saveyourassetsfirst3 |

- PM Fund Manager on Worst PM Manipulation in 14 Years: Something Ominous This Way Comes

- Legendary Gold Trader: Today is a Day That Should be Memorized

- Gold miner accepting bids

- It’s Not Just the Police – The Feds are Also Militarizing Public Schools with Grenade Launchers, M16s and Tanks

- It’s official: The record-breaking Alibaba IPO is done. This is what happened today.

- Two analysts just came up with a brand-new way to find the world’s best junior resource stocks

- June 2013 Lows Break As Silver Plunges to $17 Handle

- Chart of the Day: America’s Debt Iceberg

- Why I Believe Gold & Silver have been Massacred Since 2011

- June 2013 Lows Break As Silver Plunges to $17 Handle

- Precious metals may get more precious regardless of price

- Eric Coffin: Gold Likely Headed to $1200: Can Investors Still Find Tenbaggers?

- Grain Markets coming to Grips with Reality

- Scottish Independence: A Sign of Things to Come

- Gold still has week technical picture - Phillips

- Scotland Says "No" - Fallout May Impact Pound

- One of the most innovative cities in the world [you’ll never guess]

- Record stock buybacks: What every investor should really know

- Gold: Support at 1216/1184.50, resistance at 1231.60/1241.90

- You will be absolutely shocked to see how this trillion-dollar market really operates

- China’s long term gold plans

- Scotland Says “No” – Fallout May Impact Pound

- Scotland Says No - Pound To Suffer From Fallout

- Deutsche Bank dour over gold investment in India

- Asian gold demand to kick in here - Suchecki

- Solution to cure India of impure gold gains traction

- Silver - Almost Time to Backup the Truck and Load up

- SILVER PRICE : A Collapse and a Rally

- CHARTS : Silver Price at Critical Juncture

- Gold and Silver Technical Update

- Why I Believe Gold & Silver have been Massacred Since 2011

- ‘Shanghai Gold’ contracts aimed at foreign investors

- No merger on horizon for Alacer Gold, OceanaGold

- Gold Future Bearish Theme Reinforced

- Gold: Finding Support Where It Should

- Gold Elliott Wave Analysis: Two Scenarios Both Bearish

- Gold loses the positive momentum – Analysis - 19/09/2014

- Gold Price Analysis - September 18

- Gold Ticks Up; Watch the Year Open at 1206 if Reached

- Bird’s Eye View of the Gold Stocks

- US inflation minus 0.2% as economic growth falters

- Gold could be the beneficiary of today's asset bubbles: Jeff Nichols

- Dirty Secret of $1 Trillion Loans is When You Get Your Money Bac

- Three King World News Blogs

- Super-rich rush to buy 'Italian Job'-style gold bars

- Gold and silver end game is here, Embry tells USA Watchdog

- China Opens Gold Market to Foreigners Amid Price Ambition

- Super-Rich Rush to Buy ‘Italian Job’-Style Gold Bars

- Germanys Stolen Gold Reserves - Times are changing - the debts remain (Russian)

- sept 18./silver OI rises again/SLV inventory rises another 960,000 oz/

| PM Fund Manager on Worst PM Manipulation in 14 Years: Something Ominous This Way Comes Posted: 19 Sep 2014 12:45 PM PDT The precious metals have been under the most intense and concentrated period of downward price manipulation by the Federal Reserve/U.S. Government that has occurred over the last 14 years, except for the summer/early fall 2008. Something really bad is occurring behind the scenes with our economic and financial system that is not yet obvious. But […] The post PM Fund Manager on Worst PM Manipulation in 14 Years: Something Ominous This Way Comes appeared first on Silver Doctors. |

| Legendary Gold Trader: Today is a Day That Should be Memorized Posted: 19 Sep 2014 12:34 PM PDT With gold smashed to $1215, perhaps only a day or 2 from testing bear market lows at $1179 and silver plunging through substantial support at $18 to place new bear market lows Friday, legendary gold trader Jim Sinclair sent an email alert to subscribers stating that today’s trading action is “a classic example of “Popular Delusions, […] The post Legendary Gold Trader: Today is a Day That Should be Memorized appeared first on Silver Doctors. |

| Posted: 19 Sep 2014 11:52 AM PDT Excelsior Gold Limited is pleased to advise that it has received and is assessing proposals from 28 mining contractors in response to calls made for definitive mining submissions for the mining operations at the Kalgoorlie North Gold Project. |

| Posted: 19 Sep 2014 11:40 AM PDT Events last month in Ferguson, Missouri forced Americans to confront the frightening reality that many of of the nation's police departments have been quietly, but consistently, militarizing over the past couple of decades. It's one thing to intellectually understand that this has happened, it's quite another to see cops deploy tanks and point sniper rifles at peacefully […] The post It's Not Just the Police – The Feds are Also Militarizing Public Schools with Grenade Launchers, M16s and Tanks appeared first on Silver Doctors. |

| It’s official: The record-breaking Alibaba IPO is done. This is what happened today. Posted: 19 Sep 2014 11:39 AM PDT From Bloomberg: Alibaba Group Holding Ltd. surged in its U.S. trading debut, after the company raised a record-breaking $21.8 billion in an initial public offering. The Chinese company’s shares rose 38 percent to $94 apiece as of 11:53 a.m. in New York, after the IPO was priced at $68. The e-commerce company, which started in 1999 with $60,000 cobbled together by founder Jack Ma, is now valued at $231.7 billion. That makes it larger than Amazon.com Inc. and EBay Inc. combined, and more valuable than all but 9 companies in the Standard & Poor’s 500 Index. Ma, a former English teacher who started the company in his Hangzhou apartment, drew crowds of money managers to meetings held around the world as the company pitched itself to investors this month. Alibaba has profited from China’s burgeoning consumer class by dominating the e-commerce industry in the country of 1.36 billion people. Ma is now China’s richest man, with an estimated net worth of $21.9 billion, according to the Bloomberg Billionaires Index. He will own about 7.8 percent of the Alibaba after the IPO, company filings indicate. Large Funds At recent meetings, Alibaba’s founder focused on the company’s ambitions outside of both the e-commerce field and its home base, describing it as an “Internet company that happens to be from China.” Alibaba made the support of big institutional investors a priority during the IPO, in an effort to put shares in the hands of long-term investors. Half of the shares sold went to just 25 accounts, a highly concentrated group in an IPO, people with knowledge of the matter said, asking not to be identified as the books are private. “In the short run, it’ll outperform the market due to the demand from investors who didn’t have a chance to get into the company at the IPO, and also the IPO underwriters will work to provide stability if needed,” said Josef Schuster, the founder of IPOX Schuster LLC in Chicago. “It has got very strong momentum in the market.” Alibaba’s ability to close a deal of this size is also owed to an almost non-stop rally in shares in the U.S. — where about $15 trillion has been added to the value of equities amid three rounds of monetary stimulus from the Federal Reserve, an expanding economy and record profits. The share sale is already the largest by any company in the U.S., and could break the global record − currently held by Agricultural Bank of China Ltd.’s $22 billion IPO in 2010 − if underwriters issue more shares. Market Timing “They want to get in now before the market is no longer excited,” said Kevin Headland, director of the portfolio advisory group at Manulife Asset Management Ltd. in Toronto. Headland, whose firm manages $281 billion, plans not to invest in the shares right away. “It’s prudent to sit back and evaluate a company instead of getting caught up in the excitement,” he said. The IPO − anticipated for years − hasn’t been achieved without setbacks for Alibaba. The company would have preferred to debut in Hong Kong, though listing rules in the city don’t allow its governance structure. A small group of insiders at Alibaba control the company’s board, the kind of arrangement that’s permitted in the U.S., where founders of technology companies often maintain control through dual-class shareholdings. Counterfeit Goods As Alibaba executives met investors this month, they were queried about issues ranging from how the company plans to prevent selling counterfeit objects on its marketplaces to Alibaba’s relationship with its payments affiliate — Alipay — which is now effectively controlled by Ma. None of those factors were enough to substantially weaken demand for its shares, with Alibaba’s growth prospects too compelling for many to ignore. The concerns may have kept the company and its advisers from pushing the price too high, like Facebook Inc. did when it debuted in 2012. Facebook’s shares plunged in the months after its IPO before eventually recovering. “Perhaps learning lessons from Facebook’s IPO, Alibaba’s current pricing range strikes us as conservative, and we do not believe the valuation fully reflects the features that make the wide-moat Alibaba investment story unique,” Morningstar Inc. analyst R.J. Hottovy wrote in a note to clients. Morningstar has a fair value estimate of $90 per share on the company. Alibaba’s profits also make it a standout among technology IPOs. Twitter Inc. raised more than $2 billion last year, and Chinese rival JD.Com Inc., which has achieved a $40 billion valuation, raised about $2 billion in May — both without any annual earnings. Alibaba by comparison turns about half of its sales into income. Sustainable Model At $68 a share, Alibaba is valued at 29 times expected earnings for the year through March − below multiples fetched by Chinese and U.S. rivals including Tencent, Baidu Inc., and Amazon.com Analysts forecast that Alibaba’s earnings will grow 50 percent in fiscal 2015 from the previous 12 months. “This isn’t a situation where you’d see a high-growth company fall down to earth − it’s a very sustainable business model,” said Eric Brock, a portfolio manager at Clough Capital Partners, which oversees more than $4.5 billion in assets including the Clough China Fund. Alibaba provides various marketplaces for buyers and sellers as well as services that help them conduct their businesses. Taobao Marketplace, started in 2003, enables millions of individuals and small businesses to sell products. Tmall.com provides a virtual shopping mall, with retailers and brands offering products, and Juhuasuan operates a flash-sales model. Alibaba itself will raise about $8.4 billion from the sale, while another $867 million of the proceeds will go to Ma, IPO filings show. Yahoo’s Windfall Yahoo, which poured about $1 billion into Alibaba nine years ago, planned to sell 121.7 million of its shares in the IPO, the filings show, raising about $8.3 billion at the offering price. That will trim its stake to 16.3 percent from 22.4 percent. Japan’s SoftBank Corp., Alibaba’s largest shareholder, didn’t plan to sell shares and will have a 32.4 percent stake after the offering, according to the prospectus. Mainland Internet users have grown to 632 million and could exceed 850 million by 2015, according to government data. Alibaba has been seen as a proxy for this growth with its 279 million active buyers in the year through June, according to its prospectus. This scale has enabled the company to generate revenue of $8.46 billion in the year through March. China Risk Profit in the first quarter surged as advertisers boosted spending on the Tmall and Taobao platforms. Net income almost tripled to $1.99 billion, or 84 cents a share, in the three months ended June 30. Alibaba’s home also raises risks for investors. Like many Chinese companies, Alibaba will rely on a legal structure known as a variable interest entity, or VIE, required by the Chinese government for foreign ownership of certain industries, including Internet companies. While Alibaba gets most of its revenue from wholly foreign-owned enterprises, if China revokes its VIE license, U.S. investors could be affected, filings show. “I remain concerned about the dangers that these structures pose,” Senator Robert Casey, a Democrat from Pennsylvania, said in a letter to the U.S. Securities and Exchange Commission this week. Staying Out Some investors chose not to invest in the IPO, even though they’re enthusiastic about Alibaba’s prospects. Don Gimbel, global portfolio manager at Geneva Advisors LLC in Chicago, said he would sit out the debut to see how investors react once the shares begin to trade. “I don’t know how to value it at this point of time and that’s why I want to wait and see what the market says,” he said in an interview before the price was determined. “To say Mr. Ma is a great salesman is the understatement of the year. He’s got a great product and I think the diversification Alibaba is able to achieve because of its uniqueness in China is spectacular.” Alibaba is listed under the symbol BABA. |

| Two analysts just came up with a brand-new way to find the world’s best junior resource stocks Posted: 19 Sep 2014 11:29 AM PDT From The Mining Report: It’s never too late to find a new way to evaluate mining companies, and Jeff Desjardins and James Fraser of Tickerscores.com have developed one based on over 20 different criteria. Add in some near-term catalysts and the wheat separates from the chaff. In this interview with The Mining Report, Desjardins and Fraser share the names of companies with some of Tickerscores.com’s highest junior mining scores. The Mining Report: A recent article on Tickerscores.com, “The Great Divide: Inequality in Gold Juniors Means Opportunity,” said: “It’s clear we’ve reached a new level of separation between the wheat and the chaff.” What does that mean for investors? Jeff Desjardins: As the bear market has progressed, many companies have struggled to raise the necessary funds to advance their projects. Even for those that have been more fortunate, it has often come in the form of dilutive financings. On the other hand, quality management teams have found ways to continue to move projects forward. We’re starting to see a big separation in metrics such as cash, general and administrative expenses (G&A), news flow and, ultimately, the creation of shareholder value. For example, we cover 22 exploration companies working in Ontario and 82% of those had less than $400,000 in cash in Q1/14, up from 65% in Q3/13. Our top three exploration companies in Ontario hold an average cash position of $2.2 million ($2.2M) each. The other 19 average only a mere $150,000 per company. Furthermore, the G&A expense ratio for the bottom 19 companies is a hefty 76%, which means that $0.76 of every dollar is not going into the ground. We are looking at a great divide between the rich and the poor. The funny thing is that even though the rich companies have great management teams and cash to continue to develop their projects—key things that you want in a junior name—they are still trading at great valuations. TMR: In which mining subsector—producer, developer, explorer—is an investor likely to get the most bang for the buck? JD: All those types of companies have their advantages. It depends on an investor’s portfolio, strategy and risk tolerance. Right now, we’re focusing on developers. We published a report in early September that lists some promising companies in this stage. We believe developers with high-quality assets will be subject to merger and acquisition (M&A) activity once they are sufficiently derisked because larger companies want to buy proven resources at rock-bottom prices. Investors should look for developers with a resource of at least 3 million ounces (3 Moz) with high grade and in a safe jurisdiction. A takeover offer is rarely made before a company publishes a preliminary economic assessment (PEA) so investors should look for a PEA or feasibility study with a high net present value (NPV), low capital costs (sub-$700M) and a high internal rate of return (IRR). TMR: What jurisdictions should investors be taking a closer look at right now? James Fraser: Certainly anything in North America—Mexico, Nevada, British Columbia and Ontario. TMR: Are companies in those jurisdictions trading at a premium to the companies that aren’t? JF: Yes. Assets in certain countries in Africa and other places like Russia trade at a significant discount to a similarly sized asset in a safe jurisdiction. TMR: Tickerscores.com maintains a database of 450 companies that is constantly updated based on financials, management, stock performance and mining projects. What are the weightings for each of those elements and do those weightings change over time? JD: They definitely change over time because the weightings are based on macro market conditions. In November 2013, the weightings of those factors were: financials, 54%; management, 20%; stock performance, 4%; and the project, 22%. Right now exploration companies are 43% for financials, 17% for management, 4% for stock performance and 36% for the project. TMR: What accounts for the greater weighting in projects? JD: The biggest reason for the jump in the project weighting is based on an improvement we have made over the last year, which is adding in a drill score economic analysis. We’re looking at the economics of all drill holes for each exploration company, and comparing them against other companies in the same jurisdiction. We didn’t do that before. TMR: How do you go about analyzing drill results? JF: In the drill hole analysis, we always compare companies in similar regions to each other. In British Columbia, for example, we would be comparing companies that are typically exploring for gold and copper together. We look at how many holes a company has drilled on the property and then take a company’s best drill results to date and calculate a “gram meter” score. If an interval is 200 meters (200m) of 1 gram per ton (1 g/t), that’s a score of 200. Or if it’s 100 g/t over 2m, that’s also 200. Once we have the results for a region, we will then rank them. TMR: So as much as possible you are trying to compare apples to apples? JD: By keeping as many variables as possible the same, it makes it easier to understand the key differences between two companies. We also provide “Power Rankings” to help investors sift through companies. If something jumps out to us, we make note of it there. TMR: What are the top three or four catalysts that move the score for explorers, developers and producers? JF: It’s still a tough climate for exploration companies. The first thing we look at is cash position. A company needs money to do work. A significant financing or a well-funded joint venture partner would dramatically move a Tickerscore right now. As Jeff said, the higher quality names are outperforming while the majority of other companies are running very low on working capital. We don’t expect the latter ones to survive the next 6 to 12 months. After cash, solid exploration drill results will certainly move a stock’s Tickerscore. We see the most change in developers as they advance to the next stage, such as moving from an NI 43-101 to a PEA, or when a resource gets significantly bigger. If a company receives an important environmental certificate or mining permit, that will really move a Tickerscore. For producers it all comes down to making money. Were they profitable at the end of the quarter? Are their all-in cash costs increasing or decreasing? How do these metrics compare to previous quarters? TMR: Traditional mining equity analysts use discounted cash flow (DCF) models or other proven metrics like NAV or enterprise value to determine how companies ought to be valued. How do you think your methodology stacks up? JF: The higher-scoring companies in our database—the companies scoring over 60—are consistently outperforming the Toronto Stock Exchange and the Market Vectors Junior Gold Miners ETF (GDXJ:NYSEArca). It’s also worth mentioning that in the Tickerscores Top 10 list we published in January, our top picks for the year are up 34% year-to-date. Discounted cash flow models are generally used for producers and have limitations. The DCF model is static and does not account well for changing metal prices, increasing or declining production, or grade variability. We update our producers at least once each quarter based on their latest quarterly reports. We determine if the mine is high-grading (a process by which higher-grade ore is mined first); we also look at all-in cash costs and other variables. We use 20 different metrics to determine a Tickerscore for each company. TMR: Could you give our readers some names that have done well from the last Tickerscores Top 10 list? JF: Two companies from the April Top 10 report, both of which are up over 50%, are Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) and Garibaldi Resources Corp. (GGI:TSX.V). TMR: When Seabridge had its Kerr-Sulphurates-Mitchell (KSM) project approved by the British Columbia government, how did that influence the Tickerscore? JF: That made a huge difference. Without that permit, the company would have to revisit the permitting process. KSM still requires approval from the federal government and that decision could come in the fall. TMR: Are there near-term catalysts that will continue to move Garibaldi shares higher? JF: Yes. Garibaldi hit an intercept of high-grade silver at surface in Mexico, which moved the share price considerably higher. Now, the company is conducting follow-up drilling. Investors should look to see if the next holes return similar or better grades than the initial high-grade silver drill hole. Garibaldi is going to start work on its British Columbia projects in the next couple of weeks and, hopefully, drill a couple of holes before the snow falls. TMR: Please tell us about some companies in the most recent report that was published at the beginning of September. JD: In our Autumn 2014 report we have a mixture of exploration, development and producing companies. The companies that made this edition are some of the highest-scoring firms in our database. Each company has top-notch management, a solid balance sheet, and a promising project or mine. We also provide some near-term catalysts that investors need to watch closely. Interestingly, the first company that we highlighted in our report was Cayden Resources Inc. (CYD:TSX.V; CDKNF:OTCQX), which was just taken out by Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) for $205M at a premium of 42.5%. Our latest report went out a week before that happened, so any subscribers that were able to act quickly have already gotten a great return. Another company that we featured in our most recent Top 10 report is Marlin Gold Mining Ltd. (MLN:TSX.V). Marlin operates La Trinidad, a small heap-leach gold mine in Mexico that went into production in late February. The mine is still ramping up and, after several hiccups, is producing roughly 50 ounces (50 oz) per day. Marlin management is top-notch, led by CEO John Brownlie, who brought the El Chanate gold mine in Mexico into production. That mine was later sold to AuRico Gold Inc. (AUQ:TSX; AUQ:NYSE) and is still operating. Another thing we really like about Marlin is it created a subsidiary company called Sailfish Royalty, which will be spun out to shareholders at some point. This is an early-stage chance for investors to get in on a royalty company, which we’re big fans of. Marlin shares are tightly held with Wexford Capital owning 80% of the outstanding float. The next catalyst is commercial production, which should happen in the next several weeks. TMR: Did Marlin’s acquisition of the San Albino gold stream change its score? JF: No. Our focus is on La Trinidad but we do mention San Albino in our Power Rankings section to our subscribers. TMR: Cayden’s key projects are also in Mexico. Tell us about that name. JD: In our Tickerscores database, we independently cover 29 exploration companies that have their primary projects located in Mexico. In August, we had Cayden with the top score of 80 overall, which is actually the best exploration score in our entire database. Cayden has everything we look for in an exploration company. For us, the key is its management team, which has a proven track record. President and CEO Ivan Bebek found a multimillion-ounce gold deposit in Ghana as a cofounder of Keegan Resources. With the agreement to sell the company to Agnico Eagle at a 42.5% premium, he has done it again for Cayden shareholders. The company also has a solid balance sheet and exciting exploration results. Cayden’s El Barqueño gold project in Mexico looks as if it has potential to be 3–5 Moz. Cayden is one of the best-performing stocks year-to-date on the TSX Venture Exchange and now with the recent deal, we believe shareholders will be very satisfied. TMR: What are some other companies with exceptional Tickerscores? JF: Some other names with high scores in our database include Pretium Resources Inc. (PVG:TSX; PVG:NYSE), Lake Shore Gold Corp. (LSG:TSX), Balmoral Resources Ltd. (BAR:TSX; BAMLF:OTCQX), Rio Alto Mining Ltd. (RIO:TSX.V; RIO:BVL) and Kirkland Lake Gold Inc. (KGI:TSX). TMR: What are some examples of companies that have underperformed to date but could be poised for a turnaround? JF: A couple of development companies are Rye Patch Gold Corp. (RPM:TSX.V; RPMGF:OTCQX) and Clifton Star Resources Inc. (CFO:TSX.V; C3T:FSE). Rye Patch Gold’s stock price hasn’t done much lately, but it scores 62 in our Nevada development section. Rye Patch has several properties in Nevada, one of the best mining jurisdictions in the world. One thing we really like about the company is that it has cash flow coming from a quarterly royalty so it won’t have to go back to the market anytime soon. As of our last update, Rye Patch had $7M in cash, which was second out of 11 development companies we cover in Nevada. Insiders own roughly 5% of the stock so they are well aligned with shareholders. TMR: What are your thoughts on Rye Patch’s Lincoln Hill gold-silver project PEA? JF: Lincoln Hill is a smaller project, but it has robust economics. The IRR comes in at 53%, which is the highest of any Nevada developer we cover. The share price hasn’t done much, but all around Rye Patch is a solid company. TMR: And Clifton Star? JF: Clifton Star scores just over 50, which is in the top third of our Quebec development companies. Clifton is a very high-risk/high-reward stock. In April, Clifton Star published a prefeasibility study on its Duparquet gold project in northwestern Quebec. At $1,300/oz gold, the after-tax NPV is $135M and the IRR is 12.1% (at a 5% discount rate). For the Duparquet mine to be built, gold will need to be at least $1,500/oz. That means that Clifton Star is one of the most leveraged stocks in our database to the price of gold. Its market cap is only $7M with a deposit that’s over 4 Moz, which makes it very cheap. Clifton has $50.2M in payments between December 2014 and December 2017 to own 100% of Duparquet. TMR: How does the Tickerscore typically react when a junior brings in a big joint venture partner? JF: When a junior company brings in a major partner, it generally reflects well on the Tickerscore because that partner will likely cover the majority of costs. One example is Columbus Gold Corp. (CGT:TSX.V; CBGDF:OTCQX). It is partnered with a major producer, Nordgold N.V. (NORD:LSE), on the Paul Isnard project in French Guiana. The project currently hosts an NI-43-101-compliant resource of 4.3 Moz and three drill rigs are currently trying to outline more ounces. Nordgold is earning 50% of the project, but it is covering all the development costs—that frees up Columbus to do other things with its money. Columbus also has the Eastside project in Nevada that it hopes to drill in the fall. Nordgold can advance the Paul Isnard project much more quickly than Columbus could on its own. Mining is a capital-intensive business so any help smaller companies get from larger companies is extremely beneficial. TMR: Perhaps one more name to share with our readers before we let you go. JF: One name that was featured in our April Top 10 report is an energy stock. We usually don’t cover energy stocks but we believe Mart Resources Inc. (MMT:TSX.V) has too much potential to ignore. It’s a small oil producer in Nigeria that pays a dividend and has several catalysts in the next six months. The big catalyst for Mart is the new Umugini pipeline. Mart could double its cash flow once the pipeline is complete. The CEO owns just over 8M shares and it is rumored that Mart could make an acquisition during the next couple of months. If Mart can deliver on its catalysts, we should see a significant re-rating of the stock price. The stock has gone from $0.10/share all the way up to $2. Now it’s at $1.25/share as investors wait for that pipeline to come on-line. Investors should be cautious, though, because its main assets are in Nigeria. TMR: What should mining investors expect in the final quarter of 2014? JD: As we move into the fall, we expect to see more separation between the better companies and the weaker ones, or what we call “The Great Divide.” It’s all about the capacity to create shareholder value. The companies with no cash have severely limited capabilities to do this—and the quality names with world-class assets are going to be sought out by majors that need to replenish gold reserves. TMR: Thank you for talking with us today, Jeff and James. Jeff Desjardins founded Tickerscores.com, a universal, independent and comprehensive stock scoring system that gives investors access to investment research on mining stocks. Tickerscores has coverage of over 450 precious metals companies on the TSX and TSX.V and compares them head-to-head to make due diligence easier for investors. Each quarter, Tickerscores also puts out an in-depth Top 10 report of the highest scoring stocks in the system and other analyst picks. James Fraser, mining analyst at Tickerscores.com, is passionate about the mining sector and mining stocks. His passion led to co-authoring the book “Mining Stocks Investor Guide: a guide to investing in mining companies.” He has a finance background and has completed his Canadian Securities Course (CSC) and Conduct and Practices Handbook (CPH). When Fraser is not “digging” up the latest mining stock, he can be found enjoying a wide variety of sports or travelling the world. |

| June 2013 Lows Break As Silver Plunges to $17 Handle Posted: 19 Sep 2014 11:23 AM PDT Silver has just broken below the June 2013 low of $18, continuing its post FOMC “taper” sell-off Friday, plunging to a new bear market low of $17.77. Gold is also continuing its sell-off, but has held above $1215, still $35 off the June 2013 lows of $1179. Silver’s COMEX open plunge to new lows with a $17 […] The post June 2013 Lows Break As Silver Plunges to $17 Handle appeared first on Silver Doctors. |

| Chart of the Day: America’s Debt Iceberg Posted: 19 Sep 2014 11:00 AM PDT A money printing mirror reflection…. Courtesy SilverCoinInvestor: The post Chart of the Day: America’s Debt Iceberg appeared first on Silver Doctors. |

| Why I Believe Gold & Silver have been Massacred Since 2011 Posted: 19 Sep 2014 11:00 AM PDT The intensity of the banks' attacks on gold and silver prices have been long, drawn out, and merciless. Since 2011, the banks have been hitting completely "below the belt". They are are now All-in on their efforts to cap gold & silver, because this time they understand: it's for all the marbles. Why have the […] The post Why I Believe Gold & Silver have been Massacred Since 2011 appeared first on Silver Doctors. |

| June 2013 Lows Break As Silver Plunges to $17 Handle Posted: 19 Sep 2014 10:49 AM PDT

Click here for more on Silver’s plunge to new bear market lows: |

| Precious metals may get more precious regardless of price Posted: 19 Sep 2014 10:47 AM PDT Silver and gold always lead the way for other commodity sectors as the inflation signal for the investment/speculative trading world; despite persistent efforts to 'forget' about their natural monetary status. |

| Eric Coffin: Gold Likely Headed to $1200: Can Investors Still Find Tenbaggers? Posted: 19 Sep 2014 10:15 AM PDT The continuing strength of the U.S. dollar is bad news for the price of gold, and Eric Coffin believes that in the short term a price of $1,200/oz is possible, though there is room now for an oversold bounce. This, of course, is bad news for gold miners and explorers. But in this interview with The […] The post Eric Coffin: Gold Likely Headed to $1200: Can Investors Still Find Tenbaggers? appeared first on Silver Doctors. |

| Grain Markets coming to Grips with Reality Posted: 19 Sep 2014 09:46 AM PDT There are two factors that are now finally becoming begin to seriously take hold among those who kept insisting that grains would experience a bounce higher. The first of these is the sheer size of the upcoming harvest. The latter is the strength in the US Dollar. Early harvest results are rolling in and they are impressive! With forecasts calling for warm and mostly dry weather, harvest progress will continue as the combines move north. As the actual results are known, traders are realizing the old adage that, " a big crop gets bigger". All three grains/beans are lower this morning with beans looking like they are accelerating down. I am most interested in seeing this afternoon's COT reports on the corn because I want to see if any of the large specs ( hedge funds and other large reportables) are still net long corn or if they have whittled down those positions any. My concern for corn is very simple - IF, and this is a big "IF", that just-mentioned group remains as sizeable net longs, corn is in danger of having more downside than many are currently thinking. The reason? Those guys are going to have to get out of those losing longs. Now, even if they are spread against wheat, and so far that spread has been performing admirably with wheat fundamentals even more poor than those of corn, lifting those spreads entails a lot of corn selling that will be hitting this market at some point. Here is a picture of the spread: As you can see, it has been a most profitable strategy. If the spread moves too much in favor of corn however, livestock feeders will switch over to wheat. The spread has not moved much over -$1.20 with some resistance near -$1.40 so one wonders how much more upside this spread has. Here is the wheat chart: Talk about ugly! It hit a 51 month low this week. Even at that, the thinking is that US wheat prices are still not low enough to attract solid export business due to the global glut and the stronger Dollar. And now for corn - again, one ugly chart; however, beauty is in the eye of the beholder and for livestock and poultry producers, this chart is a thing of wondrous beauty! That brings me back to the commodity complex as a whole. This week's FOMC statement and its hawkishly construed message, has sent the Dollar higher and the commodity complex as a whole, lower. With the index moving lower one can expect to see both copper and silver heading down and that is exactly what both are doing. Copper is clinging to support near and just above the $3.06 level while silver crashed and burned through the $18 level. If silver cannot recapture that level quickly, a test of $17.50 - $17.35 is its next stop. Below that and things get very ugly as it could easily fall below $16.00. As for gold, as you can see on the chart, it is clinging for dear life to the bottom of the support band noted. Based on what I can see from this chart, there is little in the way of further support until one gets back down to the former double bottom low near $1180. There is only what I view as "psychological" support near round number $1200 but I suspect that will not hold if the Dollar index runs past 85.50. If gold does manage to get down to near $1200, Asian buying will no doubt be active but it will be insufficient to sustain the metal if Western interests become aggressive sellers. Along that line I am closing watching reported GLD holdings and to some extent, the action in the gold mining shares, which incidentally, look very heavy at the moment. We have a cattle on feed report due out this afternoon which will give us some further insight into the state of the US cattle herd. One wonders how long cattle are going to be able to buck the general selling trend being seen across the rest of the commodity complex, especially with high-priced US beef rapidly pricing itself out of the export markets. Feeder cattle also continue to defy gravity as cheap corn and abundant pasture spurs buyers to pay these outrageously expensive price for available animals. That being said, these kinds of prices, given what the board is showing for spring and summer cattle prices, are essentially guaranteeing losses to feeder buyers. One wonders how long that can continue. For now cattle bulls, especially in the feeders, are vigorously defending their positions. They seem intent on not surrendering and have the money to back up their stance it appears. A week from today we get the quarterly Snout count or the Hogs and Pigs Report. That is always a lot of fun. By the way, with the Scottish vote coming in a resounding "NO" in favor of independence, it was interesting watching the action in the British Pound last evening. As the first results started rolling in favoring remaining in the Union, the Pound began to rally. However, after the final vote was tallied the currency began to slowly relinquish its gains and is now firmly lower. This is a matter of "buy the rumor, sell the fact". The forex markets have an uncanny ability to predict election results as the Pound began rallying earlier this week AHEAD of the vote. Currency traders were clearly voting with their pocketbooks that the vote was going to be one of staying in the Union. Once the vote was cast and the results tabulated, there was no other reason to buy the Pound so down it went against King Dollar. We are firmly back to trading interest rate differentials it would seem. |

| Scottish Independence: A Sign of Things to Come Posted: 19 Sep 2014 08:00 AM PDT Human nature is highly resistant to change. This is the way of the universe. Sir Isaac Newton told us that an object at rest tends to stay at rest unless acted upon by an external force of sufficient enough to overcome the object's inertia. In chemistry, activation energy is defined as the minimum energy […] The post Scottish Independence: A Sign of Things to Come appeared first on Silver Doctors. |

| Gold still has week technical picture - Phillips Posted: 19 Sep 2014 07:48 AM PDT Julian Phillips of the Gold Forecaster suggests the price of gold looks soft on the charts, but also argues other factors will eventually come to boost it. |

| Scotland Says "No" - Fallout May Impact Pound Posted: 19 Sep 2014 07:01 AM PDT gold.ie |

| One of the most innovative cities in the world [you’ll never guess] Posted: 19 Sep 2014 07:00 AM PDT In the wake of Edward Snowden’s revelations on the NSA, a number of cities around the world are hotly competing to become the next Silicon Valley. In the process, they are creating excellent and exceptionally welcoming environments for new businesses. They want you to start your business there, so they are going out of their way to […] The post One of the most innovative cities in the world [you'll never guess] appeared first on Silver Doctors. |

| Record stock buybacks: What every investor should really know Posted: 19 Sep 2014 07:00 AM PDT From Sean Goldsmith in The S&A Digest: Corporations are buying back stock at the fastest clip since the financial crisis… The Wall Street Journal, citing data from market-research company Birinyi Associates, noted that “corporations bought back $338.3 billion of stock in the first half of the year, the most for any six-month period since 2007.” Some stats from the article: “The growth in buybacks comes as overall stock-market volume has slumped, helping magnify the impact of repurchases. In mid-August, about 25% of nonelectronic trades executed at Goldman Sachs Group Inc., excluding the small, automated, rapid-fire trades that have come to dominate the market, involved companies buying back shares. That is more than twice the long-run trend, according to a person familiar with the matter… Companies with the largest buyback programs by dollar value have outperformed the broader market by 20% since 2008, according to an analysis by Barclays PLC… According to Barclays, companies in the second quarter spent 31% of their cash flow on buybacks, the most since 2008 and up from 14% at the end of 2009. At the end of the second quarter, nonfinancial companies in the S&P 500 index held $1.35 trillion of cash, down from a record of $1.41 trillion at the end of last year, according to FactSet.” When a company buys back shares, it reduces the number of shares outstanding… That increases the earnings attributable to each share. In other words, it’s a way to goose earnings per share (EPS) without fundamental improvement in the business. It makes each share you own more valuable. Skeptics say that’s a bad thing… That share buybacks are driving the market upward. Some say it’s the only reason stocks are rising today. In an absurd op-ed in the New York Times, an economics professor from the University of Massachusetts Lowell said that stock buybacks “manipulate the stock market” and the Securities and Exchange Commission should change its rules so it can better prosecute these swashbucklers. They’re all ludicrous claims. Of course, regular buybacks over a sustained period of time are a good thing for investors. But many more things go into share-price movements than just a high volume of share repurchases. As with anything else in the market, attributing a single factor for being responsible for pushing the market higher is ignorant. I spoke with Extreme Value editor Dan Ferris about share buybacks today. As you can see from the chart below, many of the largest share repurchasers are (or have been) in the Extreme Value model portfolio…

Dan noted the total market cap for the Wilshire 5,000 – an index of nearly all U.S.-traded stocks – is nearly $20 trillion… So $338 billion in buybacks isn’t going to move the needle much. It’s foolish to suggest that repurchasing less than 2% of the equity value over a six-month time frame will support the market or even cause it to move higher. If a company bought back less than 2% of its shares in six months (or 4% annualized), we wouldn’t expect much. We should view this about the same. Of course, many 4% annual reductions in the outstanding share count can really add up. That’s what you want to see with the individual stocks you buy. But a single 2% reduction in one six-month period doesn’t seem like enough to support a $20 trillion, highly liquid market. Dan also noted that according to data compiled by the nonprofit Investment Company Institute, annual mutual fund flows were negative every year from 2008 to 2012 (meaning more money went out than in), and only turned positive again last year. So while the market was soaring, individual investors were on the sidelines. But they’ve been buying for the past year and a half as the market has risen even higher. In short, no single group can be credited with making the market go up. Corporate buyers have been known to buy more at the top, so they seem to make it fall more reliably than anything else. Individual buyers aren’t pushing the market higher while they’re pulling money out, as they did from 2008 to 2012. And in June, people started taking money out of stocks again. The S&P 500 hit an all-time high three months later in September. As we’ve noted in the Digest, nobody has ever accused “mom and pop” of being good market timers. I also spoke with Mebane Faber, cofounder and chief investment officer of asset-management firm Cambria Investment Management, about share buybacks. Meb literally wrote the book on share buybacks… He wrote a book called Shareholder Yield: A Better Approach to Dividend Investing. Shareholder yield is the total yield a company is paying investors, including both dividends and share buybacks. (Total shareholder yield also considers other ways a company can allocate capital like paying down debt or mergers and acquisitions.) Cambria also launched the Cambria Shareholder Yield Fund (SYLD) to profit from the strategy of owning companies with high shareholder yield. Steve Sjuggerud told his True Wealth subscribers to buy shares back in May 2013. They’re up 24% as of yesterday’s close. Meb told me… When you think about buybacks, you have to think from the shareholders’ perspective… If you ignore the price of the stock, dividends and buybacks are the same thing. Actually, dividends are a little less tax-efficient. And all that matters in the end to the shareholder is total yield. Shareholders don’t care where the yield comes from. They care about the aggregate amount. Regarding Meb’s comment about ignoring the price of a stock… Dividends are typically constant. Companies pay them out every quarter. Companies have more autonomy with buybacks. They can buy back shares when shares are expensive (which often destroys value) or when they’re cheap (which often creates value). Meb admitted CEOs as a whole are generally bad at timing buybacks. And buybacks typically follow the market cycle – meaning there are more buybacks toward market tops than bottoms – the same way mergers and acquisitions activity tracks the cycle. They’re highly correlated. That’s why you should look for dirt-cheap, high-quality companies that are repurchasing shares. You can still find plenty of reasonably priced companies buying back stock. For example, look at the biggest purchaser of stock in the market – consumer-products giant Apple – which trades for less than 17 times earnings. Meb also noted the buyback yield for the top buyback stocks is much higher than the dividend yield right now for the S&P 500 – 5%-6% versus just 1.9%. But investors are paying a premium for dividend yield… For the first time in history, the highest dividend-yielding stocks are trading at a premium to the S&P 500 (signaling the market’s desperate thirst for yield). The important thing to remember when discussing buybacks is the opportunity cost of that capital. What’s the best use of that capital today? Is it better to make an acquisition at all-time highs? Probably not… Should companies pay down the debt they just refinanced at record-low interest rates? Probably not… We like stocks today… As billionaire hedge-fund manager Leon Cooperman says, stocks are still “the best house in the financial-asset neighborhood.” And if you look at the above infographic from the Wall Street Journal‘s data, the biggest share repurchasers are reasonably valued (and most have dividends much larger than the yield on 10-year Treasurys). |

| Gold: Support at 1216/1184.50, resistance at 1231.60/1241.90 Posted: 19 Sep 2014 06:25 AM PDT fxstreet |

| You will be absolutely shocked to see how this trillion-dollar market really operates Posted: 19 Sep 2014 06:00 AM PDT From Bloomberg: Imagine a trillion-dollar market that runs on faxes and phone calls while routinely tying up investors’ money for months before they get any return. That’s not fiction: It’s the unregulated market for leveraged corporate loans. In a financial system that is increasingly automated, the origination and trading of loans is in the relative dark ages while money pours in from mainstream investors such as Kansas and New York pension plans and mutual funds catering to individuals seeking high yields in an era of near-zero interest rates. The antiquated structure of a market that’s ballooned from a mere $35 billion in 1997 poses a growing threat, raising the odds of gridlock in a downturn when investors expect to get their money back with a click of a button. As of yet, no regulators have taken responsibility for fixing the deficiency. “It’s a critical issue,” said Beth MacLean, a money manager at Newport Beach, California-based Pacific Investment Management Co., which oversees $1.97 trillion, including the world’s biggest bond mutual fund. “Any single retail fund not being able to meet their redemptions would have a ripple effect on the whole market.” The time it takes to settle a loan has gotten worse since the financial crisis, lengthening to an average 20 days as of June, from 17.8 days in 2007, according to data tracked by the Loan Syndications and Trading Association. In the high-yield bond market, it generally takes three or fewer days. Not Securities When regulators were drafting securities laws more than 70 years ago, company loans were excluded because they were mainly private transactions between one bank and one borrower. That’s no longer the case, as the debt is mostly syndicated, or distributed, to investors who can then trade the loans among themselves like a bond or a stock.

Judith Burns, a spokeswoman for the U.S. Securities and Exchange Commission, which has placed a priority on monitoring corporate and municipal bond trading more closely, declined to comment. So did representatives of the Federal Reserve, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corp. − which have all raised concern that banks are being too lax in their loan underwriting standards. The logjam in the modern syndicated-loan market, founded in 1982 by JPMorgan Chase & Co. Vice Chairman James B. Lee Jr., matters to more people than ever. Riskier Things Investors poured an unprecedented $62.9 billion last year into mutual funds that buy the debt, which is mostly speculative-grade, according to Lipper data. They have been lured by yields greater than those of higher-rated securities and interest payments that float above benchmark rates − with the latter being an attractive feature amid speculation the Fed may boost borrowing costs next year. Mutual funds bought 32 percent of new loans last year, up from 15 percent in 2012, LSTA data show. The New York City Employees’ Retirement System held about $961.8 million as of March 31, regulatory filings show. “Pension and retirement funds have poured in for the reason you know: They need yield,” said Erik Gordon, professor at the Ross School of Business at the University of Michigan in Ann Arbor. The low-rate environment has “forced people’s retirement to be invested in riskier and riskier things and this is an example of a riskier thing.” Some of the worst delays in settlement times can be found in the market for new loans, where Pimco’s MacLean said it’s not uncommon for months to pass before a purchase is completed. Huntsman Loan Investors committed $1.2 billion in October to fund a loan for junk-rated Huntsman Corp. For about 10 months, they didn’t receive a dime. Salt Lake City-based Huntsman obtained the financing to help pay for its purchase of Rockwood Holdings Inc.’s titanium dioxide business. The merger has taken longer than anticipated because of an antitrust holdup.

Kurt Ogden, a vice president of investor relations at Huntsman, said last month the loan commitment has been extended through Dec. 17. Investors were paid a fee in August, at which time the company also started putting aside interest that they’d receive upon settlement, said spokesman Brad Hart. While the delays wouldn’t happen in a bond offering, it’s permissible in the loan market, where each financing is crafted according to individual borrowers’ desires. Archaic System One reason there’s little momentum to streamline trading is that Wall Street banks benefit from the status quo, according to Scott Page, director of bank loans at Boston-based mutual fund firm Eaton Vance Corp. Banks earn fees for committing to fund deals until they close while shifting risk to investors. “The biggest banks who act as underwriters have an apparent self-interest in maintaining this archaic system,” Page said. “We are mystified by the fact they seem to have no interest in fixing it.” JPMorgan and Bank of America Corp., the two biggest underwriters, as well as other big banks, typically earn fees of 1 percent to 5 percent for arranging a leveraged loan, according to Standard & Poor’s data. That compares with 0.5 percentage point on bonds for investment-grade companies, and 1.3 percent for junk notes last year, Bloomberg data show. While buyers and sellers can trade stocks and bonds among themselves, they need the approval of corporate borrowers before they can exchange loans. Clerks must then update loan documents to reflect new lenders. No Incentive With loans, “there’s a high amount of faxing going on still,” said Virginie O’Shea, a senior analyst at Aite Group LLC in London. “People don’t realize that fax machines are still around in this day and age but they are.” Banks have no incentive to drag out the time it takes to settle a loan, according to Bram Smith, executive director of the New York-based LSTA, the market’s main lobbying group. “It’s a well-known fact to market participants that loan settlement is different from that of other asset classes,” he said. By recognizing the difference, both mutual funds and other investors have “prospered and grown quite nicely.” Brian Marchiony, a spokesman for New York-based JPMorgan, and Zia Ahmed, a spokesman for Charlotte, North Carolina-based Bank of America, declined to comment. While loans may be inefficient to process, their ability to be crafted for unique financing situations is what makes them attractive to many borrowers and lenders, the LSTA’s Smith said. Less Liquid Wall Street’s biggest banks have helped speculative-grade companies including cable-television provider Charter Communications Inc. and hospital operator Community Health Systems Inc. raise $405 billion this year through loans that were distributed among investors, data compiled by Bloomberg show. That’s the fastest pace ever. “Bank loans are a popular topic these days – a source of stable returns, less risk to rising interest rates,” Dennis MacKee, a representative of the Florida State Board of Administration, wrote in an e-mailed response to questions. “In return, there is a trade-off of some liquidity. The Kansas Public Employees Retirement System board of trustees agreed in May to commit $100 million to a strategy focused on high-yield bonds and leveraged loans. The concern is that there may be a mass exodus from mutual funds that could strain the loan market as investors anticipate rising borrowing costs and defaults. Mutual funds and exchange-traded funds settle investors’ redemption requests within three to seven days, according to Moody’s Investors Service data. Market Risk “There’s kind of a liquidity mismatch,” the University of Michigan’s Gordon said. When investors try to redeem and can’t get their money back right away, more will try to pull cash, risking a run, he said. The expense to investors resulting from a paper-based market’s inefficiencies stretch beyond missed payments. The market can easily turn in a month, leaving investors funding deals at yesterday’s rates. The 1.19 percent decline in loan prices since the end of June suggests that buyers of $1 billion of loans at rates set then would be overpaying by $11.9 million if the deal closed now, based on S&P and LSTA index data. Prices have declined 0.51 percent this month, to 97.8 cents on the dollar. Investors have started to push back, demanding fees on loans that fail to settle within a designated period, often a month or more, Bloomberg data show. Cost Cuts “The longer the wait, the greater the danger of a problem” for investors, former SEC Chairman Arthur Levitt said in a telephone interview. Levitt, who is on the board of Bloomberg News parent Bloomberg LP, warned more than a decade ago that debt traders and bankers needed to shrink the time it took to complete trades. The labor-intensive process of settling a loan trade requires banks to maintain teams of back-office staff at a time when they’re eliminating jobs to boost profitability. JPMorgan charges a $3,500 fee for each trade made by investors who exchange debt it helped distribute with competing firms, people with knowledge of the matter told Bloomberg News earlier this year. Those types of fees would decline or disappear if the debt fell under securities rules, according to Elisabeth de Fontenay, a Duke Law School professor in Durham, North Carolina, who previously worked as a corporate lawyer at Ropes & Gray LLP. Fund Flows There are other costs to investors. Fund managers often pay to maintain credit lines they can draw upon to meet redemptions and hold extra cash to mitigate the risk they’ll be unable to quickly sell underlying loan holdings. “Should investor flows reverse, the mismatch in bank-loan funds could pose a material risk,” Moody’s analysts led by Stephen Tu wrote in a July 7 report. While mutual-fund investors have started souring on the loans, pulling $4.7 billion this year, other institutions have continued to amass record amounts of money to buy the debt. Firms from Apollo Global Management LLC to GSO Capital Partners LP raised an unprecedented $60.7 billion in the first half of 2014 for collateralized loan obligations, which pool loans and slice them into pieces of varying risk and return. “It’s a very complex, very large challenge requiring the consensus of market participants, including, in some cases, the borrower,” LSTA representative Howard Moore said in an e-mail. “Progress has been slower than we wanted, but the LSTA and its members are committed to improving the settlement process.” Without pressure from regulators, Wall Street’s biggest banks haven’t yet overhauled the market. They’ve been cutting hundreds of thousands of jobs to reduce costs as they face stricter regulations intended to help prevent another crisis. “You have to believe having an archaic system break would ultimately be more expensive for everyone, including the agent banks,” Eaton Vance’s Page said. “Many people have approached them and they have no interest” in fixing the problem. |

| Posted: 19 Sep 2014 05:21 AM PDT China is far more adept than the capitalist West in looking to the long term and nowhere is this more apparent in its attitude towards gold. |

| Scotland Says “No” – Fallout May Impact Pound Posted: 19 Sep 2014 05:15 AM PDT

The result of the Scottish independence referendum was announced early this morning, with 55.3% of voters wanting to stay in the United Kingdom (UK) and 44.7% wanting Scotland to become an independent nation.

To some extent a cloud of economic and currency uncertainty that was hanging over Scotland and the rest of the UK has now been lifted.

Share prices of Scottish related companies such as Royal Bank of Scotland (RBS) have rebounded and sterling was higher against the euro, Swiss franc, silver and gold (see Finviz.com table).

The pledges and promises to Scottish citizens by the 'Better Together' alliance will now have to be honoured. This includes devolution and decentralisation promises by the three main parties of the 'No' campaign, the Conservatives, Labour and the Liberal Democrats. One of the most important pledges was a promise that Members of Parliament (MPs) representing British citizens in Scotland will be allowed to exclusively vote on issues which only impact those citizens. As this agreement needs to be equitable for the other nations of the UK, it will also be rolled out to MPs representing Wales and Northern Ireland. Many other UK fiscal policies that affect Scottish voters will also now become priorities amongst the Westminster political class and their civil service. The outcome of the vote however has now provided the current UK government and HM Treasury with what it sees as a mandate to continue to manage the UK economy and the British pound in a steady as she goes fashion. This will probably mean that the recent volatility experienced by the pound sterling will die down for now. However, on a broader scale, the size of the 'Yes' vote, at 45%, signals that there is still deep unease in Scotland about being part of a larger United Kingdom and this unease is not about to go away. It may well spread to Wales and Northern Ireland. The next UK Government will probably be a Labour government as the electorate protests at the way the referendum was handled by the current Conservative/Liberal Democrats coalition. Therefore, the perceived 'safe haven' status of the UK economy and the financial powerhouse of London may start to be perceived as not such a safe haven.

Given the remaining uncertainties, it will be critical to closely watch how the UK's stock and bond markets perform in the coming months, how the pound sterling performs, and how international financial companies act as regards their London headquarters. With financial might continually shifting eastwards to Singapore, Hong Kong and Shanghai, it will be interesting to see whether the City of London can now recover from its recent bout of Scottish induced panic. Sterling may also come under pressure if central banks and large institutions diversify out of sterling and into dollars, euros, Swiss francs and indeed the up and coming global currency the Chinese yuan. LBMA Gold and Silver Forward Curves Withdrawn From Next Monday (22nd September 2014) Therefore, today is the last business day that this long dated forward pricing data will be supplied by the LBMA. Forward trades are over the counter trades where the two participants agree to buy/sell gold or silver now and sell/buy it back at a later date, usually with one leg of the trade being gold or silver and the other leg being US dollars. Since the LME will no longer have this data, they cannot price forward trades and so cannot provide a clearing service for London gold forwards since they will not have pricing data to 'mark to market' any outstanding gold forwards for their clients. This forward curve data had been supplied by the eight LBMA forward market makers since 2009, and then by seven market makers after Deutsche Bank dropped out earlier this year. The CME Group also provides a clearing service for gold forwards and it is unclear how the cessation of the pricing data to the LME might affect the CME's service. The CME Group was recently appointed by the LBMA to be the calculation agent and platform provider for the new LBMA Silver Price. Shorter term gold forward data, in the form of Gold Forward Offered rates (GOFO) will continue to be supplied by the forward market makers and published by the LBMA. Therefore, the gold/silver forwards decision by the LBMA and its associated Market Makers will not affect (GOFO) data. GOFO data will still, for the time being, be published in London each business day at 11am. LBMA Says 15 Companies Expressed Interest In Running New Gold Fix When the new silver fixing auction was being debated in the summer, the World Gold Council (WGC) took the initiative and organised a conference of gold market participants including miners and refiners to work out the key features of a new gold price auction. This WGC initiative appears to have been shot down by the LBMA who felt threatened that a gold mining representative organisation was muscling in on the London gold 'price discovery' mechanism. In advance of the LBMA choosing the winning bid, which may well be CME Group/Thomson Reuters again, the LBMA will be holding another seminar for 'market participants' that will feature presentations from the short-listed candidates. As per a similar LBMA Silver Price seminar that was held in June, the upcoming LBMA gold price seminar will no doubt include various concerned regulators attending as 'observers' such as the Bank of England and the Financial Conduct Authority (FCA), as well as the International Swaps and Derivatives Association (ISDA). ISDA will be concerned about how 'price discovery' in the new LBMA Gold Price auction will impact the huge outstanding pile of gold price related derivatives that ISDA coordinates. Since gold is a monetary metal and is strategic as the basis of all fiat currencies, the Bank of England will no doubt be sending senior representatives to the seminar to protect the Bank's interests. And since trade 'clearing' of the phenomenally large volume of loco London unallocated account gold fixing trades is so important for the six bullion bank members of London Precious Metals Clearing Limited, it will be a given that HSBC, JP Morgan, Deutsche Bank, Barclays, ScotiaMocatta and UBS will attend the LBMA seminar in an attempt to preserve the City of London's unallocated account clearing status quo. View GoldCore's Latest Webinar Here: How to Buy Gold Bullion Today and When To Sell Gold MARKET UPDATE Gold climbed $3.30 or 0.27% to $1,224.90 per ounce and silver rose $0.02 or 0.11% to $18.51 per ounce yesterday. Overnight, spot gold in Singapore recovered from falls seen on the illiquid NY Globex market and rose from $1,220/oz to $1,227/oz prior to some selling during London trading. Gold is set for a 0.3% drop for the week. The metal fell to $1,216.01 in the prior session, its lowest since January – before recovering slightly. Silver, platinum and palladium were all headed for a weekly decline in prices. Platinum is currently trading at $1,347, and is 0.27% lower from yesterday and down 1.24% on the week. The palladium price was marginally lower in London trading today at $827, down 0.36% from yesterday and is 0.24% lower on the week. Physical demand in Asia has ramped up with the lower prices, giving some support. Premiums in top buyer China held steady at $5-$6 an ounce, compared with about $4 earlier in the week. Yesterday, China launched a gold exchange open to foreign players for the first time, as the world’s largest gold bullion buyer races to set the benchmark price in Asia. Short term weakness is likely as the current trend and momentum is down. The medium and long term outlook remains positive, especially given geopolitical risks and robust physical demand from the Middle East, India and China. by Ronan Manly , Edited by Mark O'Byrne |

| Scotland Says No - Pound To Suffer From Fallout Posted: 19 Sep 2014 05:01 AM PDT gold.ie |

| Deutsche Bank dour over gold investment in India Posted: 19 Sep 2014 04:41 AM PDT A shift away from physical to financial savings through bank deposits, mutual funds and insurance is gathering steam, says Deutsche Bank. |

| Asian gold demand to kick in here - Suchecki Posted: 19 Sep 2014 04:25 AM PDT The manager of analysis and research at the Perth Mint comments on the direction of the gold price and sticks his neck out again with a prediction. |

| Solution to cure India of impure gold gains traction Posted: 19 Sep 2014 04:25 AM PDT A new unique identification number for each gold jewellery to ensure purity certification is part of a plan to fight the problem of impure gold in India. |

| Silver - Almost Time to Backup the Truck and Load up Posted: 19 Sep 2014 04:15 AM PDT marketoracle |

| SILVER PRICE : A Collapse and a Rally Posted: 19 Sep 2014 04:15 AM PDT marketoracle |

| CHARTS : Silver Price at Critical Juncture Posted: 19 Sep 2014 04:15 AM PDT marketoracle |

| Gold and Silver Technical Update Posted: 19 Sep 2014 04:10 AM PDT actionforex |

| Why I Believe Gold & Silver have been Massacred Since 2011 Posted: 19 Sep 2014 03:16 AM PDT

Click here for more on why gold & silver have been massacred since 2011: |

| ‘Shanghai Gold’ contracts aimed at foreign investors Posted: 19 Sep 2014 01:32 AM PDT The new 'Shanghai Gold' contracts necessitated the importing of two tonnes of Swiss gold over 48 shipments in the first 8 months of this year. |

| No merger on horizon for Alacer Gold, OceanaGold Posted: 19 Sep 2014 01:26 AM PDT Alacer's stock jumped 10% on the ASX after an Australian newspaper reported it had rejected several takeover approaches from OceanaGold. |

| Gold Future Bearish Theme Reinforced Posted: 19 Sep 2014 12:55 AM PDT investing |

| Gold: Finding Support Where It Should Posted: 19 Sep 2014 12:50 AM PDT investing |

| Gold Elliott Wave Analysis: Two Scenarios Both Bearish Posted: 19 Sep 2014 12:45 AM PDT investing |

| Gold loses the positive momentum – Analysis - 19/09/2014 Posted: 19 Sep 2014 12:45 AM PDT economies |

| Gold Price Analysis - September 18 Posted: 19 Sep 2014 12:40 AM PDT dailyforex |

| Gold Ticks Up; Watch the Year Open at 1206 if Reached Posted: 19 Sep 2014 12:40 AM PDT dailyfx |

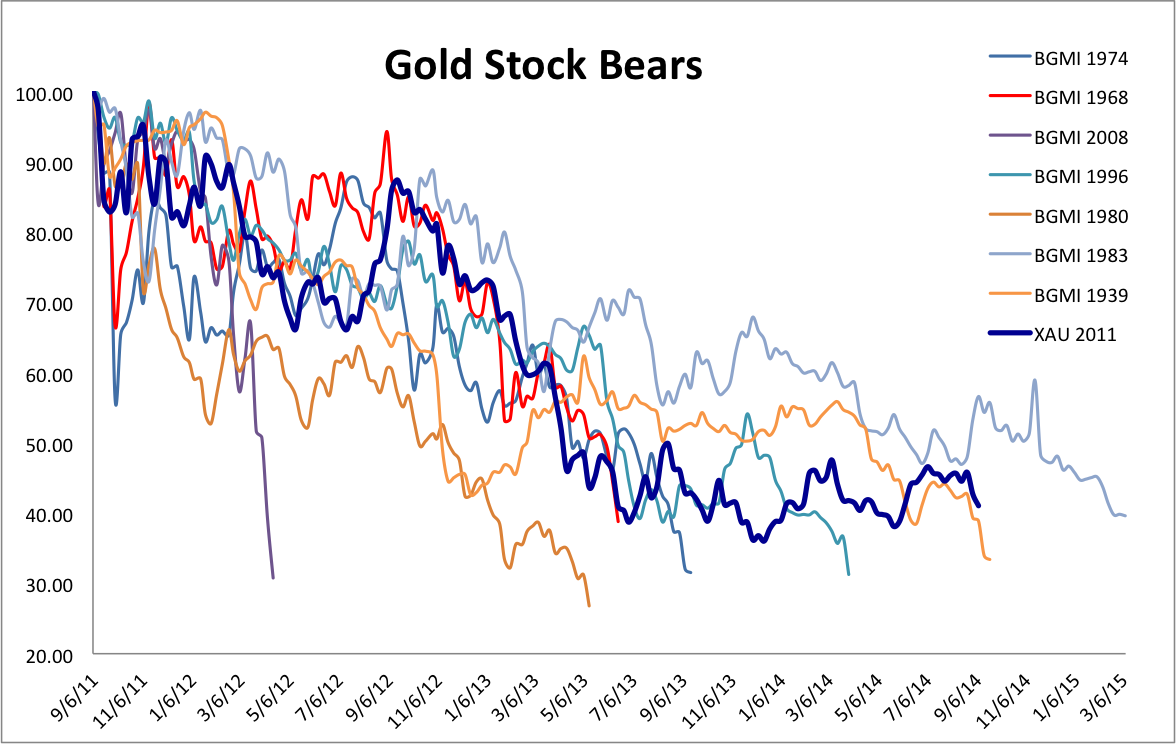

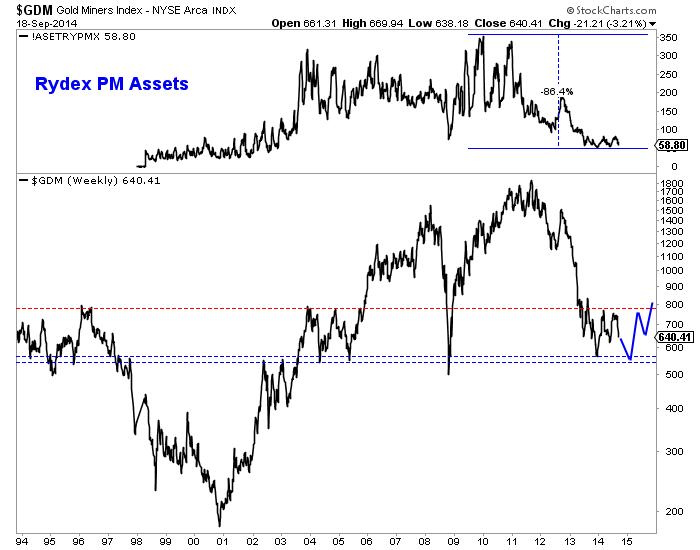

| Bird’s Eye View of the Gold Stocks Posted: 18 Sep 2014 11:44 PM PDT Since last summer, investing in the mining sector has been akin to riding a mini roller coaster. There have been two huge rallies, two sudden and sharp declines while more than a handful of individual stocks have rebounded over 200% from their lows. Nevertheless, as we noted a few weeks ago the weakness of the metals won out and are dictating the terms. Since we covered the metals in our last missive we wanted to focus solely on the miners. A look at the bear market analog chart as well as a very long-term chart of GDM illustrates the coming risks and opportunities. Here is the updated bear analog chart for the gold stocks. The XAU is used for the current bear market. This chart helped identify the opportunity at the June 2013 and December 2013 lows. There has been only one bear market worse than 70%. If you believe the gold stocks have not bottomed then this is the second worst bear in terms of time. The chart argues that if the December low is taken out, it would be so only marginally. A 65% loss at the December 2013 low could become 67% or 68% but probably not anything worse.

Below is a weekly line chart of GDM, the NYSE Gold Miners index and the basis for GDX. This is one of the broadest indices for miners. GDM has two levels of strong support which date back 20 years. GDM would have to decline 13% and 17% to test those supports. At the top, we plot the assets in the Rydex Precious Metals Fund which have dwindled 86%. We plot in blue a rough projection only for consideration purposes.

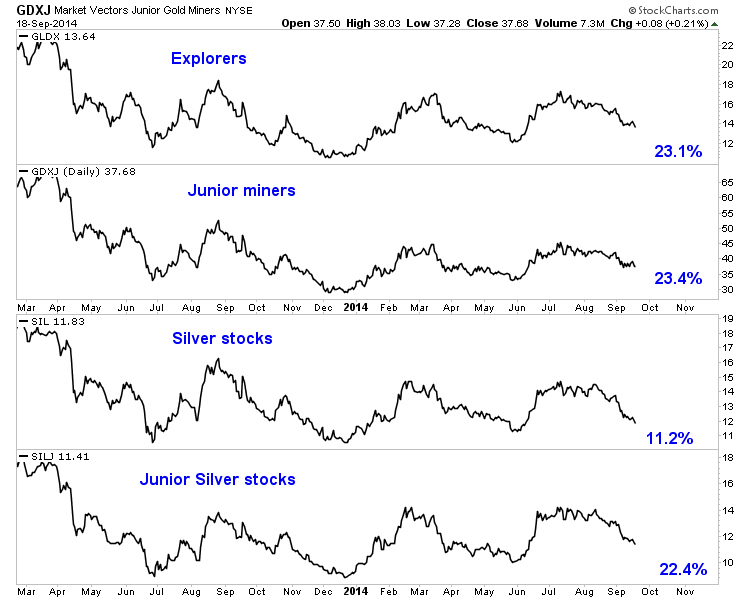

In looking at long-term charts of miners, I find that a double bottom (seen above) is definitely possible. In the chart below we plot GLDX, GDXJ, SIL and SILJ. Considering a 3% margin of error, three of the four ETFs would have to decline more than 25% to rule out a long-term double bottom.

The risk is quite clear. Failed moves produce fast moves. The miners failed to breakout and have tumbled. The late May lows mark the next support but these points do not amount to much beyond the daily charts. Furthermore, after $1200 Gold's next strong support isn't until $1080, the 50% retracement of the entire bull market. Hence, there is a growing risk of the miners falling to their December lows. Therein lies the opportunity. Only time will tell but that point could immediately mark a shift from risk to amazing opportunity. We invite you to learn more about our premium service in which we will soon publish a report on our top 5 buys at the bear market bottom. Good Luck! Jordan Roy-Byrne, CMT

The post Bird's Eye View of the Gold Stocks appeared first on The Daily Gold. |

| US inflation minus 0.2% as economic growth falters Posted: 18 Sep 2014 11:30 PM PDT The fall in CPI inflation to minus 0.2 per cent in the United States last month is the latest indicator that the US economic recovery is stuttering to an end. Moderate inflation indicates a healthy economy, no inflation means the pulse is failing. Still readers of the financial columns could be forgiven for missing this key piece of economic data. It was hardly reported in a financial media taken over by a wave of propaganda to sell the $22 billion Alibaba IPO today. Deflation next? The facts speak for themselves. The US economy is flirting with deflation, that is to say the falling prices that the Federal Reserve has been printing money like nobody’s business to avoid since the Global Financial Crisis. Why is this happening now? Basically the price of commodities has slumped across the board this year due to the recession in China, that none of the official figures come close to revealing. Chinese factories need less raw materials so commodity prices are going down. Electricity consumption in China is down two per cent this year. That’s a more realistic gauge of GDP than the completely ludicrous GDP figures produced by the authorities. Aren’t falling prices in the US something to be happy about? True this is fine so long as your salary does not fall or your job disappear. The higher US dollar is also a consequence and that is not good for exports nor earnings brought home by US multinationals. Deflationary shock There is also a reason why the Fed has battled so hard to prevent deflation. It’s utterly toxic to a heavily indebted economy like the US as it increases the real cost of that debt. How will the Fed respond? That really is the $64 billion question. More money printing would be the standard answer except that the Fed is committed to winding up its QE program next month as the US economy is ’so strong’. What will it take to shake this belief? Near zero inflation ought to be enough but clearly it is not. A Wall Street crash, on the other hand, would be a wake up call. |

| Gold could be the beneficiary of today's asset bubbles: Jeff Nichols Posted: 18 Sep 2014 11:16 PM PDT Jeff Nichols warns that optimism about US economy may be misplaced as OECD has cut its growth projections for US and other economies. |

| Dirty Secret of $1 Trillion Loans is When You Get Your Money Bac Posted: 18 Sep 2014 11:02 PM PDT Imagine a trillion-dollar market that runs on faxes and phone calls while routinely tying up investors’ money for months before they get any return. That’s not fiction: It’s the unregulated market for leveraged corporate loans. In a financial system that is increasingly automated, the origination and trading of loans is in the relative dark ages while money pours in from mainstream investors such as Kansas and New York pension plans and mutual funds catering to individuals seeking high yields in an era of near-zero interest rates. The antiquated structure of a market that’s ballooned from a mere $35 billion in 1997 poses a growing threat, raising the odds of gridlock in a downturn when investors expect to get their money back with a click of a button. As of yet, no regulators have taken responsibility for fixing the deficiency. This longish, but very interesting Bloomberg article, filed from New York, appeared on their Internet site at 9:29 a.m. Denver time yesterday morning---and it's courtesy of reader Howard Wiener. |

| Posted: 18 Sep 2014 11:02 PM PDT The first interview is with David P. out of Europe---and it's headlined "A Major War is Now Raging in the Gold Market"---and the second with Egon von Greyerz is entitled "Here is the Great-Game Changer That Will Shock the World". And lastly is this commentary by Nigel Farage---and it bears the headline "The Chilling Truth About Putin, Europe and Gold" [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests to them, and not to me. Thank you. - Ed] |

| Super-rich rush to buy 'Italian Job'-style gold bars Posted: 18 Sep 2014 11:02 PM PDT The super-rich are looking to protect their wealth through buying record numbers of "Italian job" style gold bars, according to bullion experts. The number of 12.5 kg gold bars being bought by wealthy customers has increased 243pc so far this year, when compared to the same period last year, said Rob Halliday-Stein founder of BullionByPost. The bars which are made from pure gold and are worth more than £300,000 each at today's prices of $1,223 (£760) an ounce. The sales of 1kg gold bars, worth about £25,000 each, has doubled during the three months ended August, when compared to the same period last year, according to ATS Bullion sales figures. Sales of the more popular gold coins such as the quarter ounce sovereign and one ounce Krugerrand have also doubled this year, according to figures from BullionByPost. This gold-related news item appeared on The Telegraph's website at 10:45 a.m. BST on Thursday London time---and I found it embedded in a GATA release. It is, of course, worth reading. |

| Gold and silver end game is here, Embry tells USA Watchdog Posted: 18 Sep 2014 11:02 PM PDT USA Watchdog's Greg Hunter this week interviewed Sprott Asset Management's John Embry about manipulation of the monetary metals markets. "I have never seen it any more intense in terms of pressure in the paper market, which indicates we are near the end and there is something seriously wrong with the system," Embry says. The interview is headlined "Gold and Silver End Game Here: John Embry" and can be read and watched at USAWatchdog.com Internet site. Harold Wiener was one of the first people through the door with this interview, but I borrowed the above paragraph of introduction from Chris Powell. |

| China Opens Gold Market to Foreigners Amid Price Ambition Posted: 18 Sep 2014 11:02 PM PDT China will give foreign investors direct access to its gold market for the first time today as the biggest-consuming nation seeks to exert more influence over prices while boosting the yuan’s global use. The Shanghai Gold Exchange will start trading contracts in the city’s free-trade zone that will be linked to its domestic spot market and available to about 40 international members including Goldman Sachs Group Inc. and UBS AG. Access was previously limited to some Chinese units. Gold in China this year cost as much as $31 an ounce more and $42 less than the London spot price, according to data compiled by Bloomberg. “It’s indicative of the ambition to move the gold market more to where the consumption is,” Victor Thianpiriya, commodity strategist at Australia & New Zealand Banking Group Ltd., said by phone from Singapore. “It makes sense that price discovery occurs in the center of consumption.” This Bloomberg article, co-filed from Singapore and Beijing, appeared on their website at 8:05 a.m. MDT yesterday---and it's another article I found in a GATA release very early yesterday morning. |