Gold World News Flash |

- 18 Stats That Prove That Government Dependence Has Reached Epidemic Levels

- The Reds Are Coming

- Press’ anti-gold scare tactics largely ineffective

- Of Kings and Gold. Has China Cornered the Gold Market?

- The Empty Vaults of London

- Golden rally helps metals producers buck the FTSE's downward trend

- Left-Right Coalition Introduces Two New Raw Milk Freedom Bills

- Antal Fekete mistakes GATA's objectives for a trading strategy

- China allows gold imports via Beijing, sources say, amid reserves buying talk

- Mike Kosares: Anti-gold scare tactics aren't very effective lately

- TF Metals Report: The empty vaults of London

- Road to WW3 -- Transnistria looks to follow Crimea example

- China Doesnt Need Much Gold To Create a Gold-Based Dollar ...

- James Turk On The Money Bubble

- Jay Taylor -- Is The Petrodollar Doomed? 16.Apr.14

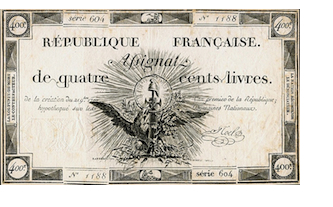

- Foreign Exchange Rates 1913-1941 #3: The Brief Rebuilding of the World Gold Standard System

- Gold and Silver - Counting Blessings and Tender Mercies

- Gold And Silver - Gann, Cardinal Grand Cross, A Mousetrap, And Wrong Expectations

| 18 Stats That Prove That Government Dependence Has Reached Epidemic Levels Posted: 21 Apr 2014 01:00 AM PDT from Silver Doctors:

The following are 18 stats that prove that government dependence has reached epidemic levels… |

| Posted: 20 Apr 2014 11:30 PM PDT by Tom Chatham, SilverBearCafe.com:

Once the petrodollar is destroyed and we lose reserve currency status, the American people will suddenly find themselves broke and priced out of world markets for necessary goods. When this happens this country will be forced to utilize its gold and natural resources to finance a new economy. |

| Press’ anti-gold scare tactics largely ineffective Posted: 20 Apr 2014 11:00 PM PDT by Michael J. Kosares, USAGold:

When I took-in the headline — Bumpy ride in store for gold with price forecast to fall 15% — with my morning coffee, my first reaction was to disregard it, as I do most of the day-to-day, routinely negative Financial Times' reports on gold. Scanning the article (with the hope some nugget of important information might be gleaned), something tugged at the back of my mind with respect to the entities referenced — Gold Fields Mineral Services (GFMS), Goldman Sachs and Credit Suisse. |

| Of Kings and Gold. Has China Cornered the Gold Market? Posted: 20 Apr 2014 11:00 PM PDT Finance and Eco. |

| Posted: 20 Apr 2014 10:30 PM PDT from TF Metals Report:

With the price smashes of the past few weeks, the increasing desperation of the bullion banks seems palpable. First, a recap (and don’t click the “play” button on the podcast player just yet)…

How and why did this happen? Let’s start with the “why”. |

| Golden rally helps metals producers buck the FTSE's downward trend Posted: 20 Apr 2014 10:00 PM PDT The gold price has risen about 8pc since the start of the year, boosting miners' shares This posting includes an audio/video/photo media file: Download Now |

| Left-Right Coalition Introduces Two New Raw Milk Freedom Bills Posted: 20 Apr 2014 09:00 PM PDT by Heather Callaghan, Activist Post:

You go to your farm source and pick up your rich-tasting nutrient dense white gold. Plus, all the non-tampered with veggies – straight from the ground. What a great buy! Drinking raw milk has given you strength and energy – you’ve never felt better or more grateful. You drive back home crossing the state line. You’ve just broken the law! |

| Antal Fekete mistakes GATA's objectives for a trading strategy Posted: 20 Apr 2014 07:40 PM PDT 10:37p ET Sunday, April 20, 2014 Dear Friend of GATA and Gold: The economist Antal Fekete has written what he means as a reply to GATA Chairman Bill Murphy's March 23 interview with The Daily Bell complaining about manipulation of the gold market -- http://thedailybell.com/exclusive-interviews/35139/Anthony-Wile-Bill-Mur... -- but it's not really a reply at all. Fekete's commentary is headlined "Thank Heaven for Gold Manipulators" because he argues that manipulation of the gold market is an opportunity for traders to make money by selling call and put options on gold. But while the people in GATA would like to make money as much as anyone else, Fekete mistakes making money as GATA's objective. Rather, GATA's objectives are, first, free and transparent markets in the monetary metals and all the markets influenced by the monetary metals, and, second, limited and accountable government. GATA has never denied that traders may be able to make money gaming market manipulation by central banks. Indeed, lately it seems that most of the money being made in all markets is largely a matter of anticipating central bank interventions. That's the end of free markets and the end of free markets is the end of human progress and democracy. Fekete's commentary is posted at The Daily Bell here: http://www.thedailybell.com/editorials/35217/Antal-Fekete-Thank-Heaven-f... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair to hold gold market seminar in Toronto on April 26 Mining entrepreneur and gold advocate Jim Sinclair's next gold market seminar will be held from 1 to 5 p.m. Saturday, April 26, at the Pearson Hotel & Conference Centre at Toronto's Pearson International Airport, 240 Belfield Road, Toronto. For details on tickets, please visit Sinclair's Internet site, JSMineSet.com, here: http://www.jsmineset.com/2014/04/01/toronto-qa-session-announced/ Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| China allows gold imports via Beijing, sources say, amid reserves buying talk Posted: 20 Apr 2014 06:06 PM PDT By A. Ananthalakshmi SINGAPORE -- China has begun allowing gold imports through its capital Beijing, sources familiar with the matter said, in a move that would help keep purchases by the world's top bullion buyer discreet at a time when it might be boosting official reserves. The opening of a third import point after Shenzhen and Shanghai could also threaten Hong Kong's pole position in China's gold trade, as the mainland can get more of the metal it wants directly rather than through a route that discloses how much it is buying. China does not release any trade data on gold. The only way bullion markets can get a sense of Chinese purchases is from the monthly release of export data by Hong Kong, which last year supplied $53 billion worth of gold to the mainland. One of the reasons why China could be encouraging more direct imports was because it wanted to avoid taking the Hong Kong-to-Shenzhen route that makes its gold purchases public, while China wants to keep the trade a secret, sources said. "There is a view that why should people know how much China is buying," said one of the sources at a bullion banking operation in China. "With the Hong Kong route, there is a lot of transparency and people can easily monitor what is going in and out." ... ... For the full story: http://www.reuters.com/article/2014/04/20/china-gold-idUSL3N0N911Z201404... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: |

| Mike Kosares: Anti-gold scare tactics aren't very effective lately Posted: 20 Apr 2014 05:22 PM PDT 8:20p ET Sunday, April 20, 2014 Dear Friend of GATA and Gold: The anti-gold propaganda of mainstream financial news organizations is getting tedious, Mike Kosares of Centennial Precious Metals in Denver writes today, the more so because a little research into the price predictions of gold's disparagers finds that they are usually wrong. Kosares' commentary is headlined "Press' Anti-Gold Scare Tactics Largely Ineffective" and it's posted at Centennial's Internet site, USAGold.com, here: http://www.usagold.com/cpmforum/2014/04/20/press-anti-gold-scare-tactics... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. |

| TF Metals Report: The empty vaults of London Posted: 20 Apr 2014 05:17 PM PDT 8:15p ET Sunday, April 20, 2014 Dear Friend of GATA and Gold: JPMorganChase traded its short position in gold for a long corner not to profit by squeezing the market but to keep unloading metal to manage the price, the TF Metals Report's Turd Ferguson writes today. The exchange-traded fund GLD is still being drained to supply Asia with metal, Ferguson adds, but the supply seems tighter than ever. Ferguson's commentary is headlined "The Empty Vaults of London" and it's posted at the TF Metals Report's Internet site here: http://www.tfmetalsreport.com/podcast/5678/empty-vaults-london CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. |

| Road to WW3 -- Transnistria looks to follow Crimea example Posted: 20 Apr 2014 01:34 PM PDT There are an increasing number of calls in Transnistria to repeat follow Crimea in joining Russia. The breakway pro-Russian territory in Molvdova went through a civil war after the collapse of the Soviet Union to preserve its linguistic and cultural ties with Russia. While there is support for... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| China Doesnt Need Much Gold To Create a Gold-Based Dollar ... Posted: 20 Apr 2014 11:03 AM PDT New World Economics |

| James Turk On The Money Bubble Posted: 20 Apr 2014 09:25 AM PDT Kerry Lutz and James Turk talk about how the current system is way beyond Keynsian, it's virtually certain to end in another crisis. All the signs are there, but few wish to recognize them. Lutz and Turk also discuss how the gold standard should be listed in the Bill of Rights. As Mises said it... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Jay Taylor -- Is The Petrodollar Doomed? 16.Apr.14 Posted: 20 Apr 2014 05:06 AM PDT We talked with our old friend Jay Taylor about the impending collapse of the petrodollar. Seems like the world is ready to move on from this failed experiment, but what will become of the United States? China and Russia are setting up oil exchanges and getting ready for life without it. Jay... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Foreign Exchange Rates 1913-1941 #3: The Brief Rebuilding of the World Gold Standard System Posted: 20 Apr 2014 05:03 AM PDT New World Economics |

| Gold and Silver - Counting Blessings and Tender Mercies Posted: 20 Apr 2014 04:10 AM PDT The markets were quiet today for a stock option expiration ahead of a three day weekend. Next Thursday there will be an option expiration on the Comex for precious metals on Thursday the 24th. I would expect it to be relatively quiet since May is not a major contract month. There were more deliveries on the April contract declared, but little activity has been reflected in the Comex warehouses. |

| Gold And Silver - Gann, Cardinal Grand Cross, A Mousetrap, And Wrong Expectations Posted: 20 Apr 2014 03:49 AM PDT W D Gann has long been recognized as an astute market trader, and followers of Gann have been trying to figure out his genius. The best way to describe how he made so many successful market calls is, in a word, astrology. Having died in 1955, we did not know him, but we were fortunate enough to have met and befriended his assistant, Robert Courter. He, too, has since died, but he confirmed what many who study Gann know, that William Delbert Gann was an extraordinary astrologer, exceptional. The Square of Nine, the Circle of 360, his Hexagon, and Master Charts were all based on astrology. He did not openly admit that in his newsletters and writings, but he often mentioned "wheels within wheels," which was how the planets revolved around the Sun. Most people believe astrology to be akin to reading tea leaves or using a Ouija board, and he did not want to be put into that category. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

It is becoming evident by new revelations coming out every day now that the U.S. is being systematically impoverished and sold off to insure its total destruction. The end game here is simple and will be effective.

It is becoming evident by new revelations coming out every day now that the U.S. is being systematically impoverished and sold off to insure its total destruction. The end game here is simple and will be effective. Under normal circumstances, I might let a rutty headline about gold in the Financial Times pass without much notice. I say "rutty" because the Financial Times has long been stuck in a rut as one of the principle apologists for Keynesian economics — big banks, big deficits, big governments and powerful central banks. It doesn't think much of gold enthusiasts and gold enthusiasts do not think much of it. (Although I still read it every morning.)

Under normal circumstances, I might let a rutty headline about gold in the Financial Times pass without much notice. I say "rutty" because the Financial Times has long been stuck in a rut as one of the principle apologists for Keynesian economics — big banks, big deficits, big governments and powerful central banks. It doesn't think much of gold enthusiasts and gold enthusiasts do not think much of it. (Although I still read it every morning.)

This might not be a common scenario in your household, but it could be if you live near a state border and travel to a farm for fresh food and dairy.

This might not be a common scenario in your household, but it could be if you live near a state border and travel to a farm for fresh food and dairy.

No comments:

Post a Comment