saveyourassetsfirst3 |

- Gold ETFs losing shine in India

- CME plans to launch physically settled Asia gold futures - sources

- Two-faced Goldman appears to hedge bets on gold stocks and bullion

- [KR592] Keiser Report: Zombie Banks, Debt Schools

- 'Avoid the bears' driving gold below fundamentals - Roth Cap

- CME ANNOUNCES PLANS TO LAUNCH PHYSICALLY SETTLED ASIAN GOLD FUTURES EXCHANGE

- CME Announces Plans to Launch Physically Settled Asian Gold Futures Exchange

- Guest Post: Could a Grass-Roots Buy Silver Campaign Be a Game Changer?

- Attack of the metals short sellers: Joe Reagor

- Illegal mining booms below South Africa’s city of gold

- Peak Gold? Exploration Companies Slashing Budgets

- Silver Smashed Below $19…And Promptly Spikes Back Over $20

- Gold hoards in ETFs bleed

- The Gold Spread and Wall Street Banks

- This former "high-flyer" just shocked Wall Street

- Agenda 21: The BLM Land Grabbing Endgame

- What you are witnessing is the collapse of America

- Stop Hunting - the Financial Version of the Hunger Games

- Price & Time: Gold Cracks Big Support

- Deutsche Bank sees historically Tuesdays are not good days for Gold

- Gold and Silver Prices may be on the Rise Soon

- SDBlowout! 2014 Silver Eagles $2.39 Over Spot, ANY QUANTITY!!

- The Empty Vaults of London- Fractional Bullion System to Fail Before End of 2014?

- Gold Fundamental Analysis April 25, 2014 Forecast

- Putin Silver 1 Kilo Coins Minted In Russia

- Putin Silver 1 Kilo Coins Minted In Russia

- Western Central Banks to run out of gold this year

- Top trader Clark: Watch for this sign the rally in stocks is ending

- Earth Day: Can We Grow Enough Food, Without Oil, to Avoid a Human Dieback?

- Gold Price Analysis- April 24, 2014

- Central Bank Gold is Being Held in Investment Bank Vaults

- Three King World News Blogs

- So central bank gold is being held in investment bank vaults

- The Secret World of Gold

- Chorus to lower gold curbs grows louder in India

- China allows gold imports via Beijing, sources say, amid reserves buying talk

- GOLD - Vulnerable To The Downside With Caution

- China and U.S. likely cooperate in gold suppression, researcher Koos Jansen says

- Gold Resistance is at 1295

- Gold does it again..and confirms support at 1286

- Comex Gold (GC) Futures Technical Analysis

- TECHNICAL Gold Sinks to Monthly Bottom, Crude Oil Hits Lowest Level in Two Weeks

- ETF Chart of the Day: Silver Storm

- CHARTS - Gold and Miners Outperform Once Again

- Governments suppress gold to try to conceal inflation, Grant Williams tells KWN

- The Gold Wars

- Why Gold ?

- Why Gold ?

- This Is How Empires Collapse

- Analysts are misreading the Dow/Gold chart and what it means for the price of gold and stocks

| Gold ETFs losing shine in India Posted: 24 Apr 2014 04:00 PM PDT Mirroring the slump in imports, gold ETFs have tanked in the country, with investors jumping the bullion ETF ship. |

| CME plans to launch physically settled Asia gold futures - sources Posted: 24 Apr 2014 03:27 PM PDT Sources familiar with the matter say CME Group plans to launch a physically deliverable gold futures contract in Asia. |

| Two-faced Goldman appears to hedge bets on gold stocks and bullion Posted: 24 Apr 2014 12:52 PM PDT Goldman Sachs equities analysts seem to be at odds over gold and silver from their colleagues covering the commodities sector. |

| [KR592] Keiser Report: Zombie Banks, Debt Schools Posted: 24 Apr 2014 12:37 PM PDT We discuss how with a university education, one may steal the whole railroad but will also leave the student heavily in debt with tumbling starting salaries. In the second half, Max interviews Jan Skoyles of the Real Asset Company about China’s gold, international payment systems, bail-ins and Getting REAL. |

| 'Avoid the bears' driving gold below fundamentals - Roth Cap Posted: 24 Apr 2014 11:55 AM PDT Roth Capital's Joe Reagor argues for a higher gold price in 2015 and weighs in on gold shorts down to $1,200. |

| CME ANNOUNCES PLANS TO LAUNCH PHYSICALLY SETTLED ASIAN GOLD FUTURES EXCHANGE Posted: 24 Apr 2014 11:39 AM PDT

Click here for more on the CME’s plans to launch a physically settled gold exchanges in Asia: |

| CME Announces Plans to Launch Physically Settled Asian Gold Futures Exchange Posted: 24 Apr 2014 11:05 AM PDT

While many precious metals blogs and investors have proclaimed an imminent COMEX default since 2008, we have long maintained that the COMEX is more likely to fade into irrelevance than to outright default on gold or silver bullion as physical Asian demand would facilitate the development of physical exchanges in the east. It appears [...] The post CME Announces Plans to Launch Physically Settled Asian Gold Futures Exchange appeared first on Silver Doctors. |

| Guest Post: Could a Grass-Roots Buy Silver Campaign Be a Game Changer? Posted: 24 Apr 2014 10:00 AM PDT

The Chinese are already buying gold and won't stop. What if Mom and Pop Americans started joining them? Talk about real change! The key then (for fiat dollar defenders of the status quo) is to keep your fellow Rotarian or next door neighbor from seeing the world like some of us do. It's a given that Operation [...] The post Guest Post: Could a Grass-Roots Buy Silver Campaign Be a Game Changer? appeared first on Silver Doctors. |

| Attack of the metals short sellers: Joe Reagor Posted: 24 Apr 2014 09:42 AM PDT Despite the ongoing attack of the short-sellers, the fundamentals of gold and silver production are increasingly robust. |

| Illegal mining booms below South Africa’s city of gold Posted: 24 Apr 2014 09:13 AM PDT The government estimates there are 6,000 illegal miners underground and 8,000 on the surface, equivalent to about 10% of the number of legal employees. |

| Peak Gold? Exploration Companies Slashing Budgets Posted: 24 Apr 2014 09:00 AM PDT

As metals prices boomed during the last decade, small explorers and big miners spent billions of shareholder dollars seeking new deposits. Investors wanted the high rewards of a discovery as metals soared in price. At $1,900 per ounce of gold, even mediocre finds could make money. Richard Schodde, of MinEx Consulting, has studied past exploration [...] The post Peak Gold? Exploration Companies Slashing Budgets appeared first on Silver Doctors. |

| Silver Smashed Below $19…And Promptly Spikes Back Over $20 Posted: 24 Apr 2014 08:48 AM PDT

After a week generally free of major cartel smashes, the morning COMEX open waterfall returned (a bit earlier than normal) this morning, as gold was smashed nearly to $1265, and silver was knocked down .60 from yesterday’s trading to $18.90! *Update: the crash has turned into a crash and smash, as silver has just spiked [...] The post Silver Smashed Below $19…And Promptly Spikes Back Over $20 appeared first on Silver Doctors. |

| Posted: 24 Apr 2014 08:44 AM PDT The demand for gold remained strong in Asian countries during 2013. |

| The Gold Spread and Wall Street Banks Posted: 24 Apr 2014 08:32 AM PDT It is so obvious, and so apparent, that I wonder why commentators have only now seen fit to say something. "It" of course, being the prounoun referencing the gold spread and the insane, short-term profits the Wall Street Banks have been reaping right before our eyes. Let's talk about it. From Wikipedia: Arbitrage: |

| This former "high-flyer" just shocked Wall Street Posted: 24 Apr 2014 08:01 AM PDT From Bloomberg: Apple Inc. (AAPL) Chief Executive Officer Tim Cook just bought himself more time to prove doubters wrong over the company's growth prospects. Cook yesterday took dual steps to reassure investors who have raised questions about whether the company's most robust gains are behind it. Apple reported surging sales of iPhones, with 43.7 million purchased in the fiscal second quarter after the handset became available through the world's largest wireless carrier, China Mobile Ltd. (941) Apple also said it will increase its share repurchase authorization by $30 billion, boost its dividend, and split its stock 7-for-1. The actions are the strongest retort yet from Cook, who has been under pressure to reignite growth in the absence of any new hit products. The skittishness showed itself in the stock declining 6.5 percent for the year and 25 percent from its all-time high in 2012 through yesterday. Cook said on a conference call yesterday that the current stock price doesn't reflect the company's proper value. "Apple has created tremendous value for shareholders by developing great products that enrich people's lives and that will always be our top priority and driving force," he said. "The size of the share buyback increase is a signal of the board and the management team's strong confidence in the future of Apple." New Products Cook also reiterated there are new products in the pipeline. The Cupertino, California-based company is said to be readying bigger-screen iPhones, a watch-like wearable device, and a new Apple TV set-top box. "The possibility is out there that in the next several months, they will have a string of new devices so that by the time Christmas time comes around, they will be ready to sell them all," said Giri Cherukuri, head trader at OakBrook Investments LLC, which has about $3.2 billion under management. Apple's shares rose as much as 8.4 percent, the most since April 2012. The stock was at $565.41 at 9:34 a.m. in New York. For the quarter, net income increased 7 percent to $10.2 billion and sales rose 4.7 percent to $45.6 billion. Analysts had estimated net income of $9.1 billion, or $10.17 a share, on sales of $43.5 billion. Gross margin, a measure of Apple's profitability, was 39.3 percent, up from 37.5 percent a year ago. Revenue from what Apple calls the greater China region rose 13 percent to $9.3 billion from $8.2 billion a year ago. IPad Struggles Yet while iPhone sales increased 17 percent from a year ago, iPad sales fell 16 percent, its steepest drop on record. As lower-cost tablets flood the market, the iPad isn't the growth driver for Apple that it once was. Cook attributed the decline to smaller inventory and tough comparisons to last year when backlogged iPad mini sales from the holiday were pushed to the beginning of the year. Apple has been struggling with growth in recent quarters as the iPhone and iPad, which together account for about three-quarters of total revenue, face stiffer competition from rivals such as Samsung Electronics Co. and other lower-cost device makers using Google Inc. (GOOG)'s Android operating system. Meanwhile, the biggest locations of mobile device growth are in emerging markets such as China, where inexpensive and bigger-screen models are popular. Many customers in the U.S. and Europe also already own an adequate smartphone or tablet, leading to less frequent upgrades. June Forecast For the June quarter, Apple forecast sales in line with analysts' estimates. The company said revenue would be between $36 billion and $38 billion, with gross margin at 37 percent to 38 percent. Yet part of Apple's future success will hinge on its next batch of products. "When you're as big a company as Apple, you need to start adding some next big things," said Gene Munster, an analyst with Piper Jaffray Cos. Without providing details, Cook said Apple would debut products that go beyond the current lineup. "We currently feel comfortable in expanding the number of things we're working on and so we've been doing that in the background and we're not ready yet to pull the string on the curtain," he said. "But we've got some great things that we're working on that I'm very, very proud of and very, very excited about." Breaking Away He also highlighted the performance of the Apple TV set-top box that streams online video from iTunes and services from Hulu LLC and Netflix Inc. Apple has now sold more than 20 million units of the device since its 2007 debut. Last year, sales of Apple TV and purchases of movies and other content through the box generated more than $1 billion. Apple holds its annual developer conference in June, when it is anticipated to unveil new software for the iPhone, iPad, and Mac. With the expanded buyback program and stock split, Cook is breaking from his predecessor, Steve Jobs, who dismissed calls for Apple to do more with its cash hoard. Cook, who has faced calls from activists including David Einhorn and Carl Icahn to return more in shareholder payouts, had in April 2013 announced a plan for a total of $100 billion in dividends and buybacks. With yesterday's announcement, the program increases by another $30 billion. The company will boost its quarterly dividend about 8 percent. Apple said it plans to use the debt markets to fund the program. Cash Hoard The company's cash and equivalents stood at $150.6 billion as of the end of March, down from $158.8 billion in the prior quarter and the first sequential decline since early 2006. Apple said it was doing the seven-for-one stock split so shares would be available to a wider pool of investors, paving the way for it to potentially join the Dow Jones Industrial Average. With the split, each investor on June 2 will receive six additional shares. Those split-adjusted shares will begin trading on June 9. The company may have other uses for its cash. Apple isn't averse to making acquisitions to augment its business and bought 24 companies over the past 18 months, Cook said. The deals have tended to be small compared with the multibillion-dollar tie-ups that companies like Facebook Inc. and Google have done in recent months. "We are not in the race to spend the most or acquire the most," Cook said.

More on Apple: How to earn double-digit income from Apple. It's easier than you think. The key investor takeaways from today's big Apple announcement A fact about Apple most investors are missing |

| Agenda 21: The BLM Land Grabbing Endgame Posted: 24 Apr 2014 08:00 AM PDT

Why is the federal government so obsessed with grabbing more land? After all, the federal government already owns more than 40 percent of the land in 9 different U.S. states. Why are federal bureaucrats so determined to grab even more? Well, the truth is that this all becomes much clearer once you understand that there [...] The post Agenda 21: The BLM Land Grabbing Endgame appeared first on Silver Doctors. |

| What you are witnessing is the collapse of America Posted: 24 Apr 2014 08:00 AM PDT All empires collapse. Think of the greatest empires… or the greatest civilizations in history. They all collapsed. There's no doubt America is a great "empire"… and it's not an exception to the rule. Zero Hedge reports collapse is a process that starts with internal rot. You may not be able to see this internal rot… but it's there. Don't let the collapse surprise you… there are always signs. This is the process of an empire's collapse… 1. Institutions lose sight of their original purpose to become self-serving. Their original purpose is to serve people. Institutions lose sight when they shift from serving others to serving themselves. 2. The self-serving of one individual spoils the group. Once an institution becomes self-serving, everyone seeks to maximize his or her own piece of the pie. Related to this, they also try to shirk as much accountability as well. 3. Self-serving institutions don't promote competent leaders. Competent leaders would expose the rot. Instead the person who cons the people into thinking everything is OK is promoted. This incompetent leader wouldn't want to expose his or her self-serving interests. 4. Self-serving institutions protect the status quo... and punish innovation. They don't want to risk losing their power or control. Change is the enemy. 5. Sunk costs of an empire are enormous… so self-serving institutions resist changing to more efficient methods. If the leaders put their time and money into a project… they want to keep their project… no matter how inefficient. 6. Incompetent leaders do more of "what's worked in the past"… even if what's worked in the past is an utter failure. Incompetent leaders lack imagination and vision. 7. The lack of accountability, effectiveness, and purpose leads to diminishing returns. Each failing institution needs more money to keep its inefficient operation running. 8. Incompetence is rewarded and competence punished. Nepotism and loyalty is promoted to mask the internal rot. Competence threatens a self-serving leadership 9. As returns diminish… costs rise… and entire system becomes fragile. The institution only knows how to expand. As costs rise… the more revenue is needed. It's OK if you're a country that can print your own money. You need to print money to support huge, inefficient operations. This should sound familiar. 10. Economies of scale nor longer generate returns. Now that the scale of enterprise is global… overhead costs and a sprawling managerial infrastructure have become a drain. 11. "More of what works" preserves the internal rot. As problems arise… incompetent leaders with no resources and rising costs have no way to solve them. The façade that everything is OK is simply not. 12. The self-serving elites dominate decision-making… and ignore the common worker. When the elites ignore the common worker… they lose sight of the consequences of their decisions. The elites are too busy promoting their self-interests… and stop serving the majority of the population. This is how empires collapse. Consider Obamacare… consider bank bailouts… consider government takeovers. The government is spending money… ignoring feedback… with no accountability… and no purpose other than self-service.

More on the "End of America:" Porter Stansberry: These charts say the "End of America" cannot be stopped Six unbelievable events that could follow the "End of America" Porter Stansberry: A shocking secret about Warren Buffett and the End of America |

| Stop Hunting - the Financial Version of the Hunger Games Posted: 24 Apr 2014 07:54 AM PDT Just a quick post for now to detail some goings on this morning.... more later including some charts... The Durable Goods number that came out this morning and caused some ripples. By the way, those are "big ticket" items. The orders jumped 2.6% from February last month beating the market expectations of a 2% rise. It was also the largest increase since November. The result of this was to set off a round of short covering in the copper market as those who have been shorting copper based off of problems in China and expected slower growth there, were caught off guard by the strength of the number here. China is the world's largest user of copper but the US is still important to that market. I noticed that as copper strengthened on this bout of short covering, so too did silver. It seemed those leaning on the industrial metals from the short side decided to head to the sidelines and await some further data before pressing their case. Copper has been quietly sneaking higher over the last month tacking on some $0.25/pound and while the chart is not especially friendly, it seems to have found a bottom below $3.00 for now. As many of you who read this blog regularly know, I track that market quite closely as I believe it is a much better barometer of what is going on as far as growth or lack thereof than most anything else. The way I am reading that chart right now is that growth is not solid but neither is it all that sluggish. In other words, things are improving, but not by all that much. If copper can clear $3.20 then I will feel more comfortable about future economic growth prospects. Hey, how about that REVERSE FLASH CRASH where the "good, benign, saintly" manipulators came in an shoved gold higher in some sort of perverse spike upwards? First it was run lower and a huge number of downside sell stops were picked off enriching quite a few floor traders in the process, only to careen higher forcing a huge number of buy stops to be run. I am reminded of the old song: " A hunting we will go, a hunting we will go; Hi, Ho, the derry O, a hunting we will go". Just insert the word 'stop' in front of the word 'hunting' and you about have it. By the way, do not expect to hear any round of criticism from the GIAMATT crowd about the ricochet higher in price. After all, that is reserved only for downward moves in price. Spikes higher are perfectly acceptable because we all know that everyone who wants to buy gold in large quantities wants to make sure that they buy it in such an obvious fashion that they drive the price higher so that they can pay a much higher price for it than if they had otherwise quietly been accumulating it. I am using a bit of sarcasm here to just prove the point I continually make here at this site - today's wild swings in price are evidence of the broken nature of our markets due to the proliferation of computerized trading which rips price higher and lower as the new norm. Remember this the next time gold drops lower and up start the usual: "FLASH CRASH - evidence of evil manipulators at work" nonsense flares up. Here is what actually happened and it had NOTHING, ZERO, NADA to do with manipulators or some secret esoteric anonymous large trader lurking in London or anything else - News hit the floor that Russia has decided to hold military exercises near the Ukranian borders and that included air operations. Pro-Russian forces in eastern Ukraine are continuing to clash with Ukranian forces and that announcement sent stocks temporarily lower while gold shot higher as safe haven plays popped up. You can usually see that sort of thing when the Yen reverses and scoots higher. It looks to me like the initial spike higher has attracted some sellers now that things seemed to have calmed down a bit. We will have to wait and see how the dust settles today. As long as there are any fears of further escalations over there in Ukraine, the market will be supported. If those fears fade, watch for more selling pressure to re-emerge once again. |

| Price & Time: Gold Cracks Big Support Posted: 24 Apr 2014 07:25 AM PDT dailyfx |

| Deutsche Bank sees historically Tuesdays are not good days for Gold Posted: 24 Apr 2014 06:24 AM PDT On a historical basis, gold prices perform poorly on Tuesdays, just as equity markets do well on that day, said Deutsche Bank in a daily metal outlook. |

| Gold and Silver Prices may be on the Rise Soon Posted: 24 Apr 2014 06:12 AM PDT

|

| SDBlowout! 2014 Silver Eagles $2.39 Over Spot, ANY QUANTITY!! Posted: 24 Apr 2014 05:00 AM PDT

*While supplies last! Click or call 800-294-8732 to place your order! The post SDBlowout! 2014 Silver Eagles $2.39 Over Spot, ANY QUANTITY!! appeared first on Silver Doctors. |

| The Empty Vaults of London- Fractional Bullion System to Fail Before End of 2014? Posted: 24 Apr 2014 05:00 AM PDT

With the price smashes of the past few weeks, the increasing desperation of the bullion banks seems palpable. I now believe that we are truly witnessing the end of the era. We’ve all been waiting for the day when the fractional reserve bullion banking system would fail. I believe now that that day is very [...] The post The Empty Vaults of London- Fractional Bullion System to Fail Before End of 2014? appeared first on Silver Doctors. |

| Gold Fundamental Analysis April 25, 2014 Forecast Posted: 24 Apr 2014 04:50 AM PDT fxempire |

| Putin Silver 1 Kilo Coins Minted In Russia Posted: 24 Apr 2014 04:32 AM PDT gold.ie |

| Putin Silver 1 Kilo Coins Minted In Russia Posted: 24 Apr 2014 04:20 AM PDT Silver coins with the face of Russian President Vladimir Putin are being minted in Russia. The coins weigh one kilogram (1kg – 2.2lb) and are being launched … Today's AM fix was USD 1,283.50, EUR 928.53 and GBP 764.26 per ounce. Gold fell $0.60 or 0.05% yesterday to $1,284.40/oz. Silver fell $0.02 or 0.1% yesterday to $19.43/oz.

Spot gold bullion prices ticked lower today and gold is again testing support at $1,280/oz. A close below $1,280/oz will be short term bearish. Momentum is a powerful force and trend following traders and algorithms could push gold lower. Thus, there remains the possibility of further weakness and gold testing its big level of support above $1,180/oz. Having said that the geopolitical backdrop of increasing tensions over Ukraine between Russia and western powers and indeed between China and Japan is gold supportive. As is the still robust physical demand especially from China and Asia.

The FOMC tends to have a fleeting short term impact on gold prices and barring a major surprise, Yellen’s monetary policy is already priced in. As ever, a better than expected jobs number, could see further gold liquidations. Conversely, a worse than expected number will lead to safe haven demand and could be the catalyst gold needs to get out of its recent funk. Russia: Putin Silver One Kilo Coins Launched The private mint that produces the coins said it is planning to present some of them to the Russian leadership. The coins are commemorative in nature and are a limited edition of 500 silver coins initially. The factory states that some of the coins may be sold, but they won't be used as currency. Putin’s face is on one side of the coin while the other shows a map of the Crimean Peninsula, Moscow daily Komsomolskaya Pravda reports. Factory director Vladimir Vasyuhin explains that by bringing the Crimean peninsula “back home”, Putin had “demonstrated the qualities of a wise strategist and politician”. “Crimea’s reunification with Russia was a historic event which we decided to embody in a souvenir collection of coins,” Vasyukhin told the Itar-Tass news agency. The peninsula that has hosted Russia’s Black Sea fleet throughout its history was part of Russia for centuries before Ukrainian-born Soviet leader Nikita S. Khrushchev transferred it to the Ukrainian Soviet Socialist Republic in 1954. It made little difference to which republic the peninsula belonged when all 15 were united within the Soviet Union. But after the Soviet breakup in 1991, Russia was forced to lease back its military bases from Ukraine and lost governing authority over the predominantly ethnic Russian population of 2 million. The first issue of 25 of the commemorative coins, which are the size of a hockey puck and weigh 1 kilo each, will be given to Kremlin officials, Itar-Tass said. Neither the foundry nor the Russian news sources that wrote about the special “Crimea 2014 Collection” said how much the coins will cost or when a broader quantity will be available to collectors and the general public. Each coin has 120 millimeters in diameter and is 11 millimeters thick. The embossed images are 4 millimeters high. Each coin will have its own number and will be made of 925 grade silver or 92.5% purity. Silver at less than $20/oz remains very undervalued. It remains undervalued versus stocks, bonds and indeed gold. An allocation to silver in a portfolio will help protect and grow wealth in the coming years. |

| Western Central Banks to run out of gold this year Posted: 24 Apr 2014 04:08 AM PDT Goldmoney |

| Top trader Clark: Watch for this sign the rally in stocks is ending Posted: 24 Apr 2014 04:00 AM PDT From Jeff Clark, editor, S&A Short Report: If you took our advice to buy stocks last week, you're up a solid amount. Last Tuesday, stocks looked like they were heading over the cliff. The S&P 500 traded as low as 1,815. Many investors thought the long-awaited correction was finally here. But we said this old bull market still had one more kick left in it. So the selloff had us looking to buy stocks in anticipation of a rally going into the end of the month. On Thursday, the S&P 500 closed at about 1,865 – up 2.7% from Tuesday's low. That's a solid return for two trading days. And there's more to come. But there's also trouble brewing around the corner... With more than a week to go before the end of this seasonal bullish period, there's a good chance the S&P 500 will make a run at the 1,900 level. But there's a reason Wall Street veterans "sell in May and go away." Historically, the first day of May kicks off a seasonally weak period for stock prices. Of course, it's not as simple as just waiting until May 1 to exit our short-term trade. Sometimes, weakness sets in a few days before the start of the month, sometimes a few days afterward. Traders need to use another indicator to know when it's time to take profits. That's where the Volatility Index (the "VIX") comes in. The VIX is commonly referred to as Wall Street's fear detector. Extreme moves in the VIX are excellent contrary indicators. We buy when the VIX makes an extreme move to the upside, and we sell when the VIX makes and extreme move lower. Take a look at this chart of the VIX plotted along with its Bollinger Bands...

Bollinger Bands measure the most probable trading range for a stock or an index. Whenever a chart moves outside of its Bollinger Bands, it indicates an extreme condition – either extremely overbought or extremely oversold. Since the VIX is a contrary indicator, it's best to buy stocks when the VIX is extremely overbought. It's best to sell stocks when the VIX is extremely oversold. The blue arrows on the chart point to the times when the VIX traded above its upper Bollinger Band and then fell back below it. Those are "buy" signals. We got one early last week. The red arrows point to times when the VIX fell below its lower Bollinger Band and then closed back above it. Those are "sell" signals. There have only been two over the past year. Each one was followed by a modest decline of between 2% and 5% in the S&P 500. If the market continues higher from now until the end of the month, the VIX should continue lower. It won't take much more of a drop to get the VIX below its lower Bollinger Band. When that happens, the VIX will be on the verge of generating another broad stock market sell signal. That's when we'll know the bounce is ending and it's time to take profits on our trade.

More from Jeff Clark: Master trader Clark: A must-see update on silver Master trader Clark: Watch this chart for an "early warning" of stock market trouble Master trader Clark: A must-see update on the "ugliest chart in the market" |

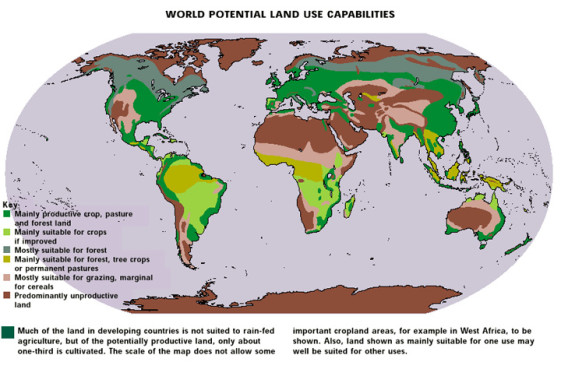

| Earth Day: Can We Grow Enough Food, Without Oil, to Avoid a Human Dieback? Posted: 24 Apr 2014 02:55 AM PDT By Lambert Strether of Corrente. The future is already here — it’s just not very evenly distributed. — William Gibson This is a two days-late Earth Day post. I’ve been thinking about this comment from lorrie:

To which commenter banger responds:

Yes, and then they’ll rocket off to Mars! Anyhow, since I’m feeling the approach of spring, I want to avoid the “too many people” claim here, especially because, whether gleeful, ghoulish, or sadly necessary slash inevitable, talk like that feels way too much like eugenics or genocide for me to be comfortable deploying it; too much like “exterminate all the brutes.” Call me Pollyanna! Of course, there are many scenarios to solve the “too many people” problem, like “Five Ways to Kill a Man,” but in bulk: Supply chain collapse, shortening life expectancy for the unterbussen, pandemic, nuclear war, and one might even (rationally) believe the elites are managing that entire portfolio, but in this post I want to consider the old-fashioned Malthusian catastrophe: Famine. Is a human, planetary dieback from famine inevitable or necessary, if we assume the end of petroleum-based agriculture? Even if the carbon barons have a sad, a naive back-of-the-envelope calculation shows no. I’ll begin by deviating sharply from Naked Capitalism’s austere policy on graphics to present an image of my friend’s garden: The yield:

Now, it is true that not all the materiel originates on the property: Straw, mulch, the climbing structures for the tomatoes, fencing, and seeds are brought in from elsewhere. And tools. And the chair. And there’s garbage pickup, a public water system, the Internet. So although my friend’s patch is highly productive, it’s not self-sufficient. (Should it be?) Nevertheless, one returns to that statistic: 600 pounds of tomatoes or so. So assume 3 tomatoes per pound, and 3 tomatoes a day, that’s 200 days of eating for one person from a quarter acre patch, and that’s before we get to the rest of the garden, or the chickens. That’s not so far from feeding one person for a year. My own experience is more or less the same; although I’m a lazy gardener — I prefer to sit in the garden, not work in it (I don’t like work) — but even so I grow around thirty winter squash, sufficient for two months eating, especially with butter and salt (and a heat source). With work, I could feed myself, for a year — assuming in my climate, preservation — on about an eighth of an acre. And we three are not alone. David Blume writes:

My point is not that everybody gets yields like this, but that yields like this are not exceptional. Do they take place on a larger, continental scale? Yes. Sharashkin, Gold, and Barham, “Sustainable Growing Practices in Russia,” University of Missouri – Columbia:

So, 35 million into 8 million hectares is a bit less than a quarter hectare per patch, or an eighth of an acre (my size). And they get very good yield. (These numbers also suggest that my friend, David Bruce, and I are in no way exceptionally skilled.) So, do these numbers scale up globally? On the back of the envelope, they do. From Prairie Soils & Crops Journal [PDF]:

So, if Big Oil and Big Ag vanished from the face of the earth tomorrow — as perhaps, for the sake of mitigating climate change, they should do — we at least have the arable land to support 6.790 billion of us, on the back of the envelope; and if we consider I could support myself on 0.125 acres, and the Russian yields come with a growing season of around three months, we could have considerable margin. (See also here, here, and here.) At this point, I should concede that “But I said back of the envelope!” can’t wave away all objections, and so I’ll deal with a few I can think of. First, arable land is by no means evenly distributed: To which I would respond that most future disaster scenarios assume migration, so why not assume migrations whose end point is one’s own patch of land? I’d also point out that arable doesn’t include forests, but we are also familiar with the concept of edible forests, and so, over time, there are not only many more places to settle than the map above would imply, we have even more margin for our per capita calculations. Second, what about Manhattan? What about it?

Third, vast changes in political economy would be required for such a system of horticulture to come into place. To which I would respond Yes, and your point? This passage on Jefferson highlights the opportunities and dangers:

And speaking of manure, Jefferson’s “ideal of stewardship” was also “rooted in” chattel slavery, of which he was a “vigilant” advocate, and his “innovations” were powered by the coffle. So we’d have to think about that; a feudal society of serfs tied to the land, or a Reconstruction Era proto-fascist regime of terrorized sharecroppers, would not be a happy outcome, for all the yield of “minuscule plots” owned (for some definition of ownership) and worked by millions of people. We’d also have to be smart about our common pool resources: Water, pollinators, seeds, and even soil. (Maybe if Jefferson had practiced no till cultivation, he wouldn’t have had to worry quite so much about manure. Anyhow, the frontier closed a long time ago. The earth is round!) So, I started out wondering if we could feed ourselves from our gardens while moving away from the “too many of us” slash dieback narrative, and I hope I made at least a semi-plausible case that we can, although let me throw in a ceteris paribus to be safe. I ended up with a vision of an alternative society entirely appropriate for Earth Day — a vision that moves beyond the “groaf/jobs” paradigm that allcoppedout speaks of. Would it really be so bad to work half the year, make your own shoes, and stay loaded on your own beer? Adam Smith’s work ethic is for robots, no? Who needs it? So, optimism! |

| Gold Price Analysis- April 24, 2014 Posted: 24 Apr 2014 02:35 AM PDT dailyforex |

| Central Bank Gold is Being Held in Investment Bank Vaults Posted: 24 Apr 2014 02:18 AM PDT "There's not a lot to read into yesterday's price action" ¤ Yesterday In Gold & Silver[Note: After three years without a break, I'll be taking some time off. There will be no Gold and Silver Daily next week. Ed] The gold price action on Wednesday was a real yawner. The only activity worthy of mention was the small rally that began at the London a.m. gold fix---and "da boyz" took care of that at exactly 1 p.m. BST---20 minutes before the Comex open. From there it got sold down to its 10:35 a.m. EDT low---and then recovered a bit before trading sideways for the remainder of the day. The highs and lows aren't worth looking up. Gold finished the Wednesday trading session at $1,283.70 spot---unchanged on the day. Volume, net of April and May, was only 113,000 contracts. It was pretty quiet in silver yesterday as well---and there really isn't anything to talk about here. Like gold, the highs and lows aren't worth looking up. Silver closed yesterday afternoon in New York at $19.45 spot, up 6.5 cents on the day. Volume, net of roll-overs was pretty quiet at 19,000 contracts. The price action in platinum and palladium barely had a pulse, either. Here are the charts. The dollar index closed around 79.90 on Tuesday in New York---and didn't do much until moments before London opened yesterday. By 9:30 a.m. BST, the 79.70 low was in---and the index rallied quietly back to almost unchanged, as it closed on Wednesday at 79.86---down a whole 4 basis points. The gold stocks opened in the black---and then began to rally convincingly about an hour after the equity markets opened in New York. Their highs came about 2:20 p.m. EDT---and then they gave up a bit going into the close. The HUI finished up 2.07% on the day. The silver equities price path looked similar, but Nick Laird's Silver Sentiment Index closed up only 1.02% This is the second day in a row that the precious metal equities vastly outperformed the metals themselves---and I've very encouraged by that. The CME Daily Delivery Report showed that 56 gold and a whopping 151 silver contracts were posted for delivery within the Comex-approved depositories on Friday. Once again the largest short/issuer in gold was Jefferies and, once again, the two biggest long stoppers were JPMorgan and Canada's Scotiabank. But the totally out-of-the-blue surprise was the 151 silver contracts that were posted for delivery, as there was no hint of it in the current CME's Daily Information Bulletin. I would guess that this delivery was arranged privately---and left until the last possible moment. It was the biggest Comex silver short [JPMorgan] delivering to the second largest Comex silver short [Canada's Scotiabank]. One crook lending a helping hand to another crook, methinks. The link to yesterday's Issuers and Stoppers Report is here---and it's worth a quick peek. While on the subject of deliveries, according to the current CME Daily Information Bulletin, there are around 600 gold contracts still open in April---and that's netting out the deliveries due today, plus the 56 contracts posted for delivery tomorrow. Any bets that JPMorgan and Scotiabank are long/stoppers on what's left to deliver this month? The only other unknown would be the identity of the short/issuer. Jefferies, perhaps---but that's a lot of contracts for a company their size. In the end, it doesn't really matter who they are, but it's fun to speculate, now that we're down to the final days before all and sundry have to make their intentions known. There were no reported changes in either GLD or SLV yesterday. The U.S. Mint had a smallish sales report. They sold 50,000 silver eagles---and that was it. There was no in/out movement in gold at the Comex-approved depositories on Tuesday---and only smallish in/out movement in silver, as 20,717 troy ounces were received---and 88,852 troy ounces were shipped out. The link to that activity, such as it was, is here. Here are two more gold and silver charts courtesy of Nick Laird that he whipped up for us yesterday. The top chart in both is the spot price in each metal going back about 8 years. The 2-colour charts below that show the long and short positions of the Big 4 and Big 8 traders in each in the Commitment of Traders Report over the same time period. Note the short positions of the Big 8 in gold vs. the Big 8 in silver over time---especially over the last six months or so. I have very few stories for you today---and the final edit is yours. ¤ Critical ReadsWeapon of Last Resort: ECB Considers Possible Deflation Measures One of European Central Bank President Mario Draghi's most important duties is watching his mouth. One ill-considered utterance is enough to sow panic on the financial markets. Speaking to gathered journalists at the Spring Meetings of the International Monetary Fund and the World Bank, Draghi twice almost uttered a word he has been at pains to avoid. "Defla…", Draghi began, before stopping himself and continuing with the term "low inflation." Yet despite Draghi's efforts, the specter of deflation was omnipresent in Washington during the meetings. And it is one that is making central bank heads and government officials nervous across the globe. The IMF in particular is alarmed, with Fund economists warning that there is currently up to a 20 percent risk of a euro zone-wide deflation. IMF head Christine Lagarde has called on European central bankers to "further loosen monetary policy" to address the danger. This longish article is worth reading---and it showed up on the German website spiegel.de very early yesterday evening Europe time---and it's the first offering of the day from Roy Stephens. Europe braces for gas showdown with Russia, helped by Japan's nuclear restartThe Western powers are scrambling to bolster defences against a halt in Russian gas supplies after the Kremlin tightened the energy noose on Ukraine, and paramilitary actions in eastern Ukraine increased the risk of a full-blown sanctions war. The Geneva deal reached last week to defuse the crisis is close to disintegration, with the U.S. government openly accusing Russia of carrying out covert operations across the Donbass region. Two key U.S. senators have already called for sanctions on large Russian banks, mining companies and energy groups, including the state gas monopoly Gazprom. Any such move would freeze gas deliveries to the E.U., since few European banks would risk defying U.S. regulators by handling Gazprom transactions. Dmitry Medvedev, Russia’s premier, accused the Americans of “pure bluff”, challenging the U.S. to show its teeth. “You can, of course, continue to expand the 'black list’: it will lead absolutely nowhere,” he told the Duma. This commentary by Ambrose Evans-Pritchard is definitely worth reading---and it was posted on the telegraph.co.uk Internet site late on Tuesday evening BST. It's the second offering in a row from Roy Stephens. Putin Has Taken Control of Russian FacebookRussian president Vladimir Putin has essentially taken control of VKontakte, the home-grown Russian social network which is that country's version of Facebook. The founder and CEO, 29-year-old Pavel Durov, posted on his VK page that he had finally given up control of the company to two investors allied with Putin, Buzzfeed reported: Announcing his firing on his VKontakte page, Durov said: “Today, VKontakte goes under the complete control of Igor Sechin and Alisher Usmanov.” Usmanov is a metals tycoon who expanded into tech via his company Mail.ru, which has steadily upped its stake in the Russian social network. Until recently, Usmanov owned a 10% stake in Facebook. Sechin is the leader of the hardline silovik faction that backs Putin, is CEO of Rosneft, the state-owned oil company, and is believed to be one of the Russian president’s closest advisors. Generally, Putin has maintained his control of Russia by allowing his allies to control vast chunks of the economy, like Rosneft. This appears to be an extension of that control into social media. This very interesting news item was posted on the businessinsider.com Internet site at noon EDT on Tuesday---and I thank West Virginia reader Elliot Simon for pointing it out. Seven Ukraine/Russia-related stories 1. At Funeral, Expressions of Grief and Anger Toward Kiev Officials: The New York Times 2. Russia Warns Ukraine of Potential Military Response: The New York Times 3. Russian FM Lavrov threatens response if interests in Ukraine attacked: UPI 4. Russia warns it will respond if interests attacked in Ukraine: The Guardian 5. Separatist 'army of the east' guards a stronghold in Luhansk: The Guardian 6. Kiev must immediately deescalate east Ukraine crisis, call back troops - Moscow: Russia Today 7. Lavrov to RT: Americans are 'running the show' in Ukraine: Russia Today Putin's Dilemma: Fending off the United States' Imperial HandThe United States is in the opening phase of a war on Russia. Policymakers in Washington have shifted their attention from the Middle East to Eurasia where they hope to achieve the most ambitious part of the imperial project; to establish forward-operating bases along Russia’s western flank, to stop further economic integration between Asia and Europe, and to begin the long-sought goal of dismembering the Russian Federation. These are the objectives of the current policy. The US intends to spread its military bases across Central Asia, seize vital resources and pipeline corridors, and encircle China in order to control its future growth. The dust-up in Ukraine indicates that the starting bell has already been rung and the operation is fully-underway. As we know from past experience, Washington will pursue its strategy relentlessly while shrugging off public opinion, international law or the condemnation of adversaries and allies alike. The world’s only superpower does not have to listen to anyone. It is a law unto itself. The pattern, of course, is unmistakable. It begins with sanctimonious finger-wagging, economic sanctions and incendiary rhetoric, and quickly escalates into stealth bombings, drone attacks, massive destruction of civilian infrastructure, millions of fleeing refugees, decimated towns and cities, death squads, wholesale human carnage, vast environmental devastation, and the steady slide into failed state anarchy; all of which is accompanied by the stale repetition of state propaganda spewed from every corporate bullhorn in the western media. Isn’t that how things played out in Afghanistan, Iraq, Libya and Syria? This commentary by Mike Whitney falls into the absolute must read category---and is by far the most important story in today's column. It was posted on the counterpunch.org Internet site yesterday---and it's another contribution to today's column from Roy Stephens, for which I thank him. Three King World News Blogs1. Art Cashin: "Fed's Plan to Use Stocks to Boost U.S. Economy Has Failed" 2. James Turk: "Western Central Banks To Run Out Of Gold This Year" 3. Grant Williams: "West Hemorrhaging Gold But Here's Its True Achilles' Heel" [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests to them, and not to me. Thank you. - Ed] Goldman Sachs Stands Firm as Banks Exit Commodity TradingGoldman Sachs Group Inc., whose three top executives began their careers at the firm in the commodity-trading unit, is poised to gain market share as pressure from regulators drives competitors to scale back. Barclays Plc, the U.K.’s second-largest bank, said that it’s exiting commodities businesses other than trading precious metals and derivatives tied to oil, U.S. gas and commodity indexes. In January, the London-based bank cut jobs in the group that traded raw materials and in February shut power-trading desks in the U.S. and Europe. JPMorgan Chase & Co. last month announced the $3.5 billion sale of its raw-materials trading unit to Mercuria Energy Group Ltd. and Morgan Stanley plans to sell its physical oil business to Russia’s OAO Rosneft. Goldman Sachs, Morgan Stanley, Barclays and JPMorgan were the biggest traders of commodity derivatives among banks, according to a Greenwich Associates survey last year. “The more banks that exit commodities trading, the less competitive it becomes for the banks which stick with it,” Jeffery Harte, an analyst at Sandler O’Neill & Partners LP, said in a phone interview. Goldman Sachs has “the bigger franchise to be a winner. It now has a much bigger piece of a much smaller pie.” This Bloomberg story showed up on their website late on Tuesday afternoon Denver time---and it's the second offering of the day from Elliot Simon. So central bank gold is being held in investment bank vaultsYesterday's Reuters report about changes at the gold and currency trading desks of investment banks is notable for more than its acknowledgment that central banks are surreptitiously trading gold every day, an acknowledgement made last September by the Banque de France. For in reporting that "banks that serve central banking customers with large bullion reserves to manage will have a greater need to offer gold trading and storage services," Reuters also has acknowledged that much central bank gold is now held outside central bank vaults. That's what the reference to "storage services" is about. Presumably the central bank gold being vaulted by investment banks is gold that central banks have leased or swapped into the market for market-rigging purposes. This commentary by Chris Powell, with two embedded must read links, was posted on the gata.org Internet site yesterday. The Secret World of GoldThis 42:34 minute video has been around the block, as it has been viewed over 179,000 time on the youtube.com Internet site, but I don't ever remember seeing it before, or even posting it in this column, although I'm sure I did. However, based on the viewings, you've probably already seen it. [I just watched it from start to finish right now---and I don't remember seeing it before---however I do remember posting it.] But just in case you were on some other planet when it was made public, like I obviously was---here it is again---and I thank Casey Research's own John Grandits for bringing it to my attention on Monday. And if you haven't seen it yet---it's certainly a must to view. Chorus to |

| Posted: 24 Apr 2014 02:18 AM PDT 1. Art Cashin: "Fed's Plan to Use Stocks to Boost U.S. Economy Has Failed" 2. James Turk: "Western Central Banks To Run Out Of Gold This Year" 3. Grant Williams: "West Hemorrhaging Gold But Here's Its True Achilles' Heel" [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests to them, and not to me. Thank you. - Ed] |

| So central bank gold is being held in investment bank vaults Posted: 24 Apr 2014 02:18 AM PDT Yesterday's Reuters report about changes at the gold and currency trading desks of investment banks is notable for more than its acknowledgment that central banks are surreptitiously trading gold every day, an acknowledgement made last September by the Banque de France. For in reporting that "banks that serve central banking customers with large bullion reserves to manage will have a greater need to offer gold trading and storage services," Reuters also has acknowledged that much central bank gold is now held outside central bank vaults. That's what the reference to "storage services" is about. Presumably the central bank gold being vaulted by investment banks is gold that central banks have leased or swapped into the market for market-rigging purposes. This commentary by Chris Powell, with two embedded must read links, was posted on the gata.org Internet site yesterday. |

| Posted: 24 Apr 2014 02:18 AM PDT This 42:34 minute video has been around the block, as it has been viewed over 179,000 time on the youtube.com Internet site, but I don't ever remember seeing it before, or even posting it in this column, although I'm sure I did. However, based on the viewings, you've probably already seen it. [I just watched it from start to finish right now---and I don't remember seeing it before---however I do remember posting it.] But just in case you were on some other planet when it was made public, like I obviously was---here it is again---and I thank Casey Research's own John Grandits for bringing it to my attention on Monday. And if you haven't seen it yet---it's certainly a must to view. |

| Chorus to lower gold curbs grows louder in India Posted: 24 Apr 2014 02:18 AM PDT India's Commerce Ministry came out in favour of axing restrictions on gold imports. "The present gold import policy is workable only for a short distance. When this policy was conceptualised, it was for a limited objective...the Department of Commerce has taken a very clear decision that this policy is not sustainable in the long run," Commerce Secretary Rajeev Kher told media persons. He further said that the policy needed to be appropriately amended. In order to check India's rising current account deficit (CAD), the government had raised import duties on bullion, while the Reserve Bank of India had imposed additional curbs on the import of the metal to jewellery exporters. Almost in tandem, as the Commerce Ministry pitched for the removal of restrictions on gold imports, came the news that India's gems and jewellery exports fell by about 9% to $39.5 billion in 2013-14. This gold-related news item, filed from Mumbai, was posted on the mineweb.com Internet site yesterday. |

| China allows gold imports via Beijing, sources say, amid reserves buying talk Posted: 24 Apr 2014 01:55 AM PDT China has begun allowing gold imports through its capital Beijing, sources familiar with the matter said, in a move that would help keep purchases by the world's top bullion buyer discreet at a time when it might be boosting official reserves... Read |

| GOLD - Vulnerable To The Downside With Caution Posted: 24 Apr 2014 01:05 AM PDT actionforex |

| China and U.S. likely cooperate in gold suppression, researcher Koos Jansen says Posted: 24 Apr 2014 01:02 AM PDT GATA |

| Posted: 24 Apr 2014 12:55 AM PDT dailyfx |

| Gold does it again..and confirms support at 1286 Posted: 24 Apr 2014 12:50 AM PDT fxstreet |

| Comex Gold (GC) Futures Technical Analysis Posted: 24 Apr 2014 12:35 AM PDT fxempire |

| TECHNICAL Gold Sinks to Monthly Bottom, Crude Oil Hits Lowest Level in Two Weeks Posted: 24 Apr 2014 12:35 AM PDT dailyfx |

| ETF Chart of the Day: Silver Storm Posted: 24 Apr 2014 12:25 AM PDT etftrends |

| CHARTS - Gold and Miners Outperform Once Again Posted: 24 Apr 2014 12:10 AM PDT marketoracle |

| Governments suppress gold to try to conceal inflation, Grant Williams tells KWN Posted: 24 Apr 2014 12:02 AM PDT GATA |

| Posted: 23 Apr 2014 10:45 PM PDT Gary North |

| Posted: 23 Apr 2014 10:30 PM PDT Cato |

| Posted: 23 Apr 2014 10:30 PM PDT Cato |

| Posted: 23 Apr 2014 09:01 PM PDT

Before an empire collapses, it first erodes from within. The collapse may appear sudden, but the processes of internal rot hollowed out the resilience, resolve, purpose and vitality of the empire long before its final implosion. This is how empires collapse: one complicit participant at a time. By Charles Hugh Smith, Of Two Minds: [...] The post This Is How Empires Collapse appeared first on Silver Doctors. |

| Analysts are misreading the Dow/Gold chart and what it means for the price of gold and stocks Posted: 23 Apr 2014 08:56 PM PDT Take a look at the Chart of the Day below that shows the ratio between the Dow Jones Index and the price of gold. Analysts have drawn a rather distorted looking trend line channel showing a break-out to the upside. That would seem to indicate higher stock market prices and a lower gold price. However, if instead you continue the downward trend line to the top of the recent high then you still get the classic bell-shaped curve beloved by hedge funds and other chartists. This would clearly indicate a long-term reversal to the mean will continue in the Dow/Gold, perhaps with quite a dramatic correction to the downside. So the Dow Jones would fall and gold prices rise. Bell-curve or not? Does this graph look like a bell-shape or it is broken? We see a distortion caused by an unsustainable spike in share prices last year and the impact of Indian taxes on the gold market. If that is true then the clever thing to be doing would be to accumulate gold at current prices and sell stocks. That’s the reverse of the consensus view now but when was the consensus ever a good guide? |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Based on the Elliot Wave Theory and other indicators, the next wave for a rise in price may be coming.

Based on the Elliot Wave Theory and other indicators, the next wave for a rise in price may be coming.

No comments:

Post a Comment