said, 'In West Africa, Ebola is now an epidemic of the likes that we have not seen before. It’s spiraling out of control. It is getting worse… And if the outbreak is not stopped now, we could be looking at hundreds of thousands of people infected, with profound political and economic and security implications for all of us. So this is an epidemic that is not just a threat to regional security — it’s a potential threat to global security.' "You should reread every word in that statement. "Unfortunately," Stephen goes on, "most of the world's health organizations have been playing catch-up with Ebola, and that U.S. commitment of 3,000 troops is still catch-up. "The Cubans, Chinese, French and British have sent fewer than 500 health workers — total. A few months ago, 30,000 workers might have stopped the disease. Now it may require the commitment of 100,000 nurses, troops, doctors and aid givers, but only if they get there soon. But they won't. Within just a few months, Ebola will likely be so out of control that it will finally get the attention it deserves, but then it may be too late. "Here's why: Ebola cases are doubling about every 21 days, the amount of time a person can take to show symptoms after being exposed. "You can start almost anywhere on any day since the outbreak began and then see that the numbers double every three weeks. That means that by the end of December, we should be looking at 300,000-400,000 cases, again with the number doubling within three weeks and then doubling again, etc. Even the Centers for Disease Control has predicted a worst-case scenario of nearly 1.5 million cases by the end of January. "With a death rate that is probably running at least 70% (despite other numbers you may have read, Ebola cases are vastly underreported), it won't take 300,000 new cases of Ebola to cause most countries to shut their borders. "We are in completely unknown territory with this epidemic." "When President Obama talks about threats to national security, he isn't kidding. It is not beyond reasonable scenarios to think of entire cities or regions of the United States under military quarantine. "Drugs can help, but they can't win this battle. Everything about fighting Ebola takes time and trained personnel and quarantining until the disease takes it course. Those 3,000 U.S. troops the military is trying to get on the ground in West Africa? They won't actually be there in force until well into November. We can mobilize for a war in a matter of days, but we have no infrastructure for public health. We've been ignoring it and spending less on it since the days of public bomb shelters in the 1950s and '60s. "We are in completely unknown territory with this epidemic. The bubonic plague of the Middle Ages killed no more than a third of those who got it. "This disease kills as many as 90%. Protecting the people who are trying to help has become a losing battle. About 75% of the health workers who have been fighting Ebola in Africa are dead from the disease. If Ebola gets out of hand in the United States, there aren't enough hazmat suits to go around. "We saw what one case in Dallas could do to the stock market in one day. "Start multiplying that sort of scenario and see where you end up. Ebola is a threat to world order, to national order and to civilization itself. We need to see this as the threat it really is — potentially far greater than anything we have faced — before it really is too late." That's not all Stephen told us… He shared his quick-and-dirty survivalist's guide with us too: "1. Get out of any city when there are more than 10 Ebola cases, before it's surrounded by the National Guard. "2. The ideal retreat is far from the madding crowd and has a water supply you can access without electrical power. "3. You'll need at least six months of food (hint: You can fill that pantry quickly and easily and cheaply with a trip to Costco that involves 100 pounds of rice, 100 pounds of dried beans, several quarts of olive oil, 50 pounds of flour, a bottle of yeast and as many cans of tuna, tomatoes, beans and mushrooms as fit in your car. A few gallons of citrus juice and 10 pounds of dried fruits will keep the scurvy away. Don't forget the tea and coffee for comfort.) You might not need to panic just yet, but it’s good to be prepared. This is a nasty virus. And if it really gets moving, things could turn ugly very quickly… "The virus attacks the body's soft tissues," Chicago Tribune correspondent Paul Salopek said during an Ebola outbreak in 2000, "a process some doctors describe, bluntly, as like watching a patient 'dissolve.'" Yikes. There's no cure. No effective treatment. And no vaccine to speak of yet. But there's still hope, whether the vaccines roll in or not. Here's why… "Presently," one allopathic doctor we mentioned briefly yesterday, Dr. Mark Sircus, writes, "Ebola treatments typically involve the use of intravenous fluids, antibiotics, and oxygen. "Treatment may also include the use of medications to control fever, help the blood clot, and maintain blood pressure. "Even with such supportive care," he writes, "death occurs in 50-90% of people with Ebola." The Ebola virus, as mentioned yesterday, can cause the immune system to run out control and release a "cytokine storm." This storm causes tiny