saveyourassetsfirst3 |

- Harvey Organ Updates His Readers- Will Continue Posting on SilverDoctors

- Koreans Are Getting in on the Trend — Renminbi Deposits in Korea Surge 55-Fold!

- Alasdair Macleod: A Market Reset Is Due

- Gold 1240 Looms Large

- Not Just The Largest Economy – Here Are 26 Other Ways China Has Surpassed America

- Gold mining could help spread Ebola

- These four dumb mistakes cost one man his life savings. Don't let it happen to you.

- First Majestic Silver Corp reports 5% growth in production in Q3

- Video of the Day – NYPD Officer Steals Brooklyn Man’s Money Then Pepper Sprays Him

- Gold recovers on pullback in US dollar, Silver volatility predicts turning point: ETFS

- Here's one big reason the Bernanke Asset Bubble could go on longer than anyone expects

- Tuesday Tumult

- Jim Willie: The Economic ENDGAME Has Arrived

- This chart says gold stocks could be repeating an "explosive" pattern

- Gold Prices Rally Strongly amid Falling Equities

- Gold rally extends to the 1240 first resistance area

- Ted Butler’s Silver Price Outlook – Why This Time Could Be Different

- Swiss Gold Referendum 'propaganda war' begins

- Zeal: US Dollar Super-Overbought

- Indian gold smugglers get creative

- Metals market update for October 14

- Teetering gold price dents jewelry demand in India

- World's top 10 silver producers updated – companies & countries

- Gold ETFs see inflows for the first time in weeks

- Swiss Gold Referendum “Propaganda War” Begins

- Swiss Gold Referendum “Propaganda War” Begins

- AdvisorShares: Bullish on gold priced in euro – gold priced in dollars, not so much

- 1000-year old Viking treasure hoard found in Scotland

- Five Reasons Why The Market Vectors Gold Mining ETF(NYSEARCA:GDX) Could Be The Next Monster Trade

- Silver Signals Bullish Continuation in the Short-term

- Gold Climbs As USD Dips, Crude Oil Resumes Descent On Supply Swell

- CHARTS : The 64-Month Pattern in Stocks and Gold

- Powerful Reversal And Shakeout In The Junior Gold Miners At May Lows Around $33

- Powerful Reversal and Shakeout in the Junior Gold Miners at May Lows

- This Is What Happens When Someone Is Desperate To Sell $750 Million Of Stocks

- Record bust in Cambodia signals Thai dollar counterfeiting boom

- Faber's likely last time on BNN: Gold and silver markets are manipulated

- Russia gold production: Too much of a good thing?

- Gold sparkles ahead of Diwali

- Indian gold import curbs to stay, advises former Finance Minister

- Asian Market Hubs Move Into Gold

- China sees rapid growth in gold leasing

- China now takes nearly all world gold production, Shanghai exchange chief confirms

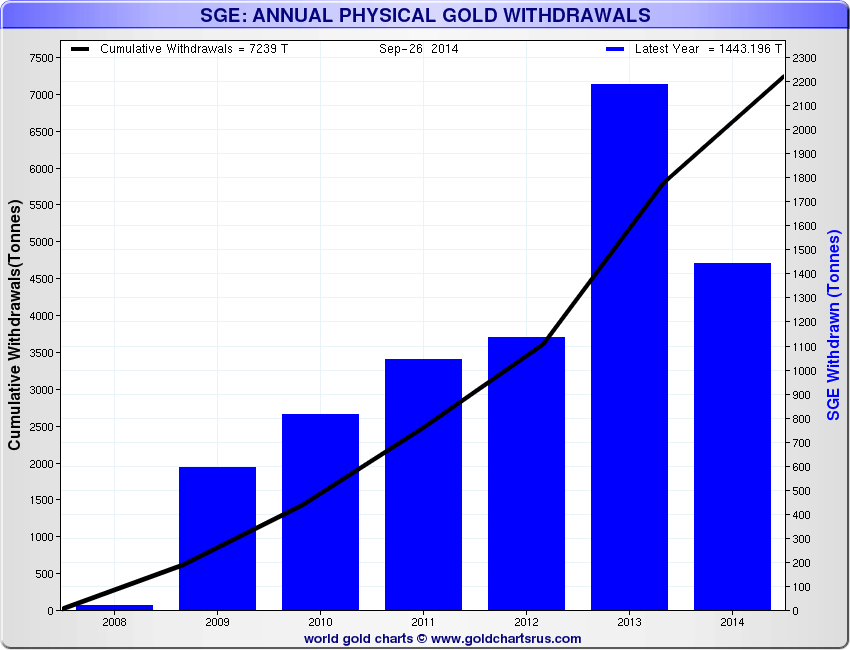

- China Now Takes Nearly All World Gold Production, Shanghai Exchange Chief Confirms

- Four week high for gold as its safe haven status boosts demand

- Sudden fall in US dollar has Dennis Gartman worried as stocks dive again and gold jumps

- What’s happening as US stocks slump again along with oil and gold rises?

- 12 Charts That Show The Permanent Damage That Has Been Done To The U.S. Economy

- Peak Gold, easier to model than Peak Oil ? Part II

- Harvey Organ Updates His Readers

| Harvey Organ Updates His Readers- Will Continue Posting on SilverDoctors Posted: 14 Oct 2014 12:05 PM PDT As many of you know, my website was pulled Friday afternoon and I could not post. Here is a copy of the email that I received: Submitted by Harvey Organ: support@blogger.com Oct 10 (3 days ago) to me, blogger-dmca-n. Hello,We’d like to inform you that we’ve received a court order regarding your blog http://harveyorgan.blogspot.com/. In accordance with […] The post Harvey Organ Updates His Readers- Will Continue Posting on SilverDoctors appeared first on Silver Doctors. |

| Koreans Are Getting in on the Trend — Renminbi Deposits in Korea Surge 55-Fold! Posted: 14 Oct 2014 11:45 AM PDT The Bank of Korea — South Korea's central bank — released data that says South Korean domestic deposits have reached 16.19 billion Chinese renminbi in July this year, which is a 55-fold increase from the same period last year when renminbi deposits accounted for only 290 million. Sayonara to the dollar’s reserve currency status? Submitted by Simon […] The post Koreans Are Getting in on the Trend — Renminbi Deposits in Korea Surge 55-Fold! appeared first on Silver Doctors. |

| Alasdair Macleod: A Market Reset Is Due Posted: 14 Oct 2014 11:15 AM PDT Recent evidence points increasingly towards global economic contraction. Parts of the Eurozone are in great difficulty, and only last weekend S&P the rating agency warned that Greece will default on its debts “at some point in the next fifteen months”. Japan is collapsing under the wealth-destruction of Abenomics. China is juggling with a debt […] The post Alasdair Macleod: A Market Reset Is Due appeared first on Silver Doctors. |

| Posted: 14 Oct 2014 11:12 AM PDT |

| Not Just The Largest Economy – Here Are 26 Other Ways China Has Surpassed America Posted: 14 Oct 2014 10:30 AM PDT In terms of purchasing power, China now has the largest economy on the entire planet, but that is not the only area where China has surpassed the United States. China also accounts for more total global trade than the U.S. does, China consumes more energy than the U.S. does, and China now manufactures more goods […] The post Not Just The Largest Economy – Here Are 26 Other Ways China Has Surpassed America appeared first on Silver Doctors. |

| Gold mining could help spread Ebola Posted: 14 Oct 2014 10:27 AM PDT How Ebola could affect gold mining on the African continent? |

| These four dumb mistakes cost one man his life savings. Don't let it happen to you. Posted: 14 Oct 2014 10:11 AM PDT From Dan Ferris, editor, Extreme Value: Tubs of Fun is a simple carnival game. You throw a softball into a plastic tub from a few feet away. The object is to make the ball stay in the tub. It sounds easy, but it’s not. The ball is too bouncy, and the tub is too hard. It’s difficult to keep the ball from bouncing out of the tub. The player has the illusion he’s throwing a ball into a container. But he’s really just throwing it at a solid wall. To make it worse, the worker running the game lets you take a practice throw. First he drops a softball in the tub, and it stays, because he’s standing right next to the tub. Then you throw a softball, and the ball he dropped in absorbs the energy from the one you threw, and your ball stays, too. But when you play for real money, you can only throw the ball into an empty tub. If you’re not the sharpest tool in the shed, you won’t figure this trick out. But hey, it’s a carnival game. Everybody knows you’re not supposed to win. Right? Well, no. Not everybody… Enter 30-year-old Henry Gribbohm, a tough-looking, tattooed young man with a toddler to care for and $2,600 in cash burning holes in the pockets of his dusty work pants. On a spring day, Gribbohm walked into the Fiesta Shows traveling carnival in Epsom, New Hampshire. He walked out shortly after, his pockets empty, with a large stuffed banana toy with a smiley face and a dreadlocks haircut draped across the top of his toddler’s stroller. A news reporter said the funky banana toy was worth $149. Gribbohm watched the worker do his little practice throw routine and didn’t figure out the ruse. So Gribbohm played and played… He lost $300 within minutes, all he had in his pockets. He went home and fetched another $2,300, all that remained of his life savings. He returned to the game and lost all that, too. He admitted on camera, “You get caught up in the whole double-or-nothing-I’ve-got-to-win-my-money-back…” The thing is… many investors are walking in Gribbohm’s shoes… They’re making exactly the same mistakes… Gribbohm’s first mistake was ignorance of the game he was playing. Gribbohm was on a financial mission. He started playing Tubs of Fun to win a Microsoft Xbox Kinect video game device (valued at $100). When his first attempts were unsuccessful, he ran home, got more money, and kept at it. Gribbohm later filed charges against the game owner, alleging fraud. Yes, Henry Gribbohm thinks alleging a carnival game was fixed is a plausible defense for being clueless enough to give $2,600 away voluntarily. He kept plowing money into a carnival game… while being totally ignorant of the fact that carnival games are rigged. You might think Gribbohm is uniquely naive. But millions of investors are just as bad as he is. They have no idea that Wall Street is often about the same as a carnival. Wall Street is in the business of selling stocks and bonds. This business generates billions of dollars in fees. It’s a business that allows bankers to drive around in $300,000 cars… afford $10 million homes in the Hamptons… and collect absurd bonuses. That money comes from customers who are encouraged to buy every piece-of-crap security the bankers can come up with. Think about the brokers, lawyers, accountants, and other people you do business with. Always ask what they get out of it. Ask what has to happen for them to make money. When you buy stocks, ask who’s selling them, or who has sold you on the idea of buying them. Know the business you’re in, and know the businesses you deal with. Gribbohm’s second mistake was pursuing easy financial gain. Most people don’t understand that easy financial gain is one of the worst things that can happen to them. Ask a lottery winner. According to author Don McNay’s book, Life Lessons from the Lottery, the lives of lottery winners are usually a wreck within about five years of winning. Lottery winners get a ton of money they didn’t earn without any practice at hanging onto large sums of money. It’s really, really hard to do that. It’s like ordering a drink at your favorite watering hole and being dropped into a giant vat of beer. Technically speaking, you got what you asked for… just more. More is bad when you’re not prepared for it… when you didn’t do more to earn it. Aspiring to easy financial gain might be normal, but it’s also self-destructive. Gribbohm was trying to win a $100 prize by playing a $2 carnival game. His results speak for themselves. Investors make this same mistake as well. They buy risky options and hot tips from friends in the pursuit of fast, easy gains. They see the stock market as a lottery… rather than a place where one can buy pieces of world-class businesses that they can hold for decades. Gribbohm’s next big mistake was giving in to a bias toward action. Nobody likes to sit still. And that’s too bad. Famous 17th-century French mathematician and scientist Blaise Pascal said, “All men’s miseries derive from not being able to sit in a quiet room alone.” If you search for Gribbohm’s picture on Google, you’ll see that he’s a tough-looking guy. You can imagine him giving in to pressure to “act like a man.” Men don’t refrain from action. Men act. They take dramatic and constant action. When the going gets tough, the tough get – you get the picture. People think “doing something” is always the answer. Nobody thinks doing nothing is the answer. On the flip side, the actions that keep you from losing your ass at the carnival and in the market will certainly not impress other tough guys, nor attract women looking for tough guys. Taking big risks is more likely to make you feel like a swaggering gambler, someone who’s “not afraid to risk it all on a roll of the dice.” It’ll at least attract a fair amount of attention. Henry Gribbohm got plenty of attention! Fear is the dominant emotion in the market at all times. When it appears greed has taken over, it’s really just the fear of being left out. That fear drives people to constantly seek action. The final mistake Gribbohm made was not knowing how far he was going to go. Gribbohm’s story shows you how crazy financial decisions can get, especially when speculating on great financial gain. He lost because he couldn’t trust himself. He didn’t decide beforehand how he’d behave if presented with a game like Tubs of Fun. What will you do if the stock market falls? What are your goals? I can’t really answer any of those questions, but I can tell you what I’ll do. I’m a dedicated lifetime buyer of equities. I do what I believe is enough homework to know which stocks to buy and which ones to avoid. Other things being equal, when the market falls, I buy more of what I like, same as I do when chocolate-chip cookies go on sale at the grocery store. I want more cookies, so I like it when my money buys more of them. I like equity returns, too, so I really like it when my dollar buys bigger ones. Every stock investor faces a list of huge unknowns. You’re not in control of stock prices or interest rates or tomorrow’s headlines. You must make your own behavior in the stock market the most solid, reliable of known entities. You must be in control of yourself. At any point during his incredible losing streak, Gribbohm could have wised up and walked away… but he didn’t. Many investors are making the same mistakes he did. If you’re one of them, wise up and walk away. And before you come back, make sure you learn the game you’re playing.  Henry Gribbohm and his prize (Photo via Death and Taxes) |

| First Majestic Silver Corp reports 5% growth in production in Q3 Posted: 14 Oct 2014 10:09 AM PDT Total silver production for the quarter consisted of 2,680,439 ounces of silver, relatively unchanged compared to the same quarter in 2013. |

| Video of the Day – NYPD Officer Steals Brooklyn Man’s Money Then Pepper Sprays Him Posted: 14 Oct 2014 09:30 AM PDT The Brooklyn district attorney's office is investigating allegations that an NYPD cop swiped more than $1,000 from a man during a stop-and-frisk, then pepper-sprayed him and his sister when they complained. Submitted by Michael Krieger, Liberty Blitzkrieg: Earlier this week, I highlighted the growing practice of police stealing American citizens' hard earned cash with reckless […] The post Video of the Day – NYPD Officer Steals Brooklyn Man's Money Then Pepper Sprays Him appeared first on Silver Doctors. |

| Gold recovers on pullback in US dollar, Silver volatility predicts turning point: ETFS Posted: 14 Oct 2014 09:19 AM PDT Weak data from Germany underscores the fragile state of the Euroarea, bolstering the case for further easing from the European Central Bank, which may strengthen demand for gold as a monetary metal. |

