Gold World News Flash |

- Fed HYPERINFLATION and the 1% Who PROFIT From It

- Will The Fed Turn Us Back Up?

- Gold and Silver Speculation

- 16 Signs That Most Americans Are NOT PREPARED For The Coming Economic Collapse

- Shocking Charts Show Silver Set For A Staggering $70 Surge

- Charles Goyette: Ukraine May Accelerate Petro Dollar’s Death

- Will We Demand the Inexpensive Fix Which Will Prevent Armageddon … Or Focus On Over-Blown Dangers?

- Guest Post: 16 Signs That Most Americans Are Not Prepared For The Coming Economic Collapse

- Silver and Gold Prices Have Posted Their Lows with Gold Closing at $1,305.50

- Silver and Gold Prices Have Posted Their Lows with Gold Closing at $1,305.50

- Telegraph notes research on China's huge gold demand by GoldMoney's Macleod

- Gold Pushed Above $1,310 By US Fed Statement

- Gold Daily and Silver Weekly Charts - Who or What Will Let the Dawg Out?

- Gold Daily and Silver Weekly Charts - Who or What Will Let the Dawg Out?

- One Market to Avoid Like the Plague in April

- Rick Rule - Silver & A Golden Opportunity For Investors

- Welcome to the Currency War, Part 15: Europeans Ordered to Start Consuming

- In The News Today

- Liz Warren Predicts the Collapse of the Middle Class in 2008

- Liz Warren Predicts the Collapse of the Middle Class in 2008

- Charles Goyette: Ukraine May Accelerate Petro Dollar's Death

- Buying Goldandsilver Yet?

- Buying Goldandsilver Yet?

- U.S. Dollar MELTDOWN to Establish GLOBAL Currency

- The Great Unwashed American Energy Independence

- CORPORATOCRACY

- China Gold Imports Through Hong Kong

- China Gold Imports Through Hong Kong

- China 'has more gold than official figures show'

- Gold Prices Erase 0.9% Gain Despite Fresh Ukraine Tensions, Physical Tightness Fades Again in London

- What’s going on with silver?

- Big Winners from the Russia-Crimea Fallout

- Monetary Collapse and Silver Price Not So Orderly Rise

- Precious Metals Market Report with Franklin Sanders

- How will Gold respond to global Deflation?

- Gold Price Stuck in a Rut?

- Gold Price Stuck in a Rut?

- Insider Gold Stock Secrets

- Insider Gold Stock Secrets

- Gold Import Rules: India's BJP Manifesto Silent

- Gold Import Rules: India's BJP Manifesto Silent

- How will gold respond to global deflation?

- Puerto Rico's Tax Benefits—More than 'The Better Florida'

- Puerto Rico's Tax Benefits—More than 'The Better Florida'

- Puerto Rico's Tax Benefits—More than 'The Better Florida'

- Are You Prepared for a Bull Market that Will Shock Even the Most Ardent Goldbugs?

- Are You Prepared for a Bull Market that Will Shock Even the Most Ardent Goldbugs?

- Are You Prepared for a Bull Market that Will Shock Even the Most Ardent Goldbugs?

| Fed HYPERINFLATION and the 1% Who PROFIT From It Posted: 10 Apr 2014 12:50 AM PDT Fed policies have been historically very obvious. More money printing and low interest rates. This has caused a dramatic decline in the value of the US dollar. As a result, the middle class has become less and less of reality.The elite are benefitting from the inflationary policies because they... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

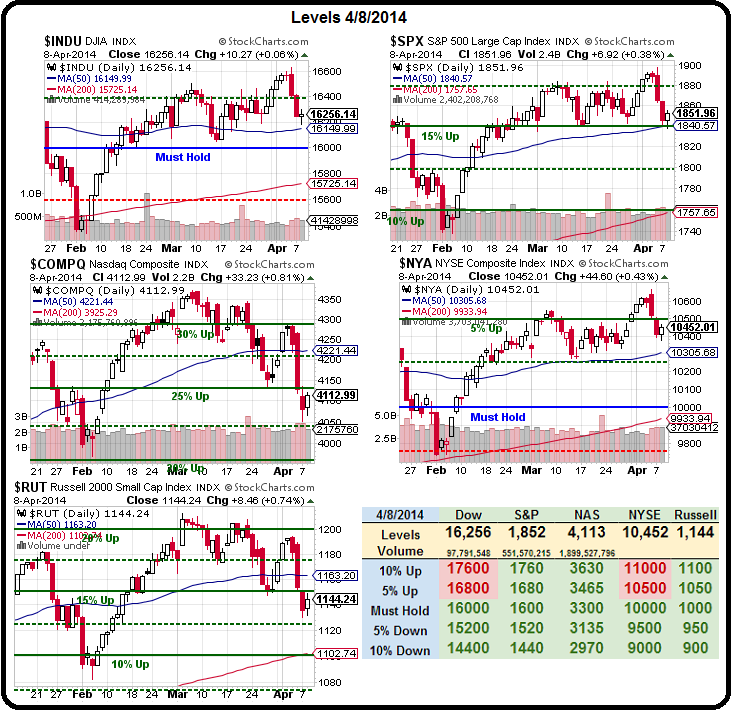

| Posted: 09 Apr 2014 10:12 PM PDT By Phil of Phil's Stock World (originally published on April 9, 14) As nasty as our Big Chart looks at the moment, we only have two Vomiting Cobra Patterns (Nasdaq and Russell) while the other three indexes are still forming Spitting Cobras, which are only LIKELY to head lower.

Forget the Ukraine, there's an all-out Global currency war being waged as we speak and yesterday the Dollar was the clear winner by losing 1% of its value in a single day. With over 250 days left until the end of the year, that extrapolates out to -150% by Christmas, which means you'd better start shopping now, before your next IPhone costs $1,000 (if you can afford the gas to get to the store, that is).

A weak currency may not be good for those with JOBS, who get paid in Dollars, or those with small businesses, who buy more and more expensive raw materials and then have to accept Dollars from customers. But for our Corporate Citizens, it could not be better. They sell 50% of their goods overseas so a weak Dollar is great for sales and it lowers the relative wages they pay US workers and, of course, it makes Dollar debt so much cheaper to pay back. That is how the Interests of our Corporate Citizens and the Government align. Our Government also has a lot of debt to pay back, but they have to pay it back in Dollars and, the less the Dollar is worth, the cheaper it is to pay it back. USUALLY, when your currency is weak, interest rates rise to compensate – so there's a check and balance to the system but the Fed has destroyed those checks and balances, allowing us to devalue our currency with NO CONSEQUENCES – EVER!!!

Well, maybe not "ever," as other countries (cough, Japan! cough, cough) also have mountains of debt that they would like to print their way out of too. China wants a weak currency so they can sell their goods overseas and Germany wants a weak Euro for the same reason. So it's a global race to the bottom and Corporations love it as it even boosts their earnings since they sell the same stuff now for $40 that they used to sell for $20 10 years ago. It makes every CEO look like a genius. He boosts the "earnings" of his company and justifies his bonus – which keeps him miles ahead of inflation and, after all, as long as the top 0.01% are winning – don't we all win?

The other 10,989,000 families in the top 10% shared the rest of the $350Bn; it's enough for them to each get $31,000 but, of course, the top 0.1% (110,000 families) grabbed $635,000 for themselves and that added up to $70Bn and the next 440,000 families in the top 0.5% (not including those above) gave themselves $125,000 raises for another $55Bn, which left just $225Bn to go to the other 10.5M families in the top 10%, which worked out to just $21,500 in raises over 10 years for the top 10% – no wonder they want to steal more money from the bottom 90% – they barely got any in this round!

What's missing from this chart? Wealth creation. There simply wasn't any! No new wealth was created at all outside of capital gains (which were a lot!) in America in the past 10 years. Money was taken from the wages of the bottom 90% and transferred to the top 10%, but mostly the top 0.01%.

Imagine what it's like to only earn $34,000 and, 10 years later, being paid $30,400 for the same job. That's the income for the ENTIRE family, not per person. That's how the bottom 90% of America is living and that is why we're short XRT (see – it does relate to the markets), because most people simply have no disposable income. That's also why we short oil at $102.50 (there this morning) – because, no matter how rich the top 1% get, they can only fly one jet at a time and only use one limo at a time. So things like oil and gasoline, which must be consumed in mass quantities, are simply unaffordable over a certain price. This again is great for rich people as the lack of demand from poor people keeps prices low when they gas up the Range Rover. This is unacceptable, to reasonable people, and can't last. It wouldn't last if the Fed didn't make it all possible by artificially manipulating the money supply and the interest rates to mask over what is becoming a plantation-style economy, where the great mass of workers barely make enough while the masters live in blissful luxury in the big house. For now, the Corporate Media keeps the masses in line but can we really expect another 10 years of this to continue without some blow-back? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 09 Apr 2014 09:59 PM PDT by Keith Weiner

There is a stark difference between the states of the markets for the monetary metals. The number of open futures contracts in gold is low, while in silver it's high. First, let's look at the data and then we'll discuss what it means. Here is the graph showing the open interest.

The picture is clear enough. Since the beginning of fall, the number of gold contracts has blipped up and down and now there are somewhat fewer (-3.7%). Meanwhile, the number of silver contracts has gone up substantially (+39%). Now let's look at the ratio of gold contracts to silver contracts, going back to 2010.

There is an unmistakable downward trend since the middle of 2010, almost 4 years ago. Then, there were about five gold contracts for every silver contract. Today, the ratio is down to two. OK, but what does this mean? Open interest is a proxy for speculative interest. This is not simply because contracts are created by buying, and destroyed by selling. You can't assume that contracts are created and destroyed as the price moves. To see why it doesn't work that way, look at the stock market. The price of a stock can move all over the place, but there need not be any change to the number of shares outstanding. In the futures market (unlike in the stock market), the number of contracts changes continually. Contracts are added or removed by the computer software that operates the market. When you buy or sell, an existing contract may be transferred from one party to another, or a new one may be created. It's complex, but in essence if you want to buy a contract just when else wants to sell, the contract will change hands. It works similarly if you want to sell short, right when someone who is already short wants to buy. By contrast, if there is no current owner of a contract to sell it to you, when you want to buy, then a new contract must be created. Who sells, who takes the short side of this contract? It can certainly be someone else wants to speculate on a falling price. There are always (well, usually) traders who go short silver. However, I don't think that this is the full explanation of the data shown in these two graphs. I favor a theory of arbitrage. If it's profitable to buy metal in the spot market and sell a future against it, then someone will take this trade. This short seller is a source of unlimited contract creation, if it's profitable. It's called carrying the metal. If you carry, then you make a small spread—without price risk. This spread is called the basis—the price of the future minus the price of spot metal. Or, more precisely, basis = Future(bid) – Spot(ask), because you must pay the ask when you buy the metal, and accept the bid when you sell the future. Let's take a look at the gold basis and silver basis for the Dec 2014 contract, from early fall through today.

The profit to carry gold has been steadily falling. It began at 0.35% (annualized), when the duration was 15 months. It was hardly the stuff of legends—or getting rich quick—even last October. That meager margin has been steadily eroding, and is now 0.1% for 8 months. Suffice to say that gold carry has offered little or no opportunity to make money. Therefore the gold carry trade has not been a big source of contract creation. The profit to carry silver, by contrast, has not much changed. It's still around 0.5% (annualized) or more. This is far more attractive than gold, and probably more attractive than other opportunities in our zero-interest world. Therefore, the silver carry trade has created many silver contracts. What drives the basis spread? Speculators, when they buy a future, drive up its price just a little bit. This is the inducement to the arbitrager to buy a bar of metal and sell the future to the speculator. The arbitrager carries metal, to provide a service to the speculator. He is the one who "converts" (I use this term carefully, in the full context defined here) metal to paper, a bar to a contract. He's ready, willing, and able to deliver that bar should the speculator have the cash to demand delivery. The long and short of it (to make a tired cliché into a dreadful pun) is that in gold, there just is not much speculation, and therefore no profit to be made carrying the metal, and therefore when a buyer occasionally comes to the market his demand can be satisfied by a previous buyer who is selling a contract. However, in silver buyers are running at a much more torrid pace. They're too numerous to be satisfied by the occasional seller. They bid up the price of the futures, which makes it attractive for arbitragers to carry silver and sell them the contracts they desire. Incredible as it may seem, at the low price of $20, speculation in silver is rampant. Market participants are trying to front-run a big price move. Due to rumors or gut feel or for whatever reason, they are expecting not only that silver will outperform gold, but that the silver price will rocket to a much higher price. Their frenetic buying of futures has pulled a lot of silver into carry trades. Maybe hoarders will all of a sudden increase their appetite for silver metal that they will take off the market and bury. If so, the silver futures speculators will be proven right, and they will make a lot of dollars (money is a different story entirely). I would not recommend that anyone bet his hard-earned money on a maybe. The data—both open interest and basis—show that the buying in the silver market is primarily speculators. They cannot sustain a higher price forever. They are merely trying to front run a higher price driven by hoarders. If hoarders don't come in, the speculators will be forced to capitulate. When that happens, watch out below. The neutral price of silver is in the $16's today. If the price overshoots as far to the downside as it is now stretched to the upside, we could see silver with a 12 handle.

© 2014 Monetary Metals. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 16 Signs That Most Americans Are NOT PREPARED For The Coming Economic Collapse Posted: 09 Apr 2014 09:50 PM PDT by Michael Snyder, The Economic Collapse:

Sometimes I think that I sound like a broken record. I am constantly using phrases such as “get prepared while you still can” and “time is running out”. In fact, I use them so often that people are starting to criticize me for it. But the truth is that only a small percentage of people out there are actively taking steps to get ready for what is coming. Most of the country is not prepared at all. In many ways, it is just like 2007 all over again. There were many people that could see what was about to happen and were doing all they could to warn people, but most did not listen. And then the great financial crisis of 2008 struck and millions of people lost their jobs and their homes. Unfortunately, the next great wave of the economic collapse is going to be even more painful than the last one. It is imperative that people get prepared for what is on the horizon, but for the most part it is just not happening. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shocking Charts Show Silver Set For A Staggering $70 Surge Posted: 09 Apr 2014 09:01 PM PDT  Today KWN is putting out a special piece which has some absolutely outstanding silver charts that were sent to us by David P. out of Europe. These are charts that the big bullion banks follow closely in the gold and silver markets, as well as big money and savvy professionals. David lays out the roadmap for a stunning advance in the price of silver, and also reveals some fascinating points about this bull market in silver. Today KWN is putting out a special piece which has some absolutely outstanding silver charts that were sent to us by David P. out of Europe. These are charts that the big bullion banks follow closely in the gold and silver markets, as well as big money and savvy professionals. David lays out the roadmap for a stunning advance in the price of silver, and also reveals some fascinating points about this bull market in silver.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Charles Goyette: Ukraine May Accelerate Petro Dollar’s Death Posted: 09 Apr 2014 08:40 PM PDT from WallStForMainSt: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will We Demand the Inexpensive Fix Which Will Prevent Armageddon … Or Focus On Over-Blown Dangers? Posted: 09 Apr 2014 05:45 PM PDT Well-known physicist Michio Kaku and other members of the American Physical Society asked Congress to appropriate $100 million to harden the country’s electrical grid against solar flares. As shown below, such an event is actually the most likely Armageddon-type event faced by humanity. Congress refused. Kaku explains that a solar flare like the one that hit the U.S. in 1859 would – in the current era of nuclear power and electric refrigeration – cause widespread destruction and chaos. Not only could such a flare bring on hundreds of Fukushima-type accidents, but it could well cause food riots globally. Kaku explains that relief came in for people hit by disasters like Katrina or Sandy from the “outside”. But a large solar flare could knock out a lot of the power nationwide. So – as people’s food spoils due to lack of refrigeration – emergency workers from other areas would be too preoccupied with their own local crisis to help. There would, in short, be no “cavalry” to the rescue in much of the country. In fact, NASA scientists are predicting that a solar storm will knock out most of the electrical power grid in many countries worldwide, perhaps for months. See this, this, this, this, this, this and this. News Corp Australia noted in February:

This is not just a theoretical fear: the Earth has narrowly missed being crisped by a large solar flare several times in the last couple of years. For example, the Los Angeles Times reported last month:

Meteorologist Jeff Masters notes:

Masters points out that the U.S. electrical grid is extremely vulnerable:

What would happen to nuclear power plants world wide if their power – and most of the surrounding modern infrastructure – is knocked out? Nuclear power companies are notoriously cheap in trying to cut costs. If they are failing to harden their electrical components to protect against the predicted solar storm, they are asking for trouble … perhaps on a scale that dwarfs Fukushima. Because while Fukushima is the first nuclear accident to involve multiple reactors within the same complex, a large solar storm could cause accidents at multiple complexes in numerous countries. Most current reactors are of a similarly outdated design as the Fukushima reactors, where the cooling systems require electricity to operate, and huge amounts of spent radioactive fuel are housed on-site, requiring continuous cooling to prevent radioactive release. (Designs which would automatically shut down – and cool down – in the event of an accident are ignored for political reasons.) If the nuclear power companies and governments continue to cut costs and take large gambles, the next nuclear accident could make Fukushima look tame. A large solar storm which knocks out electrical grids over wide portions of the planet will happen at some point in the future. Don’t pretend it is unforeseeable. The nuclear power industry is on notice that it must spend the relatively small amounts of money necessary to prevent a widespread meltdown from the loss of power due to a solar storm. G2 Bulletin reports:

Making Ourselves More Vulnerable to TerrorismIn addition, we’ve spent tens of trillions on the “war on terror”, but have failed to take steps to protect against the largest terrorist threat of all: an attack on the power supplies to nuclear power plants. An electromagnetic pulse (EMP) which took out the power supply to a nuclear power plant would cause a Fukushima-style meltdown, and spent fuel pools are extremely vulnerable to terrorism. Indeed, failing to harden our electrical grid invites a terrorist EMP attack because it is such an obvious vulnerability … its like waiving a red flag in front of a bull. Given that the Department of Homeland Security concludes that even North Korea can launch an EMP attack on the U.S., this is a real vulnerability. Unless we harden our electrical system to withstand electrical pulses, an EMP remains an attractive method for bad guys to bring the U.S. to its knees. Bottom line: Failing to harden our grid invites catastrophe from solar flares and terrorists. It makes us doubly vulnerable. There’s An Easy Fix … Are We Smart Enough to Take It?Japan’s nuclear meltdown, the economic crisis and the Gulf oil spill all happened for the same reason: big companies cutting every corner in the book – and hiding the existence of huge risks – in order to make a little money. There are relatively easy fixes to the threat from solar flares. The head of the leading consulting firm on the effect of electromagnetic disruptions on our power grid – which was commissioned to study the issue by the U.S. federal government – stated that it would be relatively inexpensive to reduce the vulnerability of our power grid:

Mechanical engineer Matthew Stein notes (footnotes omitted):

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Guest Post: 16 Signs That Most Americans Are Not Prepared For The Coming Economic Collapse Posted: 09 Apr 2014 05:33 PM PDT Submitted by Michael Snyder of The Economic Collapse blog, Sometimes I think that I sound like a broken record. I am constantly using phrases such as "get prepared while you still can" and "time is running out". In fact, I use them so often that people are starting to criticize me for it. But the truth is that only a small percentage of people out there are actively taking steps to get ready for what is coming. Most of the country is not prepared at all. In many ways, it is just like 2007 all over again. There were many people that could see what was about to happen and were doing all they could to warn people, but most did not listen. And then the great financial crisis of 2008 struck and millions of people lost their jobs and their homes. Unfortunately, the next great wave of the economic collapse is going to be even more painful than the last one. It is imperative that people get prepared for what is on the horizon, but for the most part it is just not happening. A lot of it has to do with the fact that we have such short memories and such short attention spans in America today. Thanks to years of television and endless hours on the Internet, I find myself having a really hard time focusing on anything for more than just a few moments. And we are accustomed to living in an "instant society" where we don't have to wait for anything. In such a society, we are used to "news cycles" that only last for 24 hours and very few people take a "long-term view" of anything. And another one of the big problems that we are facing is something called "normalcy bias". The following is how Wikipedia defines it...

Over the past several years, the U.S. economy has been relatively stable. And that is a good thing. But it has also lulled millions upon millions of people into a false sense of security and complacency. At this point, most Americans consider 2008 to be a temporary bump in the road, and most assume that the U.S. economy will always be strong. Unfortunately, that is not the truth. As I have written about previously, the long-term trends that are destroying our economy have continued to get worse since 2008, and none of the problems that caused the last financial crisis have been fixed. We are steamrolling toward the edge of an economic cliff, and most people in our entertainment-addicted society are totally oblivious to what is going on. So they are not doing anything to get ready for the immense economic pain that is coming. The following are 16 signs that most Americans are completely unprepared for the coming economic collapse... #1 Could you come up with $2000 right now? According to a shocking study that was just released, most Americans could not...

#2 In that same study, Americans were asked the following question...

An astounding 60 percent of people that responded said that they do not. #3 Another study found that less than one out of every four Americans has enough money stored away to cover six months of expenses. #4 Some people are actually trying really hard to get ahead, but admittedly that is really tough to do when we are all being taxed into oblivion. In fact, it was reported this week that Americans now spend more on taxes than they spend on food, clothing and housing combined. #5 Right now, more Americans are dependent on the government than ever before. In fact, according to the U.S. Census Bureau, 49 percent of all Americans live in a home that currently gets direct monetary benefits from the federal government. #6 It is estimated that less than 10 percent of the entire U.S. population owns any gold or silver for investment purposes. That is a stunning number. #7 It has been estimated that there are approximately 3 million "preppers" in the United States. But that means that almost everyone else is not prepping. #8-16 The following are nine more statistics that come from a survey conducted by the Adelphi Center for Health Innovation. As you can see, a significant portion of the population is not even prepared for a basic emergency that would last for just a few days...

What do you think is going to happen to these people once the economy collapses and there is chaos in the streets? How are they going to survive? After all of these years of writing about the coming economic collapse, nothing has changed as far as the long-term outlook is concerned. We are still heading toward a complete and total economic meltdown. But most Americans continue to have faith in the system, and the mainstream media keeps assuring them that everything is going to be just fine. And in this "dumbed-down" society of ours, most people are perfectly content to let others do their thinking for them. In America today, only one out of every six Americans can even find Ukraine on a map of the world. That is how far we have fallen. In this day and age, it is imperative that we all learn how to think for ourselves. The foundations of our society are crumbling, our economic system is failing and the blind are leading the blind. If we do not learn to make our own decisions, we are just going to follow the rest of the herd into oblivion. In addition, we all need to start taking a long-term view of things. Just because the economic collapse is not going to happen this month does not mean that it is not going to happen. When you step back and take a broader view of what is happening, it becomes exceedingly clear where we are heading. Sadly, most Americans will never do that. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and Gold Prices Have Posted Their Lows with Gold Closing at $1,305.50 Posted: 09 Apr 2014 04:27 PM PDT

Yes, yes, markets and the FOMC conspired to leave me with egg all over my face. Or did they? Silver fell 28.7 cents to 1975.5c while the GOLD PRICE lost $3.20 to $1,305.50. But isn't that the durndest thing: gold's now trading in the aftermarket at $1,314.10 (as I expected) and silver at 1991c. Can anybody spell paint-the-tape? How did it play out? About New York opening somebody sold lots of gold, driving the price down form $1,308 to $1,301. Traded sideways from 9:00 to 3:00 p.m, gapped down from $1,305 for an instant, then gapped above $1,306 and shot clean to $1,315. Then it backed off but held above $1,310. SILVER PRICE? Ditto. GOLD/SILVER RATIO today rose to 66.085, not a helpful sign, and silver persists in lagging behind and not closing above 2015c. Ahh, but today silver's low at 1960c painted a double bottom for the move with an earlier low at 1958c. In fact, silver has four times defended this level. That could be good OR bad. Still I am persuaded that silver and GOLD PRICES have posted their lows and, once silver gets into gear, will rise. Closes below $1,277 or $1,960 would gainsay that interpretation and open the door to lower prices. On the remote chance I might be right, y'all ought to buy a little silver and gold. Today near Pittsburgh a high school student with two kitchen knives stabbed 20 other kids before the principal tackled him. This brings to mind a number of questions: How long before the Obama administration acts to outlaw kitchen knives and end tragic incidents like this forever? Why do people need those assault-style butcher knives in their kitchens anyway, since an ordinary dull table knife will cut everything but meat? Why do people need more than one sharp knife to run a kitchen? Why do knife-nuts need so many knives? Are serrated knives EVER safe? It also raises another line of questioning: Were there no chairs in that high school that someone could pick up and throw at the knifer? Were the students so trained to call 911 that nobody knew how to protect himself? Was the principal the only person trained to tackle knifers? Finally the third set of questions, along the "Is it real or Memorex?" line. Did this really happen? If it did really happen, what sort of psychotropic drugs was the knifer taking? What other important thing happening in the world did this event distract our attention from? If all this weren't crazy enough, ponder this: Greece, yes, the Greek government which is bankrupt from now until, oh, about a.d. 2255, is about to re-enter the bond market to sell 2.5 billion Euros worth of bonds. Top that: they are looking for an interest rate of 5.3% or less. Mean as I sound, I have to say it: any loony who buys those bonds deserves what he will get, which will be another default. The market is not benevolent. Minutes of the last FOMC meeting were released today and showed that all the members agreed to jettison any objective standards for action. That is, they would keep on tapering and suppressing interest rates until, well, I reckon until it FEELS good. Why this should make stock investors more optimistic -- to learn that the pilot has no idea where he is going and won't know to land when he gets there -- I could not say, but stocks did rise today, although they may have risen for propitious astrological signs, for all I know. Listen, I know that a 1.1% increase in the Dow (up 181.04 to 16,437.18) and the S&P500 (up 20.22 to 1,872.18 makes everybody feel rich, but today hasn't changed the charts. I'm not saying they won't change and turn up, but this alone didn't do it. It did close both above their 20 DMAs, but still below relevant resistance and coming off a downward key reversal. Dow in Silver jumped up 2.6% to 831.42 (S$1,074.97). Remains above the 20 DMA but the MACD has signaled sell. Dow in gold rose 1.28% to 12.59 oz (G$260.26 gold dollars). Trying to roll over downward. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver and Gold Prices Have Posted Their Lows with Gold Closing at $1,305.50 Posted: 09 Apr 2014 04:27 PM PDT

Yes, yes, markets and the FOMC conspired to leave me with egg all over my face. Or did they? Silver fell 28.7 cents to 1975.5c while the GOLD PRICE lost $3.20 to $1,305.50. But isn't that the durndest thing: gold's now trading in the aftermarket at $1,314.10 (as I expected) and silver at 1991c. Can anybody spell paint-the-tape? How did it play out? About New York opening somebody sold lots of gold, driving the price down form $1,308 to $1,301. Traded sideways from 9:00 to 3:00 p.m, gapped down from $1,305 for an instant, then gapped above $1,306 and shot clean to $1,315. Then it backed off but held above $1,310. SILVER PRICE? Ditto. GOLD/SILVER RATIO today rose to 66.085, not a helpful sign, and silver persists in lagging behind and not closing above 2015c. Ahh, but today silver's low at 1960c painted a double bottom for the move with an earlier low at 1958c. In fact, silver has four times defended this level. That could be good OR bad. Still I am persuaded that silver and GOLD PRICES have posted their lows and, once silver gets into gear, will rise. Closes below $1,277 or $1,960 would gainsay that interpretation and open the door to lower prices. On the remote chance I might be right, y'all ought to buy a little silver and gold. Today near Pittsburgh a high school student with two kitchen knives stabbed 20 other kids before the principal tackled him. This brings to mind a number of questions: How long before the Obama administration acts to outlaw kitchen knives and end tragic incidents like this forever? Why do people need those assault-style butcher knives in their kitchens anyway, since an ordinary dull table knife will cut everything but meat? Why do people need more than one sharp knife to run a kitchen? Why do knife-nuts need so many knives? Are serrated knives EVER safe? It also raises another line of questioning: Were there no chairs in that high school that someone could pick up and throw at the knifer? Were the students so trained to call 911 that nobody knew how to protect himself? Was the principal the only person trained to tackle knifers? Finally the third set of questions, along the "Is it real or Memorex?" line. Did this really happen? If it did really happen, what sort of psychotropic drugs was the knifer taking? What other important thing happening in the world did this event distract our attention from? If all this weren't crazy enough, ponder this: Greece, yes, the Greek government which is bankrupt from now until, oh, about a.d. 2255, is about to re-enter the bond market to sell 2.5 billion Euros worth of bonds. Top that: they are looking for an interest rate of 5.3% or less. Mean as I sound, I have to say it: any loony who buys those bonds deserves what he will get, which will be another default. The market is not benevolent. Minutes of the last FOMC meeting were released today and showed that all the members agreed to jettison any objective standards for action. That is, they would keep on tapering and suppressing interest rates until, well, I reckon until it FEELS good. Why this should make stock investors more optimistic -- to learn that the pilot has no idea where he is going and won't know to land when he gets there -- I could not say, but stocks did rise today, although they may have risen for propitious astrological signs, for all I know. Listen, I know that a 1.1% increase in the Dow (up 181.04 to 16,437.18) and the S&P500 (up 20.22 to 1,872.18 makes everybody feel rich, but today hasn't changed the charts. I'm not saying they won't change and turn up, but this alone didn't do it. It did close both above their 20 DMAs, but still below relevant resistance and coming off a downward key reversal. Dow in Silver jumped up 2.6% to 831.42 (S$1,074.97). Remains above the 20 DMA but the MACD has signaled sell. Dow in gold rose 1.28% to 12.59 oz (G$260.26 gold dollars). Trying to roll over downward. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Telegraph notes research on China's huge gold demand by GoldMoney's Macleod Posted: 09 Apr 2014 04:16 PM PDT China 'Has More Gold Than Official Figures Show' By Olivia Goldhill http://www.telegraph.co.uk/finance/commodities/10753182/China-has-more-g... China could be holding even more gold than previously realised, according to Alasdair Macleod, a researcher at online precious metals trader GoldMoney. Official figures from China Gold Association (CGA) show that the Asian superpower consumed 1,176 tonnes of gold in 2013, 41 percent higher than in 2012. However, about 500 tonnes of gold from Chinese mines and scrap is unaccounted for by the CGA. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Mr Macleod believes the country holds more gold that the stated figures suggest, and in fact consumed 4,843 tonnes in 2013 alone. He raised his estimate after researching Chinese Gold Reports, where he said he found details of the amount of gold vaulted. He said the quantity of vaulted gold has been increasing steadily. "Nobody had really any idea how much was going into the vaulting figures," Mr Macleod said. "The changes in the level of vaulted gold has been increased on a fairly consistent level almost at exactly the same rate as the increase in deliveries." Increased levels of gold held by China match with the country's politics, according to Mr Macleod. "It fits in with what appears to be China's geo-political strategy when it comes to gold," he said. "China, by having control of a large amount of gold, has leverage in the financial relationship with the West. Owning gold gives power to China over America," he said. Martin Arnold, director-research analyst at ETF Securities, said that estimates of China's store of gold may well be too low. "The evidence suggests that China is a very big consumer of gold with a gap in reporting for the last several years. It does point to some build up of stocks. "China is the world's biggest producer of gold. Not only do they consume all the gold that is mined in the country but are also a net importer. 2013 was a record level -- we're talking several million ounces, to the extent where we're looking at about 35 million ounces in terms of the net gold import," he said. Mr Arnold said that by owning gold, China diversified its reserves and so is less dependent on US treasuries. "The US dollar over the past decade or so has been in a period of structural decline so when the public sector invests their holdings, they don't want to hold it all in US treasuries, which are necessarily dollar-based," he said. China is one of the biggest holders of US treasuries in the world. "China have got a large foreign exchange reserve with over L3.5 trillion invested around the world and so necessarily a large part of that goes into US treasuries," said Mr Arnold. Owning a lot of gold to diversify investments means China is not beholden to the political decisions or monetary policy decisions from the United States, he said. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Pushed Above $1,310 By US Fed Statement Posted: 09 Apr 2014 02:54 PM PDT The US Fed announced today, through the FOMC statements, that rate hikes should not be expected as fast as some market participants are expecting it. That was enough food to cause the markets to change directions. Stocks levitated higher. Similarly, gold and bonds were pumped, while the US dollar was dumped on the prospects on longer low interest rates in the US. This is what Dan Norcini, professional trader, had to say about today’s market reactions:

Gold rose significantly. The 5-minute chart shows the push at the FOMC announcement, at 2PM. From Dan Norcini:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Who or What Will Let the Dawg Out? Posted: 09 Apr 2014 01:13 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Who or What Will Let the Dawg Out? Posted: 09 Apr 2014 01:13 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| One Market to Avoid Like the Plague in April Posted: 09 Apr 2014 01:10 PM PDT Sometimes avoiding a negative catalyst can be just as important as finding a positive catalyst. After all, every dollar that you can avoid losing is one more dollar that you get to spend. Chinese Internet stocks may be facing a high risk of a negative catalyst during the month of April, and they should, therefore, be avoided until May. Virtually all U.S.-listed Chinese Internet stocks tend to be American Depository Receipts or ADRs, which have to file a Form 20-F instead of a Form 10-K for their year-end reports. For companies with a Dec. 31 year-end, the deadline to file these forms is typically April 30. Sometimes avoiding a negative catalyst can be just as important as finding a positive catalyst. These stocks have been amazing highfliers over the past year. Shares of Vipshop (VIPS) are up by more than 400%. Once-tiny Dangdang (DANG) is up 300%. Internet game play YY (YY) is up 400%. Meanwhile, search giants Baidu (BIDU) and Qihoo (QIHU) are up 90% and 290%, respectively. Yet over the past three years, we have seen accounting scandals with this group of stocks in which problems at one company can drag down the whole sector. One memorable example was Longtop Financial in 2011. Longtop was an IPO, not a reverse merger, and was brought public by Goldman Sachs, not by some rinky-dink operator. When Longtop imploded due to a massive fraud, the entire space of Chinese ADRs took a dive, even though the majority of them displayed no evidence of fraud. What I want to tell you today is that the time of peak risk for these stocks is April of every year. Interim financial statements (quarterly numbers) typically receive minimal review from the auditor during the year. It is only at year-end that the numbers are reviewed, and we hear about the results only when the 20-F is filed by April 30. The risk we are trying to avoid is that one Chinese ADR has a problem and fails to file its 20-F, which would drag down the entire space. To be clear, even if you own a company that has no problems whatsoever, the fact that these stocks often trade as a group means that you can still risk suffering meaningful losses just due to the "contagion effect." The spark for the contagion does not have to be a missed 20-F filing or an auditor resignation. This year presents significant "disclosure risk" in the 20-F's. New requirements from the SEC will force these U.S.-listed Chinese companies to add scary new language to the 20-F filings. These will warn U.S. investors about structural risks. New and scary disclosure is the theme of this earnings season. In December, market bellwether Baidu was forced to add a new disclosure to explain the implications of its VIE structure to U.S. investors. Other companies are likely to follow suit — either proactively or as required by the SEC. VIE stands for "variable interest entity," and it means that investors who own such a stock don't actually have an ownership claim on the underlying assets of the company. Instead, what they typically own is a share in a Cayman Islands company. The Cayman company's sole meaningful asset is a mere contract by which it hopes it can get the right to the underlying revenue or net income from the company in China. Two points need to be made. First, note that this VIE arrangement says nothing about the actual assets — you just don't own them at all. Second, it is important to realize that many legal experts consider the contract to be entirely unenforceable. So why does such a disadvantaged structure exist in the first place? It is because the Chinese government considers the Internet to be a sensitive national industry and prohibits direct ownership by foreigners. But because U.S. investors were so hungry to buy these stocks, investment bankers cooked up a structure to circumvent the prohibition of ownership. Sounds a bit dicey, right? Is this all news to you? You are not alone. When I speak to even some of the largest institutions, they still don't fully understand the VIE. Chinese Internet stocks may be facing a high risk of a negative catalyst during the month of April… Investors have chosen to simply ignore the risks due to the fact that the Chinese Internet stocks are rising so dramatically and they don't want to miss out. But I expect much additional disclosure in the 20-F filings in a few weeks, and it may scare investors out of many of these stocks. Many investors who didn't know about these structural limitations may decide that it is time to take some money off the table and reap the gains. Hopefully, if you owned any Chinese Internet stocks, you sold them before April. For those who wish to own them longer term…they can always be bought back again in early May — after any potential skeletons have already been released from the closet. Tomorrow we'll take a specific look at one of these companies– I have some profitable thoughts I'd like to share with you. Regards, Rick Pearson P.S. As a general rule, don't simply buy companies that look cheap — sniff out timely catalysts. They offer the best opportunities for gains in today's markets. As I write to you over the coming months, I'll show you how to maximize your returns over time using these catalysts. While every trade won't be a home run, the strategy should substantially outperform. The best way for you to stay in the loop is by signing up to receive the Daily Reckoning by email. There's more content in the email that you're not getting right now – and I'd hate for you to miss out on any new catalyst opportunities. So click here now and sign up. It only takes a second… and you'll be glad you did. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rick Rule - Silver & A Golden Opportunity For Investors Posted: 09 Apr 2014 12:46 PM PDT  Today one of the wealthiest people in the financial world spoke with King World News about silver and the incredible opportunities for investors in key markets. This is an important interview with Rick Rule, who is business partners with billionaire Eric Sprott, where he discusses exactly what he is doing with his firm's money, as well as what investors should be doing with their own money. Today one of the wealthiest people in the financial world spoke with King World News about silver and the incredible opportunities for investors in key markets. This is an important interview with Rick Rule, who is business partners with billionaire Eric Sprott, where he discusses exactly what he is doing with his firm's money, as well as what investors should be doing with their own money.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Welcome to the Currency War, Part 15: Europeans Ordered to Start Consuming Posted: 09 Apr 2014 11:03 AM PDT For the past couple of years the European Central Bank has been the only sane inmate in the asylum. Unfortunately, in a crazy world being sane just gets you into trouble. Sound monetary policy leads to a strong currency, which in a currency war is tantamount to unilateral disarmament. Unable to export sufficiently to a world of weak currencies, the eurozone is tipping into deflationary depression (with several members already there and unable to get out). So…

Some thoughts Not so long ago the idea of any central bank buying asset-backed bonds would have been seen as both dangerously experimental and as crossing a line into industrial policy, where the government intervenes in the marketplace to pick winners and losers. In the US case, the Fed buying mortgage-backed bonds is an explicit subsidy to housing and the banks that depend on it. The result: more Americans are buying homes they probably can’t afford and the big banks — because their too-big-to-fail status makes them in effect government-guaranteed entities which allows them to borrow at artificially-low rates — are taking an even-bigger share of the mortgage business. In no rational world could this be seen as a proper or wise use of taxpayer resources. In Europe the effect will be similar, with central bank asset-backed bond purchases subsidizing the big banks that originate and package the loans. That the European ABS market is currently small means that the ECB will be explicitly directing its citizens to borrow more money from banks, which will then package those loans into bonds and, in effect, sell those bonds to taxpayers (the people who were directed to borrow the money in the first place). Again, in no rational world is this logical or sound policy. And yet this is how the currency war is being fought. The euro is too high due to Europe’s excessive debt and the ECB’s previous reluctance to inflate those debts away. This is pushing the Continent’s worst-run countries (of which there are many) into a deflationary spiral from which they can’t escape with the euro worth $1.35. So from the point of view of politicians who want to be reelected, the only solution is a cheaper currency achieved via a much higher money supply, which in turn is achieved by encouraging the banking system to write more loans. Nothing about this is new, other than the entities making the policy mistakes. If the ECB succeeds in pushing the euro down to, say, $0.90, then France, Italy and Spain will stabilize while failed US states like California and Illinois implode. And the focus will shift back to the dollar, leading to a new round of Federal Reserve QE, and so on. With each iteration the total amount of global debt will rise, making the required monetization and market manipulation that much more extreme, until, finally, the major economies realize that the only kind of devaluation that sticks will be against gold. I’ll go out on a limb and predict that well before the end of this decade a new monetary regime will be announced in which all the major currencies are linked to gold at an exchange rate equivalent to $10,000/oz. Everyone with fiat currency savings will lose 80% of their purchasing power, while everyone with hard asset savings will see a commensurate increase in real wealth. Assuming, of course, that governments allow this wealth transfer to take place. By the time monetary panic makes a new gold standard conceivable, lots of other things, like wealth taxes and asset confiscations, will also be on the table. So buying hard assets is just the first, easiest step. Keeping them will take a lot more thought and planning. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 09 Apr 2014 10:11 AM PDT Dr. Paul Craig Roberts: Gold and The Dollar Are In A Fight to the Death! Donetsk’s pro-Russian activists prepare referendum for ‘new republic’ Protesters declare Kiev government illegitimate and fire its officials appointed to east Ukraine region Alec Luhn in Donetsk The Guardian, Tuesday 8 April 2014 15.56 EDT Irina Grinenko rushed through... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liz Warren Predicts the Collapse of the Middle Class in 2008 Posted: 09 Apr 2014 10:05 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liz Warren Predicts the Collapse of the Middle Class in 2008 Posted: 09 Apr 2014 10:05 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Charles Goyette: Ukraine May Accelerate Petro Dollar's Death Posted: 09 Apr 2014 09:59 AM PDT Charles Goyette is an American talk show host and writer. He is a libertarian commentator, who is noted for his outspoken anti-war views, his opposition to the war in Iraq, and his economic commentary. He is the author of the book The Dollar Meltdown: Surviving the Impending Currency Crisis with... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 09 Apr 2014 08:52 AM PDT One investor's take on the difference between gold and silver... OFTEN people ask me if I hold "goldandsilver" as if it were one word, writes Chris Martenson at Peak Prosperity. I do own both, but for almost entirely different reasons. Gold, to me, is a monetary substance. It has money-like qualities and it has been used as money by diverse cultures throughout history. I expect that to continue. There is a slight chance that gold will be re-monetized on the international stage due to a failure of the current all-fiat regime. If or when the fiat regime fails, there will have to be some form of replacement, and the only one that we know works for sure is a gold standard. Therefore, a renewed gold standard has the best chance of being the 'new' system selected during the next bout of difficulties. So gold is money. Silver is an industrial metal with a host of enviable and irreplaceable attributes. It is the most conductive element on the periodic table, and therefore it is widely used in the electronics industry. It is used to plate critical bearings in jet engines and as an antimicrobial additive to everything from wall paints to clothing fibers. In nearly all of these uses, plus a thousand others, it is used in vanishingly-small quantities that are hardly worth recovering at the end of the product life cycle – so they often aren't. Because of this dispersion effect, above-ground silver is actually quite a bit less abundant than you might suspect. When silver was used primarily for monetary and ornamentation purposes, the amount of above-ground, refined silver grew with every passing year. After industrial uses cropped up, that trend reversed, and today it's thought that roughly half of all the silver ever mined in human history has been irretrievably dispersed. Because of this consumption dynamic, it's entirely possible that over the next twenty years not one single net new ounce of above ground silver will be added to inventories, while in contrast, a few billion ounces of gold will be added. I hold gold as a monetary metal. I own silver because of its residual monetary qualities, but more importantly because I believe it will continue to be in demand for industrial uses for a very long time, and it will become a scarce and rare item. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 09 Apr 2014 08:52 AM PDT One investor's take on the difference between gold and silver... OFTEN people ask me if I hold "goldandsilver" as if it were one word, writes Chris Martenson at Peak Prosperity. I do own both, but for almost entirely different reasons. Gold, to me, is a monetary substance. It has money-like qualities and it has been used as money by diverse cultures throughout history. I expect that to continue. There is a slight chance that gold will be re-monetized on the international stage due to a failure of the current all-fiat regime. If or when the fiat regime fails, there will have to be some form of replacement, and the only one that we know works for sure is a gold standard. Therefore, a renewed gold standard has the best chance of being the 'new' system selected during the next bout of difficulties. So gold is money. Silver is an industrial metal with a host of enviable and irreplaceable attributes. It is the most conductive element on the periodic table, and therefore it is widely used in the electronics industry. It is used to plate critical bearings in jet engines and as an antimicrobial additive to everything from wall paints to clothing fibers. In nearly all of these uses, plus a thousand others, it is used in vanishingly-small quantities that are hardly worth recovering at the end of the product life cycle – so they often aren't. Because of this dispersion effect, above-ground silver is actually quite a bit less abundant than you might suspect. When silver was used primarily for monetary and ornamentation purposes, the amount of above-ground, refined silver grew with every passing year. After industrial uses cropped up, that trend reversed, and today it's thought that roughly half of all the silver ever mined in human history has been irretrievably dispersed. Because of this consumption dynamic, it's entirely possible that over the next twenty years not one single net new ounce of above ground silver will be added to inventories, while in contrast, a few billion ounces of gold will be added. I hold gold as a monetary metal. I own silver because of its residual monetary qualities, but more importantly because I believe it will continue to be in demand for industrial uses for a very long time, and it will become a scarce and rare item. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Dollar MELTDOWN to Establish GLOBAL Currency Posted: 09 Apr 2014 08:36 AM PDT The lust for ever-increasing power by the US hasn't stopped. However, the world seems to be changing its mind on fuelling this desire. As time goes on, many countries have decided to purchase the Chinese currency instead of the US dollar.This is slowly causing a global shift in power over to... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Great Unwashed American Energy Independence Posted: 09 Apr 2014 08:15 AM PDT The eurocrisis is over, the US Navy makes fuel from seawater, and America will be energy independent by 2037, according to the EIA. Boy, where do we begin? We’re getting flooded with an increasing amount of sheer nonsense wrapped in sheep’s clothing, and it’s hard to keep up. We not only live in a pretend economy, by now most of what we think we see isn’t really there at all. Indeed, there’s not even a there there anymore. Look, if you believe that the Navy can power its fleet with fuel made from seawater, you should probably know there’s a lot of gold in the oceans as well. Which means that you are potentially very wealthy. All you have to do is dig it out. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 09 Apr 2014 08:01 AM PDT Record US corporate profits are the beneficiary of easy money, near zero interest rates and monopolist aided government tax policies. The upward surge in earnings since the depths of the financial collapse proves one incontrovertible fact; namely, tax regulations, implemented to aid favorite companies, is the operational model of the corporatist economy. Americans for tax fairness for 2013 report on 10 Companies and Their Tax Loopholes. Included in this examination on Bank of America, Citigroup, ExxonMobil, FedEx, General Electric, Honeywell, Merck, Microsoft, Pfizer and Verizon, indicated "corporations have stepped into the fray with some of the most aggressive lobbying we’ve seen in years – calling for cuts to corporate tax rates, a widening of offshore tax loopholes." | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Gold Imports Through Hong Kong Posted: 09 Apr 2014 07:35 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China Gold Imports Through Hong Kong Posted: 09 Apr 2014 07:35 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China 'has more gold than official figures show' Posted: 09 Apr 2014 07:22 AM PDT Precious metals researcher says the quantity of vaulted gold in China is rising steadily This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Prices Erase 0.9% Gain Despite Fresh Ukraine Tensions, Physical Tightness Fades Again in London Posted: 09 Apr 2014 06:47 AM PDT GOLD PRICES dropped all of this week's earlier 0.9% rise lunchtime Wednesday in London, falling back to $1303 per ounce as European stock markets rose with weaker government bond prices despite fresh tension between Western allies and Russia over Ukraine. With Russian, US, European Union and Ukrainian politicians due to meet next week in Paris, Kiev today gave separatists in the east a "48-hour ultimatum" to quit regional government buildings. Russian equities fell to buck Wednesday's global trend, and the Dollar held near 2-week lows at $1.38 per Euro. That edged gold prices for Eurozone investors 0.7% below last week's finish at €944 per ounce. China gold prices ended Wednesday unchanged, with a slight Shanghai premium of $1 per ounce over London quotes turning into a 50c discount at the close. "Gold was particularly well bid through the Asian session Tuesday," notes one bank trading desk in Asia. "There was some speculator short-covering in the Far East," adds Japanese trading house Mitsui's Singapore team, "[with] Chinese participants playing catch-up after Monday's [Ching Ming] holiday." "Physical demand in China appears to be reviving," says Commerzbank's commodities team, also ascribing the week's earlier gold price rise to Ukraine tensions. But while "imports by China picked up in February," says bullion bank Scotia Mocatta's latest monthly report, "we wait to see if that remains the case in March given that premiums [over London gold prices] have fallen." Turning to former world No.1 consumer India, "Any easing of import restrictions would likely boost [gold price] sentiment considerably," Scotia reckons. Finally launched on Monday as voting began in India's month-long national elections however, the BJP manifesto fails to mention gold or the anti-import rules imposed by the ruling Congress Party in summer 2013. Wednesday in London, heart of the world's wholesale gold market, the interest rate offered to would-be borrowers of gold ticked back above 0% for the first time in a week on 1-month swaps. Typically positive, the so-called Gold Forward Rate offers an incentive to potential gold borrowers who have to pay storage fees, and lose interest on cash, for the duration of the swap. GOFO rates fell to 4-month lows in mid-February at minus 0.05% on 1-month swaps, suggesting tighter supply to meet short-term wholesale gold bullion demand. "Fading physical tightness and positive global growth [will] cap rallies" in gold prices, says the latest note from French investment and London bullion bank Societe Generale's precious metals analyst Robin Bhar. That echoes comments last week from analysts at fellow London market-maker Deutsche Bank, who also cited rising GOFO rates as a sign that "support from physical tightness has begun to fade." | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 09 Apr 2014 06:34 AM PDT The Real Asset Co | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Big Winners from the Russia-Crimea Fallout Posted: 09 Apr 2014 06:00 AM PDT Last month, Russian President Vladimir Putin gave a short, emotional speech on the annexation of Crimea. "After a long, hard and exhausting voyage," said Putin, employing timeless, classic nautical analogies, "Crimea and Sevastopol are returning to their harbor, to their native shores, to their home port, to Russia!" Meanwhile, Western political leadership — U.S., EU and NATO — can do little other than bellyache about international law. That, and enact sanctions against individual Russians while imposing banking restrictions and kicking Russia out of the G-8. Looks like there's more to come. What does this mean for investors? …if the metal supply chain gets nailed due to Russian sanctions, we're all in trouble in a hurry. Of course, Russia is a commodities giant. Russian outputs are important to the global supply chain for many items. Russia is a major producer and exporter of oil, natural gas, ores, refined metals and industrial minerals. According to a recent analysis by the British firm Roskill, the extractive, energy and chemical sectors are vital to the Russian economy and accounted for an estimated 80% of Russian export revenues in 2013. It's important to realize, however, that Russia's commodities role is multidimensional. That is, Russia is more than a major producer and exporter of energy and materials; Russia is also an important player within Western supply and product chains. Thus, targeting Russian companies has the potential to blow back on many Western businesses and economies. Let's look at just a few parts of the Russia-related metal supply chain. This affects all sorts of things in the West, from drill pipe to auto production, construction and household appliances. As I see it, if the metal supply chain gets nailed due to Russian sanctions, we're all in trouble in a hurry. Nickel: Consider the metal nickel. It's much more than the 5 cent piece in your pocket. Nickel is critical to manufacturing stainless steel and much else. Russia's big player, Norilsk Nickel, extracts ore in Russia but refines product in Finland. Overall, Russia is the world's second-largest producer of nickel products, after China. But China consumes most of its nickel domestically, which leaves Russia as the world's key "swing" supplier. In 2013, Russia accounted for 26% of global nickel cathode exports, or around 13% of total world consumption of nickel. Without Russian nickel, the world's steel industry will be quickly disrupted. Cobalt: Russia is also an important supplier of cobalt, used in steel and other alloys. Russia accounts for about 6% of global mine output of cobalt and 3% of global refined output. Most Russian cobalt production is related to Norilsk operations in Finland, where cobalt comes out of nickel production. At 6% and 3%, as noted, Russian cobalt numbers are relatively low overall, but the point is that if Western sanctions somehow choke off Norilsk operations in Finland, we'll see the impact on global availability of refined cobalt. Vanadium: Russia is the world's third-largest producer of vanadium — providing about 10% of the world's supply. Vanadium is critical to hardening steel and other alloys and is a key element for the future of utility-scale storage batteries. If vanadium supply takes a hit, all manner of metal and energy projects could be disrupted. Tungsten: Russia is the world's second-largest producer of tungsten (behind China) and accounted for about 6% of global supply in 2013. Don't be fooled by that low raw number, though, because about 70% of global tungsten is a Chinese play. So that Russian 6% "global" statistic is really about 20% of what's available to the world outside of China. Tungsten is critical to building machine tools as well as manufacturing drill bits. In essence, tungsten is used for requirements that call for hard, dense metals with high melting points. Europe is a major tungsten importer from Russia, and much European industry will have to scramble to make up for any loss due to sanctions. Titanium: Russia is a large supplier of aerospace-grade titanium to both the U.S. and Europe, accounting for about 12% of imports. Two important buyers are Boeing and Airbus, whose operations could be slowed by lack of titanium supply, certainly in the short term. I could go on with other energy and materials that come out of Russia, but you get the point. Western politicians may feel like they have to "do something" about Russia annexing Crimea. Thus, they are moving with sanctions. For our purposes, on the investment front, one potential result of Western sanctions will be to give Russian leadership even more incentive to look east, toward Chinese markets. China is a major consumer of many raw materials and refined products and would likely be able to buy and use Russian materials that no longer move west. Different commodities will move in different ways, of course; some more than others… So what's the investment forecast from all of this? Risk on? Risk off? Sunny skies and nice karma? Well, I don't like precipitous political-military things, like Russia grabbing Crimea, no matter how deep the historical roots. Still, what's done is done. From what I understand of Russia and its leadership, Crimea isn't going back to Ukraine. Never. Western politicians can bang their drums, but Russia is Russia, and Russian leaders are pursuing what they see as their national interests. In the short term, from all of this, sanctions might blow back. In the West, we could see critical metal disruptions out of Russia, which would hurt many Western companies, from automakers to aerospace and more. I can envision slowdowns, layoffs and more Federal Reserve stimulus. I also foresee good opportunities with European energy plays like Statoil (STO:NYSE) and Total (TOT:NYSE) as they work to reduce Europe's evident energy supply risk from Russia. I'll discuss this more in your upcoming May issue of OI. In the medium term, supply chains will rebalance considering the new political and economic risks of doing business in Russia. More purchasing agents will source materials away from Russia — although it might just mean buying Chinese material made from Russian ores. China will be a winner from any Russian shift eastward. In the long term, we'll likely see new investment opportunities with Western-oriented companies as they work to make up shortfalls from lost Russian supplies and markets. Western governments will go with large, significant players to get things done — plays like Freeport-McMoRan Copper & Gold (FCX:NYSE), to name one among several. Best wishes, Byron W. King Ed. Note: Every crisis presents an opportunity. You just have to know where to look. That’s where Byron can help… As a frequent contributor to the FREE Daily Resource Hunter email edition, he’s shown readers a wealth of great profit opportunities — especially in the commodity and energy spaces — that could have helped them profit in any kind of market. Don’t miss out on an incredible free resource that could help you grow your wealth in uncertain times. Sign up for the FREE Daily Resource Hunter email edition, right here. This article was originally published in Daily Resource Hunter. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Monetary Collapse and Silver Price Not So Orderly Rise Posted: 09 Apr 2014 05:35 AM PDT We are about to see the end of our current international monetary system. Based on much of the evidence that I have written about previously, this appears to be a certainty. The systematic build-up of this current monetary order went together with the gradual phasing out of silver from the monetary order. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Precious Metals Market Report with Franklin Sanders Posted: 09 Apr 2014 05:00 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| How will Gold respond to global Deflation? Posted: 09 Apr 2014 03:52 AM PDT With economies slowing down in China, Japan, Eastern Europe and other regions of the globe, many investors wonder if 2014 will deliver another global deflationary epidemic. As I’ll explain in this commentary, the next six months has the potential to be the most exciting period for investors since the 2010 financial crisis in Europe. | ||||||||||||||||||||||||||||||||||||||||||||||||||||