saveyourassetsfirst3 |

- 2014 silver prices to consolidate, limited downside - CPM Group

- Northern Star seeks more gold after deals for Barrick mines

- Silver: the world’s most undervalued asset

- Are ‘dollar bugs’ insane?

- Gold to consolidate with NY weakness - Phillips

- The Blueprint to Ending the Fed!

- New poll: These are America's greatest financial concerns

- Is Chinese Gold Demand Decreasing…Or is Western Supply Running Dry?

- Why China rules global Gold Market?

- Mercenary Links April 29th: Labor Shortages

- GOLD & SILVER COT’S: THIS IS A SETUP!

- Gold Rebounds From 50% Retracement of Rally from Recent Low

- Gold & Silver COT’s: This is a Setup!

- Central banks soon may not have any intermediaries for rigging gold

- Pricing Mechanism for Gold and Silver to Break?

- Gold Down On More Technically Related Selling

- Ramping Up

- Unbelievable: Video shows brutal skirmish between Ukrainian nationalists and riot police

- Ted Butler: Silver is Akin to a Lit Match & a Barrel of Dynamite!

- What to drive Gold this week?

- Silver – The World’s Most Undervalued Asset?

- Gold eyes demand from key consumers India, China

- Silver - The World’s Most Undervalued Asset?

- Price & Time: Fibonacci "Time Reversal" in Gold

- Master trader Clark: These two sectors could get crushed in the next correction

- Gold Mining Stocks Break Out but Gold Price Fails to Follow

- Momentum stocks have a lot further to fall warns Jim Cramer

- Health Care Information Technology: A Danger to Physicians and to Your Health

- Spot gold may revisit low of $1,268.24

- Barrick-Newmont Merger Collapses into Toxic War of Words

- For Gold and Silver, Critical Support Holds

- Gold & Silver Trading Alert: Miners Break Out but Gold Fails to Follow so Far

- Is Gold Capitulation Coming?

- Gold Prices April 29, 2014, Technical Analysis

- Gold: Upside Potential

- Gold Building Base for a Rally?

- Will Gold Price See A Bullish Reversal?

- Gold Daily and Silver Weekly Charts - FOMC, GDP, Non-Farm Payrolls and End of April

- US Dollar Index Forecast April 29, 2014, Technical Analysis

- The Real Unemployment Rate: In 20% Of American Families, EVERYONE Is Unemployed

- Gold & Silver Trading Alert: Miners break out but gold fails to follow

- Embry: Russia is fitter fiscally than U.S. and knows Wests vulnerability with gold

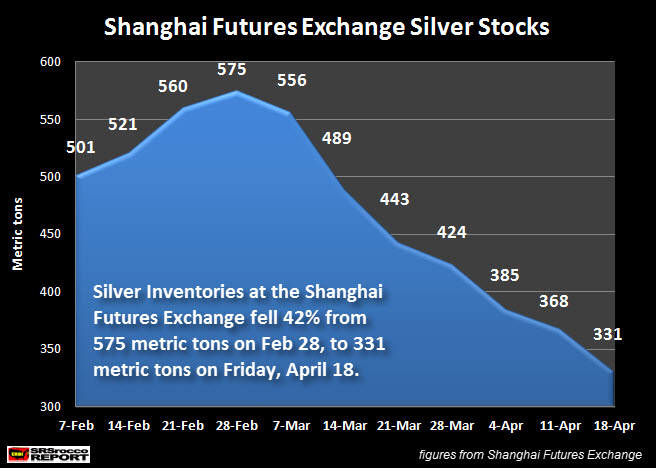

- The Decline In Shanghai Silver Stocks Picks Up Speed

- april 28.2014/No change in gold and silver inventories at GLD/SLV/ Gold and silver hit/Tension remain elevated in the Ukrainian/Russian crisis/

- Gold Successfully Tests Medium Term Support Points

- Precious Metals Complex Flashing Buy Signal

- US Shoots Self in Foot Via Sanctions: Dollar to Be Driven Out of Trade Settlement!

- Gold Settles Today At $1299.0 After Choppy Session

- The Pope Is Completely Wrong About Capitalism And Inequality

- Why The Silver Bear Market Is About To End

| 2014 silver prices to consolidate, limited downside - CPM Group Posted: 29 Apr 2014 02:51 PM PDT Driven lower by a shift in investor sentiment away from silver in 2013, says CPM Group in its latest silver report. | ||||||||||||||||

| Northern Star seeks more gold after deals for Barrick mines Posted: 29 Apr 2014 02:33 PM PDT Perth-based Northern Star Resources is seeking to expand output to as much as 600,000 gold ounces a year. | ||||||||||||||||

| Silver: the world’s most undervalued asset Posted: 29 Apr 2014 01:17 PM PDT | ||||||||||||||||

| Posted: 29 Apr 2014 01:00 PM PDT

If you are a "dollar bug" you DO have "full faith" in the credit worthiness of the U.S. government. If you are a "gold bug," you don't. Two groups. Two ways of looking at the world. It's this simple. To quote the great Billy Joel, when it comes to whether you are a believer [...] The post Are 'dollar bugs' insane? appeared first on Silver Doctors. | ||||||||||||||||

| Gold to consolidate with NY weakness - Phillips Posted: 29 Apr 2014 12:34 PM PDT Julian Phillips sees lackluster price movement in gold, short term, as it bumps along matching the dollar. | ||||||||||||||||

| The Blueprint to Ending the Fed! Posted: 29 Apr 2014 12:25 PM PDT

Congressional candidate Dennis Linthicum joins Metals & Markets to discuss the blueprint to ending the Fed, as well as: CME announces plans to launch a PHYSICALLY SETTLED gold exchange in Asia Russian media reporting that Russia, Kazakhstan and Belarus will sign an agreement in May to accelerate the formation of an economic union and a joint “gold” currency: the [...] The post The Blueprint to Ending the Fed! appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||

| New poll: These are America's greatest financial concerns Posted: 29 Apr 2014 12:00 PM PDT If you're worried about not having enough money… you're not alone. Gallup just released its poll on America's top financial concerns. The greatest financial concern of over 59% of Americans… is not having enough money for retirement. The next greatest concern for 53% of Americans is unexpected medical costs. This is followed by 48% of Americans concerned with maintaining their standard of living. These are all valid concerns... After five years of the Federal Reserve printing money, the top 1% has done very well for itself. Unfortunately, the rest of America hasn't fared as well. The U.S. dollar isn't worth the paper it's printed on… and this is the first time in American history the current generation will not be better off than their parents. It seems Obama has heard these concerns... Maybe he has heard Americans are concerned about not having enough money for retirement. His answer… MyRA. Maybe he has heard Americans are worried about unexpected medical costs. His answer… Obamacare. The problem with this is Obama will need to print more money to fund these programs… and it's this printing that got us into this mess in the first place. Click on the image to see the other top financial concerns...

More on the Bernanke Asset Bubble: This little-noticed development could mean the end of the Fed's super-low interest rates Janet Yellen finally admits: The "Bernanke Asset Bubble" is here to stay | ||||||||||||||||

| Is Chinese Gold Demand Decreasing…Or is Western Supply Running Dry? Posted: 29 Apr 2014 11:45 AM PDT

Chinese gold demand has dipped slightly in recent weeks. I can't think of any reason why the Chinese would buy less gold, the precious metal they recognize for its true value, when gold is dirt cheap at $1300. One reason that certainly would dampen SGE withdrawals would be western supply running dry – most of Chinese gold demand [...] The post Is Chinese Gold Demand Decreasing…Or is Western Supply Running Dry? appeared first on Silver Doctors. | ||||||||||||||||

| Why China rules global Gold Market? Posted: 29 Apr 2014 11:15 AM PDT Last year China's private-sector demand for gold reached a record level of 1,132 tonnes, and according to the World Gold Council (WGC), the Asian nation could easily dominate the gold market once again, as they predict demand growing 20 percent by 2017. | ||||||||||||||||

| Mercenary Links April 29th: Labor Shortages Posted: 29 Apr 2014 11:09 AM PDT Mercenary Links April 29th: Labor shortages arising in US cities… ‘iron curtain’ sanctions hit Russia… the decline and fall of bank trading desks… a 2,000 horsepower electric dragster, the new field of mental analytics, and more. ~~~

~~~ ~~~ ~~~

~~~

~~~

~~~

~~~

~~~ ~~~

~~~

~~~ ~~~

~~~

~~~ | ||||||||||||||||

| Gold Rebounds From 50% Retracement of Rally from Recent Low Posted: 29 Apr 2014 10:25 AM PDT | ||||||||||||||||

| Gold & Silver COT’s: This is a Setup! Posted: 29 Apr 2014 10:15 AM PDT

This past reporting period we saw a very rapid decline followed by an equally impressive "rally". It is my firm belief that the decline was due to serious shorting by the speculators and it is not yet the time-frame the bullion banks desire for an all out price smash, so they quickly manipulated the strings, [...] The post Gold & Silver COT’s: This is a Setup! appeared first on Silver Doctors. | ||||||||||||||||

| Central banks soon may not have any intermediaries for rigging gold Posted: 29 Apr 2014 10:01 AM PDT GATA | ||||||||||||||||

| Pricing Mechanism for Gold and Silver to Break? Posted: 29 Apr 2014 09:00 AM PDT

What role will China, Russia and India play in pricing gold and silver on a global scale once all these new markets are online and moving most, if not all, of the global gold and silver? What role will the 5 bullion banks, all Rothschild controlled banks, what role will they play in setting the [...] The post Pricing Mechanism for Gold and Silver to Break? appeared first on Silver Doctors. | ||||||||||||||||

| Gold Down On More Technically Related Selling Posted: 29 Apr 2014 08:20 AM PDT forbes | ||||||||||||||||

| Posted: 29 Apr 2014 08:06 AM PDT OK, so now the fun really starts. Today is expiration day of the May Comex silver contract and tomorrow brings all kinds of "news". Already, the battle for gold at the 200-day moving average has begun. Let's get it on! | ||||||||||||||||

| Unbelievable: Video shows brutal skirmish between Ukrainian nationalists and riot police Posted: 29 Apr 2014 08:00 AM PDT As Ukraine's military mobilizes… so do its citizens. Ukrainian nationalists attack riot police in Donetsk, Ukraine. It's not just the pro-Russian Ukrainians causing a stir… it's now happening on both sides. The pictures and video below show a peaceful demonstration by Ukrainian nationalists… but this doesn't last long. Riot police are called out… and tensions increase… just before a few masked nationalists with clubs standoff with the riot police. Then violence erupts.

More on Ukraine: That was fast: Reports say last week's Ukraine accord is already "near collapse" Ukraine reports: Russia is preparing for all-out "invasion" Must see photos of Ukraine's and Russia's massive military buildup | ||||||||||||||||

| Ted Butler: Silver is Akin to a Lit Match & a Barrel of Dynamite! Posted: 29 Apr 2014 07:27 AM PDT

It is said that history doesn’t repeat itself, but in the case of silver, I don’t see how that can be avoided. In more ways than not, silver today reminds me of the time when it traded under $5 per ounce. As was the case back then, the thought that it might eventually climb more [...] The post Ted Butler: Silver is Akin to a Lit Match & a Barrel of Dynamite! appeared first on Silver Doctors. | ||||||||||||||||

| Posted: 29 Apr 2014 07:23 AM PDT Gold drew some support to start the week from continuing geopolitical tensions surrounding Ukraine, but activity overall could be subdued ahead of US economic events later in the week, said Commerzbank. | ||||||||||||||||

| Silver – The World’s Most Undervalued Asset? Posted: 29 Apr 2014 06:28 AM PDT

Silver dipped to $19.10/oz overnight and remains under pressure this morning . With the gold: silver ratio at just over 66 ($1,290/$19.38/oz), silver remains a compelling buy at these levels. The stealth phenomenon that is silver stackers or long term store of value buyers of silver coins and bars continues and is seen in the [...] The post Silver – The World's Most Undervalued Asset? appeared first on Silver Doctors. | ||||||||||||||||

| Gold eyes demand from key consumers India, China Posted: 29 Apr 2014 06:05 AM PDT The gold market will be watching to see if physical demand from key consumers China and India pick up on price retreats, as was the case in 2013, said Morgan Stanley. | ||||||||||||||||

| Silver - The World’s Most Undervalued Asset? Posted: 29 Apr 2014 06:01 AM PDT gold.ie | ||||||||||||||||

| Price & Time: Fibonacci "Time Reversal" in Gold Posted: 29 Apr 2014 05:45 AM PDT dailyfx | ||||||||||||||||

| Master trader Clark: These two sectors could get crushed in the next correction Posted: 29 Apr 2014 04:00 AM PDT From Jeff Clark in Growth Stock Wire: The stock market fired a warning shot earlier this month. After setting a new all-time high above 1,894, the S&P 500 dropped 80 points – roughly 4.2% – in just two weeks. This fast downside action is just a small sample of what may happen when the stock market finally enters a correction phase. But we're not there yet. As I said last week, the old bull market still has one more kick left in it. And the recent bounce is giving traders a chance to cash out on some long positions and make a short trade or two. You see, the bounce is ending. As I told you on Tuesday, we're coming up on a seasonally weak period for stock prices. And there are two sectors in particular that look vulnerable for a decline... Let's start with real estate. Here's a chart of the iShares U.S. Real Estate Fund (IYR)...

For the past six months, IYR has been trading in a bearish rising-wedge formation. In this pattern, a stock makes consistently higher highs and higher lows but the distance between each new high and low is smaller. Eventually, the stock has to break out of the pattern one way or another. When that happens, it usually results in a big move. Most of the time, a rising wedge breaks to the downside. We saw this happen recently with the financial sector. The Financial Select Sector Fund (XLF) broke its rising-wedge pattern to the downside and lost more than 5% in just a few days. The chart of IYR shows similar potential. Right now, IYR is bumping into the resistance line of the rising-wedge pattern. Aggressive traders can put on a short trade here in anticipation of the resistance line holding and turning IYR back down. A minor move down that takes back half the height of the wedge gives us a downside target of about $64 per share. A strong move lower will reverse the entire wedge pattern and target $61 per share. The other sector that looks like a low-risk short sale is health care. Here's the chart of the Health Care Select Sector Fund (XLV)...

XLV broke down from a rising-channel pattern earlier this month. It also broke below its 50-day moving average (DMA). Over the past two weeks, though, XLV has bounced back up and is now testing the former support line of the rising channel. It's also testing its 50-DMA. XLV is unlikely to overcome this "double resistance" on its first attempt. So aggressive traders can look to short the health care sector here in anticipation of the resistance lines holding and turning XLV lower again. The immediate downside target for XLV is the February low at about $55 per share. The real estate and health care sectors have both benefited from the recent bounce in the stock market. But as we come to an end of the seasonally strong second half of April and roll into the seasonally weak period that starts in May, traders should take advantage of the chance to profit on the potential downside of these two sectors.

More from Jeff Clark: Top trader Clark: Watch for this sign the rally in stocks is over | ||||||||||||||||

| Gold Mining Stocks Break Out but Gold Price Fails to Follow Posted: 29 Apr 2014 03:10 AM PDT marketoracle | ||||||||||||||||

| Momentum stocks have a lot further to fall warns Jim Cramer Posted: 29 Apr 2014 03:05 AM PDT ‘If history is any guide, then the high-flying biotechs, Internet plays, and of course the cloud-based software-as-a-service stocks, could still have a long way to fall.’ That’s the conclusion of Jim Cramer after consulting with top technical analyst Tim Collins, who noted similarities between the current decline in momentum stocks and the dotcom collapse back in 2000. Ominously Collins found that patterns among stocks such as Cisco, Priceline, JDSU, Amazon, ICG and Akamai in 2000 appear to be similar to patterns that are currently emerging in the momentum stocks of 2014… | ||||||||||||||||

| Health Care Information Technology: A Danger to Physicians and to Your Health Posted: 29 Apr 2014 12:49 AM PDT The causes of the crapification are legion, but one that is having a bigger impact on health care than is widely recognized is bad information technology implementation. And I don’t mean the healthcare.gov website. In case you missed it, the Federal government is in the midst of a $1 trillion experiment to promote (as in force) the use of Electronic Health Care records, or EHRs. Astonishingly, this program has been launched with no evidence to support the idea that rendering records in electronic form will save patient lives. From a Freedom of Information Act filing by the American Association for Physicians and Surgeons got this response, which was reprinted in their April newsletter (emphasis ours):

Now of course, one might argue based on intuition that surely electronic data would help patient care. Think of all those illegible doctor scrawls that get misread from time to time. But you need to weigh those errors against those of bad data entry, difficult to read file formats, difficulty in converting records to electronic form, and greater risk of loss of patient data (hard disk crashes and faulty backups). In fact, I’ve seen good health care information technology in action. When I lived in Sydney in 2002 to 2004, every doctor I saw had a little black flat panel screen in their office or examination room, and most would enter data during the session. The doctors I saw were in solo or small practices. Their fee levels (assuming a dollar for dollar exchange rate, which was not the case at the time) were 25% to 35% of New York City rates for comparable services. That suggests that the use of IT wasn’t a costly addition to their practice overheads. But could the US adopt the sensible course, which would be to look for successful health care information technology implementations overseas and learn from them? No way. As Informatics MD notes at the Health Care Renewal blog (emphasis ours):

We’ll get to the lousy patient outcomes part in due course. But I wanted to focus on a less obvious but no less significant element of this health care information technology push: that it is accelerating the death of solo practices. Mind you, this was already well underway, as reader Juneau noted in our recent post on corporatized medicine:

This article from UTSanDiego explains the impact of the health care information technology requirements from the doctor perspective:

The article concedes that the productivity loss should decline over time. But we have the hard dollar cost combined with the toll on doctors’ time….and worse outcomes from a medical safety standpoint. From a Sunday post at the Health Care Renewal website:

So in other words, the implementation of EMR had nothing to do with improving patient care. Nada. It was all about the money, supposedly improving doctor’s ability to get money back from insurers and helping the government catch cheats. And if you think I’m exaggerating the risk to patients, the latest ECRI Institute report puts health care information technology as the top risk in its 2014 Patient Safety Concerns for Large Health Care Organizations report. Note that this ranking is based on the collection and analysis of over 300,000 events since 2009. ECRI did an earlier deep dive on the health care information technology issue in 2012,. †he results were not pretty. The Institute found 171 technology-induced problems were reported in 9 weeks by 36 “facilities,” which were mainly hospitals. Eight of the incidents resulted in harm to the patient and three may have contributed to deaths. Health Care Renewal gave a back-of-the-envelope calculation as to how to extrapolate these results to the US as a whole:

One of the basic concepts I learned many years ago was that managing was all about making decisions under uncertainty, and that there was a cost to obtaining information to try to reduce uncertainty. The gains in certainty had to be weighed against other costs. But that isn’t what is operating here. It’s not hard to see that this is an enormously expensive exercise relative to the promised gains in billing efficiency and in catching cheaters. Even before you get to loss of doctor productivity or the harm done to patients, this IT boondogle doesn’t remotely pass muster as an investment to lower costs. So it should be no surprise that it was thrown in the 2009 stimulus package, as something that on a superficial level sounded like it was worth doing and wasn’t as controversial as other spending options. After all, throwing money at white collar workers is not a hard sell, particularly if you pretend you can increase government efficiency, rather than helping struggling borrowers or *gasp* poor people. And our latest example of crapification is well beyond the point of no return. High levels of disapproval by doctors and bad patient outcomes are irrelevant, since each group’s welfare was never the object of this exercise. This is kleptocracy, designed and executed to occur where the grifters were confident the public would never take notice. | ||||||||||||||||

| Spot gold may revisit low of $1,268.24 Posted: 29 Apr 2014 12:45 AM PDT brecorder | ||||||||||||||||

| Barrick-Newmont Merger Collapses into Toxic War of Words Posted: 29 Apr 2014 12:23 AM PDT The post Barrick-Newmont Merger Collapses into Toxic War of Words appeared first on The Daily Gold. | ||||||||||||||||

| For Gold and Silver, Critical Support Holds Posted: 28 Apr 2014 11:30 PM PDT thestreet | ||||||||||||||||

| Gold & Silver Trading Alert: Miners Break Out but Gold Fails to Follow so Far Posted: 28 Apr 2014 11:30 PM PDT SunshineProfits | ||||||||||||||||

| Posted: 28 Apr 2014 11:25 PM PDT etfdailynews | ||||||||||||||||

| Gold Prices April 29, 2014, Technical Analysis Posted: 28 Apr 2014 11:20 PM PDT fxempire | ||||||||||||||||

| Posted: 28 Apr 2014 11:15 PM PDT investing | ||||||||||||||||

| Gold Building Base for a Rally? Posted: 28 Apr 2014 11:15 PM PDT dailyfx | ||||||||||||||||

| Will Gold Price See A Bullish Reversal? Posted: 28 Apr 2014 11:10 PM PDT marketoracle | ||||||||||||||||

| Gold Daily and Silver Weekly Charts - FOMC, GDP, Non-Farm Payrolls and End of April Posted: 28 Apr 2014 11:00 PM PDT Le Cafe Américain | ||||||||||||||||

| US Dollar Index Forecast April 29, 2014, Technical Analysis Posted: 28 Apr 2014 10:45 PM PDT fxempire | ||||||||||||||||

| The Real Unemployment Rate: In 20% Of American Families, EVERYONE Is Unemployed Posted: 28 Apr 2014 09:21 PM PDT

According to shocking new numbers that were just released by the Bureau of Labor Statistics, 20 percent of American families do not have a single person that is working. How can anyone not see what is happening to us? America is in the midst of a long-term economic decline, but the mainstream media and most of [...] The post The Real Unemployment Rate: In 20% Of American Families, EVERYONE Is Unemployed appeared first on Silver Doctors. | ||||||||||||||||

| Gold & Silver Trading Alert: Miners break out but gold fails to follow Posted: 28 Apr 2014 05:51 PM PDT The situation in the precious metals sector remains tense--miners have broken above the declining resistance line, while gold hasn't. | ||||||||||||||||

| Embry: Russia is fitter fiscally than U.S. and knows Wests vulnerability with gold Posted: 28 Apr 2014 05:03 PM PDT GATA | ||||||||||||||||

| The Decline In Shanghai Silver Stocks Picks Up Speed Posted: 28 Apr 2014 05:00 PM PDT

Over the past two months, gold inventories at the Comex have risen slowly, while silver warehouse stocks continue to decline. A total of 17.2 million ounces of silver were removed from the Shanghai (10.2 million oz) and Comex (7 million oz) exchanges since the end of February. For some reason, a great deal more silver is [...] The post The Decline In Shanghai Silver Stocks Picks Up Speed appeared first on Silver Doctors. | ||||||||||||||||

| Posted: 28 Apr 2014 03:25 PM PDT | ||||||||||||||||

| Gold Successfully Tests Medium Term Support Points Posted: 28 Apr 2014 03:18 PM PDT Commodity Trader | ||||||||||||||||

| Precious Metals Complex Flashing Buy Signal Posted: 28 Apr 2014 03:08 PM PDT It looks like gold and silver stocks bottomed on Monday, April 21, and that gold and silver also bottomed this week. Really? The usual reaction is, "the stocks have been hammered, gold is off over 30% from its highs, and silver is down nearly 60%. Sentiment is low, few people are interested, and gold and silver will probably crash again in a few weeks." Exactly!We have been conditioned to expect lower prices in spite of:

And don't forget that central banks everywhere are openly and excessively printing their paper currencies to encourage inflation, politicians are fomenting wars, and the global monetary system is more unstable every day. Accidents can happen, and those accidents will justifiably encourage people to shift assets to something solid and real – like gold and silver. But, you have heard it all before. So, listen to an excellent technician: Nicholas Migliaccio does his own brand of technical analysis, and his comment is, "DON'T MISS THIS RALLY!!!" Why? Price movement, breadth, and volume, and he has the graphs and analysis to support his statement. Download his pdf here: Precious Metals Buy Signal My view is shown in these three graphs of daily data for the XAU (gold stock index), GLD (gold ETF) and SLV (silver ETF).

The XAU, gold, and silver look like they have bottomed. Asian demand is strong, and we have been assured by central banks that they will devalue their currencies to create inflation. Gold, silver, and their stocks will benefit. Consider Nick's article, ignore the nonsense that gold is dangerous, and buy coins or bars. GE Christenson, aka Deviant Investor | ||||||||||||||||

| US Shoots Self in Foot Via Sanctions: Dollar to Be Driven Out of Trade Settlement! Posted: 28 Apr 2014 03:00 PM PDT

In the latest Keiser Report, Max Keiser and Stacy Herbert discuss the American Dream as being chained to the booth in the waffle house as cogs in the wheels generating income for Wall Street sharpies and the poverty of this century in which the beggar is a reminder of nothing. In the second half, Max [...] The post US Shoots Self in Foot Via Sanctions: Dollar to Be Driven Out of Trade Settlement! appeared first on Silver Doctors. | ||||||||||||||||

| Gold Settles Today At $1299.0 After Choppy Session Posted: 28 Apr 2014 02:59 PM PDT Gold finished the session slightly lower Monday but well off its lowest levels of the session as a better than expected housing number initially pushed Gold to its low for the session at 1292.1 early this morning. President Barack Obama announced new sanctions against some Russians on Monday aimed at stopping Russian President Vladimir Putin from fomenting rebellion in eastern Ukraine but said he was holding broader measures against Russia’s economy “in reserve”. Tensions over Ukraine weighed on world stocks on Monday, keeping them near 10-day lows, though European indexes benefited from well received corporate results and merger speculation and U.S. stocks opened higher. In the physical metals market, premiums in top buyer China were at about $2 an ounce. Hong Kong customs office data showed China bought less gold in March from Hong Kong than in the previous month, although the drop was smaller than expected, analysts said. Given the geo-political situation in Eastern Europe, I look for a two sided choppy trading session tomorrow ahead of Wednesday afternoon's Fed announcement. Having said that it is May options expiration for both Silver and Gold tomorrow, so if we were to see some wild price action it most likely would be in the morning. U.S. economic releases are highlighted by Consumer Confidence at 9am central. Spot gold today

Daily Swing #s GCM14 April 29th

Source: Walsh Trading Inc, www.walshtrading.com

| ||||||||||||||||

| The Pope Is Completely Wrong About Capitalism And Inequality Posted: 28 Apr 2014 02:52 PM PDT

In case you missed it, here is the tweet by the Pope that is causing such an uproar... https://twitter.com/Pontifex/status/460697074585980928 By itself, that statement could perhaps be "interpreted" a number of different ways. But this follows other statements by the Pope that make it exceedingly clear what he is talking about. Here is one example...

Yes, the Pope is correct to highlight the plight of the homeless and the needy. Even in "wealthy America", we have an epidemic of hunger. This is something that I wrote about yesterday. And yes, the Pope is correct to point out society's obsession with the stock market. Personally, I have been relentless in criticizing the big Wall Street banks. But the solution is not to take everything away from everybody and put it into a giant pile and redistribute it equally. History has shown us what happens when a society adopts an extreme form of socialism or communism. The incentive to work is destroyed, the incentive to create new ideas and new businesses is destroyed, and living standards for everyone go down. Please don't think that I am defending our current system. What we have in the United States today is not the kind of pure capitalism that our founders intended. Instead, it is a form of collectivism where nearly all of the economic power is now in the hands of giant collectivist institutions. That includes public collectivist institutions (the government) and private collectivist institutions (large corporations). In this type of economic environment, it should not be a surprise that government dependence is at an all-time high, the number of Americans that are self-employed is at an all-time low and millions of small businesses are being regulated out of existence. Collectivism, socialism and communism are all close cousins. People are promised that such systems will result in greater "equality", but it never seems to actually work out that way. Instead, the small elite that hold all the power usually end up enjoying the vast majority of the benefits. And without a doubt, as the power of the government and the power of the corporations has increased, inequality has been rising. Just check out the following chart from a new book by 42-year-old French economist Thomas Piketty entitled "Capital In The Twenty-First Century"... As I write this, Pinketty's book is the number one seller on Amazon. That is pretty remarkable for an economics treatise. But Pinketty fails to realize what actually caused U.S. income inequality to start skyrocketing in 1971. As Brian Domitrovic recently detailed, that was the year when the U.S. completely went off the gold standard and the Federal Reserve started running wild...

So much has gone wrong since 1971. Out national debt has gotten more than 40 times larger, our economic infrastructure has been absolutely gutted and the value of the U.S. dollar has declined by well over 80 percent. Once again, we need to go back to a system that much more closely resembles what our founders intended. Did you know that the greatest period of economic growth in U.S. history was when there was no income tax, no IRS and no Federal Reserve? We could have such a system again. But the solutions being proposed by the mainstream media, our politicians and even the Pope involve even more centralization of economic power. If we follow this path to the end, we will ultimately become like North Korea. It is hard to describe the crushing poverty that exists in that hellhole of a country. In North Korea, there is so little electricity that the country appears almost totally dark from space at night. Just check out this picture taken by NASA... North Korea may have more "equality" than we do, buy in that country "a ballpoint pen is considered a luxury item". Here is much more on what life is like for ordinary people inside North Korea from the New York Post...

Would you like to live in such a society? When you take away the incentive to work and the incentive to create, you end up with a much poorer society. Without outside help, much of North Korea would have already starved to death by now...

Yes, something needs to be done about the rising level of income inequality in our country. The middle class is being systematically destroyed and most of our politicians do not seem to care. Some big steps in that direction would be going back to a much purer form of capitalism, shutting down the Federal Reserve, changing laws to shift power much more in the direction of individuals and small businesses, and ending the practice of shipping millions of our good paying jobs to communist nations such as China. We also need a massive shift in our culture. We need to shift away from a culture of greed and selfishness to a culture of love, compassion and generosity. Those that have been blessed have a responsibility to be a blessing. That is something that we have largely forgotten. But trying to use government and taxation to wipe out inequality never works and will only make society poorer. This is a lesson that Barack Obama, the Democrats, the Republicans, the mainstream media and the Pope all desperately need to learn. | ||||||||||||||||

| Why The Silver Bear Market Is About To End Posted: 28 Apr 2014 02:22 PM PDT After three years of declining silver prices, Jeff Clark from Casey Research believes the bear market is coming to an end. In particular, he is looking at several data points which he explains in this article. First off, from an historical perspective, it seems that we have had 7 bear markets over the past four decades. Four of them lasted longer and three were shorter. Four declined less than today; two were about the same; and only one was significantly deeper.

Over the past 40 years, there has been no bear market that would extend the low past this October. It seems safe to conclude that the end of the down cycle is in or close. Below are several data points which signal that current prices cannot last too much longer. 1. The US Mint (Still) Can't Keep Up with DemandThe sharp drop in the silver price in 2013 unleashed a wave of pent-up demand for silver coins. Look at the response from investors.

The question this year is if those record levels could continue to be supported. The first quarter is over, so it is difficult you the answer. The US Mint sold 13,879,000 ounces in Q1, 2.4% less than the 14,223,000 sold in the first quarter last year. Here's the monthly breakdown:

January's 36% decline from the prior year looks big, but it's not what you think: the Mint didn't begin sales until the end of the second week of the month. The monthly total thus reflects only 2.5 weeks of sales. And March sales were the fourth-biggest month ever. Add in April's sales figures and the US Mint is now on pace to exceed 2013 totals. 2. Silver ETFs Have Net Inflows (Again)You might remember that silver ETFs' holdings were largely flat last year, unlike the mass exodus seen in gold funds. The pattern is continuing this year. Holdings in silver exchange-traded products (ETPs) have risen 3.5% year to date, an additional 17.5 million ounces. In fact, the net purchases by silver ETPs have totaled $354 million YTD, the largest influx of all commodity ETPs! Meanwhile, gold-backed ETPs have seen sales of 500,000 ounces, about a 1% drop. 3. Jewelers Love Low PricesLow silver prices have led to increased silver jewelry purchases. As just one example, the UK reports that silver jewelry sales jumped 40.4% in February, to 351,791 items. 4. India Just Won't Stop BuyingIndia imported 5,500 tonnes last year, 180% more than 2012. Imports comprised 20% of all global demand. Last month's silver imports were 250% lower. This was mostly due to the recent increase in import duties, and the fact that six banks got permission to import gold, which would soften purchases of me. This could partly explain why silver price has struggled. But as long as politicians keep gold restrictions in place, Indians will keep buying silver. 5. China: More Silver for SolarChinese imports of silver rose drastically in February, up by 75% month on month and 90% year on year to 358 tonnes, the highest since March 2011. Though lower the following month, March imports were up 16% year over year. China's solar industry is growing explosively. In 2009, it represented about 0.2% of the global market; this year, it's estimated to be one-third. It's interesting to note that my price rose in February and fell in March, which suggests that Chinese demand affects my price, too. 6. Supply Sources Are ConcerningSo far, suppliers have managed to meet demand. However, there are dark clouds on the horizon…

By Jeff Clark, Senior Precious Metals Analyst

|

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment