saveyourassetsfirst3 |

- Silver price 'keen to rise' - Phillips

- Timmins gold Q1 production up 24% YoY

- Welcome to the Currency War, Part 15: Europeans Ordered to Start Consuming

- Deposit Insurance System Will Increase Physical Gold Demand in China

- As predicted, ECB will now go ‘QE-crazy’ and start printing up to 15 tr. Euro to keep global Ponzi going

- Centamin Q1 gold output disappoints

- GBP/USD - Steady Ahead Of Fed Minutes

- PFGBest SpongeBob SquarePants silver coins will not be stored in a pineapple under the sea

- James Altucher: The ultimate cheat sheet for investing your money

- Buy Side Expects Family Dollar Earnings Hiccup

- AUD/USD - Aussie At 5 Month Highs After Strong Data

- Have We Reached Peak Wall Street?

- Jim Willie: US Dollar to be Reduced to the Dustbin of History

- Fed to the Sharks, Part 2: Housing and the Death of the Middle Class

- The Insanity Of U.S. Energy Independence & Cracks Beginning To Appear In The Natural Gas Industry

- DGCX volumes cross three million contracts in Q1

- China 'has more gold than official figures show'

- Stewart Thomson: Indian National Election is the Most Bullish Event for Gold in Past 100 Years!

- Russian MPs Call for End of Petro-Dollar: “The Dollar is Evil – Dirty Green Paper Stained with Blood”

- Gold and Oil Rise As U.S. - Russia Relations Deteriorate Sharply

- Gold and oil rise

- Who will reverse ban on gold imports?

- 100 oz Silver OPM Bars Only 49 Cents Over Spot, ANY QTY!

- Turkey Mar Gold imports down 88.91% Silver up 138.13%

- Gold and Oil Rise As U.S. – Russia Relations Deteriorate Sharply

- Gold trades near two-week high as investors await Fed minutes

- Gold futures hit a 12-month high on the Dubai Gold and Commodities Exchange

- Gold and the ideal buy point

- Gold price trades back above 55DMA ahead of Fed minutes

- Why I REALLY moved to Puerto Rico... and you should, too

- Koos Jansen: China gold demand fell in last week of March but remains high

- How will gold respond to global deflation?

- China Gold Demand Fell in the Last Week of March, But Remains High

- Two King World News Blogs

- U.K.’s Royal Mint strikes special shipwreck silver coin

- Koos Jansen: China gold demand fell in last week of March but remains high

- Turkey's gold imports nosedive amid graft scrutiny

- Bullion and Energy Market Commentary

- Leeb sees petro-dollar fading; Boyd acknowledges gold price is managed

- TECHNICAL - Gold Holds Above 200-Day Average For Third Day

- TECHNICAL - Gold and Crude Oil Prices Press Higher as US Dollar Nose-Dives

- Gold Price Analysis- April 9, 2014

- "What Yellen Says Matters to Gold": Frank Holmes

- Puerto Rico's Tax Benefits—More than 'The Better Florida'

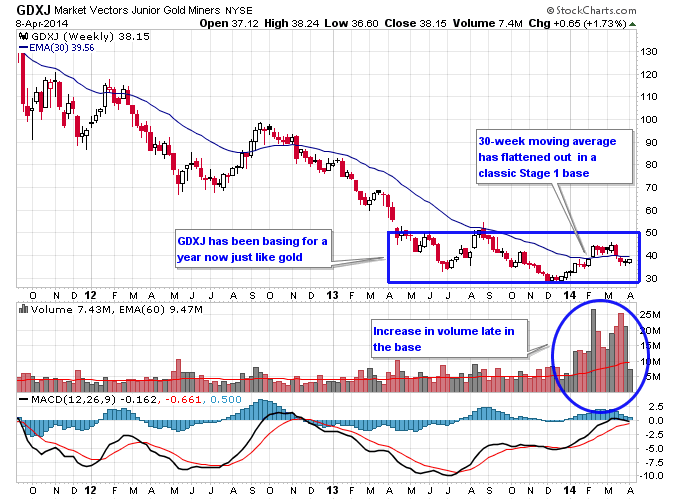

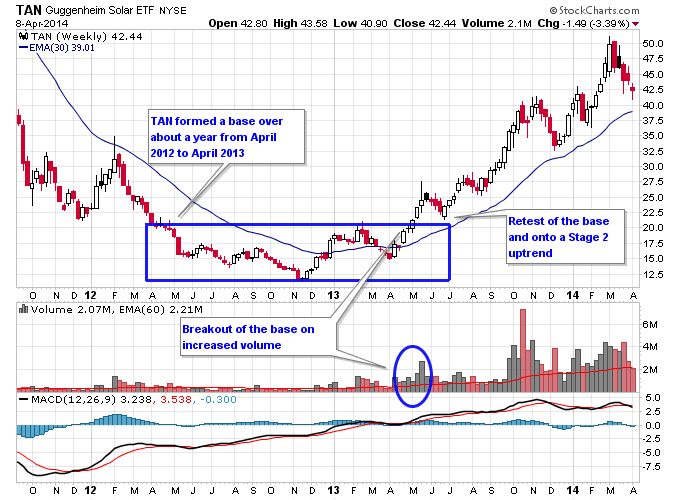

- Are You Prepared for a Bull Market that Will Shock Even the Most Ardent Goldbugs?

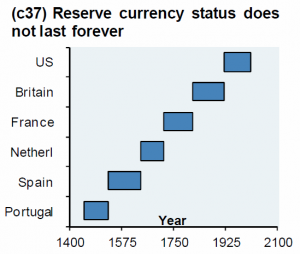

- Reserve Currency: Is the Yuan Tearing Down the US Dollar?

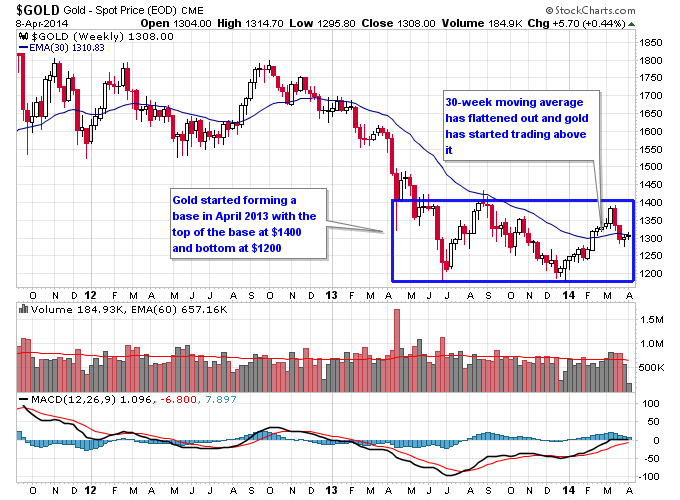

- GOLD AND THE IDEAL BUY POINT

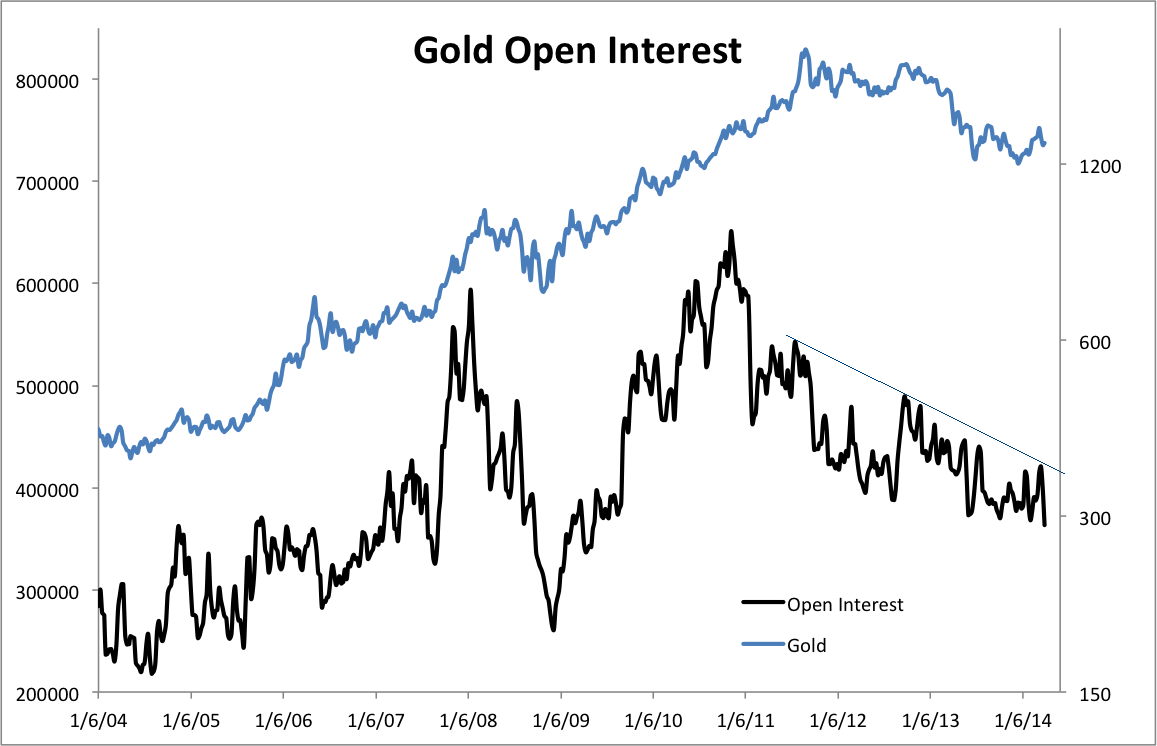

- Gold’s Open Interest Hits 5-Year Low

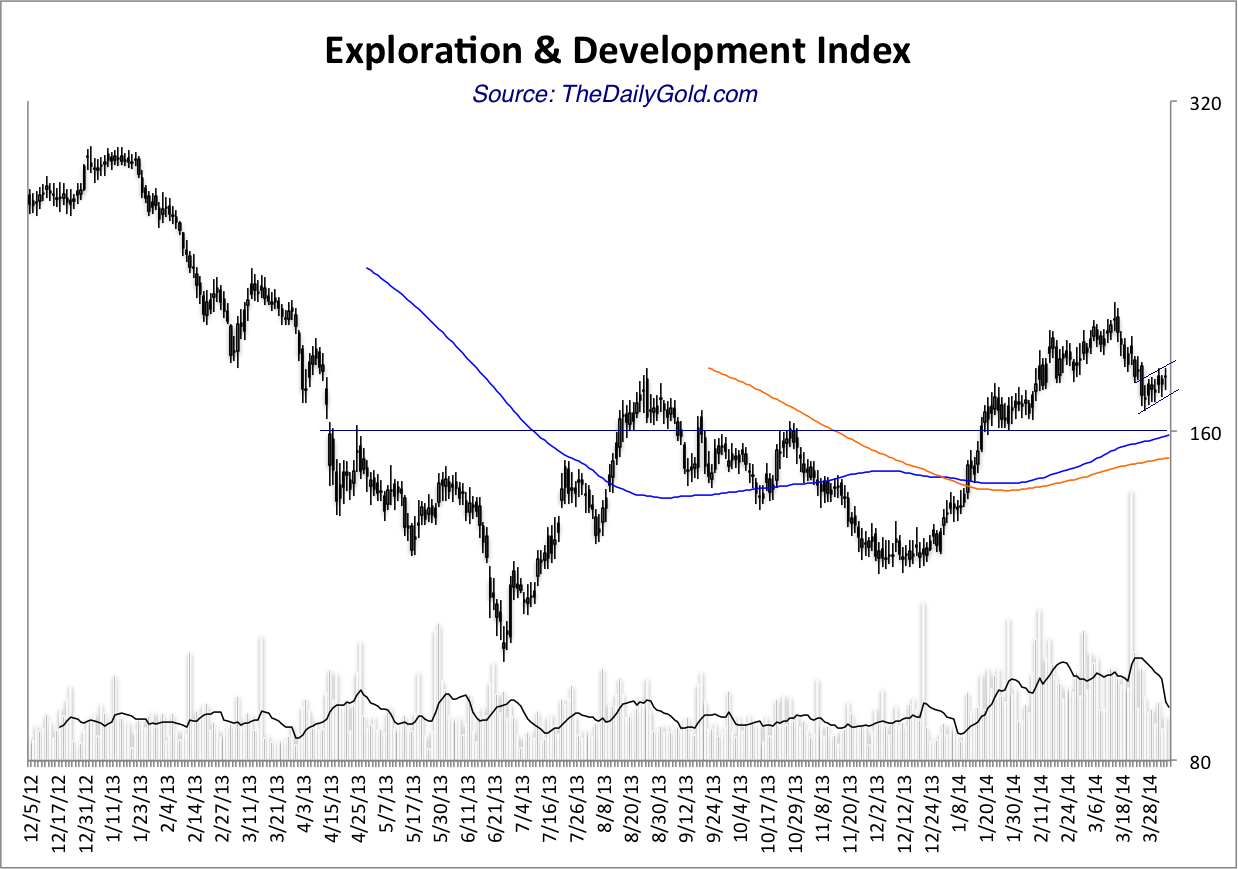

- Exploration & Development Index Update

- Predatory Equity: How Private Equity Came to New York’s Rental Market

| Silver price 'keen to rise' - Phillips Posted: 09 Apr 2014 01:24 PM PDT Gold is to consolidate, Julian Phillips says, and meantime monetary policy may have to be loosened in the EU. |

| Timmins gold Q1 production up 24% YoY Posted: 09 Apr 2014 12:06 PM PDT Timmins Gold outlined strong quarterly results in its latest production update. |

| Welcome to the Currency War, Part 15: Europeans Ordered to Start Consuming Posted: 09 Apr 2014 11:03 AM PDT For the past couple of years the European Central Bank has been the only sane inmate in the asylum. Unfortunately, in a crazy world being sane just gets you into trouble. Sound monetary policy leads to a strong currency, which in a currency war is tantamount to unilateral disarmament. Unable to export sufficiently to a world of weak currencies, the eurozone is tipping into deflationary depression (with several members already there and unable to get out). So…

Some thoughts Not so long ago the idea of any central bank buying asset-backed bonds would have been seen as both dangerously experimental and as crossing a line into industrial policy, where the government intervenes in the marketplace to pick winners and losers. In the US case, the Fed buying mortgage-backed bonds is an explicit subsidy to housing and the banks that depend on it. The result: more Americans are buying homes they probably can’t afford and the big banks — because their too-big-to-fail status makes them in effect government-guaranteed entities which allows them to borrow at artificially-low rates — are taking an even-bigger share of the mortgage business. In no rational world could this be seen as a proper or wise use of taxpayer resources. In Europe the effect will be similar, with central bank asset-backed bond purchases subsidizing the big banks that originate and package the loans. That the European ABS market is currently small means that the ECB will be explicitly directing its citizens to borrow more money from banks, which will then package those loans into bonds and, in effect, sell those bonds to taxpayers (the people who were directed to borrow the money in the first place). Again, in no rational world is this logical or sound policy. And yet this is how the currency war is being fought. The euro is too high due to Europe’s excessive debt and the ECB’s previous reluctance to inflate those debts away. This is pushing the Continent’s worst-run countries (of which there are many) into a deflationary spiral from which they can’t escape with the euro worth $1.35. So from the point of view of politicians who want to be reelected, the only solution is a cheaper currency achieved via a much higher money supply, which in turn is achieved by encouraging the banking system to write more loans. Nothing about this is new, other than the entities making the policy mistakes. If the ECB succeeds in pushing the euro down to, say, $0.90, then France, Italy and Spain will stabilize while failed US states like California and Illinois implode. And the focus will shift back to the dollar, leading to a new round of Federal Reserve QE, and so on. With each iteration the total amount of global debt will rise, making the required monetization and market manipulation that much more extreme, until, finally, the major economies realize that the only kind of devaluation that sticks will be against gold. I’ll go out on a limb and predict that well before the end of this decade a new monetary regime will be announced in which all the major currencies are linked to gold at an exchange rate equivalent to $10,000/oz. Everyone with fiat currency savings will lose 80% of their purchasing power, while everyone with hard asset savings will see a commensurate increase in real wealth. Assuming, of course, that governments allow this wealth transfer to take place. By the time monetary panic makes a new gold standard conceivable, lots of other things, like wealth taxes and asset confiscations, will also be on the table. So buying hard assets is just the first, easiest step. Keeping them will take a lot more thought and planning. |

| Deposit Insurance System Will Increase Physical Gold Demand in China Posted: 09 Apr 2014 10:40 AM PDT

As Western economies become more and more policy and stimulus driven, socialist China is becoming more market driven, preparing to withdraw official support and let defaults occur to clean up malinvestments and unviable businesses. The first corporate bond default in history happened past February (2014). Efforts to carefully move towards market driven mechanisms are introduced to [...] The post Deposit Insurance System Will Increase Physical Gold Demand in China appeared first on Silver Doctors. |

| Posted: 09 Apr 2014 10:34 AM PDT

|

| Centamin Q1 gold output disappoints Posted: 09 Apr 2014 10:26 AM PDT Centamin gold production falls in Q1 due primarily to technical problems, since corrected, in its u/g operations, but still maintains full year gold output guidance of 420,000 ounces |

| GBP/USD - Steady Ahead Of Fed Minutes Posted: 09 Apr 2014 10:12 AM PDT By Kenny Fisher The US dollar sustained sharp losses against the pound on Tuesday, but is steady in Wednesday trading. The currency is trading in the mid-1.67 range in the North American session. On the release front, British Trade Balance showed improvement in March and beat the estimate. In the US, today's highlight is the release of the minutes of the Federal Reserve's last policy meeting. We could see some movement from the pair following the release. The UK trade deficit narrowed in March, dropping to -9.1 billion pounds. This was a strong improvement from the previous release of -9.8 billion, and beat the estimate of -9.3 billion. On Tuesday, the pound posted sharp gains on Tuesday, bolstered by an excellent reading from Manufacturing Production. The indicator gained 1.0%, easily surpassing the estimate of 0.3%. There was more good news, as NIESR GDP Estimate improved to 0.9%, after two straight |

| PFGBest SpongeBob SquarePants silver coins will not be stored in a pineapple under the sea Posted: 09 Apr 2014 10:07 AM PDT Silver collectable coins struck with the image of cartoon character SpongeBob SquarePants will be destroyed by this weekend. |

| James Altucher: The ultimate cheat sheet for investing your money Posted: 09 Apr 2014 10:04 AM PDT In the history of capitalism, this is the hardest time ever to invest. People are going broke, losing their jobs, and fear more than greed rules the news and tries to rule thoughts. In short: people are scared. And I do think the uncertainty is going to rise quickly, so I wanted to put this note together. In 2001 and 2002, I lost all my money through bad investing. The same thing happened to me on a couple of occasions after that. So why should anyone listen to me about investing? You shouldn't. You shouldn't listen to anyone at all about investing. This is your hard-earned money. Don't blow it by listening to an idiot like me. Here's my experience (and perhaps I've learned the hard way about what NOT to do and a little bit about what TO do). I've run a hedge fund that was successful. I ran a fund of hedge funds, which means I've probably analyzed the track records and strategies of about 1,000 different hedge funds. I've been a venture capitalist and a successful angel investor (I was a HORRIBLE venture capitalist though - but I put that under the category of "does not work well with others"). I can't raise money anymore. Nor do I want to play that game. I don't BS about my losses and everyone else does. So I'm not in that business anymore. It's too much work to run a fund anyway. In the past 15 years, I've tried every investing strategy out there. I honestly can't think of a strategy I haven't experimented with. I've also written software to trade the markets automatically and I did very well with that. And I've written several books on my experiences investing, with topics ranging from automatic investing to Warren Buffett, to hedge funds, to long-term investing (my worse-selling book, "The Forever Portfolio", which has sold 399 copies since it came out in December 2008, including one copy for the entire last quarter). Incidentally, why publish a book called "The Forever Portfolio" during the worst financial crisis in history? I begged my publisher (Penguin) to postpone but they couldn't. "It's in the schedule" was their magic incantation. Publishers largely suck. The good news is: they will never make back the advance. That said, all of the picks in that book have done excellently since then, but the one thing I am proud of is that I made a crossword puzzle for the book. I don't know of any other investing book with a crossword puzzle in it. So, Ok! Let's get started. Don't follow any of my advice. This is advice that I do and follow and it works for me. A.) SHOULD I DAYTRADE? Only if you are also willing to take all of your money, rip it into tiny pieces, make cupcakes with one piece of money inside each cupcake and then eat all of the cupcakes. Then you will get sick, and eat all of your money, but it will taste thrilling along the way. Which is what daytrading is. B.) I DON'T BELIEVE YOU. MANY PEOPLE DAYTRADE FOR A LIVING. No. I personally know of two. Maybe three. And they work 24 hours a day at it and have been doing it for a decade or more. So unless you want to put in that amount of time and be willing to lose a lot first, then you shouldn't do it. One more thing: when you daytrade and lose money it's not like a job. When you go into a job you NEVER lose money. If you show up for two weeks, you get paid. Even if you have been warned repeatedly about sexual harassment you still get paid. You might get fired but they won't take your money. The stock market TAKES your money on bad days. Sometimes it takes a lot of your money. We're not used to the brutality of that and it can destroy a person psychologically, which makes one (me) trade even worse. C.) WELL, WHO MAKES MONEY IN THE MARKET THEN? Three types of people:

I've seen it for 20 years. I've seen every scam. I can write a history of scams in the past 20 years. Without describing them, here's the history: Reg S, Calendar trading, Mutual fund timing, Death spirals, Front running, Pump and Dump, manipulating illiquid stocks, Ponzi schemes, and inside information. Inside information has always existed and always will exist. One time I wanted to raise money for one of my funds. I went to visit my neighbor's boss. The boss had been returning a solid 12% per year for 20 years. Everyone wanted to know how he did it. "Get some info while you are there," a friend of mine in the business said when he heard I was visiting my neighbor's boss. The boss said to me, "I'm sorry, James. We like you and if you want to work here, then that would be great. But we have no idea what you would be doing with the money. And here at Bernard Madoff Securities, reputation is everything." So I didn't raise money from Bernie Madoff although he wanted me to work there. Later, the same friend who wanted me to get "info" and "figure out how he does it" said to me: "We knew all along he was a crook." Which is another thing common on Wall Street. Everybody knows everything in retrospect, and nobody ever admits they were wrong. Show me a Wall Street pundit who says "I was wrong" and I'll show you... I don't know... something graphic and horrible and impossible [fill in blank]. D.) So how can one make money in the market? I told you about: #1. Pick some stocks and hold them forever. E.) What stocks should I hold? Warren Buffett has some advice on this (and I know because I wrote THE book about him. A friend of mine who knows him, told me my book was the only book that Buffett thought was accurate about him). He says, "If you think a company will be around 20 years from now, then it is probably a good buy right now." I would add to that, based on what Warren does. It seems to me he has five criteria:

With Coke, Buffett knew that everyone in the world would be drinking sugared water before long. Who can resist? He also started buying furniture companies right before the housing boom. He knew that as the population in the U.S. grows, people will need chairs to sit on. Note that Buffett is not what some people call a "value investor." But I won't get into that discussion here. F.) WHAT ELSE? One time I accidentally got an email that was intended for a famous well-known investor. It was from his broker and contained his portfolio. I can't say how this accident happened, but it did. Of course, I opened the email. This is a man who writes about lots of stocks. His entire portfolio was in municipal bonds. I don't know whether or not municipal bonds are good investments. But I would look into stocks that are called "closed-end funds" that invest only in municipal bonds. They usually pay good dividends, usually trade for less than their cash or assets in the bank, and are fairly stable (it's very hard for a municipality to not pay back its debts for various reasons, some of them constitutional). But do a lot of research into the towns. I'll tell you one story. I had an idea for a fund in 2008 when oil was crashing at the end of the year. Stocks/funds that invested in municipal bonds in Texas were getting destroyed. Somehow, because oil was going down, everyone naturally assumed that Texas was going to simply disappear. I researched every municipal bond out there and found a good set of Texan cities that were being sold off with everyone else even though they had nothing to do with oil. I pitched it to a huge investor who had told me he wanted to back me on any idea I could come up with. He loved the idea. He loved it so much he told me, "You're too late. We already have about $500 million in this strategy and we bought the very stocks you are recommending." They went up over 100% in the next six months while the world was still in financial collapse. So he made a lot of money. As for me, I didn't put a dime into my own strategy and made nothing. G.) SHOULD I PUT ALL OF MY MONEY IN STOCKS? No, because you'll never know anything about a company and you won't get the kind of deals that Warren Buffett gets. So use these guidelines:

G, PART 2.) WHAT IF WE ARE IN A BUBBLE? Bubbles don't mean anything. We had an internet bubble in the 90s. Then a housing bubble. Bubbles, bubbles, bubbles. And if you just held through all of that, your stock portfolio would have been at an all-time high last Friday. So ignore cycles and bubbles and ups and downs. And NEVER, EVER read the news. The news has no idea about the financial world and what makes it tick. Any investing off the news is like taking out your eyes because you trust a blind person to drive you to work. H.) MY FRIEND HAS A BUSINESS IDEA. SHOULD I INVEST IN IT? Probably not. But if you want a checklist, make sure these four boxes can be checked:

I can say this: Every time I have invested with this approach, it's worked miracles. And every time I have not invested in this approach, it's been a DISASTER. Claudia doesn't let me invest in a private company unless all four items on my checklist apply. Which is important because I tend to believe everything people tell me. So I'm happy to invest in a time portal black hole machine. I.) WHAT DO YOU THINK OF BITCOIN? I think bitcoin has about a 1 in 100 chance of being a survivor. So I have 1% of my portfolio in bitcoin. J.) WHAT ABOUT METALS AS A HEDGE AGAINST INFLATION? No, they have zero correlation with inflation. The best hedge against inflation is the U.S. stock market since about 60% of revenues of the S&P 500 come from foreign countries. K.) WHAT ABOUT METALS LIKE GOLD? DON'T THEY HAVE INTRINSIC VALUE? The only currency in the history of mankind that had actual intrinsic value was when people traded barley in the markets of the ancient city of Ur. Since then, we've developed currencies that we had to have faith in their value. Every currency has faith and hope backing it. When people began to lose faith in U.S. currency (in the Civil War), the words "In God We Trust" were put on the dollar bill to trick people into having faith in it. But if you're going to pick a metal, wait until the gold/silver ratio gets higher than it's historical average and buy silver. How come? Because silver is both a precious metal (like gold) and an industrial metal (also like gold, but much, much cheaper). So there actually is some intrinsic value in silver. I bought some silver bars back in 2005. But then lost them when I moved. That's why nobody should listen to me about investing. L.) WHAT ABOUT MUTUAL FUNDS? No. Mutual funds, and the bank representatives that push them, consistently lie about the fees they are charging. I know this from experience. One time I accompanied a friend of mine who had made some money (she was a model and had a good run for awhile) and was looking to invest it. She asked me to go with her to see her bank representative who had some "ideas." Because she was beautiful, I went with her to the bank. I didn't talk at all during the meeting, but jotted down every time the bank guy lied. He lied five times. Afterwards I explained each of the lies to her. What happened? She put all her money with the guy. "He's practically family." I can't argue with a good salesman. But he lied about the mutual funds' performance that he was pitching, the fees they were charging, the commissions he was charging, and a few more I can't remember now. I wrote an article about it in the Financial Times back then. Fact: Mutual funds don't outperform the general market, so better to invest in the general market without paying the extra layer of fees. Use the criteria I describe above, pick 20 companies, and invest. M.) WHAT ARE SOME GOOD DEMOGRAPHIC TRENDS?

N.) IS A HOUSE A GOOD INVESTMENT? Everyone will disagree with me on this, but the answer is an emphatic "NO!" It has all the qualities of a horrible investment: a) Constant extra layers of fees and taxes that never go away (maintenance, property taxes, etc. that all rise with inflation). b) Usually housing is too-large a percentage of someone's portfolio. Even just the down-payment ends up being the largest expense of someone's life. c) Usually massive debt is involved. If you can avoid, "a," "b," and "c," and don't mind the opportunity cost in the time required to maintain your house, then go for it. Else, rent, and use the money you saved for other investments that will be less stressful and pay off more. Fact: Housing has returned 0.2% per year in the past 100 years. O.) IF NO HOUSING AND ONLY 30% OF MY PORTFOLIO IN STOCKS, THEN WHAT SHOULD I DO WITH THE REST OF MY MONEY? Why are you in such a rush to put all of your money to work? Relax! Don't do it! There's a saying "cash is king" for a reason. I will even say "cash is queen" because on the chessboard the king is just a figurehead and the queen is the most valuable piece. Cash is a beautiful thing to have. You can pay for all of your basic needs with it. You can sleep at night knowing there is cash in the bank. I love a stress-free life. When I look back at the past 15 years, the times when I've been most stressed are when I've been heavily invested and the times when I've been least stressed is when I had cash in the bank. With cash in the bank you, can also invest in yourself. P.) WHAT DOES THAT MEAN, "INVEST IN MYSELF?"

Q.) SHOULD I SAVE MONEY WITH EACH PAYCHECK? No. Just try to make more money. That is easier than saving money. I find that whenever I try to save money I end up spending more. I don't know why that is. I'm a horrible spender, which is probably why I've gone broke so many times. Better to just make more with many streams of income so you don't have to worry about going broke. And then saving will come naturally as you make more money. Don't forget that a salary will never make you money. After taxes and the daily grind, and your exhaustion and the feelings of "I hate my job," and then inflation and then new expenses (kids), you will never be able to save. Avoiding Starbucks every day won't make you a millionaire, that's a fact. I say it glibly, "Try to make more money." I know it's not that easy. But in the long run, if you have a constant focus on alternative ways to make more money, then you will. R.) WHAT ELSE SHOULD I DO WITH MY MONEY? Forget about it. Money is just a side effect of health. I talk a lot about "The Daily Practice" I started doing when I was at my lowest point. I know now after years of doing it that it has worked. I've done very well with it, and I started doing it when I was dead broke, lonely, angry, depressed, and suicidal. I didn't start it from a position of privilege. And you don't have to buy my book. I'm not selling anything. Here's the whole thing: Stay physically healthy in whatever way you know how (sleep well, eat well, exercise). Be around good people who love you and respect you and who you love and respect, and be grateful every day. Think of new things each day (or all day) to be grateful for. "Gratitude" is another word for "abundance," because the things you are most grateful for, become abundant in your life. And finally, write down 10-20 bad ideas a day. Or good ideas. It doesn't matter. After exercising my idea muscle for six months, I felt like an idea machine. It was like a super power that just wouldn't stop. More on this in another post. Money and abundance in your life is a natural side effect of the above. I know this for myself, but now since writing about it for almost four years, I can tell you from the letters I get that it works for others. S.) WHAT'S IN IT FOR YOU? I don't know. I used to write about money stuff because I wanted investors, or I wanted to sell books, or get speaking engagements. Now I want none of that. But I get worried that in a world of increasing economic uncertainty, more and more people are getting "stuck" and are scared about what is happening. Too many people I know are nervous and depressed. There's nothing else to know about investing your money. If your bank tries to give you any advice just say, "Thanks, but I'm ok." If they want you to put your money in a savings account "so you can get the interest," I would politely decline. There's a reason they are asking you to do this, and I have no idea what it is but it's not good for you. You won't get rich investing your money, but you can do very well. And if you combine that with investing in yourself, you will get wealthy. But only if you remember that financial wealth is a side effect of real inner wealth. This is the most powerful investment you can do with your time and your life. You can always make money back when you've lost it. But one single split moment of stress and anxiety you will NEVER make back again. Investing in the future will never bring back the past. To be able to sit and not have a million stressful thoughts racing through your head. To be able to appreciate everything around you for the abundance it is. Most people think they need to say "thank you" to the world. But the world is constantly saying "thank you" to you for being alive, for creating new things, new energies, new experiences. Every day, give the world at least one more reason to whisper "thank you" to you. If you can hear that whisper, everything else, every gift in life, becomes expected. You earned it. Just take it. Crux note |

| Buy Side Expects Family Dollar Earnings Hiccup Posted: 09 Apr 2014 10:02 AM PDT Family Dollar Stores Inc. (FDO) is set to report FQ2 2014 earnings before the market opens on Thursday, April 10th. Family Dollar Stores is a discount retailer that now operates over 8,000 stores. Recently Family Dollar announced that it will be adding 400 new food items and slashing prices on nearly 1,000 products. Over the past two years Family Dollar has reported year over year growth in EPS and revenue 6 and 8 times, respectively. This quarter both profit and revenue are expected to fall below last year's numbers as retailers continue to face a challenging period due to the poor weather. Here's what investors expect from FDO Thursday. The information below is derived from data submitted to the Estimize.com platform by a set of Buy Side and Independent analyst contributors. (click to enlarge) (Click Here to see Estimates and Interactive Features for Family Dollar Stores) The current |

| AUD/USD - Aussie At 5 Month Highs After Strong Data Posted: 09 Apr 2014 09:58 AM PDT By Kenny Fisher AUD/USD continues to push upwards, as the pair trades in the mid-0.93 level. The Aussie has gained over 100 pips since Monday, as the currency trades at five-month highs against the US dollar. In economic news, Home Loans and Consumer Sentiment showed significant improvement in March. Australian data looked sharp on Wednesday. Westpac Consumer Sentiment came in at 0.3%, its first gain since October. Home Loans followed suit, jumping 2.3%, well above the estimate of 1.7%. This was the best showing from the housing indicator in five months. The strong data boosted the Aussie, which finds itself within striking distance of the 0.94 level. The Federal Reserve will be front stage and center on Wednesday, as the markets await the releases of the minutes of its most recent policy meeting. Last week, Fed chair Janet Yellen sounded dovish in her outlook on the US economy, saying that |

| Have We Reached Peak Wall Street? Posted: 09 Apr 2014 09:15 AM PDT

The U.S. dollar's status as a reserve currency is a key component of U.S. global dominance. Were the dollar to be devalued by Fed/Wall Street policies to the point that it lost its reserve status, the damage to American influence and wealth would be irreversible. What if Wall Street is Recognized as a Strategic Threat [...] The post Have We Reached Peak Wall Street? appeared first on Silver Doctors. |

| Jim Willie: US Dollar to be Reduced to the Dustbin of History Posted: 09 Apr 2014 09:01 AM PDT

In this MUST LISTEN interview, Jim Willie discusses: 1. The Ukraine turmoil and Russia and China's coordinated Financial and Commercial Response to the threats of the West led by the US 2. Though most of the Non-Western world is backing Russia, there are 3 countries in particular that will play a key supporting role in [...] The post Jim Willie: US Dollar to be Reduced to the Dustbin of History appeared first on Silver Doctors. |

| Fed to the Sharks, Part 2: Housing and the Death of the Middle Class Posted: 09 Apr 2014 08:02 AM PDT The Fed sacrificed the foundation of middle class wealth–stable housing values–to boost bank profits. Lest you think the phrase “death of the middle class” is hyperbole, please examine these two charts, keeping in mind the middle class by definition must be in the middle of income/wealth distribution–conventionally, between 40% and 80%, i.e. the 40% between the bottom 40% and the top 20%. See that little red wedge? That’s the bottom 80%–the entire middle class and everyone below the middle class.

Here’s another look at the wealth distribution: the middle class’s share of wealth is modest, unless you define the top slice of households just below the top 1% as “middle class.” But since the top 19% cannot be in the “middle,” attempting to boost the wealth of the middle class by including the wealthy is truly Orwellian.

Why has the middle class eroded? We can start by looking at income. As noted yesterday in Fed to the Sharks, Part 1, household income for the bottom 90% has stagnated for 40 years. The next chart shows how financialization boosted asset valuations in waves of boom and bust. Some of the first two waves of financialization leaked into wages, but the Fed’s bubble-blowing since 2009 has failed miserably to increase incomes: disposable income fell off a cliff in 2009 and has continued falling, despite the Fed’s blowing new bubbles in bonds, stocks and housing.

So what does the Fed have to do with the death of the middle class? As noted inWhat’s the Primary Cause of Wealth Inequality? Financialization (March 24, 2014), the short answer is when investment returns exceed economic growth, the rich get richer, increasing inequality. And when do investment returns exceed economic growth? When the Federal Reserve makes credit very cheap for financiers and speculators, which drives up asset prices as everyone with access to cheap credit bids up assets. Low interest rates and free-flowing credit inflate bubbles. We can discern an implicit agenda in the Fed’s policy of making credit cheap and abundant: since income for the bottom 90% is stagnating, the only way to boost consumption and debt is to inflate an asset owned by middle class households: housing. Unfortunately, credit-driven speculative bubbles inevitably burst and housing valuations crashed.

The Fed responded to the housing crash with an unprecedented policy of buying over $1 trillion in home mortgages (mortgage-backed securities), roughly 10% of all existing mortgages in the U.S. In conjunction with the Fed’s other policies (purchasing Treasury bonds and relaxing banking rules) and the opening of the loose-lending FHA spigots, housing recovered nicely–until the Fed slackened the pace of its purchases of bonds and mortgages. Housing immediately began trending down. In response, the Fed restarted buying Treasuries and mortgages in enormous quantities. And sure enough, housing recovered.

But asset bubbles do not replace income or savings. The only way to benefit from bubbles in housing is to trade: buy in at the bottom and sell out at the top. In essence, the Fed’s bubble-blowing forced every homeowner into becoming a speculator. There’s another agenda at work of course: increasing debt and bank profits derived from debt. What better way to insure banking profits than to spark a speculative bubble in the core asset of the middle class–housing. Rising prices created temporary (and enticing) home equity that could be tapped with a loan (HELOCs–home equity line of credit), and the temptation to selling out and moving up the food chain to a bigger home and bigger mortgage was equally compelling. Even better, banks and Wall Street had perfected the securitization of once-safe home mortgages. Banks had no need to take on the risk of holding mortgages–the big money was in originating the mortgages, packaging them into securities and selling the tranches to investors. The much-ballyhooed “ownership society” turned out to be ownership of debt, not equity. Debt is profitable for banks; people owning homes free and clear is not. In effect, the Fed sacrificed the foundation of middle class wealth–stable housing values–to boost bank profits. Take a look at what happened to financial profits in the 2002-2007 housing bubble: they skyrocketed to new heights. And look what happened when housing and the banks’ securitization scams blew up: financial profits completely collapsed.

Middle class wealth was Fed to the sharks. As the current housing bubble deflates, the investor-buyers who fueled the rally are exiting en masse: what’s the value of an asset when the bid vanishes, i.e. there’s nobody left who’s willing to pay today’s prices? The Fed has failed to restore middle class wealth with its latest housing bubble,and the costs of the bubble’s collapse will fall not on the Fed but on those who believed the recovery was more than Fed manipulation. |

| The Insanity Of U.S. Energy Independence & Cracks Beginning To Appear In The Natural Gas Industry Posted: 09 Apr 2014 08:00 AM PDT

The notion of future U.S. Energy Independence will seriously disappoint the market and American public. This strategy of energy independence put forth by the energy industry and U.S. Govt may buy some time for our anemic economy and the U.S. Dollar, but will back-fire in a big way when overall oil and gas production declines [...] The post The Insanity Of U.S. Energy Independence & Cracks Beginning To Appear In The Natural Gas Industry appeared first on Silver Doctors. |

| DGCX volumes cross three million contracts in Q1 Posted: 09 Apr 2014 07:42 AM PDT Dubai Gold & Commodities Exchange (DGCX) total volumes in March increased 2% from the previous month to aggregate 1,023,410 contracts, valued at USD 30.15 billion. The growth in March enabled the Exchange's first quarter volumes to cross three million contracts. |

| China 'has more gold than official figures show' Posted: 09 Apr 2014 07:22 AM PDT Precious metals researcher says the quantity of vaulted gold in China is rising steadily This posting includes an audio/video/photo media file: Download Now |

| Stewart Thomson: Indian National Election is the Most Bullish Event for Gold in Past 100 Years! Posted: 09 Apr 2014 07:00 AM PDT

The Indian nation election is arguably the most bullish event for gold of the past 100 years. That election began yesterday. It's the world's largest national election, so it's a long process. The results should be released around May 16. Other than a bullet or vote counting fraud, I don't think anything can stop Narendra [...] The post Stewart Thomson: Indian National Election is the Most Bullish Event for Gold in Past 100 Years! appeared first on Silver Doctors. |

| Posted: 09 Apr 2014 07:00 AM PDT

A group of Lower House MPs are urging Russian oil and gas producers and traders to stop using the US dollar. They say this means sharing profits with the USA, and making Russia vulnerable to western sanctions. "The dollar is evil. It is a dirty green paper stained with blood of hundreds of thousands of [...] The post Russian MPs Call for End of Petro-Dollar: “The Dollar is Evil – Dirty Green Paper Stained with Blood” appeared first on Silver Doctors. |

| Gold and Oil Rise As U.S. - Russia Relations Deteriorate Sharply Posted: 09 Apr 2014 06:32 AM PDT gold.ie |

| Posted: 09 Apr 2014 06:26 AM PDT Gold rose $12.30 or 0.95% yesterday to $1,308.80/oz. Silver gained $0.13 or 0.65% to $20.01/oz. |

| Who will reverse ban on gold imports? Posted: 09 Apr 2014 06:19 AM PDT According to the Forex Association of Pakistan, the rupee strengthens against dollar in ongoing trade. |

| 100 oz Silver OPM Bars Only 49 Cents Over Spot, ANY QTY! Posted: 09 Apr 2014 06:00 AM PDT

Fed Minutes Blowout: 100 oz Silver OPM Bars 49 Cents Over Spot ANY QTY at SDBullion! Click or call 800-294-8732 to place your order! The post 100 oz Silver OPM Bars Only 49 Cents Over Spot, ANY QTY! appeared first on Silver Doctors. |

| Turkey Mar Gold imports down 88.91% Silver up 138.13% Posted: 09 Apr 2014 05:15 AM PDT Turkey imported 14.741,67 tons of silver in March alone, a rise of 138.13% from 6.190,42 tons in the same month last year. |

| Gold and Oil Rise As U.S. – Russia Relations Deteriorate Sharply Posted: 09 Apr 2014 04:35 AM PDT Symbolism is important and Putin may be sending the U.S. a message in the aftermath of JPMorgan unilaterally deciding to block an official Russian wire transfer, regarding how they might use gold as geopolitical weapon should economic and currency wars deepen. Today’s AM fix was USD 1,309.75, EUR 949.92 & GBP 782.74 per ounce. Gold rose $12.30 or 0.95% yesterday to $1,308.80/oz. Silver gained $0.13 or 0.65% to $20.01/oz.

Russia and the U.S. are on a collision course after tensions flared anew in Ukraine, which is supporting gold. Russian forces are deployed on the border and the U.S. says they're concerned that Russia may be planning further incursions into eastern Ukraine after annexing Crimea. The Russian government said Ukraine's crackdown on separatists in the east risks sparking civil war. U.S. Secretary of State John Kerry accused Russia of using "special forces and agents" to spark unrest, as Ukrainian authorities sent security forces to Kharkiv to try to rid the country's second biggest city of separatists. In Luhansk, 330 kilometers southeast of Kharkiv, pro-Russian protesters who seized a building of Ukraine's state security service took hostages, planted mines and made threats with explosives and weapons, according to the Ukrainian security forces. Early today, they said that talks led to the release of 51 hostages without violence or injuries.

Geopolitical unrest has prompted investors to buy oil and gold which rose overnight. Gold climbed to the highest price in almost two weeks while crude oil also rose. Kerry said yesterday that additional sanctions targeting Russia's energy, banking and mining industry are "all on the table" if Russia intervenes further in Ukraine. North Atlantic Treaty Organization (NATO) Secretary General Anders Fogh Rasmussen said that any further Russian move into Ukraine "would be an historic mistake" and "a serious escalation." He warned that "it's obvious that the evolving security situation in Ukraine makes it necessary to review our defense plans." Russia has as many as 40,000 soldiers stationed along the frontier, according to the U.S. and NATO. Putin says they are conducting military exercises and will withdraw soon.

According to reports in Russia's RIA Novosti, Bank Rossiya, has introduced a new logo which is a gold ruble. Officials stated that the new logo, the golden badge of the Russian national currency will be officially adopted by Bank Rossiya. It will symbolize a sign of stability and security of the ruble gold reserves of the country. Bank Rossiya has decided to work exclusively with the national currency, to cease foreign currency operations in response to U.S. sanctions imposed last week according to Reuters. The golden logo is a symbol which will symbolize the rouble's stability and its backing by the country's gold reserves, the bank explained to Itar-Tass. Symbolism is important and Putin may be sending the U.S. a message in the aftermath of JPMorgan unilaterally deciding to block an official Russian wire transfer, regarding how they might use gold as geopolitical weapon should economic and currency wars deepen. |

| Gold trades near two-week high as investors await Fed minutes Posted: 09 Apr 2014 04:29 AM PDT Gold is trading higher as traders wait on clues on the outlook for U.S. monetary policy. |

| Gold futures hit a 12-month high on the Dubai Gold and Commodities Exchange Posted: 09 Apr 2014 04:15 AM PDT Gold futures volume on the Dubai Gold & Commodities Exchange surged 32 per cent in March from the same month last year to record its highest monthly volume in 12 months. The contract’s exceptional performance saw DGCX’s precious metals segment registering year-on-year growth of 38 per cent. Total volumes in March increased two per cent from the previous month to aggregate 1,023,410 contracts, valued at $30 billion. The growth in March enabled the Exchange’s first quarter volumes to cross three million contracts. Dubai’s growing gold trade Gary Anderson, CEO of DGCX said: ‘The surge in Gold futures volume reflects the steadily increasing interest the contract has seen from global traders over the last few years. The Exchange’s flagship contract provides an effective hedging mechanism that is particularly valuable to gold markets in Asian hubs like Singapore, which have substantial gold trading links with Dubai. ‘We will also launch a spot gold contract in June this year which will complement our existing gold futures to create a larger gold ecosystem in Dubai. Once launched, we believe the DGCX Spot Gold contract will add significant value to local physical market participants since it fills the gap for a physically delivered contract.’ Among other contracts, copper futures registered 3,435 contracts while silver futures traded 4,087 contracts. Growth highlights in the currency segment included euro futures, which rose by 66 per cent, and Indian rupee mini and yen futures that grew by two and three per cent respectively from the previous month. DGCX’s newest contract, Plastics futures, traded 1,950 contracts in March. Energy too In the Exchange’s energy segment, DGCX WTI futures contract was the key driver, with a year-on-year increase of 114 per cent. Both euro and Indian rupee mini futures recorded their second highest average daily open interest of 1,806 and 6,016 contracts respectively in March 2014. The DGCX is the only derivatives exchange in the Middle East. The 267-member exchange was stablished in 2005and is majority owned by Dubai Multi Commodities Centre. It’s clearly capitalizing on Dubai’s growing role in the regional commodities business with 40 per cent of the world’s gold traded through the city last year and a leading role in global diamond trading. The DMCC is the fastest growing free zone in the city with 89,000 employees, way ahead of the Dubai International Financial Centre at 15,000, although they launched around the same time. |

| Posted: 09 Apr 2014 04:15 AM PDT This article analyzes gold's current basing phase and discusses the right signals for buying back in. |

| Gold price trades back above 55DMA ahead of Fed minutes Posted: 09 Apr 2014 04:12 AM PDT |

| Why I REALLY moved to Puerto Rico... and you should, too Posted: 09 Apr 2014 04:00 AM PDT By Alex Daley, Chief Technology Investment Strategist, Casey Research: Much fuss was made yesterday when my colleague Nick Giambruno released a report outlining the incredible tax benefits to be had, by Americans no less (the only people in the world to be taxed back home even when we leave), in Puerto Rico. As you may have seen, that report was based in large part on my personal experience relocating to the island, a process I started in earnest last October. And, yes, I am here, writing you at this moment from beautiful Palmas Del Mar – if you ask me, the most beautiful piece of coastland on the island, but only just being rediscovered after a long hiatus from the spotlight. What can I say, I love a comeback story, especially when it looks like this…

Yes, my decision to move to Puerto Rico was influenced by the tax incentives. But they were only one contributing factor. Why I chose to land in Puerto Rico is much more nuanced than that. It all boils down to one thing: Opportunity. Everyone likes to save on taxes. That's a given. But if I've learned one thing in my short business life thus far: it's that it's always better to make $4 than to save $2. No disparagement intended to Ben Franklin, but a penny saved is not a penny earned. Not if, in the time and effort saving it took, you could've created two or four or eight more pennies for yourself. I'm here in Puerto Rico because I believe it will provide me with the opportunity to make many more pennies. Here's why. Infrastructure and Convenience Unlike many other low-tax jurisdictions, Puerto Rico is in the unique position of having been a U.S. territory for a century now. That means all sorts of things, from familiar legal systems to easy travel. But one of the most surprising implications is that U.S. companies and even certain U.S. government agencies have a presence down here. My town is a few miles down the road from the world's fourth-busiest Walmart. There is a Costco here. Closer, in fact, than the one we had in Vermont. There's also a Cartier – I'm not much of a jewelry buyer, but you get my point. Many if not most of the conveniences of the U.S. are to be had here. And the same goes for far more than shopping. The highways across the island are much like in the U.S., including, unfortunately, the traffic into and out of the big city. But I'll take that any day over the frightening, windy back roads that litter Jamaica, Grenada, St. Kitts, the Caymans, and many of the other places considered before settling on this place. And gas here is just a tiny fraction more expensive than back in the States. Of course, roads rarely matter for me since I work from home, where my simple Internet connection is at least 10 times faster than the one in the office in Vermont – courtesy of Liberty cable. My cell phone, on AT&T, works much better here too. What's not the same here (they have the FBI, DEA, etc.) is at least comfortingly familiar (courts, MPH speed limits, and AutoExpreso, i.e., EZPass). But most importantly, it's fully developed. There's no grass hut customs office, no lack of a UPS store – the entire infrastructure needed to run a business well is here. We tend to lose power often, yes. A few times each month for a few hours at a time. And electricity rates are about twice as high as in the States, though we use so much less of it here without any need for heat and barely any for AC. Still, the power bill can be a drag. But not everything can be perfect, even when the weather is: 86 and sunny. All year. 'Nuff said.

Though my belly says differently, I like to exercise. I spent the last decade of my life split between some of the rainiest and snowiest locations in the US. And I hate gyms. Since coming here, I've lost 14 pounds and counting, just from getting outside to swim, walk, golf, and play tennis – activities that have been closed (to me) most of the year, and that apparently constitute enough caloric burn to make up for my awful, airport-heavy diet. I have more energy, I feel better. Many people are looking for that same lifestyle. Which, ironically, makes it far easier to recruit talent to the island than to many mainland destinations. I've already convinced a handful of people to make the move, and I'm not even actively hiring down here just yet – I'm waiting for some red tape to clear. If you're thinking of starting or expanding a business, think carefully about whether it will be easier to recruit people to the tax-free (state tax-free only, mind you) zone in Albany, NY, to the expensive and tiny island of St. John, or to a country bigger than Rhode Island or Delaware with year-round sunshine. But it's not like I need to recruit that many people here. There are already plenty here. Labor, Services, and Networking The other day, during one of those intermittent power outages, I took the opportunity to swing up to Sam's Club and pick up a few things – all commercial sites, and most high-end homes, have generators to cope. $400 worth of crap I didn't really need later, I was waiting in line at the checkout, as the obligatory pile of cash was counted out at the register in front of me (almost no one here uses bank accounts or credit cards, and it's part of their well-known fiscal troubles…). While waiting, I told my wife about my struggle finding qualified PHP developers. These are jobs that pay $40-50/hour, i.e., $60K to $100K/year, and way up from there. Yet it takes us months to hire for them. The woman behind me in line must have overheard our conversation, because she started asking me if I worked for Palmas and were we hiring – she'd applied a dozen times already. She, like many others here, was looking for work. The official unemployment rate is 15%. According to the CIA World Factbook, it's 26%. The median household income is also a relatively low $18,000/year. That's double most places in the Caribbean, but still quite low compared to the States. Looked at societally, that's bad. For a business operator, though, it has distinct advantages. Yes, with high unemployment comes crime. But the reputation this island has garnered in the States is undeserved. The crime rate in San Juan is about the same as in Baltimore, Detroit, Cleveland, or Atlanta. Any large city has crime-ridden areas. But like those cities, San Juan has wonderful neighborhoods too. And it's surrounded by some beautiful suburbs. Go into the country, like I did, and it's calm and quiet and borderline idyllic. Our community is triple gated (community, development, building), which garners comments from friends and family who visit. But it doesn't need to be. It reminds me of the much more unsightly seven-foot walls with razor wire and broken-glass tops in Spain's posher areas, which are 90% to convey status. Once you understand the small cultural differences, not moving here because of crime is like not moving to Missouri because of St. Louis, to Florida because of Miami, or to Tennessee because of Memphis. When you do go to hire, employment laws are close to the same here as in the States. They have Social Security, Medicare, and worker's comp. Workers from the mainland can come here without a visa (and vice versa). It's familiar, yet there is a big labor surplus holding down wages. I've been thinking about starting a call center down here – just searching for the right person to run it (I've got a job I love and don't need another one) – as it's an ideally suited location:

One of these days – hopefully soon – I'll find that call center operator who will work for sweat equity to get things off the ground, or the bootstrap customer to pay them. But the labor is there. And not just labor for lower-skilled work, either. The island has a very large skilled labor population, too, thanks to that high college degree rate. There are hundreds of law offices, accountants, engineers, and other professional firms. Investment banks, construction companies, you name it. The colleges here are strong in math and business. And virtually any service provider or knowledge worker you'd look for in any other major metropolitan area can be found here. I've even got investment bankers knocking on the door. Then there are the other entrepreneurs. One of the things that attracted me most to Puerto Rico wasn't the tax incentives themselves, but the idea of living near and collaborating with so many like-minded people. And that has proven as good as or better than I hoped. Between everyday social activities and organized mixers like the meetings of the "Act 20/22 Society," there has been a non-stop barrage of new people to meet, all of whom are as entrepreneurial as I am. Business ideas floated around dinner, hiring tips over golf, late-night real estate investment discussions, dozens of emails to share investment ideas – all just this week. The one thing that really stuck with me when I read Rich Dad, Poor Dad many years ago was the part that if you don't hang around with the kind of people who talk about money and how to make money, then you'll never learn how or find opportunities to make more of it. In life, I have always looked for those kinds of communities, and every place I've lived I've found small pockets of like-minded people. But here, it's like I just struck pay dirt. Ease of Starting and Operating a Business The same factors that make hiring in Puerto Rico easy, make starting a business simple here, too. I fully intend to learn Spanish – it's good for me and good for the kids. But I cannot be expected to do so in a matter of months, and certainly not as a prerequisite to doing business. Thankfully, that has not been an issue at all. All federal laws and forms are available in English, for one. Just about everyone you deal with in the business and government world speaks enough English to help you, and the majority, especially the younger population, speaks it very well. Unlike farther-flung Spanish-speaking countries like Belize and Panama, running into someone at the local government office who cannot speak enough English to help you rarely happens here, except far outside of the cities. When it does, there are lawyers and accountants everywhere to help. LLCs, partnerships, corporations, and all that other stuff is effectively the same here as in the U.S. Payroll services can be had from U.S. companies like ADP or from local ones. Same with insurance for your business, cars, health, and more. Banks are a little slower than in the U.S., but offer the same services like ACH, wires, credit lines, online access, etc. It's familiar, simple, and not overly burdened with red tape – you can even set up a corporation online in a few minutes. Sure, there are some tough parts about starting a business here. For one, they've yet to come to terms with virtual work, and the idea is at direct odds with one of their most stubborn bureaucracies: the town office permit folks. On the U.S. mainland, at least anywhere I have lived, you do not need any special permit to use your home as an office, only as a retail business. Want to found an Internet startup from your garage? No problem. Want to sell antiques from your front lawn? Problem. In Puerto Rico, the model is backwards. To set up an office, you must register it with the town. The towns inspect your office to make sure it is real. They contact your neighbors to make sure they are OK with it. And they come back regularly to do it again and again. That struck me as odd at first. But the more I considered it, it's not much different than in the States: to own a business in Vermont, I needed half a dozen forms from half a dozen offices and paid a fee for each one. I didn't have to pay a fee to get a sales-and-use tax permit in Puerto Rico, though. They don't want to get in the way of my ability to pay taxes, as so many U.S. agencies seem to want to. Instead, they are focusing on a different set of problems, ones unique to a largely urban island with high unemployment. Like trying to stop the streets from looking like a Turkish bazaar as they do elsewhere around the Caribbean – something they've managed very well here. The quirks are just different from the quirks many of us grew up with, because the circumstances are different. But it's the big things that matter – things like tax policy, access to smart people, services, technology, and more. And there, Puerto Rico scores very highly. And, Yep, Lower Taxes I work hard for my money. I work hard to find great investments that translate into profits. And I work hard to run my businesses. And the more of each I get to keep, the more I earn next year by investing it further. Hopefully, growing up, someone taught you about the magic of compounding interest (I got it from my dad, who more than once said, "Hey, read this article on mutual funds in Esquire.") Well, one of the things almost none of those lessons include is the effect of taxes. When you pay taxes on your investment income, it decreases dramatically over time. The longer you can defer taxes, the better for your pocket book. If you can reduce them or remove them entirely, the benefits are huge. For instance, say you invest $100,000 in a 5% CD that compounds yearly. If you pay 35% tax on the interest each year, and reinvest the rest, then at the end of 20 years you've earned $89,583 in interest. Not bad for an incredibly conservative investment. However, take those taxes on interest down to 0%, which Puerto Rico's new tax incentives provide, and you earned $165,329, or 85% more income. That's a pretty big tax penalty the U.S. imposes, and that many more years you have to work before you can retire. If you live in California, where the combined tax rate for some is now in excess of 50%, the effect is even more dramatic. You would have only earned $63,861, losing out on over $100,000 in earnings. That's enormous! Yes, you could earn $165K inside an IRA thanks to tax deferral. But then try withdrawing it. At 39.6%, federal taxes chip it right down to $99,858. Get stung by that California 50% and you're even worse off again. Now, here's the real kicker. In order to invest that $100K back home, you already had to pay taxes on it – they don't let you put nearly that much in an IRA or 401(k) each year. Before you paid those payroll taxes, it was probably $165,000 (assuming the same 39.6% in federal taxes). If instead you earned that income in Puerto Rico at a net effective tax rate of 15% – which can be easily achieved with Act 20 benefits for your business and a 4% tax on earnings – then you would have $147,283 to invest to begin with. After 20 years at 5%, you'd have saved $243,500 for your retirement – that's nearly three times what you would have earned in the United States, getting taxed again and again and again. Or about 2.5x what your IRA or 401(k) would have netted you. It's not about how much money you have to invest. It's how much you have to reinvest. And a big part of that is how much you have left over after taxes. Here in Puerto Rico, you could have much more left over, and many more opportunities to invest. The New Land of Opportunity To me, this is the new land of opportunity. There is a critical combination here of an underutilized but well-educated workforce, a culture that is obviously changing for the better, and a tax regime that is committed to letting entrepreneurs reinvest more of our money back into our businesses. Add those three together and there would be something good going on down here. But there's another factor: The Internet. With the ability to do many jobs from the convenience of anywhere, thanks to Skype, GoToMeeting, Gmail, Dropbox, and thousands of other tools that finally make the home office a reality, the opportunity is enormous. Computer programming. Asset management. Graphic design. Public relations. Marketing and advertising. Research and development. Information processing. Customer service. The number of service-based businesses that can operate from here is amazing – far more potential than the manufacturing sector ever brought. Puerto Rico is off to a slightly slower start than its predecessors in India, Singapore, Hong Kong, and even around Latin America in recognizing the value wooing the service economy can bring to its people. However, it is on the right course now and has some tail winds to help it catch up – advantages that no other nation on earth can provide to the world's largest market of investors and entrepreneurs, Americans. It's hard for me to sum up all the things I like about Puerto Rico in a few pages – and there's no way the editors here will let me go longer, lest I bore you to death. But if you made it this far, then I encourage you to go one step farther. Consider joining me and your like-minded investors and entrepreneurs in Puerto Rico. Join me and the 200 or so other pioneers here in the new land of opportunity. Read my firsthand account of how, right here. And feel free to ask me any questions you'd like – in the comments below, or via email.

More from Casey Research: Doug Casey's nine secrets for making a fortune in the markets Casey Research: Why gold has plummeted and Bitcoin has soared Casey Research: Now is the best time to buy gold again |

| Koos Jansen: China gold demand fell in last week of March but remains high Posted: 09 Apr 2014 02:32 AM PDT GATA |

| How will gold respond to global deflation? Posted: 09 Apr 2014 02:20 AM PDT Clif Droke |

| China Gold Demand Fell in the Last Week of March, But Remains High Posted: 09 Apr 2014 02:13 AM PDT "Another day where JPMorgan et al had to step in front of rallies" ¤ Yesterday In Gold & SilverGold added three bucks to its price during the first several hours of Far East trading on their Tuesday morning---but flat-lined at $1,300 the ounce until about 1:30 p.m. Hong Kong time. Then the gold price added another eight bucks or so in pretty short order---and added about the same amount shortly after the London open as the gold price rose into the 10:30 a.m. BST London a.m. gold "fix". Volumes were enormous, as the not-for-profit sellers were everywhere. That was its high tick of the day---and from there it chopped quietly lower into the 5:15 p.m. EDT electronic close in New York. The CME Group recorded the high and low ticks at $1,134.70 and $1,296.80 in the June contract. Gold closed the Tuesday session at $1,308.00 spot, up $11.10 on the day---but well of its high tick. Volume, net of April and May, was around 129,000 contracts---with more than a third of that coming before the London a.m. fix, as JPMorgan et al were the short sellers of last resort right from the moment that the price break-out started, throwing everything they had at it to prevent the price from closing about its 50-day moving average---which it broke through handily at the London morning gold fix. With some minor exceptions, the silver price followed a similar price as gold's, with the high tick coming at the London a.m. gold fix as well. After that it chopped lower into the close. The CME recorded the high and low as $20.175 and $19.85 in the May contract. Silver's volume on that early rally wasn't overly heavy---and there were no moving averages involved, so "da boyz" had a pretty easy time of it as far as price management was concerned. Silver closed in New York at $20.06 spot, up 19.5 cents on the day. Volume, net of roll-over, was only 14,500 contracts, which was a thousand contracts less than Monday's net volume. Silver's gross volume on that early rally wasn't overly heavy---and there were no moving averages involved, so "da boyz" had a pretty easy time of it as far as price management was concerned. After the price got capped, roll-over action really picked up. Platinum traded unsteadily higher on Tuesday, with its high coming at noon in New York. After that, the price didn't do much. Palladium also rallied, but that rally ended at 9 a.m. in London---and the price traded sideways in a very tight range for the remainder of the Tuesday session---gaining back 2 of the 3 percentage points it got docked in Monday's trading. It's high tick came at noon EDT as well. The dollar index closed late on Monday afternoon at 80.22---and then traded ruler flat until around 2:45 p.m. Hong Kong time on their Tuesday. Then the decline began---and the 79.72 bottom was painted just a few minutes after 2:30 p.m. EDT. From there the index rallied a handful of basis points into the close. The index finished the Tuesday trading session at 79.78---down 44 basis points on the day. The gold stocks gapped up a bit more than 2% at the open---and then faded a bit, hitting its low tick around 11:35 a.m. EDT. After that, the stocks rallied slowly but steadily into the close---and finished the day nearly on their high tick. The HUI finished up 2.35%. The silver equities gapped up as well, but put their low in much earlier in the day---and Nick Laird's Intraday Silver Sentiment Index closed up a very decent 2.11%. The CME's Daily Delivery Report showed that 137 gold and 2 silver contracts were posted for delivery within the Comex-approved depositories on Thursday. The only short/issuer in gold was Jefferies---and the two biggest long/stoppers were JPMorgan and Canada's Scotiabank, as they will take delivery of 105 contracts between them. The link to yesterday's Issuers and Stoppers Report is here. There was another withdrawal from GLD yesterday. This time it was 86,707 troy ounces that was withdrawn by an authorized participant. And as of 10:02 p.m. EDT yesterday evening, there were no reported changes in SLV. The U.S. Mint had a small sales report. They sold 308,500 silver eagles. There wasn't a lot of in/out activity in either gold or silver on Monday over at the Comex-approved depositories. As a matter of fact, there was no in/out activity in gold at all---and in silver, there was 39,185 troy ounces reported received---and 125,273 troy ounces shipped out. The link to that activity is here. Here's a chart that Nick Laird slid into my in-box just after midnight Denver time. It's the updated "Monthly Chinese Gold Net Imports from Hong Kong" graph and, as always, it's a sight to behold. I have the usual number of stories for you today, but I'm very light on anything regarding precious metals, as there wasn't much news of that sort on the Internet yesterday. As I've said before, it's always "feast or famine" in my Wednesday column, as most of the really big stories show up over the weekend, or on Monday. However, there are still quite a few other stories worthy of your attention. ¤ Critical ReadsHigh-Frequency Trading Falls in the Cracks of Criminal LawWords like “rigged” and “scam,” which have been used to describe how high-frequency trading firms make money in the markets, usually indicate something illegal has occurred. The attorney general, Eric H. Holder Jr., added to that perception when he confirmed at a congressional hearing on Friday that the Justice Department was investigating high-frequency trading “to determine whether it violates insider trading laws.” Federal prosecutors will join with the Securities and Exchange Commission and the Federal Bureau of Investigation, both of which have been scrutinizing high-frequency trading for some time. The investigations are sure to pick up steam on the heels of the publicity surrounding Michael Lewis’s new book, “Flash Boys: A Wall Street Revolt.” Mr. Lewis portrays how firms use the advantage of just a few milliseconds to trade ahead of the rest of the investing world to reap profits by snatching the best prices for stocks. This plays into what New York State’s attorney general, Eric T. Schneiderman, has called “Insider Trading 2.0,” a call for greater regulation of trading to level the investment playing field. This story was posted on The New York Times website just before noon EDT yesterday---and I thank reader Dan Lazicki for today's first story. Dark markets may be more harmful than high-frequency tradingFears that high-speed traders have been rigging the U.S. stock market went mainstream last week thanks to allegations in a book by financial author Michael Lewis, but there may be a more serious threat to investors: the increasing amount of trading that happens outside of exchanges. Some former regulators and academics say so much trading is now happening away from exchanges that publicly quoted prices for stocks on exchanges may no longer properly reflect where the market is. And this problem could cost investors far more money than any shenanigans related to high frequency trading. When the average investor, or even a big portfolio manager, tries to buy or sell shares now, the trade is often matched up with another order by a dealer in a so-called "dark pool," or another alternative to exchanges. Those whose trade never makes it to an exchange can benefit as the broker avoids paying an exchange trading fee, taking cost out of the process. Investors with large orders can also more easily disguise what they are doing, reducing the danger that others will hear what they are doing and take advantage of them. This Reuters article was posted on their Internet site in the wee hours of yesterday morning, but because I was already 'full up' in Tuesday's column already, it had to wait until today. I thank reader Harry Grant for sending it along. SEC Goldman Lawyer Says Agency Too Timid on Wall Street MisdeedsA trial attorney from the Securities and Exchange Commission said his bosses were too “tentative and fearful” to bring many Wall Street leaders to heel after the 2008 credit crisis, echoing the regulator’s outside critics. James Kidney, who joined the SEC in 1986 and retired this month, offered the critique in a speech at his goodbye party. His remarks hit home with many in the crowd of SEC lawyers and alumni thanks to a part of his resume not publicly known: He had campaigned internally to bring charges against more executives in the agency’s 2010 case against Goldman Sachs Group Inc. The SEC has become “an agency that polices the broken windows on the street level and rarely goes to the penthouse floors,” Kidney said, according to a copy of his remarks obtained by Bloomberg News. “On the rare occasions when enforcement does go to the penthouse, good manners are paramount. Tough enforcement, risky enforcement, is subject to extensive negotiation and weakening.” This Bloomberg news item appeared on their website late Monday evening MDT---and my thanks go out to U.A.E. reader Laurent-Patrick Gally. John Crudele: Did Goldman use HFT to rig markets for the U.S. government?Yep, the stock market is rigged. I've been explaining this to you for nearly 20 years. But thanks to best-selling author 'Michael Lewis intriguing book "Flash Boys," which comes to the same conclusion, a much wider slice of America is talking about it now. But Lewis' book -- as well-written and riveting as his best-seller "Moneyball" -- touched on only one way the stock market was rigged: through high-frequency trading (HFT). And the book deals only with how manipulation has been occurring in recent years. This must read story by John was posted on The New York Post website just before midnight on Monday evening EDT---and I found it in a GATA release last night. How the CIA Made Dr. Zhivago Into a Weapon — Paul Craig RobertsWhen Soviet authorities refused to publish prominent Soviet writer Boris Pasternak’s masterpiece, Dr. Zhivago, the CIA turned it into a propaganda coup. An Italian journalist and Communist Party member learned of the suppressed manuscript and offered to take the manuscript to the Italian communist publisher in Milan, Giangiacomo Feltrinelli, who published the book in Italian over Soviet objections in 1957. Feltrinelli believed that Dr. Zhivago was a masterpiece and that the Soviet government was foolish not to take credit for the accomplishment of its greatest writer. Instead, a dogmatic and inflexible Kremlin played into the CIA’s hands. The Soviets made such a stink about the book that the controversy raised the book’s profile. According to recently declassified CIA documents, the CIA saw the book as an opportunity to make Soviet citizens wonder why a novel by such a prominent Russian writer was only available abroad. The CIA arranged for a Russian language edition to be published and distributed to Soviet citizens at the World Fair in Brussels in 1958. The propaganda coup was complete when Pasternak received the Nobel Prize for literature in October 1958. The use of Pasternak’s novel to undermine Soviet citizens’ belief in their government continued as late as 1961. That year I was a member of the US/USSR student exchange program. We were encouraged to take with us copies of Dr. Zhivago. We were advised that it was unlikely Soviet customs inspectors would know English and be able to recognize book titles. If asked, we were to reply “travel reading.” If the copies were recognized and confiscated, no worry. The copies were too valuable to be destroyed. The custom officials would first read the books themselves and then sell them on the black market, an efficient way to spread the distribution. This amazing, but obviously very true story showed up on Paul's website yesterday---and my thanks go out to South African reader B.V. for bringing it to our attention. It's a short and fascinating read. No legal means exist to challenge mass surveillance - SnowdenNo legal means exist to challenge mass surveillance, said NSA whistleblower Edward Snowden, testifying to the Parliamentary Assembly of the Council of Europe. A former NSA contractor, Snowden was speaking to the PACE session in Strasbourg via a video link-up from Moscow. Wanted in the US on treason charges, he sparked a huge international scandal last year he leaked to the media classified evidence of American government spying programs. “This is an unprecedented form of political interference that I don’t believe can be seen elsewhere in western governments,” he went on. “But no legal means currently exist to challenge such activities or to see penalties for such abuses,” he said. E.U. court scraps data surveillance lawThe E.U. court in Luxembourg has struck down a law on internet and phone surveillance, saying its loose wording opens the door to untoward snooping on private lives. It said in its verdict on Tuesday (8 April) the “data retention directive” constitutes a “particularly serious interference with the fundamental rights to respect for private life and to the protection of personal data” in Europe. It also said Europeans are likely to feel “their private lives are the subject of constant surveillance” if the bill is left intact. The directive, passed in 2006, has already been transcribed into national law in most member states. The article, filed from Brussels, was posted on the euobserver.com Internet site late yesterday morning Europe time---and it's the second contribution in a row to today's column from Roy Stephens. Euro-Catch 22: Mario Draghi's woes over Q.E.Actually, Super Mario faces an incredible dilemma - damned if he does and damned if he doesn’t. To work, Q.E. must trickle into the real economy. Even in U.K./U.S. schemes, often the cash has remained stubbornly within the investment world chasing paper assets as opposed to invigorating the manufacturing and service economy. Within the E.U. the problem is not just this trickle down aspect. Rather vital issues with the banks themselves have not been addressed. Put simply: the political class remain in denial at the extent of banks’ problems. Many EU banks may fail the autumn round of stress tests. Gutless eurozone governments have palpably failed to take control of the economic situation, wrapping bandages around vast festering wounds. Thus throughout the eurozone, there are many zombie banks, de facto insolvent entities being protected by stubborn (scared) politicians. These walking dead institutions are not merely in the depressed Mediterranean nations with rampant unemployment, they even exist in Angela Merkel’s otherwise prosperous German hinterlands. Given how she has sought to ‘punish’ incompetent governments, her hypocrisy in punishing other citizens (e.g. in Ireland) to protect her banks is rather incredible. It also threatens the long-term survival of the euro, let alone the EU. This op-ed piece appeared on the Russia Today Internet site early yesterday morning Moscow time---and it's the third offering in a row from Roy. Moscow warns Kiev against using military, mercenaries in southeastern UkraineThe Russian Foreign Ministry has voiced concerns over the buildup of Ukrainian forces and US mercenaries in the southeastern part of the country, calling on Kiev to immediately cease military preparations which could lead to a civil war. As parts of Ukraine push for greater autonomy – with Donetsk and Kharkov declaring independence on Monday – the self-imposed government in Kiev is reportedly dispatching additional forces in turbulent regions to avoid potential disobedience by local law enforcements. “We are particularly concerned that the operation involves some 150 American mercenaries from a private company Greystone Ltd., dressed in the uniform of the [Ukrainian] special task police unit Sokol,” the Russian Foreign Ministry said in a statement. “Organizers and participants of such incitement are assuming a huge responsibility for threatening upon the rights, freedoms and lives of Ukrainian citizens as well as the stability of Ukraine.” This must read news item showed up on the Russia Today website in the very wee hours of yesterday morning Moscow time---and this story is the second story of the day from reader B.V. |

| Posted: 09 Apr 2014 02:13 AM PDT 1. The first interview is with Dr. Stephen Leeb---and it's headlined "Collapse of the United States---and a New Economic World Order" 2. The second commentary is with Sean Boyd, the CEO of Agnico Eagle. It's entitled "Stunning Reasons for Gold to Smash Through $2,000" [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests, to them, and not to me. Thank you. - Ed] |

| U.K.’s Royal Mint strikes special shipwreck silver coin Posted: 09 Apr 2014 02:13 AM PDT More than 70 years after the Royal Mint ordered silver supplies from India after England’s silver stocks were depleted due to war, the Royal Mint has announced it is offering a silver coin made from the sunken merchant ship, S.S. Gairsoppa. The ship was carrying a large shipment of silver bullion, pig iron and tea and was sailing under the protection of naval convoys when a storm forced the S.S. Gairsoppa to break free and head for the safety of Galway Harbor off the coast of western Ireland. The ship was torpedoed by a German U-Boat on February 17, 1941; only one person ultimately survived after it sank within 20 minutes and crew members took refuge in a rubber raft. Florida-based Odyssey Marine Exploration finally located the ship 300 miles off the Irish coast at a depth of three miles in September 2011. Odyssey recovered 2,792 silver ingots, or more than 99% of the insured silver reported to be aboard the S.S. Gairsoppa when she sank. This very interesting story appeared on the mineweb.com Internet site on Monday. |