blood vessels to burst all over the body. …your odds of surviving an Ebola outbreak could largely depend upon the strength of your immune system. This, in turn, can cause the blood pressure to plummet and lead to multiple-organ failure from the shock. Here's how Sircus says we may be able to prevent that storm from happening in the infected, while also helping to keep the virus population weak… "It has long been apparent that an increased susceptibility to infectious diseases is common in malnourished human populations," Sircus says. "This has been traditionally viewed as simply a consequence of the fact that the immune system must be maintained by adequate nutrition in order to function optimally. "Only recently have data begun to accumulate in support of the idea that nutritional factors may sometimes have a direct effect on pathogens, and that passage through nutritionally deficient hosts may facilitate evolutionary changes in infectious agents." Greaaat. We spoke yesterday about how your odds of surviving an Ebola outbreak could largely depend upon the strength of your immune system. Sircus takes it a step further and suggests that nutrition plays a major role in who lives and who dies — and that weak immune systems could be making the virus stronger. Has anyone raised the question why Ebola is so deadly in Liberia, a country with vast malnutrition and severely deficient immune systems (and, not to mention, rampantly poor sanitation)? Last year, the Ministry of Agriculture reported that 35.8 percent of the country's population suffer from malnutrition. If Dr. Sircus is right, that could mean that each host that doesn't kill the virus only gives it more strength. So not only is it spreading, it could be getting stronger. This only solidifies what we said yesterday: Every health official on Earth should be encouraging the masses to get healthy and build a strong immune system. By doing so yourself, you'll do your part in weakening Ebola's potential stranglehold on humanity. By raising your immune system, you're essentially becoming a "white blood cell" for the human race if Ebola comes your way. According to Sircus, there are eight specific and essential natural medicines that could greatly increase your chances for survival (these are listed below). Some are probably in your kitchen. A couple more maybe behind the mirror in the bathroom. They're inexpensive and extremely common. Consider carefully what Sircus says about them, and then do your own research. The situation is not hopeless. There are things you can do in the event of a pandemic. God forbid you get infected. But if you survive and never reach Stage Two (and only experience the flu-like walk-in-the-park part of Ebola)… Many top health officials claim you'll have active immunity for up to 10 years, maybe more. By the time your immunity wears off, Ebola will have become a thing of the past. Here's the key… …it is inexcusable that medical and health officials continue to frown on the use of un-patentable medicines… "Patients who are critically ill with Ebola have high nutritional requirements that need to be addressed," Dr. Sircus writes. "Nutritional feeding is critical to patient outcome." There's a huge distinction between natural allopathic medicine, Sircus says, and contemporary medicine. Biggest one, they differ in opinions on what defines "treatment." "Instead of using toxic pharmaceuticals that diminish the immune system by further driving down nutritional status," Sircus says, "we use, we treat and cure through the fulfillment of nutritional law. "We do not need to develop expensive drugs waiting while millions potentially die. Right in the emergency room are already excellent medicines that doctors are familiar with that save lives every day. "Nutritional medicine is safer and more effective than pharmaceutical medicine. Just ask any emergency-room or intensive-care-ward doctor right after he has injected magnesium chloride or sodium bicarbonate to save someone's life. "With Ebola raging in Africa and threatening the rest of the world, it is inexcusable that medical and health officials continue to frown on the use of un-patentable medicines like the ones mentioned [below]. "The substances in the natural allopathic protocol for Ebola offer a power unequalled in the world of medicine that we can harness to save many lives of people infected with Ebola. "However," Sircus opines, "some people would enjoy seeing millions, if not billions, of people die to reduce population down to a more manageable level. "Others would rather stick with their professional pride or obedience to medical officials and let patients die than even think of what should work to decrease the death rate from Ebola. "It really would be a shame if the medical world stands by and lets this pandemic take hold. "The secrets of emergency room and intensive care medicine," Sircus says, "hold the key to resolving Ebola." "Magnesium salts, sodium bicarbonate (baking soda), iodine, selenium, and vitamin C are concentrated nutritional medicinals that have been used in the direst of medical circumstances. "They are widely available, inexpensive and safe to administer round the clock at high dosages. "The core of the natural allopathic protocol redefines the way emergency room and intensive