saveyourassetsfirst3 |

- $5,000/oz gold 'achievable' - Sprott exec

- Major silver traders fear end of silver fix

- ECB gold agreements then/now

- European central banks cut gold sales cap, but don't fret - experts

- Strong gold move 'very close' - Phillips

- Silver In The Dead Zone Of Disinterest

- Is Family Dollar Stores A Buy For Dividend Investors Today?

- Max Keiser: Bankers Killing Bankers for the Insurance Money & Another Look at 9/11

- Thai gold imports plunge amid political deadlock

- Casey Research: This could be the biggest oil news of the year

- USD/CAD - Listless In Thin Holiday Trade

- Encana Corporation, Wells Fargo And Barrick Gold Lead 20 Best Value Long Bond Trades

- Chris Duane: End of London Fix is the Beginning of the End of Silver Manipulation

- Koos Jansen: Chinese real estate debt is being settled in silver

- Gold consumption in Thailand expands 73 percent

- Hedge funds cut bullish bets on gold futures

- Are short silver prices set up for another heartbreak?

- Gold Fails to Hold Gains

- Critical support in silver

- Are The London Gold Vaults Running Empty?

- Looking Forward (and Glancing Behind While Doing So)

- Ira Epstein views on Gold: Neither bullish nor bearish

- FIRSTHAND ACCOUNT: INVESTMENT GRADE SILVER SHORTAGE DEVELOPING IN CHINA

- We could finally have some good news from the crisis in Ukraine

- Conspiracy fact: Euopean central banks again admit, renew secret coordination on gold

- Eric Sprott: Manipulation Ends When Someone Finally Fails- & We Are Not Far Off Here

- Gold remains an important element

- New Indian government unlikely to repeal gold import rules soon

- India's gold bar imports tumbled

- The End (of the Silver Fix) Is Nigh

- Gold prices may not move into higher until Summer or Autumn: Jeffrey Nichols

- Gold “Important” And No Plan To Sell Significant Quantity Of - ECB

- Gold Standards and the Real Bills doctrine in US Monetary Policy (Timberlake)

- How to move from a chip shop to owning a London building & directing a feelgood movie

- Gold “Important” And No Plan To Sell Significant Quantity Of – ECB

- Michael Curran believes Gold will finish the year somewhere in $1,400 plus

- US Dollar Capped at Resistance, SPX 500 Bounce Looks Corrective

- Time Is the Trigger for Equities and Bullion: Charles Oliver

- Michael Perelman: The Rise of Free-Trade Imperialism and Military Keynesianism

- The Birth of a Eurasian Century: Russia and China Do Pipelineistan

- Gold – Maintains Range Between $1275 and $1315

- The costs of a Gold Standard

- Philip Pilkington: Why Thomas Piketty is Wrong About Inflation and Interest Rates

- Firsthand Account: Investment Grade Silver Shortage Developing in China

- $7,000 gold, $400 oil and $100 silver will help beat a coming US deflation explains Jim Rickards

- PM Fund Manager: Smoking Gun on The Fed’s Money Laundering T-Bond Purchases

- Alasdair Macleod: Firmer Tone for Gold & Silver

- Gold Investors Weekly Review – May 16th

- U.S. Dollar Index (DX) Futures Technical Analysis – May 19, 2014 Forecast

- Silver Stealth Buying

| $5,000/oz gold 'achievable' - Sprott exec Posted: 19 May 2014 08:14 PM PDT Charles Oliver, a Sprott portfolio manager, argues gold could move to $5,000 an ounces, just as it boomed in the 2000s. |

| Major silver traders fear end of silver fix Posted: 19 May 2014 07:49 PM PDT Silver traders in India - a leading consumer of the metal - outline concerns about the end of the silver fix in London. |

| Posted: 19 May 2014 07:45 PM PDT Here are the ECB's gold agreements on central bank gold sales, 2009 and now 2014, which is getting extra scrutiny for lack of gold cap. |

| European central banks cut gold sales cap, but don't fret - experts Posted: 19 May 2014 07:34 PM PDT The ECB and 20 others say they currently don't have any plans to dispose of 'significant' amounts of gold, without giving a limit. |

| Strong gold move 'very close' - Phillips Posted: 19 May 2014 03:02 PM PDT Julian Phillips, of the Gold Forecaster, points to TA signs of a strong move coming and also outlines a potential non-dollar first in a big energy deal. |

| Silver In The Dead Zone Of Disinterest Posted: 19 May 2014 12:59 PM PDT From Ryan Jordan, PhD, silver researcher: "At the moment no one is paying attention to the silver market – it looks to me as though capitulation has finally set in. If you are someone who has enjoyed big gains in other asset classes (like stocks), now would be a great time to diversify into a beaten down, cheap asset that, by definition, can't be printed at will and has been money for thousands of years." Yes, silver is languishing in a "dead zone" of disinterest, low prices, weak sentiment, and investor exhaustion. Silver visited this $19 – $20 zone in early 2008, July 2008, December 2009, May 2010, June 2013, December 2013, and May 2014. From another perspective, all the price gains of the past six years have vanished. It is not surprising that most investors have lost interest in silver. Examine the following graph of silver prices for the past seven years. But wait! There is more to the story.

I doubt another low in COMEX prices will occur (courtesy of the high-frequency traders) and my expectation is that silver prices will be higher by the end of 2014, and much higher in three years.

GE Christenson | The Deviant Investor |

| Is Family Dollar Stores A Buy For Dividend Investors Today? Posted: 19 May 2014 12:10 PM PDT Family Dollar Stores, Inc. (FDO) operates a chain of self-service retail discount stores primarily for low- and middle-income consumers in the United States. This dividend champion has paid dividends since 1976 and has managed to increase them for 38 years in a row. The company's latest dividend increase was announced in February 2014 when the Board of Directors approved a 19.10% increase in the quarterly dividend to 31 cents /share. The company's peer group includes Dollar General (DG), Dollar Tree (DLTR), and Wal-Mart Stores (WMT). Over the past decade this dividend growth stock has delivered an annualized total return of 6.60% to its shareholders. The company has managed to deliver a 10.40% average increase in annual EPS over the past decade. Family Dollar is expected to earn $3.15 per share in 2014 and $3.51 per share in 2015. In comparison, the company earned $3.83/share in 2013. (click to |

| Max Keiser: Bankers Killing Bankers for the Insurance Money & Another Look at 9/11 Posted: 19 May 2014 12:00 PM PDT

Two big, macabre stories came out of Wall Street recently: the rash of banker deaths by apparent murder and/or suicide, and speculation that bank CEOs themselves are behind the trend to cash in on the insurance. It turns out that banks take out life insurance policies on their employees, and those policies pay out death benefits to [...] The post Max Keiser: Bankers Killing Bankers for the Insurance Money & Another Look at 9/11 appeared first on Silver Doctors. |

| Thai gold imports plunge amid political deadlock Posted: 19 May 2014 11:55 AM PDT A local importer reckons Thailand's purchases may be 150 to 200 metric tons because of falling prices and the country's political crisis. |

| Casey Research: This could be the biggest oil news of the year Posted: 19 May 2014 11:41 AM PDT By Marin Katusa, Chief Energy Investment Strategist, Casey Research: Large international oil companies (IOCs) and the largest national oil companies (NOCs) are all anxiously watching an oil well that's being drilled by a North American company in a little, out-of-the-way country in Europe. In fact, this country—Albania—has recently garnered so much attention from Big Oil due to the results of the elephant potential of this oil deposit that the Albanian Energy Ministry just decided to establish an open-tender system for the next round of sales of blocks with major oil and gas potential. If you're not familiar with it, "open tender" is an auction process where the highest bidder gets the land blocks. The Energy Ministry wouldn't do this unless the demand were significant, and when Doug Casey and I visited the region recently, we were very impressed with its world-class potential. We're both excited to see the oil well results that are slated to come out within the next few months—so are the IOCs and NOCs, and so should you. To share our excitement, Doug and I thought it would be a great idea to literally bring you into the room to see and hear what we see and hear—and thanks to modern technology, I present to you today the Casey Energy Report (CER) Crossfire. One of the few times I filmed a CER Crossfire was with Keith Hill from Africa Oil. It's not something I do regularly—only when I'm really excited about a company. The company we have on CER Crossfire today, Petromanas Energy (PMI.V), is chasing world-class, elephant oil deposits, but rather than deepwater Africa (like Keith did with Africa Oil), it's drilling deep onshore in Europe. As you will hear me discuss in the video, the last time I've seen a company chasing deep world-class oil deposits with this kind of massive upside was Africa Oil. Shell, one of the largest IOCs, is paying almost all of the US$70 million this oil well costs to drill to earn its 75% share of the project, and it will do the same with the next well. We haven't seen such a high reward-to-risk ratio in a long time. So, rather than reading a long missive, I invite you to watch this edition of the Casey Energy Report Crossfire with Glenn McNamara, the CEO of Petromanas. I think it will definitely be worth your time. Now You Can Take the Lead… We Make It Simple We expect great things from this company. You can read our ongoing guidance on Petromanas and our other top energy stocks every month in the Casey Energy Report. In the current issue, for example, you'll find an in-depth field report on the Europe trip Doug and I took, what we learned at our site visits, and which companies are poised to benefit most from the budding European Energy Renaissance. There's no risk in trying it: If you don't like the Casey Energy Report or don't make any money within your first three months, just cancel within that time for a full, prompt refund. Even if you miss the cutoff, you can cancel anytime for a prorated refund on the unused part of your subscription. You don't have to travel 300+ days a year to discover the best energy investments in the world—we do it for you. Click here to get started.

More from Casey Research: Forget what you've heard about "green energy"… Europe could soon be desperate for oil Casey Research: What you need to know about the bear market in silver How Russia could take down America… without firing a single shot |

| USD/CAD - Listless In Thin Holiday Trade Posted: 19 May 2014 11:34 AM PDT By Kenny Fisher The Canadian dollar is showing little movement on Monday, as USD/CAD trades in the mid-1.08 range in the North American session. On Friday, there was mixed news out of the US, as Building Permits shot higher while UoM Consumer Sentiment weakened in April. Canadian Foreign Securities Purchases disappointed in April, posting a decline. On Monday, trading is light as Canadian markets are closed for a holiday. As well, there are no US releases on Monday, so we could be in for an uneventful day. In the US, last week ended with encouraging housing numbers. Building Permits jumped to 1.08 million, well above the estimate of 1.01 million. This was the highest level we've seen since December 2006. Housing Starts continues to move higher and climbed to 1.07M, compared to the estimate of 0.98M. This marked a five-month high. Meanwhile, UoM Consumer Sentiment dipped to 81.8 points, short |

| Encana Corporation, Wells Fargo And Barrick Gold Lead 20 Best Value Long Bond Trades Posted: 19 May 2014 11:03 AM PDT We last ranked the best value fixed rate corporate bond issues on May 9, 2014 for maturities of 10 years or more. Today we rank the best value corporate bond trades with daily trading volume of at least $5 million and maturities of 20 years or longer as of May 16, 2014. On May 16 in the U.S. bond market, there were 26,825 bond trades in 4,547 non-call fixed rate corporate bond issues representing $8,100,647,287 in notional principal. Which 20 trades were the best trades of the day, and how do we decide the answer to that question? Today, we answer those questions for bonds with maturities of 20 years or longer. Conclusion: We find the best-value non-call senior fixed rate 20 year maturity or longer bond trades on May 16, 2014 were issues by these firms: ENCANA CORPORATION (ECA) WELLS FARGO & CO. (WFC), 2 issues BARRICK NORTH AMERICA |

| Chris Duane: End of London Fix is the Beginning of the End of Silver Manipulation Posted: 19 May 2014 10:45 AM PDT

Silver Shield’s Chris Duane joins Sean from the SGTReport to discuss last week’s PM market bombshell that the London fix will end Aug 14th. Duane states that the end of the fix is the beginning of the end of the silver manipulation. Duane’s full interview with SGT is below: Silver Shield Uncle Slave Only $2.99 [...] The post Chris Duane: End of London Fix is the Beginning of the End of Silver Manipulation appeared first on Silver Doctors. |

| Koos Jansen: Chinese real estate debt is being settled in silver Posted: 19 May 2014 10:31 AM PDT GATA |

| Gold consumption in Thailand expands 73 percent Posted: 19 May 2014 10:30 AM PDT Gold shipments to Southeast Asia's biggest consumer are forecast to contract by as much as half this year, |

| Hedge funds cut bullish bets on gold futures Posted: 19 May 2014 10:23 AM PDT Hedge funds cut bullish bets on gold futures by the most in a month as holdings of physical bullion in exchange-traded funds dropped to the lowest since 2009. |

| Are short silver prices set up for another heartbreak? Posted: 19 May 2014 10:21 AM PDT For long term investors and precious metals observers, the range-bound price action has rubbed salt into the open wound of short price sentiment. |

| Posted: 19 May 2014 09:58 AM PDT |

| Posted: 19 May 2014 09:25 AM PDT Speculative short positions (half) are justified from the risk/reward perspective in gold, silver, and mining stocks. |

| Are The London Gold Vaults Running Empty? Posted: 19 May 2014 09:15 AM PDT

Chinese net gold imports in March, (at least 111.1 tonnes), were not sourced from London, as they have been in the past year. UK total net gold export in March collapsed 85 % m/m from 107 tonnes in February to 16 tonnes in March, net export to Switzerland fell by 72 % from 119 in February [...] The post Are The London Gold Vaults Running Empty? appeared first on Silver Doctors. |

| Looking Forward (and Glancing Behind While Doing So) Posted: 19 May 2014 09:02 AM PDT |

| Ira Epstein views on Gold: Neither bullish nor bearish Posted: 19 May 2014 08:44 AM PDT "I am not of the opinion that the current formation is bullish, but until $1,277.70 is broken, it's no longer bearish," said the director of the Ira Epstein division of The Linn Group. |

| FIRSTHAND ACCOUNT: INVESTMENT GRADE SILVER SHORTAGE DEVELOPING IN CHINA Posted: 19 May 2014 08:42 AM PDT

"3 months ago, when I inquired about buying some more bars, they said that I would have to wait a month. |

| We could finally have some good news from the crisis in Ukraine Posted: 19 May 2014 08:32 AM PDT From Bloomberg: President Vladimir Putin ordered Russian troops near the Ukrainian border back to base, the Kremlin said, signaling a possible easing of tensions six days before Ukraine’s presidential election. Putin told forces in the Rostov, Belgorod and Bryansk regions to return to their bases after completing exercises, according to the presidential press service. The president welcomed contacts last week between the government in Kiev and supporters of a decentralization of powers to the country’s regions, including the mainly Russian-speaking east. The comments came as Ukrainian forces continued skirmishes with pro-Russian insurgents after separatists in the Donetsk and Luhansk regions said they planned their own elections later this year. Putin, whom the Ukrainian government accuses of fomenting unrest in the east and who annexed Crimea in March, promised a withdrawal of Russian forces from the border two weeks ago. NATO Secretary General Anders Fogh Rasmussen said today he’s yet to see any sign troops have been pulled back. “There does appear to have been a moderation in tensions,” Tim Ash, head of emerging-markets research at Standard Bank Plc in London, said in an e-mail. “Both sides now are probably waiting to see the outcome of the presidential election next weekend and how this leaves the lay of the land.” Russian Markets Russia’s benchmark Micex Index of stocks was 1.4 percent higher at 4:52 p.m. in Moscow. It’s climbed 8 percent this month. The ruble rose 0.5 percent against the central bank’s target dollar-euro basket as investors pared bets Russia will intervene in Ukraine and trigger harsher sanctions from the U.S. and the European Union. “I think it’s the third Putin statement on withdrawal of Russian troops, but so far we haven’t seen any withdrawal at all,” Rasmussen told a news conference in Brussels. I strongly regret that because a withdrawal of Russian troops would be a first important contribution to de-escalating the crisis.” NATO says Putin has 40,000 troops on the border and has expressed concern that events in eastern Ukraine may be a precursor to a land grab similar to the annexation of Crimea. A spokesman for Ukraine’s Border Service, though, said it had seen a reduction in Russian activity on the frontier in the past week. Presidential Vote Ukrainian Prime Minister Arseniy Yatsenyuk said today the government will try to ensure the May 25 presidential election goes ahead throughout the country, though any difficulties in some regions won’t affect the legitimacy of the poll. “We realize that in certain places it will be difficult to conduct voting, but there are very few such places, and this will not affect the election results,” he said at a meeting in Kiev with officials from the Central Electoral Commission, the Interior Ministry and the Security Service. “Special security arrangements will be imposed in the Donetsk and Luhansk regions, as well as other regions where we expect there will be attempts to disrupt the elections,” acting Interior Minister Arsen Avakov said. “We will concentrate soldiers sent from calmer regions in the hottest spots.” While 100 percent of polling stations in other regions have received official lists of voters, only 26 percent in Donetsk and 16 percent in Luhansk have done so due to separatist attacks and because people are refusing to work for the electoral authorities, Andriy Mahera, the deputy head of the Electoral Commission, said in an interview. Mostly ‘Favorable’ ‘Violence and threats against members of election commissions has intensified in both regions,” the Washington-based National Democratic Institute said in a statement that described the environment for the vote as “favorable” in most of Ukraine. The NDI is sending a mission to observe the election jointly led by former U.S. Secretary of State Madeline Albright. “At this point, it is unclear how many of the 5 million Donetsk and Luhansk voters will have opportunities to cast ballots,” it said. Putin called on Ukraine’s government to “immediately halt” its “punitive operation” against pro-Russian rebels who have held referendums that they say justify their secession bid and set up their own administration. Putin discussed Ukraine with his Security Council in the Black Sea city of Sochi today before flying to China. With the Ukraine conflict increasingly alienating Putin from the U.S. and the European Union, he’s seeking to complete an agreement on supplying natural gas to the world’s second-largest economy. Slovyansk Clash In the latest fighting, a soldier was killed and another wounded when rebels attacked a Ukrainian military outpost near Slovyansk, about 200 kilometers (125 miles) from the Russian border, from a position in a nearby kindergarten at 4:30 a.m. local time, the Defense Ministry said on its website. The Defense Ministry also said government forces seized shoulder-fired anti-aircraft rockets from insurgents in Kramatorsk last night. A number of people who identified themselves as Russian journalists and were filming the insurgents were detained along with the rebels. The deputy head of the Ukrainian Security Council, Viktoria Syumar, said on Facebook the journalists had provided “information support” to the rebels and were “de facto members of terrorist groups.” Opinion Poll A poll before the presidential election showed billionaire Petro Poroshenko, who owns a confectionery empire, in first place with 40 percent. Serhiy Tigipko was second with 9 percent, ahead of former Prime Minister Yulia Tymoshenko with 8.8 percent. The May 6-8 mobile-phone survey by GfK Ukraine had a margin of error of 3.5 percentage points. The separatists, who occupy buildings and broadcasting towers in about 15 cities, said they’d hold their own vote, possibly around Sept. 14, to elect new officials for their self-proclaimed “Donetsk People’s Republic.” The U.S. and the EU have imposed sanctions on Russian companies and people in Putin’s inner circle and vowed to tighten them if he disrupts the presidential election. “There is a possibility that Russia will not face a third round of sanctions over the coming weeks” given its attempts by to ease tensions, Gillian Edgeworth, chief economist for eastern Europe, the Middle East and Asia at UniCredit Bank AG in London, said in an e-mailed note. “Over recent weeks, there was at times a risk that the election could not take place, but at this stage it is likely that in many parts of the country, the outcome should improve the legitimacy of governance in Ukraine.”

More on the Ukrainian crisis: Controversial report reveals Vladimir Putin's real reasons for invading Ukraine How the Ukrainian crisis could be creating a real-life Tony Stark Russia warns: Ukraine "as close to civil war as you can get" |

| Conspiracy fact: Euopean central banks again admit, renew secret coordination on gold Posted: 19 May 2014 08:31 AM PDT GATA |

| Eric Sprott: Manipulation Ends When Someone Finally Fails- & We Are Not Far Off Here Posted: 19 May 2014 08:00 AM PDT

I am very excited about developments in the gold and silver markets today. I have been speculating since late 2012 that Western central banks could be running out of gold. I put the sell-off in gold and silver in 2013 to the fact that the Western banks needed a way to generate physical gold supplies. [...] The post Eric Sprott: Manipulation Ends When Someone Finally Fails- & We Are Not Far Off Here appeared first on Silver Doctors. |

| Gold remains an important element Posted: 19 May 2014 07:47 AM PDT Gold moved higher today in euros, pounds and dollars after the ECB and 21 other central banks announced a new gold agreement. |

| New Indian government unlikely to repeal gold import rules soon Posted: 19 May 2014 07:34 AM PDT The hopes of relaxation of gold import norms by the to-be-formed new government under Narendra Modi has deflated the gold premiums in India. |

| India's gold bar imports tumbled Posted: 19 May 2014 07:30 AM PDT According to data, the gold bar imports by the country in April this year witnessed a huge drop of 43.36% over the previous year. |

| The End (of the Silver Fix) Is Nigh Posted: 19 May 2014 07:00 AM PDT

It's history. The silver Fix will be ended in August, after 117 years. The silver community is excited. Many believe that the Fix is part of the apparatus that is suppressing the silver price. Without suppression, the price will shoot up to $100 or $250 or whatever number. Dismantling this very visible operation of the [...] The post The End (of the Silver Fix) Is Nigh appeared first on Silver Doctors. |

| Gold prices may not move into higher until Summer or Autumn: Jeffrey Nichols Posted: 19 May 2014 06:24 AM PDT Gold may not move into a higher trading range until summer or autumn, said Jeffrey Nichols, managing director of American Precious Metals Advisors. |

| Gold “Important” And No Plan To Sell Significant Quantity Of - ECB Posted: 19 May 2014 05:31 AM PDT gold.ie |

| Gold Standards and the Real Bills doctrine in US Monetary Policy (Timberlake) Posted: 19 May 2014 05:30 AM PDT EconJournal |

| How to move from a chip shop to owning a London building & directing a feelgood movie Posted: 19 May 2014 05:11 AM PDT

|

| Gold “Important” And No Plan To Sell Significant Quantity Of – ECB Posted: 19 May 2014 04:28 AM PDT The ECB, the Swiss National Bank (SNB) and the Riksbank of Sweden announced a new gold agreement this morning. They announced they have no plans to sell significant quantities of gold and reaffirmed the importance of gold bullion as a monetary reserve. Today's AM fix was USD 1,301.00, EUR 948.67 and GBP 773.85 per ounce. Gold fell $2.50 or 0.19% Friday to $1,293.10/oz. Silver slipped $0.12 or 0.62% to $19.36/oz. Gold and silver both finished up for the week at 0.34% and 1.10% respectively. Gold moved higher today in euros, pounds and dollars after the ECB and 21 other central banks announced a new gold agreement. The new agreement was expected but the timing was unexpected as the last agreement was not due to expire until September 27.

The crisis in Ukraine and risk of increased tensions between Russia and the west continues to provide support for gold. A further deterioration in relations seems likely and should push gold higher. Also supporting gold is the likelihood that the incoming government in India will relax import restrictions and duties, in the world's second largest buyer. Over the weekend, incoming Indian leader Modi told thousands of supporters that he represents a break from past governments after winning the nation's biggest electoral mandate in 30 years. Last week, Reserve Bank of India Governor Raghuram Rajan said that the new Indian finance minister will decide on easing gold import curbs.

Gold "Important" And ECB No Plan To Sell Significant Quantity Of Gold Twenty one central banks including the ECB, the central banks of the euro area (Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, Spain), the SNB and the Riksbank announced the fourth gold agreement between the central banks for the next 5 years. In a joint statement, the central banks confirmed their intentions with regard to their gold holdings and the participants in the gold agreement made the following declaration: - Gold remains an important element of global monetary reserves. - The participants in the gold agreement will continue to coordinate their gold transactions so - The participants currently have no plans to sell any substantial quantities of gold. The press release from the SNB can be read here. The agreement, which applies as of 27 September 2014, following the expiry of the current

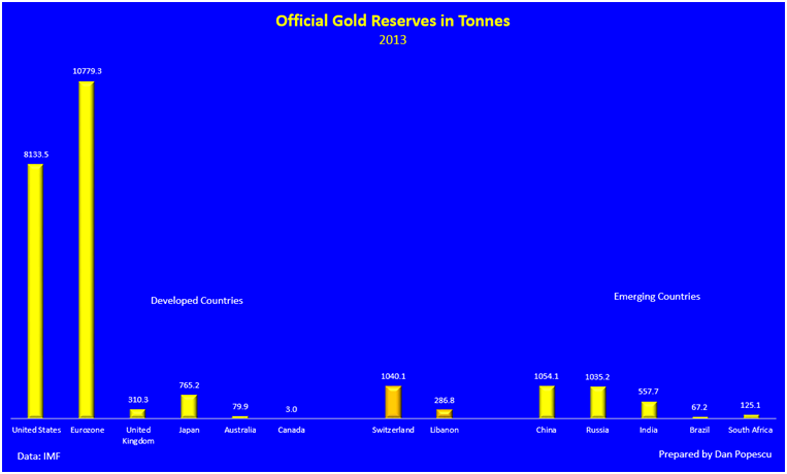

The timing of the announcement was unexpected as the current agreement does not expire until September. It is understandable that the central banks value their gold as "important element of global monetary reserves," given the still lingering economic problems in Greece, Italy, Spain, Portugal, Ireland and Cyprus and continuing ultra loose monetary policies in the Eurozone – with the possibility of negative interest rates. Thus, European central banks are likely to continue to be reluctant to sell their substantial gold reserves which total of 10,779.3 tonnes or 8,972.6 tonnes ( EU G6). There is also the fact that while Eurozone banks balance sheets have recovered somewhat, many are far from robust and remain vulnerable. Should there be a 'Black Swan' event or economies slow down again, central banks may require their gold reserves in order to maintain confidence in the single currency and other fiat currencies. It is believed that there is little appetite for a new gold agreement among the rest of the world and among the emerging market central banks such as China. Most of the central banks that were signatories to the Washington Agreement, clearly do not want to sell their gold reserves. The World Gold Council released data showing that global official gold reserves totalled 31,890.7 tons as of February, 2014. Of this total figure, the euro area held a total of 10,779.3 tons making it the largest holder of gold reserves in the world with 36.6% of the total global gold reserves. The second largest holder of gold reserves is the U.S. with 8,133.5 tonnes. China’s central bank gold reserves data has remained at 1,054 tons since the beginning of 2009. No change has occurred in 4 and a half years, despite most market participants believing that China is quietly accumulating gold reserves. China is likely to announce a sharp increase in their reserves to over 3,000 or 4,000 tonnes in the coming months. The previous European gold agreement, agreed in August 2009, committed the central banks to sell no more than 400 tonnes per year and no more than 2,000 tonnes in the five-year period. Sales under the current pact have only totalled around 200 tonnes, 10 times less than was permissible. The global and Eurozone debt crisis created a new found awareness of gold as a safe haven monetary asset. This reluctance to sell gold is likely to continue. Indeed, many central banks are already under pressure to repatriate their gold reserves from the UK and the U.S.

Gold reserves and the price of gold are closely watched on financial and foreign exchange markets – as a barometer of inflation expectations, of systemic risk and of confidence in fiat currencies. The central banks at the time of the first agreement, the Washington agreement, affirmed that gold remained an important part of the global monetary system, setting the basis for a long and upward trend for the gold price. The initial statement does not mention the sales ceiling for the pact and some market participants are surprised they did not reaffirm the sales ceiling. The European Central Bank has told Reuters that there is indeed no formal ceiling included in the new CBGA. There was no mention of gold leasing and the use of futures and options by central banks in the agreement. There was in 1999 and 2004 but not in 2009 and again now. The Bank of England did not sign the agreement. The Bank of England signed the first Washington Agreement in 1999 but opted out in 2004 and 2009. The opt out may be because the UK gold reserves are now insubstantial. By signing the agreement, the BOE might again draw attention to Gordon Brown’s controversial gold sales. Click here for the GoldCore Essential Guide to Storing Gold In Signapore. |

| Michael Curran believes Gold will finish the year somewhere in $1,400 plus Posted: 19 May 2014 04:15 AM PDT Michael Curran believes gold will finish the year somewhere in $1,400-1,500 an ounce range. "We're seeing a flat summer and then there will be some catalysts later in the year to push gold higher. Our current target would be $1,400 an ounce plus,†said Michael Curran. |

| US Dollar Capped at Resistance, SPX 500 Bounce Looks Corrective Posted: 19 May 2014 01:05 AM PDT dailyfx |

| Time Is the Trigger for Equities and Bullion: Charles Oliver Posted: 19 May 2014 01:00 AM PDT |

| Michael Perelman: The Rise of Free-Trade Imperialism and Military Keynesianism Posted: 19 May 2014 12:00 AM PDT Yves here. Please welcome Michael Perelman, a economics professor who is more an economist manque than the conventional sort. Perelman now focuses particularly on economic history, which consist in large measure of describing not just how older economic theories have been distorted or misrepresented, but how the conventional accounts of economic development too often contain significant omissions and misrepresentations. For instance, his book The Invention of Capitalism describes how proto-capitalists managed to seize former community resources (the best known being pastureland, but hunting and other rights also came to be restricted). Part of the legitimation of this effort was to present free peasants, who could live comfortably without working very hard, as being made morally deficient by having too much leisure time. They’d clearly become better people if they were made by their betters to apply themselves. The post that follows is excerpted from a yet-to-be-published book by Perelman, The Matrix: An Exploration of the Surprising Interactions Between War, the Economy, and Economic Theory. Please note that I have edited out some fascinating sections that go a bit more into economic history in the interest of maintaining focus on the core arguments. So if any discontinuities have resulted, the fault is mine, not Perelman’s. By Michael Perelman, a professor of economics at California State University, Chico World War I provided a dramatic opportunity for the muscular Christians to display American power on a world wide stage although the population of the United States was not ready for another war, especially after the negative experience in the Philippines. President Woodrow Wilson, previously a founder of the American Economic Association, president of Princeton University, and governor of New Jersey, was first elected president in 1912, before the war had begun. He ran for reelection in 1916, with a promise to stay out of World War I, angering Theodore Roosevelt who responded, charging that “professional pacifists, through President Wilson, have forced the country into a path of shame and dishonor” (Thayer 1919, p. 419). Once safely reelected, Wilson, in the grand tradition of American politics, quickly broke his word, calling for an American entry into the war. Unlike Roosevelt for whom war was a romantic adventure, Wilson’s war promised great material benefits. Running as a peace candidate had helped Wilson win reelection, especially in light of the sour taste left by the war in the Philippines. Neutrality, besides being popular, made good economic sense. The war was already bringing the United States out of the depression it had entered in 1913. Its future First World War allies purchased 77 per cent of U.S. exports in 1913, generating ‘the greatest industrial boom the nation had had until that time’ (Lens 2003: 253). Large conglomerates benefited disproportionately, expanding production of munitions and other exports (Desai 2013, p. 74). Since the British had suspended gold payments and embargoed loans “for undertakings outside the Empire,” Wall Street was now the banking center of the world (Desai 2013, p. 74; citing Lens 2003, p. 252). American business also profited from the withdrawal of British and other European businesses from Latin America, allowing the United States to take center stage as a global financial power. American business benefited further from the withdrawal of British and other European businesses from Latin America. This situation was too good to last. Because the war so fully depleted the Allies’ financial resources, European buying power could no longer buoy the U.S. economy. The US ambassador in London reported on the international situation, which he found “most alarming to the financial and industrial outlook of the United States.” He warned that British and French inability to keep up orders would surely mean “a panic in the United States.” The ambassador concluded, in a clear anticipation of military Keynesianism (to be discussed in the next chapter), that it was not ‘improbable that the only way of maintaining our present preeminent trade position and averting a panic is by declaring war on Germany’ (quoted in Lens, 2003, p. 260). Wilson complied with the ambassador’s suggestion. In retrospect, Wilson timed his move very well. Keeping the United States out of the war until his second term gave the European powers time to exhaust themselves, leaving an opening for a fresh United States military to play a prominent, if not decisive, role. Wartime conditions also proved to be a dramatic turning point in the financial status of the United States, which had always been a chronic debtor, dependent upon a considerable part of Britain’s capital exports. The sudden surge of wartime costs, including American exports, turned the tables, making the Allies dependent on external credit (Desai 2013, p. 75). Between 1914 and 1917, the years between United States’ entry into the war and the outbreak of the Russian Revolution, Europe’s need for wartime financing opened the door for U.S. banks, led by Morgan, to raise massive loans for the allied governments. Waiting to join the war until the Allies were exhausted offered an enormous geo political victory well beyond what the use of military force could have brought. As Radika Desai observed: “The United States was far from isolationist when the First World War started: Wilson kept the United States out of the war initially to wait for a stalemate so that it could step in as arbiter and architect of a US centred postwar order” (Desai 2013, pp. 74). Making the World Safe for War Wilson’s victory was short lived. To begin with, Wilson suffered a debilitating stroke that removed him from the political scene. Public knowledge of the human costs of World War I was temporarily limited because of intense censorship. Even though the armistice came relatively fast after the United States entered the fray, the country still lost 100,000 troops. The prosperity that massive spending on World War I brought was only temporary. By 1920, the economy experienced the second most severe depression of the Twentieth Century. Had Wilson’s health held up, a reelection campaign would have been doomed from the start. The unpopularity of the war, the depression that followed, as well as Wilson’s internationalist vision, symbolized by his plan for the League of Nations, created a political atmosphere that allowed the Republicans to regain their longstanding political control, which they had exercised throughout most of the late Nineteenth Century. Because a high degree of economic planning was key to the American success in the war, the belief in market efficiency waned; however, the postwar depression revived support for market fundamentalism, allowing the Coolidge administration to win election on a platform of doctrinaire laissez faire policy, despite the highly regarded performance of economic planning during the war. The Tragic Imperial DanceWars, of course, always have unforeseen consequences. In a biblical sense, wars beget more wars. Consider the case of World War I. In the lead up to the war the same war which was sold as a war to end all wars three challengers United States, Germany, and Japan were already nipping at the heels of the great imperial powers of France and England. All three were experiencing very rapid economic growth without enjoying comparable political and economic influence around the world. Germany was the great looser in the conflict, although the Ottoman Empire lost the most territory. The resulting instability in the Middle East has troubled the world ever since. Germany’s military defeat and the even more humiliating conditions of its surrender set the stage for a far more devastating challenge to the world order. Crushing reparations, along with the loss of territory, created untenable political conditions. As John Maynard Keynes, a major representative of the English government during the peace negotiations, predicted: “(People in) their distress may overturn the remnants of organization, and submerge civilization itself” (Keynes 1919, p. 144). Conditions in Germany eventually led to the rise of the Nazis. France and England suffered lesser setbacks. Besides their human and economic costs of the war, the United States demanded that they repay their immense war debts to American creditors, allowing the United States to gain power and influence at their expense. This demand was part of the United States’ effort to use its postwar power to dislodge the colonial holdings France and England. Japan, following its defeat of Russia in the early part of the century, was not involved in World War I, sparing her the heavy costs experienced by the great European powers. Instead, Japan was busily building up its military power and extending its sphere of control. Most worrying was its expanding occupation of China, a country lusted after by all of the five rival imperial powers. Unlike France, England, Japan, and Germany, which already had beachheads in China, the United States had only gotten as far as the Philippines. After the War, the United States, concerned about Japan’s rising influence in the Pacific, used embargoes of strategic materials, such as petroleum, tin, and rubber to strangle the Japanese economy. Eventually, Japan responded in the attack on Pearl Harbor. Germany began carving out territory in Europe to regain and expand its prewar powers. When the United States entered the war, just as was the case in World War I, the country’s intentions were to elevate its degree of international influence. In particular, the United States was intent on ramping up its efforts to strip France and England of their colonies, especially in the case of India. The American goal was not to create its own traditional colonial empire, but to build a new kind of empire based on trade rather than direct colonial authority. Opening the previously colonial territories to American trade would give the United States what it wanted. It could dominate territories by virtue of its economic muscle without incurring the expense of administration. This kind of policy was expected to be capable of displacing much of the French and English power, without the need to resort to military force – an ideology that came to be known as free trade imperialism. Because the expected benefits from American market efficiency in the new territories turned out to be insufficient to create conditions in which the territories were free from effective resistance to American influence, the United States lacked a means of control that would serve as an alternative to direct colonial rule. The experience in the Philippines, where extensive military surveillance allowed the United States to shame or blackmail people to refrain from challenging the power of the United States proved to be extremely effective. After World War II, the CIA raised this practice to a much higher level, but the agency never acquired the means to operate as extensive a network of informants that the military had in the Philippines. As a result, the CIA frequently resorted to overthrowing uncooperative governments. Doing so also gave considerable force to threats of installing a new government. Such actions frequently created blowbacks that worked against the interests of the United States. Military KeynesianismOne of the most embarrassing episodes in the relationship between war and economic thinking came at the end of World War II. The combination of the Great Depression followed by World War II led to a period of unparalleled economic success in the history of the United States. However, few economists recognized the role of the Depression in eliminating old and obsolete businesses, clearing the way for this period of prosperity. Alexander Field has recently made a powerful case for the rapid productivity gains during the Depression (Field 2011). The Depression set the stage for the New Deal, which put the economy on more solid ground – a thesis that has become increasingly controversial in the face of growing market fundamentalism. Instead, most economists emphasized how World War II created enough government spending to rescue the economy. This perspective gained powerful support in John Maynard Keynes’ influential book, The General Theory of Employment, Interest and Money (Keynes 1936), which laid out the case for government intervention during economic downturns. However, doctrinaire supporters of laissez faire still believed that depressions should be allowed to run their course. Other than giving tax cuts, the best government policy would be to remain neutral, allowing market forces to make the necessary corrections. Antagonists of government activism tarred Keynes as a socialist, or even worse, a communist. In reality, Keynes was hardly attempting to lay out a roadmap to socialism; Instead, Keynes himself was deeply conservative, writing once: “[T]he class war will find me on the side of the educated bourgeoisie” (Keynes 1925, p. 297). Seeing how the Great Depression unleashed a powerful disgust with what markets wrought, Keynes had feared that capitalism was threatened, especially since the Nazi takeover in Germany and the communist revolution in Russia were elevating the role of the state relative to private business. This trend was not limited to these two dramatic examples. All of the great capitalist states were increasing the role of government relative to the market. In that environment, Keynes saw his work as an effort to safeguard capitalism by stemming the growing tide of socialism. Because Keynes’ American followers mostly advocated a relatively a crude application of his work, narrowly emphasizing government spending alone, without taking Keynes’ far broader approach into account, they were partially responsible for business’ hostile response to Keynes. Keynes expressed his distance from the crude version of American Keynesian in 1944, when Lady Keynes enquired after some prominent Keynesians gave a dinner for Keynes in Washington, “How was it?” Keynes replied, “I was the only non Keynesian there” (Ballard 1995, p. 335; citing Robinson 1972). Business leaders as a whole initially appreciated the immediate beneficial results of the New Deal in healing some of the wounds that the Depression caused. However over time, many of them became increasingly suspicious of government involvement in the economy. In addition, while business had also been supportive of the government’s economic activism during World War II, they also realized that successful government wartime planning had improved the public’s faith in the government’s capacity to manage the economy. Given the woeful performance of business leading up to the depression business had good reason to be nervous about public opinion. As a result, the political climate became increasingly antagonistic to the gains of the New Deal and unreceptive to Keynes’ analysis. Shortly after the war, business interests began a concerted effort to undo some of the gains of the New Deal, beginning with the weakening of the labor movement. For this reason, the opening shot in the attack on the New Deal was the Taft Hartley law, which greatly weakened the power of unions. Business’ support for this measure was strong enough that Congress was able to override a presidential veto. McCarthyism made the political atmosphere poisonous. Economic issues became framed in terms of patriotism rather than serious economics. Economists soon became reluctant to advocate anything that could be even remotely associated with socialistic tendencies, learning from the case of a Canadian economist, Lorie Tarshis, who wrote the earliest textbook that included Keynes’ economic theory. A firestorm pressured universities to cease assigning it. Paul Samuelson, who later became an advisor to Presidents Kennedy and Johnson in addition to being the first American economist to win the Nobel Prize in economics, followed with his own offering, which became the most popular introductory economics textbook in the United States. The attack on Samuelson’s book was fierce. The Veritas Foundation was a leader in this war on Samuelson’s book (Leeson 1997, p. 125). A commentator in the right wing Educational Reviewer asked: “Now if (1) Marx is communistic (2) Keynes is partly Marxian, and (3) Samuelson is Keynesian, what does that make Samuelson and others like him? The answer is clear: Samuelson and the others are mostly part Marxian socialist or communist in their theories” (quoted in MacIver 1955, p. 128). Despite Samuelson’s long history of antagonism to Marxian ideas, tarring him along with Keynes was effective. Samuelson recalled how much he felt the pressure, “having tasted blood in trying to root the Tarshis text out of colleges everywhere, some of the same people turned toward my effort” (Samuelson 1997, p. 158). Samuelson succeeded at defending his work, but at a serious cost. In a 1977 lecture, Samuelson described how he felt compelled to go to great lengths to make his book less controversial, undermining its quality:

In the United States, during the end of the 1950s, the economy was showing signs of sluggishness. Economists took to heart Keynes’ idea that special efforts are necessary to revive the economy when demand is insufficient. Cold War antipathy toward anything even vaguely related to socialism made one vulnerable to accusations of dangerous political sentiments. While support for government spending might be dangerous, military spending was patriotic because it was largely directed against the Soviet Union. In addition, much of the anti-government rhetoric in the United States was built on a dogmatic insistence that government spending is, by its very nature, an unproductive drain on the economy, while private business spending alone is productive. Given this environment, many of the leading Keynesian economists in the United States learned to avoid the scrutiny that Samuelson and Tarshis experienced, shielding themselves from any taint of socialism by using the military as a cover. Either because they succumbed to the anticommunist climate of the day or because they feared they had no chance of stimulating the economy through any productive government spending, they recommended unproductive spending. These Keynesians adopted a stunted version of their master’s approach to immunize their brand of economics from the charge of socialism or communism. They did so by restricting their calls for increased spending to military programs, presumably intended to assist in the fight against communism – an approach that became known as military Keynesianism. The underlying principle of military Keynesianism was not new, as shown by the advice of the ambassador in the last chapter; however the benefits of advocating military Keynesianism were undeniable. Military Keynesianism allowed economists to burnish their patriotic credentials while getting credit for improving the economy at the same time. In this way, economists could win the gratitude of powerful interests in government, business and the military. Here is Business Week writing about the position of a one time radical, but highly respected economist, Lawrence Klein:

|

| The Birth of a Eurasian Century: Russia and China Do Pipelineistan Posted: 18 May 2014 11:58 PM PDT Yves here. I’m a big fan of Pepe Escobar’s work at Asia Times, so I’m delighted to have the opportunity to run one of his posts here. Astute readers will no doubt point out that some of the elements of the Russia-Chinese emergent plan, such as reliance on gold-backed currencies, are sorely misguided. But the bigger point is that the two nations are looking hard for ways to undermine the US economic hegemony. And in any struggle, plans seldom survive first contact with the opposition. Much depends on how well each side adapts to and exploits changing conditions.

HONG KONG — A specter is haunting Washington, an unnerving vision of a Sino-Russian alliance wedded to an expansive symbiosis of trade and commerce across much of the Eurasian land mass — at the expense of the United States. And no wonder Washington is anxious. That alliance is already a done deal in a variety of ways: through the BRICS group of emerging powers (Brazil, Russia, India, China, and South Africa); at the Shanghai Cooperation Organization, the Asian counterweight to NATO; inside the G20; and via the 120-member-nation Non-Aligned Movement (NAM). Trade and commerce are just part of the future bargain. Synergies in the development of new military technologies beckon as well. After Russia’s Star Wars-style, ultra-sophisticated S-500 air defense anti-missile system comes online in 2018, Beijing is sure to want a version of it. Meanwhile, Russia is about to sell dozens of state-of-the-art Sukhoi Su-35 jet fighters to the Chinese as Beijing and Moscow move to seal an aviation-industrial partnership. This week should provide the first real fireworks in the celebration of a new Eurasian century-in-the-making when Russian President Vladimir Putin drops in on Chinese President Xi Jinping in Beijing. You remember “Pipelineistan,” all those crucial oil and gas pipelines crisscrossing Eurasia that make up the true circulatory system for the life of the region. Now, it looks like the ultimate Pipelineistan deal, worth $1 trillion and 10 years in the making, will be inked as well. In it, the giant, state-controlled Russian energy giant Gazprom will agree to supply the giant state-controlled China National Petroleum Corporation (CNPC) with 3.75 billion cubic feet of liquefied natural gas a day for no less than 30 years, starting in 2018. That’s the equivalent of a quarter of Russia’s massive gas exports to all of Europe. China’s current daily gas demand is around 16 billion cubic feet a day, and imports account for 31.6% of total consumption. Gazprom may still collect the bulk of its profits from Europe, but Asia could turn out to be its Everest. The company will use this mega-deal to boost investment in Eastern Siberia and the whole region will be reconfigured as a privileged gas hub for Japan and South Korea as well. If you want to know why no key country in Asia has been willing to “isolate” Russia in the midst of the Ukrainian crisis — and in defiance of the Obama administration — look no further than Pipelineistan. Exit the Petrodollar, Enter the Gas-o-Yuan And then, talking about anxiety in Washington, there’s the fate of the petrodollar to consider, or rather the “thermonuclear” possibility that Moscow and Beijing will agree on payment for the Gazprom-CNPC deal not in petrodollars but in Chinese yuan. One can hardly imagine a more tectonic shift, with Pipelineistan intersecting with a growing Sino-Russian political-economic-energy partnership. Along with it goes the future possibility of a push, led again by China and Russia, toward a new international reserve currency — actually a basket of currencies — that would supersede the dollar (at least in the optimistic dreams of BRICS members). Right after the potentially game-changing Sino-Russian summit comes a BRICS summit in Brazil in July. That’s when a $100 billion BRICS development bank, announced in 2012, will officially be born as a potential alternative to the International Monetary Fund (IMF) and the World Bank as a source of project financing for the developing world. More BRICS cooperation meant to bypass the dollar is reflected in the “Gas-o-yuan,” as in natural gas bought and paid for in Chinese currency. Gazprom is even considering marketing bonds in yuan as part of the financial planning for its expansion. Yuan-backed bonds are already trading in Hong Kong, Singapore, London, and most recently Frankfurt.

It’s common knowledge that banks in Hong Kong, from Standard Chartered to HSBC — as well as others closely linked to China via trade deals — have been diversifying into the yuan, which implies that it could become one of the de facto global reserve currencies even before it’s fully convertible. (Beijing is unofficially working for a fully convertible yuan by 2018.) The Russia-China gas deal is inextricably tied up with the energy relationship between the European Union (EU) and Russia. After all, the bulk of Russia’s gross domestic product comes from oil and gas sales, as does much of its leverage in the Ukraine crisis. In turn, Germany depends on Russia for a hefty 30% of its natural gas supplies. Yet Washington’s geopolitical imperatives — spiced up with Polish hysteria — have meant pushing Brussels to find ways to “punish” Moscow in the future energy sphere (while not imperiling present day energy relationships). There’s a consistent rumble in Brussels these days about the possible cancellation of the projected 16 billion euro South Stream pipeline, whose construction is to start in June. On completion, it would pump yet more Russian natural gas to Europe — in this case, underneath the Black Sea (bypassing Ukraine) to Bulgaria, Hungary, Slovenia, Serbia, Croatia, Greece, Italy, and Austria. Bulgaria, Hungary, and the Czech Republic have already made it clear that they are firmly opposed to any cancellation. And cancellation is probably not in the cards. After all, the only obvious alternative is Caspian Sea gas from Azerbaijan, and that isn’t likely to happen unless the EU can suddenly muster the will and funds for a crash schedule to construct the fabled Baku-Tblisi-Ceyhan (BTC) oil pipeline, conceived during the Clinton years expressly to bypass Russia and Iran. In any case, Azerbaijan doesn’t have enough capacity to supply the levels of natural gas needed, and other actors like Kazakhstan, plagued with infrastructure problems, or unreliable Turkmenistan, which prefers to sell its gas to China, are already largely out of the picture. And don’t forget that South Stream, coupled with subsidiary energy projects, will create a lot of jobs and investment in many of the most economically devastated EU nations. Nonetheless, such EU threats, however unrealistic, only serve to accelerate Russia’s increasing symbiosis with Asian markets. For Beijing especially, it’s a win-win situation. After all, between energy supplied across seas policed and controlled by the U.S. Navy and steady, stable land routes out of Siberia, it’s no contest. Pick Your Own Silk Road Of course, the U.S. dollar remains the top global reserve currency, involving 33% of global foreign exchange holdings at the end of 2013, according to the IMF. It was, however, at 55% in 2000. Nobody knows the percentage in yuan (and Beijing isn’t talking), but the IMF notes that reserves in “other currencies” in emerging markets have been up 400% since 2003. The Fed is arguably monetizing 70% of the U.S. government debt in an attempt to keep interest rates from heading skywards. Pentagon adviser Jim Rickards, as well as every Hong Kong-based banker, tends to believe that the Fed is bust (though they won’t say it on the record). No one can even imagine the extent of the possible future deluge the U.S. dollar might experience amid a $1.4 trillion Mount Ararat of financial derivatives. Don’t think that this is the death knell of Western capitalism, however, just the faltering of that reigning economic faith, neoliberalism, still the official ideology of the United States, the overwhelming majority of the European Union, and parts of Asia and South America. As far as what might be called the “authoritarian neoliberalism” of the Middle Kingdom, what’s not to like at the moment? China has proven that there is a result-oriented alternative to the Western “democratic” capitalist model for nations aiming to be successful. It’s building not one, but myriad new Silk Roads, massive webs of high-speed railways, highways, pipelines, ports, and fiber optic networks across huge parts of Eurasia. These include a Southeast Asian road, a Central Asian road, an Indian Ocean “maritime highway” and even a high-speed rail line through Iran and Turkey reaching all the way to Germany. In April, when President Xi Jinping visited the city of Duisburg on the Rhine River, with the largest inland harbor in the world and right in the heartland of Germany’s Ruhr steel industry, he made an audacious proposal: a new “economic Silk Road” should be built between China and Europe, on the basis of the Chongqing-Xinjiang-Europe railway, which already runs from China to Kazakhstan, then through Russia, Belarus, Poland, and finally Germany. That’s 15 days by train, 20 less than for cargo ships sailing from China’s eastern seaboard. Now that would represent the ultimate geopolitical earthquake in terms of integrating economic growth across Eurasia. Keep in mind that, if no bubbles burst, China is about to become — and remain — the number one global economic power, a position it enjoyed for 18 of the past 20 centuries. But don’t tell London hagiographers; they still believe that U.S. hegemony will last, well, forever. Take Me to Cold War 2.0 Despite recent serious financial struggles, the BRICS countries have been consciously working to become a counterforce to the original and — having tossed Russia out in March — once again Group of 7, or G7. They are eager to create a new global architecture to replace the one first imposed in the wake of World War II, and they see themselves as a potential challenge to the exceptionalist and unipolar world that Washington imagines for our future (with itself as the global robocop and NATO as its robo-police force). Historian and imperialist cheerleader Ian Morris, in his book War! What is it Good For?, defines the U.S. as the ultimate “globocop” and “the last best hope of Earth.” If that globocop “wearies of its role,” he writes, “there is no plan B.” Well, there is a plan BRICS — or so the BRICS nations would like to think, at least. And when the BRICS do act in this spirit on the global stage, they quickly conjure up a curious mix of fear, hysteria, and pugnaciousness in the Washington establishment. Take Christopher Hill as an example. The former assistant secretary of state for East Asia and U.S. ambassador to Iraq is now an advisor with the Albright Stonebridge Group, a consulting firm deeply connected to the White House and the State Department. When Russia was down and out, Hill used to dream of a hegemonic American “new world order.” Now that the ungrateful Russians have spurned what “the West has been offering” — that is, “special status with NATO, a privileged relationship with the European Union, and partnership in international diplomatic endeavors” — they are, in his view, busy trying to revive the Soviet empire. Translation: if you’re not our vassals, you’re against us. Welcome to Cold War 2.0. The Pentagon has its own version of this directed not so much at Russia as at China, which, its think tank on future warfare claims, is already at war with Washington in a number of ways. So if it’s not apocalypse now, it’s Armageddon tomorrow. And it goes without saying that whatever’s going wrong, as the Obama administration very publicly “pivots” to Asia and the American media fills with talk about a revival of Cold War-era “containment policy” in the Pacific, it’s all China’s fault. Embedded in the mad dash toward Cold War 2.0 are some ludicrous facts-on-the-ground: the U.S. government, with $17.5 trillion in national debt and counting, is contemplating a financial showdown with Russia, the largest global energy producer and a major nuclear power, just as it’s also promoting an economically unsustainable military encirclement of its largest creditor, China. Russia runs a sizeable trade surplus. Humongous Chinese banks will have no trouble helping Russian banks out if Western funds dry up. In terms of inter-BRICS cooperation, few projects beat a $30 billion oil pipeline in the planning stages that will stretch from Russia to India via Northwest China. Chinese companies are already eagerly discussing the possibility of taking part in the creation of a transport corridor from Russia into Crimea, as well as an airport, shipyard, and liquid natural gas terminal there. And there’s another “thermonuclear” gambit in the making: the birth of a natural gas equivalent to the Organization of the Petroleum Exporting Countries that would include Russia, Iran, and reportedly disgruntled U.S. ally Qatar. The (unstated) BRICS long-term plan involves the creation of an alternative economic system featuring a basket of gold-backed currencies that would bypass the present America-centric global financial system. (No wonder Russia and China are amassing as much gold as they can.) The euro — a sound currency backed by large liquid bond markets and huge gold reserves — would be welcomed in as well. It’s no secret in Hong Kong that the Bank of China has been using a parallel SWIFT network to conduct every kind of trade with Tehran, which is under a heavy U.S. sanctions regime. With Washington wielding Visa and Mastercard as weapons in a growing Cold War-style economic campaign against Russia, Moscow is about to implement an alternative payment and credit card system not controlled by Western finance. An even easier route would be to adopt the Chinese Union Pay system, whose operations have already overtaken American Express in global volume. I’m Just Pivoting With Myself No amount of Obama administration “pivoting” to Asia to contain China (and threaten it with U.S. Navy control of the energy sea lanes to that country) is likely to push Beijing far from its Deng Xiaoping-inspired, self-described “peaceful development” strategy meant to turn it into a global powerhouse of trade. Nor are the forward deployment of U.S. or NATO troops in Eastern Europe or other such Cold-War-ish acts likely to deter Moscow from a careful balancing act: ensuring that Russia’s sphere of influence in Ukraine remains strong without compromising trade and commercial, as well as political, ties with the European Union — above all, with strategic partner Germany. This is Moscow’s Holy Grail; a free-trade zone from Lisbon to Vladivostok, which (not by accident) is mirrored in China’s dream of a new Silk Road to Germany. Increasingly wary of Washington, Berlin for its part abhors the notion of Europe being caught in the grips of a Cold War 2.0. German leaders have more important fish to fry, including trying to stabilize a wobbly EU while warding off an economic collapse in southern and central Europe and the advance of ever more extreme rightwing parties. On the other side of the Atlantic, President Obama and his top officials show every sign of becoming entangled in their own pivoting — to Iran, to China, to Russia’s eastern borderlands, and |

| Gold – Maintains Range Between $1275 and $1315 Posted: 18 May 2014 11:25 PM PDT forexfactory |

| Posted: 18 May 2014 10:45 PM PDT Mises.org |

| Philip Pilkington: Why Thomas Piketty is Wrong About Inflation and Interest Rates Posted: 18 May 2014 09:19 PM PDT By Philip Pilkington, a writer and research assistant at Kingston University in London. You can follow him on Twitter @pilkingtonphil. Originally published at Fixing the Economists I have pointed out on here recently that Thomas Piketty's views on public sector debt are wholly un-Keynesian. Well, we should also point out that his view of inflation and interest rates are also fairly un-Keynesian. Piketty basically thinks that the reason that governments have been able to run persistent government deficits is due to consistent inflation which erodes the real interest rates governments must pay on their debt. This may be true, but the conclusions he draws from it are altogether incorrect and, again I must stress, not the conclusions a Keynesian economist would draw. Piketty writes,

In his book Money, the Post-Keynesian economist Roy Harrod brings to the reader's attention a part of Keynes' monetary theory that is not widely appreciated today. Namely, that Keynes thought — contrary to what the vast majority of working economists today assume — that the expected rate of inflation and, indeed, the actual rate of inflation have no effect on baseline interest rates. Harrod writes,

This leads Harrod to say, echoing Keynes, that central banks have entire control over the rate of interest. The markets really just have to take what they can get in this regard. If the choice is between cash being eroded by, say, a 7% rate of inflation every year and a bond yielding 3% being eroded by a 7% rate of inflation, the investor just has to make their choice and stand by it. Of course, the money could flee the country. That is, there could be a run on the currency in question. But that seems very unlikely outside of a hyperinflation. And in a hyperinflation the dynamics will be self-limiting in two directions. (1) The rapidity of the increase in the money supply will greatly outpace any foreign outflow. (2) In a hyperinflation a currency generally loses its foreign exchange value almost completely, making it impossible for people to take their money out of the country and buy foreign assets. Outside of a hyperinflationary collapse of an economy, people have to work and earn money and businesses have to turn a profit. This requires money to circulate within the country. Ultimately, this money has to go somewhere when it accrues as savings and if all of it left the country at once the economy would simply come to a halt. This has never happened in history, of course, and if you think it through it is truly an absurdity. In practice the markets just have to accept the fact that they might have negative yield on their hands. Ceteris paribus this will put them under very great pressure to invest the money in riskier assets within the country and this is part of the Keynes schema. Harrod writes,

This is extremely important because the Keynesian view is very much so at odds with what many working economists will tell you. The Keynesian view will tell you that in an inflation risky assets will become more popular. That means that interest rates on these assets will fall, not rise. Interest rates on safe assets, like Treasury Bills, will remain wherever the central bank sets them. This is also what the historical data shows to be the case. So, why don't working economists generally accept this? Two reasons. First, is the loanable funds theory. This theory states that interest rates must increase when output increases. When confronted with the fact that the monetary authorities set the interest rate, loanable funds theorists have recourse to the soothing idea that too much demand will lead to inflation and this will lead to an automatic rise in interest rates. This myth salvages the model in which these economists have invested their intellectual capital. But it is inaccurate and at odds with reality. Secondly, many working economists work in central banks or market institutions. The idea that inflation might lead to a rise in interest rates serves a nice mythic purpose for both. For the central bankers it acts as a taboo that reinforces their inflation fears because they believe that if they violate some sort of Divine Law then they will lose control over the situation. For the market economists it gives the illusion that their institutions — market institutions — have some modicum of control over interest rates. It also serves as an implicit threat to the authorities that if they dare to provoke inflation — which, of course, the financial markets hate beyond all else — market actors will jack up the interest rate. But none of this is true. In reality, the authorities control the interest rate and no amount of inflation will move it beyond the boundaries in which they set it. High inflation may be an evil in its own right but let's not fool ourselves with some sort of old time religion. Economists like Piketty would do well to give these issues a bit more thought before spooking the general public with the boogeyman of the supposed burdens of public sector debt and the supposed unsustainability, reminiscent of the doomsday warnings of the Austrian cranks, of eroding it through a healthy inflation. |

| Firsthand Account: Investment Grade Silver Shortage Developing in China Posted: 18 May 2014 09:01 PM PDT

We have well documented over the past few months the unprecedented flows of physical gold and silver being drained out of Western vaults and shipped East. SD reader Chichura, an American currently residing in China, has provided a boots-on-the-ground first-hand account which substantiates our recent claims that spiking silver premiums on the Shanghai Gold Exchange indicate [...] The post Firsthand Account: Investment Grade Silver Shortage Developing in China appeared first on Silver Doctors. |

| $7,000 gold, $400 oil and $100 silver will help beat a coming US deflation explains Jim Rickards Posted: 18 May 2014 08:40 PM PDT Gold investors ought to be reading ‘The Death of Money’ by Jim Rickards this summer. He explains how an executive order raising the gold price to $7,000 will be the only way to break a deflationary downward spiral in the US if money printing reaches its limits and the Fed pulls back, as is happening this year. ‘The Federal Reserve could make this price stick by conducting open market operations…’ he says. ‘The purpose would not be to enrich gold holders but to reset general price levels… this kind of dollar devaluation against gold would quickly be reflected in higher dollar prices for everything else. $400 oil ‘The world of $7,000 gold is also the world of $400 per-barrel oil and $100 per-ounce silver. Deflation’s back can be broken when the dollar is devalued against gold, as occurred in 1933 when the United States revalued gold from $20.67 per ounce to $35 per ounce, a 41 per cent dollar devaluation.’ His conclusion is that ‘if the Unites States faces severe deflation again, the antidote of dollar devaluation against gold will be the same because there is no other solution when printing money fails.’ One important thing to note about Jim Rickards is that he’s a respected money manager and not a diehard believer in everything shiny. What he provides is a logical end-game to the times we are living through. Gold guru Jim Sinclair has said the same albeit without this full macro analysis. Logic also tells you that a money with a fixed supply like gold will be worth more in a world awash with money printing. This explanation just points a path to how it gets there. It takes several leaps forward to achieve this and timing this is always going to be impossible. But events are going to start moving fast. Bond exit Last week saw a record amount taken out of US treasury bonds, according to market reports. It is not yet known who sold. Russian sales have been strong since the start of the year. China’s economy is slowing and this could be money coming out for a rainy day. However, this is fully in line with the thesis propounded by Jim Rickards about a US dollar collapse. Gold, he argues, would probably emerge at the heart of a new global monetary system as the only money that you can really trust. Time perhaps to download the full book for some early summer reading. ArabianMoney investment newsletter subscribers (click here) will have our latest round-up on precious metals in the next issue and hear why June may be the best month to buy gold. |

| PM Fund Manager: Smoking Gun on The Fed’s Money Laundering T-Bond Purchases Posted: 18 May 2014 05:37 PM PDT

Precious Metals Fund Manager Dave Kranzler joins the show this week to discuss: Cartel capping gold at $1300 and silver at $20 London silver fix to end in August after 117 years- is the end of the silver manipulation at hand? Kranzler discusses the Smoking Gun on The Fed’s money laundering US Treasury purchases through [...] The post PM Fund Manager: Smoking Gun on The Fed’s Money Laundering T-Bond Purchases appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Alasdair Macleod: Firmer Tone for Gold & Silver Posted: 18 May 2014 03:00 PM PDT

This week started with a severe markdown in gold and silver prices when markets opened in the Far East on Monday morning, taking gold down $12 to $1278 and silver only 12 cents to $19.03. The clue in this was the resilience of silver, which hardly moved: it was an attack on the gold price [...] The post Alasdair Macleod: Firmer Tone for Gold & Silver appeared first on Silver Doctors. |