Gold World News Flash |

- Comex Casino Lies & Silver Skyrocketing To New All-Time High

- Silver, Gold, and What Could Go Wrong

- You Can’t Eat Gold… But It’s Portable, Easy To Trade and Confiscation-Proof

- The Gold Price Closed Up $8.60 at $1,327.20

- Gold’s Touchdown Pass: CPI Or Fed Beige Book?

- Financial FRAUD to Cause Devastating MELTDOWN!

- Russia conspired to destroy US dollar with China – clip from Meltdown America documentary

- Richard Russell - The Cheapest Thing On The Planet Is Silver

- Plunging GOFO Rates

- The Gold Price Closed Up $8.60 at $1,327.20

- Bart Chilton Joins America's Largest Law Firm As Policy Advisor

- James Turk: Comex Casino Lies & Silver Skyrocketing To New All-Time High

- Is China Already The World's Largest 'Owner' As Opposed To 'Holder' Of Gold?

- Baltic Dry Drops For 15th Day To Lowest In 9 Months (Back Below $1000)

- Grant Williams: All markets are rigged, maybe gold most of all

- American Dream, India Edition

- American Dream, India Edition

- Silver is in backwardation and Comex prices are misleading, Turk tells KWN

- The Credit-Driven Economy

- The Credit-Driven Economy

- Gold Daily and Silver Weekly Charts - The Mother of Madness - Bart Through the Revolving Door

- Gold Daily and Silver Weekly Charts - The Mother of Madness - Bart Through the Revolving Door

- Comex Casino Lies & Silver Skyrocketing To New All-Time High

- Selling gold and piling up debt is crazy, Embry tells KWN

- TF Metals Report: Plunging GOFO rates

- New York Fed contradicts its former vice president about gold accounts

- Top 17 Reasons To Buy Gold Right Now

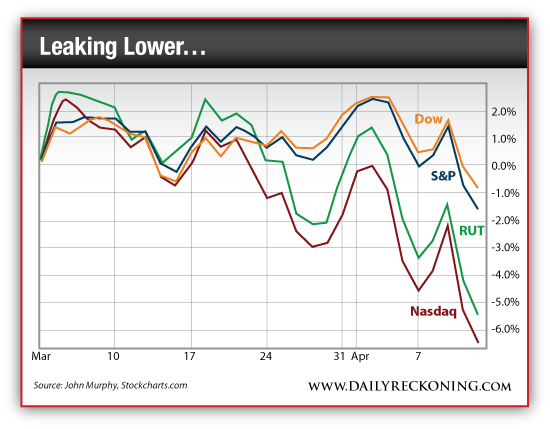

- Attention: This is Not a Stock Market Correction

- This Week’s Inflation Report Could Change Everything For Gold and Silver

- How I Intend to Survive the Meltdown of America

- Platinum or gold: Which is the better bet?

- Gold Prices Hit 3-Week High, Analysts Cite Ukraine "Safe Haven" Appeal and Asian "Bargain-Hunting" Despite Falling Demand Data

- Gold Prices Hit 3-Week High, Analysts Cite Ukraine "Safe Haven" Appeal and Asian "Bargain-Hunting" Despite Falling Demand Data

- Gold Prices Hit 3-Week High, Analysts Cite Ukraine "Safe Haven" Appeal and Asian "Bargain-Hunting" Despite Falling Demand Data

- ECB policymakers plot QE road map

- Silver Price Ultimate Rally: When Paper Assets Collapse

- Economists notwithstanding, Indians know how to put their gold to work

- Jim Rickards: Money Printing Will Destroy Confidence At Some Point

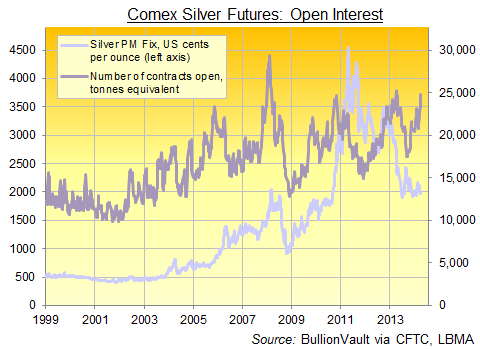

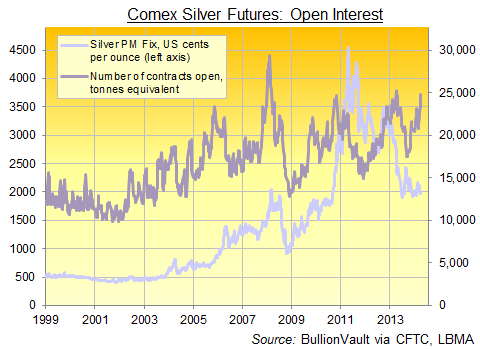

- Silver Prices "Ready to Break Out" as Futures Betting Jumps to Pre-Crash Level

- Silver Prices "Ready to Break Out" as Futures Betting Jumps to Pre-Crash Level

- Gold, Crude Oil and SP500 Elliott Wave Patterns

- Fourth Reversals in The Gold and Silver Charts

- Precious Metals – Week of 04.13.14

| Comex Casino Lies & Silver Skyrocketing To New All-Time High Posted: 14 Apr 2014 11:30 PM PDT from KingWorldNews:

Some reports have tried to explain this surge in open interest by saying that banks are using the futures market to finance their holding of physical silver. This is a common procedure, but only works when silver is in contango, i.e., the futures price is above the spot price. But silver is in backwardation in the front month – and for large trades it appears to be in backwardation up to three months forward – which is the interesting part that I think is misleading so many investors. | ||||||||||||||||||||||||||||||||||||||||

| Silver, Gold, and What Could Go Wrong Posted: 14 Apr 2014 11:05 PM PDT | ||||||||||||||||||||||||||||||||||||||||

| You Can’t Eat Gold… But It’s Portable, Easy To Trade and Confiscation-Proof Posted: 14 Apr 2014 11:00 PM PDT ShtfPlan | ||||||||||||||||||||||||||||||||||||||||

| The Gold Price Closed Up $8.60 at $1,327.20 Posted: 14 Apr 2014 10:37 PM PDT

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||

| Gold’s Touchdown Pass: CPI Or Fed Beige Book? Posted: 14 Apr 2014 10:00 PM PDT from KitcoNews: | ||||||||||||||||||||||||||||||||||||||||

| Financial FRAUD to Cause Devastating MELTDOWN! Posted: 14 Apr 2014 09:56 PM PDT Fraud is everywhere in this system. Warren Buffet pretends to be innocent and is first in line to receive billions of tax payer bailouts! The economy is now built upon the Fed's money printing and is thereby extremely fragile. The public will wake up only after they have realized that their money... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||

| Russia conspired to destroy US dollar with China – clip from Meltdown America documentary Posted: 14 Apr 2014 09:20 PM PDT from CaseyResearchFan : | ||||||||||||||||||||||||||||||||||||||||

| Richard Russell - The Cheapest Thing On The Planet Is Silver Posted: 14 Apr 2014 09:02 PM PDT  With continued turmoil and uncertainty in global markets, today KWN is publishing another important piece that was written by a 60-year market veteran. The Godfather of newsletter writers, Richard Russell, says that he is buying physical silver because it's "dirt cheap." Russell also warned that the gold/silver ratio may plunge from 66/1 down to 16/1. This means the price of silver would more than triple the upside surge he expects for gold. With continued turmoil and uncertainty in global markets, today KWN is publishing another important piece that was written by a 60-year market veteran. The Godfather of newsletter writers, Richard Russell, says that he is buying physical silver because it's "dirt cheap." Russell also warned that the gold/silver ratio may plunge from 66/1 down to 16/1. This means the price of silver would more than triple the upside surge he expects for gold. This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Apr 2014 09:00 PM PDT from TF Metals Report:

As expected, London gold forward rates are plunging again during the New York Comex delivery month. In the recent past, this signal of tight physical supplies has correlated with higher prices. So, are we on the verge of another rally? Longtime readers will recall that we first identified this phenomenon back in October of last year so you can start today by reviewing this: http://www.tfmetalsreport.com/blog/5155/gofo-yourself We wrote about GOFO again in December: http://www.tfmetalsreport.com/blog/5311/yah-wellgofo-yourself And the pattern really began to assert itself in February and March of this year. Please be sure to review this link before continuing: http://www.tfmetalsreport.com/blog/5530/negative-gofo-and-rising-gold-prices | ||||||||||||||||||||||||||||||||||||||||

| The Gold Price Closed Up $8.60 at $1,327.20 Posted: 14 Apr 2014 07:36 PM PDT

Aurum et argentum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2014, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||

| Bart Chilton Joins America's Largest Law Firm As Policy Advisor Posted: 14 Apr 2014 07:27 PM PDT It seems like it was only yesterday (actually it was early November) when infamous CFTC commissioner, legendary threat to gold manipulators nowhere, and Alexander Godunov impersonator, Bart Chilton made a very dramatic exit stage left. Here is what we said at the time:

The rhetorical answer to the rhetorical question: of course it was all for show, confirmed moments ago when Chilton became just the latest "regulator" to take the great revolving door out of a worthless public service Washington office into a just as worthless, but much better paying private-sector Washington office. Presenting the latest employee of DLA Piper, the largest law firm in the US, and possibly the world, by number of partners - Bart Chilton, poet. From DLA Piper.

Yes, we did harbor hopes that Chilton could actually become a whistleblower. But the prospect of living in the apartment below Snowden collecting nothing while actually doing some real work for the first time in his life, surely seemed far less apetizing than sitting in a glass corner office at 500 Eighth Street, NW, collecting over a million a year for doing nothing. Appropriately enough, the DLA press release concludes with the following.

So, in retrospect, a non-fiction autobiography too? | ||||||||||||||||||||||||||||||||||||||||

| James Turk: Comex Casino Lies & Silver Skyrocketing To New All-Time High Posted: 14 Apr 2014 06:47 PM PDT As global markets continue to see some wild trading, today James Turk told King World News that silver is actually in backwardation, but the Comex casino is not reporting prices accurately. He also included two fantastic charts. This is a must read for all gold and silver investors, but particularly for those investing in or trading silver. | ||||||||||||||||||||||||||||||||||||||||

| Is China Already The World's Largest 'Owner' As Opposed To 'Holder' Of Gold? Posted: 14 Apr 2014 06:36 PM PDT Submitted by John Browne via Euro Pacific Capital, For decades many of us in the hard money world have speculated that cloak and dagger activity by large financial interests has played a large role in determining performance in the gold market. The focus of this alleged manipulation is believed to be in the London market, and has been widely referred to as "The London Fix." However those who have blown the whistle have been dismissed as alarmists, gold bugs, conspiracy theorists or worse. But recent revelations should bring us closer to the truth. On March 11, 2014, the Wall Street Journal reported that AIS Capital Management had filed a class action suit, against a number of large banks including, Barclay's PLC, Deutsche Bank, HSBC, and many others, alleging that the banks conspired to manipulate the price of gold for their own gain. This suit comes on the heels of official investigations in the UK and in Germany. Like the London Inter Bank Offered [interest] Rate (LIBOR), the London Gold price forms a benchmark for the spot price for major gold metal transactions throughout the world. The LIBOR scandal rocked the financial world. But Germany's senior financial regulator declared possible gold manipulation as "worse than LIBOR". These words appeared to give new meaning to the word 'fix'. To get at the truth, it helps to try to follow the international flows of gold, to see who is buying, who is selling, and where the gaps may appear. Major gold trading has long been shrouded in mystery. Despite returns required by the IMF, trading in the Far East is difficult to trace accurately. In 2009, China's central bank disclosed that its gold holdings had increased by 75 percent from 600 to 1,054 tonnes, or metric tons. According to Wikipedia, this made China the world's sixth largest holder. Gold Field Mineral Services (GFMS) estimates the world's total gold production for 2013 was 2,982 tonnes. With an annual production of some 428 tonnes, according to Forbes Asia, China is the world's largest producer. But, like Russia, China exports no gold. If China's last three years annual assumed production is aggregated, China's 2009 declared holdings of 1054 tonnes should have increased since by some 1,284 tonnes, for a total of some 2,338 tonnes. This would make China one of the world's largest holders. But the story does not end there. China imports massive amounts mainly via Hong Kong and Shanghai. According to Forbes Asia, the China Gold Association showed that China's gold consumption increased by 41 percent over 2012 to 1,176 tonnes in 2013. (China does not publish official numbers so discrepancies range in the hundreds of tonnes) Adding these imports to China's domestic production of 428 tonnes indicates that China accumulated at least 1,604 tonnes last year. India's imports, as reported by Bloomberg, were 978 tonnes last year. Therefore, China and India together accumulated 2,582 tonnes or over 86 percent of total worldwide production of 2,982 tonnes. Furthermore, combining China's aggregate domestic production and apparent imports indicates that she has now over 3,514 tonnes. Assuming the U.S. still owns all the gold held by the Fed, this would make China the world's second largest national owner. In addition to China and India, Indonesia, Saudi Arabia and Thailand increased their gold holdings in 2013. As gold is a widely recognized representation of wealth, this represents a massive transfer of 'real' wealth from West to East. Clearly, the massive Eastern demand for physical gold has made it much more difficult for Western central banks' mission to lower the market price of gold. That is unless Western central banks have been leasing out gold secretly to market buyers, who have been 'encouraged' politically, like Germany, not to take physical delivery? When, at the beginning of 2013, Germany asked for the repatriation of just 300 tonnes of its holdings of 3,396 tonnes, the Fed asked for a five-year delayed delivery. By year's end, the Fed had sent Germany only 5 tonnes. Although privately owned, partly by bankers, the Fed is audited only partially. Could it be that a large portion of the Fed's published gold holdings of 8,133.5 tonnes is now actually the property of other nations, like Germany? Is China already the world's largest 'owner' as opposed to 'holder' of gold? If so, China, with a mature financial center in Hong Kong, already is further along the path than most have predicted towards challenging the vital reserve currency status and international credibility of the U.S. dollar. Clearly the recent price rise in gold owes something to inflation fears, repressed interest rates and to the Ukrainian situation. In the meantime, a growing awareness of a possible serious and increasing shortage of physical gold and a decline in the power of western central banks to suppress the price, point to a resumption of the fundamental bull market in gold, despite a possible increase in fears of recession. | ||||||||||||||||||||||||||||||||||||||||

| Baltic Dry Drops For 15th Day To Lowest In 9 Months (Back Below $1000) Posted: 14 Apr 2014 06:08 PM PDT And still the mainstream media's discussion of the collapse in the Baltic Dry shipping index is entirely absent. As we have been pointing out for weeks now, something extreme is occurring in the cost of shipping dry bulk around the world. 2014 is now witnessing the biggest drop in price (a typical seasonal pattern) to start the year since records began. Today's drop to $989 (the first time below $1000 since June 2013) is the 15th drop in a row and it's not just this index that is fading: Capesize, Panamax, and Supramax rates are all falling. As we noted previously, the shipbuilding industry is already feeling the pain.

| ||||||||||||||||||||||||||||||||||||||||

| Grant Williams: All markets are rigged, maybe gold most of all Posted: 14 Apr 2014 04:21 PM PDT 7:23p ET Monday, April 14, 2014 Dear Friend of GATA and Gold: All markets are rigged these days, perhaps the gold market most of all, fund manager Grant Williams writes in the new edition of his "Things That Make You Go Hmmm ..." letter. Williams echoes the observation made first four years ago by GATA's late board member Adrian Douglas that gold almost always goes down during London trading hours even as it is rising elsewhere, a reincarnation of the London gold pool of the 1960s: Williams writes: "In order for market rigging to be stopped, the changes have to come from those entrusted with regulation, in the form of stern punishments for those caught rigging them, and there must be changes to the rules to close the loopholes that allowed this kind of activity to occur in the first place. "Instead, the bodies which supposedly oversee the markets are involved in the most serious rigging of all. "What chance is there that we will see any change? "Get used to it, folks. As anyone who looks at financial markets up close with their eyes open will tell you, they are all rigged -- it's simply a question of degree. The question is: Do you adapt and work around the rigging or do you simply decide not to play? "Central banks and governments seriously hope you choose the former option." Williams' letter is headlined "What's the Frequency, Zenith?" and it's posted at the Mauldin Economics Internet site here: http://www.mauldineconomics.com/ttmygh/whats-the-frequency-zenith CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. | ||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Apr 2014 02:53 PM PDT Forget India's gold buying. But what about US-style resource consumption...? INDIA last week kicked off the world's largest election, writes Frank Holmes at US Global Investors, with its national elections that will run from April 7 through May 12. The second-most populous country, India is home to 1.2 billion people. The size of the voting population is a staggering 815 million. The election will decide the parliament and ultimately determine the next Prime Minister of the country. India is a fascinating country that I have written about many times in relation to gold's Love Trade. The love for gold is a cultural phenomenon that is shown in gifts given for weddings and festivals, and the idea that one's wealth is defined by ownership of physical gold jewelry and gold coins. In my travels I have seen this love for gold first-hand, and witnessed the vast population that makes up the energy of India. Did you know that half of India's population is under the age of 25? This youthful group makes up 600 million people, equating to twice the population of the United States! India's young population cares about jobs and economic opportunities. This will likely be the focus on their minds when they go to the voting polls. The candidate who seems favored to win the office of prime minister is Narendra Modi, of the Bharatiya Janata Party (BJP). Modi has a complicated past, with connections to violent, sectarian events. But as The Economist describes him, he is also known as "a man who, by his own efforts, rose from humble beginnings as a tea-seller." This boot-straps tale resonates with the voters who are reaching to improve their own economic situations. Modi is known as a business-friendly candidate. In his home state, he has a history of being open to foreign investment, and has pursued economic relationships with Europe and the US Over the past decade, a great shift has taken place in India. Urbanization trends show that about half of the population lives in urban areas. Although official government definitions of rural and urban areas don't quite match what we think of in the West, the trend shows that the number of urban dwellers could double in the next 25 years. Urban dwelling usually is paired with an increase in wealth as city residents have more regular incomes. We've seen this increase in wealth with the rise in cell phone usage in India and television ownership. Now, 65 percent of Indian households own a TV set. With Internet-enabled phones and televisions, the people are connected and share ideas across the country. These people are striving for the American Dream. As I've mentioned, every American born will need whopping 2.9 million pounds of minerals, metals and fuels in their lifetime. When you think about babies born in India, aspiring to the American lifestyle, you can begin to recognize the implications for resources demand in this part of the world. | ||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Apr 2014 02:53 PM PDT Forget India's gold buying. But what about US-style resource consumption...? INDIA last week kicked off the world's largest election, writes Frank Holmes at US Global Investors, with its national elections that will run from April 7 through May 12. The second-most populous country, India is home to 1.2 billion people. The size of the voting population is a staggering 815 million. The election will decide the parliament and ultimately determine the next Prime Minister of the country. India is a fascinating country that I have written about many times in relation to gold's Love Trade. The love for gold is a cultural phenomenon that is shown in gifts given for weddings and festivals, and the idea that one's wealth is defined by ownership of physical gold jewelry and gold coins. In my travels I have seen this love for gold first-hand, and witnessed the vast population that makes up the energy of India. Did you know that half of India's population is under the age of 25? This youthful group makes up 600 million people, equating to twice the population of the United States! India's young population cares about jobs and economic opportunities. This will likely be the focus on their minds when they go to the voting polls. The candidate who seems favored to win the office of prime minister is Narendra Modi, of the Bharatiya Janata Party (BJP). Modi has a complicated past, with connections to violent, sectarian events. But as The Economist describes him, he is also known as "a man who, by his own efforts, rose from humble beginnings as a tea-seller." This boot-straps tale resonates with the voters who are reaching to improve their own economic situations. Modi is known as a business-friendly candidate. In his home state, he has a history of being open to foreign investment, and has pursued economic relationships with Europe and the US Over the past decade, a great shift has taken place in India. Urbanization trends show that about half of the population lives in urban areas. Although official government definitions of rural and urban areas don't quite match what we think of in the West, the trend shows that the number of urban dwellers could double in the next 25 years. Urban dwelling usually is paired with an increase in wealth as city residents have more regular incomes. We've seen this increase in wealth with the rise in cell phone usage in India and television ownership. Now, 65 percent of Indian households own a TV set. With Internet-enabled phones and televisions, the people are connected and share ideas across the country. These people are striving for the American Dream. As I've mentioned, every American born will need whopping 2.9 million pounds of minerals, metals and fuels in their lifetime. When you think about babies born in India, aspiring to the American lifestyle, you can begin to recognize the implications for resources demand in this part of the world. | ||||||||||||||||||||||||||||||||||||||||

| Silver is in backwardation and Comex prices are misleading, Turk tells KWN Posted: 14 Apr 2014 02:41 PM PDT 5:40p ET Monday, April 14, 2014 Dear Friend of GATA and Gold: Comex silver futures prices are misleading, GoldMoney founder and GATA consultant James Turk tells King World News today, with real metal scarce and silver in backwardation in Europe, where most real metal trades. An excerpt from Turk's interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/4/14_Co... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. | ||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Apr 2014 02:40 PM PDT The Fed's brainless PhD theory seems to work in practice. So far... WE RETURN to familiar territory. We have seen it before, writes Bill Bonner in his Diary of a Rogue Economist. The slowdown in the economy. The overpricing of assets (particularly stocks). The huge increase in debt. The Fed's QE and ZIRP. But for all its familiarity, it remains strange...and mysterious. Let's backtrack. The foundation for today's peculiar economy was laid in the 1960s and 1970s. In 1968, President Johnson asked Congress to end the requirement that US Dollars be backed by gold. Then in 1971, President Nixon issued Executive Order 11615, which "closed the gold window." This meant the Dollar was not directly convertible to gold. The supply of money and credit no longer had any anchor in a physical commodity. It could now be created ex nihilo and ad nauseam by private banks, aided and abetted by the Fed. The PhDs running the Fed had a theory – one that seems childishly naïve but that, nevertheless, seems to work in practice (so far). The more you could get people to borrow, they reasoned, the more demand for goods and services there'd be...and the more the economy would produce to meet this new demand. This would give Americans more access to jobs, incomes...and the satisfaction of getting something for nothing. The theory maintained that, as long as consumer prices didn't get out of control, banks could create as much credit as they wanted, stimulating growth. After some shilly-shallying in the 1970s, the new credit-driven economy began to take shape in the 1980s. Since then, $33 trillion of spending, buying, investing, producing, consuming and speculating has taken place – all funded by credit. Had the level of debt to GDP kept steady, there would have been about $1 trillion a year less economic activity over the last three decades. Is that a success for the PhDs? Or what? "Or what?" is our guess and our question. During almost that entire time – from 1980 to 2013 – consumer prices did not get out of control. Instead, they seemed to come more under control, with a gradually falling CPI (aided by jiving the figures!) from over 13% in 1980 to barely 1% today. But here is the curious and incomprehensible part. If you earned $100 a week, you could normally spend $100 a week. If you had $10 in savings, your savings would represent stored-up buying power. So you might choose, in one week, to spend that too. In that week, you would enjoy $110 worth of what the world had on offer. And the economy around you would enjoy an extra $10 worth of demand. But the $33 trillion spent by Americans over the last four decades or so did not come from savings. Instead, it came out of thin air – from the banking system, which contrary to the common belief that it requires some pre-existing money (in the form of cash deposits or reserves) to make loans, simply creates them out of nothing. In other words, this credit creation did not represent resources that had been set aside – like seed corn – to prime future growth. No one ever deprived himself of a single meal, or as much as a single beer, to save the money. No one troubled himself to work even a single hour to earn it. No one toiled or spun... Now, if the guy with the saved $10 lent it to someone else...and the borrower spent it...it would have the same effect as if he had spent it himself. So, if the economy had borrowed $33 trillion from savings...and spent it...you'd see the same effect, right? And what if the $10 or the $33 trillion couldn't be paid back? Then the savings would be lost. The savers would be out. But at least it would make sense. The automobiles, shopping malls, vacations, retirements, silly gadgets, health-care scams, parasitic legal actions and false-shuffle financial products would have been funded by real money. They would exist for a reason, if not necessarily a good one. But what happens if the $33 trillion of pure credit, unbacked by savings, cannot be repaid? Who is out? Who loses? And how did all those real things...the $33 trillion worth of goods and services...come to exist in the first place, if there were no real money or resources ever made available to fund them? Is anyone else concerned about this? Are we all alone here? | ||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Apr 2014 02:40 PM PDT The Fed's brainless PhD theory seems to work in practice. So far... WE RETURN to familiar territory. We have seen it before, writes Bill Bonner in his Diary of a Rogue Economist. The slowdown in the economy. The overpricing of assets (particularly stocks). The huge increase in debt. The Fed's QE and ZIRP. But for all its familiarity, it remains strange...and mysterious. Let's backtrack. The foundation for today's peculiar economy was laid in the 1960s and 1970s. In 1968, President Johnson asked Congress to end the requirement that US Dollars be backed by gold. Then in 1971, President Nixon issued Executive Order 11615, which "closed the gold window." This meant the Dollar was not directly convertible to gold. The supply of money and credit no longer had any anchor in a physical commodity. It could now be created ex nihilo and ad nauseam by private banks, aided and abetted by the Fed. The PhDs running the Fed had a theory – one that seems childishly naïve but that, nevertheless, seems to work in practice (so far). The more you could get people to borrow, they reasoned, the more demand for goods and services there'd be...and the more the economy would produce to meet this new demand. This would give Americans more access to jobs, incomes...and the satisfaction of getting something for nothing. The theory maintained that, as long as consumer prices didn't get out of control, banks could create as much credit as they wanted, stimulating growth. After some shilly-shallying in the 1970s, the new credit-driven economy began to take shape in the 1980s. Since then, $33 trillion of spending, buying, investing, producing, consuming and speculating has taken place – all funded by credit. Had the level of debt to GDP kept steady, there would have been about $1 trillion a year less economic activity over the last three decades. Is that a success for the PhDs? Or what? "Or what?" is our guess and our question. During almost that entire time – from 1980 to 2013 – consumer prices did not get out of control. Instead, they seemed to come more under control, with a gradually falling CPI (aided by jiving the figures!) from over 13% in 1980 to barely 1% today. But here is the curious and incomprehensible part. If you earned $100 a week, you could normally spend $100 a week. If you had $10 in savings, your savings would represent stored-up buying power. So you might choose, in one week, to spend that too. In that week, you would enjoy $110 worth of what the world had on offer. And the economy around you would enjoy an extra $10 worth of demand. But the $33 trillion spent by Americans over the last four decades or so did not come from savings. Instead, it came out of thin air – from the banking system, which contrary to the common belief that it requires some pre-existing money (in the form of cash deposits or reserves) to make loans, simply creates them out of nothing. In other words, this credit creation did not represent resources that had been set aside – like seed corn – to prime future growth. No one ever deprived himself of a single meal, or as much as a single beer, to save the money. No one troubled himself to work even a single hour to earn it. No one toiled or spun... Now, if the guy with the saved $10 lent it to someone else...and the borrower spent it...it would have the same effect as if he had spent it himself. So, if the economy had borrowed $33 trillion from savings...and spent it...you'd see the same effect, right? And what if the $10 or the $33 trillion couldn't be paid back? Then the savings would be lost. The savers would be out. But at least it would make sense. The automobiles, shopping malls, vacations, retirements, silly gadgets, health-care scams, parasitic legal actions and false-shuffle financial products would have been funded by real money. They would exist for a reason, if not necessarily a good one. But what happens if the $33 trillion of pure credit, unbacked by savings, cannot be repaid? Who is out? Who loses? And how did all those real things...the $33 trillion worth of goods and services...come to exist in the first place, if there were no real money or resources ever made available to fund them? Is anyone else concerned about this? Are we all alone here? | ||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - The Mother of Madness - Bart Through the Revolving Door Posted: 14 Apr 2014 01:22 PM PDT | ||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - The Mother of Madness - Bart Through the Revolving Door Posted: 14 Apr 2014 01:22 PM PDT | ||||||||||||||||||||||||||||||||||||||||

| Comex Casino Lies & Silver Skyrocketing To New All-Time High Posted: 14 Apr 2014 12:43 PM PDT  As global markets continue to see some wild trading, today James Turk told King World News that silver is actually in backwardation, but the Comex casino is not reporting prices accurately. He also included two fantastic charts. This is a must read for all gold and silver investors, but particularly for those investing in or trading silver. As global markets continue to see some wild trading, today James Turk told King World News that silver is actually in backwardation, but the Comex casino is not reporting prices accurately. He also included two fantastic charts. This is a must read for all gold and silver investors, but particularly for those investing in or trading silver.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||

| Selling gold and piling up debt is crazy, Embry tells KWN Posted: 14 Apr 2014 11:34 AM PDT 2:30p ET Monay, April 14, 2014 Dear Friend of GATA and Gold: Sprott Asset Management's John Embry today tells King World News that it's crazy for the United States and other Western countries to be selling gold and accumulating stratospheric levels of debt: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/4/14_Th... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit: Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | ||||||||||||||||||||||||||||||||||||||||

| TF Metals Report: Plunging GOFO rates Posted: 14 Apr 2014 11:19 AM PDT 2:16p ET Monday, April 14, 2014 Dear Friend of GATA and Gold: The TF Metal Report's Turd Ferguson today reports confirmation that declining gold forward offered interest rates signal scarcity and a rising price and constitute a good trading indicator. His commentary is headlined "Plunging GOFO Rates" and it's posted at the TF Metals Report here: http://www.tfmetalsreport.com/blog/5663/plunging-gofo-rates CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair to hold gold market seminar in Toronto on April 26 Mining entrepreneur and gold advocate Jim Sinclair's next gold market seminar will be held from 1 to 5 p.m. Saturday, April 26, at the Pearson Hotel & Conference Centre at Toronto's Pearson International Airport, 240 Belfield Road, Toronto. For details on tickets, please visit Sinclair's Internet site, JSMineSet.com, here: http://www.jsmineset.com/2014/04/01/toronto-qa-session-announced/ Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||

| New York Fed contradicts its former vice president about gold accounts Posted: 14 Apr 2014 10:59 AM PDT 2:03p ET Monday, April 14, 2014 Dear Friend of GATA and Gold: The Federal Reserve Bank of New York has contradicted the assertion of its former vice president that it has provided gold accounts to bullion banks. The assertion of such accounts was made by H. David Willey, the former New York Fed vice president in charge of foreign central bank accounts and the gold vault at the New York Fed, in a speech given in May 2004 to the American Institute for Economic Reserve in Great Barrington, Massachusetts. See Page 62 here: http://www.gata.org/files/WilleySpeechAIERMay2004.pdf Willey said: "The Federal Reserve Bank of New York provides limited facilities for gold transactions. The bank will allow gold accounts only for foreign monetary authorities and for banks that are members of the Federal Reserve System, not for other gold dealers in the U.S. markets." ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata This was more of an admission of the New York Fed's involvement with the gold market than seemed ever to have been made officially, so in January your secretary/treasurer asked the New York Fed's public information office about it: Does the New York Fed provide gold accounts to bullion banks, or did the New York Fed ever do so, as its former vice president said in that speech in 2004? The New York Fed's public information office acknowledged the question but refused to pursue the information sought. So your secretary/treasurer put the question by certified mail to the president of the New York Fed, William Dudley, and sought the assistance of some members of Congress in getting an answer. That answer arrived today, 2 1/2 months later, in the form of a letter from Timothy J. Fogarty, the New York Fed's senior vice president for central bank and international account services, apparently Willey's successor. Fogarty wrote: "The bank presently opens and maintains gold custody accounts only at the request of central banks, governments, and official international organizations, and we have not located any evidence that the bank has historically opened a gold custody account at the rquest of a member bank of the Federal Reserve System. ... "In connection with Congress' lifting of the ban on private ownership of gold in 1974, the Board of Governors of the Federal Reserve System publicly issued a policy statement on December 9, 1974, which expressly stated that the Federal Reserve banks will not perform services for member banks with respect to gold, including safekeeping. In accordance with that policy statement, the bank has not provided gold custody services to member banks from 1974 to the present." Fogarty's letter is posted at GATA's Internet site here: http://www.gata.org/files/NewYorkFedReply-04-11-2014.pdf So somebody has gotten this issue very wrong. In a presentation to the Committee for Monetary Research and Education in New York in May 2003, Willey expressed doubt that the U.S. government was trying to suppress the gold price: https://groups.yahoo.com/neo/groups/gata/conversations/messages/1506 If he's still around, maybe he can explain why his former employer maintains that he didn't know what he was talking about in Great Barrington. CHRIS POWELL, Secretary/Treasurer Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Silver mining stock report for 2014 comes with 1-ounce silver round Future Money Trends is offering a special 18-page silver mining stock report about how to profit with the monetary and industrial metal in 2014, and it comes with a free 1-ounce silver round. Proceeds from the report's sales are shared with the Gold Anti-Trust Action Committee to support its efforts to expose manipulation in the monetary metals markets. To learn about this report, please visit:

This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||||||||||||||||||

| Top 17 Reasons To Buy Gold Right Now Posted: 14 Apr 2014 09:33 AM PDT Just remember whoever gets left holding the most reserve notes will have enormous supply of paper to repurpose as wall paper or some other craft. You don't want to hold the paper. It's just another financial "asset" like a stock. Only the real metal is worth anything. The capital controls we have... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||||||||||||||||||||||||||||||||||

| Attention: This is Not a Stock Market Correction Posted: 14 Apr 2014 09:05 AM PDT The bull market has warped your brain. For the better part of the past year, stocks have offered nothing but backslaps and high-fives. Your favorite names streaked higher. Your losing trades were few and far between. And most importantly, every single setback miraculously ended in furious buying and another round of new highs for stocks… That's why you're convinced we are now in the midst of a major market correction. But I have news for you… That's why you're convinced we are now in the midst of a major market correction. Not yet, at least. No, the action you've seen over the past couple of weeks is a minor pullback at best. That's it. After the market mercifully closed Friday afternoon, investors had the chance to stew over its downright awful performance over the weekend. The Nasdaq dropped more than 3% on the week. The growth stock rout continued. But a correction? Not even close… The NASDAQ hasn't breached its February lows yet. That's right. Even after last week's gut-punch, the tech-heavy index isn't even trading at 2014 lows. Keep this in mind as a new trading week begins. Now's not the time to try and pick out comeback plays. I'm very skeptical of any market rally. Every move higher is a dead-cat bounce until proven otherwise. Simply put, I do not think the market can just ignore the breakdown we're seeing in the Nasdaq… "The lost decade for stocks began with a 2000 collapse in the Nasdaq market as the dot.com bubble burst," writes technician John Murphy over at Stockcharts.com. "Since market bottoms were formed at the end of 2002 and the spring of 2009, however, the Nasdaq has been a market leader." Remember, the Nasdaq has been a critical component of the current bull market. Murphy points out that the Nasdaq Composite has gained 245% since the October 2002 bottom – compared to a gain of 124% for the S&P 500. The Nasdaq has also almost doubled-up the S&P since the March 2009 bottom. Now, we're seeing the overheated market leader begin to lag in a big way. That's a big warning sign you shouldn't ignore… Regards, Greg Guenthner P.S. Over the past couple of weeks, you've witnessed some pretty big drops in popular growth stocks. But these aren't the only names taking on water…Sign up for the Rude Awakening for FREE today to see how you can bet against crumbling stocks for big gains… | ||||||||||||||||||||||||||||||||||||||||

| This Week’s Inflation Report Could Change Everything For Gold and Silver Posted: 14 Apr 2014 08:00 AM PDT Renewed tensions in Ukraine, a weaker U.S. dollar, and a faltering domestic stock market combined to support precious metals prices last week as most risk assets declined. Dollar weakness appears to be the biggest short-term driver for gold while steady demand in China and India continues to be one of the [...] | ||||||||||||||||||||||||||||||||||||||||

| How I Intend to Survive the Meltdown of America Posted: 14 Apr 2014 07:39 AM PDT Dear Reader, It is with a troubled heart that I sit down to write today, there being reports of casualties in new fighting in eastern Ukraine. I worry, of course, about my friends and students in the country who may well be in physical danger soon, if the conflict escalates. But that’s personal; as an investment analyst, it’s the financial war the Russians seem quite willing to wage that really has my attention. It should have yours as well. As one of the experts in our just-released Meltdown America video noted, the Kremlin had already made moves to dethrone the US dollar as the world’s reserve currency before the renewed East-West tensions of this year. Putin has openly threatened what amounts to economic warfare as a response to sanctions placed on Russia after its Crimea grab. Now bullets are flying—can Putin’s financial ICBM be far behind? Mind you, the US and global economies are on such shaky ground, they could come crashing down without any help from Gospodin Putin. One of the things that really struck me while watching Meltdown America was the way the writing was clearly visible on the wall in past cases of financial collapse and hyperinflation—but no one wanted to believe it. That’s the way I see the US today. Life seems so normal and there’s so much wealth even in poorer regions, it’s hard to believe the cracks in the foundation could really bring down everything built on it. And that’s exactly why the cracks never get fixed; people don’t want to see them, and politicians do everything possible to deny they exist. So they widen and deepen until the collapse becomes inevitable—and I believe we have already passed the point of no return. It’s just a matter of time now. Gloomy thoughts indeed, but I’m not here to depress anyone. Hopefully, I can help deliver a wake-up call, as per our Meltdown America video. Perhaps even more useful, I can tell you what I’m doing about it. As you probably know already, precious metals are a key part of my strategy. As Doug Casey likes to say, gold is the only financial asset that is not simultaneously someone else’s liability. It’s solid value you can hold in your hand, and come what may, use to store and protect wealth, as well as to make payments when all other systems fail. Again, as Doug says, I buy gold for prudence and gold stocks for profit. If I’m right about the economic trouble ahead, gold will protect me, and my gold stock picks will make me a fortune. This is why we focus so much on precious metals and related mining stocks in these Metals & Mining Monday daily dispatches. Fear not; we’ll have plenty more relevant ideas and actionable information in future editions. But Doug also says that our biggest risk today is not market risk; it’s political risk. He has moved to rural Argentina to get out of harm’s way. He’s picked a beautiful place, and I had intended to move to Cafayate myself, but then I got married… and plans changed. Specifically, I need to remain in the US for some years to come. So instead of expatriating, I’ve moved to Puerto Rico, a US territory that is rapidly becoming the only tax haven that matters for US taxpayers. People keep asking me why I chose Puerto Rico and if I’m happy with my choice, so I’ve decided to skip writing about metals this week and write instead about my move here. It’s a break from tradition, but one I hope will provide as much value as anything I could write about rocks at this time. Sincerely, Louis James

| ||||||||||||||||||||||||||||||||||||||||

| Platinum or gold: Which is the better bet? Posted: 14 Apr 2014 07:30 AM PDT | ||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Apr 2014 06:17 AM PDT GOLD PRICES touched 3-week highs for Dollar investors overnight Monday, coming within 15¢ of $1330 per ounce as Ukraine's interim president Turchynov said Kiev was preparing an "anti-terrorist operation" against pro-Russian separatists who have seized regional government buildings in several eastern towns and cities. The UK ambassador to the United Nations claimed Saturday that Russia has moved between 35,000 and 40,000 troops to its eastern border, "equipped with combat aircraft, tanks, artillery and logistical support units." Easing back and then bouncing higher from $1320 per ounce – just beneath April 2013's gold crash low, hit 12 months ago tomorrow in the metal's worst drop in three decades – gold prices rallied faster for UK and Euro investors as the Dollar extended its rise on the currency markets. "Globex gold opened up strongly this morning," says a note from Swiss refinery and finance group MKS's Asian team, referring to the 23-hours-a-day Comex futures platform, "as investors clamoured to initiate safe-haven longs." "Tensions between Russia and the West over Ukraine [are] giving support to gold," reckons Dutch bank ABN Amro's analyst Georgette Boele, quoted by Reuters. "The unsettled geopolitical situation in Ukraine is...providing an element of support for gold," agrees US brokerage INTL FCStone's Edward Meir, quoted by Bloomberg. Last week, however, the giant SPDR Gold Trust last week shed 0.5% of the gold bullion needed to back its shares, taking the total to a 5-week low of 804 tonnes More than 2% below the peak of late March, that level was a three-year low when first reached in December. Hedge funds and other leveraged speculators meantime cut their net bullishness on gold prices by almost 5%, weekly data from US regulators showed Friday. Over the week-ending last Tuesday, the so-called "net spec long" position of bullish minus bearish nets held by all non-industry traders in Comex futures and options fell below 418 tonnes equivalent – its lowest level since mid-February. Trying to explain the rise of gold prices, "part of the increase," says the Frankfurt-based commodities team at Commerzbank, "could be attributable" to speculators growing their bets after last Wednesday's release of meeting notes from the US Federal Reserve. Those notes showed much less desire amongst Fed members for interest-rate hikes than previous comments suggested. "China and India could also have contributed to the price hike," Commerzbank adds, citing "speculation" of stronger Indian imports in March and saying that sub-$1300 gold prices were "obviously regarded as attractive." But "physical demand remain[s] cautious," says the latest note from refining group Heraeus's HQ in Hanau, Germany, "and there are no signs of this improving. "Data from China points towards unchanged, if not lower demand." Gold bullion prices in Shanghai closed Monday at a 3-week high in the Yuan, but continued to trade at a rare discount to the world's reference rate of London settlement. Now trading at a discount rather than premium for 7 weeks running, Shanghai's most active gold contracts ended Monday $2.50 per ounce below London spot quotes. | ||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Apr 2014 06:17 AM PDT GOLD PRICES touched 3-week highs for Dollar investors overnight Monday, coming within 15¢ of $1330 per ounce as Ukraine's interim president Turchynov said Kiev was preparing an "anti-terrorist operation" against pro-Russian separatists who have seized regional government buildings in several eastern towns and cities. The UK ambassador to the United Nations claimed Saturday that Russia has moved between 35,000 and 40,000 troops to its eastern border, "equipped with combat aircraft, tanks, artillery and logistical support units." Easing back and then bouncing higher from $1320 per ounce – just beneath April 2013's gold crash low, hit 12 months ago tomorrow in the metal's worst drop in three decades – gold prices rallied faster for UK and Euro investors as the Dollar extended its rise on the currency markets. "Globex gold opened up strongly this morning," says a note from Swiss refinery and finance group MKS's Asian team, referring to the 23-hours-a-day Comex futures platform, "as investors clamoured to initiate safe-haven longs." "Tensions between Russia and the West over Ukraine [are] giving support to gold," reckons Dutch bank ABN Amro's analyst Georgette Boele, quoted by Reuters. "The unsettled geopolitical situation in Ukraine is...providing an element of support for gold," agrees US brokerage INTL FCStone's Edward Meir, quoted by Bloomberg. Last week, however, the giant SPDR Gold Trust last week shed 0.5% of the gold bullion needed to back its shares, taking the total to a 5-week low of 804 tonnes More than 2% below the peak of late March, that level was a three-year low when first reached in December. Hedge funds and other leveraged speculators meantime cut their net bullishness on gold prices by almost 5%, weekly data from US regulators showed Friday. Over the week-ending last Tuesday, the so-called "net spec long" position of bullish minus bearish nets held by all non-industry traders in Comex futures and options fell below 418 tonnes equivalent – its lowest level since mid-February. Trying to explain the rise of gold prices, "part of the increase," says the Frankfurt-based commodities team at Commerzbank, "could be attributable" to speculators growing their bets after last Wednesday's release of meeting notes from the US Federal Reserve. Those notes showed much less desire amongst Fed members for interest-rate hikes than previous comments suggested. "China and India could also have contributed to the price hike," Commerzbank adds, citing "speculation" of stronger Indian imports in March and saying that sub-$1300 gold prices were "obviously regarded as attractive." But "physical demand remain[s] cautious," says the latest note from refining group Heraeus's HQ in Hanau, Germany, "and there are no signs of this improving. "Data from China points towards unchanged, if not lower demand." Gold bullion prices in Shanghai closed Monday at a 3-week high in the Yuan, but continued to trade at a rare discount to the world's reference rate of London settlement. Now trading at a discount rather than premium for 7 weeks running, Shanghai's most active gold contracts ended Monday $2.50 per ounce below London spot quotes. | ||||||||||||||||||||||||||||||||||||||||

| Posted: 14 Apr 2014 06:17 AM PDT GOLD PRICES touched 3-week highs for Dollar investors overnight Monday, coming within 15¢ of $1330 per ounce as Ukraine's interim president Turchynov said Kiev was preparing an "anti-terrorist operation" against pro-Russian separatists who have seized regional government buildings in several eastern towns and cities. The UK ambassador to the United Nations claimed Saturday that Russia has moved between 35,000 and 40,000 troops to its eastern border, "equipped with combat aircraft, tanks, artillery and logistical support units." Easing back and then bouncing higher from $1320 per ounce – just beneath April 2013's gold crash low, hit 12 months ago tomorrow in the metal's worst drop in three decades – gold prices rallied faster for UK and Euro investors as the Dollar extended its rise on the currency markets. "Globex gold opened up strongly this morning," says a note from Swiss refinery and finance group MKS's Asian team, referring to the 23-hours-a-day Comex futures platform, "as investors clamoured to initiate safe-haven longs." "Tensions between Russia and the West over Ukraine [are] giving support to gold," reckons Dutch bank ABN Amro's analyst Georgette Boele, quoted by Reuters. "The unsettled geopolitical situation in Ukraine is...providing an element of support for gold," agrees US brokerage INTL FCStone's Edward Meir, quoted by Bloomberg. Last week, however, the giant SPDR Gold Trust last week shed 0.5% of the gold bullion needed to back its shares, taking the total to a 5-week low of 804 tonnes More than 2% below the peak of late March, that level was a three-year low when first reached in December. Hedge funds and other leveraged speculators meantime cut their net bullishness on gold prices by almost 5%, weekly data from US regulators showed Friday. Over the week-ending last Tuesday, the so-called "net spec long" position of bullish minus bearish nets held by all non-industry traders in Comex futures and options fell below 418 tonnes equivalent – its lowest level since mid-February. Trying to explain the rise of gold prices, "part of the increase," says the Frankfurt-based commodities team at Commerzbank, "could be attributable" to speculators growing their bets after last Wednesday's release of meeting notes from the US Federal Reserve. Those notes showed much less desire amongst Fed members for interest-rate hikes than previous comments suggested. "China and India could also have contributed to the price hike," Commerzbank adds, citing "speculation" of stronger Indian imports in March and saying that sub-$1300 gold prices were "obviously regarded as attractive." But "physical demand remain[s] cautious," says the latest note from refining group Heraeus's HQ in Hanau, Germany, "and there are no signs of this improving. "Data from China points towards unchanged, if not lower demand." Gold bullion prices in Shanghai closed Monday at a 3-week high in the Yuan, but continued to trade at a rare discount to the world's reference rate of London settlement. Now trading at a discount rather than premium for 7 weeks running, Shanghai's most active gold contracts ended Monday $2.50 per ounce below London spot quotes. | ||||||||||||||||||||||||||||||||||||||||

| ECB policymakers plot QE road map Posted: 14 Apr 2014 04:51 AM PDT By Claire Jones A European Central Bank policy maker has offered hints on how the eurozone's monetary guardians would embark on an asset-buying, or quantitative easing, programme to stave off low inflation. Benoit Coeure, a member of the ECB's executive board who is seen as one of the officials closest to president Mario Draghi, indicated at the International Monetary Fund's spring meetings in Washington that the central bank could buy a broad range of assets with maturities of up to 10 years. While the ECB has used the US meetings to signal that eurozone policy makers would cut interest rates before resorting to QE, further falls in inflation would force the central bank to buy bonds outright. ... ... For the full story: http://www.ft.com/intl/cms/s/0/d84f40e8-c32e-11e3-b6b5-00144feabdc0.html ADVERTISEMENT Buy precious metals free of value-added tax throughout Europe Europe Silver Bullion is a fast-growing dealer sourcing its products from renowned mints, refiners, and distributors. Because of a legal loophole that will close soon, you can acquire the world's most popular bullion coins free of value-added tax throughout the European Union. You can collect your order in person at our headquarters in Tallinn, Estonia, or have it delivered in any of the 28 EU countries. Europe Silver Bullion is owned and operated by North American and European experts in selling, storing, and transporting precious metals. We have an extensive product inventory of silver, gold, platinum, and palladium, and our network spans the world. Visit us at www.europesilverbullion.com. Join GATA here: Porter Stansberry Natural Resources Conference Committee for Monetary Research and Education http://www.cmre.org/news/spring-meeting-2014/ Canadian Investor Conference 2014 http://cambridgehouse.com/event/25/canadian-investor-conference-2014-inc... New Orleans Investment Conference https://jeffersoncompanies.com/new-orleans-investment-conference/home * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Safe and Private Allocated Bullion Storage In Singapore Given the increasing risks in financial markets, it is more important than ever to own physical bullion coins and bars and to store them in the safest vaults in the world in the safest jurisdictions in the world. Gold advocates Jim Sinclair and Marc Faber have recommended Singapore. Now, with GoldCore, you can own coins and bars in fully insured, segregated, and allocated accounts in Singapore with the ability to take delivery. Learn more by downloading GoldCore's Essential Guide To Storing Gold In Singapore: http://info.goldcore.com/essential-guide-to-storing-gold-in-singapore And for more information call Daniel or Sharon at +44 203 0869200 in the United Kingdom or at +1-302-635-1160 in the United States. Or email them at info@goldcore.com. | ||||||||||||||||||||||||||||||||||||||||

| Silver Price Ultimate Rally: When Paper Assets Collapse Posted: 14 Apr 2014 04:36 AM PDT The relationship between the Dow and silver has been very consistent during the last 100 years. After each of the major Dow peaks (real, not necessarily nominal peaks), we eventually had a major bottom in silver. Below, is a 100-year inflation-adjusted Dow chart: | ||||||||||||||||||||||||||||||||||||||||