saveyourassetsfirst3 |

- Gold price in for another tough year, but floor to be found around $1,150

- What to expect in the new year from gold - Holmes

- Exceptional demand sees U.K. Royal Mint run out of sovereign gold coins

- Precious Metals: Risk Management To Opportunity

- UK Mint runs out: “Due to the low price level, we’re currently experiencing high demand.”

- Fed Tapering? With These Deflation Risks?

- JPMorgan and Market Manipulation

- Gold’s support above $1,200 getting stronger – Phillips

- Forex Trading Alert: U.S. Dollar Extends Gains

- Citi not bullish on gold's outlook

- Can't-miss headlines: Gold slides to $1,220, Impact hits gold in Mexico & more

- Gold stands by for U.S. headwinds

- The gold-silver ratio and $150 silver

- Can a monetary "deflation" happen in a world of floating exchange rates and no gold standard?

- More Puzzle Pieces

- First Majestic’s Del Toro Silver Mine Pours Silver Doré

- Global Currency Reset, Amero, The Gold Silver Ratio and $150 Silver

- Where is the German Gold?

- Is the gold correction over?

- Bundesbank changes its story about gold repatriated from New York Fed

- TEOTWAWKI

- 23 Reasons to Be Bullish on Gold

- Bron Suchecki: Tricks can be played with Comex gold storage data

- Gold mine deals seen rebounding on fire-sale prices

- Alasdair Macleod: Gov’t Has Lost Control, Complete COLLAPSE of the DOLLAR Coming!

- Platinum bonds seen beating bearish gold

- Gold focuses on differing economic trajectories

- Economic Growth Is Achieved By Two Events

- John Williams- Currency Panic & Hyperinflation Arrives in 2014!

- Stewart Thomson: Lower Oil To Fuel Gold Higher In 2014

- Global Currency Reset, Amero, The Gold Silver Ratio and $150 Silver

- Global Currency Reset, Amero, The Gold Silver Ratio and $150 Silver

- Buy Gold As Wealth

- 2014 The End Of The Beginning

- Chinese FX Expert Says Gold is a Currency That China Must Dominate

- Seven King World News Blogs/Audio Interviews

- Race to Debase: Fiat Currency vs. Gold -- Fiat Currency vs Silver :: 2000 - 2014

- Hedge Funds Raise Gold Wagers as Yamada Sees $1,000

- Iran tries to reverse a slumping birth rate: offers gold coins

- India May Keep Gold-Import Curbs Past March to Contain Deficit

- Chinese Gold Demand Strong at Start of 2014

- Chinese FX expert says gold is a currency that China must dominate

- Gold Ends Weaker On Technical Correction, Firmer U.S. Dollar

- Gold 1206 is Now Possible Support before the Low

- Gold: Technical Signs Suggest Possible Bounce This Week

- TD Securities - Silver spot price could rally to 21.9 on break above 20.45

- In the land of the goldbugs who choose to be blind, the one-eyed blogger is king

- Paolo Lostritto Outlines the Lombardi Method of Gold Investing

- My gold fund has fallen by half. Should I sell?

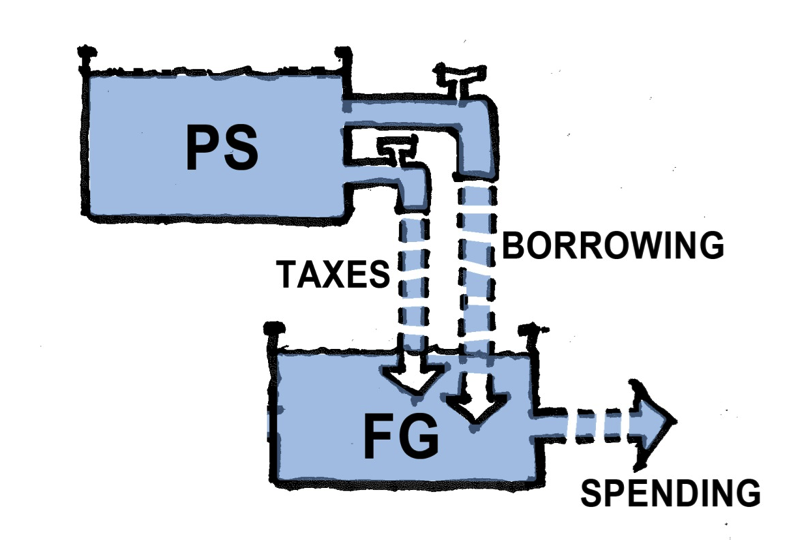

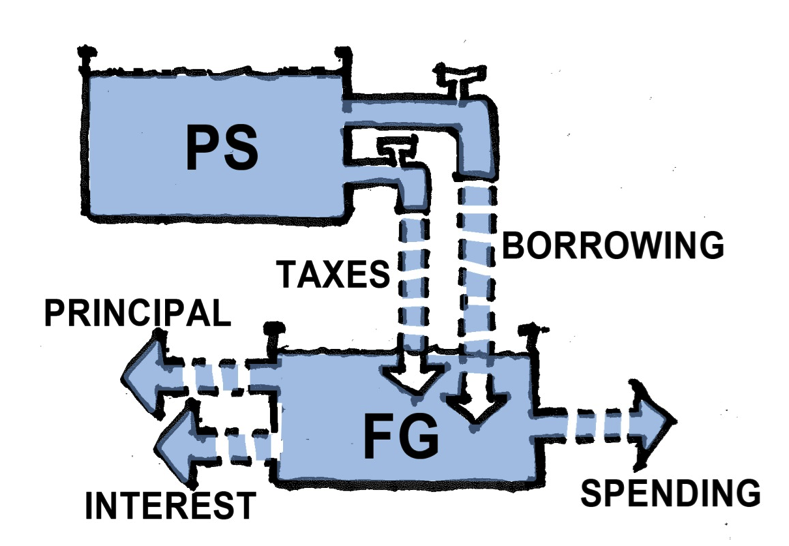

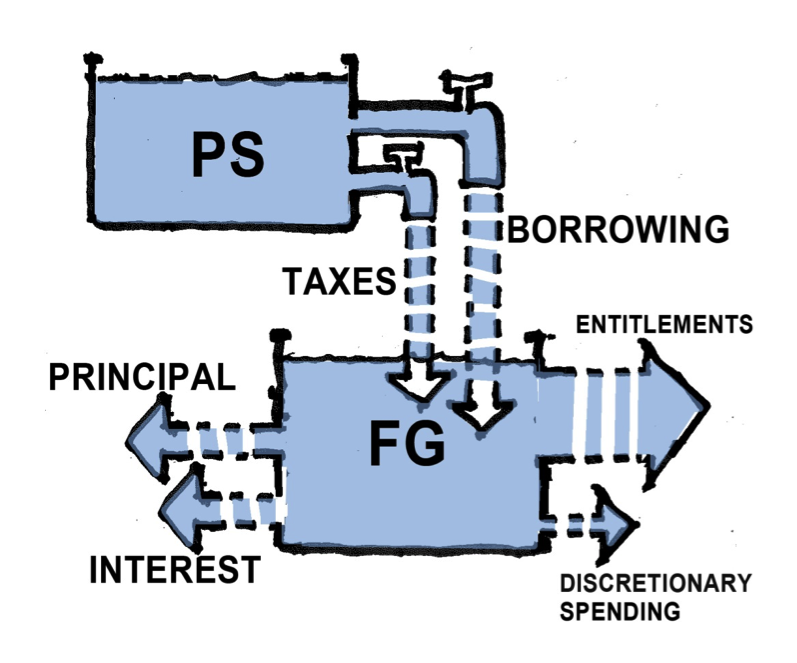

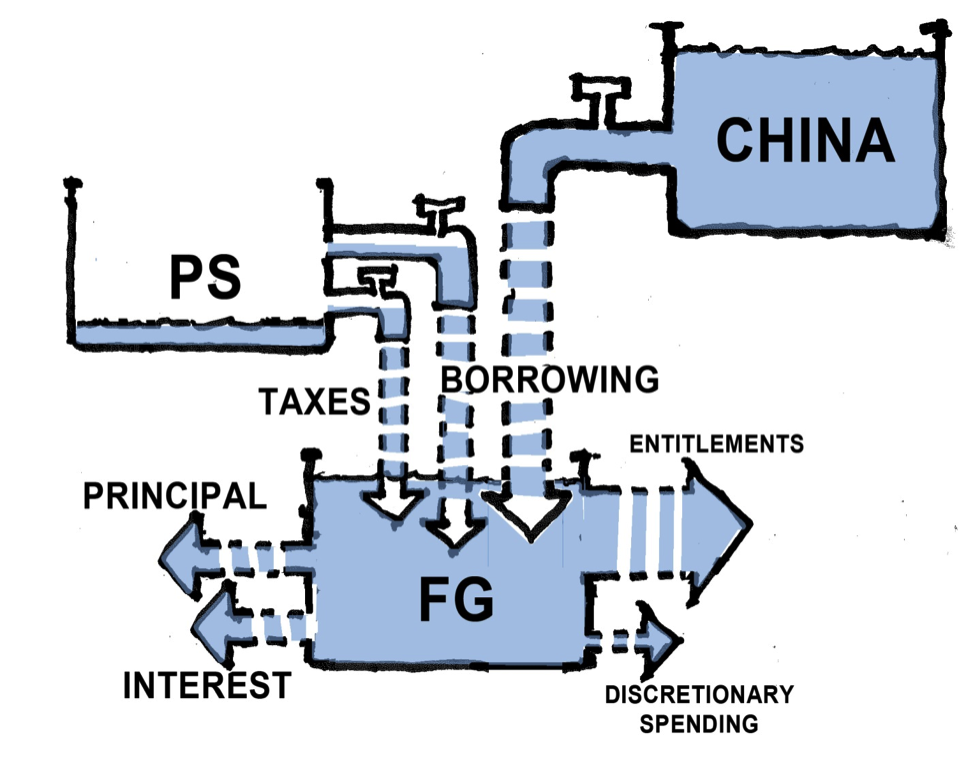

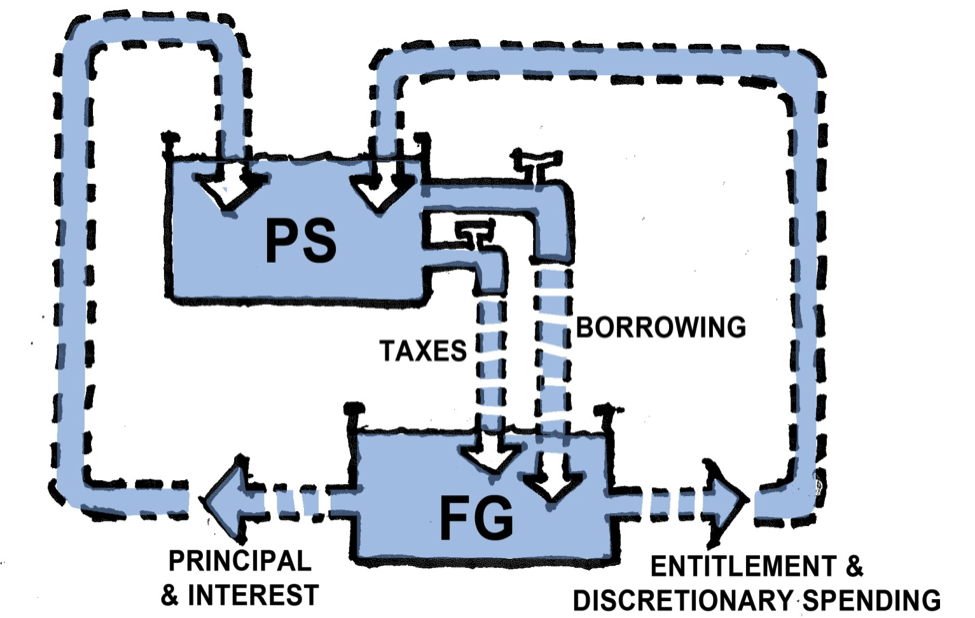

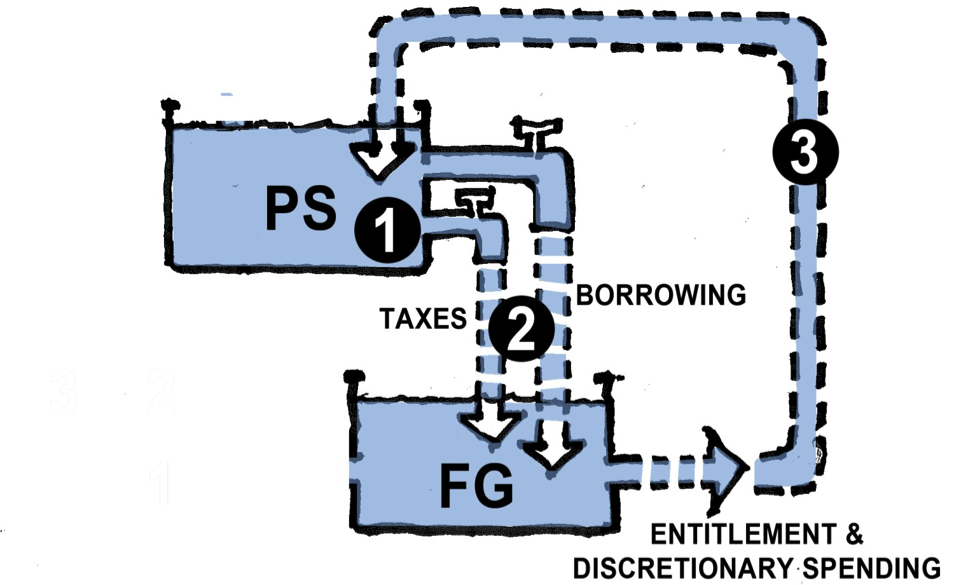

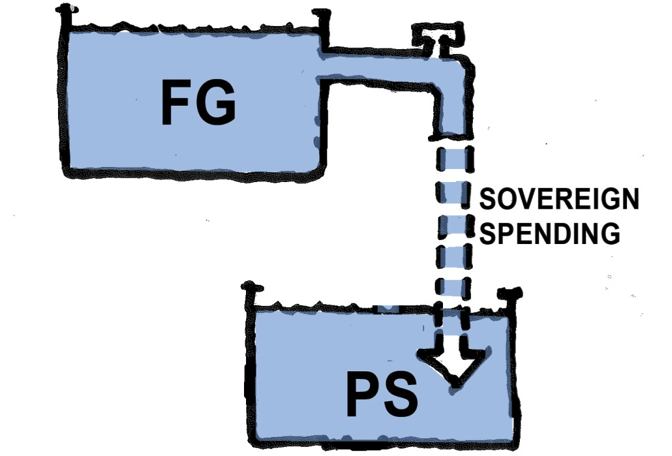

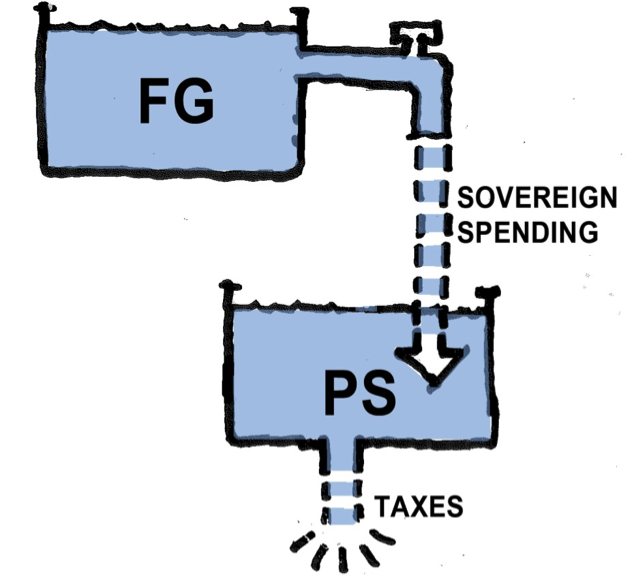

- Diagrams and Dollars: Modern Money Illustrated (Part 1)

| Gold price in for another tough year, but floor to be found around $1,150 Posted: 08 Jan 2014 05:28 PM PST According to Natixis's Nic Brown, while prices are likely to push lower in 2014, they are unlikely to push much below $1150 before turning. |

| What to expect in the new year from gold - Holmes Posted: 08 Jan 2014 05:24 PM PST After three years of pain, can gold stocks break their losing streak and see a gain in 2014, asks Frank Holmes |

| Exceptional demand sees U.K. Royal Mint run out of sovereign gold coins Posted: 08 Jan 2014 05:21 PM PST The mint expects to have stocks of the coins again by the end of January, it said after experiencing exceptional demand on the back of low prices. |

| Precious Metals: Risk Management To Opportunity Posted: 08 Jan 2014 01:02 PM PST What Has Been A solid 2.5 years of risk management (to varying degrees) has been required of precious metals investors. It was most intensely required after the announcement of QE3, when the net commercial short position in silver began a relentless march toward a very bearish alignment in late 2012 and then the HUI Gold Bugs index lost an important support level at around 460. Here is the chart of silver with a heavy commercial net short position from NFTRH 215, dated 12.2.12: (click to enlarge) As for the HUI, NFTRH 215 also noted this on 12.2.12:

The sharp rally into and through |

| UK Mint runs out: “Due to the low price level, we’re currently experiencing high demand.” Posted: 08 Jan 2014 01:02 PM PST U.K. Royal Mint Runs Out of Sovereign Gold Coins on Demand

I love the January sales! Who doesn’t love a 50% discount? |

| Fed Tapering? With These Deflation Risks? Posted: 08 Jan 2014 12:58 PM PST The US central bank may be a long way from finished printing money yet... AN ARTICLE in the Wall Street Journal on Monday, "Where Deflation Risks Stir Concerns", brought to mind some very serious considerations, writes Miguel Perez-Santalla at BullionVault. Though recent memory only recalls the deflation and anemic economy of Japan, it behooves us to take a larger look at history to see the reaction of more open societies to this type of crisis. As stated in that WSJ article:

This was due to the inability of a business to remain profitable, forcing them to cut back on pay and let go of workers. That drove unemployment higher. But what the article fails to mention is that this was also a major catalyst in what led to Germany's uprising and eventually to World War Two. In fact, economic strife in the twentieth century, which opened the door to revolutionaries, was the major driver of the bloodshed that followed throughout Europe, for example in Bolshevik Russia and the Spanish Civil War as well. Today in the European Union, "Prices are falling only in Latvia, Greece and Cyprus," says the WSJ. Looking at these three countries and the social unrest reported, this is certainly a cause for concern. Will there be more violent outbreaks caused by a shrinking economy? Will there be a domino effect that spreads throughout the Eurozone to other weaker economies? In the experiment of social engineering we call the Eurozone there are concerns for its survival. The coming years will surely be a test of the governing bodies' ability to control in a peaceful manner both social unrest and increasing poverty. The recent economic calamity has spread real hardship. On the other side of the Atlantic the United States of America, which has pretty much felt insulated from the economic woes of Europe, may come to have this concern as well. The increasing income disparity, between rich and poor, combined with a deflationary economy, would be disastrous for the nation. Though currently growth looks positive it remains a concern to the US government and the Federal Reserve that we may slip into a period of falling prices, wages and credit. The world is a much smaller place than it was less than a lifetime ago. This means that these concerns are not only valid but also an ominous threat. This is the reason why the Fed remains cautious and not so ready to stop its Quantitative Easing money-printing as many economists expect. The US has historically been able to beat the threat from deflation mostly on the back of a growing population, increasing the utilization of natural resources to the benefit of economic productivity. But currently the population is growing at its slowest rate since the Great Depression. This combined with low credit growth and near-deflation in many consumer prices, plus our already large public debt burden, poses a long term threat. In the US, new gas and oil exploration and discoveries have grown, and this in no small way has been a positive factor to the overall economy, driving down many prices by cutting fuel costs. But will it be enough in the face of our other economic obstacles? Will the combination of a possible Eurozone deflation with a slow growing US, as well as rising inequality, trigger major social unrest here? With such uncertainty over the future of the global and domestic economies it is logical to seek some assurances. This is most likely why our Gold Investor Index in December remained positive, coming in at 52.9 and showing yet again more buyers of gold than sellers. Overall, and led by primarily long-term buy and hold investors, BullionVault users continue to maintain their position in the only sure thing the global economy has ever known. The risk of deflation, which led the Fed to print unheard of quantities of money starting 2008, isn't done yet. |

| JPMorgan and Market Manipulation Posted: 08 Jan 2014 12:47 PM PST For several years evidence has been gathering about the suppression of precious metal prices in the face of skyrocketing demand for the physical precious metals in places like India and China. They have recently been buying up a major chunk of what is reportedly a year’s worth of production. Evidence has been accumulating that banks and government entities that claim to have large stores of the physical precious metals may only have a tiny fraction of what they claim. The precious metals investment community was certainly shaken when the Fed told Germany, when they asked for their gold back, that they needed to wait 7 years to get it back. (Remember it’s all supposedly tucked away safely in Fed vaults) What’s that? Say that again! It will take the Fed 7 years to return another government’s property they stored with them for safekeeping? This is 2014 – planes cross the ocean in hours, ships take several days, FedEx has next day delivery. I’m sure if the Fed told Germany they could get their gold tomorrow Germany could arrange transportation the day after. They only reason I can think of that it would take seven years is because the Fed doesn’t have it. If they have another explanation I’m willing to hear it along with insistence for the first independent audit of Fort Knox and the Fed vaults in a long time. One of the leading investigators into the manipulation of the precious metals market is Ted Butler. In his post 2013 – The Year of JPMorgan Ted details some of the suspicious moves by JPMorgan that just appear to be much more than mere coincidence. Everyone who is interested in the precious metals and investing should read this article and go to Ted’s site SilverSeek According to Ted Butler the price moves in the market took place over such a short time span, about five trading days, and the movements don’t seem like they were driven normal market forces. With Ted’s calculation that JPMorgan stood to profit by 3 Billion Dollars their motivation is not hard to figure out. But Ted tells this sordid tale better than I. He’s been following this much longer than I have and has uncovered the research to back up his claims. I would urge you all to go to 2013 – The Year of JPMorgan and read the full article. The chances of getting any of our politicians to take action is slim to none. Now that corporations have been declared “persons” by the conservative court and tons of money are to be had for the politician listening to Wall Street Lobbyists maybe even the dream of democracy is slipping away under the corporatization of the government. There are some pundits that have recently proclaimed that gold is going to $700. You can believe that if you want and place your vote (and your money that way) But as for me personally I’ll be placing my bets with JPMorgan, India and China and picking up some precious metals bargains now. As always consult with your financial adviser before making any investment. All investments, including precious metals carry the risk of a significant loss of capital. I converted my IRA to a precious metals IRA earlier this year. It was a two week search to find the 4 required entities that would both work together and meet my standards. There are some vitally important differences and questions about the type of account, storage, business separation of the different parties, etc. that you need to have answered before you proceed. Within a few weeks I’ll be completing a video course on how to set it up and offering it here on preciousmetalsinvesting.com Even after doing my due diligence the metals took their dive this year and I saw the value of my IRA sink significantly. I wasn’t worried because an IRA is a long term investment. But, as one who is involved in precious metals I admit the sector is volatile and the ride can be bumpy. In short, if you can’t stand the heat stay out of the kitchen. |

| Gold’s support above $1,200 getting stronger – Phillips Posted: 08 Jan 2014 12:23 PM PST Despite attempts to knock gold back, the price is well supported at these levels and psychologically strong, says Julian Phillips. |

| Forex Trading Alert: U.S. Dollar Extends Gains Posted: 08 Jan 2014 12:14 PM PST SunshineProfits |

| Citi not bullish on gold's outlook Posted: 08 Jan 2014 12:11 PM PST Citi is not bullish on Gold at this stage. The early signs of growth in Europe, the pickup in growth in the U.S. and the improvement in global economy suggest that people are becoming more risk seeking. Hence in all probabilities, they may shed their gold holdings, which normally are... |

| Can't-miss headlines: Gold slides to $1,220, Impact hits gold in Mexico & more Posted: 08 Jan 2014 12:02 PM PST The latest morning headlines, top junior developments and metal price movements. Today the gold price is on the decline and Impact cuts some high grade silver and gold in Mexico. |

| Gold stands by for U.S. headwinds Posted: 08 Jan 2014 11:53 AM PST The gold price has shown itself to be relatively resilient in the first week of 2014; however, it is about to face a barrage of headwinds in the coming days and weeks -- courtesy of the U.S. Federal Reserve. |

| The gold-silver ratio and $150 silver Posted: 08 Jan 2014 11:43 AM PST There are a number of reasons that silver should revert to the long term historical mean but the two primary ones are the fact that geologically in the earth's crust there are fifteen parts of silver to every one part of gold. |

| Can a monetary "deflation" happen in a world of floating exchange rates and no gold standard? Posted: 08 Jan 2014 11:42 AM PST Itulip |

| Posted: 08 Jan 2014 11:30 AM PST Did you know that the Yuan has now surpassed the Euro in trade settlement? In fact, the market share that global trade is now settling in Yuan is almost 5 times higher today than it was just 2 years ago. Big deal you say? Well, it is a big deal, very big! What this means is that the Yuan is emerging from obscurity and making itself ready to step in as the dollar steps out. I ask you this, have you ever wondered “why” China is buying every ounce of gold that they can get their hands on? Is it because they see gold as undervalued? Are they buying all this gold hoping to “make a profit?” The answers are no. Of course they see gold as undervalued but more importantly they see it as “scarce” and NO they are absolutely not looking to make a profit. What China is doing is simply “building and fortifying their foundation.” This foundation is to support their currency and its value when (not if) the dollar is shunned for trade settlement. Is this speculation on their part? I highly doubt it. Ask yourself why the Saudis are making so much noise about “fracking.” Why now? We know for a fact that the Chinese and Saudis have met over the last 2 years and particularly in the last 6-8 months, do you suppose the “Petrodollar” system might have been discussed? Just a little. These are just more pieces to the puzzle that if you are watching closely will give you clues to what’s really happening. Do you think that Russia is standing behind Syria and facing us down was per chance? Or the current war of words between Japan and China? Do you really believe that China is barking at Japan and has forgotten that by treaty “we must protect” Japan? Never since WWII, during the cold war or afterwards has Russia and China stood up to the US as they are now. But why now? Because they not only sense weakness, they can clearly see it. They know that our “reporting” of things economic and financial are bogus. They know exactly how much gold they have moved into their own borders and they can do more than the simple math required to figure out how close to the bottom of the barrel we really are. Others around the world can see this too. Why do you think Great Britain recently met with China? For afternoon tea? No, Britain wants to know where they will stand in this after the smoke clears…because they can see it happening and they KNOW. We Americans for the most part don’t know. Is it because we are a “foolish” country or breed? No, but we have been dumbed down purposely. You don’t agree or believe me? Watch this. It takes a comedian, Conan O’Brien to tell you the truth. How many TV stations across the country said exactly the same thing? Could it be coincidence that every single “news anchor” had the exact same words? Not possible but the larger ramifications are what? Maybe that we are not only hearing but one side (the official side) to every story? It has taken a long time but finally the LA Times did a story on the radiation hitting the west coast from the Fukushima disaster. For how long has this topic been on the radar of “alternative news?” And the quote from San Jose officials as to why the levels of radiation are so high? “We are befuddled?” Really? My point is this, we are in the midst of losing the privilege of issuing the reserve currency…yet very few Americans know or understand this. Foreigners can see it clearly and are preparing which is why gold demand all over the world has exploded.Similar Posts: |

| First Majestic’s Del Toro Silver Mine Pours Silver Doré Posted: 08 Jan 2014 11:20 AM PST The first silver doré bar production at First Majestic's T.FR Del Toro Silver Mine in Zacatecas, Mexico was announced December 4, 2013. In making that announcement, First Majestic CEO Keith Neumeyer stated, "The commencement of silver doré production at Del Toro is another significant milestone for First Majestic this year. The Del Toro Silver Mine continues to be a substantial growth driver for the Company as silver production ramps up from this new mine. With the plant construction nearly complete, this achievement puts First Majestic on track to reaching its tenth consecutive year of growth in silver production." We had the opportunity to speak with Mr. Neumeyer December 16th, 2013, "Since 2005 we have invested approximately $150 million dollars in the Del Toro mine. It's the Company's largest investment ever so achieving production from Del Toro is our most important achievement in 2013." said Neumeyer. Read the Entire Interview at Resources Wire The post First Majestic's Del Toro Silver Mine Pours Silver Doré appeared first on The Daily Gold. |

| Global Currency Reset, Amero, The Gold Silver Ratio and $150 Silver Posted: 08 Jan 2014 11:15 AM PST

There are a number of reasons that silver should revert to the long term historical mean but the two primary ones are the fact that geologically in the earth's crust there are fifteen parts of silver to every one part of gold. The other reason is that silver is used in many industrial, technological, medical [...] The post Global Currency Reset, Amero, The Gold Silver Ratio and $150 Silver appeared first on Silver Doctors. |

| Posted: 08 Jan 2014 10:48 AM PST Almost a year ago, the German government put in a formal request to reclaim (repatriate) a portion of their gold reserves held outside of Germany. Reports on the progress of this initiative have raised quite a few questions. |

| Posted: 08 Jan 2014 10:32 AM PST After more than a decade of perpetual strength, gold suffered its worst losses since the early 1980s. Many investors have eschewed the metal in favor of stronger markets; however, this has helped to return this long-term bull market to health. |

| Bundesbank changes its story about gold repatriated from New York Fed Posted: 08 Jan 2014 10:02 AM PST GATA |

| Posted: 08 Jan 2014 09:30 AM PST

Bleeding a patient is ALWAYS done gradually. They won't announce a 10% devaluation, they will do 4%, then follow up later with 6% more. Currency controls work, to a point – they keep the large masses of people from moving wealth, but never those who have substantial amounts of it. Also, when an entire populace [...] The post TEOTWAWKI appeared first on Silver Doctors. |

| 23 Reasons to Be Bullish on Gold Posted: 08 Jan 2014 09:03 AM PST 23 Reasons to Be Bullish on Gold |

| Bron Suchecki: Tricks can be played with Comex gold storage data Posted: 08 Jan 2014 09:02 AM PST GATA |

| Gold mine deals seen rebounding on fire-sale prices Posted: 08 Jan 2014 08:31 AM PST Investment bankers see gold-mining deals rebounding this year from a near-decade low as producers target assets at fire-sale prices after the metal plunged. |

| Alasdair Macleod: Gov’t Has Lost Control, Complete COLLAPSE of the DOLLAR Coming! Posted: 08 Jan 2014 08:15 AM PST

In this interview with Finance & Liberty’s Elijah Johnson, Alasdair Macleod discusses the worst year price wise for gold since 1981 in the face of all-time record physical demand for both gold and silver in 2013, and states that western governments have destroyed their currencies and lost control of the system! Alasdair’s full interview with [...] The post Alasdair Macleod: Gov’t Has Lost Control, Complete COLLAPSE of the DOLLAR Coming! appeared first on Silver Doctors. |

| Platinum bonds seen beating bearish gold Posted: 08 Jan 2014 08:15 AM PST According to Momentum Asset Management, South African platinum company bonds will probably outperform the debt of gold producers this year. |

| Gold focuses on differing economic trajectories Posted: 08 Jan 2014 08:00 AM PST With Janet Yellen confirmed as the new Fed chairman, gold is now focused on the different economic trajectories of the various major economies. The U.S. is strengthening while the U.K. is trying to cool off its hot housing market. |

| Economic Growth Is Achieved By Two Events Posted: 08 Jan 2014 07:45 AM PST Richard Duncan, author of The Dollar Crisis has some interesting views on the economy. They are a bit off the beaten path, but very much worth pondering. Summing up his views… THE FACTORS THAT LEAD TO A GROWING ECONOMY Economic growth is achieved by two events. New workers coming into the work place and credit growth. Both are now failing. We have shrinking demographics and less income growth. Credit growth drove the economy since 1960. In 1964 it was one trillion. Now it's $58 trillion, a 58-times expansion of credit. In 2008 credit started to contract. The Fed reacted by instituting QE and since then the Fed has increased its balance sheet by $3 trillion. QE drove the economy, taking the place of the contraction in credit growth. The household sector net worth is up 40 percent since the onset of QE. Stocks are up. Property values are up. The increase in wealth is holding things together. The Fed needs the wealth effect from rising stocks and housing. The stock market is driven by QE liquidity, but if the Fed tapers the stock market could crash. The Fed will have to taper gently. They will have to find a balance, supporting the "wealth effect" without simultaneously creating a stock market "bubble." (Honestly, I think that they already have!) The economy used to be driven by labor and income growth; now its added leverage – QE, which pours into the stock and housing market and creates the "wealth effect," which spills back into the economy. We live in the later stages of an aging population (aging baby boomers), which has pushed the Labor Participation Rate back to levels last seen in the 1970s. Globalization is holding down wages. Credit growth must be OVER 2 PERCENT AFTER INFLATION to support the economy. Credit grew 9-fold from 1952 to 2007 before the recession set in. Is the recession over? Recessions don't end until credit rises above 2 percent after inflation and that has yet to happen. To catch up, credit needs to grow 4 percent! It needs to grow to $58 trillion, which requires an additional $2.3 trillion of NEW CREDIT GROWTH. Without this much growth in credit we won't be able to stimulate the economy. IT WON'T HAPPEN. THE EFFECT OF BUDGET DEFICITS ON THE ECONOMY Most people believe that a SHRINKING budget deficit is a good thing. From its peak, our budget deficit will shrink by $400 billion in 2014. But that means $400 billion LESS re-circulating back into our economy. China recycles their budget surplus (which comes from our dollars traded for their Walmart everythings) back into our economy. What else can you do with dollars? You spend them in the US (sooner or later). If China spends the surplus to buy euro or with other countries, the dollars eventually will come back into our Treasuries, either directly or indirectly, second hand. Never forget that liquidity drives asset growth! Fiat money is created by central banks printing money to finance government borrowing. Government borrowing sucks liquidity OUT with increased BUDGET DEFICITS. Non-U.S. central banks with trade surplus dollars CREATE LIQUIDITY. China has $3.7 trillion in foreign currency reserves. They create yuan to buy U.S. dollars from Chinese industry, which arrive by their trade surplus. They need to re-invest these dollars to get interest. The U.S. Current Account Deficit peaked in 2006 at $800 billion. They were accumulated by foreign central banks and RECYCLED BACK to the U.S. This year there will only be $400 billion recycled back, a drop of $400 billion! (See article in Jim Sinclair's portion of the Featured Articles section on trade deficit with China) In order to compensate for the loss the Fed created between one trillion and $1.4 trillion of fiat liquidity (QE). The projected deficit for 2014 is "only" $700 billion so that leaves an extra $700 billion of liquidity to flow into stocks and real estate – all courtesy of the Fed and their massive excess liquidity. The problem is the excess liquidity inflates assets (stocks, housing). When there is negative liquidity, assets fall. The Fed's QE plus our trade deficit (which is recycled back to the U.S.) equals liquidity. Our budget deficit with China is around $330 billion. What will they do with it? Buy dollar assets, of course. There is nothing else they can do (if they want a return on the surplus). And we support their economy by buying their products. THEY MUST ACCUMULATE DOLLARS (TO SUPPORT THEIR ECONOMY) AND THEY MUST BUY U.S. TREASURYS TO GET INTEREST. All of this reminds me of the uneasy truce that the rival biker gangs (Sons of Anarchy and Mayans) maintain in the great series, Sons of Anarchy. Highly recommended! To wrap this up, remember what Bill Holter is often pointing out – China will continue to accept dollars as long as they can recycle them for physical gold. That is an over-simplification, but it rings strongly of the truth. They need us, we need them, and THEY NEED OUR GOLD. And so we oblige. But that will soon come to an end and then we will let the politicians work it out, while we revel in the massive new wealth our gold holdings will reflect.Similar Posts: |

| John Williams- Currency Panic & Hyperinflation Arrives in 2014! Posted: 08 Jan 2014 07:00 AM PST

Economist John Williams thinks 2014 will mark the beginning of hyperinflation. Williams contends, "You are going to see, early on, a crisis in the dollar that will start to trigger the inflation . . . as the inflation picks up, that's going to savage the economy, which is already in a depression. It never recovered." [...] The post John Williams- Currency Panic & Hyperinflation Arrives in 2014! appeared first on Silver Doctors. |

| Stewart Thomson: Lower Oil To Fuel Gold Higher In 2014 Posted: 08 Jan 2014 06:00 AM PST

Barring a black swan event, lower oil prices are quite likely in 2014, and that should be viewed as very good news for gold investors! Lower oil is good news because oil imports are the main cause of the Indian current account deficit (CAD). The current Indian government has done nothing substantial to reduce oil [...] The post Stewart Thomson: Lower Oil To Fuel Gold Higher In 2014 appeared first on Silver Doctors. |

| Global Currency Reset, Amero, The Gold Silver Ratio and $150 Silver Posted: 08 Jan 2014 05:02 AM PST gold.ie |

| Global Currency Reset, Amero, The Gold Silver Ratio and $150 Silver Posted: 08 Jan 2014 04:40 AM PST There are a number of reasons that silver should revert to the long term historical mean but the two primary ones are the fact that geologically in the earth's crust there are fifteen parts of silver to every one part of gold. The other reason is that silver is used in many industrial, technological and medical devices and applications today and since the Industrial Revolution a huge amount of silver has been used up. Silver is like oil in that respect, and unlike gold, a lot of silver has been consumed and is gone forever. Today's AM fix was USD 1,226.50, EUR 902.50 and GBP 747.37 per ounce. Gold fell $6.50 or 0.52% Yesterday, closing at $1,232.30/oz. Silver slipped $0.30 or 1.49% closing at $19.87/oz. Platinum dropped $3.01, or 0.2%, to $1,409.74/oz and palladium rose $3 or 0.4%, to $738.25/oz.

Gold edged down in London for the second day ahead of the release of the U.S. Federal Open Market Committee minutes. Strong support is at $1,180/oz which could turn into a double bottom and resistance is at $1,250/oz and $1,270/oz. FXStreet.com’s Dale Pinkert interviewed Research Director, Mark O’Byrne on Monday about the current state of the gold and silver markets, the history of paper currencies, a global currency reset, the amero currency, the gold silver ratio and silver rising to $150/oz in the coming years. Another topic looked at was bail-ins by banks of individual creditors becoming one of the most under appreciated risks of our time and noting Poland’s recent government confiscation of pensions.

They discuss how the gold silver ratio throughout history has been 15:1. Today it is at over 60:1 (see chart) and GoldCore believe it will revert to the mean. There are a number of reasons that silver should revert to the long term historical mean but the two primary ones are the fact that geologically in the earth's crust there are fifteen parts of silver to every one part of gold. The other reason is that silver is used in many industrial, technological, medical applications today and since the Industrial Revolution a huge amount of silver has been used up.

It is for this reason that we are more bullish on silver than on gold in terms of price. We continue to believe that silver will surpass its inflation adjusted high of $150/oz in the coming years. It was noted how international storage of coins and bars is becoming a popular diversification for U.S. citizens in Zurich, Singapore and Hong Kong. Dale asked some good questions and had a great expression that we had not heard before "Don't wait to buy gold and silver. Buy gold and silver and wait." |

| Posted: 08 Jan 2014 03:30 AM PST Here at preciousmetalsinvesting.com we invest part of our wealth in the physical precious metals because it is one of the only investments that eliminates counter-party risk. However it is sometimes hard in today’s market where the focus is on short term price movement to remember why you invested in precious metals in the first place. The voices of anti precious metals pundits are often loud and sometimes we have trouble listening to our own wisdom. It’s interesting to note that current studies in Neuroscience which have tracked the record of financial pundits points out the truly dismal record most of them have. Studies have shown that the degree to which the typical pundit is certain in his prognostication and the more assured in his own wisdom the less likely he is to be right. We have seen some pretty spectacular “bu-yah” failures recently. Phillip Tetlock a Leonore Annenberg University Professor, School of Arts and Sciences (Psychology) and Wharton School (Management), Phd. from Yale, chair at the University of California followed up this initial study by picking 284 people who made their living “commenting or offering advice on political and economic trends.” The conclusion, after all the data was tallied, was that they tended to perform worse than random chance. I think a quote from Dow Theory Letter's Richard Russell puts things in the right perspective: "A few thoughts about gold. Never buy gold for a profit, gold is a measure of wealth. Count your gold holdings in the number of ounces, not the current worth in dollars. You don't price the home you live in every day, or with each passing week. Nor should you price your gold holdings in dollars with each passing day. Gold is a timeless wealth asset; an asset that will have a value with the passing of time. Remember this: Of the original issues that made up the Industrial Average, only one remains. And that stock is General Electric. And what happened to all the rest? In investing, nothing is permanent except gold. But remember, do not buy gold with the idea of making a profit. Buy gold because it is pure wealth, and may be the last man standing." |

| Posted: 08 Jan 2014 02:45 AM PST In Time of the Vulture: How to Survive the Crisis and Prosper in the Process (2007), I predicted a cataclysmic economic crisis was about to occur. At the time, few believed a severe financial crisis likely. It had been seven years since the 2000 dot.com bubble collapse and signs of recovery were everywhere. But, in 2006, Bill Bonner in his commentary, Ponzi Economy, explained why a crisis was coming. The US economy, fueled by a two-decade credit boom, had become a "ponzi economy", a gigantic speculative bubble, about to burst. PONZI ECONOMY

If, as we believe, we’re at the beginning of the disaster stage, the Fed’s real enemy is not inflation at all; it’s deflation – Bill Bonner. Bonner was right and, now, 6 ½ years later the beginning of the disaster stage is over. The end of the beginning has been reached. The disaster comes next. THE REAL ENEMY – DEFLATION

Deflation was the cause of the Great Depression and the possibility of another massive deflationary collapse—a black sinkhole of collapsing demand—is what central bankers fear most of all. When a deflationary collapse is severe enough—if the preceding bubble is large enough—it becomes a depression. In the 20th century a deflationary depression had happened only once; after the 1929 stock market crash in a devastating monetary cataclysm known as the Great Depression.

http://www.investinganswers.com/financial-dictionary/economics/deflation-1160 In 2010, I wrote: Deflationary depressions occur after the collapse of large speculative bubbles. The collapse of the 1920s US stock market bubble, then the largest bubble in history, caused the Great Depression of the 1930s. The collapse of the far larger dot.com and US real estate bubbles will cause the next. …The present economic crisis is similar to that of a patient who has suffered a massive near-fatal heart attack. Presently surviving only because of constant care and unprecedented levels of medication, it is the unprecedented levels of medication that will ultimately cause the patient's death. The amount of monetary stimulus keeping the global economy afloat has never been greater. Two of the largest economies in the world, the US and Japan, now have interest rates close to zero… QUANTITATIVE EASINGThe 2008 economic crisis was so severe central banks around the world were forced to slash interest rates to historic lows and began buying record amounts of government bonds to force rates lower to enable governments to borrow at far below market rates. This is the raison d’être for central banks' quantitative easing: As demand falls, central banks are buying unprecedented amounts of government debt in order to keep sufficient capital circulating in their increasingly sclerotic economies; and, as a result, central bank balance sheets are now filled with historic levels of increasingly suspect government debt. The world's central banks not only now own record amounts of government debt, the value of that debt—if marked-to-market—is significantly lower than nominally priced; and, if interest rates rise, central bank balance sheets could be wiped out resulting in the bankruptcy of central banks themselves.

CENTRAL BANKS: DRINKING POISON TO CURE THIRST

By their excessive monetization of debt, QE etc., the Fed, the BOE, the ECB, BOJ and the PBOC are drinking poison to cure thirst; and, while they're desperately hoping to restart their moribund economies, their attempts to do so may bring about what they're trying to avoid—a catastrophic deflationary collapse. Literally, trillions of dollars of Fed liquidity, QE1, QE2, QE3, combined with simultaneous and unprecedented monetary stimulation by the central banks of Europe, England, Japan and China have been required to offset the ultimately fatal decline in demand that occurs in the deflationary wake of large collapsing bubbles—and despite the unprecedented levels of quantitative easing by central banks, deflation is now gaining the upper hand.

Ben Bernanke's strategy of monetary easing is drawn directly from the playbook of Milton Friedman, Bernanke's mentor at the University of Chicago. Friedman believed that sufficient expansion of the money supply, i.e. artificial inflation, during the 1930s would have overcome the deflationary forces responsible for the Great Depression.

By applying Friedman's ivory tower solution, Bernanke and other central bankers contributed to the now extraordinarily high levels of government indebtedness which could trigger the very crisis central bankers are trying to avoid, i.e. another 1930s deflationary collapse. On January 2, 2014, economists Carmen Reinhart and Kenneth Rogoff warned of this possibility in their paper presented to the American Economic Association:

Bernanke did not admit that Friedman's solution had failed. History will do that. TIMING THE TIME OF THE VULTUREIn times of expansion, it is to the hare the prizes go. Quick, risk taking, and bold, his qualities are exactly suited to the times. In periods of contraction, the tortoise is favored. Slow and conservative, quick only to retract his vulnerable head and neck, his is the wisest bet when the slow and sure is preferable to the quick and easy. Every so often, however, there comes a time when neither the hare nor the tortoise is the victor. This is when both the bear and the bull have been vanquished, when the pastures upon which the bull once grazed are long gone and the bear’s lair itself lies buried deep beneath the rubble of economic collapse. This is the time of the vulture, for the vulture feeds neither upon the pastures of the bull nor the stored up wealth of the bear. The vulture feeds instead upon the blind ignorance and denial of the ostrich. The time of the vulture is at hand. The above words 'came' to me in 1991. At the time, there were no signs of an impending economic collapse. Nonetheless, I began studying the Great Depression and by the end of the decade, when the dot.com bubble burst I was convinced another depression, a massive deflationary collapse, was on the way; except this time the severity of the collapse would be even greater because it would be accompanied by monetary chaos. In the 1930s, the international monetary system was stabilized by gold because of the convertibility of paper money to gold. In 1971, however, the critical link between gold and paper money was severed as the US could no longer meet its obligations under Bretton-Woods. The consequences of that act of monetary apostasy are now in motion. In 2006, I wrote in Time of the Vulture :

I wrote those words in 2006 when central banks were net sellers of gold; and, in 2010, as I predicted, central banks instead became net buyers adding to the already growing global demand for gold. In a free market, supply and demand dynamics would have sent gold soaring in 2013 as global demand for physical gold reached at all time highs. Instead, in 2013, the price of gold fell 28%, testament to the power of the bankers' paper money to distort free market dynamics. The bankers' distortion of free markets began soon after the bankers' introduction of debt-based paper money in 1694 resulting in economic expansion and contraction phases caused by credit and debt replacing supply and demand as primary economic principles. Today, the bankers credit and debt 'Ponzi Economy' has become the global economic paradigm; indebting the world beyond its ability to pay except now by 'ponzi-financing', i.e. borrowing in order to borrow more. In 2010, I wrote:

CRUCIFIED ON A CROSS OF PAPER MONEYPonzi-financing is the final stage in the bankers' 300-year old ponzi scheme. An extreme deflationary collapse is about to take away all what credit created and the take-away will not be easy for those attached to the world that is passing away. The global economic collapse along with increasingly severe earth changes, e.g. record heat, record cold, earthquakes, drought, floods, etc., are the trigger events for a paradigm shift of cosmic proportions. The rebalancing of universal polarities is underway. A better world is coming. In my youtube video, The End of the Beginning, Parts 1&2, I discuss the present and future stages of the collapse from a different economic perspective than in this article. See http://youtu.be/yRw5hA3DC_M . On February 21/22, I will be speaking in Las Vegas at the Liberty Mastermind Symposium, February 21/22. For details see http://libertymastermind.us/ .

Buy gold, buy silver, have faith. Darryl Robert Schoon www.survivethecrisis.com | www.drschoon.com |

| Chinese FX Expert Says Gold is a Currency That China Must Dominate Posted: 08 Jan 2014 02:33 AM PST "Another engineered price decline during the Comex trading session in both gold and silver" ¤ Yesterday In Gold & SilverThe two smallish rallies in Far East trading on their Tuesday was the only time that gold was in positive territory yesterday. The high was in about 2:30 p.m. Hong Kong time---and 90 minutes before the London open. By the time trading began on the Comex at 8:20 a.m. EST, the gold price was back down to its Monday close. Then the engineered price decline began, with most of the loss in by the open of the equity markets in New York. The low tick was around 10:35 a.m.---and the rally that began around noon ran out of gas about 3:30 p.m. in electronic trading. The CME recorded the high and low ticks at $1,244.70 and $1,224.20 in the February contract. Gold closed on Tuesday at $1,231.80 spot, down an even six bucks from Monday. Volume, net of roll-overs out of the February contract, was around 108,000 contracts, which wasn't particularly heavy. The silver price action followed mostly the same path as gold, except the high tick came around 10:30 a.m. Hong Kong time. The light and low ticks were reported as $20.28 and $19.625 in the March contract, which was more than a 3% intraday move. Silver closed at $19.845 spot, down 32.5 cents from Monday. Volume was pretty decent at around 43,000 contracts, which was about 5% more volume than on Monday. Platinum didn't do much yesterday, but the smallish rally in palladium appeared to get capped just before 1 p.m. EST in Comex trading, as it appeared that the price was really about to take off. Here are the charts. The dollar index closed late on Monday afternoon in New York at 80.67. From there it rose to 80.79 by about 2:30 p.m. in Hong Kong on their Tuesday---and hit its low of 80.61 shortly after 12 o'clock noon in London. Then away it went to the upside, but that rally ran out of gas at 80.92---very close to the London p.m. gold fix---and that turned out to be the high of the day as well. By 12:15 p.m. EST, the index was down to 80.72---but rallied into the close from there. The dollar index finished the day at 80.87---which was up 20 basis points from Monday's close. Once again, it's more than a stretch to match the price moves in the precious metals to anything that was going on in the currency market. Not surprisingly, the stocks gapped down at the open, but the damage wasn't as bad as one would expect. The stocks spent the rest of the day inching higher, but at 3:15 p.m. EST, a serious buyer put in an appearance---and the gold equities popped into positive territory right at the close. The HUI finished up 0.18%. The HUI finished up 0.19% on Monday. The silver equities did OK as well, at least considering the pounding that the metal itself got, but the chart only bears a passing resemblance to the HUI---and Nick Laird's Intraday Silver 7 Index closed up the tiniest possible amount---and that was 0.01%. It could have been far worse. The CME's Daily Delivery Report showed that zero gold and 7 silver contracts were posted for delivery within the Comex-approved depositories on Thursday. There were no reported changes in GLD yesterday---and as of 9:57 p.m. EST yesterday evening, there were no reported changes in SLV, either. Once again, the U.S. Mint did not update its website with 2014 sales. If they have sold anything in 2014 so far, it's not possible to read that data the way the applicable web page is set up. There was almost no in/out movement in gold at the Comex-approved depositories on Monday. They reported receiving only 707 troy ounces of gold---and didn't ship any out. Of course it was far more active in silver, as 717,017 troy ounces were received---all in the CNT depository---and 180,514 troy ounces were reported shipped out. The link to that activity is here. I don't have all that many stories for you today---and the final edit is yours. ¤ Critical ReadsJ.P. Morgan banker joked that Madoff's accounting firm might be a car washThe government paints a damning picture of J.P. Morgan Chase & Co. in its dealings with Bernie Madoff. The $1.7 billion settlement revealed Tuesday portrays bank employees who were alternately too incompetent to notice, or too calculating to bother reporting, that Madoff was running a gigantic Ponzi scheme. The J.P. Morgan banker assigned to helping Madoff Securities for years had no clue how much money was in the Madoff account, and signed off on compliance reports because he couldn’t see a reason not to, according to the government’s charges. Others within J.P. Morgan and the predecessor banks later subsumed by J.P. Morgan started raising questions about Madoff beginning in the mid-1990s, and one senior executive joked via email that they should visit Madoff’s accountant’s office to make sure it wasn’t a car wash. Employees then yanked out most of the bank’s own money invested with Madoff-related funds and congratulated themselves after his arrest on the money they’d saved the bank. I knew it would be bad...but even I was aghast at how widespread the knowledge was inside the firm that Madoff was running a Ponzi scheme. One can easily extrapolate this into the precious metals arena. This martketwatch.com story was posted on their Internet site during the New York lunch hour yesterday...and I thank Roy Stephens for today's first news item. It's definitely worth your time. JPMorgan is Penalized $2 Billion Over MadoffTwo men who occupy coveted roles in Manhattan’s power elite, one the city’s top federal prosecutor and the other its top banker, sat down in early November to discuss a case that was weighing on them both. Preet Bharara, the United States attorney in Manhattan, and Jamie Dimon, the chief executive of JPMorgan Chase, gathered in Lower Manhattan as Mr. Bharara’s prosecutors were considering criminal charges against Mr. Dimon’s bank for turning a blind eye to the Ponzi scheme run by Bernard L. Madoff. Mr. Dimon and his lawyers outlined the bank’s defense in the hopes of securing a lesser civil case, according to people briefed on the meeting. But at the cordial meeting in Mr. Bharara’s windowless conference room lined with law books, the prosecutors would not budge. Mr. Bharara — flanked by his own lieutenants, including Richard B. Zabel and Lorin L. Reisner — made it clear that he thought the wrongdoing was significant enough to warrant a criminal case. On Tuesday, Mr. Bharara announced the culmination of that case, imposing a $1.7 billion penalty stemming from two felony violations of the Bank Secrecy Act, a federal law that requires banks to alert authorities to suspicious activity. The prosecutors, calling the amount a record for violating that 1970 federal law, will direct the money to Mr. Madoff’s victims. But nobody is going to jail. This longish article on the Madoff decision was posted on The New York Times website yesterday morning...and will appear in their print edition today. My thanks go out to Phil Barlett for sending it our way. Royal Bank of Scotland Japan Unit Sentenced in Libor ProbeRoyal Bank of Scotland Group Plc was ordered to pay $50 million by a federal judge in Connecticut over claims that it rigged the London interbank offered rate. RBS Securities Japan Ltd. in April pleaded guilty to wire fraud as part of a settlement of more than $600 million with U.S and U.K. regulators over Libor manipulation, according to court filings. U.S. District Judge Michael P. Shea in New Haven today sentenced the Tokyo-based unit of RBS, Britain’s biggest publicly owned lender, to pay the agreed-upon fine, according to a Justice Department statement. RBS was among six companies fined a record 1.7 billion euros ($2.3 billion) by the European Union last month for rigging interest rates linked to Libor. The combined fines for manipulating yen Libor and Euribor, the benchmark money-market rate for the euro, are the largest-ever EU cartel penalties. This short Bloomberg story was posted on their website early on Monday evening MST...and my thanks go out to reader M.A. for finding it for us. Eurozone losing 'safety margin' against deflation trap as core gauge falls to record lowEurozone inflation has fallen to the lowest recorded under two key measures, raising the risk of a textbook deflation trap if recovery falters or there is an unexpected shock. Core inflation – stripping out food and energy – fell to 0.7pc, lower than at any time following the Lehman crisis. “It's lower than when the European Central Bank was forced to cut rates in November,” said David Owen from Jefferies Fixed Income. “A large number of countries across the periphery are either in deflation already or very close, and this is spreading to France. The ECB will have to do quantitative easing in the end,” he said. I had a story on this issue in yesterday's column---and it was posted on the spiegel.de Internet site. This one is from Ambrose Evans-Pritchard...and he has a way of cutting to the chase that that leaves his European counterparts in the dust. This must read article was posted on the telegraph.co.uk Internet site late yesterday afternoon GMT...and it's another contribution from Roy Stephens. Goodyear executives released after being held hostage by French workersWorkers at a doomed Goodyear tyre factory in northern France released the two executives they were holding hostage on Tuesday afternoon. The men had been detained by up to 200 employees who blocked their escape with a tractor tyre as they arrived at a meeting with union leaders on Monday. Immediately after the men left, officials from the factory's CGT union announced they would occupy the site. Goodyear announced it was closing the plant, throwing 1,173 employees out of work, after several years of turbulent relations between management and unions. This news item appeared on The Guardian website late yesterday afternoon GMT...and is a follow-up to the one I posted in this space yesterday. It's also another offering from Roy. Malta's sale of E.U. passports causes controversyA British consultancy firm, Henley & Partners, stands to make tens of millions of euros for helping Malta create up to 20,000 new EU citizens-on-paper. The scheme will provide money for a €1 billion investment fund in the tiny Mediterranean country, whose national budget is just €3 billion a year. It will see Malta sell 1,800 passports for €650,000 each, before closing down the programme. But every main applicant can also buy additional passports for children up to 26 years old, for their spouse, and his or her spouse's parents and grandparents, for between €25,000 and €50,000 per head. This interesting news item, filed from Brussels, was posted on the euobserver.com Internet site yesterday morning Europe time...and once again I thank Roy Stephens for bringing it to our attention. More Israel disclosures in Snowden's trove of 'significant stories' – GreenwaldGlenn Greenwald, the investigative journalist who first published Edward Snowden leaks, said that the NSA whistleblower still has "a huge number of very significant stories to reveal," including those relating to Israel. "There definitely are stories left that involve the Middle East, that involve Israel. The reporting is going to continue at roughly the same pace that has been happening," the former Guardian journalist said in an interview with Channel 10 television station that aired Monday night. "I don’t want to preview any stories that aren’t yet published, but it’s definitely the case that there are a huge number of very significant stories that are left to report," the Brazil-based Greenwald said, adding that the journalists will continue releasing stories "at roughly the same pace that has been happening. One can only imagine what these stories will reveal. If I were the Israeli leadership, military, or Mossad...I'd be worried. This Russia Today story was posted on their website late yesterday morning Moscow time...and I thank South African reader B.V. for sharing it with us. It's worth reading. Syria ships out first batch of chemical weapons materialsSyria has started moving chemical weapons materials out of the country in a crucial phase of an internationally backed disarmament program that has been delayed by war and technical problems. The Organisation for the Prohibition of Chemical Weapons said on Tuesday that "priority chemical materials" were transported to the port of Latakia and onto a Danish vessel which was now sailing towards international waters. The OPCW did not disclose what percentage of Syria's toxic arsenal -- which totals 1,300 tons in all -- had been removed but said nine containers of the most dangerous chemical materials were on the Danish cargo vessel. New police sackings over Turkey fraud probeThe Turkish government has dismissed 350 police officers in Ankara, local media reports say, in the latest twist in a corruption scandal embroiling powerful politicians. The officers were sacked on Tuesday by a government decree published at midnight and included chiefs of the financial crimes, anti-smuggling, cyber crime and organised crime units, the private Dogan News Agency reported. Erdogan responded by sacking hundreds of police officials across the country, including the powerful Istanbul police chief. Erdogan's critics accuse him of desperately trying to protect his cronies, and the appointment of Selami Altinok, a little-known governor with no background in police work, as Istanbul's new police chief was further seen as an attempt to shut down the investigation. This must read news item was posted on the aljazeera.com Internet site yesterday...and it's another contribution from Roy Stephens. U.S. and Iran find common enemy in jihadist groupIt’s rare that Washington and Tehran are on the same wavelength. But the U.S. and Iran are in agreement when it comes to Iraq: on Sunday, the two countries both said they would support Iraqi authorities faced with an insurrection led in large part by the Islamic State of Iraq and the Levant (ISIL), a group of al Qaeda-affiliated jihadists. I posted a story about the fighting in Iraq in yesterday's column, but this story includes the Iran angle. It was posted on the france24.com Internet site yesterday...and it's the final offering of the day from Roy Stephens, for which I thank him. It's a must read, especially for students of the New Great Game. Seven King World News Blogs/Audio Interviews1. Tom Fitzpatrick: "Despite Setback Gold May Be Poised For a Monster Rally". 2. Michael Pento: "Boldest Predictions For 2014, Including Gold". 3. Robert Fitzwilson: "The Great Gold Robbery". 4. Ron Rosen: "Here is the Most Frightening Prediction For 2014". 5. Grant Williams: "Gold War Heats Up as Bears Become Increasingly Desperate". 6. The first audio interview is with Bill Fleckenstein...and the second audio interview is with John Mauldin |

| Seven King World News Blogs/Audio Interviews Posted: 08 Jan 2014 02:33 AM PST 1. Tom Fitzpatrick: "Despite Setback Gold May Be Poised For a Monster Rally". 2. Michael Pento: "Boldest Predictions For 2014, Including Gold". 3. Robert Fitzwilson: "The Great Gold Robbery". 4. Ron Rosen: "Here is the Most Frightening Prediction For 2014". 5. Grant Williams: "Gold War Heats Up as Bears Become Increasingly Desperate". 6. The first audio interview is with Bill Fleckenstein...and the second audio interview is with John Mauldin |

| Race to Debase: Fiat Currency vs. Gold -- Fiat Currency vs Silver :: 2000 - 2014 Posted: 08 Jan 2014 02:33 AM PST How has your Paper Currency performed versus Silver and Gold in the 21st Century? You may be surprised by the answers below. Below you will find 120 fiat currency's nominal values versus silver and gold prices thus far in the 21st Century. Not one paper currency has outperformed bullion thus far, see for yourself... This interesting table of numbers was posted on Mike Maloney's website goldsilver.com yesterday...and it's worth skimming. |

| Hedge Funds Raise Gold Wagers as Yamada Sees $1,000 Posted: 08 Jan 2014 02:33 AM PST Hedge funds raised their bullish gold bets to a six-week high, splitting with analysts at Technical Research Advisors LLC and Goldman Sachs Group Inc. who are predicting more declines after last year’s rout. Gold tumbled 28 percent in 2013, the first decline in 13 years and the biggest since 1981, after some investors lost faith in the metal as a store of value. The Federal Reserve on Dec. 18 cut the pace of its monthly bond purchases. Bullion is poised to fall another 19 percent in the coming months to $1,000 an ounce, said Technical Research’s Louise Yamada, who’s the former head of technical research at Citigroup Inc. “With gold, in the short-term, we’re being pulled in multiple directions,” said Michael Cuggino, who manages about $10 billion of assets at Permanent Portfolio Family of Funds Inc. in San Francisco. “There were sellers trying to get out in front of the tapering. Physical demand is OK, but not strong. You also have increasing economic activity, which could begin to accelerate inflation.” This is another typical garbage story about gold. This one turned up on the Bloomberg website during the Denver lunch hour yesterday...and I thank reader Ken Hurt for sending it our way. |

| Iran tries to reverse a slumping birth rate: offers gold coins Posted: 08 Jan 2014 02:33 AM PST In Iran, free condoms and government-backed vasectomies are out, replaced by sermons praising larger families and discussions of even offering gold coins to the families of newborns. Having successfully curbed birth rates for two decades, Iran now is promoting a baby boom to help make up for its graying population. But experts say it is difficult to encourage Iranians to have more children in a mismanaged economy hit by Western sanctions and 36 percent inflation. "A gold coin won't change couples' calculations," said Mohammad Jalal Abbasi, head of Demographics Department at Tehran University. "Many young Iranians prefer to continue their studies, not marry. Lack of financial ability to buy a house and meet expenses are among other reasons why the youth postpone marriage or have no interest in raising many children." Low birth rates are a product of an increase in living standards and a well-educated population. China is also promoting a baby boom for the same reason, but it's already far too late for Japan, as their population is going to implode no matter what they do. This very interesting AP story was posted on their website early Monday afternoon EST...and my thanks go out to Nick Giambruno, the Senior Editor over at the InternationalMan.com Internet site for sending it around yesterday. |

| India May Keep Gold-Import Curbs Past March to Contain Deficit Posted: 08 Jan 2014 02:33 AM PST India should retain curbs on gold imports at least until March to stabilize the current-account deficit that weakened the rupee to a record low last year, Economic Affairs Secretary Arvind Mayaram said. The government needs to keep the deficit low and should not tamper with the restrictions on gold shipments until at least the end of the fiscal year on March 31, Mayaram told the Press Trust of India. D.S. Malik, a finance ministry spokesman in New Delhi, confirmed the comments to Bloomberg News today. “Gold imports have been identified by policy makers as a problem area because this is not some kind of productive imports,” said Siddhartha Sanyal, an economist at Barclays Plc in Mumbai. “Just because the numbers are favorable for the last few months, I don’t think they will change it dramatically. They are not in any big hurry to change it.” This gold-related news item, co-filed from Mumbai and New Delhi, was posted on the Bloomberg website very early yesterday morning MST...and I thank Manitoba reader Ulrike Marx for finding it for us. It's not overly long...and it's worth reading. |

| Chinese Gold Demand Strong at Start of 2014 Posted: 08 Jan 2014 02:33 AM PST Chinese gold buying has noticeably picked up at the start of 2014, helped by softer prices and the approach of Chinese New Year holidays, traders and analysts said. The premium in China has risen to $20 an ounce, perhaps $10 higher than a week ago, said Bernard Sin, global head of precious metals trading with MKS (Switzerland) SA. “That is an indication that demand is relatively healthy,” he said. He also cited good demand in Hong Kong and Thailand. Joni Teves, analyst with UBS, said volume on the Shanghai Gold Exchange picked up significantly lately, with combined turnover for the two gold contracts around six-month highs. They reached 34 metric tons Monday and averaged 24 tons over the first few business days of 2014, compared to an 18-ton average in December, she said. This gold commentary was posted on Kitco website yesterday morning...and it's also courtesy of Ulrike Marx. |

| Chinese FX expert says gold is a currency that China must dominate Posted: 08 Jan 2014 02:33 AM PST Yesterday, gold researcher and GATA consultant Koos Jansen disclosed a speech given to a gold conference in Beijing last year by Tan Ya Ling, president of the China Foreign Exchange Investment Research Institute, arguing that gold is a currency and and potentially the world reserve currency and that China needs to dominate the world gold market. An English translation of the speech is posted at Jansen's Internet site ingoldwetrust.ch. It's definitely worth reading. |

| Gold Ends Weaker On Technical Correction, Firmer U.S. Dollar Posted: 08 Jan 2014 01:40 AM PST forbes |

| Gold 1206 is Now Possible Support before the Low Posted: 08 Jan 2014 01:40 AM PST dailyfx |

| Gold: Technical Signs Suggest Possible Bounce This Week Posted: 08 Jan 2014 01:40 AM PST actionforex |

| TD Securities - Silver spot price could rally to 21.9 on break above 20.45 Posted: 08 Jan 2014 01:40 AM PST invezz |

| In the land of the goldbugs who choose to be blind, the one-eyed blogger is king Posted: 08 Jan 2014 01:04 AM PST I have a post up on the corporate blog about Comex stocks coverage (owners per ounce) talking about yet another example of the one-eyedness (a mind not open to all the data and varying interpretations) I discussed in yesterday's post. The post is a rework/expansion on this personal blog post on Comex stocks. The interesting thing to me about those bloggers who have been using Nick Laird's owners per ounce charts for registered gold and its current 80:1 ratio is that to get to that chart you have to scroll past the chart for total gold stock and its 5:1 ratio. In other words you have to wilfully ignore the 5:1 ratio and the big difference between this and the 80:1 ratio. Now I can admit that maybe such bloggers disagree with my views that you have to look at both eligible and registered stocks (although I fail to see how when there is over 5 million ounces of conversion volume between the two categories during 2013) in assessing the likelihood of a Comex default or shortage of gold, but surely anyone who isn't one-eyed would want to at least discuss/explain the 80:1 and 5:1 discrepancy to their readers? For those who like to use both of their eyes, consider these points from the corporate post: 1. people only keep metal in a Comex deliverable form and in Comex warehouses because they are expecting to sell it back in the futures (if they took it off eligible there would be costs to get it accepted back as eligible) and they will sell it if the price is right 2. sellers may try and "hide" their intention to sell by holding eligible (making it look like gold is not available for delivery and thus get the price bid up) then at the last minute instantly change their gold to registered status 3. Silver Doctor's theory that "the owners [or eligible] would likely be strong-armed or forced into converting their eligible supplies into registered should things become desperate for the cartel 4. 2.6 million ounces (80 tonnes) was converted from eligible to registered, indicative of point 2 5. 3.2 million ounces (100 tonnes) was converted from registered to eligible, indicative of strong hand longs standing for delivery? With some points from this post: 5. you can deliver 3 kilo bars against a Comex futures contract (note there is a cash adjustment for any over/under ounces as the result of delivery of odd weight 100oz bars or kilo bars against a futures contract) 6. BBs have been proven to deliver tonnes of kilo bars into Comex warehouses, this could indicate weak markets where they park metal until demand returns (see here: " the owner may simply want to vault their metal securely, before using it to meet demand elsewhere – for manufacturing, or from investors in another marketplace, such as Asia") 7. consequently, movements of round ounce tonne lots, indicative of kilo bars, out of the warehouses may be an advance bullish signal of Asian demand returning And this interesting story from Martin Armstrong: 8. "To create the fundamental, they moved inventory from New York to London. They were manipulating silver as always. Playing games with the inventories. They were moving silver from New York to London where the Buffett orders were being executed. This made the US warehouse inventories drop sharply." to give the impression of a shortage of silver And finish with this interesting point made to me in an email by a Mr D: 9. A BB is only legally obliged to deliver from registered stock. Failure to deliver eligible gold wouldn't be a default. So this eligible gold could be safely used as the basis for a lot of transactions outside Comex that are completely opaque while it the gold remains on show to the Comex punters I think all the above makes a strong case for looking at the total Comex stocks (both eligible and registered). I personally think the Martin Armstrong story is the most telling. By focusing on the 80:1 ratio bloggers may well be (hopefully innocently) helping those playing games with reported warehouse stocks. I'd like to think that after this gold bear market the eligible stocks are now mostly held by strong hands rather than just being BB inventories, and thus a squeeze is in play, but I'm keeping my mind (and both eyes) open to the fact that the figures may be gamed. I hope you also choose to not be blind. |

| Paolo Lostritto Outlines the Lombardi Method of Gold Investing Posted: 08 Jan 2014 12:00 AM PST |

| My gold fund has fallen by half. Should I sell? Posted: 07 Jan 2014 10:37 PM PST Ask the expert: Investors lost thousands last year backing gold funds. Should they sell or hang on? This posting includes an audio/video/photo media file: Download Now |