Gold World News Flash |

- MUST READ: Do NOT Let the “Strong” Dollar Illusion Lead Your Wealth Preservation Strategies Astray

- Can The Petrodollar Survive Low Interest Rates?

- What Might Have Been

- The U.S. National Debt Has Grown By More Than A Trillion Dollars In The Last 12 Months

- Junior Miners Holding Long Term Support, Bouncing Off 200 Day Moving Average

- Silver and Gold Prices Gained with the Gold Price Closing at $1,235.20

- Some Fundamental Thoughts Behind The Tragedy Of The Euro

- Will The Swiss Vote to Get Their Gold Back?

- Silver's lockdown may be facing a challenge, Embry tells KWN

- Pope Francis And The Third World War

- Gold Daily and Silver Weekly Charts - Straining

- China, Russia, Gold & A New World Order Rising From The East

- U.S. Dollar and Gold Elliott Wave Projection

- Bank Insider: Worst Depression Ever Coming

- The Depression, World War II, And What They Really Mean

- China advances gold exchange launch; Singapore delays contract

- The Collapse Of U.S. Silver Stocks As Public Debt Skyrockets

- U.S. Dollar’s Turn to Cause a Recession

- Cycle Analysis Supports Both Bearish and Bullish Views On Gold and Silver

- Gold: Janet & Raj Stoke The Bulls

- War In Silver Rages As People’s Confidence In The West Fades

- Is The Fed About To Write the Next Chapter For Silver?

- Gartman Letter cites Koos Jansen and Gold Newsletter on Chinese gold demand

- Gold Bullion "Turnaround Likely Mid-2015" as Fed Looks to Raise Rates, Shanghai Brings FTZ Bourse Forward to Thurs

- Gold's move from West to East is said intended to rebalance FX reserves

- Why Money Is Worse Than Debt

- The Most Important Chart Right Now

- Switzerland's Gold Vote

- Russian Stocks: Betting on the Now

- The Emergence of the US Petro-Dollar

- The Emergence of the U.S. Petro-Dollar

- Last Stand Approaching for Gold

| MUST READ: Do NOT Let the “Strong” Dollar Illusion Lead Your Wealth Preservation Strategies Astray Posted: 16 Sep 2014 09:20 PM PDT by JS Kim, Smart Knowledge U:

Recently, Central Bankers have colluded to destroy other weak currencies to create the illusion of US dollar strength. The US dollar's greatest competitors are the Euro, the British Pound and the Japanese Yen, and Rothschild controlled Central Bankers have destroyed all these currencies in recent months. Rothschild-directed Central Bankers have crashed the Euro by 7.34% in the past four months, the Japanese Yen by 5.78% in an astonishing two months, and the British Pound by an astounding 6.58% in just two months as well. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Can The Petrodollar Survive Low Interest Rates? Posted: 16 Sep 2014 07:58 PM PDT Submitted by Luke Gromen via Sprott Global, Where does capital really come from? Most US policymakers believe that capital comes from debt issued by the Fed and its member banks; most other big debtor countries agree (i.e. Japan). On the other hand, policymakers of the world’s biggest creditor nations (led by China) believe that real capital is the surplus produced from production and trade (which has been mainly accumulated in US dollars and ultimately backs the US dollar as the primary reserve currency). For the past 7-12 years the two conflicting ideas about capital have begun to have noticeable effects in certain global asset markets. The chart below, showing gold, oil, and Fed Funds rates, illustrates what has occurred. For most of the three decades from 1973-2002, these asset classes traded closely together; in the last decade, they have been diverging dramatically. We’ll explain why this happened and the critical implications it holds for the USD prices of oil and gold.

Under the “Petrodollar arrangement,” key oil exporters promised to only price oil in USD and US interest rates were then managed so that oil exporters were indifferent to whether they stored currency reserves earned from oil exports in US Treasuries or in gold (which had always settled oil prior to 1971 via a gold-backed USD and, prior to that, gold-backed sterling). At the time, the US was the world’s largest trading nation and oil producer. The Fed consistently managed the Fed Funds rates to keep oil prices steady, even when it required mid-teens interest rates and back-to-back recessions in 1980-1982. Since US Fed Funds rates were managed to preserve US creditors’ and oil exporters’ purchasing power in oil terms, the system proved acceptable to most nations. While the Petrodollar arrangement worked well for nearly thirty years, the arrangement began to wobble beginning around 2002-04, due to a unique combination of factors:

Oil prices began steadily rising in 2002 and 2003 while Fed Funds rates remained low to mitigate the fallout from the 2001 US recession/Tech Bubble. As a result, the number of barrels of oil that could be purchased for a face-value US Treasury bond declined sharply. In the chart below, you can see that in 2004, face value US Treasuries “broke support” to new 20-year lows versus oil. The dollar was collapsing against oil, likely to the chagrin of oil exporters (and US creditors like China that needed oil imports) holding US Treasuries from years of exports to the US.

After maintaining a range of 55-60 barrels of oil per US Treasury from 1986-1999, a $1,000 face value US Treasury went from buying 60 barrels of oil in 1999 to under 30 by early 2004. This threatened the Petrodollar system. Since US Treasuries were collapsing versus oil prices oil exporters might eventually be better off leaving oil in the ground. This forced US policymakers into an important decision:

The US decided to go with the first option; in June 2004 the Fed began raising rates slowly. This was bad for the US housing market, which had become dependent on a variety of highly-levered mortgage products that were often tied to Fed Funds rates. The housing market began to weaken as rates rose and after only 12 months and a 4.25% rise in interest rates the housing market peaked in 3Q05 and then began to weaken notably. It was a critical but little-appreciated moment in US economic history. The US economy had now become too ‘financialized’ to withstand anything more than token interest rate hikes. The US economy limped along in 2006 and early 2007 until collateral damage from falling home prices began to spread into the broader financial system, first through subprime loan defaults, then into more traditional lending markets. It wasn’t long before the global banking system was affected, along with other levered institutions like AIG. To prevent big banks and financial institutions from going under, the US Fed first slashed rates to near 0% and then expanded its balance sheet 5 times in 5 years to an unprecedented $4.5 trillion. While these moves “saved the system” from systemic collapse, they came at a significant cost: US policymakers and pundits took 2007-08 to mean that the US could never default on its debt because the Fed could always print money to pay back debts that are denominated in US dollars. Oil exporters (and other US creditors) took a very different lesson from the crisis: The US economy had now become so dependent on low interest rates that it could never again manage its interest rates to keep oil prices steady without blowing up the global financial system. The Petrodollar system, which had allowed the US dollar to supplant gold as the backing for the oil trade from 1973-2002, was irrevocably broken. Understandably, creditor nation policymakers did not find lending money to the US at near 0% to buy real goods and, most importantly, oil from creditor nations particularly attractive. That arrangement would be akin to a land lord lending to her renters cash at 0% interest to pay their rent. So as the Fed expanded its balance sheet 5.5 times from 2009 to 2013, creditor nations deployed significant amounts of capital into a variety of real assets including physical gold. Why physical gold and not gold futures? Another lesson that the creditor nations learned from 2007-08 was that any highly-levered US financial market (like gold futures markets) is ultimately a general obligation of the US government and US Fed and will, if necessary, be paid out in cash. After concluding that US policymakers could never again manage the relationship of Fed Funds rates to oil prices, creditor nation policymakers began reverting to the oil settlement asset that had been used for decades before the Petrodollar - physical gold. Physical gold collateral was removed from the western bullion banking system, leading to the sharp drop in gold futures prices seen in 2013. What does this mean for gold and oil prices going forward? It’s likely quite bullish for both. Gold could be returning to the global financial system as a means of settlement, which could ultimately drive physical gold prices significantly higher through higher demand. The price of US oil imports would likely increase if the dollar loses its 41-year monopoly in settling oil trades. This would provide an incentive for increased North American oil production and benefit companies involved in the domestic energy services sector and related manufacturing industries. The rollout of yuan-denominated physical gold trading in the Shanghai Free Trade Zone is set to begin September 291, followed by the rollout of yuan-denominated oil (and other commodities) expected before year end. The pricing of oil in yuan and ability to settle that trade in physical gold also priced in yuan may prove to be a critical milestone for the return of physical gold for settling international trade. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 Sep 2014 06:37 PM PDT From Slope of Hope: Well, here we are again. On Wednesday, an elderly dwarf will capture the attention of the entire financial world as she bleats out whatever she and her minions believe will shore up the house of cards they have created. In a sane and just world, the aforementioned bridge troll would be an untenured economics professor at a mid-tier liberal arts college, but as it is now, Yellen is one of the most powerful humans (more or less) on the planet. We are six years...........six.........years..........into this madness, and it shows no sign of stopping. Why should it? After all, statists and central planners have been doing a bang-up job of making the rich richer (which, in spite of the weary "dual mandate" trotted out in front of a smirking Congress, appears to be the only true raison d'etre behind the Federal Reserve). What if it had gone differently? What if, six years ago, in the throes of the financial crisis, the political leaders in D.C. had decided that enough was enough, and they were going to seize the opportunity to make real and meaningful positive changes? (OK, stop laughing; seriously, stop it; I'm trying to write a post here; bear with me, because this is a fantasy piece, after all). So instead of doing what they did, just imagine with me events more along these lines: + Executives are aggressively prosecuted and, where possible, imprisoned - Executives were kicked in the ass during the (much, much tinier) S&L Crisis in the late 1980s; why not do the same now? Angelo Mozilo might look good in an orange jumpsuit; it would complement his flesh tone. Some argue they didn't break any laws. I am highly confident that, given enough resources, a skilled team of aggressive prosecutors could find a meaningful number of executives and a sufficient docket of salient laws that were bent or broken. For God's sake, at least give it a shot. + 2008 and 2009 bonuses have a special 99% surtax - It was galling that, for instance, the giant bonuses to AIG employees got paid out (Congress whined there was nothing it could do). If the bonuses had to be paid, fine, go ahead and pay 'em. But please take note that all bonuses paid by financial service companies from September 19, 2008 to December 31, 2009 are subject to a special 99% income tax. + Goldman Sachs and Morgan Stanley go bankrupt - Yep, just like Lehman. They would probably both ultimately survive in some form, but a far smaller and more benign form than before. Oh, and those payments from AIG Financial Services? Sorry, AIG is bankrupt. They are going to pay out 0 cents on the dollar. Sorry about that. The 100% payment that Goldman actual got...........let's just say that it didn't take place, because it shouldn't have taken place. + Confiscatory and Targeted Asset Tax - Basically go after the bad guys. Dick Fuld? Time to pay back all those ill-gotten gains. Same for Joe Cassano. Claw back as much as possible, since God knows the country needs it worse than the 1%. + Glass-Steagall Reinstated - Not all of FDR's laws were bad, after all, and this gem needed to come back. Let's just pretend that it did, back and even better (and more thorough) than before. + Foreclosures Got Foreclosed - Can't make your mortgage payment? Bought off more than you could chew? Tough titties. The house gets foreclosed. Everyone has to play by the same rules. No mortgage "relief". No hanging out in the house for years until the bank finally gets the right to boot you out. If you can't afford it, you can't afford it. Ta-ta. + D.C. Gets Out of the Business of Business - Fannie Mae? Shut it down. Same for Freddie Mac. Oh, and hey you guys at the Federal Reserve: it isn't your job to push up stock indexes. Your friends may be suffering (if "suffering' means having a net worth of $50 million instead of $500 million) but you are out of the business of artificially propping up business. + America Gets Educated - Americans need to understand why it's time to take some bitter medicine for the country's long-term good. There are two aspects to this: shame and knowledge. The "shame" aspect is to make very clear who the nitwits were in government who put us in this position (like, oh, Chris Cox and Phil Graham leap to mind). The "knowledge" aspect is to educate in a systematic, consistent, and long-term fashion the American public to explain (probably in a fairly dumbed-down fashion, but explained nonetheless) the roots of what happened, why the next few years were going to be tough, but how it would be essential for us to hunker down as a nation and get through this, having learned our lessons. Now, in the above scenario, the equity markets would have probably kept suffering, even after a dead-cat bounce in 2009. They would have ground lower and lower, perhaps bottoming at 5,000 on the Dow. But, oh, around about now, a base would start forming, and by 2016, the healing would be firmly in place. We'd probably start a new era of real, honest growth and strength. But back to reality: none of this happened, and little of it had a real chance of happening. Instead, we have completely papered over the problem, performing the equivalent of covering a cancer patient with band-aids. The upper crust have gotten to enjoy six solid years of a faux prosperity, thanks to their buddies at the Fed, and the cataclysm that will unfold will someday finally be understood as having been utterly preventable. So let's all get ready for Yellen to continue this little farcical nightmare in which we're all living. There will come a day when the markets stop respecting the little lady and her printing press. Whether that day of reckoning is this week or years from now remains to be seen, but at this point, we can really only conclude this: the bad guys completely got away with it, and America as a whole has been played the fool. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The U.S. National Debt Has Grown By More Than A Trillion Dollars In The Last 12 Months Posted: 16 Sep 2014 04:57 PM PDT Submitted by Michael Snyder via The Economic Collapse blog, The idea that the Obama administration has the budget deficit under control is a complete and total lie. According to the U.S. Treasury, the federal government has officially run a deficit of 589 billion dollars for the first 11 months of fiscal year 2014. But this number is just for public consumption and it relies on accounting tricks which massively understate how much debt is actually being accumulated. If you want to know what the real budget deficit is, all you have to do is go to a U.S. Treasury website which calculates the U.S. national debt to the penny. On September 30th, 2013 the U.S. national debt was sitting at $16,738,183,526,697.32. As I write this, the U.S. national debt is sitting at $17,742,108,970,073.37. That means that the U.S. national debt has actually grown by more than a trillion dollars in less than 12 months. We continue to wildly run up debt as if there is no tomorrow, and by doing so we are destroying the future of this nation. The chart that I have posted below shows the exponential growth of the U.S. national debt over the past several decades. Anyone that would characterize this as "under control" is lying to you... This is the greatest government debt bubble in the history of the world, but very few people seem to have any desire to do anything about this anymore. We are literally gorging on debt, and most Americans seem to think that it is just fine and dandy. Perhaps that it is because we have never really experienced any serious consequences for going into so much debt yet. But when it comes to running up debt, a day of reckoning always comes eventually. Just ask Greece. And the absolutely insane spending policies of this administration and this Congress are hastening the day when our day of reckoning will arrive. Consider the following facts...

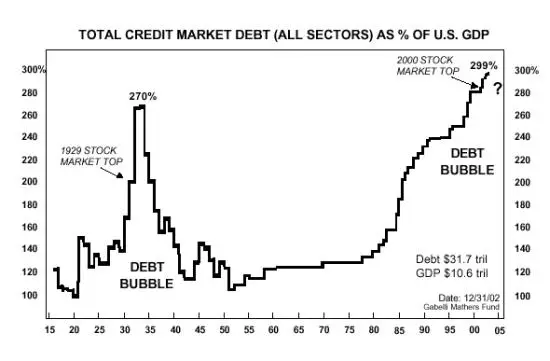

Thomas Jefferson once said that "the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale." What we are doing to future generations is absolutely unconscionable. We are stealing trillions upon trillions of dollars from our children and our grandchildren, and we are willingly consigning them to a lifetime of debt slavery. I have said this before, but it bears repeating. If future generations get the chance, they will look back and curse us for what we have done to them. And shame on anyone that would dare to suggest that we should continue to run up more debt that future generations will be expected to repay. But government debt is far from the only massive debt bubble that we are dealing with as a country. 40 years ago, the total amount of debt in our nation (all government debt plus all business debt plus all individual debt) was sitting at a grand total of about 2.3 trillion dollars. Today, that total has grown to 59.4 trillion dollars. As the chart posted below shows, our total debt bubble is now more than 25 times larger than it was just 40 years ago... If you were to take all forms of debt in our country and divide it up equally to each person, the average family of four would owe approximately $735,000. This is not anywhere close to being sustainable, but most Americans don't seem to care. They just continue to recklessly run up even more debt. However, there are signs that we are starting to hit a wall with all of this debt. For example, an astounding 35 percent of all Americans have debts that are so overdue that they have been referred to collection agencies. Our nation has become an ocean of red ink from sea to shining sea, and the only way to keep the bubble from bursting is for the total amount of debt to continue to grow much faster than the overall economy is growing. Obviously this cannot happen indefinitely, and when this house of cards comes crashing down it is going to be absolutely horrific. For much more on all of this please see my previous article entitled "The United States Of Debt: Total Debt In America Hits A New Record High Of Nearly 60 Trillion Dollars". The big question is how long our "bubble economy" can keep going before it finally collapses. It has gotten to the point where even some of the biggest banks in the world are admitting that what we have been doing is completely and totally unsustainable. Just consider the following excerpt from a recent article by Joshua Krause... ***** Recently, strategists for Deutsche Bank released a startling study in regards to government debt. They decided to investigate whether or not the bond market is currently in a bubble. What they found was, unlike previous eras, the past 20 years has seen no lag between economic booms and busts:

Essentially, our current system has been dying a very slow death. It’s running out of steam. ***** Sadly, most Americans have no idea that we are living in a giant debt-fueled bubble that has a limited lifespan. Most Americans just assume that since the politicians tell them that everything is going to be okay that they don't need to be concerned about any of this. But every single day our debts get even larger and our long-term financial problems get even worse. Someday this bubble is going to burst and then all hell will break loose. It is just a matter of time. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

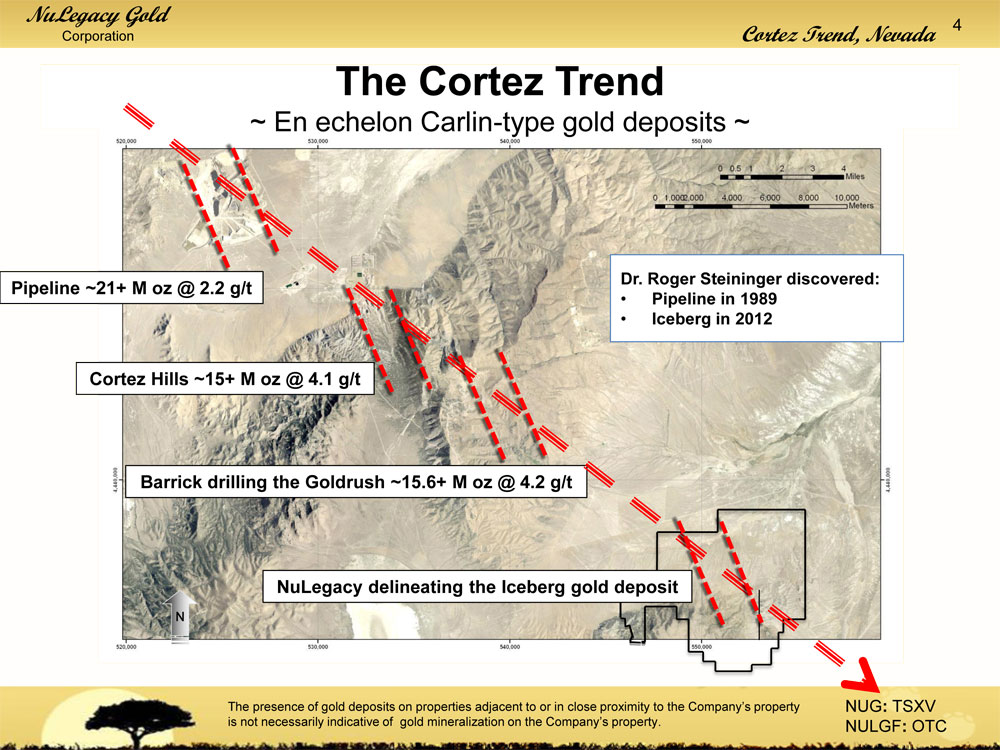

| Junior Miners Holding Long Term Support, Bouncing Off 200 Day Moving Average Posted: 16 Sep 2014 04:11 PM PDT Despite the shorts in precious metals reaching record heights, the junior gold miners (GDXJ) continue to find support at the 200 day moving average, a critical area of long term support. This may be signaling to investors that gold may soon bottom around $1200 and that the major miners may start looking for economic deposits to replace current resources that are being exhausted. If you find quality gold properties near majors with top notch management with track records then you have a good shot to make a profit even through this historic bear market. For instance, about a month ago I sent out a report that the “Smart money is looking at the Cortez Trend”. I highlighted a small junior called Nulegacy Gold (NUG.V or NULGF) partnered with Barrick (ABX) which I visited only six weeks ago. Nulegacy may be at just the beginning of discovering a gold deposit on trend with Barrick’s three multi-million ounce deposits. These massive deposits are some of the lowest cost and most profitable mines for Barrick in the entire world. Nulegacy’s deposit is next to Barrick’s Goldrush Deposit which is one of the best greenfield discoveries in the world with over 14 million ounces of gold. Recently a major billion dollar private equity fund has taken a 19.9% in Nulegacy for $3.5 million which will help Nulegacy expand exploration and earn in to the deal with Barrick. This deal provides financial security for the company and is a significant development in Nulegacy’s history. In addition, Nulegacy has significantly strengthened its board with the addition of Alex Davidson who was the former VP of exploration for Barrick during its major growth years. He was instrumental in Barrick acquiring those profitable Cortex Mines from Placer Dome. He retired from Barrick in 2009 but is still recognized in the mining exploration circle.

In conclusion, I was early highlighting this story more than a year ago at under a dime and you may have not believed me when I told you that Nulegacy owns prime real estate in the Cortez Trend. Its understandable at that point to be a little skeptical with an early stage explorer in Nevada. However, after seeing a major private equity firm become a 19.9% strategic partner and seeing old time famous veterans from Barrick such as Alex Davidson joining the board, an investor should be more confident that this is a first class exploration target with the potential to become a major resource for Barrick. Take a look at Nulegacy before the potential breakout as two drill rigs are on the property. Disclosure: I am a Nulegacy shareholder and the company is a website sponsor. Conflicts of interest apply and one should do their own due diligence. ___________________________________________________________________________ Sign up for my free newsletter by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… Accredited investors looking for relevant news click here… To send feedback or to contact me click here… Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and Gold Prices Gained with the Gold Price Closing at $1,235.20 Posted: 16 Sep 2014 03:33 PM PDT

Blasted FOMC meeting has cast its destabilizing pall over all markets. The GOLD PRICE rose $1.60 to $1,235.20 today, the SILVER PRICE gained ten cents to 1865.6c. Both are waiting for the FOMC announcement. Have y'all noticed that throughout the last week's weakness the GOLD/SILVER RATIO has not moved much, staying in the 66+ range. That's positive for both metals, because when they are plunging with determination, that ratio soars. Once again we see the great Federal Reserve which was supposed to stabilize markets only destabilizes markets by its interference. When they make me dictator the first thing I'll do is abolish the Fed. Second thing is pull the funding for NPR. Third thing will be to legalize raw milk and Farm Gate Sales. Now to markets: That "idea" I mentioned yesterday took the form in the stock market today of "Janet Yellum won't change anything tomorrow" which provided an excuse for the market to rise. But in the US dollar index, where the bet has been Mother Yellum would raise interest rates soon, speculators were starting to puke in their waste baskets. Dow today made a new intraday high, but not a new high close. Rose 100.83 (0.6%) to 17,131.97. S&P500 added 14.85 (0.75%) to 1,998.98. That brought the Dow but not the S&P500 back up to the level it had been eroding from for the last two weeks. Dow in Gold hit a new high today at 13.85 oz (G$286.30 gold dollars), higher by half an ounce than the December high. Sho' nuff Fish or Cut Bait Time. Must reverse soon, I'd say tomorrow. Dow in silver rose 0.34% to 915.12 oz (S$1,183.19 silver dollars). Tomorrow would be a good time for the DiS to turn 'round, too. US dollar index gave up 15 basis points (0.17%) to 84.22. Still fighting and fiddling with that 9 year downtrend line. A fall here would not necessarily negate the potential for the dollar to break out later. Disappointing interest rate news out of the FOMC tomorrow will send the dollar skidding. Euro gained 0.15% to $1.2960 while the yen moved up only 0.04% to 93.33. SPECIAL OFFER -- My overstocked Krugerrands I've bought a lot of South African Krugerrands lately & find myself overstocked, so I'm pricing these to move. South Africa revolutionized the gold coin industry in 1968 when they introduced a gold coin containing exactly one troy ounce of gold -- it made the math easy to figure what it was worth. They have minted these 22 karat (91-2/3% pure) coins in the same weight and fineness ever since. They proved so popular that in 1985 when the US began minting the gold American Eagle, they copied the Krugerrand specifications exactly. I have only Eighty (80) coins to sell. No re-orders at these prices after those are spoken for. Spot gold basis is $1,235.20. OFFER NO. 1 Four (4) each South African Krugerrands at $1,272.75 each for a total of $5,091.00 plus $35 shipping for a grand total of $5,126.00. That's a premium of 3.0% over melt value. OFFER NO. 2 Five (5) each South African Krugerrands at $1,272.25 each for a total of $6,363.75 plus $35 shipping for a grand total of $6,398.75. That's a premium of 3.0% over melt value. OFFER NO. 3 -- Mix and Match Any lot of eight (8) or more South African Krugerrands at $1,272.75 each plus $35 per order shipping. Still at a premium of 3%. NOTE: I will charge shipping only once per order no matter how many lots you buy. Special Conditions: First come, first served, and no re-orders at these prices. I will write orders based on the time I receive your email Send email to offers@the-moneychanger.com Sorry, we will not take orders for less than the minimum shown above. All sales on a strict "no-nag" basis. We will ship as soon as your check clears, but we allow Two weeks (14 days) for your check to clear. Calls looking for your order two days after we receive your check will be politely and patiently rebuffed. It increases your chances of getting your order filled if you offer me a second choice, e.g., "I want to order Three lots of Offer #3 but if not available will take One lot of Offer #2." ORDERING INSTRUCTIONS: 1. You may order by e-mail only to offers@the-moneychanger.com. No phone orders, please. Please do NOT order by replying to THIS email, because it will not reach me timely. Please include your name, shipping address, & phone number in your email. Surprising as it is, we cannot ship to you without your address. Sorry, we cannot ship outside the United States or to Tennessee. Repeat, you must include your complete name, address, and phone number. We will read your mind, but will have to charge you three times the price. Cheaper if you just supply your information so I don't have to read your mind. 2. When you buy from us, we cannot later change or cancel the trade. We are giving you our word that we will sell at that price, & you are giving us your word that you will buy at that price, regardless what later happens in the market, up or down. If you break your word to us, we will never again do business with you. 3. Orders are on a first-come, first-served basis until supply is exhausted. 4. "First come, first-served" means that we will enter the orders in the order that we receive them by e-mail. 5. If your order is filled, we will e-mail you a confirmation. If you do not receive a confirmation, your order was not filled. 6. You will need to send payment by personal check or bank wire (either one is fine) within 48 hours. It just needs to be in the mail, not in our hands, in 48 hours. 7. "No Nag Basis" means that we allow fourteen (14) days for personal checks to clear before we ship. 8. Mention goldprice.org in your email. Want your order faster? Send a bank wire, but that's not required. Once we ship, the post office takes four to fourteen days to get the registered mail package to you. All in all, you'll see your order in about one month if you send a check. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Some Fundamental Thoughts Behind The Tragedy Of The Euro Posted: 16 Sep 2014 03:30 PM PDT “The most important book on the Euro from an Austrian Economics point of view,” that is how Jeff Deist, President of the Mises Institute, referred to the book “The Tragedy of the Euro.” The book was written by Philipp Bagus, professor of economics at Universidad Rey Juan Carlos in Madrid, is a young scholar with a large influence, having forecast all the problems with the Euro and having persuaded many economists on the Continent that this currency is no better than any fiat currency (source: Mises Institute). Jeff Deist speaks to author Philipp Bagus in the interview which is available below. We highlight some extremely interesting quotes from the interview. The discussion is a must-listen for everyone who wants to understand the fundamental issue with the Euro. The book has a dedicated page on the Mises Institute website where it is available in ebook format. Additionally, readers should definitely check the new summary of the book, written by Claudio Grass, managing director from Global Gold Switzerland, in his latest outlook report. According to Philipp Bagus, the Euro was an attempt to get rid of the disciple of the Bundesbank (German central bank). The Bundesbank was trying to inflate less, due to the “inflation-phobia” from the German population (caused the hyperinflation of 1923) and the inflationary period after WW II. One German generation experienced the loss of all their savings twice. That is why the German central bank relied much less to the money printing machine than the other European countries. So if the other European countries wanted to keep the exchange rate more or less stable with the German Mark, they had to follow the monetary policy of the Bundesbank. In other words, if the French government had a deficit and wanted their central bank to finance it, there was a depreciation of the French Franc, which is embarassing to politicians. The Euro was an attempt to get rid of this discipline that the Bundesbank was putting on European monetary policy. The following quotes from the interview contain some key thoughts on the fundamental issue of the Euro and why the currency is not achieving its objective of harmonization:

A possible solution, detailed in the paper “How to exit the euro” by Philipp Bagus, would be to orderly exit the Euro by introducing a “gold Euro.” In such a scenario, all the gold in the European central banks would be used to back the Euro. Each country would have a different ratio of gold backing compared to the outstanding currency in that country. In order to get the ratios aligned between countries, there should be some redistribution necessary between the central banks, but it would result in a Euro that would be fully backed by gold.

Listen to the inteview | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will The Swiss Vote to Get Their Gold Back? Posted: 16 Sep 2014 02:07 PM PDT On November 30th, voters in Switzerland will head to the polls to vote in a referendum on gold. On the ballot is a measure to prohibit the Swiss National Bank (SNB) from further gold sales, to repatriate Swiss-owned gold to Switzerland, and to mandate that gold make up at least 20 percent of the SNB’s assets. Arising from popular sentiment similar to movements in the United States, Germany, and the Netherlands, this referendum is an attempt to bring more oversight and accountability to the SNB, Switzerland’s central bank. ….no tyrannical regime in history has bullied Switzerland as much as the United States government has in recent years. The Swiss referendum is driven by an undercurrent of dissatisfaction with the conduct not only of Swiss monetary policy, but also of Swiss banking policy. Switzerland may be a small nation, but it is a nation proud of its independence and its history of standing up to tyranny. The famous legend of William Tell embodies the essence of the Swiss national character. But no tyrannical regime in history has bullied Switzerland as much as the United States government has in recent years. The Swiss tradition of bank secrecy is legendary. The reality, however, is that Swiss bank secrecy is dead. Countries such as the United States have been unwilling to keep government spending in check, but they are running out of ways to fund that spending. Further taxation of their populations is politically difficult, massive issuance of government debt has saturated bond markets, and so the easy target is smaller countries such as Switzerland which have gained the reputation of being "tax havens." Remember that tax haven is just a term for a country that allows people to keep more of their own money than the US or EU does, and doesn’t attempt to plunder either its citizens or its foreign account-holders. But the past several years have seen a concerted attempt by the US and EU to crack down on these smaller countries, using their enormous financial clout to compel them to hand over account details so that they can extract more tax revenue. The US has used its court system to extort money from Switzerland, fining the US subsidiaries of Swiss banks for allegedly sheltering US taxpayers and allowing them to keep their accounts and earnings hidden from US tax authorities. EU countries such as Germany have even gone so far as to purchase account information stolen from Swiss banks by unscrupulous bank employees. And with the recent implementation of the Foreign Account Tax Compliance Act (FATCA), Swiss banks will now be forced to divulge to the IRS all the information they have about customers liable to pay US taxes. On the monetary policy front, the SNB sold about 60 percent of Switzerland’s gold reserves during the 2000s. The SNB has also in recent years established a currency peg, with 1.2 Swiss francs equal to one euro. The peg’s effects have already manifested themselves in the form of a growing real estate bubble, as housing prices have risen dangerously. Switzerland… is ruled by a group of elites who are more concerned with their own status… than with the good of the country. Given the action by the European Central Bank (ECB) to engage in further quantitative easing, the SNB’s continuance of this dangerous and foolhardy policy means that it will continue tying its monetary policy to that of the EU and be forced to import more inflation into Switzerland. Just like the US and the EU, Switzerland at the federal level is ruled by a group of elites who are more concerned with their own status, well-being, and international reputation than with the good of the country. The gold referendum, if it is successful, will be a slap in the face to those elites. The Swiss people appreciate the work their forefathers put into building up large gold reserves, a respected currency, and a strong, independent banking system. They do not want to see centuries of struggle squandered by a central bank. The results of the November referendum may be a bellwether, indicating just how strong popular movements can be in establishing central bank accountability and returning gold to a monetary role. Regards, Ron Paul Ed. Note: Sick and tired of central banks decimating your purchasing power? Don’t worry… There are alternatives… Including one “underground banking system” that’s working wonders for a handful of savvy investors right now. Readers of today’s Daily Reckoning email edition got a chance to get in on this banking system for themselves. But if you didn’t get today’s issue, you might have missed out. Don’t let another great opportunity like this pass you by. Sign up for The Daily Reckoning email edition, for FREE, right now and start reaping all of the financial benefits of being a subscriber. This article originally appeared at The Ron Paul Institute. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver's lockdown may be facing a challenge, Embry tells KWN Posted: 16 Sep 2014 02:01 PM PDT 5p ET Tuesday, September 16, 2014 Dear Friend of GATA and Gold: The silver futures market seems to be in "total lockdown," Sprott Asset Management's John Embry tells King World News today, even as there also seems to be a deep-pocketed long ready to challenge price suppression. Embry's comments on silver and on the world economic situation generally are excerpted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/9/16_Wa... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair Plans Market Seminar in Nashville on September 20 Mining entrepreneur and gold advocate Jim Sinclair will hold his next market seminar on Saturday, September 20, in Nashville, Tennesse. For details about attending, please visit: http://www.jsmineset.com/qa-session-tickets/ Join GATA here: Casey Research 2014 Summit http://www.caseyresearch.com/summit/2014-fall Canadian Investor Conference http://cambridgehouse.com/event/31/canadian-investor-conference-toronto-... New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pope Francis And The Third World War Posted: 16 Sep 2014 01:21 PM PDT Anglosaxon Hegemony is Finished With the open air decapitation of British hostage David Haines by ISIS psychopaths, the image of the “Anglosaxon world” has suffered another heavy blow. The killing of Haines was preceded by the killing of two American hostages. It is hard to not understand why American and British targets were chosen by ISIS. The role of British, French and American “nation-building” in the Middle East after the collapse of the Ottoman Empire in 1917-18 is primordial. Revenge against “the Anglosaxon world” is possibly the main emotional focus of ISIS and other Crony Islamic psychopaths in the region. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Straining Posted: 16 Sep 2014 01:16 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China, Russia, Gold & A New World Order Rising From The East Posted: 16 Sep 2014 01:13 PM PDT  Today an acclaimed money manager spoke with King World News about China, Russia, gold, and a New World Order that is rising in the East. Stephen Leeb also spoke about how the Russians and the Chinese are planning to set up this new hub of power in the East. Today an acclaimed money manager spoke with King World News about China, Russia, gold, and a New World Order that is rising in the East. Stephen Leeb also spoke about how the Russians and the Chinese are planning to set up this new hub of power in the East.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Dollar and Gold Elliott Wave Projection Posted: 16 Sep 2014 01:01 PM PDT Gold is now at a key juncture and it should reveal its price action structure in the coming weeks. The first chart is my main Elliott Wave count and shows a Double Three Corrective Pattern (W)-(X)-(Y) in process from the top in 2011. You can see that Gold is currently in a corrective channel and should end soon a Wave (ii) which is also composed of a Double Three Corrective Pattern. If that scenario plays out Gold should enter a Wave (iii) that should send it to around $1550 which would be the minimum target. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank Insider: Worst Depression Ever Coming Posted: 16 Sep 2014 12:09 PM PDT Bank Insider James Rickards reveals the depth of the Global Banking Collapse that is about to affect billions. The feds are gearing up to face Americans protesting the intentional importation of illegal immigrants and Alex breaks it all down on this Monday, July 7 edition of the Alex Jones... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Depression, World War II, And What They Really Mean Posted: 16 Sep 2014 11:21 AM PDT Nearly a century after the fact, the Great Depression remains THE object lesson for virtually every branch of economics. To monetarists the fact that the US money supply fell by nearly a third in the 1930s illustrates the need for a central bank to maintain steady money growth. To Keynesians the Depression’s depth and duration proved that capitalist systems are inherently unstable and need a big, powerful government to manage them. World War II, in this framework, saved the US economy from permanent 25% unemployment. To Austrians, meanwhile, the Depression demonstrated that 1) the best way to prevent a bust is to avoid the preceding boom, which is another way of saying that the size and composition of the national balance sheet is the key to everything, and 2) the best way to get through a bust is to let market forces liquidate the bad debt as quickly as possible. A September 14 DollarCollapse column took the Austrians’ side in the debate and illustrated the point with the following chart, which depicts the massive deleveraging of the 1930s. Not surprisingly, since the Depression means so much to so many, this generated some conflicting comments, the most challenging of which came from reader Eric Original:

This deserves a response, both because the final spike in debt/GDP was indeed partially caused by GDP shrinking faster than debt, and because it gets at some of the deeper, more interesting parts of the story. So, here goes: During the initial stages of a credit bubble debt soars but debt/GDP rises more slowly, because the proceeds from all those new loans get spent, thus producing “growth” which shows up as rising GDP. In other words both the numerator and denominator of the ratio go up. But — and this, I think, is the crucial fact for Austrians — extremely easy money leads people to buy things and make investments that they wouldn’t otherwise buy or make. This “malinvestment” pumps up growth in the near-term but doesn’t generate sufficient cash flow thereafter to service the related debt. So the initial debt-driven pop in GDP is an illusion. Later, when those bad investments can’t cover their interest payments and go bust the economy shrinks, for a time, faster than societal debt, which causes debt/GDP to spike. But the actual spike in debt/true GDP happened earlier. It isn’t reflected in official statistics because there’s no way, in the heat of an asset bubble, to separate good investments from bad. As Warren Buffett likes to say, it’s only when the tide goes out that you see who’s swimming naked. But if the above chart could be constructed using 20-20 hindsight, the late 1920s would show a huge increase in debt/true GDP and the early 1930s would show a quick deleveraging rather than a gradual one lasting a decade. By 1939, not only would debt be a smaller part of the economy than in 1929, but the quality of the remaining debt would be far higher. That society would be ready to grow again, regardless of whether or not there’s a war. The other thing that keeps this debate alive is the assumption that there are painless alternatives to deleveraging after a credit bubble. Keynesians (who are now mostly running things) believe that if the government borrows to make up for the private sector’s deleveraging — or convinces the private sector to keep borrowing to replace those old bad debts — growth will resume without the need for layoffs and bankruptcies. Variations on this strategy are being tried by virtually every major country. Japan has been at it since the 1990s and has lately added extreme debt monetization to its ongoing huge deficits. The US since 2008 has gone the same route, expanding government debt by enough to offset the credit card and mortgage debt that’s been written off, while buying back several trillion dollars of bonds with newly-created dollars. Now Europe is getting ready to do something equally big (see OECD slashes growth forecasts, urges aggressive ECB action). So far the results aren’t encouraging: Japan is stagnant while continuing to pile up government debt, and now appears to be out of options. The US is reporting official GDP growth and falling unemployment but the case can be made that those numbers are largely fictitious (full-time jobs continue to decline, for instance, which means real unemployment continues to increase) and in any event a rising dollar is threatening even that modest momentum. Europe seems to be beyond saving, but the ECB is still going to try. The mainstream response of “well, we just need more debt and faster money printing” is disturbing both because it fits the common definition of mental illness (repeating the same behavior while expecting a different outcome) and because it magnifies the consequences of failure. If, as Austrians believe, there is no alternative to deleveraging after a boom — in other words, if booms and busts are two sides of the same event and therefore by definition have to occur together — then the extra $100 or so trillion dollars the world has taken on since the tech stock bust of 2000 makes the resulting, inevitable, deleveraging that much scarier. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China advances gold exchange launch; Singapore delays contract Posted: 16 Sep 2014 10:09 AM PDT By A. Ananthalakshmi SINGAPORE -- China will launch its international gold exchange 11 days ahead of schedule, sources said today, racing ahead in the scramble to set up an Asian bullion benchmark as rival Singapore is forced to delay its gold contract due to technical issues. Asia, home to the world's top two gold buyers -- China and India -- has been clamouring to gain pricing power over the metal and challenge the dominance of London and New York in trading. The state-run Shanghai Gold Exchange will launch the global gold bourse in the Shanghai free-trade zone on Thursday, two sources familiar with the matter told Reuters. The SGE had initially planned the launch for Sept. 29. ... ... For the remainder of the report: http://www.reuters.com/article/2014/09/16/china-gold-contract-idUSL3N0RH... ADVERTISEMENT Silver mining stock report comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Casey Research 2014 Summit http://www.caseyresearch.com/summit/2014-fall Canadian Investor Conference http://cambridgehouse.com/event/31/canadian-investor-conference-toronto-... New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Collapse Of U.S. Silver Stocks As Public Debt Skyrockets Posted: 16 Sep 2014 10:05 AM PDT The U.S. Empire is in real trouble. This is due to its idiotic business model of selling quality assets while acquiring massive liabilities and debts. Of course, the U.S. Government realizes this is not a sustainable way to do business, but at least for now.... we continue to have our Bread & Circuses, McDonalds & NFL Football for a bit longer. Furthermore, Americans have no clue that the role of the U.S. Dollar as the world's reserve currency continues to disintegrate each passing day as more countries elect to by-pass the Dollar and trade in other currencies... especially the Chinese Yuan. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Dollar’s Turn to Cause a Recession Posted: 16 Sep 2014 09:55 AM PDT Europe is an economic basket case while the US is kind-of sort-of recovering. Why? Several reasons, but the only one that really matters these days is that in 2012 and 2013 the eurozone operated with tight monetary policy and an appreciating currency while the US created new money with abandon and let the dollar fall. So US products got cheaper on global markets and US companies and consumers were able to borrow at more favorable rates. The result: relatively fast growth in the US and a descent into deflationary depression for the eurozone. Here’s the euro vs the dollar between early 2012 and early 2014: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cycle Analysis Supports Both Bearish and Bullish Views On Gold and Silver Posted: 16 Sep 2014 09:53 AM PDT When considering whether an asset is ready to turn higher, I generally look for an extreme negative sentiment level during an extreme price decline while the asset is in the timing band for a Cycle Low. At present, both Gold and Silver sentiment are approaching extremes, likely indicating that an ICL is near. But let's consider the chart from a broader perspective with the following question: Since this is just week 15 of the current IC, are there enough bears to lead us to believe that an IC low is near? In a bull market, low sentiment is a great predictor of a turn. But if Gold is still in a bear market, or even if it's in a more neutral bottoming period, sentiment might not be negative enough yet for an ICL. The same logic applies to the COT report (below). Speculators have not yet taken short positions as at other recent Cycle ICLs, suggesting that there is short selling ahead. As bearish as this sounds, there is a "rest of the story" in support of my view that we're still at a major decision point for Gold. If June 2013 was the final capitulation low that ended the bear market, and I still believe that it was, it was followed by a retest in Dec 2013. Each ICL since has attracted fewer Short speculators and far less hedging…and that's not bear market behavior. Such apathy and disinterest is often observed at – or after – bear market lows. Given the cross-currents, I stand by my work and maintain that no analysis can predict Gold's direction until the consolidation zone is resolved. The best stance at present is to be neutral with a "wait and see" bias. It's a cliché, but cash is a position. Although my official stance toward Gold is neutral, my analysis has been tilting more heavily bearish in recent weeks…and for good reason as it turns out. Gold closed this past week below $1,240, which was the last ICL, so an Investor Cycle failure is in play. The implication, of course, is that Gold is in longer term decline. It also means that the Yearly Cycle (which started in June 2013) is in decline and moving toward a YCL. It seems that every analyst and blog are now focused on $1,179 – the current bear market low and 2013's Yearly Cycle Low – and how Gold is likely to fall below it. The massive triangle patterns sported by the Gold and Silver charts have gone mainstream. From a contrarian standpoint, such obvious commentary could wind up working in the precious metals' favor; broadly held expectations often end up over-crowding a trade. In this case, a contrarian might expect a surprise turn and an early ICL. We can't say for sure what will happen. Through the past 13 years and more than 35 Investor Cycles, ICLs formed 10 times between weeks 15 and 18 – essentially where we are at present. Technically, all the readings we look for at major Cycle Lows are in place today. So although the weekly Cycle count is relatively early, there is absolutely enough precedent here to support an ICL. Supporting this position are the Miners, which are simply refusing to fall – normally by this point in a bearish Investor Cycle, they would be getting murdered. In closing, I circle back to a recurring theme…that the evidence currently supports both bullish and bearish views. With Gold still in a well-established triangle pattern, the uncertainty is not surprising. This week, however, the bear has begun to stir, with Gold pushing lower and taking out a key Cycle pivot. The current set up is undeniably negative, and odds are that we are still several weeks from an ICL. So the only prudent expectation here is to the downside. The downside case is supported by the current trend, and a test of the last Yearly Cycle Low (June 2013) at $1,179 is likely coming. That is the last line of support for Gold and potentially where the bulls will mount an attack.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold: Janet & Raj Stoke The Bulls Posted: 16 Sep 2014 09:32 AM PDT Graceland Update | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| War In Silver Rages As People’s Confidence In The West Fades Posted: 16 Sep 2014 08:38 AM PDT  Today a man who has been involved in the financial markets for 50 years told King World News that a war is now raging in the silver market as people's confidence in the West fades. John Embry, who is business partners with billionaire Eric Sprott, also discussed the massive manipulation of markets by the U.S. government. Today a man who has been involved in the financial markets for 50 years told King World News that a war is now raging in the silver market as people's confidence in the West fades. John Embry, who is business partners with billionaire Eric Sprott, also discussed the massive manipulation of markets by the U.S. government.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is The Fed About To Write the Next Chapter For Silver? Posted: 16 Sep 2014 07:53 AM PDT Since peaking around 21.60 in early July, Silver has sold off consistently for the past two months. By last week, the gray metal had drifted all the way down to test the critical support zone around 18.25-50; this level represents the 4-year low in silver and has provided meaningful support on three separate occasions over the last 14 months (for more on this area, see my colleague Fawad Razaqzada's note from last week, "Can Silver Defend $19 Again?"). Now, metal traders are wondering, "will this level finally break, or is another rally to above $20 in the cards?" As we go to press, the short-term technical picture favors the bears. As the 4hr chart below shows, silver has been in a bearish channel for over two weeks now. Just this morning, the metal peeked out above the channel, but was quickly rejected back lower, creating a large Bearish Pin Candle,* or inverted hammer pattern. This candlestick formation shows a sharp shift from buying to selling pressure and is often seen at near-term tops in the market. With the RSI still well within bearish territory, the sellers could look to drive the metal back into the key 18.25-50 support area later this week. Only a break above today's high at 18.85 would shift the near-term bias to the topside for another run back toward $20. Meanwhile, the fundamental side of the ledger is a bit murkier. With a plethora of high-impact economic data scheduled for the last 72 hours of the week, volatility will likely be elevated for all trading instruments. While both Scotland's independence referendum and the ECB TLRTO auction will be important, the marquee event for silver will be tomorrow's Fed decision and statement. Another $10B taper of the QE program is all-but-inevitable, so the key variable will be whether the central bank tweaks its statement to suggest that it may raise interest rates sooner. We'll have a full Fed preview out later today, but if the Fed statement suggests earlier rate hikes are possible, the dollar may rally and silver could fall back into 18.25-50 support. On the other hand, a status-quo statement and press conference would disappoint dollar bulls, likely leading silver to break out of its bearish channel and target $19 in the short-term and potentially the $20 level in time. *A Bearish Pin (Pinnochio) candle, or inverted hammer, is formed when prices rally within the candle before sellers step in and push prices back down to close near the open. It suggests the potential for a bearish continuation if the low of the candle is broken.

You can find more of FOREX.com's research at http://www.forex.com/latest-forex-research.html

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions. Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that FOREX.com is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. FOREX.com is regulated by the Commodity Futures Trading Commission (CFTC) in the US, by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investment Commission (ASIC) in Australia, and the Financial Services Agency (FSA) in Japan. Please read Characteristics and Risks of Standardized Options. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gartman Letter cites Koos Jansen and Gold Newsletter on Chinese gold demand Posted: 16 Sep 2014 07:52 AM PDT By Dennis Gartman https://www.thegartmanletter.com/ Regarding Chinese gold demand, which we wrote about yesterday, it is open to debate and our old friend, Brien Lundin of the Jefferson Companies in New Orleans, wrote to share his insights. We've chosen to share them further with our readers, with his approval. Brien wrote: * * * Hi, Dennis: In your letter this morning, you noted that Chinese gold demand was recently reported to be down about 50 percent year over year. This is erroneous information from the World Gold Council, as I've been noting in Gold Newsletter -- https://jeffersoncompanies.com/ Here's an explanation that I put in our September issue. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata "There's a lot of misinformation on this topic. The mainstream financial media keeps parroting numbers from the World Gold Council and other sources, which typically rely on import statistics from Hong Kong. However, China has recently opened up new ports of entry for gold, a move that has correspondingly reduced the import numbers from Hong Kong. "Much more relevant are gold delivery statistics from the Shanghai Gold Exchange, which directly indicate wholesale gold demand in China. Koos Jansen of -- -- and -- -- is today's leading reporter of Chinese gold demand dynamics, and he relies on the Shanghai Gold Exchange numbers for his analyses. Using the SGE reports, Jansen notes that Chinese gold demand year to date is down about 17 percent from last year's torrid pace. "In comparison, the financial media is reporting that Chinese demand is down about 50 percent over last year. "So you can see that China -- while certainly not buying as much gold as last year -- is still buying the metal at a level that, if not for last year, would have set records. "Moreover, Jansen is reporting that SGE deliveries over the past couple of weeks have risen significantly, an indication that China is now returning to the market as bulls have hoped. If the current levels keep up, the difference between last year's buying levels and this year's will narrow considerably. "Add it all up and we see that just as the cure for low prices is low prices, the current decline in gold could in itself spawn a powerful short-covering rally in the near future. It's also running straight into a growing headwind of Chinese buying." I thought you'd like to be aware of this issue, Dennis, as the facts on the ground in China run counter to the prevailing wisdom regarding gold demand in the markets. There's much more behind it, including why the SGE is more accurate than the World Gold Council numbers and why the WGC is relying on Hong Kong statistics and reports from the China Gold Association. The bottom line is that Chinese gold demand is still price-sensitive and a bit lower than last year, but it is has also maintained a basic run-rate that is far higher than anything experienced before 2013 and still rivals the record levels of last year. Longer term, it seems that the growing gold demand in China is an instrument of official policy to some extent, the purpose of which will be revealed over the coming months and years. All the best, and keep up the great work. -- Brien * * * This is not even "Gold bug-y"-type work. This is hard data mining and we find it interesting, wondering why the World Gold Council of all groups might have gotten this wrong. Join GATA here: Casey Research 2014 Summit http://www.caseyresearch.com/summit/2014-fall Canadian Investor Conference http://cambridgehouse.com/event/31/canadian-investor-conference-toronto-... New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 Sep 2014 05:33 AM PDT GOLD BULLION prices ticked higher in London on Tuesday, recovering almost 1% from last week's new 2014 closing low as European stock markets followed Asian equities lower. Crude oil contracts touched a 1-week high in the US and rose earlier in Europe, but only due "merely to the rollover" from the October expiry to the November contract, says Germany's Commerzbank. Major government bond prices rose, pushing interest rates down, as the US Federal Reserve began its 2-day policy meeting in Washington – widely expected by analysts to end with a cut to QE asset purchases, plus a "hawkish" tone on when the central bank will start raising rates from zero. "Looming interest rate rises," says the latest Precious Metals Weekly from London-based consultancy Metals Focus, "will continue to discourage investor buying and may in fact lead to modest selling. But "the turning point for prices is likely to emerge around mid-2015...perhaps surprisingly [because of] interest rate rises in the US" which are likely to be "only modest and slow," Metals Focus believes. Short-term, says a technical analysis from French investment bank and London bullion market-maker Societe Generale, prices for gold last week "broke the trend line which was running since last December. "Although the price action looks weak, daily indicators are at support and could pause a little." "We remain biased to further downside," agrees SocGen's fellow London market-maker Scotia Mocatta in a technical note. "However, we [also] note that bearish momentum indicators are showing early signs of moderation." "Interest in the physical market," says the commodity team at Australia's ANZ Bank, "appears to be improving from the key importer of India" after August import data showed a year-on-year jump of 176% in gold inflows by value, rising above $2 billion. Gold bullion imports to India were effectively blocked by strict rules in summer 2013, sparking a flood of smuggling only tempered when new gold import licenses were extended to so-called "star trading houses" in June. "Gold imports are likely to pick up even further," says another analyst's note, "in advance of the religious festivals of Dhanteras and Diwali in October." Over in China – now the world's No.1 gold bullion buyer above India – prices rose less quickly in Shanghai than London today, pushing the premium for wholesale metal delivered in China down to $3.40 from Monday's closing level above $5 per ounce. The Shanghai Gold Exchange announced it's bringing forward the launch of its international Yuan-gold market – hosted inside the city's free-trade zone – from the end of this month to Thursday, citing the diary schedules of senior officials who will attend. Six major Chinese banks led by ICBC – the world's largest bank by assets – will provide clearing and settlement services to the Shanghai Free-Trade Zone's new gold trading bourse. The first 40 approved members of the FTZ gold exchange include London market makers HSBC, UBS and Goldman Sachs. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold's move from West to East is said intended to rebalance FX reserves Posted: 16 Sep 2014 05:26 AM PDT China May Boost Gold Reserves amid Imbalances in Holdings By Feiwen Rong and Glenys Smi http://www.bloomberg.com/news/2014-09-15/biggest-banks-said-to-overhaul-... China may join other emerging countries in boosting gold reserves as the precious metal makes up a smaller share of its foreign-exchange holdings compared with developed economies, said a London-based researcher. The country hasn't announced any changes to state gold reserves since authorities in 2009 said holdings totaled 1,054.1 metric tons. While China holds the world's biggest foreign-exchange reserves, bullion accounts for 1.1 percent of the total, compared with about 70 percent for the U.S. and Germany, the biggest gold holders, World Gold Council data show. ... Dispatch continues below ... ADVERTISEMENT Free Storage with BullionStar in Singapore Until 2016 BullionStar is a Singapore-registered company with a one-stop bullion shop, showroom, and vault at 45 New Bridge Road in Singapore. BullionStar's solution for storing bullion in Singapore is called My Vault Storage. With My Vault Storage you can store bullion in BullionStar's bullion vault, which is integrated with BullionStar's shop and showroom, making it a convenient one-stop-shop for precious metals in Singapore. Customers can buy, store, sell, or request physical withdrawal of their bullion through My Vault Storage® online around the clock. Storage is FREE until 2016 and will have the most competitive rates in the industry thereafter. For more information, please visit Bullion Star here: "It is clear that Western central banks over time will be reducing their reserves and China and other Asian countries will be increasing," David Marsh, managing director at the Official Monetary and Financial Institutions Forum, said in a Sept. 11 interview in Beijing. "Gold will become more traded among central banks in the next 30 years because there are colossal imbalances in world gold holdings as a percentage of overall asset reserves." Central banks, net buyers of gold for 14 straight quarters, last year helped limit bullion's losses that were the most since 1981 and may increase purchases to as much as 500 tons this year after adding 409 tons last year, the London-based council said Aug. 14. The precious metal rose 3 percent this year as geopolitical tensions boosted demand for a haven. Bullion for immediate delivery climbed 0.3 percent to $1,237.04 by 10:44 a.m. in Beijing, according to Bloomberg generic pricing. The metal fell 28 percent last year, the biggest annual decline in more than three decades, and is down 36 percent from a record $1,921.17 reached on Sept. 6, 2011. Russia is among nations that added gold to reserves this year, boosting holdings to the highest in at least two decades and surpassing China's hoard to become the fifth-largest by country, data from the council show. "I don't know if China has been boosting their official gold reserves," said Marsh, who co-founded the group that tracks economic and monetary policies. "But I'd rather think over the past six or seven years the Chinese authorities probably have been adding to their holdings in different ways." Foreign-exchange reserves of China, the second-biggest economy, have nearly doubled to $3.99 trillion since April 2009 when the nation last announced changes to bullion holdings, according to State Administration of Foreign Exchange data. Last year the country, also the biggest bullion producer, overtook India as the top gold user after price declines spurred buying. The U.S. holds 8,133.5 tons of gold in reserves, while Germany keeps 3,384.2 tons and Italy has 2,451.8 tons, World Gold Council data show. Russia keeps 1,105.3 tons, or 9.8 percent of its total holdings, according to the data. Join GATA here: Casey Research 2014 Summit http://www.caseyresearch.com/summit/2014-fall Canadian Investor Conference http://cambridgehouse.com/event/31/canadian-investor-conference-toronto-... New Orleans Investment Conference https://jeffersoncompanies.com/landing/noic2014?IDPromotion=614011014520... Mines and Money London http://www.minesandmoney.com/london/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 16 Sep 2014 02:12 AM PDT Submitted by Francis Schutte, founder of Goldonomic.com: Everybody has to spend energy, has to work for his living. This is true for Government as well as for the Billionaires and for the ordinary employee. Nothing – except for Sunshine and Air – comes for free. Note that today, sometimes people even pay for sunshine (vacation) and Air (airports in Venezuela). Governments and Central Banks (which are like economic Siamese twins) not only print Fiat Money but on top they make the cost to print more money, issue new debt and serve past debt ridiculously low….In reality, Real Interest rates (nominal interest rate less real inflation rate) or the cost to issue more fiat money has even become negative. Propaganda must be extremely solid to keep such a mirage alive and absolute no accident may happen.

Note 1 : up to today we still don’t know what really made the Big Crash of 1929 happen. Some blame the bad state of the economy, others the overextended on margin (debt) thriving Stock Markets. Fact is we had a Debt bubble like we have today. Note 2: Bond markets show Huge Top formations and we already have indications that the price has fallen down out of the top.

Modern Money is worse than debt. Nowadays it has a negative value – whoever exchanges it for goods and services, gets automatically mugged! Whoever buys Treasuries and Bonds gets mugged, Whoever keeps money in saving accounts and as bank deposits gets mugged, whoever buys a life insurance gets mugged, whoever buys Real Estate gets mugged, whoever keeps banknotes under his mattress gets mugged…Apparently there is no way to escape the global holdup by Governments and Bankers. Governments are using the so created Fiat Debt Money to pay for Goods and Services. The are getting richer for each Dollar/Euro/Yen/Sterling note they bring into circulation. (reality is that they get less broke for it is mathematically impossible to cover all the historic and future debt). Those who understand what is happening, know that as sellers they have become subjects of theft in broad daylight. Governments are paying for Goods and services with ‘negative fiat money’ or to put it blunt, the buyer is exchanging his goods and is getting more debt than Assets in return. By doing so, Authorities deny the very existence of the Constitution.

Today’s situation is actually a lot worse than the one pictured by ‘the emperor has no clothes’ . Therefore the one million dollar timing question is to find out WHEN some accident will make it all blow up. The second million dollar question is to find out which action, what happening will actually make it happen….