Gold World News Flash |

- Ink + Paper Doesn't Equal Value: Prechter on Fiat Money

- Gold Bar & Coin Demand Hits 4-Year Low

- Gold Bar & Coin Demand Hits 4-Year Low

- Inside the Sausage Factory

- Inside the Sausage Factory

- Petro-Dollar's Endgame

- Petro-Dollar's Endgame

- Time Is the Trigger for Equities and Gold Bullion

- Time Is the Trigger for Equities and Bullion: Charles Oliver

- Strong Gold Demand and Dwindling Gold Deposits Make Gold a Compelling Investment

- Major silver traders fear end of silver fix

- Gold – A 40 Year Perspective

- Richard Russell - I’m Afraid We’ll See Blood Spilled In America

- Guess which empire came to an end today?

- THE SILVER & GOLD FIX BROKEN — Andy Hoffman

- Thai Stocks Tumble As Army Censors Media To "Avoid Provoking Unrest"

- 'Smoking Gun' From The Federal Reserve's Murder Of The Middle Class

- The Gold Price Remains in it's Uptrend Since 24 April Closing Up at $1,293.80

- The Gold Price Remains in it's Uptrend Since 24 April Closing Up at $1,293.80

- A Coordinated Hack on the World Reserve Currency

- Gold Prices "Set to Bottom" in Summer 2014

- Gold Prices "Set to Bottom" in Summer 2014

- Central banks suppress gold and oil to disguise inflation, Turk tells KWN

- Platinum And Palladium: The Birth of a New Bull Market

- Gold Daily and Silver Weekly Charts - The Usual

- Gold Daily and Silver Weekly Charts - The Usual

- Silver In The Dead Zone Of Disinterest

- Only mainstream financial journalism thinks central banks are out of the gold market

- Behind The Mainstream Media Lies, People Are Suffering

- A Comforting Solution to an Economic Nightmare

- How Long Can Phase II of the Gold Pool Be Sustained

- Precious Metals Still “Stuck In Neutral”

- Silver Price at Critical Support

- Indian Elections boost Gold Prices

- Gold Prices Rise as Eurozone Central Banks Revise Sales Agreement, Speculative Betting Falls

- New CBGA Affirms Gold's "Monetary Role" But Lack Sales Limit

- New CBGA Affirms Gold's "Monetary Role" But Lack Sales Limit

- The Birth of a New Bull Market

- Conspiracy fact: Euopean central banks again admit, renew secret scheming on gold

- Time Is the Trigger for Equities and Bullion: Charles Oliver

- Time Is the Trigger for Equities and Bullion: Charles Oliver

- Time Is the Trigger for Equities and Bullion: Charles Oliver

- Precious Metals – Week of 05.18.14

| Ink + Paper Doesn't Equal Value: Prechter on Fiat Money Posted: 20 May 2014 01:43 AM PDT My dad will turn 84 this year. When he was born, you could walk into a Federal Reserve Bank or the Treasury and redeem your paper money for gold. It actually said you could on every piece of U.S. paper currency: "Redeemable in gold on demand at the United States Treasury, or in Gold or lawful money at any Federal Reserve Bank." You can't do that today, which helps explain why my dad is so grumpy. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bar & Coin Demand Hits 4-Year Low Posted: 20 May 2014 01:15 AM PDT Gold bar investing fell hard in Q1, ETFs flatlines, jewelry hit 9-year high... GOLD BAR and coin demand amongst private investors globally fell to its lowest level since early 2010 during the first quarter of this year, says the latest report from market authority the World Gold Council. Global gold jewelry demand, in contrast, rose to its greatest Q1 weight since 2005, the new Gold Demand Trends says, as "Consumers generally made the most" of the intervening drop in world prices, down 30% across 2013 as a whole and losing 25% in spring last year alone. "A strengthening economic environment," says the World Gold Council, "was further supportive for [jewelry] demand." Gold investing was "significantly weaker" than early 2013's elevated levels, reports the mining-owned market development organization, which says the drop in gold bar and coin demand amongst private households came thanks to disappointment that world prices didn't fall further from New Year's dip below $1200, plus local currency weakness in some major demand cenetrs. Bar and coin demand in No.1 gold buyer China and No.2 India – where import restrictions to try and boost the Rupee's value have forced inflows to the less visible "grey market" – more than halved in Q1 2014, dropping 54% and 55% by weight respectively and falling well over 60% by value from Q1 2013. India's year-on-year drop in legal gold imports then worsened in April, notes the latest Precious Metals Update from gold bar refining giant Heraeus, dropping 74% from 2013's record levels, sparked last spring by the 2013 crash in world gold prices and finally leading the Congress-led government – defeated by a landslide in this month's national elections – to impose a de facto gold import ban from July. No.3 consumer the United States saw Q1 gold bar and other retail investment purchases fall one-third by weight and some 45% by value. Turkey's weak Lira currency pushed local gold prices higher, with the fourth largest consumer market losing 59% of household bar and coin demand year-on-year by weight, down two-thirds in Dollar equivalent terms. Professional investor demand was meantime neutral, with holdings amongst exchange-traded trust funds steadying after 2013's liquidation. ETF stocks of large wholesale gold bullion bars, vaulted with major bullion banks to back the value of the trusts' shares, were flat in Q1 2014. That compares to outflows of 177 tonnes in the first quarter of last year. "Flows of gold from Western vaults to satisfy the demand of eastern consumers," says the World Gold Council, "have slowed as global gold markets have gradually returned to a more 'normal' state of affairs" – evidenced by the drop in Asian gold premiums over and above London's prevailing large-bar price, taken as the benchmark by bullion dealers worldwide. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Bar & Coin Demand Hits 4-Year Low Posted: 20 May 2014 01:15 AM PDT Gold bar investing fell hard in Q1, ETFs flatlines, jewelry hit 9-year high... GOLD BAR and coin demand amongst private investors globally fell to its lowest level since early 2010 during the first quarter of this year, says the latest report from market authority the World Gold Council. Global gold jewelry demand, in contrast, rose to its greatest Q1 weight since 2005, the new Gold Demand Trends says, as "Consumers generally made the most" of the intervening drop in world prices, down 30% across 2013 as a whole and losing 25% in spring last year alone. "A strengthening economic environment," says the World Gold Council, "was further supportive for [jewelry] demand." Gold investing was "significantly weaker" than early 2013's elevated levels, reports the mining-owned market development organization, which says the drop in gold bar and coin demand amongst private households came thanks to disappointment that world prices didn't fall further from New Year's dip below $1200, plus local currency weakness in some major demand cenetrs. Bar and coin demand in No.1 gold buyer China and No.2 India – where import restrictions to try and boost the Rupee's value have forced inflows to the less visible "grey market" – more than halved in Q1 2014, dropping 54% and 55% by weight respectively and falling well over 60% by value from Q1 2013. India's year-on-year drop in legal gold imports then worsened in April, notes the latest Precious Metals Update from gold bar refining giant Heraeus, dropping 74% from 2013's record levels, sparked last spring by the 2013 crash in world gold prices and finally leading the Congress-led government – defeated by a landslide in this month's national elections – to impose a de facto gold import ban from July. No.3 consumer the United States saw Q1 gold bar and other retail investment purchases fall one-third by weight and some 45% by value. Turkey's weak Lira currency pushed local gold prices higher, with the fourth largest consumer market losing 59% of household bar and coin demand year-on-year by weight, down two-thirds in Dollar equivalent terms. Professional investor demand was meantime neutral, with holdings amongst exchange-traded trust funds steadying after 2013's liquidation. ETF stocks of large wholesale gold bullion bars, vaulted with major bullion banks to back the value of the trusts' shares, were flat in Q1 2014. That compares to outflows of 177 tonnes in the first quarter of last year. "Flows of gold from Western vaults to satisfy the demand of eastern consumers," says the World Gold Council, "have slowed as global gold markets have gradually returned to a more 'normal' state of affairs" – evidenced by the drop in Asian gold premiums over and above London's prevailing large-bar price, taken as the benchmark by bullion dealers worldwide. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 May 2014 01:10 AM PDT Author: Ron Paul Publisher: Grand Central Publishing (2009) Binding: Hardcover, 176 pages Funny money picked apart by Ron Paul's lifetime of no-BS politics... RON PAUL is now retired from professional politics, leaving a need for at least one Congressperson who you feel isn't fundamentally BS-ing you, writes Nathan Lewis at New World Economics. Oddly, he found a lot of political support for his unfashionably libertarian plain-speaking. People apparently found it more appealing than the usual favors-for-votes propositions upon which most politicians base their careers. In the end, he basically had to fire himself, declining another run for office at age 77. Much of his extraordinary term in office revolved around the topic of money, which itself is remarkable. As Paul recounts in his 2009 book End the Fed:

