saveyourassetsfirst3 |

- Respected Canadian gold analyst goes native with the juniors

- Billionaire Gertler’s DRC gold deposit ‘world class’

- Gold prices jump after strong ADP jobs data

- Paper implosion bullish for gold, says Tocqueville's John Hathaway

- Can't-miss headlines: Gold resumes fall, Baja shares crumble to C$0.005 & more

- Buy The Dollar, Sell The Kiwi

- At London conference Hathaway predicts implosion of paper gold

- Alasdair Macleod: Gold and interest rates

- Timmins Gold: 4 Different Insiders Have Purchased Shares Since November 7

- Ron Paul: Bitcoin could ‘destroy the dollar’

- Verizon: A Stock For Long-Term Investors

- Eric Sprott: The West Will Regret All Its Financial Policies Someday Soon!

- Silver Standard Resources' CEO Presents at Scotiabank Annual Mining Conferences 2013 (Transcript)

- Hyperinflation of the reserve currency

- If You Were Going to Buy a Mining Stock, Which Would It Be?

- TBTF Banks Are Taking Over As Number Of U.S. Banks Falls To All-Time Record Low

- Gold jumps after strong ADP jobs data, "short-covering" likely

- US economic data spurs Commodity buying; Equities weaken

- When Obama speaks, only gold and silver listen

- Bill Gross: “Investors Are All Playing The Same Dangerous Game—That Depends On Perpetual Cheap Financing”

- Gold and silver await data

- No Bubbles Here

- Shanghai Gold Exchange Cumulative Deliveries Of 8,655 Tonnes

- Stockings to strain with gold bullion this Christmas

- Advanced Automated Trading Systems & Indicators with NinjaTrader

- BITCOINS, THE SECOND BIGGEST PONZI SCHEME IN HISTORY

- Come On Bennie, I Dare Ya!

- Paper gold traders overpowering physical holders for now

- Bullion smuggling outstrips narcotics to feed Indias gold habit

- 5 CHARTS: The Real Story Behind Silver

- Stewart Thomson: What’s Broke In Gold & How To Fix It

- A gold investor’s perspective: From the Taj Mahal to Westminster Abbey

- Gold Has Held Its Purchasing Power Very Well

- Era Of Depositor Bail-In Cometh (Part 1)

- The Era Of Depositor Bail-In Cometh

- Era Of Depositor Bail-In Cometh (Part 1)

- Get the best price for your Gold, Silver in Holiday season: Expert

- 5 CHARTS: The Real Story Behind Silver

- Silver Mining Company Says It’s Helpless Against Market Manipulation

- OECD educational report: Pisa fever is causing east Asia's demographic collapse

- Return the treasures Britain looted, Chinese tell Cameron

- Three King World News Blogs

- India's Gold smugglers make a killing as hawala premium doubles

- Gold smugglers adopting methods of drug couriers

- Korea Exchange to begin physical gold trading

- Mike Maloney: How to Hide Your Gold and Silver

- Silver mining company says it's helpless against market manipulation

- Links 12/4/13

- Is Bitcoin the new gold?

- TECHNICAL - Gold Market is Quiet Following Large Down Day

| Respected Canadian gold analyst goes native with the juniors Posted: 04 Dec 2013 08:26 PM PST George Topping joins Wolfden Resources. We hear more about it from Wolfden President Donald Hoy. | ||||||||||

| Billionaire Gertler’s DRC gold deposit ‘world class’ Posted: 04 Dec 2013 03:38 PM PST Moku-Beverendi has the potential to contain a world-class deposit just as the Kibali gold project does, his Fleurette Group says. | ||||||||||

| Gold prices jump after strong ADP jobs data Posted: 04 Dec 2013 03:19 PM PST Jumping to $1,229 on Wednesday, gold defied analyst expectations and reversed earlier 1% losses after stronger-than-expected US jobs data. | ||||||||||

| Paper implosion bullish for gold, says Tocqueville's John Hathaway Posted: 04 Dec 2013 02:46 PM PST John Hathaway's interpretation of gold's decline, with prices nearing $1,200 as he spoke on Wednesday morning, paints an exceptionally bullish long-term picture. | ||||||||||

| Can't-miss headlines: Gold resumes fall, Baja shares crumble to C$0.005 & more Posted: 04 Dec 2013 02:05 PM PST The latest morning headlines, top junior developments and metal price movements. Today, gold price slides closer to $1,200 while heavy junior shareprice movements catch the eye. | ||||||||||

| Posted: 04 Dec 2013 12:49 PM PST A small battle has been waged between the United States and New Zealand for the past few years. This war is not based upon the movement of troops of ships, but rather it is based purely upon economics. At stake are hundreds of jobs in the logistics, manufacturing, and tourism sectors. The battle ultimately will not be resolved in a single engagement, but rather through time, currency strength and economic activity will dictate the victor. Since the financial crisis, the United States has been a net exporter to New Zealand. In 65% of all months since 2008, the United States has accrued a deficit totaling $2.8 billion with its trading partner. In recent months however, exchange rate volatility and dollar weakness has lead to a reversal of the status quo in that the United States is now running a surplus with New Zealand. This reversal in trade balance as well | ||||||||||

| At London conference Hathaway predicts implosion of paper gold Posted: 04 Dec 2013 12:31 PM PST GATA | ||||||||||

| Alasdair Macleod: Gold and interest rates Posted: 04 Dec 2013 12:31 PM PST GATA | ||||||||||

| Timmins Gold: 4 Different Insiders Have Purchased Shares Since November 7 Posted: 04 Dec 2013 12:20 PM PST Editors' Note: This article covers one or more micro-cap stocks. Please be aware of the risks associated with these stocks. In this article, I will feature one gold miner that has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

Timmins Gold (TGD) engages in the acquisition, exploration, development, and operation of mineral resource properties in Mexico. (click to enlarge) Insider buying during the last 30 days Here is a table of Timmins Gold's insider-trading activity during the last 30 days by insider.

| ||||||||||

| Ron Paul: Bitcoin could ‘destroy the dollar’ Posted: 04 Dec 2013 12:17 PM PST Ron Paul: Bitcoin could ‘destroy the dollar’  Yeah, I got bitcoin, bitchez! Gold. Silver. Bitcoin. Enough said. | ||||||||||

| Verizon: A Stock For Long-Term Investors Posted: 04 Dec 2013 12:17 PM PST When we talk about leading wireless service providers in the US the first name that comes to mind is Verizon (VZ). The company is popular and has been in the limelight because of its multi-billion dollar deal to acquire the 45% stake of Verizon Wireless previously held by Vodafone (VOD). (click to enlarge) Year to date Verizon's stock has earned 14.68% and has outperformed the second largest wireless service provider AT&T. The share price of smaller companies in the industry was very volatile as was the case with T-Mobile and this company outperformed Verizon. Before going into the discussion of prospects and forecasts I will highlight the company's historical performance to support my analysis. Company History During the third quarter of fiscal year 2013 the company's wireless segment managed to post revenues of $20.4 billion reflecting an increase of 7.2% year over year. Out of this total revenue figure | ||||||||||

| Eric Sprott: The West Will Regret All Its Financial Policies Someday Soon! Posted: 04 Dec 2013 12:01 PM PST

Eric Sprott recently joined Matterhorn Asset Management’s Lars Schall to discuss the metals, QE, and how the great Keynesian fiat experiment is likely to end for Western governments. Sprott claims that the West will one day soon regret all of its financial policies including QE, ZIRP, and gold suppression, and that the major governments carrying [...] The post Eric Sprott: The West Will Regret All Its Financial Policies Someday Soon! appeared first on Silver Doctors. | ||||||||||

| Silver Standard Resources' CEO Presents at Scotiabank Annual Mining Conferences 2013 (Transcript) Posted: 04 Dec 2013 11:49 AM PST Silver Standard Resources Inc. (SSRI) Scotiabank Annual Mining Conferences 2013 December 04, 2013 10:00 AM ET Executives Geoff Burns - President and Chief Executive Officer, Pan American Silver Corp. John Smith - President and Chief Executive Officer, Silver Standard Resources Inc. Kevin McArthur - President and Chief Executive Officer, Tahoe Resources Inc. Darren Blasutti - President and Chief Executive Officer, US Silver & Gold Inc. Analysts Trevor Turnbull - Scotiabank Presentation Trevor Turnbull - Scotiabank We are going to start our second silver panel. This time we are going to talk about people operating in essentially the rest of the world, touch on Mexico again briefly but look at some other jurisdictions. For anyone who may have come in since the first panel, I am Trevor Turnbull. I look at intermediate gold space as well as a lot of the silver producers. We've got four panelists this time; Pan American | ||||||||||

| Hyperinflation of the reserve currency Posted: 04 Dec 2013 11:40 AM PST The recent rise in interest rates foreshadows the unavoidable demise for the dollar. Not only did the rise in rates have an immediate effect on the housing recovery, it also indirectly exposed the system to another vulnerability, that is, the Fed is not only the lender of last resort but... | ||||||||||

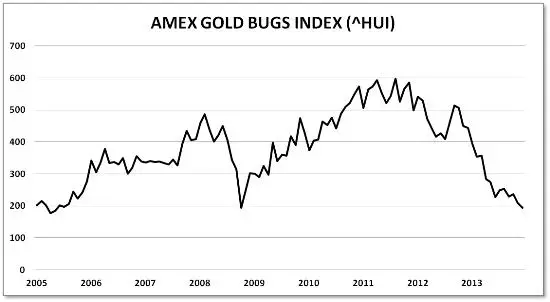

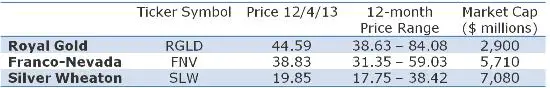

| If You Were Going to Buy a Mining Stock, Which Would It Be? Posted: 04 Dec 2013 11:36 AM PST Let's say you've got some traditional mutual funds full of stocks and bonds and they're way up. You're worried by all the taper talk and the charts that show share prices and margin debt back up to pre-crash levels, and you're wondering whether it's time to redirect some of that capital to someplace that no one is calling a bubble. Meanwhile, you’ve noticed that precious metals mining stocks are in another of their periodic corrections, with this one looking a lot like 2008's bloodbath — which was followed by an epic bull market: But with gold and silver below the production cost of a lot of miners, there's a ton of risk to go with the seemingly huge upside. So committing to individual miners is terrifying. Still, that’s how it always looks at the bottom. So if you're going to buy one, which would it be? Let's start with the premise that at a bear market bottom investors, having been faked out so many times on the way down, don't trust the turn. So to the extent that they buy anything, they buy the safest names. If the miners keep to this pattern, next year will be good for the best and mediocre for the rest. And in mining the safest bets are the royalty and streaming companies that don't actually mine metal themselves but contract with other mines to take part of their future output. They do this in a variety of ways ranging from buying up existing royalty agreements that call for a given number of ounces delivered over a specified period of time, to in effect making equity investments in mines in return for some portion of future production. The first is passive investing, the second more like venture capital. The biggest companies in this space have been able to gain interests in lots of mines on generally favorable terms. Here are the three to consider: Not Risk-Free The other issue is the availability of good investments going forward. The royalty companies have to invest their cash at rates that exceed their cost of capital. Such deals are scarce in this environment and will get scarcer if metals prices don’t recover. Here again, though, we're talking about diminishing cash flow, not an existential threat. Meanwhile, in a really bad market these companies become the king makers in the industry, deciding which juniors live or die and using that power to cut deals that become hugely favorable when prices revive and those new mines are developed. To sum up, these companies are not as safe as owning bullion intelligently stored, but they're safer than the typical miner, with considerable upside margin over metals prices if things turn around from here. | ||||||||||

| TBTF Banks Are Taking Over As Number Of U.S. Banks Falls To All-Time Record Low Posted: 04 Dec 2013 11:30 AM PST

The too big to fail banks were in the headlines every single day and our politicians promised to fix the problem. But instead of fixing it, the too big to fail banks are now 37 percent larger and our economy is more dependent on them than ever before. And in their endless greed for even [...] The post TBTF Banks Are Taking Over As Number Of U.S. Banks Falls To All-Time Record Low appeared first on Silver Doctors. | ||||||||||

| Gold jumps after strong ADP jobs data, "short-covering" likely Posted: 04 Dec 2013 11:29 AM PST Jumping to $1,229 per ounce in London trade Wednesday, gold defied analyst expectations and reversed earlier 1% losses after stronger-than-expected U.S. jobs data. | ||||||||||

| US economic data spurs Commodity buying; Equities weaken Posted: 04 Dec 2013 10:58 AM PST We were treated to several pieces of economic news in today' session. The ISM number, private jobs numbers from ADP and New home sales. New home Sales numbers were up 25% in October compared to September. The spike was the sharpest monthly increase in more than 30 years. It should be kept in mind however that the September number was especially low. Some things I am taking away from this report - first, the average price range of the homes sold was lower. Second - home mortgage loan rates have been rising. That is pushing down the price of the home that many buyers can afford. They are obviously opting for lower priced homes. Regardless, that coupled with the news from ADP that 215,000 private sector jobs were added last month ( the market was expecting 178,000) brought in a significant amount of buying into the copper market. That yanked silver higher as those two metals have recently been moving more or less in tandem. Later in the session gold then seemed to finally catch up as we got yet another one of those sharp, short covering rallies that gold has been famous for over the last few weeks. We'll have to see how long this one lasts. AT least the mining shares as evidenced by the HUI stopped moving lower today as well. For once we seem to have those going higher alongside of the actual metal on the Comex. That is always helpful to the bullish cause. I am really not quite sure what the catalyst was for the pop higher in gold other than the fact that it managed to hold above an important chart support level near $1200. Also working in its favor is the fact that crude oil prices have been moving strongly higher now for the last few days. Traders continue to anticipate that the opening of that new pipeline from Cushing down to Port Arthur is going to relieve the burgeoning crude supplies at that key point even though stocks of the black liquid remain extremely high. Notably, refinery runs are very strong and this is helping to pull down the number of barrels in storage. Traders are expecting these newly refined products to be exported out through the Gulf of Mexico. This continues to put a floor under the unleaded gasoline market which had been dropping rather precipitously of late. Heating oil prices are firm. Lots of cold weather around. We also had another burst of money flowing into the soybean and corn markets this morning. In effect, we had higher energy prices, some higher grain prices, a rise in cotton, a rise in the base metals, etc... It seemed as if the play for today was to generally buy commodities once again. When you get the kind of rally that we witnessed today in copper, and then in silver, it is going to be hard to press the gold lower. That means short covering as shorts do not want to lose profits or if they have sold near the bottom, develop large losses. Interestingly enough, the sharp spike in interest rates did not offer much in the way of support to the US Dollar. It basically floated around the unchanged level for most of the session. That makes the strength in some of the commodity markets all that more notable. I keep watching this S&P 500 and it keeps looking the same to me, namely "toppy" but so far it continues to hold up. I am once again noticing a higher day in the VIX. With the yield on the Ten Year note reaching a high thus far of 2.852%, we might be seeing a general round of NERVOUSNESS beginning to creep into these equities. I remain of the view that equities are going to have to break down to give us a SUSTAINED move higher in gold. I mentioned that I would be watching the gold delivery process as it unfolds for the month of December. As expected, JP Morgan continues to be the standout LARGE STOPPER for their HOUSE account. Morgan has been buying the physical against hedge fund selling. Gold's bounce up and away from that critical chart support level down near $1200 has been impressive. No doubt there will be some technical chartists looking at this and calling a double bottom on the intermediate term chart. I will need to see the metal scale $1280 at a minimum however and RETAIN those gains before concurring with that view. I would also need to see some more definite signs of a solid bottom in the HUI as an additional confirmation. Also, the big test for gold, will come this Friday as we await the next payrolls number. If the number comes in stronger than expectations, look for that TAPERING chatter to start up again which would likely pressure the gold market as it should bring some strength into the Dollar. The problem that the Fed has however is the same as it experienced this past summer. Rising interest rates threaten to crimp consumer borrowing. The Fed gets extremely nervous as a result when the yield on the Ten Year starts creeping closer to that 3% mark. If the bond and note markets react to the number by pushing lower and thus kicking rates higher, Fed officials, especially the more dovish ones, may not welcome the higher long term rates. I would expect them to hit the microphones and beginning tamping down any tapering expectations if that is indeed the case. Keep in mind that as traders we are watching for a change in inflation expectations/sentiment to occur in the market. Once that occurs, the metals will respond accordingly. Until it does however, rallies will be viewed as shorting opportunities. Stay nimble and do not get married to any particular view. Let the market tell us when things are changing. | ||||||||||

| When Obama speaks, only gold and silver listen Posted: 04 Dec 2013 10:29 AM PST  Wait. What did this jackass just say?  Dude. I’m shorting that dollar.  Wee hee! I’ve got gold, silver and bitcoin. Talk some more Obama! | ||||||||||

| Posted: 04 Dec 2013 10:15 AM PST

Investors are all playing the same dangerous game that depends on a near perpetual policy of cheap financing and artificially low interest rates in a desperate gamble to promote growth. The Fed, the BOJ (certainly), the ECB and the BOE are setting the example for global markets, basically telling investors that they have no alternative than [...] The post Bill Gross: "Investors Are All Playing The Same Dangerous Game—That Depends On Perpetual Cheap Financing" appeared first on Silver Doctors. | ||||||||||

| Posted: 04 Dec 2013 10:12 AM PST The rest of the week will be focused on lots of U.S. data and the central bank meetings on Thursday. Whilst everyone is thinking about non-farm payrolls on Friday, first up is Wednesday's release of the US Federal Reserve's Beige Book. | ||||||||||

| Posted: 04 Dec 2013 10:00 AM PST For anyone that still believes TPTB are actually "geniuses in disguise," I present exhibit #1; the financial "Maestro" himself, Alan Greenspan. His business career would make a great comic book; of how he started as an avid Ayn Rand disciple, penning Gold and Economic Freedom in 1966, before "turning to the dark side" upon becoming Fed Chairman in 1987. Clearly, the stars were aligned to create a true classic tragic hero – as just months after his appointment, a major stock crash occurred. It was at this point, armed with full government approval (as evidenced by creation of the President's Working Group on Financial Markets) that he forsook all he had learned, in the pursuit of wealth and power. Over the subsequent two decades – before handing the reins– he engineered the modern "alchemy" that has destroyed global economic activity, setting into motion the final throes of a doomed monetary system. In Gold and Economic Freedom, he famously wrote the following, scathing criticism of the very system he later fostered. Be warned, this will be the most intelligent thing you'll ever hear from a Central banker. In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. Thereafter, he made one intelligent comment in nearly five decades of public service; regarding the "Irrational Exuberance" he sensed in the late 1996 stock market. Of course, he did nothing about it; instead, holding the Fed Funds rate near multi-decade lows until the internet bubble popped – after which, he lowered it to nearly 0%, fostering the property bubble that subsequently destroyed the global economy in 2008. In fact, his justification for holding rates so low throughout the late 1990s equity bubble has become the mantra of those pointing to Central banker incompetence… It is impossible to identify a bubble until after it has burst. And to take this particular banker's incompetence a step further, here's what he said just after the Glass Steagall Act was repealed in 1999 (just before the market crashed), of the rapid growth of money center banks… I believe the general growth in large [financial] institutions have occurred in the context of an underlying structure of markets in which many of the larger risks are dramatically — I should say, fully — hedged. -NYtimes.com, October 8, 2008 Not to mention, his comments on subprime lending in late 2004… Improvements in lending practices driven by information technology have enabled lenders to reach out to households with previously unrecognized borrowing capacities. -Federalreserve.gov, October 19, 2004 …and derivatives in mid-2005… The use of a growing array of derivatives and the related application of more-sophisticated approaches to measuring and managing risk are key factors underpinning the greater resilience of our largest financial institutions. Derivatives have permitted the unbundling of financial risks. -Federalreserve.gov, May 5, 2005 Worse yet, these sentiments were mirrored exactly by his protégé and successor, Helicopter Ben himself; who in said the following in 2002, upon become a Federal Reserve Governor. The Fed cannot reliably identify bubbles in asset prices. Second, even if it could identify bubbles, monetary policy is far too blunt a tool for effective use against them. -FederalReserve.gov, October 15, 2002 In his defense, the concept of "quantitative easing" had not yet been created. But then again, Janet Yellen certainly was aware of QE when she made the below comment last month at her Senate confirmation hearing. The perfect hedge, as she straddles the line between Greespan's feigned ignorance, and Bernanke's futility. I think it is important for the Fed, hard as it is, to attempt to detect asset bubbles when they are forming. -Janet Yellen, November 19, 2013 Anyhow, I thought it important to give a bit of background on the Maestro's track record, before showing you his latest gem, espoused amidst a multi-million book tour. This does not have the characteristics, as far as I'm concerned, of a stock market bubble. The stock price generally goes up about 7% a year for the long term. It didn't go anywhere since October 2007, and the result of that is we're just now breaching that. We have had no growth in stock prices for years. -Bloomberg, November 27, 2013 In other words, he claims today's equity surge cannot possibly be a bubble because the market is simply "catching up" to five years of poor performance. In other words, it's like saying it can't possibly be murder, since the suspect has had a clean record for the past five years. To refute Bernanke's foolishness, let's start with the fact that over $10 trillion has been overtly printed by the Fed in the past five years; most of which, has been directly injected into speculative investments by the "TBTF" banks receiving these essentially free subsidies. Is it even remotely possible that such a quantity of printed money could have altered market dynamics a tad since 2007? Or how about the fact that the recent market surge coincided perfectly with the historic 2011 commencement of the "terrible money printing trio" of Operation Twist, QE3, and QE4? Moreover, does it strike you as strange, Sir Alan, that nearly the entire growth in equity averages is attributed to soaring P/E ratios, as opposed to earnings growth? Or that by any objective measure, the gap between macroeconomic and equity performance has reached an historic high, per below? Let alone, amidst historically low Presidential approval ratings in all the world's major economies?

How about record high margin debt – yes, higher than in both 2000 and 2007; amidst record hedge fund leverage?

Or better yet, a record low in bearish equity sentiment? Could it possibly be due to the moral hazard created by five years of maniacal money printing, market manipulation, and propaganda?

And finally, if anything shouts financial bubble louder than the ongoing mania in "crypto-currencies" like Bitcoin I'd like to know what it is.

Of course, the irony of the situation is that even after being attacked by TPTB for two straight years, there are still some that believe Precious Metals are in a "bubble." Down 35% and 60%, respectively, since the Fed, BOJ, and nearly all Central banks started "turbo-printing" in late 2011, gold and silver are now trading at – unquestionably – their lowest valuations relative to the global money supply in recorded history. Objectively, worldwide physical demand will reach an all-time high in 2013, yet not a peep about this historic development from the MSM. Conversely, all that's reported of PMs is that their recent decline is due to a "recovering" economy and prospects for an end to QE. Yet, anytime the "t word" is even mentioned, stock and bond markets spasm uncontrollably – terrified of what a non-Fed supported financial environment might look like. I first wrote of the "Precious Metals Anti-Bubble" back in February 2012 – with gold and silver prices dramatically higher than they are today. And thus, with prices well below the cost of production, amidst record global debt levels, money printing, and unemployment, use your own judgment as to what assets are currently in "bubbles," and which aren't.Similar Posts: | ||||||||||

| Shanghai Gold Exchange Cumulative Deliveries Of 8,655 Tonnes Posted: 04 Dec 2013 09:48 AM PST Stacy Summary: China leads the world in gold, silver and bitcoin. Unlike much of the West, they seem not only capable of holding more than one idea at a time but they also put their money where their mouths are. ETF holders and Western speculators can shriek all they want, but the unbanked and the people without bailout calmly prepare to rule the world. | ||||||||||

| Stockings to strain with gold bullion this Christmas Posted: 04 Dec 2013 09:14 AM PST The subdued price of the precious metal has sparked a Christmas stocking goldrush, according to Rob Halliday-Stein, founder of BullionByPost.co.uk. This posting includes an audio/video/photo media file: Download Now | ||||||||||

| Advanced Automated Trading Systems & Indicators with NinjaTrader Posted: 04 Dec 2013 09:08 AM PST Good Morning, I just want to touch on two things… the market and my new charting with NinjaTrader Today's video covers the SP500 in a little more detail along with natural gas and precious metals. It is a big day for the financial sector (banking stocks) and if they turn around and rally expect the SP500 to post some solid gains. Precious metals may keep selling off. Trend is still firmly down. Natural Gas is looking lofty… I am starting to drool over a short play or inverse ETF play for that. I am keeping my eye on it. Financials are on fire this morning, they did gap lower but have posted some big gains this morning. Anyone who got long in the past three days with me should be at breakeven or in the money now. Let's hop this is a key pivot low and prices rally/grind higher into the holiday season/year end. Below is a daily chart of the SP500 index using the NinjaTrader platform. Over the last few months as you likely know, we have been completing our fully automated SP500 trading system so that it will be available to our followers. Over the next month we will be phasing all our charting analysis, tools, indicators and systems to run on the NinjaTrader platform. Reason? because NinjaTrader Rocks! and supports all our custom indicators and automated trading systems much better than what we are using now. Anyways, back to the chart below… As you can see there is potential for the SP500 to pullback several percentage points. As long as it stays above our blue support line and short term high volume zone we will remain long the market adding on dips.

Talk soon, Chris Vermeulen

The post Advanced Automated Trading Systems & Indicators with NinjaTrader appeared first on ETF Trading Gold Newsletter. | ||||||||||

| BITCOINS, THE SECOND BIGGEST PONZI SCHEME IN HISTORY Posted: 04 Dec 2013 09:00 AM PST

I hereby make a prediction: Bitcoins will go down in history as the most spectacular private Ponzi scheme in history. It will dwarf anything dreamed of by Bernard Madoff. (It will never rival Social Security, however.) The fundamental characteristic of money is its relatively stable purchasing power. Bitcoins will never achieve this. It is a [...] The post BITCOINS, THE SECOND BIGGEST PONZI SCHEME IN HISTORY appeared first on Silver Doctors. | ||||||||||

| Posted: 04 Dec 2013 08:50 AM PST This Spring, as the global economy weakened to its worst state since the 2008 crisis, Cartel efforts to discredit gold and silver accelerated to levels even I had not seen; and I've watched tick for tick for nearly 12 years. As you know, the year's first PM "selling climax" occurred in late June, when Bennie made the worst mistake of his career. Not that rates wouldn't ultimately surge anyway, but in his fear of leaving a legacy of lowering rates to zero and keeping them there indefinitely, he catastrophically suggested the Fed might taper QE if the economy improved. Since then, the global economy is indisputably worse; with the only real "bright spot" being the all-out Central bank liquidity blitz that has produced surging stock markets – and equally incredibly, narrowing European sovereign bond spreads. And oh yeah, cooked NFP reports – whistleblowers et al – only showing "improved employment" due to a plunge in the Labor Participation Rate to a 35-year low and increased minimum wage jobs. Worse yet, the housing sector has indisputably rolled over – en route to plunging off a cliff. Everything from home sales to residential permits to construction spending is falling; and following a brief (Fed generated, let's not kid ourselves) interest rate dip after the September and October "no taper" announcements, rates are again rising sharply. According to the BLS itself, housing represents nearly half the U.S. economy – not to mention, a significant percentage of the nation's net worth; and it has nowhere to go but down. This morning, with the benchmark 10-year Treasury yield again surging above the Fed's current "Maginot Line" at 2.8%, it was just reported that mortgage and refinancing-related loan activity plummeted by simply astounding numbers; considering they were already at multi-year lows.

We're just two weeks from the Fed's last meeting of the year; and no doubt, TPTB want to publish another "better than expected" NFP report on Friday. If they do – "birth/death" jobs, "seasonal adjustments," and Labor Participation Rate declines and all – they may well destroy America's economy with one fell swoop. A rise above 3.0% on the ten-year will likely have catastrophic economic impacts the world round; which shows you how dire the global economic situation is, given 3.0% is still near the record lows achieved by the Fed's "QE4" program earlier this year. Not that Bennie's going to do anything but maintain the status quo; as both he and Janet Yellen last month promised "no taper" indefinitely. Nor will the Fed ever do anything, lest the aforementioned bond crash would commence on their watch. But either way, I feel compelled to dare them to speak of tapering. And FYI, Precious Metal sentiment just fell to multi-year lows, with both gold and silver trading well below their respective costs of production. Gee, I wonder how this will end up.Similar Posts: | ||||||||||

| Paper gold traders overpowering physical holders for now Posted: 04 Dec 2013 08:09 AM PST As stock prices have outperformed and inflation has not surfaced, traders and investors have lost interests in gold as a safe haven and an inflation hedge. | ||||||||||

| Bullion smuggling outstrips narcotics to feed Indias gold habit Posted: 04 Dec 2013 08:01 AM PST GATA | ||||||||||

| 5 CHARTS: The Real Story Behind Silver Posted: 04 Dec 2013 08:01 AM PST

As the world continues down the road of self-destruction via its highly leveraged paper financial markets, there's a much more fascinating story worth looking at. Hidden from the majority of the public and misunderstood by the so-called professional metal analysts, is the Real Story Behind Silver. From the SRSRocco Report: The real problem today as [...] The post 5 CHARTS: The Real Story Behind Silver appeared first on Silver Doctors. | ||||||||||

| Stewart Thomson: What’s Broke In Gold & How To Fix It Posted: 04 Dec 2013 08:00 AM PST

Only Indians can fix what is broken in the gold market, and they are working maniacally to do it. Give India's gold buyer class the time they need to really fix what is really broken in the gold market, and they will get the job done. 2013 Gold Maples As Low As $35.99 Over [...] The post Stewart Thomson: What’s Broke In Gold & How To Fix It appeared first on Silver Doctors. | ||||||||||

| A gold investor’s perspective: From the Taj Mahal to Westminster Abbey Posted: 04 Dec 2013 07:54 AM PST India's growing GDP is very important to gold's rise, especially when it comes to the Love Trade. The math shows that an increasing GDP per capita in this part of the world has historically been linked to the rising price of gold. | ||||||||||

| Gold Has Held Its Purchasing Power Very Well Posted: 04 Dec 2013 07:45 AM PST I got another email from Backwoods Jack today below:

I replied:

Similar Posts: | ||||||||||

| Era Of Depositor Bail-In Cometh (Part 1) Posted: 04 Dec 2013 07:02 AM PST gold.ie | ||||||||||

| The Era Of Depositor Bail-In Cometh Posted: 04 Dec 2013 05:47 AM PST

The era of bondholder bailouts is ending and that of depositor bail-in is coming. The changing financial landscape post crisis poses challenges to savers and investors globally. It is important we consider how savings and investments can be protected. Bail-ins are a risk in the coming years and yet there is a lack of appreciation of [...] The post The Era Of Depositor Bail-In Cometh appeared first on Silver Doctors. | ||||||||||

| Era Of Depositor Bail-In Cometh (Part 1) Posted: 04 Dec 2013 04:31 AM PST The changing financial landscape post crisis poses challenges to savers and investors globally. The era of bondholder bailouts is ending and that of depositor bail-in is coming. Today's AM fix was USD 1,213.00, EUR 892.57 and GBP 741.13 per ounce. Gold rose $3.70 or 0.3% yesterday, closing at $1,222.70/oz. Silver slipped $0.03 or 0.16% closing at $19.12/oz. Platinum climbed $14.50, or 1.1%, to $1,352.25/oz and palladium rose $3, or 0.4%, to $711.97/oz. Gold in euros fell to 892.16 euros/oz, the lowest since August 3, 2010. Gold in euros has fallen 30% this year, against 28% for gold in dollar terms. Gold fell to 740.64 pounds/oz, the lowest since August 3, 2010. Gold has fallen 28% in sterling terms this year. Gold is higher in Aussie dollars this morning, due to weak Q3 GDP growth and concerns about the Australian economy. Gold fell to the lowest in almost five months in London this morning as very tentative signs of improving U.S. economic growth added to continuing speculation that the Federal Reserve may reduce its massive $85 billion per month bond buying programme. U.S. manufacturing accelerated at the fastest pace in more than two years in November, data showed on December 2. Less positive data showing consumer sales on Black Friday were worse than expected was ignored. Gold is set for the first annual drop in 13 years as trend following traders and more speculative investors lose faith in the metal as a trade. Store of value and financial insurance bullion buyers remain steadfast and continue to buy physical on the dip – especially in Asia and of course China.

It is interesting to note that the hedge fund Tiberius, who have been highly vocal as bearish on gold for years have changed their long term position. They remain bearish in the short term but believe that weak hands have been washed out of the market. They believe that strong hands will propel prices higher again – possibly later in 2014.

Minutes of the Fed's October meeting released November 20 showed that policy makers expected an improving economy to warrant trimming debt purchases in coming months. The Fed next gathers on December 17-18. Reducing the huge bond buying programme has been suggested for some years now. As ever, ignore the jawboning – watch what they do, rather than what they say.

Era Of Bond Holder Bailouts Ending – That Of Depositor Bail-In Cometh (Part 1) The changing financial landscape post crisis poses challenges to savers and investors globally. It is important we consider how savings and investments can be protected. Bail-ins are a risk in the coming years and yet there is a lack of appreciation of this risk as there was a lack of appreciation of the risks posed by the Irish property bubble and the global debt crisis. This research note is therefore timely and welcome as there is a lack of research regarding a bailin and bail-ins and the ramifications thereof. It will take a number of years for the final configuration of the new financial order to become clear. This means that there are difficulties inherent in selecting appropriate investments when the ultimate outcome is unclear. Apart from that, what we do know at present is that there are straws in the wind that should concern savers. The approach taken with failing banks in Europe, to in one form or another socialise the debts across taxpayers created a so called doom loop. As the banks got weaker more and more of their debts were passed to already strained sovereign treasuries, weakening them and making it more difficult for them to intervene early in stressed banks. The realisation that, with banks which were multiples in size of the sovereign regulating them, this could not go on was slow to emerge but it has now done so. In an as yet to be determined but medium term future, banks which face losses will have to act in an avowedly capitalistic manner. First reserves and equity, then senior, then junior debt will be used as the risk capital in order to fill these debt holes. What is new is that if losses continue, after burning through this capital, rather than the state, it is depositors who will be in play. Beyond that we see other threats to the stability and profitability of the banking system. The EU has launched a consultative process on the sustainability of the present financial system and has concluded in early work that a much more hybrid system, merging the bank based continental system and the Anglo Saxon market scheme, is needed. Combined with the inevitability of inflation (even the desirability of same in so far as it entails in its early stages a recovered economy), these suggest that savers will face a complex and perhaps lower return environment in the medium term. In that context a move to increased allocation of savings to alternative investments, including a prudent allocation of some 5% to 10% to precious metals, is a sensible policy. This research note is very useful in pulling together some of these strands and others and should be required reading for savers internationally and for medium and long term investors.

His research on gold has established that gold is important as a long term diversification due to gold's "unique properties as simultaneously a hedge instrument and a safe haven." Download our Bail-In Guide: Protecting your Savings In The Coming Bail-In Era (11 pages) | ||||||||||

| Get the best price for your Gold, Silver in Holiday season: Expert Posted: 04 Dec 2013 03:32 AM PST A reputable jeweler or coin dealer should pay you between 70 and 80 percent of the current bullion melt value of the gold. Remember that you'll receive less money for an ounce of 14 karat gold jewelry than you will for gold that is 18 karat, Fuljenz pointed out. | ||||||||||

| 5 CHARTS: The Real Story Behind Silver Posted: 04 Dec 2013 02:40 AM PST srsroccoreport | ||||||||||

| Silver Mining Company Says It’s Helpless Against Market Manipulation Posted: 04 Dec 2013 02:28 AM PST "Based on these numbers, it's pretty easy to see who runs the show in the precious metals" ¤ Yesterday In Gold & SilverIt was a lot quieter on Tuesday as far as price action was concerned, but I'm sure you've already noted gold made a new low for this move down, and as is usually the case, it came at the London p.m. gold fix. The subsequent rally didn't get far, or wasn't allowed to get far. From there the gold price traded flat into the close. The high and low ticks recorded by the CME were $1,225.80 and $1,214.60 in the February contract. Gold closed at $1,224.30 spot, up and even $5.00 from Monday's close. Net volume, although not heavy, wasn't exactly light either at 124,000 contracts. The silver price didn't do much either, and it's a coin toss as to whether the low tick came at 11 a.m. in London, or at the London p.m. gold fix. Not that it mattered when it happened, I suppose, but it was another new low for this move down. The tiny rally off the low at the p.m. fix met the same fate at the precise same time as the gold rally did. The highs and lows, such as they were, were $19.335 and $18.975 in the March contract as posted on the CME's website. Silver finished the Tuesday trading session at $19.175 spot, down 3 cents from Monday. Considering the lack of price movement, net volume was pretty chunky at 46,000 contracts. Platinum had a tiny rally in early morning trading in the Far East that didn't last. But the next rally attempt that began at the Comex open, lasted until noon before trading sideways into the close. Palladium finished in the black as well, but platinum was the star of the day. Here are the charts. The dollar index closed on Monday afternoon in New York at 80.90. It rallied to its 80.99 high shortly before 1 p.m. in Far East trading, and then began to decline steadily until it hit its low of 80.51 around 11:45 a.m. in New York. The index rallied slowly and unsteadily into the close from that low, finishing the Tuesday session at 80.61, down 29 basis points from Monday. The gold stocks attempted to rally at the start of trading in New York, but quickly fell into negative territory as gold hit its low at the London p.m. fix, which came shortly after 3 p.m. GMT, or 10 a.m. in New York. The attempted rally off that low got nowhere, and the gold stocks slid some more into the close. The HUI finished down another 1.55%. The HUI is already down 7.5% in the first two trading days of December. The chart pattern for the silver equities looked similar, but Nick Laird's Intraday Silver Sentiment Index only closed down 0.10%. The CME Daily Delivery Report showed that 328 gold and 126 silver contracts were posted for delivery within the Comex-approved depositories on Thursday. The shocking thing about the gold deliveries was not that the big short/issuer was JPMorgan out of its client account with 300 contracts, but that the big long/stopper [drum roll, please!] was JPMorgan out of it's in-house [proprietary] trading account with 336 contracts. How's that for insider trading!!! You either trick or lie to your clients into going short, and then the company itself scoops up their positions by standing for delivery against them. You couldn't make this stuff up!!! The Volcker Rule can't get enacted soon enough for either Ted Butler, or for me. In silver, the largest short/issuer was Jefferies with 103 contracts. And it should come as no surprise that JPMorgan was by far the biggest long/stopper with 98 contracts; 84 for its in-house account, and the balance for its client account. In distant second was Canada's Bank of Nova Scotia with 19 contracts stopped. The link to yesterday's Issuers and Stoppers Report is here, and it's worth a quick look for obvious reasons. It was no surprise to find that an authorized participant had made another withdrawal from GLD yesterday. This time it was 57,881 troy ounces. There was a withdrawal from SLV as well, but only 145,587 troy ounces. That's too small an amount for a 'plain vanilla' withdrawal because of price, and also too small to be a fee payment, so I'd guess that the owner of that silver needed it elsewhere. Over at Switzerland's Zürcher Kantonalbank for the week ending on November 29, they reported smallish declines in both their gold and silver ETFs. Their gold ETF dropped by 22,122 troy ounces, and their silver ETF fell by 256,081 troy ounces. The U.S. Mint had another sales report yesterday. They sold 9,000 troy ounces of gold eagles and 110,500 silver eagles. Gold movement inside the Comex-approved depositories on Monday is hardly worth writing about, as only 314 troy ounces were reported received, and nothing was shipped out. Here's the link to that 'activity'. In silver, nothing was reported received, but 642,141 troy ounces were reported shipped out of HSBC USA's vault on Monday. The link to that action is here. I have the usual number of stories for a mid-week column, and I hope you find something of interest in today's selection. ¤ Critical ReadsU.S. stocks fall for third day on taper worriesU.S. stocks fell Tuesday, with the S&P 500 and the Dow Jones Industrial Average falling for a third straight day on uncertainty over when the Federal Reserve will begin to scale back stimulus and self-fulfilling fears the market was overdue for a pullback from record levels. The Dow Jones Industrial Average dropped more than 100 points during the session before settling at 15,914.62, down 94.15 points, or 0.6%, taking it well below the psychologically important 16,000 level. The drop was the index’s biggest one-day decline since Nov. 7. The S&P 500 lost 5.75 points, or 0.3%, to 1,795.15 and the Nasdaq Composite declined 8.06 points, or 0.2%, to 4,037.20. “I hate to use the words, ‘we’re due,’ but we’ve gone straight up,” said J.J. Kinahan, chief derivatives strategist at TD Ameritrade in Chicago. This news item was posted on the marketwatch.com Internet site just after the markets closed in New York yesterday afternoon...and I thank Roy Stephens for today's first story. Dr. Marc Faber: Not a good time to buy stocksThis 6:58 minute video interview was posted on the foxbusiness.com Internet site after the markets closed in New York on Monday...and my thanks go out to reader Ken Hurt for sending it our way. It's worth a listen. A Picture Worth a Thousand Words: One Of These Is The "Real" EconomyIt seems some among the mainstream media believe "the economy is improving." In the interests of clearing up that little misunderstanding, we hope the following chart will clarify which "economy" is improving... That's all there is to this tiny story, but the chart in this Zero Hedge article from yesterday afternoon is a must to see...and I thank reader M.A. for bringing it to our attention. Bill Gross Explains What "Keeps Him Up At Night"What keeps us up at night? Well I can’t speak for the others, having spoken too much already to please PIMCO’s marketing specialists, but I will give you some thoughts about what keeps Mohamed and me up at night. Mohamed, the creator of the “New Normal” characterization of our post-Lehman global economy, now focuses on the possibility of a” T junction” investment future where markets approach a time-uncertain inflection point, and then head either bubbly right or bubble-popping left due to the negative aspects of fiscal and monetary policies in a highly levered world. Investors are all playing the same dangerous game that depends on a near perpetual policy of cheap financing and artificially low interest rates in a desperate gamble to promote growth. The Fed, the BOJ (certainly), the ECB and the BOE are setting the example for global markets, basically telling investors that they have no alternative than to invest in riskier assets or to lever high quality assets. “You have no other choice,” their policies insinuate. “Get used to negative real interest rates, move out on the risk spectrum and in the process help heal the real economy,” they seem to command. With Top 4 U.S. Banks Holding $217 Trillion in Derivatives, Total Number of U.S. Banks Drops to Record LowOvernight, The Wall Street Journal reported a financial factoid well-known to regular readers: namely that as a result of a broken system that ever since the LTCM bailout has encouraged banks to become take on so much risk they become systematically important (as in their failure would "end capitalism as we know it"), and thus Too Big To Fail, there has been an unprecedented roll-up of existing financial institutions especially among the top, while the smaller, less "relevant", if far more prudent banks have been forced out of business. "The decline in bank numbers, from a peak of more than 18,000, has come almost entirely in the form of exits by banks with less than $100 million in assets, with the bulk occurring between 1984 and 2011. More than 10,000 banks left the industry during that period as a result of mergers, consolidations or failures, FDIC data show. About 17% of the banks collapsed." The point here is that the number of banks is largely irrelevant: it is obvious that the big will keep on getting bigger, and the Big 5 banks will do all in their power to either acquire their profitable competition or put everyone else out of business. However, the far bigger question is what happens to bank deposits once the Fed start to taper, ends QE or outright unwinds its balance sheet, which ultimately would soak up trillions from bank deposits. Because if there is one thing that is clear is that without the Fed, and without commercial bank loan creation (which has been non-existent in the past 5 years), bank balance sheet would be exactly where they were the day Lehman died. Finally, one does not need to go any further than the following chart from the OCC [See Table 9, Page 36 for the precious metals. - Ed] showing total bank derivative holdings for all US banks and just the Top 4. The punchline: just the 4 biggest U.S. banks hold $217.5 trillion, or 93% of the total $233.9 trillion in derivatives. This Zero Hedge piece is worth spending a few minutes on...and I'll have more on the precious metal derivatives in The Wrap. This is the second news item in a row from Ulrike Marx. Detroit Eligible To File Chapter 9; Pension Haircuts Allowed Bankruptcy Judge RulesAs somewhat expected - though hoped against by many Detroit union workers - Judge Steven Rhodes appears to have confirmed Detroit is eligible for bankruptcy protection (after pointing out that the city's accounting was accurate...and it is indeed insolvent) making this the largest ever muni bankruptcy. The city will now begin working toward its next major move - the submission of a plan to re-adjust its more than $18 billion in debt - including significant haircuts for pension funds and bondholders. With Detroit as precedent, we can only imagine the torrent of other cities in trouble that will be willing to fold. He did provide an "out" though: Rhodes warns the city that just because pension rights can be impaired, doesn't mean he will approve a plan with steep cuts. This is another article from Zero Hedge, this one from late yesterday morning EST...and I thank reader M.A. for his second contribution to today's missive. There was also a 2-page story about this in The New York Times yesterday...and it's worth your while as well. It's courtesy of Roy Stephens. Grant Williams on Flushing the Impurities of Q.E. From the System Grant Williams "pulls no punches" in this all-encompassing presentation as the "Things That Make You Go Hmmm" author reflects on what is behind us and looks ahead at the ugly reality that we will face when "the impurities of QE are finally flushed from the system." U.K. Households Raid Savings at Record RateHouseholds are pulling money out of their savings accounts at the fastest rate in modern record, according to Bank of England figures. In the past year, families have withdrawn £23bn from their long-term savings accounts to convert into cash and put into current accounts - the equivalent of around £900 for every household in the country. It is the most dramatic evidence yet that Britons are paying for the rising cost of living by raiding their savings accounts. No surprises here, as this is happening in just about every country in the Western world at the moment. This SkyNews story was picked up by the uk.news.yahoo.com Internet site early yesterday morning GMT...and my thanks go out to West Virginia reader Elliot Simon. Derivative markets have already upgraded Britain to AAAThe cost of insuring British debt against default has fallen below the levels for the US, Switzerland, Japan and every major eurozone state except Germany, marking a dramatic change of view on UK’s economic prospects. Credit default swaps (CDS), used for insuring and trading sovereign debt, are “pricing” British bonds as if they were top-notch AAA quality. This comes amid growing speculation that rating agencies may soon shift gears and start to upgrade the UK. The CDS contracts for the UK have been on a downward trend for months as growth picks up, cutting below countries that still have AAA ratings such as Austria, Australia and Canada. As you already know, dear reader, computer algorithms and high-frequency trading can set a price/value on anything that they choose to...including affecting credit ratings if necessary. This Ambrose Evans-Pritchard article was posted on the telegraph.co.uk Internet site on Monday evening...and my thanks go out to Roy Stephens once again. It's worth reading. MPs ask MI5 boss to justify claim that NSA leaks endangered national securityA committee of MPs challenged the existing system of oversight for the security services by asking the head of MI5 to justify his claims that the Guardian has endangered national security by publishing leaks from the former NSA contractor Edward Snowden. In an unprecedented step, Keith Vaz, the chairman of the home affairs select committee, announced that spy chief Andrew Parker had been summoned to give evidence in public to the Commons committee next week. The decision was taken at a private session of the select committee on Tuesday before the body heard evidence from Guardian editor Alan Rusbridger seeking to justify the Guardian's decision to publish a string of stories based on US and UK intelligence agency files leaked by Snowden to the media. This very interesting news item was posted on The Guardian's website late yesterday evening GMT...and it's another offering from Roy Stephens, for which I thank him. No Confidence Vote Fails: Yanukovych Brings Dissenters Into LineUkrainian President Viktor Yanukovych prevented a palace coup against his government on Tuesday. His party managed to see off a vote of no co | ||||||||||

| OECD educational report: Pisa fever is causing east Asia's demographic collapse Posted: 04 Dec 2013 02:28 AM PST the Netherlands, our close cultural kin. But before we all flagellate ourselves – let alone think of copying the Shanghai success formula – just remember one thing. There is a body of scholarship showing that the collapse of the fertility rate to dangerously low levels across east Asia is the direct consequence of school cramming and "education fever". This is well-known to demographers and those who follow the Far East closely, but less known in the West. The CIA World FactBook says fertility rates have fallen to: Hong Kong (1.04%), Singapore (1.10), Taiwan (1.15), Japan (1.20), Korea (1.22%). These figures may be a little too low. Japan and Singapore have seen a small bounce lately. But the picture is clear enough, and Shanghai is thought to be around 1.08 percent at this point, a harbinger of things to come across China's eastern seaboard. They are all far below the stability level of 2.1 percent. The whole of east Asia faces an acute ageing crisis. It has already begun in Japan. This blog from Ambrose Evans-Pritchard yesterday is a very interesting read and it's the second-last offering of the day from reader Roy Stephens. | ||||||||||

| Return the treasures Britain looted, Chinese tell Cameron Posted: 04 Dec 2013 02:28 AM PST British Prime Minister David Cameron faced demands for the return of priceless artifacts looted from Beijing in the 19th century on Wednesday, the last day of his visit to China. "When will Britain return the illegally plundered artifacts?" the organisation asked, referring to 23,000 items in the British Museum which it says were looted by the British Army, part of the Eight-Nation Alliance that put down the Boxer Rebellion at the end of the 19th century, a popular uprising against the incursion of European imperial powers in China. To the Chinese, the ransacking of the Forbidden City, and the earlier destruction of the Old Summer Palace in Beijing in 1860 -- about which one British officer wrote: "You can scarcely imagine the beauty and magnificence of the places we burnt. It made one?s heart sore to burn them" -- remain key symbols of how the country was once dominated by foreign powers. Well, dear reader, if you want to know one of the reasons that Britain gave Hong Kong back to China without a whimper, this is one of them...along with the other opium war that occurred earlier in the 19th century. This absolute must read commentary was posted on the france24.com Internet site early this morning...and I thank South African reader B.V. for sliding it into my in-box in the wee hours of this morning. That link to the "opium war" in this paragraph is a must read as well, as it includes China's connection to silver, amongst other things. We haven't heard the last of this, and one has to wonder what new direction China will go from here, as they're obviously turning up the heat on many fronts now. | ||||||||||

| Posted: 04 Dec 2013 02:28 AM PST 1. Grant Williams: "Stunning Event is About to Completely Alter the War on Gold". 2. Jean-Marie Eveillard: "There Are Absolutely Terrifying Risks Facing Global Markets". 3. Ron Rosen: "60-Year Market Veteran - This Will Send Gold and Oil Soaring". [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests, to them, and not to me. Thank you. - Ed] | ||||||||||

| India's Gold smugglers make a killing as hawala premium doubles Posted: 04 Dec 2013 02:28 AM PST According to World Gold Council, gold is entering the country unofficially through India’s porous borders helped to meet pent-up demand, together with an influx of recycled gold that was drawn out by higher prices and promotions offered by retailers during the third quarter to end-September. “Reports that a good market for 10-tola (100 grams) bars is re-emerging, due to the relative ease with which they can be concealed, reinforce this view,” the WGC said in a report last month. The WGC report also noted that Thailand is being used as a route to channel gold into other markets, notably India and Vietnam. “Investigations and seizures by financial intelligence agencies in the recent past have revealed that smugglers are now flying consignments of gold to Bangladesh and Nepal and then using couriers to carry them across the border,” the report said. No story surprises me regarding gold smuggling into India. This one was posted on the firstpost.com Internet site yesterday...and it's worth reading. My thanks go out to Ulrike Marx once again. | ||||||||||

| Gold smugglers adopting methods of drug couriers Posted: 04 Dec 2013 02:28 AM PST Gold smugglers are adopting the methods of drug couriers to sidestep a government crackdown on imports of the precious metal, stashing gold in imported vehicles and even using mules who swallow nuggets to try to get them past airport security. | ||||||||||

| Korea Exchange to begin physical gold trading Posted: 04 Dec 2013 02:28 AM PST Korea Exchange Inc. will begin physical gold trading on March 24 as Park Geun Hye’s government seeks to wring tax revenue out of a market that’s dominated by illegal transactions. The exchange will use 1 gram units of bullion of 99.99 percent purity to spur liquidity and delivery will be in 1 kilogram bars, the bourse said in a statement today. Trading will start on a test basis for two weeks from Feb. 10 before full operations, it said. South Koreans hold seven times as much gold as the 104.4 metric tons in their central bank’s vaults and the majority of trading is on the black market to evade import duty and value- added tax, according to government estimates. Park, who marks the one-year anniversary of her election as president this month, scaled back welfare pledges in September as her administration forecast the first drop in revenue in four years. This Bloomberg story found a home over at the mineweb.com Internet site yesterday...and it's the final contribution of the day from Ulrike Marx. | ||||||||||

| Mike Maloney: How to Hide Your Gold and Silver Posted: 04 Dec 2013 02:28 AM PST For gold and silver bullion buyers, the question arises of where to take delivery of and safeguard your precious metals. Taking physical delivery of your gold or silver is often the most rewarding part of the purchasing experience, as it gives you, the bullion investor, a fuller understanding of the real value of tangible monetary assets. As one of the industry's leading bullion dealers, we at GoldSilver.com pride ourselves on investing and buying bullion right alongside our customers. Because we are such proponents of taking physical delivery first, we have compiled a few creative storage solutions based on voluntary, anonymous, customer feedback. This very interesting commentary was posted on the 24hgold.com Internet site on Monday...and it's definitely worth reading. My thanks go out to Elliot Simon for sending it our way. | ||||||||||

| Silver mining company says it's helpless against market manipulation Posted: 04 Dec 2013 02:28 AM PST A GATA supporter wrote the other day to the investor relations officer of a silver mining company in which he is invested to complain about the company's seeming indifference to the manipulation of the monetary metals markets. He soon received this reply: "Thanks for your email. We share your frustration about the silver price. However, we don't attempt to take action against the bullion bankers for manipulation because 1) it is primarily the responsibility of the U.S. Commodity Futures Trading Commission, not the companies, to regulate these markets, so the companies would have to sue the bullion banks too; 2) manipulation is just too difficult to prove; 3) such a lawsuit would take many years and cost many millions of dollars with no certainty as to the outcome; and 4) every company invests its cash where it thinks it can create the biggest return to shareholders. "In our case, we think investing shareholder money in things we can control, such as growing our business and our profits, is of greater benefit to our shareholders than investing in things we cannot control, such as suing the bullion bankers and the CFTC, both of which have far more financial and human clout than we companies do. They would just outspend us and stall for time." This is the biggest bulls hit cop-out I can think of. There are a multitude of ways that the silver/gold mining industry [or a group of its members] can take a stand without a lawsuit of any kind...and it would put enormous pressure on the CFTC and the bullion banks involved. Of course it would be helpful if the World Gold Council and The Silver Institute would get onside on this...but these two organizations are there for precisely the purpose of insuring that this sort of action is never taken. All current and past directors of these organizations sold out to the dark side of The Force long before they were "invited" to serve in them. I found this story on the gata.org Internet site last evening...and it's a must read for sure. | ||||||||||

| Posted: 04 Dec 2013 01:53 AM PST My cat Gabriel is asking to become a fur coat. He managed to delete nearly all of my links. No joke, he destroyed over a hour of work. Snowy Owls Spotted in Tri-State Area NBCPhiladelphia (Carol B) Which schools make graduates most likely to cheat? Colleges with the most alumni on AshleyMadison Daily Mail Brinicle’ ice finger of death filmed in Antarctic BBC (Carol B) Cotton Ball Diet Gaining Popularity, Worrying Health Officials Inquisitr (furzy mouse) Chemotherapy needs gut bacteria to work ScienceNews Scout [NLP, Move up from Twitter Feeds to Court Opinions] Patrick Durusau (Lambert) Growth zombie feasts on Australian brains MacroBusiness Korea and world fear Fukushima's radiation Korea JoonAng Daily OECD educational report: Pisa fever is causing east Asia’s demographic collapse Ambrose Evans-Pritchard, Telegraph Biden arrives in China amid tensions over air zone BBC Exclusive: Chinese authorities conduct unannounced ‘inspections’ of Bloomberg News bureaus CNN (furzy mouse) China must not copy the Kaiser's errors Martin Wolf, Financial Times. The one part I’m not sure about is Wolf’s assumption that China would suffer more in a full-blown conflict. The US has stupidly allowed China to assume a monopoly in at least two critical goods: rare earths and ascorbic acid, which among other things is an important food preservative. China is also an important source of computer chips. I am sure reader can add to this list. Will the Generals Intervene Again in Thailand? BusinessWeek Unilever CEO Says Emerging Market Slowdown to Last for Years Bloomberg Mass Die-Off of West Coast Sealife: Fukushima Radiation … Or Something Else? George Washington Can Greece’s SYRIZA Change Europe’s Economy? Yanis Varoufakis, Boston Review Unions fire warning shots over privatisations Cyprus Mail Big Brother is Watching You Watch

Obamacare Launch

GOP cure for Obama: Impeachment Dana Milbank, Washington Post Alec in crisis after donor exodus Guardian The Googlization of the Far Right: Why Is Google Funding Grover Norquist, Heritage Action and ALEC? Truthout (Paul Tioxon) Detroit Eligible for Bankruptcy Protection, Judge Rules Wall Street Journal Detroit: Eligibility and Pensions Adam Levitin, Credit Slips Wal-Mart pays lawyer fees for dozens of executives in bribery probe Reuters Walmart Is Selling Banksy’s “Destroy Capitalism” Print Slate (bob) Federal Regulators Expected to Approve Toughened Volcker Rule Next Week Wall Street Journal. Mirabile dictu. The $5 trillion dilemma facing banking regulators Felix Salmon. I hope to address this. I think the framing is all wrong. Liquidity that depends on government backstopping is a subsidy to financial markets at the expense of the real economy. Being an investor is about bearing risk at a price. Investors need to factor in liquidity risk. And investors invested in the stone ages of lower liquidity (as in the 1980s) and didn’t bitch about bonds being not that liquid. Europe to unleash heavy rate-fixing fines Financial Times Is gold headed for bear capitulation? MacroBusiness Grace and the Cycle of Abuse Ian Welsh Antidote du jour (furzy mouse): | ||||||||||

| Posted: 04 Dec 2013 01:41 AM PST The digital currency has soared in value. Is it a good investment or just the latest fad? This posting includes an audio/video/photo media file: Download Now | ||||||||||

| TECHNICAL - Gold Market is Quiet Following Large Down Day Posted: 04 Dec 2013 01:30 AM PST dailyfx |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment