saveyourassetsfirst3 |

- London's precious metals fixes fixable?

- Gold Sold but Fails to Fold

- Historical analysis shows what to expect from gold and silver this year

- Bank jurisdiction key in gold storage - Phillips

- Gold & Silver COT Charts

- Despite gold curbs, jewellers manage record exports

- Global Gold Demand Steady Despite Indian Repression; Stealth PBOC Buying Not Factored In

- Are Silver Prices Set Up for Another Heartbreak?

- KGHM Polska- An Undervalued Copper And Silver Producer

- USD/CAD - Loonie Loses Ground As Wholesale Sales Slides

- Gold Price In The Post-Nixon Era

- Gold Holds Support; Constricts Further

- Decision Time for Silver

- What you really need to know about this “blockbuster” new book on the economy

- Balmoral Confirms High-Grade Ni-Cu-PGE Mineralization Over 45.28 Metres on New Horizon; Grasset Property, Detour Trend, Quebec

- Housing Bubble 2.0 is Popping…

- Gold Prices Will Rise on Robust Demand and Instensifying Currency War

- Mercenary Links May 20th: Lingering Woes

- Latest ECB gold sales agreement raises questions

- China gold demand drops

- German TV network broadcasts long program on gold market manipulation

- Gold Price Manipulation Goes Mainstream On German TV

- Indian gold consumption to increase?

- Lies, Inflation, and the Minimum Wage

- LBMA accredits MMTC Pamp India for Gold delivery in India

- The Meat Crisis Is Here: Price Of Shrimp Up 61% – 7 Million Pigs Dead – Beef At All-Time High

- Silver jewelery exports surge in India

- Gold policy change in the works?

- Global gold demand steady despite Indian repression

- BARBAROUS RELIQUARY: HOLDING THE METALS IN A POST – WESTERN WORLD

- Indian Gold demand witness a significant decline in Q1: WGC

- Frank Curzio: This could be the safest "700% upside" investment you ever see

- Global Gold Demand Steady Despite Indian Repression; Stealth PBOC Buying Not Factored In

- Dennis Gartman cutting Gold positions by about a third

- Ilargi: European Democracy Is Roadkill

- Conspiracy Fact: European Central Banks Again Admit, Renew Secret Coordination on Gold

- CME Cuts Silver, Gold Trading Margins

- Koos Jansen: Chinese real estate debt is being settled in silver

- Jeff Clark: The Birth of a New Bull Market

- Gold bar and coin demand slumps to 4-year low

- Smart recovery of Indian gold jewellery exports in April

- Gold Appetite Shrinks in Thailand Amid Political Deadlock

- World Gold Council: First-Quarter Demand Holds Steady With Year-Ago Levels at 1,074.5 Tonnes

- Degussa purchases world’s largest gold bullion collection

- Conspiracy fact: European central banks again admit, renew secret coordination on gold

- Seven King World News Blogs/Audio Interviews

- DoJ Does Victory Lap on Credit Suisse Guilty Plea on Single Criminal Charge

- Gold & Silver Trading Alert: Critical Support in Silver

- Gold "Important" And No Plan To Sell Significant Quantity Of - ECB

- A Whistleblower’s Tainted Defeat: CA Appellate Reversal Paves Way for Continued Bank Retaliation

| London's precious metals fixes fixable? Posted: 20 May 2014 03:33 PM PDT The London silver fix in its current form will go. Can the others be saved? Should they be saved? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 May 2014 12:50 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Historical analysis shows what to expect from gold and silver this year Posted: 20 May 2014 12:39 PM PDT From The Gold Report: Charles Oliver, lead portfolio manager with the Sprott Gold and Precious Minerals Fund, believes the only thing between investors and bigger investment returns on precious metals equities and bullion, especially silver, is time. In this interview with The Gold Report, Oliver discusses silver and gold demand drivers, as well as portfolio ideas that figure to get bigger with time as the trigger. The Gold Report: “Sell in May and go away” is a common investing axiom but does it have any validity? Charles Oliver: I recently went through some research on seasonality in the gold price. March has been negative in the gold space in six of the last eight years, April has proven negative four out of the last eight years, and May and June have both been negative five of the last eight years. However, we see a fairly dramatic turnaround in July where six of the last eight years have been positive. In August, another six of the previous eight years have been positive; September has been positive five of the last eight years. The “sell in May” adage could actually represent a great buying opportunity on the pullback. TGR: What are some investment themes you expect to dominate through the rest of the year? CO: It really comes down to printing money. The U.S. has reduced its money printing but it is still aggressively printing. Now we’re hearing about the Europeans potentially getting into quantitative easing. The debasement of currencies is an ongoing theme. The other key theme is the demand for physical gold. China has become the world’s largest gold buyer, consuming about 40% of the world’s mine production. India, which historically had been the world’s largest gold consumer, has established some tariffs on gold imports, so there’s been some pullback there. It’s noteworthy that over the last couple of decades the European central banks have been collectively selling gold. That stopped a couple of years ago. Some numbers from the Swiss Customs Authority show that Germany, France, Singapore, Thailand, even the United Kingdom, are fairly significant gold buyers. These are very positive events. TGR: What about geopolitical events? Do you expect those to dramatically influence gold prices? CO: Historically, wars and the risk of wars have been quite positive for the gold price yet recent events in the Ukraine haven’t seen gold do anything. In fact, it’s trading near the bottom end of its recent range. But should things escalate, I feel strongly that it will have a positive impact. I certainly hope that it doesn’t come to that but the risk seems significant. TGR: What is the investor pulse in the precious metals space? CO: A year ago investors were selling a little, as they had been for some time. The selling had mostly stopped by the end of the 2013 and the people who didn’t have long-term conviction had left. In early 2014 I was a bit surprised to see U.S. value investors streaming in because we had been through a period of net redemptions. When the Americans come into the market they can have quite a dramatic impact on prices. I’ll call it sporadic because it has not been a consistent stream. TGR: What happened to those bids? CO: Generally speaking, American investors, portfolio managers and pension funds were saying at the end of 2013, “We’ve had some good returns in the general market but the market is looking somewhat expensive.” They were looking for areas where there was good value. The gold price had been hammered over the last couple of years so they were starting to move some of their allocations into that space. We’ve also seen some private equity buying assets and taking them private. And some Asian interests dipping their toes in the water. People are starting to wake up and show some interest but they are still waiting for some sort of trigger in order to say that this is the time to jump in. TGR: Any idea what that could be? CO: I’ve spent a lot of time thinking about that question. I liken the 1974 to 1976 period to today. In 1974, the oil price was going up after the oil embargo and inflation was going up, too. It was peculiar because the gold price went from about $200 per ounce ($200/oz) to $100/oz over the next couple of years. Then in 1976 gold suddenly went from $100/oz to about $800/oz. I have spent a lot of time trying to determine the trigger for that event. Sometimes it is just time. When I look back at 2013, I see a lot of positive fundamentals—strong Chinese demand, huge amounts of money printing—yet the gold price went down. Sometimes it’s just the way the markets time themselves. TGR: Do investors need to revise their price expectations for precious metals equities? There is zero froth in this market. CO: I think that’s a good way of putting it. I’m continually trying to figure out where the market may go. Not too long ago I said that by the end of this decade gold should be approaching something like $5,000/oz, which would have a huge impact upon the markets and stock valuations. The market is valuing equities as if gold is going to stay at $1,200–1,300/oz forever. I believe that the market will be proven wrong over time. TGR: Gold is trading at roughly 67 times silver. Does that make silver your preference? CO: Yes. It was Eric Sprott who came up with the thesis and I fully embrace it. For over 1,000 years, the silver-gold price relationship was close to 16:1, so that implies that if gold is $1,600/oz, the silver price would be $100/oz. The last time that happened was 1980 when the gold price was roughly $800/oz and the silver price was around $50/oz. Over the next couple of years, I expect to see that 67:1 ratio migrate toward 16:1. TGR: Yet the trend is moving in the opposite direction. CO: In the short term sometimes these things happen. About 25% of the weighting in the Sprott Gold and Precious Minerals Fund (SPR300:TSX) is in silver equities, which is probably among the highest in the peer group for precious metals funds. TGR: What’s your investment thesis for silver versus gold? CO: About two-thirds of mined silver is used in industry, whereas gold has virtually no industrial usage. Gold is considered a reserve currency whereas silver is not. About 150 years ago many countries had silver reserves backing their currencies. Today they don’t but China has trillions of U.S. dollars that it is converting into hard assets. The Chinese are buying a lot of gold but if they ever decide to be a silver buyer we would see a huge shift in the price of silver. Look at every mined commodity out there today—copper, nickel, zinc, iron ore—China accounts for 40–50% of global consumption. TGR: Is it all about margin for precious metals equities? CO: A lot of these companies are producing gold at $1,000/oz or silver at $18/oz. Should silver go up to $30/oz, that $2/oz margin suddenly becomes $12/oz—a sixfold increase. Shifts in commodity prices could have huge impacts on the profitability of these companies. TGR: Tell us about some of your top silver holdings. CO: Among my top 10 silver holdings, I have Silver Wheaton Corp. (SLW:TSX; SLW:NYSE), Pan American Silver Corp. (PAA:TSX; PAAS:NASDAQ) and Tahoe Resources Inc. (THO:TSX; TAHO:NYSE), which operates one of the world’s newest silver mines. I visited Tahoe’s Escobal mine in Guatemala earlier this year to check out its ramp-up period because that can be challenging. The company is doing a very good job of ramping up to nameplate capacity. Tahoe’s Q1/14 results beat the expectations of most analysts and a number of them are revising their forecasts upward. In the gold space I have companies such as Osisko Mining Corp. (OSK:TSX) and IAMGOLD Corp. (IMG:TSX; IAG:NYSE). TGR: I thought the Osisko story was finished. CO: A byproduct of the Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE)/Agnico-Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) takeover bid for Osisko is a potential Osisko spinout company. For every Osisko share, investors would own one share of the spinco. It means roughly 15% of an Osisko share is represented by the value of the spinco and the other 85% consists of shares in Agnico-Eagle, Yamana and cash. An Osisko shareholder today will end up owning a combination of all three companies, plus the cash component of the offer. One thing that keeps me excited about the spinco is that it is going to have a 5% royalty on the Canadian Malartic gold mine. It would also have a 2% royalty on the Hammond Reef and Kirkland Lake assets, as well as a large land package in Mexico. The Osisko spinco would be Canada’s newest royalty company and royalty companies often get a premium valuation. TGR: Does the new company have a ticker? CO: Osisko shareholders will have to vote to accept the Agnico-Eagle and Yamana bid. I expect it will pass and the Osisko spinco should be trading sometime in June. TGR: Osisko was targeted largely because it had a large low-grade, low-cost asset in a safe jurisdiction. Does that make companies like Detour Gold Corp. (DGC:TSX) and Tahoe Resources takeover targets? CO: Certainly both Detour and Tahoe would fit the model sizewise. Goldcorp Inc. (G:TSX; GG:NYSE) walked away from the Osisko bid and clearly it wants to continue to grow through mergers and acquisitions. What will Goldcorp do? I’m not expecting the company to come out tomorrow and make an acquisition on either of these names, but I think it will certainly do the diligence work. Goldcorp already owns 40% of Tahoe, which has a world-class asset with world-class operating statistics. Goldcorp is already in Guatemala; I’m not sure if it wants to increase its weighting there. In the case of Detour, yes, it’s in Canada, and from that point of view, quite attractive. Detour is still in the ramp-up stage and perhaps it has finally reached the point where it is producing and reducing its cash costs. But I think Detour is still a year behind Osisko on that front. TGR: Detour just published Q1/14 results. It had an adjusted net loss of $0.20/share, while it produced roughly 107,000 oz gold. Your thoughts? CO: I was impressed at what Detour was able to achieve because it was a tough winter. I had some concerns that the weather might have proven to be an impediment, but the company produced a significant amount of gold. I think the grade was 0.9 grams per ton. Some of that was from stockpiles to buffer the grade at the mill. There are always a few bumps in the road but Detour has done very well. TGR: In early 2013 that stock was above $25/share. Now it’s about $11/share. What’s going to get it back above, say, $15/share? CO: A couple of things. As I said earlier, I believe the gold price is going higher. With higher gold prices come higher margins. And I think the market is still putting a discount on Detour as it’s in the ramp-up phase. As the company brings down cash and operating costs quarter by quarter and approaches Detour Lake’s nameplate production capacity, the stock will get back to a higher valuation. TGR: Do you have any more gold names for us? CO: I’ll mention some of my larger holdings of nonproducers: Dalradian Resources Inc. (DNA:TSX) and Asanko Gold Inc. (AKG:TSX; AKG:NYSE.MKT) that form part of a diversified portfolio. TGR: What is the Dalradian story over the next 18 months or so? CO: The company will continue to derisk the Curraghinalt project in Northern Ireland. Dalradian will go underground and through further drilling convert a fair amount of the Inferred resources to the Measured and Indicated category. As the market gets confidence with those numbers, it will start to rerate the company. A lot of people were concerned about whether mining would occur in Northern Ireland. To address that, Dalradian is looking to make a concentrate instead of using cyanide. The company is doing things that will ultimately make it more attractive. TGR: Why do you own Asanko? CO: It used to be called Keegan Resources. The management of Asanko bought into the project for around $27 million. These are the people that ran LionOre Mining, which under a decade ago was the subject of a bidding war between Xstrata Plc (XTA:LSE) and Norilsk Nickel Mining Co. (GMKN:RTS; NILSY:NASDAQ; MNOD:LSE). They’re good people with good operational experience. Asanko merged the PMI Ventures assets with those that were in Keegan and now has two projects within about 10 kilometers of each other, which are expected to have synergies. The company also has a significant amount of cash. TGR: The Sprott Gold and Precious Minerals Fund has held positions in Pretium Resources Inc. (PVG:TSX; PVG:NYSE), Guyana Goldfields Inc. (GUY:TSX), Unigold Inc. (UGD:TSX.V) and Kirkland Lake Gold Inc. (KGI:TSX). Does it still have positions in those names? CO: Pretium and Guyana are among my top holdings. Unigold, which you mentioned, is a small-cap name in the Dominican Republic. Unfortunately it has been the victim of the small-cap market where investors have turned their backs on these types of companies through no fault of management. I think Unigold has an interesting property with lots of opportunities and drill targets, and could potentially have a mineable resource one day. TGR: Guyana Goldfields’ flagship Aurora project has outlined 6.5 million ounces Measured and Indicated, yet the stock price is falling. CO: The company is at the point where it is ordering equipment, getting its financing in place, and then it will start building and moving Aurora forward. Again, it’s time and execution. TGR: Pretium had a bumpy ride in 2013. Do you still have faith in management? CO: Yes. I visited Brucejack in British Columbia last year. It’s a “nuggety” project that’s difficult to model. It takes a lot of drilling to get that necessary level of confidence. Last year the company processed a 10,000-ton bulk sample that produced around 6,000 ounces (6 Koz) or about 0.6 ounces per ton. In February, Pretium sent another 1,000-ton sample to the mill and it produced around 3 ounces gold per ton. The important thing to look at with this company is that there is lots of gold underground; the model still needs work to figure out how best to mine it. Pretium is proceeding with further studies on Brucejack, but I think it will be a mine. It’s also a potential acquisition as it is a high-grade deposit in Canada. TGR: Kirkland Lake Gold forecasts roughly 126 Koz in production in 2014. Is that realistic? CO: It will probably come close to that number. Kirkland Lake has a new CEO, George Ogilvie, and a fairly dramatic change in ideology. A couple of years ago the company was focused on mining everything in the mine. Ogilvie is focused on mining more profitable ounces. TGR: I understand that Kirkland has been attempting to lower costs. Is that working? CO: Kirkland Lake is not yet profitable, but it has instituted a new program to mine higher grades. It will focus on the high-grade ore because that is where it will make a profit. This is the same strategy that Rob McEwen put into place at the Red Lake mine. I think Kirkland has huge potential but it ultimately comes down to strategy execution. TGR: In March you said that gold would reach $5,000/oz within a few years. That seems optimistic. CO: It’s based on the historical relationship between the Dow Jones Industrial Average and the gold price. Over the last 100 years there have been three times when it has cost 1 to 2 ounces gold to buy the Dow. The last time was 1980 when the gold price was $800/oz and the Dow was 800. People roll their eyes when you forecast big numbers. In 2004 or 2005, I said gold would reach $1,000/oz. When it reached $1,000/oz, I moved to $2,000/oz and we almost got there. With the willingness of the market to continue to print money, I believe that we are going to get that 2 or 3 to 1 relationship with the Dow. With the Dow at 16,000, I think $5,000/oz is achievable. It’s not really that the gold price is increasing, it’s that paper currencies are depreciating in value. TGR: Thank you for your time and commentary, Charles. Charles Oliver joined Sprott Asset Management in 2008. He is lead portfolio manager of the Sprott Gold and Precious Minerals Fund. Previously, he was at AGF Management Limited, where his team was awarded the Canadian Investment Awards Best Precious Metals Fund in 2004, 2006 and 2007. His accolades also include: Lipper Awards’ best five-year return in the Precious Metals category (AGF Precious Metals Fund, 2007), and the Lipper Award for best one-year return in the Precious Metals category 2010.

More on gold and silver:

Casey Research: What you need to know about the bear market in silver Master trader Clark: The next major gold rally is starting now Incredible chart shows a RARE opportunity in silver right now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank jurisdiction key in gold storage - Phillips Posted: 20 May 2014 12:23 PM PDT In his regular update on the gold price, Julian Phillips, of the Gold Forecaster, weighs in on Credit Suisse tax evasion case. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

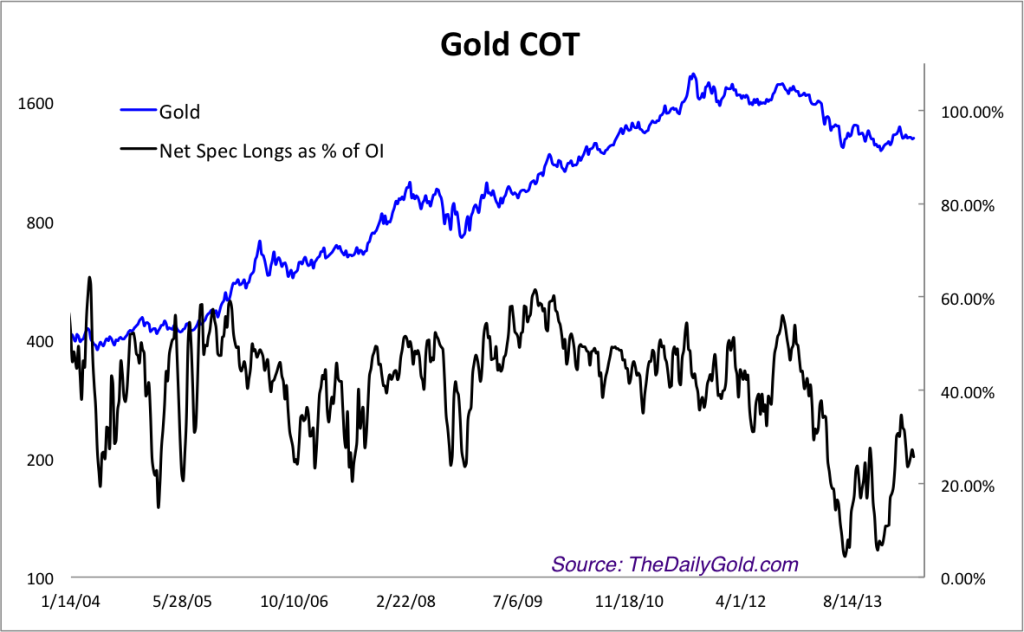

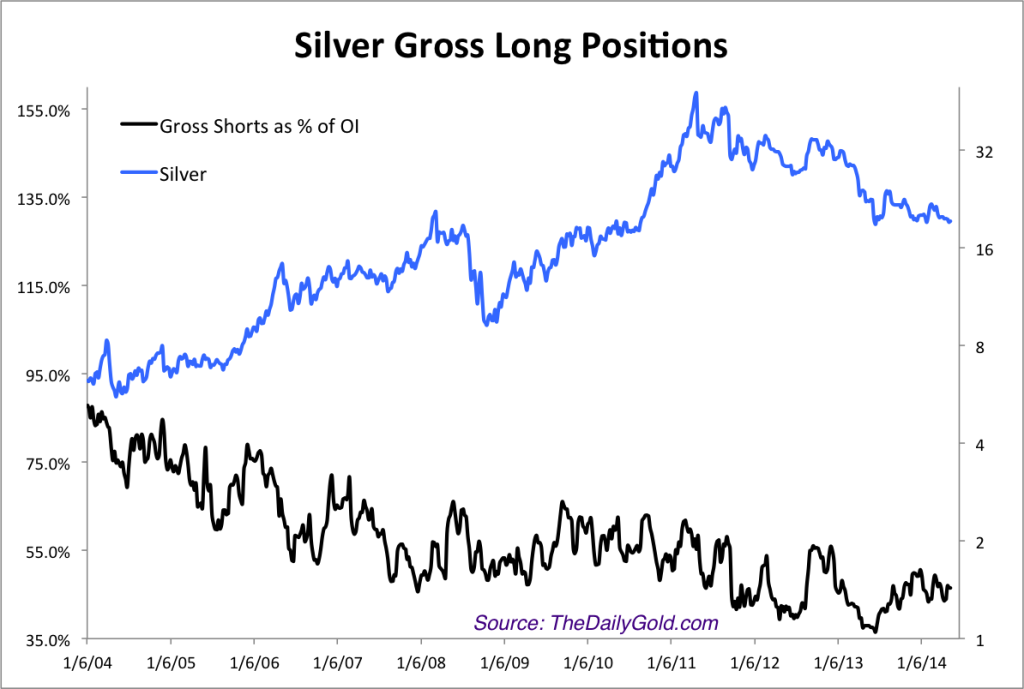

| Posted: 20 May 2014 12:09 PM PDT First here are the COTs, showing net speculative long positions as a percentage of open interest… Gold…

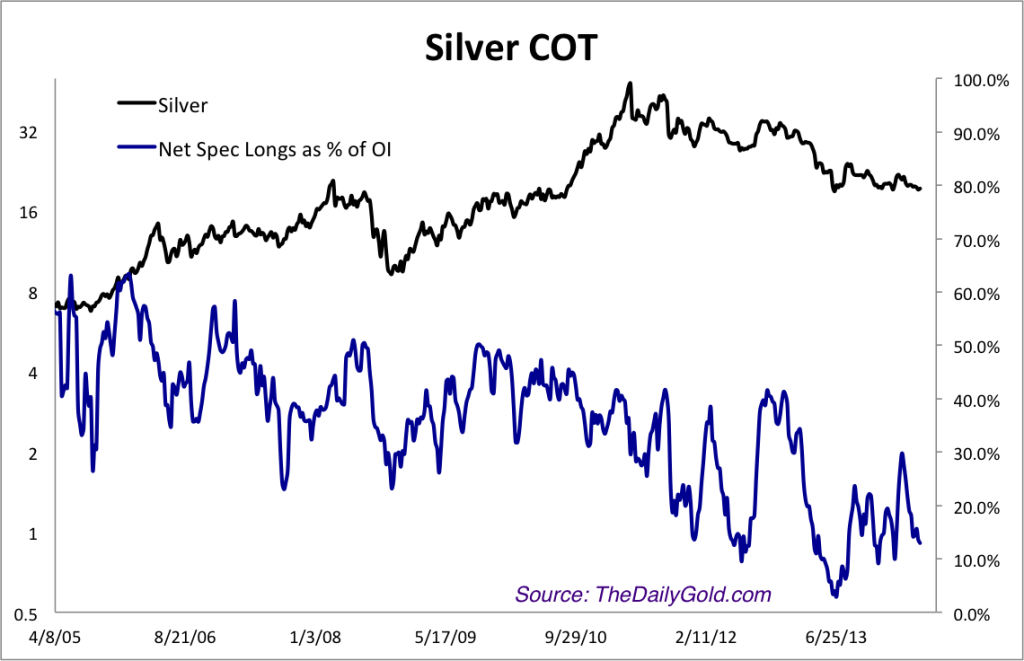

Silver….

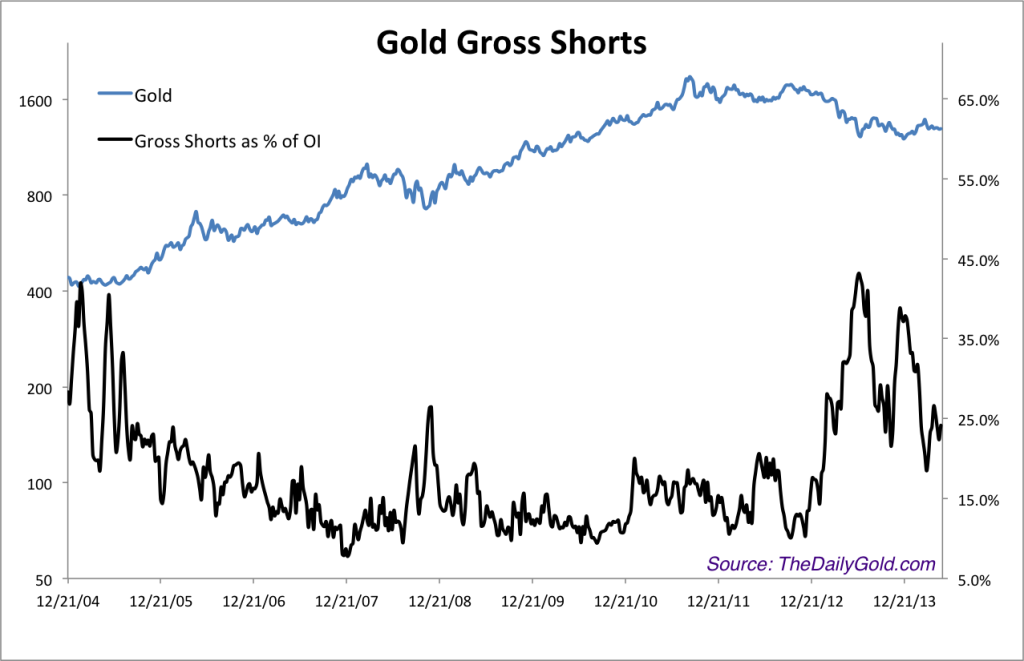

Moving along, here is a breakdown by short and long positioning for Gold…

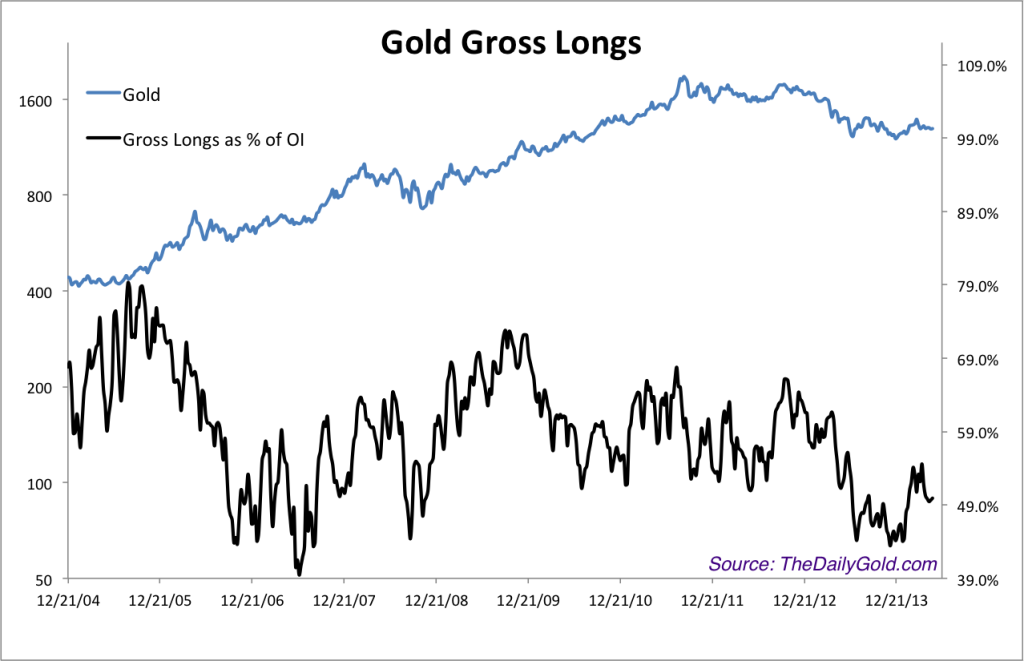

Here is the breakdown by long and short positioning in Silver….

For premium analysis, consider our premium service.

The post Gold & Silver COT Charts appeared first on The Daily Gold. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Despite gold curbs, jewellers manage record exports Posted: 20 May 2014 12:06 PM PDT Indian gold jewellery & source: "Any respite the government felt through lower imports was negated by a big jump in smuggling," a trader says. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global Gold Demand Steady Despite Indian Repression; Stealth PBOC Buying Not Factored In Posted: 20 May 2014 12:00 PM PDT

After the record year for gold demand that was 2013, gold demand made a robust start to 2014 – virtually unchanged year-on-year at 1,074.5 tonnes according to the World Gold Council data. An important caveat to the figures is the 'elephant in the room' that is demand from the People's Bank of China (PBOC). The PBOC [...] The post Global Gold Demand Steady Despite Indian Repression; Stealth PBOC Buying Not Factored In appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Are Silver Prices Set Up for Another Heartbreak? Posted: 20 May 2014 12:00 PM PDT

Jeffrey Lewis asks: Are Silver Prices Currently Being Set Up for Another Heartbreak? By Dr. Jeffrey Lewis, Silver-Coin-Investor: For long term investors and precious metals observers, the range-bound price action has rubbed salt into the open wound of short price sentiment. That is, if there is anyone left to remember the move up to [...] The post Are Silver Prices Set Up for Another Heartbreak? appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| KGHM Polska- An Undervalued Copper And Silver Producer Posted: 20 May 2014 11:59 AM PDT (Editor's Note: Investors should be mindful of the risks of transacting in illiquid securities such as KGHPF. The company's European listings under KGHA offer an alternative, however those listings also have limited liquidity.) KGHM Polska (OTC:KGHPF) is a Poland-based company, one of the world's ten biggest refined-copper producers in 2013 (according to Bloomberg). In 2013 the company produced around 530 tons of copper in concentrate (the leader, Codelco of Chile, produced 1,523 tons). This is what most people know, especially those interested in commodity markets. But what most people do not know is that, according to The Silver Institute, in 2012 KGHM was the biggest world producer of silver. In 2013 the company produced 41.0 million ounces of silver. The second in the rank silver producer, BHP Billiton, produced 39 million ounces. Goldcorp, which is a classic precious metals producer, was fourth in the rank, with a production standing | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD/CAD - Loonie Loses Ground As Wholesale Sales Slides Posted: 20 May 2014 11:52 AM PDT By Kenny Fisher The Canadian dollar has lost ground on Tuesday, as USD/CAD trades at the 1.09 line in Tuesday's North American session. The loonie posted losses as Canadian Wholesale Sales came in at -0.4%, well short of the estimate of 0.4%. It's a very quiet schedule in the US, as today's only releases are speeches from two FOMC members. In the US, last week ended with encouraging housing numbers. Building Permits jumped to 1.08 million, well above the estimate of 1.01 million. This was the highest level we've seen since December 2006. Housing Starts continues to move higher and climbed to 1.07M, compared to the estimate of 0.98M. This marked a five-month high. Meanwhile, UoM Consumer Sentiment dipped to 81.8 points, short of the estimate of 84.7 points. US numbers have generally been strong, and last week's, employment and manufacturing numbers looked sharp. Unemployment Claims were outstanding, dropping to | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price In The Post-Nixon Era Posted: 20 May 2014 11:37 AM PDT Gold bull market: during the late 1960s and 70s Gold bear market: during the 80s and 90s Gold bull market: since 2001 Now we need to know:

or

My answer: Gold peaked in 2011, bottomed in June and December of 2013, and should rally for at least several years, and probably until the end of the decade. Why? Examine the following graph of weekly gold prices since 1977 and the 144 week simple moving average shown in red. The uptrend since 2001 is clear and pronounced. The correction since 2011 is unmistakable.

The spreadsheet (not shown) indicates:

Gold did NOT blow-off into a bubble high in 2011, all the drivers for higher gold prices are still valid, international demand is strong, supply will be reduced when the western central banks run out of gold or terminate "leasing" into the market, and US, EU and Japanese government expenses, "money printing" and bond monetization are out of control and accelerating. Gold prices will climb a wall of worry in the years ahead.

GE Christenson | The Deviant Investor | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Holds Support; Constricts Further Posted: 20 May 2014 11:18 AM PDT There was some news today dealing with gold demand from out of China, now the world's largest gold consumer, and it was not particularly friendly for the yellow metal. The World Gold Council announced that Q1 gold demand was 18% less than the previous year for the same time period. It was the 55% drop in bar and coin purchases that was primarily behind the fall off. India was not exempt either as its gold demand fell 26%. The WGC data showed an overall drop in global demand by 52% compared to a year ago resulting in a four year low. Combine this with the big drop in GLD holdings, and you can see why gold has thus far been stymied in any attempt to mount a sustained upward move in price. The demand simply is not there. That could change but until it does, the metal will continue to attract selling on rallies. By the way, as an aside, this is another of the reasons that I suggest that the readers here ignore the now commonplace, breathless talk about "gold backwardation". If gold demand were that strong as these non-stop gold promoters insist, the WGC would not be reporting falling demand. Then again, some of these charlatans will no doubt inform us that the WGC is in bed with the powers that be and is distorting its own data in order to steer investors away from gold. Sweeping away all the cobwebs and clearing the fog from their obfuscations, the gold price chart continues to reveal that pattern that is making me nervous about its fortunes. The pattern of LOWER HIGHS is not changing. Rallies are attracting selling at progressively lower points and while support is holding, the persistent inability of the mining shares to get anything going on the upside, is suggesting ( note - this is not conclusive yet ) that the support level is not going to hold. The events in Ukraine remain a wild card however. The upcoming vote is going to be closely watched but more so, the reaction to that vote. Also, any further weakness in the broader equity markets will bring, as it did in today's session, more safe haven buying into the yellow metal. Some equity players are unsure whether the weakness in the smaller cap stocks is going to spillover into the larger caps. It seems that anytime stocks waver in the least, gold gets a safe haven bid. It is just one more thing for traders to have to decipher when attempting to approach this market for a trade. One thing is for certain - trading gold has become a shortest of time frame trades. One cannot hold a position for any length of time in this completely unpredictable and volatile environment. Just today, after the Russell 2000 had managed nice back to back recoveries from the recent selling, it fell lower again. Currently it is down 1.96% compared to the 0.84% fall in the S&P 500 index and a 0.99% drop in the Dow. At the same time, the yield on the Ten Year Treasury has moved slightly lower once more. One can see the corresponding linkage when these safe haven/ risk aversion moves are underway. Small Cap stocks underperforming mid to large caps is a sure sign of this risk aversion trade. Both the Yen and the Dollar are also a wee bit higher at the moment. Disappointing sales numbers from retailers seemed to be the culprit that induced the selling in the equities, brought a bid into gold and the other safe havens. Here is a chart of the GDXJ. As you can see, it is working on putting in the lowest daily closing price since April 17th of this year; in other words, the lowest close in a month. It is sitting right at a key support level so if the juniors are going to manage a bounce, they are going to have to do it almost immediately or risk another leg down. The ADX is rising once more indicating that the potential for a trending move is now more realistic but until that support level gives way, the index is still in a range, albeit at the bottom of the range. The Daily Chart of the HUI is not any better. It is working on the lowest closing price in three months. On the grains front - traders are back to chasing soybeans higher once more, as if we are going to run completely out of beans before turning right around and throwing them all out. This market is about as convoluted as I can ever recall seeing it, especially the old crop as the situation involving those tight carryover stocks is at the forefront of their minds again. Technically based buying is was seen in new crop beans as overhead resistance levels were taken out which brought in momentum-based buying. That buying then evaporated and sellers took over. Right now the beans are lower but whether or not they stay there or go on another wild tear higher is anyone's guess. The initial catalyst behind the early session buying was news that China was into the US bean market as USDA this morning announced a purchase of 110,000 mt of optional origin beans. Combine those two words, "China" and "beans" and the result is always buying in the pit. KC wheat is outperforming the Chicago wheat market as deterioration of that crop was reported yesterday. While recent rains will have helped ameliorate the slide in condition ratings, traders were looking backward at the damage and felt that perhaps some got too optimistic on prospects too quickly. After all, wheat prices had dropped over $0.80/bushel in less than two weeks time. Throw in the fact that the HRS crop is behind schedule for planting and that was enough to convince some shorts to go ahead and book some gains. Corn is being pressured however by a strong planting pace ( 73% compared to the 5 year average of 76% and last year's 65%) although some of the northern tier states are running behind the norm. It does look like there is going to be an open window up there however this week so traders are looking at substantial progress to be made by the time next Monday rolls around and we get the new and updated planting progress report. Generally speaking, from this point on out, rains will now tend to be viewed as helpful for the crop. For corn, 34% of the crop has emerged compared to the 5 year average of 42% and last year's 17%. Beans are 9% emerged compared to an 11% five year average and last year's 3%. The cheaper corn, along with good pasture conditions, and tightness for feeder supplies is driving feeder cattle prices to record high prices. How high can they go is the big question at this point. Let's see what we get when the trading for today's session ends. Trying to extrapolate from daily market action nowadays is becoming almost an exercise in futility due to the wild price swings and shifting sentiment. Perhaps we need to just take things on an hourly basis. That seems to be the new "long term" horizon. Spurs up one game on the Thunder. I like KD and believe he is a great role model but I like the Spurs more. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 May 2014 11:05 AM PDT Chart 1: Silver finds itself between a downtrend and a strong support… Source: Bar Chart (edited by Short Side of Long)

Precious metals sector outperformed majority of other asset classes in Q1 of 2014, however that strength has recently dissipated. Whats even more interesting is the fact that while Gold and various miners rebounded powerfully in quarter one, Silver has continued to disappoint. As we can see in Chart 1, the metal now finds itself at a technical pressure point. To break on the upside, Silver will have to overcome a downtrend line, which has been in place since the bear market began in May 2011. On the other hand, if Silver was to move towards new bear market lows, it will first have to break a strong support area around $18.50 to $19.00 per ounce. A break in either direction could occur very soon, and would be a leading indicator for the rest of the PM space. So which way will Silver move? While I wish I could answer that question with precision, unfortunately I do not know as my crystal ball is currently getting fixed. What I will do is place forward a handful of clues, so that we can work on probabilities and case scenarios.

Chart 2: Silver has declined 15% over last 3 months, but not yet oversold Source: Short Side of Long

Over the last three months, Silver has sold off by about 15%. As we can see from Chart 2 above, Silver is slightly oversold, but not yet past the 1.5 standard deviations on the downside (or about 19% decline) that I like to use. Therefore, more selling could come in the short term, before we consider the long side. Keep in mind that Silver usually follows Gold closely and Gold itself is even less oversold over the last 3 months. Finally, most of other classic technical indicators (RSI, MACD, STO, etc) are not at oversold daily or weekly levels either.

Chart 3: Change in hedge fund positioning is now close to bearish levels Source: Short Side of Long

Recent COT report, released last Friday, continues to show that hedge funds and other speculators continue to dislike Silver. However, future positioning hasn't reached extreme bearish levels just yet. Last time we saw those type of conditions, signalling a contrarian buy signal, was around the back part of the panic sell off in middle of 2013. Since there is numerous ways to track the COT report, I thought I'd include a few other interesting charts:

Chart 4: Premium during topping phase, discount during basing phase? Source: Short Side of Long

As precious metals sector was building a complicated top from 2011 into 2012, majority of the closed ETFs (such as Central Fund of Canada) displayed a premium to its net asset value. In other words, retail investors were bullish on Gold and Silver, just prior to a correction. Today, we have a totally opposite picture. The sector has corrected rather sharply in 2013 and ever since the sell off, retail investor have pushed the CEF ETF into discount territory (refer to Chart 4). While lower prices are still possible, it is almost always wiser to be a buyer when majority are sellers. Therefore, if the ETF traded at a premium near its peak, most likely the current discount is a signal that we are closer to the final bottom. Chart 5: Sentiment on Silver has been very negative throughout '13/'14 Source: SentimenTrader (edited by Short Side of Long)

Next up, we look at SentimenTrader's public opinion levels. As we can see, Silver continues to hold support around $19, while sentiment on the metal is rather negative (only 31% bulls today compared to 91% bulls in May 2011). Public opinion readings this low are a decent indicator of a possible reversal in price, however at times negative sentiment readings can also occur just prior to a final collapse. Finally, there are many other indicators traders should research prior to making up their minds on the up and coming Silver move. These include Gold sentiment indicators, Gold Miners breadth readings, ETF fund flow data, volatility and put / call ratios, ratio between Silver & Gold, Silver & Silver Miners and Gold & Gold Miners, and so forth. It is very important to do your own research before anticipating the next move. However, when it comes to speculating on price directions, maybe the most prudent advice I could give is to follow Jesse Livermore, who famously said:

The post Decision Time for Silver appeared first on The Daily Gold. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What you really need to know about this “blockbuster” new book on the economy Posted: 20 May 2014 11:02 AM PDT From Jeff Thomas for Casey Research: Europe is abuzz with Capital in the Twenty-First Century by French economist Thomas Piketty, released in Europe in March of this year and now a best-seller. It has since crossed the Atlantic and is already the number-one best-seller for booksmith Amazon. It has been called a "blockbuster" of a book, and many reviewers believe that it has the ability to revolutionise the study of economics. Here are a few quotes from reviews: In Piketty's view, the solution is a measure beyond the political reach of any individual nation or international body, as they are now constituted: a global wealth tax. Only such a tax "would contain the unlimited growth of global inequality of wealth, which is currently increasing at a rate that cannot be sustained in the long run." —Thomas B. Edsall Many of the book's 700 pages are spent marshalling the evidence that 21st-century capitalism is on a one-way journey towards inequality – unless we do something. … Piketty’s call for a "confiscatory" global tax on inherited wealth makes other supposedly radical economists look positively house-trained. He calls for an 80% tax on incomes above $500,000 a year in the US, assuring his readers there would be neither a flight of top execs to Canada nor a slowdown in growth, since the outcome would simply be to suppress such incomes. … Piketty's Capital, unlike Marx's Capital, contains solutions possible on the terrain of capitalism itself: the 15% tax on capital, the 80% tax on high incomes, enforced transparency for all bank transactions, overt use of inflation to redistribute wealth downwards. —Rosaline Christine McGreevy His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality. … A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today. —Amazon The words, "Brilliant!", "Ground-breaking!" and "Visionary!" will no doubt be seen in many reviews of Mr. Piketty's book. He has written some 700 pages and gone back as far as the eighteenth century in his research, so few would doubt that he has been thorough. And there can be no doubt that the world is presently facing greater economic turmoil than it ever has in history. One might say that his tome is "right on time." So let us examine his principal conclusions and learn why so many people are seeing his vision as the answer to the world's troubles. He recommends:

Why didn't anyone else think of this brilliant plan? Well actually, they did. In fact, the above is essentially the shopping list of the IMF, the EU, the OECD and, in fact, many of the governments that make up what was formerly described as "the free world." Piketty's "vision" so closely follows the visions of these entities that, if he did not exist, they might have had to invent him. After all, if governments come up with an economic plan that is dramatically socialistic, they might be regarded as being somewhat suspect. However, if an economist, who is of course "independent" in his thinking, offers a grand solution, it becomes easier for the masses to swallow. Readers of International Man are likely to take a different view. They may argue that the observation that "satisfactory answers have been hard to find for lack of adequate data and clear guiding theories" is poppycock. Libertarians and contrarians have been offering very real solutions for decades. Unfortunately, Boobus humanus rarely bothers to pay attention to any view that is not the one currently being promoted by the governments of the day. As Doug Casey says so accurately: Even when people recognize and intellectually understand the philosophy of personal freedom and responsibility, most just can't integrate it into themselves emotionally. And others simply refuse to grasp it intellectually. I'm afraid libertarianism is fated to appeal to only a small minority. It's interesting to draw a parallel between Mr. Piketty and John Maynard Keynes. Mister Keynes published his The General Theory of Employment, Interest, and Money in 1936. It was therefore well timed to provide the populace (who were then struggling with the Great Depression) with a brilliant solution from a Cambridge-educated economist. Mister Keynes' book was an instant hit with most all governments of the day, as it endorsed more state-controlled, socialistic economic principles. Since 1936, Keynesian economics has been the standard for most all governments and is regularly referred to, to explain why they employ such confiscatory policies. Now, just in time for the Greater Depression, fate has delivered what we might term Mister Piketty's "Revised Keynesianism"—an economic standard for the twenty-first century, and one which takes the power of governments up several notches. Will the governments of the world respond to this new vision and announce that Mister Piketty has "shown the way" out of the current debacle, which has been blamed on capitalism? Most definitely. Just as Mister Keynes was "just right" for the goals of governments in the twentieth century, Mister Piketty is just right for the goals of governments in the twenty-first century. And, as in the Great Depression, the great majority of people will not only accept the new approach, but applaud. Of course, those of us with a libertarian bent could simply choose to regard Mister Piketty as a misinformed academic who fails to understand economics, but this would be a mistake. Yes, there are many people today who are thinking in a more libertarian direction. Indeed, many are seeking to internationalise themselves in order to save their liberty and their wealth. Far more people, however, who also fear the downfall of the present economic system, are sitting tight, in the hope that the light will suddenly go on in the minds of economists and political leaders alike, that what is needed is a more free-market society. This group of people hopes that national leaders will "come to their senses" and reverse the trend toward socialism and fascism. These latter people might do well to consider that the blueprint for the future has now been published. The blueprint implies that the reason Keynesianism has failed is not that it was socialistic. We are told that it failed because it was not radical enough; not far-reaching enough. A more totalitarian Keynesianism was needed and has now been provided. If the reader lives in the EU, US, or other country whose economic direction is similar, he is left with the question of whether it is in his interest to remain in a jurisdiction that is likely to become even more totalitarian during and after the Greater Depression. P.S. I believe one of the problems is that people tend to hope until the last minute that the major economic crisis, the political turmoil, "can't happen here." When they finally acknowledge what is going on, it's often too late. The timely documentary Meltdown America shows how stealthily financial collapse, war, hyperinflation can creep up on us—and why it can and will "happen here." Listen to crisis survivors from Zimbabwe, Serbia, and Argentina, as well as world-renowned experts, in this eye-opening video—click to watch it here.

More from Casey Research: Forget about the Keystone XL… Obama's "secret pipeline" is a much bigger deal Casey Research: What you need to know about the bear market in silver Casey Research: How Russia could take down America… without firing a single shot | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 May 2014 10:47 AM PDT VANCOUVER, BC–(Marketwired – May 20, 2014) -

Balmoral Resources Ltd. (“Balmoral” or the “Company”) (TSX: BAR)(OTCQX: BALMF) today confirmed the discovery of high-grade nickel-copper-PGE mineralization associated with the previously highlighted (see NR14-09, April 30, 2014) net textured sulphide zone in hole GR-14-25.The net textured zone, one of four mineralized intervals in the hole, returned a near surface intercept of 1.79% nickel, 0.19% copper, 0.42 g/t platinum and 1.04 g/t palladium over 45.28 metres. This high-grade interval is capped by, and includes, 1.11 metres of massive to semi-massive sulphide which returned 10.60% Ni, 0.45% Cu, 2.04 g/t Pt and 5.23 g/t Pd, confirming the potential for very high grade nickel and PGE values within the system (see table below). Hole GR-14-25 is the first hole on the property to intersect Horizon 3 of the Grasset Ultramafic Complex (see Figure 1 and Figure 2). This newly discovered, sulphide rich horizon is open in all directions and sits approximately 100 metres southwest of, and stratigraphically above, two other vertically oriented Ni-Cu-PGE mineralized horizons within the southern-most portion of this sparsely tested, up to 16 kilometre long, ultramafic sill complex.

The 45.28 metre net-textured interval in GR-14-25 exhibits excellent internal continuity and uniformly exhibits strong nickel and PGE grades (SeeFigure 3). Today’s results also confirm the presence of nickel-copper-PGE mineralization for over 840 metres laterally, and 300 metres vertically, along Horizon 1; and for over 540 metres laterally and 240 metres vertically along Horizon 2. The first test of Horizon 3 was hole GR-14-25 which intersected the high-grade mineralized zone at less than 100 metres vertical depth. All three mineralized horizons remain open in all directions, save Horizon 1 which appears to be terminated by the Sunday Lake Deformation Zone to the south. Massive nickel-copper-PGE bearing sulphides have been intersected along both Horizon 1 and Horizon 3 in the limited (10 holes) drilling completed to date. The host Grasset Ultramafic Complex is interpreted to stretch for 16 kilometres across Balmoral’s wholly owned Grasset and Fenelon Properties. It has seen only limited drilling, focused primarily in an area 8.3 kilometres northwest of the current discovery. Similar nickel-copper-PGE sulphide mineralization is known to occur in this area, suggesting significant potential for additional discoveries along the length of the Complex. Recently received thin section analyses (see www.balmoralresources.com) indicate the presence of abundant pyrrhotite and pentlandite, with lesser chalcopyrite, magnetite (after chromite), pyrite and millerite (the latter a nickel sulphide with strong nickel tenure) within the high-grade, net textured zone. Pentlandite, which appears to host the bulk of the nickel mineralization, occurs as isolated mineral grains which the Company believes to be favourable from a metallurgical viewpoint. The Company anticipates that drilling and geophysical work on the Grasset Property will resume, ground conditions permitting, in mid-June, followed shortly thereafter by the resumption of drilling on Balmoral’s Martiniere high-grade gold property 40 kilometres to the west. “The broad, high-grade nature of the Grasset Ni-Cu-PGE discovery provides Balmoral with a second exciting, near-term growth opportunity in Quebec” said Darin Wagner, President and CEO of Balmoral Resources. “With recent price increases demonstrating the sensitivity of the nickel market to political uncertainties in major producing regions, the lack of new nickel discoveries globally over the past several years, the strength of the grades, wide nature of the intercepts, significant PGE content and apparent scale of the mineralized system, the Grasset discovery would appear to position the Company to attract significant interest from investors in both the precious and base metal sectors.” QP and Quality Control Mr. Darin Wagner (P.Geo.), President and CEO of the Company, is the non-independent qualified person who has approved the scientific and technical information contained in this news release. Mr. Wagner has supervised the work programs on the Grasset Property, visited the property on multiple occasions, has examined the drill core from the holes summarized in this release, reviewed the results with senior on-site geological staff and reviewed the available analytical and quality control results. Balmoral employs a quality control program for all of its drill programs, to ensure best practice in the sampling and analysis of drill core. This includes the insertion of blind blanks, duplicates and certified standards into the sample stream. NQ-sized drill core is saw cut with half of the drill core sampled at intervals based on geological criteria including lithology, visual mineralization and alteration. The remaining half of the core is stored on-site at the Company’s Fenelon field camp in Central Quebec. Drill core samples are transported in sealed bags to ALS Minerals Val d’Or, Quebec analytical facilities. Base metal analysis were initially obtained via ICP-AES with both Aqua Regia and 4 Acid digestion employed. The two digestion methods show good correlation. Nickel values in excess of 10,000 ppm are reanalyzed using a sodium peroxide fusion followed by ICP-AES finish. PGE values were obtained via industry standard fire assay with ICP-AES finish using 30 g aliquots. Following receipt of assays, visual analysis of mineralized intercepts is conducted and additional analysis may be requested. ALS Minerals is ISO 9001:2008 certified. About Balmoral Resources Ltd. - www.balmoralresources.com Balmoral is a Canadian-based discovery company focused on high-grade gold and nickel discoveries on its wholly owned, 700 square kilometre Detour Trend Project in Quebec, Canada. With a philosophy of creating value through the drill bit and a focus on proven productive precious/base metal belts, Balmoral is following an established formula with a goal of maximizing shareholder value through discovery and definition of high-grade, Canadian gold and base metal assets.

The post Balmoral Confirms High-Grade Ni-Cu-PGE Mineralization Over 45.28 Metres on New Horizon; Grasset Property, Detour Trend, Quebec appeared first on The Daily Gold. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Housing Bubble 2.0 is Popping… Posted: 20 May 2014 10:45 AM PDT

The housing "recovery" of 2012 – 2013 was nothing more than a product of the mult-trillion dollar market rigging that has been implemented by the Federal Reserve and the U.S. Government . TARP, TALF, HAMP, HARP, FHA, FNMA, QE – all acronyms for "our economy is collapsing and we're going to print as much money [...] The post Housing Bubble 2.0 is Popping… appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Prices Will Rise on Robust Demand and Instensifying Currency War Posted: 20 May 2014 10:34 AM PDT Gold prices remain stuck in a narrow range between $1,290 and $1,305, the downside being limited by geopolitical concerns and the upside being capped by generally good U.S. data, which suggest the U.S Federal Reserve will carry on with the current pace of stimulus tapering. Meanwhile reports show that the Chinese are buying less gold this year and demand during the Golden Week holidays that began on 1 May dropped some 30% from a year ago. After an exceptional year for gold sales in 2013, the situation is back to something like 2012, according to Haywood Cheung, president of the Chinese Gold & Silver Exchange Society. While China surpassed India as the biggest bullion consumer last year, the buying frenzy, triggered by a price slump last April has not been repeated this year. “Before, when they walk into a jewellery shop, they spend about HK$10,000 ($1,290), and now it’s about HK$5,000 to HK$6, 000,” Cheung told Bloomberg, quoting estimates by the society’s 171 members including HSBC Holdings and Chow Tai Fook Jewellery Group, the largest listed jewellery chain. “Last year was something special. We’re back to something like 2012. Wait till next year, we’ll start to pick up gradually and come back to 2013 levels,” Cheung added. Chinese gold and silver jewellery sales dropped 30% to 20.8bn yuan ($3.3bn, €2.4bn, £1.9bn) in April from a year ago, according to government data. Net gold imports into mainland China from Hong Kong hovered at 275.6 tonnes in the first three months of 2014 as against 210.5 tonnes in the corresponding period a year ago. According to the Swiss Federal Customs Administration, more than 80% of Switzerland’s gold and silver bullion and coin exports found their way into Asia in January. Some reports show that China imported nearly 1,160 tonnes of gold from Hong Kong in 2013 in the wake of the price slump. Gold consumption in China hovered at a record 1,176.4 tonnes last year. The flow of bullion from the west to the east was emphasised by the World Gold Council in November 2013, citing higher activity at refiners in Switzerland that were recasting bullion into the higher-purity, smaller-sized bars preferred by Asian buyers. While the drop in demand is quite substantial, and even though analysts attribute the decline to a weaker yuan, which has made gold less attractive to Chinese buyers of bullion, the fall in Hong Kong shipments coincides with another event. The Chinese government announced the opening of official gold imports through Beijing–the first time foreign bullion sales will be allowed directly through the capital. Up until now, Hong Kong has been the preferred channel for China’s gold imports. But authorities are reportedly uneasy about Hong Kong’s extensive and transparent reporting on trade. By using Beijng as a port of entry, imports into China may become more opaque, once again.This will allow China’s banks to build a sizeable position in physical gold without global buyers realizing the accumulation is taking place. The fall in Hong Kong gold trade may not be as significant as it seems if Chinese purchases are moving to more-secretive sales through Beijing. And, this may result in permanent decrease in the amount of trade conducted through other cities. We could thus be witnessing the beginning of a new era in the global gold market. Of course, there’s no way to know for sure what’s happening with Chinese purchases. But the timing of the shifts in trade is certainly something that is worth considering. In India, Narendra Modi, the controversial Hindu nationalist won a landslide victory in the country's general election. Few predicted his conservative, pro-business Bharatiya Janata party, in opposition since 2004, would win 282 of the 543 directly elected seats in India’s lower house and international investors and local businessmen have welcomed the huge mandate for the BJP, which has promised to implement wide-ranging economic reforms. Though economic growth was strong through much of the decade of rule by Congress, it has faltered in recent years. Even though, India announced yet another hike in the import tariff value of gold on Friday, analysts believe that the new government may ease the restriction on gold imports. Last year duties on gold imports were increased several times. Currently, they stand at 10%. Other measures include an 80-20 rule that stipulates that a minimum of 20% of all gold imported must be exported before further imports can be made. The Reserve Bank of India that imposed the restrictions ignored the fact that gold has been part of the Indian culture for centuries. It's normal to buy and store gold and give it as a gift at weddings and certain times of year. The government did not want money going into gold so the government curbed gold imports, causing internal pricing to go through the roof and also were the cause of a dramatic increase in the smuggling of the yellow metal. As the conflict in Ukraine continues and while the West blames Russia as the cause, Russian President Vladimir Putin has informed multiple European states that Moscow will not supply gas to Europe through Ukraine as of June 1 if Kiev does not pay its bills. On Thursday, Putin said Russian gas exporter Gazprom had been forced to demand Ukraine pay in advance for gas as of June after its debt for gas already delivered reached $3.5 billion. Putin also urged European leaders to do more to help Ukraine through its economic crisis and to resolve the standoff over gas, repeating a threat to cut exports if Kiev fails to pay in advance for June deliveries. As the US and EU threaten to halt Russia from what they perceive as destabilising Ukraine by imposing a string of sanctions against the country, Russia has been working on trade arrangements that minimize the participation (and influence) of the US dollar. For decades, virtually all oil and natural gas around the world has been traded in U.S. dollars. However, the struggle over Ukraine has caused Russia to completely re-evaluate the financial relationship that it has with the United States. If it starts trading a lot of oil and natural gas for currencies other than the U.S. dollar, that will be a massive blow for the petrodollar, and it could end up dramatically changing the global economic landscape. According to various sources, Russia's Ministry of Finance is ready to green-light a plan to radically increase the role of the Russian ruble in export operations while reducing the share of dollar-denominated transactions. The "de-dollarization meeting" was chaired by First Deputy Prime Minister of the Russian Federation Igor Shuvalov, proving that Moscow is very serious in its intention to stop using the dollar. A subsequent meeting was chaired by Deputy Finance Minister Alexey Moiseev who later told the Rossia 24 channel that "the amount of ruble-denominated contracts will be increased", adding that none of the polled experts and bank representatives found any problems with the government's plan to increase the share of ruble payments. Of course, the success of Moscow's campaign to switch its trading to rubles or other regional currencies will depend on the willingness of its trading partners to get rid of the dollar. Sources cited by Politonline.ru mentioned two countries that are already willing to support Russia: Iran and China. Given that Vladimir Putin will visit Beijing on May 20, it can be speculated that the gas and oil contracts that are going to be signed between Russia and China will be denominated in rubles and yuan, not dollars. While China and Russia both expand their respective currency's acceptance and accumulate more gold, the US dollar will ultimately lose its status as the world's reserve currency. And, while most western central banks as well as the Bank of Japan continue to devalue their respective currencies, the on-going currency war will intensify. The prudent minority won't be beguiled into holding paper currencies, and instead they will diversify into hard assets, such as gold and silver.  gold price Gold prices continue to trade sideways, hovering around the $1300/oz. level and the 200 day MA. Prices remain stuck between $1280/oz. and $1320/oz. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mercenary Links May 20th: Lingering Woes Posted: 20 May 2014 10:33 AM PDT Mercenary Links May 20th: Mortgage, home equity woes linger… Russia close to $400 billion China pipeline deal… Thailand’s army declares martial law… China’s Elon Musk, New York’s surging heroin trade, and more. ~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 May 2014 10:12 AM PDT "Having some gold is still a preferred option in China." | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| German TV network broadcasts long program on gold market manipulation Posted: 20 May 2014 10:01 AM PDT GATA | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Manipulation Goes Mainstream On German TV Posted: 20 May 2014 09:58 AM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Indian gold consumption to increase? Posted: 20 May 2014 09:56 AM PDT "Indian people don't buy gold to speculate, it's a necessity." | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lies, Inflation, and the Minimum Wage Posted: 20 May 2014 09:24 AM PDT Regular readers are familiar with the Great Inflation Lie. Lying about inflation is a device of deceit which governments use to pad numerous economic statistics, since most of these statistics only have relevance/legitimacy if fully "deflated" by the (real) prevailing rate of inflation. The example with which readers are most familiar is that understating inflation can be used to exaggerate GDP, on a point-for-point basis. Understate the rate of inflation by 5%, and you overstate GDP by an equal 5%. It is thus through this Lie (which is getting larger every year) that the U.S. government has been able to pretend that it's Greater Depression is actually an "economic recovery". However, readers have also previously seen another manifestation of the Great Inflation Lie: to hide the collapse in Western wages, which (in real dollars) have fallen by more than 50% over the past 40 years. The chart below illustrates this Lie perfectly.

[chart courtesy of Nowandfutures.com] The blue line (wages deflated with the "official" rate of inflation), shows the myth: wages which have supposedly stayed roughly flat in real dollars. The green line shows the truth: wages deflated with the real rate of inflation. As readers can see for themselves; the collapse in Western wages has dragged them all the way back (in real dollars) to Great Depression levels. But not all Western nations (and their citizens) have bought into this Corporate mythology, and doomed the vast majority of their populations to little more than slave wages. A few Western nations have shielded their populations from this wage-destruction via (unreported) inflation, and the differences between their economies and ours are highly revealing – especially when viewed from the bottom (i.e. the "minimum wage"). | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LBMA accredits MMTC Pamp India for Gold delivery in India Posted: 20 May 2014 09:16 AM PDT The London Bullion Markets Association (LBMA) has accredited MMTC-Pamp India Pvt Ltd (MPIPL), a joint venture between Pamp SA, Switzerland and the Indian public sector MMTC Ltd, for gold delivery in India. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Meat Crisis Is Here: Price Of Shrimp Up 61% – 7 Million Pigs Dead – Beef At All-Time High Posted: 20 May 2014 09:15 AM PDT

As the price of meat continues to skyrocket, will meat soon be considered a “luxury item” for most American families? This week we learned that the price of meat in the United States rose at the fastest pace in more than 10 years last month. Leading the way is the price of shrimp. According to the U.S. [...] The post The Meat Crisis Is Here: Price Of Shrimp Up 61% – 7 Million Pigs Dead – Beef At All-Time High appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver jewelery exports surge in India Posted: 20 May 2014 09:09 AM PDT The silver jewelery exports from India recorded a significant jump of 75.4% year-on-year to $1,459.87 million. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold policy change in the works? Posted: 20 May 2014 08:59 AM PDT India is likely to witness increased demand for gold during the second half of the year. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Global gold demand steady despite Indian repression Posted: 20 May 2014 08:36 AM PDT Gold prices are marginally lower today as market participants digest yesterday's European central bank gold agreement. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BARBAROUS RELIQUARY: HOLDING THE METALS IN A POST – WESTERN WORLD Posted: 20 May 2014 08:00 AM PDT

A recent Chairman of that private corporation in control of the finances – perhaps even, the destiny – of the USA for the past 100 years, famously referred to the yellow metal as "a barbarous relic". Although this Ph'd prophet of policy-managed markets has hardly been a fount of wisdom in the course of his career… in this case [...] The post BARBAROUS RELIQUARY: HOLDING THE METALS IN A POST – WESTERN WORLD appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Indian Gold demand witness a significant decline in Q1: WGC Posted: 20 May 2014 07:53 AM PDT India, the second biggest bullion consuming nation, gold demand declined significantly by 26% year-on-year to 190.3 tons during the first-quarter of this year, as per the World Gold Council. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Frank Curzio: This could be the safest "700% upside" investment you ever see Posted: 20 May 2014 05:59 AM PDT From Frank Curzio, editor, Phase 1 Investor: Uranium prices are in freefall. As regular readers know, uranium – the fuel used in nuclear power stations – collapsed in 2011. It has since been in a steady downtrend. And so far this year, the radioactive metal has fallen hard. It’s down 16% since the start of 2014. For comparison, gold prices are up 8% and the S&P 500 Index is up 2% during the same time frame. But it appears the bottom in uranium prices is finally here. And the recent pullback gives us the chance to buy one stock with triple-digit upside and limited downside risk for cheap today. Let me explain… Longtime readers know uranium, like most commodities, goes through huge boom and bust cycles. Up until early 2011, uranium had seen an incredible boom. But then a tsunami swept through Japan and caused radiation to leak from the Fukushima Daiichi nuclear power plant. Uranium prices were around $65 a pound just before the disaster. But after the disaster, there was a fundamental change in the uranium market – and prices plunged. France – the second-largest consumer of nuclear energy – said it would cut its share of nuclear power for electricity generation by 33%. Germany – the fifth-largest consumer – said it would completely phase out nuclear energy within 10 years. Italy, Switzerland, and Belgium also shelved projects to build out nuclear power stations. But the big news came out of Japan. The world’s third-largest nuclear-energy consumer said it would abandon nuclear energy altogether. This was a huge blow to the industry. Japan sold its stockpiled uranium into the market… which depressed prices further. Sentiment toward the sector has been terrible ever since. And analysts have been trying to call a bottom – and spot the next “boom” cycle – in uranium for more than a year. But prices have averaged around $37 a pound since March 2011 – until this year. Take a look at this chart of the uranium price…

The latest downturn has now pushed uranium prices below $30 per pound for the first time since 2005. And sentiment toward the metal could not be worse. I recently spoke with energy expert Rick Rule. He told me right now, spot uranium is selling for below the production cost of many miners. In short, many uranium producers are no longer making money. The good news is, it appears the bottom in uranium prices is finally here. You see, for the first time since the Fukushima nuclear disaster, there are positive catalysts in the uranium market. And just the smallest bit of positive news could result in a huge spike in prices for this hated sector. In mid-December, a new political party was elected into office in Japan. The new trade minister said Japan will likely reopen nuclear plants that pass stringent safety tests. He’s also considering keeping plants open that are more than 40 years old. Next month, this plan will finally come to fruition – Japan is expected to reactivate its first nuclear reactor. And 17 of Japan’s 48 idled reactors are expected to restart over the next few months. This will create demand for uranium. Rick says demand will also come from places like China and India. Their growing economies are desperate for sources of low-cost electric power. Uranium is a key component of their future energy plans. So these countries will provide a huge source of demand for decades. Higher uranium demand will be good news for many uranium stocks – like Fission Uranium. Fission is sitting on one of the largest uranium discoveries in the past decade. It’s called Patterson Lake South (PLS) – and it’s located in Canada’s Athabasca Basin, the most prolific uranium-producing area in the world. I first recommended the company to my Phase 1 Investor subscribers over a year ago. At the time, it was trading for under C$0.50 a share. (We originally invested in Fission Energy, which later became Fission Uranium.) The stock moved up to C$1.70 before pulling back to the C$1.20 level recently. The push lower was mostly due to the collapse in uranium prices over the past few months. But there’s plenty of upside ahead… Fission’s PLS property is projected to have more than 100 million pounds of high-grade uranium. That makes it one of the largest uranium mines on the planet. And we have the chance to get in at a huge discount. Based on my analysis, Fission is worth at least C$2.50 a share (at least double its current level) at the current price of uranium. As I mentioned earlier, there are plenty of catalysts that could result in strong demand for uranium over the next 12 to 24 months. If only a few nuclear plants come back online, it should be enough to easily push uranium prices north of $40 per pound (still a depressed level based on historical prices). If uranium prices simply push to $60 per pound (the price uranium traded before the Fukushima disaster) over the next five years, Fission could be worth C$7 to C$10 a share. That’s a 480% to 700% gain from the current price. And uranium prices doubling in the next five years is conservative based on the massive pullback in the commodity over the past few years. The metal could head even higher. My advice is to take a small position in Fission Uranium. The stock trades on the Toronto Stock Exchange under the symbol FCU.V. The market-cap is more than $400 million – so you will not have to worry about a lot of volatility in the stock. If uranium prices stay at current levels, the stock is easily worth more than twice the current price. However, if uranium prices jump higher in the years ahead, you could be sitting on a life-changing investment. Based on the risk-to-reward ratio, you won’t find a better investment in the commodity space than Fission Uranium.