Gold World News Flash |

- A Bankrupt World, $26,000 Gold & The Destruction Of Wealth

- Why Bankers that Use HFT Algorithms Literally Impede Life, Liberty & the Pursuit of Happiness (Connecting the Dots)

- Silver Up & S&P Down

- Richard Russell - The Dollar Will Crash In A Matter Of Months

- The Secret World of Gold HD

- Confidence in U.S. Debt "Reaching a Tipping Point"

- "Riders On The Storm:" A Fictional Letter Explaining What Is Going On In Russia

- Is The US Military Preparing For The Collapse Of The Dollar?

- Uncovered California

- Is The Petrodollar Doomed -- Jay Taylor

- How China's Commodity-Financing Bubble Becomes Globally Contagious

- Turk describes to KWN exactly how gold was manipulated today in light trading

- The Earnings Season: "House Of Cards"

- Silver Miners Have Been Exploited For Generations By The Pilgrims Society

- Gold Daily and Silver Weekly Charts - Lies, Damn Lies, and an Option Expiration

- Gold Daily and Silver Weekly Charts - Lies, Damn Lies, and an Option Expiration

- Gold Market Now Seeing Deepest Backwardation In 8 Months!

- New York Sun: Piketty's gold?

- If QE works so well, von Greyerz asks, why don't they do a lot more?

- Sprott cites GATA consultant on Chinese demand, notes paper bombing of gold

- A $10 Billion Company that’s Actually Undervalued

- Gold Price In Ukraine 75% Higher In 2014

- Gold Market Update

- James Rickards : Death Of Money Coming To A Central Bank Near You Soon

- Anti-Gold Scare Tactics Seem To Be Largely Ineffective

- Anti-Gold Scare Tactics Seem To Be Largely Ineffective

- Fukushima Disaster : Tokyo Hides Truth As Children Die, Become Ill From Radiation

- A Bankrupt World, $26,000 Gold & The Destruction Of Wealth

- The Financial Scam that Every American Falls For

- Where To STASH Your CASH - Under The MATTRESS Or In The STOCK MARKET? No Mention of GOLD or SILVER

- Barrick and Newmont reported to remain eager for merger

- Loose Talk On China Demand Sinks Gold

- The Dark Side Of The Silver Mining Industry

- Strong U.S. Dollar Rally Could Pull Rug From Under Gold and Silver

- Silver Feeble Rally Fails to Hold Breakout, Falling Back Towards Support

- A Crisis vs. THE Crisis: Keep Your Eye on the Ball

- British Pound Looks Vulnerable At The Highs

- J.S. Kim: High-frequency trading rigs far more than gold and silver

- Gold and Silver Stocks Sitting Tight

- Press Anti-Gold Scare Tactics Largely Ineffective

- Only A Widespread Understanding Of Money And Credit Will Change Our System

- Willem Middelkoop and Terence van der Hout: Turnaround Stories Revolve Around Proven Management

- Willem Middelkoop and Terence van der Hout: Turnaround Stories Revolve Around Proven Management

- Willem Middelkoop and Terence van der Hout: Turnaround Stories Revolve Around Proven Management

- Gold rally helps metals producers buck the FTSE's downward trend

| A Bankrupt World, $26,000 Gold & The Destruction Of Wealth Posted: 22 Apr 2014 12:30 AM PDT from KingWorldNews:

Paul Craig Roberts gives very interesting interviews on KWN. According to Roberts, the risk of a world war is high. He likens the current situation to the start of World War I. Of course we hope that there will not be another world war, but the risks are there. Also, both war and civil unrest cycles are peaking within the next 18 months. And the geopolitical risk is major not only in Ukraine, but there are many other danger zones like the Middle East, China, and Japan. | ||||||||||||||||||||||||||||||||||||||||

| Posted: 22 Apr 2014 12:00 AM PDT by JS Kim, Gold Seek:

| ||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Apr 2014 11:05 PM PDT | ||||||||||||||||||||||||||||||||||||||||

| Richard Russell - The Dollar Will Crash In A Matter Of Months Posted: 21 Apr 2014 09:02 PM PDT  With continued turmoil and uncertainty in global markets, today KWN is publishing another important piece that was written by a 60-year market veteran. The Godfather of newsletter writers, Richard Russell, made this ominous prediction, "In a matter of months, I see the dollar crashing." Russell also stated that he is buying all of the physical gold and silver he can, "while they are still available." With continued turmoil and uncertainty in global markets, today KWN is publishing another important piece that was written by a 60-year market veteran. The Godfather of newsletter writers, Richard Russell, made this ominous prediction, "In a matter of months, I see the dollar crashing." Russell also stated that he is buying all of the physical gold and silver he can, "while they are still available." This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Apr 2014 08:20 PM PDT from Stan Malhotra: | ||||||||||||||||||||||||||||||||||||||||

| Confidence in U.S. Debt "Reaching a Tipping Point" Posted: 21 Apr 2014 07:54 PM PDT IN THIS INTERVIEW: - Currency vs. Money ►2:39 - What kind of monetary system is best? ►9:35 - U.S. Dollar built on confidence, the system is "reaching a tipping point" ►12:48 - Cost of energy to rise significantly ►16:36 - Buy gold and enjoy Social Security & Medicare as it lasts ►21:22 ABOUT... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||

| "Riders On The Storm:" A Fictional Letter Explaining What Is Going On In Russia Posted: 21 Apr 2014 07:20 PM PDT Submitted by John Carter, Gennady, Hello! It’s a long time since we’ve spoken. I still remember our adventures in New York with pleasure. Of course, we’ve noticed the posts you’ve been making recently on RSB 117. Don’t worry, you aren’t in any trouble, these are all reasonable questions to ask. Have we really thought about the long-term economic consequences of our actions? Do we actually understand the likely effects in the markets, and the way they will affect our macroeconomic stability and growth prospects? Are we really willing to sacrifice all the benefits of a convertible ruble and access to world capital markets, just for Crimea, and part of the Ukraine, and perhaps some tiny, insignificant pieces of Estonia or Moldova? The questions are reasonable ones, but that doesn’t actually mean that we would prefer that you continue to ask them in public in such an acute and penetrating way, simply because we’d prefer that not many people deduce their correct answers at this point. So Higher has authorized me to share with you some of the actual logic of our overall strategic thinking. Of course, we must ask that you exercise the utmost in discretion, as usual. But we thought it would be useful to give you, at least, some idea of what is really going on, and where we are headed with it, as it may be necessary to turn to you, at some point, for advice on tactics. First, the strategic objective. It’s true, as you say, that our hand has been forced by recent events, but in fact we are exploiting an unexpected opportunity, not fighting a fire, executing a contingency plan developed some time ago, one of several we have available to take advantage of likely occurrences, one that will significantly advance our long-term strategic goals. If it hadn’t been Crimea, now, it would have been something else, in the next few years. An opportunity to do what? Our public story has always been that we are engaged in some kind of atavistic gathering of the Lands, doing our best to recreate the good old days of the vanished Soviet Union. This is a convenient belief, so we have encouraged it. It is convenient because it allowed us to establish, in Georgia and elsewhere, the principle that we could still use naked force in inter-state relations, without provoking the alarm that a more obviously open-ended program of conquest might have. But really, one should think in more ambitious terms. Of course, the Lands must be gathered, but there are two other things driving our overall strategic approach, one a problem and one an opportunity. The problem is America. The opportunity is Europe. The moment to move against both of them is now. This is our chance to finally break NATO. We’ll get away with it because we’re going to do it subtly, destroying the alliance by snipping threads, here and there, that will cause the whole thing to unravel under the stresses of the coming few years. Our opponents have forgotten the difference between lies and the truth, and as a result they typically have no idea, themselves when they are bluffing. It is finally time to call a bluff – the claim that NATO would defend former Soviet republics – that our opponent never knew was a bluff, and so invalidate even their more serious promises. How? We are about to do something that we have seen the Americans do several times now, most recently against Iran; fight a largely economic and financial war. The twist is that we are by far the weaker power, so we must do it in a clever way. But our opponents are, for now, so poorly led that they have put themselves in an enormously vulnerable position. We can withstand another crash in world markets – all we’ll have to do is arrest a few people, it will be salutary – but none of our opponents will win the next election if there’s another crisis like the one in ’08, or an even worse one, so for them finding some way to accommodate us before we can bring that about is a matter of political life and death. Of course, the real reason the markets have to crash, sooner or later, is that the Fed and the Bank of Japan and the ECB would have to keep geometrically expanding the volume of money printing to keep the bubble they’ve already blown up from bursting, but instead the Fed has already reached its limits and is starting to taper. Even if they flinch this time, and re-expand QE, as we expect them to, continued geometric increase is impractical for very long. So the effort to prevent a crash in financial markets by surrendering to our demands will ultimately fail, but before it does, we can expect our opponents to offer many valuable concessions. Once the final panic in the market does get underway, we will be able to take advantage of its disorganizing effects, while they will be crippled by them. Democracies are easily distracted. Who knows how long from now that will be? Not I, or anyone. It could happen tomorrow, or not for another five years. In the meantime, it is very much in our interest to keep the threat that we will precipitate a crash alive. We are facing opposing powers that are intrinsically much stronger than we are, governed by people with no real survival instincts, who have made no effective preparations of any kind for a military or economic conflict. In that kind of strategic environment, great things can be accomplished with slender means. Fortune favors the bold. The trick will just be keeping the conflict non-kinetic and unconventional, and achieving as much as we can before they finally wake up and make a real stand. Each action must seem independent, each move must seem like it might be the last one we’ll make. Bit by bit, step by step, we will back them into a corner, simply because their planning horizon is three days, and ours is thirty years. The risk is limited, because our opponents are desperate for peace, and will gladly let us switch off the war the minute it begins to go against us. (This is the meaning of the American president’s endless “exit ramps”; what he is actually telling us is that we can end the confrontation whenever we please.) By now American voters are very tired of their endless imperial wars, which started so many weary years ago, and as far as they can see, have achieved exactly nothing for them. The whole project of empire has been publicly discredited, though no part of the empire has been relinquished. That’s the paradox of Obama’s presidency – he still carries on all the various wars of empire and meddling provocations, but at the same time doubts their necessity, and is constantly tempted to repudiate them. The tentacles of the jellyfish continue to sting, like independent creatures, even after the brainless animal has lost interest in the fight. He wants to overthrow several of the world’s governments, and is actively undermining them – but his heart really isn’t in it. He starts wars that he has no will to win. This, to our minds, is a strategic vulnerability that simply has to be exploited, because it means he can be fought – and beaten – fairly easily. Nothing can enhance a state’s prestige and influence more than taking on and defeating the currently paramount power, so America’s current strategic stance – impressive means, incoherent goals, absolutely no political will to achieve them, an attention span of three days – is a standing invitation to attack. We have done quite well against them in Syria, and there is no reason to think their performance on the Ukraine will be any better. Samantha Powers will still be piously scolding us and threatening to un-friend us on Facebook as the tanks roll into Kiev; she might well go on doing the same thing if we took Warsaw, or Berlin, though of course we currently have no plans to send tanks to those two places. The natural tendency of the American voter is isolationism – he has difficulty seeing why other peoples’ troubles should matter to him, though he’s a good fighter once he’s reluctantly become involved in them. The trick is just to find some way to tip him back into his pre-1942 state of selfish indolence without doing any actual fighting. A much higher oil price and a deeper depression might do it, at this point, so it’s fortunate that we’re in a position to bring that about. The people who make up America’s current political leadership won’t really put up much resistance – they tolerate the existence of the empire because it’s lucrative for powerful constituents, and costs them, personally, nothing, but they are presiding over an inherited political system and an inherited security architecture which they fundamentally don’t believe in, don’t understand, and have no will to defend. If they have to choose between health care and Europe’s security, of course they will choose the good they understand and believe in – freedom from pain and the postponement of personal death for as long as possible – over the one they’ve never understood or sympathized with. If we are really determined to restore full Russian sovereignty, up to and including the right to go to war on other powers without seeking anyone’s permission, as is our sacred obligation as guardians of the security of the Russian people and nation, war with America or her proxies can’t be avoided anyway, because as things are now, we won’t ever again be able to exercise our sovereign rights to make war and peace without fighting them, they will always get involved at an early stage. Since war can’t be avoided, and we’re the weaker power, if we want to win we must attempt to control the time and circumstances of the fight. We must fight a limited war when we can win, in a clever way that allows us to win, to avoid having to fight a war when we can’t. That means we have to start the fight ourselves, instead of waiting for them to start it. We must attack, because we are the weaker party, and need to keep the strategic initiative to achieve our goals. So much for the problem, now for the opportunity. Only a year or two ago, the European Union seemed to be teetering on the verge of dissolution. I think that it would be very much in our interests to see that actually happen, especially if NATO goes with it. (This is why Estonia is essential; NATO thinks they will defend it, we must show them that they will not. Once one NATO member has been abandoned to our mercies, the principle will have been established, and we can deal with the Poles – our single biggest problem – at our leisure.) The EU, as it presently exists, is a relic of an American-backed project to create a European super-state, a United States of Europe, that specifically and deliberately excludes us. In any such confederation, German hegemony is virtually certain. That is intolerable. We, of course, would prefer to see a European political architecture that includes us, one in which we have a chance at playing a leading role. But only by destroying the existing EU, and NATO, and starting over from scratch will we really be able to arrive at a satisfactory outcome. The near-dissolution of the EU a couple of years ago was the result of an economic crisis, and so the question of whether or not it is possible to bring another such crisis about naturally arises. It’s my belief, as I’ve already explained, that an eventual renewal of the crisis is not only possible, but inevitable. Given that inevitability, the only choice available to us is that of whether or not to take control of the event, and use it. The strange thing, really, is the apparent conviction, on the part of many European and American elected officials, that another financial crisis can actually be avoided, forever. Apparently they think that they can indefinitely postpone the next recession. From the outside, however, it has become quite obvious that the “developed” economies are locked in a cycle of artificial booms and genuine busts. It’s useless to speculate on the ultimate reason – what we actually know is that this is a group of people who for more than a decade now have not achieved anything like the rates of economic growth they had expected and planned for. As any polity experiencing a growth shock of this kind would, they have been resorting to more and more desperate expedients to try to delay the day of reckoning with this huge ongoing shortfall, in the process making things worse and worse each time they lose control. Russia, and Brazil and China for that matter, are simply carried along as passengers on this increasingly violent roller-coaster ride. If we don’t want our currencies to appreciate uncontrollably against the dollar, we have to print rubles or yuan to buy up the excess dollars the Fed is printing to try to keep the world economy from crashing, so we inflate our own economies and pile up huge reserves of foreign exchange in the upswing, and then in the downswing, when the panic finally comes, all that money tries to rush out of our economies at once, making our markets and our currencies crash. So you see, Gennady, another crash in the ruble and the MICEX is inevitable, sooner or later, simply as a consequence of the Fed’s current policies, whether we annex parts of the Near Abroad, or not. The question is just whether we initiate it ourselves, and ride the storm, first using the threat of a global financial crisis to manipulate and damage our enemies, or else are mere passive victims of the cycle, as we were in the last two iterations. The question is whether we Russians are capable of learning anything from experience, whether we have learned not to be the greatest fools in an artificial bull market. Perhaps, if we can develop the political will to abandon convertibility quickly enough, we can even avoid being caught in the crash, this time. The reserves the Fed forced us to accumulate will allow us to postpone the decision for years, if we’d like, and in that amount of time, it may even be possible to complete the operation and escape default and devaluation. If not, well, those are both things we know how to do, and last time the pain only lasted two or three years, which is nothing. Since another panic in world markets is inevitable sooner or later, we plan to try to use it, this time, surf on it, let it carry us to our strategic goals. In order to do that, we need to be, or at least to appear to be, in control of the timing of events. The threat of cutting off Europe’s natural gas is a threat of precipitating a European recession, which would reduce tax revenues and bring the Mediterranean bond markets back into difficulties. A shock from the price of oil at the same time would make things even worse. The Europeans will concede anything in order to avoid that, because it threatens their whole European project, for which they have already sacrificed so much. This great harm, which is actually going to befall them no matter what they do, can be made to look, for a little while, like something it is in our power to provoke or prevent. They will allow us to get away with murder, if we can just produce that illusion – and it’s our job to take as much advantage of this fleeting opportunity as we can. In the end, though, we really may have to go so far that we do force them to give up the oil and gas, because another European recession or depression now is absolutely necessary to our longer-term strategic plans. We can promise to turn the gas back on, if they’ll just give us Ukraine, but then drag things out somehow during the negotiation of the details, insisting on various implausible principles in a tedious and impractical manner, so that the economic damage is done anyway… We ourselves are likely to get caught in the depression as well, of course, no matter what we do, war or no war – which is why we actually need an external enemy now, to justify an increase in political repression and the imposition of exchange controls. During a war, many ways of managing an economy that would be impossible during peacetime are perceived as legitimate, so a confrontation with Europe will, in some ways, give us more freedom of action. The Americans are in a position to take a more hawkish stance than the Europeans, and they may eventually begin to agitate for that approach, as things move on. Obama is in his second term, and the Democrats might not mind being out of power for the next two years, if they are going to be really bad ones for the voter, so even higher oil prices might be tolerable as far as they are concerned, as long as the other party can be blamed for their effects. Sooner or later, wise old men like Brzezinski, who still remember what it is like to have an actual thinking opponent, will be listened to. Or perhaps not, perhaps it will simply be impossible for the current leadership to ever wrap their heads around the idea of actually getting into a fight against someone with the means to fight back. The European leaders, in any case, are, in our judgment, such complete pacifists that instead of welcoming their assistance in a crisis, they may easily be brought to resent the Americans’ hawkish interference, which perhaps can be used to drive a wedge between the two parties. We must try our best to seem, at some crucial point, both reasonable and conciliatory to the Europeans, and utterly insane and out of control to the Americans. Given the somewhat differing character of the two ruling elites, and the in particular the rather thoughtless jingoism of the Republicans, and their great love of draconian sanctions, that shouldn’t actually be all that difficult to accomplish. Perhaps a Republican victory in the upcoming American midterm election would serve our purposes – another way a crisis in financial markets could benefit us strategically. Our immediate objective, by first threatening and then managing an economic crisis, is, of course, to regain control of the Ukraine, the whole thing, unopposed, step by step, perhaps annexing the East if that’s convenient, and at the same time to intimidate the Europeans, force them to publicly back down, to openly beg us to turn the gas back on, and have the Americans do nothing very effective to rescue them. The cherry will be Estonia; having failed to defend Ukraine, NATO will find it hard to rally to reverse the results of yet another referendum, even one conducted on the soil of a nominal NATO member. Kerry and Merkel may well abandon the Estonians to their fate – if so, that will be the last that will be heard of the North Atlantic Treaty Organization. If not, we can always drag out the crisis, and use it to extract more concessions in other domains. At the end, we want discredited European leaders bickering with each other as the EU and NATO crumble, and an exasperated America confined to the sidelines. This will establish a precedent – if the Americans didn’t do anything about the first act of bullying, what is going to make them do something about the next one, or the next one, or the next one after that? It will show who really has the leverage in Europe, now. At the same time, the world economy will be crashing again. Nationalists will be rising to power in European countries, and the people who run Europe now will do anything to defeat them. One side or the other will end up as our allies. We’ll simply support whichever looks weaker. Beppo Grilli as Prime Minister of Italy or Marine Le Pen as Prime Minister of France would be a political windfall beyond our wildest dreams. We think we can manipulate such a combination of circumstances to our ultimate advantage, especially if we can get the Americans out of the picture – a protracted period of chaos and disunity in Europe is exactly what we need now. While the threat of gas and oil cutoffs and the recession and crashes those could produce are our main point of leverage, there are other tools as well. It is important to keep direct military pressure on Ukraine. We can’t afford to let the situation stabilize as it is now, and we have yet to encounter any effective resistance, so the thing is to push on as quickly as is possible without provoking a real reaction. We need to discredit the Kiev government and, eventually, replace them with our allies. Ultimately we must use as much force as is necessary to achieve that goal, even if it means shooting some rioters in the streets. But here as everywhere, we can only win by fighting smart. I think you know what I mean by that, in a Ukrainian context. Of course, as you’ve correctly pointed out, the Ruble will eventually crash, no matter what we do, if the crisis goes on long enough. Since we didn’t want it to appreciate in a way that would kill our economy, we were forced, by QE, to accumulate huge dollar reserves, enough t | ||||||||||||||||||||||||||||||||||||||||

| Is The US Military Preparing For The Collapse Of The Dollar? Posted: 21 Apr 2014 06:46 PM PDT It almost happened in 2008... but as this excerpt from Casey Research's Meltdown America documentary notes, it appears the US military is preparing for the potential collapse of the US dollar. As Scott Taylor warns, "...if the carrot (of credit worthiness) is fading, and the stick (of military threat) is weak, that empire is going to come down in a hurry..." which leaves a serial economic mis-manager only one option to 'secure' the empire.

To see what the consequences of economic mismanagement can be, and how stealthily disaster can creep up on you, watch the 30-minute documentary, Meltdown America. Witness the harrowing tales of three ordinary people who lived through a crisis, and how their experiences warn of the turmoil that could soon reach the US. Click here to watch it now. | ||||||||||||||||||||||||||||||||||||||||

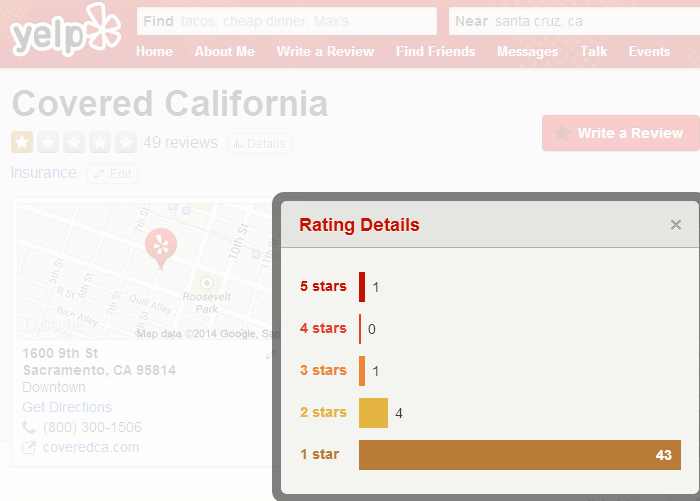

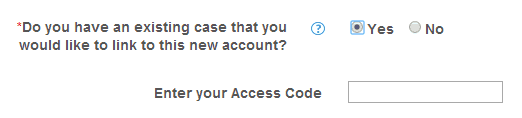

| Posted: 21 Apr 2014 06:43 PM PDT I've shared my gripes about Covered California before, such as here and here. I've got more to add. I'm self-employed, so I get insurance through the so-called Covered California system of health insurance. California is one of the many states that decided, in its infinite wisdom, to not hang off the federal government's healthcare.gov site, but instead spend $100 million of its own to re-invent the wheel.

So instead of one wholly integrated federal health care system, we have something like 30 disparate systems, all of them expensive, and none of them perfect. Indeed, "not perfect" is an absurd understatement, roughly equal to Oprah being "not petite." Allow me to offer my own personal example. When I initially signed up for the service in December, I decided to be cheap and buy the Bronze level of service, since my medical needs are approximately zero. The signup went decently well (although it was clear the web site was sorta kinda broken), and I was on my way. Healthnet was the private insurance carrier that provided my lame-ass Bronze coverage, and that was that. A couple of weeks later, I decided Bronze was a pretty pathetic level, and that Silver would be a more appropriate product for me. Now, in a just and sane universe, I would have signed on to the web site, clicked the Upgrade button, agreed to the higher premium, and we would all go on with our lives. Ho ho ho! Nope. Not even close. I debated whether or not to share with you all I went through to execute this ostensibly simple procedure, but honestly, even with the most riveting writing, I would lose all of you along the way. There were many steps, many phone conversations, and many dozens of hours expended on this ridiculous act. There were false starts, dead ends, and wrong turns. If there is a Hell, they surely will model it on my experience upgrading from Bronze to Silver. But that was weeks ago. I'm not going to go back down that path, because, at long last, I finally got the upgrade done, and I was on my way. So what am I griping about now? It's good that you ask, because I just happen to be typing right now, and I'd be glad to respond. On Friday, my doctor's office contacted me to tell me they weren't getting paid, because my insurance had been cancelled. Umm..........what? Given what screw-ups both Covered California and Healthnet are, I wasn't shocked, but after spending so much time and energy finally getting upgraded, it made me sick to think I'd have to venture back into The Land That Competency Forgot to deal with this. But, sure enough, I logged onto Healthnet and was greeting with the following:

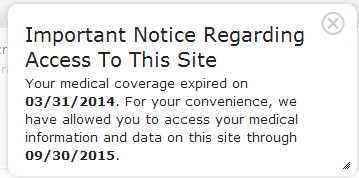

For my convenience. For. My. Convenience. You douchenozzles! The last thing you care about in the world is my convenience! So then I called them, and I felt kind of honored, in a way, because as luck would have it, I managed to reach the winner of the World's Most Dim-Witted Person contest to help me. What a treat! So after speaking with her at great length (because, let's face it, my time has no value), it was determined that..........my premiums were promptly paid, yes. I hadn't done anything wrong, yes. But, according to Ms. Dim, Covered California had cancelled the policy on April 3 for no reason, and that Covered California was in the process of fixing this, and it would be all just dandy in a week or ten days. See, the beauty of the State and a Private Company partnering like this is they can always blame Although I could have just left it at that, I'm not naive enough to think that everything was going to work itself out, so I called Covered California (which is akin to the proverbial jumping out of the frying pan and into the fire, because let's remember, at least Healthnet is a private company). So, after a lot of waiting, I reached a human at CoveredCA and told her the situation.' She carefully examined my records and said, nope, they didn't cancel me, and there was nothing untoward about my account at all. She had no idea what Healthnet was talking about. Well, OK, fine. But while I had her on the phone, I explained to her that I'd like to be able to log in to my own CoveredCA account from time to time, and my username and password weren't working. She explained to me that the username/password I had wouldn't work, but that I should create a new account, just like I did the first time, and enter a special Case Number when prompted in order to "link" to my information. OK, fine. So she told me the access code, letter by letting, emphasizing which letters were uppercase and which were lowercase. I carefully repeated it back to make sure I had it right, because getting a human on the phone is time-consuming enough. Later on, I went to the web site, and I dutifully started to create a new account. I saw the field she mentioned, which gave me a sense of relief, because that's where I was supposed to enter my code:

I carefully entered the code and clicked the Submit button. It waited a moment, and then up came a dialog box saying that the code wasn't valid. Although I knew I entered the code carefully, I tried once again, this time, triple-checking each letter. I clicked Submit. Same deal. I tried a third time. No change. Thus, I called them yet again. After a long while, I got another human, and I explained the situation. She said to me, and I'm not making this up: "Oh, yes, that's the correct Access Code. But those don't actually work." It soon became evident that the entire Access Code schtick was just a sorry waste of time. It didn't work at all. And when I expressed astonishment that their $100 million site had this error, she laughed, "Oh, that's nothing! That's one of the small problems! You wouldn't believe how many glitches there are." NEWS FLASH: I had thrown out the figure "$100 million" a couple of times, I realize. This was just a dumb guess. I took the time to actually find out what it cost, and I'm sorry I didn't do better research for my readers. Turns out the costs were $489 million. Sorry 'bout dat. In any case, I am a healthy, relatively young person, and the preceding has been a taste of my experience. I can't imagine what someone with real health needs would go through. But I'll close by saying this: I realize I piss and moan and bitch about people who work for Goldman Sachs, or JP Morgan, or wherever else. But you know what...........they're supposed to make lots of money, and it just so happens they're very good at it. Getting hired at a place like Goldman Sachs is a very big deal, and although these people are no saints............they are good at what they do. They have to be, because private enterprise doesn't tolerate otherwise. When you're dealing with state bureaucrats, however, it's an entirely different universe. You are dealing with some of the dumbest folks on the planet, fiercely protected by entrenched unions, and utterly devoid of incentive to do anything but punch a clock and get through their day. The old saw, cited for years to avoid national health, about government-based health care having "the efficiency of the post office and the sensitivity of the IRS" was far too optimistic. I'm here to tell you.............it sucks out loud. So, for your own sake, don't ever get sick.  | ||||||||||||||||||||||||||||||||||||||||

| Is The Petrodollar Doomed -- Jay Taylor Posted: 21 Apr 2014 06:11 PM PDT We talked with our old friend Jay Taylor about the impending collapse of the petrodollar. Seems like the world is ready to move on from this failed experiment, but what will become of the United States? China and Russia are setting up oil exchanges and getting ready for life without it. Jay... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||

| How China's Commodity-Financing Bubble Becomes Globally Contagious Posted: 21 Apr 2014 06:09 PM PDT "Marubeni [the world's largest soybean exporter to China] is deluded in thinking that payments will come once the cargoes have sailed," is the message from an increasing number of liquidity-strapped Chinese firms, "If they take these cargoes, some could go bankrupt. That's why they choose not to honor the contracts." As we explained in great detail here, this is the transmission mechanism by which China's commodity-financing catastrophe spreads contagiously to the rest of the world. A glance at the Baltic Dry is one indication of the global nature of the problem (and Genco Shipping's $1 billion bankruptcy), but as Reuters reports, "If buyers cannot resolve the issue, they may also cancel future shipments."

Reuters notes that China's soybean imports in the first quarter jumped 33.5 percent, a record for the quarter and industry sources see a rush of cargoes in the second quarter. The rise comes amid an increasing use of soybeans in financing trades to secure credit.

And the lack of liquidity and forced losses means China's buyers ain't paying...

Of course, this odd 'beggars are choosers' almost monopoly of buying pressure dry-up means Chinese buyers can play hard-ball...

And the lower prices will only exacerbate liquidity problems as collateral value tumbles on the soybean-backed loans. And this means counterparty risk is rising broadly - which means haircuts (or Letters of Credit) soar, collapsing liquidity conditions and leading to a further vicious tightening cycle...

As we explained previously,

And sure enough that is what Reuters reports above is happening... which means only one thing... We explained precisely this a few days ago in "What Is The Common Theme: Iron Ore, Soybeans, Palm Oil, Rubber, Zinc, Aluminum, Gold, Copper, And Nickel?" As briefly noted above, these are all the commodities that serve as conduits in China's numerous Commodity Funding Deals. Only no more. Which means that far form merely crushing exporters who suddenly are dealing with Chinese importers who have torn apart contracts, obviously with no recourse, suddenly China's entire "hot money" laundering infrastructure (which as explained over the weekend, has gold performing an even greater role than copper) is about to collapse. And when the counterparties of China's hundreds of billions in CCFDs decide to also get out of Dodge and unwind these deals (amounting to hundreds of billions in notional), only to find the underlying commodity has not only been re-re-rehypotecated countless times and has been sold, then there is truly no way of saying what happens next. | ||||||||||||||||||||||||||||||||||||||||

| Turk describes to KWN exactly how gold was manipulated today in light trading Posted: 21 Apr 2014 05:20 PM PDT 8:15p ET Monday, April 21, 2014 Dear Friend of GATA and Gold: GoldMoney founder and GATA consultant James Turk describes to King World News exactly how the gold market was manipulated today in light trading conditions. Turk adds that gold now stands at the greatest backwardation it has seen in eight months. An excerpt from the interview is posted at the KWN blog here: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | ||||||||||||||||||||||||||||||||||||||||

| The Earnings Season: "House Of Cards" Posted: 21 Apr 2014 04:32 PM PDT Submitted by Lance Roberts of STA Wealth Management, Just like the hit series "House Of Cards," Wall Street earnings season has become rife with manipulation, deceit and obfuscation that could rival the dark corners of Washington, D.C. From time to time I do an analysis of the previous quarters earnings for the S&P 500 in order to reveal the "quality" of earnings rather than the "quantity" as focused on by Wall Street. One of the most interesting data points continues to the be the extremely low level of "top line" revenue growth as compared to an explosion of the bottom line earnings per share. This is something that I have dubbed "accounting magic" and is represented by the following chart which shows that since 2009 total revenue growth has grown by just 31% while profits have skyrocketed by 253%. As I have discussed previously:

As we enter into the tsunami of earning's reports for the first quarter of 2014, it will be important to look past the media driven headlines and do your homework. The accounting mechanizations that have been implemented over the last five years, particularly due to the repeal of FASB Rule 157 which eliminated "mark-to-market" accounting, have allowed an ever increasing number of firms to "game" earnings season for their own benefit. This was confirmed in a recent WSJ article which stated:

This should not come as a major surprise as it is a rather "open secret." Companies manipulate bottom line earnings by utilizing "cookie-jar" reserves, heavy use of accruals, and other accounting instruments to either flatter, or depress, earnings.

Of course, the reason that companies do this is simple: stock based compensation. Today, more than ever, many corporate executives have a large percentage of their compensation tied to company stock performance. A "miss" of Wall Street expectations can lead to a large penalty in the companies stock price. As shown in the table, it is not surprising to see that 93% of the respondents pointed to "influence on stock price" and "outside pressure" as the reason for manipulating earnings figures. Note: For fundamental investors this manipulation of earnings skews valuation analysis particularly with respect to P/E's, EV/EBITDA, PEG, etc. Revenues, which are harder to adjust, may provide truer measures of valuation such as P/SALES and EV/SALES. So, as we head into earnings season, it is important to be aware of what is real, and what isn't. Wade Slome brought this into focus recently via the Investing Caffeine blog: where he pointed out four things to look for:

For really short term focused traders none of this really matters as price momentum trumps fundamentals. However, for longer term investors who are depending on their "hard earned" savings to generate a "living income" through retirement, understanding the "real" value will mean a great deal. Unfortunately, there are no easy solutions, online tips or media advice that will supplant rolling up your sleeves and doing your homework. As the WSJ article concludes:

Couldn't have said it better myself. | ||||||||||||||||||||||||||||||||||||||||

| Silver Miners Have Been Exploited For Generations By The Pilgrims Society Posted: 21 Apr 2014 01:26 PM PDT In his latest letter, Charles Savoie, silver expert and author, explains with a recent example how he has attempted to inform society since December 2004 that the precious metals suppression is coming from the top down from one organization only, with a branch in London and a branch in Manhattan: The Pilgrims Society. Savoie describes and documents at great length (+500 pages) at SilverStealers.net how members of the organization have been seizing silver, stealing silver, devastating silver mining companies, shoving silver and gold out of the money system, and feeding off mining shareholders carcasses since its founding in 1902-1903. Based on the income figures of several members of the Silver Users Association, compared to the silver miners, Savoie points to the major disconnect between users and consumers of the grey metal. He considers the Silver Users Association to have a responsibility in this matter, suppressing the silver price at the expense of the profitability of silver miners.

Savoie looks in detail who is behind the silver suppression scheme:

Read the full document

| ||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Lies, Damn Lies, and an Option Expiration Posted: 21 Apr 2014 01:11 PM PDT | ||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Lies, Damn Lies, and an Option Expiration Posted: 21 Apr 2014 01:11 PM PDT | ||||||||||||||||||||||||||||||||||||||||

| Gold Market Now Seeing Deepest Backwardation In 8 Months! Posted: 21 Apr 2014 12:41 PM PDT  As global markets continue to see some wild trading, today James Turk told King World News that the gold market is now seeing the deepest backwardation in 8 months. This is one of Turk's most important interviews ever because it exposes just how phony the paper gold and silver markets have become. Turk also discussed how this historic backwardation will be resolved in this powerful and timely interview. As global markets continue to see some wild trading, today James Turk told King World News that the gold market is now seeing the deepest backwardation in 8 months. This is one of Turk's most important interviews ever because it exposes just how phony the paper gold and silver markets have become. Turk also discussed how this historic backwardation will be resolved in this powerful and timely interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Apr 2014 10:59 AM PDT 1:55p ET Monday, April 21, 2014 Dear Friend of GATA and Gold: Reflecting on French economist Thomas Piketty's new book, "Capital," the New York Sun today offers a most politically incorrect explanation for the explosion in income inequality and unemployment in the United States since the 1970s: the end of the dollar's gold convertibility and the unleashing of the age of infinite fiat money. The Sun's commentary is headlined "Piketty's Gold?" and it's posted here: http://www.nysun.com/editorials/pikettys-gold/88678/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair to hold gold market seminar in Toronto on April 26 Mining entrepreneur and gold advocate Jim Sinclair's next gold market seminar will be held from 1 to 5 p.m. Saturday, April 26, at the Pearson Hotel & Conference Centre at Toronto's Pearson International Airport, 240 Belfield Road, Toronto. For details on tickets, please visit Sinclair's Internet site, JSMineSet.com, here: http://www.jsmineset.com/2014/04/01/toronto-qa-session-announced/ Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||

| If QE works so well, von Greyerz asks, why don't they do a lot more? Posted: 21 Apr 2014 10:53 AM PDT 1:47p ET Monday, April 21, 2014 Dear Friend of GATA and Gold: In an interview today with King World News, Swiss gold fund manager Egon von Greyerz offers what may be the best mocking yet of "quantitative easing." "It amuses me," von Greyerz says, "that the Bank of England has just published a paper stating that QE has raised growth in the United Kingdom by 3 percent or 50 billion pounds. Isn't this wonderful? Supposedly money printing raises GDP in real terms. So the U.K. has had QE of 375 billion pounds, which has raised real growth by 50 billion pounds. So why don't they print 375 trillion instead? This way the U.K. would be the biggest and most prosperous economy in the world." Von Greyerz's interview is excerpted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/4/21_A_... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: | ||||||||||||||||||||||||||||||||||||||||

| Sprott cites GATA consultant on Chinese demand, notes paper bombing of gold Posted: 21 Apr 2014 10:40 AM PDT 1:40p ET Monday, April 21, 2014 Dear Friend of GATA and Gold: Interviewed by Sprott Money News, Sprott Asset Management CEO Eric Sprott cites gold researcher and GATA consultant Koos Jansen and GoldMoney's Alasdair Macleod in support of his belief that the World Gold Council's estimates of China's gold demand are grossly understated. Sprott also discusses last week's manipulation of the gold market via the dumping of a huge amount of paper gold. The interview is 10 minutes long and can be heard at the Sprott Money Internet site here: http://www.sprottmoney.com/sprott-money-weekly-wrap-up CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. | ||||||||||||||||||||||||||||||||||||||||

| A $10 Billion Company that’s Actually Undervalued Posted: 21 Apr 2014 10:13 AM PDT Venture capital financings are at their highest level in 14 years… Tech M&A last year eclipsed the sky-high levels of 2000… The NASDAQ is hovering around 4,100… One could argue that, once again, we're in the middle of a "tech bubble." But the stock market aside, I'd argue that many of today's technology companies are undervalued. In fact, I believe they present a stunning opportunity for profit. Did you happen to see this New York Times article about Airbnb last month? Airbnb is a hospitality start-up that lets people rent out rooms (or their entire home) to travelers. They help facilitate the transaction and take a cut of sales. When the company was first getting started, it was valued at $1 million. When we compare Airbnb to traditional hotel chains, you can begin to see why I think Airbnb might be undervalued. In the article above, you'll see that Airbnb is on the verge of closing a new round of financing – at an eye-popping $10 billion valuation. A 990,000% increase in value in only 4 years – now that's a staggering number. But does that imply that Airbnb is overvalued? Does it mean there's a tech bubble? As far as I'm concerned, the answer is no. Let's take a look at why Airbnb may be undervalued. It's tough to look at a superficial comparison between tech startups and their public market counterparts. Since it's rarely an apples-to-apples comparison, it requires some thought and analysis. Tech startups, for example, tend to be more efficient than large incumbents. They create new ways of doing things and entirely new business models. Think about Amazon.com compared to Walmart. Unlike Walmart, Amazon doesn't have any physical locations. They don't have to invest in the expensive construction and staffing of stores. The company eliminated those costs and passed the savings onto the customer. This led to robust growth, healthy margins and a valuation that's increased rapidly. The same could be said of Airbnb. Airbnb is pioneering a new business model around hospitality. The company doesn't build hotels. It doesn't own property. The company merely brokers rooms or homes and collects a fee. When we compare Airbnb to traditional hotel chains, you can begin to see why I think Airbnb might be undervalued. Take a look at Hyatt, for example. Hyatt has over 147,000 hotel rooms available worldwide. It has a market cap (the public market equivalent of "valuation") of $8.3 billion. That equates to roughly $56,000 in market value per room. Now look at Starwood. Starwood has 346,000 rooms and commands a $14.55 billion market cap. That's roughly $42,000 in market value per room. Now let's look at Airbnb. Airbnb has over 500,000 rooms available on its site. But it's only valued at $10 billion… That means Airbnb generates just $20,000 in market value per room. This is a company that's growing faster than, and will soon have more rooms than, any other hotel chain in the world. And yet, Airbnb commands a market value per room that's less than half of Hyatt's (a company one-fifth its size). That sure looks like a potential investment opportunity to me. The mainstream media enjoys writing sensational stories about young founders raising millions of dollars at billion-dollar valuations. And while the big numbers may be reminiscent of the dot-com days, we shouldn't let our emotions get the best of us. Private start-ups like Airbnb are generating real financial value. They're generating meaningful cash flow and revenue growth. And thanks to the JOBS Act, you now have the opportunity to invest in private starts-ups – like the next Airbnb – at its earliest stages. My co-founder, Matt, wrote a fantastic essay last week that sums up why our team believes private markets are a big part of a better, richer future. If you haven't read it yet, definitely take a look. Happy investing! Best Regards, Wayne Mulligan Ed. Note: Every day, Tomorrow in Review readers are given a “review of the future” so to speak. And because of that, they’re able to anticipate and earn more money and save more time by living smarter. That's just one small benefit of being a subscriber to the FREE Tomorrow in Review email edition. Sign up for FREE, right here, and never miss another great opportunity like this. | ||||||||||||||||||||||||||||||||||||||||

| Gold Price In Ukraine 75% Higher In 2014 Posted: 21 Apr 2014 09:56 AM PDT As we have repeated over and over again, gold should primarily act as an insurance policy which protects your purchasing power during a currency crisis. And despite the fact that most economic pundits want us to believe there is an economic recovery, the truth of the matter is that the recovery is very weak; the economy remains fragile. Apart from that, a global currency crisis is playing out and it will probably hit most of the currencies in the years ahead. Recently, in the heat of the emerging market crisis, we wrote Gold Price Exploding In Emerging Markets. The charts in the article show the explosive price action in local currencies of the emerging markets that were hit hardest. That's the insurance policy in action. Another “real time” example of the inverse correlation between currency and gold is Ukraine. Their currency, the Hryvnia, has been in free fall in 2014. It is the world's worst performing currency this year. The following chart shows how the Hryvnia has been devalued significantly against the USD in 2008/2009, from 0.22 to 0.12. It remained rather stable until 2014, as the currency collapsed from 0.12 to 0.08 since the start of this year. At the same time, the price of gold in Hryvnia went from 4,000 to 8,000 in 2008/2009. Since the beginning of this year, Hryvnian gold exploded from 10,000 to 17,444 last week. One could easily observe that this is an example of runaway inflation, even hyperinflation. In such a situation, gold is known to hold its value. It proves that people do not hold gold to have more value in terms of a currency. Rather, one holds gold as monetary insurance to preserve its purchasing power when things turn out bad. Those owning gold in Ukraine can make use of it in the coming months to buy the same amount of products like food and fuel as before. Some could use this crisis as an opportunity and buy land or businesses to generate future income.

The irony in this story is that Ukraine had doubled their official gold reserves, from 20 tonnes to 40 tonnes, over the course of the past decade. With the recent tensions between Russia and Ukraine, the United States stepped in and “rescued” the gold reserves of Ukraine. Some weeks ago, pro Russian newspaper, reported that orders were given by one of the “new leaders” of Ukraine to transport all the gold reserves of the Ukraine to the United States. Or, as Zerohedge observes rightfully, “the best source of validation, and refutation, of this story would be the people of Ukraine, alas since not even Americans are entitled to observe how much gold is in Fort Knox, somehow we doubt that the Central Bank of Ukraine will be any more lenient in providing visiting and viewing hours for its much more compact gold inventory. Especially since the local population is far more busy celebrating its “liberation” by western powers.”

| ||||||||||||||||||||||||||||||||||||||||

| Posted: 21 Apr 2014 09:45 AM PDT Clive Maund | ||||||||||||||||||||||||||||||||||||||||

| James Rickards : Death Of Money Coming To A Central Bank Near You Soon Posted: 21 Apr 2014 09:40 AM PDT James G Rickards : Death Of Money Coming To A Central Bank Near You Soon Kerry Lutz had a long discussion with Jim Rickards about his new book and the coming death of the dollar, along with most of the world's major currencies. According to Jim, the IMF is already going through dry runs ... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||

| Anti-Gold Scare Tactics Seem To Be Largely Ineffective Posted: 21 Apr 2014 09:38 AM PDT | ||||||||||||||||||||||||||||||||||||||||

| Anti-Gold Scare Tactics Seem To Be Largely Ineffective Posted: 21 Apr 2014 09:38 AM PDT | ||||||||||||||||||||||||||||||||||||||||

| Fukushima Disaster : Tokyo Hides Truth As Children Die, Become Ill From Radiation Posted: 21 Apr 2014 09:35 AM PDT The tragedy of the Fukushima nuclear plant disaster took place almost three years ago. Since then, radiation has forced thousands out of their homes and led to the deaths of many. It took great effort to prevent the ultimate meltdown of the plant -- but are the after effects completely gone?... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||

| A Bankrupt World, $26,000 Gold & The Destruction Of Wealth Posted: 21 Apr 2014 08:56 AM PDT  Today a 42-year market veteran spoke with King World News about a bankrupt world, $26,000 gold, and the destruction of wealth. Below is what Egon von Greyerz, who is founder of Matterhorn Asset Management out of Switzerland, had to say in this powerful interview. Today a 42-year market veteran spoke with King World News about a bankrupt world, $26,000 gold, and the destruction of wealth. Below is what Egon von Greyerz, who is founder of Matterhorn Asset Management out of Switzerland, had to say in this powerful interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||

| The Financial Scam that Every American Falls For Posted: 21 Apr 2014 08:51 AM PDT Economics has been called the "dismal science." But even that is merely fraud and flattery. Economics is dismal, but it isn't science. At best it is merely voyeurism — peeping in people's windows as they go about their business and trying to figure out what they are doing. At worst, it is pompous theorizing about how to get the schmucks to do better. We doubt that you are especially interested in economics, dear reader. We know we are not. But we can't resist a good comedy… or a good opportunity to point and giggle. We keep our eye on economists and politicians the way children watch clowns; we can't wait to see them get whacked in the head or trip over each other. But what is amusing is also instructive. Are clowns not people too? Are they not part of human life… human organization… and human economy? Every one of them is driven by the same motors that power everyone else. They want power… glory… money. But how do they get it? Can we not watch politicians and economists and learn something about ourselves? One of the many conceits of politicians and economists is that they are somehow out of the ordinary. They are godlike, or so they pretend, having no other ambition but to make the world a better place. Neither drink, nor meat, nor false witness cross their lips. They sweat for no material gain… and know no lust — save for the betterment of all mankind. They pass laws… they enact codes and regulations… they jiggle this lever and turn another — as if they were the masters of the whole human race, rather than mere parts of it themselves. Since they float above it all, they are not subject to the normal temptations. The rest of us spend our whole lives like animals — craving profits, mates, status, pride, love, and money like raccoons searching for a garbage pail without a lid. Unless we are kept in tight cages, who knows what we will do? That is why the tabloid press — especially in Britain — loves stories about government ministers having affairs with their secretaries or cheating on their income tax. Who doesn't like to see hypocrisy revealed in public? It is as though the king himself had been caught with his pants down; we gape… and see that he is human, just like the rest of us. But thank God there are leaders! Thinkers! Theorists with their "isms" and their rat wire… ready not merely to keep us from hurting one another, but also to give us a sense of moral purpose. It is not enough that we should each seek happiness in our own private way, we must Free the Sudetenland! Abolish Poverty! Make the World Safe for Democracy! We must realize our manifest destiny… and provide lebensraum (living space) for the German people! Full employment! A minimum wage! No humbug left behind! We bring this up only to laugh at it. In the early 20th century, John Maynard Keynes came up with a new idea about economics. The politicians loved it; Keynes explained how they could meddle in private affairs on a grand scale — and, of course, make things better. Keynes argued that a government could take the edge off a business recession by making more credit available when money got tight… and by spending itself to make up for the lack of spending on the part of consumers and businessmen. Keynes suggested, whimsically, hiding bottles of cash all around town, where boys might find them, spend the money, and revive the economy. The new idea caught on. Soon economists were advising all major governments about how to implement the new "ism." It did not seem to bother anyone that the new system was a fraud. Where would this new money come from? And what made anyone think that the economists' judgment of whether it made sense to spend or save was better than any individual's? All the Keynesians had done was to substitute their own guesses for the private, personal, economic opinions of millions of ordinary citizens. They had resorted to what Franz Oppenheimer called "political means," instead of allowing normal "economic means" to take their own course. The economists wanted what everyone else wants — power, prestige, women (except for Keynes himself, who preferred men). And there are only two ways to get what you want in life, dear reader. There are honest means, and dishonest ones. There are economic means, and there are political means. There is persuasion… and there is force. There are civilized ways… and barbaric ones. The economist is a harmless crank as long as he is just peeping through the window. But when he undertakes to get people to do what he wants — either by offering them money that is not his own… by defrauding them with artificially low interest rates… or by printing up money that is not backed by something of real value (such as gold)… he has crossed over to the dark side. He has moved to political means to get what he wants. He has become a jackass. Keynesian "improvements" were applied in the 1920s — when then Fed governor Ben Strong decided to give the economy a little "coup de whiskey" — and later in the 1930s when the stock market was recovering from the hangover. The results were predictably disastrous. And along came other economists with their own bad ideas. Rare was the man, such as Robert Lucas or Murray Rothbard, who pointed out that you could not really improve economic results with political means. If a national assembly could make people rich simply by passing laws, we would all be billionaires, because assemblies have passed a multitude of laws and seem capable of enacting any piece of legislation brought before them. If laws could make people wealthy, some assembly somewhere would have found the magic edicts — simply by chance. But instead of making them richer, each law makes them a little poorer. Every time political means are used they interfere with the private, civilized economic arrangements that actually get people what they want. An ounce of [gold] today buys about the same amount of goods and services as an ounce in 1913. One man makes shoes. Another grows potatoes. The potato grower goes to the cobbler to buy a pair of shoes. He must exchange two sacks of potatoes for one pair of penny loafers. But then the meddlers show up and tell him he must charge three sacks… so that he can pay one in "taxes," to the meddlers themselves. And then he needs to put in an alarm system in his shop, and buy a hardhat, and pay his helper minimum wage, and fill out forms for all manner of laudable purposes. When the potato farmer finally shows up at the cobbler's he is informed that the shoes will cost seven sacks of potatoes! That is just what he has to charge in order to end up with the same two sacks he needed to charge in the beginning. "No thanks," says the potato man, "At that price, I can't afford a pair of shoes." What the potato grower needs, say the economists, is more money! The money supply has failed to keep pace, they add. That was why they urged the government to set up the Federal Reserve in the first place; they wanted a stooge currency that would be ready to go along with their plans. Gold is fine, they said, but it's anti-social. It resists new "isms" and drags its feet on financing new social programs. Why, it is positively recalcitrant! Clearly, when we face a war or a Great National Purpose we need money that is willing to stand up and sign on. Gold malingers. Gold hesitates. Gold is reluctant and reticent. Gold is fine as a private money. But what we need is a source of public funding… a flexible, expandable national currency… a political money that we can work with. We need a dollar that is not linked to gold. In the many years since the creation of the Federal Reserve System as America's central bank, gold has remained as steadfast and immobile as ever. An ounce of it today buys about the same amount of goods and services as an ounce in 1913. But the dollar has gone along with every bit of political gimcrackery that has come along — the war in Europe, the New Deal, World War II, the Cold War, the Vietnam War, the War on Poverty, the War on Illiteracy, the New Frontier, the Great Society, Social Security, Medicare, Medicaid, the War in Iraq, the War on Terror — the list is long and sordid. As a result, guess how much a dollar is worth today in comparison to one in 1913? Five cents. Keynesianism is a fraud. Supply-siderism is a con. The dollar is a scam. All were developed by people with good intentions. But these good intentions not only paved the road to Hell, they greased it. There was no point putting on the brakes. Once underway, there was no stopping it. Right now, the U.S. slides towards some sort of Hell. Half a century of deceit has produced a nation that is ready to believe anything… and go along with anything… provided it promises to make them rich. They will be very disappointed when they discover that all the political means they counted on — the phony money, the laws, the regulations, and the wars — have made them poorer. That is when we will really need cages… "Nothing in nature is evil," said Marcus Aurelius. Keynes was human. Even Adolf Hitler was a man, a part of nature himself. And the Evil Empire, was it not created by men too, men who — like economists and politicians — followed their own natural impulses? Adolf may have erred and strayed. But he did so with the best of intentions: He thought he was building a better world. And he had all the "reasons" you could ask for. He could argue all day; "proving" that his plan was the best way forward. Not that there weren't arguments on the other side. What were smart people to do? People argued about Keynesianism for many years. Each side had good points. One was convincing; the other was persuasive. It was like a couple arguing in divorce court — the husband forgot to take out the trash and knocked over a vase; the wife ran him over with the family car. "He had it coming," she says. What would an observer think? No amount of logic could help him. Both parties made good points. All the judge could do was to fall back on his own deep sense of right and wrong, of proportion… and good taste. "She shouldn't have run him down," he says. "Love the man, hate the sin," say the Baptist preachers. They have a useful point. There's no point in hating Adolf, Josef, Osama… John Maynard… or any of the other thousands of clowns who entertain, annoy and murder us. They are God's creatures too, just like the rest of us. What they did wrong was what they always do wrong… they all resorted to political means, to get what they wanted. We do not hate them; we just hope they get what they deserve. Regards, Bill Bonner Ed. Note: Bill tends to wear a lot of hats at Agora. If he's not telling you to watch out for in the stock market, he's writing about the best ways to protect your health, wealth, and freedom from D.C. growing reach. Readers of Laissez Faire Today get these messages from Bill (and more) all the time, sent straight to their email inbox. In addition, they’re given regular chances to discover actionable profit opportunities that can help growth their wealth in any kind of market. Click here to sign up for Laissez Faire Today, for FREE, and make sure you're on Bill's list of contacts. This article originally appeared here. This article was also prominently featured in Laissez Faire Today. | ||||||||||||||||||||||||||||||||||||||||

| Where To STASH Your CASH - Under The MATTRESS Or In The STOCK MARKET? No Mention of GOLD or SILVER Posted: 21 Apr 2014 08:45 AM PDT When stock markets become volatile, investors get nervous. In many cases, this prompts them to take money out of the market and keep it in cash. Cash can be seen, felt and spent at will, and having money on hand makes many people feel more secure. But how safe is it really? Read on to find out... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||