Gold World News Flash |

- Chris Powell on the Suppression of the Gold Price by Western Central Banks

- Bargain Gold and Silver Prices Boost Worldwide Coin Demand

- Lodes of reasons for silver’s decline

- Will The Central Bankers Invade Switzerland Next?

- Bill Holter: An open letter to the mining industry

- The Economic ENDGAME Has Arrived | Jim Willie

- The Gold Price Rose a Sizzling $19.30 Today to Close at $1,224.60

- Why the Fed Will Continue to Print Money in 2015

- Gold Price – A Significant Bounce Off Support

- 3 Factors that Shape Every Gold Investment Strategy

- Gold Daily and Silver Weekly Charts - China Is Back From Holiday

- The Next Round of the Financial Crisis is at Our Doorstep.

- Schizo Market Has Biggest Plunge In 6 Months Following Most Euphoric Surge Since 2011

- The Fourth Central Bank Gold Agreement - Started 27-9-2014 - What Gives?

- Meet The World's First "Undercover, Super-Secret Central Banker"

- Central Banks "Face a Mess" Buying Gold, Platinum & Palladium

- Greyerz - We Are Seeing Massive Gold Demand In The East

- Now is the Time to Flip Your Dollars for Gold

- It’s Inflation All the Way, Baby!

- Meaningful Energy Bottom Close at Hand

- Dollar "Blow Off" Missing. But Stocks?

- "I Look Like a Dope," Says Silver Bull

| Chris Powell on the Suppression of the Gold Price by Western Central Banks Posted: 10 Oct 2014 12:00 AM PDT from Goldbrokercom: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bargain Gold and Silver Prices Boost Worldwide Coin Demand Posted: 09 Oct 2014 11:15 PM PDT Bargain prices for gold and silver is fueling global demand for bullion coins. During September sales by the U.S. Mint of American Eagle gold and silver bullion coins increased dramatically. Sales of the American Eagle gold bullion coins during September rose to 58,000 ounces, up from 25,000 in August. Sales of the American Eagle silver [...] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

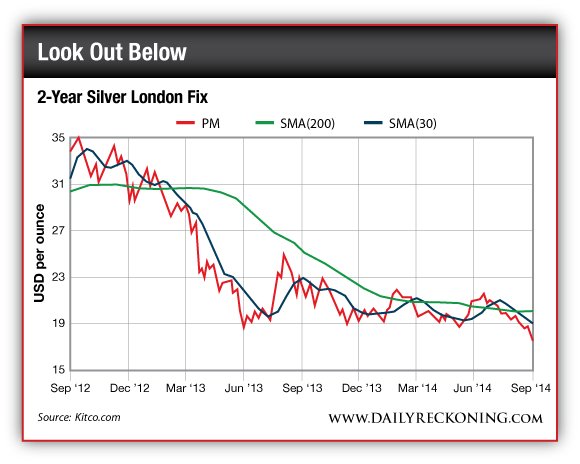

| Lodes of reasons for silver’s decline Posted: 09 Oct 2014 08:20 PM PDT by David Potts, The Sydney Morning Herald:

Still, he got me thinking. Silver has always been the poor relation to gold. Normally one ounce of gold will buy 15 ounces of silver, today it’s almost 70 ounces. Clearly either silver is dead cheap or gold is extremely over-valued. A statistical fact is “reversion to the mean” – that is, nothing stays out of whack forever even if it takes an awfully long while to get back to where it should be. So something has to give. Read More @ smh.com.au | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will The Central Bankers Invade Switzerland Next? Posted: 09 Oct 2014 08:09 PM PDT German recession fears mount. Home-builders giving huge incentives to people to buy homes. The Swiss will vote on Nov 30 to go back to a gold back currency. Obama is planning to make huge amount of mass arrests. Uganda is being hit with an Ebola like fever. China gets advanced weaponry and the... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bill Holter: An open letter to the mining industry Posted: 09 Oct 2014 07:18 PM PDT 10:18p ET Thursday, October 9, 2014 Dear Friend of GATA and Gold: Gold and silver mining companies should note the documentation GATA has produced about central bank suppression of the price of the monetary metals and act against it before many companies are driven out of business, Miles Franklin market analyst Bill Holter writes today in "An Open Letter to the Mining Industry": http://blog.milesfranklin.com/an-open-letter-to-the-mining-industry CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Economic ENDGAME Has Arrived | Jim Willie Posted: 09 Oct 2014 06:09 PM PDT IN THIS INTERVIEW:- The U.S. dollar is dying ►0:55- ZIRP and QE to infinity is inevitable ►5:04- Fed "taper" is a lie ►9:12- Systemic failure ahead ►14:37- Logical conclusion: rejection of U.S. dollar ►18:27- How would a "Gold Trade Standard" impact the global banking system? ►22:11- Why did gold... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Rose a Sizzling $19.30 Today to Close at $1,224.60 Posted: 09 Oct 2014 05:06 PM PDT

The GOLD PRICE rose $19.30 (1.63%) from yesterday's Comex close to $1,224.60. Silver rose 2.07% or 35.2 cents to $17.367. Remember that in yesterday's aftermarket silver was at $17.45 and the gold price at $1,223.60, so neither made any real gains today. HOWEVER, do not pass in ignorance by this other fact: they held their gains. Notice that silver is beginning to show moves over 2% a day, and gold over 1.5%. Sizzling. The GOLD PRICE climbed yesterday above its 20 DMA and today punctured that first $1,224 resistance. High today came at $1,234, above the next resistance at $1,232.70, but gold couldn't hold on there. The SILVER PRICE at its $17.72 high today punched through its $17.69 20 DMA, but fell back. Silver still has not penetrated its downtrend line from August, tomorrow about $17.47. That $17.50 is also lateral support/resistance. Everything is still pointing heavenward. The GOLD/SILVER RATIO is one little question mark in my mind. After rising on 3 October to its peak, it gapped down, but has since traded back to fill the gap. Today it closed at 70.513. I would like to see it fall some, which would put silver outpacing gold a little, a component of nearly every precious metals rally. STILL TIME TO SWAP GOLD FOR SILVER. The gold price has given us three days' higher closes after a key reversal. That confirms a rally, but was that low on 6 October THE low, the end of the 3 year correction. Durned if I know yet, but I suspect it is. I know I'm just a nat'ral born durned fool from Tennessee, but I bought more gold today. Well, lookee here now! I reckon them FOMC market meeting gooses to the stock market work about like feeding cotton candy to a kid at a fair. It looks gracious big, and it goes down easy, but it don't fill you up and might make you throw up. Yesterday the stock market cheerleaders were crowing over the Dow's biggest one day gain of the year. Today I reckon they are pretty shy over the Dow's biggest one day LOSS of the year, back to back. Dow tail-spun 334.97 (1.97%) to 16,659.25. Mercy, the S&P500 did worse, losing 40.68 (2.07%) to land with a thud at 1,928.21. Today's fall brought the Dow within 100 points of its 200 day moving average (16,591.44, S&P500's is at 1905). No, Virginia, this is NOT the place from great which bounce- backs begin, this is the edge of the cliff that waterfalls pour over. 'Bout time y'all started thinking about protecting those stock market gains by liquidating and buying silver and gold.

