saveyourassetsfirst3 |

- Reason # 5 The Silver Noose is Tightening: Silver Recycling Plunging

- The Depression, World War II, And What They Really Mean

- Gold Big Breakdown Possible as Long as Below 1300

- Attention junior resource investors: This could be your last great buying opportunity of the year

- Metals market update for September 16

- Zimbabwe to revive gold market?

- The Entire Housing Market Hit A Wall In August

- Here are the only places in the world where you won't pay property taxes

- Shanghai gold trading platform given surprise launch date

- True or False: The Indian gold market is dead

- Cycle Analysis Supports Both Bearish and Bullish Views On Gold and Silver

- Report points to surge in Indian gold imports

- Copper Short Squeeze Pulls Metals Higher

- Indian jewelry exports on the rise

- Stuck Inside of the CME with the COMEX Blues

- The Silver Sentiment Cycle: Why Silver Will Rally for the Next 3-7 Years

- BO POLNY: Gold Price Suppression Ends in 2014 with a Gold Spike!

- Gold nearing critical support points on the charts

- Is The Fed About To Write the Next Chapter For Silver?

- The U.S. National Debt Has Grown By More Than A Trillion Dollars In The Last 12 Months

- Gold imports soar 176% in India

- Yuan-centric gold pricing imminent and important - Phillips

- Gold trading hubs vie for Asian demand

- Gold contracts and exchanges vie for Asian attention

- Gold Demand In India Nearly Triples As China Launches Global Gold Bourse This Thursday

- Silver could rebound strongly on global economic recovery: ETFS

- Gold Demand In India Triples As China Launches Global Gold Bourse This Thursday

- Jim Willie: US Plans to Collapse Europe in Last-Ditch Effort to Save Petro-Dollar!

- Scotland gold demand rises before independence referendum

- CHARTS : The Dow/Gold Ratio - Reviewing the Rebound

- Technical analysis of Gold for September 15, 2014

- Gold: $1.252 For A Closing Basis As the New Stop For Shorts

- Why Money Is Worse Than Debt

- Why ECB QE Is Bearish For Gold Prices

- Junior Miners Breaking Out Higher Forecasting Gold and Silver Bottom

- Gold mining stocks have outperformed the Dow since 1920

- Betting against Gold, by De Gaulle

- Hedge funds have silver prices wrong as Shanghai inventory running out

- Indian Trade Deficit Widens as Gold Imports Surge 176%

- Inflation Watch: How Much $1 Used To Get You!

- Slovak Prime Minister Warns Ukraine of ‘Ultimate Disintegration’

- Seven King World News Blogs/Audio Interviews

- Koos Jansen: China again buys the dip in gold---and silver gets scarcer

- Ron Paul: Will the Swiss vote to get their gold back?

- Anxious Scottish investors have been buying gold

- Export Growth to Lift Italian Gold Jewellery Demand and Bullion Imports to Six-Year High

- Private homes in Iran hold more gold than Central Bank

- AngloGold Ashanti of South Africa Abandons Spin Off Plans

- South African gold, PGM, diamond and copper outputs down sharply

- Indian trade deficit widens as gold imports surge 176%

| Reason # 5 The Silver Noose is Tightening: Silver Recycling Plunging Posted: 16 Sep 2014 12:30 PM PDT

Over 1 in every 4 ounces of silver that planet earth will bring out of the ground this year, will be shuffled through the vast halls of Comex warehouses. Over 1 in 4. The Comex system has gone from moving perhaps 1 million ounces of silver per week, to moving nearly 1 million ounces…per day! In fact, in just the last two business days, the Comex has moved over a whopping 4 million ounces of silver! Click here for more on why the Silver Noose is Tightening on the Banksters: |

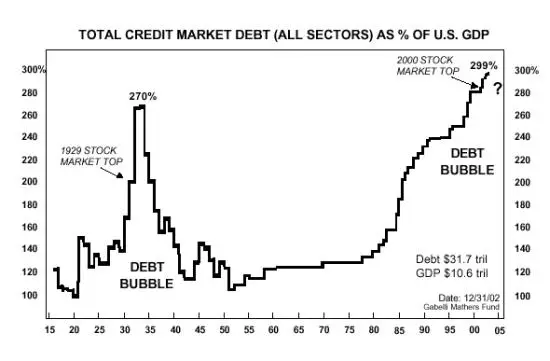

| The Depression, World War II, And What They Really Mean Posted: 16 Sep 2014 11:21 AM PDT Nearly a century after the fact, the Great Depression remains THE object lesson for virtually every branch of economics. To monetarists the fact that the US money supply fell by nearly a third in the 1930s illustrates the need for a central bank to maintain steady money growth. To Keynesians the Depression’s depth and duration proved that capitalist systems are inherently unstable and need a big, powerful government to manage them. World War II, in this framework, saved the US economy from permanent 25% unemployment. To Austrians, meanwhile, the Depression demonstrated that 1) the best way to prevent a bust is to avoid the preceding boom, which is another way of saying that the size and composition of the national balance sheet is the key to everything, and 2) the best way to get through a bust is to let market forces liquidate the bad debt as quickly as possible. A September 14 DollarCollapse column took the Austrians’ side in the debate and illustrated the point with the following chart, which depicts the massive deleveraging of the 1930s. Not surprisingly, since the Depression means so much to so many, this generated some conflicting comments, the most challenging of which came from reader Eric Original:

This deserves a response, both because the final spike in debt/GDP was indeed partially caused by GDP shrinking faster than debt, and because it gets at some of the deeper, more interesting parts of the story. So, here goes: During the initial stages of a credit bubble debt soars but debt/GDP rises more slowly, because the proceeds from all those new loans get spent, thus producing “growth” which shows up as rising GDP. In other words both the numerator and denominator of the ratio go up. But — and this, I think, is the crucial fact for Austrians — extremely easy money leads people to buy things and make investments that they wouldn’t otherwise buy or make. This “malinvestment” pumps up growth in the near-term but doesn’t generate sufficient cash flow thereafter to service the related debt. So the initial debt-driven pop in GDP is an illusion. Later, when those bad investments can’t cover their interest payments and go bust the economy shrinks, for a time, faster than societal debt, which causes debt/GDP to spike. But the actual spike in debt/true GDP happened earlier. It isn’t reflected in official statistics because there’s no way, in the heat of an asset bubble, to separate good investments from bad. As Warren Buffett likes to say, it’s only when the tide goes out that you see who’s swimming naked. But if the above chart could be constructed using 20-20 hindsight, the late 1920s would show a huge increase in debt/true GDP and the early 1930s would show a quick deleveraging rather than a gradual one lasting a decade. By 1939, not only would debt be a smaller part of the economy than in 1929, but the quality of the remaining debt would be far higher. That society would be ready to grow again, regardless of whether or not there’s a war. The other thing that keeps this debate alive is the assumption that there are painless alternatives to deleveraging after a credit bubble. Keynesians (who are now mostly running things) believe that if the government borrows to make up for the private sector’s deleveraging — or convinces the private sector to keep borrowing to replace those old bad debts — growth will resume without the need for layoffs and bankruptcies. Variations on this strategy are being tried by virtually every major country. Japan has been at it since the 1990s and has lately added extreme debt monetization to its ongoing huge deficits. The US since 2008 has gone the same route, expanding government debt by enough to offset the credit card and mortgage debt that’s been written off, while buying back several trillion dollars of bonds with newly-created dollars. Now Europe is getting ready to do something equally big (see OECD slashes growth forecasts, urges aggressive ECB action). So far the results aren’t encouraging: Japan is stagnant while continuing to pile up government debt, and now appears to be out of options. The US is reporting official GDP growth and falling unemployment but the case can be made that those numbers are largely fictitious (full-time jobs continue to decline, for instance, which means real unemployment continues to increase) and in any event a rising dollar is threatening even that modest momentum. Europe seems to be beyond saving, but the ECB is still going to try. The mainstream response of “well, we just need more debt and faster money printing” is disturbing both because it fits the common definition of mental illness (repeating the same behavior while expecting a different outcome) and because it magnifies the consequences of failure. If, as Austrians believe, there is no alternative to deleveraging after a boom — in other words, if booms and busts are two sides of the same event and therefore by definition have to occur together — then the extra $100 or so trillion dollars the world has taken on since the tech stock bust of 2000 makes the resulting, inevitable, deleveraging that much scarier. |

| Gold Big Breakdown Possible as Long as Below 1300 Posted: 16 Sep 2014 11:21 AM PDT |

| Attention junior resource investors: This could be your last great buying opportunity of the year Posted: 16 Sep 2014 11:10 AM PDT From The Gold Report: Brien Lundin, founder of Jefferson Financial, producer of the New Orleans Investment Conference and Gold Newsletter, believes at least a small amount of the massive liquidity produced by loose monetary policy in Western economies will find its way into mining equities following a summer pullback in equity prices—but don’t wait long. Lundin expects the “buying opportunity” to last for two, maybe three weeks before seasonal gold demand pushes prices higher. In this exclusive interview with The Gold Report, Lundin discusses a select group of gold and precious metals equities that he expects to perform well as near-term news reaches the market. The Gold Report: On July 30, you sent out a Gold Newsletter alert that forecast a pullback in the midsummer bull market. The next day the Dow dropped 317 points, while the NASDAQ fell about 93 points. Since then the Dow has climbed back above 17,000, the NASDAQ above 4,600. Should investors dismiss that drop or do you believe it was akin to a tremor preceding an earthquake? Brien Lundin: That particular call made me look like a genius at the time, but right after that drop the stock market took off and reached new highs. The stock sell-off in late July was a sign that investors were nervous because we haven’t had a meaningful correction during this bull market. However, there are potential pitfalls ahead for the economy—we still have to navigate the U.S. Federal Reserve’s ending of quantitative easing and its first interest rate hikes. There’s nothing directly ahead that indicates a major correction will occur, yet these things happen when you’re least expecting them. TGR: You’ve been warning investors in Gold Newsletter about the erosion of the foundation of the U.S. equity market. Please give our readers a few points to underpin your thesis. BL: When I put forth that thesis, Q1/14 gross domestic product (GDP) had missed consensus estimates by 3.3%. The consensus going into that report was for 1.2% growth but it turned out to be just 0.1%—only to be subsequently revised further down to -2.1%. The miss for the consensus estimate was remarkable. I posited that these reports had possibly captured some underlying weakness in the economy. I expected a rebound in Q2/14 because a lot of economic activity was put off due to the unusually cold winter weather. But Q2/14 GDP was over 4%. I certainly wasn’t expecting anything like that, and neither was anyone else. So, the idea of a major stock market decline stemming from a weakening U.S. economy has become more remote, at least for the time being. TGR: What are you seeing now? BL: The massive amount of money created in developed economies since the 2008 credit crisis really has not resulted in significant retail price inflation. If anything, there has been disinflation in major economies, such as in Europe where the European Central Bank is now turning to quantitative easing. The real result of quantitative easing in the U.S. and loose money policy throughout the Western economies is a virtual flood of liquidity looking for places to land. It’s why we have U.S. Treasuries being bid down to their lowest rates ever, while the U.S. stock market is hitting record highs. Those two asset classes should be at opposite sides of the seesaw, but there’s so much money looking for a home that both are soaring simultaneously. TGR: The Market Vectors Junior Gold Miners ETF (GDXJ:NYSEArca) has been trading lower since mid-July. In fact, the Dow Jones Industrial Average has outperformed that ETF over the last month or so. Is that a buying opportunity? BL: I think so. The timing is critical, though. While I don’t see a near-term, fundamental driver to push the market higher in the very near future, there are some factors that I think will push the junior resource stocks and the metals higher this fall. So your real buying opportunity is probably over the next couple of weeks. All of the liquidity that I referred to earlier has to go somewhere. There’s a broad consensus that gold is going lower and a lot of money is shorting gold. At some point over the next month or so—at the first sign that gold is not going lower—we’re going to see some short positions get covered, and that ocean of money is going to start sloshing into gold and silver. At that point we should also see stronger seasonal demand for gold and that also will help power the gold equities market forward. TGR: One company that you follow in Gold Newsletter, Cayden Resources Inc. (CYD:TSX.V; CDKNF:OTCQX), recently received a takeover bid from Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE). The cash and share deal values Cayden at about CA$209 million, a 45% premium to Cayden’s share price on the day the bid was made. What stands out in that transaction? BL: A lot of people were surprised by that transaction because Cayden does not yet have a resource estimate for El Barqueño, nor even all the necessary permits to drill the targets it had found through surface sampling. It’s a very early-stage takeout bid, but as we’ve been reporting in Gold Newsletter, anyone looking at El Barqueño could see how the geological model was fitting together and the clear potential for a multimillion-ounce deposit. Cayden also has a great land position with the Morelos Sur project, which is next to Goldcorp Inc.’s (G:TSX; GG:NYSE) Los Filos mine. That gives Cayden a lot of leverage, and thus the bid by Agnico Eagle could be just the first volley in a bidding war. It’s quite possible that Goldcorp will make a counterbid to acquire the important land next to Los Filos. TGR: Keegan Resources. Cayden Resources. Both juniors received takeover bids. Should investors follow Ivan Bebek and his team to the next company? BL: Absolutely. Bebek and his team had Keegan, which became Asanko Gold Inc. (AKG:TSX; AKG:NYSE.MKT). We have followed Asanko in Gold Newsletter from its inception and still recommend it. That team now has another winner with Cayden and already has other things in the works. I’m not certain what that venture would be but it would really behoove investors to jump on board once this team gets moving on it. TGR: What are some other junior gold names you’re following in Gold Newsletter? BL: I like Almaden Minerals Ltd. (AMM:TSX; AAU:NYSE). The company recently published a revised preliminary economic assessment (PEA) on its Tuligtic project in Mexico that improves its net present value and rate of return, while lowering capital costs—which are still about $400 million ($400M), but that’s much better than before. Almaden is now focusing on drilling some targets outside the resource zone. It’s an intriguing exploration area around the current resource. The project has a long way to go up the value curve as it works more on the economics and toward feasibility. TGR: Almaden just raised more money to drill other targets on Tuligtic but it spent a lot of money trying to find the high-grade core of the Ixtaca deposit, which really hasn’t been found yet. Now it’s going to focus on other targets. How should investors read that? BL: The other targets where Almaden is drilling are areas where it has already done some exploration drilling. Almaden is attempting to expand its resource, but Ixtaca is already a multimillion-ounce deposit that justifies development. What the company doesn’t have right now is a market where these kinds of achievements are rewarded. When the market turns around, the major producers will cherry pick the best of these deposits at reasonable prices. There aren’t many at the top of the list but I think Almaden is going to be there. Companies that control these projects will be taken out at significant premiums to their current levels. Cayden may just be the first shoe to drop as these larger companies become more aggressive before the market takes off again. TGR: What are some others? BL: I also like Columbus Gold Corp. (CGT:TSX.V; CBGDF:OTCQX). It is about to get a third drill turning on its Montagne d’Or deposit, part of the Paul Isnard project in French Guiana. Joint-venture partner Nordgold N.V. (NORD:LSE) is funding all of the exploration up to $30M or a bankable feasibility study to earn 50.1% of the project. The drill results have been great. One recent hole hit 33.5 meters of 3.15 g/t Au. Essentially, the company is expanding the resource even as they’re infill drilling. Columbus also raised some money that will help it advance a great suite of exploration projects in Nevada. It’s a company that is going to keep turning out news for the foreseeable future and is a great buy for a long-term investor looking for real value. TGR: In May, Columbus announced that its PEA on the Paul Isnard project in French Guiana overstated the grade and ounces contained in the deposit. Nonetheless, a few days later, Nordgold made its scheduled $4.2M payment to Columbus to continue its earn-in. The share price is now about $0.40. What’s next? BL: It’s obvious that Nordgold didn’t see that hiccup with the resource estimate as an issue. Some of the grades were “smeared” across areas where there wasn’t enough drilling density to support those grades. As the companies continue infill drilling at much tighter drill spacing, they are bringing Inferred ounces into the Indicated category. The deposit is growing because a lot of those ounces were never included in any previous resource estimate. The resource will probably end up significantly larger than it was before that little hiccup. It has a clear path toward production at this point, and it’s all paid for. One other company I like in the gold space is Precipitate Gold Corp. (PRG:TSX.V). The company is drilling its project in the Dominican Republic that’s adjacent to GoldQuest Mining Corp.’s (GQC:TSX.V) Romero discovery. Precipitate has found some great surface gold anomalies from trenching and is drilling below these trenches. We expect some results fairly soon. That’s an exploration play that has a lot of potential in the very near term. TGR: In your newsletter you call Precipitate a “buy” yet the 12-month price charts for Precipitate and GoldQuest look quite similar. Why a “buy” for one and not the other? BL: The charts may look similar, but the market values certainly aren’t. Precipitate is a buy right now precisely because GoldQuest had made a discovery, and Precipitate has yet to. Thus, the upside potential is very large for Precipitate at this point. TGR: It’s a good sign that you’re once again adding companies to Gold Newsletter and placing some of them on your buy list. Please tell us about some recent additions. BL: One is Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX; LY1:FSE). We had previously recommended the company, but it went relatively dormant as the market went into its multi-year malaise. Lion One is headed by noted mining financier Wally Berukoff and it was rejuvenated when it became apparent that Berukoff was going to move the company’s Tuvatu gold project forward. Berukoff is a proven entrepreneur in the resource industry and his decision to once again advance the company caused me to put it back on our recommended list. Lion One has a clear path to production. The capital cost to build a mine is going to be $40M or less and I don’t think raising that amount will pose a problem for that group, even in this market. That’s a company looking to take advantage of the next up cycle. TGR: Is $40M all Lion One needs to build a mine in Fiji? BL: That’s all it needs in capital. It will obviously need some permits but a good bit of that work was done while the company had supposedly gone quiet. Fiji is generally pro-mining and many locals are looking for work, so I don’t really see any big roadblocks as Lion One advances Tuvatu toward production. TGR: What are some others that you’ve added? BL: An interesting company I recommended recently is Inca One Resources Corp. (IO:TSX.V). Illegal mining In Peru has created an environmental catastrophe, so the government is clamping down on illegal miners and forcing them to process their ore at approved facilities. Inca One is taking advantage of the new laws by building milling facilities, buying ore from the miners and making a markup on that ore. The business model is eminently scalable. When the company reaches a production rate of about 100 tonnes per day, which it should shortly, it expects to deliver free cash flow of about $9M per year. This concept can be applied throughout Peru. It’s a huge market so, although there are competitors, there’s more than enough artisanal gold production in Peru to accommodate them all. Inca One has great management, a great business model and it should remain ahead of the pack. It’s not the type of company that will be leveraged to the price of gold because its margins will remain fairly constant. TGR: How does it actually work? BL: The miner delivers the ore, the ore gets tested and the miner is paid once the test result is in. The miner can take it or leave it at that point but if he takes it, he gets a cash payment and doesn’t feel that he’s been misled or cheated if the recovery rate is lower than expected. I think that transparency will help Inca One get more business from local miners than other companies in the same business. TGR: We have talked a lot about gold companies. What are some other junior resource companies that you’re following? BL: I like Wellgreen Platinum Ltd. (WG:TSX.V; WGPLF:OTCPK;). The Wellgreen deposit in the Yukon is absolutely enormous. The challenge is how to develop it at a reasonable capital expense. The plan is to attack the higher-grade zones first to achieve a quicker payback on capital as development ramps up. The deposit is so large that it is essentially a strategic deposit that some larger company will own at some point. A smaller company like Wellgreen can only keep advancing it toward production. The next PEA will go a long way toward convincing the market that this is a viable, highly economic deposit. TGR: Perhaps a few more companies? BL: Fission Uranium Corp. (FCU:TSX.V) continues to plough ahead with drilling on one of the world’s richest uranium deposits. The company has been boring the market with one stellar drill result after another so the price has actually slid some over the summer. This is a great buying opportunity. TGR: New drill results have expanded the high-grade R780E zone on its Patterson Lake South property in Saskatchewan. In fact, all of the drill holes so far have hit uranium mineralization. Is this still a standalone company if spot uranium was at $50/lb? BL: Absolutely not. Fission is really a bet on higher uranium prices. The uranium story is inevitable, just not necessarily imminent. We keep waiting for these supply-demand factors to impact the uranium price and they will eventually. Once that happens Fission is going to be one of the first companies taken out. As it stands now, it’s just a great value play. We talk about all of these separate mineralized zones, but all these zones are going to connect in one very large deposit. It’s worth every bit and more of what the company is selling for right now. People should just buy it, hold it and wait for a takeout scenario. TGR: Do you want to discuss another uranium explorer? BL: There’s an interesting new uranium exploration play—Roughrider Exploration Ltd. (REL:TSX.V)—that I think could make some waves soon. As you’ll remember, Hathor was a huge success with its Roughrider uranium discovery in the Athabasca Basin. The name isn’t a coincidence. Roughrider Exploration is being advanced with the help of Dale Wallster, the geologist who discovered the original Roughrider property and vended it into Hathor. Now this new venture is exploring its extensive land position on trend from the original Hathor discovery. It’s a new recommendation of mine, and I’m excited about the upside if the company can find even a sniff of a new discovery. TGR: One last company? BL: I’ll give you two that I’m looking closely at, but have yet to recommend in Gold Newsletter. One, Aftermath Silver Ltd. (AAG:TSX.V), has a very interesting, high-grade silver deposit that could be brought into production very quickly. The company still has to raise the necessary funds, which is tough to do in the current market. But once silver begins to rebound, that won’t be hard at all, and this will be an extremely leveraged play on silver Another is Source Exploration Corp. (SOP:TSX.V). The company has been getting very impressive grades from its Las Minas gold project in Mexico, and the mineralization is looking like it’s holding together very well. As I say, I haven’t recommended the company yet, but I’m watching it closely. The drill results have been quite remarkable. TGR: Every year your company, Jefferson Financial, puts on the New Orleans Investment Conference. This year the show celebrates its 40th anniversary from October 22–25. The headline event is a panel discussion with former Fed Chairman Alan Greenspan, legendary investor Porter Stansberry and Marc Faber, publisher of the Gloom, Boom & Doom newsletter. What can investors learn from this? BL: On the Greenspan panel we’re going to pointedly ask him about the Fed and the Treasury’s role in manipulating the gold price and how that occurs, if it occurs. He no longer has any reason to obscure the truth. There will also be a moderated Q&A with Greenspan where he’ll take questions from the audience. Those two panels with Greenspan are going to make headlines, if not history. He has a fascinating story. Greenspan was one of the most ardent and eloquent goldbugs in the 1960s. He was a close follower of Ayn Rand and some of his writings on gold still stand today as among the best ever produced on the role of gold in protecting citizens from currency depreciation. The rest of our lineup includes Dr. Charles Krauthammer, Peter Schiff, Rick Rule and Doug Casey. People come back year after year because they get to meet these experts and talk with them. They get stock recommendations and strategies that they’ll never get anywhere else. It’s always a dynamic event. TGR: Thank you for talking with us, Brien. With a career spanning three decades in the investment markets, Brien Lundin serves as president and CEO of Jefferson Fin |

| Metals market update for September 16 Posted: 16 Sep 2014 10:42 AM PDT Gold climbed $3.20 or 0.26% to $1,233.90 per ounce and silver rose $0.03 or 0.16% to $18.68 per ounce yesterday. |

| Zimbabwe to revive gold market? Posted: 16 Sep 2014 10:37 AM PDT The Zimbabwean government has decided to lower the royalty on gold from 7% to 5% in an attempt to boost gold production from the country. |

| The Entire Housing Market Hit A Wall In August Posted: 16 Sep 2014 10:30 AM PDT This is 2005/2006 all over again. You can ignore reality, but you can't ignore the consequences of reality. Submitted by PM Fund Manager Dave Kranzler, Investment Research Dynamics: "I spent well over an hour surveying the housing market in my area (south-metro Denver) and the market is flooded with homes for sale, with many […] The post The Entire Housing Market Hit A Wall In August appeared first on Silver Doctors. |

| Here are the only places in the world where you won't pay property taxes Posted: 16 Sep 2014 10:25 AM PDT By Nick Giambruno, Senior Editor, InternationalMan.com:Do you really own something that you are forced to perpetually make payments on and which can be seized from you if you don't pay? I would say that you don't. You would possess such an item, but you wouldn't own it—an important distinction A ridiculous perversion of the concept of ownership and property rights has infected most of the world like a virus: something that most people unquestioningly accept as a normal part of life—like it's a part of the eternal fabric of the cosmos. I am talking about property taxes, of course. You know, the annual tax you pay that is based not on whether any income was generated, but rather on the underlying value of real estate you supposedly "own." There is no way to pay off this obligation in one fell swoop; it stays with you for as long as you "own" the property. In actuality, you don't own anything which you must pay property taxes on—you are merely renting it from the government. Suppose you bought a sofa set and coffee table for your living room for $5,000 cash, and then had the obligation to pay $100—or a percentage of the furniture's value—in tax each year for as long as you "owned" it. Then suppose that for whatever reason you're unable or unwilling to pay your furniture's property tax. It won't take long for the government to swoop in and confiscate it to pay off your delinquent taxes. You get to "own" it as long as you pay the never-ending annual fee—stop paying and you'll find out who really owns it. While many people would correctly find a furniture property tax absurd, they also illogically find it acceptable for the government to levy an insatiable tax on different assets—namely their homes, offices, and raw land. But to me at least, the type of asset being taxed is not what makes it absurd, it's the concept of property taxes that is absurd. Respect for property rights and property taxes are mutually exclusive concepts. What's yours is yours, and you shouldn't need to pay the government for permission to keep it. It's not uncommon for people in North America and Europe to pay tens of thousands of dollars per year in property taxes… just to live in their own homes. And this burden will almost certainly continue to rise. Property taxes are constantly being raised in most places, especially in places with poor fiscal health. It's very possible that over a lifetime, the total amount of property taxes extracted will exceed what was paid for the underlying property in the first place. And, just like the furniture example above, if you don't pay your property tax (AKA government rent) on the home you thought you owned, it will be confiscated. This is not as uncommon as some would believe. It was estimated that 10,000 people in Pennsylvania alone lose their homes annually because they aren't able to keep up with the property taxes. Using the word "own" and "ownership" in these contexts is the sloppy use of the word—which always leads to sloppy thinking. Speaking of sloppy thinking, expect Boobus Americanus to say things like "how would we pay for local services like public schools if it weren't for property taxes?" Of course, these services could be funded in many different ways—or better, they could be provided for in the free market. But don't expect that to happen. In fact, given the social, political, and economic dynamics in the US and most of the rest of the West, expect the opposite—property taxes have nowhere to go but north. It doesn't have to be this way. You can own real estate in certain countries and can skip the annual property-tax harvest. I have previously written that I view real estate in foreign countries—along with physical gold held abroad—as superior vehicles for long-term savings. However, foreign real estate has its drawbacks. It's illiquid and has carrying costs like maintenance expenses and, of course, property taxes. To diminish these costs that eat away at your real estate investment, it is essential to minimize or eliminate them. Here's a list of countries that do not levy any property taxes:

That's it. If you want to escape the rapacious and ridiculous property tax, these are your options. Ireland would have been on this list, but it recently adopted a property tax. This does not bode well for other EU countries that conceivably could face fiscal troubles and turn to property taxes as a solution—like Malta and Croatia. Colombia, Costa Rica, Ecuador, and Nicaragua have property taxes, but the obligations are generally negligible. The risk, of course, is that since a property tax is already in place in these countries it can easily be increased whenever the government decides it needs more revenue. Case in point: the bankrupt government of Greece. Consider the excerpt below from an article in The Guardian. “The joke now doing the rounds is: if you want to punish your child, you threaten to pass on property to them… Greeks traditionally have always regarded property as a secure investment. But now it has become a huge millstone, given that the tax burden has increased sevenfold in the past two years alone.” The country on the list above that most interests me is the Cayman Islands, but to each his own. This is because most Caymanians are vehemently opposed to all forms of direct taxation and have never had it in their history. That attitude and history is a good guarantor that it will be very unlikely for a property tax to be imposed sometime in the future. In any case, buying foreign real estate is a very individualized and often complex decision—but one that provides huge diversification benefits. Property taxes are but one consideration. You should look at foreign real estate less as a vehicle for a quick return and more as a diversified long-term store of wealth. Wherever you decide to buy, it should also be in a place that you would actually want to spend some significant time in. That way, the property has value to you, regardless of whether it proves to be a good investment. One expert on foreign real estate whom I'd highly recommend is none other than Doug Casey, the original International Man and my mentor. Doug's been to over 175 countries and invested in real estate in a number them. He wrote a thick and detailed chapter on foreign real estate, including his favorite markets, for our Going Global publication, which is a must-read for those interested in this extremely important topic. |

| Shanghai gold trading platform given surprise launch date Posted: 16 Sep 2014 10:23 AM PDT Today the Chinese government backed Shanghai Gold Exchange (SGE) brought forward the launch date of its international gold trading platform which is hosted in the city's free trade zone (FTZ). The gold trading platform will be known as the 'international board.' |

| True or False: The Indian gold market is dead Posted: 16 Sep 2014 10:15 AM PDT Trade statistics for the month of August have just been released in India, showing a huge surge in gold imports compared to August of 2013. |

| Cycle Analysis Supports Both Bearish and Bullish Views On Gold and Silver Posted: 16 Sep 2014 09:53 AM PDT When considering whether an asset is ready to turn higher, I generally look for an extreme negative sentiment level during an extreme price decline while the asset is in the timing band for a Cycle Low. At present, both Gold and Silver sentiment are approaching extremes, likely indicating that an ICL is near. But let's consider the chart from a broader perspective with the following question: Since this is just week 15 of the current IC, are there enough bears to lead us to believe that an IC low is near? In a bull market, low sentiment is a great predictor of a turn. But if Gold is still in a bear market, or even if it's in a more neutral bottoming period, sentiment might not be negative enough yet for an ICL. The same logic applies to the COT report (below). Speculators have not yet taken short positions as at other recent Cycle ICLs, suggesting that there is short selling ahead. As bearish as this sounds, there is a "rest of the story" in support of my view that we're still at a major decision point for Gold. If June 2013 was the final capitulation low that ended the bear market, and I still believe that it was, it was followed by a retest in Dec 2013. Each ICL since has attracted fewer Short speculators and far less hedging…and that's not bear market behavior. Such apathy and disinterest is often observed at – or after – bear market lows. Given the cross-currents, I stand by my work and maintain that no analysis can predict Gold's direction until the consolidation zone is resolved. The best stance at present is to be neutral with a "wait and see" bias. It's a cliché, but cash is a position. Although my official stance toward Gold is neutral, my analysis has been tilting more heavily bearish in recent weeks…and for good reason as it turns out. Gold closed this past week below $1,240, which was the last ICL, so an Investor Cycle failure is in play. The implication, of course, is that Gold is in longer term decline. It also means that the Yearly Cycle (which started in June 2013) is in decline and moving toward a YCL. It seems that every analyst and blog are now focused on $1,179 – the current bear market low and 2013's Yearly Cycle Low – and how Gold is likely to fall below it. The massive triangle patterns sported by the Gold and Silver charts have gone mainstream. From a contrarian standpoint, such obvious commentary could wind up working in the precious metals' favor; broadly held expectations often end up over-crowding a trade. In this case, a contrarian might expect a surprise turn and an early ICL. We can't say for sure what will happen. Through the past 13 years and more than 35 Investor Cycles, ICLs formed 10 times between weeks 15 and 18 – essentially where we are at present. Technically, all the readings we look for at major Cycle Lows are in place today. So although the weekly Cycle count is relatively early, there is absolutely enough precedent here to support an ICL. Supporting this position are the Miners, which are simply refusing to fall – normally by this point in a bearish Investor Cycle, they would be getting murdered. In closing, I circle back to a recurring theme…that the evidence currently supports both bullish and bearish views. With Gold still in a well-established triangle pattern, the uncertainty is not surprising. This week, however, the bear has begun to stir, with Gold pushing lower and taking out a key Cycle pivot. The current set up is undeniably negative, and odds are that we are still several weeks from an ICL. So the only prudent expectation here is to the downside. The downside case is supported by the current trend, and a test of the last Yearly Cycle Low (June 2013) at $1,179 is likely coming. That is the last line of support for Gold and potentially where the bulls will mount an attack.

|

| Report points to surge in Indian gold imports Posted: 16 Sep 2014 09:53 AM PDT The Gems and jewelry Export Promotion Council (GJEPC) has released the details of imports of raw materials for gems and jewelry for the month of August 2014. |

| Copper Short Squeeze Pulls Metals Higher Posted: 16 Sep 2014 09:49 AM PDT If you ever want to know why we commodity traders are occasionally prone to be heard muttering meaningless, seemingly disconnected sentences, rambling incoherent utterances and other assorted bewildering, strange words, it is because life in the commodity futures pits can produce some of the most inexplicable and bizarre moments that the vast majority of sane, otherwise blissfully ignorant folks will never quite comprehend. Take copper for example. Around 10:00 CDT, the red metal began to lift sharply higher on big volume. Something began to rattle the shorts in the market. Then at the start of the next hour, it really took off. Look at the extent of the price spike. It ran from 3.10 to near 3.21, a HUGE 11 cent per pound jump on no discernible news whatsoever. By the way, for enquiring minds, that is a near $2500.00 move per contract! Do any of you remember that recent COT chart I posted of the copper market noting the hedge funds had begun positioning on the short side of the market in anticipation of slowing global economic growth? Well guess what? They all must have run at the same time! I am still trying to discover what the catalyst was to shove copper prices this higher in such a short period of time. I did note however that the move higher in the copper also coincided with a strong burst of buying in the crude oil and related energy markets. Also, in trading the soybean market, I also noted a surge of buying interest coming in at the same time. This all occurred against a backdrop of a push higher in the major currencies against the US Dollar. What this tells me, and I still do not know the reason behind the move, was that this was the same old MACRO TRADE that we have seen in the past wherein INDEX FUNDS come in and buy a basket of commodities, across the board, regardless of fundamentals, because of the lower dollar trade. That will explain some of this but a large part of the move across the sector was also due to hedge fund short covering. What makes this even more strange is that expectations are that the press release coming from the FOMC tomorrow is expected to provide some more definitive data on any upcoming rate hike. That has been expected to provide another upside boost to the US Dollar. Maybe the market is changing its views on that? Who knows? Whatever the reason the initial burst of buying has seemed to abate somewhat as the panicked shorts in the red metal apparently have been flushed out but now what? Also, this big buying binge has been accompanied by another surge in the equity markets with the S&P climbing back above 1990. I can tell you this - anyone who dismisses the Dollar's significance when it comes to asset prices is making a huge mistake. That big macro trade is always ready to come piling on or come piling off. By the way, at the risk of having some fun with the "Gold is Always Manipulated All the Time" crowd, ( GIAMATT), is a big short squeeze higher considered upside manipulation or it is "Normal"? Those of us who have borne the brunt of the attacks from this group already know the answer to that. I merely point this out to show their complete silence by way of their condoning sharp spikes higher in price while constantly complaining and bemoaning all sharp moves lower in price. "oh Ye Hypocrites - why art thou so silent at such sinister conduct"? Enough fun for now however! Remember, copper prices have been taking their cue mainly from disappointing Chinese economic data news with traders fearing a slowdown in the expected growth rate would crimp demand for the metal. Combine that with Dollar strength due to expectations, whether perceived rightly or wrongly is immaterial, of higher interest rates here in the US, and commodities have distinctly fallen out of favor with would be buyers, not to mention been the target of aggressive hedge fund related selling. Any sort of news therefore that sends the Dollar lower (such as dovish talk on interest rates ), for whatever reason, can easily spark a big wave of short covering across the commodity complex. That is exactly what we got across the vast majority of the complex this AM. Keep in mind that there are many who believe that the economy is in no shape to handle higher interest rates as it is not growing near fast enough nor has enough inherent strength to overcome the drag that would come from higher loan rates. We'll see whether this is a one-day blip ( although it is terrifying if one is short in some of those markets that experienced a squeeze of this nature) and it all is for naught tomorrow when we get the actual FOMC decision to taper another $10 billion in QE plus news on the interest rate front or it is might be the start of more prolonged move. I tend to think it is the former and will fade out fairly quickly but with these goofy markets and computers running the show, anything is possible. All one can do is to stay nimble and either learn to get the hell out of the way or trade very small at times. Be careful out there folks! If the FOMC release tomorrow is considered dovish, there could very well be more selling pressure seen in the Dollar, even though the Euro zone is a mess and going nowhere anytime soon. Ditto that for Japan. |

| Indian jewelry exports on the rise Posted: 16 Sep 2014 09:18 AM PDT The silver jewelry exports from India surged by 84.80% year-on-year to touch $234.82 million (Rs. 1,430.08 crores) during the month of August this year, while its gold jewelry exports too rose by 10.44% year-on-year to $634.46 million (Rs 3,863.85 crores), in accordance with the latest data released by the Gems... |

| Stuck Inside of the CME with the COMEX Blues Posted: 16 Sep 2014 09:15 AM PDT Precious metals prices remain range-bound over the short-term after a devastating three year run. From a technical standpoint, it doesn’t look great; we are stuck in this limbo of tightly controlled price limbo while the world continues to melt apart for the 99.9%. COMEX positioning for the big banks and speculators has not changed that […] The post Stuck Inside of the CME with the COMEX Blues appeared first on Silver Doctors. |

| The Silver Sentiment Cycle: Why Silver Will Rally for the Next 3-7 Years Posted: 16 Sep 2014 08:45 AM PDT In the early 1970s silver went from "ho-hum" to "enthusiasm" to "wow, who would believe it could go to $6.40?" After the 2008 crash silver went from "going back to 5 bucks" to "enthusiasm" to "wow, who would believe it could go above $45?" As a reminder, after silver rallied to the then astounding price […] The post The Silver Sentiment Cycle: Why Silver Will Rally for the Next 3-7 Years appeared first on Silver Doctors. |

| BO POLNY: Gold Price Suppression Ends in 2014 with a Gold Spike! Posted: 16 Sep 2014 08:30 AM PDT Only the Resolute Bulls Will Be Left Standing to Experience a Moon Shot to $2000 in 2014! Once all but the Resolute Bulls are wiped out, Gold and Silver will do an immediate price reversal and leave all who sold their Gold and Silver standing empty handed as the new 7-year Gold Bull market cycle […] The post BO POLNY: Gold Price Suppression Ends in 2014 with a Gold Spike! appeared first on Silver Doctors. |

| Gold nearing critical support points on the charts Posted: 16 Sep 2014 08:21 AM PDT Commodity Trader |

| Is The Fed About To Write the Next Chapter For Silver? Posted: 16 Sep 2014 07:53 AM PDT Since peaking around 21.60 in early July, Silver has sold off consistently for the past two months. By last week, the gray metal had drifted all the way down to test the critical support zone around 18.25-50; this level represents the 4-year low in silver and has provided meaningful support on three separate occasions over the last 14 months (for more on this area, see my colleague Fawad Razaqzada's note from last week, "Can Silver Defend $19 Again?"). Now, metal traders are wondering, "will this level finally break, or is another rally to above $20 in the cards?" As we go to press, the short-term technical picture favors the bears. As the 4hr chart below shows, silver has been in a bearish channel for over two weeks now. Just this morning, the metal peeked out above the channel, but was quickly rejected back lower, creating a large Bearish Pin Candle,* or inverted hammer pattern. This candlestick formation shows a sharp shift from buying to selling pressure and is often seen at near-term tops in the market. With the RSI still well within bearish territory, the sellers could look to drive the metal back into the key 18.25-50 support area later this week. Only a break above today's high at 18.85 would shift the near-term bias to the topside for another run back toward $20. Meanwhile, the fundamental side of the ledger is a bit murkier. With a plethora of high-impact economic data scheduled for the last 72 hours of the week, volatility will likely be elevated for all trading instruments. While both Scotland's independence referendum and the ECB TLRTO auction will be important, the marquee event for silver will be tomorrow's Fed decision and statement. Another $10B taper of the QE program is all-but-inevitable, so the key variable will be whether the central bank tweaks its statement to suggest that it may raise interest rates sooner. We'll have a full Fed preview out later today, but if the Fed statement suggests earlier rate hikes are possible, the dollar may rally and silver could fall back into 18.25-50 support. On the other hand, a status-quo statement and press conference would disappoint dollar bulls, likely leading silver to break out of its bearish channel and target $19 in the short-term and potentially the $20 level in time. *A Bearish Pin (Pinnochio) candle, or inverted hammer, is formed when prices rally within the candle before sellers step in and push prices back down to close near the open. It suggests the potential for a bearish continuation if the low of the candle is broken.

You can find more of FOREX.com's research at http://www.forex.com/latest-forex-research.html

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions. Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that FOREX.com is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. FOREX.com is regulated by the Commodity Futures Trading Commission (CFTC) in the US, by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investment Commission (ASIC) in Australia, and the Financial Services Agency (FSA) in Japan. Please read Characteristics and Risks of Standardized Options. |

| The U.S. National Debt Has Grown By More Than A Trillion Dollars In The Last 12 Months Posted: 16 Sep 2014 07:00 AM PDT On September 30th, 2013 the U.S. national debt was sitting at $16,738,183,526,697.32. As I write this, the U.S. national debt is sitting at $17,742,108,970,073.37. That means that the U.S. national debt has actually grown by more than a trillion dollars in less than 12 months. We continue to wildly run up debt as if there is no tomorrow, and […] The post The U.S. National Debt Has Grown By More Than A Trillion Dollars In The Last 12 Months appeared first on Silver Doctors. |

| Gold imports soar 176% in India Posted: 16 Sep 2014 05:38 AM PDT August gold demand in India surges ahead of the festival season in India and in comparison to low demand last year. |

| Yuan-centric gold pricing imminent and important - Phillips Posted: 16 Sep 2014 05:33 AM PDT Julian Phillips of the Gold Forecaster looks more closely at the impact of Chinese new gold market and what it says currency wise. |

| Gold trading hubs vie for Asian demand Posted: 16 Sep 2014 05:32 AM PDT Exchanges at Hong Kong, Singapore, Dubai and Thailand compete in a race to grab the bulk of Asian demand for gold. |

| Gold contracts and exchanges vie for Asian attention Posted: 16 Sep 2014 05:30 AM PDT Exchanges at Hong Kong, Singapore, Dubai and Thailand compete in a race to grab the bulk of Asian demand for gold. |

| Gold Demand In India Nearly Triples As China Launches Global Gold Bourse This Thursday Posted: 16 Sep 2014 05:24 AM PDT Gold Webinar – Your Questions & Answers’ Today September 16, 2014 at 1300 EST, 6pm BST > See here Indians Prepare To Buy Gold At Diwali

The Death Of The Indian Gold Market Has Been Greatly Exaggerated Trade statistics for the month of August have just been released in India, showing a huge surge in gold imports compared to August of 2013. The value of gold officially imported into India in August totalled $2.04 billion, which was nearly three times more than the August 2013 figure of $739 million. Although the Indian trade deficit fell to $10.84 billion in August from $12.2 billion in July on the back of a lower oil price and a drop in the value of oil imports from $14.3 billion to $12.8 billion, the deficit would have been lower were it not for the surge in the value of gold imports. Official gold imports for the three months to June had fallen to $7 billion from $16.5 billion in the similar three month period last year. But Indian customs seizures have also risen suggesting the unofficial import trade is just circumventing the restrictions. Import restrictions had curbed official imports but gold smuggling has intensified. Gold smugglers are very resourceful when it comes to importing gold into India, and smuggling is also set to intensify before the Diwali festival in October. Recent gold premiums in India have been $4-$5 an ounce but are expected to increase to between $10-$12 an ounce as the festival and wedding seasons peak. In India, gold demand rises during the festival season from a monthly average of 40-50 tonnes to over 60 tonnes a month. As usual, there is expected to be a pick-up in gold demand this year ahead of the five day festival centred around Diwali. Diwali is on October 23 but the five day festival really begins with Dhanteras, the first day of Diwali on October 21 and ends with the last day called Bhai Dooj on October 25. The wedding season is also approaching and this peaks in November and December. Gold is given as gifts and dowries during the wedding season and also acts as a source of demand for jewellery. Over the last two years, there has been a concerted effort by the Indian government and the central bank, the Reserve Bank of India, to discourage gold imports. This has taken the form of continued hikes in gold import duties, the introduction of various gold import restrictions for banks and trading houses, while at the same time incentivising Indian banks to promote gold-backed products and gold deposit schemes so as to take Indian gold out of circulation and into the hands of the banks. Without citing the Indian government’s orchestrated campaign to try to smash Indian gold imports, some anti-gold media have recently been calling the death of gold buying in India, pointing to the increased interest by the younger urban population in modern financial savings and investments. However, the fact that Indian gold imports remain strong and bounce back any time government restrictions are lowered proves that this anti-gold media sentiment is mistaken. Today the Chinese government backed Shanghai Gold Exchange (SGE) brought forward the launch date of its international gold trading platform which is hosted in the city's free trade zone (FTZ). The gold trading platform will be known as the 'international board'. In a surprise announcement, the SGE said today that the international board will go-live this Thursday September 18, eleven days ahead of its original launch date of Monday September 29. Forty members of the Exchange including global banks UBS, Goldman Sachs, HSBC and Standard Chartered, will participate in gold trading on the SGE's international board, trading 11 yuan denominated physical gold contracts including the large 12.5 kg (400 oz) bar, the ever popular 1 kg bar and a 100 gram contract. The location of the SGE international board in the Shanghai free trade zone is symbolic in that this location has been earmarked by the Chinese government as part of financial sector internationalisation strategy. The SGE is also opening a precious metals vaulting facility in the free trade zone with a 1,000 tonne capacity limit. In a related development yesterday, the Hong Kong based precious metals trade organisation, the Chinese Gold and Silver Society (CGSE) announced that they have been given permission by the Chinese government to construct a precious metals storage vaulting facility in a special economic zone in Shenzhen in China. The CGSE is the the first non-mainland entity to be given such permission. The CGSE's vaulting facility will have a 1,500 tonne capacity and will be completed by late 2016 or early 2017. Shanghai skyline Developments in the Asian precious metals markets are continuing to advance at a rapid pace. The pace of developments changes daily as illustrated by the acceleration this week of the Shanghai Gold Exchange's international board. Indian buying has remained strong throughout the period of weakening prices and the period of artificial demand constraints imposed by the Indian financial authorities. In Asia gold demand remains an overall structural phenomenon, and is not purely cyclical. MARKET UPDATE Gold climbed $3.20 or 0.26% to $1,233.90 per ounce and silver rose $0.03 or 0.16% to $18.68 per ounce yesterday. Gold recovered overnight in Asian trading and reached $1,235.80 in Singapore before hitting $1,238.00 in London, up 0.45% from yesterday's New York close. Silver was trading at $18.75, up 0.53% from New York close yesterday. In the platinum group metals, palladium was 0.71% lower today at $839, while platinum edged lower by 0.15% at $1,369. Receive our award winning research here |

| Silver could rebound strongly on global economic recovery: ETFS Posted: 16 Sep 2014 05:16 AM PDT Silver's strong correlation with gold has been the main price driver, in the absence of a strong demand catalyst. |

| Gold Demand In India Triples As China Launches Global Gold Bourse This Thursday Posted: 16 Sep 2014 05:03 AM PDT gold.ie |

| Jim Willie: US Plans to Collapse Europe in Last-Ditch Effort to Save Petro-Dollar! Posted: 16 Sep 2014 05:00 AM PDT In his latest interview with Finance & Liberty, Hat Trick Letter Editor Jim Willie discusses how the escalation of Russian sanctions will impact European & the US economies, the irony of Germany resisting fascism in the West- resulting in the Germans moving away from Europe & the US and towards Russia, and how the US […] The post Jim Willie: US Plans to Collapse Europe in Last-Ditch Effort to Save Petro-Dollar! appeared first on Silver Doctors. |

| Scotland gold demand rises before independence referendum Posted: 16 Sep 2014 04:57 AM PDT Mark O'Byrne, director at GoldCore in Dublin, says Scottish demand for gold as a protection of wealth has increased so far this month. |

| CHARTS : The Dow/Gold Ratio - Reviewing the Rebound Posted: 16 Sep 2014 03:20 AM PDT goldbroker |

| Technical analysis of Gold for September 15, 2014 Posted: 16 Sep 2014 02:20 AM PDT mt5 |

| Gold: $1.252 For A Closing Basis As the New Stop For Shorts Posted: 16 Sep 2014 02:15 AM PDT investing |

| Posted: 16 Sep 2014 02:12 AM PDT Submitted by Francis Schutte, founder of Goldonomic.com: Everybody has to spend energy, has to work for his living. This is true for Government as well as for the Billionaires and for the ordinary employee. Nothing – except for Sunshine and Air – comes for free. Note that today, sometimes people even pay for sunshine (vacation) and Air (airports in Venezuela). Governments and Central Banks (which are like economic Siamese twins) not only print Fiat Money but on top they make the cost to print more money, issue new debt and serve past debt ridiculously low….In reality, Real Interest rates (nominal interest rate less real inflation rate) or the cost to issue more fiat money has even become negative. Propaganda must be extremely solid to keep such a mirage alive and absolute no accident may happen.

Note 1 : up to today we still don’t know what really made the Big Crash of 1929 happen. Some blame the bad state of the economy, others the overextended on margin (debt) thriving Stock Markets. Fact is we had a Debt bubble like we have today. Note 2: Bond markets show Huge Top formations and we already have indications that the price has fallen down out of the top.

Modern Money is worse than debt. Nowadays it has a negative value – whoever exchanges it for goods and services, gets automatically mugged! Whoever buys Treasuries and Bonds gets mugged, Whoever keeps money in saving accounts and as bank deposits gets mugged, whoever buys a life insurance gets mugged, whoever buys Real Estate gets mugged, whoever keeps banknotes under his mattress gets mugged…Apparently there is no way to escape the global holdup by Governments and Bankers. Governments are using the so created Fiat Debt Money to pay for Goods and Services. The are getting richer for each Dollar/Euro/Yen/Sterling note they bring into circulation. (reality is that they get less broke for it is mathematically impossible to cover all the historic and future debt). Those who understand what is happening, know that as sellers they have become subjects of theft in broad daylight. Governments are paying for Goods and services with ‘negative fiat money’ or to put it blunt, the buyer is exchanging his goods and is getting more debt than Assets in return. By doing so, Authorities deny the very existence of the Constitution.

Today’s situation is actually a lot worse than the one pictured by ‘the emperor has no clothes’ . Therefore the one million dollar timing question is to find out WHEN some accident will make it all blow up. The second million dollar question is to find out which action, what happening will actually make it happen….

Forecast economic evolutions and financial markets is a rather easy exercise compared to Timing when these will unfold. TIMING when something will happen is extremely difficult. Technically speaking, bottom and top formations can be short but sometimes last for years. Easy to forecast the Target based on the size of the formation. Hard to forecast when the price will break out of the bottom (Gold & Silver) or down of a top (Bonds, Money). Experience teaches us that price can break out once we have completed ¾ to 4/5th of a pattern. And ¾ to 5/5th we have for Bonds and Gold/Silver. The respective formations started in 2010/11 and are still maturing and it can take another 12 to 18 months before we see some action.

Because the many warnings issued by Financial analysts fail to become reality in the short/medium term, people which want Immediate satisfaction rather believe the Propaganda sold by the Authorities through the Mainstream Media’s and are becoming dangerously Complacent. Also Authorities are seen as almighty and the Herd becomes convinced they will come up with a decent solution….that is until we actually have a catharsis and/or a war. Note: there are more and more indications pointing to the fact that WW III will be fought in the Middle-East but also in EUROPE! The future for the West will be very bleak if our central planners continue to play games by manipulating major markets and selling lies through the mainstream media. Some day the can will hit the wall and it will be Game Over. Unless off course you are prepared. Price goes up or comes down when Time is up and nobody believes it will.

In the mean time, many who are invested in Gold & Silver are unhappy and some start to doubt whether they made the right decision, disbelief is growing and some investors/traders start to liquidate or have liquidated their positions…The sector is being purified and is preparing for the next dramatic Bull run which will happen at some time in the near future. The special ratio PF charts in the subscriber’s sections clearly show the latest configuration for Gold expressed in the major currencies – as well for the Miners – . The only thing we can’t predict at this time is WHEN it will happen.

|

| Why ECB QE Is Bearish For Gold Prices Posted: 16 Sep 2014 01:35 AM PDT marketoracle |

| Junior Miners Breaking Out Higher Forecasting Gold and Silver Bottom Posted: 16 Sep 2014 12:55 AM PDT GoldStockTrades |

| Gold mining stocks have outperformed the Dow since 1920 Posted: 15 Sep 2014 11:30 PM PDT Goldmoney |

| Betting against Gold, by De Gaulle Posted: 15 Sep 2014 11:30 PM PDT Food for thought |

| Hedge funds have silver prices wrong as Shanghai inventory running out Posted: 15 Sep 2014 11:28 PM PDT Silver is a rare commodity in Shanghai these days. Just look at the graph above showing the falling inventories of silver in the Shanghai Futures Exchange. At what point will the inventory be low enough to actually reverse the recent price falls in silver? Tipping point Bullionstar.com says: ‘The current scarcity has diminished the gap between Chinese and London spot prices. If we subtract 17 per cent VAT from the SGE silver prices, the discount to London spot was four per cent on September 12th. ‘This is the smallest discount since September 2011, when the price of silver made a massive vertical slide. If the discount reaches zero and turns into a premium it would significantly stress world silver demand as China would increase imports.’ So the silver market looks close to a tipping point and the recent sell-off is over done. Hedge funds are on the wrong side of the curve on silver and should be buying and not selling. Futures markets are difficult beasts for non-professional analysts but they are where commodity prices are ultimately set. They can also behave pretty bizarrely as they are now for silver with prices falling while stocks are running out in what is the biggest consumer market for silver, China. Markets do, however, have a habit of correcting their accounting errors quite suddenly. If financial markets turn turtle on us in the next few weeks silver is set up for a rapid price reversal. |