Gold World News Flash |

- Economic Reset, War, & "Controlled Collapse" | Fabian Calvo

- Currencies weaken and gold flows from West to Asia, Sprott says

- Speak Loudly and Carry a Wet Noodle

- Richard Russell - World On The Edge Of A Catastrophic War

- US Dollar To Be SWEPT OUT OF RUSSIA

- Listen, Silver: We Need to Talk

- Silver $50: April 2011 Part 2

- Convergence of Doom

- Iron Ore Prices Tumble As China Crackdown Begins

- UPDATE: The Decline In Shanghai Silver Stocks Picks Up Speed

- Guest Post: Suspicious Deaths Of Bankers Are Now Classified As "Trade Secrets" By Federal Regulator

- Epidemic Of Hunger: New Report Says 49 Million Americans Are Dealing With Food Insecurity

- Ted Butler: The world's most undervalued asset

- Precious Metals Complex Flashing Buy Signal

- Gold Settles Today At $1299.0 After Choppy Session

- Embry: Russia is fitter fiscally than U.S. and knows West's vulnerability with gold

- Why The Silver Bear Market Is About To End

- Listen, Silver: We Need to Talk

- Why A Stock Market Collapse Would Be A Good Thing

- Jim’s Mailbox

- 4 Completely Real Alternatives to Bitcoin

- Virtually all asset classes may be in decline... Except the Dollar

- Gold Daily and Silver Weekly Charts - FOMC, GDP, Non-Farm Payrolls and End of April

- Gold Daily and Silver Weekly Charts - FOMC, GDP, Non-Farm Payrolls and End of April

- Why Popping the Credit Bubble Would Destroy the US Empire

- Mine closings drop Ghana's gold production by 14%

- Currencies weaken and gold flows from West to Asia, Sprott says

- Currency, Economic and Military Wars to drive Gold to $2,000+ in 2014

- Financial Lessons from the Head of the Fed

- Gold offtake in Shanghai resumes rise

- Silver $50: April 2011 Part 2

- Silver $50: April 2011 Part 2

- Silver $50: April 2011 Part 2

- GOLD and the UKRAINE...

- Gold & Silver May Be Setting Up To Crush The Shorts

- Will Gold Price See A Bullish Reversal?

- Demand to Buy Gold "Missing" as Ukraine Violence Grows, US Adds Sanctions

- Buy Signal in the Gold and Silver Sector

- Gold and The Ukraine Crisis

- Barrick Gold says Newmont terminates takeover talks

- A Nice Rebound For Gold, But Will It Last?

- Listen, Silver: We Need to Talk

- Thibaut Lepouttre's Commodity Plays in a Sideways Market

- Thibaut Lepouttre's Commodity Plays in a Sideways Market

- Thibaut Lepouttre's Commodity Plays in a Sideways Market

| Economic Reset, War, & "Controlled Collapse" | Fabian Calvo Posted: 29 Apr 2014 12:07 AM PDT IN THIS INTERVIEW:- "The world in which we live and operate is on the verge of a monumental change" ►1:04- Eurasian Economic Union and new currency, called the Altyn* ►4:19- Ukraine readying their military.** WWIII coming? ►6:29- Since 2008, America has fundamentally changed ►9:16- We're headed for... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Currencies weaken and gold flows from West to Asia, Sprott says Posted: 28 Apr 2014 11:30 PM PDT by Chris Powell, GATA:

Dear Friend of GATA and Gold: Currencies are weakening worldwide even as gold being exported from the West to Asia is increasing, Sprott Asset Management CEO Eric Sprott notes in the weekly market review with Sprott Money News. Some of that gold, Sprott adds, is likely coming out of central bank vaults. The interview is 8 minutes long and can be heard at the Sprott Money Internet site here: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Speak Loudly and Carry a Wet Noodle Posted: 28 Apr 2014 09:40 PM PDT from Dan Norcini:

Sellers in gold wasted no time in declaring their view of the “strong message” ( note sarcasm here ) being sent to Russia proceeding to knock it back down below the $1300 level. Further aiding the move lower was the heavy selling in Newmont and more weakness in Barrick over the announcement that any merger between the two was off the table for now. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Richard Russell - World On The Edge Of A Catastrophic War Posted: 28 Apr 2014 09:01 PM PDT  With continued turmoil and uncertainty in global markets, today KWN is publishing another important piece that was written by a 60-year market veteran. The Godfather of newsletter writers, Richard Russell, is urging people to buy physical silver, and cautioning that the world may be on the edge of another catastrophic war. Russell also warns something bad is headed our way we haven't seen in at least 60 years. With continued turmoil and uncertainty in global markets, today KWN is publishing another important piece that was written by a 60-year market veteran. The Godfather of newsletter writers, Richard Russell, is urging people to buy physical silver, and cautioning that the world may be on the edge of another catastrophic war. Russell also warns something bad is headed our way we haven't seen in at least 60 years. This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Dollar To Be SWEPT OUT OF RUSSIA Posted: 28 Apr 2014 08:40 PM PDT from Koos Jansen: “Russian MPs are worried the US Dollar system may collapse in 2017 due to the growth of US government debt.” | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Listen, Silver: We Need to Talk Posted: 28 Apr 2014 08:20 PM PDT by Louis James, Casey Research:

Dear Silver, Happy anniversary. It was on April 25, 2011 that you hit $49.80 per ounce in the New York spot market. Today, three years later, you sell for around $20, nearly 60% less. Is your bear market almost over—or are these low prices here to stay? Your price has lagged gold this year, so your normal volatility is lacking. How much longer will you be stuck? Jeff Clark, silver investor Here's her polite response: Dear Mr. Clark, I have good news for you. While some investors have lost interest in me and my price is at 2010 levels, things will soon change. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Apr 2014 08:11 PM PDT Bullion Vault | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Apr 2014 07:29 PM PDT by Andy Hoffman, MilesFranklin.com:

However, since several comments struck a chord, I want to address them here. Two were related to the same topic; i.e., "too much repetition of gold/silver manipulation" and "newsletters spend way too much time discussing manipulation and the Cartel." Meanwhile, another – albeit not necessarily "negative" – stated "specific investment advice on gold and silver should be included." | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Iron Ore Prices Tumble As China Crackdown Begins Posted: 28 Apr 2014 07:27 PM PDT After the initial crash in many of the commodities backing China's shadow-banking system's ponzi, levels recovered modestly as rumors were spread of bailouts, stimulus, and in fact the exact opposite of what the Chinese government had declared it was trying to do. That ended for Iron Ore this weekend when, as The FT reports, China announced plans to get tougher on loans for iron ore imports as concerns grow that steel mills are using import loans to stay afloat in defiance of policies to reduce overcapacity in heavily polluting and lossmaking industries. Iron Ore prices tumbled overnight, closing near the lowest levels since Sept 2012 as it appears the PBOC and CBRC are serious and set to implement the tougher rules on May 1st.

As The FT reports, The China Banking Regulatory Commission warned banks to tighten controls over letters of credit for iron ore imports in a document that caused iron ore futures in China to drop 5 per cent on Monday. Rumours of the stricter measures, which are expected after the May 1 holiday, have been circulating in China for at least two months, after a hasty stock sale caused ore prices to tumble in late February.

But it's clear, the mills are unable to stop for fear of what the consequences are...

And therefore...

The major problem, of course, is any restriction or tightening is necessarily lowering the price of the iron ore... thus reducing the value of collateral and thus worsening credit conditions in a vicious circle as firms can borrow less and less actual Yuan against their inventory at a time when cash flows are becoming increasingly negative from demand collapse. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

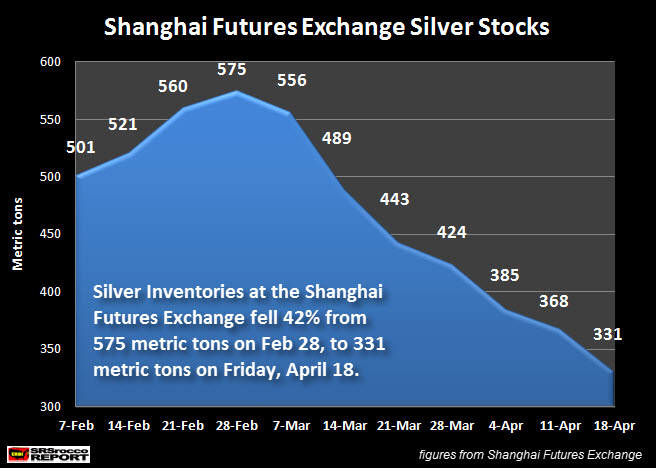

| UPDATE: The Decline In Shanghai Silver Stocks Picks Up Speed Posted: 28 Apr 2014 07:20 PM PDT by Steven St. Angelo, SRS Rocco:

Someone is taking delivery of silver from the Shanghai Futures Exchange in a big way. The amount of silver withdrawn from the exchange increased substantially this week. Matter-a-fact, more silver was removed this week than in the past three weeks combined. Earlier this week, I posted a chart on the change in silver warehouse stocks at the Shanghai Futures Exchange. In less than two months, silver inventories at the exchange declined 244 metric tons. Here is the chart from my prior article: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Guest Post: Suspicious Deaths Of Bankers Are Now Classified As "Trade Secrets" By Federal Regulator Posted: 28 Apr 2014 06:46 PM PDT Submitted by Pam Martens and Russ Martens of Wall Street On Parade, It doesn’t get any more Orwellian than this: Wall Street mega banks crash the U.S. financial system in 2008. Hundreds of thousands of financial industry workers lose their jobs. Then, beginning late last year, a rash of suspicious deaths start to occur among current and former bank employees. Next we learn that four of the Wall Street mega banks likely hold over $680 billion face amount of life insurance on their workers, payable to the banks, not the families. We ask their Federal regulator for the details of this life insurance under a Freedom of Information Act request and we’re told the information constitutes “trade secrets.” According to the Centers for Disease Control and Prevention, the life expectancy of a 25 year old male with a Bachelor’s degree or higher as of 2006 was 81 years of age. But in the past five months, five highly educated JPMorgan male employees in their 30s and one former employee aged 28, have died under suspicious circumstances, including three of whom allegedly leaped off buildings – a statistical rarity even during the height of the financial crisis in 2008. There is one other major obstacle to brushing away these deaths as random occurrences – they are not happening at JPMorgan’s closest peer bank – Citigroup. Both JPMorgan and Citigroup are global financial institutions with both commercial banking and investment banking operations. Their employee counts are similar – 260,000 employees for JPMorgan versus 251,000 for Citigroup. Both JPMorgan and Citigroup also own massive amounts of bank-owned life insurance (BOLI), a controversial practice that pays the corporation when a current or former employee dies. (In the case of former employees, the banks conduct regular “death sweeps” of public records using former employees’ Social Security numbers to learn if a former employee has died and then submits a request for payment of the death benefit to the insurance company.) Wall Street On Parade carefully researched public death announcements over the past 12 months which named the decedent as a current or former employee of Citigroup or its commercial banking unit, Citibank. We found no data suggesting Citigroup was experiencing the same rash of deaths of young men in their 30s as JPMorgan Chase. Nor did we discover any press reports of leaps from buildings among Citigroup’s workers. Given the above set of facts, on March 21 of this year, we wrote to the regulator of national banks, the Office of the Comptroller of the Currency (OCC), seeking the following information under the Freedom of Information Act (See OCC Response to Wall Street On Parade’s Request for Banker Death Information): The number of deaths from 2008 through March 21, 2014 on which JPMorgan Chase collected death benefits; the total face amount of BOLI life insurance in force at JPMorgan; the total number of former and current employees of JPMorgan Chase who are insured under these policies; any peer studies showing the same data comparing JPMorgan Chase with Bank of America, Wells Fargo and Citigroup. The OCC responded politely by letter dated April 18, after first calling a few days earlier to inform us that we would be getting nothing under the sunshine law request. (On Wall Street, sunshine routinely means dark curtain.) The OCC letter advised that documents relevant to our request were being withheld on the basis that they are “privileged or contains trade secrets, or commercial or financial information, furnished in confidence, that relates to the business, personal, or financial affairs of any person,” or relate to “a record contained in or related to an examination.” The ironic reality is that the documents do not pertain to the personal financial affairs of individuals who have a privacy right. Individuals are not going to receive the proceeds of this life insurance for the most part. In many cases, they do not even know that multi-million dollar policies that pay upon their death have been taken out by their employer or former employer. Equally important, JPMorgan is a publicly traded company whose shareholders have a right under securities laws to understand the quality of its earnings – are those earnings coming from traditional banking and investment banking operations or is this ghoulish practice of profiting from the death of workers now a major contributor to profits on Wall Street? As it turns out, one aspect of the information cavalierly denied to us by the OCC is publicly available to those willing to hunt for it. On March 24 of this year, we reported that JPMorgan Chase held $10.4 billion in BOLI assets at its insured depository bank as of December 31, 2013. We reached out to BOLI expert, Michael D. Myers, to understand what JPMorgan’s $10.4 billion in BOLI assets at its commercial bank might represent in terms of face amount of life insurance on its workers. Myers said: “Without knowing the length of the investment or its rate of return, it is difficult to estimate the face amount of the insurance coverage. However, a cash value of $10.4 billion could easily translate into more than $100 billion in actual insurance coverage and possibly two or three times that amount” said Myers, a partner in the Houston, Texas law firm McClanahan Myers Espey, L.L.P. Myers’ and his firm have represented the families of deceased employees for almost two decades in cases involving corporate-owned life insurance against employers such as Wal-Mart Stores, Inc., Fina Oil and Chemical Co., and American Greetings Corp. (Families may be entitled to the proceeds of these policies if employee consent was required under State law and was never given and/or if the corporation cannot show it had an “insurable interest” in the employee — a tough test to meet if it’s a non key employee or if the employee has left the firm.) As it turns out, the $10.4 billion significantly understates the amount of money JPMorgan has tied up in seeking to profit from workers’ deaths. Since Wall Street banks are structured as holding companies, we decided to see what type of financial information might be available at the Federal Financial Institutions Examination Council (FFIEC), a federal interagency that promotes uniform reporting standards among banking regulators. The FFIEC’s web site provided access to the consolidated financial statements of the bank holding companies of not just JPMorgan Chase but all of the largest Wall Street banks. We conducted our own peer review study with the information that was available. Four of Wall Street’s largest banks hold a total of $68.1 billion in BOLI assets. Using Michael Myers’ approximate 10 to 1 ratio, that would mean that over time, just these four banks could potentially collect upwards of $681 billion in tax free income from life insurance proceeds on their current and former workers. (Death benefits are received tax free as is the buildup in cash value in the policies.) The breakdown in BOLI assets is as follows as of December 31, 2013: Bank of America $22.7 billion Wells Fargo 18.7 billion JPMorgan Chase 17.9 billion Citigroup 8.8 billion In addition to specifics on the BOLI assets, the consolidated financial statements also showed what each bank was reporting as “Earnings on/increase in value of cash surrender value of life insurance” as of December 31, 2013. Those amounts are as follows: Bank of America $625 million Wells Fargo 566 million JPMorgan Chase 686 million Citigroup 0 Given the size of these numbers, there is another aspect to BOLI that should raise alarm bells among both regulators and shareholders. The Wall Street banks are using a process called “separate accounts” for large amounts of their BOLI assets with reports of some funds never actually leaving the bank and/or being invested in hedge funds, suggesting lessons from the past have not been learned. On May 20, 2008, Bloomberg News reported that Wachovia Corp. (now owned by Wells Fargo) and Fifth Third Bancorp reported major losses on failed gambles with BOLI assets. “Wachovia reported a $315 million first-quarter loss in its bank-owned life insurance program, known as BOLI, because of investments in hedge funds managed by Citigroup Inc. Fifth Third said in a lawsuit filed last month that it had losses of $323 million from Citigroup’s Falcon funds, which slumped more than 50 percent in the past year as the subprime market collapsed.” Citigroup’s Falcon Strategies hedge fund had lost as much as 75 percent of its value by May 2008. Following are the names and circumstances of the five young men in their 30s employed by JPMorgan who experienced sudden deaths since December along with the one former employee. Joseph M. Ambrosio, age 34, of Sayreville, New Jersey, passed away on December 7, 2013 at Raritan Bay Medical Center, Perth Amboy, New Jersey. He was employed as a Financial Analyst for J.P. Morgan Chase in Menlo Park. On March 18, 2014, Wall Street On Parade learned from an immediate member of the family that Joseph M. Ambrosio died suddenly from Acute Respiratory Syndrome. Jason Alan Salais, 34 years old, died December 15, 2013 outside a Walgreens inPearland, Texas. A family member confirmed that the cause of death was a heart attack. According to the LinkedIn profile for Salais, he was engaged in Client Technology Service “L3 Operate Support” and previously “FXO Operate L2 Support” at JPMorgan. Prior to joining JPMorgan in 2008, Salais had worked as a Client Software Technician at SunGard and a UNIX Systems Analyst at Logix Communications. Gabriel Magee, 39, died on the evening of January 27, 2014 or the morning of January 28, 2014. Magee was discovered at approximately 8:02 a.m. lying on a 9th level rooftop at the Canary Wharf European headquarters of JPMorgan Chase at 25 Bank Street, London. His specific area of specialty at JPMorgan was “Technical architecture oversight for planning, development, and operation of systems for fixed income securities and interest rate derivatives.” A coroner’s inquest to determine the cause of death is scheduled for May 20, 2014 in London. Ryan Crane, age 37, died February 3, 2014, at his home in Stamford, Connecticut. The Chief Medical Examiner’s office is still in the process of determining a cause of death. Crane was an Executive Director involved in trading at JPMorgan’s New York office. Crane’s death on February 3 was not reported by any major media until February 13, ten days later, when Bloomberg News ran a brief story. Dennis Li (Junjie), 33 years old, died February 18, 2014 as a result of a purported fall from the 30-story Chater House office building in Hong Kong where JPMorgan occupied the upper floors. Li is reported to have been an accounting major who worked in the finance department of the bank. Kenneth Bellando, age 28, was found outside his East Side Manhattan apartment building on March 12, 2014. The building from which Bellando allegedly jumped was only six stories – by no means ensuring that death would result. The young Bellando had previously worked for JPMorgan Chase as an analyst and was the brother of JPMorgan employee John Bellando, who was referenced in the Senate Permanent Subcommittee on Investigations’ report on how JPMorgan had hid losses and lied to regulators in the London Whale derivatives trading debacle that resulted in losses of at least $6.2 billion. Related Articles: Swiss Insurers and JPMorgan Have More than ‘Suicides’ in Common A Rash of Deaths and a Missing Reporter — With Ties to Wall Street Investigations Suspicious Death of JPMorgan Vice President, Gabriel Magee, Under Investigation in London JPMorgan Vice President’s Death in London Shines a Light on the Bank’s Close Ties to the CIA As Bank Deaths Continue to Shock, Documents Reveal JPMorgan Has Been Patenting Death Derivatives | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Epidemic Of Hunger: New Report Says 49 Million Americans Are Dealing With Food Insecurity Posted: 28 Apr 2014 05:48 PM PDT Submitted by Michael Snyder of The Economic Collapse blog, If the economy really is "getting better", then why are nearly 50 million Americans dealing with food insecurity? In 1854, Henry David Thoreau observed that "the mass of men lead lives of quiet desperation". The same could be said of our time. In America today, most people are quietly scratching and clawing their way from month to month. Nine of the top ten occupations in the U.S. pay an average wage of less than $35,000 a year, but those that actually are working are better off than the millions upon millions of Americans that can't find jobs. The level of employment in this nation has remained fairly level since the end of the last recession, and median household income has gone down for five years in a row. Meanwhile, our bills just keep going up and the cost of food is starting to rise at a very frightening pace. Family budgets are being squeezed tighter and tighter, and more families are falling out of the middle class every single day. In fact, a new report by Feeding America (which operates the largest network of food banks in the country) says that 49 million Americans are "food insecure" at this point. Approximately 16 million of them are children. It is a silent epidemic of hunger that those living in the wealthy areas of the country don't hear much about. But it is very real. The mainstream media and our politicians continue to insist that "things are getting better", and that may be true for Wall Street, but the man who was in charge of the new Feeding America report says that the level of suffering for the tens of millions of Americans that are food insecure has not changed...

In fact, a different report seems to indicate that hunger in America is actually getting worse...

If someone tries to tell you that "the economy is getting better", that person is probably living in a wealthy neighborhood. Because those that live in poor neighborhoods would not describe what is going around them as an "improvement". In particular, many minority neighborhoods are really dealing with extremely high levels of food insecurity right now. The following comes from a recent NBC News article...

But if you don't live in one of those areas and you don't know anyone that is facing food insecurity, it can be difficult to grasp just how much people are actually suffering out there right now. For example, consider the story of a young mother named Tianna Gaines Turner...

Have you ever been in a position where you had to skip meals just so that other family members could have something to eat? I haven't, so it is hard for me to imagine having to do such a thing. But there are millions of parents that are faced with these kinds of hard choices every day. Things can be particularly hard if you are a single parent. Just consider the story of Jamie Grimes...

I have such admiration for working single mothers. Many of them work more than one job just so that they can provide for their children. It can be absolutely frustrating to work as hard as you possibly can and still not have enough money to pay the bills at the end of the month. Those that believe that the economy has gotten "back to normal" just need to look at the number of women that have been forced to turn to government assistance. As I mentioned the other day, a decade ago the number of American women that had jobs outnumbered the number of American women on food stamps by more than a 2 to 1 margin. But now the number of American women on food stamps actually exceeds the number of American women that have jobs. The truth is that we are nowhere close to where we used to be. The last major economic downturn permanently damaged the middle class, and now the next major economic downturn is rapidly approaching. Right now, there are nearly 50 million Americans that are facing food insecurity. When the next economic crisis strikes, that number is going to go much higher. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ted Butler: The world's most undervalued asset Posted: 28 Apr 2014 05:21 PM PDT 8:20p ET Monday, April 28, 2014 Dear Friend of GATA and Gold: Silver is the world's most undervalued asset because of the price suppression aimed at it by the most concentrated short position in the commodities market, silver market whistleblower Ted Butler writes tonight at GoldSeek's companion Internet site, SilverSeek. Butler's commentary's is headlined "The World's Most Undervalued Asset" and it's posted here: http://www.silverseek.com/commentary/worlds-most-undervalued-asset-13135 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Precious Metals Complex Flashing Buy Signal Posted: 28 Apr 2014 03:08 PM PDT It looks like gold and silver stocks bottomed on Monday, April 21, and that gold and silver also bottomed this week. Really? The usual reaction is, "the stocks have been hammered, gold is off over 30% from its highs, and silver is down nearly 60%. Sentiment is low, few people are interested, and gold and silver will probably crash again in a few weeks." Exactly!We have been conditioned to expect lower prices in spite of:

And don't forget that central banks everywhere are openly and excessively printing their paper currencies to encourage inflation, politicians are fomenting wars, and the global monetary system is more unstable every day. Accidents can happen, and those accidents will justifiably encourage people to shift assets to something solid and real – like gold and silver. But, you have heard it all before. So, listen to an excellent technician: Nicholas Migliaccio does his own brand of technical analysis, and his comment is, "DON'T MISS THIS RALLY!!!" Why? Price movement, breadth, and volume, and he has the graphs and analysis to support his statement. Download his pdf here: Precious Metals Buy Signal My view is shown in these three graphs of daily data for the XAU (gold stock index), GLD (gold ETF) and SLV (silver ETF).

The XAU, gold, and silver look like they have bottomed. Asian demand is strong, and we have been assured by central banks that they will devalue their currencies to create inflation. Gold, silver, and their stocks will benefit. Consider Nick's article, ignore the nonsense that gold is dangerous, and buy coins or bars. GE Christenson, aka Deviant Investor | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Settles Today At $1299.0 After Choppy Session Posted: 28 Apr 2014 02:59 PM PDT Gold finished the session slightly lower Monday but well off its lowest levels of the session as a better than expected housing number initially pushed Gold to its low for the session at 1292.1 early this morning. President Barack Obama announced new sanctions against some Russians on Monday aimed at stopping Russian President Vladimir Putin from fomenting rebellion in eastern Ukraine but said he was holding broader measures against Russia’s economy “in reserve”. Tensions over Ukraine weighed on world stocks on Monday, keeping them near 10-day lows, though European indexes benefited from well received corporate results and merger speculation and U.S. stocks opened higher. In the physical metals market, premiums in top buyer China were at about $2 an ounce. Hong Kong customs office data showed China bought less gold in March from Hong Kong than in the previous month, although the drop was smaller than expected, analysts said. Given the geo-political situation in Eastern Europe, I look for a two sided choppy trading session tomorrow ahead of Wednesday afternoon's Fed announcement. Having said that it is May options expiration for both Silver and Gold tomorrow, so if we were to see some wild price action it most likely would be in the morning. U.S. economic releases are highlighted by Consumer Confidence at 9am central. Spot gold today

Daily Swing #s GCM14 April 29th

Source: Walsh Trading Inc, www.walshtrading.com

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Embry: Russia is fitter fiscally than U.S. and knows West's vulnerability with gold Posted: 28 Apr 2014 02:41 PM PDT 5:40p ET Monday, April 28, 2014 Dear Friend of GATA and Gold: Judging by debt burdens, Russia is in better economic shape than the United States, Sprott Asset Management's John Embry tells King World News today, and Russian President Vladimir Putin knows very well the West's vulnerability to a puncturing of paper gold. An excerpt from the interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/4/28_Pu... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why The Silver Bear Market Is About To End Posted: 28 Apr 2014 02:22 PM PDT After three years of declining silver prices, Jeff Clark from Casey Research believes the bear market is coming to an end. In particular, he is looking at several data points which he explains in this article. First off, from an historical perspective, it seems that we have had 7 bear markets over the past four decades. Four of them lasted longer and three were shorter. Four declined less than today; two were about the same; and only one was significantly deeper.

Over the past 40 years, there has been no bear market that would extend the low past this October. It seems safe to conclude that the end of the down cycle is in or close. Below are several data points which signal that current prices cannot last too much longer. 1. The US Mint (Still) Can't Keep Up with DemandThe sharp drop in the silver price in 2013 unleashed a wave of pent-up demand for silver coins. Look at the response from investors.

The question this year is if those record levels could continue to be supported. The first quarter is over, so it is difficult you the answer. The US Mint sold 13,879,000 ounces in Q1, 2.4% less than the 14,223,000 sold in the first quarter last year. Here's the monthly breakdown:

January's 36% decline from the prior year looks big, but it's not what you think: the Mint didn't begin sales until the end of the second week of the month. The monthly total thus reflects only 2.5 weeks of sales. And March sales were the fourth-biggest month ever. Add in April's sales figures and the US Mint is now on pace to exceed 2013 totals. 2. Silver ETFs Have Net Inflows (Again)You might remember that silver ETFs' holdings were largely flat last year, unlike the mass exodus seen in gold funds. The pattern is continuing this year. Holdings in silver exchange-traded products (ETPs) have risen 3.5% year to date, an additional 17.5 million ounces. In fact, the net purchases by silver ETPs have totaled $354 million YTD, the largest influx of all commodity ETPs! Meanwhile, gold-backed ETPs have seen sales of 500,000 ounces, about a 1% drop. 3. Jewelers Love Low PricesLow silver prices have led to increased silver jewelry purchases. As just one example, the UK reports that silver jewelry sales jumped 40.4% in February, to 351,791 items. 4. India Just Won't Stop BuyingIndia imported 5,500 tonnes last year, 180% more than 2012. Imports comprised 20% of all global demand. Last month's silver imports were 250% lower. This was mostly due to the recent increase in import duties, and the fact that six banks got permission to import gold, which would soften purchases of me. This could partly explain why silver price has struggled. But as long as politicians keep gold restrictions in place, Indians will keep buying silver. 5. China: More Silver for SolarChinese imports of silver rose drastically in February, up by 75% month on month and 90% year on year to 358 tonnes, the highest since March 2011. Though lower the following month, March imports were up 16% year over year. China's solar industry is growing explosively. In 2009, it represented about 0.2% of the global market; this year, it's estimated to be one-third. It's interesting to note that my price rose in February and fell in March, which suggests that Chinese demand affects my price, too. 6. Supply Sources Are ConcerningSo far, suppliers have managed to meet demand. However, there are dark clouds on the horizon…

By Jeff Clark, Senior Precious Metals Analyst

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Listen, Silver: We Need to Talk Posted: 28 Apr 2014 01:31 PM PDT I wrote to Silver last week, and she answered back. I’d like to share our correspondence with you… Dear Silver, Happy anniversary. It was on April 25, 2011 that you hit $49.80 per ounce in the New York spot market. Today, three years later, you sell for around $20, nearly 60% less. Is your bear market almost overâ€"or are these low prices here to stay? Your price has lagged gold this year, so your normal volatility is lacking. How much longer will you be stuck? Jeff Clark, silver investor | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why A Stock Market Collapse Would Be A Good Thing Posted: 28 Apr 2014 01:26 PM PDT I’m not going to argue here that a market collapse would be a positive thing no matter what, because the implications of a true collapse would be so deep and widespread that they’re too hard for anyone to oversee. But having said that, truth finding and price discovery are crucial for a functioning economy, and there is not a shred of truth left in the markets nor is it possible to discover anything about any price as a free market would have set it. And that means there’s no trust or confidence left in markets, there’s only a shaky trust in authorities propping them up. Neither of which can last forever. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Apr 2014 01:20 PM PDT Jim, Egon gives us three choices: 1.Major military conflict. 2. Full blown economic war. 3. Both choices as scenarios. It doesn’t look like any of the choices are going to be very palatable for stock players. CIGA Larry and Miki Military Wars, Economic Wars, Currency Wars & $10,000 Gold Today a 42-year market veteran warned... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 Completely Real Alternatives to Bitcoin Posted: 28 Apr 2014 01:16 PM PDT It's been nearly two Months since Mt. Gox filed for bankruptcy, and Bitcoin is still struggling to recover. Once considered the best answer to a currency question no one asked, Bitcoin is in dire straits. Even a poorly planned benefit concert couldn't restore faith in the beleaguered cyber-crypto currency. But fear not! Despite Bitcoin's woes, a new and equally confusing fake currency is waiting in the wings to boost the hopes and dreams of a handful of "savvy" investors… if only to dash them a few months later. Sure, you'll see the usual suspects like Dogecoin, Litecoin and Namecoin. But none of them have the same potential for utter disappointment and failure as these alternatives. #4. Barney Francs Barney Francs are designed to provide "financial stability" to the fledgling digital currency sector by setting specific regulations on what can and cannot be purchased with Barney Francs. It also allows for the bailout of any bank foolish enough to accept Barney Francs as actual currency. #3. Johnny Cash The "outlaw" of the digital currency space, Johnny Cash will be the new "currency du jour" for the Internet's black sites. It will be traded primarily on an exchange run from the prison cell of Mt. Gox's former CEO, Mark Karpelès. #2. KrugerRand Pauls The closest thing to a "gold standard" in the digital world, KrugerRand Pauls are designed to promote sound money policies in the digital currency space. Backed by Congressman Rand Paul's own personal gold stash, holders of KrugerRand Pauls will be able to exchange their digital currency for a piece of paper with the word "gold" on it, personally signed by Congressman Paul's assistant. #1. Peter Coynes Created by the Managing Editor of The Daily Reckoning, Peter Coynes give you daily updates on investment opportunities you can only make with Peter Coynes, as well as a skeptical look at the world of digital currencies… including Peter Coynes. If you know of any others we failed to mention, please feel free to leave them in the comments section below… | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Virtually all asset classes may be in decline... Except the Dollar Posted: 28 Apr 2014 01:14 PM PDT SPX was stopped twice at 1872.00, but the third attempt apparently was the charm. It now appears that the first attempt at 1872.00 completed a sub-Minute Wave (a) of a Minute Wave [b] and the last attempt was sub-Minute Wave (c) of Minute Wave [b]. The rally attempt may be over. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - FOMC, GDP, Non-Farm Payrolls and End of April Posted: 28 Apr 2014 01:13 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - FOMC, GDP, Non-Farm Payrolls and End of April Posted: 28 Apr 2014 01:13 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Popping the Credit Bubble Would Destroy the US Empire Posted: 28 Apr 2014 01:05 PM PDT Coming off successes in Iraq and Afghanistan, it makes sense that the US should send troops to Ukraine, no? When we first read this in the Washington Post, we thought it might be a late April Fools' Day joke. Then we discovered the writer was sincere about it; apparently, James Jeffrey is a fool all year round:

And why not? The US has a global empire, supported by an unprecedented mountain of debt. All bubbles need to find their pins. And all empires need to blow themselves up. What Jeffrey is proposing is to speed up the process with more reckless troop deployments. We're with him all the way… Push ol' Humpty Dumpty off the wall and get it over with… so the US can go back to being a decent, normal country without phony "red alerts"… "see something, say something" snitches… and a trillion-dollar "security" budget that reduces our safety. But we doubt it will be that easy. Empires do not go gently into that good night. Instead, they rail… rant… and rave against the dying of the light. They also make one awful mess of things. Empires depend on military force for their survival. And to meet their budget goals. Typically, they steal things. In the Punic Wars, for example, the Romans filled an alarming budget gap by conquering the city of Tarentum. They then stole all that was portable… and sold its citizens into slavery. All bubbles need to find their pins. And all empires need to blow themselves up. Problem solved… for a while. The US is unique in the annals of imperial history. It always imagines it will reap a rich reward – at least in status, if not in money – from its conquests. It never does. President Wilson believed he would be hailed as a great international statesman. Instead, Europeans laughed at him and his 14 Points. ("Even God himself only needed 10," quipped French prime minister Georges Clemenceau.) President Johnson imagined a big "thank you" from the Vietnamese. Instead, he got a "no thanks" from Americans. And President George W. Bush imagined the oil riches of Iraq flowing back to the homeland… only to end up with the most costly and unrewarding war in US history. It is only because the US is so rich that it has been able to afford this kind of malarkey. But that is coming to an end. For much of the last 30 years, the imperial war machine has been financed mainly on credit – aided and abetted by a credit-crazed central bank. How long this can go on is anyone's guess. Probably no longer than the Fed's credit bubble can continue to inflate. In the meantime, the defense contractors, the military lobbyists, and the other zombies in the security industry will continue to push for more meddling – in Syria… Ukraine… heck, wherever… The bubble must find its pin somewhere! The US empire and its credit bubble will probably come to an end at the same time. Each depends on the other. If the US were not so big and powerful, it could not impose its money as the world's reserve currency. Without its position as the issuer of the world's reserve currency (dollars instead of gold), the US wouldn't be able to flood the world with its cash. Without the rest of the world's need for dollars, the credit bubble couldn't continue growing. And without the credit growth there would be no way to pay the expense of maintaining a worldwide empire. This does not explain the miracle of "growth without savings", but it gives us a hint as to what will happen when the trick no longer works. All bubbles… and all empires… eventually blow up. An empire that depends on a credit bubble is doubly explosive. All it takes is a turn in the credit cycle, and the fuse is lit. We wrote a book on the subject, along with co-author Addison Wiggin, in 2006. From the invasion of the Philippines to the Vietnam War… the US empire was financed by the rich, productive power of the US economy. But as the war in Vietnam was winding down, the source of imperial finance changed from current output to future output. The US switched to a purely paper money system… and turned to borrowing to finance its military adventures. Today's blockhead puffs out his chest and enjoys feeling like a big shot. He passes the bill on to tomorrow's taxpayer. The argument for heavy security spending collapsed between 1979 (when China took the capitalist road) and 1989 (when Russia abandoned communism). But by then, the "military-industrial complex" (or the military-industrial-congressional complex) President Eisenhower warned us about was already firmly in control of Washington. Presidents – Democrat and Republican – came and went. Nothing nor nobody could keep resources from the security industry. One disastrous adventure led to another. Each provided a source of more funding… more status… more power… more generals… more security clearances… more clandestine, "off-budget" operations… and more jackass parasites pretending to protect Americans from unknown enemies. The return on investment from this spending was probably well below zero. That is to say the foreign meddling probably created more enemies than it neutralized. But it didn't matter. Besides, the same phenomenon was happening in other major industries. In health care, education and finance more and more resources were commanded by political considerations – even though these industries were still considered part of the private sector economy. In education, for example, the number of teachers stagnated, as the number of administrators and "educators" soared. Freighted with zombies, there were few real gains in these sectors. Meanwhile, the US manufacturing sector withered. Real wages stopped increasing. Economic growth slowed. And social welfare spending increased. "Guns and Butter" was LBJ's promise. Both were greasy and slippery. And without the strong growth of the 1950s and 1960s, it was not possible to pay for so much zombie lard. The US empire turned to credit. It has not had a genuinely balanced budget since. Instead, since the end of the Carter administration, deficits have increased, year after year. When the Reagan team came into office in the early 1980s there was a fierce internal battle about what to do with federal finances. The fiscal conservatives – led by David Stockman, Reagan's young budget director – felt the government had an obligation to balance its budget. The new, or "neo," conservatives were more hip to the public mood… and to the miracle made possible by increasing credit. "Deficits don't matter," said Dick Cheney. The neocons won. Stockman left the administration and went to work on Wall Street. Deficits soared. Later, Stockman wrote a good book, The Great Deformation, explaining how the US economy had been corrupted by its leading industries: government, security and finance. By the 1990s, the combination of a bull market on Wall Street, falling interest rates, the end of the Cold War and disillusionment with old-style democratic spending left the Clinton administration in a rare sweet spot. It found it couldn't spend money fast enough. Its revenues were high. Its spending opportunities were low. The result was what was feted as a "balanced budget" – but the books only balanced if you ignored the cost of Social Security! It was President George W. Bush, however, who really took the lid off the credit machine. Regards, Bill Bonner P.S. You missed out today. In the email edition of The Daily Reckoning we talked about “Mutually Assured Financial Destruction”. That’s what the U.S. and Russia are trapped in. You would’ve received my essay too… but with added context and market commentary. In fact, you’re missing 50% of what we publish by only reading our website. If you like what we publish, then you should subscribe to receive our daily reckonings by email. Click here to sign up for free right now. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mine closings drop Ghana's gold production by 14% Posted: 28 Apr 2014 11:59 AM PDT Ghana Gold Output Seen Falling 500,000 Ounces on Mine Closings By Ekow Dontoh Gold production in Ghana, the continent's second-largest producer after South Africa, may fall 500,000 ounces this year as declining prices prompted some mines to suspend operations, the Minerals Commission said. Output for 2014 is estimated at 3.1 million ounces, down from an initial target of 3.6 million, Daniel Krampah, the commission's assistant manager of financial analysis, said today by phone in the capital, Accra. "We will definitely record lower volumes this year," said Krampah. "Some companies have placed their mines under care and maintenance." ... ... For the full story: http://www.bloomberg.com/news/2014-04-28/ghana-gold-output-seen-falling-... ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Currencies weaken and gold flows from West to Asia, Sprott says Posted: 28 Apr 2014 11:51 AM PDT 2:50 ET Monday, April 28, 2014 Dear Friend of GATA and Gold: Currencies are weakening worldwide even as gold being exported from the West to Asia is increasing, Sprott Asset Management CEO Eric Sprott notes in the weekly market review with Sprott Money News. Some of that gold, Sprott adds, is likely coming out of central bank vaults. The interview is 8 minutes long and can be heard at the Sprott Money Internet site here: http://www.sprottmoney.com/sprott-money-weekly-wrap-up CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Currency, Economic and Military Wars to drive Gold to $2,000+ in 2014 Posted: 28 Apr 2014 11:10 AM PDT KWN weekly – April 27, 2014This week Egon discusses on KWN the likelihood of wars, not just currency but economic and military wars. The consequences for the world will be devastating and for gold very positive. Greyerz: "Eric, sadly the potential of a major war is now increasing dramatically. I would almost say that it's certain we will either … Read the rest | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial Lessons from the Head of the Fed Posted: 28 Apr 2014 11:00 AM PDT In the documentary, Money for Nothing: Inside the Federal Reserve, current Fed chair, Janet Yellen gave rather candid answers to questions the American public has about how the Fed works and actions they took since the financial crisis. I will highlight some of the questions, capture her response, and provide commentary. Was the Federal Reserve justified in bailing out the entire financial system in '08-'09? Janet Yellen: This is why the Fed was set up in 1913. It is to provide liquidity to the financial system as a whole at a time when you have a financial panic. Liquidity dries up in the market and prices can just go into free-fall ultimately bankrupting not only the entities associated with the start of the trouble but anyone who has any connection to them. Comment: Whatever your feelings on whether the Fed should have been created in the first place, it is true that their stated goal was to provide liquidity in the financial system. Certainly prices can go into free-fall. The issue really is WHAT prices would have gone into free-fall and who would have been affected by their fall. David Stockman did a nice job of debunking the theory that the entire credit system would seize up in the, albeit difficult read, The Great Deformation. No doubt Wall St. and the large investment banks would have taken a beating (see Lehman Brothers and Bear Stearns) though I think it is much more debatable if small to mid-sized banks would have been affected in the same way. Does the Fed favor Wall Street over Main Street? Janet Yellen: Our commitment is to the well-being of America's households. I know it looks like we are very focused on the financial system. That should never be mistaken as a focus on Wall St. as opposed to Main St. We may make mistakes and we face complex challenges. As we have gone through this crisis, the Fed has had to intervene in ways that are dramatic. People have been angry that resources have been channeled towards institutions that were the cause of the financial panic. Those of us inside the Fed have the same anger. Our focus is on creating jobs and price stability. Comment: I appreciated her candor about the mistakes they made given their complex challenges. I might suggest that some of those challenges are self-inflicted since their original charter was not to create jobs and stabilize prices. If one argues that the Fed should be there to provide liquidity, that is one thing. To say they need to create jobs and stabilize prices is another. Another point… providing liquidity was originally defined as giving banks cash required in the event of a systemic bank run. Bank runs were not a problem in 2008 but rather the price collapse of derived financial products traded by large investment banks. This is problem #1 with the Fed. They have expanded their mission and have been anointed Wizards by government and the financial system. Didn't the Fed know that low interest rates…would stimulate the housing market…concerned about fueling a bubble? Janet Yellen: The stimulus that the Fed applied to the economy in '03-'05 was intended to reduce high unemployment, idle capital and idle resources. When interest rates go down, of course, spending that is sensitive to interest rates rises and housing is highly interest rate sensitive. No surprise this gave rise to a boom in housing. The Fed was not behaving in a way that was irresponsible. We did end up with financial excesses. Comment: Interesting that her predecessor, Bernanke, did not see the housing bubble at all. Yellen also commented that despite the fact that she acknowledged that a boom in housing would emerge, she could not conclude this would lead to a bubble. A couple of points I will make. First, and once again, it is not the Fed's job to reduce unemployment. Secondly, if she concludes accurately that they were going to create a housing boom, how does she distance that conclusion from a bubble? In my book, I outlined the steps needed for a bubble creation and one was “The means to speculate with credit.” Lower Fed interest rates = means to speculate. Can the U.S. grow its economy without creating bubbles? Janet Yellen: We have a problem transitioning to an economy that seems like it's operating on a sound basis in all sectors of the economy without having dangerous overhangs of debt. Households probably need to save more. Consumer spending should be a smaller share of GDP. The government also has a lot of debt. If we go another decade, 20 years without dealing with it [government debt], that's going to be a crisis. What's going to get us to full employment? Investment can't fill up that whole gap. The only answer I can see is our net exports to the rest of the world. I think the rest of the world, and particularly Asia, needs to focus more on consumer spending. Comment: Certainly households should save more. They did for the early part of the recession but now the trend has reversed. She indicates that consumer spending should not be counted on to revive the economy yet that is precisely what low interest rate policies are trying to coax. She suggests that government debt is not a problem right now. Of course when her own Fed is buying $85 billion of Treasuries per month, I guess that masks the crisis. If they were not making these purchases, longer term interest rates would be higher and would encourage the very savings she suggests households need. Encouraging other countries to spend and buy our goods and services is a logical approach except that the Euro zone is having their own problems and China is one massive bubble. Regards, Jim Mosquera Ed. Note: As long as the Fed exists, it will continue to try to “fix” the economy through its dual mandate to create jobs and stabilize prices. And no matter how this influences is the economy, you’ll want to insure the safety and security of your own financial future. That’s why The Daily Reckoning exists… to provide readers with the knowledge they need to safeguard and grow their wealth no matter what happens. Sign up for the Daily Reckoning, for FREE, right here and start discovering actionable investment solutions for whatever happens next. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold offtake in Shanghai resumes rise Posted: 28 Apr 2014 10:59 AM PDT 2p ET Monday, April 28, 2014 Dear Friend of GATA and Gold: Gold researcher and GATA consultant Koos Jansen reports today that after a few weeks of decline, gold offtake from the Shanghai Gold Exchange rose during the week of April 14: http://www.ingoldwetrust.ch/sge-withdrawals-29-mt-week-16-ytd-635-mt CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

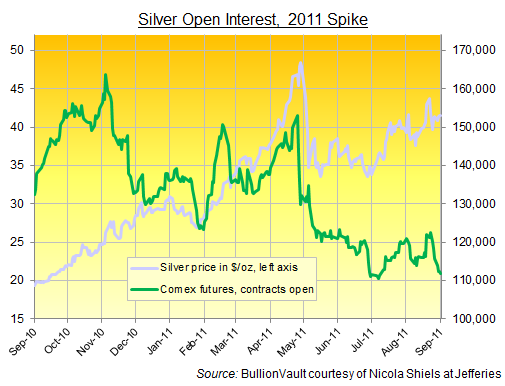

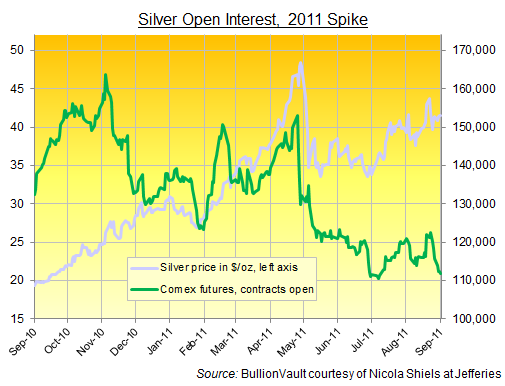

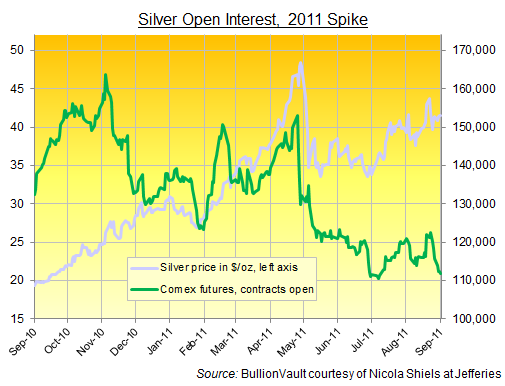

| Posted: 28 Apr 2014 10:13 AM PDT Silver prices looked overdone to many players at $50. Its drop surprised even them... SILVER's photovoltaic use by the solar industry played a big part in the metal's surge to $50 per ounce this week in April 2011, writes Miguel Perez-Santalla at Bullionvault, completing his 2-part analysis of silver's peak 3 years ago. But while the PV industry's role in creating what many investors saw as a silver shortage 3 years ago was far more talked about than true, solar did then play a very real part in the fundamental drop in demand which resulted from that spike. In the three years since April 2011's jump to $50 silver, the energy industry has significantly reduced the amount of silver needed for photovoltaic paste in solar panels. This "thrifting" means that a solar panel of the same dimension produced after 2011 contains significantly less silver than the older versions, up to 80% less in some applications. Because the investment surge which drove prices higher fundamentally dented silver's appeal to this major consumer industry. In fact, it dented silver's use across those industrial applications which rely on it. Full-year 2012 demand from industry was, according to the Silver Institute's data from Thomson Reuters GFMS, down by 7% from the peak of 500 million ounces in 2010. In contrast for investors, it was the speed of the drop in silver prices following its $50 top of 3 years ago which drew so much ire. Some proceeded to persist with claims to US regulator the CFTC requesting investigations, even bringing a lawsuit against major bullion banks J.P.Morgan and HSBC alleging some kind of manipulation. Within the last twelve months both the CFTC and the 2nd US Circuit Court of Appeals in New York have found no indications of collusion or criminal abuse of the silver market by any parties. This was no surprise to industry experts. But the speed of silver's plunge did surprise, and hurt, many investors and traders. The silver market is much smaller than the gold market, and at times suffers from great volatility. Comparing what's called "Open Interest", which is the number of contracts open on any given business day in the Comex futures market, gold is at least twice the size of the silver market. In London's over-the-counter market (where participants deal with each directly, rather than through standardized contracts on a formal trading exchange) the value of gold trading has averaged 8 times that of silver over the last 3 years. This means that a trade considered small in the gold market may actually be large in the silver market, because it has fewer participants willing to buy or sell at any given time.  Interestingly, during the price rally from September 2010 to the high in April 2011 open interest in the silver futures contract – though it did grow – was not astronomical or out of proportion to previous historical figures. So while though there was good participation in the marketplace it was not out of the norm for that time period. The first signs that money was departing the market however came on 25 April 2011 when the CME first raised margin requirements on contract holders. This meant you needed to have more cash on hand to hold the same position you had the day before. The next big decline registered in market participants then coincided with another increase in margin requirements on 5 May. There is nothing abnormal or suspicious here. The exchange needs to make certain that holders of leveraged positions are viable counterparties in a volatile market. So they ask for greater protection. Holders who don't have the financial means to meet the new requirements then liquidate some or all of their contracts. Increased silver margins in April and May 2011 did of course take a toll on the price, as would be expected in an extremely volatile market. Liquidation added to the downward momentum and kept the prices subdued moving forward. Between 25 April and 27 June, Comex open interest in silver futures shrank 23% as the silver price dropped 29%. It is apparent that the weakening price combined with the new margin requirements were of direct influence on open interest. Because as the silver price declined those holding contracts at higher prices would need to raise more cash to meet the exchange requirement or sell their contracts. It is my estimation that many traders holding long positions felt that trying to stay in the market would be the same as trying to catch a falling knife. If they were in the black they took their profits and if the traders were in the red they didn't want to suffer any more losses. Looking at the preceding chart, you can see that price was more volatile than the contract liquidations. Additionally, looking at the holdings of SLV – the largest silver exchange-traded trust fund – during that period, it was more stable again, declining only 15% to a balance of 309 million ounces. Comex warehouse stockpiles of silver bars only fell by 2.8 % for a balance of 99 million ounces. This would make it apparent that the violent price swings were not caused by any direct fundamental factors from physical investment holdings. So what led the selling? Further up the supply chain, the spike was of course an opportunity that silver miners could not resist. If they think the market is overdone, they need to sell metal for future delivery, and that is exactly what started happening. In an article published in February of 2011, the Wall Street Journal reported one such company, Boliden, was taking advantage of what they believed were already very high prices versus their cost of production. Many public miners would have had greater difficulty to do so as they had come under fire from shareholders in the past after the lack of participation of the initial upward of the commodities sector which began in 2006. Hedging for many had become a bad word but at the high levels in the beginning of 2011 it would have behooved them to buck the status quo and make the sale. Come March of 2011 there were many analysts also calling the silver market too high, too hot and a bubble. Analysis from HSBC Global Asset Management added to this growing sense of an impending market correction. In hindsight of course we all knew it was coming. But some investors, led by claims of that $50 silver shortage in 2011 became more caught up in the bullish rhetoric than others, and some were obviously still buying. What surprised everyone was the volatility in silver's initial drop, tempered into summer 2011 only by gold's separate, smaller but equally dramatic surge to $1900 per ounce. Day traders and high frequency hedge funds (running HFT programs) love volatility. This is because at times of great price moves, more opportunities arise for them to get in and out of the market with quick profits. Given the huge spike in Comex silver trading volumes, we can assume that such short-term players were primarily buying as the price rose and selling while the price dropped, tracking and extending the market's direction as this chart shows.  So here, with hindsight, are some fundamental, geopolitical and economical considerations unique to the silver market's $50 peak of April 2011. The story was good at the time, though many market people, including me, kept scratching our heads as the price kept rising. The way I look at it however the market is always right. All the participants' actions dictate where the price goes, which is why you step aside when you don't understand the level it's got to. Silver looked way overdone, but the real price at any given time is what the market will bear. Was silver worth $50 an ounce? Some buyers thought so, but I fear many more probably never gave it a thought. Someone will no doubt pay that much again. What silver is worth is determined every day in what we call the market place. When I want to know what it is worth I look to the last price it traded in the market where I would participate. So in physical investment silver, I look to the BullionVault order board just like anyone else using that simple, low-cost platform. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||