Gold World News Flash |

- How Gold Will Respond to Declining Discovery

- Check out what Google autocomplete tells us about America

- The SECRET SILVER STOCKPILE, Part I

- Gold Daily and Silver Weekly Charts – Hotel California

- Governments suppress gold to try to conceal inflation, Grant Williams tells KWN

- China and U.S. likely cooperate in gold suppression, researcher Koos Jansen says

- Gold Prepared for the Attack of the Short Sellers

- Groupthink Or Black Swan Rising? Not A Single 'Economist' Expects An Economic Downturn

- Weak U.S. Housing Data Supports Euro

- Gold and Silver Stocks Begin Oversold Bounce

- Hoisington On The End Of The Fed's (Mythical) "Wealth Effect"

- Thomas Piketty's "Sensational" New Book

- The Middle Class In Canada Is Now Doing Better Than The Middle Class In America

- Mugabe Considers Revival Of "Hyperinflated" Zimbabwe Dollar

- The Gold Price Added $3.60 Today for a Comex Close at $1,284.20

- The Gold Price Added $3.60 Today for a Comex Close at $1,284.20

- Eight Energy Myths Explained

- West Hemorrhaging Gold But Here’s Its True Achilles’ Heel

- Gold Sentiment Reaching Key Level

- Gold Daily and Silver Weekly Charts - El Camino Real

- Gold Daily and Silver Weekly Charts - El Camino Real

- Gold's long backwardation makes Turk expect a good year for the monetary metal

- Why Niocorp (NB.V or NIOBF) Is Soaring Over 230% in 2014

- Turk - Western Central Banks To Run Out Of Gold This Year

- Gene Arensberg: Elephant tracks signal upward reversal in gold

- The Secret Silver Stockpile, Part I

- Silver $50: Three Years After the "Shortage"

- Silver $50: Three Years After the "Shortage"

- Silver $50: Three Years After the "Shortage"

- How Gold Will Respond to Declining Discovery

- So central bank gold is being held in investment bank vaults

- "Technicals Dominate" Gold Prices But "Algos Disappointed" as Trading Stays "Dull"

- Gold and Miners Outperform Once Again

- The current London Gold Pool will collapse as the first did, Grant Williams tells KWN

- Reuters notes that central banks trade gold every day but doesn't grasp what it means

- The Big Currency Reset

- The Big Currency Reset

- More War Needed

- More War Needed

- Gold in Crisis

- Gold in Crisis

- Prepared for the Attack of the Short Sellers: Joe Reagor

- Prepared for the Attack of the Short Sellers: Joe Reagor

- Prepared for the Attack of the Short Sellers: Joe Reagor

| How Gold Will Respond to Declining Discovery Posted: 23 Apr 2014 11:00 PM PDT by Bill Bonner, Daily Reckoning.com:

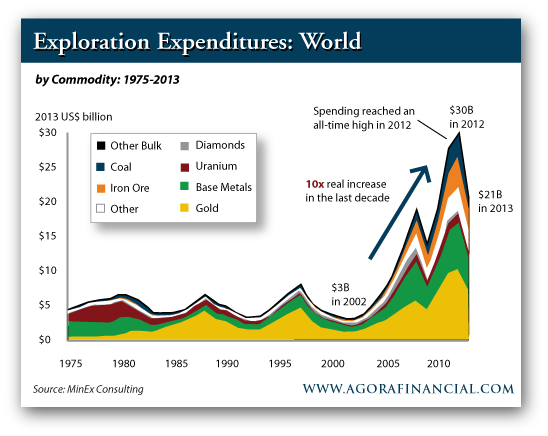

Richard Schodde, of MinEx Consulting, has studied past exploration cycles in detail. He says we are seeing a tightening of the sector, as the availability of capital has plummeted. Costs of exploration are coming down as companies cut back on high-salaried employees and reduce operating costs. The following chart from MinEx shows exploration expenditures rising quickly during the boom years: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Check out what Google autocomplete tells us about America Posted: 23 Apr 2014 10:30 PM PDT from Sovereign Man:

If you're not sure, ask Google. It seems that millions of Americans already have asked this question, along with: "Why does the government want to kill us?", and "Can the government take your gold?" These are among the jewels of Google autocomplete– instantly displaying results from the most popular searches. Try it yourself. The results vary slightly based on geography, but if you type, for example, "Obama is ", I get the following: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The SECRET SILVER STOCKPILE, Part I Posted: 23 Apr 2014 08:15 PM PDT by Jeff Nielson, Bullion Bulls Canada:

Actual (versus "official") inventories of gold in the bankers' metals warehouses today are now a large, negative number – in the many millions of ounces. Official (and visible) default in the gold market has only been averted by a cornucopia of fraud, primarily "fractional-reserve banking" in the gold market, i.e. through "selling" each ounce of actual gold possessed by the banking cabal to numerous chump-owners. The magnitude of this 'fractional-reserve' fraud is something about which we can only speculate, but we do have parameters. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts – Hotel California Posted: 23 Apr 2014 08:00 PM PDT from Jesse's Café Américain:

Like the Hotel California, you can check out, but you can never leave. When I was seconded to the ITU in Genève for many weeks at a time, I used to stay in a smaller hotel on the Rue Gevray that was called the Hotel California. It was very convenient because they had efficiency rooms on the top floor with a small kitchen and a balcony with a nice view of the lake. And it was not a bad walk up the hill to the old League of Nations building, and an equally pleasant walk over to the restaurant areas. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Governments suppress gold to try to conceal inflation, Grant Williams tells KWN Posted: 23 Apr 2014 07:50 PM PDT 10:50p ET Wednesday, April 23, 2014 Dear Friend of GATA and Gold: Gold price suppression is crucial to Western governments that are creating vast amounts of money in the name of rescuing their economies, Singapore gold fund manager Grant Williams tells King World News. It's a matter of concealing inflation, he says. An excerpt from the interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/4/23_We... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| China and U.S. likely cooperate in gold suppression, researcher Koos Jansen says Posted: 23 Apr 2014 07:40 PM PDT 10:43p ET Wednesday, April 23, 2014 Dear Friend of GATA and Gold: China and the United States are probably cooperating for the time being in suppressing the price of gold so that China can obtain gold to hedge its foreign exchange surplus of U.S. dollars without collapsing the dollar's value or exploding the gold price, China gold market expert Koos Jansen tells Sprott Money News in an interview today. Jansen, a consultant to GATA, adds that he expects China's next official announcement of its gold reserves to be in the range of 4,000 to 5,000 tonnes. The interview is available in both audio and text at the Sprott Money Internet site here: http://www.sprottmoney.com/news/ask-the-expert-koos-jansen-april-2014 Meanwhile Jansen reports at his Internet site, In Gold We Trust, that Chinese gold demand remains in a downtrend over the last few weeks: http://www.ingoldwetrust.ch/chinese-gold-demand-dropping CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Prepared for the Attack of the Short Sellers Posted: 23 Apr 2014 07:07 PM PDT Despite the ongoing attack of the short-sellers, the fundamentals of gold and silver production are increasingly robust. ROTH Capital's Joe Reagor tells The Gold Report why he believes the price of gold is steaming toward $1,500/oz, with silver prices following in the wake. Reagor highlights several junior precious metals miners in a market that is out to prove the bears The Gold Report: Let's talk about the growth and stability of gold and silver sales in Q2/14. What catalysts are on the horizon? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Groupthink Or Black Swan Rising? Not A Single 'Economist' Expects An Economic Downturn Posted: 23 Apr 2014 07:06 PM PDT Submitted by Pater Tenebrarum of Acting-Man blog, A 100% ConsensusThis doesn't happen very often. Marketwatch reports that Jim Bianco points out in a recent market comment that the 67 economists taking part in a regular Bloomberg survey have a unanimous forecast regarding treasury bond yields: they will be higher 6 months from now. This is a truly striking result, and given the well-known propensity of mainstream economists to guess wrong (their forecasts largely consist of extrapolating the most recent short term trend), it may provide us with a few insights. In fact, considering that there have been only a handful of instances since 2009 when a majority of the economists surveyed predicted a decline in yields, we can already state that their forecasts regarding treasuries are quite often (though obviously not always) wide of the mark. In fact, so far this year they are already wrong again – and so are fund managers, as they hold their lowest exposure to treasuries in seven years. This is not the only thing there is complete unanimity about. Not a single economist taking part in a separate survey believes an economic downturn is possible.

(emphasis added) Color us unsurprised regarding the fact that the 'most hated asset class' has turned out to be one of the better performing so far this year. Gold is probably hated even more, and for similar reasons. Everybody expects the weakest recovery of the entire post WW2 era to reach 'escape velocity' (whatever that is supposed to mean), even after adding almost $8 trillion to the federal debt and some $4.8 trillion to the broad true money supply since the 2008 crisis have led to such a dismal outcome (of course as card-carrying Austrians we believe this development is precisely what should have been expected).

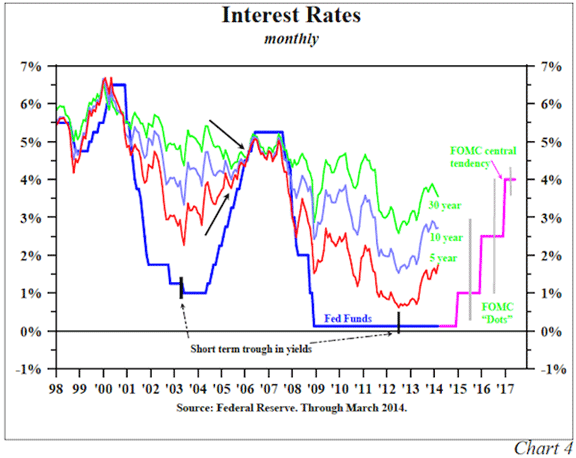

Likely OutcomesWhile treasury bond yields have only moved down a little so far this year, one must keep in mind that they are at a historically very low level to begin with. At a yield of roughly 4%, a 50 basis points move represents 12.5% of the entire distance to zero. However, we also know that a lot more downside is possible. Yields have already been quite a bit lower on a number of occasions. There can be little doubt that if the consensus of economists turns out to be wrong again, it will likely be wrong on both t-bond yields and the economy. As an aside, it is noteworthy that long term yields have weakened considerably even while five year yields have remained roughly unchanged and yields on the short end of the curve have actually risen slightly since the beginning of the year. We interpret this as the market judging the Fed to be adopting a tighter monetary policy, and expecting weaker aggregate economic activity to ultimately result from this new stance. Clearly, the 'tapering' of 'QE' does represent a tightening of policy, no matter what Fed members are saying about it. It means the pace of money supply inflation is being slowed down. Note that something similar happened in the run-up to the 2008 crisis, only in this instance the yield curve actually inverted prior to the economic downturn. One should not expect a complete yield curve inversion to warn in a timely fashion of a recession when the central bank is hell-bent on keeping its policy rate at or near zero. We know this from 'ZIRP' experiments that have been undertaken in other countries, such as e.g. Japan. If the economy doesn't do what seemingly everybody expects it to do in the famed 'second half' (practically the entire sell-side shares the consensus of the economists surveyed by Bloomberg), then treasuries and gold should be expected to rise, while equities could end up getting hit quite badly.

30 year t-bond yield: declining since the beginning of the year – click to enlarge.

It is clear that one of the reasons why economists expect no contraction in the economy is that 'traditional' recession indicators still appear largely benign, if somewhat weaker than previously. We prefer to keep an eye on things most people don't watch, such as the ratio of capital to consumer goods production, which shows how factors of production are pulled toward the higher stages of the capital structure when monetary pumping is underway. This ratio tends to peak and reverse close to recessions. Its recent trend isn't entirely conclusive yet as it has begun to move sideways, but it clearly seems to be issuing a 'heads up' type warning signal.

Capital vs. consumer goods production – it tends to peak close to the beginning of recession periods, and declines while recessions are underway, as the production structure is temporarily shortened again – click to enlarge.

Note also that the transition from expansion to contraction is usually quite swift, and never widely expected.

Conclusion:This is an astonishing degree of consensus thinking, but it perfectly mirrors the complacency we see in stock market sentiment and positioning data. The probability that such a unanimous view will turn out to be correct is traditionally extremely low. The economy is likely resting on a much weaker foundation than is generally believed. This is not least the result of massive monetary pumping and deficit spending, both of which tend to severely weaken the economy on a structural level, even though they can create a temporary illusion of 'growth'. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Weak U.S. Housing Data Supports Euro Posted: 23 Apr 2014 07:04 PM PDT Earlier today, the common currency moved higher against the U.S. dollar after data showed that the euro zone manufacturing PMI rose to 53.3 in April from 53.0 in the previous month (while analysts had expected an unchanged reading). Later in the day, the Commerce Department showed that sales on new homes dropped 14.5%, which supported the euro as well. Whether these positive numbers are in line with the technical picture of EUR/USD? | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver Stocks Begin Oversold Bounce Posted: 23 Apr 2014 06:56 PM PDT The bottoming process for gold and silver shares has been arduous as they’ve oscillated back and forth for almost a year. We noted a month ago that the failed breakout in March was strong evidence that an interim top was in place. Heading into this week it looked like the miners would fall further before finding support. However, over the past two days the sector clearly reversed its short-term course. For now this appears to be a rebound from an oversold bounce. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

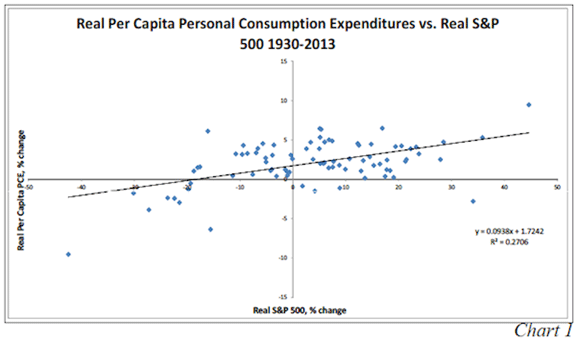

| Hoisington On The End Of The Fed's (Mythical) "Wealth Effect" Posted: 23 Apr 2014 06:35 PM PDT Authored by Lacy Hunt and Van Hoisington of Hoisington Investment Management, Hoisington Investment Management – Quarterly Review and Outlook, First Quarter 2014Optimism at the FOMCThe Federal Open Market Committee (FOMC) has continuously been overly optimistic regarding its expectations for economic growth in the United States since the last recession ended in 2009. If their annual forecasts had been realized over the past four years, then at the end of 2013 the U.S. economy should have been approximately $1 trillion, or 6%, larger. The preponderance of research suggests that the FOMC has been incorrect in its presumption of the effectiveness of quantitative easing (QE) on boosting economic growth. This faulty track record calls into question their latest prediction of 2.9% real GDP growth for 2014 and 3.4% for 2015. A major reason for the FOMC’s overly optimistic forecast for economic growth and its incorrect view of the effectiveness of quantitative easing is the reliance on the so-called “wealth effect”, described as a change in consumer wealth which results in a change in consumer spending. In an opinion column for The Washington Post on November 5, 2010, then FOMC chairman Ben Bernanke wrote, “...higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.” Former FOMC chairman Alan Greenspan in a CNBC interview on Feb. 15, 2013 said, “The stock market is the key player in the game of economic growth.” This year, in the January 20 issue of Time Magazine, the current FOMC chair, Janet Yellen said, “And part of the [economic stimulus] comes through higher house and stock prices, which causes people with homes and stocks to spend more, which causes jobs to be created throughout the economy and income to go up throughout the economy.” FOMC leaders may feel justified in taking such a position based upon the FRB/US, a large- scale econometric model. In part of this model, employed by the FOMC in their decision making, household consumption behavior is expressed as a function of total wealth as well as other variables. The model predicts that an increase in wealth of one dollar will boost consumer spending by five to ten cents (see page 8-9 “Housing Wealth and Consumption” by Matteo Iacoviello, International Finance Discussion Papers, #1027, Board of Governors of the Federal Reserve System, August 2011). Even at the lower end of their model's range this wealth effect, if it were valid, would be a powerful factor in spurring economic growth. After examining much of the latest scholarly research, and conducting in house research on the link between household wealth and spending, we found the wealth effect to be much weaker than the FOMC presumes. In fact, it is difficult to document any consistent impact with most of the research pointing to a spending increase of only one cent per one dollar rise in wealth at best. Some studies even indicate that the wealth effect is only an interesting theory and cannot be observed in practice. The wealth effect has been both a justification for quantitative easing and a root cause of consistent overly optimistic growth expectations by the FOMC. The research cited below suggests that the concept of a wealth effect is in fact deeply flawed. It is unfortunate that the FOMC has relied on this flawed concept to experiment with over $3 trillion in asset purchases and continues to use it as the basis for what we believe are overly optimistic growth expectations. Consumer Wealth and Consumer SpendingMany episodes of rising and falling financial and housing asset wealth have occurred throughout history. The question is whether these periods of wealth changes are associated in a consistent and reliable way with changes in consumer spending. We examined, separately, percent changes in real consumption expenditures per capita against percent changes in the real S&P 500 index (financial wealth) and against percent changes in Robert Shiller’s real home price index (housing wealth). If economic relationships are valid they should work for all time periods, regardless of highly different idiosyncratic conditions, as opposed to an isolated subset of historical experience. As such, we conducted our analysis from 1930 through 2013, the entire time period for which all variables were available. Financial Wealth. Chart 1 is a scatter diagram of current percent changes in both real per capita personal consumption expenditures (PCE), the preferred measure of spending, and the real S&P 500 stock price index. It is made up of 84 dots, which constitutes a robust sample. Over our sample period, as with most extremely long periods, time will tend to link economic variables to each other; population is a key factor that can cause such an association. By expressing consumption in per capita terms, trending has been reduced, and in turn, an artificially overstated degree of correlation has been avoided.

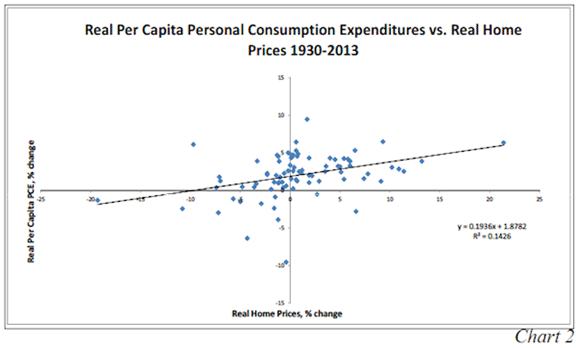

If financial wealth drives consumer spending, an unambiguous positively sloped line should be evident on this scatter diagram. Larger gains in the S&P 500 would be associated with faster increases in spending; conversely, declines in the S&P 500 would be tied to lower spending. If there was a strong positive correlation, the large gains in stock prices would be associated with strong gains in spending, and they would fall in the upper right quadrant of the graph. In addition, sizeable declines in the S&P would be associated with large decreases in consumer spending, and the dots would fall in the lower left quadrant, resulting in an upward sloping line. For the relationship to be stable and dependable the dots should be packed in an around the trend line. This is clearly not the case. The trend line through the dots is positive, but the observations in the upper left quadrant of the graph and those in the lower right exhibit a negative rather than positive correlation. Furthermore, the dots are not clustered close to the trend line. The goodness of fit (coefficient of determination) of 0.27 is statistically significant; however, the slope of the line is minimally positive. This suggests that an approximate one dollar increase in wealth will boost real per capita PCE by less than one cent, far less than even the lower band of the effect in the Fed’s model. Theoretically, lagged changes are preferred because when current or coincidental changes in economic variables are correlated the coefficients may be biased due to some other factor not covered by the empirical estimation. Also, lags give households time to adjust to their change in wealth. As such, we correlated the current percent change in real per capita PCE against current changes as well as one- and two-year lagged changes (expressed as a three-year moving average) in the S&P 500. The lags did not improve the goodness of fit as the coefficient of determination fell to 0.21. An increased dollar of wealth, however, still resulted in a one cent increase in consumption. We then correlated current percent change in real per capita PCE with only lagged changes in the real S&P 500 for the two prior years (expressed as a two-year moving average), and the relationship completely fell apart as the goodness of fit fell to a statistically insignificant 0.06. Housing Wealth. Chart 2 is a second scatter diagram, relating current percent changes in real home prices to current percent changes in real per capita PCE. Once again, the trend line does have a small positive slope, but there are so many observations in the upper left quadrant that the coefficient of determination does not meet robust tests for statistical significance. The dots are even more dispersed from the trend line than in the prior scatter diagram.

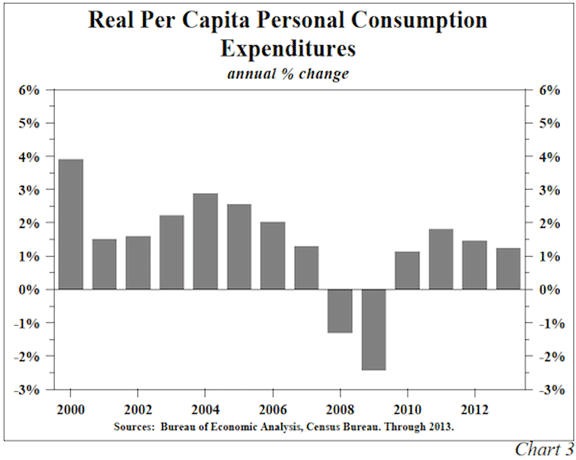

As with the analysis on financial wealth, when current changes in consumption were correlated against the lagged changes in home prices (both the three-year moving average and the two-year moving average), the goodness of fit deteriorated significantly and was not statistically significant in either case. Correlations, or the lack thereof, indicated by these scatter diagrams do not prove causation. Nevertheless, economic theory offers an explanation for the poor correlation. If a person has an appreciated asset and wishes to increase spending, one option is to sell the asset, capture the gain and buy something else. However, the funds to make the new purchase comes from the buyer of the asset. Thus, when financial assets are sold, money balances increase for the seller but fall for the buyer. The person with an appreciated asset could choose to borrow against that asset. Since new debt is current spending in lieu of future spending, the debt option may only provide a temporary boost to economic activity. To avoid an accentuated business cycle, debt must generate an income stream to repay principal and interest. Otherwise any increase in debt to convert wealth gains into consumer spending may merely add to cyclical volatility without producing any lasting benefit. Scholarly ResearchScholarly research has debated the impact of financial and housing wealth on consumer spending as well. The academic research on financial wealth is relatively consistent; it has very little impact on consumption. In “Financial Wealth Effect: Evidence from Threshold Estimation” (Applied Economic Letters, 2011), Sherif Khalifa, Ousmane Seck and Elwin Tobing found “a threshold income level of almost $130,000, below which the financial wealth effect is insignificant, and above which the effect is 0.004.” This means a one dollar rise in wealth would, in time, boost consumption by less than one-half of a penny. Similarly, in “Wealth Effects Revisited 1975- 2012,” Karl E. Case, John M. Quigley and Robert J. Shiller (Cowles Foundation Discussion Paper #1884, December 2012) write, “The numerical results vary somewhat with different econometric specifications, and so any numerical conclusion must be tentative. We find at best weak evidence of a link between stock market wealth and consumption.” This team looked at quarterly observations during the 17-year period from 1982 through 1999 and the 37-year period from 1975 through the spring quarter of 2012. The research on housing wealth is more divided. In the same paper referenced above, Karl E. Case, John M. Quigley and Robert J. Shiller write, “In contrast, we do find strong evidence that variations in housing market wealth have important effects upon consumption.” These findings differ from the findings of various other economists. In “The (Mythical?) Housing Wealth Effect” (NBER Working Paper #15075, June 2009), Charles Calomiris, Stanley D. Longhofer and William Miles write, “Models used to guide policy, as well as some empirical studies, suggest that the effect of housing wealth on consumption is large and greater than the wealth effect on consumption from stock holdings. Recent theoretical work, in contrast, argues that changes in housing wealth are offset by changes in housing consumption, meaning that unexpected shocks in housing wealth should have little effect on non- housing consumption.” Furthermore, R. Glenn Hubbard and Anthony Patrick O’Brien (Macroneconomics, Fourth edition, 2013, page 381) provide a highly cogent summary of the aforementioned research by Charles Calomiris, Stanley D. Longhofer and William Miles. They argue that consumers “own houses primarily so they can consume the housing services a home provides. Only consumers who intend to sell their current house and buy a smaller one – for example, ‘empty nesters’ whose children have left home – will benefit from an increase in housing prices. But taking the population as a whole, the number of empty nesters may be smaller than the number of first time home buyers plus the number of homeowners who want to buy larger houses. These two groups are hurt by rising home prices.” Amir Sufi, Professor of Finance at the University of Chicago, also indicates that the effect of housing wealth is much smaller than assumed in the policy models and earlier empirical research. Dr. Sufi calculates that an increase of one dollar of housing wealth may yield as little as one cent of extra spending (“Will Housing Save the U.S. Economy?”, April 2013, Chicago Booth Economic Outlook event). This is in line with a 2013 study by Sherif Khalifa, Ousmane Seck and Elwin Tobing (“Housing Wealth Effect: Evidence from Threshold Estimation”, The Journal of Housing Economics). These economists found that a threshold income level of $74,046 had a wealth coefficient that rounded to one cent. Income levels between $74,046 and $501,000 had a two cent coefficient, and incomes above $501,000 had a statistically insignificant coefficient. In total, the majority of the research is seemingly unequivocal in its conclusion. The wealth effect (financial and housing) is barely operative. As such, it is interesting to note its actual impact in 2013. Where Was the Wealth Effect in 2013?If the wealth effect was as powerful as the FOMC believes, consumer spending should have turned in a stellar performance last year. In 2013 equities and housing posted strong gains. On a yearly average basis, the real S&P 500 stock market index increase was 17.7%, and the real Case Shiller Home Price Index increase was 9.1%. The combined gain of these wealth proxies was 26.8%, the eighth largest in the 84 years of data. The real per capital PCE gain of just 1.2% ranked 58th of 84. The difference between the two was the fifth largest in the 84 cases. Such a huge discrepancy in relative performance in 2013, occurring as it did in the fourth year of an economic expansion, raises serious doubts about the efficacy of the wealth effect (Chart 3).

In econometrics, theoretical propositions must be empirically verifiable. Researchers using numerous statistical procedures examining various sample periods should be able to identify at least some consistent patterns. This is not the case with the wealth effect. Regardless if examining a simple scatter diagram or something far more sophisticated, the wealth effect is weak and inconsistent. The powerful wealth coefficients imbedded in the FRB/US model have not been supported by independent research. To quote Chris Low, Chief Economist of FTN (FTN Financial, Economic Weekly, March 21, 2014), “There may not be a wealth effect at all. If there is a wealth effect, it is very difficult to pin down ...” Since the FOMC began quantitative easing in 2009, its balance sheet has increased more than $3 trillion. This increase may have boosted wealth, but the U.S. economy received no meaningful benefit. Furthermore, the FOMC has no idea what the ultimate outcome of such an increase will be or what a return to a ‘normal’ balance sheet might entail. Given all of this, we do not see any evidence for economic growth as robust at the FOMC predicts. Without a wealth effect, the stock market is not the “key player” in the economy, and no “virtuous circle” runs through the stock market. We reiterate our view that nominal GDP will rise just 3% this year, down from 3.4% in 2013. M2 growth in the latest twelve months was 5.8%, but velocity should decline by at least 3% and limit nominal GDP to 3% or less.

The Flatter Yield Curve: An Opportunity for Treasury Bond InvestorsThe Fed has indicated that the federal funds rate could begin to rise in the next couple of years, and the Treasury market has moderately anticipated this event. Similar to the 2004-2005 federal funds rate cycle, long before the federal funds rate increased short Treasury rates began their ascent (Chart 4). Interestingly, once the federal funds rate did begin to rise in 2004, long Treasury rates fell over the next two years. From May of 2004 until Feb. 2006 the federal funds rate increased by 350 basis point (bps) and the five-year note increased by 80 bps, yet the 30-year bond fell by 84 bps as inflation expectations fell. If the Fed follows through with its forecast and short rates rise, the dampening effect on inflation expectations should again cause long rates to fall. On the other hand, should economic activity continue to moderate then the downward pressure on inflation will continue. The prospect for lower Treasury yields appears favorable. Van R. Hoisington | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Thomas Piketty's "Sensational" New Book Posted: 23 Apr 2014 06:03 PM PDT Submitted by Hunter Lewis via The Mises Economic blog, This 42 year economist from French academe has written a hot new book: Capital in the Twenty-First Century. The US edition has been published by Harvard University Press and, remarkably, is leading the best seller list, the first time that a Harvard book has done so. A recent review describes Piketty as the man “who exposed capitalism’s fatal flaw.” So what is this flaw? Supposedly under capitalism the rich get steadily richer in relation to everyone else; inequality gets worse and worse. It is all baked into the cake, unavoidable. To support this, Piketty offers some dubious and unsupported financial logic, but also what he calls “a spectacular graph” of historical data. What does the graph actually show? The amount of U.S. income controlled by the top 10% of earners starts at about 40% in 1910, rises to about 50% before the Crash of 1929, falls thereafter, returns to about 40% in 1995, and thereafter again rises to about 50% before falling somewhat after the Crash of 2008. Let’s think about what this really means. Relative income of the top 10% did not rise inexorably over this period. Instead it peaked at two times: just before the great crashes of 1929 and 2008. In other words, inequality rose during the great economic bubble eras and fell thereafter. And what caused and characterized these bubble eras? They were principally caused by the U.S. Federal Reserve and other central banks creating far too much new money and debt. They were characterized by an explosion of crony capitalism as some rich people exploited all the new money, both on Wall Street and through connections with the government in Washington. We can learn a great deal about crony capitalism by studying the period between the end of WWI and the Great Depression and also the last twenty years, but we won’t learn much about capitalism. Crony capitalism is the opposite of capitalism. It is a perversion of markets, not the result of free prices and free markets. One can see why the White House likes Piketty. He supports their narrative that government is the cure for inequality when in reality government has been the principal cause of growing inequality. The White House and IMF also love Piketty’s proposal, not only for high income taxes, but also for substantial wealth taxes. The IMF in particular has been beating a drum for wealth taxes as a way to restore government finances around the world and also reduce economic inequality. Expect to hear more and more about wealth taxes. Expect to hear that they will be a “one time” event that won’t be repeated, but that will actually help economic growth by reducing economic inequality. This is all complete nonsense. Economic growth is produced when a society saves money and invests the savings wisely. It is not quantity of investment that matters most, but quality. Government is capable neither of saving nor investing, much less investing wisely. Nor should anyone imagine that a wealth tax program would be a “one time” event. No tax is ever a one time event. Once established, it would not only persist; it would steadily grow over the years. Piketty should also ask himself a question. What will happen when investors have to liquidate their stocks, bonds, real estate, or other assets in order to pay the wealth tax? How will markets absorb all the selling? Who will be the buyers? And how will it help economic growth for markets and asset values to collapse under the selling pressure? In 1936, a dense, difficult-to-read academic book appeared that seemed to tell politicians they could do exactly what they wanted to do. This was Keynes’s General Theory. Piketty’s book serves the same purpose in 2014, and serves the same short-sighted, destructive policies. If the Obama White House, the IMF, and people like Piketty would just let the economy alone, it could recover. As it is, they keep inventing new ways to destroy it. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Middle Class In Canada Is Now Doing Better Than The Middle Class In America Posted: 23 Apr 2014 05:05 PM PDT Submitted by Michael Snyder of The Economic Collapse blog, For most of Canada's existence, it has been regarded as the weak neighbor to the north by most Americans. Well, that has changed dramatically over the past decade or so. Back in the year 2000, middle class Canadians were earning much less than middle class Americans, but since then there has been a dramatic shift. At this point, middle class Canadians are actually earning more than middle class Americans are. The Canadian economy has been booming thanks to a rapidly growing oil industry, and meanwhile the U.S. middle class has been steadily shrinking. If current trends continue, a whole bunch of other countries are going to start passing us too. The era of the "great U.S. middle class" is rapidly coming to a bitter end. In recent years, I have been up to Canada frequently, and I am always amazed at how much nicer things are up there. The stores and streets are cleaner, the people are more polite and it seems like almost everyone that wants to work has a job. But despite knowing all this, I was still surprised when the New York Times reported this week that middle class incomes in Canada have now surpassed middle class incomes in the United States...

And things are particularly dire for those in the U.S. on the low end of the scale...

Even while our politicians and the media continue to proclaim that everything is "just fine", the U.S. middle class continues to slide toward oblivion. The biggest reason for this is the lack of middle class jobs. Millions of good jobs have been shipped overseas, and millions of other good jobs have been replaced by technology. The value of our labor is declining with each passing day, and this has forced millions upon millions of very qualified Americans to take whatever they can get. As NBC News recently noted, this is a big reason why the temp industry has been booming...

It has been estimated that one out of every ten jobs is now filled by a temp agency. I have worked for temp agencies myself in the past. Big companies like the idea of having "disposable workers", and this is a trend that is likely to only grow in the years ahead. But temp jobs and part-time jobs don't pay as well as normal jobs. And those kinds of jobs generally cannot support middle class families. At this point, nine out of the top ten occupations in the United States pay an average wage of less than $35,000 a year. That is absolutely stunning. These days most families are barely scraping by, and they don't have much extra money to go shopping with. This is a big reason for the "retail apocalypse" that we are now witnessing. This week we learned that retail stores in the United States are closing at the fastest pace that we have seen since the collapse of Lehman Brothers. But you won't hear much about that on the mainstream news. You can find lots of "space available" signs and empty buildings in formerly middle class neighborhoods all over the country. For example, one of my readers recently shot the following YouTube video in Scottsdale, Arizona. As you can see, empty commercial buildings are all over the place... As the middle class shrinks, more families are being forced to take in family members that can't find decent work. I have written previously about the huge rise in the number of young adults that are moving back in with their parents. But this is not just happening to young people. As the Los Angeles Times recently detailed, the number of Americans 50 and older that are moving in with their parents has absolutely soared in recent years...

The U.S. economy is slowly but steadily falling apart, and more people fall out of the middle class every single day. A recent Gallup survey found that 14 percent of all Americans would experience "significant financial hardship" within one week of a job loss. An additional 29 percent of all Americans would experience "significant financial hardship" within one month of a job loss. That means that 43 percent of the entire country is living right on the edge. It is no wonder why only about 30 percent of all Americans believe that we are moving in the right direction as a nation. Most people know deep down that something is seriously wrong. But most people can't explain exactly what that is or how to fix it. Meanwhile, the politicians and the media keep telling us that if we just keep doing the same old things that everything will work out okay somehow. The blind are leading the blind, and we are rapidly marching toward disaster. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mugabe Considers Revival Of "Hyperinflated" Zimbabwe Dollar Posted: 23 Apr 2014 04:38 PM PDT It seems every bubble is coming back. 5 Years after Zimbabwe abandoned the Zim Dollar (in favor of the US Dollar) after inflation surged to 500 billion percent the year before (according to the IMF), Bloomberg reports that Robert Mugabe's ruling party is considering reintroducing the local currency as it struggles to meet its monthly wage bill. "If they bring back the [Zim] dollar it will quickly deteriorate to worse than then, we'll have nothing," warns one businessman as the appeal of reviving the Zimbabwe Dollar - allowing the government to print money to meet its needs - is surely outweighed by the lessons of the past. "We'll just die - we can't go back to 2008," but it seems governments never learn and memories are short. Get long wheel-barrows.

As Bloomberg reports, Zimbabwe is weighing the reintroduction of the national currency it abandoned in 2009 in favor of the U.S. dollar as it struggles to meet its monthly wage bill, three members of the ruling party's decision-making body said.

Is that really an option? It seems governments never learn or care to learn... | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Added $3.60 Today for a Comex Close at $1,284.20 Posted: 23 Apr 2014 04:17 PM PDT

The GOLD PRICE added $3.60 today for a Comex close at $1,284.20. Silver closed Comex up 7.9 cents to 1943c. Ranges today were tiny, the GOLD PRICE range was $8.70 and the SILVER PRICE range was 17 cents, but their gains bring little comfort. The overlapping trading simply doesn't depict a rally, but correction without much conviction or direction. I'm still guessing that the downside risk for the gold price probably isn't more than $14 from here. Silver on 15 April made a low at 1922c, and another on 21 April at 1923c. That might have fulfilled the downside thrust, but we might still witness a V-move to 1900c. In any event, all that is my anticipating, since neither market has yet flashed a signal it is turning up. Be patient here, but don't go to sleep. I bought a good bit today to balance my own position. I don't think there's too much downside risk here, and I certainly don't want to be short. Markets are drifting, without much conviction one way or the other. Like a torpid snake, though, that can change any time. On narrow ranges today stocks turned down, slightly. Dow abdicated 12.72 (0.08%) to a 16,501.65 close. S&P500 dropped 4.16 (0.22%) to close at 1,875.39. Since markets don't make triple tops (or bottoms) but usually break through that barrier to continue higher, we can probably expect a higher top in stocks. However, the charts don't speak unequivocally. As they rise in seniority from Nasdaq Comp to S&P500 to the Dow, they look better. First two are in downtrends, Dow has moved sideways, yet the overall uptrend says they will move yet higher, unless a breakdown is confirmed. That would require universal closes below the 200 day moving averages. Dow in gold inched down 0.19% to 12.85 oz (G$265.63 gold dollars). Dow in Silver hooked down 0.232% to 848.94 oz (S$1,098.91 silver dollars). That probably does not mark the top, although yesterdays 851.70 oz was awfully close to the 853.66 oz (S$1,103.72) December 2013 high. Yet the high lieth not far away. US DOLLAR INDEX fell 4 basis points, nothing really, but it has been repulsed trying to climb above the 20 and 50 day moving averages, to its shame revealing its weakness. One of these days the dollar will do something, but probably not tomorrow. Drifting sideways. Euro rose a little today, 0.8% to $1.3817, but not enough to break above its downtrend line. Not enough to sneeze at, in fact. Yen is tippy-toeing back and over its 50 DMA. Rose 0.1% to 97.57 cents per Y100, going nowhere. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Added $3.60 Today for a Comex Close at $1,284.20 Posted: 23 Apr 2014 04:17 PM PDT

The GOLD PRICE added $3.60 today for a Comex close at $1,284.20. Silver closed Comex up 7.9 cents to 1943c. Ranges today were tiny, the GOLD PRICE range was $8.70 and the SILVER PRICE range was 17 cents, but their gains bring little comfort. The overlapping trading simply doesn't depict a rally, but correction without much conviction or direction. I'm still guessing that the downside risk for the gold price probably isn't more than $14 from here. Silver on 15 April made a low at 1922c, and another on 21 April at 1923c. That might have fulfilled the downside thrust, but we might still witness a V-move to 1900c. In any event, all that is my anticipating, since neither market has yet flashed a signal it is turning up. Be patient here, but don't go to sleep. I bought a good bit today to balance my own position. I don't think there's too much downside risk here, and I certainly don't want to be short. Markets are drifting, without much conviction one way or the other. Like a torpid snake, though, that can change any time. On narrow ranges today stocks turned down, slightly. Dow abdicated 12.72 (0.08%) to a 16,501.65 close. S&P500 dropped 4.16 (0.22%) to close at 1,875.39. Since markets don't make triple tops (or bottoms) but usually break through that barrier to continue higher, we can probably expect a higher top in stocks. However, the charts don't speak unequivocally. As they rise in seniority from Nasdaq Comp to S&P500 to the Dow, they look better. First two are in downtrends, Dow has moved sideways, yet the overall uptrend says they will move yet higher, unless a breakdown is confirmed. That would require universal closes below the 200 day moving averages. Dow in gold inched down 0.19% to 12.85 oz (G$265.63 gold dollars). Dow in Silver hooked down 0.232% to 848.94 oz (S$1,098.91 silver dollars). That probably does not mark the top, although yesterdays 851.70 oz was awfully close to the 853.66 oz (S$1,103.72) December 2013 high. Yet the high lieth not far away. US DOLLAR INDEX fell 4 basis points, nothing really, but it has been repulsed trying to climb above the 20 and 50 day moving averages, to its shame revealing its weakness. One of these days the dollar will do something, but probably not tomorrow. Drifting sideways. Euro rose a little today, 0.8% to $1.3817, but not enough to break above its downtrend line. Not enough to sneeze at, in fact. Yen is tippy-toeing back and over its 50 DMA. Rose 0.1% to 97.57 cents per Y100, going nowhere. Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

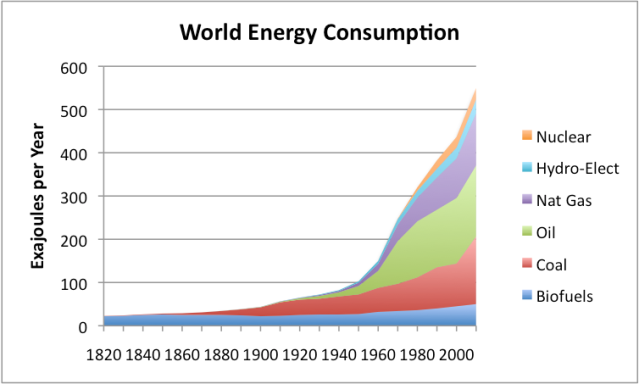

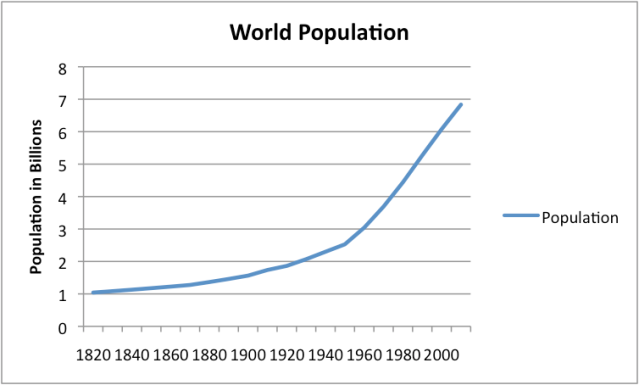

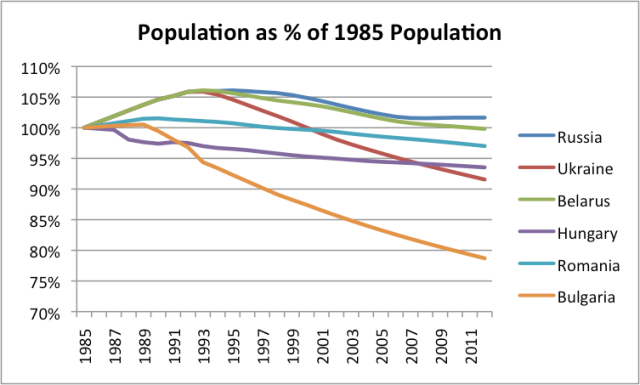

| Posted: 23 Apr 2014 03:35 PM PDT Submitted by Gail Tverberg of Our Finite World blog, Republicans, Democrats, and environmentalists all have favorite energy myths. Even Peak Oil believers have favorite energy myths. The following are a few common mis-beliefs, coming from a variety of energy perspectives. I will start with a recent myth, and then discuss some longer-standing ones. Myth 1. The fact that oil producers are talking about wanting to export crude oil means that the US has more than enough crude oil for its own needs. The real story is that producers want to sell their crude oil at as high a price as possible. If they have a choice of refineries A, B, and C in this country to sell their crude oil to, the maximum amount they can receive for their oil is limited by the price the price these refineries are paying, less the cost of shipping the oil to these refineries. If it suddenly becomes possible to sell crude oil to refineries elsewhere, the possibility arises that a higher price will be available in another country. Refineries are optimized for a particular type of crude. If, for example, refineries in Europe are short of light, sweet crude because such oil from Libya is mostly still unavailable, a European refinery might be willing to pay a higher price for crude oil from the Bakken (which also produces light sweet, crude) than a refinery in this country. Even with shipping costs, an oil producer might be able to make a bigger profit on its oil sold outside of the US than sold within the US. The US consumed 18.9 million barrels a day of petroleum products during 2013. In order to meet its oil needs, the US imported 6.2 million barrels of oil a day in 2013 (netting exported oil products against imported crude oil). Thus, the US is, and will likely continue to be, a major oil crude oil importer. If production and consumption remain at a constant level, adding crude oil exports would require adding crude oil imports as well. These crude oil imports might be of a different kind of oil than that that is exported–quite possibly sour, heavy crude instead of sweet, light crude. Or perhaps US refineries specializing in light, sweet crude will be forced to raise their purchase prices, to match world crude oil prices for that type of product. The reason exports of crude oil make sense from an oil producer’s point of view is that they stand to make more money by exporting their crude to overseas refineries that will pay more. How this will work out in the end is unclear. If US refiners of light, sweet crude are forced to raise the prices they pay for oil, and the selling price of US oil products doesn’t rise to compensate, then more US refiners of light, sweet crude will go out of business, fixing a likely world oversupply of such refiners. Or perhaps prices of US finished products will rise, reflecting the fact that the US has to some extent in the past received a bargain (related to the gap between European Brent and US WTI oil prices), relative to world prices. In this case US consumers will end up paying more. The one thing that is very clear is that the desire to ship crude oil abroad does not reflect too much total crude oil being produced in the United States. At most, what it means is an overabundance of refineries, worldwide, adapted to light, sweet crude. This happens because over the years, the world’s oil mix has been generally changing to heavier, sourer types of oil. Perhaps if there is more oil from shale formations, the mix will start to change back again. This is a very big “if,” however. The media tend to overplay the possibilities of such extraction as well. Myth 2. The economy doesn’t really need very much energy.

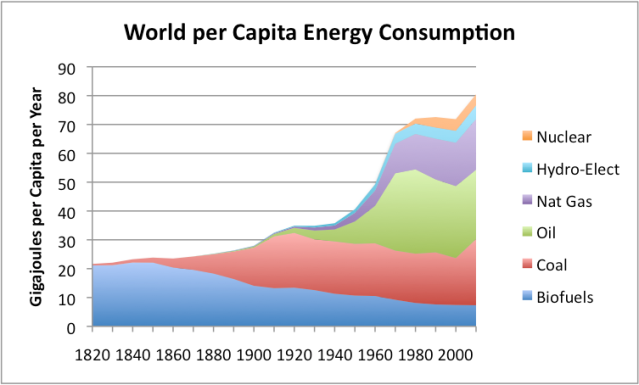

We humans need food of the right type, to provide us with the energy we need to carry out our activities. The economy is very similar: it needs energy of the right types to carry out its activities. One essential activity of the economy is growing and processing food. In developing countries in warm parts of the world, food production, storage, transport, and preparation accounts for the vast majority of economic activity (Pimental and Pimental, 2007). In traditional societies, much of the energy comes from human and animal labor and burning biomass. If a developing country substitutes modern fuels for traditional energy sources in food production and preparation, the whole nature of the economy changes. We can see this starting to happen on a world-wide basis in the early 1800s, as energy other than biomass use ramped up.  Figure 1. World Energy Consumption by Source, Based on Vaclav Smil estimates from Energy Transitions: History, Requirements and Prospects and together with BP Statistical Data on 1965 and subsequent The Industrial Revolution began in the late 1700s in Britain. It was enabled by coal usage, which made it possible to make metals, glass, and cement in much greater quantities than in the past. Without coal, deforestation had become a problem, especially near cold urban areas, such as London. With coal, it became possible to use industrial processes that required heat without the problem of deforestation. Processes using high levels of heat also became cheaper, because it was no longer necessary to cut down trees, make charcoal from the wood, and transport the charcoal long distances (because near-by wood had already been depleted). The availability of coal allowed the use of new technology to be ramped up. For example, according to Wikipedia, the first steam engine was patented in 1608, and the first commercial steam engine was patented in 1712. In 1781, James Watt invented an improved version of the steam engine. But to actually implement the steam engine widely using metal trains running on metal tracks, coal was needed to make relatively inexpensive metal in quantity. Concrete and metal could be used to make modern hydroelectric power plants, allowing electricity to be made in quantity. Devices such as light bulbs (using glass and metal) could be made in quantity, as well as wires used for transmitting electricity, allowing a longer work-day. The use of coal also led to agriculture changes as well, cutting back on the need for farmers and ranchers. New devices such as steel plows and reapers and hay rakes were manufactured, which could be pulled by horses, transferring work from humans to animals. Barbed-wire fence allowed the western part of the US to become cropland, instead one large unfenced range. With fewer people needed in agriculture, more people became available to work in cities in factories. Our economy is now very different from what it was back about 1820, because of increased energy use. We have large cities, with food and raw materials transported from a distance to population centers. Water and sewer treatments greatly reduce the risk of disease transmission of people living in such close proximity. Vehicles powered by oil or electricity eliminate the mess of animal-powered transport. Many more roads can be paved. If we were to try to leave today’s high-energy system and go back to a system that uses biofuels (or only biofuels plus some additional devices that can be made with biofuels), it would require huge changes. Myth 3. We can easily transition to renewables. On Figure 1, above, the only renewables are hydroelectric and biofuels. While energy supply has risen rapidly, population has risen rapidly as well. When we look at energy use on a per capita basis, the result is as shown in Figure 3, below.  Figure 3. Per capita world energy consumption, calculated by dividing world energy consumption (based on Vaclav Smil estimates from Energy Transitions: History, Requirements and Prospects together with BP Statistical Data for 1965 and subsequent) by population estimates, based on Angus Maddison data. The energy consumption level in 1820 would be at a basic level–only enough to grow and process food, heat homes, make clothing, and provide for some very basic industries. Based on Figure 3, even this required a little over 20 gigajoules of energy per capita. If we add together per capita biofuels and hydroelectric on Figure 3, they would come out to only about 11 gigajoules of energy per capita. To get to the 1820 level of per capita energy consumption, we would either need to add something else, such as coal, or wait a very, very long time until (perhaps) renewables including hydroelectric could be ramped up enough. If we want to talk about renewables that can be made without fossil fuels, the amount would be smaller yet. As noted previously, modern hydroelectric power is enabled by coal, so we would need to exclude this. We would also need to exclude modern biofuels, such as ethanol made from corn and biodiesel made from rape seed, because they are greatly enabled by today’s farming and transportation equipment and indirectly by our ability to make metal in quantity. I have included wind and solar in the “Biofuels” category for convenience. They are so small in quantity that they wouldn’t be visible as a separate categories, wind amounting to only 1.0% of world energy supply in 2012, and solar amounting to 0.2%, according to BP data. We would need to exclude them as well, because they too require fossil fuels to be produced and transported. In total, the biofuels category without all of these modern additions might be close to the amount available in 1820. Population now is roughly seven times as large, suggesting only one-seventh as much energy per capita. Of course, in 1820 the amount of wood used led to significant deforestation, so even this level of biofuel use was not ideal. And there would be the additional detail of transporting wood to markets. Back in 1820, we had horses for transport, but we would not have enough horses for this purpose today. Myth 4. Population isn’t related to energy availability. If we compare Figures 2 and 3, we see that the surge in population that took place immediately after World War II coincided with the period that per-capita energy use was ramping up rapidly. The increased affluence of the 1950s (fueled by low oil prices and increased ability to buy goods using oil) allowed parents to have more children. Better sanitation and innovations such as antibiotics (made possible by fossil fuels) also allowed more of these children to live to maturity. Furthermore, the Green Revolution which took place during this time period is credited with saving over a billion people from starvation. It ramped up the use of irrigation, synthetic fertilizers and pesticides, hybrid seed, and the development of high yield grains. All of these techniques were enabled by availability of oil. Greater use of agricultural equipment, allowing seeds to be sowed closer together, also helped raise production. By this time, electricity reached farming communities, allowing use of equipment such as milking machines. If we take a longer view of the situation, we find that a “bend” in the world population occurred about the time of Industrial Revolution, and the ramp up of coal use (Figure 4). Increased farming equipment made with metals increased food output, allowing greater world population.  Figure 4. World population based on data from “Atlas of World History,” McEvedy and Jones, Penguin Reference Books, 1978 Furthermore, when we look at countries that have seen large drops in energy consumption, we tend to see population declines. For example, following the collapse of the Soviet Union, there were drops in energy consumption in a number of countries whose energy was affected (Figure 5). Myth 5. It is easy to substitute one type of energy for another. Any changeover from one type of energy to another is likely to be slow and expensive, if it can be accomplished at all. One major issue is the fact that different types of energy have very different uses. When oil production was ramped up, during and following World War II, it added new capabilities, compared to coal. With only coal (and hydroelectric, enabled by coal), we could have battery-powered cars, with limited range. Or ethanol-powered cars, but ethanol required a huge amount of land to grow the necessary crops. We could have trains, but these didn’t go from door to door. With the availability of oil, we were able to have personal transportation vehicles that went from door to door, and trucks that delivered goods from where they were produced to the consumer, or to any other desired location. We were also able to build airplanes. With airplanes, we were able to win World War II. Airplanes also made international business feasible on much greater scale, because it became possible for managers to visit operations abroad in a relatively short time-frame, and because it was possible to bring workers from one country to another for training, if needed. Without air transport, it is doubtful that the current number of internationally integrated businesses could be maintained. The passage of time does not change the inherent differences between different types of fuels. Oil is still the fuel of preference for long-distance travel, because (a) it is energy dense so it fits in a relatively small tank, (b) it is a liquid, so it is easy to dispense at refueling stations, and (c) we are now set up for liquid fuel use, with a huge number of cars and trucks on the road which use oil and refueling stations to serve these vehicles. Also, oil works much better than electricity for air transport. Changing to electricity for transportation is likely to be a slow and expensive process. One important point is that the cost of electric vehicles needs to be brought down to where they are affordable for buyers, if we do not want the changeover to have a hugely adverse effect on the economy. This is the case because salaries are not going to rise to pay for high-priced cars, and the government cannot afford large subsidies for everyone. Another issue is that the range of electric vehicles needs to be increased, if vehicle owners are to be able to continue to use their vehicles for long-distance driving. No matter what type of changeover is made, the changeover needs to implemented slowly, over a period of 25 years or more, so that buyers do not lose the trade in value of their oil-powered vehicles. If the changeover is done too quickly, citizens will lose their trade in value of their oil-powered cars, and because of this, will not be able to afford the new vehicles. If a changeover to electric transportation vehicles is to be made, many vehicles other than cars will need to be made electric, as well. These would include long haul trucks, busses, airplanes, construction equipment, and agricultural equipment, all of which would need to be made electric. Costs would need to be brought down, and necessary refueling equipment would need to be installed, further adding to the slowness of the changeover process. Another issue is that even apart from energy uses, oil is used in many applications as a raw material. For example, it is used in making herbicides and pesticides, asphalt roads and asphalt shingles for roofs, medicines, cosmetics, building materials, dyes, and flavoring. There is no possibility that electricity could be adapted to these uses. Coal could perhaps be adapted for these uses, because it is also a fossil fuel. Myth 6. Oil will “run out” because it is limited in supply and non-renewable. This myth is actually closer to the truth than the other myths. The situation is a little different from “running out,” however. The real situation is that oil limits are likely to disrupt the economy in various ways. This economic disruption is likely to be what leads to an abrupt drop in oil supply. One likely possibility is that a lack of debt availability and low wages will keep oil prices from rising to the level that oil producers need for extraction. Under this scenario, oil producers will see little point in investing in new production. There is evidence that this scenario is already starting to happen. There is another version of this myth that is even more incorrect. According to this myth, the situation with oil supply (and other types of fossil fuel supply) is as follows: Myth 7. Oil supply (and the supply of other fossil fuels) will start depleting when the supply is 50% exhausted. We can therefore expect a long, slow decline in fossil fuel use. This myth is a favorite of peak oil believers. Indirectly, similar beliefs underly climate change models as well. It is based on what I believe is an incorrect reading of the writings of M. King Hubbert. Hubbert is a geologist and physicist who foretold a decline of US oil production, and eventually world production, in various documents, including Nuclear Energy and the Fossil Fuels, published in 1956. | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| West Hemorrhaging Gold But Here’s Its True Achilles’ Heel Posted: 23 Apr 2014 02:29 PM PDT  Today one of the most highly respected fund managers in Singapore warned King World News that the West is continuing to hemorrhage gold, but also cautioned that was not the West's true Achilles' heel. Grant Williams, who is portfolio manager of the Vulpes Precious Metals Fund, described the great danger for the West, and also discussed the massive demand coming out of the East from countries such as Russia and China. Today one of the most highly respected fund managers in Singapore warned King World News that the West is continuing to hemorrhage gold, but also cautioned that was not the West's true Achilles' heel. Grant Williams, who is portfolio manager of the Vulpes Precious Metals Fund, described the great danger for the West, and also discussed the massive demand coming out of the East from countries such as Russia and China.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Sentiment Reaching Key Level Posted: 23 Apr 2014 02:26 PM PDT This article is based on the latest premium edition of the Sentimentrader report (click here for a free trial). Market sentiment towards gold and silver are analyzed and put into perspective. In March, we showed the sentiment report for gold and silver. In Gold and Silver Sentiment Improving Significantly, we showed how gold sentiment had been improving but was due for a break. The key was not to pull back to a score of 40 or 50. From the latest sentiment report, it appears that sentiment towards both gold and silver has reached a normal pullback. However, it should not go lower from here.

From Sentimentrader:

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - El Camino Real Posted: 23 Apr 2014 01:40 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - El Camino Real Posted: 23 Apr 2014 01:40 PM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold's long backwardation makes Turk expect a good year for the monetary metal Posted: 23 Apr 2014 12:36 PM PDT 3:35p ET Wednesday, April 23, 2014 Dear Friend of GATA and Gold: The long and continuing backwardation in gold makes GoldMoney founder and GATA consultant James Turk think that the gold price suppression scheme will run out of metal soon and that this will be a good year for gold and silver. Turk's comments come in an interview with King World News: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/4/23_Tu... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Niocorp (NB.V or NIOBF) Is Soaring Over 230% in 2014 Posted: 23 Apr 2014 12:31 PM PDT On April 4th, 2014, I published a report on Niocorp (NB.V or NIOBF) with an interview with the CEO Mark Smith. Since that time the stock has soared parabolically. I have owned this stock for more than two years and just took some partial profits above $.50 in Canada. I will look to add on pullbacks to the 20 or 50 day moving averages. Niocorp is soaring and has reached a short term overbought condition. New investors should look for a healthy pullback or consolidation to the 20 or 50 day moving averages. Niocorp (NB.V or NIOBF) has soared over 230% this year while the S&P500 has been flat. As a long term investor back from 2012 I have taken some partial profits on this major move. Instead of chasing the stock higher wait for pullbacks as the long term uptrend may be just beginning. See my recent interview with CEO Mark Smith below. Mark built Molycorp (MCP) from hardly nothing to a billion dollar company…Niocorp (NB.V or NIOBF) may be his next major project he brings into production. I would like to warn you that the stock has soared on major volume. Try not to chase the stock higher and look instead for healthy pullbacks to support to add. The stock has nearly doubled in less than four weeks, so a healthy shakeout could be restorative at this point. Disclosure: Author Owns Niocorp and has recently taken partial profits above $.50. Niocorp is a website sponsor. ___________________________________________________________________________ Sign up for my free newsletter by clicking here… Sign up for my premium service to see new interviews and reports by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… Accredited investors looking for relevant news click here… Please forward this article to a friend. To send feedback or to contact me click here… Listen to other interviews with movers and shakers in the mining industry below or by clicking here… Listen to internet radio with goldstocktrades on BlogTalkRadio

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Turk - Western Central Banks To Run Out Of Gold This Year Posted: 23 Apr 2014 10:59 AM PDT  As global markets continue to see some wild trading, today James Turk told King World News that Western central banks are going to run out of gold this year. This is one of Turk's most important interviews because he is now predicting that the West will run out of gold to keep the price suppressed. Turk also followed up on his viral interview which covered the unprecedented and historic backwardation we are seeing in the gold market. As global markets continue to see some wild trading, today James Turk told King World News that Western central banks are going to run out of gold this year. This is one of Turk's most important interviews because he is now predicting that the West will run out of gold to keep the price suppressed. Turk also followed up on his viral interview which covered the unprecedented and historic backwardation we are seeing in the gold market.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||||||||||||||