Gold World News Flash |

- The Divergence Between Debt and Gold

- More Imaginary ‘Terrorism’

- Nigel Farage On The Chilling Truth About Putin, Europe & Gold

- The Collapse of the Concept of Fiat Currency

- FX Markets In Turmoil On Scottish Vote & Japan Economic Downgrade

- DOLLAR COLLAPSE: Largest Event in Human History | Duane & Hoffman

- When War Erupts Patriots Will Be Accused Of Aiding "The Enemy"

- FX Markets In Turmoil On Scottish Vote & Japan Economic Downgrade

- BofA Says Bearish Bonds Means Bullish Greenback

- Why Global Growth Is So Disappointing

- The Next Crisis - Part 1

- Gold Price Bounced Smartly Up Off the Low

- Monetary Policy Weighs on Precious Metals

- Gold Daily and Silver Weekly Charts - Making Room for Alibaba - For All That

- A Comprehensive View On Europe’s Geopolitical Situation

- Elliott Wave Projection For Gold Price And US Dollar

- Bad News for Gold from the Strong Dollar

- Global Leaders Lying About The State Of The Economy, As Gold Is On Sale

- US Dollar Index Still Rising

- What The Next Crisis Will Look Like

- A Major War Is Now Raging In The Gold Market

- Silver Price: A Collapse and a Rally

- Silver Buyers Keep Stacking And Demand Higher Despite Falling Prices

- Monetary Policy Weighs on Gold and Silver

- Gold Price Hammered by Strong U.S. Dollar

- Gold Prices Erase All 2014 Gains on US Fed Outlook, Asian Demand "Good" as Shanghai Launches FTZ Trading

- China opens gold market to foreigners amid price ambition

- Gold and silver end game is here, Embry tells USA Watchdog

- Super-rich rush to buy 'Italian Job'-style gold bars

- Miner raises funds to dig for gold in Ireland

- Super-rich rush to buy 'Italian Job' style gold bars

- "Gradual" Gold Bull Market to Start 2015, "Next Floor at $1200" Says GFMS

- It’s Not the Fed Taking Gold Down, but the Vote in Scotland

- Apples to Apples in Mining Analysis

- All Hail the US "Petro-Dollar"

- Silver: A Collapse and a Rally

- The Hottest Trend in Technology Today

- Jim Bianco on Gold, Oil, and Why the Market Doesn't Care About Geopolitical Events

| The Divergence Between Debt and Gold Posted: 19 Sep 2014 12:00 AM PDT Le Cafe Américain | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 18 Sep 2014 11:00 PM PDT by Jeff Nielson, Bullion Bulls Canada:

Note one thing which the Liars of the Corporate media are NEVER able to supply as they fabricate these imaginary “terrorist plots”: a rational MOTIVE. Exactly how does “beheading” some anonymous, Australian do ANYTHING to remove the Puppet Tyrants which the West has planted throughout the Muslim world…??? PLEASE: think when you read this nonsense. Because if you think, you will immediately reject these absurd “plots” — because they make absolutely no sense at all. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nigel Farage On The Chilling Truth About Putin, Europe & Gold Posted: 18 Sep 2014 09:02 PM PDT  On the heels of the Scottish vote, today MEP Nigel Farage spoke with King World News about the chilling truth regarding Europe, Putin, Russia and the Ukraine crisis. Farage also discussed what is happening with the gold market and his speech in the European Parliament. On the heels of the Scottish vote, today MEP Nigel Farage spoke with King World News about the chilling truth regarding Europe, Putin, Russia and the Ukraine crisis. Farage also discussed what is happening with the gold market and his speech in the European Parliament.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Collapse of the Concept of Fiat Currency Posted: 18 Sep 2014 08:40 PM PDT from perpetualassets: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX Markets In Turmoil On Scottish Vote & Japan Economic Downgrade Posted: 18 Sep 2014 08:10 PM PDT from ZeroHedge:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DOLLAR COLLAPSE: Largest Event in Human History | Duane & Hoffman Posted: 18 Sep 2014 07:55 PM PDT IN THIS INTERVIEW:- Silver market below $19 ►0:54- Gold sentiment nearly as low as the beginning of the gold bull market ►4:45- State secessions coming? ►8:19- "The largest event in human history" ►15:11- Retirement account vs physical precious metals? ►19:15 [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| When War Erupts Patriots Will Be Accused Of Aiding "The Enemy" Posted: 18 Sep 2014 07:17 PM PDT Submitted by Brandon Smith via Alt-Market blog, In modern times, war is never what it seems. Mainstream historians preach endlessly about grand conflicts over territory, resources, political impasse, and revenge, but the cold hard reality is that all of these “motivations” are actually secondary, if they are relevant at all. As I and many analysts have covered in great detail in the past, most wars are engineered wars. International elites have long seen advantages in pitting two seemingly opposed societies or ideologies against each other while playing both sides of the chessboard to direct events towards a predetermined and desired outcome. This is undeniable historical fact. If you really want to understand the past, or the intricacies of war, you will be lost unless you accept that most conflicts are designed; they are not random or natural. They are not extensions of man's mere greed or ignorance. They are not products of resource scarcity (a common and overly simplistic misconception used to mislead activists). They are not inevitable developments of “overcomplexity” according to the Rand Corporation's “linchpin theory” propaganda. They are not the product of too much national sovereignty or individual liberty. No; traditional war is a tool for the organized ruling class. It always has been and always will be. This tool is used to turn the world into a vast petri dish, a bubbling beaker in a laboratory where social engineers hope to destroy the “old” to create something “new”. At its most paramount of purposes, the despair and terror of war is intended to change the fundamental collective unconscious of nations and populations. It is meant to change our beliefs, our morals, our principles. It is meant to mutate us into something else, something malleable and terrible, something we would not normally recognize. As we continue into the latter quarter of 2014, exactly 100 years after the first world war, I see much evidence to suggest we are headed for yet another engineered conflagration. It may be a war of terrorism and attrition between the U.S. and ISIS (an insurgency funded and trained by Western covert agencies). It may be a war of economic escalation between the West and the East (even though Russia is just as much a pawn of international banks like Goldman Sachs as any country in the West). Or, we may see all out global holocaust depending on the level of desperation and insecurity amongst the elites. What each liberty movement proponent, constitutionalist, and freedom fighter around the world needs to understand is that while we will be told that the enemy is Muslim extremism, or Russian aggression, or eastern economic subversion, the real target will be YOU. The advantages of war at this time would be immense to the globalist establishment, but the primary function will be the ability to co-opt, demonize, and/or wipe out legitimate opposition during the fog and confusion. If you have ever noticed that each consecutive presidential administration seems progressively more hell-bent than the last to sabotage our infrastructure and push us towards endless confrontation, you might want to ponder the possibility that the New World Order does not end with the fall of the American empire - it BEGINS with the fall of the American empire. Imagine a war in which a tangible and immediate threat is presented against the U.S. Not a CNN covered carpet bombing campaign in some poverty stricken hole on the other side of the world, but a real war right on our very own doorstep. Now, consider how this would psychologically affect the general public, and twist the principles of the average person. Imagine the kinds of morally relative impasses people would be willing to accept when they are truly afraid. Imagine what they would sacrifice to quell that fear. Imagine who they would sacrifice. In such an environment, the concepts of free speech and personal dissent are rarely respected. In war, dissent is often labeled treason, and free speech is labeled a peacetime privilege. The truth becomes a nuisance, or even a threat to the endurance of the state and by extension the collective. The same argument always arises – the argument that the survival of the group outweighs any disagreement the individual may have with the objectives of the group's leadership. In turn, calls for “unification” reach a religious fervor, regardless of whose benefit this unification ultimately serves. In the meantime, those who were tolerated as activists now become enemies of the state simply for doing what they have always done. The propaganda is already being put in place to assure the liberty movement is caught in the crossfire between the East and West. For years I have been warning readers about the false East/West paradigm and the directed build up to conflict with Russia and China with the goal of creating a rational historical narrative by which the dollar could be supplanted as the world reserve currency to make way for a long planned basket currency system under the control of the IMF and the Bank of International Settlements. During the crisis, Americans blame the East for the implosion of the dollar system rather than international and central bankers (the true culprits), and chaos ensues as the masses turn on each other while the elites sit back in relative comfort, letting us destroy each other. Another aspect of this plan, I believe, involves the hijacking of the image of the liberty movement. The liberty movement is essentially the most dangerous unknown element on the elite's global chessboard. In fact, because we understand that international financiers and central bankers are the real enemy, we have the ability to leave the chessboard entirely and play by our own rules. Widespread economic or military conflict provides an opportunity to neutralize liberty activists who might turn revolutionary. Recently, I came across an article from 'The Atlantic' titled 'Russia And The Menace Of Unreality'. Now, some alternative analysts would read this article and immediately shrug it off as yet another attempt by the Western media machine to propagandize against Russia. Though their motivations are genuine, these analysts would be cementing the delusion that Russia is the “good guy” and the U.S. is the ever present “bad guy”. The Atlantic piece is a far more intricate manipulation than they would be giving credit for. In the past I have pointed out that Russian government funded media outlet RT in particular is in fact an ingenious psy-op, not only run by the Russian government as The Atlantic asserts, but influenced by the globalist establishment. It is effective mainly because most of what it reports is absolutely true. What it does NOT report is where we must focus. This might be confusing unless you grasp how false paradigms work. The conflict dynamic between the U.S. and Russia is no more real than the conflict dynamic between Democrats and Republicans. If you understand that this time around, America is scripted to lose its pro-wrestling match with Russia, everything else comes into focus. As far as RT is concerned, here's the problem: 1) First, RT is relentless in its coverage of corruption within Western governments, but rarely if ever reports anything negative on the Russian establishment. I'm sorry, but Russia's economic policy is dominated by central bankers who are advised directly by Goldman Sachs and who are avid members of the IMF and the BIS. The RDIF (Russian Direct Investment Fund), manages billions in investments in Russia, works closely with Goldman Sachs, and the managing director of this institution is former IMF head and SDR advocate Dominique Strauss-Kahn. Vladimir Putin has openly called for the IMF's Special Drawing Rights basket currency to replace the dollar, demanded that Ukraine take loans from the IMF denominated in SDR's, and has a long time friendship with Mr. NWO himself, Henry Kissinger. The only “conflict” Russia has expressed with the globalists at the IMF is that it wishes to be more fully included in the SDR basket system, which has been the planned intention of the IMF anyway. All of this, and RT doesn't have any hard questions about the loyalties of its own government? 2) Second, the fact based reporting of RT, at least when it comes to the Western side of the globalist establishment, mimics the alternative journalism growing in popularity in the the U.S. At bottom, RT is a newcomer to the world of independent news analysis, but it is ultimately NOT independent, and most of what they do amounts to little more than regurgitated content from more original and insightful Western independent media sources. The Atlantic article above, very cleverly, makes it sound as if it is we witless writers in America who are getting all our info and inspiration from RT. And this is where we begin to see the true nature of the psy-op... 3) Third, because RT mimics our independent media so well, it appeals greatly to a large percentage of liberty movement activists, who tend to forget or are simply unaware that Russia is as much a part of the problem as our own government. There are many liberty proponents who will angrily defend Russia and RT without question simply because RT “speaks their language”, so Russia must be on their side. This was not as pressing an issue two years ago, when conflict with Russia was a ridiculous notion for many people. But today, conflict with Russia, at the very least on an economic scale, is an inevitability. If you read in full the linked Atlantic article, the narrative that is being constructed is clear – the establishment hopes to rewrite the history and image of the liberty movement by painting us as dupes radicalized by Russian propaganda, rather than being the originators of our own grassroots movement with our own philosophy and methodology. Through this, they take away our ownership of our own cause. Also, by blindly supporting Russia or the Russian government without considering their participation in the globalist run crisis, liberty activists help reinforce the soon-to-be manufactured lie that we are nothing but puppets of the Putin regime. If we publicly question the intentions of the Russian government as much as we question our own government, we can help to defuse this lie before it can take hold. How the mainstream views us or portrays us is not as important as how we view and present ourselves. If we become starry-eyed cheerleaders for Russia, we will lose our sovereign identity as a self motivated counter-movement to the NWO. If you believe like I do that a second American revolution is coming, identity means everything, and it should not be cast aside lightly. Mark my words, one day our activism will be deemed treason, and our rebellion will be marginalized as a servant satellite astro-turf movement organized by Russian interests. We can't prevent how they will label us, but we can make it clear now that we work for NO government, by refusing to disregard the trespasses of any government, even those who appear to support our position. Tied closely to the Russian issue, the liberty movement also has the return of the “White Al-Qaeda” meme to look forward to. I have seen a tidal wave of mainstream news stories lately preaching the horrors of a white middle-class America secretly swarming to the Syrian border to join ISIS. The narrative is setting the stage for false flag terrorism, to be sure, but it is also injecting the theme that anyone who is anti-establishment could be a terrorist. Not an American bred “terrorist” with his own American-centric ideology fighting against what he sees as a despotic government, but a mercenary extremist desperate for any cause, latching onto the concept of Muslim caliphate because he is bewildered, angry, or insane. In this way, the elites hope to kidnap the liberty culture's identity, rewriting us into their theater not even as “misguided” freedom fighters, but rather, as pawns of a foreign cabal. Many people could be convinced to join a fight by Americans for Americans, no matter how the mainstream portrays our character. But, no one wants to join a group of traitors and sellouts fighting for theocratic Muslim monsters, or covert Russian agencies after the East is blamed for the collapse of the dollar. The complete erasing and rewriting of a movement's identity through false association is advanced 4th generation warfare, and it can only be accomplished in the midst of overwhelming catastrophe. The masses have to be so afraid they begin to lose memory of what life was like before, let alone who stood for what cause. The public is already quite familiar with the idea that governments buy revolutionaries and create rebellions, just as our government has done in Syria. Why wouldn't they believe that the Liberty Movement's rebellion is also actually bought and paid for by some outside enemy, rather than real Americans battling for real freedom? This examination is not meant to undermine the positive accomplishments made so far by liberty advocates. We have come a long way. However, if we underestimate or oversimplify the task we have ahead of us, or the well calculated strategies of the internationalists, then we are destined to fall into the trap of becoming yet another element of another false paradigm ourselves, and we will lose. This is a war on all fronts; informational, emotional, intellectual, psychological, spiritual, and physical. It goes well beyond any war ever fought in generations past. If individuals and the activist movement at large do not have the insight and courage to commit fully to combat on every level, they should throw in their bug-out bags and give up now. If they do have the courage, then it is surely time to begin... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FX Markets In Turmoil On Scottish Vote & Japan Economic Downgrade Posted: 18 Sep 2014 06:36 PM PDT Cable (GBPUSD) is surging as the first results from the Scottish Referendum hit and a resounding "No" to independence appears confirmed. Almost back to pre-Scottish-Vote-fears level (1.66), cable is up 250 pips in the last 24 hours (its biggest move in over a year). GBP is also strengthening notably against EUR (2-year highs), CHF (2 year highs) and of course the JPY (6 year highs) as the Japanese government admits defeat and downgrades its economic assessment for the first time in 5 months (hence sell JPY as they 'must' do more money printing (despite Japanese businesses all pushing for a stronger JPY). FX markets are extremely volatile this evening and implicitly, equity futures are clanging around cluelessly. The USD Index is flat (gaving retraced all FOMC gains). Chaos in FX tonight...

GBPUSD is retracing all the Scottish vote fears...

And GBPJPY punched through 180 (as USDJPY broke 109)

As USDJPY is up 2 big figures from pre-FOMC...

After Japan downgraded its economic assessment for the first time in 5 months...

Abe, you have a problem (as the Sont CEO recently explained)

Because nothing says Buy The F##king Parabolic Meltup in today's new normal like an economic downgrade...

Gold is also sliding (except in JPY terms of course) - driven more by Japan than Scotland

Charts: Bloomberg | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BofA Says Bearish Bonds Means Bullish Greenback Posted: 18 Sep 2014 06:24 PM PDT US Treasuries are breaking out, according to BofAML's Macneil Curry, which is very supportive of the US dollar (especially against the JPY and EM FX). The only caveat, he warns, keep a close eye on fixed income volatility...

Via BofAML, 5yr Treasuries are breaking out. This is supportive of the US $ against ¥ US Treasuries yields are on the move, resuming their long term uptrend. Our focal point for this move is 5yr yields which have broken out from a 1yr range trade and resumed their long term bear trend, targeting 2.025%/2.055% and eventually 2.18%/2.25%. This should help propel the US $ higher and maintain its long term bull trend. Looking at a weekly chart of the US $ Index, the trend is on track for long term targets between 89/91, particularly as the weekly ADX is breaking out through 6yr trendline resistance (meaning the trend has further room to run). In the very short term, however, we could see a period of pause in both the US $ bull trend and the advance in treasury yields as 2yr yields are testing a confluence of l/term support at 58.9bps/61.1bps and the US $ Index is testing the Jul'13 highs at 84.75. But we must stress that this should be a temporary pause and ultimately a buying opportunity. In particular we think that the next bout of US $ strength is likely to come against EM FX. $/¥ should also continue to appreciate, with a break of 108.95/109.00 exposing 12yr trendline resistance at 109.31 ahead of 110.67 and eventually beyond. One CAVEAT keep a close eye on FI Vol. A spike in the MOVE Index could lead to a nasty corrective snap back, albeit a snap back to buy $/¥; especially if 107.49/50 holds. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Global Growth Is So Disappointing Posted: 18 Sep 2014 05:49 PM PDT Submitted by Salient Partners' Epsilon Theory blog, Take your instinct by the reins The politics of dancing The fault, dear Brutus, is not in our stars, but in ourselves. In theory there is no difference between theory and practice. In practice there is.

Year after year we have had to explain from mid-year on why the global growth rate has been lower than predicted as little as two quarters back. … Indeed, the IMF's expectation for long-run global growth is now a full percentage point below what it was immediately before the Global Financial Crisis. … But it is also possible that the underperformance reflects a more structural, longer-term, shift in the global economy, with less growth in underlying supply factors. There is one great mystery in the high falutin’ circles of the Fed, ECB, and IMF today. Why is global growth so disappointing? There are different variations on this theme – why aren’t businesses investing more? why aren’t banks lending more? – but it’s all one basic question. First the Fed, then the BOJ, and now the ECB have taken superheroic efforts to inflate financial asset prices in order to bridge the gap between the output shock of 2008 and a resumption of normal economic growth. They’ve done their part. Why hasn’t the rest of the world joined the party? The thinking was that leaving capital markets to their own devices in the aftermath of the Great Recession could result in a deflationary equilibrium, which is macroeconomic-speak for falling into a well, breaking your leg, at night, alone. It’s the worst possible outcome. So the decision was made to buy trillions of dollars in assets, forcing all of us to take on more risk with our money than we would otherwise prefer, and to jawbone the markets (excuse me … “employ communication policy”) to leverage those trillions still further. All this in order to buy time for the global economic engine to rev back up and allow private investment activity to take over for temporary government investment activity. It was a brilliant plan, and as emergency intervention it worked like a charm. QE1 (and even more importantly TLGP) saved the world. The intended behavioral effect on markets and market participants succeeded beyond Bernanke et al’s wildest dreams, such that now the Fed finds itself in the odd position of trying to talk down the dominant Narrative of Central Bank Omnipotence. But for some reason the global economic engine never kicked back in. The answer? We must do more. We must try harder. And so we got QE2. And QE3. And Abenomics. And now Draghinomics. We got what we always get in the aftermath of a global economic crisis – a temporary government policy intervention transformed into a permanent government social insurance program. But the engine still hasn’t kicked in. So now villains must be found. Now we must root out the counter-revolutionaries and Trotskyites and Lin Biao-ists and assorted enemies of progress. Because if the plan is brilliant but it’s not working, then obviously someone is blocking the plan. The structural villains per Stanley Fischer (who is rapidly becoming a more powerful Narrative voice and Missionary than Janet Yellen): housing, fiscal policy, and the European economic slow-down. Or if you’ll allow me to translate the Fed-speak: consumers, Republicans, and Germany. These are the counter-revolutionaries per the central bank apparatchiks. If only everyone would just spend more, why then our theories would succeed grandly. Hmm. Maybe. Or maybe what we want and what we need has been confused. Maybe the thin veneer of ebullient hollow markets has been confused for the real activity of real companies. Maybe the theatre of a Wise Man with an Answer has been confused for intellectually honest leadership. Maybe theoretical certainty has been confused for practical humility. Maybe the fault, dear Brutus, is not in external forces like Republicans or Germans (or Democrats or Central Bankers), but in ourselves. Let me suggest a different answer to the mystery of missing global growth, a political answer, an answer that puts hyper-accommodative monetary policy in its proper place: a nice-to-have for vibrant global growth rather than a must-have. The problem with sparking renewed economic growth in the West is that domestic politics in the West do not depend on economic growth. What we have in the US today, and even more so in Europe (ex-Germany), are not the politics of growth but rather the politics of identity. At the turn of the 20th century the meaning of being a Democrat or a Republican was all about specific economic policies … monetary policies, believe it or not. You could vote for Republican McKinley and ride on a golden coin to Prosperity for all, or you could vote for Democrat Bryan and support silver coinage to avoid being “crucified on a cross of gold.”

Today’s elections almost never hinge on any specific policy, much less anything to do with something as arcane as monetary policy. No, today’s elections are all about social identification with like-minded citizens around amorphous concepts like “justice” or “freedom” … words that communicate aspirational values and speak in code about a wide range of social issues. Don’t get me wrong. There’s nothing inherently bad or underhanded about all this. I think Shepard Fairey’s “HOPE” poster is absolute genius, rivaled only by the Obama campaign’s genius in recognizing its power. Nor am I saying that economic issues are unimportant in elections. On the contrary, James Carville is mostly right when he says, “It’s the economy, stupid.” What I am saying is that modern political communications use neither the language nor the substance of economic policy in any meaningful way. Words like “taxes” and “jobs” are bandied about, but only as totems, as signifiers useful in assuming or accusing an identity. Candidates seek to be identified as a “job creator” or a “tax cutter” (or accuse their opponent of being a “job destroyer” or a “tax raiser”) because these are powerful linguistic themes that connect on an emotional level with well-defined subsets of voters on a range of dimensions, not because they want to actually campaign on issues of economic growth. Candidates have learned that while voters certainly care about the economy and their economic situation, the only time they make a voting decision based primarily on specific economic policy rather than shared identity is when the decision is explicitly framed as a binary policy outcome – a referendum. Even there, if you look at the ballot referendums over the past several decades (Howard Jarvis and Proposition 13 happened almost 40 years ago! how’s that for making you feel old?), the shift from economic to social issues is obvious.

Both the Republican and the Democratic Party have entirely embraced identity politics, because it works. It works to maintain two status quo political parties that have gerrymandered their respective identity bases into a wonderfully stable equilibrium. The last thing either party wants is a defining economic policy question that would cut across identity lines. But until the terms of debate change such that an electoral mandate emerges around macroeconomic policy … until voters care enough about Growth Policy A vs. Growth Policy B to vote the pertinent rascals in or out, despite the inertia of value affinity … we’re going to be stuck in a low-growth economy despite all the Fed’s yeoman work. I know, I know … what blasphemy to suggest that monetary policy is not the end-all and be-all for creating economic growth! But there you go. At the very moment that elections hinge on the question of economic growth, we will get it. But until that moment, we won’t, no matter what the Fed does or doesn’t do. What reshapes the electoral landscape such that an over-riding policy issue takes over? Historically speaking, it’s a huge external shock, like a war or a natural disaster, accompanied by a huge political shock, like the emergence of a new political party or charismatic leader that triggers an electoral realignment. In the US I think that the emerging appeal of national Libertarian candidates (all of whom, so far anyway, have the last name Paul) is pretty interesting. The 2016 election has the potential to be a watershed event and set up a realignment, if not in 2016 then in 2020, which hasn’t happened in the US since Ronald Reagan transformed the US electoral map in 1980. And yes, I know that the conventional wisdom is that a viable Libertarian candidate is wonderful news for the Democratic party, and maybe that will be the case, but both status quo parties today are so dynastic, so ossified, that I think everyone could be in for a rude awakening. It’s a long shot, to be sure, mainly because the US economy isn’t doing so poorly as to plant the seeds for a reshuffling of the electoral deck, but definitely interesting to watch. What’s not a long shot – and why I think Draghi’s recently announced ABS purchase is a bridge too far – is a realigning election in Italy. I like to look at aggregate GDP when I’m thinking about the strategic interactions of international politics, but for questions of domestic politics I think per capita GDP gives more insight into what’s going on. Per capita GDP gives a sense of what the economy “feels like” to the average citizen. It addresses Reagan’s famous question in the 1980 campaign with Jimmy Carter: are you better off today than you were four years ago? It’s a very blunt indicator to be sure, as it completely ignores the distribution of economic goodies (something I’m going to write a lot about in future notes), but it’s a good first cut at the data all the same. Here’s a chart of per capita GDP levels for the three big Western economies: the US, Europe, and Japan. The Great Recession hit everyone like a ton of bricks, creating an output shock roughly equal to the impact of losing a medium-sized war, but the US and Japan have rebounded to set new highs. Europe … not so much. Let’s look at Europe more closely. Here’s a chart of the big three continental European economies: Germany, France, and Italy. Germany off to the races, France moribund, and Italy looking like it just lost World War III. I mean … wow. More than any other chart, this one shows why I think the Euro is structurally challenged. First, why in the world would Germany change anything about the current Euro system? The system works for Germany, and how. Alone among major Western powers, the politics of growth are alive and well in Germany. “But Germany, unless you lighten up and embrace your common European identity, maybe this sweet deal for you evaporates.” Ummm … yeah, right. The history books are just chock-full of self-interested creditors with sweet deals that unilaterally made large concessions before the very last second (and often not even then). Second, why in the world would Italy accept anything about the current Euro system? The system fails Italy, and how. The system fails other countries, too, like Spain, Portugal, and Greece, but these countries are in the Euro by necessity. Their economies are far too small to go it alone. Italy, on the other hand, is in the Euro by choice. Its economy is plenty big enough to stand on its own, and with a vibrant export potential, an independent and devalued lira is just what the doctor ordered to get the economic growth engine revved up. Short term pain, long term gain. Why doesn’t Italy bolt? Lots of reasons, most of them identity related. Also, let’s not underestimate the power of cheap money to keep the puppet-masters of the Italian State in a Germany-centric system. The system may fail Italy as a whole, but if you’re pulling the strings of the State and can borrow 10-year money at 2.5% to keep your vita nice and dolce … well, let’s keep dancing. Still, nothing focuses the electoral mind like the economic equivalent of losing a major war. At some point in the not so distant future there will be an anti-Euro realigning election in Italy. And that will wake the Red King.

In the meantime, Draghi will go forward with his ABS purchase scheme, a brilliant theory that will deliver frustratingly slim results quarter after quarter after quarter. Until the politics of growth are embraced outside of Germany, European banks will remain reticent to lend growth capital to small and medium enterprises. Until the politics of growth are embraced outside of Germany, large enterprises with plenty of cash and access to cheap loans will remain reticent to invest growth capital. Maybe a little M&A, sure, but no new factories, no organic expansion, no grand hiring plans. The thing is, Draghi knows that he’s pushing on a string with the ABS program and that growth won’t return until the fundamental political dynamic changes in France in Italy, which is why he is calling both countries out by name to institute “structural reforms”. But in typical European fashion this entire debate is Mandarin vs. Mandarin, with almost all of the proposals focused on regulatory reform rather than something that must be hashed out through popular legislation. So long as economic policy reform is imposed from above … so long as we are engaged in modern-day analogs of Soviet Five-Year Plans … I believe we will remain stuck in what I call the Entropic Ending – a long gray slog of disappointing but not catastrophic aggregate economic growth. That’s not a terrible environment for stocks, certainly not for bonds, and the alternative – economic reform based on the hurly-burly of popular politics, is almost certain to be a wild ride that markets hate. But to get back to what we need (real growth) rather than what we want (higher stock prices) this is what it’s going to take. Elections always matter, but in the Golden Age of the Central Banker they matter even more. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

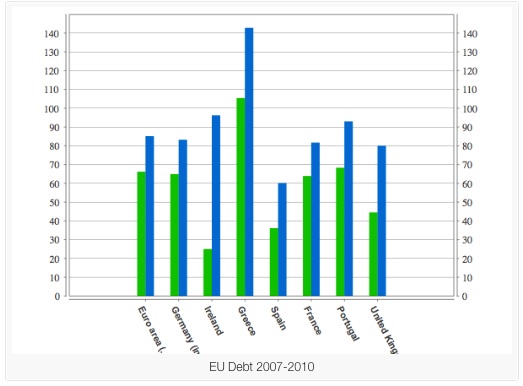

| Posted: 18 Sep 2014 04:45 PM PDT The present global financial ‘crisis’ began in 2007-8. It is not nearly over. And that simple fact is a problem. Not because of the life-choking misery it inflicts on the lives of millions who had no part in its creation, but because the chances of another crisis beginning before this one ends, is increasing. What ‘tools’ - those famous tools the central bankers are always telling us they have – will our dear leaders use to tackle a new crisis when all those tools are already being used to little or no positive effect on this one? I think it is worth remembering how many financial crises we have had since the economy became globally interconnected and since we began the deregulation of finance and the roll back of all Great Depression safeguards under Reagan and Clinton. It’s also worth noticing that the causes and pattern of the various crises have an unpleasant ring of familiarity about them – as in – the bank lobbyists making sure nothing gets learned and nothing gets changed. In the 80′s there were four financial crises: The Latin American crisis caused by those countries borrowing and the global banks agreeing to lend them far too much (too much lending to people who couldn’t afford it – check), the American Savings and Loan (S&L) crisis when American S&L’s made too many bad, long-term and leveraged loans relying on rolling over and over short-term loans to fund it all (reliance on short-term liquidity to cover massive loan books of dodgy loans – check) , and the 1987 Stock market crash when the system of global debt had its first major modern global paroxysm (systemic contagion – check) . And before the dust had even settled from that we had the Junk Bond collapse ( Too much junk – check. $400 billion in junk bonds were issued in 2013 alone). In the 90s there were two more crises (if one ignores the Mexican currency devaluation): The Asia currency crisis (a replay of the Latin Crisis with the same global banks doing the same lending to different corrupt or stupid leaders who agreed to loans on behalf of people who couldn’t afford to pay back – ie nothing learned at all - check) and the Dot Com bubble (valuations way above reality fueled by cheap money and lax lending – check). I think that’s most of the kinds of greed fueled idiocy accounted for. If you line up the S&L, the Junk Bond and the Dot Com bubble, America has had a major home-brewed financial crisis every ten years. If you consider that none of these events happened in isolation nor limited their effects to the country of origin then we have to conclude that the global financial system is prone to crises. You can, if you see the world through resolutely libertarian glasses, blame everything on interfering governments – it matters little. The fact remains that the system as is, is unstable and run by the myopic, the greedy and the corrupt. Where they draw their salary, which side of the revolving door they happen to be on, on any day seems to me irrelevant. The worst of them don’t understand and are easily bought. The best have no concern for anyone or anything beyond their next bonus. And here we are being led by them. Of course saying another crisis is coming is like saying we are due a large earthquake in Southern California. True, but it doesn’t mean one is going to happen tomorrow. What I think it does mean is that we should be thinking what our leaders, what the people they work for – the global overclass – might already have in mind or have already put in place, for what they want done next time. I think it would be foolish to imagine they have not thought about it and are not putting in place the things which will close off some futures and force us into others that they prefer. They have so very much to lose and so very much more they want to gain. The next crisis. To know what the next crisis might look like we first have to look at the conditions today that will form its starting point. Necessarily everything from here on is speculation, nevertheless even when we can’t know what people will do and what ‘events’ will overtake us, we can, I think, discern quite a bit of the general topography, the landscape, of the future. The first thing we should bear in mind is that however it starts, the next crisis will be another debt-crisis like the current one. This is because debt is now the global currency and global financing mechanism. Once it starts, however, one thing will be very different from the last time – this time nearly all nations are already heavily indebted. Last time they were not. And this is what changes everything for the over-class. Contrary to the endless misinformation repeated at every juncture by austerity politicians and bankers alike, the debt load of most nations at the beginning of the present crisis was not already out of control before the banks blew up. The green bars are debt as percentage of GDP before the bank bail outs and the blue bars are after. These are official Eurostat figures. Notice Ireland. Its debt to GDP was down at 27%. The ONLY thing that altered between 2007 and 2010 was the bank bails outs. Ireland’s ENTIRE debt problem is due to bailing out private banks and their bond holders. Britain’s debt almost doubled and again the ONLY thing that happened was bailing out the banks. The government claims that UK public debt was out of control due to spending on public services is just WRONG. UK government debt against GDP had not gone up in 7 years. Then when we bailed out the banks it nearly doubled. That is the fact as opposed to the propaganda of what happened and why. If you look a little more closely into the figures for government debt levels in Europe between 2000 and 2010 the fact is that all European nations apart from Portugal were either reducing their debt-to-GDP level or at least not allowing it to grow. Most of Europe was reducing government debt to quite manageable and historically low levels. Ireland’s debt was very low (27%). Take a good long look at those two bars for Ireland. Even Spain was bringing in more in tax than it was spending. Don’t take my word for it look at the figures yourself. Almost every European country was keeping debt to GDP even or going down – before the banks were bailed out that is. The exceptions, of course, were Greece and Italy whose debt was already very high even before they bailed out their banks. The sudden explosion of European sovereign debt is the direct and indisputable result of all our political parties deciding they would safeguard their mates’ and their own personal wealth (it is the top 10% who hold the bulk of their wealth in the financial products which would be destroyed in a bank collapse. NOT the rest of us!) by bailing out the private banks and piling their unpaid debts on to the public purse. So whatever the trigger of the next crisis may be, they know any solution which saves the wealth and power of the over-class will have to involve piling new, private-bank bad-debts on to already indebted sovereigns and that, our leaders must be keenly aware, will not be easy to force on an already angry public. They know a whole range of the assurances they might like to give us about what must be done when the next crisis hits and how those things will undoubtably save us, will not be so easy to shove down people’s throats. “So what,” I can hear the 1% saying, “can we do?” Here are some thoughts on what I think they can do, will do, are already begining to do and WHY they are doing them. The over-arching thought that I have, which shapes everything from here on, is that this crisis is no longer primarily financial; it is now political. Any solution, no matter for whose benefit, is beyond the scope of financial ‘reform’ but will depend on radical political change. In my opinion, the era of reformist politics is over. The questions are: radical change in which political direction? in whose hands? and for whose benefit? At the moment, I believe the radical thinking is almost all being done on the 1%’s side. They may talk about fixing, but what I think they mean is changing. When Obama spoke of change, he meant it. Just not primarily for you. The 1% are not stupid. They see the need for change and intend to control it. I think one of the cleverset things the 1% have done over the last few years is the way they have created a relentlless public discourse, via their paid political front-men and women and their media empires, to insist on the need to ‘fix’ and protect the system, and the extreme danger to us all should the system not be ‘saved’. This has served as a perfect cover for making sure that not enough people have noticed that the system is, in fact, being gutted and replaced by something that better serves the interests of the 1%. We have not been fixing the banks, we have been feeding them. So while the 1% are thinking ahead, too many of the 99% are still like rabbits in the headlights, mesmerized and paralysed. They have been told over and over that any radical change to our present financial and political system is impossible, and if tried, would only bring disaster upon us. The 1%, on the other hand, see clearly that the present system will bring disaster upon them if it is not changed radically. They can see that it must be almost done away with entirely – in all but name. The important thing for them is that the direction of radical change benefit them and that the 99% not even realise that it is happening. And so far it’s working – just. Just enough people continue, if grudgingly, to take refuge in a moribund political system made of parties and theories which date back to the Victorian age. The temporary triumph of the 1% is that despite the fact that no one would drive a Victorian car, nor wear Victorian shoes or clothes, they somehow feel there’s no choice but to rely on Victorian political institutions, parties and ideas. The good news is that the number who really believe this is dwindling and most of those who do, do so out of fear not faith. Which is why our present, 1% controlled politics, is increasingly about engendering fear rather than inspiring faith. Luckily truth has a wonderfully cleansing effect upon lies and fear. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Bounced Smartly Up Off the Low Posted: 18 Sep 2014 04:14 PM PDT

The GOLD PRICE three day chart shows a bottom yesterday about $1,217 and another today about $1,216. Today the gold price bounced smartly up off that low at 9:30 to its high at noon. Traded above $1,225 rest of the day. Since human beings are social animals on a par with lemmings, it's monumentally tough to run contrary to the herd. However, it's precisely moments like this when most everybody is dead-dog sure things will continue forever that they turn and go the other way. Wouldn't surprise me if gold did that tomorrow. The SILVER PRICE plunge didn't come until today, when it hit a $18.30 low. But that low was a clean V-bottom. Both silver and gold prices are powerfully oversold, but have to snap back hard before anybody but me will pay attention. Silver needs to climb above $18.75 and gold over $1,250. Otherwise the erosion will continue. Call me crazy, but I'll still take gold and silver with 6,000 years to the fiat US dollar's four decades. Continuing our lesson in not panicking today, the markets beat us with a small stick. Stocks rose, still drunk on the FOMC's non-statement, while the dollar index backed off and silver and gold fell. I'm gonna tell y'all one thing: the wonder workers and magicians at the Fed have NOT repealed the law of gravity,. This will end badly for the US dollar and for stocks. The US dollar has been a completely unbacked fiat currency since August 1971; gold and silver have been money since memory runneth not to the contrary. Those who bet against history or gravity lose.

US dollar index gave back 36 of the 53 basis points it had gained yesterday, closing at 84.39. That changes nothing, initiates no corrections. Must fall below 84.20 to talk about such things. Remains painfully overbought. Euro rose 0.43% to $1.2919. Yen fell another 0.33% after gapping down. That looks like an exhaustion gap. Closed at 92c/Y100. 10 Year Treasury note yield rose 1.12% to 2.629% and nearly touched its 200 DMA above at 2.648%. Odd. Markets really think that Janet Yellum can simply begin raising rates when the Zero Interest Rate Policy is the linchpin of all wickedness the Fed has worked since 2008? Or, maybe they're just computer jockeys following momentum. I'm too big a hick to know the difference. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Monetary Policy Weighs on Precious Metals Posted: 18 Sep 2014 02:51 PM PDT Background Gold has an inverse relationship with the US Dollar so when the dollar declines gold rises. The dollar is affected by monetary policy as decided by the various central bankers across the planet. We recently covered the effect of the European version of QE with an article entitled; ‘Why ECB QE Is Bearish For Gold Prices’ so today we will take a quick look at the ramifications for the precious metals sector emanating from the monetary policy meeting of the Federal Reserve held today. A brief overview of the Feds actions The two most important points to come out of today’s meeting were.... | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Making Room for Alibaba - For All That Posted: 18 Sep 2014 01:35 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Comprehensive View On Europe’s Geopolitical Situation Posted: 18 Sep 2014 12:55 PM PDT This an excerpt from the latest Global Gold Outlook Report (full paper). Take a free subscription to receive similar updates in the future via e-mail: www.globalgold.ch. After the end of the cold war, the United States dominated world affairs for nearly twenty years. However, the situation of a unipolar world has changed since the financial crisis of 2008 to a now multipolar world that includes China, Russia, India, Brazil and South Africa. These powers are influencing and manipulating the conflict zones we have today to their advantage. By analysing and dissecting the issues concerning the major conflict zones on our world map, as well as illustrating the parties involved, this article will explain what political and strategic interests are at play and how the development in major hotspots shape the big picture. This will identify the geopolitical forces that affect our European continent and what future concerns and worries await us. Conflict zones in the world There are now five conflict zones that affect the geopolitical situation of Europe:

Gaza, Syria, Iraq and Afghanistan all belong to a region, which the former security advisor Zbigniew Brzezinski had named the Eurasian Balkans, which included the Middle East and Central Asia. So in fact, our world incorporates two big conflict zones. One is the crumbling structure of different states in the Eurasian Balkans. The second one is Eastern Europe, in which we now have Russia struggling to be recognized as a world power. The world's conflict zones in detail Let's start with Gaza. The conflict between Israel and Hamas is a direct function of the creation of the Jewish state in 1948 and the stateless status of the Palestinians. Hamas fired rockets of different ranges, mostly coming from Iran, against Israel. By firing these rockets, Hamas demonstrated its willingness to inflict damage on Israel. By responding with air and ground attacks against Gaza, Israel was pursuing the following objectives:

After the retreat of the Israeli army from Gaza, Hamas reactivated its launching of rockets against Israel. Now there is a truce, but how long will it be observed? The war in Syria has two origins: the geopolitical rivalries between Iran, Turkey and Saudi Arabia, and the dictatorship of the religious minority of the Alawites under the leadership of the al-Assad family ruling a Sunni majority. The ayatollahs of Tehran want to extend the country's sphere of influence. For this reason, they support the regime of the Alawites, an offshoot of the Seventh Shiite branch, in Syria. Turkey and Saudi Arabia feel threatened by such influence. They therefore seek to overthrow the Shiite regime in Syria and replace it with a Sunni one. This is also why Turkey is now supporting the opposition oriented towards the Muslim Brotherhood with weapons. Because of this situation, the Salafist jihadist Islamic State (of Iraq and the Levant), ISIS, could grow to the best-organized group in Syria. The situation in Iraq is similar: Under the leadership of their Caliph al-Baghdadi, ISIS has conquered the western part of Iraq! The Iraqi army now controls only the southern region of Iraq. The Peschmergas, the army of the Kurdish Republic, are fighting ISIS from their territory in the northeastern part of Iraq with the support of American airstrikes. The fighting between ISIS and the Iraqi army is mostly around Baghdad. ISIS' main objective appears to be to destroy the Iraqi government and its army. Like in Syria, there is no longer an identity of a state of Iraq. With the creation of the Caliphate, ISIS has changed the whole structure of Iraq and Syria that was built by the British and the French after 1918 and the partitioning of the Ottoman Empire. This leads us to question what the future holds, whether other states like Turkey, Iran and Saudi Arabia could fall and new states could be created based on different religions and ethnicities. It is expected that the USA and its allies will mostly retreat from Afghanistan by the end of this year. This will create a vacuum in large parts of Afghanistan, which the Taliban who mostly belong to the ethnicity of the Pashtuns and the Tajiks of the former Northern Alliance could fill up with their combatants. The security forces of Afghanistan are still too weak to control the whole country. Obama had previously announced the Americans would definitely leave by the end of 2016. If the Taliban could occupy the South of Afghanistan, the North and the West would belong to the Tajiks. Such a development could also destabilize Pakistan. With these ambitions in mind, the Pashtuns of Afghanistan and Pakistan could erect a new country, Great Pashtunistan. The Tajiks of Afghanistan and Tajikistan could unite, creating a Great Tajikistan. Closer to home, the territory of today's Ukraine had belonged to different larger countries. Until the middle of the 18thcentury, the Tatars, who were controlled by the Ottoman Empire, ruled the southern part. Western and northern Ukraine were part of the Confederation of Poland and Lithuania. Since Empress Catherine the Great, the East had belonged to Russia. With the definitive dissolution of the Confederation in 1795, the Hapsburgs could annex the western part and Russia the northern part. After the First World War, Poland annexed the West of Ukraine, which was a Hapsburg territory at the time. When Hitler and Stalin destroyed Poland in 1939, the West of Ukraine became attached to the Soviet Republic of Ukraine. Finally, Chruschtschow added the Krim. So in fact, today we have a country that is mostly divided between the West, which is Ukrainian and the East, which is Russian. The southern region belongs to Ukrainians, who in the past were greatly influenced by Russian culture. The struggle we see today could in fact end in the partition of Ukraine, which is certainly one of the strategic objectives of the Russian President Putin. The role of regional powers All these conflict zones are dominated by the rivalries and ambitions of different regional powers. In the Middle East the key players are Turkey, Iran and Saudi Arabia. In Gaza, Turkey and Iran are struggling to influence the military actions of Hamas. Iran is delivering long-range missiles to Hamas to target the southern part of Israel. Turkey and Qatar together have contact with the political wing of Hamas. Both countries are politically oriented towards the Muslim Brotherhood, which was crushed last year by the new regime in Egypt led by former Field Marshal al-Sisi. Meanwhile, al-Sisi's regime found strong political and financial support by Saudi Arabia and other Gulf states. In Syria, the al-Assad regime receives Iranian support. While Iran is allegedly sending Hezbollah combatants from Lebanon (Hezbollah belongs to the same Shiite sect as the Iranians), Turkey is providing military support to the moderate opposition of the Syrian Free Army against the regime. It is said, yet unconfirmed, that until last year Saudi Arabia was helping the Salafist opposition. Whether this includes ISIS is questionable. The Saudis face a challenge in that they seek both an anti-Assad Syria and an anti-Shiite regime in Iraq, and at the same time want more moderate Sunni regimes gaining ground by fighting jihadist forces such as al-Qaeda, ISIS included. However, the situation in Syria has changed. The moderates are controlling only a small part of the country, the regime is surviving and the Salafists like ISIS are in a strong position. If ISIS can really consolidate the Caliphate with part of Iraq and Syria, then ISIS will pose a great threat to the kingdoms of Jordan and Saudi Arabia. Meanwhile, Iran extends its support to the regime and army in Iraq, who also belong to the same Shiite sect, as Turkey promotes the interests of the Kurds in Northern Iraq. By so doing, Turkey serves the interests of the Kurdish population within its own borders and secures the supply of crude oil from the fields of Northern Iraq. Afghanistan is the focus of the regional powers Iran and Pakistan. On one hand, Iran is influencing and helping the Tajiks of the former Northern Alliance. On the other hand, Pakistan is doing the same with the Taliban who, as we said earlier, mostly belong to the ethnicity of the Pashtuns. However, both have different futures when it comes to the possible partitioning of Afghanistan. While Iran stands to benefit, this is not the case for Pakistan. The identity of Pakistan could be threatened by the creation of a Great Pashtunistan by the Taliban. Therefore, the regime and existence of the Pakistani Republic is at stake. The case of Ukraine is more complicated. Here we have the global powers struggling for influence in Europe. Smaller states like Poland and Lithuania are mostly interested in Ukraine's membership in the EU and NATO. The region's history and the geopolitical situation are motivating these two countries to play a bigger role in the region's political developments. On the other end we have Germany which still favours maintaining a good relationship with Russia. The role of Russia and the USA in these conflict zones In addition to the regional powers Iran and Turkey, Russia and the United States are in direct competition on having the farthest-extending and strongest political influence on the states of the Middle East, particularly since 2008, the year of the war in Georgia. If in the Middle East the USA is helping one side, Russia is supporting the other – it is a matter of balance of powers. At the same time, both have developed opposing blocs of regional powers. Syria is now the best example, which embodies the rivalries between the two superpowers in the Middle East. The USA is supporting Turkey and Saudi Arabia for their influence on the outcome of the war in Syria. Through its (indirect) support of the Syrian Free Army, the USA not only seeks to destroy the regime of Bashar al-Assad, but also to get Russia out of Syria altogether. By so doing, Russia will lose its foothold in the region. The most important difference between the politics and strategies of Russia and the USA are their geopolitical interests. Both seek to extend their own regional influence while diminishing that of the other. Iran is a pivotal issue. As Russia seeks to help Iran gain further regional power, the USA seeks to end this perspective. In Iraq we have a similar situation. Russia is sustaining Iran and the Shiite government in Baghdad. Because of Russia's involvement in this conflict, the USA is still reluctant to send fighter aircrafts and weapons to the government of Iraq. Now we find them supporting the Peschmergas (and in this way also the army of Iraq) by launching airstrikes against ISIS. Realizing the increasing geopolitical importance of the Middle East, Russia has high ambitions for greater influence on the region. Therefore, the USA's actions in the civil war in Iraq must come with great caution. Any wrong step could cause the loss of a critical Sunni partner, such as Saudi Arabia, to the Russian camp. Although it may be very unlikely to happen, the risk remains. In Afghanistan, however, the two superpowers see eye to eye on what is at stake. The Russians fear the takeover of the Taliban in the future. Therefore, they were willing to sell combat helicopters to the USA for the army of Afghanistan to fight the Taliban. Similarly, a year ago, Russia was supporting the Americans with the use of Russian territory for American logistics in Afghanistan. However, this phase of collaboration is now over. Ukraine set the scene of direct confrontation between Russia and the USA. While Russia supports the separatist movements with weapons and fighters, American Special Forces are advising the Ukrainian army in their engagement against the separatists. The USA has an interest in the membership of Ukraine in NATO and the EU, but Russia cannot accept such a possibility and is therefore destabilizing the country. With the war in Ukraine President Putin probably has the following strategic objectives:

The role of the EU Today, the EU is still only a political and economic union as it lacks a military instrument. Because of this situation, NATO is the military protection to the EU. Without NATO, the EU has no military power. In this sense, the foreign policy of the EU is not credible without NATO. That credibility is based on the military capacity to respond to an act of aggression against Europe. Because of the disarmament of different states in Europe like Germany after the end of the cold war, this capacity no longer exists. In the last 6 years Russia has expanded and modernized the conventional forces by increasing its defence budget. Therefore, what we have in Europe is a rather unique situation as NATO's deterrence capacity in relation to Russia diminished over time. NATO can no longer protect the small states in the Baltic region. For this reason the foreign policy of the EU has lost credibility. Social unrest On another level, the sanctions of the EU and the USA on Russia could lead to a recession of the economies in Europe. Such a recession will drive up unemployment rates in the EU, which will mainly affect the population under 25. In turn, the result could be social unrest, a danger that the mainstream media fails to address. At the same time, the sanctions of the EU still have very little influence on the strategy and politics of Russia. The breakdown of the limes and the jihadists In retrospect of the potential crisis in Europe, many of the Arab states in Northern Africa and the Middle East, which the British and the French created after 1918, are now breaking down. These states were the limes, which gave the European states the possibility to control and to influence the migration process from Africa and Asia to Europe for many years. Now the limes have broken down. In the next ten to twenty years the social, economic and demographic structure of Germany, France, Britain and other European countries will be affected by the influx of migrating Africans and Asians and therefore could completely change the social structure of Europe. The fact that the majority of this migrant population is coming from Muslim countries suggests there is a great probability that the next twenty years will witness the emergence of a Muslim majority in many European countries. The past decades of constant war and struggles in the Middle East region along with the accelerating religious war between the Sunni and the Shiite has and will lead to further radicalization of the masses. Europeans are becoming increasingly fearful of Muslims because of the negative and bad image of Muslims presented in the mainstream media. Moreover, the economic environment, which has already led to a staggering 30-60% youth unemployment rate in European nations, is further deteriorating. Negativity can only bring out more negativity and this will lead to additional tension in the Eurozone. While some are concerned that at some point many jihadists of European origins will come back from the battlefields in Syria and Iraq and be ready for action in Europe, one should never forget the factors that created this situation in the first place. The future of Europe will be determined by the ongoing conflicts in the Middle East and in Ukraine, by the migration of millions of people and by the threat of force by European jihadists. Because of all these factors, there is a possibility that the conflict in Ukraine and the future migration process could destabilize Europe. In fact, I believe that the Caucasian race, which has dominated the world since the 17th century, could disappear in Europe. In twenty years, there could be a new Europe with a strong relationship with Africa and Asia. The tradition of Europe, which was built up by Emperor Charlemagne, will no longer exist. This an excerpt from the latest Global Gold Outlook Report (full paper). Take a free subscription to receive similar updates in the future via e-mail: www.globalgold.ch. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Elliott Wave Projection For Gold Price And US Dollar Posted: 18 Sep 2014 12:34 PM PDT In this excellent market analysis, Trader MC points out that the current gold price, between $1192 and $1240, is trading at key levels. Patterns change with the psychology of the market and it is important to adjust in real time. He concludes that “the gold market structure should reveal itself very soon, we just have to be patient and let the market come to us.” The analysis is based on Elliott Wave patterns and market cycles. By Trader MC: Gold is now at a key juncture and it should reveal its price action structure in the coming weeks. The first chart is my main Elliott Wave count and shows a Double Three Corrective Pattern (W)-(X)-(Y) in process from the top in 2011. You can see that Gold is currently in a corrective channel and should end soon a Wave (ii) which is also composed of a Double Three Corrective Pattern. If that scenario plays out Gold should enter a Wave (iii) that should send it to around $1550 which would be the minimum target.

The next chart is a closer view of Gold that shows the projection of the corrective Wave (Y) within the Wave (ii). In case Wave (X) equals Wave (Y) Gold could reach $1192. Wave (Y) is also composed of three corrective subwaves a-b-c and if wave c has a Fibonacci connection with wave a (c = 1.618 x a) then Gold could reach $1217 which would be the extreme of Wave (ii).

The Elliott Wave Principle prepares us psychologically for the highest probable outcome but also alerts quickly when something is wrong in case we need to change our strategy. $1178 is a key level for my main count to play out but if this level is broken I will switch to the following bear count which shows an impulsive downmove in progress since 2011 top. An impulsive downmove is composed of 5 waves and Gold could currently be in the final Wave 5 as it broke down of a corrective Triangle Pattern which is characteristic of a Wave (4) (price action just broke down below point d at $1240).

If $1178 is broken we should see an acceleration move to the downside for Wave 5. On the following chart you can see different targets for Wave (5) using a Fibonacci projection of Wave (1) and Wave (3) from the top of Wave (4) as Wave (5) has usually a Fibonacci relationship with these waves. If this scenario plays out, the first possible target would be $1150-$1155 as it corresponds to 0.618 Fibonacci level from the low in 2008 to the top in 2011 and it also matches with 0.50 Fibonacci level of Wave (1). The second possible target would be around $1104-$1109 as it matches with the Fibonacci numbers 0.382 of Wave (3) and 0.618 of Wave (1). Lastly you can see that the next Fibonacci convergence zone targets are $1036-$1039 (0.50 of Wave (3) and 0.786 of Wave (1)) and $947-$964 (0.618 of Wave (3) and Wave (5) equals Wave (1)). US Dollar analysis It is also important to keep an eye on the Dollar structure as the Dollar Index has usually an inverse relationship with Gold (except in the 80′s when central planners did not create trillions of free dollars). On the long term US Dollar chart, readers can see that the Dollar is in a 30 years Wedge Pattern and has been forming a Triangle Pattern these last 5 years. This Triangle Pattern should be completed soon and a breakout either to the upside or to the downside should be very telling for the Gold Market structure. The current Wave (E) or d of the Triangle Pattern is composed of 3 corrective waves A-B-C and the Dollar Index should make soon a final Wave 5 up before reversing to the downside. The Dollar is also approaching key levels for its market structure. Check the two detailed Elliott Wave charts of the US Dollar here.

Cycles and market timing research > more info.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bad News for Gold from the Strong Dollar Posted: 18 Sep 2014 12:01 PM PDT Expect a drop to $1200 near-term, says a man who called the bull market in 2001... ERIC COFFIN is the editor of the HRA (Hard Rock Analyst) family of publications. With a degree in corporate and investment finance, plus extensive experience in merger and acquisitions and small-company financing and promotion, Coffin has for many years tracked the financial performance and funding of all exchange-listed Canadian mining companies, and has helped with the formation of several successful exploration ventures. One of the first analysts to point out the disastrous effects of gold hedging and gold loan-capital financing in 1997, he also predicted the start of the current secular bull market in commodities based on the movement of the US Dollar in 2001 and the acceleration of growth in Asia and India. Now Coffin tells The Gold Report how the continuing strength of the US Dollar is bad news for the price of gold, and believes that in the short term a price of $1200 per ounce is possible, though there is room now for an oversold bounce... The Gold Report: You told us last year you were "neutral" on the state of the US economy. Since then, the headline unemployment number has improved. Even so, as David Stockman, former director of the Office of Management and Budget, says, there have been no net new jobs created since July 2000, and jobs paying over $50,000 per year have disappeared by 18,000 per month since 2000. What is your view of the health of the US economy? Eric Coffin: I'm more positive than neutral these days, but I do agree somewhat with Stockman. As unemployment falls toward 6%, we would expect an increase in wage gains. But we're just not seeing that. And five years into the latest expansion, we're not seeing the economic growth spurts that tend to occur coming out of a really bad recession. I don't see how the US economy keeps reproducing the 4% growth of Q2 2014 if we don't see higher wage gains and higher paying jobs created. TGR: You've used the term "smack down" with regard to the recent falls in the gold price. What do you mean by this? Eric Coffin: It's a wrestling term and means being thrown to the mat. This is what has happened to gold time after time, after every uptrend. The current smack down is due more to strength in the US Dollar than anything else. Gold does trade as a currency sometimes and for the past few weeks it has held a strong inverse correlation to the US Dollar. I think physical demand will ultimately determine the price level, but ultimately it can be a long time when you're trading. TGR: Why isn't physical demand determining the price now? Eric Coffin: It's because of trading in the futures market. When somebody dumps 500 tons there, gold has to drop $200 per ounce. The futures market can overwhelm the physical market in terms of volume and often does. Most traders in the futures market (NYMEX or COMEX) are not buying gold and taking delivery. They are trading as a hedge, or just trading. The physical market, the place where people actually buy bullion, coins and bars, is not predominantly in London or New York but rather in China and India. And because of the smuggling that has arisen in India to circumvent increased tariffs, and imports moving to cities that do not release import statistics in China, it is difficult to know how much bullion Asia is buying right now. TGR: Large short-term trades in paper gold could be used to manipulate the market, and an increasing number of people believe gold is being manipulated downward in this manner. Do you agree? Eric Coffin: I'm not really a conspiracy guy. That said, when we see things like the sale in August of 400 tons in about 10 minutes, we have to wonder what's going on. Again, when Germany requests its gold from the US and is told delivery will take seven years, it makes you wonder how much of that gold has been hedged or lent already. TGR: Where do you see gold going for the rest of the year? Eric Coffin: I think we are going to be trapped in this currency trade cycle for a little while. The European Central Bank (ECB) cut its rates. One of its deposit rates is now negative. Mario Draghi, the president of the ECB, is talking about starting up quantitative easing. If that happens, or if traders believe it will, the Euro, which has already fallen from $1.40 to about $1.28 to the Dollar, could fall to $1.20 or $1.10. And this strengthening of the Dollar is not good for gold. The other factor of gold being traded on a currency basis is the possibility of Scottish independence, fear of which has already resulted in a significant decline in the British Pound. TGR: Will $1250 per ounce gold lead to gold miners suspending production? Eric Coffin: If gold stays at $1200-1250 per ounce for an extended period, there will be mine closures. Obviously, not all mines have the same costs, but the average all-in cost per ounce for gold miners is about $1200 per ounce. Already, some mines are high-grading to keep profit margins up. Most of the large miners have already cut exploration budgets pretty significantly. We can assume that the pipeline is going to get smaller and smaller when it comes to new projects, even high-quality projects. TGR: How badly will this gold price decline hurt the junior explorers? Eric Coffin: It's hurt a lot of them already. It's much more difficult to raise money than it was two or three years ago, although it's probably slightly better now than early this year. That could change on a dime, of course, if the gold price falls to $1200 per ounce or rises back through $1300 per ounce. Already, quite a few companies are keeping the lights on but not much else. We desperately need a few good discoveries – companies going from $0.20 to $5/share and getting taken out. TGR: You've been visiting mine sites in the Yukon. What do you like about this jurisdiction? Eric Coffin: It's a great area geologically, but it has some challenges. It can be an expensive place to work, so being close to infrastructure or designing an operation that doesn't require a huge amount of nearby infrastructure is critical. Power costs are a big item. There's no end of places in the Yukon where hydropower could be generated fairly cheaply, but that is not going to happen on a large scale unless the federal government steps up, and that would be nice to see. TGR: How does Alaska compare to the Yukon as a mining jurisdiction? Eric Coffin: They're similar in many ways. Alaska, like the Yukon, is not low-cost, but it is mining friendly and even farther down the road when it comes to settling aboriginal issues. The key to success in Alaska is being close to the coast or major population centers or infrastructure. TGR: How do you rate copper's prospects? Eric Coffin: There are several large producers that have either recently come onstream or will come onstream in the next few months. So copper is probably going to be in at least a small surplus for the next year or two. The price could fall back to $2.50-2.75/pound ($2.50-2.75/lb). I'm not terribly concerned about that. Copper should be fine in the long term and a good copper operation can make plenty of money at those prices. TGR: The bear market in the juniors is now 3.5 years old. Should investors expect a general upturn any time soon? Eric Coffin: I doubt it if you mean a broad market rise that lifts all boats. My expectation at the start of this year, which is looking fairly dodgy right now admittedly, was for a 30% TSX Venture Exchange gain for 2014. That is possible with only a small subset of companies doing very well, which is my expectation. Investors always want to look for the tenbaggers. It doesn't matter what the market is like and, obviously, potential tenbaggers often turn into actual one and a half or two baggers, which is just fine. You want to find the projects with the highest potential for resource growth or new discovery and management teams that know how to explore them and finance them on the best possible terms. That is the combination that gives you the potential biggest wins. TGR: Eric, thank you for your time and your insights. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||