| Argonaut Gold Produces 30,963 Au-eq oz in Q1 2014, an Increase of 4% Over Prior Year Posted: 15 Apr 2014 11:55 AM PDT Toronto, Ontario – (April 15, 2014) Argonaut Gold Inc. ("Argonaut", "Argonaut Gold" or the "Company"; TSX: AR), announced today that the Company had production of 30,963 gold equivalent ounces ("GEOs") during the first quarter ended March 31, 2014 ("Q1"). This included 22,171 GEOs at its 100% owned El Castillo Mine ("El Castillo") located in Durango, Mexico and 8,792 GEOs at its 100% owned La Colorada Mine ("La Colorada") located near Hermosillo, Mexico. | | 1st Quarter | Change | | 2014 | 2013 | | Total Gold Equivalent Ounce Production: | | GEOs loaded to the pads1 | 52,605 | 42,451 | ↑24% | | GEOs projected recoverable ounces1,2 | 29,325 | 25,004 | ↑17% | | GEOs produced ounces1 | 30,963 | 29,881 | ↑4% | | GEOs ounces sold1 | 30,165 | 26,586 | ↑13% | 1 GEOs are based on conversion ratio of 55:1 for silver to gold

2 Recoverable ounces – see tables titled first quarter 2014 El Castillo Operating Statistics and first quarter 2014 La Colorada Operating Statistics FIRST QUARTER 2014 HIGHLIGHTS: El Castillo - GEO production of 22,171 ounces consisting of 21,976 gold ounces and 10,737 silver ounces (GEOs at 55:1 conversion rate).

- 39,924 gold ounces loaded on the leach pads equating to 22,278 projected recoverable gold ounces.

- Mining:

- New mining equipment added to increase capacity from 69 thousand tonnes per day ("ktpd") to 87 ktpd, or a 26% increase.

- Mine plan has moved out of transitional ore into more oxidized material which should result in improved recoveries in the future.

- Crushing and conveying:

- West overland conveyor moved a new record of 1,345,339 tonnes.

- East crusher – 1,497,323 tonnes crushed and loaded to pad.

- Pad expansion of cell 8 is ahead of schedule

- Cell portion 2a to be completed in June and cell portion 3c to be completed in September.

- Renegotiated lease terms for El Castillo mining equipment to reduce the overall finance costs of the equipment by reducing interest rates from 10.4% to 5.7%.

La Colorada - GEO production of 8,792 ounces, consisting of 7,563 gold ("Au") ounces and 67,579 silver ("Ag") ounces (GEOs at 55:1 conversion rate).

- An internal assessment of reprocessing old heap leach material shows positive results incorporating four million tonnes of 0.35 grams per tonne ("g/t") Au and 11.2 g/t Ag, with recoveries estimated at 50% Au and 30% Ag.

- 10,812 gold ounces and 102,766 silver ounces loaded on the pad; 7,048 projected recoverable GEOs to leach pad.

- An additional secondary crusher was added to the crushing circuit in March increasing the crushing circuit to five cones from four cones for a 25% increase in crushing capacity.

- Former El Castillo crusher in place at La Colorada.

Magino - Two rounds of heap leach metallurgical test work have been completed at Magino; positive results warranted more test work be done to analyze the heap leach potential of the lower grade material at Magino.

San Antonio - The Company was notified on April 10, 2014 that the appeal to overturn the MIA ruling from 2012 was denied. The Company plans to appeal this ruling.

San Agustín - 11,172 metres of drilling completed to date including 10,173 metres of reverse circulation ("RC") in 103 drill holes and 999 metres of core in 13 drill holes.

- Metallurgical test work:

- Drilling is complete for all PQ core and it has been sent to Kappes Cassiday & Associates in Reno, Nevada to conduct metallurgical column tests.

- Run of mine ("ROM") coarse ore samples have been collected and transported to El Castillo for bulk ROM column testing.

- 2 RC drill rigs operating at site.

- Drill results will be released following completion of analysis in late second quarter or early third quarter 2014.

CEO Commentary

Pete Dougherty, President and CEO said, "While we had a soft production profile in the first quarter of 2014, overall production has begun to improve at both locations (March production was up 18% over January). The Company expects a stronger second quarter of production as we continue to ramp up throughput. The Company is encouraged by the heap leach results at Magino prompting further studies and evaluation. At the San Antonio project, we believe that there is broad community and government support, and we are committed to moving this project forward. Drilling at San Agustín is going extremely well and we are happy with the progress at this time. Our goal is to provide the results from over 15,000 metres of drilling by late second quarter or early third quarter." FIRST QUARTER 2014 EL CASTILLO OPERATING STATISTICS | 3 Months Ended March 31 | | | 2014 | 2013 | % Change |

| | Mining | | | Tonnes ore (000's) | 3,666 | 3,173 | ↑16% | | Tonnes waste (000's) | 4,164 | 3,014 | ↑38% | | Tonnes mined (000's) | 7,829 | 6,186 | ↑27% | | Tonnes per day (000's) | 87 | 69 | ↑26% | | Waste/ore ratio | 1.14 | 0.95 | ↑20% | | Heap Leach Pad | | | Tonnes ore direct to leach pad (000's) | 823 | 1,729 | ↓52% | | Tonnes crushed (000's) | 1,497 | 1,432 | ↑5% | | Tonnes overland conveyor (000's) | 1,345 | NA | NA | | Production | | | Gold grade (g/t)1 | 0. 34 | 0.35 | ↓3% | | Gold loaded to leach pad (oz)2 | 39,924 | 36,023 | ↑11% | | Projected recoverable gold ounces (oz)3 | 22,278 | 21,534 | ↑3% | | Gold produced (oz) | 21,976 | 23,125 | ↓5% | | Gold sold (oz) | 20,906 | 19,509 | ↑7% | 1 ”g/t” is grams per tonne

2 ”oz” means troy ounce

3 Recovery rates: ROM oxide 50%, crushed oxide 70%, ROM transition 40%, crushed transition 60%, crushed sulfides argilic 30%, crushed sulfides silicic 17% Richard Rhoades, Chief Operating Officer, said, "At El Castillo we have expanded the fleet and increased the mining capacity. This increase will address a higher strip ratio in 2014 and lower projected mine grades of 0.315 g/t. The strip ratio was up 20% for the quarter as the final push back on the north side of the pit was initiated. The mine plan has moved production out of the transitional material which saw a reduction from 36% transitional material in the fourth quarter 2013 to 20% transitional material in the first quarter of 2014. For 2014, we anticipate 90% of mined material will be oxides and 10% will be transitional. At the west overland conveyor system, we have increased production and as a result the Company anticipates lower per tonne cost as we reduce the tonnes hauled by truck." | FIRST QUARTER 2014 LA COLORADA OPERATING STATISTICS | | 3 Months Ended March 31 | | | 2014 | 2013 | % Change |

| | Mining | | | Tonnes ore (000's) | 560 | 557 | ↑1% | | Tonnes waste (000's) | 4,043 | 3,799 | ↑6% | | Total tonnes (000's) | 4,603 | 4,355 | ↑6% | | Waste/ore ratio | 7.22 | 6.82 | ↑6% | | Tonnes rehandled (000's) | 70 | 0 | - | | Heap Leach Pad | | | Tonnes ore to leach pad (000's) | 635 | 573 | ↑11% | | Production | | | Gold grade mined (g/t)1 | 0.57 | 0.27 | ↑111% | | Gold loaded to leach pad (oz)2 | 10,812 | 5,142 | ↑110% | | Projected recoverable GEOs loaded3 | 7,048 | 3,471 | ↑103% | | Gold produced (oz) | 7,563 | 5,782 | ↑31% | | Silver produced (oz) | 67,579 | 44,879 | ↑51% | | GEOs produced4 | 8,792 | 6,598 | ↑33% | | Gold sold (oz) | 7,733 | 5,932 | ↑30% | | Silver sold (oz) | 73,211 | 54,269 | ↑35% | | GEOs sold4 | 9,064 | 6,919 | ↑31% | 1 ”g/t” is grams per tonne

2 ”oz” means troy ounce

3 Recovery rates: Gold 60%, Silver 30%

4 GEOs based on conversion ratio of 55:1 for silver to gold Richard Rhoades said "At La Colorada, mine grades improved during the first quarter of 2014 to 0.57 g/t, up 111% over the prior year. Production saw an improvement to 8,792 GEOs versus 6,598 GEOs in Q1 of the prior year for a 33% increase. We have completed an internal assessment of reprocessing old heap leach material which shows positive results incorporating four million tonnes of 0.35 g/t Au and 11.2 g/t Ag, with recoveries estimated at 50% Au and 30% Ag. This will be incorporated into the mine plans in the future. In addition to adding material to the mine plan at La Colorada, the Company has added to the crushing capacity at the property. An additional secondary cone was added to the new circuit. We now have five 400 horsepower cones compared to four 400 horsepower cones in the prior circuit. We have also added a previously utilized crusher at El Castillo in parallel to increase total crushing capacity. The additional crushing capacity was installed by the end of March and should increase capacity and production throughout the year." Magino Metallurgical Test Work

Two sets of heap leach metallurgical test work were conducted on the low grade material at Magino with results noted below. These composites were sent to Kappes, Cassiday & Associates ("KCA") in Reno, Nevada who completed column tests on the material. | Phase 1 | | Sample # | Crush Size

mm | Head Grade

g/t | Au %

recovery | Days of

Leach | Consumption

Cyanide kg/MT | Consumption

Lime kg/MT | | 67111 B | 19 | 0.829 | 37% | 94 | 0.56 | 0.50 | | 67111 C | 12.5 | 0.649 | 49% | 94 | 0.53 | 1.00 | | 67111 D | 9.5 | 0.694 | 52% | 94 | 0.61 | 1.00 | | Phase 2 | | Sample # | Crush Size

mm | Head Grade

g/t | Au %

recovery | | Consumption

Cyanide kg/MT | Consumption

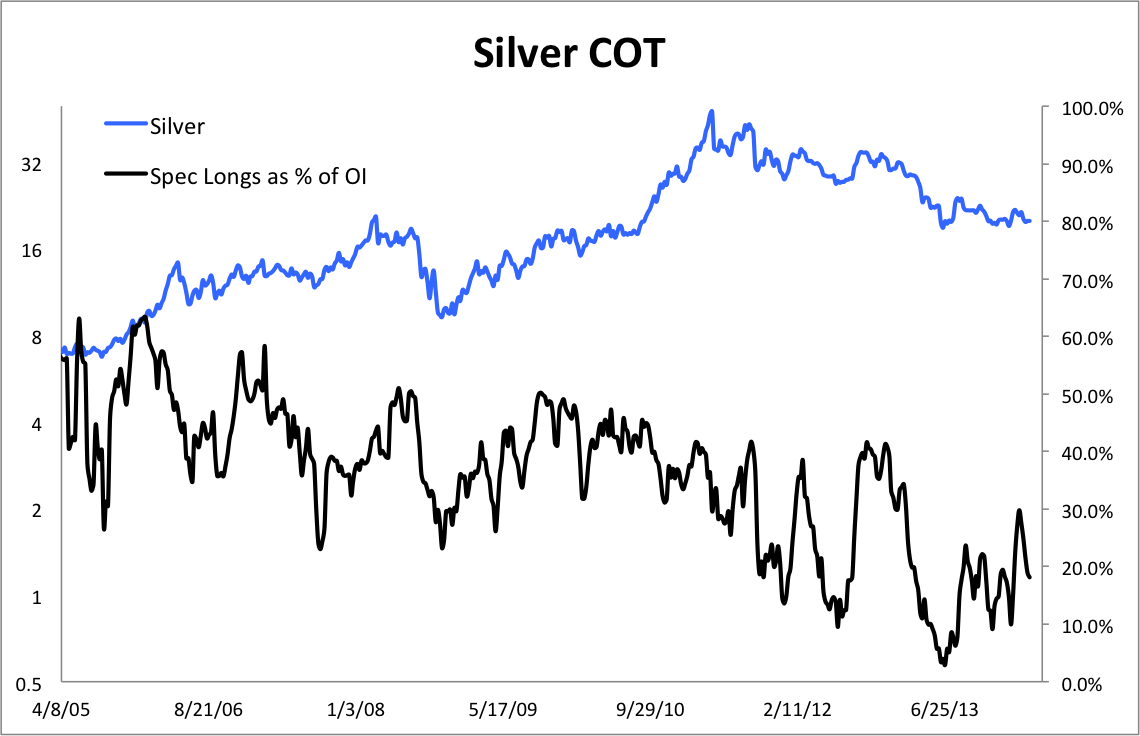

Lime kg/MT | | 67165 A | 12.5 | 0.725 | 60% | 102 | 0.69 | 1.00 | | 67166 A | 12.5 | 0.500 | 57% | 102 | 0.75 | 1.00 | | 67167 A | 31.5 | 0.665 | 41% | 102 | 0.75 | 0.50 | | 67167 B | 12.5 | 0.610 | 56% | 102 | | | Gold Wipes Out all of April; Bounces from Month Open Posted: 15 Apr 2014 11:21 AM PDT | | Silver COT Charts Posted: 15 Apr 2014 11:19 AM PDT Here are four charts that breakdown the Silver COT. Data is a week old so keep that in mind. First, here is the general COT. The black is the net speculative position (long) as a percentage of open interest. It has declined materially over the past few weeks.

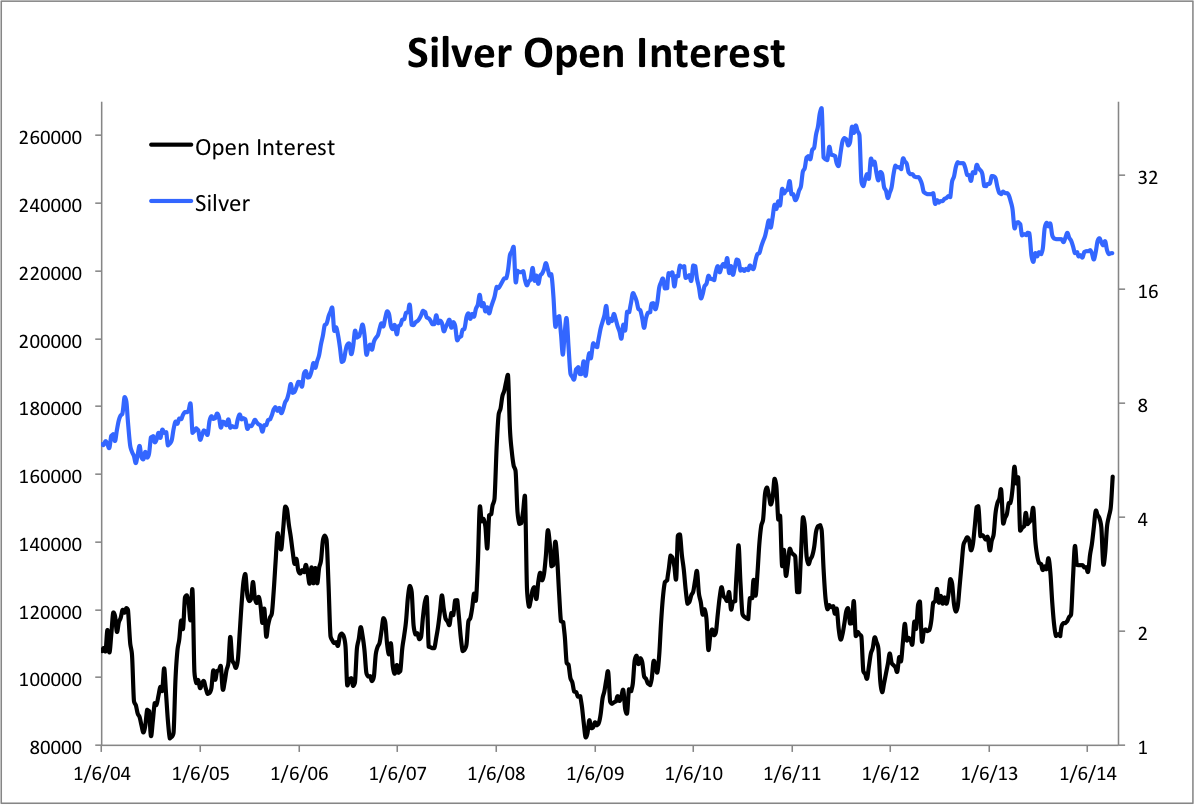

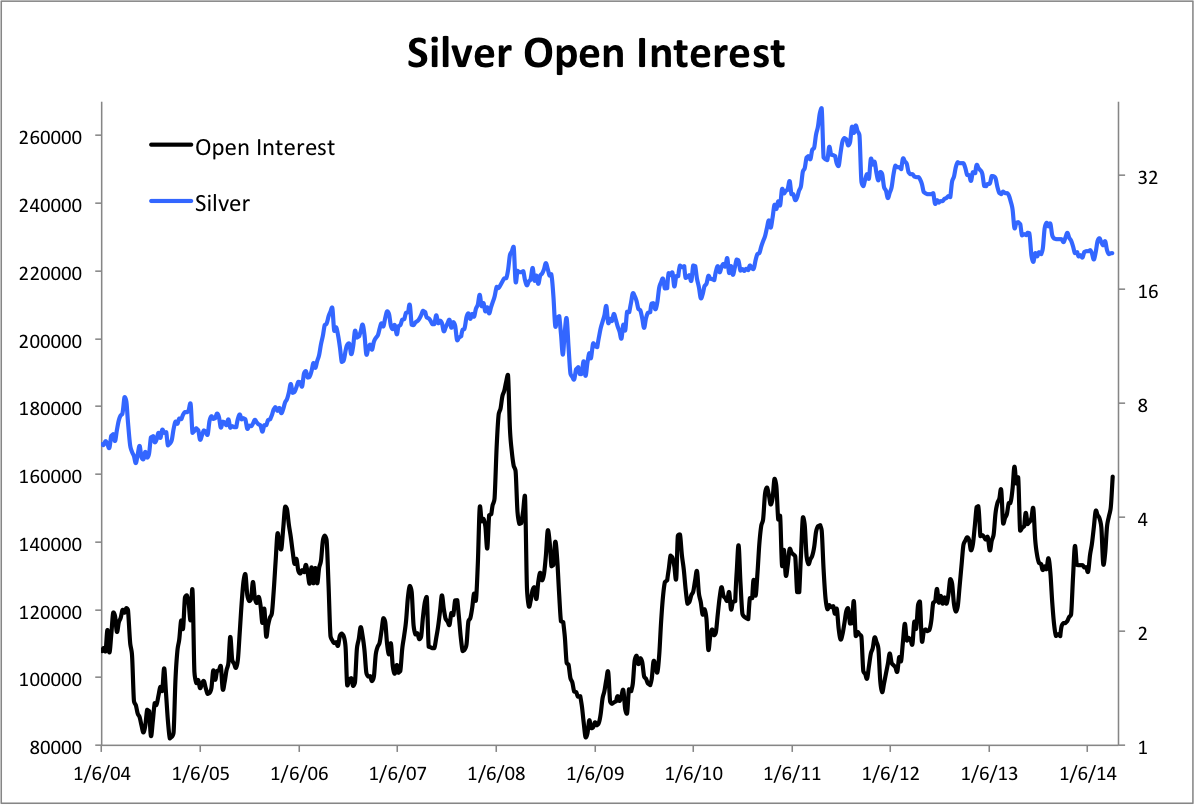

Next is open interest. Interestingly, unlike Gold whose open interest is at 5-year lows, Silver’s open interest is robust.

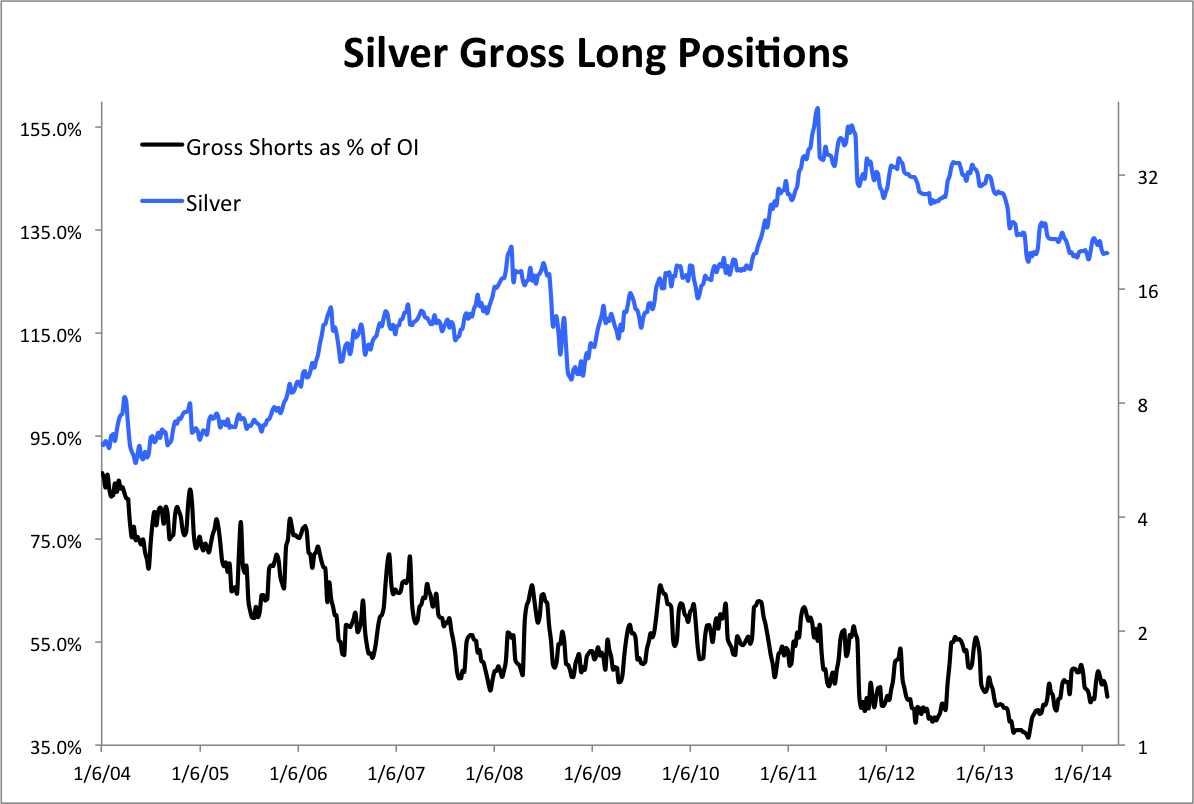

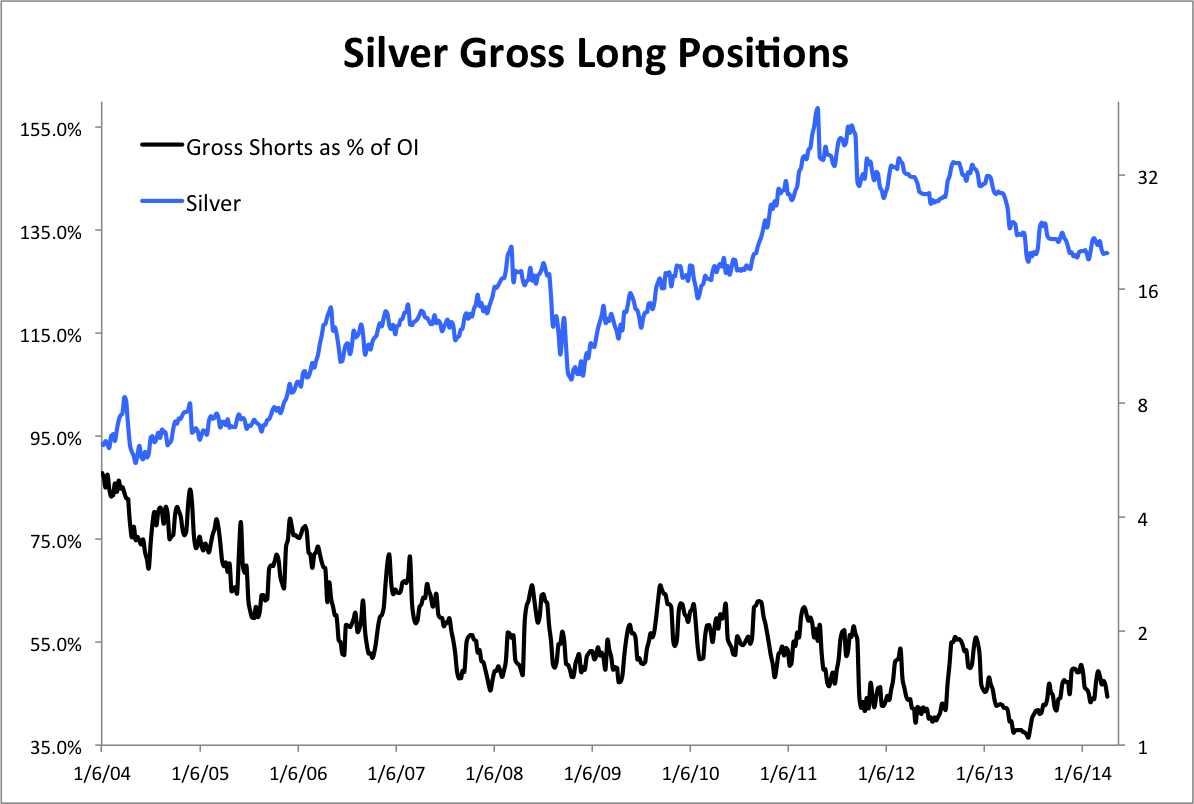

Here is the speculative gross long position as a percentage of open interest. (There is an error in the legend). Note how speculative longs have steadily declined throughout this bull market.

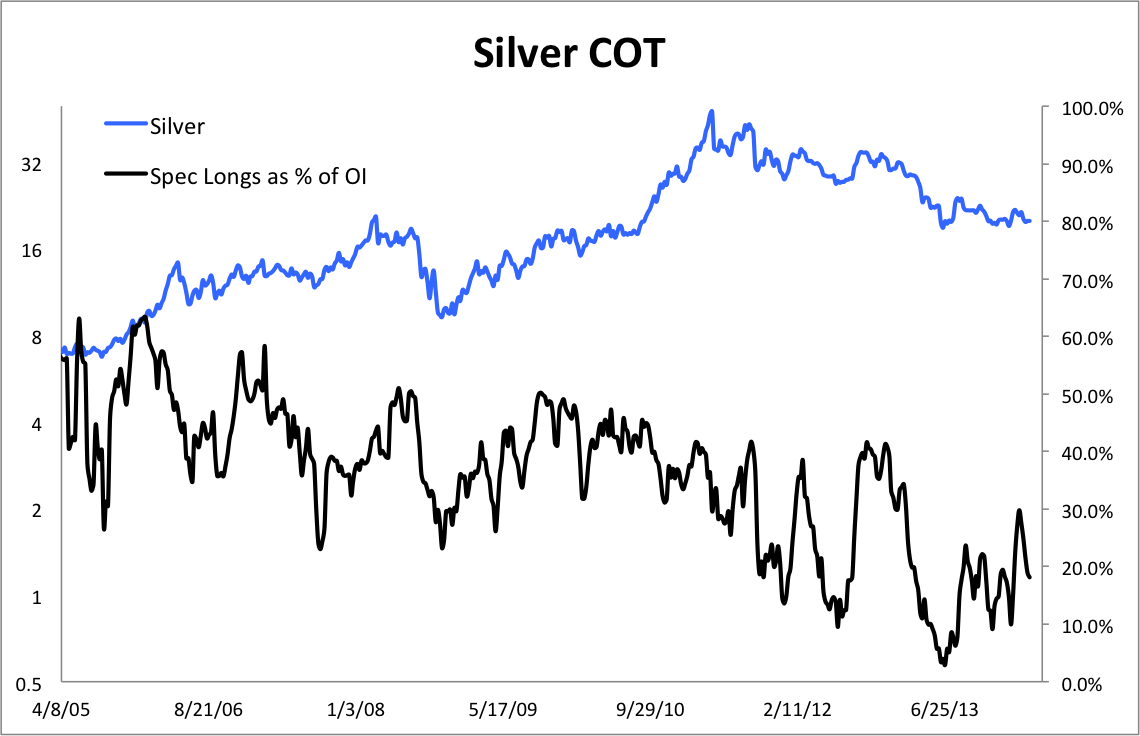

Here is the gross short position. Note how it was extremely elevated at the end of 2013.

This is a sample of some of the things we look at in our premium service. The post Silver COT Charts appeared first on The Daily Gold.  | | Bitcoin, Gold, Cigarettes & Paper Money Posted: 15 Apr 2014 10:32 AM PDT

Due to the recent, and probably the largest loss of bitcoins ever, because of the ongoing Mt. Gox scandal, there has been a lot of speculation on the stability of bitcoins. Though the technicalities of the working of bitcoins is something I am totally unqualified to explain, the evolutionary trend…. Read More >>> | | Puerto Rico’s Tax Benefits- ‘The Better Florida’ Posted: 15 Apr 2014 10:30 AM PDT Puerto Rico promises to now do for Americans what Singapore and Hong Kong have done for bankers and businessmen from London. In this interview with The Gold Report, three experts with in-depth knowledge of the pros and cons of living and investing in Puerto Rico share what it is like on the ground for investors. InternationalMan.com Senior Editor [...] The post Puerto Rico’s Tax Benefits- ‘The Better Florida’ appeared first on Silver Doctors. | | Hardly a mention of central banks in FT report on London gold fix Posted: 15 Apr 2014 10:01 AM PDT GATA | | US Silver output falls to 80900 kg in Nov: USGS Posted: 15 Apr 2014 09:53 AM PDT The average daily silver production in November 2013 was 2,700 kg, compared with 3,140 kg in November 2012, and 2,890 kg for the full year 2012. | | China Demand News, Lessening Ukraine Tensions Sink Gold Posted: 15 Apr 2014 09:16 AM PDT Last evening I posted the news concerning the World Gold Council's report about Chinese gold demand for 2014. Please see that post for the details.Also, chatter continues to surface that China's economy is slowing. Now whether or not that is indeed the case can be argued, ( I tend to think that it is because of what is happening with the price of copper ) but many traders are viewing such talk as bearish for the price of the metal. The reason? If the economy slows the thinking is that there will not be as much money around with which to buy gold. Along this line is news out of China that its money supply grew only 12.1% in March compared to the same period the previous year. The People's Bank of China has a target of 13% growth. This is the first time since April 2012 that the target has been missed. Another way of saying this is that Chinese credit growth is slowing and that has the buyer of both base and precious metals spooked ( palladium and platinum have been running on Ukraine issues ). This is the reason that silver is getting whacked with an ugly stick today and why copper is swooning once again. Traders are going to be watching the GDP numbers for China due out overnight here in the US. This will more than likely be a market mover for copper. Remember, I am just telling you what the market is trading on; I am not saying it is gospel truth so please, gold perma-bulls, keep the nastygrams at a minimum.Related to this are reports about Chinese use of gold for collateral in financing business deals. Estimates vary about this but the Financial Times reports that the WGC estimates it may be a high as 1,000 metric tons. That is not an insignificant number!Today, if that were not bad enough for gold, traders interpreted President Putin's call for talks for a diplomatic solution to the situation in the Ukraine as a lessening of tensions. That is taking some of the risk premium out of gold although traders are reluctant to press it down below support at this time as that situation is anything but resolved. Still, any ratcheting down of tensions is negative to gold.It must be kept in mind by those who buy gold based on geopolitical events that this is perhaps one of the most riskiest of reasons to buy the metal. I have said it before and will repeat it - price rises in gold due to geopolitical events can and will evaporate just as quickly as they began. Remember that when you bet the farm on more "end of the world as we know it" talk coming from the gold bugs. Most seasoned traders look to sell such rallies knowing that once the event is full priced in, there is no longer any fuel for a further rally unless things worsen beyond what the market has currently priced in. It is the old adage of "buy the rumor and sell the fact".From a technical perspective, nothing has changed in relation to gold in one iota. It is still in a broad trading range. Our old friend, the $1280 region continues to define the lower portion of the range while the top of the range has been pressed lower towards $1320. To change the complexion, one or the other level must give way. If the bulls can break through this week's high, they should be able to reach $1340 where another test will occur. On the bottom, a breach of $1280 would portend another drop of $20 towards $1260. Support is layered in $20 increments. Once again the usual claptrap about GOFO and backwardation in gold has surfaced. Ignore it and listen to what the market is saying. Gold is range trading - no more and no less.By the way, for those of my European friends who trade the yellow metal, Euro gold has support near the 930 level. Resistance is near 960 followed by 980. A quick look at silver by request.... notice that while the metal has bounced off its initial level of chart support shown by the upper red rectangle, it has as of yet, been unable to move convincingly above it. A close BELOW $19.50 and the odds favor a move down towards $19 once again. The metal remains below its 50 day moving average, which is bearish. Also, the ADX, while it has been steadily falling indicating the lack of a clearly defined trend is showing some subtle signs that is has stopped falling and may be getting ready to rise. If, and this is a big "if" at the current time, we see it breach $19 and be unable to get back above it, the ADX will be rising indicating the potential for a fresh leg lower in the metal. That would set it on course to fall towards $18.35 - $18.20.On the grains front - soybeans continue moving higher as that tight old crop carryover situation here in the US has resulted in a bidding war for available supplies, in spite of the fact that the big S. American crop is now workings its way into distribution channels. The market is ensuring a huge acreage number for this season here in the northern hemisphere. Farmers are no doubt going to oblige.The beans seem to be pulling everything higher including wheat and corn, which is off to a slow planting start this season. I personally have learned to ignore all that talk about "slow plantings" because too many of these newbie traders have never seen a piece of modern farm equipment but the fact is that the market still reacts to this sort of talk so one has to respect it. As mentioned in a previous post, I am hopeful for large and healthy corn and bean crops this season up here as our livestock and poultry producers need a break from this high priced feed.The Euro failed at 1.39 and has now fallen to 1.38. There is some support on the charts near the 1.37 level. If that fails, we could see the beginning of a trending move lower for the Euro.One last thing - any of you hog producers out there, please be mindful about what I wrote this weekend about 4th quarter hog prices. Don't let the wildly bullish talk from some who keep talking about how "cheap" 4th quarter hogs are in relation to the summer months beguile you into missing out on locking in some excellent profits. They are cheap for a reason! Traders - keep in mind that I am speaking about producers who have to manage price risk and can secure good to excellent profits in their expected production with strategically placed hedges. They must take a different approach to markets than we speculators.There are several option strategies which can be employed. Talk to your broker if you have any questions. One can secure price protection on various percentages of expected marketings while keeping some open as "gambling stocks" in the event of higher prices later this season. Just be careful as a great deal of uncertainty remains in this market and that is causing some wild swings in price. That will continue until the market settles this virus issue one way or the other. If you roll the dice betting on nothing but higher prices, your odds of getting it right are 50-50. I would not want to bet the farm on that especially if I had the opportunity to guarantee myself some good profits and thus sleep well at night. | | Is Silver In A Bull Or Bear Market? Posted: 15 Apr 2014 09:02 AM PDT Silver has underperformed gold lately. In the first quarter of 2014, both metals have rallied nicely, but, somehow suprisingly, gold did better than silver. It leaves a lot of investors with the question whether silver is in a bull or in a bear market. David Morgan, founder of The Morgan Report, one of the most qualitative precious metals investing newsletters, discusses his view on that question. He reminds us that, a year ago, he told people that silver was a buy at or below $30 an ounce. The key support level, up until then, was $25 to $26 an ounce. After it broke down, it is acting as a very strong resistance level. Back then, when silver was trading around $30 an ounce, there was a 10% spread between silver spot price and resistance at $26. That is not a major number in the context of financial markets. The key point was not the spread, but the fact it broke through that support level which had held for several years, making its importance so great. However, in the big picture of things, Morgan does not consider this as THE most important fact. If silver goes to $100 an ounce, which is line with Morgan’s expectations, it will not make a difference whether you bought at $20 or $30. From that point of view, the grey metal is now in a bear cycle during a secular bull market. After gold and silver have gone up for 12 years in a row, it went lower the 13th year. There is nothing unusual about that, as all markets go up and down. The rationale behind the continuation of the secular bull market is based on the fundamental and technical picture. From a fundamental point of view, it is a fact that all fiat currencies eventually go down. The dollar as reserve currency is on that path currently. That is evidenced by major countries like India, Australia or Russia setting trade agreements outside of the dollar. There is a clear trend towards trade settlements in local currencies or gold (say, anything but the dollar). Russia is proving right now their desire to settle energy payments outside the dollar. They are about to close a huge gas contract with China. The petrodollar is the main reason why the dollar is a reserve currency. If that breaks, the dollar’s position will break as well, which is a positive for the metals. From a technical point of view, basic analysis shows that the major uptrend line is not touched. This implies that both silver (and gold) are still in an uptrend. The key indicator to determine whether silver follows gold in the bull market is the gold:silver ratio. At the start of the bull market in 2001, the ratio was 80 to 1. Today, it hovers around 60 to 1. If silver would be in a bear market, decoupling from gold, the gold:silver ratio would be greater than 80 to 1. Silver simply does what it is good at, i.e. confusing investors. People must understand that the gold:silver ratio is a very accurate way to see which metal is performing best against the other(s). For investors that started accumulating silver at the beginning of the bull market, when it was trading below $5 an ounce, silver is providing still much more return than gold. As long as the gold:silver ratio remains within its normal bandwidth, there is no worry that silver has left the bull market. The psychological impact is the biggest challenge for an investor, as usual. On the one hand, $1300 sounds more powerful than $20. On the other hand, the number of early adopters was limited, as in every emerging bull market. As silver became more popular as momentum started to buil on stronger volume, most silver investors started investing between $30 and $48. A lot of those investors have given up in the last 2 years. They could not stand the emotional pressure. Unfortunately for them, this is typical behaviour during a bottoming process. The following long term chart makes the point clear. Silver, as usual, follows gold’s trend but with some leverage (both to the upside and the downside). The bottom part of the chart shows the gold:silver ratio over the last ten years. The ratio stands somewhere in the middle between its two extremes, i.e. 30 and 90. Chart courtesy: Sharelynx.

In that respect, an extremely interesting chart, not discussed by Morgan but available through Sharelynx (the most comprehensive gold data service), is presented below. It shows the future price of silver based on a gold price and gold:silver ratio. If we apply a conservative gold price projection of $3000 with the current gold:silver ratio of 60:1, the future silver price in such a scenario would be $75. In the extreme scenario where gold would go to $6000 with a gold:silver ratio of 40 (still within the historic bandwidth), the silver price would be $150. This is not to predict those prices, it merely serves as a framework with fair price projections.

On the shorter timeframe, David Morgan expects a stronger than average summer for the metals. The Ukraine situation which results in Russia opting out of the dollar based payment system, will have big repercussions. That will not happen overnight, nor should one expect a massive and sudden market participation. This trend will likely put a floor below gold. Big money will enter the precious metals complex as soon as a trend is established. They do not try to pick a bottom or top, but rather ride a trend. Silver’s trend is above $21, a price level which was tested twice. For a trend to be established, it should stay above it with big volume. For more conservative investors, it is the $25 or $26 level that is critical. Breaking those levels on big volume will be the confirmation that the bull market is still present. The importance of those levels should not be underestimated, given that “old support becomes new resistance.” Given how (commodity) markets work, one can expect at least 3 attempts before silver will pierce through it. More about The Morgan Report, the most qualitative precious metals investment newsletter, with a 30-day free trial. | | Fed to the Sharks, Part 1: The Fed Takes Our Money, Gives It to Banks Who Loan It Back to Us at 16% Posted: 15 Apr 2014 09:00 AM PDT | | Peru Gold output drops 3.14% to 11097 kg in Feb Posted: 15 Apr 2014 08:19 AM PDT The country produced 19442 kg of silver in February, declined by 7.14% from 20938 kg in February 2013. | | New Derivatives Rules Rescinded To Help Banks Make More Money Posted: 15 Apr 2014 08:00 AM PDT The rules originally established to help protect the system from bank greed and fraud connected to derivatives were just rescinded by the same Basel Committee that drafted the original blueprint – article link. The original rules would have significantly curtailed the ability of banks to underwrite the derivatives they sell to pension funds and hedge [...] The post New Derivatives Rules Rescinded To Help Banks Make More Money appeared first on Silver Doctors. | | Silver, Gold, and What Could Go Wrong Posted: 15 Apr 2014 07:54 AM PDT Richard Russell is almost 90 years old and has seen it all. He recently stated: "My advice, as it has been, is to move to the sidelines while holding large positions in physical silver and gold. Regardless of what the markets do, silver and gold represent eternal wealth, and the bid to sleep undisturbed at night. No amount of money is worth the loss of peace of mind. The power of gold opened the American West and populated Alaska. Men have spent their lives searching for gold. You can own gold by the simple action of swapping Federal Reserve notes for the yellow metal. I advise you to do it." Richard Russell – April 10, 2014 He stated on March 31, 2014: "Here's what I did last week. I took some unbacked junk currency called Federal Reserve Notes, and with them bought some constitutional money, known as silver. I consider gold and silver, now being manipulated, as on the bargain table." Richard Russell thinks the stock market is currently dangerous and that silver and gold are safe. He understands that gold and silver are eternal wealth with NO counter-party risk. What is counter-party risk? It is the risk that paper wealth is not real, that debts will not be paid, that dollars, yen, and euros will decline in purchasing power, that your employer will declare bankruptcy and your pension will be cut in half, that your brokerage account will be hypothecated by management, that your bank will declare bankruptcy and your deposits in that bank are unsecured liabilities of the bank and may not be paid either timely or in full. In short, there is counter-party risk in almost everything. Examine the following graph of the S&P500 Index for the past 20 years. Does that graph inspire confidence in further gains in that index, or does it cause you to think about corrections and crashes?

Yes, the Bernanke/Yellen "put" may support the market as the Fed does not want a market crash. But what happened to the power of the "put" in 1987, 2000, and 2007? Now look at the following 20 year graph of silver. Instead of being at all-time highs, like the S&P, it is off nearly 60% from its high. Silver looks like a better place to park, as Richard Russell says, unbacked junk currency called Federal Reserve Notes, instead of in the S&P.

What do we know for certain? - The grass is still green.

- The sun still shines.

- The government is spending and spending and spending.

- The Fed is injecting liquidity, monetizing bonds, creating currency swaps, and "printing money."

- Inflate or die remains the unspoken command.

- Silver and gold will continue their rise as the purchasing power of fiat currencies declines.

- Politicians talk.

- Debt is increasing and people are realizing it can never be repaid.

- Gold and silver are still real money, even if they are suppressed, denigrated, hated, and lied about. Why should we expect anything different? They are competitors to a paper currency backed only by the full faith and credit of a country which spends roughly $1,000,000,000,000 more each year than it extracts in revenue.

So what could go wrong? Let me count the ways. - Derivative crash

- Another war in the Middle-East

- Large scale dumping of US T-bonds

- Failure of confidence in the dollar, caused by loss of confidence in either political or monetary leadership

- More foreign policy blunders

- Any war with either China or Russia

- Loss of reserve currency status for the US dollar

- Evidence that most of the gold supposedly stored at the NY Fed is gone, missing, leased, borrowed, or hypothecated.

What else could go wrong? Sarcasm alert! - Congress balances the budget in an election year and causes an immediate depression.

- The US government admits it will not repay its bonds. Financial chaos overwhelms the nation.

- China and Russia publicly apologize for criticizing the Fed's "money printing" and agree to all US foreign policy objectives. The world is stunned into silence and then laughs.

- Israel and Iran declare peace and mutual harmony. More stunned silence and laughter.

- Politicians swear they will tell the truth and forego the use of Teleprompters. Wouldn't it be nice?

- China agrees to dump over 10,000 tons of gold on the market at sub $500 prices in the spirit of international cooperation. The S&P soars, gold crashes, and politicians sprain their arms patting each other on the back.

- Goldman Sachs and JP Morgan announce they will donate 100% of their profits from Proprietary and High Frequency Trading in 2013 to charity. Financial stocks plummet and politicians worry about future payoffs.

Bottom line: There is an abundance of risk in the world that involves other parties, other countries, derivatives, debt, debt, and lots more debt. Gold and silver have no counter-party risk and will retain their value regardless of whether the debts are paid, regardless of political promises, regardless of monetary and fiscal policy, and regardless of the Bernanke/Yellen put. GE Christenson | The Deviant Investor | | China and gold: the most, biggest, best Posted: 15 Apr 2014 07:17 AM PDT | | Gold paves streets for China's rising urban middle classes Posted: 15 Apr 2014 07:17 AM PDT | | How I Intend to Survive the Meltdown of America Posted: 15 Apr 2014 07:01 AM PDT By Louis James, Chief Metals & Mining Investment Strategist It is with a troubled heart that I look at the continued fighting in eastern Ukraine. I worry about my friends and students in the country who may well be in physical danger soon, if the conflict escalates. As an investment analyst, it's the financial war the Russians seem quite willing to wage that has my attention. It should have yours as well. In our just-released documentary, Meltdown America, one of the experts noted that the Kremlin had already made moves to dethrone the US dollar as the world's reserve currency before the renewed East-West tensions of this year. Putin has openly threatened what amounts to economic warfare as a response to sanctions placed on Russia after its Crimea grab. Now bullets are flying—can Putin's financial ICBM be far behind? Mind you, the US and global economies are on such shaky ground, they could come crashing down without any help from Gospodin Putin. One of the things that really struck me while watching Meltdown America was the way the writing was clearly visible on the wall in past cases of financial collapse and hyperinflation—but no one wanted to believe it. That's the way I see the US today. Life seems so normal and there's so much wealth even in poorer regions, it's hard to believe the cracks in the foundation could really bring down everything built on it. And that's exactly why the cracks never get fixed; people don't want to see them, and politicians do everything possible to deny they exist. So they widen and deepen until the collapse becomes inevitable—and I believe we have already passed the point of no return. It's just a matter of time now. Gloomy thoughts indeed, but I'm not here to depress anyone. Hopefully, I can help deliver a wake-up call. Perhaps even more useful, I can tell you what I'm doing about it. Of course, precious metals and the associated stocks are a key part of my strategy. As Doug Casey likes to say, I buy gold for prudence and gold stocks for profit. If I'm right about the economic trouble ahead, gold will protect me, and my gold stock picks will make me a fortune. But Doug also says that our biggest risk today is not market risk; it's political risk. He has moved to rural Argentina to get out of harm's way. I've moved to Puerto Rico, a US territory that is rapidly becoming the only tax haven that matters for US taxpayers. Million-Dollar Condos for Half Price As I type here in my new home office, I glance up and see waves of Caribbean blue crashing on the palm-lined beach. Surfers are out in force. Scattered clouds add to the already amazing variety of colors in the ocean. I wonder if I will have time to go for a swim before dinner—and I'm amazed yet again to think that it was a shot at lower taxes that brought me here to Puerto Rico. It seems almost unnatural for me to be able to enjoy so much beauty while saving money, but that's exactly what I'm doing.

The view from my new home office. You see, the economy here never really recovered from the crash of 2008. This is very bad news for long-suffering Puerto Ricans trying to make ends meet. When I first came here with my wife to check the place out, locals kept asking us why we were thinking of moving here; jobs are scarce, and something of an exodus is taking place in the opposite direction (Puerto Ricans are US citizens and can travel and work freely anywhere in the US). But I wasn't coming to Puerto Rico to sell hot dogs. My income doesn't depend on the local economy, so its woes are an obvious opportunity for a contrarian speculator like me. Take the most simple and basic asset class one can invest in as a Puerto Rico play: real estate. The market has been so devastated that million-dollar condos are selling for half price. When we closed on our new place, the seller came up short, and we had other options, so we weren't willing to pay more. The real estate agents involved were so eager to keep the deal from falling through, they kicked in with their own money to help the seller out. Personally, I'm not a big fan of gated communities, but for people who are concerned about possible social unrest in the future, it's good to know that you can buy properties in some of the most posh and secure communities on the island with no money down. Now, as much as I like a contrarian bargain, and as much as my wife loves the tropical weather, what really brought us here were the new tax incentives the government of Puerto Rico enacted to make the island more attractive to investors and employers. The critical point here is that Puerto Ricans are exempt from US federal income taxes, even though they are US citizens. They pay Puerto Rican taxes, of course, and those have generally been similar to US taxes, so the island has never been seen as a tax haven before. That all changed in 2012, when Puerto Rico passed Acts 20 and 22. Act 22 Act 22 is basically a 100% capital-gains tax holiday designed to attract investors to come live in Puerto Rico. Exactly what is included or excluded is beyond the scope of this article, but for me, the important thing is that it covers the stocks I already owned when I moved here on January 1, 2014. Given that the market bottomed at almost the same time, I have no gains to be taxed on for 2013, and will not be taxed for the gains I make going forward—all the way to 2036. This alone was worth the move to Puerto Rico, in my opinion. Happily, the application process was simple. My wife downloaded the form and filled it out. I signed it, and a couple weeks later, we got an official tax holiday decree in the mail—no questions asked. I had to accept the conditions of the decree in front of a notary and send in an acceptance form with a $50 filing fee, and that was it. Didn't even have to hire a lawyer. This tax break is not available to current residents of Puerto Rico—it's designed to attract wealthy people to come live on the island, after all—but it's available to all others who move here, including but not limited to US taxpayers. Act 20 Act 20 is a tax break on corporate earnings designed to incent job creation in Puerto Rico. The idea is to persuade US employers who might set up call centers in India, or create other similar jobs abroad, to do so closer to home, by offering them a 4% corporate earnings tax rate. My fellow Casey Research editor Alex Daley has moved to Puerto Rico as well, and we've formed a company here that exports writing and analytical services to Casey Research in Vermont. This is the basis of our application for Act 20 tax benefits, which has not been approved yet, but which we understand is close. If we get our Act 20 decree approved, we'll still have to pay regular income taxes on our base salaries, but the lower tax rate applied to our corporate income will result in a drastically lower total income tax rate for us as individuals. I'll be sure to let readers know when we get our Act 20 decree approved. All 100% Legal The beauty of this is that Puerto Rico's tax breaks are not shady tax dodges set up by entities of questionable legality or trustworthiness, but perfectly legal tax incentives within the US. Act 20 and Act 22 benefits are available to non-US persons, but they are especially important to US taxpayers because, unlike almost every other country in the world, the US taxes its serfs citizens whether they live in the US or abroad. In other words, while a Canadian can get out of paying Canadian income taxes by moving out of Canada, a US person cannot escape US taxes by moving to Argentina, or anywhere else—anywhere besides Puerto Rico. It's like expatriation without having to leave the US, truly a unique situation. And it's a win-win situation; people like us bring much-needed money, ideas, and energy to the island, while getting to keep more of what our crisis-investing strategy nets us. We create jobs, rather than take them. We are part of the solution here, and we've been made very welcome. Is It Safe? So that's why I'm here. Whether or not my Act 20 status gets approved, I'm so happy about my Act 22 decree that I'm convinced we did the right thing moving here. When I tell people what I've done and why, most get immediately excited by the idea—and then they balk. The first question they ask is usually: What about crime? Puerto Rico isn't a large island, and a good chunk of its three million inhabitants are clustered in and around the capital city of San Juan. Of course there is crime here, as there is in any large city. There are places I would not walk alone at night—just as there are in New York City. Mexico City, Buenos Aires, La Paz… the capital of any other Latin American country or Caribbean country I've been to is much larger, more polluted, and more dangerous than San Juan. In my subjective view, San Juan, with its old Spanish fortifications and amazing beaches, is more beautiful. And you can drink the water here. Sure, it might be cleaner and safer in Palm Beach, Florida—but it's a lot more expensive there, it has less charm, and there's no Act 20 nor 22. It's a matter of priorities. When I say this, most people remain skeptical; they read about the economic problems Puerto Rico has and the financial trouble the government is in, and they wonder if things could get worse. Of course they can—but if Doug is right about The Greater Depression about to envelop the whole world, things are going to get worse everywhere. Here at least, people are already used to massive unemployment. It won't come as a shock; it's never left since 2008. Another way of looking at it is that since tropical storms hit the island from time to time (southern Florida is much more prone to major hurricanes than Puerto Rico, but they do happen), people here are more prepared for disasters than in many other parts of the US. The better apartment buildings and hotels have their own electricity generators. Nobody can freeze to death here, anyway, and fruit trees grow all over the island. There's a lot more I could say, but the bottom line is that I think Puerto Rico is a much better place to ride out a global financial storm than Miami, or Anchorage, or almost any city in between. A self-sustaining farm in rural Alabama might be better, but that's not the sort of place I want to live. I Like It Here That last is an important point: if I have to hunker down to ride out an economic storm, it should be in a place where I like being. Puerto Rico is beautiful and bountiful year-round. I speak Spanish, but most people in San Juan are bilingual, so that's not really an issue. Our new flat is blocks from the best schools, shops, and restaurants in town—and even the hospital. I open the window and the fresh air coming off the ocean carries the sound of waves, sometimes laughing children. There's more noise pollution during the day, but at night, the city calms down, and we can hear the famous Puerto Rican coquí frogs, which my daughter calls "happy frogs." Ten floors up, the ocean breeze is cool enough that we have yet to turn on the air conditioning. The beaches are fantastic, and the clear water makes for great diving. I've never been a surfer, but the waves here are famous too, so I'm thinking of trying it out. There's no end of other things to try out, and the neighboring islands have their own charms to offer as well. Granted, my wife and I try to be smart about what we do and where we go, but we've never felt unsafe here—well, apart from the crazy drivers. We like it here. We're happy. For tax reasons, for quality of life, and with the potential meltdown of America in mind, we're glad we made the move. Find Out More Doug Casey's International Man Editor Nick Giambruno, Alex Daley, and I have coauthored a special report on Puerto Rico's stunning new tax advantages. The report gets into all the details I didn't have time or space for here. We cover all the specifics of what, why, and how. The report includes links to the forms you need, as well as recommended resources, from lawyers to realtors. Whether you're thinking about expatriating or you're just tired of paying high taxes, I think Puerto Rico is a place you should consider. I know of no better resource to help you get started than our special report. For your own health, wealth, and enjoyment, I encourage you to get your copy today. | | SGE Withdrawals Hit 585 MT YTD, Up 23% YOY! Posted: 15 Apr 2014 07:00 AM PDT SGE withdrawals have been in a down trend for five weeks. In these weeks withdrawals have been lower than the year to date weekly average. This is not surprisingly after an unprecedented start in 2014. During four of the first seven weeks of this year SGE withdrawals, which equal Chinese demand, transcended global mining production. SGE withdrawals [...] The post SGE Withdrawals Hit 585 MT YTD, Up 23% YOY! appeared first on Silver Doctors. | | GEAB 84 est disponible ! L’Europe entraînée dans une division du monde entre débiteurs et créditeurs : les solutions désespérées des États-Unis pour ne pas sombrer seuls Posted: 15 Apr 2014 06:37 AM PDT - Communiqué public GEAB N°84 (15 avril 2014) -  Dans la confrontation actuelle entre Russie et Occident sur la crise ukrainienne, l'image de la guerre froide vient inévitablement à l'esprit et les médias en sont évidemment friands. Or, contrairement à ce qu'ils laissent sous-entendre, ce n'est pas la Russie qui cherche le retour d'un rideau de fer mais bel et bien les États-Unis. Un rideau de fer séparant anciennes puissances et pays émergents, monde d'avant et monde d'après, débiteurs et créditeurs. Et ce dans l'espoir un peu fou de préserver l'American way of life et l'influence des États-Unis sur « leur » camp à défaut de pouvoir l'imposer sur le monde entier. En d'autres termes, sombrer avec le plus de compagnons possible pour avoir l'impression de ne pas sombrer.

Pour les États-Unis, c'est en effet l'enjeu actuel : entraîner avec eux tout le camp occidental pour pouvoir continuer à dominer et à commercer avec suffisamment de pays. On assiste ainsi à une formidable opération de retournement d'opinions et de leaders en Europe afin d'assurer des gouvernants dociles et compréhensifs vis-à-vis du patron américain, soutenue par une blitzkrieg pour les lier définitivement avec le TTIP et pour les couper de ce qui pourrait être leur planche de salut, à savoir les BRICS, leurs immenses marchés, leurs dynamiques d'avenir, leur lien avec les pays en voie de développement, etc. Nous analysons tous ces aspects dans ce numéro du GEAB, ainsi que l'utilisation subtile de la crainte d'une déflation pour convaincre les Européens d'adopter les méthodes US.

À la lumière de la dangerosité extrême des méthodes employées par les États-Unis, il va sans dire que quitter le navire US ne serait pas un acte de trahison de la part de l'Europe, mais bien une avancée majeure pour le monde comme nous l'avons déjà longuement analysé dans de précédents numéros du GEAB (1). Malheureusement les dirigeants européens les plus raisonnables sont complètement paralysés et la meilleure stratégie qu'ils soient encore capables de mettre en œuvre actuellement, dans le meilleur des cas, semble être une simple temporisation (2), certes utile et bienvenue mais guère suffisante…

Plan de l'article complet :

1. BAS LES MASQUES

2. VITE UN TTIP

3. UNE ABERRATION ÉCONOMIQUE

4. INSTILLER LA PEUR DE LA DÉFLATION EN EUROPE, LA SECONDE ARME US

5. DÉBITEURS CONTRE CRÉDITEURS, LE MONDE COUPÉ EN DEUX

Nous présentons dans ce communiqué public des extraits des parties 1 et 2.

BAS LES MASQUES À l'heure d'internet et des affaires de type « -leaks », garder un secret est devenu difficile pour les agents secrets et pour les pays aux mains sales. Outre les révélations de Snowden ou de Wikileaks, on a encore appris récemment que les États-Unis étaient derrière un réseau social à Cuba visant à déstabiliser le pouvoir en place (3). Ou on a pu visionner cette vidéo fuitée opportunément sur Youtube (4) montrant les Américains à la manœuvre derrière le coup d'État en Ukraine. Ou encore, il semblerait qu'ils ne soient pas innocents dans la déstabilisation actuelle d'Erdoğan en Turquie (5), pays dont nous détaillerons la situation dans le prochain GEAB (6)… Les masques tombent… sur des évidences certes, mais que plus personne ne peut ignorer.

Mais les États-Unis ne se contentent plus des pays en développement ou des républiques bananières... En Europe, ils parviennent également à retourner les dirigeants les uns après les autres, afin qu'ils suivent les intérêts américains docilement. Ce n'est plus « Ce qui est bon pour General Motors est bon pour l'Amérique » comme le déclarait Charles Wilson (ex-PDG de GM) en 1953, mais « Ce qui est bon pour les États-Unis est bon pour l'Europe ». Ils avaient déjà le soutien de Cameron, Rajoy, Barroso, Ashton… Ils ont réussi à obtenir celui de la Pologne de Donald Tusk alors que celui-ci était fortement réfractaire en début de mandat (7), celui de l'Italie grâce au coup d'État opportun de Renzi (8), et de la France de Hollande/Valls grâce en particulier au remaniement ministériel et un premier ministre peu suspect d'antiaméricanisme. Contrairement au début de son mandat où il jouait la carte de l'indépendance, sur le Mali ou sur d'autres fronts, François Hollande semble maintenant complètement soumis aux États-Unis. Quelles pressions a-t-il subies ? L'Allemagne, quant à elle, résiste encore un peu mais pour combien de temps (9) ? Nous approfondissons cette réflexion à la partie Télescope.

L'Europe est ainsi entraînée vers l'intérêt US qui n'est pas le sien, ni en termes de politique, ni de géopolitique, ni de commerce comme nous le verrons. Alors que les BRICS ont choisi une voie opposée et cherchent à se dégager à tout prix de l'influence désormais profondément néfaste des États-Unis, l'Europe est pour l'instant le dindon de la farce. En témoigne par exemple l'achat par la Belgique de 130 milliards de dollars de bons du Trésor américain en trois mois d'octobre 2013 à janvier 2014 (dernière donnée disponible (10)), soit un rythme annuel supérieur à son PIB (11)… Ce n'est certainement pas la Belgique elle-même qui est responsable de cette aberration, mais bien sûr Bruxelles, c'est-à-dire l'UE en tant que petit soldat US.

Politiquement l'Europe est donc étouffée par les États-Unis qui peuvent s'en donner à cœur joie en l'absence de tout leadership. Et le moyen de sceller définitivement cette mainmise américaine sur l'Europe s'appelle TTIP…

VITE UN TTIP Nous l'avons déjà amplement documenté : contrairement aux discours triomphants de la « reprise » reposant sur les prix immobiliers qui remontent et la bourse qui est au plus haut, l'économie réelle US est aux abois. Le taux de privation alimentaire est plus élevé qu'en Grèce.  Les magasins, même bon marché, mettent la clé sous la porte faute de clients (12). Les demandes d'emprunt immobilier sont au plus bas, ce qui augure mal de la suite et présage un retournement imminent comme nous l'avons anticipé au GEAB n°81. [...] Mais, comme nous l'avons déjà dit, là n'est pas l'essentiel. L'enjeu majeur du TTIP, c'est la préservation du dollar dans les échanges commerciaux et le maintien de l'Europe dans le giron US afin d'éviter que ne se constitue un bloc Euro-BRICS capable de faire contrepoids aux États-Unis. Ainsi la crise ukrainienne, sous le prétexte de l'agressivité russe et de l'approvisionnement gazier, est un bon moyen, dans la panique, d'imposer l'agenda des États-Unis et des lobbies face à des dirigeants européens trop faibles pour agir. Ce qui n'était pas prévu, c'est que l'intérêt de ces lobbies ne va pas forcément dans le sens qu'on croit… [...] ---------- Notes : 1 Et comme la Chine, en particulier, lui enjoint de faire via ses accords de swap par exemple. 2 En attendant les élections européennes, notamment. 3 Source : The Guardian, 03/04/2014. 4 Source : Reuters, 06/02/2014. 5 Suite à l'utilisation par les États-Unis des réseaux sociaux à Cuba comme mentionné précédemment, pas étonnant qu'Erdoğan ait décidé de couper Twitter en Turquie. Par ailleurs, le Turc Fethullah Gülen, instigateur du mouvement Gülen s'opposant au gouvernement Erdoğan, réside… aux États-Unis. Sources : Aljazeera (13/03/2014), Wikipédia. 6 Petite parenthèse : notre équipe ne peut s'empêcher de penser que si De Gaulle, si admiré en France, gouvernait aujourd'hui, il serait lui aussi considéré comme un autocrate à renverser, à l'instar d'Erdoğan ou Poutine… Diriger efficacement dans l'intérêt de son pays semble maintenant considéré comme incompatible avec la démocratie sous sa forme actuelle, qui se doit d'être faible… 7 Source : Wikipédia. Donald Tusk est maintenant un fervent supporteur du gaz de schiste en Pologne et s'élève contre la Russie. Sources : Wall Street Journal (11/03/2014), DnaIndia (05/04/2014). 8 Lire aussi RT, 01/04/2014. 9 Source : EUObserver, 10/04/2014. 10 Source : US Treasury. 11 Son excédent commercial d'environ 1% du PIB aura du mal à expliquer cette capacité d'achat à lui tout seul… 12 Voir par exemple ABCNews, 10/04/2014. | | Pension funds--85% will go bust within 30 years Posted: 15 Apr 2014 06:20 AM PDT Many pension plans assume they will earn 7% to 8% annual returns, which is far too high. How does gold come into play?  | | Gold negatively affected by election process in India Posted: 15 Apr 2014 06:06 AM PDT Election code of conduct negatively impacts gold trade in India.  | | 85% of Pension Funds Will Go Bust Within 30 Years Posted: 15 Apr 2014 06:01 AM PDT gold.ie | | China gold demand seen rising 25% by 2017 as buyers get wealthier Posted: 15 Apr 2014 06:01 AM PDT GATA | | Power & Moral relativity Posted: 15 Apr 2014 05:11 AM PDT

Keynesian theory is a constructionist worldview applied to money. Austrian economics takes much more of an essentialist view. We gold bugs are essentialists when it comes to money, stubbornly clinging to the surety and scarcity of our barbarous relics. Keynes, Krugman & Bernanke teach that money is created—created by human will through their wise and benevolent leadership. But are they consciously duping us? read more  | | Believe it or not, Congress could soon do the "right thing"... and these stocks will SOAR Posted: 15 Apr 2014 04:00 AM PDT From Frank Curzio, editor, Small Stock Specialist: We are about to see a massive spending boom take place in the natural gas industry. Currently, the biggest hurdle for energy companies selling U.S. natural gas overseas is getting government approval to build liquefied natural gas (LNG) export facilities. Only six applications to build such terminals have been approved since 2011. Right now, there are 23 more just sitting on the Department of Energy's (DOE) desk. But soon, that could all change... ---------------Recommended Links--------------- ----------------------------------------------- [Last] Wednesday, the U.S. House of Representatives voted to advance a bill that would eliminate the need for government approval of LNG export facilities. That means energy companies would be able to build these LNG facilities almost the same way McDonald's builds new restaurants across the U.S. – whenever and whenever they want to. If the House and the Senate approve the bill – which is a strong possibility – we would see an immediate $160 billion in spending by big energy companies. That would lead to windfall profits in the industry... As longtime Growth Stock Wire readers know, America has an abundance of cheap natural gas. Overseas supplies are lower and prices are much higher – often 200%-400% higher. This is a huge opportunity for folks who can get our cheap natural gas to the global market. But getting approval to build exporting facilities along U.S. coastlines is a lengthy process. If energy companies are able to bypass the DOE approval process, there will be a mad rush to build many LNG terminals all at once. Sempra Energy – a utility giant that got approval for its LNG export terminal in February – estimates it will spend $7 billion to construct its new facility in Louisiana. That's a conservative number compared with other LNG-approved facilities. So if this bill passes and all 23 companies currently awaiting approval are able to build their facilities... that amounts to at least $160 billion spent on new construction. That's great news for companies like KBR (KBR) and Chicago Bridge & Iron (CBI). KBR receives 40% of its revenues from LNG projects. CBI receives more than 30% from LNG infrastructure. Whenever the government approves a new facility, these two companies are likely to sign contracts to build them. Both companies generate a combined $18 billion in sales. That's great. But it's nothing compared with the $160 billion in contracts that could soon be up for grabs. If CBI and KBR receive just 12% of this money, their sales will double. Remember... this bill has not been approved by Congress yet. The House advanced it – meaning it is slotted to come up for a vote... and the House will likely approve it. But getting the bill through the Senate will be far more challenging. Most Democrats (who control the Senate) are against building these facilities. But new developments out of Russia are beginning to change some of their minds... For example, there are huge concerns about energy security in Europe and Ukraine. They import most of their natural gas from Russia. But Russia has a history of cutting off supplies during times of crisis. Its desire to seize control of Ukraine classifies this as a "time of crisis. If more LNG facilities can be built in the U.S. over the next one to three years, Europe and Ukraine will likely import natural gas from us. This would alleviate their energy concerns. It would increase profits for U.S. businesses. And it could cripple Russia's economy – which depends heavily on revenue from natural gas sales. Even if this LNG bill does not become law, the 23 pending applications will still get approved. It will just take a few more years. But no matter what happens, KBR and Chicago Bridge & Iron are still buys here. I've touted both companies several times in Growth Stock Wire. CBI has been a big winner. KBR is down after reporting a weak quarter in February due to several delayed orders – creating a great buying opportunity. These names could see a huge short-term boost if this bill gets approved. If not, they are still solid long-term growth plays trading at a discount to the overall market. More from Frank Curzio: This is one of the biggest trends in the world. It's not too late to get in now.

Frank Curzio: These super-rare stocks can help you create a million-dollar portfolio

Frank Curzio: Stocks are headed even higher from here

| | Matt Badiali: This country holds the key to gold and copper this year Posted: 15 Apr 2014 04:00 AM PDT From Matt Badiali, editor, S&A Resource Report: If you read finance or resource media long enough, you'll eventually come across the old idea that copper is "the metal with a PhD in economics." This is the idea that checking the price of copper gives you a quick gauge of the global economy. Copper is useful in a million ways. So when an economy is rolling, copper is in demand… and its price rises. I thought that the table was set for a copper rally this year. At the end of 2013, I predicted that copper would go up, while gold would go down in 2014. But I was wrong... at least for now. Right now, there is a 20% "spread" in the performance of the two metals... The price of gold is up 10% so far this year, while copper prices are down 10%. However, the performances of the two metals are linked... in China. China uses an immense amount of copper. It also smelts (that's the process of turning ore into metal) the most copper in the world (over 200% more than the next closest country, Japan). China has the world's largest smelting facility. It can process 900,000 metric tons of copper per year. It has three of the ten largest smelters in the world. In 2012, it produced almost 6 million metric tons of copper. That means the country has a huge supply of the metal. It also means China exerts huge influence over copper prices. So if anything, copper's Ph.D. is in Chinese economics. However, the first-ever Chinese bond default hit in mid-March. The news sent copper prices to a four-year low. The companies holding these bonds buy some of that copper. If they go bankrupt, some of the demand goes away. Remember, these bonds were thought to be safe because it was assumed the Chinese government would backstop them as a part of the planned economy. But by allowing one of these businesses to default, the government has told the market this isn't a safe assumption. Chinese businesses have trillions of dollars in these bonds... and the companies holding them are no longer protected by the government. That's why investors bailed out of copper and currencies related to it. The drop dragged down the currencies of major copper producers like Chile. Investors went to a safe haven instead – gold. But Goldman Sachs' head of commodities research, Jeffrey Currie, thinks gold will end 2014 at $1,050 per ounce. He thinks economic recovery will doom the gold price. The Chinese economy is so huge, it could easily surprise the doubters. It's early yet in 2014, so a rebound in copper (and a slump for gold) may still be possible. Crux note: Matt Badiali has been watching China closely. He's believes they'll be involved in an upcoming "currency war"... and says it could start as early as April 24th. You can learn how the Chinese government will unveil their "secret weapon" by clicking here. You can also read more from Matt Badiali on The Crux by clicking here.  | | How to Invest in, Buy, Sell, Store and Insure Precious Metals in Canada Posted: 15 Apr 2014 03:58 AM PDT This report was written for the Canadian public, primarily. However, anyone interested in investing in precious metals will find plenty of useful information, since investment options are probably the same in every country. Moreover, even if you are not a Canadian you might want to consider investing in Canada to diversify your investment portfolio In this report, the authors discuss options of investing in physical (bullions, numismatic coins and collectible items, junk coins, silverware and flatware, jewelry) and paper (trusts, investment through companies that buy/sell and store precious metals for you, deposit programs, bank gold/silver certificates) precious metals. Readers get to know all available options along with advice on how to buy and sell precious metals on Ebay, which can be very profitable if you follow our recommendations. Some investments are riskier than others, due to stock market risk, storage companies’ default risk or even the risk of burglary (in case you keep your precious metals at home). The report covers the risks and how to protect your precious metals. | | COMEX Gold hits 3 week high Silver slips to $19.81 Oz Posted: 15 Apr 2014 03:20 AM PDT COMEX gold prices reached its highest level in 3-week on Monday while COMEX silver prices slipped to $19.81 an ounce. | | COMEX Gold hits 3 week high Silver slips to $19.81 Oz Posted: 15 Apr 2014 03:20 AM PDT COMEX gold prices reached its highest level in 3-week on Monday while COMEX silver prices slipped to $19.81 an ounce. | | Planned Obsolescence Disguised as Innovation, Oligopoly Disguised as a Free Market, and the Enrichment of Oligarchs Posted: 15 Apr 2014 02:30 AM PDT Yves here. We are delighted to feature this post from Roy Poses, who with his colleagues at Health Care Renewal, have been providing consistently high quality analysis of the often dubious practices and economics of the health care system. By Roy Poses, MD, Clinical Associate Professor of Medicine at Brown University, and the President of FIRM – the Foundation for Integrity and Responsibility in Medicine. Cross posted from the Health Care Renewal website The New York Times published another article in its series on the high cost of US health care. This one, focused on the care of type 1 diabetes mellitus and other chronic diseases, shines some light on the business management practices that now determine how our health care system functions, or not, and implies who benefits the most from them. Planned Obsolescence Disguised as Innovation The article first discussed the brave new world of type 1 diabetes treatment. The introductory theme was: Today, the routine care costs of many chronic illnesses eclipse that of acute care because new treatments that keep patients well have become a multibillion-dollar business opportunity for device and drug makers and medical providers.

Much of modern diabetes treatment seems to depend on medical devices and disposable medical supplies: That captive audience of Type 1 diabetics has spawned lines of high-priced gadgets and disposable accouterments, borrowing business models from technology companies like Apple: Each pump and monitor requires the separate purchase of an array of items that are often brand and model specific. A steady stream of new models and updates often offer dubious improvement: colored pumps; talking, bilingual meters; sensors reporting minute-by-minute sugar readouts. [Diabetes patient] Ms. Hayley's new pump will cost $7,350 (she will pay $2,500 under the terms of her insurance). But she will also need to pay her part for supplies, including $100 monitor probes that must be replaced every week, disposable tubing that she must change every three days and 10 or so test strips every day.

Of course, the device and supply manufacturers claim that the high prices reflect the value of the wondrous new innovations: Companies that produce the treatments say the higher costs reflect medical advances and the need to recoup money spent on research.

Yet now the Times reporter was able to find physicians who claim the “innovations” are really just the latest version of planned obsolescence: Diabetes experts say a good part of what companies label as innovation amounts to planned obsolescence. Just as Apple customers can no longer buy an iPhone 3 even if they were content with it, diabetics are nudged to keep up with the latest model.

For example, Those companies spend millions of dollars recruiting patients at health fairs, through physicians' offices and with aggressive advertising — often urging them to get devices and treatments that are not necessary, doctors say. ‘They may be better in some abstract sense, but the clinical relevance is minor,’ said Dr. Joel Zonszein, director of the Clinical Diabetes Center at Montefiore Medical Center. ‘People don't need a meter that talks to them,’ he added. ‘There's an incredible waste of money.’ Pharmaceutical companies have also discovered this model. insulin … has been produced with genetic engineering and protected by patents, so that a medicine that cost a few dollars when Ms. Hayley was a child now often sells for more than $200 a vial, meaning some patients must pay more than $4,000 a year.

In particular, Synthetic human insulin is safer for patients, who sometimes developed reactions

to animal insulin. But it is made by only three companies: Eli Lilly, Sanofi and Novo Nordisk. Manufactured in microbes, each one's product has minor dissimilarities that reflect the type of cell in which it was made. Since the companies owned the cell lines, it is nearly impossible for other companies to make exact copies or even similar versions that would be cheaper, even once the patents expire. And the pharmaceutical companies defend the patents ferociously. What's more, the three companies continued to refine their product, adding chemical groups that made the insulin absorb somewhat more quickly or evenly, for example. They are called insulin analogues, and their benefits are promoted tirelessly to doctors and patients.

Of course, the pharmaceutical companies also claim that it’s all about innnovation, Dr. Todd Hobbs, chief medical officer of Novo Nordisk, defended the rising prices of insulin, linking them to medical benefits. ‘The cost to develop these new insulin products has been enormous, and the cost of the insulin to the consumer in developed countries has risen to enable these and future advancements to occur,’ he wrote in an email.

Not everyone is convinced, ‘The insulins are tweaked for minor benefits that may help a small number of patients with difficult-to-control diabetes, and result in major price increases for all,’ [Kings College, London, UK Professor] Dr. Pickup said. Because of analogues, he added, Britain's National Health Service has had to spend 130 percent more on insulin in the past five years. In the United States, said Dr. Zonszein at Montefiore, the price of Humalog, Lilly's analogue insulin, was typically two to four times that of its older human insulin line, called Humulin. ‘There is not a lot of difference between Humulin and analogues,’ he said, but he noted that Humulin was getting ‘hard to find.’ Sanofi Aventis has stopped selling its older product in the United States, and Mr. Kliff, the financial analyst, said other companies were likely to follow suit, effectively forcing patients to use the costlier versions.

The arguments about valuable innovation also do not explain why the prognosis of diabetes in the US does not seem to reflect all the money we spend on the disease, Complication rates from diabetes in the United States are generally higher than in other developed countries. That is true even though the United States spends more per patient and per capita treating diabetes than elsewhere, said Ping Zhang, an economist at the Centers for Disease Control and Prevention. The high costs are taking their toll on public coffers, since 62 percent of that treatment money comes from government insurers. The cumulative outlays for treating Type 1 and Type 2 diabetes reached nearly $200 billion in 2012, or about 7 percent of America's health care bill. So to summarize, there is considerable evidence that companies that make drugs and devices to manage type 1 diabetes constantly provide “innovations,” yet most are minor changes that encourage obsolescence of previous products, but do not provide important increases in benefits or reductions in harm for patients. Oligopoly Disguised as a Free Market

Many in the US sing the praises of our supposed free-market health care system. As noted above however, the insulin market is an oligopoly, dominated by three companies. The diabetes device market is also dominated by a few companies, and in particular, the insulin pump market is dominated by a single company, Medtronic is the dominant insulin pump manufacturer, serving 65 percent of American patients and the majority of those worldwide. Though smaller companies sell cheaper pumps, it is hard to make inroads: Once familiar with the Medtronic system and its extensive support network for troubleshooting problems, patients are reluctant to switch. Doctors are leery of prescribing equipment from a new company that may be out of business in a year; their office computer may not sync with the new software anyway.

Of course, Medtronic public relations will justify it all again based on innovation, Medtronic declined to talk about specific prices, but said a core tenet was to make only ‘a fair profit.’ Amanda Sheldon, a spokeswoman, added: ‘We are committed to reinvesting in research and development of new technologies to improve the lives of people with diabetes, and our current pricing structure ensures that we can bring new products to market.’

The article also discussed the prices of treating chronic diseases other than diabetes. For example, see how a nominally non-profit hospital priced treatments for chronic diseases, Dr. Kivi was on high doses of steroids for debilitating joint pain that left him unable to walk at times. But when his last three-hour infusion at NYU Langone Medical Center's outpatient clinic generated a bill of $133,000 — and his insurer paid $99,593 — Dr. Kivi was so outraged that he decided to risk switching to another drug that he could inject by himself at home.

However, this pricing appears to have been facilitated by the hospital’s increasing market domination generated by its purchase of physician practices, He had moved his care to NYU Langone to follow his longtime doctor, who had moved her practice from a nearby hospital where the same infusion had been billed at $19,000. The average price that hospitals paid for Dr. Kivi's dose of Remicade late last year was about $1,200, according to Medicare data.

So in summary, a few companies now dominate the production of drugs and devices for the management of diabetes, and a few large hospitals may increasingly dominate the treatment of particular chronic diseases. Such oligopolists are able to increase prices without improving treatment to or outcomes of patients. Enrichment of the Oligarchs

This example shows how the current US health care system is dominated by huge organizations, mostly for-profit corporations but including some nominally non-profit corporations that act similarly. They loudly proclaim innovation, but much of that innovation seems to provide few benefits to patients, and actually appears to be planned obsolescence. The result is high and ever-rising prices. So if patients do not benefit from this, who does? It does not appear to be the health care professionals, Meanwhile, as the price of supplies rises, endocrinologists remain among the lowest-paid specialists in American medicine, meaning severe physician shortages in many areas and long waits to see a doctor.

We have seen other examples of how leaders of the big health care organizations have become as rich as royalty. Therefore, let us consider the pay of the leaders of the organizations mentioned above. I will focus on the two US based corporations, Eli Lilly and Medtronic, and the New York hospital, NYU Langone Medical Center. Eli Lilly According to the company’s 2014 proxy statement, the 2013 total compensation of its five highest paid hired executives was - John C Lechleiter PhD, CEO $11,217,000 - Derica W Rice, CFO $5,176,822 - Jan M Lundberg, PhD, EVP, Science and Technology $4,774,535 - Michael J Harrington, General Counsel $3,174,222 - Erico A Conterno, President Lilly Diabetes $3,009,041 Note that all of these executives save Mr Harrington have also amassed more than 100,000 shares of company stock, and Dr Lechleiter has amassed more than 1,000,000. It should be no surprise, given our recent discussion (e.g., here) of the currently symbiotic relationship among top health care corporations and academic medicine, that several of the members of the Lilly board of directors that has exercised stewardship over the company, and is thus responsible for these gargantuan compensation packages and the business practices discussed above are top academic leaders. These include, - Alfred G Gilman, MD, PhD, Regental Professor Emeritus, recent (until 2009) executive vice presdient, provost, and dean of medicine, University of Texas Southwestern - William G Kaelin Jr, MD, Professor of Medicine, Associate Director of Basic Science, Dana-Farber Cancer Center, Harvard University - Marschall S Runge MD, Executive Dean and Chair of the Department of Medicine, University of North Carolina Medical School - Katherine Baicker PhD, Professor of Health Economics, Harvard University School of Public Health (I must note that Prof Baicker is also – amazingly – on the Medicare Payment Advisory Committee, MEDPAC). - Ellen R Marram, Trustee, New York-Presbyterian Hospital - Ralph Alvarez, President’s Council, University of Miami - R David Hooper, Trustee, Children’s Hospital of Colorado - Franklyn G Pendergast MD PhD, Professor, Mayo Medical School All but the newest directors were paid at least $250,000 a year by the company (and thus by the executives the directors are supposed to supervise), and all but the newest directors had accumulated tens of thousands of shares of stock or the equivalent as pay for their services. Medtronic Similarly, according to the company’s 2013 proxy (the latest now available), CEO Omar Ishrak made $8,975,866 in 2013, and the next four highest paid executives all made over $2,500,000 each. Mr Ishrak owned or could acquire the equivalent of more than 500,000 shares of stock, and the other top paid executives owned of could acquire from over 100,000 to over 1,000,000 shares of stock. Again, the executives were nominally supervised by a board of directors that included an academic and non-profit leader, Dr Victor J Dzau, MD former chancellor for health affairs at Duke University, and president-elect of the Institute of Medicine (note that we discussed Dr Dzau’s conflicts of interest most recently here). It also included a former government leader, Michael O Leavitt, former US Secretary of Health and Human Services; and a hospital leader, Preetha Reddy, Managing Director of Apollo Hospitals Enterprise Limited (India). NYU Langone Medical Center The Medical Center’s 2011 US form 990 is old, but the latest available, and is remarkably obscure, omitting, for example, mentioning the titles of any of the people listed as highest paid officers and employees. The current CEO, was listed as receiving total compensation of just over $2.000,000. Four individuals then received over $1,000,000. The 990 form also mentioned that the Medical Center provided some individuals with first class travel, tax gross-up payments, housing allowances, and reimbursement for personal services. Neither the 990, nor the center’s web-site makes all the possible conflicts of interest of its trustees obvious. So in summary, the large organizations, for-profit and non-profit, that are able to greatly increase their prices through planned obsolescence disguised as innovation, and oligopoly disguised as free markets, are able to make their top executives very rich, and also enrich those who are supposed to exercise stewardship over them. Summary