saveyourassetsfirst3 |

- U.S. Propaganda Enters Into Insane, Irrational Overdrive in Attempt to “Sell” War in Syria

- Corvus Gold Identifies Vein Shoot Target & Reports Phase I Results, North Extension Drilling

- How to master any game (including life) and win

- The Curious Item the Chinese Can’t Get Enough Of (It’s Not What You Think)

- Controversial chart suggests deflation could be coming

- Gold Recovery Analogs

- Balmoral Resources Continues to Expand Grasset Discovery

- US Gold futures fall 5.91% in Sept, worst monthly loss since July 2013

- Gold continues sliding as labor market picks up

- ENTIRE Board of the Bank of Cyprus Forced to Resign

- Metals market update for October 1

- Jay Taylor Urges Investors to Stay Liquid for the Coming Gold Boom

- Equity Markets Remain Jittery

- Nepal's gold imports plummet

- Indian government slashes gold, silver tariff

- Nouriel Roubini rolls out his three horsemen of the Apocalypse how real are they?

- Gold Revaluation: Return of the King

- The Pure Hell At The Heart Of The Ebola Pandemic In Africa Could Soon Be Coming To America

- Marc Faber defends his failed investment predictions and still waiting for doom and gloom

- Gold Revaluation: Return of the King

- Greenspan's 'Golden Rule: Why China is buying'

- Gold Is “Universally Acceptable” and Why China Is Buying – Greenspan

- Gold Is “Universally Acceptable” and Why China Is Buying - Greenspan

- TECHNICAL - GOLD Might Correct Higher But Not Much

- Gold Prices Killed by Not-So "Super" Dollar

- Here be treasure: map of where Brits are hoarding gold

- Gold hoarding secrets of the UK mapped

- Largest Precious Metals Comparison Site Integrates Bitcoin

- Comex Gold Futures (GC) Technical Analysis – October 1, 2014 ...

- TECHNICAL - Gold Aiming to Extend Down Move After Hitting 9-Month Low

- Gold Still Testing Huge 1206 Level

- Koos Jansen: China aims to exceed U.S. in gold reserves

- Canaccord's Joe Mazumdar Shares His Favorite Get Rich Slow Schemes

- Golden Rule—Why Beijing is Buying: Alan Greenspan

- Morningstar strips Pimco Total Return Fund of its gold rating

- Alasdair MacLeod: Gold's Role as a Safety Net for the Economic Tightrope Ahead

- U.S. gold output declines on back of Newmont, Barrick

- Swiss Gold Referendum Attracting Attention Two Months Ahead of Vote

- Golden Rule---Why Beijing is Buying: Alan Greenspan

- Koos Jansen: China aims to exceed U.S. in gold reserves

- Mike Kosares: Why China thinks gold is the buy of the century

- Why a strong US dollar is a big negative for dollar-linked countries like the UAE and China

- Singapore Becoming Global Gold Hub - Launches Kilo Bar Contract And Gold ATMs

- Andrew Maguire Camp Responds to William Cohan: Enough of the Obfuscation, Let’s See Your Article

- Patient Zero: CDC Confirms First US Ebola Case Diagnosed Dallas

- Mental Training, Part 4: Avoid these Mistakes when Buying Silver

- Rout Continues, Silver Smashed to $16 Handle & New 4 Year Low!

- sept 30/Another loss of 2.39 tonnes of gold at the GLD/no change in silver at SLV/another big hit on silver and gold today/

- Silver losing its luster?

- Gold ETF holdings decline as gold loses its bid

| U.S. Propaganda Enters Into Insane, Irrational Overdrive in Attempt to “Sell” War in Syria Posted: 01 Oct 2014 12:15 PM PDT Thanks to a dizzying barrage of lies, mainstream media fear-mongering and a couple of beheadings, the Obama Administration finally achieved its long sought after war in Syria. The tactic that proved most effective in mobilizing the American public back into a shivering, post-9/11 fetal position, was the same tactic used by elites in the UK to convince Scotland […] The post U.S. Propaganda Enters Into Insane, Irrational Overdrive in Attempt to "Sell" War in Syria appeared first on Silver Doctors. | ||||||

| Corvus Gold Identifies Vein Shoot Target & Reports Phase I Results, North Extension Drilling Posted: 01 Oct 2014 11:20 AM PDT

Vancouver, B.C. – Corvus Gold Inc. ("Corvus" or the "Company") – (TSX: KOR, OTCQX: CORVF) announces results from the final six holes of its 2014 Phase I drill program and the first hole of its Phase II drill campaign at the North Bullfrog Project in Nevada. Holes NB-14-393 through NB-14-398 extended the main Josh Vein structural zone of the Yellowjacket deposit an additional 200 metres to the north and defined a new parallel target zone to the west of the main Josh Vein called NW10, which is similar to the recently discovered Rhyolite Zone to the East (NR14-17, September 4, 2014). This new discovery has broadened the total width of the Yellowjacket structural zone in the north and has provided critical data in defining a new high-grade shoot target at the intersection of the NW10, Josh Vein and Rhyolite zones. In addition, the new NW 10 zone has now extended vein/stockwork mineralization to over 250 metres in depth, thereby expanding the overall potential of the system. The initial hole of the Phase II program intersected a high-grade internal shoot in the main Josh Vein target that returned encouraging results and key data that warrants follow-up drilling. This shoot target is developing within an essentially undrilled area of the Yellowjacket deposit ("gap area") immediately north of the intersection of the West Vein and the Josh Vein (Figure 1). Hole NB-14-399 tested the uppermost part of the shoot target, and returned 9.4 m @ 2.5 g/t gold & 13.7 g/t silver including 1.6 m @ 10.6 g/t gold and 59 g/t silver. Follow-up holes below hole NB-14-399 are intersecting broad zones of vein and stockwork material at depth (results pending). In many epithermal vein deposits like Yellowjacket, internal zones of very high-grade can develop in shoot type features, which is the target in this new area of the system. Three additional holes have been completed in the target with at least two more planed. Jeff Pontius, Corvus CEO, stated: "The new holes currently being drilled in the shoot target within the gap area are very exciting as it appears we are outlining a potentially large area which could host significantly higher grades and might add considerably to the overall Yellowjacket resource and deposit. Results from the last drill holes of the Phase I program have increased the extension potential of the Yellowjacket system to the north, which remains open, and showed that gold mineralization can occur in different host rocks thereby significantly adding to the potential of the overall District. In addition, expanding the system at depth has increased the size potential of the deposit and with new high-grade targets developing from each round of drilling, the potential of the overall system is even greater." Full news release on Corvus Gold’s website The post Corvus Gold Identifies Vein Shoot Target & Reports Phase I Results, North Extension Drilling appeared first on The Daily Gold. | ||||||

| How to master any game (including life) and win Posted: 01 Oct 2014 11:12 AM PDT By James Altucher: I swept the chess pieces to the floor and ran out. The pieces were still popping around on the ground like popcorn when I left the room where the match was being played. It was my school versus some other school. I had lost. I didn’t care at all about the rest of my team. Losers. The coach of the team, an English teacher, ran out after me but he was sort of laughing. “Stop,” he said. “Wait.” But I didn’t want to. I had lost. I was worthless. I hated myself. I hated everyone. The rest of my team was laughing. I could hear them. Laughing at me. The other team was in shock. I am a sore loser. It’s not that I’m so competitive with others. But I’m competitive with myself. I like to do better than I did before. Sometimes that means something very bad: I like to be perfect at the things I’m interested in. Of course, it’s impossible to be perfect. I had nightmares that night. My dad opened my door at 3 in the morning and asked if I was ok. “No,” and there was nothing he could do. I didn’t go to school the next day or the next. I was a loser with acne, and now a bad chess player. A year later I was t highest ranking under 20-year-old in my state. And then I basically stopped playing, except when my life was in big transition in the 90s and then I played quite a bit. But I played other games, during other transitions. I always played games to escape the bad things that were happening in my life. The best games are a metaphor for life. So I would always escape my life (a bad relationship, a bad trade, a bad business, feelings of being useless, etc.) by playing games. I played a lot of the game “Go” when I was burnout and about to get kicked out of graduate school. I played a lot of poker (365 nights straight, including the night my daughter was born) when I was, well, becoming a father! I played a lot of Scrabble when I went broke. And then Hearts. And then backgammon. There is a particular grammar to mastering a game, and it’s not different from the grammar of mastering anything. Once you learn how to speak one new language, it’s easy to learn how to speak a third language and even easier to learn how to speak a fourth language. I’ve seen this across every game player I know. Someone who is good at chess can easily master poker. Or − and I’ve told this story before − there’s Falafel. Around 1994, I started playing Falafel in Washington Square Park. He was homeless and often had grass in his dirty hair from wherever it was he had been sleeping the night before. We’d play for 50 cents a game, sometimes a dollar depending on what he could afford to risk losing. He wasn’t as good as me ,so I’d give some odds. His name was Falafel because that is all he would eat. Then he disappeared. It was six months before I saw him at the park again. He was smiling. In just a few months time he had become one of the best backgammon players in the world. He had started playing Wall Street bankers in a price club on the Upper West Side. He built up to a bankroll of $800,000. Then he lost it all. Then he made it all back. A game player can’t be stopped. Twenty years later, I think he is now ranked #1 in the world at backgammon, when comparing his moves with the moves a computer would make. Then there was Ylon. He was a chess master (the first time we ever played, I beat him, but then he solidly has turned the table on me) who switched from chess to backgammon to poker. Now, $6 million in poker winnings later, he runs a bar in Brooklyn. Mastering a game requires you to do the exact opposite of what everyone else does. Since 99.99% of people won’t master a game, you need to do the reverse to conquer them. I don’t know, maybe that above paragraph is the only rule you need to know. But I love games so much I have ten or eleven other rules. Here’s what I’ve learned from mastering the various games I’ve played: A) LOOK AT ALL OF THE ‘CANDIDATE MOVES’ This applies to everything: games, business, relationships, everything in life. I see it happen in reverse too many times. People think of a “what if” and then go way deep down analyzing that “what if” as if there was a 100% chance it would happen rather than an almost 1% chance it would happen. Like “What if my wife is cheating?” or “What if my idea is bad?” or “What if this marketing plan doesn’t work out?” In the 1950s classic chess book, “Think Like a Grandmaster,” Alexander Kotov’s first technique is to: “List all the candidate moves first.” In other words, list all the options that can happen. Don’t go deeply down ANY OF THEM. Then start to look slightly deeper down each one and see which options you can quickly eliminate. This saves you mental energy and time. This one technique raises your IQ. It turns out, some 30 years later, this is how chess computers are programmed. The best chess computers are now solidly better than humans. The first thing a chess program does when looking at position: it lists the candidate moves. B) DON’T TAKE TOO MANY RISKS Games are all about taking risks. But if you take too many risks, you always lose. In backgammon, if you leave too many “blots” open, you will get hit, sent back to the bar, and eventually get blocked off the board and lose. If you play too conservatively, you’ll also lose. Trial and error tells you how many risks to take, but err on the side of not taking risks. This is true for business, also. People say to me, “I have a great idea! Should I quit my job and just go for it?” Answer: NO. Do both at the same time. I was at my fulltime job for 18 months while pursuing my side business. By the time I left my full time job to be a full time CEO of my side business I had 11 employees. I took a lot of risks in those 18 months. But I didn’t do anything that would risk losing the game. C) LOOK FOR THE SHORT CUTS Every game, and almost every life situation, has short cuts: ways you can get better without learning the entire literature of the game from beginning to end. A great example is Scrabble. If you want to be the best Scrabble player in the world then it certainly helps to know all the legal words. But if you want to be a better Scrabble player than 95% of the other Scrabble players it helps to know just two things: 1. All the two letter words 2. All the Q words without U: qat, qopf, qi, qanat, etc. And if you want to go one step further and be the coolest guy at the table, learn the six letters S A T I N E. Almost every letter you can add to those six will make a legal seven letter world. Example “E,” Etesian. “X,” Antisex. If you are home for Thanksgiving and someone breaks out the board (and has the latest official Scrabble dictionary so “ZA” and “QI” are legal), then you’ll almost certainly win if you just know those two things. What if your cousins want to play Monopoly instead? Ok, do everything you would normally do but with one difference. Buy, borrow, beg, steal, to get the orange properties. Trust me. D) PLAY PEOPLE BETTER THAN YOU You’re the average of the five people you spend your time with. When I was playing a lot, many of my friends didn’t want to play me. They didn’t want to lose. I specifically wanted to play people I would lose to. Over and over again. You learn more from losing than winning. Losing is not failure. Losing gives you a treasure trove of insights into how you, personally, can get better. When I was first starting out, I would always find people better than me. When I first moved to NY, I even moved in with a player much stronger than me at chess. We’d play all night. I got better until finally I was at least as good as him, if not better (we played a match once and when he was two games down he quit the match). If you’re starting out in business, work first for a good company that has a high profit margin. This is a business run by good businessmen. Learn from them. If you can’t directly learn from them, read from them. Study what they do. Break it down. Don’t waste time with the people who will bring you down. E) LUCK FAVORS THE PREPARED I was in a poker hand with Irv Gotti, the CEO of rap label Murder, Inc. He was laughing and every time I’d raise he wouldn’t even hesitate before raising me again. We were in his offices and there were two tables in a private game. The guy next to me had just produced the movie “300.” David Schwimmer was a regular in the game. Another guy had just sold his poker software company for $50 million. And Irv Gotti was the host. There was a lot of money around the table. I had a great hand, Irv kept raising me. And then on the final card dealt, he got the card he needed and won the hand, and I had no money left at the game, so I left. He just got lucky, I thought. And that card was certainly lucky. But he had been in worse hands that night. He had people intimidated with his non-stop talk. He would aggressively raise so people would be afraid to play against him because he was too unpredictable. Just those things, let him build up a bankroll where he could take more risks even in situations where the odds were against him. I don’t know how much money he made that night, but I know what I left with: $0. I also found out that he took lessons from very good poker players and at that point, I hadn’t played or studied in years. He was more prepared than me. Whenever you feel like saying, “I was just unlucky,” trust me when I say, “You’re probably an idiot.” Analyze the reality. Don’t just try to make yourself feel better. Blaming is draining. In chess there’s a saying, “Only the good players get lucky.” This applies to every area of life. As Scott Adams (creator of Dilbert) said to me, “If you know you’re only going to succeed at 10% of the things you try, make sure you try 100 things.” F) STUDY THE HISTORY Every game, every industry, has its history. A history of successful business models, of successful people, of styles in which the game was played. Of colorful personalities. If you don’t love the history of what you want to master, then you will never master it. Simon Rich, one of the funniest writers I have ever read, the youngest writer of SNL ever, and now working on two movies and a sitcom, said to me, “If you don’t wake up and want to write first thing, you probably shouldn’t be writing.” In the course of our discussion, he must’ve referred to 50 different books and comedians and movies, etc. It’s like the movie Groundhog Day. Bill Murray relives every day over and over. He becomes a better person for it. You can’t do that. You can’t relive the same day. But you can relive the thousands of days before you in the area you are most interested in by studying the history of the field you love. Writers should of course constantly read. You can’t write a good book if you havn’t read 500 other good books. You can’t write a good screenplay if you havn’t watched 100s of movies and appreciate the beauty of specific shows from the 60s, the 70s, and the various eras of movies that came after that. I don’t think I know a single chess master who hasn’t read through Bronstein’s “1953 Zurich International” tournament book at least a dozen times. Or Mikhail Tal’s “Best games.” Poker players have read Doyle Brunson’s classic a dozen times. And entrepreneurs have all now read Walter Isaacson’s book on Steve Jobs and dozens of other biographies of successful businessmen. The history of a game or life is your virtual mentor if you don’t have a direct mentor. G) MASTER YOUR PSYCHOLOGY I was a very bad sore loser. If I even lost one game in a tournament, I would drop out. As mentioned above, I lost one game and swept the pieces to the floor, creating a scene, and making someone else clean up after my mess. Not to mention making a fool of myself. “Failure” is the hip new word. People say, “You have to fail to succeed.” This is not true. Failure is the fastest way to becoming a failure. Instead, view everything as an experiment. Every experiment has problems. As Peter Thiel says, “Get good at solving hard problems.” When something doesn’t work out, see how you can make it 5% better the next time. There’s always a next time. If there wasn’t a next time, Warren Buffett would’ve quit investing in 1956. Or 1957. Or 1958. Instead, almost 60 years later, he’s still learning from the things he tries (and he’s made many multi-billion dollar mistakes even in the past decade) and then he tries to make the next situation 5% better so he doesn’t make the same mistakes. If you love someone or something, you will have many many opportunities to kiss. If one kiss isn’t perfect, then be 5% better in how you treat that person, in how you surprise, in how you learn, in how you study, and the next kiss will be love. Better to love than to be bitter, than to think you’re unlucky, than to not be prepared, then to not delight the people around you. H) TEWARI ANALYSIS This is a trick in a game called, “Go.” Which happens to be the most popular board game in the world, but many in the U.S. don’t know about it because it’s popular in Japan, Korea, and China. No computer can play Go. It’s too difficult. Much more difficult than chess. And when I play through a game played by two professionals it’s almost like they are not playing a game, but mutually creating a new work of art that takes my breath away. I used to take lessons from a guy who had been the Chinese Amateur Champion a year or so earlier. I would make a move and he would shake his head. He knew one English word: “No.” Then he would show me why. He would take off the last few moves made and then recreate the position but put the pieces down as if we had made the moves in a different order. Then a light would shine, “Ahh!” Because if I had made the move I was planning, in the exact same position but as if the moves leading up to that position were in a different order, then it suddenly was clear why my move was bad. Example: Someone wrote to me the other day that they had made $50 million dollars when they were very young. Then very quickly, the person had lost $30 million and was feeling horrible. Tewari analysis would say: “Well, what if you had simply gone from $0 to $20 million, rather than from $0 to $50 million, and then down to $20 million?” You would be in the exact same situation, but you probably wouldn’t feel horrible. Our minds give great weight to the perception of motion. The way to get around this is to rewire the mind to show that forward motion was still there, it just doesn’t seem that way because of how you were perceiving it. Change your perception of motion, and you change your potential for happiness. I) PLAY THE CARDS IN FRONT OF YOU One time I was playing poker at a club and Norm McDonald, the comedian, came in and started playing. He was a funny guy, so there was a lot of chatter at the table. Norm would play every hand. Normally in poker you’re probably dealt two hands an hour that are worth playing, and chances are you’ll lose at last 50% of those hands. But Norm played and raised and played and raised. He had a beautiful girl with him and it was no fun for him if he wasn’t in the hand. So he lost all his money and then got more money out and then lost that and eventually left. Someone said afterwards, “When Norm comes here, it’s like a vacuum cleaner on his wallet.” Too many people don’t have the right preparation. They haven’t tested their product. They haven’t studied the game they are in. But they play as if they are already on top. It’s not such a bad strategy to “fake it til you make it.” But make sure nobody knows you’re doing that. The short cut in poker: don’t bluff. If you have a good hand, play it. Count on the fact that someone else will bluff and you will make a lot of money. If you have pieces in chess that aren’t at their full potential (for example, there is a saying, “a knight on the rim is dim”) then “play your cards” by figuring out how to make that knight stronger in the next few moves. Don’t go for a full out attack on the other person’s king when your pieces are not really in place for it. Too many people do that. Just play what is in front of you. Improve incrementally and be PATIENT. You will have your chance to win many times. But you will lose ALL of your chances if you waste them. J) A BAD PLAN IS BETTER THAN NO PLAN Peter Thiel told me that on our podcast. He was referring to business. Guess what? Peter Thiel is also a very strong chess master and the saying “A bad plan is better than no plan” is a saying in chess. Having a bad plan gives you several things: 1. Realization that you need a plan. 2. Opportunities to see if that plan is not working. 3. Ways to analyze when the plan goes awry. 4. A chance to change the plan if it’s not working. Having no plan gives you none of these opportunities to get better. K) Maybe most important: THE THREAT IS STRONGER THAN THE EXECUTION I remember studying a match in, I think, 1984, between the British chess champion, Nigel Short, and the U.S. Champion, Lev Alburt. The British Champion wiped him out. I’m not going to Google it but I think the final score was 9-1. When I studied the games, I noticed that the British champion was constantly “bothering” the U.S. champion. He would make non-stop, but frivolous threats, against Lev Alburt’s queen. Alburt wasn’t going to lose his queen but he had to waste a move getting his queen safe. Eventually Nigel Short would have the better position because he had gained so much time by threatening non-stop. Microsoft always announces software years before it’s done. This is called “vaporware,” but nobody really knows whether or not their vaporware will become real or not so, this often dissuades competitors. H. Ross Perot used to buy up shares of a big company (for instance, GM) and start shouting how poorly the company was run and that he could do a better job. He wasn’t really going to take over the company, but many people thought he was because of his “threats” and they would start buying up shares. Then he would sell his shares after they had run up significantly (or a company like GM would pay him off in a process called “greenmail”) and he would make a lot of money. — I love games. Any game. And, for me, studying the subtleties of games are like studying a bible. The metaphors to life are so real that I’ve learned to live my life by the above rules. Recently, Claudia and I have been playing an Argentinian card game called Truco. We can play for hours. Half of the time she is screaming (she will deny this ,but I have a positive score against her). I can see there is a lot of strategy in the game. But the game is VERY Argentinian. For instance, if I Google strategy for Truco, it doesn’t give me the strategic tips I expect. It just says to joke and talk louder than your opponent so they get distracted. This strikes me as typical Argentina, a country settled hundreds of years ago by pirates escaping the law rather than by Puritans escaping religious persecution. Truco is actually a beautiful game and I love its subtleties. But when we are done playing, ultimately, I love the person I am playing with. This is how you master the game of life. The Curious Item the Chinese Can’t Get Enough Of (It’s Not What You Think) Posted: 01 Oct 2014 11:00 AM PDT China has quickly become the 15,000 ton dragon in the room. The truth is, the greatest culprit in sky-rocketing prices of this American commodity, has been China (and no, it’s not what you think)! In fact, the dragon has been gobbling them up like mad, and they show no signs of slowing down, either… Submitted by […] The post The Curious Item the Chinese Can't Get Enough Of (It's Not What You Think) appeared first on Silver Doctors. | ||||||

| Controversial chart suggests deflation could be coming Posted: 01 Oct 2014 10:30 AM PDT From Chris Kimble at Kimble Charting Solutions: Click on chart to enlarge Well, October is here and it’s time for the baseball post-season to start… Speaking of baseball, is a “New Deflationary Ball Game” starting in a variety of assets? This 5-pack reflects that a variety of long-term support and resistance line breaks are taking place. The U.S. dollar (upper left) is pushing above a 9-year resistance line recently. At the same time the TR commodity index, gold, and silver are each breaking a support line that has been in place for over a decade. Crude oil is attempting to break a 5-year support line at this time as well. Are we seeing the beginning of a whole new price game for these key global assets? It is still early in this process. Should the U.S. dollar keep pushing higher, these other assets could find themselves a good percentage below current prices. I have shared for the past two years that silver’s downside target that I am interested in comes into play around the $15 zone, which is fast approaching. | ||||||

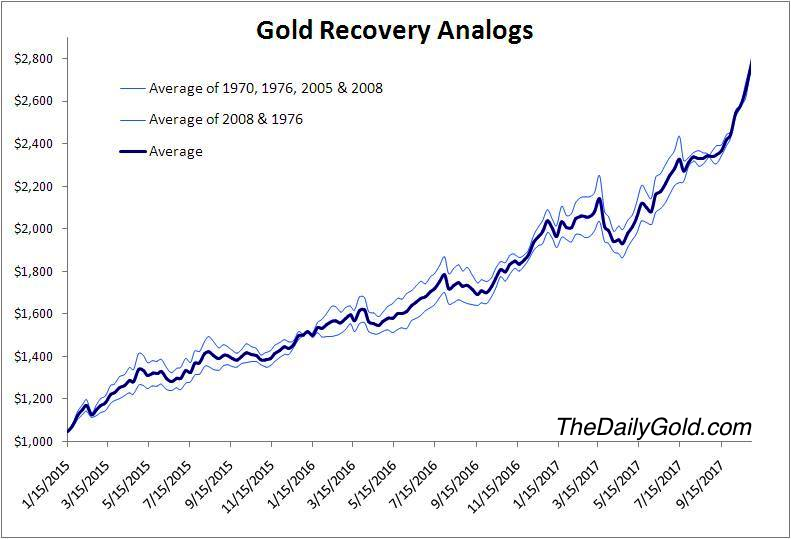

| Posted: 01 Oct 2014 10:29 AM PDT In this chart we have a starting point of $1050/oz on January 15, 2015. This chart uses weekly data so that means Gold could make a daily close or a intraday tick much lower than $1050. Anyway, we use that starting point along with the average recovery of some of Gold’s greatest cyclical bull runs. Even at a starting point of $1050 more than three months from now Gold could rally to $1400 in May (if it follows the average of the 1976 and 2008 recoveries).

The post Gold Recovery Analogs appeared first on The Daily Gold. | ||||||

| Balmoral Resources Continues to Expand Grasset Discovery Posted: 01 Oct 2014 10:26 AM PDT Bullet points from the news release….

(Vancouver, October 1, 2014) Balmoral Resources Ltd. (“Balmoral” or the “Company”) (TSX: BAR; OTCQX: BALMF) reported results for on-going testing of the Horizon 3 nickel-copper-PGE discovery on the Company’s wholly owned Grasset Property in Quebec. Drilling continues to rapidly expand the size of the Ni-Cu-PGE mineralized zone. Results from 12 recently completed holes, and several pending intercepts, imply more than a doubling of both the strike and down-dip extent of the Horizon 3 discovery. The Horizon 3 sulphide zone remains open to depth and to the northwest (see Figure 1). The Company also reported the first intersections of high-grade “Footwall-Style” Ni-Cu-PGE-Au veining, reported that it has intersected massive sulphide mineralization in three recently completed holes and reported several high-grade gold intercepts from altered volcanic and intrusive rocks in the hanging wall to Horizon 3. Today’s results were highlighted by holes GR-14-44 and GR-14-47, the latter being the deepest intercept reported to date. Hole GR-14-44 returned a 44.87 metre intercept grading 1.53% nickel, 0.16% copper, 0.37 g/t platinum and 0.86 g/t palladium with a higher grade core returning 12.57 metre grading 2.91% Ni, 0.44% Cu, 0.74 g/t Pt and 1.84 g/t Pd. Hole GR-14-47 returned a similarly broad intercept returning49.25 metres grading 1.28% Ni, 0.13% Cu, 0.31 g/t Pt and 0.76 g/t Pd, which includes a high grade core of 21.89 metres grading 2.21% Ni, 0.23% Cu, 0.57 g/t Pt and 1.42 g/t Pd (see Figures 2 and 3). “Today’s results demonstrate a rapid expansion of the Horizon 3 discovery both along strike and to depth, increasing our confidence in the potential of both the Horizon 3 discovery and the Grasset Ultramafic Complex as a whole” said Darin Wagner, President and CEO of Balmoral. “On-going drilling has continued to intersect net-textured style sulphide mineralization along the projection of Horizon 3 northwest of and beneath the holes reported today. We are also encouraged to see the development of massive sulphide mineralization, both at depth and to the northwest, in a series of pending holes.” Full Release on Balmoral’s Website The post Balmoral Resources Continues to Expand Grasset Discovery appeared first on The Daily Gold. | ||||||

| US Gold futures fall 5.91% in Sept, worst monthly loss since July 2013 Posted: 01 Oct 2014 10:18 AM PDT The S&P 500 Index has dropped almost two percent since reaching an intra-day peak of 2,019 on 19 September. The Euro Stoxx 50 Index was almost flat for the quarter and rose 1.68% in September. | ||||||

| Gold continues sliding as labor market picks up Posted: 01 Oct 2014 09:54 AM PDT The U.S. Comex gold futures fell 5.91% during September and 8.43% in Q3. | ||||||

| ENTIRE Board of the Bank of Cyprus Forced to Resign Posted: 01 Oct 2014 09:45 AM PDT Cyprus’ central bank sent a letter to Bank of Cyprus on Monday, publicly 'requesting' that the bank's -entire- board of directors resign. It was only 18-months ago that one of the brokest banking systems in the world became the first modern example of financial cannibalism. I'm sure you remember how it all went down in Cyprus […] The post ENTIRE Board of the Bank of Cyprus Forced to Resign appeared first on Silver Doctors. | ||||||

| Metals market update for October 1 Posted: 01 Oct 2014 08:32 AM PDT Gold fell $7.50 or 0.62% to $1,209.00 per ounce and silver slipped $0.44 or 2.52% to $17.05 per ounce yesterday. | ||||||

| Jay Taylor Urges Investors to Stay Liquid for the Coming Gold Boom Posted: 01 Oct 2014 08:30 AM PDT Jay Taylor doesn’t beat around the bush—he believes the price of gold is being suppressed to support the U.S. dollar and underwrite American foreign policy. But the publisher and editor of J. Taylor’s Gold, Energy & Tech Stocks and host of the radio show “Turning Hard Times into Good Times” thinks that this suppression will […] The post Jay Taylor Urges Investors to Stay Liquid for the Coming Gold Boom appeared first on Silver Doctors. | ||||||

| Posted: 01 Oct 2014 08:25 AM PDT Stocks continue to waver with some investors fretting about overall slowing global economic growth. The September Manufacturing PMI numbers were released this morning by the Institute for Supply Management showing a fall to 56.6 from August's 59.0 reading. The reading remains above 50 showing continued expansion but the pace slowed and that is feeding into those concerns noted above. The one number that I found noteworthy was the New Orders index. That fell to 60.0 from August's 66.7, which was a multi-year high according to Dow Jones. Again, nothing strongly negative but it does reflect a slowing trend and that is spooking equity bulls somewhat. That is bringing some strong buying into the bond market which notched a three week high today. The flip side to this were numbers out of China. It's version of the manufacturing PMI came in at a 51.1 reading for September. That was steady with the August reading. Investors/traders are looking at this and seeing the glass half full this morning ( especially in the copper and silver markets). The thinking is, "Yes, we knew China was slowing down but at least it seems to have stabilized". One month does not a trend make but for today, copper is breathing a sigh of relief and has thus managed to hold above $3.00. Silver seems to be taking its cues from the red metal and has clawed back above $17 on the number. The weakness in the stock markets has sent some safe haven buying into gold this morning ( note the Yen is also higher confirming the safe haven bid seen in the gold and bond markets ) and that is keeping the metal afloat above psychological and round number support at $1200. Even the HUI is bouncing today. Something also I am watching this morning is the further melt-up in the feeder cattle market. In going over the COT data for this very small and thinly traded futures market, I noted that the small specs or general public, have been holding the bulk of the short position in there and they are being mercilessly brutalized by the hedge funds who are squeezing them to kingdom come. Again, this market is currently experiencing a parabolic blow off run which I want to hasten to add makes it EXTREMELY DANGEROUS for all by the most experienced and nimble trader. Be careful with it unless you have some very deep pockets. Every now and then a mania comes along in the futures world and this market is one of them. When the panic buying out at the auction barns in the country is going to come to an end is anyone's guess but with replacement feeders fetching such nose-bleed prices, my view is that once the panic ends, the fall will be quite dramatic. Oh would I have loved being a cattle guy at this time in the industry with calves to sell! it was not that long ago when you could not GIVE them away. Crude oil has erased half of yesterday's massive losses as an unexpected drop in supplies. More later.... | ||||||

| Posted: 01 Oct 2014 08:08 AM PDT Nepal's gold imports dropped sharply by 7.8% during fiscal 2013-'14 when compared with the previous fiscal. | ||||||

| Indian government slashes gold, silver tariff Posted: 01 Oct 2014 07:51 AM PDT The Indian government today announced a cut in import tariff value for gold and silver. The import tariff value of gold was slashed by over 5%. | ||||||

| Nouriel Roubini rolls out his three horsemen of the Apocalypse how real are they? Posted: 01 Oct 2014 07:28 AM PDT Professor Nouriel Roubini, the economist who correctly called the US subprime crisis is back in the news today with an article highlighting the three most plausible ‘black swans’ that could jeopardize global financial markets which he sees as complacent and unaware as just before the First World War started 100 years ago. ‘First, the Middle East turmoil could affect global markets if one or more terrorist attack were to occur in Europe or the US – a plausible development, given that several hundred Islamic State jihadists are reported to have European or US passports. Markets tend to disregard the risks of events whose probability is hard to assess but that have a major impact on confidence when they do occur. Thus, a surprise terrorist attack could unnerve global markets.’ Correct He’s right. Think back to 9/11 and how that pummelled global stock markets and kept the dot-com crash falling. ‘Second, markets could be incorrect in their assessment that conflicts like that between Russia and Ukraine, or Syria's civil war, will not escalate or spread. Russian President Vladimir Putin's foreign policy may become more aggressive in response to challenges to his power at home, while Jordan, Lebanon, and Turkey are all being destabilized by Syria's ongoing meltdown.’ Less plausible. The Islamic State is universally unpopular. It could not muster a single friend in the United Nations. Most Syrians hate it. Mr. Putin is a calculating and pragmatic man on a fool’s errand but no lunatic. ‘Third, geopolitical and political tensions are more likely to trigger global contagion when a systemic factor shaping the global economy comes into play. For example, the mini-perfect storm that roiled emerging markets earlier this year – even spilling over for a while to advanced economies – occurred when political turbulence in a few countries (Turkey, Thailand, and Argentina) met bad news about Chinese growth. China crisis? ‘China, with its systemic importance, was the match that ignited a tinderbox of regional and local uncertainty…Today (or soon), the situation in Hong Kong, together with the news of further weakening in the Chinese economy, could trigger global financial havoc.’ Far more likely. The Chinese economy is so opaque. They still claim 7.5 per cent growth will be achieved this year while electricity consumption is off two per cent and iron and copper prices have fallen off the edge of a cliff. A hard landing would not be a surprise to anybody except the financial markets. Perhaps we could offer a fourth horseman of the Apocalypse to make up the traditional number. Maybe the Japanese economy will implode. Negative GDP of seven per cent in the second quarter was hardly great news for an economy only slightly smaller than China. Of course these two eastern stars would crash together as Japan is China’s largest business partner. | ||||||

| Gold Revaluation: Return of the King Posted: 01 Oct 2014 07:22 AM PDT

Click here for more on why the Fed may be ready to implement GOLD REVALUATION: | ||||||

| The Pure Hell At The Heart Of The Ebola Pandemic In Africa Could Soon Be Coming To America Posted: 01 Oct 2014 07:00 AM PDT The number of Ebola cases in Liberia and Sierra Leone is doubling approximately every 20 days. People are dropping dead in the streets, large numbers of bodies are being dumped into the rivers, and gravediggers can hardly keep up with the the number of corpses that are being delivered to the cemeteries. As you read […] The post The Pure Hell At The Heart Of The Ebola Pandemic In Africa Could Soon Be Coming To America appeared first on Silver Doctors. | ||||||

| Marc Faber defends his failed investment predictions and still waiting for doom and gloom Posted: 01 Oct 2014 06:55 AM PDT Legendary investment commentator Marc Faber apologizes for getting the US stock market wrong for two years but still thinks he will be proved right in the end, whenever that happens. He called the slowdown in China a year ago but gold has not done well. Now he says the strong US dollar is a symptom of tightening global liquidity. That’s the trouble for contrarians. You can look stupid at the top of the market. Who has the last laugh is another matter… Marc Faber, publisher of the Gloom, Boom & Doom report, talks about the outlook for global stocks and investment strategy. Faber speaks with Betty Liu on Bloomberg Television’s ‘In the Loop’… | ||||||

| Gold Revaluation: Return of the King Posted: 01 Oct 2014 06:00 AM PDT As QE is wound down, has former Fed Chairman Alan Greenspan signaled to the world that a triumphant return of gold is on the horizon via gold revaluation? Submitted by Stewart Thomson, Graceland Updates: In America, there is a lot of talk about higher interest rates, and I would argue that most of those fears are already factored […] The post Gold Revaluation: Return of the King appeared first on Silver Doctors. | ||||||

| Greenspan's 'Golden Rule: Why China is buying' Posted: 01 Oct 2014 05:17 AM PDT Alan Greenspan, former U.S. Fed Chairman, writes a defense of gold as central bank asset and speculates on China's reserves. | ||||||

| Gold Is “Universally Acceptable” and Why China Is Buying – Greenspan Posted: 01 Oct 2014 05:13 AM PDT Alan Greenspan comments, “"If the dollar or any other fiat currency were universally acceptable at all times, central banks would see no need to hold any gold. The fact that they do indicates that such currencies are not a universal substitute. Greenspan, former Chairman of the Federal Reserve Board of the United States from 1987 to 2006, points out that if the world's largest gold consumer, China, used a portion of its massive $4 trillion foreign exchange reserves to buy enough gold bullion it could displace the U.S. as the world's largest holder of gold bullion.”

Alan Greenspan, former Chairman of the Fed, had an article entitled "Golden Rule – Why Beijing Is Buying" published in Foreign Policy, the journal of the influential Council on Foreign Relations in which he extols the virtues of gold as "universally acceptable." Greenspan, former Chairman of the Federal Reserve Board of the United States from 1987 to 2006, points out that if the world's largest gold consumer, China, used a portion of its massive $4 trillion foreign exchange reserves to buy enough gold bullion it could displace the U.S. as the world's largest holder of gold bullion. The U.S. holdings are believed to be just over 8,500 tonnes with an estimated value of just $328 billion as of spring 2014.

He concedes that "a return to the gold standard in any form is not on anybody's horizon" right now but points out that if sovereign governments have financial crises, their fiat currencies may not be accepted as payment. He highlights that bullion holds special properties that no currency can claim, except maybe silver. The fiat currencies and moving exchange rates that make up our monetary system of today are backed by the tax raising abilities of government's of sovereign nations. However, gold bullion for over 2000 years has been an "unquestioned acceptance as payment", writes Greenspan. "No questions are raised when gold or direct claims to gold are offered in payment of an obligation; it was the only form of payment, for example, that exporters to Germany would accept as World War II was drawing to a close." "Today, the acceptance of fiat money — currency not backed by an asset of intrinsic value — rests on the credit guarantee of sovereign nations endowed with effective taxing power, a guarantee that in crisis conditions has not always matched the universal acceptability of gold." "If the dollar or any other fiat currency were universally acceptable at all times, central banks would see no need to hold any gold. The fact that they do indicates that such currencies are not a universal substitute. Of the 30 advanced countries that report to the International Monetary Fund, only four hold no gold as part of their reserve balances. Indeed, at market prices, the gold held by the central banks of developed economies was worth $762 billion as of December 31, 2013, comprising 10.3 percent of their overall reserve balances. (The IMF held an additional $117 billion.) " "If, in the words of the British economist John Maynard Keynes, gold were a "barbarous relic," central banks around the world would not have so much of an asset whose rate of return, including storage costs, is negative." In the article, he also suggests that China will find it hard to compete with the U.S. in the long term as China is an authoritarian, one party state and does not have free markets. This comparison is questionable given that many are concerned that the U.S. markets are no longer free. Markets see daily interventions and manipulations and are increasingly influenced by corporate and banking monopolies including the Federal Reserve itself and its continuing massive intervention in financial markets and the monetary system. There are also concerns that the U.S. is jettisoning many of the civil liberties, civil rights and freedoms that the Founding Fathers fought for and achieved and the emerging surveillance state has the hallmarks of a potentially authoritarian one or two party, corporate state. The article shows that senior monetary officials and policy makers continue to see gold as an important part of our modern financial and monetary system and as an important strategic assset. Influential global policy makers do not see gold as a "barbarous relic" as many of Keynes ardent disciples of today, including Paul Krugman, would have people believe. While he says that gold is important and the Chinese are right to accumulate it, he appears be warning the Chinese government that accumulating too much gold might lead to a very strong yuan on international markets which could lead to deflation and a recession in China's export dependent economy.

Greenspan has on a few occasions warned that the U.S. needs to be careful not to debase the dollar and engage in fiat money 'extremis.' If that happens fiat dollars would no longer be accepted on global markets with attendant difficult financial and economic consequences. MARKET UPDATE Gold in US Dollars – 2 Years (Thomson Reuters) Gold in Singapore stayed around the $1,206 an ounce level in lack lustre trade. In late morning trade in London prices have crept marginally higher. Gold fell $7.50 or 0.62% to $1,209.00 per ounce and silver slipped $0.44 or 2.52% to $17.05 per ounce yesterday. It is interesting to note that gold's falls continue to be primarily in dollar terms and that gold in euros and pounds has seen only minor falls. Gold fell to a nine-month low yesterday as the dollar rose again and commodities led by crude oil tumbled on concerns about the U.S. economy. Gold touched its lowest since January 1st at $1,204.40 an ounce. U.S. consumer confidence fell in September, the first time in five months that this has happened and July home prices rose less than expected from a year earlier, underscoring the fragility of the U.S. economy. Another report yesterday showed business activity growth in the U.S. Midwest decelerated slightly in September. Gold is down 6% in dollar terms for the month erasing the gains for the year. The quarterly drop is around 9%, marking the sharpest monthly loss since June 2013 and first quarterly loss this year. The dollar surged to a four-year high against a basket of currencies and a two-year high against the euro on Tuesday despite weak U.S. economic data. Earlier this month, the U.S. Federal Reserve indicated it could raise borrowing costs faster than expected. Something it has suggested for more than 5 years now. The peculiar phenomenon of gold falling sharply into quarter end continues and has all the hallmarks of certain entities attempting to 'paint the tape' and curtail 'animal spirits' and hence demand in the gold market. Previous quarter end sell offs have proved good buying opportunities for those accumulating bullion on the dip (see chart above).

RECEIVE OUR IMPORTANT MARKET UPDATES HERE | ||||||

| Gold Is “Universally Acceptable” and Why China Is Buying - Greenspan Posted: 01 Oct 2014 05:01 AM PDT gold.ie | ||||||

| TECHNICAL - GOLD Might Correct Higher But Not Much Posted: 01 Oct 2014 04:45 AM PDT countingpips | ||||||

| Gold Prices Killed by Not-So "Super" Dollar Posted: 01 Oct 2014 04:03 AM PDT Gold prices have been hammered by the rising US Dollar. What might October hold...? DOLLAR UP, gold down, writes Adrian Ash at BullionVault. That's pretty much the lesson for precious metals investors looking at any long-term rise in the US Dollar since exchange rates began floating in 1973. And now in late 2014, says former chief economist at Swiss bank UBS, George Magnus "It looks as though the third US Dollar uptrend of the post-Bretton Woods era may be underway." Just so long as you also ignore his warning against "extrapolating" short-term noise into long-term forecasts...  Might Magnus be right? For gold prices, as the chart shows, it's less the absolute level than the Dollar's direction of travel that counts. Starting from all-time lows in spring 2011, today's greenback hardly matches the "Super Dollar" of the early 1980s. Yet the background rhymes...

Even with the Federal Reserve still sticking however to its "considerable" delay for raising rates from zero, the third-quarter of 2014 proved ugly for Dollar investors holding non-US assets. Gold for US investors marked the end of Q3 by hitting new 2014 lows, losing 5.8% on the London PM Fix for the month of September alone. Silver fell to the lowest Dollar price since May 2010...down more than 12% from the end of August. Yet gold priced in Euros, in contrast, remains near the top of its 12-month range. Even in the British Pound...flattered by Tuesday's GDP revisions...gold has held 3% higher from New Year. Gold's recent drop, in other words, is entirely relative. And this split between Dollar and non-Dollar gold prices might widen in October. First there is the European Central Bank's meeting concluding Thursday. Mario Draghi and his team have long hinted at some kind of QE-style money printing. The latest inflation print of just 0.3% per year across the 18-nation union will loom large. Then, in the last week of October, the US Federal Reserve will face the opposite problem. It is set to taper the last $15 billion of its monthly QE printing. That leaves rising inflation, and strong GDP, begging for an end to the "extended time" promised for zero US interest rates. Before then, we've got US jobs data Friday (with an early look in ADP's private-sector estimate mid-week). Then, mid-month, the European Court of Justice will hear a legal challenge to the Eurozone central bank's Outright Monetary Transactions (OMT)...the 2012 plan which finally stemmed the single currency's debt crisis. Mario Draghi hasn't actually fired any OMT money at weak-economy bonds yet. But if the Court decides the plan is illegal (insomniacs will enjoy reading the arguments here. Or better still here) it could spark fresh panic...out of Greek, Spanish and other debt-heavy markets...pulling the Euro lower again. Analysts are of course aligned with the Euro bears betting against the currency in the forex market. Barclays Bank today cut its 12-month forecast for EUR/USD from $1.25 to $1.10 – a move which, if matched by the Dollar's other major crosses, would take the trade-weighted index to a decade high of 90 or so. Gold prices in 2004 were trading below $400 per ounce. So a blunt analysis, never mind the momentum in gold futures and options betting, says a fall in the Euro must push bullion prices lower again as the US Dollar surges. After all, it worked like clockwork in the other direction. "Gold up, Dollar down" was so solid between 2002 and 2008, it became a no-brainer trade for no-brain hedge funds. The US currency fell 30% against its major trading peers on the forex market. Gold meantime rose 160% in Dollar terms. But this relationship broke down during the financial crisis. Because gold kept rising...and rising...while the Dollar whipped higher. What are the odds today? Playing the averages, and reviewing the last 40 years (daily data, 12-month change), gold has been twice as likely to rise when the US currency is weakening on the forex market than when the Dollar Index is getting stronger. And when gold drops hard...down 10% or more from 12 months before...the Dollar has been rising 91% of the time. No-brain traders are betting this rule-of-thumb will hold firm as 2014 ends, and gold will keep falling in Dollar terms as the US currency gains versus the Euro, Yen, Pound and the rest. But watch out. Because since 1974, gold and the Dollar have also moved in the same direction some 30% of the time. And when gold rises as the Dollar also goes up (21% of the last 40 years), its gains have been markedly better on average than when the Dollar is falling. Yes, really. When gold has risen against a background of Dollar strength, gold priced in Dollars has gained 24% year-on-year on average. It's averaged 18% gains when the Dollar's been falling. Of course, investors tend to buy gold and the Dollar together when crisis hits. Not only, but not always either. You could cite any number of crises where gold failed to rise with the Dollar, and pitch them against the gold price surge of Soviet Russia invading Afghanistan in 1979, the 2008 Lehmans crash, or the 2010 Eurozone meltdown. Never mind if those events sound at all familiar here in late 2014. Ignore the fact that a rising Dollar...plus rising gold...adds up to 30% more fun for non-US investors trying to defend their money against crisis. Financial markets have avoided seeing any trouble ahead all year. So far. As an investment banker puts it to the Financial Times today...applauding this year's surge in global mergers and acquisitions..."I have never seen a market more resilient than it is today, in terms of absorbing geopolitical and financial risk." Such complacency is the reason gold investing exists, whatever the outlook for the Dollar (and "Everything seems to be Dollar positive," says another forex strategist...also tempting fate). | ||||||

| Here be treasure: map of where Brits are hoarding gold Posted: 01 Oct 2014 02:52 AM PDT | ||||||

| Gold hoarding secrets of the UK mapped Posted: 01 Oct 2014 02:52 AM PDT | ||||||

| Largest Precious Metals Comparison Site Integrates Bitcoin Posted: 01 Oct 2014 02:19 AM PDT CompareSilverPrices.com now supports Bitcoin prices for gold and silver. Since 2011 CompareSilverPrices.com (CSP) has been qualitatively easing the pains of silver investors looking to pay less for more. Now, Bitcoin enthusiasts will enjoy the same service. On October 1st, the website launched a new Bitcoin-centric precious metals service where consumers can quickly shop prices and products from dealers offering the crypto-currency as a payment method. "Bernank", head developer and Chief Printing Press operator for CompareSilverPrices.com noted that Bitcoin is a natural choice for bullion dealers:

"It's clear to me that Bitcoin will become a staple of eCommerce bullion dealers. Paying with Bitcoin often enables the consumer to enjoy immediate shipping (no need to wait for checks to clear or bankwire fees), while ensuring that the dealer always receives their payment. When bullion dealers integrate Bitcoin as a payment option, consumers enjoy the fastest service as there is no need to wait for payment to clear, and gold and silver dealers eliminate the need for a 'market loss policy' by collecting payment upfront." While "Bernank" doesn't expect to see Bitcoin outpace traditional payment methods just yet, it's clear that there are benefits tousing Bitcoin when compared to the headaches associated with credit cards and wires. "Many of the largest retail bullion dealers accept credit cards and Paypal, which puts them at risk with high fees, chargebacks and other inconveniences. Bitcoin represents an instanteous mode of value transfer without the risks dealers now face: no chargebacks, no fees, no waits. Dealers we spoke to mostly noted that integrating Bitcoin payments was straight-forward and at little or no marginal cost." CompareSilverPrices.com's new Bitcoin pricing site features Bitcoin accepting dealers Amagi Metals, Provident Metals, GoldSilverBitcoin and Agora Commodities, all of whom have made considerable inroads into the precious metals retail community, with some claiming over $10 million in sales. While it would seem that Bitcoin remains a niche or esoteric concept for gold buyers, Bitcoin-to-gold services are a new phenomenom that mutually benefit both industries as many are looking to convert portions of their cryptocurrency gains into hard assets like silver and gold in light of Bitcoin's bull market of 2013, which saw valuations rising from a low of $10 to a high over $1,200 by year's end. In adding support for Bitcoin, CSP aims to provide precious metals investors and collectors an efficient and clear overview of their options when it comes to buying bullion. The time is now for the precious metals industry to take a step into the future, and CSP is proud to be on the cutting edge of this transition with its new bitcoin service https://comparesilverprices.com/bitcoin/. | ||||||

| Comex Gold Futures (GC) Technical Analysis – October 1, 2014 ... Posted: 01 Oct 2014 01:25 AM PDT fxempire | ||||||

| TECHNICAL - Gold Aiming to Extend Down Move After Hitting 9-Month Low Posted: 01 Oct 2014 01:25 AM PDT dailyfx | ||||||

| Gold Still Testing Huge 1206 Level Posted: 01 Oct 2014 01:25 AM PDT dailyfx | ||||||

| Koos Jansen: China aims to exceed U.S. in gold reserves Posted: 01 Oct 2014 01:00 AM PDT GATA | ||||||

| Canaccord's Joe Mazumdar Shares His Favorite Get Rich Slow Schemes Posted: 01 Oct 2014 01:00 AM PDT | ||||||

| Golden Rule—Why Beijing is Buying: Alan Greenspan Posted: 30 Sep 2014 11:18 PM PDT "JPMorgan and their HFT buddies with algorithms in tow, ran amuck in the precious metals" ¤ Yesterday In Gold & SilverThe gold price didn't do a whole heck of a lot until minutes before 10:30 a.m. BST in London on their Tuesday morning---the London a.m. gold fix---and as the last chart in yesterday's edition of The Wrap indicated, the HFT boyz showed up with a vengeance once the 'fix' was in. They set a new low for this move down in the process---and that came at the noon London silver fix---and the subsequent rally to a few dollars above unchanged got dealt with in the usual manner at the London p.m. gold fix. By 12:30 p.m. EDT, the gold price was back down near its low of the day---and wasn't allowed to do much after that. The low and high were reported by the crooks over at the CME Group as $1,204.30 and $1,220.70 in the December contract. Gold closed in New York yesterday afternoon at $1,208.70 spot, down $6.30 on the day. Not surprisingly, net volume was way up there at 174,000 contracts. It was more or less the same chart pattern in silver. The high of the day, such as it was, came about 11:30 a.m. Hong Kong time---and after that, the silver chart looked pretty much the same as the gold chart for the remainder of the Tuesday session. The only major difference was the JPMorgan et al set a new low for this move down at 12:30 p.m. EDT, rather than the noon silver fix London that happened with gold. And then, like gold, the silver price wasn't allowed to do much after that. The high and low were reported as $17.57 and $16.85 in the December contract. Silver finished the trading day yesterday at $16.97 spot, down 49 cents from Monday's close. Net volume was heavy there as well at around 62,000 contracts. Platinum hit is high tick an hour or so before the Zurich open---and except for a brief bounce going into the London p.m. gold fix, it sold off quietly for the rest of the day, closing down 5 bucks on the day. Palladium's high came at the same time as platinum's, but then the HFT boyz and their algorithms really put the screws to the metal, with the new $763 low price for this move down coming shortly after 12 o'clock noon in New York. The price recovered a bunch immediately after that, before trading flat for the remainder of the day. The metal closed down 18 bucks, giving up all its Monday gains, plus four dollars more. From its high on September 1, to its low tick yesterday, the palladium price has been engineered lower to the tune of $149---or 16%. The dollar index closed at 85.61 late on Monday afternoon in New York---and its low tick of 85.50 came at 2:20 p.m. Hong Kong time. The rally to its 86.20 high came at 12:25 p.m. in London. From there it sold off to around 85.90 by 10:30 a.m. EDT---and then traded flat for the remainder of the Tuesday session, closing at 85.926, which was up 31 or so basis points from Monday. The gold stocks opened down, but rallied into positive territory for a minute or so at the London p.m. gold fix---and once JPMorgan et al showed up, the gold price, along with their associated equities, never got a sniff of positive territory again. The HUI closed down 1.99%. The silver equities got crushed under the jackboots of JPMorgan et al once again, as Nick Laird's Intraday Silver Sentiment Index closed down a whopping 3.78%. The CME Daily Delivery Report for Day 2 of the October delivery month showed that 57 gold and 170 silver contracts were posted for delivery within the Comex-approved depositories on Thursday. In gold, the short/issuer of note was HSBC USA with 49 contracts---and Barclays stopped 57 contracts. In silver, Jefferies was the short/issuer on 139 contracts---and RCG was a distant second with 30 contracts. The long/stoppers were Jefferies, Canada's Scotiabank and R.J. O'Brien with 41, 98 and 31 contracts respectively. The link to yesterday's Issuers and Stoppers Report is here. The CME Preliminary Report for the Tuesday trading session showed that there are still 2,498 gold contracts open in October, which was down 475 contracts from yesterday's report. There are still 375 silver contracts open as well, a decrease of 39 from Monday's Preliminary Report. From these numbers, one has to subtract the deliveries posted in the previous paragraph to get the true state of things as of the close of trading yesterday. An authorized participant over at the GLD ETF withdrew another 76,924 troy ounces of gold yesterday---and as of 9:52 p.m. EDT yesterday evening, there were no reported changes in SLV. But when I checked back an hour later, I was amazed to see that an eye-watering 4,075,208 troy ounces were deposited yesterday. Since August 4, there has been just under 30 million troy ounces deposited into SLV---and silver is down $3.25 the ounce over that same period. Ted and I are still looking for an explanation. By the way, over that same time period, GLD is down about 900,000 troy ounces. The U.S. Mint had another sales report yesterday to end the month. They sold 2,500 troy ounces of gold eagles---500 one-ounce 24K gold buffaloes---and a whopping 765,000 silver eagles. After discussions with Ted Butler, he seems to feel that the mystery buyer of silver eagles may have returned. We'll see what October brings. The mint also sold another 100 platinum eagles as well. Unless something is added today, the totals for the month of September are as follows: They sold 58,000 gold eagles---14,500 one-ounce 24K gold buffaloes---4,140,000 silver eagles---and 2,700 platinum eagles. The only product that didn't see a sales increase of over 100 percent compared to August were the gold buffaloes---and sales there were up 'only' 81 percent. It was another big day for gold shipments out of the Comex-approved depositories on Monday. They reported receiving a tiny 1,607 troy ounces, but 160,910 troy ounces were shipped out. The vast majority of the gold shipped out came from JPMorgan's vault---160,750.000 troy ounces, which works out to precisely 5,000 kilobars. The link to that activity is here. In silver, there was 385,747 troy ounces reported shipped in---and 879,231 troy ounces shipped out---the lion's share of which came out of the CNT Depository. The link to that action is here. I don't have that many stories for you today---and I hope you'll find some of them of interest. And starting with today's column, I will no longer be posting the daily King World News interviews. If you wish to read them on a daily basis, you can go directly to Eric's website linked here---and bookmark his Internet site for future reference. ¤ Critical ReadsFirst diagnosed case of Ebola in the U.S.A patient being treated at a Dallas hospital is the first person diagnosed with Ebola in the United States, health officials announced Tuesday. The unidentified man left Liberia on September 19 and arrived in the United States on September 20, said Dr. Thomas Frieden, director of the Centers for Disease Control and Prevention. At that time, the individual did not have symptoms. "But four or five days later," he began to exhibit them, Frieden said. The individual was hospitalized and isolated Sunday at Texas Health Presbyterian Hospital. Citing privacy concerns, health officials declined to release any details about how the patient contracted the virus, what he was doing in Liberia or how he was being treated. This story broke yesterday afternoon---and here's the CNN version of things. I thank reader David Caron for today's first story. The folks over at Russia Today also posted an article about this. It's headlined "Ebola diagnosed in U.S. for first time – Center for Disease Control"---and the link to that is here. I thank Harry Grant for sending it. Shiller: 'There Is a Sign of Some Weakening' in Housing MarketThe S&P/Case Shiller 20-city composite home price index fell a seasonally adjusted 0.5 percent in July, the third straight month of declines. When you combine that with recent decreases in existing and pending home sales, "there is a sign of some weakening" in the housing market, though it's "not dramatic," Nobel laureate economist Robert Shiller, whom the index is named after, told CNBC. Existing home sales dropped 1.8 percent in August, and pending home sales slid 1 percent. The above three paragraphs are all that's worth reading in this moneynews.com story that showed up on their Internet site at 10:58 a.m. EDT on Tuesday morning---and I thank West Virginia reader Elliot Simon for sending it. JPMorgan to face U.S. class action in $10 billion MBS caseA federal judge on Tuesday said JPMorgan Chase & Co must face a class action lawsuit by investors who claimed the largest U.S. bank misled them about the safety of $10 billion of mortgage-backed securities it sold before the financial crisis. U.S. District Judge Paul Oetken in Manhattan certified a class action as to JPMorgan's liability but not as to damages, saying it was unclear how investors could value the certificates they bought, given how the market was "not particularly liquid." He said the plaintiffs could try again to certify a class on damages. Oetken ruled 10 months after JPMorgan reached a $13 billion settlement to resolve U.S. and state probes into the New York-based bank's sale of mortgage securities. The class consists of investors before March 23, 2009 in certificates issued from nine of 11 trusts created by JPMorgan for the April 2007 offering. The other two trusts attracted only a handful of investors, and are the subject of other lawsuits. This Reuters article, filed from New York, appeared on their Internet site at 7:09 p.m. EDT on Tuesday evening---and I thank reader 'h c' for sending it our way. Morningstar strips Pimco Total Return Fund of its gold ratingMorningstar downgraded its analyst rating on the Pimco Total Return Fund to "bronze" from "gold", citing uncertainty about outflows and the reshuffling of management responsibilities after the exit of co-founder Bill Gross. Gross, the bond market's most renowned investor, quit Pimco for distant rival Janus Capital Group Inc. on Friday, a day before he was expected to be fired from the huge investment firm he helped found more than 40 years ago. Dan Ivascyn, one of Pimco's deputy chief investment officers, was named Group Chief Investment Officer to replace Gross. With Bill Gross' abrupt departure, Pimco's $222 billion flagship Total Return Fund has been taken over by Scott Mather, Mark Kiesel and Mihir Worah. This Reuters article appeared on their website at 5:15 a.m. EDT yesterday morning---and I thank Orlando, Florida reader Dennis Mong for sharing it with us. Europe's €500bn money funds risk AAA downgrade if they 'break the buck'Europe’s giant money market funds are struggling to stay afloat as negative interest rates drain the industry’s lifeblood, with many at risk of crippling downgrades by the rating agencies. Standard & Poor’s said the €500bn nexus of funds in the eurozone is facing serious stress, increasingly unable to generate profits since the European Central Bank cut its deposit rate to -0.02pc and pulled down short-term rates across the spectrum of maturities. “Pressure is building for these funds,” said Andrew Paranthoiene, the agency’s credit director. “We’re observing portfolios on a weekly basis. If there is any deviation from our credit metrics, a rating committee would determine if rating action was appropriate. In our view, any loss of capital means that the 'safety of principal’ has been breached,” he said. Standard & Poor’s rates all its European money market funds at AAA(m). Industry experts say it is unclear whether the funds could function for long at a lower rating, given the nature of their business as ultra-safe depositories of corporate cash. This Ambrose Evans-Pritchard offering appeared on the telegraph.co.uk Internet site at 7:08 p.m. BST yesterday evening---and I thank South African reader B.V. for bringing it to our attention. Germany Fights on Two Fronts to Preserve the EurozoneThe European Court of Justice announced Sept. 22 that hearings in the case against the European Central Bank's (ECB) bond-buying scheme known as Outright Monetary Transactions (OMT) will begin Oct. 14. Though the process is likely to be lengthy, with a judgment not due until mid-2015, the ruling will have serious implications for Germany's relationship with the rest of the eurozone. The timing could hardly be worse, coming as an anti-euro party has recently been making strides in the German political scene, steadily undermining the government's room for maneuver. All of the measures the ECB has announced so far, however, are mere appetizers. Financial markets have been demanding quantitative easing, a broad-based program of buying sovereign bonds in order to inject a large quantity of money into the market. Up to this stage, three major impediments have existed to such a policy: the German government's ideological aversion to spending taxpayers' money on peripheral economies; the political conception that quantitative easing would ease the pressure on peripheral economies to reform; and the court case that has been hanging over OMT (the only existing mechanism available to the ECB for undertaking sovereign bond purchases). Notably, the OMT in its original guise and quantitative easing are not precisely the same thing. In the original conception of OMT, the ECB would offset any purchases in full by taking an equivalent amount of money out of circulation, (i.e., not increasing the money supply itself). Nonetheless, any declaration that OMT is illegal would severely inhibit Draghi's room for maneuver should he wish to undertake full quantitative easing. This confluence of events leaves Merkel nervously awaiting the decision of the European Court of Justice. In truth, she is in a no-win situation. If the Luxembourg court holds OMT illegal, Draghi's promise would be weakened, removing the force that has kept many sovereign bond yields at artificially low levels and permitting the desperate days of 2011-2012 to surge back. If the European Court of Justice takes up the German court's three suggestions and undercuts OMT to the extent that the market deems it to be of little consequence, the same outcome could occur. And if the European Court of Justice rules that OMT is legal, a sizable inhibitor to quantitative easing will have been removed, and the possibility of a fully fledged bond-buying campaign will loom ever closer, much to the chagrin of the German voter and to the political gain of the Alternative for Germany. This very interesting and well written essay showed up on the stratfor.com Internet site early yesterday morning---and I thank Dan Lazicki for sending it our way. It's worth reading. Recovery? 60% of Greeks Live at or Below Poverty LevelsWhile Greek government yields (and political leaders) proclaim the troubled peripheral European nation is 'recovering', the risk of major political upheaval in Greece has not gone away ahead of next year's presidential vote next year. As Reuters notes, under growing pressure from anti-bailout leftists, Greek Prime Minister Antonis Samaras desperately needs a new narrative to get the backing of lawmakers and rally Greeks fed up with four years of austerity. We wish him luck as Keep Talking Greece notes, it is high time that the real data of the economic situation of the Greek society come to the surface and so it did this week. A report from Greece's State Budget Office found that three in every five Greeks, or some 6.3 million people, were living in poverty or under the threat of poverty in 2013 due to material deprivation and unemployment. This news item was posted on the Zero Hedge website at 10:05 p.m. EDT last night---and I thank Harry Grant for his second contribution to today's column. It's worth your time. Mass default looms as world sinks beneath a sea of debtAs if the fast degenerating geopolitical situation isn’t bad enough, here’s another lorry load of concerns to add to the pile. The U.K. and U.S. economies may be on the mend at last, but that’s not the pattern elsewhere. On a global level, growth is being steadily drowned under a rising tide of debt, threatening renewed financial crisis, a continued squeeze to living standards, and eventual mass default. I exaggerate only a little in depicting this apocalyptic view of the future as the conclusion of the latest “Geneva Report”, an annual assessment informed by a top drawer conference of leading decision makers and economic thinkers of the big challenges facing | ||||||

| Morningstar strips Pimco Total Return Fund of its gold rating Posted: 30 Sep 2014 11:18 PM PDT Morningstar downgraded its analyst rating on the Pimco Total Return Fund to "bronze" from "gold", citing uncertainty about outflows and the reshuffling of management responsibilities after the exit of co-founder Bill Gross. Gross, the bond market's most renowned investor, quit Pimco for distant rival Janus Capital Group Inc. on Friday, a day before he was expected to be fired from the huge investment firm he helped found more than 40 years ago. Dan Ivascyn, one of Pimco's deputy chief investment officers, was named Group Chief Investment Officer to replace Gross. With Bill Gross' abrupt departure, Pimco's $222 billion flagship Total Return Fund has been taken over by Scott Mather, Mark Kiesel and Mihir Worah. This Reuters article appeared on their website at 5:15 a.m. EDT yesterday morning---and I thank Orlando, Florida reader Dennis Mong for sharing it with us. | ||||||

| Alasdair MacLeod: Gold's Role as a Safety Net for the Economic Tightrope Ahead Posted: 30 Sep 2014 11:18 PM PDT WindRock interviews Alasdair MacLeod, well-known monetary expert and Director of Research at GoldMoney. Mr. MacLeod addresses such issues as: global money supplies which are now levered to 180 times pre-2008 levels; currency risk throughout the world as central bankers accelerate monetary expansion in light of continued economic weakness; inflation's impoverishing effect upon the very people policy makers hope to help through money printing; and reasons to own physical gold outside of the banking system, including the necessity of avoiding safety deposit boxes. This 31:23 minute audio interview was posted on the windrockwealth.com Internet site this week sometime---and it's worth your while. The audio quality is not the best, so you have to pay close attention. [Note: When I checked the link on this website at 4:59 a.m. EDT, the link didn't work, although it worked fine earlier. I hope it's working by the time you get around to clicking on it. - Ed] | ||||||

| U.S. gold output declines on back of Newmont, Barrick Posted: 30 Sep 2014 11:18 PM PDT Production of gold by U.S. mines was 17,700 kilograms (569,068 troy ounces) in June, down 10% from 19,600 kg (630,154 oz) in June 2013, the U.S. Geological Survey recently reported. Domestic gold production for the first six months of this year was down 8% than that of the first half of last year due to lower production from Barrick Gold’s Cortez Mine and Newmont Mining’s Nevada operations. For the first half of this year, U.S. mines produced 103,000 kg (3,311,526 oz) of gold. Nevada led production with 74,100 kg (2,382,370 oz), followed by Alaska with 15,100 kg (485,476 oz), and other states combined at 14,000 kg. The Cortez Mine in Northern Nevada produced only 13,800 kg (443,680 oz) of gold during the first half of this year, down 42% from the first six months of last year “owing to a drastic decline in grade in ore from the Cortez Hill open pit,” said the USGS. This mineweb.com gold-related news item appeared on their Internet site yesterday sometime---and my thanks go out to Manitoba reader U.M. It's definitely worth reading. | ||||||

| Swiss Gold Referendum Attracting Attention Two Months Ahead of Vote Posted: 30 Sep 2014 11:18 PM PDT A referendum on Switzerland’s gold reserves is starting to attract some attention outside of the country as a yes vote would have significant implications for the gold market, said one market analyst. On November 30, Swiss citizens will go to the polls to vote on three areas; whether or not the Swiss National Bank should increase its gold reserves to 20%, that the central bank should stop selling its precious metals and that all its gold should be held within the country. Ole Hansen, head commodity strategist at Saxo Bank in Denmark, said it is still early in the campaign, but he has started monitoring the public sentiment in Switzerland as the next two months will be a critical time. He added that the Scottish referendum, held on September 18, is a strong reminder that sentiment can shift dramatically in a very short period. With all the geopolitical instability throughout the globe and concerns about European growth, it might not take much to convince people that the central bank needs to hold more gold in its reserve, he said. This very interesting news item showed up on the kitco.com Internet site at 1:05 p.m. EDT yesterday afternoon---and I thank reader M.A. for sharing it with us. | ||||||