| Here's one big reason the Bernanke Asset Bubble could go on longer than anyone expects Posted: 14 Oct 2014 09:09 AM PDT From Bloomberg: When it comes to spurring inflation in the U.S. economy, the bond market is becoming convinced that the Federal Reserve has almost no chance of achieving its 2 percent target before the end of the decade. Inflation expectations have plummeted in the past three months, with yields of Treasuries (BUSY) implying consumer prices will rise an average 1.5 percent annually through the third quarter of 2019. In the past decade, those predictions have come within 0.1 percentage point of the actual rate of price increases in the following five years, data compiled by Bloomberg show. Even after the Fed inundated the economy with more than $3.5 trillion since 2008, bond traders are showing little fear of inflation. That may help influence U.S. monetary policy and make it harder for Fed officials to raise interest rates from close to zero as global growth weakens and the International Monetary Fund points to disinflation as a more imminent concern. “The longer inflation rates stay below their targets, the longer the Fed’s going to stay on hold,” Gregory Whiteley, a money manager at Los Angeles-based DoubleLine Capital LP, which oversees $56 billion, said by telephone yesterday. “The burden of proof is more on the hawks and the people arguing for a rise in rates. They’re the people who have to make the case.” As the Fed winds down the most-aggressive stimulus measures in its 100-year history, the debate has intensified over how soon the central bank needs to raise rates and whether the shift will herald the long-awaited bear market in bonds. Predictive Power While Dallas Fed President Richard Fisher and Philadelphia Fed’s Charles Plosser dissented at the bank’s last meeting and have both warned that keeping rates too low for too long may trigger excessive inflation, the bond market’s predictive power helps to explain why U.S. government debt remains in demand. Instead of falling, as just about every Wall Street prognosticator predicted at the start of the year, Treasuries have returned 5.1 percent in 2014. The gains have outstripped U.S. stocks, gold and commodities this year. Yields on the 10-year note, the benchmark for trillions of dollars of debt, have plummeted 0.83 percentage point this year to 2.20 percent at 9:07 a.m. in New York. The 30-year bond yield fell below 3 percent for the first time since May 2013. The rally has accelerated this month as a string of developments from lackluster wage growth to potential deflation in Europe cast doubt on the notion that price pressures will prompt the Fed to raise rates sooner rather than later. ‘Fundamental Worry’ After the annual inflation rate rose to a two-year high of 2.1 percent in May, consumer-price increases have since slowed for three straight months to 1.7 percent in August. “There’s a fundamental worry that inflation won’t be forthcoming,” Wan-Chong Kung, a money manager at Nuveen Asset Management, which oversees $225 billion, said by telephone from Minneapolis on Oct. 8. Kung said she sold her holdings of five-year Treasury Inflation-Protected Securities, or TIPS, which unlike fixed-rate bonds increase in value to compensate for rising living costs. One of the biggest reasons inflation remains muted is because consistent wage increases that spur consumer spending and demand have yet to materialize. Hourly earnings for U.S. workers, whose spending accounts for 70 percent of the economy, were unchanged last month. They have been flat or increased just 0.1 percent in four of the past seven months. Weakening global growth has also emerged as a threat. Last week, the Washington-based IMF lowered its growth outlook for next year to 3.8 percent from a July forecast of 4 percent and pointed to the increasing risk of falling prices in Europe. Global Drag Fed Vice Chairman Stanley Fischer said on Oct. 11 at the IMF’s annual meetings that if overseas growth is weaker than anticipated, “the consequences for the U.S. economy could lead the Fed to remove accommodation more slowly than otherwise.” His comments echoed those of a number of Fed officials who said the expansion “might be slower than they expected if foreign economic growth came in weaker than anticipated,” minutes from the Sept. 16-17 meeting released last week showed. “The Fed wants to raise rates, but you’re not seeing the kind of global growth that would suggest interest rates have to go up any time soon,” Jim Kochan, the chief fixed-income strategist at Wells Fargo Funds Management LLC, which oversees $221 billion, said by telephone from Menomonee Falls, Wisconsin. The consequences for inflation are already being priced into the bond market. Collective Wisdom Based on the gap between yields of government notes and TIPS, traders have scaled back estimates for average inflation through 2019 by a half-percentage point since June to 1.52 percent, Fed data compiled by Bloomberg show. That decline has significance for policy makers because yields have historically been accurate in predicting the future pace of annual cost-of-living increases. The market’s five-year forecast has understated actual inflation based on the U.S. consumer price index by a median of just 0.04 percentage point since the data began in 2003. With the Fed’s preferred measure averaging 0.34 percentage point less than CPI in that span, traders are signaling prices based on that gauge may rise as little as 1.18 percent. Through August, the personal consumption expenditures deflator has fallen short of the Fed’s 2 percent goal for 28 straight months. Fed officials “need to be paying attention to that because there’s a collective wisdom element to the TIPS market,” Mitchell Stapley, the chief investment officer for Cincinnati-based ClearArc Capital, which manages $7 billion, said in an Oct. 8 telephone interview. Less Confident Bond traders who are shunning TIPS are underestimating the risk that inflation will pick up as the U.S. economy strengthens and workers are hired at the fastest pace since 1999, according to Pacific Investment Management Co.’s Mirih Worah. Even as the rest of the world slows, the IMF boosted its forecast for U.S. growth next year to 3.1 percent, which would be the fastest in a decade. In July, the fund predicted the world’s largest economy would expand 3 percent in 2015. “For the next 12 months, headline inflation will be 1.5 percent, but not for the next five years,” Worah, one of the co-managers who succeeded Bill Gross in overseeing Pimco’s $201 billion Total Return Fund, said by telephone Oct. 9 from Newport Beach, California. “It’s overdone.” Worah said he’s been buying five-year TIPS as prices of the securities declined. In September, TIPS of all maturities lost 2.7 percent in the biggest monthly decline since June 2013. Futures traders are signaling their skepticism over accelerating inflation by pushing back projections for the Fed’s first rate increase since 2006. ‘Disinflationary Cycle’ For the first time in at least six months, they’re pricing in the likelihood the Fed won’t raise its target rate until after next September, data compiled by Bloomberg show. When it comes to a rate boost in October 2015, odds based on futures trading have fallen to little more than a coin flip. Lower commodity prices, coupled with the dollar’s strength as traders anticipate looser monetary policy in Europe and Japan, also suggest inflation will remain in check and give the Fed room to maneuver as the U.S. economy grows. Crude oil prices have fallen 20 percent from a nine-month high in June, entering a bear market last week after closing at $86 a barrel. The Bloomberg Commodity Index, which measures 22 commodities from corn to zinc, tumbled 11.8 percent last quarter in the biggest slump since the financial crisis in 2008. Most commodities are priced in dollars, which has helped reduce costs for American businesses and consumers as the U.S. currency rallied to a four-year high this month. “It’s becoming increasingly more difficult to be a hawk given what’s going on with inflation,” Kevin Giddis, the Memphis, Tennessee-based head of fixed-income capital markets at Raymond James & Associates Inc., said in a telephone interview on Oct. 10. “We are in a longer-term disinflationary cycle that is likely to keep rates low for some time.” |

| Posted: 14 Oct 2014 08:37 AM PDT Stocks are trying to bounce back this morning but who knows how long that will last? More importantly, crude is down another dollar, The Long Bond is under 3% and gold is firm at $1234. In other words, the disinflation/deflation bias still holds in anticipation of the eventuality of more QE∞. |

| Jim Willie: The Economic ENDGAME Has Arrived Posted: 14 Oct 2014 08:30 AM PDT In this MUST LISTEN interview with Finance & Liberty’s Elijah Johnson, Hat Trick Letter editor Jim Willie explains why gold & silver futures prices were smashed over the past 2 weeks, advising that the Economic ENDGAME HAS ARRIVED, and systemic failure is DEAD AHEAD. Willie breaks down the logical conclusion to the rejection of the […] The post Jim Willie: The Economic ENDGAME Has Arrived appeared first on Silver Doctors. |

| This chart says gold stocks could be repeating an "explosive" pattern Posted: 14 Oct 2014 08:29 AM PDT From Jeff Clark, editor, S&A Short Report: If you’ve been waiting to get aggressive with gold stocks, you might soon get your chance… Gold stocks have been crushed recently. The benchmark Market Vectors Gold Miners Fund (GDX) has fallen 23% in the past five weeks. In short, the gold sector is violently oversold. And with the U.S. dollar looking like it has topped, we’ll likely see a violent rally in gold stocks soon. But it’s not time to go “all in” just yet… Take a look at this chart of GDX…

Today’s setup is similar to what we saw in December. GDX suffered a huge decline in November. In early December, the stock was 14% below its 50-day moving average (DMA) – a historically extreme move. GDX rarely strays more than 10% from its 50-DMA before reversing and then coming back toward its 50-DMA. Extreme moves like this often mark significant bottoms. December was the most oversold GDX had been since the gold sector bottomed in 2008. But bottoming out is a process, not a one-day event. After falling 14% below its 50-DMA, GDX bounced hard. But it couldn’t hold onto the gains. The fund came back down, retested the low, and consolidated for most of the month before exploding more than 30% higher from January to mid-March. It looks like the same pattern is playing out today. Early last week, GDX dropped 16% below its 50-DMA. It’s more oversold than it was last December. It bounced more than 7% off the bottom early last week. But that rally failed – just like the first bounce failed last December. So if the pattern continues, GDX may need to retest the low and consolidate for a few weeks before it’s ready to start a new rally phase. I don’t see a lot more downside from here for most gold stocks. So those looking to own gold stocks in the long term can consider buying here. But traders looking for an explosive rally – similar to what we saw last January – may need to be patient for a few more weeks before aggressively buying the sector. P.S. With the recent market volatility, a lot of folks are starting to get nervous about their investments. That’s why I’ll be hosting a free live question-and-answer session about the coming market collapse this Thursday at 2 p.m. EST. If you want to learn how to prepare and profit during the next bear market, be sure to join me here. |

| Gold Prices Rally Strongly amid Falling Equities Posted: 14 Oct 2014 08:25 AM PDT The price of gold rebounded from its 15-month low last week to see its biggest weekly gain in four months. After failing to break below a key support level at $1180 an ounce the price of gold rallied higher for the first time in a long while last week, with gold bouncing $32 (2.7%) to close out the week at $1223 an ounce. The price of the yellow metal has begun this week on a firmer note as prices extend last weeks' gains. At the time of writing the price of spot gold was trading at $1233 an ounce after pushing through $1230 an ounce on Monday and hitting a four-week high as traders covered short positions while some bargain hunters stepped in to buy at the current low levels. Meanwhile global equities have fallen. The Standard & Poor's 500 Index experienced its worst three-day loss since 2011 as it fell an additional 1.6% on Monday to 1,874.82 at 4 p.m. in New York, the lowest since May and closing below its 200-day moving average for the first time since 2012. The Dow Jones Industrial Average lost 1.4% to a six-month low. Brent crude tumbled 1.5% after sliding into a bear market last week. The dollar weakened against most of its 16 major counterparts and gold gained 0.7%. The S&P 500 has fallen 6.8% from its Sept. 18 record as the Fed contemplates when to raise interest rates. The index is down 4.8% over three days, the most since November 2011. The International Monetary Fund cut its forecast for global growth last week and said the euro area faces the risk of a recession. The IMF now expects world growth to register at 3.3% in 2014, down 0.1% from its forecast in July. For 2015, it also slashed its forecast by 0.2% to 3.8%. The organization, which represents 188 countries, now expects world growth to come in at 3.3% in 2014, down 0.1% from its forecast in July. While in 2015, it expects growth of 3.8%, down 0.2% from earlier expectations. It comes less than a month after the Organisation for Economic Co-operation and Development (OECD) slashed its expectations for the global economy because of concerns about a stuttering recovery in the U.S. and the continued fragility of the euro zone. Speaking as the IMF’s World Economic Outlook was released on Tuesday, Research Director Olivier Blanchard said the world’s economic recovery was “weak and uneven,” and highlighted countries’ “very different evolutions.” “Growth is uneven and still weak overall and remains susceptible to many downside risks,” the IMF’s report said. Following the report the price of gold rebounded by 1.3%, its biggest one-day advance in two months. The IMF also warned of bubbles building in financial assets. "Downside risks related to an equity price correction in 2014 have also risen, consistent with the notion that some valuations could be frothy," it said. Also comments from some of the top U.S Fed policy makers expressed increasing concern about weakening world economies, were deemed a bit dovish by the market place. Last week, Chinese traders returned to the market following their Golden Week holiday. Bullion dealers cited solid demand for kilo bars and domestic demand for gold jewellery was strong leading manufacturers to order more of the yellow metal. In Hangzhou, retailers saw gold jewellery sales jump 106%, while stores in Tianjin saw gold and silver jewellery sales rise by more than 40%, according to a statement from the ministry of commerce earlier this week. Demand has also been increasing in India, the second biggest consumer, helped by the festival and wedding season. Indian gold premium increased to $12-$15 an ounce last week from $7 two weeks ago, dealers said. This month, India will celebrate the festivals of Dhanteras and Diwali and both are considered auspicious times for buying gold jewellery, coins or bars. As the wedding season approaches, demand for gold is expected to increase. Gifts of gold are an important part of Indian weddings. “Gold demand in the physical market has increased and is likely to remain firm until early next year because of festivals and the wedding season. Gold jewellery remains in demand during the marriage season as it is mandatory for Indian households to gift gold,” said Yash Zaveri, director of retailer Zaveri & Co. The big news of the week, which went unnoticed by mainstream media was the launch of the new gold kilo bar contract by the Singapore Exchange. The new Singapore Kilobar Gold contract is for 25 kilograms of 99.99% pure gold and began trading on the Singapore Exchange (SGX) at 8:15 a.m. on Oct. 13, introducing centralized trading and clearing of a physically-delivered gold contract in Singapore. The contract is the result of a collaboration between International Enterprise (IE) Singapore, Singapore Bullion Market Association (SBMA), Singapore Exchange (SGX) and the World Gold Council. Commenting on the significance of the announcement, Singapore's Minister of Trade and Industry Lim stated, "With our close proximity to both demand and supply in Asia, I believe that Singapore is well-placed to support the bullion industry, with substantive mutual benefits." Asia's incessant demand for physical gold is the biggest driver for the implementation of a new gold contract trade on the Singapore Exchange. "Our vision is that Asia can be a driving force to continue the growth of the bullion industry, and be a global leader in areas fundamental to the demand and trade in this region," he added. The move comes after in 2012 the Singapore Government exempted investment in precious metals (IPM) from a 7% Goods and Services levy. "The global gold market continues to shift from west to east and Singapore's ambitions to become a gold hub reflect this trend. Since its inception, the World Gold Council has worked with key market participants to drive the development of this market," said Albert Cheng, Far East Managing Director at the World Gold Council. Brink's Singapore Pte Ltd has been appointed as an Approved Vault Operator and its approved vault is at The Singapore Freeport. Banks supporting the development of the contract include JPMorgan Chase Bank, Standard Bank Plc Singapore Branch, Standard Chartered Bank and The Bank of Nova Scotia. Muthukrishnan Ramaswami, President, SGX stated, "SGX is pleased to support the consortium's efforts to develop Singapore as a global trading hub for gold. SGX's market place will enable the trading and clearing of the Singapore Kilobar Gold Contract and establish a fully transparent price discovery mechanism for gold in this region." The Shanghai Gold Exchange was launched in September inside the city’s free-trade zone, offering yuan-denominated contracts backed by gold held in Shanghai. China is now the world’s largest producer and consumer of gold, and the biggest importer, as domestic demand has outstripped supply. India also is a major buyer and importer. Two-thirds of global gold purchases come from Asia. With such demand for physical gold, it is obvious that there is a complete disconnect between the current price of gold and the real value of gold. This price suppression has been the result of the activities of the CME Group, together with major banks. By using paper contracts on Comex, these institutions are causing severe dislocations in the real world and the scam can't continue indefinitely and will cause its own demise by how it distorts the real world of supply and demand. Furthermore, the recent rally in the U.S. dollar is unjustified by the economic fundamentals and will not be sustainable in the long-term. Gold therefore remains a crucial portfolio diversifier for the potential dangers ahead. Technical picture

Gold prices have rebounded strongly from recent lows and are likely to climb higher and re-test resistance at around $1270 an ounce. |

| Gold rally extends to the 1240 first resistance area Posted: 14 Oct 2014 08:18 AM PDT Commodity Trader |

| Ted Butler’s Silver Price Outlook – Why This Time Could Be Different Posted: 14 Oct 2014 07:29 AM PDT The Commitment of Traders Report, for positions held at the close of Comex trading on Tuesday October 7th 2014, did not change much compared to a week earlier. The reporting week included October 3d on which silver was trading at its absolute lows. According to Ted Butler these lows didn’t mean much, as there was so little volume associated with them, that they were more fishing expeditions by JPMorgan and their High Frequency Trading buddies, than anything else. The powerful rallies [with high volume] off those lows pretty much negated any improvements in the COT Report that would have shown up if those rallies hadn’t occurred. Ed Steer analyzes in his daily gold and silver newsletter the COT report (www.caseyresearch.com/gsd) for the reporting week in which silver reached $16.70 and gold $1185:

What do we make out of the current gold and silver futures positions? One thing is clear, as both Butler and Steer have reiterated, the rate of accumulation in short positions of commercial traders (read: JP Morgan) during the next rally will determine to which extent the rally will run. So far, after the silver price peak in 2011, all rallies have been capped by aggressive shorting by commercials. Is there a reason to believe this time will be different? Although hesitant, COT analyst Ted Butler believes there are reasons to believe that it could be different with the next precious metals rally. From Ted Butler’s latest premium update on www.butlerresearch.com:

|

| Swiss Gold Referendum 'propaganda war' begins Posted: 14 Oct 2014 07:05 AM PDT The referendum for the Swiss Gold Initiative is scheduled for November 30th, and the propaganda war has begun. |

| Zeal: US Dollar Super-Overbought Posted: 14 Oct 2014 07:00 AM PDT The US dollar has relentlessly blasted higher in recent months, achieving its longest consecutive-week rally in history. Speculators have flooded into the world's reserve currency for a variety of reasons, ranging from Federal Reserve rate-hike hopes to festering Eurozone worries. But the resulting massive dollar surge has left it super-overbought while breeding universal bullishness, the […] The post Zeal: US Dollar Super-Overbought appeared first on Silver Doctors. |

| Indian gold smugglers get creative Posted: 14 Oct 2014 06:54 AM PDT With tight gold import curbs in place, smugglers are seen inventing novel techniques to sneak in gold into India. |

| Metals market update for October 14 Posted: 14 Oct 2014 06:50 AM PDT Gold climbed $9.00 or 0.74% to $1,232.70 per ounce and silver rose $0.10 or 0.58% to $17.45 per ounce yesterday. |

| Teetering gold price dents jewelry demand in India Posted: 14 Oct 2014 06:40 AM PDT Demand for jewellery in India seems to be badly affected by the uncertainty in gold prices. |

| World's top 10 silver producers updated – companies & countries Posted: 14 Oct 2014 06:19 AM PDT We update figures for the world's top silver producing companies and countries and see rising production this year but flat to declining output ahead. |

| Gold ETFs see inflows for the first time in weeks Posted: 14 Oct 2014 06:05 AM PDT But is Asian demand distorting the picture? Julian Phillips discusses the inflows in full detail in his daily commentary. |

| Swiss Gold Referendum “Propaganda War” Begins Posted: 14 Oct 2014 05:03 AM PDT gold.ie |

| Swiss Gold Referendum “Propaganda War” Begins Posted: 14 Oct 2014 04:59 AM PDT Swiss Gold Referendum "Propaganda War" BeginsThe referendum for the Swiss Gold Initiative is scheduled for November 30th and the propaganda war – between the Swiss National Bank (SNB) and the Swiss Parliament on one side and the Swiss People’s Party (SVP) on the other – has begun and we expect it to escalate as the day draws nearer.

The gold referendum was proposed by the SVP and backed by the necessary 100,000 signatures required the put an issue to referendum in Switzerland. The SVP is one of the largest political parties in Switzerland. The party is the largest party in the Swiss Federal Assembly, with 54 members of the National Council and 5 of the Council of States. This indicates a degree of popular support for the measure and all eyes are on November 30th. If the referendum is passed, it would result in the following: *the repatriation of Swiss gold reserves currently believed to be in the UK and Canada *an increase in gold holdings of the SNB to reflect an allocation of 20% of total reserves (today gold accounts for 7.7% of total reserves) *and a moratorium on the sale of Swiss gold reserves The SNB opposes the repatriation issue on the somewhat flimsy grounds that in a dire national emergency foreign holdings could be sold quickly whereas domestic holdings may be tied up. This appears to be disingenuous as many international buyers including the People's Bank of China and other central banks would likely be willing to buy the Swiss gold reserves in loco Switzerland, and then repatriate or take delivery to their own country. Many Swiss look with alarm at the recent German experience, when Germany attempted to have their sovereign gold repatriated from the U.S. Of the 300 tonnes requested it has, to date, received a mere 5 tonnes. Speculation, even among more sober gold analysts, is that the central banks of the world no longer have the gold they claim to have. Some of the gold belonging to the people of the west appears to have been loaned, leased or indeed sold onto the market. This may have been done in an attempt to suppress to gold price and maintain faith in the dollar, euro and other fiat currencies and indeed maintain faith in the fragile monetary and financial system. Much of the physical bullion is now in the very strong hands of store of wealth buyers in India, China and Asia. Other strong hands who have been allocating to gold are Asian and other central banks including Russia's central bank as stealth currency wars continue. That central banks have likely been involved in manipulating the gold price was confirmed again recently by Alan Greenspan in his recent essay in Foreign Affairs on gold as an invaluable monetary asset where he wrote “[the western central banks] all agreed to an allocation arrangement of who would sell how much, and when…” The requirement for the SNB to hold 20% of its reserves in gold is also opposed by the central bank on the basis of the jaded and disingenuous argument that gold does not pay interest and does not yield a dividend. Therefore, the stipends it regularly pays to the state and the cantons would have to be curtailed. This overlooks the fact that with interest rates at record low levels near 0%, central banks are receiving very little yield on their dollar and foreign exchange reserves. It also ignores the very purpose of holding gold. As we consistently emphasise, gold is a real tangible, safe haven asset that cannot be debased by politicians, bankers and central bankers. In this time of continuing QE, it is more prudent than ever to hold a greater balance of gold as a hedge against fiat currencies being further devalued and from potential declines in stock, bond and property markets. Indeed, as Bloomberg reported over the weekend, Mario Draghi has intimated that the ECB may disregard German objections and begin to expand its balance sheet and print euros in a last-ditch attempt to stave off deflation. This, despite the fact that the same policies have been an abysmal failure in Japan and are not working in the U.S. Indeed, the weak data out of Europe last week spurred Stanley Fischer, vice-chair of the Fed, to state that the European situation would have to factor into any decision to raise interest rates in the U.S. This weak data and the apparently dovish tone of last weeks Fed statement had already had an adverse affect on the dollar – reversing a 12-week run-up – and equities in recent days- indicating, once again, that currencies are as volatile as gold and, in extremis, far less safe. The reserve status of the dollar grows ever-more precarious as confirmed, yet again, over the weekend when Bloomberg reported that the governor of the central bank of China claimed that some countries were already using the yuan as a reserve currency, albeit informally. While on the subject of China it is worth noting that Chinese gold demand last year – previously regarded as voracious – was actually twice as high as had been estimated and is on track for over 2,000 tonnes again this year. The previous estimate was based on flows of gold through Hong Kong. But Xu Luode from the Shanghai Gold Exchange confirmed what more astute gold analysts have been asserting in recent months, that other cities in China are now also importing large volumes of gold – far more than through Hong Kong alone. Demand from the growing middle classes of China, India and the East continues to grow ever stronger. Clearly, China, India and Asia's appetite for gold is far from sated. Back in Switzerland, the SNB also objects to the third aspect of the Swiss Gold Initiative i.e. the moratorium on sales of Swiss gold. From their perspective it would encumber their ability to conduct business. In a shameless display of attacking the man and not the ball and with tongue planted firmly in cheek, we would question the SNB’s skill in conducting effective monetary policy at all – at least insofar as gold is concerned. We would recall how, in 1999 – around the same time as Gordon Brown’s infamous blunder, the SNB sold a whopping 50% of the gold belonging to the Swiss people at the very bottom of the market in what appears to have been an attempted coup de grace on the “barbarous relic.” Gold in U.S. Dollars- 20 Years (Thomson Reuters) Well fifteen years later and gold has risen from $250/oz in 1999 to over $1,230/oz or nearly 5 times, and gold is as valued as it has ever been, particularly by non western central banks and by the people of Asia. The maxim that all fiat currencies eventually revert to their intrinsic value has generally been vindicated in monetary and economic environments such as we are now witnessing. And if the mass of what has historically been regarded as a true store of wealth, gold bullion bars, are now sitting in vaults in the East – it suggests that we in the West could be in store for further currency devaluations and a further decline in our living standards. With this in mind we hope the Swiss people display their fierce independence and reject the advice of the “experts,” many of whom got us into this mess, in favour of the policies that have kept them peaceful and prosperous for centuries. The referendum has the potential to become a lightning rod that leads to an increase in awareness about the importance of gold as a hedging instrument and a monetary, safe haven asset. It could also potentially lead to a marked increased in official or central bank gold demand and substantially higher gold prices. Must Read Guide To Gold Storage In Switzerland GOLDCORE MARKET UPDATE Gold climbed $9.00 or 0.74% to $1,232.70 per ounce and silver rose $0.10 or 0.58% to $17.45 per ounce yesterday. Silver in U.S. Dollars – 1984 to October 14, 2014 (Thomson Reuters) Gold in Singapore ticked marginally higher initially but then saw slight falls and it remains largely unchanged from yesterday’s close in New York. SPDR Gold Trust holdings, a gauge for investor demand, climbed 1.79 tonnes to 761.23 tonnes on Monday, making it the fund’s first inflow since September 10th. Get Breaking News and Updates On Gold and Markets Here |

| AdvisorShares: Bullish on gold priced in euro – gold priced in dollars, not so much Posted: 14 Oct 2014 03:45 AM PDT etftrends |

| 1000-year old Viking treasure hoard found in Scotland Posted: 14 Oct 2014 01:59 AM PDT Derek McLennan discovered the gold and silver artifacts in a field in Dumfriesshire in southwest Scotland. |

| Five Reasons Why The Market Vectors Gold Mining ETF(NYSEARCA:GDX) Could Be The Next Monster Trade Posted: 14 Oct 2014 01:25 AM PDT inthemoneystocks |

| Silver Signals Bullish Continuation in the Short-term Posted: 14 Oct 2014 01:05 AM PDT fxpips |

| Gold Climbs As USD Dips, Crude Oil Resumes Descent On Supply Swell Posted: 14 Oct 2014 01:05 AM PDT dailyfx |

| CHARTS : The 64-Month Pattern in Stocks and Gold Posted: 14 Oct 2014 01:00 AM PDT goldseek |

| Powerful Reversal And Shakeout In The Junior Gold Miners At May Lows Around $33 Posted: 14 Oct 2014 01:00 AM PDT gold-eagle |

| Powerful Reversal and Shakeout in the Junior Gold Miners at May Lows Posted: 14 Oct 2014 12:00 AM PDT GoldStockTrades |

| This Is What Happens When Someone Is Desperate To Sell $750 Million Of Stocks Posted: 13 Oct 2014 11:22 PM PDT At 3:32 p.m. EDT on Monday (Columbus Day - with half the market absent), someone - apparently having waited to see if the almost 'ubiquitous' 330pm Ramp would occur - decided it was time to dump three-quarters of a billion dollars notional of U.S. equity market exposure in 1 second. The results of this forced liquidation (or utter disregard for fiduciary duty) were as follows... A complete collapse of all liquidity in the S&P 500 e-mini futures contract - the world's most liquid equity exposure vehicle. This Zero Hedge story from yesterday, complete with lots of charts, was posted on their Internet site at 6:22 p.m EDT---and I thank reader U.D. for passing it around. It's worth reading. |

| Record bust in Cambodia signals Thai dollar counterfeiting boom Posted: 13 Oct 2014 11:22 PM PDT Brigadier General Sar Theth is the police chief of Battambang, a languid riverside town in western Cambodia. You could also call him the seven million dollar man. On Sept. 19, Sar Theth's officers tracked three Thai men in a pick-up truck as it passed through a remote border checkpoint from Thailand. When the truck stopped in the Cambodian district of Phnom Proek, the police pounced. Inside, said Sar Theth, they found three cardboard boxes packed with $7.16 million in counterfeit hundred-dollar bills, the largest seizure of fake U.S. notes in Southeast Asia for about a decade and the biggest ever in Cambodia. "If I close my eyes and touch it, I wouldn't know it was fake," he said, rubbing one of the seized notes between thumb and forefinger at Battambang police headquarters. This Reuters story, filed from Battambang in western Cambodia, appeared on their Internet site at 6:36 p.m. EDT on Sunday evening---and it's the second contribution of the day from reader 'h c'. |

| Faber's likely last time on BNN: Gold and silver markets are manipulated Posted: 13 Oct 2014 11:22 PM PDT Financial letter writer Marc Faber made on Friday what likely will be his last appearance on Business News Network in Canada -- not because of failing health or retirement but because he declared that the monetary metals markets are manipulated. As soon as Faber made his declaration on BNN's "Business Day" program, moderator Frances Horodelski cut him off, asserting that time had run out. Horodelski asked Faber if gold would reverse upward with other commodities when the U.S. dollar falls. Faber replied: "Precious metals can still go lower, because, as some knowledgeable people have proven, the markets are manipulated. But I don't think they will stay low. I think they may go lower temporarily and then rebound strongly, and if I were a reader, I would no longer trust central banks, and [instead] say, 'I want to be my own central bank and have some gold and silver stored in a safe place, certainly not in the U.S." BNN's likely final interview with Faber is 9:22 minutes long, with the comments about gold and silver market manipulation coming at the 8:15 mark. Until BNN takes it down, it can be watched at the network's Internet site. I thank Chris Powell for wordsmithing 'all of the above'---but the first person through the door with this video clip was Ken Hurt. |

| Russia gold production: Too much of a good thing? Posted: 13 Oct 2014 11:22 PM PDT Russia is the world’s third-largest gold-producing country. Over much of the past decade, the rising price of gold made it a safe haven for investors put off by the volatility of stock markets. But in 2013, gold prices began to fall, and many market forecasters today think this trend is set to continue – due in part to a glut of gold on the market. Russian gold producers remain undeterred. By the end of 2013, for the first time in 25 years, Russia surpassed the U.S. in the total output of mined gold, reaching third place among gold-producing countries. Gold mining in Russia has been growing rapidly in recent years. According to the Federal State Statistics Service, also known as Rosstat, the amount of mined gold was 12% in 2013 and 7% in 2012. “We see that the consumption of physical gold is stable,” says Nikolai Zelensky, general director of Nordgold. “It is mostly consumed by developing countries such as China and India.” In his words, for example, China’s demand for gold in 2014 is approximately 1,000 tons a year, which is about 25% of world consumption. Of course China consumed 2,000 tonnes in 2013, but that was unknown to Zelensky when he said that, or he just reads the bilge from the World Gold Council. The rest of the article contains other inaccuracies, so I'd take what's said in this article with a big grain of salt, although Russia's production figures for 2014 are of interest. This article appeared on the rbth.com Internet site back on September 30---and it's courtesy of reader U.D. |

| Posted: 13 Oct 2014 11:22 PM PDT Much to the delight of jewellers, Indian consumers are making a scramble for gold in the build-up to Diwali on October 23, after a lacklustre festive season last year. Sales of gold jewellery and coins in October so far have accelerated in the range of 15-25% more than a year before, although it is still early to firm up a precise forecast of demand this Diwali and Dhanteras, considered auspicious for the precious metal purchases. Last year, jewellers were badly hit by a crunch in raw material supplies following imposition of a 10% import duty and the central bank’s 80:20 rule, which mandated that at least one-fifth of imported gold must be reserved for re-exports. Many jewellers in Delhi and Mumbai witnessed up to 40% drop in sales last Diwali. “After months of slowdown, things are finally beginning to look up,” a spokesperson for Tanishq, the country’s largest jewellery chain, told FE. “All the purchases that people had postponed are finally being made,” he said, adding that lower gold rates in recent days had helped accelerate demand. Gold prices in Delhi dropped over 8% in 2014 so far to R27,370 per 10 grams as of October 10, tracking a subdued trend overseas and aiding the sales. This gold-related news item, filed from New Delhi, showed up on The Financial Express website at 1:22 a.m. IST on their Sunday morning---and I thank reader U.M. for sending it our way. |

| Indian gold import curbs to stay, advises former Finance Minister Posted: 13 Oct 2014 11:22 PM PDT India’s former Finance Minister, P. Chidambaram, has advised not to lift gold import curbs earlier imposed by his government. According to him, the benefits from these restrictions are sure to outweigh the menace caused by gold smuggling. He added that the time is not ripe now to lift the sanctions imposed on gold imports, as it may result in economic imbalance. According to Mr. Chidambaram, the country should concentrate more on pushing exports in the long term. A sudden rise in exports is unlikely to happen. Hence the country must persist with controls on imports. Gold and crude oil are the goods that contribute to the high import bill. Continuing with gold import restrictions is the only option left to contain rising CAD, he added. This news item was posted on the resourceinvestor.com Internet site on Monday sometime---and it's the second offering in a row from reader U.M. |

| Asian Market Hubs Move Into Gold Posted: 13 Oct 2014 11:22 PM PDT Asians buy most of the world's gold, but nearly all of it trades in London. Now, with Western investors souring on the metal, the region is making a bid for some of the action. Three big financial hubs in Asia are separately launching trading in a gold contract, each backed with physical gold. If they draw enough investors, the contracts could influence the price of gold, which is set by a daily fix in London. ... China is now the world's largest producer and consumer of gold, and the biggest importer, as domestic demand has outstripped supply. India also is a major buyer and importer. Two-thirds of global gold purchases come from Asia, the World Gold Council says. This gold-related story is subscriber protected. What's above, plus a bit more, is posted in the clear in this GATA release where I found it on Sunday. |

| China sees rapid growth in gold leasing Posted: 13 Oct 2014 11:22 PM PDT Chinese banks saw an over 30% surge in their precious metal assets, namely gold, as gold leasing has become the new money maker in a more conservative credit market, the Shanghai-based First Financial Daily reports. According to a report published by China's Minsheng Bank, publicly listed Chinese banks held a combined asset of 477 billion yuan (US$77.70 billion) in precious metals as of the end of June. Since the metal Chinese banks dealt with is mostly gold, that amount is equivalent to 1,863 tons of gold, based on the average market price between January and June, and well above the country's gold reserve of 1,054 tons, the newspaper said. I'm not sure what to make of this news item, so I'm posting it without comment. It appeared on the Taiwan Internet site wantchinatimes.com at 10:44 a.m. local time on Sunday---and it's the final contribution of the day from Manitoba reader U.M., for which I thank her. |

| China now takes nearly all world gold production, Shanghai exchange chief confirms Posted: 13 Oct 2014 11:22 PM PDT China's annual non-government gold consumption has been officially confirmed as having reached 2,000 tonnes, gold researcher and GATA consultant Koos Jansen reports. That figure is close to annual world gold mine production. The figure, Jansen writes, was repeated several times by the chairman of the Shanghai Gold Exchange, Xu Luode, in an address to the London Bullion Market Association conference in Singapore in June. Xu's disclosure confirmed Jansen's longstanding formula for calculating Chinese gold demand, repudiated the World Gold Council's longstanding and gross underestimation of that demand, and calls into question all reporting about Chinese gold demand by mainstream Western financial news organizations. One wonders how much more gold disappears into the reserves of the People's Bank of China every year? Whatever amount it is, it's far from inconsequential. Jansen's commentary is headlined "SGE Chairman: 2013 Chinese Gold Demand Was 2,000 Tonnes" and it was posted on the Singapore website bullionstar.com at 6:23 p.m. on their Friday evening. It's a must read for sure---and I found it over at the gata.org Internet site on Saturday. |

| China Now Takes Nearly All World Gold Production, Shanghai Exchange Chief Confirms Posted: 13 Oct 2014 11:22 PM PDT "I wasn't overly surprised to see the sellers of last resort show up in force" ¤ Yesterday In Gold & SilverThe gold price rallied the moment that trading began at 6 p.m. EDT on Sunday night in New York, but it was immediately apparent that there was a willing seller laying in wait, as volume blew out right away. The Far East high came about fifteen minutes before the London open at around 2:45 p.m. Hong Kong time. From there, it was down hill into the noon London silver fix. The gold price rallied anew at that point---and showed real signs of life starting at exactly 1 p.m. EDT. It rallied without a break, past the 1:30 p.m. EDT Comex close---and through all of electronic trading---and closed on its high tick at 5:15 p.m. in New York. The low and high of the day were recorded by the CME Group as $1,223.60 and $1,238.00 in the December contract. Gold finished the Monday session at $1,237.10 spot, up $14.10 from Friday's close. Volume was only 113,000 contracts, but around 40 percent of that volume came before the 10:30 a.m. BST London morning gold fix. Silver didn't do much of anything on Monday, but a more correct way of putting it would be that silver wasn't allowed to do much. The high tick of the day came shortly before 2 p.m. Hong Kong time---and would have blasted off from there if allowed to do so, which it wasn't. The low came at 1 p.m. EDT and, like gold, rallied from there into the close of electronic trading. The low and high were reported as $17.28 and $17.68 in the December contract, an intraday move of more than 2 percent. Silver was closed at $17.50 spot, up 10.5 cents from Friday. Volume was only 27,500 contracts, but more than half of that was traded by the London a.m. gold fix. Platinum's opening rally on Sunday night in New York got hammered to a standstill as well, with the high tick coming at 8 a.m. on the button Hong Kong time. It traded flat from there until an hour before the London open--and then down it went, hitting its low tick shortly after 9 a.m. EDT in New York. It rallied ten bucks from there, before chopping sideways for the remainder of the Monday trading session. Platinum closed up 8 bucks. The palladium trading day was a mini version of platinum's chart. The low tick came at 10:30 a.m. EDT in New York---and the metal rallied back above unchanged to close up 2 dollars on the day. The dollar index closed late on Friday afternoon in New York at 85.85---and then headed lower the moment that trading got under way at 6 p.m. EDT on Sunday evening. The 85.41 Far East low came around 8 a.m. Hong Kong time---and then it rallied a bit into the 8:00 a.m. BST London open---and began to weaken from there, before starting to head lower with some authority around 3 p.m. EDT. The low tick of 85.09 came minutes after 5 p.m.---and less than 15 minutes before the precious metal market closed in New York. From that day's low, the index rallied a handful of basis points into the close. The dollar index finished the Monday session at 85.22---down a chunky 63 basis points from Friday's close. The gold stocks gapped up a couple of percent at the open--and then began to climb higher starting at 10:30 a.m. EDT. The stocks were up 5 percent at their highs, but got unceremoniously sold off starting just before 3:00 p.m EDT. The HUI manged to finish up only 1.94% on the day. The silver equities followed a similar path, as Nick Laird's Intraday Silver Sentiment Index closed up 1.90%. The CME Daily Delivery Report showed that zero gold and 21 silver contracts were posted for delivery within the Comex-approved depositories on Wednesday. October is not a normal delivery month for either metal, so these low delivery numbers, or lack of them, is not a surprise. The CME Preliminary Report for the Monday trading session showed that another 77 gold contracts disappeared from the October contract---and that number is now down to 1,057 contracts still open. October open interest for silver is now up 10 contracts to 194 outstanding. For a change, there was a deposit in GLD yesterday, as an authorized participant added 57,685 troy ounces. But over at SLV, another 1,150,471 troy ounces were reported withdrawn. There was no sales report from the U.S. Mint. There was very little activity in gold at the Comex-approved depository on Friday, as only 3,200 troy ounces were reported shipped out. In silver, there was 585,986 troy ounces reported received---and 88,177 troy ounces were shipped out the door. All the silver received was deposited at JPMorgan Chase. From zero ounces on May 1, 2011---the day of the drive-by shooting in silver---JPMorgan is now the tallest silver hog at the Comex-approved depository trough, with 48,296,488 troy ounces of the stuff. The link to that activity is here. While I'm on the subject of the Comex-approved depositories Here are a couple of charts that Nick Laird sent our way on Sunday. These 2-year charts show the total Eligible and Registered gold and silver stock held by all these same depositories. And still on the subject of Comex depositories. I mentioned that JPMorgan had gone from 'zero to hero' since May 1, 2011. Here's the chart showing the miraculous rise. Another 'zero to hero' depository is CNT, which came out of nowhere in late August 2012. Between these two depositories, they have taken in 76 million ounces of silver since their respective inceptions---and I've always wondered why they suddenly appeared out of nowhere when they did. I have a decent number of stories for a Tuesday, so I hope you have the time to read the ones that interest you. ¤ Critical ReadsThis Is What Happens When Someone Is Desperate To Sell $750 Million Of StocksAt 3:32 p.m. EDT on Monday (Columbus Day - with half the market absent), someone - apparently having waited to see if the almost 'ubiquitous' 330pm Ramp would occur - decided it was time to dump three-quarters of a billion dollars notional of U.S. equity market exposure in 1 second. The results of this forced liquidation (or utter disregard for fiduciary duty) were as follows... A complete collapse of all liquidity in the S&P 500 e-mini futures contract - the world's most liquid equity exposure vehicle. This Zero Hedge story from yesterday, complete with lots of charts, was posted on their Internet site at 6:22 p.m EDT---and I thank reader U.D. for passing it around. It's worth reading. Faber: The global economy is not healingThis 10:38 minute Fox News video clip with Marc showed up on their Internet site last Thursday---and I thank reader Ken Hurt for sharing it with us. Banks accept derivatives rule change to end 'too big to fail' scenarioThe $700 trillion financial derivatives industry has agreed to a fundamental rule change from January to help regulators to wind down failed banks without destabilising markets. The International Swaps and Derivatives Association (ISDA) and 18 major banks that dominate the market will now allow financial watchdogs to apply temporary stays to prevent a rush to close derivatives contracts if a bank runs into trouble, the ISDA said on Saturday. A delay would give regulators time to ensure that critical parts of a bank, such as customer accounts, continue smoothly while the rest is wound down or sold off in an orderly way. ... Under the new contract terms, default clauses in derivatives contracts such as interest rate or credit default swaps would be suspended for a maximum of 48 hours. I posted a story about this in Friday's column, I believe---but this Reuters piece, filed from London, adds more clarity---and I found it in a GATA release on Saturday. World leaders play war games as the next financial crisis loomsPress the uniform. Check the battle plans. Call up the reservists. Arm the bombers and refuel the tanks. Field Marshal George Osborne is going on manoeuvres. On Monday in Washington, the chancellor of the exchequer will see if Britain is ready for war. A financial war that is. Along with his allies from the United States, he will play out a war game designed to show whether lessons have been learned from the last show, the slump of 2008. Like all commanding officers, Osborne thinks he is ready. He will have general Mark Carney at his side. He has studied the terrain. He has a plan that he insists will work. Let’s hope so. Because the evidence from last week’s meeting of the International Monetary Fund in Washington was that it won’t be long before the real shooting starts. The Fund’s annual meeting was like a gathering of international diplomats at the League of Nations in the 1930s. Those attending were desperate to avoid another war but were unsure how to do so. They can see dark forces gathering but lack the weapons or the will to tackle them effectively. There is an uneasy, brooding peace as the world waits to see whether lessons really have been learned or whether the central bankers, the finance ministers and the international bureaucrats are fighting the last war. Only a real scare, as with Ebola, will lead to meaningful action. Until then, though, the Fund can sit behind its Maginot Line---and Field Marshal Osborne can play his war games. But be in no doubt: our chancellor is less Monty in the desert, than Neville Chamberlain declaring peace in our time. That's the best put-down I've seen in years! However, it sums up the situation perfectly. This commentary by The Guardian's economic editor, Larry Elliott, easily falls in the the must read category---and I thank reader 'h c' for sending it along. James Rickards: Next Crash Exponentially Larger than Any Financial Panic in HistoryJames Rickards, best-selling author of “The Death of Money,” says a huge financial panic is a mathematical certainty. Rickards explains, “It is a mathematical certainty, but I can take it further . . . what you don’t hear is this will be exponentially larger than any financial panic in the past." "The next time, the Fed is going to be in trouble. They are already insolvent on a mark- to-market basis. Each bailout gets much bigger than the one before. The Fed has a 10-foot seawall, and they are going to get hit with a 50-foot tsunami.” This 31:37 minute video interview with Jim appeared on the youtube.com Internet site on Sunday sometime---and it is, as always, courtesy of reader Harold Jacobsen. I've watched it from start to finish---and it's definitely worth your time. Snowden Vindicated—'Citizenfour' Documentary Untangles the NSA Leak SagaCitizenfour must have been a maddening documentary to film. Its subject is pervasive global surveillance, an enveloping digital act that spreads without visibility, so its scenes unfold in courtrooms, hearing chambers and hotels. Yet the virtuosity of Laura Poitras, its director and architect, makes its 114 minutes crackle with the nervous energy of revelation. Poitras, the first journalist contacted by National Security Agency whistleblower Edward Snowden, mirrors her topic. She rarely appears on news programs or chat shows. She is a mysterious character in her own movie, heard more than she is seen. But surreptitiously, Poitras has been a commander of a stream of disclosures for 16 months that have forced the NSA into a new and infamous era. Citizenfour demonstrates to the public the prowess that those of us who have worked with her on the NSA stories encountered. Her movie, the culmination of a post-9/11 trilogy that spans a dark horizon from Iraq to Guantánamo, is a triumph of journalism and a triumph for journalism. At its heart, Citizenfour is the story of how Snowden’s disclosures unfolded through Poitras’ eyes, from the first communications Snowden sends Poitras, hinting at what is to come, until Snowden sees himself vindicated through emulation. Citizenfour opens in U.S. cinemas on 24 October. This film review, originally posted in The Guardian, showed up on the alternet.org Internet site on Saturday---and it's the first contribution of the day from Roy Stephens. S&P lowers France's credit outlook to 'Negative'S&P maintained France’s rating at “AA” – two notches below the firm’s highest investment grade. But the lowered outlook indicates the rating could be downgraded sometime in the next two years if France’s economy deteriorates, the firm said. The French economy may run into trouble because the government may not be able to implement reforms need to spur growth, S&P said. The firm lowered its projections for France’s economic growth over the next three years and predicted that government deficits will take up a larger portion of the country’s gross domestic product. This short AP story found a home over at the france24.com Internet site on Saturday---and my thanks go out to Orlando, Florida reader Dennis Mong. Draghi The Dictator: "Working With the Germans is Impossible"The war of words between Europe's unelected monetary-policy dictator Mario Draghi and Germany's "but it's us that pays for all this" Bundesbank has been gaining momentum since Jens Weidmann penned his Op-Ed slamming Draghi's OMT 'whatever it takes' as "too close to state financing" in 2012. A week ago, Weidmann stepped up the rhetoric by claiming ECB policy is "hostage to politics" and has lost its independence - warning Draghi's dictatorial policies were leading Europe down a "dangerous path." But now, as pressure grows from the Spanish (record unemployment, record bad debt, record low yields), Italian (record unemployment, record debt-to-GDP, record low yields) and French (record unemployment, treaty-busting-deficits, record low yields) for Draghi to monetize more assets, he has struck back in Focus magazine, blasting Weidmann is "impossible" to work with because the Germans "say no to everything." Dis-union... In other words, the Germans won;t let me do what I want - so I'm going to ignore them... this leaves the Germans with few options - none of them 'good' for a European Union. This short Zero Hedge commentary, which is worth skimming, appeared on their website at 12:44 p.m. EDT last Friday afternoon---and it's the first of many offerings today from Manitoba reader U.M. Ditch euro, defend Italy's sovereignty!' Eurosceptic leader calls for referendumThe leader of an influential Italian Eurosceptic political party, the Five Star Movement (M5S), says he will collect one million signatures required to petition the Parliament to conduct a referendum on Italy leaving the Eurozone as soon as possible. The Italian government is not effective in restoring jobs and helping people, said Beppe Grillo, the leader of Italy's anti-establishment M5S, which burst onto the political scene last year winning 25 percent of the vote in its first parliamentary election in 2013. “Leave the euro and defend the sovereignty of the Italian people from the European Central Bank,” Grillo told his supporters at a M5S event in Rome. “We have to leave the euro as soon as possible,” he said. “We will collect one million signatures in six months and bring them to the Parliament to ask for a referendum to express our opinion.” This article appeared on the Russia Today website at 1:56 a.m. Moscow time on their Sunday morning---and it's courtesy of reader Harry Grant. Ambrose Evans-Pritchard waded into this mess as well, with a commentary headlined "The great Lira revolt has begun in Italy"---and I thank I thank South African reader B.V. for his final contribution to today's column. It was posted on the telegraph.co.uk Internet site at 6:15 p.m. BST Monday evening---and it's an absolute must read. Ukraine crisis: Putin orders thousands of troops away from borderRussian President Vladimir Putin has ordered thousands of Russian troops near the Ukrainian border to return to their usual bases, according to his spokesman. Dmitry Peskov told Russ |

| Four week high for gold as its safe haven status boosts demand Posted: 13 Oct 2014 10:56 PM PDT A month ago and the gold bears looked triumphant. Since then they’ve been in retreat as global stocks have pulled back. So too have many commodities but that has not dented the appeal of gold and silver. Now even the US dollar is weakening and that almost always great news for gold prices. AverageJoeOptions.com Founder Todd Horwitz and Bloomberg's Joseph Deaux discuss the price of gold on ‘In The Loop’… |

| Sudden fall in US dollar has Dennis Gartman worried as stocks dive again and gold jumps Posted: 13 Oct 2014 08:54 PM PDT A sudden fall in the US dollar has Dennis Gartman worried. He is only comfortable holding gold right now. This is a very fast moving market where convictions can be challenged and dumped in a matter of minutes. No wonder so many investors are selling up. Dennis Gartman of the Gartman Letter provides perspective into the market’s disconcerting environment… |

| What’s happening as US stocks slump again along with oil and gold rises? Posted: 13 Oct 2014 08:44 PM PDT Asian stocks fell, with the regional benchmark index heading for a six-month low, extending a rout in global equities after the Standard & Poor's 500 Index capped its biggest three-day loss since 2011. Gold and silver prices gained while oil was down again. Bloomberg’s David Ingles takes a look at what’s behind the global selloff on ‘First Up’… |

| 12 Charts That Show The Permanent Damage That Has Been Done To The U.S. Economy Posted: 13 Oct 2014 07:53 PM PDT