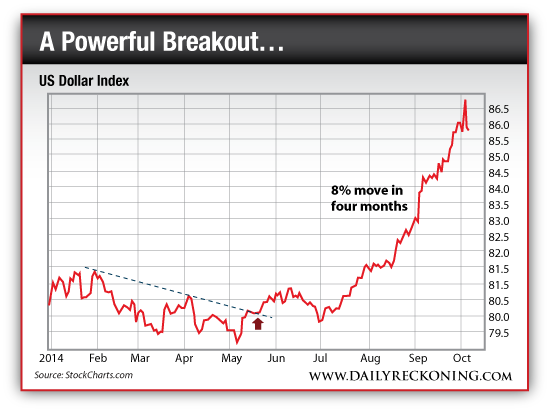

Dow in silver crashed through its20 DMA (S$1,244.95 silver dollars or 962.89 oz) and skidded to a stop down 1.89% atS$1,242.17 (960.74 oz). Captain Gravity has seized control of the ship. Chart is on the left: Dow in silver crashed through its20 DMA (S$1,244.95 silver dollars or 962.89 oz) and skidded to a stop down 1.89% atS$1,242.17 (960.74 oz). Captain Gravity has seized control of the ship. Chart is on the left:US dollar index bounced up today 0.33% or 28 basis points to 85.64, but the low came at 85.01, below the 20 DMA (85.28). Keep an eye peeled on this correction, because it will forecast the dollar's future for the next year. A failure here means no more rally, a success a long rally. The euro punched into its 20 DMA and fainted, falling back 0.33% to $1.2691. Yen added 0.29% to 92.75 cents /Y100. A rally has begun. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

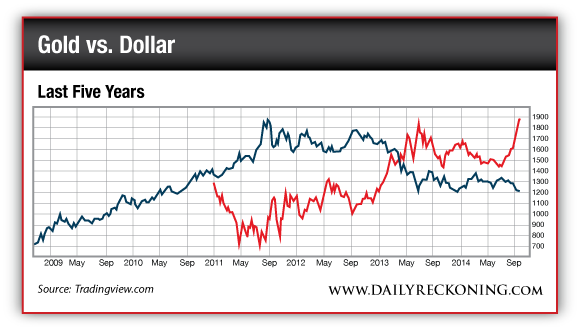

| Why the Fed Will Continue to Print Money in 2015 Posted: 09 Oct 2014 03:04 PM PDT Editor’s. Note: On Oct. 6, 2014, Jim Rickards was interviewed by Bloomberg TV for his thoughts on gold, currency manipulation and the overall strength of the global economy. You can watch the entire interview by clicking on the video, or read the transcript below… Bloomberg TV: I wonder, Jim, how you… First your reaction to that statement that the economy is stable… at least relatively. Are you encouraged by, for example, the jobs numbers that we saw last week? Jim Rickards: No, not at all. Look… Labor force participation is going down. What Janet Yellen is looking at is real wages. Forget about the unemployment rate, that's almost an artifact at this point because labor force participation is declining. She's concerned about inflation. She wants to have easy money, to create jobs until she's right about inflation. What is she looking at? She's looking at real wages. When real wages go up that means people can get a raise. When people start to get a raise that's when inflation alarms start to go up. Real wages are flat to down. They're actually down, lately. So she's not concerned at all. She's got so much slack because of the labor force participation. Real wages are going nowhere. She has no inflation concerns at all. That means… I don't see them raising rates in 2015. Bloomberg TV: Is the real wages number a demographic issue? I mean, do you see people who get paid more retiring and moving out, while people who are starting at a lower wage coming into the labor force? Jim Rickards: Well, there could be a lot of causes behind it. Some of them are demographic, some of them are structural. That's one of the debates. Is it demographic or is it structural? The answer is it's a little bit of both. But the important thing is regardless of the cause, [real wages] are on her dashboard, that's what she's looking at. So, that continues to be weak. You know, we've got 50 million Americans on food stamps… 26 million Americans unemployed or underemployed… 11 million on disability which is kind of a new form of unemployment in some cases and that's going up. Our fundamental economy is very weak… for structural reasons. Yellen is trying to address a structural problem with a liquidity solution. It doesn't work, it won't work, that's why the Fed forecasts have been wrong by orders of magnitude for five years in a row. Interestingly Madame Lagarde the other day, because the IMF meeting is coming up… The IMF forecast has been wrong five years in a row also — they lowered their forecasts. She was actually candid about it, she said "you know, this is getting a little boring we're wrong every year." But that's because we're in a depression not a cyclical recovery. Bloomberg TV: You know we had several guests on Bloomberg Surveillance this morning, though, saying that we were actually returning to Alan Greenspan's Oasis of Prosperity here in the U.S. And the big theme at those big IMF/World Bank meetings will actually be this divergence. The U.S. economy nearing escape velocity while the rest of the world slows down. And since Jim says we're in a Depression, I'm going to say he disagrees with that… Jim Rickards: Here's the thing… First of all the rest of the world is slowing down. Japan fell off a cliff in the second quarter, China is slowing down — that's actually contributing to these demonstrations [in Hong Kong]. Bloomberg TV: And look at the numbers out of Germany overnight! Jim Rickards: So, it's obvious the world is slowing down. But the idea that U.S. is going to pull the world up? Now, what's been happening lately is we have this strong dollar… That, by the way is why… See gold hasn't changed much in real value in 5,000 years. When people say gold's up or gold's down — if the dollar is your numeraire then yeah, the dollar price of gold is up or down. But the way I think about it, gold's the constant, so when I see a low dollar price of gold, what I say is the dollar's strong, and that's exactly [the way I think of it]. What's happening to gold is no different than what's happening to the euro, the yen and all the other currencies. So what we have is a strong dollar right now. But the U.S. is bearing the entire cost of global structural adjustment. We can't afford it. We threw Japan and Europe a lifeline through the strong dollar, but we're going have to pull the lifeline back in and use it ourselves. Bloomberg TV: The United States and Germany, though, are the only two developed countries that have actually reduced, since the financial crisis, their level of debt — total debt-to-GDP. There's also the fact that manufacturing… What about the great American revival of manufacturing? We've seen companies, even Lenovo, moving back to the U.S. to manufacture here, because the labor market here is becoming more competitive. Jim Rickards: Sure, a couple things, though first… Everyone in Washington is high-fiving because we cut the deficit in half in the last couple of years. It went from 1.4 trillion to $700 billion, that's true. But the debt-to-GDP ratio is still going up and that's the one that matters. The reason it's going up… you have the numerator is going up but the denominator is going down faster — in other words, we still have deficits. The debt is growing fast than the economy's growing. So the deficit has come down but the debt-to-GDP ratio is still going up. And this Geneva report that came out a couple of weeks ago showed that. That there's more debt… more leverage… more, basically, piling on of debt… globally than ever before. Bloomberg TV: I would be most concerned about household debt, though… If I were looking at… You know, you want to see how the people are doing in the country… Jim Rickards: Well, the only reason the economy got a little bit of lift in the second quarter was partly because people were willing to take on a little bit more debt. But they seem to be kind of moving the other way lately. So that's not sustainable. Bloomberg TV: Alright, so… The price of gold, you're saying, is stable, it's the dollar that moves… I mean… How does gold look, then, when you value it in terms of euros or in terms of yen? Jim Rickards: Well actually in euros it's been performing better because the euro itself is going down. But, you know, just kind of taking the dollar price of gold as our benchmark… Here's how the world is set up… The taper's going to end either this month or next month. Everyone expects the Fed to raise interest rates in 2015. The big debate is will it be March, will it be July… That's nonsense. They can't possibly raise rates because the economy's weak. Janet Yellen is not seeing anything on her dashboard that tells her to raise rates. I expect it may actually come to QE4 in the middle of 2015. Remember… Bloomberg TV: So we'll continue to grow the balance sheet. Because this is the one thing I think about… The commercials that you hear on radio telling you to go and buy gold because the Fed's printing presses are running nonstop… Makes sense… But when the Fed's printing presses stop, does that trade turnaround? You're saying that those printing presses are only on hold? Jim Rickards: Right… But they're going to have to keep printing… they have no other way. But the reason is, they're using a liquidity solution to a structural problem. It won't work, but they think it works, so they're going to keep trying. That's the bottom line. And remember, everything changes January first. We have the most hawkish FOMC you can imagine. There have been vacancies on the Board of Governors, so you're overweight presidents and you got two "super-hawks" Fisher and Plosser. January 1st the President has filled the vacancies. You got Brainerd and Sam Fisher who are doves. Let's see, one more vacancy probably get another dove, and then two more presidents coming on, Evans and Kocherlakota are doves. And Janet Yellen, you know, it took her a while to get her feet on the ground… Remember she didn't start the taper, Bernanke did. He tied her hands. And you know, she's the new kid on the block — you're not going to blow up policy in your first meeting. But by January, the governors are going to be at full strength, the presidents are going to be dovish, Yellen's gonna have her feet on the ground, and her dashboard is still not blinking red… So they'll, at best, not raise rates, and probably go to QE4. Bloomberg TV: So you're saying no rate raise for all of 2015. Jim Rickards: Not in my lifetime unless they make structural changes. Seriously we're in a depression… You can't solve a depression by printing money. You can only solve it with structural changes. Look at the Great Depression… At the beginning of WWII, we completely restructured the economy. I'm not rooting for war, I'm just saying that's the kind of drastic structural… And what does it mean today… fiscal policy, keystone pipeline, Obamacare, regulation, break up the banks… These are the things that will get the economy moving, not printing money. Bloomberg TV: Just finally… Gold, obviously you're saying it trades inversely to the dollar, but it also trades in other things such as central banks buying, retail demand… at these levels it wouldn't be surprising to see some of, in particular, the Asian retail customers coming back to the market… Central banks manipulate, even some would say… Why isn't that activity moving the price of gold? Jim Rickards: Well, because you've got two things going on at once. You've got the physical market and the paper market. Now the prices are not wildly different or else you'd be in arbitrage. But look at the physical demand in China coming out of the Shanghai Gold Exchange. I talk to people in Hong Kong and the Chinese are bringing gold in through central Asia using People's Liberation Army assets — armored cars, basically off the books… mining output, Hong Kong inputs… China has acquired 3-4 thousand tons in the last five years. That's almost 10% of all the official gold in the world. These are enormous acquisitions. Here's the thing… People say, "Oh… It goes from the GLD warehouse in London to a… safe warehouse in Shanghai… What difference does it make? The total supply of gold is unchanged." That's true, but the floating supply drops. The London gold is in the floating supply. The Shanghai gold is not. So the gold available to support the paper market is shrinking. Bloomberg TV: Alright, Jim Rickards, author of The Death of Money… Also not a proponent of Bitcoin… Right? We've talked about this… Jim Rickards: I think the technology's cool. The currency I have my doubts about, but the technology will be around. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price – A Significant Bounce Off Support Posted: 09 Oct 2014 02:54 PM PDT This is an excerpt from the daily StockCharts.com newsletter to premium subscribers, which offers daily a detailed market analysis (recommended service).

In our article on September 23 we postulated that gold seemed to be setting up for a triple bottom, but it was too soon to tell for sure. As of this week gold has reached the level of support drawn from the two previous bottoms, and it has bounced off that support. It is not yet a robust bounce, but it is at least a first small sign that a long-term bottom may be forming. In the chart below we can see the three bottoms that have formed at about the 1180 level. The recent bottom is not very prominent, but it hints at the possibility of a continued rally, and shows a window of opportunity beginning to open for gold bulls. The negative part of this picture is that the support line is part of a consolidation that is called a continuation pattern, which implies that it is just a pause before the preceding decline continues. The indicator at the bottom of the chart shows that sentiment for gold is still negative. Central Gold Trust (GTU) is a closed-end fund that owns gold, and, because it is closed-end, its shares which trade like a stock, can trade at a discount or premium to the actual value of the assets the fund owns. Because GTU is selling at a heavy discount to net asset value, we know that traders are not at all anxious to own gold. What we want to see is for GTU shares to start selling at a premium, because that will help confirm that any rally has market sentiment on its side and is likely to persist. Essential to the continued strength of gold is the continued weakness of the dollar. The next chart shows that the dollar, which experienced an unusually sharp advance, has begun to break down.

However, the weekly chart shows that this weakness may only be a technical pullback after a long-term breakout. Conclusion: Thanks to a sharp pullback by the dollar gold has managed to bounce off an important support line, and offers the possibility that another rally is beginning, a rally that could end the long decline from all-time highs. It is a time for increased attention for those who want to catch the next gold rally. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3 Factors that Shape Every Gold Investment Strategy Posted: 09 Oct 2014 01:45 PM PDT After falling from highs near $2,000 just a few years ago, gold has been languishing around the $1,200-mark for over a year, besides a few run-ups at $1,300 and $1,400. Yet the monetary conditions — inflation, printing and stimulus — that spurred gold's historic climb are still with us. What gives? It's like gold has caught a bug and just can't get well. It's not a mystery what ails it, however. Let's look at three reasons why gold is trading in the $1,200 range, and how these are the clue to our gold investment strategy. The first is the value of the dollar. Just as gold protects wealth when times are tough, the dollar fuels growth in periods of stability. The momentum of each medium tend to be counteracting, since investors have to choose between one or the other. It's no surprise that during gold's drop from $1,875 to $1,210, the dollar index climbed 70% during the same time. In short, investors will go where their bread is buttered, and while interest rates are low and fiscal stimulus is pumping throughout the economy, it's dollar-driven equities. Why hunker down wealth in gold holdings when stocks are soaring high? Even if surging share prices could be grossly inflated. Herein lies edge of the precipice of the next gold price breakout. Are these dollar driven equities performing as well as their stock prices show? Or are they inflated by a dollar that is merely faring the best in the race to the bottom between global currencies? My colleague, and fellow resource guru, Matt Insley recently summed up what has influenced the dollar index's steep climb: "The U.S. dollar index is heavily influenced by the euro — at over 57% weighting of the currency basket used to calculate the dollar index. The index itself hinges on the fate of the euro and the euro is in trouble." Forget China! The dollar's biggest influence (and conversely, gold's) is the European Union's economy and monetary policy. The second thing that determines the gold price is physical gold demand. As we just showed, demand for gold is inversely correlated to dollar demand, which is driven by both U.S. and foreign monetary policies. But who's buying the gold? India, for one, but more importantly, China, the world's largest holder of U.S. government debt. With more than $1.317 trillion in their reserves, it's safe to say the Chinese have a vested interest in a strong dollar, but China's gold buying habits reveal a bearish sentiment toward the dollar. As I've detailed before, the sleeping dragon has recently amassed as much as 7,000 tons of gold, and China is not the only country in the East staking their faith in gold. During a period of declining gold prices, India officially imported $2.04 billion worth in August 2014, nearly three times more than the $739 million imported in August 2013. Gold is particularly sensitive to political and financial fear. Remember gold is not consumed in the same sense as oil, gas, or corn. Once the precious metal has been extracted from the mine and sent into the open market it will always be there. Only a very small portion of the gold that has been mined vanishes in shipwrecks or natural disasters. The rest is still floating around, causing demand to be more of a determinant of the price of gold than supply. The third element that drives the price of gold is fear. Real or imagined, fear influences the decision making of most investors. Gold is particularly sensitive to political and financial fear. The markets are at heightened risk now that ISIS controls 60% of Syria's oil production and threatens Iraq's. And let's not forget the actions of our good friend Putin. With the annexation of Crimea and parts of Eastern Ukraine, whatever trust the west once had in Russia is gone, and it's added lots of risk to Europe's energy supply chain. Finally, fear that the market can't keep rising, even though the Fed keeps signaling that interest rates will remain low in the short-term, is driving some investors from stocks to gold. They may be premature, but all this fear is baked into the price of gold like a leaven. All in all, I'm still not committed to the bearish outlook on gold. Regards, Byron King Ed. Note: I didn’t mention the most crucial fear driver of the price of gold. It's the No. 1 threat to America, in fact. Forget ISIS, terrorist attacks, a new war or anything like that. The real threat is an "economic Pearl Harbor"… an event that could wipe out millions of unprepared Americans. Unfortunately the information is too sensitive to reveal here, but I was able to relay it to the members of The Daily Reckoning email edition. If you’d like to get a chance at this report, click here now and sign up for The Daily Reckoning, completely FREE of charge. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - China Is Back From Holiday Posted: 09 Oct 2014 01:41 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Next Round of the Financial Crisis is at Our Doorstep. Posted: 09 Oct 2014 01:21 PM PDT The next round of the financial crisis is at our doorstep.

The primary driver of the stock market, since 2009, has been the expansion of the Fed’s balance sheet. Remove this expansion and the S&P 500 would have effectively flat-lined.

Now the Fed is ending QE and “surprise” stocks are cratering.

Is this really a surprise?

After all… we know that…

1) Stocks are expensive by just about every conceivable metric. 2) Global GDP growth is overstated dramatically with China at most growing 3.5% per year, the US in recession, and Europe in a full-scale DE-pression. 3) QE is completely useless at generating growth with Japan in a triple dip recession after launching a QE program equal to 25% of its GDP and the US in recession despite having spent over $3 trillion. 4) Central Bankers don’t care in the slightest about how their policies affect the rest of us. 5) Even investing legends who have made their billions off of stocks admit the market is a complete farce and that a Crash is coming. 6) Billionaires moving their money out of stocks and into ANYTHING else at a record pace.

And finally..

7) None of initial problems which lead to the 2008 crisis (excessive leverage, rampant fraud, etc.) have been addressed.

Let’s face the facts. The very same problems that lead to 2008 remain in place today. The people who created this mess have gone unpunished. No one went to jail. No rule of law was upheld. Instead trillions of US taxpayer dollars were funneled to a bunch of crooks and liars.

And the Fed and friends actually thought growth might come out of this?

I’ve written before that the Fed’s policies were cancerous and would kill the system. This has proven to be the case…

· The bond market is illiquid and extraordinarily dangerous thanks to the Fed screwing up the yield curve and soaking up Treasuries from QE.

· The stock market has no bearing on reality, with accounting standards thrown out the window and investors fleeing in droves.

· The economy is in shambles with almost all job growth post 2008 based on phoney accounting or crappy part time jobs… again thanks to policies employed by the Fed.

· The middle class has been destroyed thanks to Dollar devaluation and rising costs of living that have wiped out savings and made it impossible for the average American to get by.

· Retirees and those close to retirement have lost valuable interest income courtesy of the Fed’s zero interest rate policy.

At the end of the day, the Fed with its misguided theories have demolished capitalism: the single most powerful form of wealth generation in the history of mankind. All the Fed has really accomplished is leverage the entire financial by an even greater amount… which has set the stage for a collapse that will make 2008 look like a picnic.

If you’ve yet to take action to prepare for the second round of the financial crisis, we offer a FREE investment report Financial Crisis "Round Two" Survival Guide that outlines easy, simple to follow strategies you can use to not only protect your portfolio from a market downturn, but actually produce profits.

You can pick up a FREE copy at:

http://www.phoenixcapitalmarketing.com/roundtwo.html

Good Investing Graham Summers Phoenix Capital Research

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Schizo Market Has Biggest Plunge In 6 Months Following Most Euphoric Surge Since 2011 Posted: 09 Oct 2014 01:06 PM PDT Yesterday's panic buying vertical ramp in stocks - decoupling from everything but the trusty partners VIX and AUDJPY - has been entirely unwound as The Dow drops over 300 points (nearly unchanged for 2014), Trannies tumble and Small Caps slump. Stocks all closed significantly lower - despite a late-day effort to lift - ending the day down from pre-FOMC Minutes. Treasuries closed 0-2bps higher in yield but had ignored equity exuberance and provided the reality check by the close. Real trading volatility ranges are surging in the major indices which historically has not been a good sign. The USD retarced some of the FOMC losses as Draghi chatter pushed EUR higher. Oil prices cratered under $85 as gold and silver rose (despite USD strength). Following yesterday's biggest intrday swing since Nov 2011, the Russell 2000 saw its worst day in 6 months.

Today was the 4th most active (in terms of quotes/trades) ever.

The last 2 days in US equity markets...

The last time we saw a cluster of intraday swings of this size was after the US downgrade in Summer 2011

As stocks - unsurprisingly - catch down to bonds...

Which left the indices well down from the FOMC Minutes...

Yesterday's proclamations about the strength of financials have been blown away as they slumped today...

On the week - despite the S&P regainiong green at the close yesterday, we are now doiwn hard!

Since the September FOMC statement, stocks are all red...

Credit had been pointing the way since early on..

HY Credit widened to one-year wides....

Treasuries inched higher in yield but remain lower and steeper on the week...

FX markets were active with Draghi chatter sending EUR lower and USD higher

Despite USD strength, PMs rose for the 4th day in a row (1st time since Feb) asd oil collapsed back below $85

Charts: Bloomberg Bonus Chart: Trading Ranges are soaring which suggests something different this time | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fourth Central Bank Gold Agreement - Started 27-9-2014 - What Gives? Posted: 09 Oct 2014 01:01 PM PDT On 19th May 2014, the European Central Bank and 20 other European central banks announced the signing of the fourth Central Bank Gold Agreement. This agreement, which applies as of 27 September 2014, will last for five years and the signatories have stated that they currently do not have any plans to sell significant amounts of gold. Collectively, at the end of 2013, central banks held around 30,500 tonnes of gold, which is approximately one-fifth of all the gold ever mined. Moreover, these holdings are highly concentrated in the advanced economies of Western Europe and North America, a statement that their gold reserves remained an important reserve asset, a statement made in each of the four agreements since then. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Meet The World's First "Undercover, Super-Secret Central Banker" Posted: 09 Oct 2014 12:38 PM PDT First a secret "Doomsday book", and now this? Flash back to those days in September 2008 when the financial system was on the verge of collapse and when first Lehman failed and then AIG was knocking on heaven's door. While the story of the former has been written, it is the still incomplete history of the latter that is the reason why Hank Greenberg, the largest shareholder of AIG at the time, is suing the US government for bailing out AIG, alleging the US exorted shareholders when it provided a $182 billion bailout to the insurance company whose Joseph Cassano had seemingly sold insurance on every insolvent mortgage-related security: a strategy which worked in a rising market and led to a near systemic catastrophe when the market crashed. We won't debate the merits of Greenberg's lawsuit, which is currently raging in court under STARR INTERNATIONAL COMPANY V. UNITED STATES, U.S. Court of Federal Claims 11-cv-00779 (it should be painfully clear by now that neither AIG nor crony capitalism as it exists now would have survived had Goldman and its NY Fed branch not extended several trillion in taxpayer funds to preserve the status quo), however we will note one thing: recall that when the terms of the AIG bailout first made waves in 2010 courtesy of Darrell Issa we found out something pecliar: none of the members of the Fed had any intentions on making their procedure public. As Reuters reported back then:

Why indeed should the Fed think that it is accountable to the US public: after all by now it has become abundantly clear the Fed only works for a very tiny subsegment of the broader population: those who have a personal net worth of at least $50 million or more. Nonetheless, after much legal fighting most of the documents ultimately did make it into the public domain and as many expected it was proven beyond a doubt that the Fed had an explicit motive of bailing out the otherwise insolvent banks that also happened to be the Fed's directors: entities such as Goldman, JPM, Citi, Merrill (if mostly their bonuses) et al. And while that may have come as a surprise to the Fed, which recently was stunned to learn that its cooption by Goldman Sachs had been documented by one of its former staffers in the form of some 47 hours of secret tapes, one person knew all along that things could very well escalate and become not only public information, but information of a very angry public if the Fed was unable to preserve a paper-wealth status quo in which personal wealth came from a printer. That person was one Quince, Edward. There is one problem: Edward Quince never actually existed. Instead, as the WSJ reports, "Mr. Quince was the pseudonym then-Federal Reserve Chairman Ben Bernanke used on emails when he was conferring with colleagues during the financial crisis. The false name was revealed as evidence as part of a class-action lawsuit against the government by shareholders of American International Group Inc.AIG -2.92%, which received a giant Fed-backed bailout as it teetered toward collapse." Yup: the world's most powerful central banker was so terrified of leaving a paper trail with his real name in what he clearly realized was borderline illegal meddling in the financial system, he felt compelled to use a pseudonym!

As it turns out, the Fed did blink. Two days after the email Lehman went bankrupt and the biggest depression in US history started, which naturally meant that the Fed had no choice but to double down, and to make mandatory moral hazard its one and only strategy. That also is very much known. What is not known is why the Fed's chairman was, in official communications, using a made up name? Mr. Dintzer, the Justice Department attorney, told everyone in the courtroom that Mr. Quince was in fact Ben Bernanke, which Mr. Geithner confirmed on the witness stand. What is perhaps most shocking is that in a room full of lawyers nobody asked the $64,000,000,000,000 question: why did Ben Bernanke feel compelled to use a pseudonym?

And yet, somehow we have a feeling that Bernanke's surprising departure from the Marriner Eccles building last year, the fact that the DJIA is about to go red on the year, and the fact that nothing that caused the financial crisis of 2008 has been fixed, are all connected. According to the WSJ, a search of other records shows at least one public reference to Mr. Quince before now. In a hearing of the House Oversight and Government Reform Committee in January 2010, Rep. Spencer Bachus (R., Ala.) read a piece of an email dated March 2009, citing Mr. Geithner (by then the U.S. Treasury Secretary) and William Dudley of the New York Fed: "Secretary Geithner e-mailed William Dudley and Edward Quince, and he said, 'Where are you on the AIG counterparty disclosure issue?' You know, are you for disclosing or not?" The email apparently went on a screen at the hearing, a transcript of the event suggests, but there was no other mention of Mr. Quince after that. The search for meaning continues:

Hmm, let's see: Edward Quince.... Quince, Edward.... QE.... Nope. No significance at all. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central Banks "Face a Mess" Buying Gold, Platinum & Palladium Posted: 09 Oct 2014 10:51 AM PDT Swiss gold referendum held as Kremlin looks to buoy platinum and palladium prices with state purchases... The CENTRAL BANKS of Russia and Switzerland are weighing the merits of buying gold and other precious metals, but for very different reasons. Now holding the world's 5th largest state gold reserves, Russian central bank chiefs plan to meet with officials from South Africa – the world's No.1 platinum mining nation – to discuss buying platinum and palladium in the open market to support prices, according to a Kremlin official. Moscow's precious metals and gems repository, Gokhran, already holds unreported quantities of palladium, of which Russia is the No.1 mine producer. Gokhran's director, Andrey Yurin, last month repeated comments he made in May about returning to buy palladium in 2015, after focusing on buying gold this year. The Swiss National Bank meantime faces a popular vote on buying gold – aimed at re-instating the Franc's bullion backing – but is campaigning against the move. Voters in Switzerland in 1999 approved an end to the legal requirement for gold reserves to back the Franc's value, and approved large sales starting at what proved two-decade lows, now some 70% below current prices. To win a place on Switzerland's next referendum, scheduled for 30 November, the "Save Our Swis Gold" initiative secured over 100,000 signatures on a petition. Its proposals risk the central bank's ability to ensure price stability and stable economic growth, finance minister Eveline Widmer-Schlumpf said Tuesday. Peter Hegglin – head of the Swiss cantons' conference of finance directors – also joined SNB president Thomas Jordan's repeated calls for voters to reject the move. "A gold supply that can't be touched isn't an emergency supply," Hegglin told a press briefing in Bern. The Swiss National Bank would on one estimate need to buy perhaps 1,500 tonnes of gold to meet the referendum's terms, which set a minimum 20% gold target for the SNB's balancesheet, swollen through quantitative easing to buy Euros and maintain the Franc's peg against its weak, neighboring currency on the forex market. "Palladium is not a gold and currency reserve," said Russian palladium miner Norilsk's CEO Vladimir Potanin this spring, when Gokhran hinted it was considering buying the precious metal. "It should be sold rather than bought by the state...We could help, and not only by buying those volumes, but by marketing the deal." Named by Moscow's minister for natural resources Sergei Donskoi as being involved with the proposed Russian-South African cartel, Norilsk said in late September it is raising funds to buy palladium from the Russian government, according to Bloomberg. Neither the Russian central bank nor Norilsk have yet confirmed Donskoi's remarks. "My initial reaction is they could probably do it," says US law professor Harry First, commenting to specialist site Mineweb on the proposed Russia-South Africa cartel. Apparently aimed at buoying metal prices after platinum and palladium hit multi-year lows in the open market, such a move would however face strong opposition from PGM consumers led by auto-makers, not least in China. Between them, Russia and South Africa account for four-fifths of the world's known platinum-group reserves as yet unmined. But "They'd really be stepping into a mess," says First. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Greyerz - We Are Seeing Massive Gold Demand In The East Posted: 09 Oct 2014 08:34 AM PDT  Today a 42-year market veteran told King World News that right now there is massive demand for gold from Swiss refiners and the demand is coming from the East. Below is what Egon von Greyerz, who is founder of Matterhorn Asset Management out of Switzerland, had to say in this extraordinary interview. Today a 42-year market veteran told King World News that right now there is massive demand for gold from Swiss refiners and the demand is coming from the East. Below is what Egon von Greyerz, who is founder of Matterhorn Asset Management out of Switzerland, had to say in this extraordinary interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

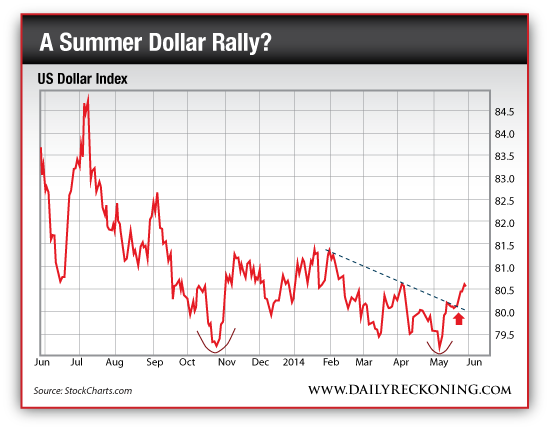

| Now is the Time to Flip Your Dollars for Gold Posted: 09 Oct 2014 08:16 AM PDT Back in May, I told you to ditch your gold for greenbacks. At the time, gold was sinking below $1,260 for the first time in months. The dollar looked like it was poised for a major breakout toward its 2013 highs. And virtually no investors were remotely interested in these developments… Of course, a lack of publicity didn't stop the market forces that were already in play. Gold tripped another 5% and sank toward its lows. And the dollar exceeded all expectations, rocketing to levels not seen since 2010. "Just a few weeks ago, many analysts were talking about a potential breakdown in the dollar," I wrote on May 30th. "But things aren’t always as they first appear. Many times, the best trades are the ones you least expect." But hang on just a minute… Gold is now enjoying its biggest three-day rally since June. And the dollar looks a little tired after its big move higher. That means it's time to flip this trade. More on this idea in just a minute. First, let's check out the recent dollar rally. Here's what I was seeing in the dollar index back in May: And here's how the move unfolded: Trading gold for greenbacks was a stellar trade — and for now, it has run its course. The dollar will need to digest its parabolic move. And gold looks ripe for a quick comeback… For the record, I think the dollar's initial move will stick. The dollar index could very well end up higher six to eight months from now — but the road could get volatile. Also, while gold remains in a bear market, snapback rallies like the one you're seeing right now can offer fantastic opportunities to score quick profits. Regards, Greg Guenthner P.S. I’m not a gold bug. I follow trends. And right now, the trend is for a quick snapback in the gold price. Next week, that could change. And if it does, I’ll be there to tell you about the new trend you need to be watching. But if you want that info first — before it hits the Daily Reckoning website… before almost anyone… I’d be happy to send you a quick email alert letting you know what to look for in the trading day ahead. Just click here to sign up for my Rude Awakening e-letter, for FREE, and each morning, right around the opening bell, you’ll receive an email with my full analysis… including the trend to follow that day, 5 important numbers to watch and at least 3 specific chances at real, actionable stock picks. All completely FREE. Click here now to sign up. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| It’s Inflation All the Way, Baby! Posted: 09 Oct 2014 06:49 AM PDT The title’s quote is one of many eminently quotable messages I had the pleasure of receiving over a few years of contact with a late, great and a very interesting man* named Jonathan Auerbach, who headed a unique specialty (emerging and frontier markets) brokerage in NYC called Auerbach Grayson. Jon was an honest and ethical man. He was also a gold bug (in that descriptor’s highest form) who innately understood the Kabuki Dance that has been ongoing by monetary authorities since the ‘Age of Inflation onDemand‘ (what guest poster Bruno de Landevoisin calls the Monetized New Millenium) started its most intense and bald faced phase in 2000. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Meaningful Energy Bottom Close at Hand Posted: 08 Oct 2014 05:00 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar "Blow Off" Missing. But Stocks? Posted: 08 Oct 2014 02:33 AM PDT The Gold/Silver Ratio already signals tight liquidity. A rising Dollar will hurt equities... USING Tom McCellan's article discussing a "blow off" move in the US Dollar as a starting point, I would like to talk about the Dollar and gold, writes Gary Tanashian in his Notes from the Rabbit Hole, and how they each fit in to the global macro backdrop. We could add silver into the mix as well because its failure in relation to gold (see the gold/silver ratio's breakout last week) is the other horseman (joining Uncle Buck) that would indicate a changing macro. Starting with the McClellan piece at MCOscillator.com, 'Commercials Betting on Big Dollar Downturn', first I would question the term "blow off" when talking about the USD. Markets that have come off of long-term basing patterns and broken above resistance with plenty of overhead resistance still to come have not blown off. A blow off is Nasdaq 2000, Uranium 2007, Crude Oil 2008, Silver 2011, etc. Reviewing the monthly chart below, we see nothing of the sort currently when considering a "blow off" move in USD. What we see is a currency that made its real blow off move in 1985 to climax the Volcker interest rate hiking regime. There is no blow off in USD. What there is is a savage upward move that we charted all along from its birth to its now mature and hysterical potential pivot point.  USD appears to be rising in response to a narrative taking shape about Fed Funds rate hikes by mid-2015. This is brought about by the strong economic performance that has taken place since we clearly anticipated it in early 2013. Let's not over complicate this. The currency's strength and associated rate hike talk are in play because of economic performance, which has been good in key areas like relatively high-paying manufacturing and generally with the improved employment (and unemployment) data. The chart below shows a disjointed but mostly positive correlation over 3-plus decades between the Fed Funds rate and USD. The little hook upward at the end of the green dotted line is not a blow off, is it? No, it is a projection by the market that the Fed will be compelled to raise interest rates because of economic strength and their own stated targets for employment (currently 5.9% unemployment).  Since we know full well that it was policy that created this phase of strength, the stock market, with its most recent in a string of corrective mini-blips, seems to be working a narrative that says a withdrawal of that policy (ZIRP) would be a bad thing for stocks. Our oft-shown S&P 500/ZIRP/Money Supply and S&P 500/Corporate Profits charts agree wholeheartedly.  The chart above states that it has been policy and policy alone (in the form of the nearly 6 year old ZIRP, along with QE's 1, 2 & 3) that has driven the economy and along with it, money supply and asset market speculation. The chart below states that corporate earnings may have begun to stall slightly in conjunction with a firming and now impulsively strong US Dollar.  But our theme has been that the US Dollar and the Gold/Silver Ratio (GSR) are running mates, the two horsemen that would change the macro. The precious metals are declining hard along with the commodity complex and inflation expectations in general. People not willing or able to make macro interpretations are getting lost in a "Where's the inflation??" hysteria. But the macro theme is that it is moves like this that bring turning points. These turning points are not always what inflationists – probably champing at the bit to get back on the soap box again – want to see. The 'inflatables' have been wiped out by the rise in the GSR and with the USD finally making a move as well, the economy is at risk because policy is no longer serving to do what it set out to do to begin with, which is to compromise the currency in favor of assets.  