saveyourassetsfirst3 |

- Korea Exchange to begin physical gold trading

- Analysts line up to declare gold’s ‘decline & fall’

- Can't-miss headlines: Gold price nears $1,200, 166m @ 6.65% Cu/7.75 g/t Au & more

- Goldcorp's Management Presents at Scotiabank Mining Conference 2013 (Transcript)

- The Next Black Swan: A Dollar Crisis

- A Reader’s Questions

- The Illusion Of Tangible Assets

- Virtual Gold Backed Currency to Rival Bitcoin?

- Is Bitcoin A Threat To Western Union?

- A Million Dollars Just Isn't What It Used To Be (Part 1)

- 7 Stocks With High Yields That Santa Claus Owns And Recommends For Retirement

- Mexican and DRC silver and gold project work awarded to MDM Engineering

- The next black swan: A dollar crisis

- 15 Signs That We Are Near The Peak Of An Absolutely Massive Stock Market Bubble

- CIA Bitcoin Conspiracy, Silver to Break the Economy

- What now for Janet Yellen and gold?

- Silver and gold as currency commodities

- Bail-Ins And Deposit Confiscation Confirmed At ‘Future of Banking in Europe’ Conference

- All that glitters is gold: India Jewellery Review 2013

- Gold, What Is It Good for?

- THEY Are Going To Confiscate YOUR Silver!!!

- The Housing Market Approaches A Cliff

- What's Up with the VIX?

- THE NEXT BLACK SWAN: A DOLLAR CRISIS

- Analysts line up to declare "decline & fall" of gold after 2.6% tumble

- Just A Few Overnight Stories

- Closing the 2008 Gap

- Bail-Ins And Deposit Confiscation Confirmed At ‘Future of Banking in Europe’ Conference

- Zimbabwe Ben, Janet “von Havenstein” Yellen And The Taper That Will Never Happen

- The Definition of Money

- Gold And Silver Approaching Critical Price Points

- THE NEXT BLACK SWAN: A DOLLAR CRISIS

- Turkey Gold imports jump to record 270.67 tons till Nov 13

- Gold Mining Executive: “You Have To Be Able To Survive The Lows In Order To Reap The Benefit Of The Highs”

- Price of Gold Can’t Stay Below the Cost of Production for Long

- History Learns That Manipulation In The Gold Market Has An Explosive Ending

- Bail-Ins And Deposit Confiscation Confirmed At ‘Future of Banking in Europe’ Conference

- Risk and Reward: China's Golden Hammer

- Worst November in 35 Years for Gold as Indias Import Ban Forces Jump in Recycling

- Bail-Ins And Deposit Confiscation Confirmed At ‘Future of Banking in Europe’ Conference

- Gold price falls below the cost of digging it out of the ground

- The Silence of the Blockheads—Maybe Soon to Be Dead Silence

- Doug Noland: Pertinent Bubble Insights from the Roaring Twenties

- Ten King World News Blogs/Audio Interviews

- India gold imports, sales stay low

- China is fully aware of gold price suppression and planning to overthrow it

- Morgan manipulates gold market, maybe China does too, Casey Research's Bud Conrad says

- Russian government radio cites GATA in report on gold market manipulation

- Alasdair Macleod: Arab gold

- Four Arabian Gulf countries said planning common currency pegged to U.S. dollar

| Korea Exchange to begin physical gold trading Posted: 03 Dec 2013 03:03 PM PST The exchange will begin physical gold trading on March 24 as the government seeks to wring tax revenue out of a market dominated by illegal transactions. |

| Analysts line up to declare gold’s ‘decline & fall’ Posted: 03 Dec 2013 02:51 PM PST "We have no doubt that gold is in a bear market," says the commodities team at Credit Suisse, repeating the view it first gave in February's End of an Era report. |

| Can't-miss headlines: Gold price nears $1,200, 166m @ 6.65% Cu/7.75 g/t Au & more Posted: 03 Dec 2013 02:26 PM PST The latest morning headlines, top junior developments and metal price movements. Today, gold falls closing in on $1,200 mark and Reservoir/Freeport report a copper-gold whopper. |

| Goldcorp's Management Presents at Scotiabank Mining Conference 2013 (Transcript) Posted: 03 Dec 2013 01:05 PM PST Goldcorp, Inc. (GG) Scotiabank Mining Conference 2013 December 03, 2013 11:40 AM ET Executives Lindsay Hall - EVP and CFO Analysts Presentation Unidentified Analyst Hi, our final speaker before the lunch break from Goldcorp Mr. Lindsay Hall, Executive Vice President and Chief Financial Officer. Most of the afternoon is going to be gold and precious metals focus so this will kick-off a shift from base metals (inaudible). Welcome. Lindsay Hall Good morning everybody. It's really nice to join the Scotiabank Mining Conference, we come every year, we want to thank Tanya back for inviting us. It's important us in the gold business that Scotiabank invest in these conferences and we attained because it's important part of our business. With me today is Jeff Wilhoit, our VP of IR. So it is a switch of a gear from your base metals into precious metals. So I'll walk through the Goldcorp's story |

| The Next Black Swan: A Dollar Crisis Posted: 03 Dec 2013 01:01 PM PST Gold Scents |

| Posted: 03 Dec 2013 01:00 PM PST I received an e-mail over the weekend with a list of questions regarding what I thought the financial world might look like during and after the coming re set/bank holiday. I first read the questions and thought to myself, I thought I’ve written about each of these questions several times over like a broken record, haven’t they already heard my opinion on all of these? To wit, here are the questions… Will ATM machines shut down? Will personal checks cease to be honored? Will business and personal deposits be lost for long periods with little recourse? Will mortgage companies accept late payments when mail ceases to be delivered? Will lenders accept pay off of loans with dollars of reduced value? Will it still be possible to borrow money? Will one be able to make purchases with junk silver even though one's state does not (yet) recognize gold and silver as legal currency? No one whom we read seems to have addressed these practical concerns of those of us who have taken recommended steps to “get out of the system” and invest in bullion. As always your comments would be much valued by those of us lucky enough to know you! While beginning to write this I realize that yes, I have answered all of these questions many times before but maybe not all at one sitting so here it goes. Will ATM’s stay open? Of course not, unlike a Saturday or Sunday holiday, when the banks close so will the ATM’s (and no access to your safe deposit boxes either). If you recall the Cyprus “bail in,” ATM’s did not distribute cash; afterwards we may even see an “Argentina style” closure where you are limited to something like $60 per week in withdrawals. How about personal (or corporate) checks? Good luck here, if bank A doesn’t trust bank B or bank C, how will anyone trust that the check will ever get cleared? And if a new currency is announced? Who in their right mind would accept a check which is actually a form of overnight credit when we are at a point where even central banks don’t trust each other? Mortgages and payments are another question. This one is tough because it will be a moving target. Government decision making and “rules” will enter the equation and no one can forecast what their “wisdom” will be. I would guess that mortgage balances will be readjusted for the new currency or ratio’d to any devaluation. Will you be able to pay your mortgage off with a couple of gold coins? Probably not but I would be willing to guess that it will require far fewer ounces than it takes right now. Another question here would be what if you do enter a reset with a big balance? Suppose you have $100K sitting in the bank, how long can you make your “new” mortgage payments if you get “bailed in” and your new balance is only $15K? Also, will mortgage balances be altered 1 for 1 with the introduction of a new currency? Will mortgage balances and account balances be “reset” equally? The next question asks if we will be able to borrow money. I would surely think “yes”…but not right away. Lending will cease for a time until lenders and borrowers understand what the terms are. I would also say that debt will be “shunned” just as it was after the Great Depression. It is well known that credit outstanding is always at its highest at the wrong time (peak asset valuations) and unused at bottoms when it makes the most sense to use credit. I would also say that once lending reboots that lenders will actually get paid for lending and borrowers will have to think long and hard about borrowing. I think that the yield curve will initially be quite high until confidence fully returns but today’s interest rates will go down in the history books as an all-time anomaly. The last question pertains to whether or not you will be able to make purchases using silver (gold). I have a 3 word answer…”Silver will spend.” You have to understand that without credit, distribution will break down. For example, the farmer uses credit to purchase seed, fertilizer and diesel fuel (and in some cases even water). He then moves his product to the Coop which transfers them to trucks (or rail), sent to other regions and then dispersed to the final stores. All of this depends on credit. Without credit none of these transactions will take place and even one failure will stop the product from getting onto the shelves. Under this scenario (which I do believe will happen at some point and to some undetermined degree), do you think a farmer will accept a check, credit card, dollar bills or a Bitcoin transfer? How about a silver dime for a dozen eggs? In the absolute worst of times, silver will spend and even be the preferred medium over almost anything else. I do want to mention that we as a nation have “advanced …so far” that individually we cannot feed ourselves as well as someone from the Middle Ages could. How many people have ever shot a hog or deer? How many have field dressed an animal? Does anyone know how to kill and prepare a chicken before cooking it? What about people in the cities? Where can they even contemplate growing tomatoes or anything else? Think for a moment about how many survived the Great Depression with help from their neighbors? Do neighbors help each other today? ..Like they once did before we got “so advanced.” You might also contemplate a world where credit breaks down and affects other things. Things like electricity, natural gas and gasoline distribution or even clean water to drink. Will the internet even stay up? In a scenario where credit breaks down…everything we know will break down with it as everything runs on and is paid for with credit. We live in a world where every single day it’s “something for nothing” because our currencies and “credit” are backed by nothing. The coming reset will return us to a world where it is “something for something.” Any new currency introduced must, in order to be accepted through confidence…have some worth or backing on its own. I have said that the coming crisis will look like “Lehman Bros. on steroids.” I say this because not only will individuals, corporations and banks not trust each other…central banks won’t either. This is the great leap from 2008, back then the belief was that “governments won’t let it happen.” Not only will “it happen” but governments will be seen as powerless to remedy and even part of the problem. No one will know who is solvent or insolvent. It will be like a giant celebration where it is well known that several (many) are infected with the HIV virus…how much “business” do you think will be done? I know that this is a very crude analogy but it is important to understand that the credit market only works when there is confidence and the real economy only works when there is credit. No confidence=no credit= no production nor distribution. A “cash and carry world” is something that none (very very few) of us know or have never known. The “lifestyle” will change no matter who or where you are. All you can do is ask yourself these questions and do the best that you can with the means available.Similar Posts: |

| The Illusion Of Tangible Assets Posted: 03 Dec 2013 01:00 PM PST By Justin O’Connell of GoldSilverBitcoin & Bitcoinomics Gold and silver investors have taken issue with Bitcoin, claiming that it is not a tangible asset, like gold and silver. Their hypothesis is usually stooped in the notion that anything is truly "physical" as we perceive it in the first place. What if, counter-intuitively, the entire universe was composed of 0′s and 1′s itself? What if the universe was digital? Wouldn't that mean that gold, silver, platinum and palladium are all, in fact, digital as well? In other words, the 0′s and 1′s of a Bitcoin are just as tangible as anything in the universe, because the universe is merely comprised of 0′s and 1′s itself, and it has the capacity to be "physical." A Bitcoin does as well. How else to explain a Casascius coin? According to Wikipedia, tangible assets are those assets with physical substance, like currencies, buildings, real estate, vehicles, inventories, equipment and precious metals. Under this definition, then, in my opinion, digital currencies like Bitcoin would be a tangible asset under basic practical and economic definitions. Since the paper on which a dollar is printed is not the value of the dollar itself, the paper is merely a medium for the data which composes a dollar or $5 or $10 or $50 or $100. There can be no delusion about this, as the most expensive Federal Reserve Note is the $100 bill, which costs 7.8 cents to print. A corollary in the decentralized virtual currency world would be, say, a USB or hard-drive onto which bitcoins have been saved. In these two cases, the paper and the USB act as mere vehicles for the actual assets. These vehicles are one way in which these two things are made tangible. But, there is still a more fundamental point to make. If the universe itself is 0′s and 1′s, then what is the physical gold we hold? It would seem to imply that the physical gold and silver in our safes at home is really just a computer code that produces in the processor of our mind the tool of a precious metal, a physical thing. The safe as well, for that matter. And you…and me… The holographic principle suggests that everything is a hologram. And that our minds are the projectors with the conductors of all the precious metals found in a computer, in our body. It's a cliche in the 21st century, that we are stardust. It pains me to type it… But, the implications of all this is that, on one level, tangible assets are illusion. And, thus, to argue Bitcoin as an intangible in the face of gold's perceived "tangibility" – as many do – is to mis-understand the fundamental nature of reality, as the high-sages currently understand it in physics. (all hail!) As I wrote in, "In A Digital Universe, Does Anything Make More Sense Than Digital Money?"

The universe is it's own block chain. The block chain is its own universe. And so is the hologram just the knowledge of itself. In one gruesome experiment, a mad scientist chopped up mice brains and put them back together. He was surprised at how well the mice were able to complete a maze to get some cheese no matter how he discombobulated their mind. Our impulse towards division of reality arises only when the opportunity for unison also exists. There must, for instance, be something to divide. Sounds like cliche and high fallutin' mumbo-jumbo, but on a serious level people hold these truths about the universe as digital to be confusing yet self-evident. That means, over time, there will be the trickle-down effect of thought, in which the public will digest the truths. Might as well apply them to money as soon as possible, since money is key to our lifestyle. Scientists have found that subatomics particles like electrons are able to instantaneously communicate with each other no matter the distance separating them. Thus, communication travels faster than the speed of light. This is the only way the "time barrier" can be broken. This led David Bohm, University of London physicist, to conclude that objective reality does not exist. There is no solid in the universe, "it is at heart a phantasm, a gigantic and splendidly detailed hologram." So, what's a hologram, exactly? A hologram represents a three-dimensional photograph made with the aid of a laser. When its halves are divided over and over, each snippet of film always contains a smaller but intact version of the original image. This is not like photographs, as each part of the hologram contains all the information possessed by the whole. This means of traditional methodology of western science hasn't made sense. It is not best to understand fog, frogs and atoms by dissecting them and studying their divided parts. In Bohm's mind, there is no faster-than-light communication taking place. There is rather no separation with which to begin. Everything is an expression of the same thing. We call this thing the Universe. It's probably a multi-verse of some sort, like an orchestra is both one and many things all at the same time. There is something, no doubt, we don't know about. Some sort of infinite interconnectedness. "Information means distinctions between things," explained Stanford University physicist Leonard Susskind during a lecture. "It is a very basic principle of physics that distinctions never disappear. They might get scrambled or all mixed up, but they never go away." Trace Mayer told me that Bitcoin is like gold you can send like e-mail. In this sense, Bitcoin is like gold and silver in a post quantum-physics world. It's truly Gold v. 2.0. |

| Virtual Gold Backed Currency to Rival Bitcoin? Posted: 03 Dec 2013 12:45 PM PST

Douglas Jackson the founder of e-gold, before it was shut down by US authorities, is now in the talks with a organization called Coeptis that hopes to launch a gold backed "bitcoin style" digital currency. The idea is great, but the question is will he be able to pull it off? Western Central banks will certainly be [...] The post Virtual Gold Backed Currency to Rival Bitcoin? appeared first on Silver Doctors. |

| Is Bitcoin A Threat To Western Union? Posted: 03 Dec 2013 12:29 PM PST Economics majors say that they're not interested in Bitcoin yet. That's a pity. The battle currently playing out on r/Bitcoin and its affiliated subreddits is the stuff of legend. Say what you like about the gall of programmers teaching themselves economics in a kind of pay-as-you-go fashion or the pitfalls of a gold standard: At the end of the day, economists still pay for their lattes by writing about currency unions rather than building them. More importantly, the obsessive media focus over the intrinsic value of the currency is overshadowing an uncomfortable truth, namely, that the much vaunted moats of major money transmission services are no more immune to technological disruption than any other service-oriented market. Exhibit A is a recent research paper from the Berenberg Bank, which has the distinction to be both Germany's oldest bank and the second oldest bank in the world after Monte dei |

| A Million Dollars Just Isn't What It Used To Be (Part 1) Posted: 03 Dec 2013 12:05 PM PST Introduction: Robert Klein recently posted an article at MarketWatch titled: "What Is Your $1 Million Payday Really Worth?" Klein says this:

|

| 7 Stocks With High Yields That Santa Claus Owns And Recommends For Retirement Posted: 03 Dec 2013 11:58 AM PST Santa Claus is a savvy investor. He is near retirement and has been investing to better enjoy retirement, making sure there are sufficient funds to cover medical and extra care expenses in later years. He understands that retirement investing has changed in recent years. During the 20th century capital gains typically provided at least 2/3 of investment gains. However since 2000, capital gains have been limited even though the Dow Jones Industrials is at record levels. Dividends supply the remainder of investment gains and the track records of company dividends have varied considerably during recent years. Some highly regarded companies have stumbled, especially during the financial meltdown 5 years ago, which resulted in dividend cuts. However Dividend Aristocrats have continued to pay dividends and also raised annual dividends for a minimum of the last 25 years. Some have streaks that exceed half a century of raising dividends. Considerations for retirement |

| Mexican and DRC silver and gold project work awarded to MDM Engineering Posted: 03 Dec 2013 11:52 AM PST MDM has announced two more contract awards to add to its string of current work with work on the Parral silver/gold tailings project in Mexico and the Misisi gold project in the DRC. |

| The next black swan: A dollar crisis Posted: 03 Dec 2013 11:27 AM PST Analysts everywhere appear to be wondering what could possibly be the catalyst to turn the gold market around. I maintain it's the same catalyst that drove the gold bull market from 2001 to 2011 — out of control currency debasement. |

| 15 Signs That We Are Near The Peak Of An Absolutely Massive Stock Market Bubble Posted: 03 Dec 2013 11:15 AM PST

One of the men that won the Nobel Prize for economics this year says that “bubbles look like this” and that he is “most worried about the boom in the U.S. stock market.” But you don’t have to be a Nobel Prize winner to see what is happening. It should be glaringly apparent to anyone [...] The post 15 Signs That We Are Near The Peak Of An Absolutely Massive Stock Market Bubble appeared first on Silver Doctors. |

| CIA Bitcoin Conspiracy, Silver to Break the Economy Posted: 03 Dec 2013 11:00 AM PST Andy Hoffman joins Elijah Johnson of Finance and Liberty and Chris Duane of Don’t Tread On Me to discuss Bitcoin, gold, silver, dollar collapse, money printing, CIA, Fed, Dow and China. To listen to the interview, please click below: CIA Bitcoin CONSPIRACY, SILVER TO BREAK THE ECONOMY – Andy Hoffman & Chris Duane Similar Posts: |

| What now for Janet Yellen and gold? Posted: 03 Dec 2013 10:53 AM PST The certain fact is that Yellen is ready to continue with Fed's expansionary operations. Therefore no tapering on the horizon so far. More money printing means greater chance for gold price to rise in the coming years. |

| Silver and gold as currency commodities Posted: 03 Dec 2013 10:43 AM PST Gold and silver have a 6,000 year history for their use as a currency, and until the last century, the price of gold and silver maintained a healthy valuation ratio of 1 ounce of gold to every 15 ounces of silver. |

| Bail-Ins And Deposit Confiscation Confirmed At ‘Future of Banking in Europe’ Conference Posted: 03 Dec 2013 10:31 AM PST gold.ie |

| All that glitters is gold: India Jewellery Review 2013 Posted: 03 Dec 2013 10:31 AM PST The FICCI in collaboration with the global management consulting firm ATKearny has released a yearly report highlighting the current condition of India's jewelry trade. The document titled 'All that glitters is gold: India Jewellery Review 2013' also underlines the challenges faced by jewelry trade and recommends possible solutions. |

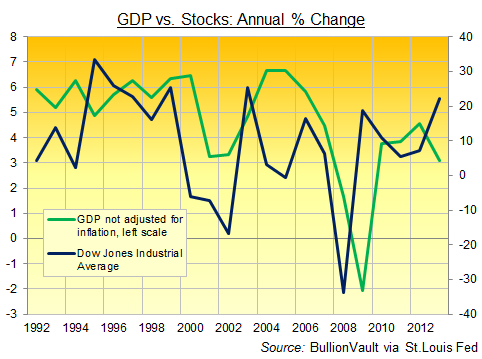

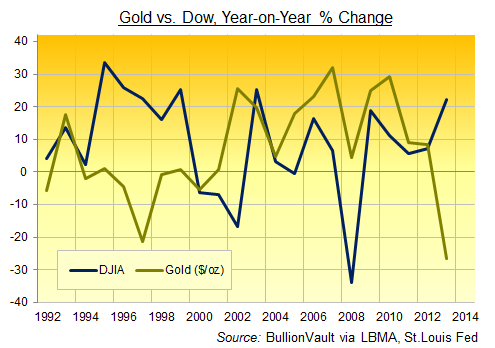

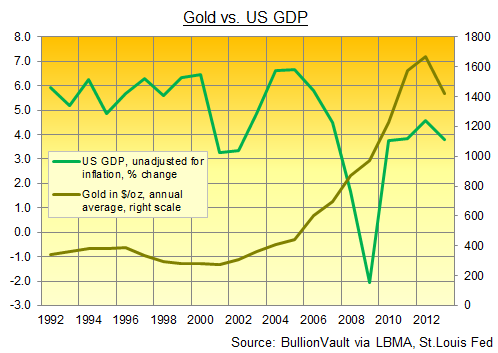

| Posted: 03 Dec 2013 10:18 AM PST Absolutely nothing! Well, except 5,000 years of value exchange, non-correlation, and preserving wealth... GOLD's VALUE is under attack, writes Miguel Perez-Santalla at BullionVault. The current market environment has led many in the press to question gold as an investment or an asset class. There have been many pieces written pointing to the 2013 decline, now 27% on the year or 35% off the high of 2011. It would seem evenhanded to make this determination on this rather short view of the market. The question then exists, what is gold good for? When looking at gold, one has to take a long-term view. Gold's position in the marketplace, both in the public domain and government function, has always come due to its primary purpose to humanity. That is as a guarantee of value. This guarantee comes from the simple fact that gold is a constant. It does not change. Its value against other forms of money or investment does. But the underlying asset, the physical metal, does not change because of any socio-economic activities or global calamities. The important thing to notice here is that gold finds its demand as a material commodity of beauty, function and form. It is a metal that has held sway as a form of money and barter throughout all of recorded history. It is one of the few constants to exist in the economy of the human animal. Because of its everlasting nature, and its ability to maintain its form uncorrupted, gold has withstood the test of time as an important vehicle for the transfer of value in our societies. To analyze gold fully would fill miles of book-shelves. We would have to study each separate economic environment to determine how gold functioned versus other commodities or negotiable instruments. Yet the thing to remember is that gold has always been available in one form or another throughout hundreds if not thousands of different economic systems. To consider making a gold investment or not in our current environment, we must to take a long view of what really is a young marketplace. In 1971 the president of the United States of America, Richard Nixon, closed the gold window at the US Treasury. This meant that the US Dollar was no longer convertible to gold. That freed the trade of gold in the US, with private individuals able to buy gold for investment from December 1974. This also meant that the other major currencies which were tied to the US Dollar through the Bretton Woods agreement were also now free-floating. So the world entered into a new experiment of unfunded money, often referred to as fiat currencies. Fiat means "Let there be" in Latin. Governments today are the sole authority behind our money. Cut free from its use as currency, however, gold has since 1971 taken its price from the increasingly free market in bullion worldwide. Within 10 years of the end of Bretton Woods, private individuals across the West world could buy and sell gold. Ten years after that, the Indian government deregulated its gold market, while the collapse of the Soviet Union also spread freedom to trade gold in Russia and central Asia. Ten years later again, China began opening its gold market too. Besides these market freedoms, taking a look at any single asset class since 1971 would also mean equating today with a period before so many changes in technology and advancements in communication. But on a 20-year horizon, US investors may want to consider gold and its value against two specific economic indicators. First there's the Gross Domestic Product (GDP) of the United States, the world's largest economy as a single country. Then there's the Dow Jones Industrial Average (DJIA), the widely followed and quoted index of US stock prices.  If you look at this graph of GDP and the Dow Jones Industrial Average you will note that they move almost in tandem. Of course there are exceptions, but it is close, and with the Dow typically pointing where the economy is headed. The numbers represent their performance on an annualized basis up or down percentage-wise. The following chart shows the change in gold prices over the same period, again by percentage. You will note that gold has moved in the opposite direction in most cases. So gold was equally fulfilling its role as financial insurance when the stock market performed well. Because gold did not.  What these graphs clearly indicate is that gold has served its primary long-term function as a store of value when other things fail. When major concerns about the global economy come into play gold is one major tradable asset which has held up under pressure. Imagine, while looking at the 20-year chart, that you were one of the investors who was wise enough to keep a 5% to 10% position of their portfolio in gold and build it up over that time horizon. They received the rewards, and reassurance, of the conservative investor. Because their insurance program paid off. While you consider this, ponder on how the stock market is regaining much of its momentum on the back of Quantitative Easing. This has profoundly changed the economic environment. This current central bank action, which is an experiment, cannot go on forever. How will the US economy react as its economic stimulus, an addictive drug, is withdrawn or tapered? What withdrawal pains will be felt in the stock market and global economies? Do you as an investor want to be caught without any provisions?  Since the tech-stock boom turned into a crash during 2000-2003, we've had the building mortgage crisis of 2005-2007, the collapse of Lehmans (and the near-collapse of everything else) in 2008, the start of the Eurozone crisis in 2010, and the US debt downgrade of summer 2011. Gold is now down significantly this year, 2013. But this does not negate gold's value or use, and like any insurance policy the best time to participate is before you need it. Gold's role as what economists call a non-correlated asset – moving free of other major indicators and investment prices – serves to protect rather than to enrich. Of course, this doesn't mean there are not trading opportunities for short term players as well. Yet making money this way is possible on a daily basis it is not the primary purpose of gold ownership. For instance Kraft Foods (KRFT). Its value as a stock is derived from the products Kraft sells and distributes and not the price action of the stock. Still there are those that trade it for the latter. Such short-term traders have enjoyed plenty of action in gold prices in 2013. But this year's price drop is only one page of a very long history, and only one page of the current chapter, too. Gold's timeless value, a constant for humanity worldwide, remains unaffected. |

| THEY Are Going To Confiscate YOUR Silver!!! Posted: 03 Dec 2013 10:01 AM PST

In his latest must watch video, the Silver Bullet Silver Shield’s Chris Duane examines the likelihood that the government will ever attempt to confiscate silver. Duane destroys the myth and irrational fears that a door-to-door confiscation of silver is coming, and like The Doc, makes the case that the most likely targets for a Federal [...] The post THEY Are Going To Confiscate YOUR Silver!!! appeared first on Silver Doctors. |

| The Housing Market Approaches A Cliff Posted: 03 Dec 2013 10:00 AM PST

What has been promoted as a housing market recovery by the financial media, Wall Street and the Obama Government is really nothing more than a dead-cat bounce in a long term bear market that has been fueled by a couple trillion in taxpayer-backed Federal Reserve and Government stimulus programs. What’s most interesting about the sequential [...] The post The Housing Market Approaches A Cliff appeared first on Silver Doctors. |

| Posted: 03 Dec 2013 09:51 AM PST One of my favorite Sentiment Indicators has been and continues to be the Volatility Index or VIX. I prefer to call it the Complacency Index. Low readings, such as we have been recording for some time now, indicate the absence of investor fear or concern. High readings reflect worry or uneasiness. Sky high readings indicate PANIC. I am not sure what is going on but the VIX has scored a five week high today for some reason. I tend to watch this indicator in conjunction with the action in the equities as a way to gauge any potential shift in overall confidence. In my view, the only thing that can bring a firm bid into gold and reverse the current bear market in the metal is a heightening of fear/unrest/unease or better, a growing lack of confidence. Yesterday we had a move higher in the Dollar. Today that has been erased. With the Dollar weakening gold is getting a bit of a bid today. Also aiding the metal is the sharp, and I do mean 'sharp' rise in crude oil. It touched $96 ( basis WTI ) in today's trade and is currently up over $2.00 barrel as I type these comments. Let's continue to monitor the progress of the VIX and especially monitor the price action in the S&P 500. Upside momentum continues to wane in the latter market but then again it has been for some time now. I keep picking up one negative divergence after another but the market keeps shrugging those off with dip buyers continuing to come in. If the stock market does finally actually respond to one of these negative chart signals, I expect the VIX to jump even more. At that point we will watch gold closely to see if it can gather some better buying interest. Stay tuned... |

| THE NEXT BLACK SWAN: A DOLLAR CRISIS Posted: 03 Dec 2013 09:20 AM PST Analysts everywhere appear to be wondering what could possibly be the catalyst to turn the gold market around. I maintain it’s the same catalyst that drove the gold bull market from 2001 to 2011. Out of control currency debasement. Does anyone seriously think that we can print trillions of dollars out of thin air for five years and not eventually have something bad happen? The next the black swan is already staring us in the face. It’s going to be a collapse in the purchasing power of the US dollar. Since the beginning of the year the dollar has been showing signs of extreme stress as it began to oscillate violently back and forth in what is known as a megaphone topping pattern. When this pattern breaks to the downside it is going to initiate the beginning stages of what will likely be a fairly severe currency crisis by next fall. In this environment I think it’s going to be impossible for the manipulation in the gold market to continue. As a matter of fact I got a signal last Tuesday that indicates to me that the forces trying to manipulate gold down to $1000 have probably thrown in the towel and given up, realizing that an impending dollar crisis is about to begin. On a cyclical analysis basis, the intermediate cycle is now running out of time for a move all the way back to the $1000 level. As you can see in the chart below the average duration for an intermediate degree cycle is between 20-25 weeks. Currently gold is on the 23rd week of this cycle. On a smaller time frame you can see the current intermediate cycle already has four daily cycles nested within it. I don’t believe there is time for a fifth daily cycle, and a fifth daily cycle would be required if gold were going to make it all the way down to $1000. On top of that the current daily cycle is now stretched to 34 days which is already longer than 90% of historical cycles. What this means is that gold is very late in its daily cycle and a bottom is due at any time. The logical trigger would be on the employment report Friday, although I think the market will be expecting that so we may get a bottom earlier in the week. Last week’s sentiment polls are also suggesting that bearish sentiment has reached levels where the market is at risk of running out of sellers. I expect when the current weekly sentiment poll comes out later this evening we will see sentiment in both gold and silver at levels comparable to the June bottom.

Source: sentimentrader.com To top it all off I’m starting to hear some of the usual clichés that always appear at major turning points. “The charts are pointing down” Folks, at bottoms the charts will always say the market is going lower. And at tops the charts will always say the market is going higher. Then there are the numerous calls for completely unrealistic targets. I’m now starting to hear $700 price targets for gold. I believe we are within days of a final bottom in this intermediate cycle. I think an initial 10-20% position can be taken anytime this week. Then once we get confirmation of an intermediate bottom one can start adding to that position. I’ll say it again, if one can pick, or even get close to, buying at a bear market bottom the initial move out of those bottoms are where the biggest gains in this business are made. The first two months out of the 2008 bear market bottom miners rallied 100%. I don’t think it’s unreasonable to expect something similar this time as this bear market has been every bit as severe as the one in 2008. And one final confirmation before I forget. Oil appears to have put in a final intermediate bottom. Look for oil to lead the commodity complex out of this bottom. |

| Analysts line up to declare "decline & fall" of gold after 2.6% tumble Posted: 03 Dec 2013 09:18 AM PST "We have no doubt that gold is in a bear market," says the commodities team at Swiss investment bank Credit Suisse, repeating the view it first gave in February's End of an Era report. |

| Posted: 03 Dec 2013 09:00 AM PST As "goldbugs" – i.e., those that believe 5,000 years of natural economic law have not been repealed by government computers – sting from yet another paper raid; the main "tool" of said computers, the New York COMEX, runs dangerously low on actual physical metal. We're told the economy is "recovering," yet construction spending was so low, even Goldman Sachs lowered its 4Q GDP growth estimate to barely above 1%. And did I mention the nearly all-time high channel stuffing among still government- controlled auto manufacturers? The stock market may be at an all-time (nominal) high, but Obama's approval rating is at an all-time low; as per below depicting homelessness, only "the 1%" are benefitting from America's economic policies. Simultaneously, it was reported that Shinzo Abe's approval rating is also plummeting to new lows; also, as the Japanese stock market makes new multi-year highs. This simply does not happen anywhere but Wonderland, Fantasyland, and Neverland; certainly not in legitimate economies, with legitimate markets!

Around the world, the hyper-inflating Venezuelan Bolivar (and stock market) aren't helping "the 99%" either; as yesterday afternoon, the ultimate irony unfolded when a national blackout occurred amidst President Maduro's speech outlining how Venezuela is being taken to pure socialism. And if you think that's bad, just wait until Obamacare's fully implemented. Simultaneously, two additional revolutions broke out – in the Ukraine and Thailand; also blamed on oppressive governments, which in 2013-speak means exported inflation from the Federal Reserve and other Central banks. Add them to the list – with the "Fragile Five" and "Arab Spring" nations, among others; a list that will only grow longer as the money printing continues. At the moment, the MSM is too focused on Bitcoin and the handiwork of the U.S. President's Working Group on Financial Markets to care; but don't worry, they will be forced to acknowledge this rising global nightmare that as the death throes of the fiat currency Ponzi become increasingly visible. And then we have last week's news that the Chinese government no longer intends to acquire foreign currency reserves; an announcement, of course, with tremendous inflationary implications – as they'll be taking their $3.7 trillion of dollars, Euros, pounds, and Yen, and using them to buy items of real value like gold, silver, oil, and wheat. Coupled with yesterday's news of the Yuan surpassing the Euro as the second most utilized currency in international trade finance, you can see the route to an inevitable, gold-backed Yuan is becoming shorter each day. And finally, for the true "oppressed" of the financial industry; i.e., those holding the assets poised to benefit most from the cycle of monetary lunacy encircling the Earth, we have this article focusing on what I have discussed ad nauseum all year. That is, the Precious Metal prices are already below the cost of production for all but the largest of mines, and well below the marginal cost of new production. In silver's case, the situation is that much direr, as 70% of such production emanates from base metal mines; which themselves are in terrible shape due to the weak global economic environment. In sum total, the "horrible headlines" that have driven our decision to protect assets with gold and silver have never been more widespread; and sadly, are set to expand further as the global fiat Ponzi demands more money printing, draconian government controls, and capital misallocation. As for me, I simply buy metal whenever I have cash; which is exactly what I have been doing for the past five years, and what I will continue to do until there is no more left to buy.Similar Posts: |

| Posted: 03 Dec 2013 08:36 AM PST A disclaimer: I am long and/or trading several regular 'bull stocks' (as well as short a couple). Don't interpret the sober message below as a 'sell your stocks right now!' style bearish warning. Indeed, after an expected choppy start to December I think more bull market mania, errr… rally, could still be ahead. But it would be just dandy if people would keep their perspective along the way. From the December 1 edition of Notes From the Rabbit Hole (NFTRH 267): Closing the 2008 'Gap' In 2008 market and economic participants suffered a hard downside 'gap' in the prices of their assets and in the levels of their expectations. The bull market that began in March of 2009 is doing a fine job of closing that gap and fully resetting the herd from the utter fear mode of Q4, 2008 to a 2007 or even 1999 style greed mode today.

The chart of gold vs. the S&P 500 [below] shows a gap up in 2007, presumably as Lehman knocked down the first of many dominoes that would fall until the previously inflated cyclical bull market totally fell apart in Q4, 2008 and bottomed in Q1, 2009. Gold is 'risk off' now. It is so risk off that many of its supporters are frightened of the monetary metal because today market risk is decidedly 'on', at the behest of policy making that has created a sea of liquidity going straight to equity assets. Think about that; people have been so thoroughly conditioned by the 'risk on' atmosphere of the current bull market that they are afraid of insurance. Insurance against what? Insurance against market risk and monetary policy induced systemic maladjustment. Gold has gone 'risk off' and that is where you want your insurance to be. You don't cheer lead and root for insurance. You hold it and hope it is not needed. That is what gold is and maybe the current situation for speculative minded gold bugs (i.e. just another flavor of casino patron) is filling a gap in their expectations as well. When enough people have learned that gold is about value only, not price, maybe this phase can end. Visually, the gap in Au-SPX appeared after the system began unraveling in 2007. Is it so hard to imagine that the psychology (gap) of that time (as fear gapped up into what would become a historic market top and meltdown) should be 'closed' by the current bear market in sound thinking and bull market in risk taking? Gold stopped making higher highs and higher lows in SPX units a long time ago. It then triggered important moving averages down and has made some genuine technical signals that imply an end to its bull market and also I might add, a beginning to a new era of 'risk on' that by long-term signals at least, appears as though it has much further to run. Appearances… isn't that what the brilliant Bernanke Fed has been all about? Here is a picture of what most people thought they knew in 2008. It is Time Magazine's picture of a 1930's depression era soup line included in NFTRH #9, from November 22, 2008. Time Magazine, October 2008 NFTRH was launched in late September, 2008 just before the acute phase of the crisis and I considered myself lucky to have such great contrarian signals coming in clusters, day after day just after launch. It was the contrarian bullish opposite to today's developing bearish contrarian structure. From NFTRH 9 (11.22.08): "Okay, everybody's got the memo; deflationary depression it is. Well not everybody… I'll go with the old pros and stick to my story that there will be recovery – born of inflation – and there will be places to invest and places to avoid. With the entire world now expert on deflation and 1930's history, I have got to believe we have a huge counterparty of 'sissies'* waiting to take the other side of the trade. I personally believe any coming stock market rebound is a trade only [ed., it was, as the bottom was ultimately in spring, 2009] and things could get worse [ed., they did] before they get better. But if I were a deflationist I would be uncomfortable with the level the major media and by extension, the public are up to speed on the concept just as I was uncomfortable with every Tom, Dick and Harry on board the inflation express [ed., in the run up to the 2007 top]." So the point of NFTRH 267's opening segment is to simply remind all of us what is actually happening out there. Expectations have been realigned. In 2008 there were long-term technical breakdowns as well. For instance, the Dow and S&P 500 each made lower lows to their 2002 lows. So gold (insurance, monetary common sense, what ever label you want to place on it) is breaking down in stock market terms and making big picture technical violations. Does this at least provide some context? The utter fear and angst of the 2008 timeframe is being corrected. Most people do not currently see it that way. They want to make 'coin' in stocks and now gold is not even on the radar of most people. I am not here to cheerlead insurance. I am here to point out that something opposite to 2008 is going on. If in 2008 the idea was to get separate from fearful masses and be bullish for coming asset price opportunities, should the idea today not be to think about getting separate from them again in their new guise as increasingly manic US stock market bulls? * 'Sissies' references an email note I received from my late friend Jonathan during the crisis. NFTRH's earliest subscribers may remember this… "Yes Gary, I spoke last night with one of the legendary street traders from the old days (pre 1990). He wants to leave Miami and work free at our shop because he has never seen a time when there is more money to be made the old fashioned way…picking off the sissies." Biiwii.com | Notes From the Rabbit Hole | Twitter | Free eLetter |

| Bail-Ins And Deposit Confiscation Confirmed At ‘Future of Banking in Europe’ Conference Posted: 03 Dec 2013 08:31 AM PST gold.ie |

| Zimbabwe Ben, Janet “von Havenstein” Yellen And The Taper That Will Never Happen Posted: 03 Dec 2013 08:00 AM PST

Rudolph von Havenstein was head of the German Central Bank during the infamous Weimar hyperinflation/currency collapse period (1921 – 1923). As most of you know, every German who had their wealth denominated in German marks on the night of November 13, 1923 woke up the next day to discover that their paper wealth was worthless. [...] The post Zimbabwe Ben, Janet “von Havenstein” Yellen And The Taper That Will Never Happen appeared first on Silver Doctors. |

| Posted: 03 Dec 2013 07:45 AM PST Sometimes, one must simply go back to the basics. And when one is charged with educating as to why one should own Precious Metals, there's no better time than when financial bubbles foster "confidence" in the dollars, euros, and yen creating them; and simultaneously, hatred of "barbarous relics" like gold and silver. Moreover, in today's situation, we not only must contend with the Fed-induced mania being created in the stock market, but the "internet-like" surge in virtual currencies like Bitcoin. Remember, the underlying cause of my abandonment of the dollar 12 years ago was realization that it, like the 599 fiat currencies before it, would inevitably be destroyed by inflation; as the definition of a Ponzi scheme is a financial arrangement that can only survive by growing exponentially larger, while simultaneously, maintaining public confidence. This is why fiat money creation exploded after the gold standard was abandoned in 1971; and consequently, why it will rise hyperbolically before eventually collapsing under its own weight. Since joining Miles Franklin two years ago, I have focused a great deal of my attention on the "definition of money"; as aside from "inflation," no concept is more badly misrepresented. The below slide is one I have utilized in numerous presentations, highlighting how there are myriad parameters that must be met to be afforded the moniker of money.

For one, it must be divisible into smaller units, so as to enable "making change; which sadly, is the only such parameter the dollar (and other fiat currencies) typically meet. Yes, the dollar is fungible, per se, in that "all dollars are created equal." However, given the rapidly changing face of the dollar itself, global uncertainty about what is a "dollar" has become significant. The U.S. $100 bill is the most counterfeited in the world; and thus, many nations' vendors no longer accept them. Trust me, I learned that the hard way this summer, in China!

Secondly, to constitute money, the item in question must be both limited in supply (i.e., scarce) and verifiable. And in the case of "dollars," not only is their supply unlimited, but as unverifiable as possible. As to the former, growth in the published money supply speaks for itself, while the really scary part is what goes unpublished. For example, the secret $16 trillion of zero interest rate "loans" the Fed handed out during the 2008-09 financial crisis; of which, it is unclear how much, if any, has ever been repaid. Moreover, the Fed's off-balance sheet "swap agreements," which pumped untold trillions into global Central banks between 2009 and 2013. And don't forget M3; i.e., the broadest U.S. Money Supply measure – which was conveniently discontinued when Ben Bernanke became Fed Chairman in 2006, under the guise of saving $1.5 million of annual administration costs.

Next, money must serve as a medium of exchange. To wit, gold and silver coins are accepted virtually everywhere; i.e., from Central banks to subsistence, bartering cultures. Conversely, dollars are, for the most part, only accepted in the United States. Yes, a handful of third-world nations are happy to accept them in lieu of their far more than local currencies. However, in most cases, dollars must first be exchanged for local currency – at great expense and inconvenience – in order to spend. Even the average Canadian business won't accept U.S. dollars, despite their trading at nearly parity to the Canadian dollar; and if the Canadians won't accept U.S. dollars, who will? And last but not least, to serve as money, a currency must provide a store of value for a material period of time. As you can see, all of the world's major currencies have lost nearly all their purchasing power against gold over the past century; which in the dollar's case, is precisely the amount of time the fiat-issuing Fed has been in existence.

In fact, in this fantastic article – which inspired today's piece – Charles Hughes-Smith speaks of various modern day "offshoots" of the monetary parameters discussed above. In other words, exactly why fiat currency has always failed when attempting to mimic money; and conversely, why physical gold and silver have always succeeded. In my mind, it is difficult to discern if it is more galling that Bitcoins – created out of thin air by a handful of computer techies – are trading nearly at parity with gold prices; or that dollars, created out of thin air by a handful of bankers, still have any remaining purchasing power. Oh well, this is not the first time repressive, self-serving governments have attempted to stave off reality with obfuscation; in today's case, using "modern-day" weapons like money printing, market manipulation, and propaganda. Fortunately, the "window" they have created still remains open; enabling you to trade your dying scrip for the security of REAL MONEY, which currently trades at its cheapest level relative to inflation in generations, if not ever. Remember, the laws of "Economic Mother Nature" are no more repealable than those of her sisters in the other sciences; and thus, whenever someone tells you dollars are Bitcoins are the "new gold," they are simply whistling on the way to their financial graves.Similar Posts: |

| Gold And Silver Approaching Critical Price Points Posted: 03 Dec 2013 07:35 AM PST Gold was down today $28 and closed the COMEX session at $1222.05, which is a loss of 2.30% on the day. Silver went $0.77 lower and closed at $19,21, a decline of 3.87%. In euro terms, gold closed the trading session at €902.82 and silver at €14.18. The short term trend is clearly down, both in gold and silver. The hourly chart tells a clear story.

The short term trend is confirming the longer term downtrend. The daily chart shows an almost perfect trendline since November 2012. Apart from the trendline, the daily chart reveals two other important things. First, both gold and silver are about to retest their June lows. Needless to say those price points are of major importance. In case they would hold with a vengeance on high volume, it could turn out to be bullish for the metals. However, if support would fail, the odds favour a break through. A second important element on the daily charts are the Commitment of Traders positions (lower part of the charts). The extreme market situation of June is back: commercial hedgers are holding historically low net short positions. Extreme positions of that "informed money" category usually point to a reversal, although timing is unpredictable. Back in June, when the metals reached their lowest price points, the COT positions were very similar as today. The third chart shows that situation in more detail.

This chart, courtesy of Sentimentrader.com, shows the positions of the commercials (green line) and large/small speculators (blue/red line). Notice the similarity with the situation in June of this year. |

| THE NEXT BLACK SWAN: A DOLLAR CRISIS Posted: 03 Dec 2013 07:31 AM PST Analysts everywhere appear to be wondering what could possibly be the catalyst to turn the gold market around. I maintain it's the same catalyst that drove the gold bull market from 2001 to 2011. Out of control currency debasement. Does anyone seriously think that we can print trillions of dollars out of thin air for five years and not eventually have something bad happen? The next the black swan is already staring us in the face. It's going to be a collapse in the purchasing power of the US dollar. Since the beginning of the year the dollar has been showing signs of extreme stress as it began to oscillate violently back and forth in what is known as a megaphone topping pattern. When this pattern breaks to the downside it is going to initiate the beginning stages of what will likely be a fairly severe currency crisis by next fall. In this environment I think it's going to be impossible for the manipulation in the gold market to continue. As a matter of fact I got a signal last Tuesday that indicates to me that the forces trying to manipulate gold down to $1000 have probably thrown in the towel and given up, realizing that an impending dollar crisis is about to begin. On a cyclical analysis basis, the intermediate cycle is now running out of time for a move all the way back to the $1000 level. As you can see in the chart below the average duration for an intermediate degree cycle is between 20-25 weeks. Currently gold is on the 23rd week of this cycle. On a smaller time frame you can see the current intermediate cycle already has four daily cycles nested within it. I don't believe there is time for a fifth daily cycle, and a fifth daily cycle would be required if gold were going to make it all the way down to $1000. On top of that the current daily cycle is now stretched to 34 days which is already longer than 90% of historical cycles. What this means is that gold is very late in its daily cycle and a bottom is due at any time. The logical trigger would be on the employment report Friday, although I think the market will be expecting that so we may get a bottom earlier in the week. Last week's sentiment polls are also suggesting that bearish sentiment has reached levels where the market is at risk of running out of sellers. I expect when the current weekly sentiment poll comes out later this evening we will see sentiment in both gold and silver at levels comparable to the June bottom. Source: sentimentrader.com To top it all off I'm starting to hear some of the usual clichés that always appear at major turning points. "The charts are pointing down" Folks, at bottoms the charts will always say the market is going lower. And at tops the charts will always say the market is going higher. Then there are the numerous calls for completely unrealistic targets. I'm now starting to hear $700 price targets for gold. I believe we are within days of a final bottom in this intermediate cycle. I think an initial 10-20% position can be taken anytime this week. Then once we get confirmation of an intermediate bottom one can start adding to that position. I'll say it again, if one can pick, or even get close to, buying at a bear market bottom the initial move out of those bottoms are where the biggest gains in this business are made. The first two months out of the 2008 bear market bottom miners rallied 100%. I don't think it's unreasonable to expect something similar this time as this bear market has been every bit as severe as the one in 2008. |

| Turkey Gold imports jump to record 270.67 tons till Nov 13 Posted: 03 Dec 2013 07:22 AM PST The country's year to date gold imports reached 270.67 tons, surpasses record gold import of 269.5 metric tons in 2005. |

| Posted: 03 Dec 2013 07:00 AM PST

When we're in an up-cycle, people can never see a reason why it's going to go down but it always does. When we're in a down-cycle, people can never see a reason why it will go up, but it [always] does. This has been a good cycle. 2013 is the first year in a while [...] The post Gold Mining Executive: "You Have To Be Able To Survive The Lows In Order To Reap The Benefit Of The Highs" appeared first on Silver Doctors. |

| Price of Gold Can’t Stay Below the Cost of Production for Long Posted: 03 Dec 2013 06:45 AM PST It is now apparent that the Fed (and bullion bank cartel) has kept the markets orderly (stable dollar, strong stock market and lower metals) for far longer than we thought possible. The technical funds (managed money) are either out of the precious metal's market or short, and the commercials (JPMorgan) continues to take the other side of the trade and add to their long position. Ted Butler put it this way:

This will end badly for the (short) technical funds. Gold is not dead and the fundamentals for silver have never looked better. The current low prices are not a threat to your holdings; they are a blessing for those of you who are still on the sidelines. After reviewing the latest COT data, Ted Butler summarized the current gold and silver pricing as follows…

Here is data from the Delayed Commitment of Traders Report (as of November 26) below:

If you are worried and losing sleep over the low silver and gold prices and want to understand JPMorgan's role in the manipulation of both, then here is the link to the Butler Research LLC newsletter: (http://www.butlerresearch.com). Butler's information is original and is the place to go for easy to understand analysis of the COT (Comex data). He not only gives you the "numbers," he explains where they stand historically and what it means for the price, going forward. Larry Edelson is holding his ground. For the last couple of months, he says gold bottoms in January, after which the bull market will resume with a vengeance. As bearish as he has been this year, he is now swinging over to a very bullish stance. His $5,000 price target for gold is even higher than Sinclair's target of $3,500. If you want to get down to basics, the price of gold can't stay below the cost of production for long. That is the best gauge of how low it will get. What is the cost of production?Similar Posts: |

| History Learns That Manipulation In The Gold Market Has An Explosive Ending Posted: 03 Dec 2013 06:18 AM PST This article contains several excerpts from Grant Williams latest excellent newsletter: Things That Make You Go Hmm (subscribe here). Williams describes in detail the London Gold Pool in the 60ies and sees parallels with today’s gold market. He strongly believes that the free market will eventually take over control in the gold market. On November 1, 1961, an agreement was reached between the United States and seven European countries to cooperate in achieving a shared, and very clearly, stated aim. The signatories to this particular agreement were, in alphabetical order, the central banks of Belgium, France, Germany, Italy, the Netherlands, Switzerland, the United Kingdom, and the United States; but unlike other agreements of the time — such as that signed at Bretton Woods in 1944 — this one had no catchy title and was agreed upon with no fanfare and no publicity. In fact, this particular agreement was, if not exactly secret, then secretive by design. It was put into place after a sudden spike in the gold price from its “official” level of $35.20 to over $40 on concerns in late 1960 that whoever won the impending US election might devalue the dollar in order to address the country’s balance of payments problem. The agreement became known as the London Gold Pool, and it had a very explicit purpose: to keep the price of gold suppressed ”under control” and pegged regulated at $35/oz. through interventions in the London gold market whenever the price got to be a little … frisky. The construct was a simple one. The eight central banks would all chip in an amount of gold to the initial “kitty.” Then they would sell enough of the pooled gold to cap any price rises and then replace that which they had been forced to sell on any subsequent weakness. The United States — which at that stage owned roughly 47% of the world’s monetary gold (excluding that owned by the Soviet bloc) — promised to match every other bank’s contribution, ounce for ounce. However, somewhat remarkably, only seven years prior, the United States’ gold hoard constituted 72% of the world’s gold (ex-those pesky Soviets) and was worth an additional $7,000,000,000. More than $5,000,000,000 had been sold between 1958 and 1960. The other tiny problem, what with the dollar’s being convertible into gold and all, was that official institutions, banks, and private holders abroad had roughly $19,000,000,000 of short-term and liquid dollar claims. So… the US Federal Reserve offered to match the contributions of Happy, Bashful, Grumpy, Sleepy, Dopey, Greedy, and Doc the other seven central banks, which meant that, at its inception, the London Gold Pool looked like this:

Initially, everything ran smoothly, and the satisfied grins at those eight central banks must have been borderline sickening to behold. Now, of course, the members of the Pool had the help of the official gold price set by the Bretton Woods agreement; but market forces sometimes inconveniently dictate that prices don’t behave as they’re supposed to, and that means interested parties need to nudge things back where they need them to be. By the time 1965 rolled around, the London Gold Pool was creaking a little at the seams because — guess what? — the price pressure was in an upward direction and the Gang of Eight were selling far more bullion than they ever had the opportunity to buy back, which meant the Pool was becoming a Puddle. Then, on November 18, 1967, after a day in which the Bank of England tapped its gold and dollar reserves to the tune of £200 million (equivalent to a little over $3 billion today) to defend the pound, Harold Wilson, Britain’s Labour Prime Minister, decided that the 20 denials he’d issued in 37 months about the likelihood of a devaluation of Sterling constituted fair warning, and so he devalued the British pound by 14%. After the devaluation, the flock to gold became even more pronounced (no surprise there), and before December 1967 turned into January 1968, Britain had been forced to sell 20x its usual amount of gold in the market to maintain price stability. At this point, London and Zurich both banned the forward selling of gold even as desire to own the precious metal (or, more accurately, demand to NOT own currencies that might be devalued) reached fever pitch. The Pool was forced to sell over 1,000 tons of gold in the market (equivalent to $1.1 billion in 1967 dollars — which used to be a lot of money); and, as if by magic, in a move that must have surprised nobody everybody, the French surrendered. French President Charles De Gaulle and his famously feisty economist Jacques Rueff pulled France from the Pool and began exchanging every dollar they held for gold. But of course there’s a slight problem with central banks trying to manipulate the price of a physical commodity lower when it has both a finite supply and a relatively small and consistent annual production curve. Actually, let me adjust that last paragraph ever so slightly in the interests of accuracy:

Did you see what I did there? A small amendment, I’ll concede, but an important one — particularly as, 52 years later, we witness the incredible power now wielded by those august institutions.

So we have a group of central banks fighting the free-market process, with a promise to essentially “do whatever it takes” to defend something. History may not repeat, but it sure as hell does rhyme. Back to the ’60s we go:

Hmmm… a “bank holiday” declared on a Friday evening, after which time there was no access to gold for two weeks for anybody who owned it and didn’t have it in their physical possession? What happened next? Let’s see:

Yes, the “free market” price of gold was 25% higher than the level at which it had been maintained by the London Gold Pool. As De Gaulle no doubt said at the time, “Quelle surprise!” By now, the chart of the gold price looked a little different from the one that had left the Pool members slapping each other on the back and congratulating themselves on a job well done:

Of course, as anybody with even a passing interest in gold knows, once the London Gold Pool cracked, dominoes began to fall in rapid succession. De Gaulle’s aggressive moves to perfect the gold backing France’s dollar reserves was tolerated begrudgingly until it reached the point where others were starting to want THEIR gold, and that just wasn’t going to be allowed to happen. In August of 1971, Richard Nixon made his famous speech about devaluation, removed the gold backing of the dollar, left France and everybody else queueing up to get their gold twisting in the wind, and ushered in the age of pure fiat currency. The parallels are frightening if you look at them closely enough — except that this time, rather than being backed by gold, the dollar is backed by “the full faith and credit of the United States government.” Yes … the full faith and credit of the government of a country with public debts of $17 trillion … and rising. Yes, THAT government. One difference, however, is that today, with no direct link between gold and confetti fiat currencies, there is of course NO official interference in the setting of the gold price. [ed. note: Grant Williams goes on to draw parallels between the rigging mechanics in the paper markets like LIBOR, foreign exchange markets, etc. He concludes the comparison by saying that "human beings have rather a poor history of eschewing the easy profit in favour of doing the right thing, when given means and motive. Governments, when faced with dilemmas, have a rather poor history of doing the right thing as opposed to whatever they think they need to do in order to cling to power. It's quite simple."] Libor, FX rates, and mortgages trades are all fiat in nature. The contracts that are exchanged have no tangible value. Such contracts can be created at the push of a button or the stroke of a pen and manipulated easily right up until the point where they can’t. Gold is a different beast altogether. The manipulation of the gold price takes place in a paper market — away from the physical supply of the metal itself. That metal trades on a premium to the futures contract for a very good reason: it has real, intrinsic value, unlike its paper nemesis. If you want to manipulate the price of a paper futures contract lower, you simply sell that paper. Sell it long, sell it short, it doesn’t matter — it is a forward promise. You can always roll it over at a later date or cover it back at a profit if the price moves lower in the interim. And of course you can do it on margin. If the trading were actually in the metal itself, then in order to weaken the price you would have to continue to find more physical metal in order to continue selling; and, as is well-documented, there just isn’t so much of it around: in recent years what little there is has been pouring into the sorts of places from which it doesn’t come back — not at these price levels, anyway. The London Gold Pool had one thing in common with the rigging of the FX, Libor, and mortgage markets: it worked until it didn’t. The London Gold Pool proved that central banks can collude cooperate to rig maintain the price of gold at what they deem manageable levels, but it also proved that at some point the pressure exerted by market forces to restore the natural order of things becomes overwhelming, and even the strongest cartels groups (whose interests happen to be aligned) — which are made up of the very institutions granted the power to create money out of thin air — can’t fight the battle any longer.

The last time an effort was made to manipulate the price of gold lower than the market wanted it to be, it ended in a quick 25% spike in the price, followed over the next decade by the manifestation of those market forces in no uncertain terms and ending in a blow-off top some 2,332% higher than the price at which gold had been held for two decades. If anything were to come of the supposed investigation into the gold price fixing and if charges were filed similar to those laid at the feet of the banks that admitted no fault in the Libor rigging, it would start a mad dash by owners of physical gold to take custody of their assets. The problem with that eventuality is that currently there are almost 70 claims on every ounce of gold in the COMEX warehouse and serious doubts about the physical metal available for delivery at the LBMA.

The London Gold Pool was designed to keep the price of gold capped in an era when the world’s reserve currency had a tangible backing. In defending the price, the eight members of the Pool were forced to sell way more gold than they had initially contributed in order to keep the price from going where it desperately wanted to go — higher. This time around, the need for the price to be capped has nothing to do with any kind of gold standard and everything to do with the defense of the fractional reserve gold lending system. Gold is moving to ever stronger hands, and when the dam does inevitably break again, the true price will be discovered by natural market forces, free of interference. This time, however, those chasing what little gold is available will include all those central banks that have kept their holdings “safe” in overseas vaults. The Bundesbank has seen the writing on the wall and demanded its gold back. They were told it would take seven years before their 30 tonnes could be returned to them. My guess is, this little scheme doesn’t have seven years left to play out. |

| Bail-Ins And Deposit Confiscation Confirmed At ‘Future of Banking in Europe’ Conference Posted: 03 Dec 2013 06:18 AM PST

A major conference on the future of banking yesterday heard contributions on a European banking union which is being negotiated by Eurozone finance ministers. One of the aspects of that union will be a ‘bail-in’ of deposits when banks fail in the future. Michael Noonan, Ireland's Minister for Finance confirmed yesterday that bail-ins or deposit [...] The post Bail-Ins And Deposit Confiscation Confirmed At 'Future of Banking in Europe' Conference appeared first on Silver Doctors. |

| Risk and Reward: China's Golden Hammer Posted: 03 Dec 2013 05:32 AM PST What if Chinese prominently announced their gold holdings, then publicly called into question the status of US gold reserves (unaudited since 1952, probably for good reason). What if they announced this fact while at the same time prominently noting all of the separate trade agreements they have signed in the last two years that cut out the US Dollar from trade settlement- you know, the agreements they have signed with Russia, India, Japan, France, Australia, Brazil, and others? |

| Worst November in 35 Years for Gold as Indias Import Ban Forces Jump in Recycling Posted: 03 Dec 2013 05:02 AM PST Bullion Vault |

| Bail-Ins And Deposit Confiscation Confirmed At ‘Future of Banking in Europe’ Conference Posted: 03 Dec 2013 04:58 AM PST The era of bondholder bailouts is ending and that of depositor bail-ins is coming. Let’s be crystal clear: The EU, UK, the U.S., Canada, Australia and New Zealand all have plans for bail-ins in the event of banks and other large financial institutions getting into difficulty. Download our Bail-In Guide: Protecting your Savings In The Coming Bail-In Era Today's AM fix was USD 1,219.00, EUR 898.50 and GBP 743.07 per ounce. Gold fell $32.20 or 2.57% yesterday, closing at $1,219.00/oz. Silver slid $0.84 or 4.2% closing at $19.15/oz. Platinum dropped $20.95, or 1.5%, to $1,336.25 /oz and palladium fell $9.78, or 1.4%, to $708.72/oz. Gold advanced from nearly a five-month low, after the biggest one-day drop since October, as investors assessed whether the U.S. economy is strong enough to warrant a move away from ultra loose monetary policies. Gold fell despite the data yesterday being mixed. It showed that while U.S. manufacturing unexpectedly accelerated in November at the fastest pace in more than two years, retail spending fell on the weekend after Thanksgiving for the first time since 2009. The overly indebted U.S. consumer is struggling which does not bode well for the consumer dependent U.S. economy.

Bulls took solace in the fact that the price falls came on very low volumes – volume was 20% below the average for the past 100 days at this time of day, data compiled by Bloomberg showed. Gold is down 26% year to date and many analysts agree that it is now very oversold. The 14-day relative-strength index fell to 30 yesterday, signaling to some analysts who study charts that the price may be set to rebound. Physical demand picked up on lower prices overnight – particularly in China and Asia. In China, now the largest buyer of gold in the world, premiums of 99.99% purity gold climbed to about $11 an ounce from $7 on Monday on the Shanghai Gold Exchange (SGE). Bail-Ins And Deposit Confiscation Coming Noonan Confirms At 'Future of Banking in Europe' Conference The toolkit underpinning the Single Resolution Mechanism is provided for in the bank recovery and resolution proposal (BRR) which was agreed last June in Council under the Irish Presidency. The proposal provides a common framework of rules and powers to help EU countries manage arrangements to deal with failing banks at national level as well as cross-border banks, whilst preserving essential bank operations and minimising taxpayers’ exposure to losses. One of the main pillars to the BRR framework to facilitate a range of actions by authorities are "resolution tools". Noonan confirmed yesterday that resolution tools include the sale of business, bridge bank and asset separation tools and also the use of bailins. The era of bondholder bailouts is ending and that of depositor bail-ins is coming. Preparations have been or are being put in place by the international monetary and financial authorities for bail-ins. The majority of the public are unaware of these developments, the risks and the ramifications. It is now the case that in the event of bank failure, your deposits could be confiscated. Let’s be crystal clear: The EU, UK, the U.S., Canada, Australia and New Zealand all have plans for bail-ins in the event of banks and other large financial institutions getting into difficulty. Download our Bail-In Guide: Protecting your Savings In The Coming Bail-In Era (11 pages) Download our Bail-In Research: From Bail-Outs to Bail-Ins: Risks and Ramifications (51 pages) |

| Gold price falls below the cost of digging it out of the ground Posted: 03 Dec 2013 02:17 AM PST |