care should be practiced on Ebola patients with proven fast-acting, safe, concentrated and mostly injectable nutritional medicines. "If the Ebola infection truly gets out of hand, it is comforting for parents to know that they can legally administer these same medicinals if infected people are treated at home. All of the natural allopathic medicines can be also taken orally or used transdermally (topically) to almost the same effect if treatment is started early enough. "People who either choose home care or have no other option need to treat everyone in the home at the same time whether demonstrating symptoms or not. Waiting for the contagion to spread inside a family, or with health care professionals in hospitals and clinics, is unwise. The main idea is to get out in front of the virus." Some of the natural allopathic medicines Dr. Sircus mentions below are probably already in your home. Here's what else he recommends… "Selenium," says Sircus, "is a strong antioxidant and anti-inflammatory that can control the cytokine storms provoked from out of control infections." Magnesium chloride (magnesium oil): According to Italian Dr. Raul Vergini, "Magnesium chloride has a unique healing power on acute viral and bacterial diseases… A few grams of magnesium chloride every few hours will clear nearly most acute illnesses, which can be beaten in a few hours. I have seen a lot of flu cases healed in 24-48 hours with 3 grams of magnesium chloride taken every six-eight hours." "Magnesium," Dr. Sircus writes on his website, "is an essential mineral used for hundreds of biochemical reactions, making it crucial for health. "Massive magnesium deficiencies in the general population have led to a tidal wave of sudden coronary deaths, diabetes, strokes, and cancer. Even a mild deficiency of magnesium can cause increased sensitivity to noise, nervousness, irritability, mental depression, confusion, twitching, trembling, apprehension, and insomnia. "The modern diet, with an overabundance of refined grains, processed foods and sugars, contains very little magnesium." Vitamin C: "Because of the seemingly exceptional ability of these viruses to rapidly deplete vitamin C stores," says Dr. Sircus, large doses "of vitamin C would likely be required in order to effectively reverse and eventually cure infections caused by these viruses… "Viral hemorrhagic fevers typically only take hold and reach epidemic proportions in those populations that would already be expected to have low body stores of vitamin C, such as are found in many of the severely malnourished Africans. "In such individuals, an infecting hemorrhagic virus will often wipe out any remaining vitamin C stores before the immune systems can get the upper hand and initiate recovery. When the vitamin C stores are rapidly depleted by large infecting doses of an aggressive virus, the immune system gets similarly depleted and compromised. "According to Dr. Thomas Levy, MD, 'Many viral infectious diseases have been cured and can continue to be cured by the proper administration of Vitamin C. Yes, the vaccinations for these treatable infectious diseases are completely unnecessary when one has the access to proper treatment with vitamin C. And, yes, all the side effects of vaccinations… are also completely unnecessary since the vaccinations do not have to be given in the first place with the availability of properly dosed vitamin C'…” Sodium Bicarbonate (baking soda): "In 1918 and 1919 while fighting the 'Flu' with the U.S. Public Health Service," Dr. Volney S. Cheney wrote to the Arm & Hammer Co. in the 1920s, "it was brought to my attention that rarely anyone who had been thoroughly alkalinized with bicarbonate of soda contracted the disease, and those who did contract it, if alkalinized early, would invariably have mild attacks. I have since that time treated all cases of 'cold,' influenza and 'la gripe' by first giving generous doses of bicarbonate of soda, and in many, many instances within 36 hours the symptoms would have entirely abated." Dr. Emanuel Revici, "the Einstein of medicine," discovered that pH modulation is the key to pain control and containment of deadly disease. Alkalizing the pH of your body with baking soda, says Sircus, "helps to contain pathology — by protecting nearby cells from chemical burns from pH imbalance." Vitamin D: "Vitamin D reduces the risk of dying from a viral infection," says Sircus. "Researchers from Winthrop University Hospital in Mineola, New York found that giving supplements of vitamin D to a group of volunteers reduced episodes of infection with colds and flus by 70% over three years. The researchers said that vitamin D stimulates 'innate immunity' to viruses and bacteria. Very few have any idea that vitamin D can be taken in high dosages like vitamin C can." Iodine: "Extremely high doses of iodine can have serious side effects," Canadian Dr. David Derry writes, "but only a small fraction of such extreme doses are necessary to kill influenza viruses." "Iodine," Sircus says, "is a must when dealing with deadly viruses and would go a long way in decreasing the death rate from Ebola… Deficiencies in iodine have a great effect on the immune system." [Many of you will find the next one controversial, but here goes…] Medical marijuana: According to Dr. Sircus, "All forms of marijuana have anti-oxidative, neuroprotective, immunomodulation, analgesic and anti-inflammatory actions." But, "cannabidiol reduces the extent of damage, reported the National Academy of Sciences. More effective than vitamins C or E, strong antioxidants such as cannabidiol (CBD) will neutralize free radicals without the accompanying high with regular marijuana used for recreational and other medical purposes." Glutathione: According to Dr. Patricia Kongshavn, "Glutathione is required in many of the intricate steps needed to carry out an immune response. It is needed for the lymphocytes to multiply in order to develop a strong immune response, and for killer lymphocytes to be able to kill undesirable cells such as cancer cells or virally infected cells. "The importance of glutathione cannot be overstated. It has multiple roles as indicated and, indeed, as one examines each system or organ more closely, the necessity for glutathione becomes increasingly evident. "These emergency room-class medicinals and therapeutic processes deliver lifesaving healing power…" "Glutathione values decline with age and higher values in older people are seen to correlate with better health, underscoring the importance of this remarkable substance for maintaining a healthy, well-functioning body." "Glutiathone," Theodore Hersch MD, said, "is the body's master antioxidant and best-kept secret to maintaining health." "These emergency room-class medicinals and therapeutic processes deliver lifesaving healing power," says Dr. Sircus. "When one learns about the above intensive care medicines, and how to use them, one gains a lot of medical power and wisdom to overcome the complications and even discomforts of the worst viral infections. "There are always other medicinals one can employ. However, when practicing emergency and intensive care medicine, one wants to select the most powerful substances that are quick acting and safe to take at high dosages. "I also recommend that physicians and other healthcare professionals as well as every household have a good nebulizer and use a high-grade colloidal silver as well as a sodium bicarbonate glutathione product alternating between the two." Regards, Chris Campbell Why the Fed Will Continue to Print Money in 2015 Posted: 10 Oct 2014 10:04 AM PDT Editor’s. Note: On Oct. 6, 2014, Jim Rickards was interviewed by Bloomberg TV for his thoughts on gold, currency manipulation and the overall strength of the global economy. You can watch the entire interview by clicking on the video, or read the transcript below… Bloomberg TV: I wonder, Jim, how you… First your reaction to that statement that the economy is stable… at least relatively. Are you encouraged by, for example, the jobs numbers that we saw last week? Jim Rickards: No, not at all. Look… Labor force participation is going down. What Janet Yellen is looking at is real wages. Forget about the unemployment rate, that's almost an artifact at this point because labor force participation is declining. She's concerned about inflation. She wants to have easy money, to create jobs until she's right about inflation. What is she looking at? She's looking at real wages. When real wages go up that means people can get a raise. When people start to get a raise that's when inflation alarms start to go up. Real wages are flat to down. They're actually down, lately. So she's not concerned at all. She's got so much slack because of the labor force participation. Real wages are going nowhere. She has no inflation concerns at all. That means… I don't see them raising rates in 2015. Bloomberg TV: Is the real wages number a demographic issue? I mean, do you see people who get paid more retiring and moving out, while people who are starting at a lower wage coming into the labor force? Jim Rickards: Well, there could be a lot of causes behind it. Some of them are demographic, some of them are structural. That's one of the debates. Is it demographic or is it structural? The answer is it's a little bit of both. But the important thing is regardless of the cause, [real wages] are on her dashboard, that's what she's looking at. So, that continues to be weak. You know, we've got 50 million Americans on food stamps… 26 million Americans unemployed or underemployed… 11 million on disability which is kind of a new form of unemployment in some cases and that's going up. Our fundamental economy is very weak… for structural reasons. Yellen is trying to address a structural problem with a liquidity solution. It doesn't work, it won't work, that's why the Fed forecasts have been wrong by orders of magnitude for five years in a row. Interestingly Madame Lagarde the other day, because the IMF meeting is coming up… The IMF forecast has been wrong five years in a row also — they lowered their forecasts. She was actually candid about it, she said "you know, this is getting a little boring we're wrong every year." But that's because we're in a depression not a cyclical recovery. Bloomberg TV: You know we had several guests on Bloomberg Surveillance this morning, though, saying that we were actually returning to Alan Greenspan's Oasis of Prosperity here in the U.S. And the big theme at those big IMF/World Bank meetings will actually be this divergence. The U.S. economy nearing escape velocity while the rest of the world slows down. And since Jim says we're in a Depression, I'm going to say he disagrees with that… Jim Rickards: Here's the thing… First of all the rest of the world is slowing down. Japan fell off a cliff in the second quarter, China is slowing down — that's actually contributing to these demonstrations [in Hong Kong]. Bloomberg TV: And look at the numbers out of Germany overnight! Jim Rickards: So, it's obvious the world is slowing down. But the idea that U.S. is going to pull the world up? Now, what's been happening lately is we have this strong dollar… That, by the way is why… See gold hasn't changed much in real value in 5,000 years. When people say gold's up or gold's down — if the dollar is your numeraire then yeah, the dollar price of gold is up or down. But the way I think about it, gold's the constant, so when I see a low dollar price of gold, what I say is the dollar's strong, and that's exactly [the way I think of it]. What's happening to gold is no different than what's happening to the euro, the yen and all the other currencies. So what we have is a strong dollar right now. But the U.S. is bearing the entire cost of global structural adjustment. We can't afford it. We threw Japan and Europe a lifeline through the strong dollar, but we're going have to pull the lifeline back in and use it ourselves. Bloomberg TV: The United States and Germany, though, are the only two developed countries that have actually reduced, since the financial crisis, their level of debt — total debt-to-GDP. There's also the fact that manufacturing… What about the great American revival of manufacturing? We've seen companies, even Lenovo, moving back to the U.S. to manufacture here, because the labor market here is becoming more competitive. Jim Rickards: Sure, a couple things, though first… Everyone in Washington is high-fiving because we cut the deficit in half in the last couple of years. It went from 1.4 trillion to $700 billion, that's true. But the debt-to-GDP ratio is still going up and that's the one that matters. The reason it's going up… you have the numerator is going up but the denominator is going down faster — in other words, we still have deficits. The debt is growing fast than the economy's growing. So the deficit has come down but the debt-to-GDP ratio is still going up. And this Geneva report that came out a couple of weeks ago showed that. That there's more debt… more leverage… more, basically, piling on of debt… globally than ever before. Bloomberg TV: I would be most concerned about household debt, though… If I were looking at… You know, you want to see how the people are doing in the country… Jim Rickards: Well, the only reason the economy got a little bit of lift in the second quarter was partly because people were willing to take on a little bit more debt. But they seem to be kind of moving the other way lately. So that's not sustainable. Bloomberg TV: Alright, so… The price of gold, you're saying, is stable, it's the dollar that moves… I mean… How does gold look, then, when you value it in terms of euros or in terms of yen? Jim Rickards: Well actually in euros it's been performing better because the euro itself is going down. But, you know, just kind of taking the dollar price of gold as our benchmark… Here's how the world is set up… The taper's going to end either this month or next month. Everyone expects the Fed to raise interest rates in 2015. The big debate is will it be March, will it be July… That's nonsense. They can't possibly raise rates because the economy's weak. Janet Yellen is not seeing anything on her dashboard that tells her to raise rates. I expect it may actually come to QE4 in the middle of 2015. Remember… Bloomberg TV: So we'll continue to grow the balance sheet. Because this is the one thing I think about… The commercials that you hear on radio telling you to go and buy gold because the Fed's printing presses are running nonstop… Makes sense… But when the Fed's printing presses stop, does that trade turnaround? You're saying that those printing presses are only on hold? Jim Rickards: Right… But they're going to have to keep printing… they have no other way. But the reason is, they're using a liquidity solution to a structural problem. It won't work, but they think it works, so they're going to keep trying. That's the bottom line. And remember, everything changes January first. We have the most hawkish FOMC you can imagine. There have been vacancies on the Board of Governors, so you're overweight presidents and you got two "super-hawks" Fisher and Plosser. January 1st the President has filled the vacancies. You got Brainerd and Sam Fisher who are doves. Let's see, one more vacancy probably get another dove, and then two more presidents coming on, Evans and Kocherlakota are doves. And Janet Yellen, you know, it took her a while to get her feet on the ground… Remember she didn't start the taper, Bernanke did. He tied her hands. And you know, she's the new kid on the block — you're not going to blow up policy in your first meeting. But by January, the governors are going to be at full strength, the presidents are going to be dovish, Yellen's gonna have her feet on the ground, and her dashboard is still not blinking red… So they'll, at best, not raise rates, and probably go to QE4. Bloomberg TV: So you're saying no rate raise for all of 2015. Jim Rickards: Not in my lifetime unless they make structural changes. Seriously we're in a depression… You can't solve a depression by printing money. You can only solve it with structural changes. Look at the Great Depression… At the beginning of WWII, we completely restructured the economy. I'm not rooting for war, I'm just saying that's the kind of drastic structural… And what does it mean today… fiscal policy, keystone pipeline, Obamacare, regulation, break up the banks… These are the things that will get the economy moving, not printing money. Bloomberg TV: Just finally… Gold, obviously you're saying it trades inversely to the dollar, but it also trades in other things such as central banks buying, retail demand… at these levels it wouldn't be surprising to see some of, in particular, the Asian retail customers coming back to the market… Central banks manipulate, even some would say… Why isn't that activity moving the price of gold? Jim Rickards: Well, because you've got two things going on at once. You've got the physical market and the paper market. Now the prices are not wildly different or else you'd be in arbitrage. But look at the physical demand in China coming out of the Shanghai Gold Exchange. I talk to people in Hong Kong and the Chinese are bringing gold in through central Asia using People's Liberation Army assets — armored cars, basically off the books… mining output, Hong Kong inputs… China has acquired 3-4 thousand tons in the last five years. That's almost 10% of all the official gold in the world. These are enormous acquisitions. Here's the thing… People say, "Oh… It goes from the GLD warehouse in London to a… safe warehouse in Shanghai… What difference does it make? The total supply of gold is unchanged." That's true, but the floating supply drops. The London gold is in the floating supply. The Shanghai gold is not. So the gold available to support the paper market is shrinking. Bloomberg TV: Alright, Jim Rickards, author of The Death of Money… Also not a proponent of Bitcoin… Right? We've talked about this… Jim Rickards: I think the technology's cool. The currency I have my doubts about, but the technology will be around. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central Bank Gold Agreement No.4 Posted: 10 Oct 2014 09:25 AM PDT "We, the undersigned, aren't selling gold anyway. But just so you know..." In MAY 2014, the European Central Bank and 20 other European gold holders announced the signing of their fourth Central Bank Gold Agreement, writes Julian D.W.Phillips at GoldForecaster. This agreement, which applies as of 27 September 2014, will last for five years and the signatories have stated that they currently do not have any plans to sell significant amounts of gold. Collectively, at the end of 2013, central banks held around 30,500 tonnes of gold, which is approximately one-fifth of all the gold ever mined. Moreover, these holdings are highly concentrated in the advanced economies of Western Europe and North America, a statement that their gold reserves remained an important reserve asset, a statement made in each of the four agreements since then. After 29 years of implied threats that gold was moving away from being an important reserve asset and the potential sales of central bank gold the gold price had fallen to $275 down from $850 in 1985. But the sales that were seen were so small that with hindsight they were seen as only token gestures. Today the developed world's central banks continue to hold around 80% or more of the gold they held in 1970. It only became clear subsequently that the real purpose behind these sales (from 1975) were to reinforce the establishment of the US Dollar as 'real money' and the removal of gold as such. The US government would brook no competition from gold, but continued to hold gold (as money 'in extremis') in 'back-up'. Then in 1999 the Euro was to be launched. It too needed to ensure that Europeans, who had a long tradition of trusting gold over currencies, would not reject the Euro in favor of gold and turn to gold and its potentially rising price. So it was decided that while gold was to be retained as an important reserve asset, its price had to be restrained for some time, while Europeans were made to accept the Euro as a reliable, functioning money in their daily lives. To that end, major European central banks signed the Central Bank Gold Agreement (CBGA) in 1999, limiting the amount of gold that signatories can collectively sell in any one year. There have since been two further agreements, in 2004 and 2009. Now the fourth Central Bank Gold Agreement is in operation. Together, the European Central Bank, the Nationale Bank van België/Banque Nationale de Belgique, the Deutsche Bundesbank, Eesti Pank, the Central Bank of Ireland, the Bank of Greece, the Banco de España, the Banque de France, the Banca d'Italia, the Central Bank of Cyprus, Latvijas Banka, the Banque centrale du Luxembourg, the Central Bank of Malta, De Nederlandsche Bank, the Oesterreichische Nationalbank, the Banco de Portugal, Banka Slovenije, Národná banka Slovenska, Suomen Pankki – Finlands Bank, Sveriges Riksbank and the Swiss National Bank say that...

The first clause confirms the ongoing role of gold as an important reserve asset. The most important part of the statement is the third part, where the signatories confirm "they do not have any plans to sell significant amounts of gold." In other words they have completed their sales. We do not expect them to resurrect their sales as they have fulfilled their purpose. Their sales stopped in 2010 in effect, bar some small sales by Germany of gold to be minted into coins. We did not consider these a part of these agreements. The statement clarifies that none of the signatories will act independently of the rest and sell gold. They will coordinate any future transactions with the other signatories should a situation arise where a signatory wishes to sell again. We believe that this will not happen because of the financially strategic and confidence building nature of their gold reserves. This agreement in lasting for five more years reassures the gold market that none of the signatories will sell gold for five years and even then they will likely make a further agreement for five more years.  To us this statement and agreement removes the specter of central bank gold sales in the future. As we have seen since these sales were halted in 2010, emerging market central banks have been buyers of gold steadily and carefully, without chasing prices. We have the impression that the bullion banks go to prospective central bank buyers and 'make the offer' of gold available on the market, which the central bank then buys. They do not announce their intentions and act so as not to affect the price barring taking stock from the market. This not only reassures gold-producing countries and companies, who can be reassured that there will be no policy of undermining the price of gold with uncoordinated sales of gold, but tells the rest of the world including emerging central bank buyers that there will be no supplies from them put on sale. Such buyers will have to find what gold they can on the open market or from their own production. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

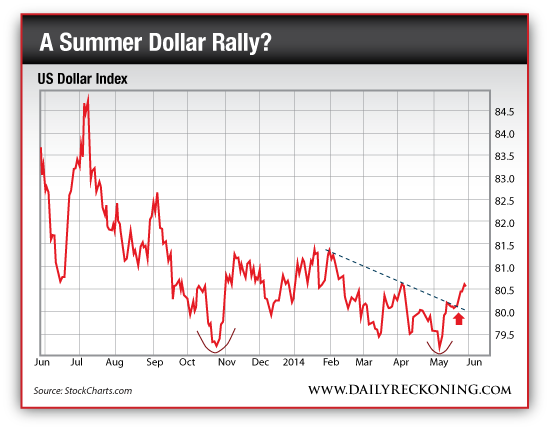

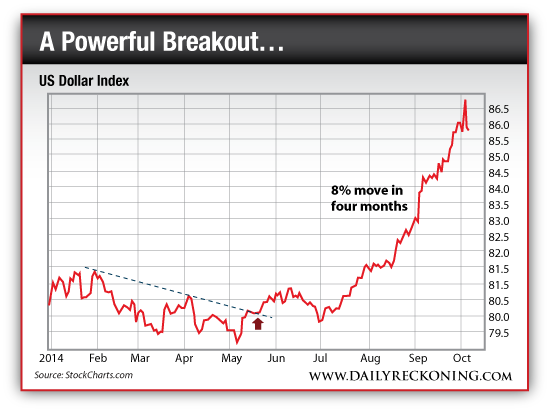

| Ditch Dollars, Buy Gold. For Now Posted: 10 Oct 2014 09:21 AM PDT Switcheroo from end-May's top tip, says this technical analyst... BACK in May, I told gold investors to ditch their gold for greenbacks, writes Greg Guenthner, holder of the Chartered Market Technician designation, in Addison Wiggin's Daily Reckoning. At the time, gold was sinking below $1260 for the first time in months. The Dollar looked like it was poised for a major breakout toward its 2013 highs. And virtually no investors were remotely interested in these developments... Of course, a lack of publicity didn't stop the market forces that were already in play. Gold tripped another 5% and sank toward its lows. And the Dollar exceeded all expectations, rocketing to levels not seen since 2010. "Just a few weeks ago, many analysts were talking about a potential breakdown in the Dollar," I wrote on May 30th. "But things aren't always as they first appear. Many times, the best trades are the ones you least expect." But hang on just a minute... Gold is now enjoying its biggest three-day rally since June. And the Dollar looks a little tired after its big move higher. That means it's time to flip this trade. More on this idea in just a minute. First, let's check out the recent Dollar rally. Here's what I was seeing in the Dollar index back in May:  And here's how the move unfolded:  Trading gold for greenbacks was a stellar trade – and for now, it has run its course. The Dollar will need to digest its parabolic move. And gold looks ripe for a quick comeback. For the record, I think the Dollar's initial move will stick. The Dollar index could very well end up higher six to eight months from now – but the road could get volatile. Also, while gold remains in a bear market, snapback rallies like the one you're seeing right now can offer fantastic opportunities to score quick profits. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||