Gold World News Flash |

- Gold Daily and Silver Weekly Charts – End of September, Hello Non-Farm Payrolls

- Richard Russell – Financial Meltdown & Once In 600-Year Event

- The French Have Backstabbed the US Petrodollar

- Final Push Down In Silver To Set Up Massive Surge Above $100

- RX For Revisionist Bunkum: A Lehman Bailout Wouldn’t Have Saved The Economy

- The Gold Price Dropped $7.00 to Close $1,210.50

- "If Something Rattles This Ponzi Scheme, Life In America Will Change Overnight"

- Why Is China Hoarding Gold? Alan Greenspan Explains

- Why These 2 Junior Miners Tripled in 2014 Despite TSX Venture Decline

- Does Surging Demand For Gold & Silver Coins Signal A Bottom?

- More Lies: Watchdog Finds Government "Greatly Exaggerated" Success In Funding Small Businesses Last Year

- The Central Bank Experiment that’s Destroying the Economy

- CURRENCY WAR! China Begins Trading with Euro!

- Mike Kosares: Why China thinks gold is the buy of the century

- Gold Daily and Silver Weekly Charts - End of September, Hello Non-Farm Payrolls

- A Historic Bottom Being Made In Gold & Silver & $10,000 Gold

- BIS is main mechanism for manipulating the gold market, Rickards says

- Koos Jansen: China aims to exceed U.S. in gold reserves

- James Rickards : Warren Buffett and China are Dumping the Dollar…Why You Should Too

- Ned Naylor-Leyland: Journalist can and should publish his report on silver rigging

- Big Al Talks Gold Reval

- Greenspan: Gold is the ultimate money and China well might want more

- US Dollar Cycle Analysis

- SP500 and GOLD Intraday Elliott Wave Analysis

- Rule - Despite Weakness, Gold & Silver Close To A Major Turn

- Alex Jones Warns of The Next 9/11

- Gold Prices Drop 6% in Sept, Silver Down 12% as Dollar Jumps, Bugs Face "Boredom or Despair" Says Gartman

- Singapore Becoming Global Gold Hub - Launches Kilo Bar Contract And Gold ATMs

- Turn the Tables on the Gold and Silver Market Manipulators

- Demand for Physical Gold Remains Strong as Bullion Banks Suppress Prices

- Making Money with Merchants of Death

- Gold - Time to Buy the Dip?

- Urging Investors to Stay Liquid for the Coming Gold Stocks Boom

- The French Have Backstabbed the US Petrodollar

- Technician: Top-Heavy Stock Market Has "More Pain to Come"; Long-Term Picture Still Favorable

| Gold Daily and Silver Weekly Charts – End of September, Hello Non-Farm Payrolls Posted: 01 Oct 2014 12:30 AM PDT from Jesse's Café Américain:

Gold is flowing from West to East. The trading action in bullion is already there. The Comex is a quaint artifact of the era of market manipulation. It is little more than a shell game. Have a pleasant evening. | ||||||||||||||||||||||||||||

| Richard Russell – Financial Meltdown & Once In 600-Year Event Posted: 30 Sep 2014 10:30 PM PDT from KingWorldNews:

So all in all, the technical background for the stock market does not look good. Nevertheless, the D-J Averages appear constructive. Below, we see the Dow testing its 50-day moving average and well above its (red) 200-day MA. But note that MACD is rolling over. | ||||||||||||||||||||||||||||

| The French Have Backstabbed the US Petrodollar Posted: 30 Sep 2014 10:00 PM PDT by Marin Katusa, Casey Research:

Until now, that is. The US has been the driving force behind implementing sanctions against Russia, but President Obama's pattern of failed foreign policy is repeating yet again. The sanctions against Russia are backfiring on the US. | ||||||||||||||||||||||||||||

| Final Push Down In Silver To Set Up Massive Surge Above $100 Posted: 30 Sep 2014 09:01 PM PDT  Today KWN is putting out a special piece which features four spectacular silver charts that show that despite the recent drop, silver is coiled to break above $100 as the bear market in the metals comes to an end. These are charts that the big banks follow closely, as well as big money and savvy professionals. David P. out of Europe sent us the four key charts that all KWN readers around the world need to see. Today KWN is putting out a special piece which features four spectacular silver charts that show that despite the recent drop, silver is coiled to break above $100 as the bear market in the metals comes to an end. These are charts that the big banks follow closely, as well as big money and savvy professionals. David P. out of Europe sent us the four key charts that all KWN readers around the world need to see.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||

| RX For Revisionist Bunkum: A Lehman Bailout Wouldn’t Have Saved The Economy Posted: 30 Sep 2014 07:37 PM PDT Submitted by David Stockman via Contra Corner blog, Here come the revisionists with new malarkey about the 2008 financial crisis. No less august a forum than the New York Times today carries a front page piece by journeyman financial reporter James Stewart suggesting that Lehman Brothers was solvent; could and should have been bailed out; and that the entire trauma of the financial crisis and Great Recession might have been avoided or substantially mitigated:

That is not just meretricious nonsense; its a measure of how thoroughly corrupted public discourse about the fundamental financial and economic realities of the present era has become owing to the cult of central banking. For crying out loud, yes, there would have been a Great Recession - even had Lehman been pawned off to Barclays with a taxpayer guarantee or if it had been bailed-out in some other manner. In fact, the Barclay’s logo did end up on Lehman’s 7th Avenue glass tower shortly after the September 15th screen shot below. Yet the decision to allow Lehman’s stock and bondholders to take a severe haircut first did not cause the thundering collapse of the housing and credit markets, nor the loss of the artificially bloated level of consumption spending, jobs and income that had accompanied the giant financial bubble that finally burst in September 2008.

The villain is the Greenspan Fed and the rampage of debt and speculation its cheap money and “wealth effects” coddling of Wall Street had engendered over the previous two decades. When Greenspan took office in 1987, total credit market debt outstanding was $10.5 trillion, but by the time of the Lehman event it was nearly $53 trillion. This means that the debt burden on the US economy had soared by 5X during a period when nominal GDP grew by only 2.9X. That’s called leveraging up big time—–and it fueled a party of consumption and speculation like the nation had not experienced since the 1920s, or even then.

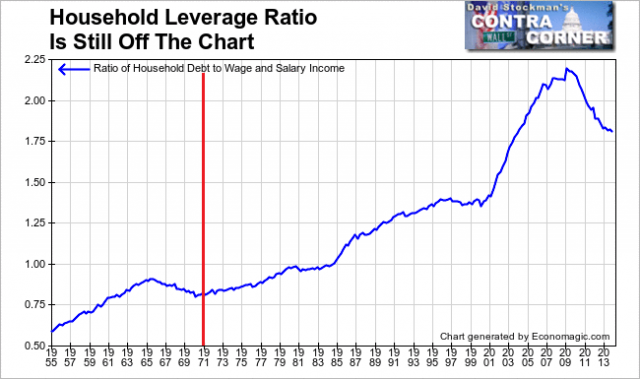

Moreover, within the household sector the explosion of debt was even more stunning owing to the Greenspan policies of cheap mortgage rates and the overt encouragement of American families to raid their home ATM machines. As shown below, household debt ballooned from just $2.7 trillion when Greenspan took charge of the Eccles Building in August 1987 to nearly $14 trillion on the eve of the crisis.

And there can be little doubt as to what explains the above mountain of household debt. American households were raiding their home ATM machines - that is, cashing out the equity in their homes - in order to indulge in a massive orgy of consumption spending that they had not earned. In fact, at the peak in 2005-2007, households were extracting cash from their ATMs at nearly a $1 trillion annual rate, ballooning their disposable incomes by upwards of 8%. That is, they were buying flat screen TVs, granite top kitchen counters, restaurant dinners and trips to the mall with money they hadn’t earned, and based on rapidly rising leverage ratios that couldn’t be sustained. What caused the Great Recession, therefore, was the day of reckoning when the household borrowing mania reached its limit. As shown below, the swing in household spending funded by withdrawals from home ATM machines was massive and violent. At its peak extent between 2006 and 2010 - it amounted to a reversal of nearly $1.4 trillion. Yes, when a gigantic, artificial spending bubble of this magnitude is pricked, the repercussions do cascade through the main street economy taking down sales, jobs and incomes as they go. Accordingly, the chart below explains the Great Recession, not some revisionist gumming from the bowels of the New York Fed as to how the economy could have been “saved” if only Tiny Tim Geithner had gotten the word on Sunday evening September 14th that Lehman was “solvent” after all. In fact, the name on the glass tower above had nothing to do with the crash of household borrowing at upwards of 30 million home ATMs depicted in the graph below. Moreover, what caused the recession to be so painful and deep is that the phony prosperity of the Greenspan era could no longer be fueled by pushing households deeper into debt. By the fall of 2008, “peak debt” had been reached in the household sector, and a modest deleveraging was begun owning to upwards of $1 trillion in mortgage defaults. But this wasn’t a recoverable loss of “aggregate demand” per the Keynesian mantra at the Bernanke Fed. The US economy was drastically squeezed by the Great Recession because artificial mortgage fueled spending was being liquidated all across America, not because punters in Lehman stock and bonds lost their shirts, and deservedly so.

In short, the Great Recession was about the abrupt end of the great financial party conducted by the Maestro. During his 19 year reign, the nation underwent a collective LBO, raising it leverage ratio from a historically sound and sustainable 1.5X national income to 3.5X on the eve of the Lehman collapse. Those two extra turns of debt amounted to $30 trillion at the time the US economy buckled in 2008; they were a measure of both the folly of the Greenspan/Bernanke spending party that had been financed by the Fed’s cheap money policies, and the enormity of the adjustment that was brought to bear on the US economy when the bubble finally collapsed.

Not surprisingly, upwards of $12 trillion in household wealth was destroyed by the financial crisis and the deep recession which followed. But given the enormous inflation of housing prices and risk asset values which had been driven by the debt bubble, it is ludicrous to suggest that save for not saving Lehman, the housing crash pictured below would not have happened. In fact, between late 1994 and early 2006 home prices in America rose each and every month for about 125 straight months, rising by nearly 140% over the period.

Needless to say, the above wasn’t sustainable and didn’t reflect either the free market at work or greed running rampant in the towns and cities of America. It was the cheap money and Wall Street coddling policies of the Fed which generated the housing binge, and the gambling hall known as Lehman Brothers that had gone along for the ride. It is therefore especially misfortunate that mainstream journalists like Stewart take up the revisionist line that Lehman was “solvent”, and that a great mistake was made in not throwing it a life line. Well, it just doesn’t fricking matter whether it was “solvent”. It was self-evidently illiquid because it - like the rest of Wall Street - had funded tens of billions of illiquid, opaque and drastically over-valued long-term assets in the short-term money markets. It was a classic, massive funding mismatch and there is no doubt whatsoever about what caused it, and why it happened. What caused it, of course, is the fundamental tool of Fed policy - that is, pegging the money market rate (federal funds) and holding it rigidly in place until a well telegraphed decision to change it is announced from the Eccles Building. Stated differently, Fed policy inherently offers a big fat yield curve arbitrage to Wall Street and a guarantee that it can be taken to the bank day after day. By contrast, in the pre-Fed era money market rates could move by hundreds of basis points per day, and that most definitely did deter large banks from loading up on illiquid assets and funding their books with hot money. To be sure, there were plenty of punters prior to 1913, but the game was played in the call money market and their were no illusions among the participants. Broker loans were instantly callable, and were called without hesitation by the street’s bankers when frothy markets took a dive. Needless to say, speculation was held in check by the discipline of the call money market and no one proposed to make a living by generating giant balance sheets with recklessly mismatched funding. The latter is a disease of the Greenspan/Bernanke/Yellen era of Keynesian central banking and massive manipulation of financial market prices and rates. Its why the balance sheet of Goldman and Morgan had reached $2 trillion with hundreds of billions of hot money funding, and why Lehman’s $800 billion balance sheet was not even remotely liquid. Indeed, the idea that the Wall Street gambling houses were “solvent” but only needed a liquidity injection goes to the very heart of the matter, explains why financial crises have become endemic in the current era and why bailouts have become standard operating procedure. Central bank apparatchiks like Tim Geithner and journalist fellow travelers like Stewart would have viewed the call market panics of the pre-Fed era as “bank runs” that needed to be stopped at all hazards. By contrast, they were, in fact, a healthy financial therapeutic that kept speculation reasonably in check. But money market pegging by the central bank, to use Friedman’s phrase, always and everywhere causes bank runs and liquidity crises in the canyons of Wall Street. Tempt the titans of finance with the opportunity to scalp prodigious profits by ballooning their balance sheets with sticky assets that yield more than the pegged cost of hot money, and they will do it every time. And when a black swan comes calling, the value of all those sticky assets will not be what’s on the books, but what can be salvaged in a plunging market when hot money lenders want their money back….and now. So of course Lehman was insolvent and massively so. It had funded itself so that its assets were only worth their fire sale price. The great error of September 2008, therefore, was not in failing to bailout Lehman. It was in providing a $100 billion liquidity hose to Morgan Stanley and an even larger one to Goldman. They too were insolvent. That was the essence of their business model. Not surprisingly, Greenspan co-architect in creating this madness was Alan Blinder. As he told Stewart in today’s article, there was no doubt that the Fed could have saved Lehman and should have:

That’s right. Its policies inherently generate runs, and then it stands ready with limitless free money to rescue the gamblers. You can call that pragmatism, if you like. But don’t call it capitalism. | ||||||||||||||||||||||||||||

| The Gold Price Dropped $7.00 to Close $1,210.50 Posted: 30 Sep 2014 06:56 PM PDT

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||

| "If Something Rattles This Ponzi Scheme, Life In America Will Change Overnight" Posted: 30 Sep 2014 06:13 PM PDT Submitted by Michael Snyder of The Economic Collapse blog, I know that headline sounds completely outrageous. But it is actually true. The U.S. government is borrowing about 8 trillion dollars a year, and you are about to see the hard numbers that prove this. When discussing the national debt, most people tend to only focus on the amount that it increases each 12 months. And as I wrote about recently, the U.S. national debt has increased by more than a trillion dollars in fiscal year 2014. But that does not count the huge amounts of U.S. Treasury securities that the federal government must redeem each year. When these debt instruments hit their maturity date, the U.S. government must pay them off. This is done by borrowing more money to pay off the previous debts. In fiscal year 2013, redemptions of U.S. Treasury securities totaled $7,546,726,000,000 and new debt totaling $8,323,949,000,000 was issued. The final numbers for fiscal year 2014 are likely to be significantly higher than that. So why does so much government debt come due each year? Well, in recent years government officials figured out that they could save a lot of money on interest payments by borrowing over shorter time frames. For example, it costs the government far more to borrow money for 10 years than it does for 1 year. So a strategy was hatched to borrow money for very short periods of time and to keep "rolling it over" again and again and again. This strategy has indeed saved the federal government hundreds of billions of dollars in interest payments, but it has also created a situation where the federal government must borrow about 8 trillion dollars a year just to keep up with the game. So what happens when the rest of the world decides that it does not want to loan us 8 trillion dollars a year at ultra-low interest rates? Well, the game will be over and we will be in a massive amount of trouble. I am about to share with you some numbers that were originally reported by CNS News. As you can see, far more debt is being redeemed and issued today than back during the middle part of the last decade... 2013 Redeemed: $7,546,726,000,000 Issued: $8,323,949,000,000 Increase: $777,223,000,000 2012 Redeemed: $6,804,956,000,000 Issued: $7,924,651,000,000 Increase: $1,119,695,000,000 2011 Redeemed: $7,026,617,000,000 Issued: $8,078,266,000,000 Increase: $1,051,649,000,000 2010 Redeemed: $7,206,965,000,000 Issued: $8,649,171,000,000 Increase: $1,442,206,000,000 2009 Redeemed: $7,306,512,000,000 Issued: $9,027,399,000,000 Increase: $1,720,887,000,000 2008 Redeemed: $4,898,607,000,000 Issued: $5,580,644,000,000 Increase: $682,037,000,000 2007 Redeemed: $4,402,395,000,000 Issued: $4,532,698,000,000 Increase: $130,303,000,000 2006 Redeemed: $4,297,869,000,000 Issued: $4,459,341,000,000 Increase: $161,472,000,000 The only way that this game can continue is if the U.S. government can continue to borrow gigantic piles of money at ridiculously low interest rates. And our current standard of living greatly depends on the continuation of this game. If something comes along and rattles this Ponzi scheme, life in America could change radically almost overnight. In the United States today, we have a heavily socialized system that hands out checks to nearly half the population. In fact, 49 percent of all Americans live in a home that gets direct monetary benefits from the federal government each month according to the U.S. Census Bureau. And it is hard to believe, but Americans received more than 2 trillion dollars in benefits from the federal government last year alone. At this point, the primary function of the federal government is taking money from some people and giving it to others. In fact, more than 70 percent of all federal spending goes to "dependence-creating programs", and the government runs approximately 80 different "means-tested welfare programs" right now. But the big problem is that the government is giving out far more money than it is taking in, so it has to borrow the difference. As long as we can continue to borrow at super low interest rates, the status quo can continue. But a Ponzi scheme like this can only last for so long. It has been said that when the checks stop coming in, chaos will begin in the streets of America. The looting that took place when a technical glitch caused the EBT system to go down for a short time in some areas last year and the rioting in the streets of Ferguson, Missouri this year were both small previews of what we will see in the future. And there is no way that we will be able to "grow" our way out of this problem. As the Baby Boomers continue to retire, the amount of money that the federal government is handing out each year is projected to absolutely skyrocket. Just consider the following numbers...

Yes, things seem somewhat stable for the moment in America today. But the same thing could have been said about 2007. The stock market was soaring, the economy seemed like it was rolling right along and people were generally optimistic about the future. Then the financial crisis of 2008 erupted and it seemed like the world was going to end. Well, the truth is that another great crisis is rapidly approaching, and we are in far worse shape financially than we were back in 2008. Don't get blindsided by what is ahead. Evidence of the coming catastrophe is all around you. | ||||||||||||||||||||||||||||

| Why Is China Hoarding Gold? Alan Greenspan Explains Posted: 30 Sep 2014 06:00 PM PDT Remember when instead of pontificating on and explaining the consequences of three decades of devastating, ruinous, irresponsible Fed policies, and eagerly sharing ideas on how to "fix" these unfixable problems, Alan Greenspan was the primary culprit behind everything that is now wrong and broken with the world's financial system? Oh, and also was not an "Austrian" economist? Good times. Today we bring you the "other" Greenspan: the one who is blissfully unaware that, almost singlehandedly, he destroyed western capitalism, which is now living day to day, on borrowed time from one central bank printer to another. Ironically, the topic of his most recent Op-Ed for the Council of Foreign Relation's Foreign Affairs magazine, is none other than the default Kryptonite to every central banker, himself included if only a decade or so ago: gold. And specifically the reason why, as we have covered consistently over the past 3 years, while the rest of the world is selling (if only paper gold), China just can't get enough of (physical) gold. So for everyone curious what the world's most infamous central banker, probably of all time, thinks about China's gold hoarding ambitions, read on. * * * Why Beijing Is Buying By Alan Greenspan, first posted in Foreign Affairs If China were to convert a relatively modest part of its $4 trillion foreign exchange reserves into gold, the country's currency could take on unexpected strength in today's international financial system. It would be a gamble, of course, for China to use part of its reserves to buy enough gold bullion to displace the United States from its position as the world's largest holder of monetary gold. (As of spring 2014, U.S. holdings amounted to $328 billion.) But the penalty for being wrong, in terms of lost interest and the cost of storage, would be modest. For the rest of the world, gold prices would certainly rise, but only during the period of accumulation. They would likely fall back once China reached its goal. The broader issue -- a return to the gold standard in any form -- is nowhere on anybody's horizon. It has few supporters in today's virtually universal embrace of fiat currencies and floating exchange rates. Yet gold has special properties that no other currency, with the possible exception of silver, can claim. For more than two millennia, gold has had virtually unquestioned acceptance as payment. It has never required the credit guarantee of a third party. No questions are raised when gold or direct claims to gold are offered in payment of an obligation; it was the only form of payment, for example, that exporters to Germany would accept as World War II was drawing to a close. Today, the acceptance of fiat money -- currency not backed by an asset of intrinsic value -- rests on the credit guarantee of sovereign nations endowed with effective taxing power, a guarantee that in crisis conditions has not always matched the universal acceptability of gold. If the dollar or any other fiat currency were universally acceptable at all times, central banks would see no need to hold any gold. The fact that they do indicates that such currencies are not a universal substitute. Of the 30 advanced countries that report to the International Monetary Fund, only four hold no gold as part of their reserve balances. Indeed, at market prices, the gold held by the central banks of developed economies was worth $762 billion as of December 31, 2013, comprising 10.3 percent of their overall reserve balances. (The IMF held an additional $117 billion.) If, in the words of the British economist John Maynard Keynes, gold were a "barbarous relic," central banks around the world would not have so much of an asset whose rate of return, including storage costs, is negative. There have been several cases where policymakers have contemplated selling off gold bullion. In 1976, for example, I participated, as chair of the Council of Economic Advisers, in a conversation in which then U.S. Treasury Secretary William Simon and then Federal Reserve Board Chair Arthur Burns met with President Gerald Ford to discuss Simon's recommendation that the United States sell its 275 million ounces of gold and invest the proceeds in interest-earning assets. Whereas Simon, following the economist Milton Friedman's view at that time, argued that gold no longer served any useful monetary purpose, Burns argued that gold was the ultimate crisis backstop to the dollar. The two advocates were unable to find common ground. In the end, Ford chose to do nothing. And to this day, the U.S. gold hoard has changed little, amounting to 261 million ounces. I confronted the issue again as Fed chair in the 1990s, following a decline in the price of gold to under $300 an ounce. One of the periodic meetings of the G-10 governors was dedicated to the issue of the European members' desire to pare their gold holdings. But they were aware that in competing with each other to sell, they could drive the price of gold down still further. They all agreed to an allocation arrangement of who would sell how much and when. Washington abstained. The arrangement was renewed in 2014. In a statement accompanying the announcement, the European Central Bank simply stated, "Gold remains an important element of global monetary reserves." Beijing, meanwhile, clearly has no ideological aversion to keeping gold. From 1980 to the end of 2002, Chinese authorities held on to nearly 13 million ounces. They boosted their holdings to 19 million ounces in December 2002, and to 34 million ounces in April 2009. At the end of 2013, China was the world's fifth-largest sovereign holder of gold, behind only the United States (261 million ounces), Germany (109 million ounces), Italy (79 million ounces), and France (78 million ounces). The IMF had 90 million ounces. However much gold China accumulates, though, a larger issue remains unresolved: whether free, unregulated capital markets can coexist with an authoritarian state. China has progressed a long way from the early initiatives of Chinese leader Deng Xiaoping. It is approaching the unthinkable goal of matching the United States in total GDP, even if only in terms of purchasing-power parity. But going forward, the large gains of recent years are going to become ever more difficult to sustain. It thus seems unlikely that, in the years immediately ahead, China is going to be successful in vaulting over the United States technologically, more for political than economic reasons. A culture that is politically highly conformist leaves little room for unorthodox thinking. By definition, innovation requires stepping outside the bounds of conventional wisdom, which is always difficult in a society that inhibits freedom of speech and action. To date, Beijing has been able to maintain a viable and largely politically stable society mainly because the political restraints of a one-party state have been offset by the degree to which the state is seen to provide economic growth and material wellbeing. But in the years ahead, that is less likely to be the case, as China's growth rates slow and its competitive advantage narrows. | ||||||||||||||||||||||||||||

| Why These 2 Junior Miners Tripled in 2014 Despite TSX Venture Decline Posted: 30 Sep 2014 05:51 PM PDT After a great start in 2014, the TSX Venture which is the index largely comprised of junior miners has headed into negative territory in 2014 down 2% in 2014. Don’t be surprised to see the US multinational corporations face headwinds from dollar strength. Already the Homebuilder ETF (XHB) is already rolling over and breaking below the 200 day moving average as US real estate becomes more expensive for overseas investors. The financials could be the next one to correct. The rising dollar is putting pressure on commodities priced in dollars. Gold and silver is struggling in new low territory. However, some US focused mining assets critical for domestic manufacturing and industry could actually be an area of strength. Despite the major dollar rally and selloff in commodity related mining stocks, two of our featured companies have done exceptionally well this year up 308% and 231% in 2014. 1)Niocorp (NB.V or NIOBF) is up 308% on the year as they advance the highest grade undeveloped niobium mine in North America. Niobium is critical to make steel lighter and stronger. They just announced a metallurgical update which demonstrated a 98& recovery of the niobium at the bench scale along with the critical metallurgical flowsheet. A flowsheet is a prerequisite for the pilot plant that will need to be built in order to publish a bankable feasibility study. "The metallurgical program has advanced quickly since April, and has delivered high metallurgical recoveries across the process steps that have been tested to date" stated Mark A. Smith, CEO of NioCorp. "We look forward to moving quickly through the balance of the metallurgical test program as we continue to de-risk the project through increased technical knowledge of this world-class deposit." Niocorp is forming a consolidation since May and may breakout of a symmetrical triangle at $.80. They are currently raising $16.5 million in which senior management is putting in $2.5 million. I expect that the closing of this financing could be a major catalyst to take Niocorp to a $1.15 target.

2)Western Lithium (WLC.TO or WLCDF) is up 231% on the year on the major advancement of Tesla and Panasonic to develop a major $5 billion battery manufacturing center near Western Lithium’s Kings Valley Lithium Deposit in northern Nevada. Western Lithium is advancing its lithium deposit at the same time the company may be able to generate near term cash flow by selling organoclays from the property that is needed in fracking. Today, Western Lithium announced a distribution agreement to sell the products in five US states, Texas, Oklahoma, Arkansas, Louisiana and New Mexico. This is a major advancement for Western Lithium to find a well known distributor to sell the product to drillers. Production is imminent and could startup as early as November. ___________________________________________________________________________ Sign up for my free newsletter by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… Accredited investors looking for relevant news click here… To send feedback or to contact me click here… Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin.

| ||||||||||||||||||||||||||||

| Does Surging Demand For Gold & Silver Coins Signal A Bottom? Posted: 30 Sep 2014 05:21 PM PDT Submitted by John Rubino via DollarCollapse blog, Reports of individuals snapping up near-record numbers of gold and silver coins are coming in from around the world:

Individual buyers aren’t the dominant players in precious metals but they do make a difference. And their renewed enthusiasm is matched by some recent national trends:

There’s no guarantee that this buying, encouraging as it seems, is anything more than a blip. But in the aggregate it does seem like a lot of buyers, old and new, are finding current prices to be attractive. That’s how bottoms form and new bull markets begin. | ||||||||||||||||||||||||||||

| Posted: 30 Sep 2014 04:46 PM PDT New investigations by the Small Business Administration (SBA) Office of Inspector General have found SBA Administrator Maria Contreras-Sweet's announcement that small businesses received 23.39% of all federal contracts was greatly exaggerated. As WaPo reports, Federal agencies overstated their success last year in contracting with small businesses that face socio-economic disadvantages finding $400 million worth of contracts that agencies gave to ineligible firms but still counted toward their targets. Rather stunningly, the report found of the top 100 recipients of the highest dollar amount of federal small business contracts, over 75% were actually current large businesses. Trust...

As The Washington Post reports,

* * * | ||||||||||||||||||||||||||||

| The Central Bank Experiment that’s Destroying the Economy Posted: 30 Sep 2014 03:03 PM PDT Addison Wiggin: When Janet Yellen gave her first news conference as Federal Reserve chair in March, the media pounced on her for "stumbling"; she was asked how soon they'd start raising the fed funds rate once quantitative easing was over and she said "about six months." The market freaked out for an hour or so. But what else could she say? Imagine if she'd been honest and said, "It all depends on the economic data and whether they meet certain thresholds. And those thresholds might change another six or 12 months down the line, depending on other variables, but I can't tell you what those variables might be. And the data we find relevant now we might also change in another six or 12 months." There'd be full-out panic because everyone would realize, "These people have no idea what they're doing." "We don't know what we're doing. This is a massive experiment. We've never done this before." Jim Rickards: Well, Addison, don't ever think for a minute that the central bankers know what they're doing. They don't. And that's my own view, but I've heard that recently from a couple central bankers. I recently spent some time with one member of the FOMC, the Federal Open Market Committee, and another member of the Monetary Policy Committee of the Bank of England, which is the equivalent of their FOMC, both policymakers, both central bankers. And they said the same thing, "We don't know what we're doing. This is a massive experiment. We've never done this before. We try something. If it works, maybe we do a little more; if it doesn't work, we pull it away, and we'll try something else." And the evidence for this is the Fed has had 15 separate policies in the last five years. If you add it all up, all the forward guidance, all the dates, all the targets, the currency wars, Operation Twist, all the flavors of QE, 15 separate policies in five years, that tells you they don't know what they're doing. They're making it up as they go along. Now, beyond that, if you look at Fed models and look at what Fed monetary economists do, they use equilibrium models. There's only one problem with equilibrium models: They bear no relationship to reality. You can't apply an equilibrium model to a complex system. They behave completely differently. If I say, "I'm holding a pen in my hand. I'm gonna release it, and I want you to forecast what's gonna happen to the pen," you'll think about it and say, "Well, that pen's gonna hit the floor." And I let go, and sure enough, it hits the floor. How do you know that? You have a model. You know the pen has weight. You understand gravity. Everything about your model, which is the correct one, says the pen's going to hit the floor. Well, the Fed has a model that says the pen's going to float to the ceiling. If you have the wrong model, you're going to get the wrong result every time. Addison: You circulate fairly comfortably among what the late C. Wright Mills called the power elite. On the day we're doing this interview, you just came from delivering a talk at the World Bank. Do you get the sense that the decision makers you speak with grasp how dire the situation is? Rickards: No. Let me put it this way: They understand the global rebalancing I describe in my book, The Death of Money, the need for China to get gold. They understand that. And that's kind of old-school central banking. That's fairly straightforward. They get that, and they're accommodating that. But what they don't get is complexity theory. What they do not get are the critical-state dynamics going on behind the scenes because they're using these equilibrium models. An equilibrium model basically says the world runs like a clock, and every now and then, there's some perturbation and it gets knocked out of equilibrium, and all you do is you apply policy and push it back into equilibrium. So it's like winding up the clock again, and it's all good. But that is not the way the world works. In complexity theory and complex dynamics, you can go into the critical state. Let's say I've got a 35-pound block of enriched uranium sitting in front of me that's shaped like a big cube. That's a complex system. There's a lot going on behind the scenes. At the subatomic level, neutrons are firing off, a lot going on. But it's not dangerous. You'd actually have to eat it to get sick. But now, I take the same 35 pounds, I shape part of it into sort of a grapefruit, I take the rest of it and shape it into a bat. I put it in the tube, and I fire it together with high explosives, I kill 300,000 people. I just engineered an atomic bomb. It's the same uranium. The point is the same basic conditions arrayed in a different way, what physicists call self-organized criticality, can go critical, blow up and destroy the world or destroy the financial system. That dynamic, which is the way the world works, is not understood by central bankers. And it's not just central bankers themselves. I've talked to monetary economists. I've talked to staff people. They look at me. They can't even process what I'm saying. They're like, "What are you talking about?" But the evidence is very, very good in terms of the way I do the analysis. So do they understand the gold rebalancing and the need to appease China? Yes, they do. But do they understand complexity theory and the danger they're creating? No, they don't. Addison: There's a theory in the blogosphere that goes like this: Since 2008, the Fed has been paying interest on "excess reserves" that banks keep parked at the Fed. At some point, the Fed will stop paying interest on those reserves, the banks will have no choice but to lend this money to businesses and consumers and suddenly there's a $2.7 trillion flood of currency inundating the economy — we're on the verge of hyperinflation. What's right or wrong about that scenario? Rickards: First of all, the reason the Fed is paying that interest is to give the banks money to pay higher insurance premiums to the FDIC. Remember, the Dodd-Frank Act raised the premiums the banks have to pay for deposit insurance. That would have hurt bank earnings. So the Fed said, "Fine, we'll just pay you on the excess reserves, take the money and pay your premiums."

So this is just another game. This is basically a backdoor way of financing the FDIC premiums with printed money so the banks don't actually have to bear the cost. Beyond that, this notion that if they stop paying the interest, all of a sudden, the banks will say, "Well, we've got to make some money, we'll go out and lend all this money," I don't agree with that at all. Here's the real problem: To have inflation, you need two things. You need money supply, but you also need velocity. Velocity's the turnover of money. So if I go out tonight and I buy a drink at the bar, and I tip the bartender, and the bartender takes a taxicab home, and the taxicab driver puts some gas in his car, that money has a velocity of 3. You've got the bartender, the taxicab and the gas station. But if I stay home and watch TV, that money has a velocity of zero. You need both money supply and velocity to cause inflation. The Fed has taken the money supply to the moon, but the velocity's collapsing. That's the problem. So what would cause inflation is not more money printing, or payment of interest on excess reserves. What would cause inflation now is the change in velocity, which is behavioral. It's the change in the psychology. That's what you have to look for, what the Fed calls inflationary expectations. I like to say that if you want inflation, it's like a ham-and-cheese sandwich. You need the ham and the cheese. Money printing is the ham and velocity is the cheese, and you need both to get the inflation. So the thing to watch for is a change in inflationary expectations, a change in behavior. And that can happen very quickly, and that's why inflation is so dangerous. It might not show up at all, and then, suddenly, it will come very quickly because it's very, very difficult to change the behavior. But once you do, it's very difficult to change it back again. And that's why inflation runs out of control. Addison: Great. Thanks, Jim. Regards, Addison Wiggin P.S. Subscribers to The Daily Reckoning email edition received a special announcement today with Jim's "Prophesy 2015 Revealed" — a special report that provides you with unique access to ongoing insights and analysis from Jim Rickards. And that’s not even half of what went on in the rest of today’s issue. For complete access to the full conversation and all the analysis we publish, you can sign up for The Daily Reckoning for FREE, right here. | ||||||||||||||||||||||||||||

| CURRENCY WAR! China Begins Trading with Euro! Posted: 30 Sep 2014 02:43 PM PDT Currency wars are always escalating particularly with China and the U.S. You can see this continuing with China now doing trade with the Euro, making big changes for the global economy. China is expanding its empire quite quickly now and this means a worrisome future for the U.S. and its Dollar. A... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||

| Mike Kosares: Why China thinks gold is the buy of the century Posted: 30 Sep 2014 02:20 PM PDT 5:17p ET Tuesday, September 30, 2014 Dear Friend of GATA and Gold: China's foreign-exchange surplus is so much larger than the nominal value of all the official gold in the world that a mightly upward revaluation of the monetary metal is inevitable, Mike Kosares of Centennial Precious Metals in Denver writes today. "China," Kosares writes, "through its staunch advocacy of gold, might already be in the process of forcing the issue." Kosares' commentary is headlined "Why China Thinks Gold Is the Buy of the Century" and it's posted at Centennial's Internet site, USAGold, here: http://www.usagold.com/publications/Oct2014R&O.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - End of September, Hello Non-Farm Payrolls Posted: 30 Sep 2014 01:14 PM PDT | ||||||||||||||||||||||||||||

| A Historic Bottom Being Made In Gold & Silver & $10,000 Gold Posted: 30 Sep 2014 12:14 PM PDT  Today an acclaimed money manager spoke with King World News about China and a historic bottom being made in the gold and silver markets. Stephen Leeb also spoke about the catalysts which are going to trigger the massive surge above the $10,000 level in gold. Today an acclaimed money manager spoke with King World News about China and a historic bottom being made in the gold and silver markets. Stephen Leeb also spoke about the catalysts which are going to trigger the massive surge above the $10,000 level in gold.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||

| BIS is main mechanism for manipulating the gold market, Rickards says Posted: 30 Sep 2014 11:20 AM PDT 2:15p ET Tuesday, September 30, 2014 Dear Friend of GATA and Gold: Interviewed by the Turkish financial journalist Erkan Oz at the Forex World conference in Istanbul last week, fund manager and author James G. Rickards remarked that central banks use the Bank for International Settlements for manipulating the gold market. As quoted by Oz, Rickards said the BIS is "the primary intermedia for manipulating the gold market. That is not a mystery. ... This BIS is manipulating the gold market. They are the intermedia between the central banks and commercial banks and other central banks. They have been doing that." The interview is posted at Oz's Internet site, Financial Flood, here: http://financialflood.blogspot.com.tr/2014/09/exclusive-interview-with-j... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Anglo Far-East is a global market leader and innovator that for more than two decades has provided private purchase, vaulting, security logistics, transport, and liquidation of allocated gold and silver bullion outside of the banking system. AFE clients include individuals, family offices, and institutions like banks and regulated funds. Anglo Far-East: Think Outside the Bank Here's what one of our generationally wealthy clients has to say about AFE: http://www.afeallocatedcustody.com/research/teleconferences/download-inf... To get started, please visit: https://secure.anglofareast.com/ Anglo Far-East: Think Outside the Bank Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||

| Koos Jansen: China aims to exceed U.S. in gold reserves Posted: 30 Sep 2014 10:37 AM PDT 1:37p ET Tuesday, September 30, 2014 Dear Friend of GATA and Gold: The president of the China Gold Association, gold researcher and GATA consultant Koos Jansen discloses today, argues that China should accumulate gold reserves greater than those of the United States because gold is a strategic asset, money without counterparty risk. The association's president, Song Xin, adds that a "gold bank" should be established by China "to break the barrier between the commodity and monetary world. It can further help us acquire reserves and give us more say and control in the gold market." Jansen's report is headlined "China Aims for Official Gold Reserves at 8,500 Tonnes" and it's posted at Bullion Star here: https://www.bullionstar.com/article/china%20aims%20for%20official%20gold... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||

| James Rickards : Warren Buffett and China are Dumping the Dollar…Why You Should Too Posted: 30 Sep 2014 10:32 AM PDT Warren Buffett and China are Dumping the Dollar…Why You Should Too Two of the major players in the investment world are getting out of the US dollar -- and into gold. In today's Daily Reckoning exclusive, Jim Rickards explains why getting out of paper money and into hard assets could be... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||

| Ned Naylor-Leyland: Journalist can and should publish his report on silver rigging Posted: 30 Sep 2014 10:23 AM PDT By Ned Naylor-Leyland Last week I wrote about financial journalist William Cohan's unpublished article about silver market manipulation and a regulatory cover-up. This week Cohan has claimed that lawyers for London metals trader and market-rigging whistleblower Andrew Maguire were stopping him from publishing his article. Cohan is demanding that the main perpetrator of metals manipulation (the institution also known as Voldemort) be named specifically in the article. Without this, Cohan says, he won't publish. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Contrary to his claim, this was never agreed by Maguire's lawyers and for legal reasons cannot happen. But since everyone has a pretty good idea who the institution is anyway, I find it ridiculous that Cohan is making a demand that cannot be met and using that as a reason to remain mute. Contrary to what he appears to be saying, this detail wasn't agreed in the version of the article he wanted to put in newspapers. Cohan appears to want this all to go away, which it won't. I repeat: Cohan told me that his article "got killed everywhere I took it" and that it is "an amazing story that really should be out there." These statements and that he did see the evidence and did write a long expose of the subject are unavoidable. Cohan's thoughts on the matter, in light of his reputation, would be worthwhile indeed and metals investors deserve to have this subject cleared up. If, as well may be the case, silver and gold prices are being managed with not just impunity but also with the collusion of the government, then this truly is a monster of a story with far-reaching implications. Maguire has been relentless in pursuit of the prosecution of criminal behavior in the metals markets, so any suggestion that he is getting in the way of Cohan's publishing his article is really absurd. Such a complaint deflects the blame, as of course Cohan said and thought he could get the article published in the mainstream financial news media and then discovered otherwise. Who other than Maguire approached the government regulators with folders full of evidence, risked life and limb to do this, and will not let go of the subject despite a monstrous cover-up admitted by a former member of the U.S. Commodity Futures Trading Commission, Bart Chilton? The article Cohan wrote can and should be published. He already has mentioned one of the things he was told not to publish -- that other enforcement agencies have been involved -- and the other detail he is insisting on cannot be included. Enough of the obfuscation, please, Mr. Cohan. Let's see your article, on your own Internet site if you can't publish it elsewhere. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/nodBy Frank Tang NEW YORK -- The London Bullion Market Association (LBMA) said on Thursday it appointed Citigroup as a market maker, underscoring the bank's ambitions to expand into the precious metals sector while others are exiting due to regulatory concerns. LBMA said it named Citibank, a unit of Citigroup, as a spot market-making member effective Thursday. Currently, LBMA has 12 market makers that serve in either one, two, or all three of the spot, forwards, and options markets. They make markets by quoting two-way prices in both gold and silver products to other market makers. ... ... For the remainder of the report: http://www.reuters.com/article/2014/09/25/lbma-citigroup-idUSL2N0RQ2A820... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Canadian Investor Conference http://cambridgehouse.com/event/31/canadian-investor-conference-toronto-... New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16e/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||

| Posted: 30 Sep 2014 10:02 AM PDT Graceland Update | ||||||||||||||||||||||||||||

| Greenspan: Gold is the ultimate money and China well might want more Posted: 30 Sep 2014 09:59 AM PDT Golden Rule: Why Beijing Is Buying By Alan Greenspan http://www.foreignaffairs.com/articles/142114/alan-greenspan/golden-rule If China were to convert a relatively modest part of its $4 trillion foreign exchange reserves into gold, the country's currency could take on unexpected strength in today's international financial system. It would be a gamble, of course, for China to use part of its reserves to buy enough gold bullion to displace the United States from its position as the world's largest holder of monetary gold. (As of spring 2014, U.S. holdings amounted to $328 billion.) But the penalty for being wrong, in terms of lost interest and the cost of storage, would be modest. For the rest of the world, gold prices would certainly rise, but only during the period of accumulation. They would likely fall back once China reached its goal. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata The broader issue -- a return to the gold standard in any form -- is nowhere on anybody's horizon. It has few supporters in today's virtually universal embrace of fiat currencies and floating exchange rates. Yet gold has special properties that no other currency, with the possible exception of silver, can claim. For more than two millennia, gold has had virtually unquestioned acceptance as payment. It has never required the credit guarantee of a third party. No questions are raised when gold or direct claims to gold are offered in payment of an obligation; it was the only form of payment, for example, that exporters to Germany would accept as World War II was drawing to a close. Today the acceptance of fiat money -- currency not backed by an asset of intrinsic value -- rests on the credit guarantee of sovereign nations endowed with effective taxing power, a guarantee that in crisis conditions has not always matched the universal acceptability of gold. If the dollar or any other fiat currency were universally acceptable at all times, central banks would see no need to hold any gold. The fact that they do indicates that such currencies are not a universal substitute. Of the 30 advanced countries that report to the International Monetary Fund, only four hold no gold as part of their reserve balances. Indeed, at market prices, the gold held by the central banks of developed economies was worth $762 billion as of December 31, 2013, comprising 10.3 percent of their overall reserve balances. (The IMF held an additional $117 billion.) If, in the words of the British economist John Maynard Keynes, gold were a "barbarous relic," central banks around the world would not have so much of an asset whose rate of return, including storage costs, is negative. There have been several cases where policymakers have contemplated selling off gold bullion. In 1976, for example, I participated, as chair of the Council of Economic Advisers, in a conversation in which then U.S. Treasury Secretary William Simon and then Federal Reserve Board Chair Arthur Burns met with President Gerald Ford to discuss Simon's recommendation that the United States sell its 275 million ounces of gold and invest the proceeds in interest-earning assets. Whereas Simon, following the economist Milton Friedman's view at that time, argued that gold no longer served any useful monetary purpose, Burns argued that gold was the ultimate crisis backstop to the dollar. The two advocates were unable to find common ground. In the end, Ford chose to do nothing. And to this day, the U.S. gold hoard has changed little, amounting to 261 million ounces. I confronted the issue again as Fed chair in the 1990s, following a decline in the price of gold to under $300 an ounce. One of the periodic meetings of the G-10 governors was dedicated to the issue of the European members' desire to pare their gold holdings. But they were aware that in competing with each other to sell, they could drive the price of gold down still further. They all agreed to an allocation arrangement of who would sell how much and when. Washington abstained. The arrangement was renewed in 2014. In a statement accompanying the announcement, the European Central Bank simply stated, "Gold remains an important element of global monetary reserves." Beijing, meanwhile, clearly has no ideological aversion to keeping gold. From 1980 to the end of 2002, Chinese authorities held on to nearly 13 million ounces. They boosted their holdings to 19 million ounces in December 2002, and to 34 million ounces in April 2009. At the end of 2013, China was the world's fifth-largest sovereign holder of gold, behind only the United States (261 million ounces), Germany (109 million ounces), Italy (79 million ounces), and France (78 million ounces). The IMF had 90 million ounces. However much gold China accumulates, though, a larger issue remains unresolved: whether free, unregulated capital markets can coexist with an authoritarian state. China has progressed a long way from the early initiatives of Chinese leader Deng Xiaoping. It is approaching the unthinkable goal of matching the United States in total GDP, even if only in terms of purchasing-power parity. But going forward, the large gains of recent years are going to become ever more difficult to sustain. It thus seems unlikely that, in the years immediately ahead, China is going to be successful in vaulting over the United States technologically, more for political than economic reasons. A culture that is politically highly conformist leaves little room for unorthodox thinking. By definition, innovation requires stepping outside the bounds of conventional wisdom, which is always difficult in a society that inhibits freedom of speech and action. To date, Beijing has been able to maintain a viable and largely politically stable society mainly because the political restraints of a one-party state have been offset by the degree to which the state is seen to provide economic growth and material wellbeing. But in the years ahead, that is less likely to be the case, as China's growth rates slow and its competitive advantage narrows. ----- Alan Greenspan was chairman of the Board of Governors of the Federal Reserve System from 1987 to 2006. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||

| Posted: 30 Sep 2014 08:25 AM PDT It seems nothing can stop the US Dollar. Since its low in April it has closed higher in four out of five months and is up almost 8.00% since then. While a run like that is in need of a rest there are some big issues that need to be considered now. DXY broke out of a six-year triangle this month. Breaking to the upside from a triangle is bullish. That triangle is essentially a six-year base and should give DXY some serious "legs" for the future. | ||||||||||||||||||||||||||||

| SP500 and GOLD Intraday Elliott Wave Analysis Posted: 30 Sep 2014 08:23 AM PDT US cash market will open in around 30mins when we may see a continuation to the upside following a reversal yesterday from 1955 seen on the S&P500. Based on the wave count we assume that price is now recovering in wave 2)/B) that could look for a resistance around 1990 later this week. | ||||||||||||||||||||||||||||

| Rule - Despite Weakness, Gold & Silver Close To A Major Turn Posted: 30 Sep 2014 08:00 AM PDT  Today one of the wealthiest people in the financial world told King World News that despite the recent and sometimes intensifying weakness, the gold and silver markets are now very close to a major turning point in this cycle. Rick Rule, who is business partners with Eric Sprott, also discussed why he is so bullish going forward. Today one of the wealthiest people in the financial world told King World News that despite the recent and sometimes intensifying weakness, the gold and silver markets are now very close to a major turning point in this cycle. Rick Rule, who is business partners with Eric Sprott, also discussed why he is so bullish going forward.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||

| Alex Jones Warns of The Next 9/11 Posted: 30 Sep 2014 07:56 AM PDT The truth is out there for who wants to listen, So many conspiracies turned out to be true and in a few years this will be the thing. And many other things to. The evidence is just to much, The fact that the architect of the twin towers said it was blown up and didn't just collapse, you can see... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||

| Posted: 30 Sep 2014 06:13 AM PDT GOLD PRICES fell hard against the Dollar mid-morning Tuesday in London, sinking to fresh 2014 lows as the US currency rose again. The Dollar extended its rise vs. the Euro to new two-year highs after last month's Eurozone inflation was reported at just 0.3% annually across the 18-nation currency union. Recording their lowest London Fix since New Year's Eve at $1210 per ounce, Dollar gold prices stood 6.3% down for September – the sharpest 1-month drop since June 2013's fall of 14%. Silver prices followed gold lower in Dollar, hitting their lowest London midday price (formerly known as the Silver Fix) since 26 March 2010 at $17.11 per ounce for a 1-month drop of 12.1%. "Until such time as the 'Gold Bugs' finally give up and exit their trades, the next bull market in gold will not begin," says Dennis Gartman, editor of eponymous tip-sheet the Gartman Letter. "The market wants to take out the true-believers before gold goes higher. It shall be either boredom or despair that shall take the 'Bugs' out. We hope for the former; we fear the latter." The surging Dollar today left gold prices for UK investors at only 3-session lows above £745 per ounce in London trade. Euro gold prices were little changed on the day, less than 5% below the last 12 months' high. Looking at Dollar gold prices, Bloomberg quotes Chinese brokerage Citics Futures' analyst Zhu Runyu, "The divergence in monetary policies between the Fed and other central banks will further push up the Dollar and weigh on gold. "As geopolitical tensions fade, gold has also lost a key price support this year." Over in Asia – where Shanghai gold trading was the quietest in three weeks as the Golden Week holidays began – the Hang Seng equity index fell hard for the fifth day running on Tuesday as Hong Kong's pro-democracy protests continued. The Hang Seng closed September almost 10% below the 6-year high hit at the start of this month. Even with riot police pulling back and the protests remained peaceful overnight, Chow Tai Fook – the world's largest jewelry retail chain – said today it's keeping some 20 stores in the city closed. Global equities meantime showed their worst quarter since the Euro debt crisis peaked in late 2012, and crude oil meantime neared its worst 1-month drop since 2012 on what some analysts called "a glut of supply". The fall in Europe's Brent contracts, reckons Commerzbank's commodities team, was "largely speculatively driven". | ||||||||||||||||||||||||||||

| Singapore Becoming Global Gold Hub - Launches Kilo Bar Contract And Gold ATMs Posted: 30 Sep 2014 05:12 AM PDT Singapore continues its push to be a global gold hub. The new exchange traded Singapore kilobar gold contract will launch in less than two weeks - on October 13. The new contract is a 1 kilogramme physically deliverable gold contract for the Asian and global wholesale gold market. In a joint statement, International Enterprise (IE) Singapore, Singapore Bullion Market Association (SBMA), Singapore Exchange (SGX) and the World Gold Council, announced the new contract yesterday. | ||||||||||||||||||||||||||||

| Turn the Tables on the Gold and Silver Market Manipulators Posted: 30 Sep 2014 05:00 AM PDT Peter Krauth writes: In theory, we have free markets, where manipulation is illegal and punishable. We've found that's not often the case in the financial markets. Unfortunately, this web of "disruptive practices" and "market rigging" is not likely to change any time soon. | ||||||||||||||||||||||||||||