Certain gold bugs are calling "Crash!" now in gold. The ones who have called so many bottoms they would look ridiculous getting on the "Gold to sub-$1000" train have simply gone quiet. Imagine that, a quiet gold bug. Well, it's happening. Most of the loud ones now are the ones trying to be square with the bearish backdrop. Being a former life-long manufacturing guy (to 2012) that is the area I'll continue to keep the pulse on. US manufacturing has experienced a re-shoring mini boom as the 'China outsource' play had many holes in it from quality and service perspectives even before I left the sector. The 1990s' theme that we are a consumer-driven economy (with all our manufacturing outsourced) and our 'King Dollar' will allow us to consume our way to prosperity at the expense of the rest of the world no longer holds water. The public (ie, consumers) has disproportionately not participated in this economic rebound. Further, the strength in the USD takes aim directly at manufacturing, which is a sector with relatively good wages. Combined with the message of the GSR's global liquidity drainage along with various global markets on the wane, the US economy and its stock markets do not want to see a perpetually strong domestic currency. Going back to the McCellan article and indeed all of our data presented to date showing an over loved US Dollar, despised Euro, bombed out commodities and precious metals all at extremes, it may be time for a rebound in the 'inflation trade', with the USD resuming its role as an anti-asset foil. But the US Dollar is bullish based on its impulsive move up from a basing pattern. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| "I Look Like a Dope," Says Silver Bull Posted: 08 Oct 2014 02:21 AM PDT Silver miners offer 10-baggers from current prices, reckons John Embry... The "METAL of the moon", as ancient Egyptians called silver, has had a tough two years, writes Byron King in Addison Wiggin's Daily Reckoning. Another way to look at it, though, is that there's strong evidence we're in the midst of a phenomenal buying opportunity. What to do? Buy or wait? Let's think it through, and start with the silver price chart...  As you can see from the chart, silver has fallen from near $35 per ounce two years ago to its current level in the $17.50 range...a 50% haircut. Yet the chart also shows the 200-day moving average for silver is flattening out in the $20 range. That's a hopeful sign. Still, the fact is that recent price actions have been downward for silver. In recent weeks, prices cracked the $19 level; and then dipped under $18. How low can silver go? To answer that question, I went to Toronto last week, and had the pleasure of spending a day with Eric Sprott, his associates and a small group of "metal guys" from across a spectrum of newsletters and research groups. The Sprott organization is one of the savviest of savvy metal-investors. At the mast-head of the ship, you'll look long and hard to find any captain with more encyclopedic knowledge of silver than Eric Sprott; and his knowledge is reflected amongst those with whom he works day to day. One participant, at the get-together, was Sprott's well-regarded John Embry, Chief Investment Strategist at Sprott Asset Management and Sprott Gold and Precious Minerals Fund. Mr.Embry has been following gold and silver markets for over 45 years – indeed, as he told me during a conversation over one of the breaks, he's been "doing gold and silver" since before President Nixon took the US off the gold standard in August 1971. Mr.Embry has seen every kind of market – up, down and sideways. Right off the bat, Mr.Embry stated that the average cost per ounce of new silver is in the range of $22 to $25 per ounce, delivered from the mine. "At current prices, I cannot see how miners can keep delivering product at a loss." He noted, to be sure, that some silver comes as a by-product of lead, zinc and copper production; and those mining groups may not be as sensitive to pricing. "But at some stage," he said, "economics will return to the driver's seat, and production will have to tighten." Right now, Mr.Embry explained, he has "never seen more negative sentiment towards precious metals." In other words, it's as bad as it has ever been. In fact, one of the worst, compounding issues is that three generations of people – especially in Western economies – have grown up and now live blissfully under the "Dollar standard." "People are invested backwards," declared Mr.Embry. To most policymakers, bankers and investors, "gold is the antichrist to their precious Dollar." Indeed, the great mass of people simply cannot wrap their brains around the idea that currency in their pocket or bank account needs any sort of "backing." Yet, declared Mr.Embry, "If the Dollar gives way against precious metals, US living standards will collapse." According to Mr.Embry, "the world has reached a hopeless situation" economically. That is, the great mass of people – certainly voters – live comfortably with bottomless levels of government debt, endless growth of government indebtedness and fiscal and monetary chicanery cannot end well. Mr.Embry expects silver and gold to reach "unimaginable prices" when the big crisis hits. But until then he said, "I look like a dope." So what's Mr.Embry's defense mechanism? Some portion of your portfolio must be invested in precious metals, especially silver. "This is the finest opportunity I've seen in my career," he said. Mr.Embry believes that investors' wealth will be protected by owning physical silver; and fortunes will be made in silver miners. "Silver is a potential 10-bagger from here," he noted; then quickly nodded to Eric Sprott, sitting in a corner, and reminded everyone that "Eric thinks we'll see 30- and 40-baggers with silver." Over the course of the day at Sprott, we went over a number of silver mining plays; I'm reviewing those names by my own standards. For now though, the mining and investment landscape is littered with the corpses of ideas that have had the dog-gone tar kicked out of them. Yet some of these ideas hold strong assets, and are well-capitalized. Opportunities are there, if you know where to look. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Bobby, my morning coffee guy, is selling the lease on his kiosk so he can stock up on silver. I hope it wasn’t something I said. A caffeine hit is one thing, but silver?

Bobby, my morning coffee guy, is selling the lease on his kiosk so he can stock up on silver. I hope it wasn’t something I said. A caffeine hit is one thing, but silver?

No comments:

Post a Comment