This attitude is reflected in statistics. With the advent of floating fiat currencies in 1971, not only the US but most developed world governments started running deficits in peacetime for the first time. At some basic level, politicians figured that the "central bank would bail them out" with some kind of money-printing. It was all funny-money in the end. It took a while, but Paul says the era of reckoning is upon us now, and indeed the Fed and other central banks are quite busy today either propping up sovereign bond markets that freely-acting investors had abandoned (Europe), or rather forthrightly engaging in printing-press finance (US and especially Japan). Paul even traces this trend back to World War I, which followed soon after the introduction of the Federal Reserve in 1913 and similar central banks worldwide patterned on the Bank of England. The centralization and monopolization of currency issuance in the late 19th century allowed governments to finance the war at least in part via the printing press, with this process led by Britain, the US, Germany, France and others. Paul thinks that fact was one cause of World War I to begin with. Governments thought that, with the printing press on their side, they could attempt another round of Imperial land-grabs. End the Fed is a personal account, with chapters on 'My Intellectual Influences', 'The Gold Commission' (which Paul participated in during 1981-1982), 'My Conversations with Greenspan', and 'My Conversations with Bernanke'. His daily exposure to the sausage-factory of Congressional policymaking has given him some insights that I think are particularly interesting. Despite the difficulty of many of these topics, Paul found that popular support was high.

People know. Even people aged 18-21. But, they need someone to put it into words. I've talked about the need for a "shelf of books" that are contemporary and correct, and which can serve as the conceptual foundation for whatever monetary system may eventually replace our present arrangements. No old books and no books that are so full of fallacy as to be unusable, no matter how well-meaning the authors may have been. People actually understand these things significantly better today than was the case in the 1960s and 1970s, although unfortunately that improvement has not been well documented in print. One reason why we still have floating currencies today is that people just didn't understand these things at all in the 1970s. You would think that after twenty years of extraordinary prosperity during the 1950s and 1960s with the Bretton Woods gold standard arrangement, and a decade of inflationary disaster in the 1970s with floating fiat currencies, that people in the US might have been a little favorable toward the Classical (gold-based) monetary approach that the US had pursued for the previous 182 years. Nope. Paul recounts his experience at the 1981 Congressional Gold Commission:

That was a typical response from other supposedly knowledgeable people at that time. The ignorance of that era is breathtaking – especially considering that the US's gold standard era had ended only ten years previous. I've added End the Fed to my personal "shelf". I might quibble with some of the details and historical interpretations – particularly regarding some of the nitty-gritty procedures of how to set up and run gold-based currencies, my personal area of focus – but that is not particularly important. End the Fed provides a big-picture view, of how rotten money leads to rottenness throughout government and society as a whole. And, it does so in an accessible way, from someone who has seen it happen first-hand over decades. Paul argues that the present system may disintegrate before too long – indeed, he doesn't expect much positive progress in monetary affairs until then. The understanding in this book helps insure that the next phase of the long evolution of humans and money won't suffer from the failings of the post-1971 floating-currency system, or, for that matter, the flawed Bretton Woods gold standard arrangement that preceded it. The stupidity of Henry Reuss in 1981 would seem...as stupid as it actually was. When the time again comes to discuss the topic of Classical and Mercantilist approaches to money (in practice, gold-based or floating fiat money), it would be nice if people at least understood what they are talking about. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 May 2014 01:10 AM PDT Author: Ron Paul Publisher: Grand Central Publishing (2009) Binding: Hardcover, 176 pages Funny money picked apart by Ron Paul's lifetime of no-BS politics... RON PAUL is now retired from professional politics, leaving a need for at least one Congressperson who you feel isn't fundamentally BS-ing you, writes Nathan Lewis at New World Economics. Oddly, he found a lot of political support for his unfashionably libertarian plain-speaking. People apparently found it more appealing than the usual favors-for-votes propositions upon which most politicians base their careers. In the end, he basically had to fire himself, declining another run for office at age 77. Much of his extraordinary term in office revolved around the topic of money, which itself is remarkable. As Paul recounts in his 2009 book End the Fed:

This attitude is reflected in statistics. With the advent of floating fiat currencies in 1971, not only the US but most developed world governments started running deficits in peacetime for the first time. At some basic level, politicians figured that the "central bank would bail them out" with some kind of money-printing. It was all funny-money in the end. It took a while, but Paul says the era of reckoning is upon us now, and indeed the Fed and other central banks are quite busy today either propping up sovereign bond markets that freely-acting investors had abandoned (Europe), or rather forthrightly engaging in printing-press finance (US and especially Japan). Paul even traces this trend back to World War I, which followed soon after the introduction of the Federal Reserve in 1913 and similar central banks worldwide patterned on the Bank of England. The centralization and monopolization of currency issuance in the late 19th century allowed governments to finance the war at least in part via the printing press, with this process led by Britain, the US, Germany, France and others. Paul thinks that fact was one cause of World War I to begin with. Governments thought that, with the printing press on their side, they could attempt another round of Imperial land-grabs. End the Fed is a personal account, with chapters on 'My Intellectual Influences', 'The Gold Commission' (which Paul participated in during 1981-1982), 'My Conversations with Greenspan', and 'My Conversations with Bernanke'. His daily exposure to the sausage-factory of Congressional policymaking has given him some insights that I think are particularly interesting. Despite the difficulty of many of these topics, Paul found that popular support was high.

People know. Even people aged 18-21. But, they need someone to put it into words. I've talked about the need for a "shelf of books" that are contemporary and correct, and which can serve as the conceptual foundation for whatever monetary system may eventually replace our present arrangements. No old books and no books that are so full of fallacy as to be unusable, no matter how well-meaning the authors may have been. People actually understand these things significantly better today than was the case in the 1960s and 1970s, although unfortunately that improvement has not been well documented in print. One reason why we still have floating currencies today is that people just didn't understand these things at all in the 1970s. You would think that after twenty years of extraordinary prosperity during the 1950s and 1960s with the Bretton Woods gold standard arrangement, and a decade of inflationary disaster in the 1970s with floating fiat currencies, that people in the US might have been a little favorable toward the Classical (gold-based) monetary approach that the US had pursued for the previous 182 years. Nope. Paul recounts his experience at the 1981 Congressional Gold Commission:

That was a typical response from other supposedly knowledgeable people at that time. The ignorance of that era is breathtaking – especially considering that the US's gold standard era had ended only ten years previous. I've added End the Fed to my personal "shelf". I might quibble with some of the details and historical interpretations – particularly regarding some of the nitty-gritty procedures of how to set up and run gold-based currencies, my personal area of focus – but that is not particularly important. End the Fed provides a big-picture view, of how rotten money leads to rottenness throughout government and society as a whole. And, it does so in an accessible way, from someone who has seen it happen first-hand over decades. Paul argues that the present system may disintegrate before too long – indeed, he doesn't expect much positive progress in monetary affairs until then. The understanding in this book helps insure that the next phase of the long evolution of humans and money won't suffer from the failings of the post-1971 floating-currency system, or, for that matter, the flawed Bretton Woods gold standard arrangement that preceded it. The stupidity of Henry Reuss in 1981 would seem...as stupid as it actually was. When the time again comes to discuss the topic of Classical and Mercantilist approaches to money (in practice, gold-based or floating fiat money), it would be nice if people at least understood what they are talking about. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 20 May 2014 01:00 AM PDT Oddly, the drop in US oil imports is what could fatally wound the #1 reserve currency... AUSTRIA, 1920-21: The government printed money to cover its debts from World War I, writes Addison Wiggin in The Daily Reckoning. Food and fuel costs exploded. Banks urged their customers to convert Austrian Kronen into a more stable currency...even though it was against the law. A law-abiding widow is wiped out on the day of a bank run. Her diary entry is reproduced in Adam Fergusson's book When Money Dies...

We've recounted the tale before. We tell it again now for two reasons. First as a reminder that most of the imbalances that caused the Panic of 2008 remain woefully out of balance. But you already knew that. There's extra urgency to our telling now: The one "X factor" the pundit class touts as the US Dollar's savior? It might prove the Dollar's final undoing. Bank runs, capital controls, an effective default on the national debt – and all because of the "prosperity" we're enjoying now. Our suspicions were first raised in January...when two "opposing" politicos held hands and sang in sweet harmony about America's energy boom. "Cheap natural gas is going to allow us to basically reshore manufacturing," says Chicago Mayor and former Obama chief of staff Rahm Emanuel. As a result, manufacturing will be "coming back in ways we can barely anticipate," says former Republican presidential contender Steve Forbes. Together they were on CNBC to pitch an event called the 'Reinventing America Summit'. Not that we disagree: It all sounds very familiar if you were following the "Re-Made in America" thesis of our own Byron King more than two years ago. Then it was radical. Now it's conventional wisdom. Leave it to us to throw a cat among the pigeons: For as much prosperity as the US energy boom is creating now...it will ultimately set off the next major economic crisis. Indeed, it will tank the US Dollar's status as the world's "reserve currency" once and for all. We say this knowing we court the wrath of conventional wisdom.

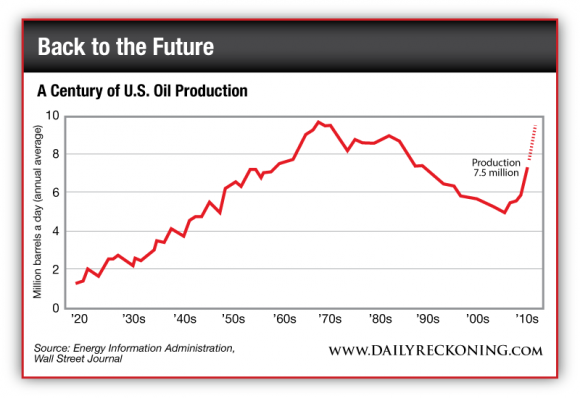

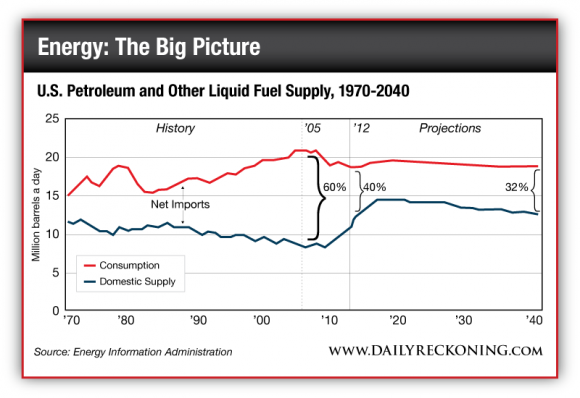

Right. Until it doesn't. The very thing helping to prop up the US Dollar now will ultimately kick out all those props and topple the greenback from its status as the world's reserve currency. Not tomorrow or even next year. But the destination is set...and our arrival is certain. It won't look exactly like Vienna in 1921...but it will feel just as awful. So strap in: Some of the ground we're about to cover might sound like old hat to you...but we promise you've never seen the dots connected in this way before. US oil production averaged 7.5 million barrels per day during 2013. The increase over 2012 marked the biggest in US history. Indeed, it's the fourth-biggest annual increase by any country ever...and Saudi Arabia holds the top three spots. And it only gets better from here. The peak year for US crude production was 1970 – a little shy of 10 million barrels per day. As you see from the "Back to the Future" chart, the US Energy Department projects the nation will once again equal that number by 2019.  In 2005 – only nine years ago – the United States imported 60% of its oil needs. By 2012, that number collapsed to 40%. Check out the chart nearby and you'll see the percentage is set to shrink even more over the next quarter-century. And make a mental note – we'll be coming back to this chart later.  As we go to press, a barrel of oil fetches $100, give or take. So every 1 million barrels per day of new supply means $100 million less imported oil every year. Lower import costs, a lower trade deficit, fewer Dollars flowing overseas – great news for the Dollar, huh? It's all good, right? Well, yes...except that now the entire structure that's supported the global financial system for 40 years is starting to come unglued. Since 1974, the world has run on "petroDollars". The petroDollar arose from the ashes of the Bretton Woods system after President Nixon cut the Dollar's last tie to gold in 1971. In the immediate post-World War II years, Bretton Woods made the Dollar the world's reserve currency – the go-to currency for cross-border transactions. If you were a foreign government or central bank, the Dollar was as good as gold – for every $35 you turned in to the US Treasury, you received one ounce of gold. Chances are you know the rest of the story: Foreigners recognized Washington was printing too many Dollars, the French wanted more gold than Washington was willing to give up and Nixon "closed the gold window". But without gold, what would continue to cement the Dollar's position as the world's reserve currency? After the "oil shock" of 1973-74, in which oil prices shot up from $3 a barrel to $12, Nixon's Secretary of State Henry Kissinger got an idea and convinced the Saudi royal family to buy in. The deal went like this: Saudi Arabia would price oil in US Dollars and use its clout to get other OPEC nations to do the same. In return, the US government agreed to protect Saudi Arabia and its allies against foreign invaders and domestic rebellions. The appeal for the House of Saud was obvious – the weight of the US military would keep the family's 7,000 princes living in the style to which they'd become accustomed. The appeal for Washington was more subtle – but no less important. Anyone who wanted to buy oil now needed Dollars to do so. That meant perpetual demand for Dollars and a cycle that goes like this... Dollars used to buy oil are deposited in the banking system to support international lending by the major banks. That lending supports the purchase of American goods – everything from Boeing airplanes to Archer Daniels Midland corn. Oh, and US Treasury debt. Can't forget that.

Then came his forecast:

Strange as it might be to imagine...the great American energy boom is hastening that day's arrival. "Let's say the US is really not importing much Arab oil anymore," says Erik Townsend in a thought experiment.

We're in debt to Mr.Townsend for helping tease out the petro-Dollar's endgame here. Erik parlayed the fortune from his first career as a software entrepreneur into a second career as a hedge fund manager who knows the oil futures market inside out. Think about it, he says: Where's the incentive to keep pricing oil in Dollars and maintaining large Dollar reserves if the US is no longer your biggest customer?

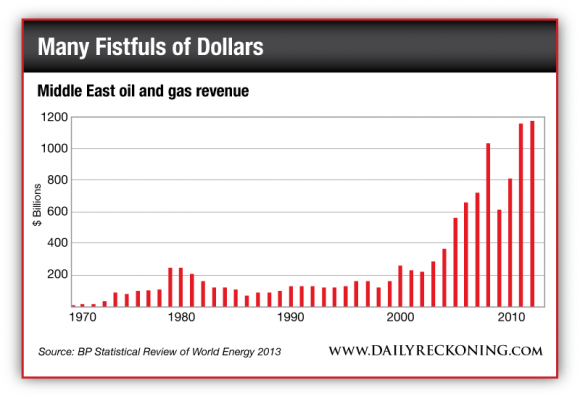

Suddenly, the fact the US needs fewer imports doesn't matter when "the rest of the world won't use Dollars for their currency." As it is, the Arab oil sheiks have more Dollars than they know what to do with. In the three decades before 2000, total energy export revenue from the Middle East totaled $3.5 trillion. In the 13 years since, the total has swelled to more than $8 trillion. By one expert estimate, some $8-10 trillion in currency balances lie in Middle Eastern hands, much of it in Dollars.  How long will they want to keep all those Dollars lying around? Especially when Asia and the Pacific now account for one-third of global oil consumption and the US only 20 per cent? Meanwhile, the world's leading oil importer – China took that crown from the United States last fall – is doing its part to undermine the petroDollar. In recent years, China has been striking agreements with many of its trade partners to do business using each other's currencies. China and Russia, China and Brazil, China and Australia, even China and its old/new enemy Japan – they all have currency swaps and other arrangements in place to bypass the Dollar. Last November brought word the Shanghai Futures Exchange was thinking about pricing its new crude oil futures contract in both Yuan and Dollars, with the aim of making that contract the new Asian benchmark. "The Yuan has become more international and more recognized by the financial market," the head of a Chinese trading firm told Reuters. But while the Arabs fret about the value of their Dollars...and the Chinese move actively to diversify away from the Dollar...it might be the Russians who deliver the final blow.

On the surface, the worst of the crisis between Ukraine and Russia appeared to be over. Markets were calming down as Russia's President Putin spoke up on the issue for the first time – pledging he would use force in Ukraine only as a "last resort" if the Russian-speaking population was in danger. Two other speeches by lesser Russian officials got much less attention. Kremlin economic aide Sergei Glazyev said if faced with Western sanctions, Russia could figure out how to avoid using the Dollar for international transactions. "We would find a way not just to reduce our dependency on the United States to zero but to emerge from those sanctions with great benefits for ourselves.

Hyperbole? Yes. Is Glazyev a junior figure? Sure. But then as if to underscore those remarks, Foreign Ministry spokesman Alexander Lukashevich said hours later, "We will have to respond...if provoked by rash and irresponsible actions by Washington...and not necessarily symmetrically." Yes, he's only a spokesman...but he speaks on behalf of Russia's wily foreign minister Sergei Lavrov. And as we go to press, he still has his job.

Understand that's a possibility, not a forecast. But almost no one noticed. Since that day, there's been little letup in the Russian chest-thumping. The website of the Voice of Russia – the new name for the Radio Moscow of old – featured a commentary in late April titled, "Time Is Running out for the US Dollar". It quoted a Russian economist saying, "The US doesn't have that much time in order to prepare for a serious weakening of the US Dollar on the global stage and, conversely, for a serious strengthening of regional currencies' role. The maximum amount of time they can count on is 18 months." From the Russians' standpoint, 18 months might be a little optimistic.

Lost jobs, lost homes, lost hope...and then what? That's when US leaders sit down with their "partners" from Europe and elsewhere and tell them China and Russia are about to become the biggest and baddest world powers – unless the West joins forces for a new global reserve currency. "We're going to merge the Dollar and the Euro and whoever else we can get onboard to do that.

That is, there will be one conversion rate between the Dollar and the new currency for the elites...and another for everyone else. Revolt in the streets? Maybe, maybe not. Mr. Townsend suggests the conversion mechanism will be so complicated few will even realize what's happening – much like the 2008 bailouts. "The government is very good at making things overly complicated for the purpose of obscuring what's really going on from the public." And to think it all began with the newfound American prosperity brought about by abundant made-in-America energy. When does Judgment Day arrive? When might the Saudis or the Russians or the Chinese – or any or all of them in cahoots – pull the plug on the petroDollar? Mr.Townsend says not on Obama's watch. That seems believable. Perhaps the most logical time is when America reaches the point of minimum reliance on foreign oil supply – the moment when petroDollars will be least necessary to grease the wheels of international commerce. That's when the sheiks and the oligarchs and the Central Committee can make their escape. We've gone from importing 60% of our oil needs in 2005 to only 40% now. Within another five years, the amount will shrink further to only 30%. This "30% threshold" might well be your cue that the crisis is nigh. No guarantees, of course...but it's not hard to believe someone in Riyadh or Moscow or Beijing is watching this very data as the US Energy Information Administration posts it online every month.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Time Is the Trigger for Equities and Bullion: Charles Oliver Posted: 20 May 2014 12:00 AM PDT by The Gold Report and Charles Oliver, Silver Seek:

The Gold Report: “Sell in May and go away” is a common investing axiom but does it have any validity?

Charles Oliver: I recently went through some research on seasonality in the gold price. March has been negative in the gold space in six of the last eight years, April has proven negative four out of the last eight years, and May and June have both been negative five of the last eight years. However, we see a fairly dramatic turnaround in July where six of the last eight years have been positive. In August, another six of the previous eight years have been positive; September has been positive five of the last eight years. The “sell in May” adage could actually represent a great buying opportunity on the pullback. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Strong Gold Demand and Dwindling Gold Deposits Make Gold a Compelling Investment Posted: 19 May 2014 11:54 PM PDT Robust gold demand and dwindling ore deposits represent an imbalance between supply and demand that almost guarantees higher long term gold prices. As discussed in Peak Gold, almost all of the earth's supply of gold reserves have already been mined. At the end of 2012 it is estimated that all the gold ever mined in [...] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Major silver traders fear end of silver fix Posted: 19 May 2014 11:30 PM PDT by Shivom Seth, MineWeb.com

With benchmark silver prices set to expire in three months traders insist they may face hurdles in imports. “The biggest issue for most of us would be that there will not be any benchmark price to look at. Transparent fair price is a must for the market to sustain and the London Bullion Market Association will soon have to choose other alternatives for fixing the silver market price,” said Prithviraj Kothari of RiddiSiddhi Bullions, a gold and silver retailer. RiddiSiddhi Bullions is among a few Indian companies that is a London Bullion Market Association’s good delivery member. The London gold and silver fixing process has been under the spotlight for several months. While in January, Deutsche Bank said it would withdraw from the London gold and silver fixing processes, as part of the scaling back of its commodities business, the London Silver Fixing Company said in a statement: “With effect from the close of business on August 14, 2014, the company will cease to administer a silver fixing, and a daily silver fixing price will no longer be published by the company.” | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 19 May 2014 11:05 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Richard Russell - I’m Afraid We’ll See Blood Spilled In America Posted: 19 May 2014 09:01 PM PDT  Today KWN is publishing another important piece that was written by a 60-year market veteran. At nearly 90 years old, the Godfather of newsletter writers, Richard Russell, warns that we will see blood in the streets as Americans revolt because of skyrocketing food prices. Russell also discusses the missing U.S. gold hoard and more. Today KWN is publishing another important piece that was written by a 60-year market veteran. At nearly 90 years old, the Godfather of newsletter writers, Richard Russell, warns that we will see blood in the streets as Americans revolt because of skyrocketing food prices. Russell also discusses the missing U.S. gold hoard and more.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Guess which empire came to an end today? Posted: 19 May 2014 09:00 PM PDT from Sovereign Man:

In other words, the sun never set on the Spanish Empire. And by the 1500s with its vast lands across the Americas, Africa, Europe, Asia, and even the South Pacific, Spain (technically the House of Habsburg) had become the first truly global superpower. The Empire's status was so great that its silver coin (the real de ocho or piece of 8) was used around the world as a global reserve standard… including in the US colonies. It didn't last. Like so many great empires that came before, Spain was beset by unsustainable spending, constant warfare, debilitating debt, and an inflated money supply. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| THE SILVER & GOLD FIX BROKEN — Andy Hoffman Posted: 19 May 2014 08:26 PM PDT

Andy Hoffman from Miles Franklin joins us to document the collapse. We discuss the end of the nearly 100-year old London SILVER FIX and much more. Andy says the dominoes are beginning to fall as the global economic outlook deteriorates and reality sets in, both for international banks and nation states. We cover a LOT of info in this one, so thanks for tuning in. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Thai Stocks Tumble As Army Censors Media To "Avoid Provoking Unrest" Posted: 19 May 2014 07:57 PM PDT Despite proclamations that markets would open 'normally', Thai SET50 (stock market) futures are indicated to open -4.2% - its biggest drop since January's collapse. Thai CDS are modestly wider (+5 to 130bps) but early Bhat weakness has been rescued back by a mysterious bidder (rumored to be the central bank by several traders). The last 2 times martial law was invoked - in an entirely non-coupy-coup-like manner - general market weakness was less than we have seen so far. Of course, the army has decided that in the interests of avoiding the "provocation of unrest and triggering fear" it will "ban the broadcast and distribution of news." Nothing like a military-coup, that is not a coup, with total media censorship to encourage capital flows and maintain peace in the nation.

But was rescued... by the central bank selling USD - USD/THB selling today in 32.650-660 area led by agents for Thailand central bank, according to an FX trader based in Asia.

These reactions are worse than the last 2 times martial law was invoked... Thailand's military imposed national martial law today for first time in 4 yrs. Here's how assets responded on Asian trading day immediately after martial law was declared in the past: April 8, 2010: Sept. 20, 2006 And so the Army has decided that it will censor the media to avoid any panic and unrest...

Seems like a great time to BTFATH in US equities - oh wait... what could possibly go wrong? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 'Smoking Gun' From The Federal Reserve's Murder Of The Middle Class Posted: 19 May 2014 05:35 PM PDT Submitted by Jim Quinn via The Burning Platform blog, "Although low inflation is generally good, inflation that is too low can pose risks to the economy – especially when the economy is struggling." - Ben Bernanke

"The true measure of a career is to be able to be content, even proud, that you succeeded through your own endeavors without leaving a trail of casualties in your wake." – Alan Greenspan There you have it – the wisdom of two Ivy League educated economists who are primarily liable for the death of the American middle class. They now receive $250,000 per speaking engagement from the crooked financial parties their monetary policies benefited; write books to try and whitewash their legacies of failure, fraud, and hubris; and bask in the glow of the corporate mainstream media propaganda storyline of them saving the world from financial Armageddon. Never have two men done so much damage to so many people, so quickly, and are not in a prison cell or swinging from a lamppost. Their crimes make Madoff look like a two bit marijuana dealer. The self-proclaimed Great Depression "expert" Ben Bernanke peddles pabulum about inflation being too low and posing dire risk to the economy, but is blasé that swelling the Federal Reserve balance sheet debt from $900 billion in 2008 to $4.4 trillion today with his digital printing press poses any systematic risk to the country and its citizens. Either his years in academia have blinded him to the reality of his actions upon the lives of real people living in the real world, or his real constituents have not been the American people, but the Wall Street bankers that pulled his puppet strings over the last eight years. Now that he has passed the Control-P button to Yellen, he is reaping the rewards of bailing out Wall Street and further enriching them with QEfinity. Ben earned a whopping $200,000 per year as Federal Reserve chairman. He now rakes in $250,000 per speech from the very financial interests who benefited from his traitorous monetary machinations. I don't think he will be invited to speak at any little league banquets by formerly middle class parents whose standard of living has been declining since the 1980s. Is it a requirement that every Federal Reserve chairperson lie, obfuscate, misinform, hide the truth, and do the exact opposite of what they say they will do? "It is not the responsibility of the Federal Reserve – nor would it be appropriate – to protect lenders and investors from the consequences of their financial decisions." - Ben Bernanke – October 2007 Greenspan, Bernanke and Yellen have always been worried about deflation, while even the government suppressed CPI calculation reveals that inflation has risen by 108% since the day Greenspan assumed office in August 1987. The dollar has lost 52% of its purchasing power in the last 27 years of Fed induced bubbles and busts. And these scholarly academic bozos have been worried about deflation the entire time. Since Nixon closed the gold window in 1971 and unleashed the two headed inflation loving gargoyle of debt issuing bankers and feckless self-serving politicians upon the American people, the dollar has lost 83% of its purchasing power (even using the bastardized BLS figures). Any critical thinking person with their eyes open knows the official inflation figures have been systematically understated since the 1980's by at least 3% per year. Should the average American be more worried about deflation or inflation, based upon what has occurred during the 100 years of the Federal Reserve controlling our currency?

I'm sure Greenspan is content and proud, as he succeeded through his own endeavors in rewarding, encouraging and propagating excessive risk taking by the Wall Street cabal during his 19 year reign of error. He exited stage left as the biggest bubble in history, created by his excessively low interest rate policy, blew up and destroyed the 401ks and home values of the middle class. This was the second bubble under his monetary guidance to burst. The third bubble created by these Keynesian acolytes of easy money will burst in the near future, further impoverishing what remains of the middle class and hopefully igniting a long overdue revolution. Greenspan's pathetic excuse for a career has benefitted those who owned him, while leaving a trail of casualties that circles the globe. His inflationary dogma, Wall Street enriching doctrine and Keynesian motivated schemes have drained the savings and confiscated the wealth of the middle class through persistent and devastating inflation. And it was done by a man who knew exactly what he was doing. "Under the gold standard, a free banking system stands as the protector of an economy's stability and balanced growth… The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit… In the absence of the gold standard, there is no way to protect savings from confiscation through inflation" – Alan Greenspan – 1966 The abandonment of the gold standard in 1971 set in motion four decades of consumer debt accumulation on an epic scale, currency debauchment, and real wage stagnation. The consumer debt accumulation was a consequence of the American middle class being lured into debt by the Too Big To Trust Wall Street banks and their corporate media propaganda machine, as a fallacious response to stagnating real wages when their jobs were shipped to China by mega-corporations using wage arbitrage to boost quarterly profits, their stock prices, and executive bonuses. The bottom four quintiles have made no progress over the last four decades on an inflation adjusted basis. The middle quintile, representing the middle class, has seen their real household income grow by less than 20% over the last 43 years. And this is using the understated CPI. In reality, even with two spouses working today versus one in 1971, real household income is lower today than it was in 1971.

The more recent data, during the Greenspan/Bernanke inflationary era, is even more disconcerting and destructive. Real median household income has grown at an annualized rate of less than 0.5% over the last thirty years. During the bubblicious years from 2000 through 2014, while Wall Street used control fraud and virtually free money provided by the Fed to siphon off hundreds of billions of ill-gotten profits from the economy, the average middle class family saw their income drop and their debt load soar. This is crony capitalism success at its finest. The oligarchs count on the fact math challenged, iGadget distracted, Facebook focused, public school educated morons will never understand the impact of inflation on their daily lives. The pliant co-conspirators in the dying legacy media regurgitate nominal government reported income figures which show median household income growing by 30% over the last fourteen years. In reality, the real median household income has FALLEN by 7% since 2000 and 7.5% since its 2008 peak. Again, using a true inflation figure would yield declines exceeding 15%.

Greenspan and Bernanke's monetary policies loaded the gun; Wall Street bankers cocked the trigger with their no doc negative amortization mortgages, $0 down – 0% interest – 7 year subprime auto loans, introducing the home equity line ATM, and $20,000 lines on dozens of credit cards; the media mouthpieces parroted the stocks for the long run and home prices never fall bullshit storyline, encouraging Americans to pull the trigger; government apparatchiks and bought off politicians and their deficit expanding fiscal policies, pointed the gun; and the American people pulled the trigger by believing this nonsense, blowing their brains all over the fine Corinthian leather interior of their leased BMWs sitting in the driveway in front of their underwater McMansions. Median household income in the United States peaked in 1999. The internet boom, housing boom and now QE boom have done nothing beneficial for middle class Americans. They have been left with lower real income, less home equity, no savings, and no hope for a better tomorrow. Most states saw their median household income peak over a decade ago, with more than half the states experiencing double digit declines and ten states experiencing declines of 19% or higher. It's clear who has benefitted from the fiscal policies of spendthrift politicians and the spineless inhabitants of the Mariner Eccles Building in the squalid swamplands of Washington D.C. – the pond scum inhabiting that town. The median household income in D.C. stands at an all-time high. Winning!!!!

A former inhabitant of Washington D.C. spoke the truth about inflation and the men who benefit from it in the 1870's. He was later assassinated. "Who so ever controls the volume of money in any country is absolute master of all industry and commerce and when you realize that the entire system is very easily controlled, one way or another, by a few powerful men at the top, you will not have to be told how periods of inflation and depression originate." – James Garfield The Federal Reserve, a private bank representing the interests of its Wall Street owners, has been in existence for 100 years. It has managed to diminish the purchasing power of the dollar by 95%, while causing depressions, enabling never ending warfare, allowing politicians to expand the welfare state to immense unsustainable proportions, and enriched its true constituents on Wall Street beyond the comprehension of average Americans. In 2002 Ben Bernanke made his famous helicopter speech where he promised to drop dollars from helicopters to fight off the ever dangerous deflation. After the Fed created 2008 worldwide financial collapse he fired up his helicopters, but dropped trillions of dollars on only one street in America – Wall Street. He dropped turkeys on Main Street, and we all know from Les Nesman what happens when you drop turkeys from helicopters. Les Nesman: Oh, they're crashing to the earth right in front of our eyes! One just went through the windshield of a parked car! This is terrible! Everyone's running around pushing each other. Oh my goodness! Oh, the humanity! People are running about. The turkeys are hitting the ground like sacks of wet cement! Folks, I don't know how much longer… The crowd is running for their lives.

Arthur Carlson: As God is my witness, I thought turkeys could fly. The intellectual turkeys running this treacherous institution create a new and larger crisis with each successively desperate gambit to keep their Ponzi scheme alive. Even though Greenspan, Bernanke and Yellen are highly educated, they are incapable or unwilling to focus on the practical long-term implications of their short-term measures to keep this perverted financial scheme from imploding. Denigrating savings and capital investment, while urging debt financed spending on foreign produced trinkets and gadget passes for economic wisdom in the waning days of our empire. Courageous and truthful leaders are nowhere to be found as the country circles the drain. Farewell middle class. It was nice knowing you.

"There are men regarded today as brilliant economists, who deprecate saving and recommend squandering on a national scale as the way of economic salvation; and when anyone points to what the consequences of these policies will be in the long run, they reply flippantly, as might the prodigal son of a warning father: "In the long run we are all dead." And such shallow wisecracks pass as devastating epigrams and the ripest wisdom." – Henry Hazlitt – Economics in One Lesson | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Remains in it's Uptrend Since 24 April Closing Up at $1,293.80 Posted: 19 May 2014 04:32 PM PDT

The GOLD PRICE on Friday lost twenty cents. Today it rose 40 cents to end at $1,293.80. That came after, however, a bully opening to the day and climb to 1,305.70 about 9:45. Rest of the day the gold price just kept on backing up. The SILVER PRICE rose three whole cents today to 1932.2c. Silver, too, began the day with promise of better things and a rise to 1968, but it faded like the gold price. These are simply dead markets, low volume, low ranges. But silver remains in an uptrend since 1 May -- higher lows and higher highs, remember. The GOLD PRICE remains in an uptrend since 24 April, except that the last high was not higher so it has formed a long-nosed even-sided triangle. It's bumping up against that upper boundary line, but can't close above its 200 dma ($1,399.38). Can't say nothing about nothing. Markets remain pretty much where they were on Friday, waiting for something to change. Man, I am excited. I was watching some red paint dry this morning, and that got my blood up. Then I watched some blue paint dry, and that was terrific. But then I looked at markets today, and had to shout, "Be still, my beating heart!" On a 104 point range (0.6% of the closing price) the Dow meandered to a close 18.85 (0.11%) higher than Friday's, at 16,510.16. S&P500 milled around and closed 7.08 (0.38%) higher at 1,884.94. That leaves the S&P500 above its 20 DMA (1,879.73) but the Dow below its 20 DMA (16,528.76). Both hit their 50 DMA's last week and rebounded higher. Both are stalled and drifting without much direction. That doesn't say that they can't go higher, just that they show no intention of that right now. Dow in Gold and Dow in Silver haven't stirred enough to talk about. US dollar index is trying to rough up its newly made friends. Dropped another 4 basis points today to close at 80.07. Apparently wants to see if it can invalidate its recent upward reversal. Euro languisheth still, but rose today 0.12% to $1.3709. Still broken. Yen is slowly, o so slowly making good on its breakout. Higher by 0.06% today to 98.58, and reaching toward its 200 DMA at 99.09. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Remains in it's Uptrend Since 24 April Closing Up at $1,293.80 Posted: 19 May 2014 04:32 PM PDT

The GOLD PRICE on Friday lost twenty cents. Today it rose 40 cents to end at $1,293.80. That came after, however, a bully opening to the day and climb to 1,305.70 about 9:45. Rest of the day the gold price just kept on backing up. The SILVER PRICE rose three whole cents today to 1932.2c. Silver, too, began the day with promise of better things and a rise to 1968, but it faded like the gold price. These are simply dead markets, low volume, low ranges. But silver remains in an uptrend since 1 May -- higher lows and higher highs, remember. The GOLD PRICE remains in an uptrend since 24 April, except that the last high was not higher so it has formed a long-nosed even-sided triangle. It's bumping up against that upper boundary line, but can't close above its 200 dma ($1,399.38). Can't say nothing about nothing. Markets remain pretty much where they were on Friday, waiting for something to change. Man, I am excited. I was watching some red paint dry this morning, and that got my blood up. Then I watched some blue paint dry, and that was terrific. But then I looked at markets today, and had to shout, "Be still, my beating heart!" On a 104 point range (0.6% of the closing price) the Dow meandered to a close 18.85 (0.11%) higher than Friday's, at 16,510.16. S&P500 milled around and closed 7.08 (0.38%) higher at 1,884.94. That leaves the S&P500 above its 20 DMA (1,879.73) but the Dow below its 20 DMA (16,528.76). Both hit their 50 DMA's last week and rebounded higher. Both are stalled and drifting without much direction. That doesn't say that they can't go higher, just that they show no intention of that right now. Dow in Gold and Dow in Silver haven't stirred enough to talk about. US dollar index is trying to rough up its newly made friends. Dropped another 4 basis points today to close at 80.07. Apparently wants to see if it can invalidate its recent upward reversal. Euro languisheth still, but rose today 0.12% to $1.3709. Still broken. Yen is slowly, o so slowly making good on its breakout. Higher by 0.06% today to 98.58, and reaching toward its 200 DMA at 99.09. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Coordinated Hack on the World Reserve Currency Posted: 19 May 2014 02:52 PM PDT “How to Hack an Electronic Road Sign,” reads the headline on a 2009 article at Jalopnik. The same headline showed up on a 2012 article at TechEBlog. Gizmodo in 2011 came up with the ingenious variation “How to Hack the New Road Signs.” We didn’t realize it’s been such a big thing for so long. Thus these signs in San Francisco — which were supposed to advise drivers about a detour around the annual Bay to Breakers 12K race over the weekend… We pass this item along as an amusing prelude to a theme our Agora Financial research team has been anticipating for years… “Enough is enough,” declared Attorney General Eric Holder this morning as he announced a hacking indictment against five officers in the People’s Liberation Army (PLA) of China. The announcement marks “the first time the United States has charged government employees with economic espionage,” says The New York Times. According to the indictment, the PLA burrowed its way into the servers of Westinghouse, Alcoa, Allegheny Technologies, U.S. Steel, the United Steelworkers union and SolarWorld. “This case,” said Holder, “should serve as a wake-up call to the seriousness of the ongoing cyberthreat.” Welcome to the party, Mr. Holder — we were writing about the PLA’s work 15 months ago. Of course, we’ve also been writing about how the hacking goes both ways; the NSA has done a crackerjack job of burrowing into the servers of Huawei, the Chinese telecom giant. Heh… Of course, the indictment begs the question: How might the Chinese respond? Our thoughts run in a couple of different directions: First, there’s the financial warfare Jim Rickards described to us over dinner last week. Consider China’s $3 billion investment in the private equity firm Blackstone Group in 2007. “It is naive,” Rickards writes in his new book The Death of Money, “not to consider that information on America’s most powerful deal machine’s inner workings is being channeled to the political bureaus of the Communist Party of China” — to be used in ways limited only by the scope of one’s imagination. Or maybe China will join with Russia tomorrow to knock out one of the major props underneath the dollar’s status as the world’s reserve currency. Russia’s President Putin pays his first call on China’s President Xi tomorrow in Shanghai; Putin is quoted as saying talks on natural gas exports from Russia to China are in “the final phase.” He didn’t say anything about the deals being transacted in rubles and yuan instead of dollars. But then, why would he before the big photo op? Just in case a big announcement comes tomorrow, you might want to bone up in advance and read an essay by our executive publisher Addison Wiggin, which was featured in The Daily Reckoning last week. Appearing in two parts - with two equally provocative titles - you can check them out here: “The US Energy Boom Will End the Dollar’s World Reserve Status” and “Prepare for the Death of the Petrodollar.” Regards, Dave Gonigam P.S. The U.S. dollar’s status as the world’s reserve currency is as shaky as its ever been. If and when it topples is anyone’s guess. But whatever happens, you’ll want to be insulated from any fallout. That’s one of the reasons I write The 5 Min. Forecast… to help readers prepare for – and profit from - whatever comes next. Click here now to sign up for The 5 Min. Forecast, and you’ll gain immediate access to a daily morning market briefing – created exclusively for Agora Financial Publication Subscribers ONLY – that’s designed to help you navigate and prosper these turbulent markets. So don’t wait. Sign up now, right here. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Prices "Set to Bottom" in Summer 2014 Posted: 19 May 2014 02:01 PM PDT Cash costs for miners are a longer-term support at $1200. For now, get ready to buy... CARLOS SANCHEZ is director of asset management at precious metals and commodities consultancy CPM Group in New York. Here he discusses his current outlook on the metals markets with Mike Norman at Hard Assets Investor... Hard Assets Investor: To start off with gold, it's really in a tight range these days, with $1250 on the downside, maybe mid-to-high $1300s at the top. Carlos Sanchez, director of asset management, CPM Group: Really since late February, early March, gold prices have come off from testing $1375 and $1380 or so. Now they're moving between, basically, an even tighter range of $1280 to $1320. I think part of that is the fact that equities have been taking all of the limelight, all of the attention from gold. A lot of investors have perhaps reduced some of their gold purchases, safety purchases, and gotten into equities. HAI: From the standpoint of competitive assets, we've been seeing record highs in the S&P and the Dow Jones. But on the flip side – and a lot of people are getting very cautious about stocks – we're seeing more forecasts of some sort of a correction. Would that trigger a move back into gold? Carlos Sanchez: I think that's what's happening to an extent. You've seen stocks continue to rise over the past several quarters. But more recently, I think what you're seeing is investors are reducing some of their stock purchase, some of their equity purchase, and moving back into perhaps some safety assets. What you've seen more recently is bonds have appreciated somewhat. The interest rate in the 10-year was close to around 3% a couple of months ago. Now it's closer to 2.6%. Gold has come off, but every time it dips – again, I mention that $1280 mark – it keeps on moving back up fairly quickly on short covering or sparking buying interest because we're still not out of the woods yet. GDP growth in the US was 0.1%, which was a bad figure. HAI: Very weak. Carlos Sanchez: European GDP is still tepid, and China is not growing at that double-digit pace that we saw in previous years. HAI: What about the Dollar? We've seen multi-year lows against the British Pound and against the Euro, close to $1.40 recently. Yet you don't see that reaction in gold prices that we usually do. Carlos Sanchez: I think a lot of investors have been thinking that some weakness in the Dollar would have pushed gold prices higher, but that hasn't been the case, and I'd relate that more to we're in this noninflationary environment, the massive push of the Fed pumping money into the market. HAI: Which has not resulted in any inflation. That surprised a lot of people. Carlos Sanchez: Definitely. It's surprised many folks. But I think it's pushed up inflation to some extent, but more so in the foods area, the agricultural area; not so much in housing, in perhaps other sectors like manufacturing, etc. HAI: Talking a little bit about foreign demand, China has been a big factor for a long time, as is India. You recently released your annual Yearbook. What are you seeing right now in terms of Chinese demand, in terms of Indian demand? Carlos Sanchez: India demand, as you know, has been sort of put on hold somewhat because of the import restrictions on gold. So, there is buying there but not at the pace we saw as previous years because of those import restrictions with the import/export deficit that India is facing. As far as China, it's seeing a pickup in demand at times when gold prices do fall below that $1300 mark. But we're past the seasonally strong period for demand. The New Year is past and given that prices are lackluster, I wouldn't be surprised to see Chinese investors wait for prices to move below $1280 to increase their purchases. And we may see that level, that lower level, over the next couple of months. HAI: So would you say that the $1250 area is basically now the new floor? Carlos Sanchez: I think that's going to be the new floor. I think $1280 right now is the floor that we're seeing, it's being tested, I think, today [May 8, 2014]. The new floor, I think, going into June, July, August, is going to be $1250 and probably $1200. HAI: Now, I've not spoken to anybody, even bears, who think that gold prices could get back down below $1000. Do you think that's completely off the table, or might the previous peak, in 1980 at $850 an ounce, see gold prices comes back down to that old high? Carlos Sanchez: No, I don't see it, I think for a couple of reasons. First of all, economically, financially, we're not out of the woods yet. There are many things politically that could go wrong. You have Russia, you have Syria, you still have the situation with Iran. You've got the US on this unprecedented program of asset purchases, stimulus, the Europe... HAI: But the Fed are backing off on the taper, they're down from $85 billion a month to $20 billion a month. Some people say that's a removal of stimulus. Carlos Sanchez: It was bullish for gold, but since 2013, this last stimulus program – the purchases program that began in 2013 and is now being backed off – hasn't really pushed the prices higher. I think another factor why gold prices are going to hold up is you have the cash cost of production, all-in cash cost of production. For many companies, that's now close to $1000, $1250. HAI: That's a longer-term supporting factor. What are we looking at now? Carlos Sanchez: I think on a short-term basis, perhaps, you want to follow the trend, which is lower right now. Into the summer, into June, July, August, I think you're going to have those cyclical lows for the year and probably for the next several years. And I think that's the opportune time to stock up on gold. HAI: All right. Carlos Sanchez, always a pleasure. Thank you very much. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Prices "Set to Bottom" in Summer 2014 Posted: 19 May 2014 02:01 PM PDT Cash costs for miners are a longer-term support at $1200. For now, get ready to buy... CARLOS SANCHEZ is director of asset management at precious metals and commodities consultancy CPM Group in New York. Here he discusses his current outlook on the metals markets with Mike Norman at Hard Assets Investor... Hard Assets Investor: To start off with gold, it's really in a tight range these days, with $1250 on the downside, maybe mid-to-high $1300s at the top. Carlos Sanchez, director of asset management, CPM Group: Really since late February, early March, gold prices have come off from testing $1375 and $1380 or so. Now they're moving between, basically, an even tighter range of $1280 to $1320. I think part of that is the fact that equities have been taking all of the limelight, all of the attention from gold. A lot of investors have perhaps reduced some of their gold purchases, safety purchases, and gotten into equities. HAI: From the standpoint of competitive assets, we've been seeing record highs in the S&P and the Dow Jones. But on the flip side – and a lot of people are getting very cautious about stocks – we're seeing more forecasts of some sort of a correction. Would that trigger a move back into gold? Carlos Sanchez: I think that's what's happening to an extent. You've seen stocks continue to rise over the past several quarters. But more recently, I think what you're seeing is investors are reducing some of their stock purchase, some of their equity purchase, and moving back into perhaps some safety assets. What you've seen more recently is bonds have appreciated somewhat. The interest rate in the 10-year was close to around 3% a couple of months ago. Now it's closer to 2.6%. Gold has come off, but every time it dips – again, I mention that $1280 mark – it keeps on moving back up fairly quickly on short covering or sparking buying interest because we're still not out of the woods yet. GDP growth in the US was 0.1%, which was a bad figure. HAI: Very weak. Carlos Sanchez: European GDP is still tepid, and China is not growing at that double-digit pace that we saw in previous years. HAI: What about the Dollar? We've seen multi-year lows against the British Pound and against the Euro, close to $1.40 recently. Yet you don't see that reaction in gold prices that we usually do. Carlos Sanchez: I think a lot of investors have been thinking that some weakness in the Dollar would have pushed gold prices higher, but that hasn't been the case, and I'd relate that more to we're in this noninflationary environment, the massive push of the Fed pumping money into the market. HAI: Which has not resulted in any inflation. That surprised a lot of people. Carlos Sanchez: Definitely. It's surprised many folks. But I think it's pushed up inflation to some extent, but more so in the foods area, the agricultural area; not so much in housing, in perhaps other sectors like manufacturing, etc. HAI: Talking a little bit about foreign demand, China has been a big factor for a long time, as is India. You recently released your annual Yearbook. What are you seeing right now in terms of Chinese demand, in terms of Indian demand? Carlos Sanchez: India demand, as you know, has been sort of put on hold somewhat because of the import restrictions on gold. So, there is buying there but not at the pace we saw as previous years because of those import restrictions with the import/export deficit that India is facing. As far as China, it's seeing a pickup in demand at times when gold prices do fall below that $1300 mark. But we're past the seasonally strong period for demand. The New Year is past and given that prices are lackluster, I wouldn't be surprised to see Chinese investors wait for prices to move below $1280 to increase their purchases. And we may see that level, that lower level, over the next couple of months. HAI: So would you say that the $1250 area is basically now the new floor? Carlos Sanchez: I think that's going to be the new floor. I think $1280 right now is the floor that we're seeing, it's being tested, I think, today [May 8, 2014]. The new floor, I think, going into June, July, August, is going to be $1250 and probably $1200. HAI: Now, I've not spoken to anybody, even bears, who think that gold prices could get back down below $1000. Do you think that's completely off the table, or might the previous peak, in 1980 at $850 an ounce, see gold prices comes back down to that old high? Carlos Sanchez: No, I don't see it, I think for a couple of reasons. First of all, economically, financially, we're not out of the woods yet. There are many things politically that could go wrong. You have Russia, you have Syria, you still have the situation with Iran. You've got the US on this unprecedented program of asset purchases, stimulus, the Europe... HAI: But the Fed are backing off on the taper, they're down from $85 billion a month to $20 billion a month. Some people say that's a removal of stimulus. Carlos Sanchez: It was bullish for gold, but since 2013, this last stimulus program – the purchases program that began in 2013 and is now being backed off – hasn't really pushed the prices higher. I think another factor why gold prices are going to hold up is you have the cash cost of production, all-in cash cost of production. For many companies, that's now close to $1000, $1250. HAI: That's a longer-term supporting factor. What are we looking at now? Carlos Sanchez: I think on a short-term basis, perhaps, you want to follow the trend, which is lower right now. Into the summer, into June, July, August, I think you're going to have those cyclical lows for the year and probably for the next several years. And I think that's the opportune time to stock up on gold. HAI: All right. Carlos Sanchez, always a pleasure. Thank you very much. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central banks suppress gold and oil to disguise inflation, Turk tells KWN Posted: 19 May 2014 01:44 PM PDT 4:45p ET Monday, May 19, 2014 Dear Friend of GATA and Gold: Western central banks are suppressing not only gold prices but oil prices too to disguise growing evidence of inflation, GoldMoney founder and GATA consultant James Turk tells King World News today. But, he adds, this won't work forever. An excerpt from the interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/5/19_Be... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Porter Stansberry Natural Resources Conference Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Platinum And Palladium: The Birth of a New Bull Market Posted: 19 May 2014 01:21 PM PDT If I asked you why you think I'm bullish on platinum and palladium, you'd probably point to the strikes in South Africa, the world's largest producer of platinum. Or maybe the geopolitical conflicts with Russia, the largest supplier of palladium. Maybe you'd even mention that some technical analysts say the palladium price has "broken out" of its trading range. These are all valid points—but they're reasons why a trader might be bullish. When the strikes end, or Russia ends its aggression, or short-term price momentum eases, they'll sell. And that will be a mistake. Because underneath the headlines lies an irreparable situation with the PGM (Platinum Group Metals) market, one that will last at least several years and probably more like a decade. This market is teetering on the edge of a supply crunch, one more perilous than many investors realize. As the issues outlined below play out, prices will be forced higher—which signals that we should diversify into the "other" precious metals now. The basic problem is that platinum and palladium supply is in a structuraldeficit. It won't be resolved when the strikes end or Russia simmers down. Here are six reasons why… #1. Producers Won't Meet the Cost of Production The central issue of the striking workers in South Africa is wages. In spite of company executives offering to double wages over the next five years, workers remain on the picket line. Regardless of the final pay package, wages will clearly be higher. And worker pay is one of the biggest costs of production. And the two largest South African producers (Anglo American and Impala), which supply 69% of the world's platinum, are already operating at a loss. Once the strike settles, costs will rise further. Throw in ongoing problems with electric power supply, high regulations, and past labor agreements, and there is virtually no chance costs will come down. This dilemma means that platinum prices would need to move higher for production to be maintained anywhere near "normal" levels. Morgan Stanley predicts it will take at least four years for that to occur.

And if the price of the metal doesn't rise? Companies will have no choice but to curtail production, making the supply crunch worse.

#2. Inventories Are Near the Bottom of the Barrel One reason platinum price moves have been muted during the work stoppage is because there have been adequate stockpiles. But those are getting low. Impala, the world's second-largest platinum producer, said the company is now supplying customers from its inventories. In March, Switzerland's platinum imports from strike-hit South Africa plummeted to their lowest level in five-and-a-half years, according to the Swiss customs bureau. Since producers can't currently meet demand, some customers are now obtaining metal from other sources, including buying it in the open market. As inventories decline, supply from producing companies will need to make up the shortfall—and they'll have little ability to do that. #3. The Strikes Will Make Recovery Difficult and Prolonged Companies are already strategizing how to deal with the fallout from the worst work stoppage since the end of apartheid in 1994…