saveyourassetsfirst3 |

- Chorus to lower gold curbs grow louder in India

- Barrick-Newmont tie-up could create new top flight Australia gold producer

- Endeavour Mining finds new gold reserves in Mali

- Long-Term Inflation: We're Better Off Than The Statistics Show

- Gold Resistnace is at 1295

- Gold price steadies above 2-1/2 month lows

- Who Says You Can’t Eat Gold? Man Swallows Twelve Gold Bars To Avoid Taxes

- This is how you could be funding China's military

- 5 Stocks, 25%-100% Upside, Thanks To The Fed

- Gold & Silver Trading Alert: Miners continue to outperform

- Gold & Silver Stocks Begin Oversold Bounce

- The current London Gold Pool will collapse as the first did, Grant Williams tells KWN

- India’s gold import likely to decline

- So central bank gold is being held in investment bank vaults

- Guest Post: The Golden Age Of Our Times Is The Age Of Gold

- The Secret Silver Stockpile, Part I

- Russia Ukraine geopolitical tensions not supporting Gold: Deutsche Bank

- Silver $50: Three Years After the "Shortage"

- Are You Prepared For the Coming Collapse?

- The Gold Bull Market is Dead! Long Live the Gold Bull ERA!

- Mortgage Standards Are Plunging – It’s Muppet Fleecing Time All Over Again

- The Empty Vaults of London- Fractional Bullion System to Fail Before End of 2014?

- Man Eats Twelve Gold Bars To Avoid Taxes

- Did the NSA Blackmail Obama? Whistle-blower Claims NSA Targeted Obama “Word for Word” Beginning in 2004

- SDBlowout! 2014 Silver Eagles $2.39 Over Spot, ANY QUANTITY!!

- Reuters notes that central banks trade gold every day but doesnt grasp what it means

- Man Eats Twelve Gold Bars To Avoid Taxes

- If you'd like to make some safe "interest" on your cash, take some OUT of the U.S. dollar and put it here instead

- Links 4/23/14

- Barclays sees China to import more Silver in 2014

- Geopolitical situation in Ukraine and its impact on gold

- Ilargi: What is the Earth Worth (6 Years Later)?

- Barclays Quits Commodities—But Retains Its Precious Metal Trading Division

- Retail Store Closures Soar In 2014: At Highest Pace Since Lehman Collapse

- Four King World News Blogs

- That Was Quick! Coins Commemorate Crimea-Russia 'Reunification'

- Goldman Sachs Upgrades Gold/Silver Stocks to Neutral; Barrick Upped to Buy

- Lawrence Williams: Anglo’s platinum policy – fact or fiction?

- Comex Gold hits 9 week low Silver up

- Gold Technical Analysis: 1275 waiting for the next market appears to wear your fingertips

- Gold: Support at 1285.50/1281.40, resistance at 1293.30/1300.90

- Technical Analysis – Gold back below 1300

- US Dollar Rebound at Risk, Crude Oil and Gold Continue to Sink

- Bullion and Energy Market Commentary

- Prepared for the Attack of the Short Sellers: Joe Reagor

- Ukraine crisis not positive for Gold Silver Support $19 13

- Mickey Mouse in Steamboat Willie on Silver Coin

- Craig Stephens This Week in China: Will China drop gold next?

- If $1m is really not enough for a happy retirement any more why buy an annuity?

- The Middle Class In Canada Is Now Doing Better Than The Middle Class In America

| Chorus to lower gold curbs grow louder in India Posted: 23 Apr 2014 04:30 PM PDT As India's commerce ministry calls for relaxation in gold import restrictions, gems and jewellery exports slump 9% to $39.5 billion in 2013-14 |

| Barrick-Newmont tie-up could create new top flight Australia gold producer Posted: 23 Apr 2014 03:01 PM PDT Australia could spawn a new mega gold producer if Barrick and Newmont spin off their Asia-Pacific assets, heating up competition with Newcrest Mining. |

| Endeavour Mining finds new gold reserves in Mali Posted: 23 Apr 2014 02:53 PM PDT The discovery could help slow a decline in Mali's gold production, which the International Monetary Fund forecasts will begin from 2015. |

| Long-Term Inflation: We're Better Off Than The Statistics Show Posted: 23 Apr 2014 12:40 PM PDT Have Americans made progress since the 1960s or 1970s? Some say not, but they are basing their conclusions on bad inflation data. A typical study looks at something like average earnings or median earnings over time, and adjusts the dollar earnings for inflation. The two possible problems are mistakes in calculating income, and mistakes in adjusting for inflation. The primary mistake in income is ignoring benefits. So when you see an analysis about the median wage rate, keep in mind that benefits have grown much faster than wages. Moreover, our income is best thought of as purchasing power: we don't want dollars per se; we want bread and shoes and movies and cars. Keep this in mind as we discuss inflation adjustment. Using the Consumer Price Index or any other common inflation measure is very challenging for long-term analysis. Let's begin with the first generation iPod. The government statisticians (at |

| Posted: 23 Apr 2014 12:40 PM PDT |

| Gold price steadies above 2-1/2 month lows Posted: 23 Apr 2014 12:10 PM PDT A softer tone to equities and the dollar helped arrest its slide above a key chart level, but demand from investors and retail buyers remained slack. |

| Who Says You Can’t Eat Gold? Man Swallows Twelve Gold Bars To Avoid Taxes Posted: 23 Apr 2014 12:00 PM PDT

MSM shills like Ezra Klein have long claimed that physical gold is worthless because you can’t eat it. Seems they were wrong. Submitted by Goldcore: Today's AM fix was USD 1,283.50, EUR 927.38 and GBP 763.76 per ounce. Yesterday's AM fix was USD 1,290.75, EUR 935.19 and GBP 767.34 per ounce. Gold fell $5.00 or [...] The post Who Says You Can’t Eat Gold? Man Swallows Twelve Gold Bars To Avoid Taxes appeared first on Silver Doctors. |

| This is how you could be funding China's military Posted: 23 Apr 2014 12:00 PM PDT China's military spending is ramping up…and they're looking to markets for funding. China is seeking to create its own military industrial complex. It's a similar idea to the U.S.'s defense contractors like Lockheed Martin or Northrop Grumman. In 1991, China witnessed America's superior defense technology in the Gulf War. Since then, China has made it a priority to achieve self-reliance in military innovation. China can't achieve the levels of advanced military technology from state funding alone. This is why China is folding weapons developers with high technology companies. The result is China's high technology companies take on new shareholders… the Chinese military. There's no denying China is a global economic superpower. Most global firms have either joint ventures in China or partnerships with China in their supply chain. It's now more likely your new technology or investment in Chinese companies could benefit China's new "shareholders."

More on China: This is China's secret "financial weapon." The launch date is closer than you think. China's new international gold standard: You can either profit from it, or be destroyed. Why China's reforms are good for the free market... but bad for the U.S. dollar |

| 5 Stocks, 25%-100% Upside, Thanks To The Fed Posted: 23 Apr 2014 11:57 AM PDT

The first year of the 20 year reign of Alan Greenspan as chair of The Federal Reserve is unforgettable. He and his team tinkered with monetary policies and by October we experienced the worst one day stock market plunge in history...a 20% shocker! His successor, Ben Bernanke, took the reins of The Fed in 2007, and by August of that year the first signs of the great financial meltdown began. During an inauspicious week that August leveraging requirements were tightened and the markets began to free fall. Bernanke and his associates back-pedaled on monetary policies and the investment markets began to teeter. As |

| Gold & Silver Trading Alert: Miners continue to outperform Posted: 23 Apr 2014 11:45 AM PDT No speculative positions are justified from the risk/reward perspective. |

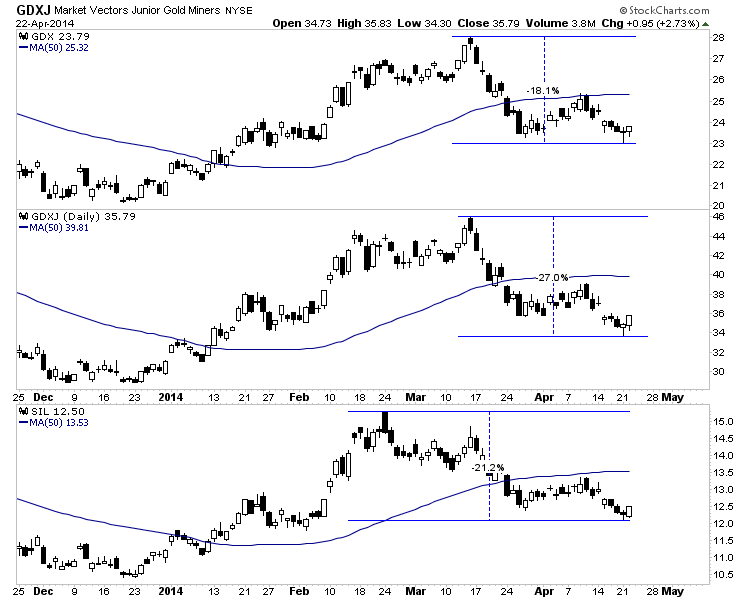

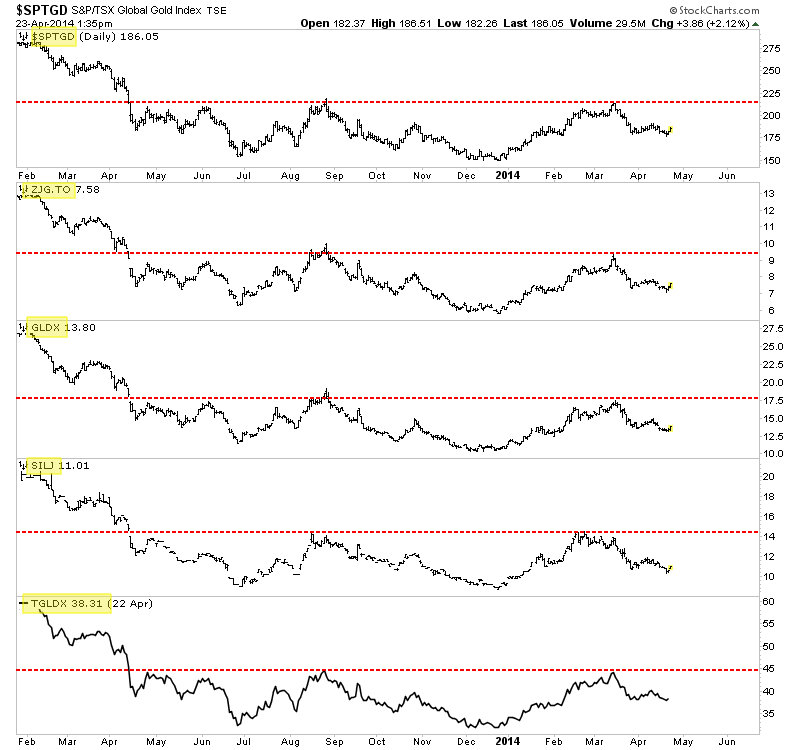

| Gold & Silver Stocks Begin Oversold Bounce Posted: 23 Apr 2014 11:30 AM PDT The bottoming process for gold and silver shares has been arduous as they've oscillated back and forth for almost a year. We noted a month ago that the failed breakout in March was strong evidence that an interim top was in place. Heading into this week it looked like the miners would fall further before finding support. However, over the past two days the sector clearly reversed its short-term course. For now this appears to be a rebound from an oversold bounce. We plot GDX, GDXJ and SIL in the chart below. As of Monday's low, the miners were very oversold in a small space of time. From recent highs GDX was down 18%, GDXJ 27% and SIL 21%. Thus the miners were ripe for a bounce. The bullish reversal on Monday coupled with confirmation on Tuesday signals that a rebound is underway. The initial upside targets are the open gaps from six days ago and the 50-day moving averages.

Is this low the right shoulder of a head and shoulders pattern and the low that springboards the sector to a sustained advance? It is really difficult to tell. My gut says no. Most of the precious metals sector failed to rally all the way back to the 2013 summer highs. We previously noted, this in addition to the strong weekly reversal was a sign of weakness. It seems unlikely the market would begin a major move higher only a single month later. Thus, we think more weakness is possible after this rally. However, we always should keep an open mind when the outlook is uncertain. The chart below plots the strongest indices which includes Canadian indices such as the TSX Global Gold Index and ZJG.to (the Canadian GDXJ) as well as GLDX (explorers), SILJ (silver juniors) and TGLDX (Tocqueville Gold fund). While a right shoulder could be forming it appears that more time and consolidation could be necessary. The time between the left shoulder and head is about five and a half months. Translate that forward for the right shoulder and June could be apt for the next low.

We should be vigilant and note the various possibilities. Inflation is starting to creep higher, by the preferred indicators of the market. Last week the Labor Department reported that wages increased at the fastest pace in more than four years. Both the CPI and PPI accelerated from February to March. The WSJ reported that big banks are ramping up lending. Meanwhile, commodity prices (CCI index) broke out of their multi-year downtrend and have held firm close to 12-month highs. The capital markets only care about the margin. Just a small sustained increase in inflation expectations could drive precious metals to confirm a bottom and the miners to begin a move that would break out of this long bottoming base. We are not saying this is imminent. We are thinking about what could be the driver of the future breakout in this sector. In the meantime, we sold all hedge positions yesterday and continue to actively research the sector for the absolute best opportunities. The next few months could be your last best chance to accumulate the companies poised to benefit from the coming revival in precious metals. If you'd be interested in learning about the companies poised to outperform, then we invite you to learn more about our service. Good Luck! Jordan Roy-Byrne, CMT Jordan @ TheDailyGold com The post Gold & Silver Stocks Begin Oversold Bounce appeared first on The Daily Gold. |

| The current London Gold Pool will collapse as the first did, Grant Williams tells KWN Posted: 23 Apr 2014 11:02 AM PDT GATA |

| India’s gold import likely to decline Posted: 23 Apr 2014 10:28 AM PDT While comparing with March, India's gold import is likely to decline in April and May as India has restricted money flow in order to raise curtain for the general elections. |

| So central bank gold is being held in investment bank vaults Posted: 23 Apr 2014 10:02 AM PDT GATA |

| Guest Post: The Golden Age Of Our Times Is The Age Of Gold Posted: 23 Apr 2014 10:00 AM PDT

Gold is the only money (gold – silver ratio must float) as everyone has known for millennia. Today most people have more or less forgotten this unique role, Western central bankers have tried for a century to put lipstick on a pig, so to speak. By deceiving us, they deceived themselves and began to believe [...] The post Guest Post: The Golden Age Of Our Times Is The Age Of Gold appeared first on Silver Doctors. |

| The Secret Silver Stockpile, Part I Posted: 23 Apr 2014 09:52 AM PDT SILVER PRICES hit $50 three years ago this week, writes Miguel Perez-Santalla at BullionVault. It was on April 25, 2011 that silver traded $49.80 per ounce in the New York spot market. That means silver traded $50 somewhere. There was a lot of business going on at that time, but after holding above $49 for the rest of that week, silver prices began to retreat. Fast. One of the factors that many traders were looking at was the Gold/Silver Ratio. Some believed that silver was much undervalued versus gold, and would recover its historical price parity of about 16 ounces of silver per ounce of gold. So even though silver hadn't been so expensive in terms of gold for 28 years, and even though Dollar prices had doubled inside 6 months, some traders felt the move wouldn't be complete unless silver traded above the $50 price level it had hit in 1980. The silver market environment of 2011's run to $50 per ounce was, however, very different to that of 1980. The principal driver back then was the continued inflation in consumer prices, plus the attempt by Nelson Bunker Hunt and his partners to corner the silver market – an attempt eventually brought to an end by efforts of the Federal Reserve Bank and certain members of the Commodities Exchange. Thirty years later the global economy again faced serious concerns. Not only was the US economy still reeling from the mortgage crisis and 2008 Lehman Brothers collapse. Now the Eurozone faced break-up as Greece, Ireland, Portugal, Italy and Spain all reported serious problems with their finances. In the United States confidence in the economy continued at record lows. The news out of Europe only heightened concerns of another financial crisis. Then the Fed announced another round of Quantitative Easing beginning in November 2010. Silver coin sales by the US Mint hit a monthly record, surpassed only by early 2011's surge in private-investor demand. Because this new QE meant printing more Dollars (or rather, their "electronic equivalent" as then Fed chair Ben Bernanke had said). So in the minds of many investors the Dollar was under the gun. Seeking safe-haven assets, likely to hold or grow their real value during a prolonged inflation, became of paramount importance. Internal to the silver market, meantime, there were reports that seemed to support a bullish long-term view on silver's industrial demand. The photovoltaic industry for one began consuming silver in much larger quantities than in previous years. Solar panel production starts with silver paste, and that requires a finer grade of silver than the main wholesale market trades. As the sector's growing demand sucked in these 0.9999 fine bars, it drew a lot of attention. Because while there was no shortage of the more common 0.999 bars, there was a shortage of immediate supply of this higher purity. And because of the growing demand, and the coincidental rise in the silver price, the story stuck. Then vice-president of sales at Heraeus Precious Metals Management in New York, I was asked to debunk this myth – the idea that the photo-voltaic industry was driving the silver price higher – for clients starting in January 2011. The bottom line was that solar-panel demand was only beginning to fill the major hole left in silver offtake by the ever-shrinking photographic industry, which had previously been the world's largest consumer of silver for many decades. Still, the physical supply anomaly between standard wholesale bars and the finer .9999 metal did give the impression that stockpiles were tight. Additionally, as that story snowballed, the incredible private-investor demand for small bars and coins in silver due to the economic global crisis caused immediately-available retail products to go to higher premiums than product for later delivery. That carried into the futures market in February 2011. Why? When demand exceeds expectations in physical goods, often it is difficult for the manufacturers to meet new customer orders quickly. If that makes supply become sporadic, it gives the impression that there is a shortage of raw material, when in reality there is only a shortage of product. But as silver prices headed for $50 per ounce 3 years ago, the idea of vanishing silver supplies – rather than just tight supply of small bars or coin – was frequently promoted by many retail distributors as part of their sales pitch. Backwardation is when the price of silver in a future month is cheaper than the "spot" or immediate month. Silver futures normally trade in the inverse position, because the seller of metal has to pay the costs to carry the inventory until settlement, and those costs are reflected in the price. So this early 2011 backwardation, suggesting a lack of immediately available silver, put another feather in the cap of silver bulls. Let's take a quick look however at the actual statistics of physical demand versus supply of silver. The photovoltaic industry did experience large growth from 2008 to 2011. In fact, in that time period the industry grew its silver demand by 338% according to Thomson Reuters GFMS. This of course was astronomical for the solar industry. But for silver demand more broadly, it barely registered as a fundamental market driver.  Looking at a chart of supply and demand for silver from 2003 to 2012 we can see that supply met demand annually. There was never any shortage. In fact, the silver market was in a significan surplus 6 times over that decade. The leading data providers in the silver market, Thomson Reuters GFMS, used to call this "implied investment". It was, as they said, "the residual" between the supply and demand data they collected. Meaning it was a balancing item, included so that supply and demand matched, whatever the shortfall or excess recorded on the visible numbers. GFMS are now calling a spade a spade, starting with their new Gold Survey 2014. Their new Silver Survey, due for launch next month through the Washington-based Silver Institute, will surely make the same change. And as you can see, if we view that old balancing item of "implied investment" as a market surplus or deficit each year, the excess of supplied metal over visible demand ran near 15% in each of 2010-2012. Yes, investment demand grew along with silver demand from the photovoltaic industry. But even the combination of the two did not exceed the growth in supply, which constantly increased because of the higher prices in the marketplace. Miners and scrap collectors were more than happy to increase supplies. So like the ancient Roman writer Phaedrus said, "Things are not always what they seem; the first appearance deceives many." And silver's seeming shortage in spring 2011 – which did so much to spur extra investment, especially from private households caught up by calls to "Buy now! Time is running out quickly!" – was in truth no such thing. In the same chart above, you will note that fabrication demand decreased in 2012. This is no surprise considering the volatility and the high price of silver in 2011. This caused what is called "thrifting" in the industrial sector. Thrifting is what manufacturers do when a commodity used to produce their product exceeds expected costs, or becomes too difficult to manage due to price volatility. To prevent losses due to wild market prices, the manufacturers begin to invest money in attempting to use the least amount possible of the offending commodity. In this case that offending commodity was silver. And the thrifting provoked by the high silver prices of early 2011...in good part provoked by that phantom shortage...led to lower industrial demand, as we'll see in Part 2. |

| Are You Prepared For the Coming Collapse? Posted: 23 Apr 2014 08:12 AM PDT Meltdown America – Are You Prepared For the Coming Collapse? |

| The Gold Bull Market is Dead! Long Live the Gold Bull ERA! Posted: 23 Apr 2014 08:11 AM PDT

Fundamentals create charts, and when those fundamentals change, the picture on the charts changes quickly. The precious metals world changed in 2013. A gold bull market in gold ended, and a gold bull era began. Submitted by Stewart Thomson: In many countries, inflation is beginning to creep higher. Please click here now. That's the Australia CPI (Consumer [...] The post The Gold Bull Market is Dead! Long Live the Gold Bull ERA! appeared first on Silver Doctors. |

| Mortgage Standards Are Plunging – It’s Muppet Fleecing Time All Over Again Posted: 23 Apr 2014 08:00 AM PDT

In February, I highlighted the fact that subprime loans were about to make a return in my piece: Subprime Mortgages are Back…This Time Marketed as "Second Chance Purchase Programs." In that article, I posited that with the "all cash" private equity shops and hedge funds no longer able to make good returns through buying new homes to [...] The post Mortgage Standards Are Plunging – It's Muppet Fleecing Time All Over Again appeared first on Silver Doctors. |

| The Empty Vaults of London- Fractional Bullion System to Fail Before End of 2014? Posted: 23 Apr 2014 07:00 AM PDT

With the price smashes of the past few weeks, the increasing desperation of the bullion banks seems palpable. I now believe that we are truly witnessing the end of the era. We’ve all been waiting for the day when the fractional reserve bullion banking system would fail. I believe now that that day is very [...] The post The Empty Vaults of London- Fractional Bullion System to Fail Before End of 2014? appeared first on Silver Doctors. |

| Man Eats Twelve Gold Bars To Avoid Taxes Posted: 23 Apr 2014 06:32 AM PDT gold.ie |

| Posted: 23 Apr 2014 06:01 AM PDT

In what is the most ironic of any of the NSA Prism-gate revelations to date, NSA Whistle-blower Russ Tice has revealed that the NSA began targeting President Obama in 2004 prior to his run for the Illinois Senate seat. Tice states that the NSA targeted Obama, his spouse, his entire family, and all of Obama’s [...] The post Did the NSA Blackmail Obama? Whistle-blower Claims NSA Targeted Obama “Word for Word” Beginning in 2004 appeared first on Silver Doctors. |

| SDBlowout! 2014 Silver Eagles $2.39 Over Spot, ANY QUANTITY!! Posted: 23 Apr 2014 06:00 AM PDT

*While supplies last! Click or call 800-294-8732 to place your order! The post SDBlowout! 2014 Silver Eagles $2.39 Over Spot, ANY QUANTITY!! appeared first on Silver Doctors. |

| Reuters notes that central banks trade gold every day but doesnt grasp what it means Posted: 23 Apr 2014 05:32 AM PDT GATA |

| Man Eats Twelve Gold Bars To Avoid Taxes Posted: 23 Apr 2014 04:36 AM PDT It is interesting to note that while thousands of Indians have engaged in gold smuggling in recent months, smuggling in the western world consists primarily of drugs. This says something about the values system of India and Eastern societies versus that of the western world. Today's AM fix was USD 1,283.50, EUR 927.38 and GBP 763.76 per ounce. Gold fell $5.00 or 0.39% yesterday to $1,285.00/oz. Silver climbed $0.03 or 0.15% yesterday to $19.45/oz. Spot gold bullion prices ticked fractionally higher today but bullion remained below the $1,300/oz psychological level and not far off yesterday's two-and-a-half-month lows. Spot gold stood at $1,283.75/1,284.55 per ounce, up just 20 cents from Tuesday, when prices briefly dipped below technical support to hit $1,276.35, the lowest since February 11. Silver bullion ticked 0.5% higher to $19.45/oz and the dollar, which touched a two-week high against the euro in the previous session, retreated somewhat to around 1.3845. Asian shares were mixed and European shares were lower after three days of gains.

Increasing geopolitical risks due to the very unstable situation in Ukraine is being ignored for now. There is also increasing geopolitical tension between China and Japan after China seized a Japanese trading vessel, resurrecting a World War II dispute. Business Man Found With 12 Gold Bars In Stomach In India CNN reports on the curious incident of the man with the golden belly in Delhi: New Delhi, India (CNN) – When a team of Indian surgeons opened up the stomach of a patient complaining of abdominal pain, they had no idea they’d extract a fortune. The patient, whose name was not released, was hiding 12 gold bars in his belly. He apparently smuggled them into India to evade import duty, police and doctors said Tuesday. Each bar weighed 33 grams, said C.S. Ramachandran, who conducted the surgery at a hospital in New Delhi on April 9. The 63-year-old patient, an Indian citizen, visited the hospital a day before with severe stomach pain and nausea. “He told us he had accidentally swallowed the cap of a plastic bottle,” Ramachandran said. Investigations could not confirm his claim. “We couldn’t (either) make out they were gold bars,” the doctor said. “But yes, X-Rays showed there was intestinal blockage, which required surgery.” On the day of surgery, stunned doctors pulled out the yellow metal from his stomach. “It was unexpected,” Ramachandran said. The hospital handed over the precious extraction to local police. The bars have since been sent to customs, which is conducting a probe, said Alok Kumar, a deputy commissioner of police. He didn’t disclose the name of the patient. Nor did he reveal which country he smuggled the gold from. The patient was discharged after the surgery, and is doing fine. CNN story read here. The gold bars are now in the care of Indian customs and the patient is under investigation for tax evasion, which certainly takes the shine off his import experiment. Fortunately for him, the export experiment under the surgeons knife was a success. The gold bars are valued not just by the owner but by the Indian government. In total they'd command an import duty of $17,000 dollars. It's little wonder some people would go to extreme lengths to try to avoid that. Yes, this is what the process of removing twelve gold bars from the stomach of a 63-year-old looks like. Each of the objects weighs 33 grams, which might not sound much. A warning here, some of what you'll see next, may upset your stomach.

It is not known if the man intended selling the gold bars on or keeping them as a store of value. It is interesting to note that while thousands of Indians have engaged in gold smuggling in recent months, smuggling in the western world consists primarily of drugs. This says something about the values system of India and Eastern societies versus that of the western world. This is the lengths that people in Asia will go to own gold and also to avoid punitive taxes on gold. Middle class and wealthy Indian and people all over Asia are choosing to escape financial repression by owning gold, including gold in vaults overseas and allocated gold storage in Singapore is attractive to them due to the lack of punitive taxes and the safety of Singapore as a jurisdiction. India remains the world’s second largest gold market after China and despite a punitive tax of 10% levied on gold imports in India, Indian investment in gold bars recorded an increase of 16% in 2013, according to the World Gold Council. Official demand surged as did unofficial demand in the form of a massive wave of gold smuggling. The World Gold Council estimates that a huge 200 tonnes of gold may have been smuggled into India in 2013 – in flower pots, stomachs and other orifices…on ships, trains, planes and automobiles. Gold is the metal most precious to the peoples of India, China and much of Asia. It is a symbol of wealth, power and beauty and the ultimate store of value. This is in contrast to people in the West, the majority of whom do not understand gold and it's value. This will change in the coming years. |

| Posted: 23 Apr 2014 04:00 AM PDT By Brett Eversole, analyst, True Wealth Systems: Your best opportunity for a safe "yield" today is taking your money OUT of the U.S. dollar... and putting into a safe currency the world has left for dead... You know the story... Cash in the bank in U.S. dollars pays you nothing. Or you can earn a measly 2.7% interest – if you're willing to lend money to the U.S. government for 10 years. But who wants to do that? In short, finding any kind of safe yield is nearly impossible. If you need yield, I've got you covered – but it's a non-traditional "yield" idea. It might not be the right trade for you... I'll let you be the judge. But this idea could safely return 10%-plus over the next year, in our zero-percent world. Importantly, we'll make this "yield" by moving money OUT of the U.S. dollar and into another HATED currency – the Canadian dollar. History shows we could earn 10%-plus over the next year in the Canadian dollar – safely – as things go back to normal. Let me explain... The "yield" we'll earn in the Canadian dollar isn't traditional... It isn't a cash payment hitting your bank account. Instead, we're betting the value of the Canadian dollar will head higher. History shows we can make this bet safely, with 10%-plus upside and just 2% downside risk. There are two major reasons I expect the Canadian dollar to move up in value. Let's look at them one by one... First, the Canadian dollar is a "commodity currency." This simply means that Canada's currency tends to fluctuate with commodity prices. It makes sense... Canada is in the top 10 of global oil exporters. The country also exports tens of billions of dollars per year in gold and coal. Naturally, Canada's economy – and currency – move alongside commodity prices. That simple relationship has worked throughout history. But it isn't working this year. Commodity prices are on the rise... and the Canadian dollar is falling. Take a look...

As you can see, the Canadian dollar tends to track commodity prices. But the relationship broke down in 2014... Commodities are up 11% and the Canadian dollar is down 3.5%. This has happened for a simple reason... Investors HATE the Canadian dollar. They want nothing to do with it right now. But this disinterest has reached an extreme. Everyone is already in the "short Canadian dollar" trade. And that gives us a great opportunity to make a contrarian bet. The chart below shows what I mean. It's the Canadian dollar versus the Commitment of Traders ("COT") report. The COT report shows what real futures traders are doing with their money. When traders all make the same bet, the opposite tends to happen. And right now, futures traders all expect the Canadian dollar drought to continue. Take a look...

The COT has only been this negative two other times in the past eight years. And you can see that the 2013 extreme didn't lead to a bounce in the value of the Canadian dollar. But remember, commodities were in the middle of a strong bear market back then. Today, commodity prices are moving higher... much like they were during the early 2007 extreme. Back then, a continued rise in commodity prices – combined with a negative extreme in the COT – led to a 27% increase in the Canadian dollar in less than a year. Now, I don't expect we'll see 27% gains today, but circumstances are similar to what they were in 2007. Commodities are on the rise, and investors hate the Canadian dollar. We need to take advantage of it! You can easily make this trade with the CurrencyShares Canadian Dollar Trust (FXC) – a simple ETF that tracks the Canadian dollar. FXC could rise to $100 or more from here, as things get back to normal. That gives us 10%-plus upside. And if we set a stop at last month's low – $88.41 – our downside is around 2%. That's a great risk/reward opportunity. And it gives us a chance to earn 10%-plus in non-traditional "yield" right now. If you're after a safe "yield," get money out of the U.S. dollar and into the Canadian dollar now.

More on the U.S. dollar: This is how Russia will replace the U.S. "petrodollar" We know China wants to displace the U.S. dollar. But now we know how. |

| Posted: 23 Apr 2014 03:50 AM PDT Apologies for the absence of my own posts. I even had to turn down BBC Radio (one of their biggest shows). This is a dreadful week for me because we have to get a filing in on the CalPERS litigation. Even though I have a very able team getting a handle on what they have and haven’t provided, the data is in lousy shape. For instance, numerous variant renderings of the same fund name means that even simple exercises like trying to tally the number of fund names are not simple. As a result, I’m having to do a lot of coordination and supervision to make sure the process and results are sound. I will hopefully be closer to normal programming by Friday AM. If you are in New York City, be sure to drop by our meetup this Friday, from 5:00 to 8:00 PM at Sláinte at 304 Bowery (map with nearby train stops here). Be there or be square! Keep Your Kitten Away From Your Laptop With This Handy Cat Desk Time. Wouldn’t work with my productivity-draining cat. He thinks my job is to pet him all the time. Women now doing lots of pointless bloke crap Daily Mash Law School Trustee’s Company Chills Critical Speech With Subpoena For Students’ Personal Emails TechDirt The Change Within: The Obstacles We Face Are Not Just External CommonDreams (Carol B) Cost of Drugs Depends on Where You Live Patient Safety Blog How Apple’s billion dollar sapphire bet will pay off Network World Activist urges 'fix' for Silicon Valley Financial Times Einhorn shorts the tech bubble MacroBusiness Sherpas Move to Shut Everest in Labor Fight New York Times Ethiopia: New railway project to link Addis Ababa with Djibouti Africa Research. Lambert: “Another Chinese train project.” China Manufacturing Output and New Orders Contract Once Again Michael Shedlock Tier 1 Chinese cities begin property discounting MacroBusiness Crunch time looms for Thailand's political crisis Financial Times 'Cheese diplomacy' fails: French experts snub North Korean officials Agence Frane-Presse (furzy mouse) Deflation Is About to Wallop Europe Bloomberg Greek Politics 4 Years After The Financial Crisis Real News Network Ukraine

Big Brother is Watching You Watch They Are Watching You, The National Security State and the U.S.-Mexican Border TomDispatch Making Sure NSA Reform Isn’t Caught in the Gears of the DC Machine EFF Phoniness, calculation, and palatable hypocrisy Dan Fejes Noam Chomsky helps explain the 'Fox Effect' in upcoming film 'Brainwashing of my Dad' Raw Story G.M. Seeks to Fend Off Lawsuits Over Switch New York Times Desperate Mission: Jeb Bush Asked Mexican Billionaire Carlos Slim To Save Lehman Brothers Forbes New York Ramps Up Ocwen Probe Wall Street Journal Peterson/CBO Beat for Austerity Goes On! Joe Firestone, New Economic Perspectives A post-crash manifesto to rebuild economics Financial Times The Future of the Captured State Simon Johnson, Project Syndicate A more equal society will not hinder growth Martin Wolf, Financial Times Sixteen for ’16 – Number 9: A Living Minimum Wage Truthout Moving in with parents becomes more common for the middle-aged Los Angeles Times (furzy mouse) If Larry Summers were worried about Thomas Piketty, he’d be awake Lambert The American Middle Class Is No Longer the World's Richest New York Times. Today’s must read. Antidote du jour (furzy mouse):See yesterday’s Links and Antidote du Jour here. |

| Barclays sees China to import more Silver in 2014 Posted: 23 Apr 2014 03:35 AM PDT According to Barclays, Chinese silver import data continue to support their expectation for an increase in industrial demand for silver this year, driven at least partly by modest global growth. |

| Geopolitical situation in Ukraine and its impact on gold Posted: 23 Apr 2014 03:00 AM PDT Finance and Eco. |

| Ilargi: What is the Earth Worth (6 Years Later)? Posted: 23 Apr 2014 02:40 AM PDT Yves here. This is a day-late Earth Day post, but the proper stewardship of this planet is a 365-day-a-year duty. Ilargi focuses on one of my pet issues, that too many of the remedies for climate change (and environmental protection generally) rely on the illusion of new technology eliminating or blunting lifestyle changes. But in most cases, this way out is illusory. It takes decades for major new technologies to be adopted widely, and we don’t have that kind of runway as far as greenhouse gases are concerned. Second, many green technology fixes merely squeeze the balloon in one place and shift the problem elsewhere. For instance, many of the solutions to water scarcity, like desalination, require energy and also produce residues that need to be disposed of. Thus the most important steps that can be taken now is conservation, particularly of energy. And we are so profligate that there’s a lot of low-hanging fruit if people and companies would make some changes. For instance:

Similarly, one of the biggest sources of wastage of potable water (one of our scarcest resources) is leaky municipal water systems. I saw a presentation years back that said it would be cost effective for city water systems to patch the leaks. But they can’t be bothered. By Raúl Ilargi Meijer, editor-in-chief of The Automatic Earth. Originally published at Automatic Earth Once more for everyone who's got even the lightest slightest shade of green in their thoughts and dreams and fingers, I'll try and address the issue of why going or being green is a futile undertaking as long as it isn't accompanied by a drive for a radical upheaval of the economic system we live in. Thinking we can be green – that is to say, achieve anything real when it comes to restoring our habitat to a healthy state – without that upheaval, is a delusion. And delusions, as we all know all too well, can be dangerous. It's not possible to "save the planet" while maintaining the economic system we currently have, because that system is based on and around perpetual growth. It's really as simple as that, and perhaps it's that very simplicity which fools people into thinking that can't be all there is to it. Switching to different fuels, alternative energy forms, is useless in such a system, because there will be a moment when the growth catches up with all preservation measures; it's not a winnable race. There will come a time when a choice between preservation and growth must be made, and the latter will always win (as long as the system prevails). It would be very helpful if the environmental movement catches up on the economics aspect, because it's not going anywhere right now. It's a feel-good ploy that comforts parts of our guilty minds but won't bring about what's needed to eradicate that guilt. If you're serious about preserving the world and restoring it to the state your ancestors found it in, it's going to take a lot more than different lightbulbs or fuels or yearly donations to a "good" cause. That, too, is very simple. You won't be able to keep living the way you do, and preserve the place you have in your society, your job, your home, your car. That is a heavy price to pay perhaps in your view, but there is no other way. Whether you make that choice is another story altogether. Just don't think you're going to come off easy. What makes it harder is the question whether we, as a species, are capable of pulling this off in the first place. Still, if we can't even get it right as individuals… But trying to answer what it would all take, in reality, is still preferable than telling ourselves, and each other, and your children, a bunch of fiction-based lies on a daily basis. At least, that's my take. Either we make an honest attempt or we say "after us the flood". Trying to find a snug and comfy but cheating place somewhere in between is an insult to ourselves, our ancestors and our progeny. I read a number of things this morning that, in typical fashion, all sort of touch on all this, as so many do all the time, but still fall short of the logical conclusion. For many, that's because perpetual growth is a hard to grasp concept, and an economic system based on it is even more difficult, but it's a terrible shame that it leads to all those well-meaning people producing what is in the end really little more than gibberish. Jeremy Brecher gets it partly right for the Nation, 'Jobs vs. the Environment': How to Counter This Divisive Big Lie While concrete, on-the-ground solutions are essential for knitting together labor and environmental concerns, our movements also need to evolve toward a common program and a common vision. We can present such initiatives as exemplars of a broad public agenda for creating full employment by converting to a climate-safe economy. There are historical precedents for such programs. Just as the New Deal in the Great Depression of the 1930s put millions of unemployed people to work doing the jobs America's communities needed, so today we need a "Green New Deal" to rebuild our energy, transportation, building, and other systems to drastically reduce the climate-destroying greenhouse gas pollution they pour into the air.

Such a shared program would end the "jobs versus environment" conflict because environmental protection would produce millions of new jobs and expansion of jobs would protect the environment. Such a program provides common ground on which both labor and environmentalists can stand. Such a program can also be the centerpiece of a larger shared vision of a new economy. After all, just expanding the kind of economy we have will just expand the problems of inequality and environmental catastrophe our current economy is already creating. The ultimate solution to the "jobs vs. environment" dilemma is to build a new economy where we all have secure livelihoods based on work that creates the kind of sustainable world we all need. … but the notion that expansion, any kind of expansion, would protect the environment is dangerous. Expansion is part of the other side's vocabulary. And using their vocabulary is not a good thing. George Monbiot quotes George Lakoff to make that exact point: Can You Put A Price On The Beauty Of The Natural World? George Lakoff, the cognitive linguist who has done so much to explain why progressive parties keep losing elections they should win, explained that attempts to monetise nature are a classic example of people trying to do the right thing without understanding frames: the mental structures that shape the way we perceive the world. As Lakoff points out, you cannot win an argument unless you expound your own values and re-frame the issue around them.

If you adopt the language and values of your opponents "you lose because you are reinforcing their frame". Costing nature tells us that it possesses no inherent value; that it is worthy of protection only when it performs services for us; that it is replaceable. You demoralise and alienate those who love the natural world while reinforcing the values of those who don't. And the rest of Monbiot's piece is sort of alright, but his from the rooftops support for more nuclear (in Britain) shows that he, like so many others, only gets part of the story.

This line of thinking should be applied not just to nature, but to all basic human necessities as well, food, water, shelter, and yes, even the energy that keeps us warm. I have often said that if you allow money into your political system, money will inevitably end up owning that system. And that is true for all resources too: in an economic perpetual growth model, money, if allowed to, will concentrate in just a few institutions and families and eventually own everything. Didn't Marx, too, say something like that a while back? And I could go on, but I already wrote it all several times, for instance on May 27 2008, and nothing has changed since. At least not for the good. And so here goes. I wrote this in reaction to an otherwise great article in Der Spiegel entitled: The Price of Survival: What Would It Cost to Save Nature? I still really like that Spiegel article, except that it's wrong on many counts. Here's from 6 years ago (and yes, I know there are things in it I have mentioned more recently as well):

I know it's the second time in a week that I quote Daly and Townsend, but that's because I hope everyone will try to understand what it means: that in the end, it's the use of energy, the amount, that counts, far more than what kind of it. Our present economic system depends for its survival on our using ever larger amounts, and we have the drive to do just that; it will take a very serious effort to resist that drive, and even then there's no guarantee the rest of mankind will do the same. But anything else, any well intentioned green initiative, is useless and futile and in the end pretty stupid, good only for some instant gratification for that part of the brain that seeks to "do good", a cheating way to feel less guilty about destroying everything around us, for telling our kids we love them and then leaving them only with smouldering remains, empty rivers and oceans, undrinkable water, infertile soil and sky high mountains of plastic, steel and aluminum. And I don't know that we can do better than that, but we can at least start by not fooling ourselves into some tempting illusionary comfort zone. Or we can just give up, that's an option too. |

| Barclays Quits Commodities—But Retains Its Precious Metal Trading Division Posted: 23 Apr 2014 02:20 AM PDT "It was another day of salami slicing in gold and platinum" ¤ Yesterday In Gold & Silver[Note: After three years without a break, I'll be taking some time off. There will be no Gold and Silver Daily next week. Ed] The gold price got sold down a few dollars in the first three or four hours of Far East trading on their Tuesday. The tiny rally that was born out of that around 1 p.m. Hong Kong time got met by the usual not-for-profit sellers 10 minutes after the Comex open---and by the time "da boyz" were done at 11:35 a.m. EDT in New York, they had sold gold down about 14 bucks from its 8:30 a.m. high. The subsequent rally from that point, such as it was, met with a willing seller the moment that it really started to gather strength shortly before 4 p.m. in electronic trading---and that was that. The CME Group recorded the high and low prices as $1,293.10 and $1,275.80 in the June contract. Gold finished the Tuesday session in New York at $12,83.70 spot, down $6.60 from Monday's close. Volume, net of April and May, was pretty decent at 131,000 contracts---and a lot of that came as a result of the engineered price decline that began at 8:30 a.m. EDT, as "da boyz" took another slice off the golden salami. The silver price action was very similar to gold's price action, but quite a bit more subdued---and the major inflection points as far as price was concerned, also occurred at the same times. Silver would have closed higher on the day, except the same seller of last resort in gold that showed up at 4 p.m. EDT, also showed up in the Comex silver market at the same time as well. And, for the second day in a row, no new lows were set. The high and low ticks, such as they were, were reported as $19.53 and $19.285 in the May contract. Silver closed in New York yesterday at $19.385 spot, down 5.5 cents on the day. Gross volume jumped up to 73,300 contracts, but once the huge amount of May roll-overs were deducted, net volume fell all the way down to about 22,500 contracts. The general shape of the platinum chart was similar in virtually every way to the gold and silver charts posted above. But the timing of the high and lows ticks was slightly different. Platinum's engineered price decline also set a a new low price tick for this move down. Palladium attempted to rally starting around 2 p.m. Hong Kong time, but the tiny gain got taken away during the London lunch hour. After that it didn't do much. Here are the charts. The dollar index closed late on Monday afternoon in New York at 79.95---and then did nothing until shortly after 2 p.m. Hong Kong time on their Tuesday afternoon. From there it chopped lower, hitting its 79.80 low tick at the 8:20 a.m. EDT Comex open. From there it rallied back to just above unchanged on the day by around 10:35 a.m., before sliding a bit lower into the close. The index finished the Tuesday session around 79.90, which was basically unchanged. The rallies in all four precious metals began the moment that the dollar index headed south in Hong Kong trading, but all four got scuppered at different times than the dollar's absolute low and, of course gold, silver and palladium's engineered price declines extended long after the dollar index had rallied back to unchanged. As a matter of fact, the index had rallied back to unchanged before prices really cratered, so the sell-offs had zero to do with what was happening in the currency markets. And, for the second day in a row, the scale of the chart makes the index movements look far more impressive than they actually were. Despite the shenanigans of JPMorgan et al, the gold stocks chopped around the unchanged mark until the low was set around 10:45 a.m. in New York. Then, despite the smack-down in the metal itself, the stocks moved solidly higher---and closed on their high tick of the day, which was probably the result of that tiny rally in gold going into the 4 p.m. close of the equity markets. The HUI finished up 1.49%. Everything that the HUI lost on Monday and Friday, plus a bit more, was recovered in Tuesday's rally. The silver equities also finished in the black, but Nick Laird's Intraday Silver Sentiment Index only finished up 1.36%---which was everything it lost on Monday. The CME Daily Delivery Report showed that 51 gold and 1 lonely silver contract were posted for delivery within the Comex-approved depositories on Thursday. Once again the biggest short/issuer was Jefferies and, once again, JPMorgan and Canada's Scotiabank [the largest silver shorts on the Comex] were the largest stoppers. The link to yesterday's Issuers and Stoppers Report is here. There were no reported changes in GLD yesterday---and as of 9:33 p.m. EDT yesterday evening, there were no reported changes in SLV, either. The U.S. Mint had another sales report yesterday. They sold 2,500 troy ounces of gold eagles---500 one-ounce 24K gold buffaloes---399,000 silver eagles----and 100 platinum eagles. Over at the Comex-approved depositories on Monday, they reported receiving a decent chunk of gold, as 89,248 troy ounces were accepted. It was divided up between Canada's Scotiabank and HSBC USA. The link to that activity is here. And, for the second day in a row, there wasn't a lot of silver activity. Nothing was reported received---and 27,003 troy ounces were reported shipped out. The link to that 'action' is here. Here's a chart that reader Brad Robertson sent our way yesterday. It's the 2-minute price tick chart [The time scale is Mountain Daylight Time---BST-7]. It shows the final smack-down in gold just after 11:30 a.m. EDT, when the final slice of the golden salami took place in Comex trading yesterday. Here are two more charts courtesy of Nick Laird over at sharelynx.com that he sent my way a couple of days ago, but had to wait until today because of space issues. They look colourful---which they are---and complicated---which they're not. This is the data for both gold and silver---and it comes out of the weekly Disaggregated Commitment of Traders Report. It's precisely same data as what's in the legacy COT Report that I talk about every week, but it just reported in different categories---in these cases, four. The first chart is the price of the metal itself. The last chart in the sequence are the spread trades in each category. They are trades that are market neutral because they represent a pair of trades that are long one month and short another, or vice versa. The middle chart is the all-important net figure---total open interest minus spread trades. It's the overall shape of the 'net figure' over time, versus the price of the metal itself in the top chart that is of interest---especially when you compare what's been going on with gold and silver prices lately. The internal dynamics of one vs. the other, especially over the last few years---and few months---is striking. As Ted Butler said to his paying subscribers on Saturday---as the net open interest in gold is approaching historic lows---the net open interest in silver is blowing out almost to new highs, despite the fact that both gold and silver are either at, or within spitting distance of their low prices as this current rendition of the engineered price declines unfold. And here is silver's chart. When the next rally in both metals begins, it will be interesting to see what happens to the net open interest in both metals. This blow-out to the upside in silver's net open interest can't go on forever. And as Ted also mentioned, the Big 8 shorts in silver are holding their biggest short position in three and a half years---and with silver at its lows for this move down, will they continue to add to their already grotesque short positions on the next rally? Stay tuned? I have the usual number of stories for a mid-week column---and I hope you find some in here that you like. ¤ Critical ReadsSocial Security, Treasury target taxpayers for their parents' decades-old debtsA few weeks ago, with no notice, the U.S. government intercepted Mary Grice’s tax refunds from both the IRS and the state of Maryland. Grice had no idea that Uncle Sam had seized her money until some days later, when she got a letter saying that her refund had gone to satisfy an old debt to the government — a very old debt. When Grice was 4, back in 1960, her father died, leaving her mother with five children to raise. Until the kids turned 18, Sadie Grice got survivor benefits from Social Security to help feed and clothe them. Now, Social Security claims it overpaid someone in the Grice family — it’s not sure who — in 1977. After 37 years of silence, four years after Sadie Grice died, the government is coming after her daughter. Why the feds chose to take Mary’s money, rather than her surviving siblings’, is a mystery. Retail Store Closures Soar In 2014: At Highest Pace Since Lehman CollapseWhat a better way to celebrate the rigged markets that are telegraphing a "durable" recovery, than with a Credit Suisse report showing, beyond a reasonable doubt, that when it comes to traditional bricks and mortar retailers, who have now closed more stores, or over 2,400 units, so far in 2014 and well double the total amount of storefront closures in 2013, this year has been the worst year for conventional discretionary spending since the start of the great financial crisis! While distressed retailers (e.g. Radio Shack) and bankruptcies, which have reached a three-year peak year-to-date, make up 63% of the unit closures in 2014, they comprise only 34% of the total square footage closed. On a square footage basis, broadline retailers contributed over 28% of closures, with M, DDS, JCP, TGT, and Sam's Club participating in right-sizing their store bases. Office supply stores have been equally significant contributors to the rationalization process as they grapple with the effects of broader distribution and deeper online penetration. We expect this trend to continue as Office Depot evaluates its real estate in the wake of its merger with OfficeMax. Even dollar stores and drug stores, which combined have consistently built out hundreds of stores per year, are beginning to reel back on expansion, with Family Dollar and Walgreens both planning to shutter underperforming stores. This Zero Hedge piece from Monday, was something I found in yesterday's edition of the King Report. Existing Home Sales Hit 1-1/2 Year Low in March U.S. home resales fell to their lowest level in more than 1-1/2 years in March, but there were signs a recent downward trend that has plagued the housing market may be drawing to an end. Hussman: The Fed Has Built a 2-Legged Stool The Federal Reserve is resting the fate of the U.S. economy on a two-legged stool by focusing only on jobs and inflation, while financial excesses are left unchecked, according to Fed perma-critic and mutual fund manager John Hussman. IRS workers who didn't pay taxes got bonusesThe Internal Revenue Service handed out $2.8 million in bonuses to employees with disciplinary issues — including more than $1 million to employees who didn't pay their federal taxes, a watchdog report says. The report by the Treasury Inspector General for Tax Administration said 1,146 IRS employees received bonuses within a year of substantiated federal tax compliance problems. Non-payment of taxes by federal employees is a government-wide problem. The IRS says 311,536 federal employees were tax delinquents in 2011, owing a total of $3.5 billion. I came close to deleting this news item after reading the first few paragraphs, but I'm glad I read the whole thing, as it's definitely worth your while. This short story was posted on the usatoday.com Internet site early yesterday evening EDT---and I thank Harry Grant for sliding it into my in-box in the wee hours of this morning. Six Ukraine/Russia/Crimea-related stories 1. As Biden lands, Russia warns Kiev to back off: The Washington Post 2. U.S. responsible for Ukrainian crisis after investing $5bn in regime change – Russia’s envoy to U.N.: Russia Today 3. Firefighters vs. arsonists: U.S. confirms $5bn spent on 'Ukraine democracy': Russia Today op-ed 4. Ukraine must urgently implement Geneva agreement - Lavrov: The Voice of Russia 5. U.S. sends 600 troops to Eastern Europe, warship USS Taylor enters Black Sea: Russia Today 6. Ukraine orders military action in the east: Al Jazeera What Germany Left Behind: A Feeling of Abandonment in North AfghanistanFor 10 years, Germany was responsible for the province of Kunduz as part of its role in the International Security Assistance Force (ISAF). It was the first real war the Bundeswehr, as Germany's military is known, participated in, and Berlin's aims were lofty indeed. German development experts were to help extend rights to women, democracy was to be fostered and the economy was to grow significantly. Billions of euros were made available -- and the blood of German soldiers was spilled. Kunduz was a place of great sacrifice. Until Oct. 6, 2013. On that day, Germany handed over the camp to Afghanistan. "They ran away," croaks the deputy police chief for the Kunduz province in his office and gestures dismissively. "They simply ran away. It was too soon." "It was too soon. It was like an escape." One can hear almost exactly the same thing from the mouths of German soldiers, some of whom even compare the Bundeswehr's departure with that of the Americans from Saigon at the end of the Vietnam War. "If there is one thing the Bundeswehr is really good at, it's retreating," is a sentiment that can often be heard in the government quarter in Berlin these days. This very interesting, but not surprising, 2-page essay appeared on the German website spiegel.de< |

| Retail Store Closures Soar In 2014: At Highest Pace Since Lehman Collapse Posted: 23 Apr 2014 02:20 AM PDT What a better way to celebrate the rigged markets that are telegraphing a "durable" recovery, than with a Credit Suisse report showing, beyond a reasonable doubt, that when it comes to traditional bricks and mortar retailers, who have now closed more stores, or over 2,400 units, so far in 2014 and well double the total amount of storefront closures in 2013, this year has been the worst year for conventional discretionary spending since the start of the great financial crisis! While distressed retailers (e.g. Radio Shack) and bankruptcies, which have reached a three-year peak year-to-date, make up 63% of the unit closures in 2014, they comprise only 34% of the total square footage closed. On a square footage basis, broadline retailers contributed over 28% of closures, with M, DDS, JCP, TGT, and Sam's Club participating in right-sizing their store bases. Office supply stores have been equally significant contributors to the rationalization process as they grapple with the effects of broader distribution and deeper online penetration. We expect this trend to continue as Office Depot evaluates its real estate in the wake of its merger with OfficeMax. Even dollar stores and drug stores, which combined have consistently built out hundreds of stores per year, are beginning to reel back on expansion, with Family Dollar and Walgreens both planning to shutter underperforming stores. This Zero Hedge piece from Monday, was something I found in yesterday's edition of the King Report. |

| Posted: 23 Apr 2014 02:20 AM PDT 1. SentimenTrader: "Presenting the Massive Tech Bubble in One Astounding Chart" 2. Dr. Stephen Leeb: "Axis of Power" as Countries Move to Link Currencies to Gold" 3. Jeffrey Saut: "Massive Volcanic Eruptions Wreaking Havoc On The World" 4. Grant Williams: "Collapse of Western Ponzi Scheme to Send Gold Skyrocketing" |

| That Was Quick! Coins Commemorate Crimea-Russia 'Reunification' Posted: 23 Apr 2014 02:20 AM PDT A Russian factory has produced 25 palm-sized silver coins bearing President Vladimir Putin's face to commemorate Crimea's "reunification" with Russia, state media reported on Tuesday. “Crimea's reunification with Russia was a historic event which we decided to embody in a souvenir collection of coins made of 925 grade silver,” said Vladimir Vasyukhinsaid, the director of the factory in Yekaterinburg, Russia, according to ITAR-TASS. Each coin weighs about 2.2 lbs. [1 kilogram] and features Putin's portrait on one side and a map of Crimea on the other. The makers had not decided how much to charge for each, the news agency reported. This news item showed up on the nbcnews.com Internet site early yesterday morning EDT---and it's the final offering of the day from Elliot Simon, for which I thank him. |

| Goldman Sachs Upgrades Gold/Silver Stocks to Neutral; Barrick Upped to Buy Posted: 23 Apr 2014 02:20 AM PDT Goldman Sachs is becoming more constructive on gold and silver equities and as a results is raising their coverage view to Neutral. Analyst Andrew Quail said, "After underperforming the SPX by 21% since September 2013, gold and silver equities now appear more fairly valued, offering an average 7% total upside. We raise our coverage view to Neutral as we believe (1) more responsible capital allocation, (2) successful cost cutting initiatives, (3) a refocus on maximizing free cash flow, and (4) sound strategic portfolio optimization should improve the positioning of our companies offsetting our below-consensus outlook for commodity prices (we forecast $1,200/oz for gold from 2015 onwards)." The firm is upgrading Barrick Gold Corp. to Buy, while initiating coverage on five others. Please excuse me for asking, but isn't this the same Wall Street investment firm that said that gold at $1,050 was a slam-dunk this year? This gold-related new item showed up on the streetinsider.com Internet site early yesterday morning EDT---and I thank Casey Research's own John Grandits for bringing it to my attention---and now to yours. |

| Lawrence Williams: Anglo’s platinum policy – fact or fiction? Posted: 23 Apr 2014 02:20 AM PDT Almost 20 years ago, Anglo American sacrificed Johannesburg Consolidated Investment (JCI) on the altar of emerging black investment in South African mining and in so doing took over the then around 50% owned JCI’s best assets. Of these perhaps the most significant were the company’s platinum mines around Rustenburg and its Union and Amandelbult operations, leaving Anglo American Platinum as comfortably the world’s largest platinum miner. Now, according to reports circulating in South Africa and in London, it appears to be looking at disposing of its deep Rustenburg platinum mining operations which it sees as a problematic and vulnerable business. As we noted in recent articles the recent takeover of union negotiating rights on the platinum mines by the fledgling, highly aggressive, AMCU, and the subsequent now 13 week-long strike which has closed the Rustenburg mining operations, appears, according to media reports, to have focused Anglo’s mind on how to rid itself of this troublesome part of its operations, which requires a significantly higher platinum price to make it decently profitable. As Lawrie has pointed out recently in another article on platinum mining, he's more than aware of the fact that platinum and palladium prices are just as managed as the prices of gold and silver. This news item was posted on the mineweb.com Internet site yesterday. |

| Comex Gold hits 9 week low Silver up Posted: 23 Apr 2014 02:01 AM PDT The most active June gold contract on the Comex division of the New York Mercantile Exchange was last traded down $6.90 at $1,281.60 an ounce. May Comex silver last traded slightly up $0.034 at $19.38 an ounce. |

| Gold Technical Analysis: 1275 waiting for the next market appears to wear your fingertips Posted: 23 Apr 2014 01:50 AM PDT wantinews |

| Gold: Support at 1285.50/1281.40, resistance at 1293.30/1300.90 Posted: 23 Apr 2014 01:50 AM PDT fxstreet |

| Technical Analysis – Gold back below 1300 Posted: 23 Apr 2014 01:45 AM PDT xm |

| US Dollar Rebound at Risk, Crude Oil and Gold Continue to Sink Posted: 23 Apr 2014 01:45 AM PDT dailyfx |

| Bullion and Energy Market Commentary Posted: 23 Apr 2014 01:45 AM PDT google |

| Prepared for the Attack of the Short Sellers: Joe Reagor Posted: 23 Apr 2014 01:00 AM PDT |

| Ukraine crisis not positive for Gold Silver Support $19 13 Posted: 22 Apr 2014 11:35 PM PDT commodityonline |

| Mickey Mouse in Steamboat Willie on Silver Coin Posted: 22 Apr 2014 09:40 PM PDT silvercoinstoday |

| Craig Stephens This Week in China: Will China drop gold next? Posted: 22 Apr 2014 08:05 PM PDT marketwatch |

| If $1m is really not enough for a happy retirement any more why buy an annuity? Posted: 22 Apr 2014 08:01 PM PDT Of course it depends very much on what makes you happy. But for many people even a retirement pot of $1 million may now not be enough to keep them in the style to which they have become accustomed. This is the flipside of the money printing and low interest rate regime of the past five years. Invest $1 million today in a pension plan and $40-50,000 is going to be your annual income, and not $70-80,000 as used to be the case. Factor in the inflation of housing and medical costs and its clear pensioners have really lost out. Stay on top That’s the position if you retire today and take an annuity. Why do that? Would it not be simpler to sit on your pot of gold and spend it gradually in the hope that times will change for investors. They often do, spectacularly and without much warning. The expert advisers who put you into an annuity too early will still get their fees. Indeed, that might be why they are selling you an annuity rather than advising you to do nothing. Doing nothing is the perogative of the rich. Only the poor let money dictate to them. If you have $1 million then a $50,000 annual drawdown is going to last you 20 years. How long will it be before markets deliver higher returns for investors? It might be less than five years and yet you are being asked to invest for two decades at today’s all-time lows. That’s simply bad advice. $1 million is still rather a lot of money unless you consider current annuties to be the new long-term normal. That they are so far away from the previous long-term averages ought to be a red light warning. You should instead manage your own money prudently and that will help to make it last longer anyway. $1m fortune A recent Bloomberg poll showed smaller investors currently have a preference for real estate and gold, with equities a distant third. Diversify for protection and avoid bonds which are suffering from the same disease as your pension pot right now. Times change. Investing now for low income sounds like a losing propostion. The financial sector robs its customers all their lives – consider how much interest you pay on mortgages, credit cards and other loans – why allow them to do it in your retirement? If you’ve been prudent enough to amass $1 million in your lifetime then let managing it be a small job for you in your retirement and cut out the middleman. You should also sign-up for our monthly investment newsletter for our best actionable investment ideas that we can’t give away for free here (click here). |

| The Middle Class In Canada Is Now Doing Better Than The Middle Class In America Posted: 22 Apr 2014 07:04 PM PDT

In recent years, I have been up to Canada frequently, and I am always amazed at how much nicer things are up there. The stores and streets are cleaner, the people are more polite and it seems like almost everyone that wants to work has a job. But despite knowing all this, I was still surprised when the New York Times reported this week that middle class incomes in Canada have now surpassed middle class incomes in the United States...

And things are particularly dire for those in the U.S. on the low end of the scale...

Even while our politicians and the media continue to proclaim that everything is "just fine", the U.S. middle class continues to slide toward oblivion. The biggest reason for this is the lack of middle class jobs. Millions of good jobs have been shipped overseas, and millions of other good jobs have been replaced by technology. The value of our labor is declining with each passing day, and this has forced millions upon millions of very qualified Americans to take whatever they can get. As NBC News recently noted, this is a big reason why the temp industry has been booming...

It has been estimated that one out of every ten jobs is now filled by a temp agency. I have worked for temp agencies myself in the past. Big companies like the idea of having "disposable workers", and this is a trend that is likely to only grow in the years ahead. But temp jobs and part-time jobs don't pay as well as normal jobs. And those kinds of jobs generally cannot support middle class families. At this point, nine out of the top ten occupations in the United States pay an average wage of less than $35,000 a year. That is absolutely stunning. These days most families are barely scraping by, and they don't have much extra money to go shopping with. This is a big reason for the "retail apocalypse" that we are now witnessing. This week we learned that retail stores in the United States are closing at the fastest pace that we have seen since the collapse of Lehman Brothers. But you won't hear much about that on the mainstream news. You can find lots of "space available" signs and empty buildings in formerly middle class neighborhoods all over the country. For example, one of my readers recently shot the following YouTube video in Scottsdale, Arizona. As you can see, empty commercial buildings are all over the place... As the middle class shrinks, more families are being forced to take in family members that can't find decent work. I have written previously about the huge rise in the number of young adults that are moving back in with their parents. But this is not just happening to young people. As the Los Angeles Times recently detailed, the number of Americans 50 and older that are moving in with their parents has absolutely soared in recent years...

The U.S. economy is slowly but steadily falling apart, and more people fall out of the middle class every single day. A recent Gallup survey found that 14 percent of all Americans would experience "significant financial hardship" within one week of a job loss. An additional 29 percent of all Americans would experience "significant financial hardship" within one month of a job loss. That means that 43 percent of the entire country is living right on the edge. It is no wonder why only about 30 percent of all Americans believe that we are moving in the right direction as a nation. Most people know deep down that something is seriously wrong. But most people can't explain exactly what that is or how to fix it. Meanwhile, the politicians and the media keep telling us that if we just keep doing the same old things that everything will work out okay somehow. The blind are leading the blind, and we are rapidly marching toward disaster. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment