saveyourassetsfirst3 |

- Chinese gangs implicated in India gold smuggling

- Barrick's Thornton emerging as gold dealmaker

- Gold falls for 4th day as investors exit bullion funds

- Anglo Asian increases Azerbaijan gold output by 32%

- Commitments Of Traders: Gold, Silver, CRB And T-Notes

- That was fast: Reports say last week's Ukraine accord is already "near collapse"

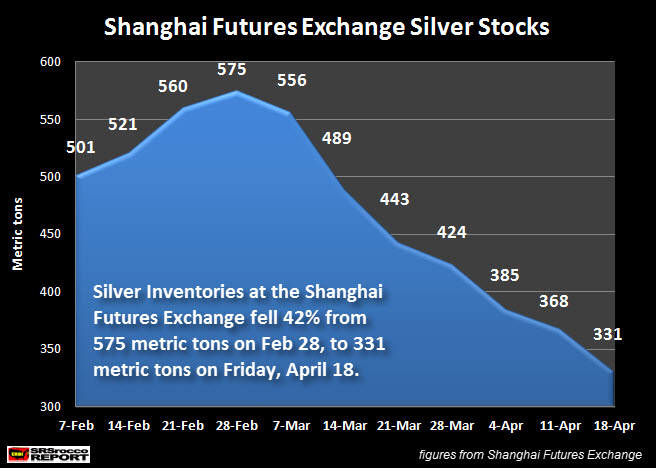

- 41 Metric Tons of Silver Withdrawn From The Shanghai Futures Exchange

- Gold Fibonacci Confluence Rests at 1260

- Bombshell Chinese Revelations: Chinese Banks And 100,000 ‘Outlets’ Selling Gold to Public!

- Harry Reid Is The Real Domestic Terrorist

- Goldman Sachs Saves Gold from Falling Apart

- Two More Victims Of The Retail Apocalypse

- Uncertain regulatory environment hurts gold loans in India

- World’s two largest gold miners in talks to merge

- Gold trades near 2-week low

- Gold recovers from early losses

- Gold & Silver: Stay the Course!

- India's current gold import policy will be short-term

- Greg Mannarino: U.S. Dollar is Going to Die!

- Gold setting up for testing the medium term support points

- The Political Poison of Vested Interests

- A top trader's must-see update on silver

- GOLD analysis for April 22, 2014

- US Dollar: Is the Rebound a Correction or a Bullish Trend Change?

- Dubai Financial Market up 51% this year and back to pre-financial crisis level

- India raises import tariff value of Gold to $431 per 10 grams

- SDBlowout! 2014 Silver Eagles $2.39 Over Spot, ANY QUANTITY!!

- Gold Silver ETFs witness strong investor demand in Feb March

- Chinese Banks And 100,000 ‘Outlets’ Selling Gold - Demand To Surge Another 25%

- What you need to know about oil and gas dividends, Part II

- Gartman sees Gold to shoot up during next one year

- China Allows Gold Imports Via Beijing Amid Reserves Buying Talk

- Doug Noland: Automatic Stabilizer?

- Russia, U.S. Trade Blame as Ukraine Accord Nears Collapse

- Nine King World News Blogs/Audio Interviews

- Sprott's Thoughts: Why Rick Rule Says ‘Anti-gold Investors Will be Destroyed’

- The New York Sun: Piketty's Gold?

- Barrick Proposal to Acquire Newmont Hits Roadblock, Sources Say

- Press’ anti-gold scare tactics largely ineffective

- Sprott cites GATA consultant on Chinese demand, notes paper bombing of gold

- China allows gold imports via Beijing, sources say, amid reserves buying talk

- Links 4/22/14

- A silver reversal is on the cards

- Gold Price Analysis- April 22, 2014

- Support Still Not Broken in Silver and Gold

- Metals Pack Fundamental Analysis April 22, 2014 Forecast – Silver

- Gold Bears Press For Test Of 100-Day Moving Average

- UPDATE 1-Japans Orix to buy gold recycler ...

- Bullion and Energy Market Commentary

- CHARTS : Gold Cant Glitter

| Chinese gangs implicated in India gold smuggling Posted: 22 Apr 2014 05:49 PM PDT New evidence suggests the involvement of Chinese mafia in smuggling gold into India. | ||||||||||||||||||||||||||||||

| Barrick's Thornton emerging as gold dealmaker Posted: 22 Apr 2014 04:05 PM PDT Though talks of a Barrick-Newmont tie-up reportedly fell apart, John Thornton, Barrick's Chairman, clearly show an appetite for M&A. | ||||||||||||||||||||||||||||||

| Gold falls for 4th day as investors exit bullion funds Posted: 22 Apr 2014 04:01 PM PDT The metal extended losses for a fourth straight day on Tuesday as outflows from physical gold funds pointed to weak investor appetite. | ||||||||||||||||||||||||||||||

| Anglo Asian increases Azerbaijan gold output by 32% Posted: 22 Apr 2014 03:59 PM PDT London-listed Anglo Asian raised production at its Gedabek mine to 11,312 gold ounces in the January-March 2014 period. | ||||||||||||||||||||||||||||||

| Commitments Of Traders: Gold, Silver, CRB And T-Notes Posted: 22 Apr 2014 01:32 PM PDT Excerpted from this week's edition of NFTRH (#287): (click to enlarge) The above CoT graph clearly shows that gold has declined as the structure improved (red arrows). It then bottoms with the circled extremes and rises in conjunction with a degrading structure (green arrows). Gold is still on its journey toward bottoming. (click to enlarge) Silver did much the same thing into last summer's bottom and its convoluted CoT structure since then has gone hand in hand with its failure to get bullish with the rest of the sector early in 2014. Silver like gold, is still on its journey to whatever bottom lay ahead. Were I to affix my tin foil hat I'd say 'sure, they're manipulating silver'. But I'd also note there is nothing we can do about it aside from watching the signals each week, not getting hurt by it and eventually capitalizing upon it. | ||||||||||||||||||||||||||||||

| That was fast: Reports say last week's Ukraine accord is already "near collapse" Posted: 22 Apr 2014 01:10 PM PDT From Bloomberg: An agreement to ease tensions in Ukraine showed signs of crumbling as the U.S. and Russia traded blame as Vice President Joe Biden meets government leaders in the Black Sea country. U.S. Secretary of State John Kerry warned Russian Foreign Minister Sergei Lavrov yesterday "there will be consequences" if Russia fails to act "over the next pivotal days" to restrain pro-Russian militants in eastern Ukraine, spokeswoman Jen Psaki said in Washington. In Moscow, Lavrov called on the U.S. to hold Ukraine's government accountable for curbing what Russia portrays as right-wing militias. Pro-Russian forces who seized buildings in at least 10 eastern Ukrainian cities have said they are not bound by the deal reached by Ukraine, the European Union, the U.S. and Russia in Geneva on April 17. The government in Kiev accuses Russian President Vladimir Putin of stirring the unrest and exploiting the situation to prepare a potential invasion. "As of today, the Russian side has shown no signal that it is ready to implement the Geneva accords," Ukraine's Foreign Ministry said late yesterday in an e-mailed statement. "Illegal armed groups controlled by Russia continue to destabilize the situation in eastern Ukraine, preparing the ground for another stage of Russian military aggression." Sanctions Approach Biden will offer U.S. support for Ukraine's sovereignty and economy in today's visit, according to an Obama administration official who briefed reporters on condition of anonymity. While the U.S. won't unveil new sanctions while Biden is on this trip, the official said President Barack Obama's administration hasn't seen progress on the accord. A decision will be made in a matter of days. The crisis has hit both Russian and Ukrainian markets. Russia's Micex Index (INDEXCF) index fell 0.6 percent at 10:17 a.m. in Moscow, taking the year-to-date decline to 11 percent. The Russian currency was 0.3 percent higher against the central bank's target basket of dollars and euros to 41.7697. Biden met Ukrainian acting President Oleksandr Turchynov and was later set to speak in what the Obama administration official described as a symbolic show of solidarity with Ukraine ahead of a May 25 presidential election. Technical Assistance Biden will unveil a package of technical assistance to Ukraine in implementing energy and economic reforms, said the official. The vice president will also continue talks on additional non-lethal security aid, the official said. "The interim Ukrainian government needs to be reassured that the U.S. will be present in the region for the long haul, not just in the heat of the crisis," said Heather Conley, director of the Europe Program at the Center for Strategic and International Studies in Washington. The U.S. has threatened further penalties against Russian interests, including measures targeting the banking and energy industries, unless progress is made in easing the crisis sparked by Russia's annexation of Crimea last month. Deputy National Security Adviser Ben Rhodes said yesterday the U.S. "will move to additional sanctions," including some on Russian President Vladimir Putin's "cronies" and their companies if pro-Russian forces don't disarm and give up the buildings they've seized. In an interview aired on MSNBC, Rhodes signaled that any expansion of sanctions would be measured, with penalties aimed at entire sectors "kept in reserve for a more dramatic escalation by the Russians." He said the administration is seeking "to bring along" European nations that have more extensive energy and trade ties with Russia than the U.S. does. Resistant Separatists U.S. Ambassador to Ukraine Geoffrey Pyatt said it will take "days, not weeks" to determine whether Russia is complying with the Geneva agreement. Russia's Lavrov called on the U.S. to avoid threats of sanctions, while brushing off accusations that Russian forces are involved in attacks in Ukraine. Russia is receiving increasing requests to intervene in eastern Ukraine to protect the Russian-speaking population, he said yesterday in Moscow. Vyacheslav Ponomaryov, who leads pro-Russian forces in Slovyansk in eastern Ukraine told reporters yesterday that "the things that were agreed on in Geneva were agreed on without us taking part." "We don't have any relation to the things that were said in Geneva," Ponomaryov said. "We are not aggressors, we are on our own land." Roadblock Killings At least three "activists" were shot dead at a roadblock in Slovyansk over the weekend, Ukraine's Interior Ministry said. The clash wounded three others, the ministry said. Ukraine's Security Service said saboteurs carried out the assault, while Lavrov yesterday blamed supporters of the government in Kiev. "This is a crime carried out by those who want to abort the implementation of the Geneva agreement," Lavrov said. "Everything points to the fact that the Kiev authorities either don't want to or can't control the extremists." Russia's Foreign Ministry blamed the Ukrainian nationalist group Pravyi Sektor for the attack, which Pravyi Sektor denied in a statement. Ukraine's Foreign Ministry reiterated in its statement there were no evidenced that Pravyi Sektor was involved.

More on Ukraine: Top Ukraine official: Russia is preparing for an all-out invasion Russia and Ukraine just ended talks to "de-escalate" the crisis. Here's what you should know. Get ready... The crisis in Ukraine could return with a vengeance | ||||||||||||||||||||||||||||||

| 41 Metric Tons of Silver Withdrawn From The Shanghai Futures Exchange Posted: 22 Apr 2014 12:55 PM PDT

In the past week, the Shanghai Futures Exchange suffered another large withdrawal of silver from its warehouse stocks. The Shanghai Futures Exchange has had another 41 metric tons (1.3 million oz) of silver withdrawn since April 10th. Silver inventories have declined to their lowest levels since the exchange started building its silver stocks in August, 2012. [...] The post 41 Metric Tons of Silver Withdrawn From The Shanghai Futures Exchange appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||

| Gold Fibonacci Confluence Rests at 1260 Posted: 22 Apr 2014 12:45 PM PDT | ||||||||||||||||||||||||||||||

| Bombshell Chinese Revelations: Chinese Banks And 100,000 ‘Outlets’ Selling Gold to Public! Posted: 22 Apr 2014 12:28 PM PDT

In a MUST SEE interview with Bloomberg, Albert Cheng, the World Gold Council's Managing Director, Far East dropped 2 bombshells regarding Chinese gold demand. First, Cheng revealed that nearly every Chinese Bank is now selling gold over the counter directly to the public, and Cheng also made the shocking revelation that over 100,000 gold dealers [...] The post Bombshell Chinese Revelations: Chinese Banks And 100,000 'Outlets' Selling Gold to Public! appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||

| Harry Reid Is The Real Domestic Terrorist Posted: 22 Apr 2014 11:45 AM PDT

With BrightSource Energy donating cash to Harry Reid's political slush fund, and with Harry Reid in control of the BLM via Neil Korntze, it should be pretty clear why Harry Reid has pro-actively taken a public stand and unleashed verbal violence on the BLM/Bundy battle. I have a good hunch he's close to getting [...] The post Harry Reid Is The Real Domestic Terrorist appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||

| Goldman Sachs Saves Gold from Falling Apart Posted: 22 Apr 2014 10:45 AM PDT Yes, you read that headline correctly, much to the chagrin of the GIAMATT crowd. What am I referring to? Answer - this morning, two analysts from that firm upgraded their recommendation on the precious metals mining sector to "Neutral" from "Sell". They cited " a more responsible use of shareholder wealth". I found that rather interesting to say the least. What was even more interesting was the headline that the story came down the Dow Jones wire under: " Gold Miners Now Less Likely to Torch Your Money". While it is a serious matter to those who have been so hurt by investing in this sector, I had to chuckle at the caption that the reporter chose. I think it pretty much summed up the sentiment of many toward these miserable things. It was this upgrade of the miners which kept gold from utterly collapsing below critical chart support centered around the $1280 level. Hedge fund selling leaned on the market early in the session with a couple of approaches to $1280 on decent volume. Price rebounded away from that support but could not manage to make much upward progress. A big push finally took it down through $1280 but with the gold miners refusing to follow, short covering took the price back up again. Obviously, there is a fierce battle occurring over this chart level. Whichever side blinks first, is going to lose it. As mentioned in recent posts, speculators are becoming more interested in playing gold from the short side, although, I wish to reiterate, they remain net long still. They are selling while bullion banks are buying to cover shorts. Ignore any talk about this being a plot of the bullion banks to take gold lower therefore. Hedge funds are already net short copper, very close, if not already there now, net short silver, and are reducing their net long exposure to gold. If the gold price cannot find its feet right here, right now, watch for increasing long side liquidation and a new wave of fresh shorting. Here is a look at the gold chart: Notice how it is flirting dangerously with that red line that has held it going back to early this month. If it cannot recover quickly, price should move to test $1260, and then $1240 if that were to fail. Again, were it not for that Goldman recommendation on the mining shares, we would not be talking about $1280 at this point but rather whether or not $1260 is going to hold. Those who keep with this non-stop gold is being manipulated lower by Goldman Sachs and JP Morgan talk would do well to thank them at this point for saving their investment account from even worse harm. There is nothing gold for the bulls as far as any sort of upside potential unless gold were to push past $1320 for starters. We'll have to see how Asia responds to the move lower this evening. Last night was not exactly a stellar endorsement. Maybe picking up the metal another $7 - $10 lower will make a difference. Incidentally, those Newmont Mining/Barrick merger rumors are continuing today. It sure did not help gold any today watching crude oil get whacked lower. It is still trading above the $100/barrel level so it is not exactly falling apart but it does appear that the $105 ceiling is still very much intact. In yesterday's post, I mentioned the planting progress or more properly, the lack thereof, in regards to corn. The "corn is never going to ever get planted this year" guys pounced all over that driving it back up above the $5.00 mark. That pressured beans as traders are concerned more farmers will have to shift to beans instead of corn. You will have to watch the weather forecasts to figure out which way these things will go from here on out. Welcome to the start of grain trading season! By the way, for those who enjoy inflicting pain upon themselves, try trading coffee if you are bored. After imploding early last week, it went flying upward on Thursday last week just about erasing the losses from the two previous trading sessions. It then fell yesterday but decided to rally over 7.5% today. In the process it managed to score a 9 week high. To put that in a bit of perspective - that is an over $4,200 move in a single contract in one day! Maybe tomorrow or Thursday it will give it all back up again. Seriously, unless you really know this particular market, leave it alone. I know a couple of guys who traded that stuff and ended up having it cost them their commodity trading career. I mention it only as an example of just how wild and unpredictable these commodity futures markets have become on account of the computer generated buying and selling. It is the norm, not the exception. Remember that whenever you are tempted to swallow that "flash crash" nonsense that constantly surfaces whenever gold has a sharp move lower. These sorts of insane price swings are everywhere, in every market anymore. Let's see how gold fares the rest of today. Perhaps I will post a more updated chart later this evening depending on how things go. Bulls are piggybacking on Goldman's recommendation to keep the price supported for now. | ||||||||||||||||||||||||||||||

| Two More Victims Of The Retail Apocalypse Posted: 22 Apr 2014 10:30 AM PDT

The US recovery is so strong, that Family Dollar is closing 370 stores! When I learned of this, I was quite stunned. If nothing is done about the long-term trends that are slowly strangling the middle class to death, this will just be the beginning. We will see millions more Americans lose their jobs, millions more [...] The post Two More Victims Of The Retail Apocalypse appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||

| Uncertain regulatory environment hurts gold loans in India Posted: 22 Apr 2014 10:08 AM PDT Gold loan companies' credit growth set to halve his year, with the RBI restricting loan to value ratio at 75%. | ||||||||||||||||||||||||||||||

| World’s two largest gold miners in talks to merge Posted: 22 Apr 2014 10:04 AM PDT The world's two largest gold miners, Barrick and Newmont, have been in talks to merge over the past week. | ||||||||||||||||||||||||||||||

| Posted: 22 Apr 2014 09:14 AM PDT Gold could find a floor if tension between Russia and the U.S./EU over Ukraine continues to be tight. | ||||||||||||||||||||||||||||||

| Gold recovers from early losses Posted: 22 Apr 2014 09:01 AM PDT Gold recovered from early losses on Tuesday as the dollar gave back some gains, but sentiment among investors continued to be lukewarm despite the uncertain backdrop. | ||||||||||||||||||||||||||||||

| Gold & Silver: Stay the Course! Posted: 22 Apr 2014 09:00 AM PDT

If you were to base your decision-making on news alone, one is not making any money from buying gold. Does that mean one should refrain from buying it? The best answer comes from knowing your objectives. If you want security from the out-of-control fiat spending of all Western governments, then yes, this continues to be the time to [...] The post Gold & Silver: Stay the Course! appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||

| India's current gold import policy will be short-term Posted: 22 Apr 2014 08:49 AM PDT While the voices have been rising to reverse heavy gold import duties, Indian Commerce Ministry has proposed to relax the restrictions over gold import by saying it is not sustainable in the long-run. | ||||||||||||||||||||||||||||||

| Greg Mannarino: U.S. Dollar is Going to Die! Posted: 22 Apr 2014 07:45 AM PDT

In this interview with Finance & Liberty’s Elijah Johnson, Greg Mannarino makes the incredible claims that the DOW may be about to collapse to 4,000, gold & silver are set to EXPLODE, & states that the US dollar is about to die, and be replaced by the Yuan as the global reserve currency. Mannarino’s full interview [...] The post Greg Mannarino: U.S. Dollar is Going to Die! appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||

| Gold setting up for testing the medium term support points Posted: 22 Apr 2014 07:18 AM PDT Commodity Trader | ||||||||||||||||||||||||||||||

| The Political Poison of Vested Interests Posted: 22 Apr 2014 07:18 AM PDT Once vested interests take control, the only possible “solution” left is collapse. I have long identified diminishing returns as a key dynamic in the current unraveling of the Status Quo. Why is this so? We can summarize diminishing returns as dumping more money, capital, energy and effort into a system just to keep the output from falling to zero. But as the costs of keeping the system from imploding rise, they soon consume all the oxygen in the system, and the system implodes anyway.

The Fatal Disease of the Status Quo: Diminishing Returns (May 1, 2013) Our Era's Definitive Dynamic: Diminishing Returns (November 11, 2013) Sickcare, higher education and insanely expensive weapons systems are all examples of this dynamic. The higher education cartel has raised gargantuan sums to fund its poor quality product by turning students into debt-serfs via student loans.

We must add a second definitive dynamic: protecting vested interests. There are many ways of describing powerful constituencies with an enormous stake in maintaining the Status Quo–vested or entrenched interests, for example–but the key characteristic is the enormous political pain that these groups can inflict on self-serving politicos. Once confronted with an aroused vested interest–public union, cartel, corporatocracy, Power Elite, etc.–politicos cave in and do what is politically expedient: avoid any real reform and simply shovel more money into the gaping maw of diminishing returns. A good example is soaring higher education costs and the decline of actual learning and the real-world value of a college diploma. The long-term studyAcademically Adrift: Limited Learning on College Campuses concluded that “American higher education is characterized by limited or no learning for a large proportion of students.” But rather than enable (or even insist) on real reforms that dramatically lowered costs and improved results, the political Status Quo responds to the higher education cartel’s screams for more money by extending more student credit and taxpayer-paid aid to the cartel. (I address all these issues in my book The Nearly Free University and The Emerging Economy: The Revolution in Higher Education.) Once politicos respond to the cries for more money and protection from diminishing returns from vested interests, the real problem festers, unsolved and addressed, while the politically expedient “solution” drains resources away from real reform and exacerbates the underlying problem. You see the end-game this cycle of vested interests and political expedience creates: as the real problems go unaddressed, they further diminish returns, which triggers even more frantic calls by vested interests for more funding and more protection from the creative destruction of diminishing returns. Meanwhile, the opportunity cost of supporting diminishing-return vested interests continually increases as scarce resources are squandered on supporting entrenched interests. Eventually the parasitic entrenched interests have consumed all the oxygen in the system and the system collapses under its own weight. In a political system where money buys concentrated political power, decisions that affect 100% of the populace are made to benefit the 5% most powerful entrenched interests. How can wise decisions be made when all decision-making centers around placating politically dominant interests? Answer: they can’t. Decisions made to protect and favor the few at the expense of the many are intrinsically unwise, as they are blind to the consequences heaped on the voiceless 95%. Vested interests span the entire political spectrum. The “progressive” favorites, banking, higher education, public unions and sickcare, are all able to veto any reforms that threaten their share of the swag or that demand higher returns on the ever-rising sums poured into these systems. The “conservative” favorites, banking (every politico is beholden to financial Elites), weaponry, energy, and corporate welfare, are equally able to squelch reform that threatens their share of the swag. Combine diminishing returns with the political dominance of vested interests and you get a system incapable of reforming itself and incapable of stopping the slide off the cliff. Vested interests have no concern for the unintended consequences of their self-aggrandizement; the entire poilitical structure is based on the faith that there is always more money to feed the insatiable hunger of entrenched interests for more funding, more protection and more power. That there might be limits that cannot be surpassed without imploding the entire rickety, corrupt system is a danger that cannot be recognized, much less discussed in the halls of power, lest the faith that unwise decisions and spending can pile up year after year and decade after decade forever be questioned. And so the only possible “solution” left is collapse. This is the lesson of the book The Upside of Down: Catastrophe, Creativity, and the Renewal of Civilization, which illustrates that the solution has always been collapse when corrupted, self-serving vested interests gain control of the political system and the economy. | ||||||||||||||||||||||||||||||

| A top trader's must-see update on silver Posted: 22 Apr 2014 06:52 AM PDT From Jeff Clark, editor, S&A Short Report: It's time to buy silver again. We last bought the metal back in January at about $19.70 per ounce. We rode the rally all the way up to $22 before stopping out last month. Overall, we earned about 3.4% in less than two months. And now that silver has pulled back to the price we bought it in January, it's time to buy again. You see, silver is one of those trades where the upside potential is so large, I'm uncomfortable being out of it for too long. And we just got a "buy" signal from one silver timing indicator... Take a look at this chart of silver...

The bottom of the chart illustrates a simple, short-term trading system for silver. The Moving Average Convergence Divergence (MACD) momentum indicator is often used for determining overbought and oversold conditions. But it can be a timing indicator, too. Without getting too complicated, when the black 12-day MACD line crosses above the red 26-day MACD line, we have a "buy" signal. When the black line crosses below the red line, we have a "sell" signal. The blue circles on the chart show the "buy" signals over the past year, while the red circles show the "sell" signals. Every trade using these signals over the past year has been profitable. If you only bought silver when the chart had "buy" signals and sold on the "sell" signals, you could have generated profits even as the metal lost 20% of its value over the past year. And as you can see from the chart, we just got another "buy" signal from the MACD indicator. So it's time to buy again.

More on silver: Amber Lee Mason: A world-class way to profit from the next big rally in silver Master trader Clark: How I'm trading silver now | ||||||||||||||||||||||||||||||

| GOLD analysis for April 22, 2014 Posted: 22 Apr 2014 06:35 AM PDT mt5 | ||||||||||||||||||||||||||||||

| US Dollar: Is the Rebound a Correction or a Bullish Trend Change? Posted: 22 Apr 2014 06:35 AM PDT dailyfx | ||||||||||||||||||||||||||||||

| Dubai Financial Market up 51% this year and back to pre-financial crisis level Posted: 22 Apr 2014 06:24 AM PDT The Dubai Financial Market General Index more than doubled last year and its up 51 per cent so far this year making it by far the best performing stock market in the world. The Dow Jones Index and S&P 500 are virtually unchanged after big gains in 2013. Why is the DFM different? Well there is the statistical caveat that it has come from a very low base. The DFM became deeply oversold in its long bear market. From a peak of more than 8,000 on the re-based index in early 2006 the DFM fell and fell bankrupting brokerage houses by the dozen on the way to its final bottom in early 2012 not far off 1,200 points, that’s not long ago. Deeply oversold Even the most stalwart buy-and-hold investor would be tested by such a horrific downturn. In 2012 the index picked itself up off the floor and gained 20 per cent as the Dubai debt debacle was consigned to history and a real estate recovery began in earnest with Arabian Spring exiles pouring into the city. The Dubai Expo win last autumn really put the wind in its sails. International investors began to notice the DFM. Economic growth also picked up sharply. This week the IMF upped its GDP growth forecast from 3.9 to 4.4 per cent for this year while E&Y forecast an average of 4.3 per cent for the next four years. This is still a long way from the 13 per cent super GDP growth of 2003-8 which ended in the spectacular bust of 2009 with a collapse in trade in the first half, a 60 per cent fall in property prices and an 80 per cent slump in auto sales. By the end of that year Dubai hit a debt crisis and turned to Abu Dhabi for a $20 billion bailout. Horrific slump In some ways the very severity of the crisis ensured a strong recovery. The bad projects and bad debts were liquidated or consolidated. The British Business Group says a third of its members went home. But from the ashes of the bust the best businesses survived, principally Emirates Airline, the airports, the Jebel Ali port and tourism. Fortunately the fall in oil prices in 2008-9 proved only temporary and the region went on to enjoy record oil revenues courtesy perhaps of commodity price inflation induced by money printing by the global central banks. The money that had flowed out of Dubai therefore quickly flowed back into the regional business hub, just as the ArabianMoney investment newsletter had predicted when it launched four years ago (subscribe here). The real estate market also confounded the doomsters and returned from the dead. Indeed, it is the impressive flow of cash into Dubai real estate that has prompted recent upward revisions of GDP. And winning the World Expo 2020 is a focus for further investment in infrastructure and real estate. Too high? However, you always have to wonder with stock markets at what point all the good news is in the share prices and then some. The DFM was certainly deeply oversold and one of the world’s cheapest emerging markets. That is not the case any longer. As in 2008 the fate of the DFM is probably in the hands of global markets which have all shown signs of topping out in the first four months of this year. Only the DFM and the Abu Dhabi Securities Exchange to a lesser extent have continued to power ahead. Did somebody say things might be getting is little over-extended now? Still we have said that rather too many times recently. OK so the market is going to rise vertically forever, and to be fair at over 5,000 it is still way off its 2006 all-time high. | ||||||||||||||||||||||||||||||

| India raises import tariff value of Gold to $431 per 10 grams Posted: 22 Apr 2014 06:17 AM PDT India has raised import tariff value on gold and silver to $431 per 10 grams and $646 per kilo grams on Wednesday. | ||||||||||||||||||||||||||||||

| SDBlowout! 2014 Silver Eagles $2.39 Over Spot, ANY QUANTITY!! Posted: 22 Apr 2014 06:00 AM PDT

*While supplies last! Click or call 800-294-8732 to place your order! The post SDBlowout! 2014 Silver Eagles $2.39 Over Spot, ANY QUANTITY!! appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||

| Gold Silver ETFs witness strong investor demand in Feb March Posted: 22 Apr 2014 05:50 AM PDT commodityonline | ||||||||||||||||||||||||||||||

| Chinese Banks And 100,000 ‘Outlets’ Selling Gold - Demand To Surge Another 25% Posted: 22 Apr 2014 04:32 AM PDT gold.ie | ||||||||||||||||||||||||||||||

| What you need to know about oil and gas dividends, Part II Posted: 22 Apr 2014 04:00 AM PDT From Matt Badiali, editor, S&A Resource Report: There is a big difference between dividends and the actual yield of a company. Unfortunately, as many authors have pointed out over the years, most investors focus on the wrong thing. I'm reading about dividends this week. A friend of mine, portfolio manager Mebane Faber, wrote a great book called Shareholder Yield: A Better Approach to Dividend Investing. You can find it on Amazon for your Kindle. And it will change how you look at companies. In Faber's view, companies have several ways to return cash to shareholders. The obvious way is through dividends. They can also buy back stock and pay down debt. According to Faber, the net of those three factors equals shareholder yield. If you add up dividends paid, plus the net dollar amount of shares bought, plus debt paid down or added, you arrive at the total shareholder yield. Divide that by the market cap and you get a percent, just like a dividend yield. When you apply this technique to the S&P 500 stocks, you find that they fall into four groups. The group with the highest shareholder yield outperforms the whole S&P 500 by more than 2% per year. Faber also warned against buying companies that have negative shareholder yield. These companies are diluting shares, stealing away the value of shareholders' existing positions. If you think of the number of shares of a company as slices in a pie, dilution happens when each slice gets smaller. It means shareholders are losing money. Even though you may appear to be making money through dividends, the new shares and added debt actually rob you of that value. Take LRR Energy (LRE), a master limited partnership (MLP) that develops oil projects. It's called an upstream MLP because it owns producing assets rather than infrastructure like pipelines. LRR Energy pays an 11% dividend yield today, for a total of $49 million in dividends. However, the company issued $59 million in new shares in the last year. Shareholders thought that they were getting a fat dividend, but actually lost 2% last year. I decided to apply this model to the oil and gas sector to see which companies are the worst offenders. I tested the 403 companies in the Bloomberg Oil and Gas universe that have more than $150 million market value. I ranked the companies by shareholder yield. However, I didn't include debt [CF: Why? That seems like a big part of Meb's formula]. I just combined the dividends paid and the net shares bought back over the past year. I then split up the results into four groups (quartiles) based on where they fell on my yield list. To make it more interesting, I included the average dividend yield of those same companies. As you can see in the table below, the group with the worst shareholder yield had a deceptively respectable 2% dividend yield (the second-highest).

That means those companies are paying a dividend, but selling shares to do it – like LRR Energy.

This shows just how critical it is for investors to understand what they are buying. A high dividend yield can mask other problems. P.S. After combing through more than 20 companies in the area, I've found five that are likely to be the biggest winners. Most of these are unknown small caps that could skyrocket in value. You can access all of my research on this situation with a 100% risk-free trial subscription to the S&A Resource Report. You can find out how to access the report immediately right here.

You can read more from Matt Badiali right here. | ||||||||||||||||||||||||||||||

| Gartman sees Gold to shoot up during next one year Posted: 22 Apr 2014 03:19 AM PDT Gold could easily be $100 higher one year from now, said Dennis Gartman, famed editor of the Gartman Letter. In the short-term gold will most likely not remain in its current $1300 territory. | ||||||||||||||||||||||||||||||

| China Allows Gold Imports Via Beijing Amid Reserves Buying Talk Posted: 22 Apr 2014 02:16 AM PDT "Well, it was pretty much the usual hatchet job by JPMorgan et al" ¤ Yesterday In Gold & Silver[Note: After three years without a break, I'll be taking some time off. There will be no Gold and Silver Daily next week. Ed] The gold price got sold off a few dollars the moment that trading began at 6 p.m. in New York on Sunday evening. Then two hours later at exactly 8 a.m. in Hong Kong on their Monday morning, a rally began that got met by usual not-for-profit sellers the moment it broke above $1,300 spot---and two hours later, gold hit its low tick of the day. Volume by lunchtime in Hong Kong was north of 32,000 contracts, a spectacular amount. From there the price began to recover, but at a snail's pace---and the rally that began at the 8:20 a.m. EDT Comex open, ran into the usual sellers of last resort. The snail's pace rally then continued into the close. The CME Group recorded the high an lows ticks as $1,302.50 and $1,281.80 in the June contract. Gold closed in New York on Monday afternoon at $1,290.30 spot, down only $4.30 on the day. Volume, net of April and May, was 104,000 contracts---and as I pointed out above, over 30% of that occurred before lunch in Hong Kong. The silver price action was a virtual carbon copy of what happened to the gold price. The low was in at 10 a.m. Hong Kong time, with a secondary low at 1 p.m. BST London time---20 minutes before the Comex open---and the subsequent rally from there got chopped off at the knees minutes after 9 a.m. EDT in New York. From there it got sold down a bit---and then traded flat from about 10:30 a.m. until a smallish rally began at 3:45 p.m. in electronic trading. The high and low ticks were recorded as $19.705 and $19.23 in the May contract---an intraday move over a bit more than 2%. Silver finished the Monday trading session at $19.44 spot, down 21 cents from Thursday's close. Net volume was pretty light at only 22,000 contracts. Gross volume was 32,000 contracts, with an incredible 11,000 of those contracts being traded by noon in Hong Kong. Platinum's vertical price spike at the Sunday night open immediately ran into a wall of sellers of last resort---and that forced the price to chop around within a five dollar range of its Thursday close, even though it was obvious that the price want to rally strongly as well. The Far East low came shortly after 10 a.m. Hong Kong time---and from there it chopped its way higher until shortly before 10 a.m. BST London time. The selling pressure began once again at that point---and the price went into a slow decline until 12:30 p.m. in New York. From there it traded sideways, with three attempts to force the price lower after that, but all of them failed. Palladium took off to the upside at the open on Sunday night as well---but the moment it got a sniff of the $800 spot price, a not-for-profit seller was there to put a quick end to that rally attempt. By the Comex open, palladium was down a bit more than a percent. But the HFT boyz showed up at, or just minutes after, the London p.m. gold fix---and palladium got creamed for another 2% in very short order. From there it rallied a bit into the close. The dollar index closed at 79.85 late on Thursday afternoon in New York last week. And even though the gold markets were closed, the dollar index did trade on Friday, but didn't do much. It got as high as 79.92 in early Far East trading on their Monday morning---but began to sell off almost immediately, with the 79.80 low of the day, such as it was, coming at 10 a.m. in London. From there the index 'rallied' as high as 79.98 shortly before noon in New York---and slid a hair into the close. The index closed at 79.95---up ten basis points from Thursday's close, but the scale of the chart makes the 'action' appear far more impressive than it really was. However, it is interesting to note that the rally---such as it was---failed to break back above the 80.00 mark. As has been the case lately, the gold stocks opened in positive territory, only to get sold down into the red almost right away---and as you can tell, this was the procedure again yesterday. The low of the day came shortly after 1 p.m. EDT in New York---and the HUI rallied for the remainder of the day, cutting its loss to only 0.23%. And as has also been the case, the silver stocks stunk up the place once again. Even though the HUI and Nick Laird's Intraday Silver Sentiment Index had the same chart pattern, the silver stocks closed down 1.23%. The CME's Daily Delivery Report showed that 68 gold and zero silver contracts were posted for delivery within the Comex-approved depositories on Wednesday. Jefferies was the only short/issuer of note with 66 contracts---and it was the usual two suspects as long/stoppers---JPMorgan and Canada's Scotiabank. The link to yesterday's Issuers and Stoppers Report is here. Since I'm talking about delivery, there are still a huge number of silver contracts in the May contract---58,529 as of this writing---that have to been sold or rolled by the end of next Monday's trading day. Whoever isn't out by that time is obviously standing for delivery. But with only five trading days left between now and then, the activity in the May contract month will be fast and furious up until then. Another day---and another withdrawal from GLD. This time an authorized participant took out 96,327 contracts. And as of 7:20 p.m. EDT yesterday evening, there were no reported changes in SLV. But when I checked back there at 9:35 p.m.----I was astonished to discover that an authorized participant had deposited 1,729,976 troy ounces. Based on current price activity, this deposit must have been used to cover an existing short position, as no other explanation is possible under the circumstances. The U.S. Mint had a sales report. They sold 691,500 silver eagles---and that was it. Over at the Comex-approved depositories on Friday, they reported receiving 16,557 troy ounces of gold---and shipped out 32,092 troy ounces. All the activity was at Brink's, Inc. and HSBC USA. The link to that is here. There wasn't much activity in silver, as nothing was reported received---and only 104,747 troy ounces were shipped out the door. All the activity was at CNT---and the link to that activity is here. The Commitment of Traders Report [for positions held at the close of Comex trading on Tuesday, April 15] was more or less what I was hoping to see---as it appeared most, if not all, of the volume from Tuesday's big price hit in both gold and silver showed up in the numbers. There will most likely be some spill-over into this Friday's report, but it shouldn't be a huge amount. Because I didn't have a column on Saturday, I'm "borrowing" a decent amount of stuff from Ted Butler's COT commentary to his paying subscribers on the weekend, which is a luxury I can't remember ever enjoying before. In silver, the Commercial net short position declined by a chunky 5,611 contracts, or 28.1 million troy ounces. The Commercial net short position now sits at 116.5 million troy ounces. Ted says that JPMorgan covered 1,700 short contracts---and pegs JPMorgan's concentrated net short position around 20,000 contracts, or 100 million troy ounces. JPMorgan's short position represents about 86% of entire short position in the Commercial category. Ted mentioned last week that there was obviously a 9-10,000 contract "value investor" embedded on the long side of the Managed Money/Technical Fund/Non-Commercial category that has been there since October of last year---regardless of what was happening price wise---up or down. Even after last Tuesday's big sell-off, that long position was still intact in this report. Unless "da boyz" can force the holder[s] of this position to liquidate, Ted feels that the bottom in silver is within a handful of contracts of being in---and that should most likely be confirmed by this coming Friday's COT Report. In gold, the Commercial net short position declined by 14,138 contracts, or 1.41 million ounces. The Commercial net short position is now down 87,605 contracts, or 8.76 million troy ounces. Ted said that the eight largest Commercial traders bought back 3,200 contracts---and their net short position is now the lowest in nearly a year---and that JPMorgan purchased "up to" 2,000 new long contracts---and their long-side corner in the Comex gold market is up to 38,000 contracts, or 3.8 million ounces. About gold's current situation, silver analyst Ted Butler had this to say---"Looking under the hood in the disaggregated report at the managed money category of gold and comparing the current technical fund position with historical levels, there doesn’t appear to be much room for further technical fund long liquidation; no more than 5,000 to 10,000 contracts of gross long liquidation compared to previous record low readings." Ted also said that "The concentrated net short position in silver is the largest of any regulated commodity by a wide margin at the equivalent of nearly 320 million troy ounces, or 40 percent of world's yearly silver production---and it remains an oddity that the concentrated short position in Comex gold is closer to its historical low, while the concentrated short position in silver is nearer the high." Here's Nick Laird's "Days of World Production to Cover Comex Short Positions" chart updated with Friday's numbers. In silver, JPMorgan's current Comex short position is 50 days of world silver production in both the red and green bars. How's that for concentration? Ted's comments about the oddity of the the short position of the Big 8 in silver and the Big 8 in gold being at such extremes is very noticeable in this chart. Here's another chart from Nick Laird. This is for silver only---and is the same data that appears in the "Days to Cover" chart above. The only difference being that it shows the short positions of the Big 4 and Big 8 traders going back seven years---and not just the current week as the "Days to Cover" chart does. And as Ted has pointed out, as silver's price has declined, the short positions of the Big 4 and 8 traders has blown out as well, which makes no sense at all. It's exactly the opposite in gold---and I'll have those charts for you tomorrow. Here's a chart that skipped my mind in my Friday column. Since the 20th of the month fell on a weekend, The Central Bank of the Russian Federation updated their website with their March data---and it showed no change in their gold reserves which still sit at 33.5 million troy ounces. Here's Nick Laird's most excellent chart. Since it was four days since my last column, I have a large number of stories for you today. I've already hacked and slashed more than I wanted to, so I'll happily leave the final edit up to you. ¤ Critical ReadsGasoline Prices Rise to 13-Month High in Lundberg SurveyThe average price for regular gasoline at U.S. pumps jumped 8.5 cents in the past two weeks to a 13-month high of $3.6918 a gallon, according to Lundberg Survey Inc. The survey covers the period ended April 18 and is based on information obtained at about 2,500 filling stations by the Camarillo, California-based company. Prices are the highest since March 22, 2013. The average is 15.55 cents higher than a year ago, Lundberg said. Gasoline has risen 39.74 cents a gallon since bottoming out in February and is up 43 cents this year. “The most important factor right now in this rise is crude oil, which rose by a very similar amount to the street-price move,” Trilby Lundberg, the president of Lundberg Survey, said in a telephone interview Sunday. “From here, we will probably see very little increase, if any, with the big caveat of course being crude. If crude prices climb even higher, then this may not be the peak.” Today's first news item, which is courtesy of West Virginia reader Elliot Simon, was posted on the moneynews.com Internet site on Sunday afternoon EDT. Brown Economists: 'Secular Stagnation' May Strangle Economy The U.S. economy may not mend its woes soon and instead may suffer a bout of "secular stagnation," Brown University economists Gauti Eggertsson and Neil Mehrotra maintain in a recent paper. This short article also showed up on the moneynews.com Internet site, but this one is from last Friday morning EDT---and it's also courtesy of Elliot Simon. Doug Noland: Automatic Stabilizer? From Yellen: “If the public understands and expects policymakers to behave in this systematically stabilizing manner, it will tend to respond less to such developments. Monetary policy will thus have an ‘automatic stabilizer’ effect that operates through private-sector expectations.” For obvious reasons, Doug's Friday commentary had to wait until today. It's always worth reading---and this one is no exception, as I read it over the weekend. Lawyers Sue Stock Market for Being RiggedOn March 30, Michael Lewis went on "60 Minutes" and said that the stock market is "rigged." This past Friday, some plaintiffs' lawyers filed a lawsuit against, um, the stock market. This raises many questions, of which the most pressing is, what took so long? The lawsuit is basically just a synopsis of Lewis's book, "Flash Boys," and, I mean, how long can that take? I feel like plaintiffs' lawyers by now must have algorithms to transform news articles into lawsuits, so what was the holdup here? The other problem with the lawsuit is that it pretty much sues the stock market for being the stock market. So the defendants include pretty much every stock and options exchange, and also literally every brokerage, and literally every high-frequency trading firm. There's a long list of brokerages and HFT firm. Every brokerage firm that transacted for clients since April 2009 is (supposedly!) a defendant in this lawsuit, including just for instance noisy HFT critics Themis Trading. And everyone who "operated alternative trading venues which provided venues for the anonymous placing of bids and offers" is (supposedly!) a defendant, including just for instance Michael Lewis's heroes at IEX. This Bloomberg story showed up on their website late yesterday morning EDT---and it's the first offering of the day from Roy Stephens. Eight E.U. states in deflation as calls grow for Q.E. in SwedenSweden has become the first country in northern Europe to slide into serious deflation, prompting a blistering attack on the Riksbank’s monetary policies by the world’s leading deflation expert. Swedish consumer prices fell 0.4pc in March from a year earlier, catching the authorities by surprise and leading to calls for immediate action to avert a Japanese-style trap. Lars Svensson, the Riksbank’s former deputy governor, said the slide into deflation had been caused by a “very dramatic tightening of monetary policy” over the past four years. He called for rates to be slashed from 0.75pc to -0.25pc to drive down the krona, and advised the bank to prepare for quantitative easing on a “large scale”. Prof Svensson said Sweden was at risk of a “liquidity trap” akin to the 1930s, with deflation causing debt burdens to ratchet up in real terms. Swedish household debt is 170pc of disposable income, among Europe’s highest. This Ambrose Evans-Pritchard commentary showed up on the | ||||||||||||||||||||||||||||||

| Doug Noland: Automatic Stabilizer? Posted: 22 Apr 2014 02:16 AM PDT From Yellen: “If the public understands and expects policymakers to behave in this systematically stabilizing manner, it will tend to respond less to such developments. Monetary policy will thus have an ‘automatic stabilizer’ effect that operates through private-sector expectations.” For obvious reasons, Doug's Friday commentary had to wait until today. It's always worth reading---and this one is no exception, as I read it over the weekend. | ||||||||||||||||||||||||||||||

| Russia, U.S. Trade Blame as Ukraine Accord Nears Collapse Posted: 22 Apr 2014 02:16 AM PDT Russia and the U.S. traded blame for failing to rein in extremists in Ukraine, as a diplomatic accord reached last week all but collapsed. U.S. Secretary of State John Kerry warned Russian Foreign Minister Sergei Lavrov today that “there will be consequences” if Russia fails to act “over the next pivotal days” to restrain pro-Russian militants in eastern Ukraine, spokeswoman Jen Psaki said in Washington. In Moscow, Lavrov called on the U.S. to hold Ukraine’s interim government accountable for curbing what Russia portrays as right-wing militias. The agreement signed in Geneva by Ukraine, the European Union, the U.S. and Russia on April 17 calls for all illegal groups to give up their arms and return seized buildings. Pro-Russian forces held their ground in several eastern cities, as their leaders denied they were bound by the accord. The government in Kiev has said Russia is behind the unrest, exploiting the situation to prepare a potential invasion. This Bloomberg story, co-filed from Moscow and Kiev, was posted on their Internet site early yesterday afternoon Denver time. | ||||||||||||||||||||||||||||||

| Nine King World News Blogs/Audio Interviews Posted: 22 Apr 2014 02:16 AM PDT 1. Victor Sperandeo [#1]: "Legend Who Predicted 1987 Crash Warns "This Will End Badly" 2. Egon von Greyerz: "A Bankrupt World---$26,000 Gold---and the Destruction of Wealth" 3. James Turk: "Gold Market Now Seeing Deepest Backwardation in 8 Months!" 4. Victor Sperandeo [#2]: "The Catastrophic End Game---and Skyrocketing Gold Prices" 5. Ronald-Peter Stoferle: "Two of the Most Remarkable Charts We've Seen This Year" 6. Robert Fitzwilson: "Shocking Events Rapidly Unfolding Around the World" 7. Richard Russell: "The Dollar Will Crash in a Matter of Months" 8. The first audio interview is with Victor Sperandeo---and the second audio interview is with Dr. Philipa Malmgren | ||||||||||||||||||||||||||||||

| Sprott's Thoughts: Why Rick Rule Says ‘Anti-gold Investors Will be Destroyed’ Posted: 22 Apr 2014 02:16 AM PDT Gold has made its way down again, to around 1,300 per ounce this month. Rick Rule, Chairman of Sprott Global Resource Investments Ltd. says that a few years out, you will be happy you stuck with gold. For context to today’s downturn, look back at the great bull market for gold in the 1970s’. As Rick recently put it to King World News, “that is the kind of regret that no investor wants to live with for the rest of their lives.” Rick believes the overall bull market will return and produce substantial returns to investors who own gold. | ||||||||||||||||||||||||||||||

| The New York Sun: Piketty's Gold? Posted: 22 Apr 2014 02:16 AM PDT In terms of public policy, though, we favor honest money. It works out better for more people. And there is a moral dimension to the question of honest money. This was a matter that was understood — and keenly felt — by the Founders of America, who almost to a man (Benjamin Franklin, a printer of paper notes, was a holdout), cringed with humiliation at the thought of fiat paper money. They’d tried it in the revolution, and it had been the one embarrassment of the struggle. They eventually gave us a Constitution that they hoped would bar us from ever making the same mistake. There is an irony here for Monsieur Piketty. It was France who gave us Jacques Rueff, the economist who had the clearest comprehension of the importance of sound money based on gold specie. He was, among other things, an adviser of Charles de Gaulle. It was de Gaulle who in 1965, called a thousand newspapermen together and spoke of the importance of gold as the central element of an international monetary system that would put large and small, rich and poor nations on the same plane. We ran the complete text of Professor Piketty’s book “Capital” through the Sun’s own “Electrically-operated Savvy Sifter” and were unable to find, even once, the name of Rueff. Reflecting on French economist Thomas Piketty's new book, "Capital," The New York Sun offers a most politically incorrect explanation for the explosion in income inequality and unemployment in the United States since the 1970s: the end of the dollar's gold convertibility and the unleashing of the age of infinite fiat money. I found this N.Y. Sun editorial embedded in a GATA release yesterday---and it's worth reading. | ||||||||||||||||||||||||||||||

| Barrick Proposal to Acquire Newmont Hits Roadblock, Sources Say Posted: 22 Apr 2014 02:16 AM PDT Talks between Barrick Gold Corp and Newmont Mining Corp about a potential merger have hit a snag, but sources close to the situation say the companies remain keen to reach a deal and discussions are likely to resume. The talks had been on for a few weeks, and the two sides had broadly agreed to a transaction under which Toronto-based Barrick would acquire Denver-based Newmont in an all-stock deal, said one source close to the matter. That source said the deal would offer Newmont shareholders a slight premium to its current share price. Newmont shares rose 6.4 percent to close at $25.05 on the New York Stock Exchange, while Barrick's shares edged down 78 cents Canadian to C$19.03. The sources, who asked not to be named due to the sensitive nature of the situation, said the talks have stalled over the issue of the spin-out of some assets from the combined entity, which is among the hurdles to a deal. This gold-related story showed up in a Reuters piece filed from Toronto very early yesterday evening---and another item I found over at the gata.org Internet site yesterday. | ||||||||||||||||||||||||||||||

| Press’ anti-gold scare tactics largely ineffective Posted: 22 Apr 2014 02:16 AM PDT The first lesson to file for future reference is that major banks with huge balance sheets and big-name consultants do not necessarily have a better crystal ball on the gold price than anyone else. The second is that, when it comes to gold reporting, one should not accept as gospel everything one sees or reads in the mainstream media. Its traditional anti-gold bias bleeds from its pages, so to speak, and should be taken with a grain of salt. The mainstream media, for whatever reason, continues to believe that it can scare potential gold owners away with its consistently negative coverage, but as a recent Gallup Poll suggests, such tactics no longer work all that well. That poll ranks gold the second best option among long-term investments behind real estate and tied with stocks. What makes gold’s poll performance interesting is that it reflects public opinion on gold after a more than two year decline that began in 2011 and at a time when real estate and stocks have enjoyed strong performances. In 2011, after ten straight years of annual gains, the public ranked gold the number one investment. Prior to 2011 gold was not included in the Gallup survey. This commentary by Mike Kosares, was posted on the usagold.com Internet site on Sunday---and it's certainly worth skimming. | ||||||||||||||||||||||||||||||

| Sprott cites GATA consultant on Chinese demand, notes paper bombing of gold Posted: 22 Apr 2014 02:16 AM PDT Interviewed by Sprott Money News, Sprott Asset Management CEO Eric Sprott cites gold researcher and GATA consultant Koos Jansen and GoldMoney's Alasdair Macleod in support of his belief that the World Gold Council's estimates of China's gold demand are grossly understated. Sprott also discusses last week's manipulation of the gold market via the dumping of a huge amount of paper gold. The interview, which was posted on the sprottmoney.com Internet site last Thursday, runs for 10:28 minutes. | ||||||||||||||||||||||||||||||

| China allows gold imports via Beijing, sources say, amid reserves buying talk Posted: 22 Apr 2014 02:16 AM PDT China has begun allowing gold imports through its capital Beijing, sources familiar with the matter said, in a move that would help keep purchases by the world's top bullion buyer discreet at a time when it might be boosting official reserves. The opening of a third import point after Shenzhen and Shanghai could also threaten Hong Kong's pole position in China's gold trade, as the mainland can get more of the metal it wants directly rather than through a route that discloses how much it is buying. China does not release any trade data on gold. The only way bullion markets can get a sense of Chinese purchases is from the monthly release of export data by Hong Kong, which last year supplied $53 billion worth of gold to the mainland. "We have already started shipping material in directly to Beijing," said an industry source, who did not want to be named because he was not authorised to speak to the media. The quantities brought in so far are small, as imports via Beijing have only been allowed since the first quarter of this year, sources said. This very interesting Reuters story, filed from Singapore yesterday, is definitely a must read. Zero Hedge also had something to say about this story as well. It's headlined "China Goes Dark: PBOC to Keep Goldbugs Clueless About Its Gold Buying Spree"---and is courtesy of reader Bill Crampton. | ||||||||||||||||||||||||||||||

| Posted: 22 Apr 2014 02:10 AM PDT 27 GIFs That Explain How To Survive In New York City Business Insider (Lambert). Fun and accurate. Non-locals not understanding the rules of how to navigate sidewalks makes the natives crazy. Meaningful Activities Protect the Brain From Depression Atlantic Physics-exploiting axe splits wood in record time Geek.com. Reader bob, who gave me detailed instructions in the wee hours of the night on how to liberate my cat from behind my overscale bookcase, isn’t buying it:

Brent Oil benchmark ‘in urgent need of reform' Telegraph Exodus of Japan Inc. Slams China Wolf Richter. This is a must read post if you have even a smidge of interest in the Japan/China row. How Chinese private equity is struggling Financial Times CSJ: Let China bubble burst MacroBusiness Death and Anger on Everest Jon Krakauer, New Yorker Charting Deaths on Mount Everest Atlantic (Lambert) The Future of Europe: An Interview with George Soros New York Review of Books Draghi's Bold Push For Creeping Defaults And Real Wage Cuts (Illustrated With Hilarious Cartoon) Wolf Richter Ukraine

Big Brother is Watching You Watch

Obamacare Launch

Horse race: Clinton vs. Warren Lambert you want to know what’s wrong with Common Core? Daily Kos (furzy mouse) California’s Drought Ripples Through Businesses, Then To Schools NPR Airbnb pulls over 2,000 sketchy New York City rental listings engadget I am in the New York Post John Hempton. Be sure to read the comments. A Chance to Remake the Fed Dave Dayen, American Prospect Does This Figure Show Why Fed Policy Failed? David Beckworth Banks Turning To Interactive ATMs To Reconnect Customers With Tellers Consumerist. Who are they trying to kid? This is about reducing the number of tellers in branches and partially replacing them with people in call centers in really low wage areas. CEO Pay is Perverse and Must be Fixed to Avoid Recurrent Crises Bill Black, New Economic Perspectives The Biggest Predictor of How Long You'll Be Unemployed Is When You Lose Your Job FiveThirtyEight ‘Living wage’ inflation Crain’s New York (MacroDigest) Housing Secretary: "the worst rental affordability crisis that this country has ever known” Daily Kos Antidote du jour (moss): | ||||||||||||||||||||||||||||||

| A silver reversal is on the cards Posted: 22 Apr 2014 12:55 AM PDT capitaltrustmarkets | ||||||||||||||||||||||||||||||

| Gold Price Analysis- April 22, 2014 Posted: 22 Apr 2014 12:35 AM PDT dailyforex | ||||||||||||||||||||||||||||||

| Support Still Not Broken in Silver and Gold Posted: 22 Apr 2014 12:30 AM PDT minyanville | ||||||||||||||||||||||||||||||

| Metals Pack Fundamental Analysis April 22, 2014 Forecast – Silver Posted: 22 Apr 2014 12:25 AM PDT fxempire | ||||||||||||||||||||||||||||||

| Gold Bears Press For Test Of 100-Day Moving Average Posted: 22 Apr 2014 12:25 AM PDT forbes | ||||||||||||||||||||||||||||||

| UPDATE 1-Japans Orix to buy gold recycler ... Posted: 21 Apr 2014 11:50 PM PDT reuters | ||||||||||||||||||||||||||||||

| Bullion and Energy Market Commentary Posted: 21 Apr 2014 11:25 PM PDT google | ||||||||||||||||||||||||||||||

| Posted: 21 Apr 2014 10:30 PM PDT thestreet |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment