saveyourassetsfirst3 |

- Chinese gold imports from Hong Kong jump 27% in Q1

- Gold offtake in Shanghai resumes rise

- Currencies weaken and gold flows from West to Asia, Sprott says

- Gold & Silver Trading Alert: Miners Break Out but Gold Fails to Follow so Far

- Buy Signal in the Gold and Silver Sector

- Canada’s Middle Class Surpasses Dying US Middle Class

- Cote d’Ivoire will become very significant gold producer - Bristow

- Mine closings drop Ghanas gold production by 14%

- Back to a gold premium in China - Phillips

- Funding gates wide open for Aureus gold mine construction

- Silver entering buy zone

- Must see photos of Ukraine's and Russia's massive military buildup

- Gold rally: How long will it last?

- US Intel Employees to be Fired for Speaking to Media Without Prior Approval

- Russian sanctions could cause gold prices to explode

- Hyperinflation watch: A Chinese shadow bank bailout may mean a crash in U.S. Treasury bonds

- Silver $50: April 2011 Part 2

- Gold Building Base for a Rally?

- The Decline In Shanghai Silver Stocks Picks Up Speed

- Use these inexpensive resources to harness success--in business, in love, in health, in life...

- Speak Loudly and Carry a Wet Noodle

- James Turk: Gold backwardation like this has never happened in history

- Caption Contest: For Lease

- Gold a 'trade for the patient' - Adrian Day

- Colombian ops unaffected by artisanal miners’ deaths - Continental Gold

- For Gold and Silver, Critical Support Holds

- Gold sinks as fear trade fades

- Barrick Gold says Newmont terminates takeover talks

- Silver Shield Silver Bull & $20 Off 2010 ATB Collection at SDBullion!

- Chinese Gold Demand Dropping

- The survey is in. Here are the most and least expensive cities in America.

- Technical Trading: Gold Continues To Hold Key Fibonacci Retracement Support

- This simple idea is the difference between winning and losing portfolios...

- US Shoots Self in Foot Via Sanctions: Dollar to Be Driven Out of Trade Settlement!

- Russian Sanctions Could See Gold Prices ‘Explode’

- Is It Time For Gold and Other Precious Metals?

- Russian Sanctions Could See Gold Prices ‘Explode’

- Steve Sjuggerud: The world's cheapest stocks right now

- Thibaut Lepouttre's Commodity Plays in a Sideways Market

- Gold Trades Nicely To The Downside

- Gold Price Analysis- April 28, 2014

- Gold / Silver / Copper futures - weekly outlook: April 28 - May 2

- Market Report: How oversold can gold get?

- Yanis Varoufakis: Europe and Greece in Review, Interviewed by Michael Maier for Deutsche Wirtschafts Nachrichten

- Gold Successfully tests medium term price points

- Latest ArabianMoney investment newsletter goes global from the Ukraine to Australia in search of market insight

- Lars Schall interviews Bill Kaye about gold suppression and the aftermath

- Jim Willie: The Climax Finale of the Petro-Dollar to Arrive in 2014!

- Yamana, Agnico both clear winners in Osisko deal

- Why Housing Has Stalled — And Why Everything Else Will Follow

| Chinese gold imports from Hong Kong jump 27% in Q1 Posted: 28 Apr 2014 04:35 PM PDT Chinese gold imports through Hong Kong fell back a little in March compared with the previous month, but the overall trend is still upwards. |

| Gold offtake in Shanghai resumes rise Posted: 28 Apr 2014 01:33 PM PDT GATA |

| Currencies weaken and gold flows from West to Asia, Sprott says Posted: 28 Apr 2014 01:33 PM PDT GATA |

| Gold & Silver Trading Alert: Miners Break Out but Gold Fails to Follow so Far Posted: 28 Apr 2014 01:12 PM PDT Gold & Silver Trading Alert: Miners Break Out but Gold Fails to Follow so Far

Gold & Silver Trading Alert originally published on April 28th, 2014 8:32 AM:

Briefly: In our opinion no speculative positions are justified from the risk/reward perspective.

The situation in the precious metals sector remains tense – miners have broken above the declining resistance line, while gold hasn't. However, taking Friday's intraday move in the USD into account, we can say more about the gold-USD link. Let's take a closer look (charts courtesy of http://stockcharts.com).

Much of what we wrote previously remains up-to-date:

(…) the session itself was very specific. We marked similar sessions (similar volatility + significant volume) on the above chart with orange rectangles. It turned out that these sessions didn't necessarily mark the final bottoms, but they have practically always (at least recently) been followed by short-term rallies (very short-term in early December 2013). Consequently, while the medium-term trend remains down, the short-term implications are bullish.

(…) we also saw a move below the previous April low and the immediate invalidation thereof, which by itself is also a bullish sign.

Gold has indeed moved higher, but it hasn't moved above the declining resistance line, so the short-term outlook here is rather mixed. We have already seen a short-term rally that was possible based on the above-mentioned comments, so this move might be over or close to being over. The volume was not low during Friday's move higher, but it was not high either, so the implications are rather unclear.

The same goes for the silver market, the situation is a bit more bullish than not, but overall rather unclear.

The mining stocks to gold ratio moved higher on Friday after a daily decline and overall closed slightly lower than it had on Wednesday. We don't view this action as a breakout just yet.

If we take a look at gold stocks from a broader perspective, we get a picture in which gold miners are declining in tune with the previous declines. By zooming out we stop to see individual short-term upswings and downswings and start to see the general direction in which the market is moving. At this time, the trend that we see is down and the pace at which gold stocks decline is normal – there has been no divergence so far. The implications are bearish.

On a short-term basis, we saw a breakout in the GDX ETF, which, of course, is a bullish sign. It hasn't been confirmed yet, and given what we wrote below the 2 previous charts, it's not strongly bullish just yet. The overall pace of the decline and the lack of breakout in the GDX:GLD ratio make waiting for the GDX's breakout necessary.

There is also another ratio that we would like to comment on today.

The above chart features the junior mining stocks to the general stock market ratio. In the majority of cases when the ratio of volumes was huge, gold was about to form a top or at least pause the rally. The signal was a bit too early in the early part of this year, but please note that gold's price at this time is lower than it was when we saw the huge ratio of volumes.

Last week we saw a huge spike in the volume ratio – a record one. As explained above, the implications are bearish.

Meanwhile, the previously-completed head-and-shoulders pattern in platinum was invalidated in the final part of last week. The invalidation itself is a bullish sign and the above chart now suggests higher platinum prices (which also, to a smaller extent, indicates higher prices for gold, silver, and mining stocks).

We started today's alert by writing that we can say a bit more about the gold-USD link. The USD Index moved lower in the first part of Friday's session and taking this move into account, we now have a clearer picture.

Comparing the 2 most recent price moves (mid-April move higher in the USD and the last several days of lower values) in the USD and gold we see that they were quite alike. The dollar corrected some of its rally and gold corrected some of its decline. There's not short-term underperformance or outperformance to speak of and the implications are neutral.

There is, however, one thing that can tell us more about the near future of the USD and precious metals prices and that's the fact that the turning point is just around the corner. In the first days of May, we can expect to see a local extreme in both markets. At this time, the short-term direction is up in case of the precious metals and down in case of the USD Index, so we are quite likely to see a downturn start in metals and miners within a week or so.

We were asked if we still think that there is real downside in the precious metals sector. The answer is yes, because the medium-term trend is still down in metals and miners (note the pace of decline in the HUI Index) and the medium-term trend is still up in the USD Index. The negative gold-USD link remains in place. We are keeping our eyes opened and will monitor the market for signs of strength.

The bottom line is that the situation in the precious metals market remains too unclear to open any speculative position and the medium-term trend remains down. The situation in gold is unclear, unclear with a bullish bias for silver and mining stocks, bullish for platinum, but with bearish indications coming from the USD Index and the juniors to other stocks ratio. “When in doubt, stay out” – and so we do.

To summarize:

Trading capital (our opinion): No positions Long-term capital (our opinion): No positions Insurance capital (our opinion): Full position

You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we’ll keep our subscribers updated should our views on the market change. We will continue to send them our Gold & Silver Trading Alerts on each trading day and we will send additional ones whenever appropriate. If you’d like to receive them, please subscribe today.

Thank you.

Przemyslaw Radomski, CFA Founder, Editor-in-chief Tools for Effective Gold & Silver Investments – SunshineProfits.com Tools für Effektives Gold- und Silber-Investment – SunshineProfits.DE * * * * * Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits’ associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski’s, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits’ employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. The post Gold & Silver Trading Alert: Miners Break Out but Gold Fails to Follow so Far appeared first on The Daily Gold. |

| Buy Signal in the Gold and Silver Sector Posted: 28 Apr 2014 01:10 PM PDT marketoracle |

| Canada’s Middle Class Surpasses Dying US Middle Class Posted: 28 Apr 2014 12:45 PM PDT

For most of Canada’s existence, it has been regarded as the weak neighbor to the north by most Americans. Well, that has changed dramatically over the past decade or so. Back in the year 2000, middle class Canadians were earning much less than middle class Americans, but since then there has been a dramatic shift. [...] The post Canada’s Middle Class Surpasses Dying US Middle Class appeared first on Silver Doctors. |

| Cote d’Ivoire will become very significant gold producer - Bristow Posted: 28 Apr 2014 12:40 PM PDT Rangold's CEO, Mark Bristow, is full of praise for Cote d'Ivoire's new investor friendly mining code which he feels will propel it to become one of the Continent's biggest gold producers. |

| Mine closings drop Ghanas gold production by 14% Posted: 28 Apr 2014 12:33 PM PDT GATA |

| Back to a gold premium in China - Phillips Posted: 28 Apr 2014 12:20 PM PDT Julian Phillips notes technical support has not been breached for gold and meantime that gold trades at premium in China again. |

| Funding gates wide open for Aureus gold mine construction Posted: 28 Apr 2014 12:10 PM PDT Aureus Mining gets access to $100 million in debt as it aims to bring online Liberia's first significant gold mine in early 2015. |

| Posted: 28 Apr 2014 12:08 PM PDT Beyond the horizontal support level, Silver has also seen a clear bullish RSI divergence at the recent lows, with price setting a new YTD low last week, while the RSI held above the late March bottom. |

| Must see photos of Ukraine's and Russia's massive military buildup Posted: 28 Apr 2014 12:00 PM PDT Zero Hedge reports military provocations in Ukraine and Russia have been getting even worse over the past two weeks. Just-released satellite photographs show the massive buildup of Ukrainian and Russian forces along the border near Slavyansk, Ukraine. Russia's military buildup started two weeks ago. The Ukrainian military buildup is likely their response. According to Russian RIA Novosti, there are "more than 15,000 troops from the Ukraine army and national guard, about 160 tanks, 230 infantry fighting vehicles and APCs, and as much as 150 mortars, howitzers and multiple launch rocket systems." See the images below. The most recent Ukrainian military buildup... See the Russian military buildup below from Digital Globe. You can see Russia's Su-27/30 Flankers... tanks... a special forces brigade... and artillery. More on Russia and Ukraine: Richard Maybury: This will be the next shoe to drop in Ukraine New reports say last week's Ukraine accord is already "near collapse" Top Ukraine official: Russia is preparing for an all-out invasion |

| Gold rally: How long will it last? Posted: 28 Apr 2014 11:57 AM PDT This morning the price of gold is holding above $1,300/oz. as both tensions in Ukraine and softer equities provide support to the yellow metal. |

| US Intel Employees to be Fired for Speaking to Media Without Prior Approval Posted: 28 Apr 2014 11:30 AM PDT

Welcome to the USSA. Members of the United States intelligence community must now operate within the boundaries of a new media policy, as contact with a journalist without prior approval can now be considered a fireable offense, their boss said on Sunday. Director of National Intelligence James Clapper signed on Sunday a directive which outlines new restrictions that intelligence [...] The post US Intel Employees to be Fired for Speaking to Media Without Prior Approval appeared first on Silver Doctors. |

| Russian sanctions could cause gold prices to explode Posted: 28 Apr 2014 11:23 AM PDT Gold eked out small gains in European trading, as growing tensions in Ukraine are contributing to higher prices. |

| Hyperinflation watch: A Chinese shadow bank bailout may mean a crash in U.S. Treasury bonds Posted: 28 Apr 2014 10:37 AM PDT Editor's note: If you've ever wondered how the Federal Reserve's massive money-printing scheme may spark hyperinflation, this piece by Gonzalo Lira shows how the catalyst may begin outside our borders...

From Gonzalo Lira, editor, Gonzalo Lira's Blog:

China's economy in 2014 is remarkably similar to America's in 2008: Both were fueled by real estate speculation, both speculative bubbles a product of cheap-and-cheerful shadow-bank financing.

And just like the U.S. in 2008, China in 2014 is looking down the barrel of a Minsky Moment: The point at which servicing debt levels becomes unsustainable, and there are no reserve cushions large enough to absorb the losses.

Lots of people are pointing this out; Mish Shedlock had a piece about it this morning, and he and others are right to worry that a shadow banking collapse will be bad for China.

But it will be even worse for the U.S.: Because after all—unlike the United States in 2008—China in 2014 has the reserves to buy its way out of the hole it's in.

In 2008, the U.S. shadow banking sector began its collapse when real-estate backed bonds turned out to be a lot dodgier than originally thought. This set off a systemic domino effect. We all know how the Global Financial Crisis (GFC) of 2008 played out.

Now, what did the U.S. Treasury and Federal Reserve do when the GFC hit? In other words, what did the American government do in the face of a collapsing financial sector?

Why simple: It threw money at the problem. But it was money that the U.S. government and Federal Reserve didn't actually have. . .

The Treasury launched the Troubled Asset Relief Program (TARP), the $700 billion bailout of American banks.

The Federal Reserve launched QE (Quantitative Easing (QE), and its various subsequent iterations, eventually "expanding its balance sheet" (i.e., printing money) by some $3 trillion and counting; and implemented the Zero Interest-Rate Program (ZIRP), which meant that if you factor in inflation, the Fed has been paying banks to borrow money since 2008—and will continue to do so through at least 2015, as they have already announced.

So in other words, the U.S. Federal government went into massive debt to save the banking sector (TARP); and the American central bank essentially debased the currency (QE, QE II and III, as well as ZIRP).

All of this was to clean up the mess left by the U.S. shadow banking sector, and protect the wider economy from the knock-on effect.

TARP and especially the Fed's machinations were considered "heroic measures" when they were implemented. Why "heroic"? Why so very novel and unorthodox (or so very orthodox if you're from Zimbabwe or Argentina)?

Simple: Because neither the Treasury nor the Fed had ready cash to pay off the clean-up.

But China doesn't have that problem. China has been a net creditor to the world. The Chinese government and the Chinese central bank have plenty of money on tap, in case needed.

Right now, China is sitting on some $1.3 trillion in U.S. Treasury bonds, not to mention a host of other liquid assets. China's government and central bank have the ready cash to pay off the collapse of their shadow banking sector.

I'm not arguing that Chinese authorities were any wiser than their American counterparts, in allowing the explosive growth of the shadow banking sector and a surefeit of debt. What I am arguing is, unlike the U.S. in 2008, China has the tools to get out of this hole relatively easily.

But what effect will this have on U.S. Treasury bonds?

Well, it will depend on how the Chinese authorities decide to clean up their shadow banking mess.

(BTW, unlike in America, the Chinese will probably be ruthless with their shadow bankers—executions are definitely in the offing. Witness what happened a few years ago with the melanin-in-powdered-milk scandal: The responsible people were tried on a Monday, found guilty on Tuesday, and put in front of a firing squad I do believe that very afternoon. (Don't you just wish American lawmakers had done the same to Dimon, Blankfein, et al.?) The Chinese, they don't mess around.)

China's shadow banking sector has exposure to both internal creditors and external (foreign) creditors. In the case of the former, if push comes to shove, the People's Bank of China (PBC) can simply nationalize the shadow banking entity which has gone broke, then print enough renminbi to settle any counterparty claims, without this renminbi-printing noticeably affecting its exchange rate or the PBC's balance sheet. The PBC certainly won't hesitate to nationalize and unwind a teetering bank (as the U.S. should have done—but didn't—in the case of Citibank), especially if such nationalization will restore internal confidence.

In the case of Chinese shadow banking entities with foreign exposure, the PBC can sell Treasuries to get dollars to pay off those foreign claims—and here we come to the nub of the issue.

If a major holder of Treasuries—such as China—all of a sudden decides to unload a big chunk of said holdings in order to get dollars so as to pay off a broken financial sector, what effect will that have on Treasury bond prices?

See why China's current shadow banking problems matter in America? If China's shadow banking sector is visited by a version of 2008's GFC, Treasuries will take a hit, as the PBC sells them in order to get the hard currency to pay off foreign creditors.

An obvious objection to this is, Why would the Chinese honor foreign obligations of its shadow banking sector, especially if that entity is broke? After all, it allowed bond holders of Chaori Solar—the first Chinese shadow banking bonds to ever default—to eat the losses.

The obvious answer is, in the face of a single bond or entity's failure, the Chinese government and central bank will proclaim caveat emptor—but in the face of a systemic collapse (such as what almost happened in the U.S. in 2008), the Chinese will shore up their shadow banking sector, no different from what the U.S. did, and for exactly the same reasons: A system-wide collapse would have devastating social and political consequences that would be far more costly than simply bailing out the shadow banks.

If and when the Chinese shadow banking sector collapses, the exact same potential outcome—generalized economic collapse—will be more than enough incentive for Chinese authorities to nationalize the sector and make their creditors whole.

(And this points to a corollary: It might be a shrewd investment to pick up some extra-cheap Chinese shadow-banking products once the sector looks on the verge of system-wide collapse. The warning, though, is that the buyer has to know when the Chinese shadow banking sector looks to be on the verge of systemic collapse—and pick products from entities that the Chinese government will not allow to fail, or at least not allow to default.)

How will the American Treasury and the Federal Reserve react to a Chinese sell-off of Treasury bonds to pay for a shadow banking bailout?

My thinking? Federal Reserve Chairwoman Janet Yellen will print and buy—in other words, more QE, which as I've said more than once is nothing but gasoline thrown on the unlit bonfire that is dollar hyperinflation.

Crux note: Many Americans are curious to know the answer to this simple question: "What will happen when the dollar crashes?" If you're one of them, you're welcome to attend a free webinar discussing the issue tonight. Financial writer and filmmaker Gonzalo Lira is hosting the event, including 20 - 30 minutes of questions and answers. The web seminar begins at 8pm EST (5pm Pacific). Click here to attend.

More on End of America: Take a look around... the American empire is collapsing If you're looking for the American dream… head to Canada "Dr. Doom" Marc Faber: A 1987-type crash... or even worse... is coming |

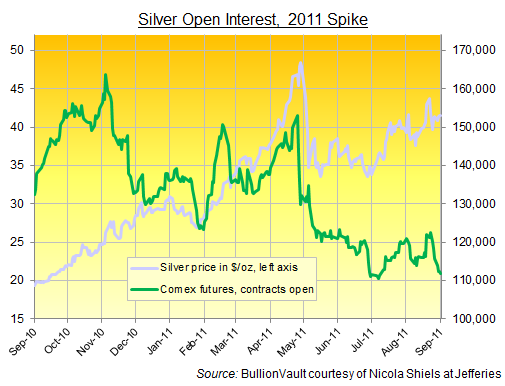

| Posted: 28 Apr 2014 10:13 AM PDT Silver prices looked overdone to many players at $50. Its drop surprised even them... SILVER's photovoltaic use by the solar industry played a big part in the metal's surge to $50 per ounce this week in April 2011, writes Miguel Perez-Santalla at Bullionvault, completing his 2-part analysis of silver's peak 3 years ago. But while the PV industry's role in creating what many investors saw as a silver shortage 3 years ago was far more talked about than true, solar did then play a very real part in the fundamental drop in demand which resulted from that spike. In the three years since April 2011's jump to $50 silver, the energy industry has significantly reduced the amount of silver needed for photovoltaic paste in solar panels. This "thrifting" means that a solar panel of the same dimension produced after 2011 contains significantly less silver than the older versions, up to 80% less in some applications. Because the investment surge which drove prices higher fundamentally dented silver's appeal to this major consumer industry. In fact, it dented silver's use across those industrial applications which rely on it. Full-year 2012 demand from industry was, according to the Silver Institute's data from Thomson Reuters GFMS, down by 7% from the peak of 500 million ounces in 2010. In contrast for investors, it was the speed of the drop in silver prices following its $50 top of 3 years ago which drew so much ire. Some proceeded to persist with claims to US regulator the CFTC requesting investigations, even bringing a lawsuit against major bullion banks J.P.Morgan and HSBC alleging some kind of manipulation. Within the last twelve months both the CFTC and the 2nd US Circuit Court of Appeals in New York have found no indications of collusion or criminal abuse of the silver market by any parties. This was no surprise to industry experts. But the speed of silver's plunge did surprise, and hurt, many investors and traders. The silver market is much smaller than the gold market, and at times suffers from great volatility. Comparing what's called "Open Interest", which is the number of contracts open on any given business day in the Comex futures market, gold is at least twice the size of the silver market. In London's over-the-counter market (where participants deal with each directly, rather than through standardized contracts on a formal trading exchange) the value of gold trading has averaged 8 times that of silver over the last 3 years. This means that a trade considered small in the gold market may actually be large in the silver market, because it has fewer participants willing to buy or sell at any given time.  Interestingly, during the price rally from September 2010 to the high in April 2011 open interest in the silver futures contract – though it did grow – was not astronomical or out of proportion to previous historical figures. So while though there was good participation in the marketplace it was not out of the norm for that time period. The first signs that money was departing the market however came on 25 April 2011 when the CME first raised margin requirements on contract holders. This meant you needed to have more cash on hand to hold the same position you had the day before. The next big decline registered in market participants then coincided with another increase in margin requirements on 5 May. There is nothing abnormal or suspicious here. The exchange needs to make certain that holders of leveraged positions are viable counterparties in a volatile market. So they ask for greater protection. Holders who don't have the financial means to meet the new requirements then liquidate some or all of their contracts. Increased silver margins in April and May 2011 did of course take a toll on the price, as would be expected in an extremely volatile market. Liquidation added to the downward momentum and kept the prices subdued moving forward. Between 25 April and 27 June, Comex open interest in silver futures shrank 23% as the silver price dropped 29%. It is apparent that the weakening price combined with the new margin requirements were of direct influence on open interest. Because as the silver price declined those holding contracts at higher prices would need to raise more cash to meet the exchange requirement or sell their contracts. It is my estimation that many traders holding long positions felt that trying to stay in the market would be the same as trying to catch a falling knife. If they were in the black they took their profits and if the traders were in the red they didn't want to suffer any more losses. Looking at the preceding chart, you can see that price was more volatile than the contract liquidations. Additionally, looking at the holdings of SLV – the largest silver exchange-traded trust fund – during that period, it was more stable again, declining only 15% to a balance of 309 million ounces. Comex warehouse stockpiles of silver bars only fell by 2.8 % for a balance of 99 million ounces. This would make it apparent that the violent price swings were not caused by any direct fundamental factors from physical investment holdings. So what led the selling? Further up the supply chain, the spike was of course an opportunity that silver miners could not resist. If they think the market is overdone, they need to sell metal for future delivery, and that is exactly what started happening. In an article published in February of 2011, the Wall Street Journal reported one such company, Boliden, was taking advantage of what they believed were already very high prices versus their cost of production. Many public miners would have had greater difficulty to do so as they had come under fire from shareholders in the past after the lack of participation of the initial upward of the commodities sector which began in 2006. Hedging for many had become a bad word but at the high levels in the beginning of 2011 it would have behooved them to buck the status quo and make the sale. Come March of 2011 there were many analysts also calling the silver market too high, too hot and a bubble. Analysis from HSBC Global Asset Management added to this growing sense of an impending market correction. In hindsight of course we all knew it was coming. But some investors, led by claims of that $50 silver shortage in 2011 became more caught up in the bullish rhetoric than others, and some were obviously still buying. What surprised everyone was the volatility in silver's initial drop, tempered into summer 2011 only by gold's separate, smaller but equally dramatic surge to $1900 per ounce. Day traders and high frequency hedge funds (running HFT programs) love volatility. This is because at times of great price moves, more opportunities arise for them to get in and out of the market with quick profits. Given the huge spike in Comex silver trading volumes, we can assume that such short-term players were primarily buying as the price rose and selling while the price dropped, tracking and extending the market's direction as this chart shows.  So here, with hindsight, are some fundamental, geopolitical and economical considerations unique to the silver market's $50 peak of April 2011. The story was good at the time, though many market people, including me, kept scratching our heads as the price kept rising. The way I look at it however the market is always right. All the participants' actions dictate where the price goes, which is why you step aside when you don't understand the level it's got to. Silver looked way overdone, but the real price at any given time is what the market will bear. Was silver worth $50 an ounce? Some buyers thought so, but I fear many more probably never gave it a thought. Someone will no doubt pay that much again. What silver is worth is determined every day in what we call the market place. When I want to know what it is worth I look to the last price it traded in the market where I would participate. So in physical investment silver, I look to the BullionVault order board just like anyone else using that simple, low-cost platform. |

| Gold Building Base for a Rally? Posted: 28 Apr 2014 10:03 AM PDT |

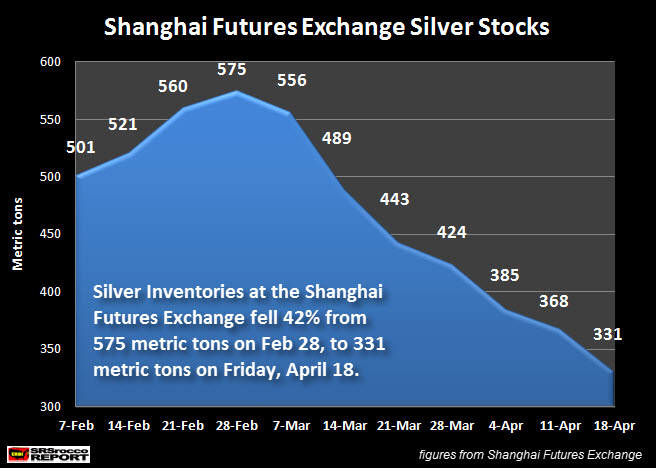

| The Decline In Shanghai Silver Stocks Picks Up Speed Posted: 28 Apr 2014 10:00 AM PDT

Over the past two months, gold inventories at the Comex have risen slowly, while silver warehouse stocks continue to decline. A total of 17.2 million ounces of silver were removed from the Shanghai (10.2 million oz) and Comex (7 million oz) exchanges since the end of February. For some reason, a great deal more silver is [...] The post The Decline In Shanghai Silver Stocks Picks Up Speed appeared first on Silver Doctors. |

| Use these inexpensive resources to harness success--in business, in love, in health, in life... Posted: 28 Apr 2014 09:45 AM PDT From Ryan Holiday, author, The Obstacle Is the Way: Very few people wake up and think "I need philosophy." This is perfectly understandable. But of course, everyone has their own problems and are dealing with the difficulties of life in some way or another. The irony is this is actually what ancient philosophy was intended to ameliorate. "Vain is the word of a philosopher," Epicurus once said, "which does not heal the suffering of man." Centuries later, Thoreau expressed this same thought: "To be a philosopher is not merely to have subtle thoughts, nor even to found a school . . . it is to solve some of the problems of life, not only theoretically, but practically." Suffering might be a strong word to describe most our travails in love, in business, with our egos, with our urges, with our jerk of a neighbor who keeps stealing our parking space. But it turns out that this was exactly what philosophy can help with. Whatever problem you're facing right now, someone else probably already went through it. And their advice and wisdom comes down to us through philosophy. It was jotted down by slaves and poets and emperors and politicians and soldiers and ordinary men and women to help with their own problems and with the problems of their friends, family and followers. This wisdom is there, available to us. Some of the best philosophers never wrote anything down–they just lived exemplary lives and provided an example which we can now learn from. That too, was philosophy. It was practical and it was applicable and it made life better. In a humble continuation of that tradition, I'd like this post to serve as a quick introduction to the world of practical philosophy–philosophy you can actually read and use in your own life. I won't pass along any of that academic stuff that Schopenhauer once dismissed as "fencing in the mirror." I want to give you the opposite of what you probably experienced in college, which despite the good intentions of your professor, you understandably resented and immediately forgot. I'm also giving you only the original texts, all of which I promise are totally readable and will change your life.

Meditations by Marcus AureliusMeditation is perhaps the only document of its kind ever made. It is the private thoughts of the world's most powerful man giving advice to himself on how to make good on the responsibilities and obligations of his positions. Trained in stoic philosophy, Marcus stopped almost every night to practice a series of spiritual exercises–reminders designed to make him humble, patient, empathetic, generous, and strong in the face of whatever he was dealing with. Well, now we have this book. It is imminently readable and perfectly accessible. You cannot read this book and not come away with a phrase or a line that will helpful to you next time you are in trouble. Read it, it is practical philosophy embodied.

Letters from a Stoic by SenecaSeneca, like Marcus, was also a powerful man in Rome. He was also a great writer and from the looks of it, a trusted friend who gave great advice to his friends. Much of that advice survives in the form of letters. Now we can read those letters and they can guide us through problems with grief, wealth, poverty, success, failure, education and so many other things. Seneca was a stoic as well, but like Marcus, he was practical and borrowed liberally from other schools. As he quipped to a friends, "I don't care about the author if the line is good." That is the ethos of practical philosophy–it doesn't matter from whom or when it came from, what matters if it is helps you in your life, if only for a second. Reading Seneca will do that. (Other collections of his thoughts are great too: Penguin's On the Shortness of Life is excellent.)

The Moral Sayings of Publius SyrusA Syrian slave in the first century BC, Publius Syrus is a fountain of quick, helpful wisdom that you cannot help but recall and apply to your life. "Rivers are easiest to cross at their source." "Want a great empire? Rule over yourself." "Divide the fire and you will sooner put it out." "Always shun that which makes you angry." Those are a few I remember off the top of my head. But all of them are good and worthy of re-reading in times of difficulty (or boredom or in preparation of a big event).

Fragments by HeraclitusThis is as ephemeral as I am going to get. While most of the other practical philosophy recommendations I'm making are bent towards hard, practical advice, Heraclitus might seem a bit poetic. But those beautiful lines are really the same direct advice and timeless, perspective-changing observations as the others. "Try in vain with empty talk / to separate the essences of things / and say how each thing truly is." "Applicants for wisdom / do what I have done: / inquire within." "Character is fate." "What eyes witness / ears believe on hearsay." "The crops are sold / for money spent on food."

Man's Search for Meaning by Viktor FranklMan is sent to a concentration camp and finds some way for good to come of it. Finds some way to turn it into the ultimate metaphor for life: that we have little control over our circumstances, complete control over our attitude, and our ability to make meaning out of the things which happen to us. In Frankl's case, we are lucky that he was a brilliant psychologist and writer and managed to turn all this into one of the most important books of the 20th century. I think constantly of his line about the man who asks, "What is the meaning of life?" The answer is that you don't get to ask the question. Life is the one who asks and we must reply with our actions.

Essays by MontaigneMontaigne was deeply influenced by some of the books I mentioned above. He was the epitome of Heraclitus's line about "inquiring within." So much so that he spent basically the entire second part of his life asking himself (and other people) all sorts of interesting questions and then exploring the answers in the form of short, provocative essays. (A favorite: Whether he was playing with his cat, or whether he was the toy to his cat). These essays are always good for a helpful thought or two–be it about death, about "other" people, about animals, about sex, or anything.

Nature and Selected Essays by Ralph Waldo EmersonWhile Montaigne's essays are good for making us think, Emerson's essays make us act. They remind us that we are ultimately responsible for our own life, for making ethical choices and for fulfilling our potential. I prefer Emerson to the more indolent Thoreau and because unlike most classic writers, he embodies that uniquely American drive and ambition (but in a healthy way). If you have not read Emerson, you should. If you have–and you remember fondly his reminders about recognizing our own genius in the work of others, or his reminders to experience the beauty of nature–that counts as philosophy. See how easy it is?

Essays and Aphorisms by Arthur SchopenhauerSchopenhauer is another brilliant composer of quick thoughts that will help us with our problems. His work was often concerned with the "will"–our inner drives and power. "For that which is otherwise quite indigestible, all affliction, vexation, loss, grief, time alone digests." But he also talks about surprisingly current issues: "Newspapers are the second hand of history"–and that the hand is often broken or malfunctioning. And of course, the timeless as well: "Hope is the confusion of the desire for a thing for its probability."

The Essential Epicurus by EpicurusFirst off, Epicurus' philosophy has almost nothing to do with our definition of the word "Epicurean." I mean look: "Live your life without attracting attention." He who has the least need of tomorrow will most gladly greet tomorrow." "It is better for you to be free of fear and lying on a bed of straw than to own a couch of gold and a lavish table and yet have no peace of mind." Epicurus was a teacher and a philosopher, and very little of his work survives. But the fragments which do are humble, noble and mostly about avoiding needless fear and anxiety in life. Those are all good things are they not? Ironically, Epicurus also has another more "scientific" side to him and there are few essays which go into great depth about "atoms." I mostly skip those and stick to the lessons on imperturbability and self-reliance. This classic essay on the life of Epicurus is also great. Misc BiographiesThis last thought will probably get me into a little trouble because I am veering off what is more directly considered "practical philosophy." But I think I am on good ground here. For starters, Cato the Younger–considered one of the most influential stoics–never wrote anything down. He was a philosopher by action and so many people studied his "work" through biography and anecdote. This was a Roman tradition. For instance, Plutarch wrote many biographies of famous historical figures–from Demosthenes to Mark Antony–which function as philosophy and moral example. A few biographies worth picking up for their practical philosophic value: Where Men Win Glory by Jon Krakauer (Pat Tillman embodies the tragic hero). Titan: The Life of John D Rockefeller (unflappable, disciplined, ultimately generous and humble–there are a lot of good stories here). I mentioned Cato earlier–the most recent biography by Jimmy Soni and Rob Goodman is quite good. I like Frederick Douglass' autobiography, My Bondage and My Freedom as well as Xenophon's Cyrus the Great (the modern business translation is most readable). I try to read at least one such biography a month, to get recommendations start here. This list is by no means conclusive. Absent are many other great works of practical philosophy, and of course, other great works of theoretical and systemic philosophy. I'm not saying those are without value. I'm just saying that when most people wake up and try to make the most of their lives–or often, just struggle to get by–that's not what they're looking for. They're looking for help. Well, philosophy can be that help. Most of us are just suspicious because we wrongly associate it with long lectures or confusing translations. That's a shame. Because the works above have long been resources for people with all sorts of problems, from fighter pilots to kings to accountants to convicts to parents to athletes. In other words, unlike most of the big intimidating (usually German) philosophers whose names you cannot pronounce, this is philosophy for outside the classroom. Take it with you, use it, depend on it. I'm sure some philosophy purists are going to object to my use of the books above and my characterization of some of their favorite thinkers. But I hope they understand that we have the same goal in mind: more people using philosophy as it was intended (improving lives). I hope the rest of you find some solace, aid or inspiration in these recommendations. Those books changed my life and I hope they'll change yours. The post originally ran on ThoughtCatalog.com. Comments can be seen there, or comment below.

More from Ryan Holiday: Must-read: Eight simple rules to live by from the world's greatest deep-sea diver Ryan Holiday: How to keep a library of (physical) books... The Notecard System: The secret to remembering, organizing, and using everything you read |

| Speak Loudly and Carry a Wet Noodle Posted: 28 Apr 2014 09:08 AM PDT That pretty much sums up the market's reaction to the announcement of a new set of "sanctions" unveiled by the current administration against Russian President Vladimir Putin and Russia over events in Ukraine. Sellers in gold wasted no time in declaring their view of the "strong message" ( note sarcasm here ) being sent to Russia proceeding to knock it back down below the $1300 level. Further aiding the move lower was the heavy selling in Newmont and more weakness in Barrick over the announcement that any merger between the two was off the table for now. The Yen also moved lower signaling the absence of any safe haven play as bonds also moved lower. Equities are moving in and out of positive territory as I type these comments. Safe havens are on hold, at least for today. There remains a great deal of volatility with short term technical factors dominating trading today. I mentioned last Friday that I do not believe gold has much upside here because at this time I do not see events in Ukraine spreading outside of that region. If the market felt like those events could be a harbinger of more to come, gold would be much stronger. That it is not, is evidence enough that while the situation remains tense, most do not see it spreading beyond that region. Rallies in gold are therefore attracting selling even as dips lower are attracting buying from some due to the ongoing geopolitical developments. As stated so many, many times here now, buying gold due to geopolitical events is extremely risky. You have no idea what might or might not happen and thus it is entirely a crapshoot. That is not trading; it is not investing either for that matter; it is gambling. If you want to gamble, head to Las Vegas or Reno - at least they have some great looking showgirls while you are losing your money. Corn continues to attract buying as traders are concerned over the slow start to planting this year. Also, the cool, wet conditions have raised concerns about poor germination of those crops which have been seeded. Soil temps are not warm enough and the market wants to see more sunshine. This past Friday's Cattle on Feed report was considered friendly to the market as it caught some by surprise who were expecting to see larger numbers moving ahead. Feeder cattle continue to make all time highs as most small specs are caught on the short side and are getting squeezed out in a brutal fashion. How some of these guys paying the kinds of prices that they are for feeders are going to be able to make any money on them is a big mystery to me but that does not seem to be impacting things at the moment. Hogs are bleeding out of some the premium in there as traders take a "show me" attitude towards the slaughter numbers and the impact from the PED virus. Crude oil continues weak in today's session further retreating from the double top near the $105 level. Silver has once again attracted selling as it neared $20. It remains stuck in a narrow range between that level and $19 on the bottom. |

| James Turk: Gold backwardation like this has never happened in history Posted: 28 Apr 2014 09:08 AM PDT Goldmoney |

| Posted: 28 Apr 2014 09:00 AM PDT

Bank of New Zealand: For Lease The post Caption Contest: For Lease appeared first on Silver Doctors. |

| Gold a 'trade for the patient' - Adrian Day Posted: 28 Apr 2014 08:57 AM PDT Net longs come back to the market, though many expect a bumpy ride for gold, even as Ukraine tensions mount. |

| Colombian ops unaffected by artisanal miners’ deaths - Continental Gold Posted: 28 Apr 2014 08:57 AM PDT Colombian government authorities are investigating an explosion which killed four people on concessions leased by Continental Gold, which the company says was being mined illegally. |

| For Gold and Silver, Critical Support Holds Posted: 28 Apr 2014 08:40 AM PDT thestreet |

| Gold sinks as fear trade fades Posted: 28 Apr 2014 08:40 AM PDT forexlive |

| Barrick Gold says Newmont terminates takeover talks Posted: 28 Apr 2014 08:32 AM PDT GATA |

| Silver Shield Silver Bull & $20 Off 2010 ATB Collection at SDBullion! Posted: 28 Apr 2014 08:27 AM PDT

The Silver Shield Silver Bull Only $2.49 Over Spot ANY QTY at SDBullion! & Doc’s Deal of the Day: $20 Off 2010 America The Beautiful Complete Inaugural 5 Coin Collection Purchase! Use coupon code $20OffATB The post Silver Shield Silver Bull & $20 Off 2010 ATB Collection at SDBullion! appeared first on Silver Doctors. |

| Posted: 28 Apr 2014 08:00 AM PDT

Gold demand has been in a downtrend for six weeks in Shanghai and premiums have been sub zero since late February, which doesn't hint at a supply shortage on the SGE. At the same time we saw GOFO rates being negative in week 15 in western markets, which does hint at supply shortages. This situation illustrates the PBOC's gold policy; [...] The post Chinese Gold Demand Dropping appeared first on Silver Doctors. |

| The survey is in. Here are the most and least expensive cities in America. Posted: 28 Apr 2014 08:00 AM PDT Here are America's most and least expensive cities in America. The Bureau of Economic Analysis just released a report that measures the regional price parity of American cities. Regional price parity is the measure of a good relative to the same good in a different region. It can be thought of as regional exchange rates. For example, Honolulu, HI is the most expensive city at 122.9. Danville, IL is the least expensive city at 79.4. Honolulu prices are around 65% higher than in Danville. If you're looking to move to a cheaper place… this information will help. It tells you where your dollar will stretch the furthest. So whether you're looking for a cheap place to retire… or to buy a second home… look for the places you like near the bottom of the list. Here's a glimpse of the most expensive regions… 1. Honolulu, Hawaii 2. New York-Newark-Jersey City, New York, New Jersey 3. San Jose-Sunnyvale-Santa Clara, California 4. Bridgeport-Stamford-Norwalk, Connecticut 5. Santa Cruz-Watsonville, California Here's a glimpse of the least expensive regions… 1. Danville, IL 2. Jefferson City, Missouri 3. Jackson, Tennessee 4. Jonesboro, Arkansas 5. Rome, Georgia Click for the full list here...

More Cruxellaneous: The 25 cheapest ways to go anywhere you want in the world... right now The top 25 international and domestic travel destinations This is the cheapest day and time of the week to book a flight |

| Technical Trading: Gold Continues To Hold Key Fibonacci Retracement Support Posted: 28 Apr 2014 07:20 AM PDT forbes |

| This simple idea is the difference between winning and losing portfolios... Posted: 28 Apr 2014 06:00 AM PDT It's the most important thing ever said about trading... If you print this quote out, pin it up close to your computer, and read it every day, you'll find trading a lot easier... and a lot more lucrative. Here's the quote: It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong. The quote comes from George Soros. And while you might not like his politics, Soros is one of the greatest traders alive. He and legendary trader Jim Rogers produced a 3,000%-plus return over 11 years in their Quantum Fund. (His most famous trade was a 1992 bet against the British pound, which netted $1 billion.) When Soros says "it's not whether you're right or wrong that's important," he means that your "batting average" as a trader barely matters. It's much more important that you maximize your winners and minimize your losers. It sounds simple, but it can be hard for many traders to put into action... The natural impulse is to close winning trades as soon as they're up 10% or 20%. You figure you can't go broke taking profits... It's also natural to want to leave losing trades alone. You hold and hope it'll come back to breakeven. But that's exactly how NOT to make money over a lifetime of trading. Instead, you need to cut your losers short and let your winners run. If you can do that, you're almost mathematically guaranteed to win. You can see what I mean in three hypothetical portfolios, which I pulled from my video "The Most Important Thing Ever Said About Trading." Each portfolio holds 10 hypothetical trades, with $10,000 in each trade. The trades were exactly the same: There were four winning trades, five losers, and one trade that broke even. The only thing that changed was the exit strategies.

The "Original Strategy" shows what the portfolio looked like at the end of the year... without closing any of the positions. You can see it just about broke even. The "Beginner's Strategy" was to take profits quickly – at 20% – but to hold the losers. That portfolio lost nearly 13%. The final strategy, "Soros' Strategy," was to cut losses quickly – at 10% – but to let winning trades ride. That portfolio returned nearly 15%. Remember, that's using the exact same trades... and only four winning trades out of 10. It's that simple. If you're a longtime reader, you've heard this all before. But it bears repeating. And it's useful to see it in action in a recent trade I recommended in DailyWealth Trader. In December, I told my readers to buy shares of the double-long biotech fund (BIB). Biotech is a "boom and bust" asset... When it booms, like it did all last year, the gains can be extraordinary. The trade moved in our favor immediately... It climbed from about $69 a share to $108. But in late February, the trend reversed... By late March, we had hit our stop. Take a look at what happened next...

BIB dropped as much as 19% after we stopped out. That's 5% below our purchase price... But because we followed our stop, we locked in a 17% gain. My colleague Steve Sjuggerud also recently exited a big winning trade in biotech. Here's what he wrote last week in DailyWealth... Personally, I believe biotech can go higher from here. However, I'm smart enough to recognize that I have no expertise or special insights here. So the smartest thing I can do is to maximize the value of my good decisions and minimize the impact of my bad decisions. In short, you need to be patient while you're making money so you can reap the full benefit of your good decisions. And you need to be impatient when you're losing money, so you don't get hurt. That's exactly what we did in DailyWealth Trader. That's what Steve Sjuggerud is doing. And that's what you need to do to put George Soros' quote to work. Crux note: Amber explains this quote beautifully in a short video. It only takes a moment to watch but it will crystallize everything. To watch Amber's video click here.

More from Amber Lee Mason: Amber Lee Mason: The Three-Minute Trading Expert Amber Lee Mason: The answer to a BIG question you're probably asking about stocks Amber Lee Mason: A world-class way to profit from the next big rally in silver |

| US Shoots Self in Foot Via Sanctions: Dollar to Be Driven Out of Trade Settlement! Posted: 28 Apr 2014 05:00 AM PDT

In the latest Keiser Report, Max Keiser and Stacy Herbert discuss the American Dream as being chained to the booth in the waffle house as cogs in the wheels generating income for Wall Street sharpies and the poverty of this century in which the beggar is a reminder of nothing. In the second half, Max [...] The post US Shoots Self in Foot Via Sanctions: Dollar to Be Driven Out of Trade Settlement! appeared first on Silver Doctors. |

| Russian Sanctions Could See Gold Prices ‘Explode’ Posted: 28 Apr 2014 04:32 AM PDT gold.ie |

| Is It Time For Gold and Other Precious Metals? Posted: 28 Apr 2014 04:25 AM PDT The post Is It Time For Gold and Other Precious Metals? appeared first on Monty Pelerin's World. Is it time to begin panning for gold, at least metaphorically? The price movement between gold and common stocks is generally loosely correlated. When gold does well, stocks often don’t and vice versa. For those versed in MPT (modern portfolio theory), gold is considered to have a low beta, even negative at times. Beta is a measure of the correlation between [...] The post Is It Time For Gold and Other Precious Metals? appeared first on Monty Pelerin's World. |

| Russian Sanctions Could See Gold Prices ‘Explode’ Posted: 28 Apr 2014 04:13 AM PDT Ukraine may have a "massively bullish impact on gold prices." The concept of MAD or mutually assured destruction was what prevented war between the superpowers during the Cold War. Today, there appears to be a lack of awareness regarding the risk of mutually assured economic destruction. Today's AM fix was USD 1,302.00, EUR 938.45 and GBP 772.79 per ounce. Gold climbed $9.80 or 0.76% on Friday to $1,302.70/oz. Silver rose $0.04 or 0.2% to $19.71/oz. Gold eked out small gains in European trading, as growing tensions in Ukraine are contributing to higher prices. On Thursday prices dropped to $1,268.40 per ounce – the lowest since early February, before rallying due to tensions over Ukraine. In the last 3 sessions, gold bullion has rallied nearly 2%, as the crisis in Eastern Europe bolsters safe haven demand.

Today, geopolitical tensions have deepened with President Obama saying that the United States will impose additional sanctions on Russia targeting individuals and companies. The move is expected to be followed by separate sanctions from the European Union. Washington said at the weekend the new sanctions would target individuals and companies close to Russian President Vladimir Putin, as well as new restrictions on high-tech exports to Russia’s defence industry. The geopolitical risks may overshadow a number of important reports on the U.S. economy this week. The conflict reached a new level over the weekend, when a group of international observers from the Vienna-based Organization for the Security and Cooperation in Europe (OSCE) were abducted by pro-Russian groups. The separatists later released one of the captives due to a medical condition requiring treatment, but also said they had no intention of freeing the others. Negotiations for the release of the observers are underway, Russia saying it will help as much as possible with the situation. Western diplomats will hold high level talks today, with the goal of agreeing further and tougher sanctions against Moscow. The BBC reported that, according to sources familiar with developments, this round of asset freezes and travel bans may target individuals at the top of Russia's energy industry. There is even speculation that Putin himself and his considerable net worth may be targeted. Russia will likely react to these sanctions and retaliate. This could come in the form of financial, economic or currency warfare. One unappreciated risk is that state sanctioned Russian hackers may target U.S. exchanges and financial infrastructure. Bloomberg reports that "U.S. officials and security specialists are warning that Russian hackers may respond to new sanctions by attacking the computer networks of U.S. banks and other companies." Cybersecurity specialists consider Russian hackers among the world's best at infiltrating networks and say evidence exists that they already have inserted malicious software on computers in the U.S. There are concerns that small numbers of computer experts could have the ability "to cripple the U.S. economy in a few days." Veteran gold analyst, George Gero, who is the precious metals analyst at RBC is not a man for hyperbole or overstatement. Indeed, he has been quite bearish on gold in recent years. However, he believes that Ukraine and the deepening crisis, could have a "massively bullish impact on gold prices." He told CNBC the following: “One of the largest suppliers of gold, and of course platinum, is Russia and if they’re going to be involved in sanctions, and more problems with Ukraine, and deliveries are curtailed—and there is already a problem in South Africa between the miners of platinum, palladium and the mining companies. All of that could somehow explode on the upside and curtail deliveries, meaning higher prices.” Russia is the fourth-largest producer of gold, outputting 7% of the world’s total supply according to the British Geological Survey. Were Russia to retaliate by banning the exports of all precious metals and by selling some of their large foreign exchange reserves and diversifying into gold, silver, platinum and palladium, it would likely lead to migh higher prices for all precious metals. There is also the strong possibility of increased safe haven demand. This is likely to materialise should economic or even military conflict materialise. HSBC point out that geopolitical incidents and a short term increase in geopolitical tensions tend to see gold prices rise, prior to the fleeting impact abating and prices falling again. However, the risk of conflict between Russia and the U.S. and EU is more than a short term risk. It is one of the greatest geopolitical challenges since the end of the Cold War. Therefore, it is likely to have a more material impact on gold prices. The concept of MAD or mutually assured destruction was what prevented war between the superpowers during the Cold War. Today, there appears to be a lack of awareness regarding the risk of mutually assured economic destruction.

|

| Steve Sjuggerud: The world's cheapest stocks right now Posted: 28 Apr 2014 04:00 AM PDT From Steve Sjuggerud in DailyWealth: My friend Meb Faber literally wrote the book on "global value"... His book Global Value: How to Spot Bubbles, Avoid Market Crashes, and Earn Big Returns in the Stock Market just came out. Meb and I were in the Bahamas together this week, speaking at a private conference. I was looking forward to his speech... You see, I am big fan of Meb's work. I started reading his blog years ago. He and I were studying the same things in the markets at the same time... but honestly, I thought his work was better than mine. So I got in touch with him, we compared notes on a lot of things, and we quickly became friends. Meb's speech covered a lot of ground... but I found his latest list of the best stock market values in the world today the most interesting thing he talked about... "Greece is the world's cheapest stock market, trading at 4.5 times earnings," Meb explained. (That number is based on Meb's preferred method of value, called "CAPE" – the cyclically adjusted price-to-earnings ratio.) "Russia is also extremely cheap – right behind Greece." Meb showed the world's top ten cheapest countries... Beyond Greece and Russia, it was mostly smaller European countries, plus Brazil. "Nobody wants to invest in these places today," he explained. "But the thing is, history shows that future stock market returns are higher when starting valuations are lower." It makes sense... If you buy cheap, then you can make a higher return. So why can't people do it? Meb explained recently on his blog why people can't pull the trigger. He used Russia as an example. He said: 1. All of the headlines are negative. 2. The investment has declined, usually by A LOT. 3. All of the trailing fundamentals are really bad. 4. People can find many reasons why "this time is different" for the value metrics not to be reflective of the current situation. 5. There is a small (but real) risk of the investment going to zero. 6. It is not popular (or patriotic) to own the investment. 7. Buying the investment, and it going down more, would pose serious career risk (or divorce risk). 8. The banking consensus is all sell-rated. 9. Flows are out. Russia checks all of these boxes and then some. Meb is putting his money where his mouth is... He's buying Russia, and Greece. But not by themselves, of course... He recommends diversifying... Specifically, Meb is buying stocks in these countries through his fund – called the Cambria Global Value Fund (GVAL). In this fund, Meb buys stocks in the cheapest countries in the world. Greece, Russia, Brazil, and some smaller European countries are the top holdings. Remember, Meb figured out what works here... He wrote the book on global value. And now he's investing based on that in the Cambria Global Value Fund. Having the guts to buy the world's cheapest markets is tough. But as Meb's book proves, it's the right way to invest. I suggest getting to know Meb's work through his blog at www.MebFaber.com. Check out his book at www.GlobalValueBook.com. And learn more about his global value fund at www.CambriaFunds.com. If it's too gut-wrenching for you to invest in these cheap countries, consider buying Meb's fund instead... he takes the guesswork and the emotional difficulty out of it for you. I have no personal stake here... I just think Meb is a smart guy... and I believe him when he says that buying a diversified handful of the world's cheapest markets really works... Check it out... Crux note: Steve just published a report every gold investor should see. In short, he's uncovered a gold stock that has produced triple-digit gains on THREE separate occasions – 736%, 850%, and 733%, to be precise – and their research suggests it's starting a fourth triple-digit move right now. Click here to see for yourself.

More from Steve Sjuggerud: Steve Sjuggerud: This is how I personally track my investments. You can, too... Most investors are scared when this happens. Here's what to do... Steve Sjuggerud: This was the worst mistake of my career... and it's happening again right now |

| Thibaut Lepouttre's Commodity Plays in a Sideways Market Posted: 28 Apr 2014 01:00 AM PDT |

| Gold Trades Nicely To The Downside Posted: 28 Apr 2014 12:35 AM PDT investing |

| Gold Price Analysis- April 28, 2014 Posted: 28 Apr 2014 12:35 AM PDT dailyforex |

| Gold / Silver / Copper futures - weekly outlook: April 28 - May 2 Posted: 28 Apr 2014 12:10 AM PDT investing |

| Market Report: How oversold can gold get? Posted: 27 Apr 2014 11:00 PM PDT Finance and Eco. |