Gold World News Flash |

- Jim Rogers Cautions "Be Prepared, Be Worried, And Be Careful... This Is Going To End Badly"

- John Rubino: “We’ll Get A Crash That’s Commensurate With The Size Of This Bubble”

- No Bubbles Here

- SILVER Elliott Wave Technical Analysis

- Using Options to Capitalize on Strong Fundamentals in Gold

- Wages Relative To Profits Drop To All Time Low

- Greenspan Baffled Over Bitcoin ‘Bubble’: “To Be Worth Something, It Must Be Backed By Something”

- When Saving Interest Rates Go Negative

- Greenspan Baffled Over Bitcoin 'Bubble': "To Be Worth Something, It Must Be Backed By Something"

- The Gold Price Rose $26.50 Today to $1,248.20

- The Gold Price Rose $26.50 Today to $1,248.20

- Mining Stocks Suggest Further Declines

- Shanghai: Enter the Gold Dragon

- It's Payback Time: Foreign UK Homebuyers To Be Subject To Capital Gains Tax

- Mexico’s Newest Old Silver Mine

- GLD loses another 2.7 tonnes of gold from the vaults in London/SLV loses a tiny 145,000 oz/gold and silver advance but be aware of jobs report on Friday

- DESTROYER OF THE DOLLAR

- Gold Ends Higher Today On Stronger Than Exptected US Jobs Data

- “Something Is Wrong”, But Little Change Will Occur Until It Is Forced

- Lassonde: This Can Radically Change The Gold Price Overnight

- Evidence on Why Gold Is Falling on the Verge of a Dollar Implosion

- Gold Daily and Silver Weekly Charts - More and More Interesting

- Gold Daily and Silver Weekly Charts - More and More Interesting

- Uranium Bellwethers Outperforming S&P500 By Wide Margin in 2013 (CCJ, ARVCF, RIO)

- Gold Heads for Biggest Gain in Seven Weeks as Dollar Pares Gains

- Evidence on Why Gold Is Falling on the Verge of a Dollar Implosion

- If You Were Going to Buy a Mining Stock, Which Would It Be?

- New Home Sales: Time For A Reality Check

- New Home Sales: Time For A Reality Check

- The Coming Leap in Mass Transit

- The Daily Market Report: Gold Rebounds on Short Covering

- Jim’s Mailbox

- This Is Why The Price Of Gold Is Going Ballistic Today

- Shanghai Gold Exchange Cumulative Deliveries Of 8,655 Tonnes Since 2009

- Shanghai Gold Exchange Cumulative Deliveries Of 8,655 Tonnes Since 2009

- Gold jumps to new highs for the week after setting a new six-month low overseas. Up more than $30 from intraday low. Outside day confirmed. Potential key reversal.

- MILLENNIALS WILL BE THE DEATH OF OBAMACARE

- Stockings to strain with gold bullion this Christmas

- Things That Make You Go Hmmm – Twisted (By The Pool)

- Evidence on Why Gold Is Falling on the Verge of a Dollar Implosion

- Gold Setting Up To Bottom; U.S. Dollar Setting Up to Crash

- No Evidence for Gold and Silver Price Manipulation

- Evidence on Why Gold Is Falling on the Verge of a Dollar Implosion - Video

- TF Metals Report: Courage and conviction

- Gold Culture - The Eastern Lust For Gold

- Central Banks and Pentagon Wars - Control Via Interlocking Complicity

- Billionaire Gertler’s DRC gold deposit ‘world class’

- Gold prices jump after strong ADP jobs data

- Paper implosion bullish for gold, says Tocqueville’s John Hathaway

- Can’t-miss headlines: Gold resumes fall, Baja shares crumble to C$0.005 & more

| Jim Rogers Cautions "Be Prepared, Be Worried, And Be Careful... This Is Going To End Badly" Posted: 04 Dec 2013 05:41 PM PST "Eventually, the whole world is going to collapse," Jim Rogers chides a disquieted CBC anchor as he explains the reality that, "we in the West have staggering debts. The United States is the largest debtor nation in the history of the world," adding that "this is going to end badly." However, the co-founder of Soros' Quantum fund is convinced that the commodity super-cycle is far from over, but driven by supply constraints (and cost increases) as opposed to demand from higher growth. The following interview provides more color on his commodity view as he re-iterates his bullish stance on Ag (with sugar a focus) and Natural Gas (some harsh natural realities coming), warning "don't get too excited about fracking," when he talks energy products. Rogers, in his inimitable way, sums up the state iof euphoria that many markets find themselves in thus, "we are all floating around on a sea of artificial liquidity right now. This is not going to last."

On the end of the commodity super-cycle:

On the next crisis:

His final words:

|

| John Rubino: “We’ll Get A Crash That’s Commensurate With The Size Of This Bubble” Posted: 04 Dec 2013 05:40 PM PST by Tekoa Da Silva, Bull Market Thinking:

It was a particularly interesting conversation, as John has written a number of prophetic books warning of growing asset bubbles, and currently produces editorial research for CFA designated fund managers worldwide. As the subject of discussion, was a recent piece published by John, entitled, "Inflation is Raging – If You Know Where to Look". In discussing his research on global markets, John notes that frightening asset bubbles are developing all over the world, and as a case in point, "Bitcoin… was about a dollar per Bitcoin a couple of years ago. Now it's $1000…A painting by Francis Bacon called 'Three Studies of Lucian Freud' [just] sold for $142 million, which was the highest price ever paid for a painting at an auction….[A] diamond [just] sold for $83 million which is the highest price ever paid at auction for a diamond, and trophy real estate in Manhattan, London, Singapore and Hong Kong have all blown through previous records…So there are asset bubbles [occurring] all over the world." |

| Posted: 04 Dec 2013 05:20 PM PST by Andy Hoffman, MilesFranklin.com:

It was at this point, armed with full government approval (as evidenced by creation of the President's Working Group on Financial Markets) that he forsook all he had learned, in the pursuit of wealth and power. Over the subsequent two decades – before handing the reins– he engineered the modern "alchemy" that has destroyed global economic activity, setting into motion the final throes of a doomed monetary system. |

| SILVER Elliott Wave Technical Analysis Posted: 04 Dec 2013 05:01 PM PST Last analysis of Silver was invalidated with downwards movement below 19.595. Members of Elliott Wave Gold were aware of a new alternate for Gold, which also works for Silver. But I did not have time to update the Silver wave count. Read More... |

| Using Options to Capitalize on Strong Fundamentals in Gold Posted: 04 Dec 2013 04:55 PM PST Throughout most of 2013, gold futures have been under major selling pressure. Gold opened the year trading around $1,675 per ounce. As of the 12/02/13 close, gold futures were trading around $1,220 per ounce which would mean that thus ... Read More... |

| Wages Relative To Profits Drop To All Time Low Posted: 04 Dec 2013 04:53 PM PST Getting paid miserable wages? Don't fret - just buy the stock of your (hopefully public) employer, and hope and pray that this time is different, and that light at the end of the tunnel is the not the next latest and greatest (and likely last) stock market collapse, in the ultimate trade off of current pay for capital gains: 19 quarters in and Labor Compensation is flat with where it was when the Great Financial Crisis began but, more crucially, employee compensation is at its lowest on record relative to corporate profits.

As we previously noted, For those curious what the reason for records corporate profits is (or rather was: we have now finally turned the cycle and Y/Y profit growth is, for the first time since 2009, finally negative), the chart below explains it all.

It also explains why 401(k) plans are now redundant: anyone who wishes to keep up with the growth rate of their employer has no choice but to buy their stock, and generate returns for all shareholders. Because corporations, people or not, now have all the leverage. |

| Greenspan Baffled Over Bitcoin ‘Bubble’: “To Be Worth Something, It Must Be Backed By Something” Posted: 04 Dec 2013 04:47 PM PST from Zero Hedge:

|

| When Saving Interest Rates Go Negative Posted: 04 Dec 2013 04:20 PM PST from BATR:

Negative interest rates simply mean it will cost you, in fees or service charges, to hold money in banking accounts. Examine Professor Kimball's ivory tower justification for seizing the value and purchasing power of your savings. |

| Greenspan Baffled Over Bitcoin 'Bubble': "To Be Worth Something, It Must Be Backed By Something" Posted: 04 Dec 2013 04:07 PM PST "In order for currencies to be 'exchangeable' they have to be backed by something," is the remarkably ironic initial comment from none other than debaser-of-the-entirely-fiat-dollar Alan Greenspan when asked about the "bubble in bitcoin," by Bloomberg TV's Trish Regan. Unable to "identify the intrinsic" backing of Bitcoin (or see bubbles in equity, credit, real estate, or greater fools) Greenspan is, apparently, capable of identifying Bitcoin "as a bubble," because "there is no fundamental means of "repaying' it by any means that is universally accepted." The farcical double-speak continues as the Maestro does a great job of making Bitcoin (which Ron Paul earlier noted could be the "destroyer of the dollar") look even better than the readily-printed fiat we meddle with every day. Greenspan explains...

