saveyourassetsfirst3 |

- Humans Need Not Apply – How Robots Will Take Over the Economy

- FOMC Statement sends Dollar Higher, Gold lower

- Can Investors still find tenbaggers?

- India's silver bar imports plunged 54% in August

- Exorbitant import duty erodes India's gold trade

- Will Gold Shock The Bears?

- Yellen’s Fed Lays Out Plans to Discontinue Taper: Gold Plunges

- Yellen’s Fed Lays Out Plans to Discontinue Taper: Gold Plunges

- Jim Willie: Obama Was Selected to Kill the Dollar!

- The NEXT Reserve Currency

- FNV's Pierre Lassonde backs Nicaragua explorer

- James Altucher: Four "insanely stupid" things you can do in ten minutes to make your life much better

- Why You Should Think Twice Before Using Facebook’s Messenger App

- Gold arriving at medium term cycle turn point

- FINALLY: This chart says gold stocks are on the verge of a BIG move

- When Complexity Becomes Chaos

- Ron Paul Asks: Will The Swiss Vote to Get Their Gold Back?

- Golden Yuan World Reserve Currency After Volcker Dooms the Dollar

- The Dollar May Remain Strong For Longer Than We Think

- Stewart Thomson: Janet & Raj Stoke The Bulls!

- Making cold climate gold mine water effluent safe for fish

- Five little-known ways to build huge wealth in your retirement account

- Charts show gold could drop to $1,000 an ounce if cluster of support lines broken

- With smuggling, India gold demand still booming - Phillips

- U.S. National Debt Surges $1 Trillion In Just 12 Months … Meanwhile FOMC “Tweaks” Wording

- U.S. National Debt Surges $1 Trillion In Just 12 Months … Meanwhile FOMC “Tweaks” Wording

- Shanghai Gold Trading: The Real Challenge to London

- 16 killed in artisanal gold mine collapse in Mali

- Gold: Trending Bearish In The Short Term

- What Is Next For The Price Of Silver: Collapse or Rally?

- Eric Coffin: Can Investors Still Find Tenbaggers?

- Price & Time: Gold Exhaustion Near?

- Gold: Bullish Attempts Remain Limited Below 1240.22

- Correction To Expand In GOLD

- Bearish Gold Trending To 1210-1215, Oil May Fall To 89-90 Before Correct

- Gold Prices September 17, 2014, Technical Analysis

- Gold And Silver Recover (But Longer Outlook Still Bearish)

- Gold – Rallies to Resistance at $1240, with Eyes on $1200

- Gold Big Breakdown Possible as Long as Below 1300

- U.S. Dollar and Gold Elliott Wave Projection

- How should you play the US dollar as the Fed meets?

- Can gold finally recover?

- Russia Central Bank Responds To Domestic Dollar Shortage, Starts Currency Swaps

- Three King World News Blogs

- Gartman Letter cites Koos Jansen and Gold Newsletter on Chinese gold demand

- China advances gold exchange launch, Singapore delays contract

- Gold's move from West to East is said intended to rebalance FX reserves

- Gold’s Move From West to East is Said Intended to Rebalance FX Reserves

- Protected: GDXJ Analysis

- Reason # 5 The Silver Noose is Tightening: Silver Recycling Plunging

| Humans Need Not Apply – How Robots Will Take Over the Economy Posted: 17 Sep 2014 01:00 PM PDT Stop what you're doing and watch this video. From Michael Krieger, Liberty Blitzkrieg: The post Humans Need Not Apply – How Robots Will Take Over the Economy appeared first on Silver Doctors. |

| FOMC Statement sends Dollar Higher, Gold lower Posted: 17 Sep 2014 12:50 PM PDT The big thing that traders are taking away from today's much anticipated FOMC statement is the $10 billion further reduction in QE which is now down to $15 billion/month. Of that remaining $15 billion in QE, $10 billion consists of Treasuries and $5 billion of MBS debt. The Fed is on track to wrap up QE completely next month and that is what has traders pushing the Dollar higher and gold lower. Simply put, the era of abundant liquidity here in the US appears to be over. Note to QE taper deniers- you had better wake up in a real hurry. The market is telling you clearly that it believes the Fed. Not that the Fed is in a hurry to raise short term interest rates. That still does not look as if it is going to happen any time soon. What it therefore translates to as far as traders are concerned, is an environment in which low inflation still appears to be the general rule and one in which economic growth will be slow to moderate at best. This means that stocks are still the place to be; gold is falling out of favor even further, and commodities in general are going to be moving lower. Not that they will not be exceptions to this general rule based on the individual set of fundamentals governing each specific commodity market. However, the big leveraged macro trade buying indiscriminately across the entirety of the commodity sector is not in the cards for now. The result of this readjustment is that the Dollar remains the "Go-To" currency which can be easily seen in the steep plunge in the Yen, Euro, Swiss Franc and Australian Dollar ( the Aussie is a good proxy for commodities in general). The British Pound is getting a bid of a respite as traders are afraid to push too hard on it with the upcoming referendum over Scotland tomorrow looming. With the Dollar/Yen hitting a six year high, the story is that the currency markets are going to dictate money flows and for now, those flows are into equities and out of commodities, including gold. I have a full plate right now but here is a quick updated chart of gold for the reader. Notice that it is poised for a test of the last remaining support zone standing between it and the psychological $1200 number. That zone extends from near $1220 down towards $1212. If it fails there, it is going to test $1200. Below that is the low at $1180. Below that? That is scary. India/Asia may be buying for festivals, etc. but that in and of itself will not be enough to launch gold higher on any wild surge higher before the year is out; not without Western oriented investment demand which has made the vote against gold for the time being. One more quick chart - the US Dollar... If the Dollar closes through 85 basis the USDX by this coming Friday afternoon, look out above! |

| Can Investors still find tenbaggers? Posted: 17 Sep 2014 12:36 PM PDT Even in a bull market investors are best advised to seek out the potential tenbaggers and presents several companies in gold, base metals and uranium with the potential to flourish even in the bad times. |

| India's silver bar imports plunged 54% in August Posted: 17 Sep 2014 12:31 PM PDT There was a significant drop in the country's silver bar imports in India during the month of August. |

| Exorbitant import duty erodes India's gold trade Posted: 17 Sep 2014 12:26 PM PDT India has lost its position as the UAE's top gold trading partner during 2013-'14 fiscal. |

| Posted: 17 Sep 2014 11:15 AM PDT investing |

| Yellen’s Fed Lays Out Plans to Discontinue Taper: Gold Plunges Posted: 17 Sep 2014 11:10 AM PDT

|

| Yellen’s Fed Lays Out Plans to Discontinue Taper: Gold Plunges Posted: 17 Sep 2014 11:05 AM PDT Yellen lays out Federal Reserve’s plans to “normalize” monetary policy Fed to officially DC QE at next meeting if economic outlook holds “Normalization” will not necessarily occur immediately Fed will use an overnight repo facility as needed during normalization process Committee is prepared to adjust its approach if necessary (translation- we’re going to try to […] The post Yellen’s Fed Lays Out Plans to Discontinue Taper: Gold Plunges appeared first on Silver Doctors. |

| Jim Willie: Obama Was Selected to Kill the Dollar! Posted: 17 Sep 2014 11:01 AM PDT In the second part of an explosive interview with Finance & Liberty’s Elijah Johnson (click here for Part 1), Jim Willie breaks down why Germany is repatriating their gold, and the implications of the Fed rehypothecating thousands of tons of gold over the past 20 years. Willie claims that German intelligence in 2011 discovered the US’ brilliant […] The post Jim Willie: Obama Was Selected to Kill the Dollar! appeared first on Silver Doctors. |

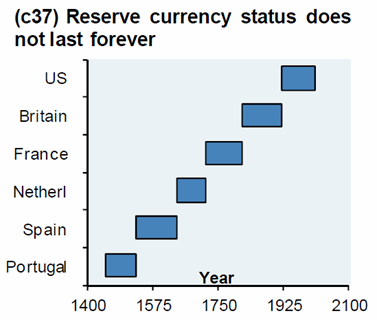

| Posted: 17 Sep 2014 10:52 AM PDT The U.S. dollar is dying an ugly death. The U.S. government knows it, and the bankers who run the U.S. government are certainly aware of it – since they are the ones who have (already) undermined its value to worthlessness. Naturally, the dollar's ugly death is never mentioned in the Corporate media. Even with the manipulation choke-hold which this banking cabal has over our so-called "markets"; it would be extremely difficult to pump-up the value of the dollar to its present, absurdly fraudulent level if everyone knew that this was a dying currency – which will be obsolete (and thus officially worthless) in a few year's time. All this is carved in stone. What has (previously) been the subject of considerable debate and speculation is what currency will replace the U.S. dollar as the world's "reserve currency". The crooked bankers and corrupt governments of the Western bloc have already floated several trial-balloons, in their efforts to attempt to maintain control over the global economy by being in complete control of the principal money supply for the global economy. "Give me control of a nation's money and I care not who makes the laws." - Mayer Amschel Rothschild (1744 – 1812) This mantra of financial criminals (in general), and crooked big-banks (in particular) is based on the simplest of premises. If one control's the printing press of a nation (or, in this case, the global economy); that criminal can print-and-steal as much currency as he/she desires – and then use all that dirty money to buy-off politicians, regulators, and entire governments. Buying politicians is "good business" (assuming that one has no scruples) because these stooges-for-hire are notoriously cheap. Spend $100's of thousands (or perhaps a few $millions) buying-off politicians, and it can yield countless $billions in (generally illegal) profits. Put another way; "investing" in governments (i.e. buying them off) pays much better than investing in markets. The result of this obsession of the Old World Order with attempting to maintain control of the printing press for the global economy has been several pathetic attempts to cobble together some (corrupt) replacement paper for the USD. First we had "the Amero". The "Amero" (as the name implies) was to be launched in North America as the official currency for that (new) bloc, and (if the banksters had succeeded in their conspiring) would have coincided with the launch of a "North American Union". However, despite having complete control over the Corporate media (and thus all mainstream "news"); the banking cabal's puppet politicians couldn't sell either the Amero or a North American Union. The next attempted replacement for the USD was even more pathetic. The bankers and their Western governments attempted to take an ordinary credit instrument (the "special drawing rights" by which the International Monetary Fund extends credit), and convert that (somehow) into a currency. This would have entirely eliminated the distinction between "money" and "debt". But it was such outrageous monetary voodoo that even the One Bank's puppet governments wouldn't embrace the scheme. In part; this was due to the simple fact that there would have been no way to portray this instrument of financial fraud (and infinite debt) as "money" to the masses of Sheep in our societies. Lesser, and even sillier schemes have been put forth by the bankers and their minions, but none of them ever achieved enough significance to merit mention. Meanwhile in the Rest of the World (i.e. its less-corrupt regimes) there has been a steady, inexorable move toward at least a quasi-legitimate replacement for the USD: China's renminbi. |

| FNV's Pierre Lassonde backs Nicaragua explorer Posted: 17 Sep 2014 10:17 AM PDT Franco-Nevada's Chairman makes an investment in a Canadian junior explorer with high grade gold properties in Nicaragua. |

| Posted: 17 Sep 2014 10:07 AM PDT From James Altucher: I’m going to be dead for about 9 or 10 TRILLION years. And only alive for the next 40 or so. It sounds like I’m trying to put things in perspective. But I’m not. It’s just true and even a little depressing. I’ve never built a rocketship that will make it into space. I’ll never cure cancer. I might not even write a bestselling novel about a teenage girl that falls in love with a dominating billionaire. Sometimes this makes me depressed. What will I do? Someone on Quora asked “What can I learn in ten minutes that will be useful for the rest of my life?” This I can do… I can show you four insanely stupid things that will make the rest of your life better. I’m not going to give you the usual “lifehack” stuff. Sometimes they work and sometimes they don’t. Evernote, new ways to floss, a new way to clear your emails… This I can’t do. I have 203,433 unread emails, not counting my spam box. Not only will I never launch a rocket into space, I will never even read all the emails addressed to me… It takes a lot of work to be really good at something in life. To get good at something you need: a teacher, a passion, to read a lot of books, practice 3-4 hours a day for many days. There are no shortcuts to learning something. In general:

Even if you have every lifehack in the book, this is what it takes to be GREAT at something you love doing. Great enough to make a living or even wealth at it. I’ve done enough interviews now on my podcast with people who the best in the world at what they do and I can see there are no real shortcuts. This is true no matter what field. So instead, I’m going to tell you four dumb things I do that I have fun with… and that have made life A LOT smoother for me. I like to be calm, to laugh, to have fun with friends, to be creative, to wake up excited for what the day holds for me FOUR “LIFEHACKS” THAT WORK FOR ME 1.) TWO DOLLAR BILLS. I have thousands of $2 bills. I always tip with $2 bills. How come? Because then people remember me. They always say, “Whoa! I’ve never had one.” And then the next time I come into an establishment, I’m remembered. This is good for restaurants, dates, poker night with friends, even for paying at the local deli. I also find whenever I move to a new town this is a quick way to make friends. I’m very shy and this gets people talking. This has been also very good on dates. Nobody ever forgets the guy with a roll of $2 bills. 2.) DOCTOR’S COAT. I wear a doctor’s lab coat most of the time. Like in airports, restaurants, walking around town. The reason? a. It’s comfortable. b. The big pockets let me put any electronic devices I might need (an ipad mini, for example, plus waiter’s pads (see below)). c. People actually do treat me like a doctor. If someone said, “I need a doctor” I would not be able to help (unless it’s easy stuff in which case I can say, “I’m not a doctor” and then perform CPR or mouth-to-mouth or Heimlich, which are all easy to learn). But the reality is, people move out of the way if you are an airport and walking around in a doctor’s coat. And in a restaurant sometimes people let me go first. Is this unfair? Well, I never claim to be a doctor. I’m just wearing a doctor’s coat because I like how it feels, looks, and the functionality of it. But if it has other benefits, which it does, I’ll take it. Besides, 99.99% of the time someone goes to the doctor here is the correct answer the doctor should give: “Go home and sleep more. Call me in a year.” 3.) WAITER’S PADS. I have about 300 waiter’s pads. I order them for about 10 cents a pad in bulk on restaurant supplies website. How come? a. I like to write ideas on pads. I write down at least 10 ideas a day. The idea muscle is a muscle like any other. If it’s not exercised, it atrophies. If it’s exercised then within six months you’re an idea machine. Try it. It’s amazing what happens. Don’t keep track of the ideas. Just become an idea machine. b. Why a pad? A screen messes with your dopamine levels. I like the visceral experience of putting pen to pad. c. Why ten ideas? Four or five ideas on any theme is easy. It’s the final five or six that makes the brain sweat. This is how you exercise the idea muscle. d. Why specifically a waiter’s pad? i. It forces you to be concise. A waiter’s pad is small lines. You can’t write a novel there. ii. It’s a great conversation piece in meetings. Once I pull out the waiter’s pad someone always says, “I’ll take fries with my burger” and everyone laughs. Again, I’m shy so it’s a good way for me to break the ice. iii. In restaurants, when you pull out a waiter’s pad, guess what? Waiters treat you better. iv. The other day in a cafe I was working and someone potentially violent came up and asked me for money. I held up my waiter’s pad and said, “I’m a waiter, do you want to order something?” and they sort of looked at me and grunted and then walked away. 4.) WATCH STANDUP COMEDY before every meeting, date, dinner, media appearance, conversation, public talk. I watch Louis CK, Daniel Tosh, Amy Schumer, Anthony Jeselnik, Jim Norton, Andy Samberg, Seth Rogen, Marina Franklin, Ellen, Bo Burnham, and maybe a dozen others. How come? I have a lot of inhibitions when I meet people. I’m scared and somewhat introverted. Standup comedians are the best public speakers in the world and I think they are the most astute social commentators on the human condition. So the reasons I watch them before most social encounters (personal, professional, media):

All of the above may make it seem like I’m a loser in many respects. I don’t deny this. Loser of what? Remember those nine trillion years? Anyway, this is the four insanely stupid things I wanted to share. And they work. |

| Why You Should Think Twice Before Using Facebook’s Messenger App Posted: 17 Sep 2014 10:00 AM PDT "Messenger appears to have more spyware type code in it than I've seen in products intended specifically for enterprise surveillance." - Jonathan Zdziarski, expert in iOS related digital forensics and security Submitted by Michael Krieger, Liberty Blitzkrieg: Anyone who reads Liberty Blitzkrieg consistently will be aware of my disdain for the company Facebook. There are many […] The post Why You Should Think Twice Before Using Facebook's Messenger App appeared first on Silver Doctors. |

| Gold arriving at medium term cycle turn point Posted: 17 Sep 2014 09:20 AM PDT Commodity Trader |

| FINALLY: This chart says gold stocks are on the verge of a BIG move Posted: 17 Sep 2014 09:10 AM PDT From Chris Kimble at Kimble Charting Solutions: CLICK ON CHART TO ENLARGE The Gold Bugs index remains above support that dates back 10-years. Over the past year and a half, the index has created a pennant pattern, a series of lower highs and high lows, teasing both the bulls and bears. As you can see, this pattern will be coming to an end soon. Pennant patterns are popular for suggesting that a large move is ahead, yet which direction is a different story. This pattern does fall under the continuation of trend category, anything is possible though! After years of disappointment, bullish miner investors should be treated to some fun upside action if the pattern breaks out to the upside. The best plan for a pennant most often is to set back and watch for the breakout and then follow it. It would appear investors won’t have to wait long for the outcome. |

| Posted: 17 Sep 2014 09:00 AM PDT Unsound money and finance are fuel for the fires lead to panic and chaos. Submitted by Dr. Jeffrey Lewis, Silver Coin Investor: Modern achievements, especially in medicine and technology (fueled by cheap energy), have made the human experience longer and easier. Yet, at the base of it all lays the irrational man, still flinging immorality […] The post When Complexity Becomes Chaos appeared first on Silver Doctors. |

| Ron Paul Asks: Will The Swiss Vote to Get Their Gold Back? Posted: 17 Sep 2014 08:00 AM PDT On November 30th, voters in Switzerland will head to the polls to vote in a referendum on gold. On the ballot is a measure to prohibit the Swiss National Bank (SNB) from further gold sales, to repatriate Swiss-owned gold to Switzerland, and to mandate that gold make up at least 20 percent of the SNB’s […] The post Ron Paul Asks: Will The Swiss Vote to Get Their Gold Back? appeared first on Silver Doctors. |

| Golden Yuan World Reserve Currency After Volcker Dooms the Dollar Posted: 17 Sep 2014 07:20 AM PDT David Jensen |

| The Dollar May Remain Strong For Longer Than We Think Posted: 17 Sep 2014 07:14 AM PDT We analyze the surprisingly likely drivers that may keep the US dollar strengthening over the next few years, especially if another economic/financial crisis arrives. While there are many reasons to fear for the longer term viability of the US dollar given America’s current misguided monetary policy and exponentially increasing debt & liabilities, the next few years could well see it appreciate further by 50-100% relative to the world’s other major fiat currencies. For those understandably disgusted by the reckless expansion of the US money supply over the past six years, it’s vitally important to remember that the road to our monetary endgame is not a straight line, nor necessarily intuitive. To have the best chance of remaining solvent, understanding the likeliest pathways the route will take is often nearly as important as correctly predicting the final destination. |

| Stewart Thomson: Janet & Raj Stoke The Bulls! Posted: 17 Sep 2014 07:00 AM PDT The average gold bear already looks a bit like the wolf character from the fairy tale, "The Three Little Pigs". The wolf repeatedly blows hot bearish analysis air at the gold brick house, and the house just stands there, immovable. I've predicted that "Queen Bankster Janet" will begin raising rates by mid-year of 2015, and […] The post Stewart Thomson: Janet & Raj Stoke The Bulls! appeared first on Silver Doctors. |

| Making cold climate gold mine water effluent safe for fish Posted: 17 Sep 2014 06:06 AM PDT Veolia Water Technologies has been working successfully with a Canadian gold mine to make effluent containing cyanide, ammonia and copper safe for downstream fish and invertebrates. |

| Five little-known ways to build huge wealth in your retirement account Posted: 17 Sep 2014 06:00 AM PDT From Bloomberg: If it seems impossible to amass a fortune in an IRA during your lifetime, think again. The Government Accountability Office reported yesterday that about 9,000 U.S. taxpayers have each accumulated at least $5 million in individual retirement accounts. While the GAO didn’t say how they managed to do so, Mitt Romney and some other successful executives offer a road map. Outsized, tax-advantaged returns in such accounts drew attention during the 2012 presidential campaign, when Republican presidential nominee Romney reported he had an IRA worth $20 million to $102 million. Congress and President Barack Obama have scrutinized IRAs since, saying they weren’t intended to be a tax shelter for millionaires and billionaires. Looking for ways to cobble together a fortune in an IRA under the current contribution limit of $5,500 a year? Here are possible strategies: First, work at a startup. If you’re an entrepreneur, you can create more than one share class of stock at your company and put $1,000 in a standard or Roth IRA, said Bill Parish, president and chief investment officer at Parish & Co., an advisory firm based in Portland, Oregon. If some shares are valued as low as $0.000001, as Yelp Inc. (YELP) reported in its S-1 filing with the Securities and Exchange Commission in 2012, that buys a chunk of equity. Direct ‘Transfer’ “The key is that you transfer the stock directly from the company to your IRA,” Parish said. As the securities appreciate, investors can sell and diversify into other holdings tax-free until they withdraw funds. Or, in the case of a Roth IRA, the gains aren’t taxed at all, Parish said. Max Levchin, chairman of San Francisco-based Yelp, reported 2.7 million shares of the company’s Class B Common Stock in his Roth IRA, according to this year’s proxy statement. Class B shares of Yelp are convertible at any time by the holder into shares of Class A on a one-to-one basis, according to the filing. Yelp shares closed at $76.54 in New York yesterday. That comes out to about $206 million worth of Yelp shares in his Roth account. At the time of the company’s S-1 filing in February 2012, Levchin reported 3.9 million shares in his Roth account. He didn’t respond to a request for comment yesterday. Initial Value The next strategy has involved placing a low initial value on an IRA’s investments. Romney, the co-founder of private-equity firm Bain Capital LLC, never explained how he accumulated so much wealth inside his IRA. Yet one way that private equity and hedge-fund managers build large balances is by valuing their company’s investments at close to nothing, and they later grow exponentially, said Bobbi Bierhals, a partner at McDermott Will & Emery LLP in Chicago. A third way to amass money in a retirement account is to work for yourself. Self-employed people including doctors and lawyers can contribute up to $52,000 this year to their IRAs. If you start at age 25 or 30 contributing the maximum amount, you don’t need extraordinary investment returns to end up with millions by the time you’re 50, Bierhals said. Avoid Diversifying Another strategy: Using a self-directed IRA to make a big bet on a closely held company, said John Olivieri, a partner in the private clients group at White & Case LLP. If the business succeeds, the IRA’s value can increase dramatically, he said. “Those clients who don’t diversify an IRA, but instead invest the whole thing in one stock or venture that does really well, will have very high balances,” Olivieri said. “Of course, they could also lose everything.” The last strategy is working for a successful company and socking away plenty in your 401(k). Sometimes the tried-and-true way to retirement security works. Employees of a company with a generous 401(k) program can end up with millions in their account over a career and then roll it into an IRA. Company stock appreciation, annual matching contributions from the employer and additional profit sharing can all add up over a career. “You can expect some people to have multimillion-dollar IRAs if they include funds from rollovers,” Parish said. IRS Rules Investors should beware, though, as manipulating IRA holdings for tax purposes can attract attention from the Internal Revenue Service. The IRS prohibits some transactions in accounts such as buying property for personal use with funds or borrowing money from it. The IRS in 2013 also proposed new reporting requirements for hard-to-value assets in IRAs that were optional this year. Other curbs are possible. In 2013, President Barack Obama proposed new limits on tax-advantaged retirement accounts, including IRAs and 401(k)-style plans. Under the plan, which hasn’t advanced in Congress, people wouldn’t be able to add tax-favored contributions once their combined account balances reach about $3.2 million. In addition to this year’s maximum annual $5,500 contribution to a standard or Roth IRA, those age 50 or older can contribute another $1,000. 401(k) Limits Contribution limits for 401(k) accounts are higher than for IRAs. Workers can direct as much as $17,500 of pretax income toward their 401(k) in 2014. Employees 50 and older can set aside an additional $5,500. Most people, of course, have far less than millions in their retirement accounts. The GAO report, based on taxpayer data through 2011, said someone who contributed the maximum amount each year to an IRA from 1975 to 2011 and invested it in the Standard & Poor’s 500 Index would have about $350,000. The total amount could be as much as $4 million per person, though, for those who rolled over 401(k) accounts or used the higher IRA contribution limits for self-employed taxpayers. A further report is expected later this year. The average balance in an IRA was $92,600 as of June, according to Fidelity Investments, the largest provider of accounts. For workers who have participated in a 401(k) plan for 10 consecutive years, the average balance is $246,200, Fidelity’s data show. |

| Charts show gold could drop to $1,000 an ounce if cluster of support lines broken Posted: 17 Sep 2014 05:20 AM PDT indiatimes |

| With smuggling, India gold demand still booming - Phillips Posted: 17 Sep 2014 05:09 AM PDT Julian Phillips of the Gold Forecaster considers further the implications of Yuan-priced gold and also touches on Indian gold demand. |

| U.S. National Debt Surges $1 Trillion In Just 12 Months … Meanwhile FOMC “Tweaks” Wording Posted: 17 Sep 2014 05:01 AM PDT gold.ie |

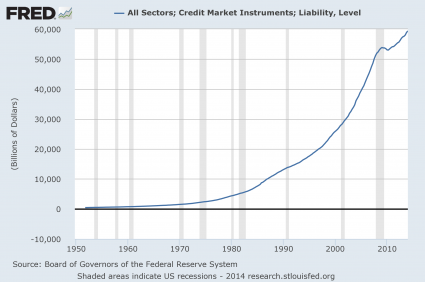

| U.S. National Debt Surges $1 Trillion In Just 12 Months … Meanwhile FOMC “Tweaks” Wording Posted: 17 Sep 2014 04:58 AM PDT The U.S. financial position continues to deteriorate badly and in the last 12 months has increased by over $1 trillion dollars.

Nick Laird of Sharelynx has just reproduced his fascinating and timely chart showing the US debt limit, the actual US debt and the gold price all in one chart. From 2000 until around the first quarter of 2013, there was a very strong and close correlation between the growth of the US national debt and the rise in the US dollar gold price. After Q1 2013 this correlation broke down according to the chart, wherein the US national debt continued to skyrocket and the US dollar gold price fell significantly. The end of Q1 2013 coincides with the smash down of the gold price in April 2013, which actually created a huge increase in demand for physical gold all across the world. Looking at the huge divergence in the graph after mid 2013 between the continued growth in the US national debt and the drop and subsequent tight trading range for gold between $1200 and $1400, one can only conclude that gold is somehow being prevented from its previous job of accurately reflecting an explosive US national debt picture. Source: Brillig.com An update on the future trend of US monetary policy is in the offing today as the US Federal Reserve's latest two day Federal Open Market Committee (FOMC) meeting concludes in Washington DC. As usual, global financial markets will scrutinise the Committee's press conference statement for any shift in Fed thinking on when the US central bank will begin to raise short term interest rates. With the Fed's QE3 asset purchase scheme coming to an end, markets are speculating on whether the Fed will, at this time, alter its recent interest rate guidance language that states that its federal funds rate would be maintained as is for a 'considerable time'. Any tweaking of this phraseology will create more price volatility in the US dollar and so would also create volatility in bond, stock and commodity markets, including precious metals markets. Markets are expecting some comment on the existing guidance but are also concerned that changing the guidance at this time may complicate the parallel track of winding down the QE program. The voting members of the FOMC comprise the Fed's five board of governors, the president of the NY Fed, and presidents of four other Fed Reserve banks who are selected on a rotating basis from the panel of the eleven other regional Fed banks. Although there are technically seven seats on the Fed board of governors, only five board seats are currently occupied. This means that there are currently ten voting members on the FOMC – Yellen, Brainard, Fischer, Powell and Tarullo from the board of governors, Bill Dudley from the New York Fed, and Plosser (Philadelphia), Mester (Cleveland), Fisher (Dallas) and Kocherlakota (Minneapolis) representing the regional Fed banks. As regards interest rate aggressiveness, Plosser, Mester and Fisher are considered the more hawkish by Wall Street watchers.

The one dissenting vote in July came from Plosser of the Philadelphia Fed who thought that the 'considerable time' language was "time dependent and does not reflect the considerable economic progress that has been made toward the Committee’s goals." Yesterday Jon Hilsenrath, the Wall Street Journal's chief economics correspondent, weighed in on the 'considerable time' speculations. Hilsenrath is perceived as being very close to the Federal Reserve powerbrokers in terms of access and information flow, so his opinion is taken seriously. Hilsenrath said yesterday that he thinks that the FOMC will probably 'qualify' their 'considerable time' phrase in some shape or form, but that since the Fed wants to communicate additional information on the timeframe of the QE bond buying operations, that the Committee may think it's too complicated for the financial markets to process all of this information at one time. Given that the global financial markets are some of the most sophisticated processors of information in the world, Hilsenrath's official view looks a little naïve. Since Hilsenrath is not naïve and appears to regularly know what the FOMC is thinking, this suggests that the Fed is most likely stalling for time in raising interest rates since it believes that the US economy is really weaker than it wants to admit.

Compared to this time last year, the national debt has grown by over $1 trillion. At the end of September 2013, the cumulative debt stood at $16.74 trillion. Now it is over $17.76 trillion. Astoundingly, more than $7 trillion of additional US national debt will have been accumulated over the 8 year duration of Obama's two presidencies, which is more than the accumulated US national debt of all previous US presidencies combined. This is not to mention the more than $200 trillion of US government unfunded liabilities such as pensions. When the total US government debt of over $17.76 trillion is added to all U.S. business and personal debt, it approaches an astronomical $60 trillion. This is more than 25 times the total outstanding debt that existed when the U.S. severed the link to the gold standard in August 1971. Since that time the Federal Reserve has encouraged and facilitated this huge growth of outstanding debt and in various crises, when it would have been more prudent to deflate asset bubbles, the Fed has continually supported these bubbles while encouraging new ones. The primary focus on the wording from the FOMC smells of an element of rearranging the chairs on the Titanic. Fiscal lunacy is alive and well in Washington with ramifications for the dollar and for investors and savers globally. Download GoldCore Insight: Currency Wars: Bye, Bye Petrodollar – Buy, Buy Gold MARKET UPDATE Gold climbed $1.60 or 0.13% to $1,235.50 per ounce and silver rose $0.03 or 0.16% to $18.71 per ounce yesterday. In early lunchtime trading in London, gold traded at $1237.75, up 0.23% from yesterday's New York close. Yesterday in New York trading, gold traded in a $1240 to $1230 range, and recovered in Asian trading earlier today. In the London morning, platinum traded at $1,366 today, down 0.22% while palladium rose 0.6% from yesterday to $844. Precious metals recovered for their third consecutive day in European trading this morning, having closed higher each day before the Fed releases its policy statement at 1800 GMT. Any increase in interest rates will tarnish gold bullion's safe haven appeal in the short term. Bearish sentiment in the markets were also reflected by outflows in SPDR gold trust which dropped 4.18 tonnes to 784.22 tonnes on Tuesday. Gold ended a 12 year rally in 2013 as the Fed planned to decrease their monthly asset purchases. Policy makers have said since March that rates would stay low for a period after it completes the bond-buying program. The yellow metal is on target for its first quarterly drop this year, while the U.S. dollar has reached a 14 month high versus 10 major currencies this week. |

| Shanghai Gold Trading: The Real Challenge to London Posted: 17 Sep 2014 04:55 AM PDT If China remains a one-way street for gold, it cannot become the world hub... SHANGHAI this week launches a new international gold exchange inside the city's free-trade zone, writes Adrian Ash at BullionVault. Most everyone thinks this is important because "global gold traders [see] the zone as a gateway to China's huge gold demand." But that's the wrong way round. Because if it's to have any real importance, the Shanghai FTZ gold bourse must mark a step towards China's gold output and private holdings flowing out into the world, not the other way round. Start with the situation today. China and the UK could hardly be more different when it comes to gold. China is the world's No.1 gold-mining producer, the No.1 importer, and the No.1 consumer. The UK in contrast...and despite spending its way to household debt worth 140% of income...has no gold jewellery demand to speak of. Private investment demand is also tiny compared to Asia's big buyers On the supply-side the UK hasn't had any gold-mine output worth noting since 1938. Nor does it currently have any market-accredited refineries for producing large wholesale bars. So you might think China plays a bigger role in the international gold market than does the UK. Yet nearly 300 years since it first seized the job, London remains the center of global gold flows, trading and thus pricing. For now at least.  Since 2004, and with no domestic mine output and next to no end demand, the UK has imported over 6,800 tonnes of gold, according to official trade statistics – more than China but behind India, the former No.1 buyer. It has also exported nearly 5,000 tonnes, more than any country except No.1 bar refiner, Switzerland. That's in a global market seeing some 4,500 tonnes of end-user demand per year. Because London is the heart of the world's gold bullion market, and the central vaulting point for its wholesale trade. (Same applies to silver, by the way – the UK was the world's No.1 importer and exporter in 2013.) The relationship with prices is clear. When metal piles up in London's vaults (where its market also offers the deepest, most liquid place for large investors to hold their gold in secure vaults, ready to sell or expand at the lowest costs) prices have tended to rise. But when the rate of accumulation in London is slowing, prices have tended to fall. Gold prices have sunk when London's vaults have shed metal. On BullionVault's analysis, those months since end-2004 where Dollar gold prices rose saw net demand for London-vaulted gold average 38 tonnes. Falling prices, in contrast, saw London's vaults lose 16 tonnes per month on average (imports minus exports). Exclude the gold-price crash of 2013 and we get the same pattern. Average net inflows when Dollar price fell were only 15 tonnes per month between 2005 and 2012. Rising prices, in contrast, saw London vaults add 48 tonnes net on average per month. So what's happening with London-vaulted gold really does matter to world prices. Far more, to date, than what's happening to China's flows. Why? The Middle Kingdom's modern gold boom has come in mining, importing and refining. But in exports it just doesn't figure. Because bullion exports are banned, thanks to Beijing deeming gold to be a "strategic metal". Never mind that China now boasts 8 gold refineries accredited to produce London-grade wholesale bars. Out of a world total of 74, that's more than any other country except Japan. But Chinese-made wholesale bars never reach London (or shouldn't...) because they are dedicated by diktat to meeting its world-beating domestic demand alone. Global investment flows are further locked out by Beijing's block on foreign cash coming into China – another key difference between the UK and China in all financial trading, not just gold. Shanghai vaults have therefore been closed to international gold investment to date. So the impact of global flows on pricing has completely passed China by. This may change this week however, when the Shanghai Gold Exchange launches its new international gold exchange inside the city's huge free-trade zone on Thursday. Six major Chinese banks will provide clearing and settlement services. The first 40 approved members of the exchange include London market makers HSBC, UBS and Goldman Sachs. But whether global investors will choose to hold gold in Shanghai vaults remains to be seen. China remains a Communist dictatorship, after all. Whereas London, even in the dark days of 1970s exchange controls – which barred UK investors from buying gold, as well as moving cash overseas – still freely allowed foreign money to come and go as it pleased, not least through the City's world-leading gold and silver markets. Remember, China's gold market has only answered Chinese supply and demand so far. Its mine-supply leads the world...but cannot reach it. China's demand has meantime needed imports from abroad to supplement what Chinese mines produce. That demand leapt when world prices fell in 2013, doubling China's net imports through Hong Kong from 2012 to well over 1,000 tonnes, and clearly showing that – for now – its gold market remains a price taker, not a price maker. The running is made instead by free-flowing investment cash choosing to buy or sell down gold holdings worldwide, and that decision shows up in London, center of the world's bullion trade. Yes, Shanghai's new free-trade zone gold market marks one step towards changing that. Yes, the FTZ is very likely to replace Hong Kong as the stop-off point for gold imports entering the world's No.1 consumer market. But only a truly liberalized gold trade, with foreign cash and gold flowing in...and out...right alongside China's domesic flows will challenge London's 300-year old dominance. |

| 16 killed in artisanal gold mine collapse in Mali Posted: 17 Sep 2014 03:53 AM PDT Ten of those killed are miners from neighbouring Guinea, while the other six are Malian citizens. |

| Gold: Trending Bearish In The Short Term Posted: 17 Sep 2014 03:50 AM PDT investing |

| What Is Next For The Price Of Silver: Collapse or Rally? Posted: 17 Sep 2014 03:32 AM PDT Facts and figures from the silver marketSENTIMENT: Sentiment for gold (and silver) is very weak – as low as it was at the bottom in June 2013. This suggests both gold and silver are again at or near a bottom. GOLD TO SILVER RATIO: The ratio is currently about 66 – near the high end of the slowly declining range for the past 27 years. See the graph and note that a high ratio indicates silver is too inexpensive in relation to gold. All of the ratio peaks (February 1991, March 1995, March – May 2003, October 2008, and July 2013) occurred at significant silver lows.

OVER-SOLD TECHNICAL INDICATORS: The silver market is "over-sold" once again, as it was in October 2008, June 2013, and December 2013. Note the chart of weekly silver and the low reading on the TDI_Trade_Signal_Line. Other weekly oscillators show similar readings. The daily chart and monthly chart for silver and the daily and monthly TDI oscillators also show "over-sold" conditions. Such "over-sold" conditions are (eventually) followed by rallies. This is not to say a market can't become temporarily more "over-sold" but the probabilities have shifted toward rally instead of decline.

CYCLES: Monthly cycles are of little use for trading, but they do help with a big picture view for investors. Silver made an important low in July 1997, another low in March 2003, a major low in October 2008, and what appears to be a major low in September 2014. They are all approximately 5.75 years apart.

DEBT: People have written about out-of-control and unpayable debt extensively. Since currency is created as debt, and most or all governments around the world run deficits and perpetually increase their debt, it is the basis of our current financial system. A quick review:

National debt has increased exponentially since 1913 at about 9.0% per year, and since 1971 at about 9.2% per year. Silver has increased exponentially since 1913 at about 3.6% per year and since 1971 at about 6.4% per year. Also exponentially increasing, on average, are gold prices, crude oil prices, politician salaries, postage prices, the number of government programs, food prices, and military spending. Do you believe that politician salaries, military spending, and national debt will continue increasing? So do I! Consequently I believe that consumer price inflation is alive and well, and that we should expect a much higher cost of living in the next few years. In the long-term, I believe the prices for gold and silver will increase even more rapidly. SummaryBig Picture – the next decade: Prices for what we need, food and energy, will continue to increase as long as we live in a debt based fiat currency economy. Silver and gold prices will rapidly increase along with debt, the money supply, and politician promises. Medium Term – several years: Silver cycles indicate another important low probably is occurring about now. Expect silver prices to rally in the next several years. Monthly Prices: Silver is "over-sold" based on the charts, the TDI oscillator, and many other oscillators. Expect silver prices to rise. The gold to silver ratio is high which indicates relatively inexpensive silver prices and higher silver prices ahead. Weekly Prices: Same as monthly prices – "over-sold" and ready to rally. Daily Prices: They are also "over-sold" but pretty much controlled by the High Frequency Trading algorithms and the temporary needs of the "powers-that-be." From Michael Pento: Why Goldman Sachs is Wrong on Gold.

Believe it! Read my book: "Gold Value and Gold Prices From 1971 – 2021." (available at Amazon.com and GEChristenson.com)

Gary Christenson | The Deviant Investor

|

| Eric Coffin: Can Investors Still Find Tenbaggers? Posted: 17 Sep 2014 01:00 AM PDT |

| Price & Time: Gold Exhaustion Near? Posted: 17 Sep 2014 12:15 AM PDT dailyfx |

| Gold: Bullish Attempts Remain Limited Below 1240.22 Posted: 17 Sep 2014 12:15 AM PDT investing |

| Posted: 17 Sep 2014 12:10 AM PDT countingpips |

| Bearish Gold Trending To 1210-1215, Oil May Fall To 89-90 Before Correct Posted: 17 Sep 2014 12:10 AM PDT investing |

| Gold Prices September 17, 2014, Technical Analysis Posted: 17 Sep 2014 12:05 AM PDT fxempire |

| Gold And Silver Recover (But Longer Outlook Still Bearish) Posted: 17 Sep 2014 12:00 AM PDT investing |

| Gold – Rallies to Resistance at $1240, with Eyes on $1200 Posted: 16 Sep 2014 11:50 PM PDT marketpulse |

| Gold Big Breakdown Possible as Long as Below 1300 Posted: 16 Sep 2014 11:45 PM PDT dailyfx |

| U.S. Dollar and Gold Elliott Wave Projection Posted: 16 Sep 2014 11:30 PM PDT co |

| How should you play the US dollar as the Fed meets? Posted: 16 Sep 2014 11:23 PM PDT Ahead of Fed chair Janet Yellen’s much anticipated statement today after a two-day meeting. AllianceBernstein chief market strategist Vadim Zlotnikov, WisdomTree director of research Jeremy Schwartz and Bloomberg's Michael McKee discuss the Fed, interest rate policy, currency markets and China. They speak on ‘Street Smart’ with Betty Liu… |

| Posted: 16 Sep 2014 11:00 PM PDT Clif Droke |

| Russia Central Bank Responds To Domestic Dollar Shortage, Starts Currency Swaps Posted: 16 Sep 2014 10:50 PM PDT With the ruble hitting record lows once again today against the U.S. dollar, it appears concerns over U.S. dollar liquidity are growing in Russia. The Russian central bank has unveiled an FX swap operation, allowing firms to borrow dollars in exchange for Rubles for a duration of 1 day (at a cost of 7%p.a.). Of course, this squeeze on USD funding - driven by Western sanctions - will, instead of isolating Russia, force Russian companies (finding USD transactions prohibitively expensive) into the CNY-axis, thus further strengthening the Yuanification of world trade and the ultimate demise of the USD as reserve currency. And funding sanctions appear to have driven the Central Bank to supply U.S. dollar liquidity into an apparently squeezed market... As Bloomberg reports---"Sanctions and closed access to foreign-exchange liquidity from the West” is feeding demand for dollars, DmitryPolevoy, chief economist ING. Foreign-exchange liquidity has “virtually dried out,” with volumes sinking to about $100 million per day, compared with $1 billion to $2 billion previously, according to Natalia Orlova, the chief economist for OAOAlfa Bank in Moscow. This article appeared on the Zero Hedge website at 2:50 p.m. EDT yesterday afternoon---and it's another contribution from reader B.V. |

| Posted: 16 Sep 2014 10:50 PM PDT 1. John Embry: "War in Silver Rages as People’s Confidence in the West Fades". 2. Stephen Leeb: "China, Russia, Gold---and a New World Order Rising From the East" 3. Jeffrey Saut: "Warren Buffett, Charlie Munger, City Slickers---and Just One Thing" [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests to them, and not to me. Thank you. - Ed] |

| Gartman Letter cites Koos Jansen and Gold Newsletter on Chinese gold demand Posted: 16 Sep 2014 10:50 PM PDT Regarding Chinese gold demand, which we wrote about yesterday, it is open to debate and our old friend, Brien Lundin of the Jefferson Companies in New Orleans, wrote to share his insights. We've chosen to share them further with our readers, with his approval. Brien wrote: * * * In your letter this morning, you noted that Chinese gold demand was recently reported to be down about 50 percent year over year. This is erroneous information from the World Gold Council, as I've been noting in Gold Newsletter -- that there's a lot of misinformation on this topic. The mainstream financial media keeps parroting numbers from the World Gold Council and other sources, which typically rely on import statistics from Hong Kong. However, China has recently opened up new ports of entry for gold, a move that has correspondingly reduced the import numbers from Hong Kong. "Much more relevant are gold delivery statistics from the Shanghai Gold Exchange, which directly indicate wholesale gold demand in China. Koos Jansen is today's leading reporter of Chinese gold demand dynamics, and he relies on the Shanghai Gold Exchange numbers for his analyses. Using the SGE reports, Jansen notes that Chinese gold demand year to date is down about 17 percent from last year's torrid pace. This commentary appeared in a GATA dispatch yesterday. |

| China advances gold exchange launch, Singapore delays contract Posted: 16 Sep 2014 10:50 PM PDT China will launch its international gold exchange 11 days ahead of schedule, sources said on Tuesday, racing ahead in the scramble to set up an Asian bullion benchmark as rival Singapore is forced to delay its gold contract due to technical issues. Asia, home to the world's top two gold buyers - China and India, has been clamouring to gain pricing power over the metal and challenge the dominance of London and New York in trading. The state-run Shanghai Gold Exchange (SGE) will launch the global gold bourse in the Shanghai free-trade zone on Thursday, two sources familiar with the matter told Reuters. The SGE had initially planned the launch for Sept. 29. This gold-related article showed up on the Reuters website at 12:41 a.m. on Tuesday---and it's another story I found over at the gata.org Internet site. |

| Gold's move from West to East is said intended to rebalance FX reserves Posted: 16 Sep 2014 10:50 PM PDT China may join other emerging countries in boosting gold reserves as the precious metal makes up a smaller share of its foreign-exchange holdings compared with developed economies, said a London-based researcher. The country hasn't announced any changes to state gold reserves since authorities in 2009 said holdings totaled 1,054.1 metric tons. While China holds the world's biggest foreign-exchange reserves, bullion accounts for 1.1 percent of the total, compared with about 70 percent for the U.S. and Germany, the biggest gold holders, World Gold Council data show. "It is clear that Western central banks over time will be reducing their reserves and China and other Asian countries will be increasing," David Marsh, managing director at the Official Monetary and Financial Institutions Forum, said in a Sept. 11 interview in Beijing. "Gold will become more traded among central banks in the next 30 years because there are colossal imbalances in world gold holdings as a percentage of overall asset reserves." Central banks, net buyers of gold for 14 straight quarters, last year helped limit bullion's losses that were the most since 1981 and may increase purchases to as much as 500 tons this year after adding 409 tons last year, the London-based council said Aug. 14. The precious metal rose 3 percent this year as geopolitical tensions boosted demand for a haven. I found this Bloomberg story embedded in a GATA release yesterday---and it's certainly worth reading. |

| Gold’s Move From West to East is Said Intended to Rebalance FX Reserves Posted: 16 Sep 2014 10:50 PM PDT "I was not overly happy with the price action on the rallies" ¤ Yesterday In Gold & SilverLooking at the Kitco chart below, you can see that the gold price made four attempts to rally during the Tuesday trading session, with the most impressive one coming at 11:40 a.m. EDT when the dollar index fell out of bed. But each time there was a not-for-profit seller in the wings to make sure that those rallies didn't go anywhere, by throwing whatever Comex paper was necessary at them. The low and high ticks were recorded as $1,232.20 and $1,243.20 in the December contract. Gold closed in New York yesterday at $1,234.90 up only $2.20 on the day when all was said and done. Obviously the price would have finished quite a bit higher if JPMorgan hadn't shown up when the did. Net volume was only 113,000 contracts, so it wasn't overly difficult for 'da boyz' to keep the gold price in line. After the obligatory down tick at the 6 p.m. open, the chart pattern in silver was more or less the same, so I won't dwell on it much further, but the price capping after the 11:40 a.m. rally is more than obvious. The low and high ticks were reported by the CME Group as $18.61 and $18.885 in the December contract as well. Silver finished the Tuesday session at $18.685 spot, up 3 whole cents from Monday. Net volume was 35,500 contracts. The platinum and palladium charts looked similar in some ways to the gold and silver charts, with the most conspicuous feature in both being the rally at 11:40 a.m. EDT. Platinum finished up 4 dollars---and palladium closed up 8 bucks. Here are the charts. The dollar index closed late on Monday afternoon in New York at 84.25---and then jumped around in a 25 basis point range for a large portion of the Tuesday session---and really looked like it wanted to head south a couple of times, but it appeared that a willing buyer was showing up to catch the proverbial falling knife until it really took at header at 11:40 a.m. EDT. It's low tick of 83.90 was met with a buyer of last resort---and it rallied back to just above the 84.00 mark, closing the Tuesday session at 84.07---down 18 basis points. I'm just speculating here, but it's a good bet that the dollar index would have closed significantly lower if left to its own devices, which it apparently wasn't. Here's the 3-day chart. The gold stocks opened a bit lower, but then quickly rallied into positive territory once gold rallied in New York. But more than half of those gains disappeared by the end of the Tuesday session---and the HUI only finished up 0.48%. The silver stocks got sold down much harder at the open---and the subsequent rally into positive territory didn't hold---as Nick Laird's Intraday Silver Sentiment Index closed down 0.15%. The CME's Daily Delivery Report showed that zero gold and 251 silver contracts were posted for delivery within the Comex-approved depositories on Thursday. There were only two short/issuers---Jefferies with 196 contracts and Barclays with 55. There's a decent list of long/stoppers---and it's worth a quick look. The link to yesterday's Issuers and Stoppers Report is here. The CME Preliminary Report for the Tuesday trading session showed that there are still 33 gold contracts open in September---and 609 silver contracts, down 15 from Monday's report. But from those 609 contracts must be subtracted Thursday's 251 contract delivery. I wasn't entirely surprised to see a withdrawal from GLD yesterday. This time an authorized participant withdrew 134,637 troy ounces. And as of 8:23 p.m. EDT yesterday evening, there were no reported changes in SLV. There was another sales report from the U.S. Mint. They sold 3,000 troy ounces of gold eagles---500 one-ounce 24K gold buffaloes---and 850,000 silver eagles. Over at the Comex-approved depositories on Monday, they reported that 32.250 troy ounces of gold were withdrawn---and all of it was from Canada's Scotiabank. Nothing was reported received. The link to that activity is here. It was much busier in silver, of course, as 598,756 troy ounces were received---and a smallish 30,417 troy ounces were removed. The big deposit was at CNT. The link to that action is here. As promised, I have a lot fewer stories today---and will probably have less as the balance of the week progresses. ¤ Critical ReadsBlackRock calls for U.S. stock market reformsBlackRock Inc, the world's largest asset manager, has asked regulators to force exchanges to lower their access fees and require greater transparency of broker dealer-run trading venues known as "dark pools." The New York-based company outlined a set of proposals aimed at boosting public confidence in the equity markets in a letter on its website to the U.S. Securities and Exchange Commission dated Sept. 12. It said that while the market is "not broken or in need of large scale change," improving current rules would help promote fairness, order and efficiency. Questions about the safety and fairness of the mostly electronic markets have risen in recent years following a raft of high-profile trading glitches by numerous market participants, causing hundreds of millions of dollars of losses. Those concerns hit the mainstream in late March with author Michael Lewis' book "Flash Boys: A Wall Street Revolt," which claimed the markets were rigged in favor of high-speed traders. This Reuters story, filed from New York, appeared on their Internet site at 6:01 p.m. EDT on Monday evening---and it's something I found in yesterday's edition of the King Report. United Offers $100,000 Buyouts to Flight AttendantsUnited Airlines, the only major U.S. carrier to post a quarterly loss this year, is offering its flight attendants buyouts of as much as $100,000 as it seeks to rein in costs. Employees who accept the early-exit plan will be eligible for lump-sum payments, said a spokeswoman, Megan McCarthy, who declined to disclose the formula needed to reach the maximum. United also is recalling 1,450 furloughed attendants, most of whom took voluntary leave one to two years ago, she said. United, a unit of United Continental Holdings Inc., is hoping for at least 2,100 takers from an attendants workforce of more than 23,000 after some senior employees sought the offer, McCarthy said. Attendants back from furlough also will help United bolster airports that were too thinly staffed, she said. This Bloomberg story, filed from Atlanta, showed up on their website at 10 p.m. Denver time on Monday evening. Reader Michael Cheverton, who sent me this story, had this to say about it---"Hi Ed, the staggering part about this article is that they say UAL shares are up 31% this year. For an industry that is in shambles and a company that will probably never make a profit again, that says something pertinent about just how screwed up the markets are." He would be right about that. France's 'super-rich' take their fortunes to BelgiumA fifth of France’s 100 richest people have moved a total of €17 billion to neighbouring Belgium in recent years, a report showed at the weekend, saying the exodus is largely due to French socialist President François Hollande’s tax policies. The report, published in Belgian financial daily L’Echo, lists France’s richest man, LVMH CEO Bernard Arnault, media moguls Stéphane Courbit and Bernard Tapie, as well as the Mulliez family, which controls the Auchan supermarket chain, among those who have made the move. But many of France’s wealthy appear to have crossed over the border only recently. Many “have shown up in the past three years, in other words since François Hollande was inaugurated as president,” the paper writes, attributing it to the socialist government’s pressure to get the economy back into the black amid soaring unemployment and a ballooning deficit. This news item showed up on the france24.com Internet site sometime on Monday---and it's the first contribution of the day from Roy Stephens. Putin, Merkel Discuss Ukrainian Ceasefire, Gas Deliveries to EuropeRussian President Vladimir Putin and German Chancellor Angela Merkel discussed in a phone call on Monday the situation around the current ceasefire regime and deliveries of Russian gas to Europe, the Kremlin said. "Putin and Merkel exchanged opinions on the situation with deliveries of Russian natural gas to EU member-states and agreed that the consultations in a three party format should continue," a statement on the Kremlin website said. The leaders also discussed the development of the situation in Ukraine with focus on the importance of strict compliance with the ceasefire regime by the sides of the internal Ukrainian conflict and the effective monitoring of the situation by the Organization for Security and Cooperation in Europe, the Kremlin said. This article appeared on the RIA Novosti website at 11:57 p.m. Moscow time on their Monday night, which was 3:57 p.m. in New York. I thank South African reader B.V. for sharing it with us. Gas onus on Ukraine, Gazprom saysReliable natural gas deliveries to Europe depend largely on contractual issues in Ukraine, Russian energy company Gazprom said Tuesday. Gazprom in June cut gas supplies to Ukraine because of ongoing disputes over pricing and debt. Ukraine pays some of the highest prices for natural gas in the region. Russia had offered a discounted price, though the Ukrainian government said it suspected the offer was politically motivated. Russia meets about a quarter of Europe's gas needs, though most of that gas runs through the Soviet-era transit network in Ukraine. Similar rows in 2006 and 2009 left European consumers in the cold and Gazprom says the onus is now on Ukraine. This UPI article put in an appearance on their website at 10:28 a.m. EDT on Tuesday---and it's the second contribution of the day from Roy Stephens. Russia Central Bank Responds To Domestic Dollar Shortage, Starts Currency SwapsWith the ruble hitting record lows once again today against the U.S. dollar, it appears concerns over U.S. dollar liquidity are growing in Russia. The Russian central bank has unveiled an FX swap operation, allowing firms to borrow dollars in exchange for Rubles for a duration of 1 day (at a cost of 7%p.a.). Of course, this squeeze on USD funding - driven by Western sanctions - will, instead of isolating Russia, force Russian companies (finding USD transactions prohibitively expensive) into the CNY-axis, thus further strengthening the Yuanification of world trade and the ultimate demise of the USD as reserve currency. And funding sanctions appear to have driven the Central Bank to supply U.S. dollar liquidity into an apparently squeezed market... As Bloomberg reports---"Sanctions and closed access to foreign-exchange liquidity from the West” is feeding demand for dollars, DmitryPolevoy, chief economist ING. Foreign-exchange liquidity has “virtually dried out,” with volumes sinking to about $100 million per day, compared with $1 billion to $2 billion previously, according to Natalia Orlova, the chief economist for OAOAlfa Bank in Moscow. This article appeared on the Zero Hedge website at 2:50 p.m. EDT yesterday afternoon---and it's another contribution from reader B.V. What draws Modi to ChinaModi is due to visit the U.S. in exactly twelve days from now. But there is nothing of the American rhetoric that used to mark a Manmohan Singh visit to the White House. An idea was thought of initially to propitiate Modi by granting him the privilege of addressing the US Congress. But it has been quietly shelved. The heart of the matter is that there had been a pronounced 'militarization' of India's strategic outlook through the past 10-15 years, which was a period of high growth in the economy that seemed to last forever. In those halcyon days, geopolitics took over strategic discourses and pundits reveled in notions of India's joint responsibility with the United States, the sole superpower, to secure the global commons and the 'Indo-Pacific'. This longish commentary falls into the must read category, especially for any serious student of the New Great Game. It was posted on the Asia Times website yesterday sometime---and it's courtesy of Roy Stephens. China's leaders refuse to blink as economy slows drasticallyChina’s leaders have brushed aside warnings of an incipient credit crunch in the Chinese economy, determined to purge excesses from the financial system despite falling house prices and the deepest industrial slowdown since the Lehman crisis. Industrial production dropped 0.4pc in August from a month earlier, a rare event that highlights how quickly China is coming off the boil. The growth of fixed asset investment fell to record lows. “It is a shockingly sharp deceleration,” said Wei Yao, from Société Générale. “What is surprising is the calm response from Beijing. The new leadership’s tolerance for short-term pain seems to have jumped by another big notch.” Electricity output has dropped 2.2pc over the past year as the authorities continue to force dinosaur industries into closure, chipping away at excess capacity. This commentary by Ambrose Evans-Pritchard showed up on the telegraph.co.uk Internet site at 7:59 p.m. BST on Monday---and I thank Roy Stephens for sending it our way. It's worth reading. Three King World News Blogs1. John Embry: "War in Silver Rages as People’s Confidence in the West Fades". 2. Stephen Leeb: "China, Russia, Gold---and a New World Order Rising From the East" 3. Jeffrey Saut: "Warren Buffett, Charlie Munger, City Slickers---and Just One Thing" [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests to them, and not to me. Thank you. - Ed] Gartman Letter cites Koos Jansen and Gold Newsletter on Chinese gold demandRegarding Chinese gold demand, which we wrote about yesterday, it is open to debate and our old friend, Brien Lundin of the Jefferson Companies in New Orleans, wrote to share his insights. We've chosen to share them further with our readers, with his approval. Brien wrote: * * * In your letter this morning, you noted that Chinese gold demand was recently reported to be down about 50 percent year over year. This is erroneous information from the World Gold Council, as I've been noting in Gold News |

| Posted: 16 Sep 2014 09:19 PM PDT The post Protected: GDXJ Analysis appeared first on The Daily Gold. |

| Reason # 5 The Silver Noose is Tightening: Silver Recycling Plunging Posted: 16 Sep 2014 07:00 PM PDT This year some 900,000 oz of silver on average have moved into or out from these six warehouses on a daily basis. The daily average movement of silver into and out from the COMEX silver warehouses at 900,000 oz is equal to 28% of total world daily mine production." -Ted Butler Over 1 in every […] The post Reason # 5 The Silver Noose is Tightening: Silver Recycling Plunging appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment