Gold World News Flash |

- Economic Growth Is Achieved By Two Events

- Louise Yamada - 2 Key Gold & Silver Charts To Start 2014

- Rick Rule – Silver Shorts About To Have A Religious Experience

- How The U.S. Employs Overseas Sweatshops To Produce Government Uniforms

- Six Reasons Why The Government Is Destroying The Dollar

- Resource Sector Starts 2014 With A Boom Higher: TSX Venture Up 11 Consecutive Days

- 23 Reasons To Be Bullish On Gold

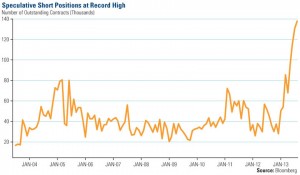

- Do The Forex Boys Expect A Rally In Metals

- Big money showing interest in monetary metals, Rule tells King World News

- Reflections on the golden dance from West to East

- Silver and Gold Prices Find Themselves Fighting Over Familiar Ground — Gold Must Hold Above $1,220

- Silver and Gold Prices Find Themselves Fighting Over Familiar Ground — Gold Must Hold Above $1,220

- Gold Daily and Silver Weekly Charts

- Gold Daily and Silver Weekly Charts

- Proof that Monday's gold smash was not a 'fat finger' mistake but an algorithm attack

- Why Gold Will Drop to $1,000 Per Ounce

- Rick Rule - Silver Shorts About To Have A Religious Experience

- 23 Reasons to Be Bullish on Gold

- Gold on Roller Coaster 2014 Start as Price Falls Again

- Inflation vs Deflation – Monetary Tectonics In 25 Amazing Charts

- Fed Tapering? With These Deflation Risks?

- Fed Tapering? With These Deflation Risks?

- Fed Tapering? With These Deflation Risks?

- Gold has beaten all other currencies since 2000

- 3-Month Silver Trade Off Extreme Sentiment

- 3-Month Silver Trade Off Extreme Sentiment

- GLD's gold sent to Asia isn't coming back, Williams tells KWN

- What Interest Rates Mean for Stocks

- What Interest Rates Mean for Stocks

- Gold vs. Fed Debasement

- Gold vs. Fed Debasement

- Who's Buying Gold, and Why

- Who's Buying Gold, and Why

- TF Metals Report: Where is the German gold?

- This Will Create A Major Panic & Then Destroy The Gold Shorts

- Profit Potential From the Front Lines of Cyberwar

- The Slow March to Ruin

- 23 Reasons to Be Bullish on Gold

- Gold’s support above $1,200 getting stronger – Phillips

- Gold price in for another tough year, but floor to be found around $1,150

- Can’t-miss headlines: Gold slides to $1,220, Impact hits gold in Mexico & more

- Platinum bonds seen beating bearish gold

- End of “Wall Street Party” Will Be a Catastrophe! Here’s Why

- Silver Price Charts and Other Factors Say Now is Time to Buy (Part 2)

- What do you know about inflation?

- US Jobs Data See Gold Prices Fall Ahead of Fed Minutes

- Gold and Money Supply Prepare for Messy Divorce

- Bron Suchecki: Tricks can be played with Comex gold storage data

- Gold price smashes again having less effect, Grant Williams tells KWN

- Market Monitor – January 8th

| Economic Growth Is Achieved By Two Events Posted: 08 Jan 2014 10:00 PM PST by David Schectman, MilesFranklin.com:

Summing up his views… THE FACTORS THAT LEAD TO A GROWING ECONOMY Economic growth is achieved by two events. New workers coming into the work place and credit growth. Both are now failing. We have shrinking demographics and less income growth. Credit growth drove the economy since 1960. In 1964 it was one trillion. Now it's $58 trillion, a 58-times expansion of credit. |

| Louise Yamada - 2 Key Gold & Silver Charts To Start 2014 Posted: 08 Jan 2014 09:01 PM PST  With major markets on the move as we kick off 2014, today King World News is pleased to share a piece of legendary technical analyst Louise Yamada's "Technical Perspectives" report. Yamada is without question one of the greatest technical analysts Wall Street has ever seen. This information is not available to the public and we are grateful to Louise for sharing her incredible work with KWN readers globally. With major markets on the move as we kick off 2014, today King World News is pleased to share a piece of legendary technical analyst Louise Yamada's "Technical Perspectives" report. Yamada is without question one of the greatest technical analysts Wall Street has ever seen. This information is not available to the public and we are grateful to Louise for sharing her incredible work with KWN readers globally. This posting includes an audio/video/photo media file: Download Now |

| Rick Rule – Silver Shorts About To Have A Religious Experience Posted: 08 Jan 2014 08:40 PM PST from KingWorldNews:

And (the big money is also circling) the certificated precious metals like the Sprott Physical Trusts. The money hasn't yet come to settle, but it's very important to know what might happen to those markets if the big money began to settle. |

| How The U.S. Employs Overseas Sweatshops To Produce Government Uniforms Posted: 08 Jan 2014 08:27 PM PST Submitted by Michael Krieger of Liberty Blitzkrieg blog, The following article from the New York Times is extraordinarily important as it perfectly highlights the incredible hypocrisy of the U.S. government when it comes to overseas slave labor and human rights. While the Obama Administration (and the ones that came before it) publicly espouse self-important platitudes about our dedication to humanitarianism, when it comes down to practicing what we preach, our government fails miserably and is directly responsible for immense human suffering. Let’s get down to some facts. The U.S. government is one of the largest buyers of clothing from overseas factories at over $1.5 billion per year. To start, considering our so-called “leaders” are supposedly so concerned about the state of the U.S. economy, why aren’t we spending the money here at home at U.S. factories? If we don’t have the capacity, why don’t we build the capacity? After all, if we need the uniforms anyway, and it is at the taxpayers expense, wouldn’t it make sense to at least ensure production at home and create some jobs? If a private business wants to produce overseas that’s fine, but you’d think the government would be a little more interested in boosting domestic industry. However, the above is just a minor issue. Not only does the U.S. government spend most of its money for clothing at overseas factories, but it employs some of the most egregious human rights abusers in the process. Child labor, beatings, restrictions on bathroom brakes, padlocked exits and much more is routine practice at these factories. Even worse, in the few instances in which the government is required to actually use U.S. labor, they just contract with prisons for less than $2 per hour using domestic slave labor. Then, when questions start to get asked, government agencies actually go out of their way to keep the factory lists out of the public’s eye, even going so far as denying requests when pressed for information by members of Congress. Sadly, as usual, at the end of the day this is all about profits and money. Money government officials will claim is being saved by the taxpayer, but in reality is just being funneled to well connected bureaucrats. From the New York Times:

Why am I not surprised…

As usual, it is all about the money. You think average Americans are seeing any of that massive profit? Believe me, someone is and it’s not you.

This is the human equivalent of factory farming and every decent American citizen should be appalled that this is happening on multiple levels. Please share this post to raise awareness. Full article here. |

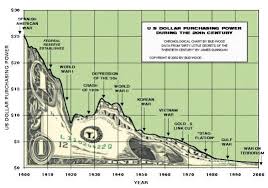

| Six Reasons Why The Government Is Destroying The Dollar Posted: 08 Jan 2014 08:20 PM PST by Daniel R. Amerman, SilverBearCafe.com:

2. It is the most effective way to not just pay down current crushing debt levels using devalued dollars, but also to deal with the rapidly approaching massive generational crisis of paying for Boomer retirement promises. |

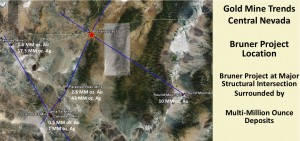

| Resource Sector Starts 2014 With A Boom Higher: TSX Venture Up 11 Consecutive Days Posted: 08 Jan 2014 07:59 PM PST It has been disappointing to see the decline over the past three years in the resource sector and commodities, but it does not surprise me. We are living in volatile, chaotic times when governments and banks will do whatever they can to disguise inflation through shorting, margin and manipulation. Eventually, these downturns end and when they do massive rebounds begin. When you see record shorts like we are seeing now in gold it usually signals a major bullish turning point imminently ahead. We must put this decline in proper perspective and realize that this is a counter-trend deviation from the long term secular uptrend in precious metals and commodities that occurs every few years. The end of 2013 marked 100 years of the Federal Reserve System. What have they accomplished? The debt of the country has soared resulting in a major loss in the purchasing power of the U.S. dollar. It has caused the few to get rich and the masses to get poorer through a hidden tax called inflation. Gold has soared exponentially over the past 100 years especially the past twelve before 2013. The dollar has lost over 95% of its purchasing power over the past century. This year marks the first annual decline in gold since 2000, which may prove to be a rare buying opportunity. The taper is not a signal to sell gold but to possibly buy. Inflation should start to pick up. Notice gold and silver are still holding the summer 2013 lows and the TSX Venture is breaking above the 200 day moving average. The TSX Venture is up 11 straight days. The small miners are a leading indicator and may be signaling the smart money is expecting gold to hold the $1200 bottom. This technical reversal may forecast increased interest of smart capital into the sector. We have already seen our featured companies such as Corvus (CORVF), Tasman (TAS), Big North Graphite (NRT.V), Lakeland Resources(LK.V) and Nulegacy Gold (NUG.V) benefit from this turn with a golden crossover. Uranerz (URZ), Comstock Mining (LODE), Wellgreen Platinum (WG.V), Pele Mountain (GEM.V) and Canamex Resources (CNMXF) are on the verge of this major bullish trend reversal of the 50 day crossing the 200 day. This improving technical landscape in our featured companies and the TSX Venture closing above the 200 day moving average while gold and silver is basing may signify that the recent taper and improving economy may actually be the beginning of a coming boom to the entire resource complex. Gold and silver may be ending a healthy correction which triggered sell stops and shook out the momentum and marginal players. Gold and silver could be putting in bottoms over the next few trading days. Mark my words when I say you ain’t seen nothing yet in this precious metals market. This period reminds me of the late 90′s when everyone was chasing high priced tech stocks and ignoring the deeply discounted junior miners. Over the next decade great wealth was made in the resource sector and dot com and biotech investors were destroyed. Precious metals are way undervalued. Gold is still cheaper than the 1980 high when inflation is factored in, yet debts are exponentially higher. Discoveries are few and far between and producers are shutting down mines. These are the ingredients to lead to the next leg higher in gold and silver. My job is to position my readers on the long term trend in real assets which over time should protect them from inflation and the loss of purchasing power of the dollar. Many banks and brokers have been shorting the resource sector and getting their retail accounts to short miners. Margin debts are reaching record highs. This may indicate a major market correction in equities and a rise in commodities similar to early 2000. Notice the Venture making a strong rally even as gold and silver prices are basing. Don’t short resource stocks especially when they are hitting three year lows and historically discounted valuations. This has got to be probably the worst possible time to sell, short or to exit the resource sector and possibly the best time to buy high quality junior miners in one’s lifetime. Governments around the world have been printing fiat currency through quantitative easing and manipulating a negative interest rate policy. Is the Euro Debt problem really solved? Is China’s banking system in trouble as well? Investors around the world must be prepared for inflation and protect themselves from situations like Cyprus where depositors were slaughtered to pay the debts of the banks. Although many investors are ignoring precious metals and the junior miners, I continue to encourage you to not follow the masses and the media. Do you really believe that the U.S., Japan or the indebted European nations will ever pay back its debts? Or that bitcoin is an alternative to gold and silver? All these indebted countries are devaluing their currencies and forcing interest rates to extremely low levels to pay back their out of control debts. I am continuing to buy gold, silver and rotating into the high quality junior miners trading literally for a penny of a penny on a dollar. Gold and silver has been a form of money for thousands of years. Who knows where bitcoin will be in two or three? When the debt storm returns like in 2010 and 2011, we may see a major move into tangible assets especially gold, silver and some of the high quality junior miners in safe jurisdictions like Nevada. This move in precious metals could come rapidly at anytime. Don't try to time the bottom as only liars can ever catch it. One could easily miss the powerful upswing where investors can make exponential gains on their money. New value buying after tax loss selling combined with short covering could lead to major gains in the miners in the first quarter of 2014. A turnaround can occur any day. In 2011, equities were cheap compared to the overvalued gold miners. Now two year later the cycle is the reverse, gold miners are cheap compared to equities. Now is the time to pick up the mining shares on the cheap when the masses are short and sell the overvalued equities which the herd are taking out margin to buy. We know these margin fed rallies usually end with a lot of pain and these sell offs in the miners provide the best buying opportunities. With regards to gold and silver, I believe we are very near a bottom. I see the downside risk as maybe $50 and the potential upside of thousands of dollars. The time to buy is when funds are facing redemption and marginal players face capitulation. We may have seen that at the end of 2013. Experienced players have never seen the shares at such bargain prices and are continuing to accumulate. The majors are already beginning to make major changes, selling assets and cutting expenses. We may be near a major bottom that comes around maybe once in a lifetime. I never thought we would see this buying opportunity happen again in my lifetime but the media, who are owned by the banks who have shorted this sector to oblivion, have wiped the marginal investor out and forced them to sell assets for pennies on the dollar. This is the law of the casino. Many go home empty handed, while only a patient few come out winners. I believe the selling capitulation now is giving value investors a major gift who may soon enter this beaten down sector big time. Look for savvy investors come swooping in to pick up shares in early 2014 as they may see unbelievable opportunities in this space. Smart investors are on the lookout for assets trading at significant discounts to what major investors paid recently. For instance, one company which I have just recently bought and plan to buy more of is Canamex Resources (CSQ.V or CNMXF). Hecla paid $.18 back in 2012 before amazing discoveries. Now Canamex can be bought at around 1/3rd of that value despite hitting unbelievable results in 2013. Some of the best I have seen from Nevada. Canamex controls the Bruner Gold Project in mining friendly Nye County, Nevada where they are making a major new gold discovery. The project is extremely well located in an area of multi-million ounce deposits near the famous Round Mountain Mine two hours southeast of Reno. Canamex has made some very positive discoveries recently at the project. The company is demonstrating that there are high grade feeder zones on the property that could be used as a starter pit. Canamex continues to hit amazing results on a consistent basis and attracted the attention of major gold producers such as Hecla who came on as a significant shareholder after months of research and due diligence on the asset back in 2012. Hecla bought a major position in this company around 15% at $.18, around three times higher than where it is now. This investment of capital, an active representative on the board and technical expertise came after six months of due diligence and analysis. Investors can buy it now at close to a 1/3rd of that Hecla’s purchase price. Over the past year, Canamex has made unbelievable geological progress. Canamex has released some awesome holes from both the historic resource area and the new discovery at Penelas East. In the historic area they hit 57.9 meters of over 5 grams/ton. In addition, The Penelas East Target is one of the seven target areas on the property and the technical team has hit on 38 out of 44 drill holes with some of the best results being over 100m of 4+ gram grade. They released results of 79.9 meters of 1.5 grams per ton. In a regular resource market these high grade results over large intersections would get the market very excited and the stock should fundamentally be at much higher levels despite a struggling gold market. As the resource market turns Canamex may be one of the first takeover targets from a major and may see increased interest as investors return to the sector in 2014. The metallurgical studies of both the historical resource area and Penelas East show that this could be a lower capital intensive asset. These geological and metallurgical results warrant further funding in 2014 as this could be the type of asset an emerging major like Hecla would want to own 100%. Look for Canamex (CSQ.V or CNMXF) to breakout from this ascending triangle at $.075. Notice the strong accumulation in the fourth quarter of this year as the company appears to be forming a bottom since this summer. Technical traders are looking for a golden crossover of the 50 and 200 day moving average which indicates a major trend change. Listen to my recent interview with Bob Kramer, CEO of Canamex Resources (CSQ.V or CNMXF) by clicking here… We discuss the recent discovery and what sets Canamex apart from so many of the junior miners. For more information on Canamex Resources visit http://canamex.us or contact CEO Robert Kramer at (604) 336-8621. Disclosure: Author/Interviewer Owns Canamex and the company is a sponsor on website. Conflicts of interest apply. Do your own due diligence.

___________________________________________________________________________ Sign up for my free newsletter by clicking here… Sign up for my premium service to see new interviews and reports by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… Accredited investors looking for relevant news click here… Please forward this article to a friend. To send feedback or to contact me click here… Listen to other interviews with movers and shakers in the mining industry below or by clicking here… Listen to internet radio with goldstocktrades on BlogTalkRadio

|

| 23 Reasons To Be Bullish On Gold Posted: 08 Jan 2014 05:58 PM PST Submitted by Laurynas Vegys via Casey Research, It's been one of the worst years for gold in a generation. A flood of outflows from gold ETFs, endless tax increases on gold imports in India, and the mirage (albeit a convincing one in the eyes of many) of a supposedly improving economy in the US have all contributed to the constant hammering gold took in 2013. Perhaps worse has been the onslaught of negative press our favorite metal has suffered. It's felt overwhelming at times and has pushed even some die-hard goldbugs to question their beliefs… not a bad thing, by the way. To me, a lot of it felt like piling on, especially as the negative rhetoric ratcheted up. Last year's winner was probably Goldman Sachs, calling gold a "slam-dunk sale" for 2014 (this, of course, after it's already fallen by nearly a third over a period of more than two and a half years—how daring they are). This is why it's important to balance the one-sided message typically heard in the mainstream media with other views. Here are some of those contrarian voices, all of which have put their money where their mouth is… And then there's the people who should know most about how sound the world's various types of paper money are: central banks. As a group, they have added tonnes of bullion to their reserves last year… China ended 2013 officially as the largest gold consumer in the world. Chinese sentiment towards gold is well echoed in a statement made by Liu Zhongbo of the Agricultural Bank of China: "Because gold has capabilities to absorb external economic shocks, growth of its use in the international monetary system will be imminent." And those commercial banks that have been verbally slamming gold—it turns out many are not as negative as it might seem… None of these parties thinks the gold bull market is over. What they care about is safety in this uncertain environment, as well as what they see as enormous potential upside. In the end, the much ridiculed goldbugs will have had the last laugh. We can speculate about when the next uptrend in gold will set in, but the action for today is to take advantage of price weakness. Learn about the best gold producers to invest in—now at bargain-basement prices. Try BIG GOLD for 3 months, risk-free, with 100% money-back guarantee. Click here to get started. |

| Do The Forex Boys Expect A Rally In Metals Posted: 08 Jan 2014 04:58 PM PST The AUDUSD is aligned to commodities like: coal, gold, copper, iron ore, rare metals. If it moves up that is in the anticipation that either the USD is moving down, or AUD will be strong because of exports Read More... |

| Big money showing interest in monetary metals, Rule tells King World News Posted: 08 Jan 2014 04:36 PM PST 7:36p ET Wednesday, January 8, 2014 Dear Friend of GATA and Gold: Sprott Asset Management's Rick Rule tells King World News tonight that big money and even government entities are beginning to show interest in the monetary metals, "the physical sector": http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/1/8_Ric... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... GATA Reception in Vancouver Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Reflections on the golden dance from West to East Posted: 08 Jan 2014 04:26 PM PST 7:28p ET Wednesday, January 8, 2014 Dear Friend of GATA and Gold: This letter seldom bothers with anonymous Internet postings, since anonymity diminishes credibility, and certainly this letter would never publicize anything anonymous that was defamatory to anyone particularly. But sometimes an anonymous blogger like the one who runs the FOFOA Internet site (it stands for "Friend of Friend of Another", a reference to the famous anonymous "Another" and "Friend of Another" disquisitions posted at the USAGold Internet site years ago) offers an especially perceptive view of gold's evolving place in the financial system that is well worth reading. FOFOA's January 1 meditation, headlined "Happy New Year," is one such meditation, and it generally reflects GATA's views. It can be found here: http://fofoa.blogspot.com/2014/01/happy-new-year.html Another such anonymous reflection turns up today on the Internet site of gold researcher and GATA consultant Koos Jansen. This commentary recognizes the golden dance between West and East and the cooperative rigging of the currency markets by the major Western and Eastern central banks while the transfer of gold eastward is carefully and surreptitously managed. It's headlined "Gold Pricing and the Flows of Gold Metal" and it's posted at Jansen's Internet site, In Gold We Trust, here: http://www.ingoldwetrust.ch/gold-pricing-and-the-flows-of-gold-metal CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... GATA Reception in Vancouver Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Silver and Gold Prices Find Themselves Fighting Over Familiar Ground — Gold Must Hold Above $1,220 Posted: 08 Jan 2014 04:26 PM PST Gold Price Close Today : 1225.30 Change : -4.10 or -0.33% Silver Price Close Today : 19.518 Change : -0.247 or -1.25% Gold Silver Ratio Today : 62.778 Change : 0.577 or 0.93% Silver Gold Ratio Today : 0.01593 Change : -0.000148 or -0.92% Platinum Price Close Today : 1412.20 Change : -0.50 or -0.04% Palladium Price Close Today : 737.40 Change : -3.40 or -0.46% S&P 500 : 1,837.49 Change : -0.39 or -0.02% Dow In GOLD$ : $277.74 Change : $ -0.22 or -0.08% Dow in GOLD oz : 13.436 Change : -0.011 or -0.08% Dow in SILVER oz : 843.46 Change : 7.09 or 0.85% Dow Industrial : 16,462.74 Change : -68.20 or -0.41% US Dollar Index : 81.180 Change : 0.170 or 0.21% Silver and GOLD PRICES find themselves fighting over familiar ground. The gold price dropped $4.10 (0.3%) to $1,225.30 while silver lost 24.7 cents (0.13%) to 1951.8c. Today changes nothing and adds no new insight. The gold price remains above its 20 DMA and in the uptrend begun on 31 December. Gold has drawn a falling bullish wedge and broke out of that, and the breakout remains above the wedge's upper boundary line. Touched off it today. The SILVER PRICE shows a similar wedge, and a like performance. Not counting the 1872c thin market low on 31 December, silver is in an uptrend with a lower boundary rising through its December lows. However, it teeters on the edge. Really can't close below 1940c and gold must hold on above $1,220. It's all one big wheezy deal, and how it turns out is anybody's guess. Balance of proof they have bottomed remains on shoulders of silver and gold, and can only be borne by rising to higher prices. Extent of that power was seen today when the mighty stock market wilted at the hint in the Federal Open Market Committee's notes of its last meeting that it might, someday, somehow "taper." This taper handle turns out to be the best tool for manipulating public opinion since terrorism was invented. Clearly, by its money printing the Fed has placed a floor under stock prices. Everybody knows it, that's why they wilt at the magic word "taper." 'Twill be hard to resist the pull of this magic. Excepting the Nasdaq twins, stock indices fell across the board. Dow lurched down 68.2 (0.41%) to 16,462.74 while the S&P500 stumbled 0.39 (0.2%) to 1,837.49. Just the chart, ma'am, and a syllogism. Definition: a downtrend is a series of lower lows and lower highs. Since 31 December 2013 Dow and S&P500 have posted lower lows and lower highs. Ergo, the Dow and S&P500 are in a downtrend, transitory and migratory as it may be. Whether this downtrend will be of the evanescent or long-lasting variety time has not yet revealed to us. But stock's slide was not enough to lower the Dow in Gold and Dow in Silver, since metals dropped more than stocks. DiG ended at 13.44 oz, up a wee 0.07%. DiS jumped 1.25% to 843.81 oz. US dollar index pulled away from its congestion today, rising 17 basis points (0,21%) to 81.18. 'Tis now reaching for the 200 DMA at 81.65. Crossing that will add gas to its tank. Euro broke clean through the lower boundary of its rising bearish wedge and lost 0.30% to $1.3578. Needs one more lower close to cement the breakdown. Next support does not appear until $1.3295. Ow. Yen changed its mind again today and fell back 0.24% to 95.38 cents/Y100. Japanese Nice Government Men don't want it to climb above that 20 DMA. Ten year US Treasury Note yield ticked up today, 1.91% to 2.993%. Probably on "taper" news. Momentum remains upward, although at a glacial pace. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Silver and Gold Prices Find Themselves Fighting Over Familiar Ground — Gold Must Hold Above $1,220 Posted: 08 Jan 2014 04:26 PM PST Gold Price Close Today : 1225.30 Change : -4.10 or -0.33% Silver Price Close Today : 19.518 Change : -0.247 or -1.25% Gold Silver Ratio Today : 62.778 Change : 0.577 or 0.93% Silver Gold Ratio Today : 0.01593 Change : -0.000148 or -0.92% Platinum Price Close Today : 1412.20 Change : -0.50 or -0.04% Palladium Price Close Today : 737.40 Change : -3.40 or -0.46% S&P 500 : 1,837.49 Change : -0.39 or -0.02% Dow In GOLD$ : $277.74 Change : $ -0.22 or -0.08% Dow in GOLD oz : 13.436 Change : -0.011 or -0.08% Dow in SILVER oz : 843.46 Change : 7.09 or 0.85% Dow Industrial : 16,462.74 Change : -68.20 or -0.41% US Dollar Index : 81.180 Change : 0.170 or 0.21% Silver and GOLD PRICES find themselves fighting over familiar ground. The gold price dropped $4.10 (0.3%) to $1,225.30 while silver lost 24.7 cents (0.13%) to 1951.8c. Today changes nothing and adds no new insight. The gold price remains above its 20 DMA and in the uptrend begun on 31 December. Gold has drawn a falling bullish wedge and broke out of that, and the breakout remains above the wedge's upper boundary line. Touched off it today. The SILVER PRICE shows a similar wedge, and a like performance. Not counting the 1872c thin market low on 31 December, silver is in an uptrend with a lower boundary rising through its December lows. However, it teeters on the edge. Really can't close below 1940c and gold must hold on above $1,220. It's all one big wheezy deal, and how it turns out is anybody's guess. Balance of proof they have bottomed remains on shoulders of silver and gold, and can only be borne by rising to higher prices. Extent of that power was seen today when the mighty stock market wilted at the hint in the Federal Open Market Committee's notes of its last meeting that it might, someday, somehow "taper." This taper handle turns out to be the best tool for manipulating public opinion since terrorism was invented. Clearly, by its money printing the Fed has placed a floor under stock prices. Everybody knows it, that's why they wilt at the magic word "taper." 'Twill be hard to resist the pull of this magic. Excepting the Nasdaq twins, stock indices fell across the board. Dow lurched down 68.2 (0.41%) to 16,462.74 while the S&P500 stumbled 0.39 (0.2%) to 1,837.49. Just the chart, ma'am, and a syllogism. Definition: a downtrend is a series of lower lows and lower highs. Since 31 December 2013 Dow and S&P500 have posted lower lows and lower highs. Ergo, the Dow and S&P500 are in a downtrend, transitory and migratory as it may be. Whether this downtrend will be of the evanescent or long-lasting variety time has not yet revealed to us. But stock's slide was not enough to lower the Dow in Gold and Dow in Silver, since metals dropped more than stocks. DiG ended at 13.44 oz, up a wee 0.07%. DiS jumped 1.25% to 843.81 oz. US dollar index pulled away from its congestion today, rising 17 basis points (0,21%) to 81.18. 'Tis now reaching for the 200 DMA at 81.65. Crossing that will add gas to its tank. Euro broke clean through the lower boundary of its rising bearish wedge and lost 0.30% to $1.3578. Needs one more lower close to cement the breakdown. Next support does not appear until $1.3295. Ow. Yen changed its mind again today and fell back 0.24% to 95.38 cents/Y100. Japanese Nice Government Men don't want it to climb above that 20 DMA. Ten year US Treasury Note yield ticked up today, 1.91% to 2.993%. Probably on "taper" news. Momentum remains upward, although at a glacial pace. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Gold Daily and Silver Weekly Charts Posted: 08 Jan 2014 03:11 PM PST |

| Gold Daily and Silver Weekly Charts Posted: 08 Jan 2014 03:11 PM PST |

| Proof that Monday's gold smash was not a 'fat finger' mistake but an algorithm attack Posted: 08 Jan 2014 02:58 PM PST 5:57p ET Wednesday, January 8, 2014 Dear Friend of GATA and Gold: Market data provider Nanex in Winnetka, Illinois, tonight produces proof that Monday's smash down in the gold futures market was not a mistaken "fat finger" trade but the product of a high-frequency algorithm trading program painstakingly designed to take the market down. Nanex's report, with great charts, is here: http://www.nanex.net/FlashCrash/OngoingResearch.html Zero Hedge's commentary on the report is here: http://www.zerohedge.com/news/2014-01-08/proof-golds-latest-slam-was-not... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT A Personal Touch in Buying Precious Metals If you've not secured your allocation of precious metals and numismatic coins, 2014 may be the last year to get them at affordable and undervalued prices. With huge amounts of gold leaving the West for Asia, the future availability of precious metals is very much in doubt. All Pro Gold has competitive pricing on all bullion and numismatic products -- and prompt delivery too. Long-time GATA supporters Fred Goldstein and Tim Murphy are glad to answer any questions or concerns about acquiring the monetary metals. All Pro Gold has an extensive electronic library of articles from the world's top market analysts. Learn more at www.allprogold.com or write to Fred and Tim at info@allprogold.com or telephone them at 1-855-377-4653. Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... GATA Reception in Vancouver Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Jim Sinclair plans seminars in Asheville and Austin Gold advocate and mining entrepreneur Jim Sinclair will hold his next market seminars from 2 to 6 p.m. Saturday, January 25, at the Clarion Inn Asheville, 550 Airport Road, Fletcher, North Carolina, and from 2 to 6 p.m. Saturday, February 8, at the Austin, Texas, Airport Hilton. Advance registration is required. Details for the Asheville seminar are posted at Sinclair's Internet site, JSMineSet.com, here: http://www.jsmineset.com/2014/01/07/north-carolina-qa-session-venue-conf... Details for the Austin seminar are posted at JSMineSet.com here: http://www.jsmineset.com/2014/01/02/austin-texas-qa-session-confirmed/ |

| Why Gold Will Drop to $1,000 Per Ounce Posted: 08 Jan 2014 02:20 PM PST When the market fails to confirm your thesis, it's time to step aside. You always hear traders say that they never "marry" a stock. That's because once you fall into the story, you tend to lose perspective. You seek out only opinions that confirm your thinking, tossing all other analysis out the window. Inevitably, this behavior leads to ruin. Even if you aren't a trader, there's still merit in adopting this maxim. It doesn't mean you have to drop all of the conviction from your investment strategy. Just know that it's impossible to tame the market. If you try to fight it at key turning points, there's a good chance you'll get burned. In December 2012, there was a new record in gold holdings by popular exchange-traded funds. The spot price hovered around $1,700. The 12-year golden bull appeared alive and well. That’s where the trouble started. At this point, gold had become too tradable with the invention of ETFs. They offered investors exposure to the physical metal. With ETFs, momentum traders could easily gain exposure to physical gold and hop right off if they didn't like the ride anymore. One of the market’s inconvenient truths is that one wave of selling can inspire countless other investors to run and hide. The same herd mentality that pushes prices skyward can also send them crashing down. That’s true of anything you trade on an open market — even gold. With that in mind, early last February, I made the following observation in The Rude Awakening as speculators exited gold:

That day, Feb. 4, gold was sitting at $1,667. A week later, we looked at the charts and called $1,550. Within the next two months, it dipped below $1,550… ultimately crashing to $1,330 by April 15. "$1,550," we wrote that day, "was enthusiastically bought every time gold dipped since its 2011 top. When this critical support area broke, it was lights out. Sellers are now in control. You must accept the fact that gold has entered a bear market." Come June 11, with gold at $1,374, I drew the new support level at $1,350. If the price crossed that line, I figured a swift drop to a range of $1,200-1,250 was reasonable. It only took another nine days for the Midas metal to break below $1,350 and sink to its year low — $1,178. At that point, I expected the metal to continue its downtrend, ultimately landing somewhere between $1,100-1,000. I still think that today. Where did I get $1,000 from, you ask? Well, $1,000 seems like a reasonable long-term floor. At that price, gold will have completely retraced its 2010-2011 push toward $2,000. I added the long-term moving average to this chart to give you a smooth look at gold's big, secular trend. Once price fell below this mark for the first time in 11 years, it became apparent that the massive uptrend was in trouble. Now, you might be thinking this is a chance to buck the herd and be a contrarian and think, Gold's dropping… people are selling… I should buy. But it's important to remember that the herd is usually wrong — at market turning points. Following the herd for the meat of a big move like the surge in stocks in the 1980s and 1990s or gold's roaring bull market in the 2000s was the correct move. But knowing when to jump on board (and when to head for the hills) is the tricky part. That's where technical analysis comes in handy. By analyzing price charts and projecting trend lines, you have the chance to spot major market turning points before the average investor catches on. If you set aside your emotions and follow the trends, you have a shot at buying into a big move while most investors are still selling — or selling out of a winning position while the herd sits and waits for a comeback that might never arrive. Let's use gold's 20-year chart as a breakdown… Take the late 1990s, for example. Gold was still locked in a downtrend — a series of lower highs and lower lows formed a downward trend channel. Instead of buying right away, you could've followed the trends and waited until the downtrend was broken. That would've been early 2002, when gold broke out toward $300. That marked a perfect opportunity for an aggressive buy. And even if you're a more conservative investor, you could have waited for a rising channel to form before making a buy. That would have postponed your purchase until mid-2003, when gold finally posted a meaningful higher low near $330. After you figured out your entry, there wasn't much more to do. Gold's bull market played out beautifully. The early stages (before most folks thought twice about gold) from 2002-06 gave you a tight rising channel. As gold started gaining popularity as an outperforming investment in 2006, you witnessed increased volatility, a much wider channel and even bigger gains. Until it broke below its trend channel, my analysis gave gold the benefit of the doubt on the upside. It wasn't until the big break that began setting up last winter that it appeared that the decade-long secular bull was finished. This is a perfect example of not trying to call a top — but to take what the market gives you. I wasn't super bearish gold at $1,800. It was still possible that the action we were seeing was noise or consolidation — or just a potential test of support (a necessity of a healthy bull run). It wasn't until just below $1,600 that I shifted my thinking firmly to the bear case. If you still doubt gold's trajectory… take a long-term look at the Dow/gold ratio. That is, the Dow Jones industrial average priced in gold.

The ratio touched an absurd peak of 43-to-1 when the tech bubble began to pop in 2000. It was reasonable to think the ratio was headed back to its 1932 level of 2-to-1… or the 1980s level of 1-to-1. In reality, the Dow-gold ratio bottomed a little below 6-to-1 in late 2011. At writing, it's back above 13-to-1. Clearly, the market didn't give a hoot about what anyone thought was reasonable. It's pretty obvious what happened when the Dow finally broke higher after years of decline versus gold. It signaled the massive performance shift we wrote about in February. After more than a decade in the driver's seat, gold is giving up ground to stocks. If you're still squeamish, ask yourself: Is your desire to buy gold based on reasonable analysis of market conditions? Or is it simply an emotional reaction to the sell-off? If you're a long-term-oriented investor, we suggest giving gold a chance to consolidate or move lower. After all, what's the rush? When was the last time you saw any asset class permanently recovered from a violent drop the very next day? It just doesn't work that way… There will be snapback rallies and more downside. Expect to wait a long, long time before a suitable base forms. The gold market experienced a great boom. Naturally, people flocked to it. Investors, traders, hedge funds and your crazy co-worker bought gold. People wanted to own it because of its performance. Now they've already left or are leaving. I don't think they'll be rushing back to buy anytime soon. Treat gold as a safe haven if you're going to buy now. If you jump into a gold position this year expecting explosive gains, you'll find nothing but disappointment… If you are well versed in trading, you could always try to play a snapback move in gold futures or miners instead. Gold will be off for a while… but miners potentially offer you a more powerful trading opportunity. You could gain some exposure through an ETF like Market Vectors Gold Miners ETF (NYSE:GDX). If that's your game, feel free to investigate it. We recommend keeping tight stops and expecting the unexpected. Regards, Greg Guenthner P.S. I’ve been telling my Rude Awakening readers about this for months now. Today I was able to share my views with Daily Reckoning, including a unique opportunity to gain exclusive access to my most in-depth market research. If you’re not getting The Daily Reckoning email edition, you’re missing out on the full story, including daily chances to learn about real, actionable profit opportunities. Don’t miss another issue. Sign up for FREE, right here. |

| Rick Rule - Silver Shorts About To Have A Religious Experience Posted: 08 Jan 2014 02:10 PM PST  Today one of the wealthiest people in the financial world warned King World News that the silver shorts are about to have a "truly religious experience." This is an incredibly important interview with Rick Rule, who is business partners with billionaire Eric Sprott, where he describes what is about to bring the gold and silver shorts to their knees and force the rigged paper markets to a "cash basis." Today one of the wealthiest people in the financial world warned King World News that the silver shorts are about to have a "truly religious experience." This is an incredibly important interview with Rick Rule, who is business partners with billionaire Eric Sprott, where he describes what is about to bring the gold and silver shorts to their knees and force the rigged paper markets to a "cash basis."This posting includes an audio/video/photo media file: Download Now |

| 23 Reasons to Be Bullish on Gold Posted: 08 Jan 2014 02:05 PM PST It’s been one of the worst years for gold in a generation. A flood of outflows from gold ETFs, endless tax increases on gold imports in India, and the mirage (albeit a convincing one in the eyes of many) of a supposedly improving economy in the US have all contributed to the constant hammering gold took in 2013. Perhaps worse has been the onslaught of negative press our favorite metal has suffered. It’s felt overwhelming at times and has pushed even some die-hard goldbugs to question their beliefs… not a bad thing, by the way. To me, a lot of it felt like piling on, especially as the negative rhetoric ratcheted up. Last year’s winner was probably Goldman Sachs, calling gold a “slam-dunk sale” for 2014 (this, of course, after it’s already fallen by nearly a third over a period of more than two and a half years—how daring they are). This is why it’s important to balance the one-sided message typically heard in the mainstream media with other views. Here are some of those contrarian voices, all of which have put their money where their mouth is…

And then there’s the people who should know most about how sound the world’s various types of paper money are: central banks. As a group, they have added tonnes of bullion to their reserves last year…

China ended 2013 officially as the largest gold consumer in the world. Chinese sentiment towards gold is well echoed in a statement made by Liu Zhongbo of the Agricultural Bank of China: “Because gold has capabilities to absorb external economic shocks, growth of its use in the international monetary system will be imminent.” And those commercial banks that have been verbally slamming gold—it turns out many are not as negative as it might seem…

None of these parties thinks the gold bull market is over. What they care about is safety in this uncertain environment, as well as what they see as enormous potential upside. In the end, the much ridiculed goldbugs will have had the last laugh.

|

| Gold on Roller Coaster 2014 Start as Price Falls Again Posted: 08 Jan 2014 01:24 PM PST Gold prices fall on Wednesday for the second consecutive session following two positive days to start 2014. ETF Securities U.S. Research Director Mike McGlone tells TheStreet's Joe Deaux that... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Inflation vs Deflation – Monetary Tectonics In 25 Amazing Charts Posted: 08 Jan 2014 01:17 PM PST We introduced the first chartbook from Incrementum Liechtenstein in the fall of last year. It showed the debt bear market in 50 amazing charts. In their second chartbook, Ronald Stoeferle and Mark Valek from Incrementum Liechtenstein analyzed in great detail the raging war between inflation and deflation, as well as gold's role in it. The authors introduce the term “monetary tectonics” as a metaphor for this war. Similar to tectonic plates under a volcano, monetary inflation and deflation is currently working against each other:

The following chart clearly shows that 2013 was a pivot year in which the monetary base M0 grew exponentially while net M2 (expressed on the chart line as M2 minus M0) declined significantly. The chartbook shows several trend which confirm the deflationary monetary pressure:

On the other hand, inflationary pressure is present through the following trends:

How is gold impacted in this inflation vs deflation war? The key conclusion of the research is that, due to the fractional reserve banking system and the dynamics of the 'monetary tectonics', inflationary and deflationary phases will alternate in the foreseeable future. Gold, being a monetary asset in the view of Austrian economics, tends to rise in inflationary periods and decline during times of disinflation. The key take-away for investors is to position themselves accordingly and consider price declines as buying opportunities for the coming inflationary period. How comes one can be so sure that inflation is coming? Consider that the government must avoid deflation; it is a horror scenario for the following reasons:

Interesting to know, Stoeferle and Valk developed the "Incrementum Inflation Signal," an indicator of how much monetary inflation reaches the real economy based on market and monetary indicators. According to the signal, investors should take positions according to the the rising, neutral or falling inflation trends.

Read the full chartbook (50 slides)

|

| Fed Tapering? With These Deflation Risks? Posted: 08 Jan 2014 12:58 PM PST The US central bank may be a long way from finished printing money yet... AN ARTICLE in the Wall Street Journal on Monday, "Where Deflation Risks Stir Concerns", brought to mind some very serious considerations, writes Miguel Perez-Santalla at BullionVault. Though recent memory only recalls the deflation and anemic economy of Japan, it behooves us to take a larger look at history to see the reaction of more open societies to this type of crisis. As stated in that WSJ article:

This was due to the inability of a business to remain profitable, forcing them to cut back on pay and let go of workers. That drove unemployment higher. But what the article fails to mention is that this was also a major catalyst in what led to Germany's uprising and eventually to World War Two. In fact, economic strife in the twentieth century, which opened the door to revolutionaries, was the major driver of the bloodshed that followed throughout Europe, for example in Bolshevik Russia and the Spanish Civil War as well. Today in the European Union, "Prices are falling only in Latvia, Greece and Cyprus," says the WSJ. Looking at these three countries and the social unrest reported, this is certainly a cause for concern. Will there be more violent outbreaks caused by a shrinking economy? Will there be a domino effect that spreads throughout the Eurozone to other weaker economies? In the experiment of social engineering we call the Eurozone there are concerns for its survival. The coming years will surely be a test of the governing bodies' ability to control in a peaceful manner both social unrest and increasing poverty. The recent economic calamity has spread real hardship. On the other side of the Atlantic the United States of America, which has pretty much felt insulated from the economic woes of Europe, may come to have this concern as well. The increasing income disparity, between rich and poor, combined with a deflationary economy, would be disastrous for the nation. Though currently growth looks positive it remains a concern to the US government and the Federal Reserve that we may slip into a period of falling prices, wages and credit. The world is a much smaller place than it was less than a lifetime ago. This means that these concerns are not only valid but also an ominous threat. This is the reason why the Fed remains cautious and not so ready to stop its Quantitative Easing money-printing as many economists expect. The US has historically been able to beat the threat from deflation mostly on the back of a growing population, increasing the utilization of natural resources to the benefit of economic productivity. But currently the population is growing at its slowest rate since the Great Depression. This combined with low credit growth and near-deflation in many consumer prices, plus our already large public debt burden, poses a long term threat. In the US, new gas and oil exploration and discoveries have grown, and this in no small way has been a positive factor to the overall economy, driving down many prices by cutting fuel costs. But will it be enough in the face of our other economic obstacles? Will the combination of a possible Eurozone deflation with a slow growing US, as well as rising inequality, trigger major social unrest here? With such uncertainty over the future of the global and domestic economies it is logical to seek some assurances. This is most likely why our Gold Investor Index in December remained positive, coming in at 52.9 and showing yet again more buyers of gold than sellers. Overall, and led by primarily long-term buy and hold investors, BullionVault users continue to maintain their position in the only sure thing the global economy has ever known. The risk of deflation, which led the Fed to print unheard of quantities of money starting 2008, isn't done yet. |

| Fed Tapering? With These Deflation Risks? Posted: 08 Jan 2014 12:58 PM PST The US central bank may be a long way from finished printing money yet... AN ARTICLE in the Wall Street Journal on Monday, "Where Deflation Risks Stir Concerns", brought to mind some very serious considerations, writes Miguel Perez-Santalla at BullionVault. Though recent memory only recalls the deflation and anemic economy of Japan, it behooves us to take a larger look at history to see the reaction of more open societies to this type of crisis. As stated in that WSJ article:

This was due to the inability of a business to remain profitable, forcing them to cut back on pay and let go of workers. That drove unemployment higher. But what the article fails to mention is that this was also a major catalyst in what led to Germany's uprising and eventually to World War Two. In fact, economic strife in the twentieth century, which opened the door to revolutionaries, was the major driver of the bloodshed that followed throughout Europe, for example in Bolshevik Russia and the Spanish Civil War as well. Today in the European Union, "Prices are falling only in Latvia, Greece and Cyprus," says the WSJ. Looking at these three countries and the social unrest reported, this is certainly a cause for concern. Will there be more violent outbreaks caused by a shrinking economy? Will there be a domino effect that spreads throughout the Eurozone to other weaker economies? In the experiment of social engineering we call the Eurozone there are concerns for its survival. The coming years will surely be a test of the governing bodies' ability to control in a peaceful manner both social unrest and increasing poverty. The recent economic calamity has spread real hardship. On the other side of the Atlantic the United States of America, which has pretty much felt insulated from the economic woes of Europe, may come to have this concern as well. The increasing income disparity, between rich and poor, combined with a deflationary economy, would be disastrous for the nation. Though currently growth looks positive it remains a concern to the US government and the Federal Reserve that we may slip into a period of falling prices, wages and credit. The world is a much smaller place than it was less than a lifetime ago. This means that these concerns are not only valid but also an ominous threat. This is the reason why the Fed remains cautious and not so ready to stop its Quantitative Easing money-printing as many economists expect. The US has historically been able to beat the threat from deflation mostly on the back of a growing population, increasing the utilization of natural resources to the benefit of economic productivity. But currently the population is growing at its slowest rate since the Great Depression. This combined with low credit growth and near-deflation in many consumer prices, plus our already large public debt burden, poses a long term threat. In the US, new gas and oil exploration and discoveries have grown, and this in no small way has been a positive factor to the overall economy, driving down many prices by cutting fuel costs. But will it be enough in the face of our other economic obstacles? Will the combination of a possible Eurozone deflation with a slow growing US, as well as rising inequality, trigger major social unrest here? With such uncertainty over the future of the global and domestic economies it is logical to seek some assurances. This is most likely why our Gold Investor Index in December remained positive, coming in at 52.9 and showing yet again more buyers of gold than sellers. Overall, and led by primarily long-term buy and hold investors, BullionVault users continue to maintain their position in the only sure thing the global economy has ever known. The risk of deflation, which led the Fed to print unheard of quantities of money starting 2008, isn't done yet. |

| Fed Tapering? With These Deflation Risks? Posted: 08 Jan 2014 12:58 PM PST The US central bank may be a long way from finished printing money yet... AN ARTICLE in the Wall Street Journal on Monday, "Where Deflation Risks Stir Concerns", brought to mind some very serious considerations, writes Miguel Perez-Santalla at BullionVault. Though recent memory only recalls the deflation and anemic economy of Japan, it behooves us to take a larger look at history to see the reaction of more open societies to this type of crisis. As stated in that WSJ article:

This was due to the inability of a business to remain profitable, forcing them to cut back on pay and let go of workers. That drove unemployment higher. But what the article fails to mention is that this was also a major catalyst in what led to Germany's uprising and eventually to World War Two. In fact, economic strife in the twentieth century, which opened the door to revolutionaries, was the major driver of the bloodshed that followed throughout Europe, for example in Bolshevik Russia and the Spanish Civil War as well. Today in the European Union, "Prices are falling only in Latvia, Greece and Cyprus," says the WSJ. Looking at these three countries and the social unrest reported, this is certainly a cause for concern. Will there be more violent outbreaks caused by a shrinking economy? Will there be a domino effect that spreads throughout the Eurozone to other weaker economies? In the experiment of social engineering we call the Eurozone there are concerns for its survival. The coming years will surely be a test of the governing bodies' ability to control in a peaceful manner both social unrest and increasing poverty. The recent economic calamity has spread real hardship. On the other side of the Atlantic the United States of America, which has pretty much felt insulated from the economic woes of Europe, may come to have this concern as well. The increasing income disparity, between rich and poor, combined with a deflationary economy, would be disastrous for the nation. Though currently growth looks positive it remains a concern to the US government and the Federal Reserve that we may slip into a period of falling prices, wages and credit. The world is a much smaller place than it was less than a lifetime ago. This means that these concerns are not only valid but also an ominous threat. This is the reason why the Fed remains cautious and not so ready to stop its Quantitative Easing money-printing as many economists expect. The US has historically been able to beat the threat from deflation mostly on the back of a growing population, increasing the utilization of natural resources to the benefit of economic productivity. But currently the population is growing at its slowest rate since the Great Depression. This combined with low credit growth and near-deflation in many consumer prices, plus our already large public debt burden, poses a long term threat. In the US, new gas and oil exploration and discoveries have grown, and this in no small way has been a positive factor to the overall economy, driving down many prices by cutting fuel costs. But will it be enough in the face of our other economic obstacles? Will the combination of a possible Eurozone deflation with a slow growing US, as well as rising inequality, trigger major social unrest here? With such uncertainty over the future of the global and domestic economies it is logical to seek some assurances. This is most likely why our Gold Investor Index in December remained positive, coming in at 52.9 and showing yet again more buyers of gold than sellers. Overall, and led by primarily long-term buy and hold investors, BullionVault users continue to maintain their position in the only sure thing the global economy has ever known. The risk of deflation, which led the Fed to print unheard of quantities of money starting 2008, isn't done yet. |

| Gold has beaten all other currencies since 2000 Posted: 08 Jan 2014 12:56 PM PST 4p ET Wednesday, January 8, 2014 Dear Friend of GATA and Gold: Lousy as 2013 was for gold in U.S. dollar terms, James Anderson of GoldSilver.com reports this week that from 2000 to the end of 2013 not one government currency performed better than gold did. A chart of government currencies' performance against gold in the new century is posted at GoldSilver.com here: http://goldsilver.com/article/race-to-debase-fiat-currency-vs-gold-fiat-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair plans seminars in Asheville and Austin Gold advocate and mining entrepreneur Jim Sinclair will hold his next market seminars from 2 to 6 p.m. Saturday, January 25, at the Clarion Inn Asheville, 550 Airport Road, Fletcher, North Carolina, and from 2 to 6 p.m. Saturday, February 8, at the Austin, Texas, Airport Hilton. Advance registration is required. Details for the Asheville seminar are posted at Sinclair's Internet site, JSMineSet.com, here: http://www.jsmineset.com/2014/01/07/north-carolina-qa-session-venue-conf... Details for the Austin seminar are posted at JSMineSet.com here: http://www.jsmineset.com/2014/01/02/austin-texas-qa-session-confirmed/ Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... GATA Reception in Vancouver Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT A Personal Touch in Buying Precious Metals If you've not secured your allocation of precious metals and numismatic coins, 2014 may be the last year to get them at affordable and undervalued prices. With huge amounts of gold leaving the West for Asia, the future availability of precious metals is very much in doubt. All Pro Gold has competitive pricing on all bullion and numismatic products. Long-time GATA supporters Fred Goldstein and Tim Murphy are glad to answer any questions or concerns about acquiring the monetary metals. All Pro Gold has an extensive electronic library of articles from the world's top market analysts. Learn more at www.allprogold.com or write to Fred and Tim at info@allprogold.com or telephone them at 1-855-377-4653. |

| 3-Month Silver Trade Off Extreme Sentiment Posted: 08 Jan 2014 12:51 PM PST Sentiment in silver futures is at an extreme. That might make a trade... TODAY we're going to share a timeless piece of trading wisdom that will help anyone make a lifetime of low-risk, high-reward trades, write Amber Lee Mason and Brian Hunt, editors of DailyWealth Trader for Steve Sjuggerud. And we're going to share our top way to put this knowledge to work right now... The piece of wisdom is: To consistently win in the market, the trader must be a "connoisseur of extremes". An extreme is when the majority of market participants are betting heavily on one side of the market. It's just like overstretching a rubber band: When it's stretched past the limit, it snaps back...and prices move at super-speed. Extremes can occur in an asset's fundamentals (valuation)...They can occur in an asset's technicals (price and trading volume)...And they can occur in market sentiment toward an asset (pessimism versus optimism). Over the last few months, we've shown subscribers a couple of sentiment extremes... A simple way to judge sentiment is with the "commitment of traders" (or COT) report. It's a government report that classifies market participants and tracks their positions. When these positions reach an extreme level of bullishness or bearishness, it can signal an impending market reversal. Since we showed a COT extreme in the oil market, prices have fallen 4%. Since we showed a COT extreme in the copper market, prices have broken out to a new eight-month high. We have a similar setup right now in silver. Take a look at the chart below. It shows the last three years of trading in silver (the black line) and the silver positions held by speculative trading funds (the blue line). As you can see, the blue line recently hit an extreme low. Speculative trading funds have rarely been this down on silver in the last 20 years.  Our go-to expert on sentiment analysis is Jason Goepfert, who runs the excellent SentimenTrader website. He notes:

That's exactly what happened to silver in late 2011: a 36% rise in two months. It happened again in summer 2012: a 33%, three-month rise. (We showed subscribers how to trade it.) And again in summer 2013: a 32%, two-month rise. (Again, we showed how to trade it.) But the best part about this "extreme" trade isn't the potential upside...It's the very low, very well-defined downside. You see, silver prices have fallen along with sentiment. Right now, the silver price is sitting just 6% above its two-year low. If silver violates these lows, silver's bear market will likely get "more extreme" before it's ready to snap back. We don't want to stick around for that. So we'd suggest setting a hard stop at $17.75. That's about 7% below today's levels. On the upside, we could easily see a quick 30% jump, just like the last three times around. In other words, you're risking $1 to potentially make $4. That's a low-risk, high-reward trade. And that's what you find when you become a connoisseur of extremes. |

| 3-Month Silver Trade Off Extreme Sentiment Posted: 08 Jan 2014 12:51 PM PST Sentiment in silver futures is at an extreme. That might make a trade... TODAY we're going to share a timeless piece of trading wisdom that will help anyone make a lifetime of low-risk, high-reward trades, write Amber Lee Mason and Brian Hunt, editors of DailyWealth Trader for Steve Sjuggerud. And we're going to share our top way to put this knowledge to work right now... The piece of wisdom is: To consistently win in the market, the trader must be a "connoisseur of extremes". An extreme is when the majority of market participants are betting heavily on one side of the market. It's just like overstretching a rubber band: When it's stretched past the limit, it snaps back...and prices move at super-speed. Extremes can occur in an asset's fundamentals (valuation)...They can occur in an asset's technicals (price and trading volume)...And they can occur in market sentiment toward an asset (pessimism versus optimism). Over the last few months, we've shown subscribers a couple of sentiment extremes... A simple way to judge sentiment is with the "commitment of traders" (or COT) report. It's a government report that classifies market participants and tracks their positions. When these positions reach an extreme level of bullishness or bearishness, it can signal an impending market reversal. Since we showed a COT extreme in the oil market, prices have fallen 4%. Since we showed a COT extreme in the copper market, prices have broken out to a new eight-month high. We have a similar setup right now in silver. Take a look at the chart below. It shows the last three years of trading in silver (the black line) and the silver positions held by speculative trading funds (the blue line). As you can see, the blue line recently hit an extreme low. Speculative trading funds have rarely been this down on silver in the last 20 years.  Our go-to expert on sentiment analysis is Jason Goepfert, who runs the excellent SentimenTrader website. He notes:

That's exactly what happened to silver in late 2011: a 36% rise in two months. It happened again in summer 2012: a 33%, three-month rise. (We showed subscribers how to trade it.) And again in summer 2013: a 32%, two-month rise. (Again, we showed how to trade it.) But the best part about this "extreme" trade isn't the potential upside...It's the very low, very well-defined downside. You see, silver prices have fallen along with sentiment. Right now, the silver price is sitting just 6% above its two-year low. If silver violates these lows, silver's bear market will likely get "more extreme" before it's ready to snap back. We don't want to stick around for that. So we'd suggest setting a hard stop at $17.75. That's about 7% below today's levels. On the upside, we could easily see a quick 30% jump, just like the last three times around. In other words, you're risking $1 to potentially make $4. That's a low-risk, high-reward trade. And that's what you find when you become a connoisseur of extremes. |

| GLD's gold sent to Asia isn't coming back, Williams tells KWN Posted: 08 Jan 2014 12:49 PM PST 3:45p ET Wednesday, January 8, 2014 Dear Friend of GATA and Gold: In the second part of his latest interview with King World News, fund manager Grant Williams, editor of the "Things That Make You Go Hmmm. ..." letter, notes the rising number of claims to each gold ounce immediately available for delivery on the New York Commodities Exchange and the huge decline in gold held by the exchange-traded fund GLD, gold that has moved to Asia and "is not coming back." An excerpt from his interview is posted at the KWN blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/1/8_Thi... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... GATA Reception in Vancouver Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |