saveyourassetsfirst3 |

- The EPS House Of Cards: Tricks Of The Trade

- Why Rick Rule Says ‘Anti-gold Investors Will be Destroyed’

- Strong U.S. Dollar Rally Could Pull Rug From Under Gold and Silver

- Newmont-Barrick merger talks kaput for now - report

- Hedge funds cut gold bets - again

- China making discreet gold imports through Beijing - sources

- Commodity managers fleeing gold

- The invincible precious metal bears

- Volcanoes All Over The Ring Of Fire Are Erupting Right Now – Is The U.S. Next?

- CoT ? Gold, Silver, Commodities & T Notes

- Gold Price In Ukraine 75% Higher In 2014

- Are You Ready For The Price Of Food To More Than Double?

- 12 gold bars recovered from Indian businessman's abdomen

- Short sellers take aim at gold miners

- Gold falls to two-week low; palladium, platinum extend slumps

- Macleod’s Market Report: COMEX Silver Open Interest Close to All-Time Highs!

- Gold and Silver Stocks Sitting Tight

- Who will drive Gold this week?

- Ukraine reports: Russia is preparing for all-out "invasion"

- J.S. Kim: High-frequency trading rigs far more than gold and silver

- Barclays sees Gold's next move to be lower

- What you need to know about oil and gas dividends – Part 1

- Gold / Silver / Copper futures - weekly outlook: April 21 - 25

- Only A Widespread Understanding Of Money And Credit Will Change Our System

- Willem Middelkoop and Terence van der Hout: Turnaround Stories Revolve Around Proven Management

- GOLD: Threatens Further Downside

- Gold: Extends Weakness On Bearish Momentum

- Share Gold Signaling Bearish Continuation

- US Dollar Nears Technical Crossroads, Crude Oil Flounders Sub-105.00

- Ilargi: Ukraine – Part of United States’ Desperate Solutions For Not Sinking Alone?

- Mike Kosares: Anti-gold scare tactics arent very effective lately

- China allows gold imports via Beijing, sources say, amid reserves buying talk

- Golden rally helps metals producers buck the FTSE's downward trend

- The Dark Side Of The Silver Mining Industry

- Gold Can?t Glitter

- Alasdair Macleod: Paper Currencies Face Ultimate Collapse- Loss of Confidence in the Dollar Could Propel Silver to $75!

- Are You Prepared for a Bull Market that Will Shock Even the Most Ardent Goldbugs?

- 18 Stats That Prove That Government Dependence Has Reached Epidemic Levels

| The EPS House Of Cards: Tricks Of The Trade Posted: 21 Apr 2014 12:35 PM PDT As we enter the quarterly ritual of the tsunami of earnings reports, investors will be combing through the financial reports. Due to the flood of information, and increasingly shorter and shorter investment time horizons, much of investors' focus will center on a few quarterly report metrics – primarily earnings per share (EPS), revenues, and forecasts/guidance (if provided). Many lessons have been learned from the financial crisis over the last few years, and one of the major ones is to do your homework thoroughly. Relying on a AAA ratings from Moody's and S&P (when ratings should have been more appropriately graded D or F) or blindly following a "Buy" rating from a conflicted investment banking firm just does not make sense. FINANCIAL SECTOR COLLAPSE Given the severity of the losses, investors need to be more demanding and comprehensive in their earnings analysis. In many instances the reported earnings numbers resemble a |

| Why Rick Rule Says ‘Anti-gold Investors Will be Destroyed’ Posted: 21 Apr 2014 12:12 PM PDT

Gold has made its way down again, to around 1,300 per ounce this month. Rick Rule, Chairman of Sprott Global Resource Investments Ltd. says that a few years out, you will be happy you stuck with gold. For context to today's downturn, look back at the great bull market for gold in the 1970s'. During [...] The post Why Rick Rule Says 'Anti-gold Investors Will be Destroyed' appeared first on Silver Doctors. |

| Strong U.S. Dollar Rally Could Pull Rug From Under Gold and Silver Posted: 21 Apr 2014 12:00 PM PDT marketoracle |

| Newmont-Barrick merger talks kaput for now - report Posted: 21 Apr 2014 11:48 AM PDT Nevada mining operation synergies which could have saved millions weren't sufficient to convince the world's two largest gold mining companies to merge, according to media reports. |

| Hedge funds cut gold bets - again Posted: 21 Apr 2014 11:23 AM PDT As the US and European economies are perceived to be improving, hedge funds become less bullish on gold. |

| China making discreet gold imports through Beijing - sources Posted: 21 Apr 2014 11:11 AM PDT Sources say China increases gold purchases through Beijing. |

| Commodity managers fleeing gold Posted: 21 Apr 2014 11:08 AM PDT Hedge funds lowered bullish bets on gold for a fourth week, the longest streak this year. |

| The invincible precious metal bears Posted: 21 Apr 2014 11:06 AM PDT Ryan Jordan of Silver News Blog ponders the trap of invincibility that he sees silver & gold bears cloaking themselves in. |

| Volcanoes All Over The Ring Of Fire Are Erupting Right Now – Is The U.S. Next? Posted: 21 Apr 2014 10:45 AM PDT

All of a sudden, the Ring of Fire is starting to tremble violently. Last month, we had a whole bunch of major earthquakes along the Ring of Fire, and this month volcanoes all over the Ring of Fire are erupting. If you are living along the west coast or near one of these volcanoes, your life could [...] The post Volcanoes All Over The Ring Of Fire Are Erupting Right Now – Is The U.S. Next? appeared first on Silver Doctors. |

| CoT ? Gold, Silver, Commodities & T Notes Posted: 21 Apr 2014 10:01 AM PDT Biwii |

| Gold Price In Ukraine 75% Higher In 2014 Posted: 21 Apr 2014 09:56 AM PDT As we have repeated over and over again, gold should primarily act as an insurance policy which protects your purchasing power during a currency crisis. And despite the fact that most economic pundits want us to believe there is an economic recovery, the truth of the matter is that the recovery is very weak; the economy remains fragile. Apart from that, a global currency crisis is playing out and it will probably hit most of the currencies in the years ahead. Recently, in the heat of the emerging market crisis, we wrote Gold Price Exploding In Emerging Markets. The charts in the article show the explosive price action in local currencies of the emerging markets that were hit hardest. That's the insurance policy in action. Another “real time” example of the inverse correlation between currency and gold is Ukraine. Their currency, the Hryvnia, has been in free fall in 2014. It is the world's worst performing currency this year. The following chart shows how the Hryvnia has been devalued significantly against the USD in 2008/2009, from 0.22 to 0.12. It remained rather stable until 2014, as the currency collapsed from 0.12 to 0.08 since the start of this year. At the same time, the price of gold in Hryvnia went from 4,000 to 8,000 in 2008/2009. Since the beginning of this year, Hryvnian gold exploded from 10,000 to 17,444 last week. One could easily observe that this is an example of runaway inflation, even hyperinflation. In such a situation, gold is known to hold its value. It proves that people do not hold gold to have more value in terms of a currency. Rather, one holds gold as monetary insurance to preserve its purchasing power when things turn out bad. Those owning gold in Ukraine can make use of it in the coming months to buy the same amount of products like food and fuel as before. Some could use this crisis as an opportunity and buy land or businesses to generate future income.

The irony in this story is that Ukraine had doubled their official gold reserves, from 20 tonnes to 40 tonnes, over the course of the past decade. With the recent tensions between Russia and Ukraine, the United States stepped in and “rescued” the gold reserves of Ukraine. Some weeks ago, pro Russian newspaper, reported that orders were given by one of the “new leaders” of Ukraine to transport all the gold reserves of the Ukraine to the United States. Or, as Zerohedge observes rightfully, “the best source of validation, and refutation, of this story would be the people of Ukraine, alas since not even Americans are entitled to observe how much gold is in Fort Knox, somehow we doubt that the Central Bank of Ukraine will be any more lenient in providing visiting and viewing hours for its much more compact gold inventory. Especially since the local population is far more busy celebrating its “liberation” by western powers.”

|

| Are You Ready For The Price Of Food To More Than Double? Posted: 21 Apr 2014 09:15 AM PDT

Do you think that the price of food is high right now? Just wait. From The Economic Collapse Blog: If current trends continue, many of the most common food items that Americans buy will cost more than twice as much by the end of this decade. Global demand for food continues to rise steadily as [...] The post Are You Ready For The Price Of Food To More Than Double? appeared first on Silver Doctors. |

| 12 gold bars recovered from Indian businessman's abdomen Posted: 21 Apr 2014 08:54 AM PDT As gold smuggling surges in India, the doctors have found 12 gold biscuits from a 63-year-old Indian business man's body. |

| Short sellers take aim at gold miners Posted: 21 Apr 2014 08:48 AM PDT Over the weekend talks between Barrick and Newmont Mining resulted in the abandonment of a merger agreement. |

| Gold falls to two-week low; palladium, platinum extend slumps Posted: 21 Apr 2014 08:42 AM PDT Gold futures fell to a two-week low on the optimistic outlook for the U.S. economy. |

| Macleod’s Market Report: COMEX Silver Open Interest Close to All-Time Highs! Posted: 21 Apr 2014 08:00 AM PDT

In western capital markets there is a widely-held view that a deteriorating economic outlook will provoke a run from commodities into cash, so those who regard gold as only a commodity are bearish but have almost certainly already sold. The four billion Asians who own most of the world’s gold take a different view, having [...] The post Macleod’s Market Report: COMEX Silver Open Interest Close to All-Time Highs! appeared first on Silver Doctors. |

| Gold and Silver Stocks Sitting Tight Posted: 21 Apr 2014 07:30 AM PDT marketoracle |

| Who will drive Gold this week? Posted: 21 Apr 2014 07:15 AM PDT United States and Chinese economic data will drive gold this week while traders also keep one eye on the situation in Ukraine. |

| Ukraine reports: Russia is preparing for all-out "invasion" Posted: 21 Apr 2014 06:38 AM PDT From Bloomberg: At least three people were killed in a clash in Slovyansk in eastern Ukraine, the nation's Interior Ministry said, as a top security official accused Russia of exploiting the violence to prepare grounds for an invasion. Three "activists" were shot to death while on duty at a roadblock in an attack early today that also left three other people injured, the ministry said in a posting on its website. It said the assailants took "wounded and killed along with them," without providing details. Ukraine's Security Service said saboteurs carried out the assault. Russia's Foreign Ministry blamed the Ukrainian nationalist group Pravyi Sektor for the violence – an allegation that Pravyi Sektor denied in a statement. Viktoria Syumar, first deputy head of the National Security and Defense Council in Kiev, said on her Facebook page that Russia's accusation and statements show it is preparing grounds to invade Ukraine. Ukrainian Prime Minister Arseniy Yatsenyuk called Russia a "threat to the globe" in an interview on NBC's "Meet the Press" program that was recorded yesterday. "If Russia pulls back its security forces and former KGB agents, this would definitely calm down the situation and stabilize the situation in southern and eastern Ukraine," he said. Military Outposts Ukrainian Defense Ministry spokesman Dmytro Horbunov said in a telephone interview with Channel 5 television today that there have been three to four cases of "provocations" by unknown people against Ukrainian military outposts in the Luhansk region in the eastern part of the country. The provocations consisted of throwing rocks and fireworks, the spokesman said. The discord adds to skepticism about whether Ukraine, the U.S., and the European Union will be able to use an April 17 Geneva accord to hold Vladimir Putin accountable for easing tensions that the Russian president says he's had no role in creating. With separatists holding their ground in several eastern cities, the prospect for a small-scale civil war has increased, said Angela Stent, director of the Center for Eurasian, Russian and East European Studies at Georgetown University in Washington. "I see this as a creeping destabilization," Stent said in an interview today. "I'm not sure it's a civil war yet, but the pre-conditions for a civil war are there." Geneva Agreement Nothing has been done to implement the agreement reached in Geneva last week among the U.S., European Union, Russian and Ukraine that was aimed at defusing the crisis, she said. "I see nothing that persuades me that anyone will be able to dislodge these people," Stent said of the pro-Russia separatists who have occupied government buildings in the Russian-speaking East. Any civil war likely would be confined to those eastern towns, where the separatist movement is based, said Stent, author of a new book on U.S.-Russian relations called "The Limits of Partnership." "It's not a large-scale civil war, but it's political paralysis because nothing's going to move forward," she said. Ukraine's Economic Minister Pavlo Sheremeta, speaking on the private television channel 1+1, said today officials expect the International Monetary Fund to act this week on a loan to the country. Ukraine's government sealed a preliminary accord with the IMF last month for as much as $18 billion in loans in the next two years. The rescue would unlock additional international financing bringing the total package to $27 billion Cold War Russia's ambassador to the U.S., Sergei Kislyak, said new economic sanctions on his country would amount to "the revival of the Cold War mentality" and would be counter-productive. "We can withstand pressures," Kislyak said on "Fox News Sunday" today. Claims that Putin seeks to restore the former Soviet Union are "a false notion" and Russia seeks only to ensure that Ukraine becomes "a country that is democratic, that supports the rights of all the ethnic groups, including certainly Russia's, and we want to have a friendly neighbor," Kislyak said. U.S. Senator Bob Corker of Tennessee, the top-ranking Republican on the Foreign Relations Committee, said the Obama administration should impose sanctions on Russia's energy and banking industries unless there's an immediate withdrawal of Russian troops from the Ukraine border. 'Day Late' "Our foreign policy is always a day late and a dollar short because we're reacting," Corker said on "Meet the Press" program today. Senator Chris Murphy of Connecticut, a Democrat on the Foreign Relations Committee, echoed Corker's call for stronger action. "I think the time is now to rapidly ratchet up our sanctions, whether it's on Russian petrochemical companies or on Russian banks," Murphy said on "Meet the Press." Geoffrey Pyatt, the U.S. ambassador to Ukraine, said he's hopeful that Ukraine can avoid a civil war. "What I hear from Ukrainians across the board, and especially on this Easter holiday, is a desire to bring everybody together," Pyatt said on CNN's "State of the Union" program today. "There are obviously efforts from small, isolated groups to stir division," Pyatt said. "But that's not what I hear from most Ukrainians, including, I should add, Ukrainians in the East." Separatists who stage demonstrations and take over government buildings don't represent the majority of Ukrainians, he said. "We're really just talking about a couple of hundred of people at most of these sites."

More on Ukraine and Russia: Russia and Ukraine just ended talks to "de-escalate" the crisis. Here's what you should know. Emerging markets expert: Here's the latest from the crisis in Ukraine Get ready... The crisis in Ukraine could return with a vengeance |

| J.S. Kim: High-frequency trading rigs far more than gold and silver Posted: 21 Apr 2014 06:02 AM PDT GATA |

| Barclays sees Gold's next move to be lower Posted: 21 Apr 2014 05:35 AM PDT After a brief push to price levels around $1325 an ounce, gold has fallen back towards $1300 an ounce, but Barclays still believe its next move will be lower. |

| What you need to know about oil and gas dividends – Part 1 Posted: 21 Apr 2014 04:00 AM PDT From Matt Badiali, editor, S&A Resource Report: Investors continue to clamor for yield. They see safety in receiving a check from companies. However, in the oil industry, companies that pay a dividend, do it for a reason. Investors looking for income need to understand what they are buying. In oil and gas, there are three main types of businesses that pay dividends. This is a general overview of the whole sector. The best kind is the big company that pays dividends from its free cash flows. Companies like ExxonMobil, ConocoPhillips, and Chevron fall into this group. These elite dividend payers are safe. However, their yields are small, under 3% on average. The second and most popular source of dividends in the oil and gas space right now is the master limited partnership (MLP). This style of business is set up to avoid taxes by passing on the majority of its earnings to its shareholders (called unit holders). These can be outstanding investments at certain times in the market. However, I'm not a fan today. That's because many of these companies exploded their balance sheets with easy, cheap debt. Energy Transfer Partners is an example of this trend. The company more than doubled its debt from $7.4 billion in 2011 to $16.4 billion in 2013. That gives it a debt to earnings (before interest, taxes, depreciation and amortization or EBITDA) ratio of over 4.3 times. That means it would take this company over four years of earnings to pay off its debt. That's high. Even though its yield is attractive at 6.5%, that giant debt load isn't. However, the third, and most attractive, type of dividend-paying company owns royalties. Royalty owners own the mineral rights on land. That doesn't mean they own the surface. It means that if you want to mine anything under the surface…water, oil, gold, silver… they get paid. These companies just sit back and collect checks while someone else does the work. That means the royalty company receives checks from any oil and gas production. Texas Pacific Land Trust (TPL) is a great example of this kind of royalty owner. This trust was founded in 1888 from the massive landholdings of the Texas and Pacific Railway. When the railroad went bankrupt, its 3.5 million acres went into trust. Only 25% of those acres remain, but they are in the heart of Texas' Permian Basin. That's one of the most prolific oil- and gas-producing regions in the U.S. As you can see, there are many ways to find dividend yield in the oil and gas space. However, there are also many ways to go wrong. Taking a capital loss, because you didn't understand what you were buying, can wipe out years' worth of dividends. Some royalty companies are outstanding, while others are trouble. I'll cover those nuances – and what they mean for investors – in a later essay. Crux Note: Matt has spent years studying the ins and outs of oil and gas production. Right now, he's uncovered five small oil companies that are about to take off... you can learn all about them by clicking here.

You can read more from Matt Badiali on The Crux by clicking here. |

| Gold / Silver / Copper futures - weekly outlook: April 21 - 25 Posted: 21 Apr 2014 02:30 AM PDT investing |

| Only A Widespread Understanding Of Money And Credit Will Change Our System Posted: 21 Apr 2014 01:43 AM PDT Submitted by Rudy J. Fritsch, editor in chief of The Gold Standard Institute Journal I have written many articles explaining and expounding on the Unadulterated Gold Standard, on how the world economy is doomed to collapse unless an ultimate extinguisher of debt… Gold… is re-introduced into the system. I have written about the technical aspects, the moral aspects, the historical aspects… yet people still resist, still don't want to know. They hope that hope alone will keep them out of trouble… and at best, most want a quick and easy explanation of why we should bother with Gold; in effect, they ask for a sound bite. Well, that is easy enough… here is the sound bite; "Gold, the Real Thing!"… end of sound bite. Of course, without the megabuck ad campaign to spread and hammer it home world wide, like the better known 'It's the Real Thing' sound bite, the 'Gold, the Real Thing!' sound bite is of little use. People will have to figure out the need for honest money for themselves; no economic or monetary revolution will be started from above; changes must start from grass roots. Only a widespread understanding of money and credit will change the system. Only popular, overwhelming demand for Gold (and Silver) money can save the world from economic chaos. Instead of fiddling with sound bites, let's look at the core issues; why is Gold essential for economic survival. Some people, in good faith, suggest that 'Gold should be money… look at how it's kept its purchasing power for thousands of years'. This is a good sentiment, but it has cause and effect mixed up; Gold should not 'be money' because it has kept purchasing power… rather, Gold has kept purchasing power because it IS money. We must understand this both intellectually and viscerally. That 'Gold IS money' is not just another sound bite but a hard fact. We must understand what money actually is… and why Gold is money. As J. P. Morgan famously stated, 'Gold is money… everything else is credit'. To put it bluntly, bank notes, Dollar bills, all forms of Fiat currency are IOU's; that is, credit (debt)… and circulating debt notes cannot extinguish debt, they simply shuffle debt around. Money and debt are polar opposites, like water and fire. Just as water extinguishes fire, so money extinguishes debt… real money that is, not debt notes masquerading as money. Bank notes are assets in the hands of the holder… that is, a Dollar bill is an asset in the wallet of the consumer… but the very same Dollar bill is a liability of the Bank of Issue, called the Central Bank. The liabilities of the Bank of Issue… that is, bank notes… Dollar bills… are balanced by assets. This is the very definition of a balance sheet; liabilities and assets must balance. And what assets does the Bank keep on the asset side of its balance sheet? Why, Treasury bonds… and Treasury bonds are also IOU's. Indeed, the very same bonds that are assets of the Bank are liabilities of the Treasury. It is crucial to understand how Fiat currency is created. The creation of paper currency is not simply a question of 'printing' more and more; that is not how the system works. Currency is borrowed into existence. More specifically, the Treasury prints a bond… a promise of future payment, with interest, and the Bank of Issue buys this bond… with freshly created bank notes. The Bank indeed 'prints' new currency… but only as a match for the bond it purchases… no more, no less… or its books would no longer balance. So you say, what does all this mean? Why is this method of creating Fiat currency a problem? Well, there are several problems, any one of which is lethal by itself. First, don't just blame 'profligate politicians' for our daunting debt tower… rather blame the system. Remember, every Dollar bill in existence has to be balanced by a Dollar of bonded debt; so, as more currency is created more debt is created simultaneously. There is a one to one correspondence between currency in circulation, and debt. For example, if there are one hundred monetary units of Dollars… say each monetary unit is a trillion… then there must be one hundred monetary units (trillions) of debt. If the 'profligate politicians' were to actually pay down the debt, say reduce debt by half; from one hundred monetary units to fifty… then bank notes would also be reduced by half. A devastating deflation would result from the disappearance of half the circulating currency… the disappearance of fifty trillion Dollars. Just as new bank notes are created by the bank of issue to buy new treasure bonds, if any existing bonds were repaid, the bank notes balanced by the bonds would go back to cyberspace, where they come from. Such a drastic reduction of the money supply would cause a devastating economic collapse… a Greater Great Depression. Under our Fiat system no debt can ever be retired. Any talk to the contrary is but a smoke screen. Unfortunately it gets worse; bonds command interest either in the form of periodic payments from the borrower to the bond holder, or in the form of a discounted purchase price and a higher pay back at maturity. For example, if there are one hundred units of currency that is balanced by one hundred units of bonded debt, and the rate of interest is five percent, then the borrower (treasury) needs to pay five monetary units of interest yearly… or something like fifty monetary units at maturity. But wait… where exactly will notes to make this payment come from? Remember, the currency in circulation is exactly equal to the sum of the bonds in the balance sheet… new currency must be created to pay interest due. To create new currency under the Fiat system, bonds need to be written… new currency must be borrowed into existence. The debt must grow year by year to avoid interest payment default. This is the real reason that banks of issue like the Federal Reserve are fighting desperately to keep interest rates low, regardless of damage done to the economy. A low interest rate reduces… but does not eliminate… the need for new money/debt creation. The debt tower must continue to grow, without limit, or face default. The pundits will suggest fine, then let's just 'inflate the debt away'… by 'printing' money to reduce the real value of debt outstanding. Of course, if you understand the need for every new dollar in circulation to be borrowed into existence, you see that this is impossible. By the flawed and over simplistic quantity of money theory, if we double the currency in circulation then we reduce purchasing power by half; twice as much 'money' chasing the same quantity of goods. Clearly, even if we ignore the flaws of the quantity theory, a theory that ignores velocity of circulation, this scenario cannot work. If we wish to double the currency in circulation from one hundred units to two hundred… hopefully reducing the purchasing power of currency by half… then we must also simultaneously double the debt. Debt grows with the growth in currency. Halving purchasing power is matched by doubling of debt. We are stymied. No payback of debt is possible, growth of the debt tower is built into the system, and inflating the debt away cannot work. The Fiat system has no escape; the world economy is doomed to ever growing debt and is doomed to destruction. The only viable alternative is to change the system. Replace debt 'money' by real money, money that will actually extinguish debt. Then the question may arise, why Gold? Why not platinum, or some other valuable commodity… perhaps even commodities that are consumed, like grains or crude? Why indeed… aside from the historical fact that God has been and is money, the reality is that Gold is the most plentiful substance on earth… measured by its stock to flow ratio. That is, the stock of Gold officially known to exist above ground in refined form represents at least eighty years of mine supply. To double the existing Gold stock would take, at the current rate of extraction, at least eighty years. This is crucial, and is the heart of why Gold is money; platinum for example has a few months of supply on hand; same for crude, grains, copper… indeed all other commodities except Silver; and Silver is the only monetary metal on Earth other than Gold. The enormous, order of magnitude greater stocks of Gold and Silver on hand ensure that any fluctuation in supply… like a mine closure, or the discovery of a new 'bonanza' will have negligible effect on the quantity and value (purchasing power) of existing stocks. In contrast, all other commodities are subject to extreme volatility due to growth/decline in consumption, and growth/decline in supplies. Gold and Silver are immune to such effects; this is why Gold has held its purchasing power for over two thousand years. We need bother with no other commodity; Gold and Silver are money, nothing else is. This is the bottom line; Fiat cannot continue indefinitely, Gold and Silver are the only monetary metals that can rescue the economy from collapse. How do we get from here to there? This is the key question, and unless we have a reasonable method of transition, we will inevitably go through the wringer. Chaos will arrive either in the form of an enormous deflationary collapse, the 'Greater Great Depression', or in the form of runaway hyperinflation like Weimar on steroids… or both! If the transition is planned and done systematically, most of the pain can be avoided. We must start by rescinding the legal tender laws that force Fiat currency into its monetary role. Gold and Silver must be allowed free circulation, as an alternative to existing Fiat paper. Gold and Silver in circulation must be in the form of physical coins with only a mass and fineness embossed on the coins; no 'face value' denominated in Fiat. It is ludicrous that one ounce Gold coins have an embossed face value of fifty or a hundred Dollars… while an ounce of Gold trades for over one thousand dollars. Once Gold and Silver are again understood to be money, the real job can begin; the reduction of the enormous debt tower, without a devastating debt collapse. This will be accomplished by the introduction of Gold Bonds. Bonds denominated in Gold units, bonds that mature into physical Gold, bonds that pay interest in physical Gold… Gold Bonds that can be exchanged over time for existing Fiat bonds, Fiat bonds that otherwise can never be repaid. Once a Gold bond matures, it is paid in full; the debt represented by the Gold bond is finally, fully extinguished. The value of Fiat bonds will indubitably decrease (in Gold terms) once real bonds are available as an alternative. The value of Fiat currency will indubitably decrease (in Gold terms) once real money is in circulation once again. Thus can the transition from Fiat to honest money be accomplished with minimum pain and without economic disaster. The availability of God bonds requires an income (by the issuer, the treasury) in Gold; a country like Australia, as well as other countries with a Gold mining industry appear to have an inside track here; a natural supply of Gold is at hand. In reality, mine supply is unnecessary. It is easy enough for any country to obtain Gold, by trading for it. Trading value for value is the fundamental reality of world trade; Gold is simply the guarantor of honest dealing. The discipline of Gold overcomes any temptation to run a trade deficit. Gold focuses attention on the real economy, on wealth creation rather than on speculation. Time is running out; how much longer can we continue to 'kick the can' into the future, passing our self-created problems on to our children and grandchildren? I suggest not much longer. The fuse is lit, and the economy is well on its way to blowing up. I suggest we start the transition now, before it's too late. |

| Willem Middelkoop and Terence van der Hout: Turnaround Stories Revolve Around Proven Management Posted: 21 Apr 2014 01:00 AM PDT |

| GOLD: Threatens Further Downside Posted: 21 Apr 2014 12:35 AM PDT stock-trkr |

| Gold: Extends Weakness On Bearish Momentum Posted: 21 Apr 2014 12:35 AM PDT fxstreet |

| Share Gold Signaling Bearish Continuation Posted: 21 Apr 2014 12:35 AM PDT fxtimes |

| US Dollar Nears Technical Crossroads, Crude Oil Flounders Sub-105.00 Posted: 21 Apr 2014 12:20 AM PDT dailyfx |

| Ilargi: Ukraine – Part of United States’ Desperate Solutions For Not Sinking Alone? Posted: 21 Apr 2014 12:03 AM PDT Yves here. While most of the commentary on the Ukraine has focused on geopolitical issues, and on the role of the neocons in the Obama Administration, this post looks at the Ukraine conflict from a different angle. It contends the drivers are actually economic (not that economics and politics are necessarily distinct). The source that Ilargi relies on is a bit screechy and appears to labor under the misapprehension that the US needs foreign lenders to finance its deficit spending. But if you can read past those shortcomings, I hope you’ll find it also raises some provocative issues. By Raúl Ilargi Meijer, editor-in-chief of The Automatic Earth. Originally published at Automatic Earth LEAP2020 is a European political/economic research institute that doesn't shy away from volunteering opinions on the topics it researches, something that works both for and against it. It publishes a new GEAB (Global Europe Anticipation Bulletin) report every month. I thought I'd share the 'public announcement' of the April 2014 issue with you, because it provides a clear idea of what some people think is going on with regards to the US/EU involvement in Ukraine and the war of verbal bellicosity they have initiated with Russia. Some voices, among them former US government official Paul Craig Roberts, are convinced there is a new neocon attempt aimed at provoking war with Putin happening. Others have pointed to the arms race many US allies in the Middle East and Asia appear to be conducting. Personally, I prefer to remain on the cautious side for now, but I do think Americans and Europeans alike should demand their media and politicians explain what really goes on, instead of merely shouting insults at anyone who looks remotely Russian. What did the US spend the $5 billion+ on that Undersecretary of State Victoria Nuland has stated was handed to an alphabet soup of Ukraine NGOs? What was Nuland doing in Kiev in the months leading up to the February coup in the first place? Ukraine had a poorly functioning government, true, but then so do dozens of other countries. Why Ukraine? Why did NATO rapidly expand eastward after the break-up of the Soviet Union despite explicit promises not to do that? Why is the US apparently about to deploy perhaps as many as 10,000 soldiers to Poland when it just signed a de-escalation deal with Russia? Are we going to hold back on asking these questions until the military chest thumping stand-off has reached a point of no return? For LEAP2020, the issues are primarily economic, not military. It sees the US as a nation on the verge of breaking down economically, which seeks to drag others (Europe) with it in order to disguise its own troubles:

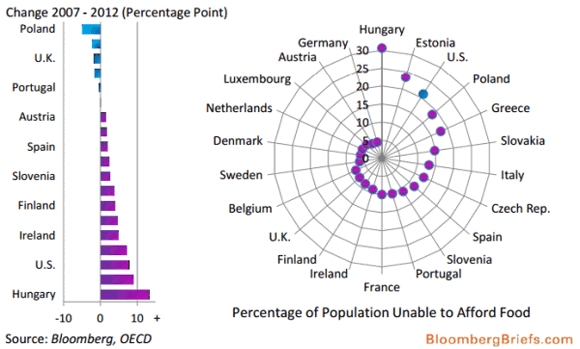

In the present confrontation between Russia and the West over the Ukrainian crisis, the image of the Cold War inevitably comes to mind and the media are obviously fond of it. However, contrary to what it gives us to understand, it's not Russia that seeks the return of an iron curtain but really the US. An iron curtain separating the old powers and emerging nations; the world before and the world afterwards; debtors and creditors. And this in the crazy hope of preserving the American way of life and the US influence over its camp in the absence of being able to impose it on the whole world. In other words, go down with as many companions as possible to give the impression of not sinking. For the US, these are the current stakes in fact: drag along the whole Western camp with them to be able to continue dominating and trading with enough countries. So, we are witnessing a formidable operation of turning round opinion and leaders in Europe to ensure docile and understanding rulers vis-a-vis the American boss, supported by a blitzkrieg to link them permanently with the TTIP and to cut them off from what could be their lifeline, namely the BRICS, their huge markets, their vibrant future, their link with developing countries, etc. We are analyzing all these aspects in this GEAB issue, as well as the subtle use of the fear of deflation to convince Europeans to adopt US methods. In the light of the extreme danger of these methods used by the US, it goes without saying that leaving the US ship wouldn't be an act of betrayal by Europe, but really a major step forward for the world as we have already extensively analyzed in previous GEAB issues. Unfortunately, the most reasonable European leaders are completely paralyzed and the best strategy that they are still capable of currently putting into effect, in the best case scenario, seems to be simply to delay, certainly useful and welcome but hardly sufficient … Layout of the full article: 1. LOWER THE MASKS 2. QUICK A TTIP 3. AN ECONOMIC ABERRATION 4. INSTIL THE FEAR OF DEFLATION IN EUROPE, THE SECOND US WEAPON 5. DEBTORS VERSUS CREDITORS, THE WORLD CUT IN TWO This public announcement contains excerpt from sections 1 and 2. LOWER THE MASKSWith the internet and leak type issues, keeping a secret has become difficult for secret agents and countries with dirty hands. Besides Snowden's or WikiLeaks disclosures, we have further learned recently that the US was behind a social network in Cuba targeting the destabilization of the government in power. We have been able to watch a video opportunely leaked on YouTube showing the Americans at work behind the coup d'etat in the Ukraine. Or again, it would seem that they are not innocent in Erdogan s current destabilization in Turkey, a country whose situation we will go into in more detail in the next GEAB issue … The masks are falling, certainly on the evidence, but that nobody can ignore. But the United States is no longer satisfied with developing countries or banana republics. In Europe, they are also managing to turn round the leaders one after the other, so that they obediently follow American interests. It's no longer what's good for General Motors is good for America as Charles Wilson (former GM CEO) said in 1953, but what's good for the US is good for Europe. It already has Cameron, Rajoy, Barroso and Ashton's support. It has succeeded in getting Donald Tusk's Poland's whilst he was strongly resistant at the beginning of his term of office, Italy's thanks to Renzi s opportunist coup d'etat, and France's Hollande/Valls thanks in particular to a ministerial reshuffle and a Prime Minister little suspected of anti-Americanism. Unlike the beginning of his term of office when he played the independence card on Mali or on other fronts, Francois Hollande seems to be completely submissive to the United States. What pressure has been put on him? As for Germany, it s still resisting somewhat but for how long (9)? We will expand on these remarks in the Telescope. Europe is thus dragged towards US interests that aren't its own, neither in terms of politics, geopolitics, or trade as we will see. Whilst the BRICS have chosen an opposite path and are seeking to withdraw from the henceforth profoundly negative influence of the US at any price, Europe is now being taken for a ride. Evidenced, for example, by Belgium's purchase of $130 billion worth of US Treasuries in three months from October 2013 to January 2014, being at an annual rate greater than its GDP. It's certainly not Belgium itself which is responsible for this aberration, but Brussels of course, that's to say the EU as a little US soldier. Politically Europe is stifled by the US which can take heart in the absence of any leadership. And the way to permanently seal this American stranglehold over Europe is called the TTIP … QUICK A TTIPWe have already amply documented it: unlike the triumphant discussions of recovery based on rising real estate prices and the stock exchange which is at its highest, the real US economy is in dire straits. Food shortages are higher than in Greece.  On the right, percentage of the population which can't afford food, by country (on the left, change 2007-2012). Source : Bloomberg / OECD. [...] But as we have already said, this isn't the most important thing. The TTIP's major stake is the Dollar's preservation in trade and keeping Europe in the US lap in order to avoid the constitution of a Euro-BRICS bloc able to counterbalance the US. Thus, the Ukrainian crisis, under the pretext of Russian aggression and gas supply, is a good way, in the panic, of imposing the US and the lobbies' agenda in the face of European leaders who are too weak to act. What wasn't expected is that the lobbies' interests are not necessarily going in the direction one thinks … |

| Mike Kosares: Anti-gold scare tactics arent very effective lately Posted: 20 Apr 2014 10:32 PM PDT GATA |

| China allows gold imports via Beijing, sources say, amid reserves buying talk Posted: 20 Apr 2014 10:32 PM PDT GATA |

| Golden rally helps metals producers buck the FTSE's downward trend Posted: 20 Apr 2014 10:00 PM PDT The gold price has risen about 8pc since the start of the year, boosting miners' shares This posting includes an audio/video/photo media file: Download Now |

| The Dark Side Of The Silver Mining Industry Posted: 20 Apr 2014 09:01 PM PDT

There is an insidious Dark Side to the silver mining industry that goes unnoticed by the majority of investors and analysts. Actually, I haven't come across one miniyng analyst who puts out comprehensive data on this very subject for the silver mining industry. According to my figures for 2013, the top primary silver miners suffered [...] The post The Dark Side Of The Silver Mining Industry appeared first on Silver Doctors. |

| Posted: 20 Apr 2014 08:40 PM PDT Precious Metals Stock Review |

| Posted: 20 Apr 2014 08:08 PM PDT

London expert Alasdair Macleod returns to the SD Weekly Metals & Markets with his brilliant PM analysis, including: Chinese 2013 gold demand 7,603 tons- More than DOUBLE Global Supply & mainstream estimates! Macleod states that China’s total gold reserves (public & private) may be between 10 and 25,000 tons of gold! Vaulting companies have never seen [...] The post Alasdair Macleod: Paper Currencies Face Ultimate Collapse- Loss of Confidence in the Dollar Could Propel Silver to $75! appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now |

| Are You Prepared for a Bull Market that Will Shock Even the Most Ardent Goldbugs? Posted: 20 Apr 2014 05:00 PM PDT

Jay Taylor understands why investors in gold and gold equities are consumed with caution. But the publisher and editor of J. Taylor’s Gold, Energy & Tech Stocks and host of the radio show “Turning Hard Times into Good Times” urges them not to lose sight of the big picture. The big, bull-market picture. Gold juniors [...] The post Are You Prepared for a Bull Market that Will Shock Even the Most Ardent Goldbugs? appeared first on Silver Doctors. |

| 18 Stats That Prove That Government Dependence Has Reached Epidemic Levels Posted: 20 Apr 2014 01:00 PM PDT

Did you know that the number of Americans getting benefits from the federal government each month exceeds the number of full-time workers in the private sector by more than 60 million? In other words, the number of people that are taking money out of the system is far greater than the number of people that [...] The post 18 Stats That Prove That Government Dependence Has Reached Epidemic Levels appeared first on Silver Doctors. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment