Gold World News Flash |

- Gold and The Dollar Are In A Fight to the Death! -- Dr. Paul Craig Roberts

- Economic Collapse 2014 -- As The IMF Pushes Recovery War Propaganda With Russia Intensifies

- Daily Nugget – gold experts are bearish

- 40 Central Banks Are Betting This Will Be The Next Reserve Currency

- Silver Price Forecast 2014: Monetary Collapse and Silver’s Not So Orderly Rise

- Leeb sees petro-dollar fading; Boyd acknowledges gold price is 'managed'

- SEC lawyer, retiring, says agency too timid with Wall Street misdeeds

- Collapse Of The United States & A New Economic World Order

- Koos Jansen: China gold demand fell in last week of March but remains high

- John Crudele: Did Goldman use HFT to rig markets for the U.S. government?

- Agnico CEO: Stunning Reasons Gold To Smash Through $2,000

- Flashback: Counterfeit Gold – How to Protect Yourself

- Misconception grows over gold demand and Shanghai discount

- 40 Central Banks Are Betting This Will Be The Next Reserve Currency

- Russian Military Spending Soars

- Guest Post: Welcome To The Casino

- Triple Whammy Shocker: Goldman Shutting Down Sigma X?

- David Stockman's "Born Again Jobs Scam": The Ugly Truth Behind "Jobs Friday"

- Today the Gold Price also Closed Above its 200 Day Moving Average at $1,308.70

- Today the Gold Price also Closed Above its 200 Day Moving Average at $1,308.70

- Wise Investments in the Next Global Arms Race

- ECONOMIC COLLAPSE 2014 -- Dollar Is Dropped As Countries And Central Banks Declared Their Holdings In Yuan

- Gold Surges & Dow Swoons

- U.S. Headed for Neo-Communism - Mikkel Clair Nissen

- Why These 2 NYSE Gold Producers are Buying This Junior During a Bear Market

- A Way to Survive the World’s Next Debt Bubble

- Gold Daily and Silver Weekly Charts - Metals Take Back Their Levels, But Germany Can't Get Their Gold

- Gold Daily and Silver Weekly Charts - Metals Take Back Their Levels, But Germany Can't Get Their Gold

- 10 Questions About Gold Investing In 2014

- Stay Hedged with Precious Metals against Geopolitical Tensions and Monetary Policies

- Collapse Of The United States & A New Economic World Order

- Max Keiser Interviews Egon von Greyerz about Fed Policy, Dollar Devaluation and Gold Pri

- Marc Faber Warns Get Your Gold Out Of The US NOW!

- Deviant Gold Q&A

- Final Bubble Phase for the Stock Market: Final Capitulation for Gold

- Misconception grows over gold demand and Shanghai discount – Phillips

- Gold price rockets back over $1,300

- Second Endeavour Silver mineworker killed in Mexico

- The Real Reason the U.S. Dollar Has Value

- Bullish Indicators from a Forgotten Market Sector

- Spot Gold Touches 2-Week High as Dollar Falls Despite Ukraine Tensions, IMF Urges Eurozone QE, Shanghai Premium Returns

- Precious Metals Market Report with Franklin Sanders

- Monetary Insurance: Protect With Physical Silver Against The Financial Winter

- Gold Miners Index: Domed House and Three Peaks Chart Pattern

- U.S. bristles at China's infringement of its monopoly on currency market rigging

- What Gold Stock Insider Trading Tells Us

- What’s Abuzz About Gold?

- Putin’s Wrath Can Be Your Gain

| Gold and The Dollar Are In A Fight to the Death! -- Dr. Paul Craig Roberts Posted: 09 Apr 2014 12:30 AM PDT Dr. Paul Craig Roberts says, "The Federal Reserve's policies are irresponsible and reckless." They put four or five banks ahead of the entire American population. They are going to save them if they have to drive the rest of the American population into the ground." As far as Russia and other... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Economic Collapse 2014 -- As The IMF Pushes Recovery War Propaganda With Russia Intensifies Posted: 08 Apr 2014 11:48 PM PDT Spain lawmakers discussing and debating Catalonia Independence. Cyprus tax revenue down as unemployment rises. IMF reporting incredible growth and recovery for wealthier nations which is a complete fabrication of what is really happening. The percentage of people insured has not changed since Obama... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Daily Nugget – gold experts are bearish Posted: 08 Apr 2014 11:30 PM PDT by Jan Skoyles, TheRealAsset.co.uk

Bearish predictions on the gold price In a new report from Morgan Stanley, we learn that gold is their least preferred commodity as the factors that boosted gold in Q1 are, apparently, no longer evident today. One of those alluded to by analyst Joel Crane is the Ukraine situation that boosted safe-haven demand. Something that Morgan Stanlye believe will no longer be a major driver in this year's gold price. Having said that, tensions increased once again yesterday and the bank have increased their average 2014 price by 5% to $1,219/oz. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 40 Central Banks Are Betting This Will Be The Next Reserve Currency Posted: 08 Apr 2014 09:52 PM PDT from ZeroHedge:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Price Forecast 2014: Monetary Collapse and Silver’s Not So Orderly Rise Posted: 08 Apr 2014 09:43 PM PDT Hubert Moolman | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Leeb sees petro-dollar fading; Boyd acknowledges gold price is 'managed' Posted: 08 Apr 2014 09:37 PM PDT 12:35a ET Wednesday, April 9, 2014 Dear Friend of GATA and Gold: At King World News fund manager Stephen Leeb sees the world transitioning away from the petro-dollar into a mechanism pricing oil in a basket of currencies: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/4/8_Col... And Agnico-Eagle CEO Sean Boyd acknowledges that the gold price is "managed" by governments as part of their general intervention in currency markets: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/4/9_Agn... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEC lawyer, retiring, says agency too timid with Wall Street misdeeds Posted: 08 Apr 2014 09:33 PM PDT By Robert Schmidt A trial attorney from the Securities and Exchange Commission said his bosses were too "tentative and fearful" to bring many Wall Street leaders to heel after the 2008 credit crisis, echoing the regulator's outside critics. James Kidney, who joined the SEC in 1986 and retired this month, offered the critique in a speech at his goodbye party. His remarks hit home with many in the crowd of SEC lawyers and alumni thanks to a part of his resume not publicly known: He had campaigned internally to bring charges against more executives in the agency's 2010 case against Goldman Sachs Group Inc. The SEC has become "an agency that polices the broken windows on the street level and rarely goes to the penthouse floors," Kidney said, according to a copy of his remarks obtained by Bloomberg News. "On the rare occasions when enforcement does go to the penthouse, good manners are paramount. Tough enforcement, risky enforcement, is subject to extensive negotiation and weakening." ... ... For the full story: http://www.bloomberg.com/news/2014-04-08/sec-goldman-lawyer-says-agency-... ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Collapse Of The United States & A New Economic World Order Posted: 08 Apr 2014 09:30 PM PDT from KingWorldNews:

"Whether it was Saddam Hussein in Iraq, or Muammar Gaddafi in Libya, the United States intervened militarily and both of these men were 'eliminated' for threatening the U.S. dollar as the world's reserve currency. he problem here for the United States is that they can't eliminate President Xi and militarily occupy China, and they can't eliminate Putin and militarily occupy Russia. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Koos Jansen: China gold demand fell in last week of March but remains high Posted: 08 Apr 2014 09:27 PM PDT 12:25a ET Wednesday, April 9, 2014 Dear Friend of GATA and Gold: Updating the Chinese gold demand figures, gold researcher and GATA consultant Koos Jansen reports that demand for the last full week in March declined a bit over the year-to-date weekly average but remained high: http://www.ingoldwetrust.ch/chinese-gold-demand-559-mt-ytd-up-16 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| John Crudele: Did Goldman use HFT to rig markets for the U.S. government? Posted: 08 Apr 2014 09:17 PM PDT Goldman Keeps Its 'Flash Boys' Under Wraps By John Crudele http://nypost.com/2014/04/07/goldman-keeps-its-flash-boys-under-wraps/ Yep, the stock market is rigged. I've been explaining this to you for nearly 20 years. But thanks to best-selling author 'Michael Lewis' intriguing book "Flash Boys," which comes to the same conclusion, a much wider slice of America is talking about it now. But Lewis' book -- as well-written and riveting as his best-seller "Moneyball" -- touched on only one way the stock market was rigged: through high-frequency trading (HFT). And the book deals only with how manipulation has been occurring in recent years. ... Dispatch continues below ... ADVERTISEMENT Jim Sinclair to hold gold market seminar in Toronto on April 26 Mining entrepreneur and gold advocate Jim Sinclair's next gold market seminar will be held from 1 to 5 p.m. Saturday, April 26, at the Pearson Hotel & Conference Centre at Toronto's Pearson International Airport, 240 Belfield Road, Toronto. For details on tickets, please visit Sinclair's Internet site, JSMineSet.com, here: http://www.jsmineset.com/2014/04/01/toronto-qa-session-announced/ I can't do justice to the "Flash Boys" storytelling here, but Lewis explains in depth how HFT uses faster computers, better cable lines, and closer access to stock markets to jump in front of regular people's trades. But to me, the very first line of the introduction of "Flash Boys" is the most intriguing thing in the whole book. Why do I think that? Because it's a topic I wrote about a number of times in 2009 when a guy named Sergey Aleynikov, who developed high-frequency trading programs, was arrested by the FBI for stealing computer code from his employer, Goldman Sachs. Lewis writes: "I thought it strange, after the financial crisis, in which Goldman had played such an important role, that the only Goldman Sachs employee who had been charged with any sort of crime was the employee who had taken something from Goldman Sachs." And -- this is the drumroll moment -- Lewis (as I did in my 2009 columns) quotes an FBI agent who said that in the wrong hands, the computer code Aleynikov allegedly stole could be used to "manipulate markets in unfair ways." "Goldman's were the right hands?" Lewis asked. As Lewis points out, everything the FBI agent knew about high-frequency trading he learned from Goldman. My question back then, as it is now, is: What was Goldman doing with this code? Why did it react so aggressively to the theft? And why did the FBI -- which has important stuff like murder and terrorism on its to-do list -- jump into the Aleynikov case within 48 hours of Goldman's complaint when the computer geek's actions really should have been handled in civil court by Goldman's lawyers? And did Goldman think there was a "fair way" to manipulate markets? Did Goldman think only it could manipulate markets? Lewis doesn't get into this, but I think Goldman by 2008 had been using its high-frequency trading program to rig the stock markets. And -- this is the most important part -- it was doing so with the blessing of Uncle Sam, hence the FBI's attentiveness. That's how Goldman could have made the case that there was a fair way to manipulate the markets. And that's probably what Goldman CEO Lloyd Blankfein meant when he oddly proclaimed in early November 2009 that he (or his company, he wasn't clear) was "doing God's work." What evidence do I have of this? Back in 2009, I looked through the phone logs of then-Treasury Secretary Hank Paulson, formerly the chief executive of Goldman, and discovered many, many calls between him and Blankfein during the financial crisis. In a Sept. 29, 2009, column I reported that Paulson spoke almost as frequently with Blankfein during the worst part of the crisis as he did with Federal Reserve Chairman Ben Bernanke. And he hardly spoke to any other Wall Street executives. In the column, I wrote: "On Wednesday, Sept. 17, 2008 ... the stock market performed horribly. By the end of the session, the Dow Jones industrial average tumbled 449 points as investors worried about the nation's financial system. "The next morning, Sept. 18, Paulson placed his first call of the day at 6:55 a.m. to Lloyd Blankfein, who succeeded Paulson as CEO of Goldman. It's unclear whether the two connected because Blankfein called Paulson minutes later. "And then Blankfein placed another call to Paulson at 7:05 a.m. for what looks like a 10-minute conversation. By 9 a.m., 30 minutes before the markets opened, the two had connected or tried to connect three times. On Sept. 17 -- the day the market was collapsing -- there were five calls between the pair. It would have been extremely odd if Paulson and Blankfein hadn't talked about wanting to see market strengthen during those three calls early Sept. 18 morning. But the market didn't open strong on Sept. 18. Stock prices did, however, begin a miraculous recovery around 1 p.m. that day. By then rumors were starting to spread about a government bailout of banks, and the market turned on a dime. Market rigging? Probably, done in a number of ways -- through leaked information and heavy trading through HFT. Wall Street pals who could have purposely changed the momentum of the market. Was the computer code that Sergey Aleynikov was accused of stealing used during that day's trading? Is that why Goldman knew the code could manipulate markets? Is that why the FBI responded so quickly? I don't have answers, but those are all legitimate questions. Tim Geithner, who was head of the New York Federal Reserve Bank at this time (and later became treasury secretary) was quoted later in an interview that Washington "was forced to do extraordinary things and, frankly, offensive things to help save the economy." Was rigging the stock market one of them? Stay tuned. ----- John Crudele is business columnist for the New York Post. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Agnico CEO: Stunning Reasons Gold To Smash Through $2,000 Posted: 08 Apr 2014 09:01 PM PDT  Today one of the top CEO's in the world told King World News that the price of gold will break $2,000, in spite of the fact that the price being actively "managed." This interview is tremendous and it will let KWN readers around the world see the gold market through the eyes of one of the greatest and well-respected veterans in the business. Below is what Sean Boyd, CEO of $5.4 billion Agnico Eagle, had to say in his powerful interview. Today one of the top CEO's in the world told King World News that the price of gold will break $2,000, in spite of the fact that the price being actively "managed." This interview is tremendous and it will let KWN readers around the world see the gold market through the eyes of one of the greatest and well-respected veterans in the business. Below is what Sean Boyd, CEO of $5.4 billion Agnico Eagle, had to say in his powerful interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Flashback: Counterfeit Gold – How to Protect Yourself Posted: 08 Apr 2014 09:00 PM PDT by Mark Nestmann, Nestmann:

Then last fall, a report emerged that China’s central bank had discovered 400-ounce gold-plated tungsten bars among those it had recently received from bonded warehouses. Assays were said to reveal at least four counterfeit bars, all supposedly from sources in the United States. re-published with permission by the author. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Misconception grows over gold demand and Shanghai discount Posted: 08 Apr 2014 08:40 PM PDT by Julian Phillips, MineWeb.com:

Silver Today – The silver price closed at $19.88 up 4 cents on Friday's close, in New York. Ahead of New York's opening, it was trading higher at $20.14. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 40 Central Banks Are Betting This Will Be The Next Reserve Currency Posted: 08 Apr 2014 07:42 PM PDT As we have discussed numerous times, nothing lasts forever - especially reserve currencies - no matter how much one hopes that the status-quo remains so, in the end the exuberant previlege is extorted just one too many times. Headline after headlines shows nations declaring 'interest' or direct discussions in diversifying away from the US dollar... and as SCMP reports, Standard Chartered notes that at least 40 central banks have invested in the Yuan and several more are preparing to do so. The trend is occurring across both emerging markets and developed nation central banks diversifiying into 'other currencies' and "a great number of central banks are in the process of adding yuan to their portfolios." Perhaps most ominously, for king dollar, is the former-IMF manager's warning that "The Yuan may become a de facto reserve currency before it is fully convertible." The infamous chart that shows nothing lasts forever... Nothing lasts forever... (especially in light of China's recent comments)

As The South China Morning Post reports, Jukka Pihlman, Standard Chartered's Singapore-based global head of central banks and sovereign wealth funds (who formerly worked at the International Monetary Fund advising central banks on asset-management issues), notes that:

The US dollar remains in charge (for now)...but

As SCMP goes on to note, the rising popularity of the yuan among central bankers is probably mainly due to Beijing's extremely favourable treatment of them as it has sought to encourage investment in the yuan.

As Pihlman explains, things are accelerating...

We leave it to a former World Bank chief economist, Justin Yifu Lin, to sum it all up...

It appears the world is beginning to listen | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Russian Military Spending Soars Posted: 08 Apr 2014 07:10 PM PDT Submitted by Zachary Zeck via The Diplomat, Russia has announced that it will increase defense spending by some 18 percent this year despite its worsening economic outlook. According to a report in Jane’s Defence Weekly, the Russian Federal Treasury announced late last month that “Expenditure on National Defense” will rise from 2,101.4 billion rubles ($58.2 billion) in 2013 to 2,488.1 billion rubles in 2014. This is projected to be about 3.4 percent of Russia’s GDP but over 20 percent of government spending. Another 16.5 percent of the government budget will go to national security and law enforcement. By contrast, in 2010 defense spending only accounted for 12.6 percent of total state spending while defense and security only accounted for about 25 percent compared to the nearly 37 percent of spending they will make up in 2014. Jane’s notes that spending on “education, housing, social care and healthcare will all fall” as a result. The increase this year follows what some estimate to be a 31 percent increase in defense spending between 2008 and 2013. Moreover, Russia intends to continue expanding its defense budget in the years ahead. According to the Jane’s report, the Russian Federal Treasury anticipates the defense budget to grow by more than 33 percent over the next two years. Thus, according to current forecasts, by 2016 the Russian defense budget will be around 3,378.0 billion rubles ($95.6 billion). The rapid increases in defense spending are not unexpected. Indeed, Russia began trying to modernize its military forces in 2008, around the time of its war with Georgia, and announced a decade-long military rearmament program two years later. Under this rearmament program, Russia intends to spend 23 trillion rubles ($723 billion) over the next ten years to modernize its armed forces. The goal is to achieve a 70 percent modernization rate by 2020. Russia’s conventional military power rapidly deteriorated following the collapse of the Soviet Union, forcing Moscow to increasingly rely on its nuclear arsenal to meet its national security needs. Before assuming the Russian presidency for a third term, Vladimir Putin laid out the case for Russia’s military modernization in an article in Foreign Policy magazine. In the piece, Putin argued that given the current international environment, “Russia cannot rely on diplomatic and economic methods alone to resolve conflicts. Our country faces the task of sufficiently developing its military potential as part of a deterrence strategy. This is an indispensable condition for Russia to feel secure and for our partners to listen to our country’s arguments.” Nonetheless, it’s far from clear that Russia will be able to meet its military modernization goals given the darkening economic outlook for the country. Already, the massive military rearmament program has elicited significant criticism from certain sectors of Russian society. With a worsening economic outlook in the short-term due to Western sanctions, and in the long-term due to Russia’s excessive reliance on energy exports, it’s quite likely that the ambitious modernization goals set out for 2020 will not be realized.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Guest Post: Welcome To The Casino Posted: 08 Apr 2014 06:09 PM PDT Submitted by Shane Obata via Triggers, Fundamentals are always important over the long term. That said, it has become quite clear that company financials are not what’s moving this market. As you’ll see in the following chart, QE has been boosting the S&P 500 since 2009. If fundamentals mattered then the words and decisions of central bankers wouldn’t be the most important headlines. We’ve all seen the charts that compare the S&P 500 and the fed’s balance sheet. Since 2009, the correlation is almost perfect QE and zero interest rate policies are forcing people to chase for yield. It’s completely unfair to repress interest rates because it punishes savers. Right now, it’s expensive to hold cash because of inflation and low interest rates. By holding down rates, the fed is masking the risk of financial assets. People who would otherwise keep their money in a savings account are buying high yield bonds and stocks because they want to maintain their purchasing power. The following chart shows that the spread between high yield bonds and treasuries has been in decline since the financial crisis. This is a result of a high demand for income generating assets. n sum, the fed’s policies have caused stock prices to diverge from economic reality. Real median household income has been in decline since the late 90s. In contrast, stock prices have rallied dramatically since the financial crisis in 07-08. The purpose here is not to prove that the S&P 500 is going to drop 86% like it did from 1930 to 1932. What we’re going to consider is the psychology behind the markets. I feel as though the markets have tended to move in similar waves because of how people think about stocks. Every market cycle is characterized by similar emotions such as greed and fear. The next chart depicts a market psychology cycle. At this point, it’s hard to dispute that we’re in the mid-late stages of the mania phase. Simply put, the economic fundamentals do not support stock prices. Often times, in the later stages of a bull market stocks will melt upwards before falling abruptly. The next chart courtesy of www.bloombergbriefs.com compares today’s market with the 1929 crash and the Nikkei’s 1989 collapse. It’s important to note that the rate of increase in stock prices – was higher right before the subsequent fall. In other words, the slope was steepest immediately before the eventual downturn. In the next section we’re going to look at some momentum stocks – they’re stocks whose prices are so disconnected from their financials that no one really knows how much they’re worth. What’s interesting that a lot of these companies are exhibiting the same patterns that are often seen with bubbles. Before we continue let’s talk about the Williams %R Indicator. It is a momentum indicator that is commonly used to indicate overbought or oversold conditions. However, through learning the HPTZ Methodology I have considered another perspective. When the indicator reaches extreme levels (-20/-80) it suggests positive or negative pressure on the market that has been shown to sustain runs or trends. If you examine the writings of Williams he discusses the use of the indicator as overbought or oversold only after an extreme has been reached and after a certain number of bars have passed. First let’s take a look at $LNG. On the monthly chart we can see that Cheniere has been ramping up for a while now. Furthemore, the monthly williams %R has been trending up steadily for years. On the weekly chart the red arrows indicate 4 different slopes. Each new slope is steeper than the last which means that $LNG’s price is increasing at a faster rate. The Williams %R on the weekly is still above -20 which is indicative of positive pressure. The hourly chart shows that $LNG continues to rise steadily. On the daily chart we can see that the daily Williams %R is showing signs of positive pressure at -15.53. The next company that we’re going to look is is $CELG. On the monthly chart it looks as though it almost went vertical. Furthemore, the monthly Williams %R – which is at -49.02 – hasn’t fallen below -80 since the beginning of 2011. The weekly chart shows that after rising steadily from 2009 to the end of 2012, $CELG begin a rapid ascent at the beginning of 2013. It has pulled back since the beginning of 2014 and the Williams %R is at -99.21; this is the first time it has been below -80 since the summer of 2013. The hourly chart shows that Celgene has been selling off for a little over a month or so. On the daily chart we can see that after an orderly rise from April of 2013 to the beginning of 2014, $CELG has now fallen off a bit. Celgene is now falling at a faster rate and the Williams %R has fallen below -80 remains in a downtrend. The last company we’re going to look at is Gilead Sciences. It’s rapid ascent is best captured by the monthly chart. The monthly Williams %R is now at -38.42 – the lowest it has been since early 2012. On the weekly chart we can see that $GILD began to accelerate at the beginning of 2013. The recent downfall has sent the weekly Williams %R below -80 for the first time since the fall of 2012. On the hourly chart we can see that $GILD has been in a downtrend since the beginning of march. The daily chart shows that the Williams %R is at -92.83 and hasn’t been above -20 since late February. $LNG, $CELG, and $GILD are three examples of stocks that have made tremendous gains over the past few years. The takeaway point is that many stocks are trading above what most people would consider reasonable valuations. A lot of the time, these companies aren’t even profitable. On a trailing twelve month basis, $LNG hasn’t made a profit in the last 5 years. Both $CELG and $GILD are profitable, however their stock prices are growing at a much faster rate than their cash flows and net income are. Is this the top? There’s no way to tell. Do some areas of the market look like past bubbles once did? Without a doubt. The last step up before the fall is often characterized by a feeling that the market is invincible. Despite the S&P’s incredible run, it cannot continue to rally forever. Eventually, economic fundamentals will matter again and when that happens it’s likely that the market will sell off. George Santayana once said that “those who cannot remember the past are condemned to repeat it” | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Triple Whammy Shocker: Goldman Shutting Down Sigma X? Posted: 08 Apr 2014 05:47 PM PDT Back on March 21, before the release of Michael Lewis' Flash Boys and before the infamous 60 Minutes interview, when Goldman COO Gary Cohn wrote his infamous WSJ Op-ed bashing HFT, it was clear that something was afoot. That something became promptly clear when it was revealed that Goldman is among the core backers of the pseudo dark-pool IEX exchange popularized as the protagonist in Flash Boys, and juxtaposed to the frontrunning, and faceless, HFT antagonist that Lewis maanged to demonize so well in the span of a few hundred pages, he promptly provoked a renewed investigation by the FBI, the SEC and DOJ into HFT. A few days later, the shocker became a double whammy when Goldman announced that in addition to turning its back on HFT which had served it so well for years, the firm would also say goodbye to the NYSE and its designated market maker post, the last remaining legacy of its $6.5 billion Spear Ledds & Kellogg acquisition from 2000. That Goldman was asking mere pennies on the dollar for the residual assets also showed just how "highly" Goldman valued said legacy operation. This is what we said at the time of the announcement:

Moments ago we got the third and final "shocker" in this series of stunning disclosures by Goldman, this time involving Goldman's own "unlit" venue - one involving its own Dark Pool - the infamous, and market dominant Sigma X, which according to the WSJ, is about to be shut down!

That this is a momentous development, if true, needs no explanation. Because while Sigma X may or may not be the top dark pool in the industry - a claim that Credit Suisse can possibly make alongside Goldman- Sigma X, which we have written about extensively over the past five years, certainly provides Goldman with not only extensive daily revenue but also gives the firm an inside look into what happens in the institutional marketplace, since the bulk of hedge funds and most mutual funds transact almost exclusively on dark pools now in an attempt to avoid precisely the parasitic HFT algos that have been the topic of so much discussion in recent days. And if Goldman is willing to exit not only HFT, not only legacy lit markets entirely, but also its dark pool, then something truly big and transformational is coming to not only the existing market structure, but something that will be so disruptive, that for once we can't wait to find out just what Goldman has up its sleeves, sleeves which also happen to house the key lawmakers in the Beltway. Why is Goldman doing this now? We don't know. It is worth noting however that on page 234 of Flash Boys, Michael Lewis cites Ron Morgan and Brian Levine, Goldman Partners and co-heads of Goldman's global stock markets, who said that "Unless there are some changes, there's going to be a massive crash, a flash crash times ten."

Goldman exiting virtually all venues except the upstart IEX is certainly a major change. Another thing that is certain: take a long, hard look at the market as you know it today, because in less than a year it will be history. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

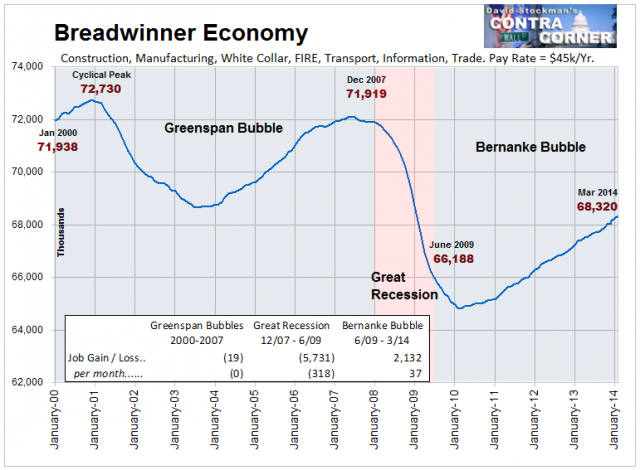

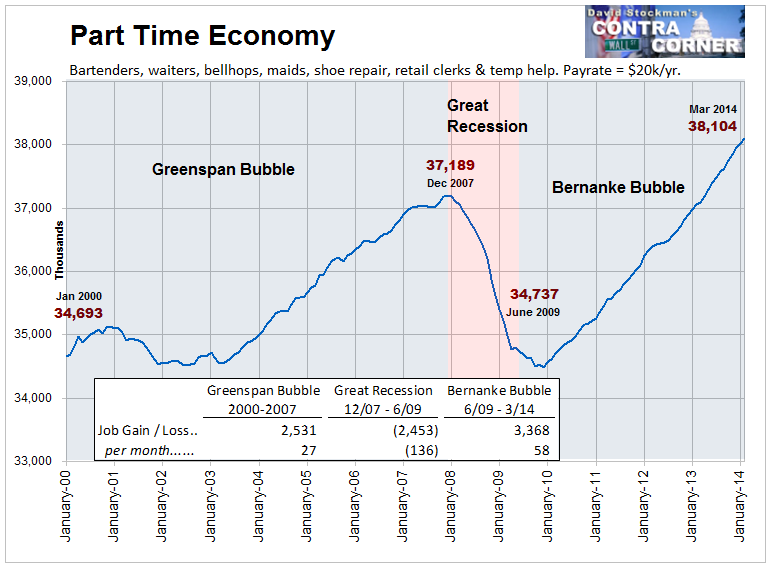

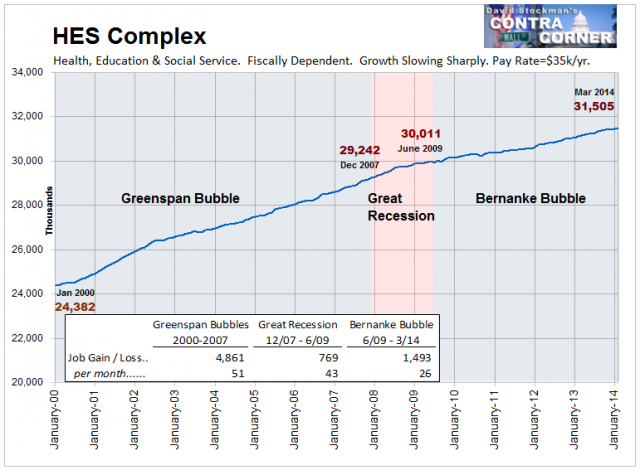

| David Stockman's "Born Again Jobs Scam": The Ugly Truth Behind "Jobs Friday" Posted: 08 Apr 2014 05:06 PM PDT Submitted by David Stockman via his Contra Corner blog, The mainstream recovery narrative has an astounding “recency bias”. According to all the CNBC talking heads, the 192,000 NFP jobs gain reported on Friday constituted another “strong” report card. Well, let’s see. Approximately 75 months ago (December 2007) at the cyclical peak before the so-called Great Recession, the BLS reported 138.4 million NFP jobs. When the hosanna chorus broke into song last Friday, the reported figure was 137.9 million NFP jobs. By the lights of old-fashioned subtraction, therefore, we are still 500k jobs short—notwithstanding $3.5 trillion of money printing in the interim. The truth is, all the ballyhooed “new jobs” celebrated on bubblevision month-after-month have actually been “born again” jobs. That is, jobs which were created during the Fed’s 2002-2007 bubble inflation; lost in the aftermath of the September 2008 meltdown; and then “recovered” during the renewed bubble inflation now underway. Stated differently, back when the NFP jobs count first clocked in at 137.9 million in the fall of 2007, the talking heads assured us that we were in a permanent “goldilocks economy” thanks to the brilliant management skills of the Fed. So here we are nearly 7 years later, still a half million jobs short, and the talking heads are gumming once again about the same old illusory “goldilocks”. Who actually pays these people to bloviate! Setting aside the utterly superficial recency bias, its not hard to see the dire reality lurking in the actual trends. To be precise, 75 months into the post-2000 cycle the US economy had generated 5 million net new jobs—that is, it was way above its prior high water mark. Likewise, 75 months on from the 1990 peak, it had produced 10 million net new jobs. So the fact that we are still in negative jobs territory this far into a recovery cycle is literally off-the-historical-charts. And the fact that we are already in month 57 of this business expansion when the ten expansions since 1950 have averaged only 53 months in duration is even more telling. Notwithstanding Bernanke’s hubristic proclamation of the Great Moderation, the Fed has not abolished recessions—so this time the cyclical clock may run out long before many actual “new jobs” are created. Indeed, by any reasonable standard, an economy which has gained 10 million new working age citizens during the past 7 years, but has generated not a single net new NFP job is failing badly. The Friday report, like the dozens before it, should have been a cause for alarm, not celebration. In fact, the true story is even worse for two reasons. First, as shown below the quality-mix of even these “born again” jobs has deteriorated sharply. Secondly, the 7 million jobs that were recovered since the official recession bottom in June 2009 had virtually nothing to do with the massive money printing campaign of the Fed or, for that matter, the rest of the Washington stimulus spree of bailouts and boondoggles. Consider first the quality deterioration, and the fact that when it comes to economics the proper metric is surely not one-job-one-vote. About half of the jobs in the NFP consist of “breadwinner” jobs in the core sectors—–manufacturing, construction, the white collar professions, FIRE, transportation and trade, information services and media and business management and support services. According to the BLS establishment survey data, these positions generate an annualized pay rate of about $45k—-marginally enough to support a family in many areas of the country. As shown below, the Breadwinner Economy has been trending south for this entire century! There were 72-73 million of these jobs in 2000; no growth happened during the entire Greenspan Bubble; a thundering collapse occurred during the Great Recession; and there has been only a tepid, fractional recovery since. In fact, among the 5.7 million Breadwinner Economy jobs lost by the time the recession officially ended in June 2009—- only 37 percent have been recovered during the nearly five years since then. And that’s notwithstanding the ritual proclamations about “progress” on each and every “Jobs Friday”. As shown below, jobs in the Breadwinner Economy pay 2.5X those in the Part Time Economy and 30% more than the HES Complex. So the implications for economic growth and living standards are self-evident. The Breadwinner Economy with half the NFP jobs accounts for more than two-thirds of aggregate wage and salary income. Accordingly, it is not surprising that the real median household income has fallen 7% since 2000. The breadwinner jobs which support it have trended sharply downward and today clock in at only 68.3 million—a level that was first reached during Bill Clinton’s second term. Yes, there has been some recovery since the recession bottom, but the rate of gain has been tepid and underscores the borrowed time point. At the rate of recovery since June 2009—-about 37,000 per month—it would take until 2024 to get back to the 73 million Breadwinner Economy jobs posted at the time that Florida’s hanging chads were being recounted after the 2000 election. Digging deeper into the Breadwinner Economy only darkens the picture. The very highest paying jobs in this broad category are in the “goods-producing” sector— construction, mining/energy and manufacturing. The NFP count for goods-producing industries in 2000 was 24.6 million. By contrast, the number reported last Friday was 18.9 million—-23% below its level 14 years ago. And don’t look for the gap to be filled any time soon. Only 9,000 jobs per month have been created in good-producing since June 2009. So by the lights of pure arithmetic, it would take until the year 2067 to regain the January 2000 high water mark! Another big chunk of the Breadwinner Economy jobs is accounted for by what we have termed “Core Government” jobs, and it includes employment at all levels of government excluding the Post Office and Education. There were 11 million of these jobs–paying upwards of $60,000 on average— in Friday’s report and that is virtually the same figure reported for December 2007. So we are at “peak jobs” in the Core Government sector, and if anything the number of these high paying jobs will also shrink during the years ahead. That prospect is owing to the inexorably tightening fiscal vice in which the public sector is now impaled. To wit, the massive growth of transfer payments due to baby boom retirements and the failed economy’s pressure on the safety net is squeezing out all other government spending—-and most especially jobs-intensive public sector service delivery. On the other side of the ledger, publicly-held debt of government at all levels is nearly $16 trillion or 95% of GDP and rising rapidly. This means that spending growth to hire more bureaucrats will be virtually impossible—-even with borrowed money. That leaves about 38 million jobs in all the other Breadwinner Economy industries mentioned above such as FIRE, trade and transportation, business services etc.—a category we have termed “core private business services”. Even here, the March print was still 425,000 below the December 2007 peak, and, more importantly, still less than 4% above its turn of the century level of 37 million jobs. Stated differently, this category is the only part of the Breadwinner Economy which has been growing, but the rate of job creation over the last 14 years has been just 8K per month. And this points to the real scam embedded in the “Jobs Friday” celebrations. Overwhelmingly, the job count gains being reported are in the Part Time Economy. This category encompasses about 38 million NFP jobs, and consist of bell-hops, bartenders, waiters, maids, nail salons, shoe repair, street vendors, retail clerks, temp jobs and the like. According to the BLS data, these categories generate an annual full-time pay equivalent of just $20,000. These are ”survival” jobs at best, yet they account for fully one-half of all the born again jobs reported since June 2009 (3.4 million out of 7 million). Unlike the Breadwinner Economy, this sector has recovered its December 2007 high water mark of 37.2 million jobs and then some. Last Friday’s report showed 38.1 million jobs in the Part Time economy for a net gain of about 3% over the past seven years. Yet even here the story is hardly reassuring. To be precise, the Part Time Economy has gained 915,000 jobs since December 2007 and 968,000 of them—more than 100%– have been in bars, restaurants, resorts, race tracks, theme parks and other places of amusement. In short, what has materialized is a Bread & Circuses economy. The BLS category containing the above industries, called “leisure and hospitality”, posted 11.7 million jobs in January 2000. The figure for March 2014 was 14.5 million. Thus, Bread & Circuses accounted for fully 40% of the entire total of 6.9 million NFP jobs created in the American economy during the 21st century. The balance and then some is attributable to the final broad NFP category we have labeled the HES Complex, which consists of health services, education in both private and public sector and social services including day care. As shown below, this has been the growth engine of the NFP. The 31.5 million jobs in the HES Complex reported for March 2014 represented a 2.3 million gain from the December 2007 peak, and a gain of 6.8 million jobs or nearly 30% from January 2000. Yet there are more than a few skunks in this woodpile, as well. Nearly 75% of the gain in HES Complex jobs this century occurred before December 2007. That robust gain of 4.9 million jobs, however was heavily concentrated in education, nursing homes, hospitals, home health care and social assistance—which accounted for 80% of the pick-up. The common characteristic of these categories is obviously that they are heavily fiscally dependent. With the exception of hospitals, all of these categories derive 75% or more of their revenues from local, state and Federal coffers, and even in the case of hospitals, Medicare, Medicaid and other public programs account for upwards of one-half of receipts. Needless to say, the fiscal vice has been tightening steadily ever since the financial crisis. Accordingly, education jobs have been flat since December 2007 and hospital and nursing homes employment has risen at only a 1% annual rate. Overall, the rate of HES Complex job growth has thus slowed sharply—-from 51K jobs per month during the Greenspan Bubble to 43K per month during the Great Recession to just 26K since June 2009. Not only has the rate of HES job growth slowed markedly in the face of peak fiscal debt, but even the job growth that has occurred has been in the lowest paying parts of the sector. That is, the gains have not been among doctors, skilled nurses or medical technicians. In fact, about 1.2 million or 80% of the HES Complex job gains since June 2009 have been among home health aids, day care workers and nursing home staff. Increasingly, what is left of the HES Complex growth machines amounts to a Bed Pan, Home Companion and Baby Sitters Brigade. Indeed, annual pay rates for the entire HES Complex average just $35,000 according to the BLS data. Obviously, the growth in recent years has been among categories where compensation is substantially lower. So this is what the Hosanna Chorus is celebrating—-a job machine that is broken and generating part-time and low-end positions that still do not add up to the 2007 high water mark. Moreover, as will be shown in the next installment, the Fed’s furious money printing has had virtually no role in generating even the “born again” jobs which have been so joyously welcomed on Jobs Friday. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Today the Gold Price also Closed Above its 200 Day Moving Average at $1,308.70 Posted: 08 Apr 2014 04:42 PM PDT

Sorry I missed y'all yesterday, all the more since it was a near perfect day for silver and GOLD PRICES. The GOLD PRICE rose today $10.70 (0.8%) to $1,308.70 while silver held its hand and rose 15.1 cents (0.8%) to 2004.2c. Gold price's little correction yesterday was picture perfect. Friday it broke through resistance at $1,295 after several tries, but closed below $1,305 resistance at $1,303.20. Yesterday it closed down at $1,298, lower but still holding solidly above $1,295 support, and closed ABOVE $1,305 resistance at $1,308.7. May I warble further? Today the gold price also closed above its 200 DMA ($1,296.90) and, yet there is more. Gold has now rallied out of the Dec-February upside down head and shoulders, broke through the neckline of that formation in a rally to $1,392.60, corrected back to the neckline for a final kiss good-bye last week, and now 'tis climbing again. THIS would be the place to buy. Although I have not yet decided yet whether the correction is complete, or whether we will see one more up and down, but I doubt any later leg down will drop lower than what we have seen. Above the 20 DMA lurks at $1,319.82. Crossing that will bring out many more of gold's fair weather friends. The gold price has seen its bottom for a while. The SILVER PRICE stands a gnat's eyelash from flashing an MACD buy signal, the full stochastic is turning up, rate of change is rising, AND (I'm almost out of breath) it bounced off its post-April 2013 downtrend line at end March. Yet for all in its favor, silver must yet close above 2015c. We ought to witness that tomorrow. By the way, silver's performance yesterday was as good as gold, with a retreat to support at 1975c and bounce back today. GOLD/SILVER RATIO today ended at 65.298, and is not dropping from its March peak as quickly as I would like, but what would I do with without something to fret about? On to stocks, yesterday the Dow dropped only ten points while the S&P500 plunged a massive 20.5 (1.1%). That trashed the S&P500 chart. A two day waterfall took it from 1897.28 to 1845.04. This also was a completed key reversal. Today it cut into but closed above the 50 DMA (1,840.57), and flopped back 6.9 (0.38%) to 1,851.96. The S&P is breaking down. Thus sayeth its position on the chart thus screameth its key reversal. Unless Wall Street's friends in the Plunge Protection Team, the Nice Government Men, step up quick the blood will be flowing up to the horses bridles. Off a new all time intraday high on Friday, a push into new high territory, the Dow closed much lower, nearly 1%. That key reversal was confirmed yesterday with another drop and close below the 20 day moving average at 16,245.87. Today it bounced like a dead cat off the pavement, up 10.27 (0.06%). As with the S&P500, the MACD indicator has flashed a big red SELL signal. Much lower prices like ahead. Dow in Gold has plunged in the last three days and today closed at 12.42 oz (G$256.74 gold dollars). This hints but does not confirm that the correction that began mid March has peaked. DiG is about to cross below its 20 and 50 DMAs. Close below 11.62 oz (G$240.21) takes it below the low of the Dec-March fall. Dow in Silver dropped 0.93% today to 810.38 oz (S$1,047.76 silver dollars). It hovereth above its 20 DMA (805.93), first tripwire of a decline. MACD has turned down, and full Stochastics are confirming a downturn. Today currency markets overthrew expectations. The Bank of Japan, contrary to the market's expectation, vowed it would hold off on monetary easing -- central-bank-speak for "inflating" -- in the short term. All the folks short yen promptly puked in their wastebaskets and splurted out orders to cover their short positions. Yen gapped up massively, above its 20 and 50 DMAs, from 97 to 98.5 at the widest. Closed up 1.34% at 98.29 cents/Y100. Dollar took this news like a rockhammer in the teeth. Dropped a huge 50 basis points or 0.62% to 79.83, wiping out all its gains since mid-March. Considering how the US Dollar has struggled since bottoming in March, and now crashes through its 20 and 50 DMAs, it hath little hope for the future. It appears to have successfully transformed a nascent rally into Waterloo. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Today the Gold Price also Closed Above its 200 Day Moving Average at $1,308.70 Posted: 08 Apr 2014 04:42 PM PDT

Sorry I missed y'all yesterday, all the more since it was a near perfect day for silver and GOLD PRICES. The GOLD PRICE rose today $10.70 (0.8%) to $1,308.70 while silver held its hand and rose 15.1 cents (0.8%) to 2004.2c. Gold price's little correction yesterday was picture perfect. Friday it broke through resistance at $1,295 after several tries, but closed below $1,305 resistance at $1,303.20. Yesterday it closed down at $1,298, lower but still holding solidly above $1,295 support, and closed ABOVE $1,305 resistance at $1,308.7. May I warble further? Today the gold price also closed above its 200 DMA ($1,296.90) and, yet there is more. Gold has now rallied out of the Dec-February upside down head and shoulders, broke through the neckline of that formation in a rally to $1,392.60, corrected back to the neckline for a final kiss good-bye last week, and now 'tis climbing again. THIS would be the place to buy. Although I have not yet decided yet whether the correction is complete, or whether we will see one more up and down, but I doubt any later leg down will drop lower than what we have seen. Above the 20 DMA lurks at $1,319.82. Crossing that will bring out many more of gold's fair weather friends. The gold price has seen its bottom for a while. The SILVER PRICE stands a gnat's eyelash from flashing an MACD buy signal, the full stochastic is turning up, rate of change is rising, AND (I'm almost out of breath) it bounced off its post-April 2013 downtrend line at end March. Yet for all in its favor, silver must yet close above 2015c. We ought to witness that tomorrow. By the way, silver's performance yesterday was as good as gold, with a retreat to support at 1975c and bounce back today. GOLD/SILVER RATIO today ended at 65.298, and is not dropping from its March peak as quickly as I would like, but what would I do with without something to fret about? On to stocks, yesterday the Dow dropped only ten points while the S&P500 plunged a massive 20.5 (1.1%). That trashed the S&P500 chart. A two day waterfall took it from 1897.28 to 1845.04. This also was a completed key reversal. Today it cut into but closed above the 50 DMA (1,840.57), and flopped back 6.9 (0.38%) to 1,851.96. The S&P is breaking down. Thus sayeth its position on the chart thus screameth its key reversal. Unless Wall Street's friends in the Plunge Protection Team, the Nice Government Men, step up quick the blood will be flowing up to the horses bridles. Off a new all time intraday high on Friday, a push into new high territory, the Dow closed much lower, nearly 1%. That key reversal was confirmed yesterday with another drop and close below the 20 day moving average at 16,245.87. Today it bounced like a dead cat off the pavement, up 10.27 (0.06%). As with the S&P500, the MACD indicator has flashed a big red SELL signal. Much lower prices like ahead. Dow in Gold has plunged in the last three days and today closed at 12.42 oz (G$256.74 gold dollars). This hints but does not confirm that the correction that began mid March has peaked. DiG is about to cross below its 20 and 50 DMAs. Close below 11.62 oz (G$240.21) takes it below the low of the Dec-March fall. Dow in Silver dropped 0.93% today to 810.38 oz (S$1,047.76 silver dollars). It hovereth above its 20 DMA (805.93), first tripwire of a decline. MACD has turned down, and full Stochastics are confirming a downturn. Today currency markets overthrew expectations. The Bank of Japan, contrary to the market's expectation, vowed it would hold off on monetary easing -- central-bank-speak for "inflating" -- in the short term. All the folks short yen promptly puked in their wastebaskets and splurted out orders to cover their short positions. Yen gapped up massively, above its 20 and 50 DMAs, from 97 to 98.5 at the widest. Closed up 1.34% at 98.29 cents/Y100. Dollar took this news like a rockhammer in the teeth. Dropped a huge 50 basis points or 0.62% to 79.83, wiping out all its gains since mid-March. Considering how the US Dollar has struggled since bottoming in March, and now crashes through its 20 and 50 DMAs, it hath little hope for the future. It appears to have successfully transformed a nascent rally into Waterloo. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wise Investments in the Next Global Arms Race Posted: 08 Apr 2014 04:19 PM PDT In late March, Russia’s president Vladimir Putin announced he’s reinstating a Stalin-era fitness program called Ready for Labor and Defense. “It hasn’t been revealed what the modern version of the program will consist of,” Time magazine informs us, “but back in the USSR, it required comrade citizens to enter competitions in sports like running, jumping, skiing, swimming and, well, grenade throwing. Tests were set and those who passed were given gold and silver badges that were worn with pride on proletarian chests.” We’re not sure which is worse… Russians anticipating the return of a “Stalin-era fitness program”… or Americans enduring Michelle Obama’s Let’s Move! campaign. But then, Putin is a variety of leader with whom Americans are generally unfamiliar. To overcome this knowledge gap, a few folks around the office here put together the following video. No, that’s not true: They put together this tongue-in-cheek video to generate some Web traffic. We guarantee you’ll be no better informed after watching it than before. But we trust you’ll be entertained. [Ed. note: If you notice a resemblance to the viral "Honey Badger" video of a few years back, that was on purpose. Well, we did our best to make the language comport with the Presbyterian standard -- Agora Inc. founder Bill Bonner's guideline that we should be comfortable showing anything we write to our mothers.] “The situation in Ukraine is a looming disaster for Western interests,” says our military affairs expert Byron King, in all seriousness. The irony is that in Ukraine, “Western interests are abstract, and the ability to enforce a ‘Western’ position is absent.” On that score, we’ll interrupt Byron long enough to share the results of a public opinion poll. In late March The Washington Post commissioned a survey of 2,066 Americans, asking them what they think the U.S. government should “do” about Ukraine. But in an online twist, the pollsters also asked them to locate Ukraine by clicking on a high-resolution world map. Each of the 2,066 responses are plotted here, the most accurate in red and the least in blue. “The farther their guesses were from Ukraine’s actual location,” write the pollsters, “the more they wanted the U.S. to intervene with military force.” The pollsters did not disclose whether they included any members of Congress in their survey. Heh… “Ukraine is a pathetic basket case,” says Byron — getting us back on track one more time. “If nothing else, Ukraine ought to be rich in agricultural potential; it ought to be a wealthy breadbasket, certainly in a world where food is getting more valuable every year. But the fact is that Ukraine is broke and has been horribly misgoverned over the past two decades since it fell out of the breakup of the former Soviet Union.” Crimea? “Russia’s incorporation of Crimea and Sevastopol is over. It’s a fait accompli. We’ve just watched history get made, and stand by… there may be more of that history stuff yet to come.” The West has little stake in Crimea, but “control of Crimea is certainly a Russian national interest,” Byron goes on. “Yet pretty much the entire leadership caste of the West was caught flat-footed by Russia’s rapid takedown of Crimea.” The Wall Street Journal says U.S. intelligence services got none of the typical warnings that precede this sort of news. Then again, “How much intelligence gathering does it take to confirm that people running Russia — certainly Mr. Putin — believe strongly in pursuing Russia’s long-term security interests?” “For investors, implications run deep,” says Byron. “We live in a time of new crisis when the dollar may strengthen due to its safe-haven status but inflation is hiding in plain sight — as close as the next federal budget or Federal Reserve meeting. “In general, I like hard assets like precious metals, key industrial metals and energy supplies. Then there’s also leading-edge technology, for which the world will always provide a market. “With what we’re seeing,” he adds, “I anticipate a new arms race.” Byron once thought Asia would be the focus of that arms race, given China’s run-ins with its neighbors. “Now I suspect that the arms race will go global. The shock waves of Ukraine and Crimea will ripple out to touch markets and investors everywhere.” Near term, if U.S. intelligence really was caught flat-footed by Crimea, that means more spending for satellites and surveillance — good news for the “Big Five” defense contractors. Regards, Dave Gonigam Ed. Note: Longer term, it means big money flows to some very small players. And in today’s issue of The 5 Min. Forecast, Dave gave readers a chance to learn more about a handful of them. And that’s just one of the many real profit opportunities he relays in every single issue. Check it out for yourself, right here. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 08 Apr 2014 03:47 PM PDT Dollar Is Dropped As Countries And Central Banks Declared Their Holdings In Yuan : The housing bubble is now showing signs of popping with mortgage origination's plunging to their lowest level. Another banker commits suicide. The US government is now pushing their agenda of disarming the American... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 08 Apr 2014 03:43 PM PDT Graceland Update | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Headed for Neo-Communism - Mikkel Clair Nissen Posted: 08 Apr 2014 03:35 PM PDT Danish author says that the American economy is being deliberately destroyed to move it even farther left, on thoughts on why the EU & US is heading towards Neo-Communism or Corporate-Communism.The Dane spends 80% of every dollar on tax.What we in America are living in right now Lars is a... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

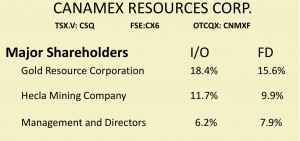

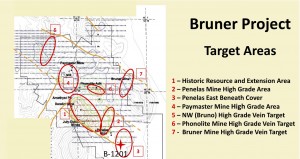

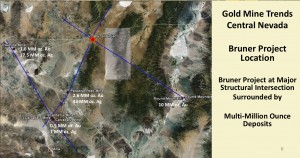

| Why These 2 NYSE Gold Producers are Buying This Junior During a Bear Market Posted: 08 Apr 2014 02:56 PM PDT Gold is gaining strength as it may soon close above the 50 day after reversing above the 200 day moving average after falling below that level last week. That may have been a shakeout of weak hands below the 200 day as it appears in 2014 money has been moving from the overbought equity market into the undervalued commodities in the form of junior miners. Look for a close above the 50 day at $1310. Investors may be preparing for the eventual reinflation, which may have been sparked by Yellen’s taper. The U.S. dollar and general equity market appears to be forming a rounding top while gold, silver and the junior miners are seeing increased accumulation a higher lows typical of new bull market moves. The key now is asset preservation in a rising interest rate, inflationary environment. I still believe gold, silver and the industrial metals specifically PGM’s, nickel and uranium could soar. These are the areas that I believe are the safest to be when interest rates are negative and when Central Banks are continuing to fire up the printing press engines. The overbought social media and marijuana stocks with no earnings could be just beginning to bust. Look at all the IPO’s in social media and pot stocks reminding us of the Dot.Com craze. While these stocks come back to earth the junior miners could actually soar as The Fed may have to reverse their taper moves and actually increase quantitative easing to deal with the aftermath of the tech/marijuana bubble bursting. The junior sector has been beaten down for almost seven years on fears of deflation and a slowing global economy especially in China. Other sectors have reinflated real estate, financials and technology to ridiculously high levels. I believe the opportunities exist in the junior miners especially the gold explorers in Nevada. Canamex Resources (CSQ.V or CNMXF) recently announced that Gold Resource Corporation (GORO) has funded the company for the next major drilling program. This investment means that Gold Resource Corp will join Hecla (HL) as a strategic partner. When you see two large NYSE gold producers take significant positions it is time to pay full attention as they did plenty of due diligence in this company which is way undervalued and not yet discovered by the retail market. There are many reasons these top miners are investing in Canamex. Canamex’s Bruner Project is located in Nevada which is probably the top gold mining jurisdiction in the world on 500 acres of private land. This means they may have a shorter permitting timeline. Canamex has excellent infrastucture with grid power only 12 miles away and access to a highway. The metallurgy is excellent with high extractions using lower levels of reagents. They have a historical resource which is growing with a recent drill intercept of 57.9 meters of over 5 g/ton. Canamex is diamond drilling five core holes to test this feeder zone. The stock sold off as they got back the first hole which did not hit. However, one should realize four more holes are coming from this area alone. In addition they will have more than fifty or so further drill holes to assay. Gold Resource Corp and Hecla did not invest millions of dollars for one drill hole. There is still a lot more from this drilling program to report. More drilling is expected from the historic resource before the core drill is moved to the Penelas East discovery where another RC drill will be coming in mid-April. Do not forget about Penelas East on a different part of the property where they hit 110 meter of over 4 g/ton material. Could they be connected with high grade feeder systems? The investment by NYSE listed Hecla and Gold Resource Corp may signal that they feel there may be a good chance. Don’t panic from the first drill hole which was disappointing. Now with cash in hand Canamex has commenced diamond drilling at Bruner. Over 10k meters of drilling will take place in 2014 following up on the high grade feeder zone in the historic resource and the Penelas East Discovery. The company could have good news flow over the next six months as they are putting together a major drilling program in 2014. See my recent interview with Canamex (CSQ.V or CNMXF) CEO Bob Kramer by clicking on the following link: http://www.youtube.com/watch?v=5MGwSvidbTo Please call Canamex CEO and Director Robert Kramer for further information: 604.336.8621 Disclosure: I am a shareholder and the company is a website sponsor. ___________________________________________________________________________ Sign up for my free newsletter by clicking here… Sign up for my premium service to see new interviews and reports by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… Accredited investors looking for relevant news click here… Please forward this article to a friend. To send feedback or to contact me click here… Listen to other interviews with movers and shakers in the mining industry below or by clicking here… Listen to internet radio with goldstocktrades on BlogTalkRadio

| ||||||||||||||||||||||||||||||||||||||||||||||||||||