So either its backed by real physical metal with intrinsic value - or the promise of someone...(increasingly politicians of course) with good credit (or a big army)?

Like fiat currencies (just ask the Venezuelans)...

So coming soon the BuffettCoin or MuskCoin (oh wait reputation), or the GatesCoin? But, Greenspan sums it all up...

Which ironically (perfectly circular) is exactly what Bernanke said about gold...

So - after that - go buy his book!?

And some more color from Ron Paul on Bitcoin as "destroyer of the US Dollar": Via Mike Krieger's Liberty Blitzkrieg blog, While we believe it is the Federal Reserve that is systematically destroying the US dollar, Bitcoin could merely be the preferred conduit through which fed up citizens decide to express their displeasure with the incredibly corrupt corporatist-facist state being shoved down our throats by a handful of insane and greedy oligarchs. Interesting comments nonetheless. From CNN Money:

Interesting times… Full article here. |

| The Gold Price Rose $26.50 Today to $1,248.20 Posted: 04 Dec 2013 03:57 PM PST Gold Price Close Today : 1,248.20 Change : 26.50 or 2.17% Silver Price Close Today : 19.77 Change : 0.76 or 4.01% Gold Silver Ratio Today : 63.123 Change : -1.14 or -1.77% Silver Gold Ratio Today : 0.0158 Change : 0.0003 or 1.81% Platinum Price Close Today : 1,375.10 Change : 20.20 or 1.49% Palladium Price Close Today : 728.60 Change : 14.55 or 2.04% S&P 500 : 1,792.81 Change : -2.34 or -0.13% Dow In GOLD$ : 263.16 Change : $ -6.13 or -2.28% Dow in GOLD oz : 12.73 Change : -0.30 or -2.28% Dow in SILVER oz : 803.57 Change : -33.56 or -4.01% Dow Industrial : 15,889.77 Change : -24.85 or -0.16% US Dollar Index : 80.62 Change : 0.02 or 0.02% I overlooked a little detail yesterday & got stung for it -- Yesterday end of day GOLD PRICE showed the first half of a key reversal. Aww, I thought, it fell sixty cents on the Comex. Besides, silver showed no such gumption, so it probably won't amount to a hill of beans. Wrong. The GOLD PRICE rose $26.50 today to $1,248.20. Let us, however, hold on to our chapeaux. Gold must close above $1,252 to confirm this is anything more than a corrective bounce. Then a rally needs to be confirmed by a close over $1,295. There's more good news, but only hints & whispers. Rate of Change has turned up. MACD is rolling up. Volume surged today, confirming the rising price. But none of these have crossed that red line yet, just as gold hasn't yet confirmed with a close over $1,252. Ohh, but I'm itching all over. The SILVER PRICE added 76.3 cents to close Comex at 1977.4c. Yet here, too, for all the zest it remained below the needful level, 2005c. Wait, wait -- look at that! Silver posted the first half of a key reversal. Traded to a new low at 1889c then ended the day higher -- much higher -- at 1977.4c. Oh, yes -- a close higher tomorrow would confirm gold's key reversal (confirmed today). More: Markets rarely behave exactly as everyone expects, & the more that expect a certain thing, the less likely it is. Even gold & silver's friends seem to think they must yet make lower lows. Well, maybe, but maybe the waterfall on Monday was THE low. Tomorrow will tell that tale. It's really instructive to read media reports about stocks. Anyone not biased toward stocks would look at the chart and say, "Whoa! A correction has begun! After all, it has (1) a key reversal, confirmed three days, & (2) a close below the 20 day moving average (15,917.84)." Instead the media reports that stock traders are "baffled" by the employment reports. Another case where you can just ignore the news and listen to the chart. The Dow lost 24.85 (0.16%) today to perch finally at 15,889.77. S&P500 lost 2.34 (0.13%) to end at $1,792.81, not quite below the 20 DMA (1,788.36). At the end of the day, just like at the end of a football game, it doesn't matter how much you came back from your loss at halftime, it matters only what the final scoreboard said. Dow's low came today at 15,791 & S&P500's at 1,779. Even though they climbed back to nearly unchanged, both still closed lower. The Dow in Gold & Dow in Silver added depth to the story. Dow in Gold was off sharply, from a 13.138 ounce (G$271.59 gold dollar) high two days ago to 12.79 oz today (basis end of day). Dow in silver dropped 3% today to 807.61 oz, down from the high at 836.19 oz on Monday. All this looks very promising, but we must see some milestone crossed for confirmation. MACD is rolling over but hasn't yet crossed, Rate of Change has turned down, RSI is moving off overbought, but still I need some further confirmation. The HUI gold stock index appeared to have broken down last week, i.e., below its June low. This comes after an apparent double bottom with June in October. If it could climb above resistance about 210 again, it would encourage gold. US dollar index punched its enemies in the eye today, but did nothing to prove its intention. Rose a mighty 1.6 basis points, which you can almost see with an electron microscope. Days range was a bit narrower than the last two days, but couldn't through the 20 DMA (81.87). Meanwhile, the MACD is calling for lower prices. After a wide ranging day when it tested the 50 and 62 day moving averages, the Euro closed up 0.02%, essential unchanged at $1,3594. Looks as if it intends to move up more than down, but stalled here at $1.3600. A break through that mark would send it jumping higher. Yen made good yesterday's threat to rally by climbing another 0.08% to 97.70 cents/Y100. Still nothing to excite anyone here. Yield on the 10 year Treasury note today rose 2.38% to 2.841%, gapped up actually, although traded in a very narrow range. It stands now right at the last little peak, so if it rises much more it will aim for 2.984%, the last high. Bond rates easing upward must make Ben Bernanke sweat bullets and Janet Yellen grow a mustache. SPECIAL OFFER: Inventory Cleanup I've had these pre-1905 Morgan silver dollars hanging around forever but I don't get a lot of call for them so here's your chance for a great buy. Inventory must move, so I'd like to say good-bye to these. OFFER No. 1. Seventy-five (75) each pre-1905 Morgan, silver dollars at $26.50 each, for a total of $1987.50 plus $35 shipping or $2,022.50. These are not bright, shiny uncirculated coins, all are simply graded strict Very Good or better, no culls, no rim dings, full rims, etc. Each coin contains 0.765 troy ounce of silver, allowing wear for circulation. Great coin for survival. I have only six (6) lots. OFFER No. 2. One hundred Thirty-five (135) each pre-1905 Morgan, silver dollars at $26.50 each, for a total of $3,577.5 plus $35 shipping or $3612.50. Same as the coins in Offer No. 1, above, but I only have one lot this size. This is the balance lot, so if I come up short I'll reduce the quantity and adjust the total price. OFFER No. 3. Eight-five (85) each pre-1905 Morgan, CULL silver dollars at $23.00 each, for a total of $1,955.00 plus $35 shipping or $1,990. A "CULL" dollar won't meet the grade of Very Good or better. Worn and might have rim dings or rims worn down in spots, but won't quite reach an honest Very Good. Another great survival coin. I have three (3) lots only. OFFER No. 4. One hundred Twenty-Nine (129) each pre-1905 Morgan CULL silver dollars at $23.00 each, for a total of $2,967.00 plus $35 shipping for a grand total of $3,002.00. This is a balance lot so if my inventory comes up short, I will reduce the quantity and adjust the total price. Special Conditions: First come, first served, and no re-orders at these prices. I will write orders based on the time I receive your e-mail. We will not take orders for less than the minimum shown above. All sales on a strict "no-nag" basis. We will ship as soon as your check clears, but we allow Two weeks (14 days) for your check to clear. Calls looking for your order two days after we receive your check will be politely and patiently rebuffed. It increases your chances of getting your order filled if you offer me a second choice, e.g., "I want to order One of Lot 3, but if not available will take One of Lot 1." ORDERING INSTRUCTIONS: 1. You may order by e-mail only to . No phone orders, please. Please do NOT order by replying to this email, because it will delay your email. Your email must include your complete name, address, & phone number. We cannot ship to you without your address. Sorry, we cannot ship outside the United States or to Tennessee. Repeat, you must include your complete name, address, and phone number. Our clairvoyant quit without warning last week, I tripped, dropped, & smashed my crystal ball, & our fortune-teller is on strike, so I can no longer read your mind. 2. When you buy from us, we cannot later change or cancel the trade. We are giving you our word that we will sell at that price, & you are giving us your word that you will buy at that price, regardless what later happens in the market, up or down. If you break your word to us, we will never again do business with you. 3. Orders are on a first-come, first-served basis until supply is exhausted. 4. "First come, first-served" means that we will enter the orders in the order that we receive them by e-mail. 5. If your order is filled, we will e-mail you a confirmation. If you do not receive a confirmation, your order was not filled. 6. You will need to send payment by personal check or bank wire (either one is fine) within 48 hours. It just needs to be in the mail, not in our hands, in 48 hours. 7. "No Nag Basis" means that we allow fourteen (14) days for personal checks to clear before we ship. Want your order faster? Send a bank wire, but that's not required. Once we ship, the post office takes four to fourteen days to get the registered mail package to you. All in all, you'll see your order in about one month if you send a check. 8. Mention goldprice.org in your email. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| The Gold Price Rose $26.50 Today to $1,248.20 Posted: 04 Dec 2013 03:57 PM PST Gold Price Close Today : 1,248.20 Change : 26.50 or 2.17% Silver Price Close Today : 19.77 Change : 0.76 or 4.01% Gold Silver Ratio Today : 63.123 Change : -1.14 or -1.77% Silver Gold Ratio Today : 0.0158 Change : 0.0003 or 1.81% Platinum Price Close Today : 1,375.10 Change : 20.20 or 1.49% Palladium Price Close Today : 728.60 Change : 14.55 or 2.04% S&P 500 : 1,792.81 Change : -2.34 or -0.13% Dow In GOLD$ : 263.16 Change : $ -6.13 or -2.28% Dow in GOLD oz : 12.73 Change : -0.30 or -2.28% Dow in SILVER oz : 803.57 Change : -33.56 or -4.01% Dow Industrial : 15,889.77 Change : -24.85 or -0.16% US Dollar Index : 80.62 Change : 0.02 or 0.02% I overlooked a little detail yesterday & got stung for it -- Yesterday end of day GOLD PRICE showed the first half of a key reversal. Aww, I thought, it fell sixty cents on the Comex. Besides, silver showed no such gumption, so it probably won't amount to a hill of beans. Wrong. The GOLD PRICE rose $26.50 today to $1,248.20. Let us, however, hold on to our chapeaux. Gold must close above $1,252 to confirm this is anything more than a corrective bounce. Then a rally needs to be confirmed by a close over $1,295. There's more good news, but only hints & whispers. Rate of Change has turned up. MACD is rolling up. Volume surged today, confirming the rising price. But none of these have crossed that red line yet, just as gold hasn't yet confirmed with a close over $1,252. Ohh, but I'm itching all over. The SILVER PRICE added 76.3 cents to close Comex at 1977.4c. Yet here, too, for all the zest it remained below the needful level, 2005c. Wait, wait -- look at that! Silver posted the first half of a key reversal. Traded to a new low at 1889c then ended the day higher -- much higher -- at 1977.4c. Oh, yes -- a close higher tomorrow would confirm gold's key reversal (confirmed today). More: Markets rarely behave exactly as everyone expects, & the more that expect a certain thing, the less likely it is. Even gold & silver's friends seem to think they must yet make lower lows. Well, maybe, but maybe the waterfall on Monday was THE low. Tomorrow will tell that tale. It's really instructive to read media reports about stocks. Anyone not biased toward stocks would look at the chart and say, "Whoa! A correction has begun! After all, it has (1) a key reversal, confirmed three days, & (2) a close below the 20 day moving average (15,917.84)." Instead the media reports that stock traders are "baffled" by the employment reports. Another case where you can just ignore the news and listen to the chart. The Dow lost 24.85 (0.16%) today to perch finally at 15,889.77. S&P500 lost 2.34 (0.13%) to end at $1,792.81, not quite below the 20 DMA (1,788.36). At the end of the day, just like at the end of a football game, it doesn't matter how much you came back from your loss at halftime, it matters only what the final scoreboard said. Dow's low came today at 15,791 & S&P500's at 1,779. Even though they climbed back to nearly unchanged, both still closed lower. The Dow in Gold & Dow in Silver added depth to the story. Dow in Gold was off sharply, from a 13.138 ounce (G$271.59 gold dollar) high two days ago to 12.79 oz today (basis end of day). Dow in silver dropped 3% today to 807.61 oz, down from the high at 836.19 oz on Monday. All this looks very promising, but we must see some milestone crossed for confirmation. MACD is rolling over but hasn't yet crossed, Rate of Change has turned down, RSI is moving off overbought, but still I need some further confirmation. The HUI gold stock index appeared to have broken down last week, i.e., below its June low. This comes after an apparent double bottom with June in October. If it could climb above resistance about 210 again, it would encourage gold. US dollar index punched its enemies in the eye today, but did nothing to prove its intention. Rose a mighty 1.6 basis points, which you can almost see with an electron microscope. Days range was a bit narrower than the last two days, but couldn't through the 20 DMA (81.87). Meanwhile, the MACD is calling for lower prices. After a wide ranging day when it tested the 50 and 62 day moving averages, the Euro closed up 0.02%, essential unchanged at $1,3594. Looks as if it intends to move up more than down, but stalled here at $1.3600. A break through that mark would send it jumping higher. Yen made good yesterday's threat to rally by climbing another 0.08% to 97.70 cents/Y100. Still nothing to excite anyone here. Yield on the 10 year Treasury note today rose 2.38% to 2.841%, gapped up actually, although traded in a very narrow range. It stands now right at the last little peak, so if it rises much more it will aim for 2.984%, the last high. Bond rates easing upward must make Ben Bernanke sweat bullets and Janet Yellen grow a mustache. SPECIAL OFFER: Inventory Cleanup I've had these pre-1905 Morgan silver dollars hanging around forever but I don't get a lot of call for them so here's your chance for a great buy. Inventory must move, so I'd like to say good-bye to these. OFFER No. 1. Seventy-five (75) each pre-1905 Morgan, silver dollars at $26.50 each, for a total of $1987.50 plus $35 shipping or $2,022.50. These are not bright, shiny uncirculated coins, all are simply graded strict Very Good or better, no culls, no rim dings, full rims, etc. Each coin contains 0.765 troy ounce of silver, allowing wear for circulation. Great coin for survival. I have only six (6) lots. OFFER No. 2. One hundred Thirty-five (135) each pre-1905 Morgan, silver dollars at $26.50 each, for a total of $3,577.5 plus $35 shipping or $3612.50. Same as the coins in Offer No. 1, above, but I only have one lot this size. This is the balance lot, so if I come up short I'll reduce the quantity and adjust the total price. OFFER No. 3. Eight-five (85) each pre-1905 Morgan, CULL silver dollars at $23.00 each, for a total of $1,955.00 plus $35 shipping or $1,990. A "CULL" dollar won't meet the grade of Very Good or better. Worn and might have rim dings or rims worn down in spots, but won't quite reach an honest Very Good. Another great survival coin. I have three (3) lots only. OFFER No. 4. One hundred Twenty-Nine (129) each pre-1905 Morgan CULL silver dollars at $23.00 each, for a total of $2,967.00 plus $35 shipping for a grand total of $3,002.00. This is a balance lot so if my inventory comes up short, I will reduce the quantity and adjust the total price. Special Conditions: First come, first served, and no re-orders at these prices. I will write orders based on the time I receive your e-mail. We will not take orders for less than the minimum shown above. All sales on a strict "no-nag" basis. We will ship as soon as your check clears, but we allow Two weeks (14 days) for your check to clear. Calls looking for your order two days after we receive your check will be politely and patiently rebuffed. It increases your chances of getting your order filled if you offer me a second choice, e.g., "I want to order One of Lot 3, but if not available will take One of Lot 1." ORDERING INSTRUCTIONS: 1. You may order by e-mail only to . No phone orders, please. Please do NOT order by replying to this email, because it will delay your email. Your email must include your complete name, address, & phone number. We cannot ship to you without your address. Sorry, we cannot ship outside the United States or to Tennessee. Repeat, you must include your complete name, address, and phone number. Our clairvoyant quit without warning last week, I tripped, dropped, & smashed my crystal ball, & our fortune-teller is on strike, so I can no longer read your mind. 2. When you buy from us, we cannot later change or cancel the trade. We are giving you our word that we will sell at that price, & you are giving us your word that you will buy at that price, regardless what later happens in the market, up or down. If you break your word to us, we will never again do business with you. 3. Orders are on a first-come, first-served basis until supply is exhausted. 4. "First come, first-served" means that we will enter the orders in the order that we receive them by e-mail. 5. If your order is filled, we will e-mail you a confirmation. If you do not receive a confirmation, your order was not filled. 6. You will need to send payment by personal check or bank wire (either one is fine) within 48 hours. It just needs to be in the mail, not in our hands, in 48 hours. 7. "No Nag Basis" means that we allow fourteen (14) days for personal checks to clear before we ship. Want your order faster? Send a bank wire, but that's not required. Once we ship, the post office takes four to fourteen days to get the registered mail package to you. All in all, you'll see your order in about one month if you send a check. 8. Mention goldprice.org in your email. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Mining Stocks Suggest Further Declines Posted: 04 Dec 2013 03:41 PM PST In our last essay we examined the situation in the US Dollar Index (from many perspectives) and the Euro Index, as many times in the past it gave us important clues about future precious metals' moves. Back then we wrote that the ... Read More... |

| Shanghai: Enter the Gold Dragon Posted: 04 Dec 2013 03:40 PM PST from McalvanyFinancial: This week: |

| It's Payback Time: Foreign UK Homebuyers To Be Subject To Capital Gains Tax Posted: 04 Dec 2013 03:36 PM PST Back in September 2012 when we, correctly, suggested that one of the main drivers of demand (and increasingly becoming the only one) for US housing, especially in the mid and high-end, was foreigners - particularly of the oligarch persuasion - who come to the US to park their embezzled and otherwise ill-gotten funds, courtesy of the NAR's anti-money laundering exemptions, which means that they can buy any house, sight unseen, cash upfront (recall that a record 60% of all home purchases are all cash, which explains why mortgage bankers are being fired by the thousands left and right), no questions asked. One thing we made very clear, though, is that since one never actually buys the real estate, but merely rents it from Uncle Sam (or any other Development Market host nation), there is little preventing the host from cranking up the tax system, or outright changing it, when the need to raise funds strikes. After all what rights do criminal foreigners with multi-million homes in New York (or San Fran, or London, or any other major metropolis that is the target of offshore capital) actually have. Which is why, over a year after this prediction, we find that if not the US (yet) then certainly London, where the housing bubble is greater than anything seen in the US thanks to Russian and Asian hot money, is doing just this. Earlier today, the London Assembly passed a motion welcoming a possible move by the government to bring in capital-gains tax on foreign investors selling a home in the city. The motion was passed today with 13 votes in favor and 6 against, according to an e-mailed statement by the 25-member assembly, whose main function is to hold the capital's mayor to account. The populist angle was naturally present to justify this decision: "Londoners' right to own a decent home must be put before speculative investors in London's property market," assembly member Tom Copley from the Labour Party, in opposition nationally, said in the statement. "London property is becoming a global reserve currency for people to keep their money and to make money out of London property." That actually is a spot on and very accurate assessment, especially in a world in which the governments of these same nations (recall that the US Mint is the first to propose a gold-backed Bitcoin token) for clear reasons, turn a blind eye to various forms of below the radar money transfers, many involving Bitcoin. After all, what better way to "honeypot" and trap foreign capital than by making inbound cash transfers easy, and then once the real estate "reserve currency" has been acquired, to change taxes and force foreigners to pay up for the privilege of having been allowed to park their illegal capital there in the first place. As Bloomberg reports, the full passage of this tax proposal is likely only a matter of time now:

Frankly, the only question we have is why it took London so long, although "building up a critical mass" of future capital gains taxpayers is probably the answer. And soon, after this has been tested in the UK, where will it go... but to the US. We would not be surprised if the ultra-luxury segment in US housing suddenly becomes just a tad wobbly as foreigners seek to quietly but promptly sell now and avoid capital gains, before, like in London, this becomes the law in the US next. Who knows: lesser things have popped housing bubbles in the past. |

| Mexico’s Newest Old Silver Mine Posted: 04 Dec 2013 03:18 PM PST Bob Moriarty It’s rare that I go on a tour to a company that I have never heard of, but it happened when I went to visit Sierra Metals (SMT-T) a week ago. I’d make the pitiful claim that I didn’t know them because they changed their name a year ago from Dia Brias except for the fact I had never heard of Dia Brias either. In any case, |

| Posted: 04 Dec 2013 03:16 PM PST by Harvey Organ, HarveyOrgan.Blogspot.ca:

Gold closed down $26.50 to $1248.20 (comex closing time ). Silver was up 77 cents at $19.77. In the access market today at 5:15 pm tonight here are the final prices: gold: $1244.00 Zero hedge discusses gold trading today vs stocks; |

| Posted: 04 Dec 2013 03:05 PM PST Ron Paul Says Bitcoin Could be the "Destroyer of the Dollar" Posted on December 4, 2013 by Michael Krieger http://libertyblitzkrieg.com/ Personally, I wouldn't put it that way. The dollar is being destroyed by the Federal Reserve. Bitcoin is merely a preferred conduit through which fed up citizens decide to express their displeasure with the incredibly […] |

| Gold Ends Higher Today On Stronger Than Exptected US Jobs Data Posted: 04 Dec 2013 02:59 PM PST This market commentary is written by Adrian Ash from Bullionvault.com, who publishes a daily market update. Jumping to $1229 per ounce in London trade Wednesday, gold defied analyst expectations and reversed earlier 1% losses after stronger-than-expected US jobs data. Today’s private-sector ADP Payrolls Report said 215,000 jobs were added in the US last month, against consensus forecasts of 173,000. Rising ahead of that number, used by some as an advance guide to Friday’s official US non-farm payrolls figures, gold had then fallen $5 per ounce before jumping 0.9% in volatile trade. Gold “[had] hit a fresh 5-month low in every session this week,” says the Reuters newswire. “Recent short-term stabilisation was much weaker and shorter than expected,” says the latest technical analysis from Axel Rudolph at Commerzbank in Frankfurt. Repeating the same view on silver, “Remains bearish,” Rudolph concludes. “Gold has a decent chance of retesting its 2013 lows sometime in December given all that is going on,” reckons Edward Meir at brokerage INTL FCStone, citing this coming Friday’s US jobs data and then the Federal Reserve meeting ending Weds 18 Dec. “Support is at the major low of $1180 from June 2013,” says chart analysis from London market-maker ScotiaMocatta, warning that technical indicators suggest “gold has room to fall further before being hindered by ‘oversold’ signals.” But “The main risk for gold is a short squeeze,” counters ANZ Bank, pointing to the large short position now built up by speculative traders in US gold futures. Previously peaking in early July, the gross short position in US gold futures and options was quickly unwound as the gold price began a 20% rally from June’s 3-year low. ”Comex gold shorts are at a 4-month high ahead of Friday's US employment data,” agrees Walter de Wet at Standard Bank in London, noting the latest US futures positioning figures. Either that means “disappointing data could very likely trigger large-scale short covering and push gold higher, quickly,” says de Wet. Or Friday’s non-farm payrolls report “is irrelevant to participants as the majority looks through the noise towards the end goal, i.e. tapering and a slow normalisation of US monetary policy which is coming closer by the day.” |

| “Something Is Wrong”, But Little Change Will Occur Until It Is Forced Posted: 04 Dec 2013 02:58 PM PST The reality is relatively simple even though the appearance is complicated and confusing. What are we talking about?

We all know "something is wrong" but we keep riding the same corrupt "gravy train" because it works for many powerful people. Consider the interlocking complicity involved in the following: Iraq and Other Wars: The previous administration produced "evidence" that Iraq had weapons of mass destruction and then claimed it was necessary to invade Iraq, distribute oil contracts to American and British oil companies, initiate "no-bid" contracts to politically connected American military contractors, massively increase government debt, and create huge profits for selected companies and industries. Those profits flowed back to the financial elite, agreeable congressmen, others in government, and to many American workers. Even though it is now generally agreed that Iraq had no weapons of mass destruction and no means of launching those non-existent weapons against the United States, a great many connected people and businesses benefited financially from the Iraq War. Interlocking complicity worked well to promote the war and to profit from it. Pentagon Accounting: About 12 years ago, Secretary of Defense, Donald Rumsfeld revealed that $2.3 Trillion was "missing" from the Pentagon books. ("War Racket Update" by acting-man.com – site down temporarily) "A number of knowledgeable observers admitted that the Pentagon's 'books are cooked' and that in essence, a giant cover-up was going on. A mixture of waste and theft on a truly breathtaking scale was and still is underway." It has been my experience that bad or fraudulent accounting is enabled, encouraged, or actively created by management. We can safely assume that the many highly intelligent people who work at the Pentagon could more accurately and transparently manage their operations if they wanted to do so. Hence, fraud and theft exist because management wants it – many people benefit while accountability is neither encouraged nor beneficial to those who are actually in charge. The powers-that-be, congress, the administration, and military contractors are complicit in working the system so that all parties benefit, other people pay the costs, there is minimal accountability, and the necessary payoffs are made. Interlocking complicity works well for those in charge of Pentagon funds and for those receiving the funds. Government Debt: Congress has not passed a budget in five years and has been deficit spending for decades. The shortfall between revenues and expenses is borrowed with the understanding that the debts will never be paid – just "rolled over." The financial and political elite benefit, government pays out massive amounts for military contracts, health care, prescription drugs, retirement programs, Social Security payments, Medicare, unemployment, aid to states, and it goes on and on. That explains how the U.S. government is officially in debt over $17 Trillion and has accrued another $100 – $200 Trillion in liabilities that have been promised but are not currently funded. Since most Americans are benefitting from one or more of these government distributions, most Americans are complicit in this giant borrow, spend and print Ponzi scheme. Because so many people benefit, few individuals or businesses want the process materially changed. Of course many people talk about balancing the budget, cutting spending, and fiscal accountability, but it is only talk. Because Congress has been unable to pass a budget in five years and must borrow a $Trillion or so each year there will be no accountability or budget cutting anytime in the near future. Interlocking complicity rules while we ride the giant government gravy train. QE and the Levitation of Stock and Bond Markets. Even a quick glance at the last five years of market prices shows that QE has been a huge benefit to the stock and bond markets and that much of the funny money being "created out of thin air" by the Fed finds its way into those markets. Hence the stock and bond markets have been levitated while "main street" and the bottom 90% (those who have little of their net worth in stocks and bonds) have derived minimal or no benefit from QE. However, most of us realize that the US government cannot limit spending to only the revenue it collects, and that QE greatly benefits the financial and political elite. Interlocking complicity dictates that QE will continue as long as possible, even though "printing money" and debasing the currency have never successfully worked throughout history. Central Banks and Gold Price Suppression: Central Banks (Bank of England, Federal Reserve, ECB) have sold or "leased" gold into the market, via bullion banks, to suppress the price of gold and to promote the idea of Pound, Dollar and Euro strength. Since central banking rules allow them to claim that gold is still their asset, even though it is physically gone, this process can work until the central banks are unwilling or unable to sell or "lease" additional gold. The Chinese, Indians, and Russians have purchased the gold directly from bullion banks, or taken delivery on futures contracts, shipped the gold to Switzerland where it has been melted down into kilo bars, and then moved it to the Eastern countries. A huge amount of gold has left the west where it is undervalued and now is vaulted in the East where it is better appreciated. During the past several years the Chinese have vastly increased their gold holdings at favorable prices while dumping some of their depreciating dollars. The Western central banks further the illusion of value in unbacked debt based paper money while claiming gold is in a bubble, gold and the gold standard are barbarous relics, and enabling paper currencies to survive for a while longer. Interlocking complicity in the gold leasing and gold price suppression scheme currently benefits both the eastern and western countries. SUMMARYThe Pentagon cannot account for $Trillions. Since there is little incentive to stop the fraud, waste, and phony accounting, and since there is a large incentive for it to continue, expect the graft, corruption, black budget items, and payoffs to continue. Interlocking complicity works especially well at the Pentagon. The US government does not want to cut spending and has a limited ability to increase revenues. Expect borrow and spend politics to dominate until a "reset" occurs and then expect a crisis and many speeches from important politicians who just noticed what has been obvious for decades. Interlocking complicity works well for congressional payoffs, reelection speeches, increasing power to the administrative branch, and, of course, massive profits to the industries that benefit the most from deficit spending, such as military contractors, banking, health care, pharmaceuticals and others. Gold price suppression benefits western governments and central banks while the Chinese and Russians benefit by purchasing valuable gold with increasingly devalued dollars. Expect gold price suppression to continue until the west runs out of gold that can be melted down and shipped east. However, demand for physical gold is quite strong while supply is limited. Expect gold to trade MUCH higher in the next few years. Interlocking complicity produces a degree of stability as it helps maintain the status quo, which is very important to the powers-that-be. Interlocking complicity ensures that accountability, oversight, and ethical practices are low priorities, while payoffs and no-bid contracts will maintain their important role in government operations. Interlocking complicity ensures that little change will occur until it is forced upon us. Ask yourself:

Additional Reading: Ron Paul: The Mythical Merits of Paper Money |

| Lassonde: This Can Radically Change The Gold Price Overnight Posted: 04 Dec 2013 02:45 PM PST  On the heels of some wild trading in the gold and silver markets, today legendary Pierre Lassonde warned King World News about a "seminal event" that can radically change the gold price "overnight." Lassonde also told KWN what to expect in the gold market going forward, as well as the mining shares. Lassonde is arguably the greatest company builder in the history of the mining sector. He is past President of Newmont Mining, past Chairman of the World Gold Council and current Chairman of Franco Nevada. On the heels of some wild trading in the gold and silver markets, today legendary Pierre Lassonde warned King World News about a "seminal event" that can radically change the gold price "overnight." Lassonde also told KWN what to expect in the gold market going forward, as well as the mining shares. Lassonde is arguably the greatest company builder in the history of the mining sector. He is past President of Newmont Mining, past Chairman of the World Gold Council and current Chairman of Franco Nevada. Lassonde is one of the wealthiest, most respected individuals in the gold world, and as always King World News would like to thank him for sharing his wisdom with our global readers during this critical period in these markets. This posting includes an audio/video/photo media file: Download Now |

| Evidence on Why Gold Is Falling on the Verge of a Dollar Implosion Posted: 04 Dec 2013 02:28 PM PST By Bud Conrad, Chief Economist Bud Conrad, Casey Research chief economist, predicts in this fascinating interview with Future Money Trends that the US dollar will implode and be replaced with a new currency, quite possibly one backed by gold. Then why is the gold price dropping like a brick in the face of dollar devaluation? Watch the video for Bud’s eye-opening answer… Is now a good time to load up on gold—and how should you invest? Get all the details in our FREE Special Report, The 2014 Gold Investor’s Guide. Click here to read it now. |

| Gold Daily and Silver Weekly Charts - More and More Interesting Posted: 04 Dec 2013 01:28 PM PST |

| Gold Daily and Silver Weekly Charts - More and More Interesting Posted: 04 Dec 2013 01:28 PM PST |

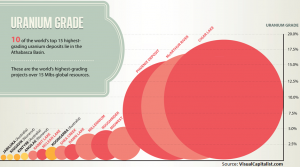

| Uranium Bellwethers Outperforming S&P500 By Wide Margin in 2013 (CCJ, ARVCF, RIO) Posted: 04 Dec 2013 12:56 PM PST The recent low price in uranium which hit 8 year lows in 2013 may actually be the catalyst to look for higher grade and more economic uranium deposits in the Athabasca Basin in mining friendly Saskatchewan. Higher cost mines are being shut down or delayed, however new uranium discoveries are receiving a lot of attention especially in the Athabasca Basin which is the highest grade uranium mining district in the world. This low price in uranium is why Cameco, Rio Tinto and Denison have been buying junior uranium explorers in the Athabasca Basin trading at bargains. These assets are high grade meaning potentially lower production costs in a stable jurisdiction. Smart money knows nuclear power is here to stay as there are more reactors operating and under construction now post-Fukushima than from before the once in a millennium natural disaster. Even after Fukushima, the Athabasca Basin has been the one bright light in a resource sector covered with darkness. Right after Fukushima, Cameco and Rio Tinto, both with billions of dollars of market cap went into a bidding war over Hathor. Rio won with a bid of $642 million. Eventually, Denison bought out Fission for their J-Zone asset next door to Roughrider making themselves a target for either Cameco or Rio. Now, Fission’s new spin out is buying Alpha for $180 million for the new Patterson Lake South Discovery. What does all this M&A activity in Athabasca uranium miners mean in a bear market in the resource sector? Smart money is telling us that the Athabasca Basin represents one of the great areas to make wealth in discovery of uranium. Look at the Athabasca Basin bellwethers such as Cameco, Rio and Areva whose share price has moved significantly higher to pay top dollar for the best discoveries in the Basin. The Athabasca Basin is attracting capital that is looking for 10-20 fold increases. The key to invest in early stage exploration is to find the right people. Look for the best personnel who have proven track records of success in this area with this commodity. Jody is now the exploration manager for Lakeland Resources (LK.V). Lakeland just announced an option agreement with another junior. This will help the company increase the probability of a discovery without major dilution as the partner will spend $1.2 million over the next 12 months and $6.5 million over 48 months. This will make Lakeland one of the more aggressive explorers in the Athabasca Basin with anticipated drilling beginning in the first quarter of 2014. Lakeland’s share structure may be one of the best in the Athabasca Basin with close to 30 million shares outstanding. Close to 40% is owned by management and institutions. There is a very small float for retail investors. Lakeland has acquired a large land package across the Northern part of the Basin. Lakeland just announced that exploration is active on the Riou Lake Uranium Property located in the Northern Part of the Basin. They are doing the initial work for a winter drilling program in the first quarter of 2014. Lakeland believes there will be strong news flow over the coming several months that could build significant value in this early stage situation. Although this is early-stage and ground floor, this company has the people, the properties and the share structure to potentially create a lot of wealth for uranium investors. Lakeland should find support at the 200 day moving average. Look for a cup and handle breakout at $.15 which could lead to a major move. See my recent interview with Lakeland’s exploration manager Jody Dahrouge who is one of the best geologists in the Athabasca Basin. For more information on Lakeland contact Roger Leschuk, Corporate Communications at Ph: 604.681.1568 or TF: 1.877.377.6222 ___________________________________________________________________________ Sign up for my free newsletter by clicking here… Sign up for my premium service to see new interviews and reports by clicking here… Please see my disclaimer and full list of sponsor companies by clicking here… Accredited investors looking for relevant news click here… Please forward this article to a friend. To send feedback or to contact me click here… Listen to other interviews with movers and shakers in the mining industry below or by clicking here… Listen to internet radio with goldstocktrades on BlogTalkRadio

|

| Gold Heads for Biggest Gain in Seven Weeks as Dollar Pares Gains Posted: 04 Dec 2013 12:55 PM PST 04-Dec (Bloomberg) — Gold headed for the biggest jump in seven weeks as the dollar pared gains and commodity prices advanced, led by crude oil, renewing demand for an inflation hedge. The Bloomberg U.S. Dollar index traded little changed after rising as much as 0.3 percent against a basket of currencies. The Standard & Poor's GSCI Spot Index of 24 raw materials rose as much as 0.6 percent, the third straight advance, and crude oil in New York climbed to a five-week high. "We saw gold take off as the dollar began its slide," Frank Lesh, a trader at FuturePath trading in Chicago, said in a telephone interview. "Also, the strength in commodities continues to support gold and with some support coming in from technical buying." [source] |

| Evidence on Why Gold Is Falling on the Verge of a Dollar Implosion Posted: 04 Dec 2013 11:44 AM PST Bud Conrad, Casey Research chief economist, predicts in this fascinating interview with Future Money Trends that the US dollar will implode and be replaced with a new currency, quite possibly one backed by gold. Read More... |

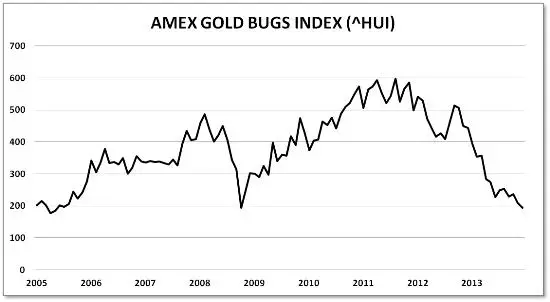

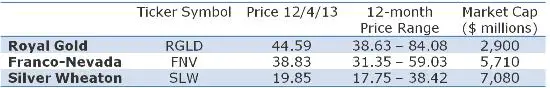

| If You Were Going to Buy a Mining Stock, Which Would It Be? Posted: 04 Dec 2013 11:36 AM PST Let's say you've got some traditional mutual funds full of stocks and bonds and they're way up. You're worried by all the taper talk and the charts that show share prices and margin debt back up to pre-crash levels, and you're wondering whether it's time to redirect some of that capital to someplace that no one is calling a bubble. Meanwhile, you’ve noticed that precious metals mining stocks are in another of their periodic corrections, with this one looking a lot like 2008's bloodbath — which was followed by an epic bull market: But with gold and silver below the production cost of a lot of miners, there's a ton of risk to go with the seemingly huge upside. So committing to individual miners is terrifying. Still, that’s how it always looks at the bottom. So if you're going to buy one, which would it be? Let's start with the premise that at a bear market bottom investors, having been faked out so many times on the way down, don't trust the turn. So to the extent that they buy anything, they buy the safest names. If the miners keep to this pattern, next year will be good for the best and mediocre for the rest. And in mining the safest bets are the royalty and streaming companies that don't actually mine metal themselves but contract with other mines to take part of their future output. They do this in a variety of ways ranging from buying up existing royalty agreements that call for a given number of ounces delivered over a specified period of time, to in effect making equity investments in mines in return for some portion of future production. The first is passive investing, the second more like venture capital. The biggest companies in this space have been able to gain interests in lots of mines on generally favorable terms. Here are the three to consider: Not Risk-Free The other issue is the availability of good investments going forward. The royalty companies have to invest their cash at rates that exceed their cost of capital. Such deals are scarce in this environment and will get scarcer if metals prices don’t recover. Here again, though, we're talking about diminishing cash flow, not an existential threat. Meanwhile, in a really bad market these companies become the king makers in the industry, deciding which juniors live or die and using that power to cut deals that become hugely favorable when prices revive and those new mines are developed. To sum up, these companies are not as safe as owning bullion intelligently stored, but they're safer than the typical miner, with considerable upside margin over metals prices if things turn around from here. |

| New Home Sales: Time For A Reality Check Posted: 04 Dec 2013 10:45 AM PST If "cynicism" is a view of reality and truth, then "hope" is nothing but fantasy and faith - Dave in Denver...Most of you have seen or will see the media headlines broadcasting a big October for new home sales. But as is normally the case with numbers put together, manipulated and released by the U.S. Government, the report is full of serious flaws. Not only that, but if you really dig deeply into the actual monthly numbers and also consider the extreme degree of downward revisions that have been applies since at least July, the new home sales report is downright ugly. And that's not cynicism, it's fact. It just so happens that I did the above analysis and laid out the data, facts and source citations in this article just published: Today's New Home Sales Report Is Very Bearish. Please note that the stock market agrees with take on the numbers, as the Dow Jones Homebuilder Index is down 1.5% right now and 2.3% from its initial spike after the report hit the tape. Furthermore, the stock market, after a big spike higher on the new homes report, is now down 10 pts as measured by the S&P 500 futures contract (front month) and 1% from its high of the day. Be careful out there with your investments in the stock market. We are witnessing a bubble in stocks that exceeds the one in 1999 that led to the collapse in early 2000. I will note that the dollar has taken a big turn down today and gold and silver are having their best day in several weeks, with silver up over 4% and gold up 2.2%. Something ain't right out there behind the scenes. ...The power of accurate observation is commonly called cynicism by those who have not got it - George Bernard Shaw |

| New Home Sales: Time For A Reality Check Posted: 04 Dec 2013 10:45 AM PST If "cynicism" is a view of reality and truth, then "hope" is nothing but fantasy and faith - Dave in Denver...Most of you have seen or will see the media headlines broadcasting a big October for new home sales. But as is normally the case with numbers put together, manipulated and released by the U.S. Government, the report is full of serious flaws. Not only that, but if you really dig deeply into the actual monthly numbers and also consider the extreme degree of downward revisions that have been applies since at least July, the new home sales report is downright ugly. And that's not cynicism, it's fact. It just so happens that I did the above analysis and laid out the data, facts and source citations in this article just published: Today's New Home Sales Report Is Very Bearish. Please note that the stock market agrees with take on the numbers, as the Dow Jones Homebuilder Index is down 1.5% right now and 2.3% from its initial spike after the report hit the tape. Furthermore, the stock market, after a big spike higher on the new homes report, is now down 10 pts as measured by the S&P 500 futures contract (front month) and 1% from its high of the day. Be careful out there with your investments in the stock market. We are witnessing a bubble in stocks that exceeds the one in 1999 that led to the collapse in early 2000. I will note that the dollar has taken a big turn down today and gold and silver are having their best day in several weeks, with silver up over 4% and gold up 2.2%. Something ain't right out there behind the scenes. ...The power of accurate observation is commonly called cynicism by those who have not got it - George Bernard Shaw |

| The Coming Leap in Mass Transit Posted: 04 Dec 2013 10:44 AM PST Have you ever had a humbling “foot in the mouth” moment? I sure have. It happened a couple of years ago when I first heard about a service, a smartphone app, aiming to fundamentally alter the taxi industry. I was at a monthly dinner with a dozen venture capitalists and angel investors. After a few glasses of cabernet, when we were going around the table to talk about exciting or harebrained ideas we’d recently come across, I stood up to blast holes through this new taxi idea. The top 20 U.S. markets for mass transit cater to 2.2 billion riders per year… whoever succeeds in capturing this market could become a billion-dollar company. I ranted to my colleagues that the idea was impossible to execute and bound to fail. Trying to break into regulated markets like transportation, I said, is like sticking needles in your eye. And beyond that, in my mind, nobody would ever use or pay extra for a service like this — especially in places like New York City, where yellow taxis dot the road at all hours. Fast-forward a few months to a bitterly cold and rainy night. I’d just ducked out of a steakhouse and was standing on the corner of 49th and Lexington Avenue, drenched, trying to hail a cab. The wind was howling, my loafers were soaked and there wasn’t an empty yellow cab in sight. Desperate, I pulled out my iPhone and clicked on the very same taxi app I’d verbally torn apart only a few months prior. And what do you know: Within four minutes, my opinion of the product and the company changed. Because within four minutes I was sitting in the back seat of a Lincoln Navigator, hot air blowing at me from my personally controlled vents. I’d been able to track the position of the car on my phone while I waited inside the warm, dry steakhouse, so I knew exactly when it would be at the curb. Sure, it cost a few dollars more than a yellow cab, but the overall experience was fantastic. Now I use the service constantly. The service is Uber. And since the night of my foot-in-the-mouth remarks, the company has grown like a weed, making a huge dent in the taxi industry. In fact, the company recently raised over $250 million from Google at an eye-popping $3.5 billion valuation. Given this company’s humble beginnings — and my initial skepticism — I’ve become open to the idea of small, private companies “disrupting” (that’s geek-speak for fundamentally changing) regulated and public-sector industries. In fact, there’s a company raising money on AngelList right now that’s looking to disrupt mass transit. In fact, it could become the “Uber of mass transit”… From an investor’s perspective, the opportunity is huge. The top 20 U.S. markets for mass transit cater to 2.2 billion riders per year. Even at a few dollars in revenue per ride, whoever succeeds in capturing this market could become a billion-dollar company. The company I’m referring to on AngelList is called Leap Transit. They launched a trial in San Francisco. Within four months, they registered over 4,000 members, provided rides to over 2,300 people and are already generating revenue. Based on the size of the market opportunity and the results of the test, the company attracted the attention of famed venture capital firm Andreessen Horowitz (early backers of Facebook and Twitter) as well as Ron Conway’s SV Angel fund (early investors in Google). They’re both investing in this round of financing. Leap essentially operates its own fleet of buses, much like Uber operates a fleet of cabs. That might sound dull at first blush, but the way Leap leverages technology is downright innovative and exciting. For one thing, there won’t be any standardized routes or schedules. The bus routes will be crowdsourced — meaning, the service will intelligently generate new routes based on riders’ pickup locations and destinations. So if you and dozens of other people live in the same area and are all headed downtown, the bus will automatically generate the most optimal route and pickup schedule. And like Uber, Leap will allow you to check arrival times and track the current location of the bus right from your mobile phone. So no more wondering when your bus will arrive, wondering where it is or running to the stop in a panic. On top of that, the buses have comfortable seating, air conditioning and free Wi-Fi, so you can work or relax while in transit. We believe Leap Transit has the makings of a successful company… and a successful investment. The company is currently raising $2 million on AngelList and, as mentioned, already has some high-profile investors involved. The valuation is $4 million. Given the opportunity size, the company’s progress so far and the skills of their management team, we believe that’s an attractive figure. Although the $2 million round recently became fully subscribed, there might still be an opportunity for you to get involved. You see, on equity crowdfunding sites like AngelList, people “reserve” shares before they actually purchase them. If they don’t complete the investment process, shares become available again and are usually allocated on a first-come, first-serve basis. So if you’re a believer in the idea of privatizing public-sector industries and like what Leap Transit is doing, add your name to the waiting list. Best Regards, Wayne Mulligan Ed. Note: Identifying the “next big thing” in any industry is nearly impossible. But that won’t stop investors from trying. Wouldn’t you like to be one of the handful of people who get it right before anyone else? That’s why readers of the free Tomorrow in Review email edition are treated to every day — the chance to get in on the ground floor of the world’s most innovative and game-changing technologies… before they become household names. And since it’s free, you’ve got nothing to lose and a lot to gain. Sign up for Tomorrow in Review right here. This article appears courtesy of Crowdability.com |

| The Daily Market Report: Gold Rebounds on Short Covering Posted: 04 Dec 2013 10:28 AM PST

A better than expected ADP jobs survey print for November, created some upside risk for Friday’s nonfarm payrolls report. Additionally, new home sales jumped in October. While services ISM disappointed, the data were generally perceived to be supportive of the near-term taper scenario. This is reflected in the surge in the 10-year yield to 2.84%, and the fact that stocks remain defensive on the heels of the last three-days of losses. So, is gold finally shaking off the shackles of this silly inverse correlation to taper expectations? Or is this simply technical buying and/or short covering in the paper market ahead of the June low? It is perhaps too early to tell on the former, but short positions in Comex futures were at a four-month high. Earlier today, ANZ Bank said that "the main risk for gold is a short squeeze." Apparently… You may recall that the 21.5% rally we initially saw off the 1179.83 June low began with short-covering. What we are seeing today may be the beginning of another substantial short-covering rally into year-end. Of course our clients — and most physical buyers for that matter — are not speculators. However, many are taking advantage of the opportunity presented by the short-sellers in the paper market to lay in some real gold at a great price for their long-term wealth preservation and hedging needs. Any boost they’re now getting from the squeeze being put on the paper shorts is just a little icing on the cake. |

| Posted: 04 Dec 2013 10:06 AM PST Jim, I have been following the December Deliveries and posted the following on a Precious metals message board. I thought you might appreciate the potential situation right now on the COMEX that I see… CIGA Liambert COMEX DEC GOLD UPDATE: Still 597K ounces outstanding in position to issue delivery (Tuesday Final). 109K ounces have stood... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. |

| This Is Why The Price Of Gold Is Going Ballistic Today Posted: 04 Dec 2013 10:01 AM PST  With gold and silver staging a dramatic rally off today's lows, today a man out of Europe who has been extremely accurate with his calls on the gold market sent King World News the reasons for this incredible rally. KWN was given exclusive distribution rights to the outstanding piece below by Ronald-Peter Stoferle of Incrementum AG out of Lichtenstein. With gold and silver staging a dramatic rally off today's lows, today a man out of Europe who has been extremely accurate with his calls on the gold market sent King World News the reasons for this incredible rally. KWN was given exclusive distribution rights to the outstanding piece below by Ronald-Peter Stoferle of Incrementum AG out of Lichtenstein.This posting includes an audio/video/photo media file: Download Now |

| Shanghai Gold Exchange Cumulative Deliveries Of 8,655 Tonnes Since 2009 Posted: 04 Dec 2013 09:44 AM PST |

| Shanghai Gold Exchange Cumulative Deliveries Of 8,655 Tonnes Since 2009 Posted: 04 Dec 2013 09:44 AM PST |

| Posted: 04 Dec 2013 09:36 AM PST |

| MILLENNIALS WILL BE THE DEATH OF OBAMACARE Posted: 04 Dec 2013 09:34 AM PST The only way Obamacare had a chance of not being a multi-trillion dollar bottomless pit of deficits was if the young healthy Millennials who voted for Obama in droves signed up for Obamacare. Obama needed their premiums to pay for the obese sickly Boomers and the Free Shit Army who will utilize their free medical […] |

| Stockings to strain with gold bullion this Christmas Posted: 04 Dec 2013 09:14 AM PST The subdued price of the precious metal has sparked a Christmas stocking goldrush, according to Rob Halliday-Stein, founder of BullionByPost.co.uk. This posting includes an audio/video/photo media file: Download Now |

| Things That Make You Go Hmmm – Twisted (By The Pool) Posted: 04 Dec 2013 09:09 AM PST Things That Make You Go Hmmm – Twisted (By The Pool) By Grant Williams | December 2, 2013 This is an early warning. I’m going to be talking about gold (again) this week, so those amongst you who just kinda wish I wouldn’t do that may be excused. There. Now it’s just us. On […] |

| Evidence on Why Gold Is Falling on the Verge of a Dollar Implosion Posted: 04 Dec 2013 08:50 AM PST Evidence on Why Gold Is Falling on the Verge of a Dollar Implosion By Bud Conrad, Chief Economist Bud Conrad, Casey Research chief economist, predicts in this fascinating interview with Future Money Trends that the US dollar will implode and be replaced with a new currency, quite possibly one backed by gold. Then why is […] |

| Gold Setting Up To Bottom; U.S. Dollar Setting Up to Crash Posted: 04 Dec 2013 08:39 AM PST The next the black swan is already staring us in the face. It’s out of control currency So says Toby Connor (goldscents.blogspot.com) in edited excerpts from his original article* entitled THE NEXT BLACK SWAN: A DOLLAR CRISIS. [The following is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here). The excerpts may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]Connor goes on to say in further edited excerpts: U.S. Dollar Since the beginning of the year, [as seen in the chart below,] the dollar has been showing signs of extreme stress as it began to oscillate violently back and forth in what is known as a megaphone topping pattern. When this pattern breaks to the downside it is going to initiate the beginning stages of what will likely be a fairly severe currency crisis by next fall. In this environment I think it’s going to be impossible for the manipulation in the gold market to continue. As a matter of fact I got a signal last week that indicates to me that the forces trying to manipulate gold down to $1000 have probably thrown in the towel and given up, realizing that an impending dollar crisis is about to begin. Gold: Cyclical Analysis On a cyclical analysis basis, the intermediate cycle is now running out of time for a move all the way back to the $1000 level. As you can see in the chart below the average duration for an intermediate degree cycle is between 20-25 weeks. Currently gold is on the 23rd week of this cycle.

On a smaller time frame you can see the current intermediate cycle already has four daily cycles nested within it. I don’t believe there is time for a fifth daily cycle, and a fifth daily cycle would be required if gold were going to make it all the way down to $1000.

On top of that the current daily cycle is now stretched to 34 days which is already longer than 90% of historical cycles. What this means is that gold is very late in its daily cycle and a bottom is due at any time. The logical trigger would be on the employment report Friday, although I think the market will be expecting that so we may get a bottom earlier in the week. Gold: Sentiment Last week’s sentiment polls are also suggesting that bearish sentiment has reached levels where the market is at risk of running out of sellers. I expect when the current weekly sentiment poll comes out later this evening we will see sentiment in both gold and silver at levels comparable to the June bottom.

Source: sentimentrader.com I believe we are within days of a final bottom in this intermediate cycle. I think an initial 10-20% position can be taken anytime this week. Then once we get confirmation of an intermediate bottom one can start adding to that position. I’ll say it again, if one can pick, or even get close to, buying at a bear market bottom the initial move out of those bottoms are where the biggest gains in this business are made. The first two months out of the 2008 bear market bottom miners rallied 100%. I don’t think it’s unreasonable to expect something similar this time as this bear market has been every bit as severe as the one in 2008. Oil Confirmation Oil appears to have put in a final intermediate bottom. Look for oil to lead the commodity complex out of this bottom. [Editor's Note: The author's views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]*http://goldscents.blogspot.com/2013/12/the-next-black-swan-dollar-crisis.html Related Articles: 1.

If we want to better understand the answer to the elusive question of “When will the fiat US dollar collapse?”, we have to watch the petrodollar system and the factors affecting it. Read More » 3.

The term 'safe fiat currency’ is as intellectually disingenuous as terms like 'fair tax' or 'government innovation' but, as we've been exploring recently why modern central banking is completely dysfunctional, it does beg the question– is any currency 'safe'? Let's look at the numbers for some data-driven analysis. Words: 575 Read More » 4. Gold To Begin a Parabolic Rise In 2014 – Here's Why

We are now starting the hyperinflationary phase in the USA and many other countries – and this will all start in 2014. What will be the trigger? The answer is simple – the fall of the U.S. dollar. Read More » 5. What Would USD Collapse Mean for the World? I came to the conclusion several years ago that it was just a matter of time before the world realized that the relative functionality of the U.S. dollar was about to go belly up – to collapse. [Below is an explanation as to why I have come to that conclusion and what I think it would mean for the well-being of the world.] Words: 881 Read More » 6.

China, Russia and other nations are exiting their dollar-denominated holdings in favor of gold. This action should put pressure on the dollar and U.S. treasuries, pushing not only central banks, but mainstream investors towards the safety of precious metals and other tangible assets that cannot be defaulted on. There will be a rush out of dollars and into assets with no counter-party risk, it is just a matter of how soon it happens. Read More »

7. If the U.S. national debt continues to grow then the U.S. dollar system will collapse in 2017 suggests a Russian lawmaker in submitting a bill to the country's parliament that would ban the use or possession of the American currency. Read More » 8. The Collapse of the U.S. Dollar is Unavoidable! Here's Why The mother of all collapses is still in front of us. Below are my reasons why that is the case and how to protect yourself financially from such an eventuality. Read More » 9. Expect Gold to (Only) Drop to $1,150 by Mid-2014! Here's Why The gold price will likely decline to $1,150 next spring but should find enough buyer support from physical buyers and jewellery makers to prevent a fall below $1,000. Read More » The post Gold Setting Up To Bottom; U.S. Dollar Setting Up to Crash appeared first on munKNEE dot.com. |

| No Evidence for Gold and Silver Price Manipulation Posted: 04 Dec 2013 08:29 AM PST Grant Williams This is an early warning. I'm going to be talking about gold (again) this week, so those amongst you who just kinda wish I wouldn't do that may be excused. There. Now it's just us. On November 1, 1961, an agreement was reached between the United States and seven European countries to cooperate in achieving a shared, and very clearly, stated aim. |

| Evidence on Why Gold Is Falling on the Verge of a Dollar Implosion - Video Posted: 04 Dec 2013 08:24 AM PST By Bud Conrad, Chief Economist Bud Conrad, Casey Research chief economist, predicts in this fascinating interview with Future Money Trends that the US dollar will implode and be replaced with a new currency, quite possibly one backed by gold. Then why is the gold price dropping like a brick in the face of dollar devaluation? Watch the video for Bud's eye-opening answer… |