Gold World News Flash |

- China Mining Some Gold For A Staggering $2,500 An Ounce

- Is the Fed increasingly monetizing government debt?

- Shanghai Exchange Has Delivered More Gold Than Fort Knox!

- Horrific Consequences: “People Don’t Understand the Scale of the Emergency That’s Going On Right Now”

- The Gold Price Closed Down $15 at $1,233.20

- The Gold Price Closed Down $15 at $1,233.20

- Citi: Bitcoin Could Look Attractive To Reserve Managers As A Complement To Gold

- GMO's James Montier Skewers Bridgewater: Risk Parity = "Snake Oil In New Bottles"

- Gold Price is Being Held Back by One Gov't!

- 2 Fantastic Charts Show Gold May Quickly Surge $200

- Eric Sprott: The Curious Case For Silver

- Using Options to Capitalize on Strong Fundamentals in Gold

- Do Not Count On Gold To Get Rich, It Will Help People Survive

- Swiss refinery report: Gold supply has never been tighter

- David Morgan on QE, BitCoin and the Precious Metals Debt Card

- Deutsche Bank exits commodities trading ... except for monetary metals

- Gold Daily and Silver Weekly Charts - Non-Farm Payrolls Tomorrow

- Gold Daily and Silver Weekly Charts - Non-Farm Payrolls Tomorrow

- China is mining gold at as much as $2,500 per ounce, Leeb tells KWN

- Biotech Breakthrough: The Age of Immunotherapy

- Is Atlas Starting To Shrug?

- Is Atlas Starting To Shrug?

- China Mining Some Gold For A Staggering $2,500 An Ounce

- On-Sale in 2014: Silver to $16.76, $15.15, then $13.71

- In The News Today

- Turkish gold imports hit highest on record in 2013

- Godu kopen tegen $100 korting?

- Time for Goldbugs to Admit Defeat?

- Comex Deliverable Gold Still Out On the Tails of Leverage at 57 to 1

- Comex Deliverable Gold Still Out On the Tails of Leverage at 57 to 1

- Not All Boats Are Rising For The SP500!

- Lassonde - This Will Trigger Next Leg Of The Gold Bull Market

- Harmony Gold ordered to pay for water pollution

- Bull market or bear market – where does gold stand now?

- Gold falls as market wakes up to Fed expectations

- Can’t-miss headlines: Gold, copper pop, high-grading & more

- Gold Bull Over? Time for Goldbugs to Admit Defeat?

- Gold Prices Lose "Short-Covering Rally" After Strong US Jobs & GDP Data

- Gold 2.0 NOT Tulip Mania: How Big Is The Cryptocurrency Opportunity?

- The Eastern Lust for Gold

- Gold falls as market wakes up to Fed expectations

- “New Gold” Found In America

- Gold retreating at 1228.51 (-9.30). Silver 19.35 (-0.232). Dollar better. Euro easier. Stocks called better. US 10yr 2.84% (+1 bp).

- Got Gold Report: Unprecedented bullish indicator in gold futures trading data

- U.S. Marches Down the Road to Financial Perdition – No One Cares Until It Matters

- Capitalising on Gold Strong Fundamentals Using Options

- Gold Mining Stocks Suggest Further Declines

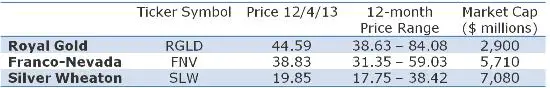

- What Are Royalty & Streaming Companies? Why Invest In Them?

- Grant Williams: Today's gold suppression will break just as London Gold Pool did

- Comex and Shanghai - Gold and Silver Deliveries Compared Over the Last Five Years

| China Mining Some Gold For A Staggering $2,500 An Ounce Posted: 05 Dec 2013 10:30 PM PST from KingWorldNews:

So what we are seeing right now in terms of the gold price is just a short-term phenomena. China is the world's largest producer of gold, and they keep all of that gold production. So not only are the Chinese vacuuming up all of the gold from the West, but they are also keeping the world's largest volume of production for themselves as well. This is why the West is losing control and the people in the West are going to be the bag holders. | ||||||||

| Is the Fed increasingly monetizing government debt? Posted: 05 Dec 2013 10:00 PM PST by Axel Merk, Ph. D, SilverBearCafe.com:

What is debt monetization? A central bank is said to monetize a government's debt if it helps to finance its deficit. The buying of Treasuries by the Federal Reserve is a clear indication that the Fed is doing just that, except that Bernanke argues the motivation behind Treasury purchases is to help the economy, not the government. | ||||||||

| Shanghai Exchange Has Delivered More Gold Than Fort Knox! Posted: 05 Dec 2013 09:01 PM PST  On the heels of more volatile trading in global markets, today Canadian legend John Ing told King World News that the Shanghai Gold Exchange has now delivered more than gold than what is supposedly stored at Fort Knox in the United States. Ing, who has been in the business for 43 years, also spoke about how this will impact the price of gold in the future. Below is what Ing had to say in his fascinating interview. On the heels of more volatile trading in global markets, today Canadian legend John Ing told King World News that the Shanghai Gold Exchange has now delivered more than gold than what is supposedly stored at Fort Knox in the United States. Ing, who has been in the business for 43 years, also spoke about how this will impact the price of gold in the future. Below is what Ing had to say in his fascinating interview.This posting includes an audio/video/photo media file: Download Now | ||||||||

| Posted: 05 Dec 2013 08:45 PM PST from Mac Slavo, SHTFPlan:

We now know that Maloney was right. In 2008 we saw asset valuations from stocks to commodities lose significant value. It was a deflationary impact so threatening that the U.S. government was on the brink of a collapse which sunsequently led to members of Congress being warned that if nothing was done there would be tanks on the streets of America. This was followed by an unprecedented bailout package, which included an astronomical infusion of cash by the Federal Reserve under the direction of Chairman Ben Bernanke. Since then we've seen a massive reflation in a system where the economic fundamentals have only gotten worse – stock markets have hit all time highs, home prices have seemingly re-stabilized and personal debt is approaching 2007 levels. | ||||||||

| The Gold Price Closed Down $15 at $1,233.20 Posted: 05 Dec 2013 07:40 PM PST Gold Price Close Today : 1,233.20 Change : -15.00 or -1.20% Silver Price Close Today : 19.51 Change : -0.26 or -1.31% Gold Silver Ratio Today : 63.20 Change : 0.07 or 0.11% Franklin didn't publish commentary today, if he publishes later it will be available here. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||

| The Gold Price Closed Down $15 at $1,233.20 Posted: 05 Dec 2013 07:40 PM PST Gold Price Close Today : 1,233.20 Change : -15.00 or -1.20% Silver Price Close Today : 19.51 Change : -0.26 or -1.31% Gold Silver Ratio Today : 63.20 Change : 0.07 or 0.11% Franklin didn't publish commentary today, if he publishes later it will be available here. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||

| Citi: Bitcoin Could Look Attractive To Reserve Managers As A Complement To Gold Posted: 05 Dec 2013 06:35 PM PST Bitcoin and other Internet currencies are viewed by some as a Beanie baby fad and, as Citi's Steve Englander notes, by others as revolutionizing the financial system. Market acceptance of alternative currencies now looks to be growing a lot faster than the pace at which the supply of Bitcoin and Bitcoin wannabees is expanding the Internet money supply. The responses fell into five categories which we feel are well worth considering before trading or utilizing the digital currency (including Bitcoin's role in reserves management). Englander's previous "Bitcoin as a currency" report generated a lot of comment. In the note, he argued that something as replicable as Bitcoin would generate a lot of imitators and that there was an infinite supply of Bitcoin-like competitors at low marginal cost. The responses generally fell into five categories: Citi's Steve Englander Addresses 5 key responses to his previous more negative view on Bitcoin. 1) Bitcoin is a generic payment system as much or more than a specific store of value and has tremendous advantages over current payments systems 2) Its run-up in price represents dissatisfaction with central banks and money printing and the desire for a currency not driven by political opportunism 3) First mover and networking economies of scale advantage will make Bitcoin and a couple of other internet moneys dominate Internet money in the future 4) It can keep growing as long as there was a group of individuals and businesses willing to accept it 5) It’s a tulip bubble and will collapse Many commented that Bitcoin was revolutionary as a payments mechanism, rather than as a store of value. The run-up in the price of Bitcoin could be viewed as speculative but its impact on the payments system would be durable, even if the price stabilized or fell. Bitcoin’s competitors are credit card companies, wire transfer companies, weak fiat currencies and the like. Its advantage was that that its secure cryptography gives it strong security with respect to falsifying transactions and the transactions cost is almost zero. So you would not have to hold Bitcoin in order to transact in it, at least not for very long. Anonymity was also viewed as a plus by many, but whether governments can, will and should get some handle on internet transactions is under debate. Some also argue that its decentralization is an advantage. The ‘ledger’ that keeps track of Bitcoin transaction seems resistant to fraud, but there have been issues with Bitcoin exchanges and other elements of the transactions process. Investors who focused on the potential Impact of Bitcoin on the payments system sometimes saw the Bitcoin appreciation as a distraction. Bitcoin’s sharp price run-up is attracting more involvement now, but could be a disadvantage if price ever took a big fall. 2) Bitcoin as an alternative to fiat currencies When G3 central banks are expanding their balance sheets like there is no tomorrow, you can understand the search for alternative stores of value. Some make a ‘wisdom of crowds’ argument that monetary management is likely to be better if it reflects the judgment of a diffuse constituency of users rather than a central bank governor or board. In short, this is the gold standard, but with a lot more portability and ability to transact. That said, Bitcoin protocols are decided by a group of programmers, and their goodwill is taken for granted. To some investors it is perfectly clear that the combined judgments of individuals across the globe will be superior to the centralized policies made by central banks. To many holding this viewpoint, the ineptness of global central banks has made the bar for outperformance pretty low. This view probably appeals to you if you think the panics of 1837, 1873 or 1893 were preferable to the Great Recession of 2008 (http://en.wikipedia.org/wiki/Panic_of_1837, http://en.wikipedia.org/wiki/Panic_of_1873, http://en.wikipedia.org/wiki/Panic_of_1893). In those times the absence of a central bank did not preclude private sector speculation from generating bubbles and panics. Admittedly, some of those panics started because of failed attempts to manipulate or corner certain markets, a feature Bitcoin’s proponents may feel it is immune to. Bitcoin started as an experiment in a currency that was neither commodity-based nor backed by a governmental authority. There is a risk that participants in the Bitcoin ecosystem may become more self-interested over time, the way broadcast television started with Paddy Chayefsky and quickly morphed into The Beverley Hillbillies. Even now it is unclear to what degree the ‘miners’ out there should be seen as public servants. We are left with the possibility that the properties of a Bitcoin ecosystem that comes to be driven by individual self-interest will differ from its intended properties. Greed and panic could enter as a significant part of the ecosystem. By contrast, central banks have a mandate to stabilize the economy and financial system, even if you see their performance as inept in practice. Nevertheless, it is not so obvious that a good system driven by individual self-interest will produce a more stable economic and financial system than an imperfect system of central banks trying to stabilize economic and financial markets. Many supporters of Bitcoin argue strongly that this is the case, however. 2a) Bitcoin as a reserves alternative Reserve managers are likely wondering whether Bitcoin is the answer to their most perplexing problem – where to find a pure store of value, how to avoid currencies backed by erratic central banks and how to dethrone the USD from its perch in the international monetary system. Bitcoin is much more interesting than the IMF’s SDRs from a reserve manager perspective because it is independent of major currencies. The reserve manager operational problem is two-fold: 1) how to sell a truckload of USD, and to a lesser degree EUR and JPY, without excessively depressing the value of the USD that they are selling and 2) what to buy when there are few attractive, liquid alternative. Bitcoin doesn’t avoid 1) but addresses 2) to some degree. Bitcoin with its inelastic supply and deflationary bias would look attractive to reserve managers as a complement to gold, and in contrast to fiat currencies in unlimited supply. As a group, reserve managers are conservative and probably would like to see how Bitcoin evolves. Given the reserves management problem discussed above, there is some incentive for the biggest reserve managers to encourage development of this market to see if it is viable in the long term. Even if it ends up just as a transactions vehicle, countries may choose to transact in Bitcoin or the like, if it enables them to reduce the overhang of USD that they need to hold because of its role in international trade and finance. Conclusions: i) Reserve managers will not be the first to adopt Internet currencies but they have incentives not to be the last; and ii) The USD would likely be undermined on its international role, were this to occur. 3) First mover advantages This may be the most contentious area. Bitcoin fans argue that being the first in any area where there are networking economies gives you an immense advantage. Replicability is not an issue because potential imitators will find that businesses and households will sign up with the network that gives them the greatest ability to interact. The analogy is drawn to Internet retail and social media businesses where the business model can be copied but where a couple of companies at most dominate the space. (On the other hand, I still have my login/passwords to a variety of ‘first movers’ services that no one under 40 would even recognize.) With respect to money, households and businesses will choose the one with the greatest acceptance, so the first mover has a big advantage even if the technology can be copied. This is a very important argument for entrepreneurs involved with Bitcoin and the few other currencies that are leading the charge to commercialize it.. Where diseconomies of scale enter Bitcoin is through the price exposure. The maximum amount of Bitcoin is predetermined and looks likely to be hit in the 22st century. The supply of Bitcoin is set to grow relatively slowly, arguing that the price should keep rising. You can argue that the price of Bitcoin is irrelevant, since it simply reflects the unit of account for transactions. You can also see that there is a host of alternatives that may have some modest advantage over Bitcoin. Both holders of Bitcoin and transactors in Bitcoin have to assess whether the Bitcoin network advantage is strong enough to outweigh the benefits from Bitcoin alternatives. You can find examples of both, but networking situations in other domains are less dependent on reputation than are Bitcoin and other Internet currencies. And such reputational equilibria are very fragile, and probably will not survive any unaddressed issues of theft or fraud. Moreover, if you transact in Bitcoin, you likely will choose to hold some to facilitate transactions. The speculative surge in Bitcoin may be a disadvantage if you can find a substitute that has similar characteristics but less of a speculative component. The question is how expensive is it for a business or individual to have more than one internet currency and how much of a disincentive is it to hold a Bitcoin if the price is high, when there are good substitutes with lower prices. 4) The Bitcoin ecosystem is growing exponentially There is a short to medium term Bitcoin argument that goes something like this. We are just scratching the surface of payment system/alternative currency development. Whatever the competitive environment, in a market that is growing exponentially fast, any reasonable player will get bid up. Ultimately when market growth flattens out, there will be a sorting out of winners and losers, but that flattening out is not visible anytime soon, barring disaster. If this is a repeat of the Internet bubble, we are in 1997, not 2000, so the gravitational pull of the technology will mask small warts and crevices in individual applications. This is not an argument most of us feel comfortable with, because there is the risk that our calculus is wrong or that some disaster either through fraud, government interference or some breakdown in the system occurs before the market flattens. However, many investors feel so confident that we are just in the takeoff stage, that they see themselves with a margin to invest. They also have incentives to advocate forcefully the widening of the market because that enhances the value of all existing applications. 5) Tulip bubbles About 40% of the comments I received argued outright that Bitcoin and similar internet currencies were bubbles, or tools to evade taxes, or conduct illegal activity. Basically, the view was that the Bitcoin appreciation reflects a mixture of greed and optimism, as in Boileau (1674), “A fool always finds a greater fool to admire him." The major issues have been touched on above – replicability, susceptibility to government interference, security vulnerabilities outside the ‘ledger’ level, inability to reverse any transaction, dependence on reputation, fragility and so on. Those who think this is the internet in 1997 should recall that the NASDAQ was back to 1997 levels in 2002, and even briefly touched 1996 levels, so getting in early may mean getting in really early. Just as with the railroads and Internet, it may revolutionize society more than it makes money for investors. Some investors argued the reverse of most of the pro-Bitcoin commentators, seeing it as most likely a bubble but on the off chance that it wasn’t, it was worth buying a couple in case the price kept shooting up. It was viewed as the high risk, high return investment, with compensation that it was good cocktail party conversation. Conclusions Bitcoin and other Internet currencies are viewed by some as a Beanie baby fad and by others as revolutionizing the financial system. Market acceptance of alternative currencies now looks to be growing a lot faster than the pace at which the supply of Bitcoin and Bitcoin wannabees is expanding the Internet money supply. That is unlikely to persist over the medium and long term, but for now it looks as if it would take a major scandal, security breach or heavy-handed governmental intervention to derail it. Internet currencies suffer from the absence of an anchor to determine their value and from their dependence on reputation and fashion. Replicability is an issue that the Internet currencies will not be able to overcome easily. The role in the payments system is very concrete to investors, although many also see value in a currency in inelastic supply whose value is determined by consensus rather than the monetary authority. Among skeptics, a minority think that security is a much bigger issue than proponents admit. However correct the longer-term concerns, there is nothing obvious to derail the expansion of Internet currencies in the near-term, as they are meeting both legitimate and illicit economic and social needs. | ||||||||

| GMO's James Montier Skewers Bridgewater: Risk Parity = "Snake Oil In New Bottles" Posted: 05 Dec 2013 05:58 PM PST Nearly a year ago, we penned "Return = Cash + Beta + Alpha": in which we performed "An Inside Look At The World's Biggest And Most Successful "Beta" Hedge Fund. The fund in question was Bridgewater, and Bridgewater's performance was immaculate... until the summer when the sudden and dramatic rise in yields as a result of the Bernanke Taper experiment, blew up Bridgewater's returns for 2013 and at last check, at the end of June, was down 8% for the year. As further explained in ""Yield Speed Limits" And When Will "Risk Parity" Blow Up Again", an environment in which rates gap suddenly higher (and in the current kneejerk reaction market all moves are purely in the form of gaps as risk reprices from one quantum to another in milliseconds) is the last thing Ray Dalio's strategy wants. Be that as it may, and successful as Dalio's fund may have been until now, tonight James Montier of Jeremy Grantham's GMO takes none other than Bridgewater to task, in a letter in which among other things, he calls risk parity "just old snake oil in new bottles", and sums up his view about the strategy behind Bridgewater in the following equation: Risk Parity = Wrong Measure of Risk + Leverage + Price Indifference = Bad Idea and proceeds to skewer it: 'At a fundamental level, risk parity is the antithesis of everything that we at GMO hold dear. " Read on for his full critique. No Silver Bullets in Investing (just old snake oil in new bottles), by James Montier of GMO As I have written many times before, leverage is far from costless from an investor's point of view. Leverage can never turn a bad investment into a good one, but it can turn a good investment into a bad one by transforming the temporary impairment of capital (price volatility) into the permanent impairment of capital by forcing you to sell at just the wrong time. Effectively, the most dangerous feature of leverage is that it introduces path dependency into your portfolio. Ben Graham used to talk about two different approaches to investing: the way of pricing and the way of timing. "By pricing we mean the endeavour to buy stocks when they are quoted below their fair value and to sell them when they rise above such value… By timing we mean the endeavour to anticipate the action of the stock market…to sell…when the course is downward." Of course, when following a long-only approach with a long time horizon you have to worry only about the way of pricing. That is to say, if you buy a cheap asset and it gets cheaper, assuming you have spare capital you can always buy more, and if you don't have more capital you can simply hold the asset. However, when you start using leverage you have to worry about the way of pricing and the way of timing. You are forced to say something about the path returns will take over time, i.e., can you survive a long/short portfolio that goes against you? Exhibits 10 and 11 highlight this problem. Exhibit 10 shows the value/growth expected return spread over time. I've marked three points with red stars. Let's imagine you had all of this time series history in the run-up to the late 1990's tech bubble. Given history and assuming you were patient enough to wait for value to get one standard deviation cheap relative to growth, you would have put this position on in September 1998. If you had been even more patient and waited for a 2 standard deviation event, you would have started the position in January 1999. If you had displayed the patience of Job, and waited for the never before seen 3 standard deviation event, you would have entered the position in November 1999. Exhibit 11 reveals the drawdowns you would have experienced from each of those points in time. Pretty much any one of these would likely have been career ending. They nicely highlight the need to say something about the "way of timing" when engaged in long/short space. As usual, Keynes was right when he noted "An investor who proposes to ignore near-term market fluctuations needs greater resources for safety and must not operate on so large a scale, if at all, with borrowed money." Risk Parity = Wrong Measure of Risk + Leverage + Price Indifference = Bad Idea At a fundamental level, risk parity is the antithesis of everything that we at GMO hold dear. We have written about the inherent risks of risk parity before, however I think they can be stated simply as the following: I. Wrong measure of risk Many proponents of risk parity use volatility as their measure of risk. As I have argued what seems like countless times over the years, risk is not a number. Putting volatility at the heart of your investment approach seems very odd to me as, for example, it would have had you increasing exposure in 2007 as volatility was low, and decreasing exposure in 2009 as volatility was high – the exact opposite of the valuation-driven approach. As Keynes stated, "It is largely the fluctuations which throw up the bargains and the uncertainty due to fluctuations which prevents other people from taking advantage of them." II. Leverage I've already discussed leverage in the previous section, enough said I think. III. Lack of robustness There are no general results for risk parity. That is to say that adding breadth doesn't necessarily improve returns. The returns achieved in risk parity backtests are very sensitive to the exact specification of the assets used (i.e., J.P. Morgan Bond Indices vs. Barclays Aggregates). Furthermore, decisions on which assets to include often appear fairly arbitrary (i.e., why include commodities, which, as Ben Inker has argued, may well not have a risk premia associated with them). All in all, the general lack of robustness raises the distinct spectre of data mining, and hence fragility. IV. Valuation indifference Proponents of risk parity often say one of the benefits of their approach is to be indifferent to expected returns, as if this was something to be proud of. I've heard them argue that "risk parity is what you should do if you know nothing about expected returns." From our perspective, nothing could be more irresponsible for an investor to say he knows nothing about expected returns. This is akin to meeting a neurosurgeon who confesses he knows nothing about the way the brain works. Actually, I'm wrong. There is something more irresponsible than not paying attention to expected returns, and that is not paying attention to expected returns and using leverage! As with risk factors (and smart beta), risk parity ultimately comes down to portfolio construction. It is implemented via assets, and can thus be priced. Anna Chetoukhina and I have constructed a model risk parity portfolio using just three simple assets: U.S. equities, U.S. bonds, and U.S. cash. We constructed our risk parity portfolio to have the same volatility as a 60/40 equity/bond portfolio. The relative performance of our risk parity strategy against the 60/40 portfolio is shown in Exhibit 12. As per Anderson et al four distinct periods of performance can be identified. In the early sample (1926-1945) risk parity is an undisputed victor in the performance sweepstakes. However, as they say, payback is a bitch: in the period 1946-1982, the 60/40 took sweet revenge. During the long bull market (in both stocks and bonds) of 1983-2000, the strategies were approximately tied. In the more recent period (2001-2010), risk parity is once more faring better. Of considerably more interest to me than the performance were the weights held by the risk parity strategy over time (see Exhibit 13). On average the strategy held 44% in stocks, 155% in bonds, and was short 99% cash. The weights, of course, varied considerably over time. Using these exposures we can apply our expected returns to see what risk parity is priced to deliver (an anathema to the disciples of this strange art, no doubt). The results of this assessment can be found in Exhibit 14. Over long periods of time risk parity doesn't look very different in return space from a 60/40 portfolio. Currently both the 60/40 portfolio and risk parity display the problems we have previously referred to as the purgatory of low returns. This is certainly a problem for some of its proponents whom I have heard argue that 60/40 is priced currently to deliver a low return, and thus one should follow a risk parity approach! Strangely enough, when risk parity is priced to do well relative to the 60/40, it does indeed do well. If you lever up cheap bonds you can get good outcomes (assuming you know something about the path those returns will take, of course). Similarly, if risk parity is priced to do worse than the 60/40, it tends to do so. If you lever up expensive bonds things don't tend to turn out too well. There is no magic to risk parity (see Exhibit 15). | ||||||||

| Gold Price is Being Held Back by One Gov't! Posted: 05 Dec 2013 04:24 PM PST In 2013 the Indian Government raised import duties to 15% on gold. It then prevented the import of gold unless 20% of that gold was exported. Now this is blocked too. What impact has this had on the gold price? Read More... | ||||||||

| 2 Fantastic Charts Show Gold May Quickly Surge $200 Posted: 05 Dec 2013 03:27 PM PST  On the heels of continued downside pressure in the gold and silver markets, today top Citi analyst Tom Fitzpatrick spoke with King World News about what may cause a quick $200 surge higher in the price of gold. Fitzpatrick also sent King World News two fantastic charts. Below is what Fitzpatrick had to say both of his key charts. On the heels of continued downside pressure in the gold and silver markets, today top Citi analyst Tom Fitzpatrick spoke with King World News about what may cause a quick $200 surge higher in the price of gold. Fitzpatrick also sent King World News two fantastic charts. Below is what Fitzpatrick had to say both of his key charts.This posting includes an audio/video/photo media file: Download Now | ||||||||

| Eric Sprott: The Curious Case For Silver Posted: 05 Dec 2013 02:57 PM PST This is a guest post by David Franklin from Sprott’s Thoughts: It has been a difficult year for silver investors with the metal falling by 36% year-to-date. While the Federal Reserve balance sheet continues to expand, 'taper' discussions by the Federal Open Market Committee have weighed heavily on the price performance of all the precious metals this year. By our calculations, over the last five years silver has a beta to the gold price of 1.5. This implies that price changes in gold are magnified in silver. Combine this with an 80% correlation in the price action between gold and silver over the same time frame and it's easy to see that where the price of gold goes, the price of silver goes faster. As we break down the fundamentals for silver, market developments this year give rise to a curious conundrum – how can the case for silver be stronger while the price continues to languish? We begin with investor sentiment. We use current ETF holdings and coin demand to gauge investor appetite for the metal. In both cases demand has been robust. Last month, the US Mint confirmed a record year for sales of silver coins – and we still have four weeks to go. Authorized purchasers of the coins ordered their full weekly allocation of 500,000 coins, bringing the total sales to date this year to a record 40.175 million ounces, the Mint said. That sales figure topped the previous annual record of 39.869 million ounces seen in 2011.1 Yes, the roughly 40 million ounces of silver only accounts for maybe 5% of overall demand, but it also represents a huge increase from a decade ago when it comes to investor interest in physical metal. In fact, globally, silver investment demand is up from essentially ZERO just 10 short years ago.2 Silver ETF's continue to add to holdings as well. According to Bloomberg, holdings across all silver ETF's have increased by 4% so far this year and 6% over the last 12 months. Compare that to gold ETF holdings, which are down 30% so far in 2013 – a shocking contrast. Silver investors have added to their positions during this price decline. However this isn't even the biggest news in silver this year. Last month, somewhat surprising news came out of India that roughly 130 million ounces of silver were imported into that country in just the first six months of the year. And recent data confirms this trend is continuing. Data from Thomson Reuters GFMS shows that India has continued to be a massive new buyer in the market, with India's silver imports rising to a three-month peak in October, putting them on track to hit a record this year. Buyers there are choosing silver over gold to meet high seasonal demand. Silver imports jumped 40% to 338 tonnes in October from 241 tonnes in September, GFMS data showed. "By the end of the year, silver imports should be at 5,200-5,400 tonnes," said Sudheesh Nambiath, an analyst with Thomson Reuters GFMS. This would be more than India's record high purchases of 5,048 tonnes in 2008.3 For perspective the world's silver mines produce approximately 24,000 tonnes of silver, so this new buyer is purchasing approximately 22% of world silver production compared with almost zero last year. And when you consider that approximately half the silver production is used for investment purposes, they are on track to buy 44% of the world's mined silver available for investment. This phenomenon is unparalleled in the precious metal markets this year and represents a tectonic shift in silver market demand. One might expect a price reaction to this news, but none has been evident. In fact, silver has seen its biggest annual drop in at least three decades. The price has fallen so fast that it has been difficult for most miners to adjust their costs appropriately and the price for silver has dropped below its marginal cost of production. In a note last month, Dundee Capital Markets revealed that the all-in cash costs of the silver producers it covers fell an average of 13%, to $20.08 per ounce, during the third quarter of this year.4 With silver languishing at approximately $19, most major miners are losing money on every ounce produced. We have already begun to see production increases curtailed in this new environment, which should give further support to the metal price in the future. From looking at the chart of silver prices you would never know that such fundamental changes have taken place in the silver market. Investors have ignored doomsayers and continue to add to their physical and ETF positions. And why shouldn't they? If there is a full global economic recovery, industry will continue to consume half the silver mined in any given year, which will support prices. If there is no recovery, continued monetary support from the central banks will debase paper currencies further supporting an allocation to the metal. And with the addition of a massive new buyer to the market this year it can't be long before investment stocks of silver reflect this new reality. Further support to the price can be seen from the fact that it now costs more to produce an ounce than it is worth, providing investors an opportune entry point.

| ||||||||

| Using Options to Capitalize on Strong Fundamentals in Gold Posted: 05 Dec 2013 02:40 PM PST GoldandOilGuy | ||||||||

| Do Not Count On Gold To Get Rich, It Will Help People Survive Posted: 05 Dec 2013 02:07 PM PST This is a guest post from Liberty Gold and Silver, written by Mike McGill. With the precious metals market in the doldrums and at the bottom of a thirty month correction, there has definitely been some hand wringing and a whole bunch of moping from investors who purchased gold and silver at or near the 2011 highs. This is natural and to be expected. Nobody wants to lose money. People purchase investments ostensibly to make money – hopefully, a lot of it. Here at the trading desk of Liberty Gold and Silver, we hear our share of complaints as well. However, the complaints originate predominantly from a small minority of our customers. A synopsis of the fundamental attitudes of this minority goes something like this: "We bought our gold and silver not for fundamental reasons, such as safety and security, but solely to make a so-called quick "paper" profit in the same way that stock day traders and house flippers do. Precious metals are simply another trading vehicle, no different than any other that is strictly used for financial gain; and we got into this because we noticed the markets were surging just like the recent Bitcoin phenomenon and we wanted to get in on the exciting fast action." The basic problem with this thinking, as we see it, stems from a complete lack of understanding of the history of failed empires, paper money, and world reserve currencies. A solid study of the above can lead to one and only one conclusion. In the collapse of any financial or social system, precious metals have not only proved invaluable, but ABSOLUTELY MANDATORY for citizens caught up in the unbelievable chaos and suffering that arises from such a collapse. This is an historical fact.

There is a very old proverb relating to the necessity for precious metals whose origin has long been forgotten. It is this; "Silver will feed you, gold will save your life." Allow me to share a very pointed story told to me a few decades back by a dear now departed friend. His name was Nicholas Bierman. Nick was a great teacher and mentor to me and assisted me in one of the darkest and loneliest periods of my life. Nick was a German Jew. His father owned a successful printing company whose business began to suffer decline following Germany's defeat in World War I. The nation was devastated and profoundly in debt. Its government, the Weimar Republic, decided it would follow the path that all deeply indebted governments do when they cannot pay their financial obligations. It began to crank up the printing presses and attempt to inflate (print its way) out of the deep hole in which it found itself. Nick's father being the prudent type decided that he would begin converting all his excess company profits into gold coins as a safety measure. At the end of the First World War, an ounce of gold for about forty German marks. By 1925, the German mark had been destroyed by raging hyperinflation and it took over one trillion marks to buy that same ounce of gold. A loaf of bread went for billions of marks. Social chaos reigned. Well to do citizens found themselves begging in the streets almost overnight. All distribution channels for food and necessities collapsed as credit dried up and banks failed one after another. There were riots in the streets. Countless people starved or were killed. In this environment, the fascist Brown Shirts, led by Adolph Hitler began their ascension to power. However, Nick's father was able to provide for food and other necessities by bartering a small portion of his gold. Their family survived the great post World War I depression and profited afterwards. Nick's father never forgot this lesson and tenaciously held onto the remainder of his gold even when the German economy fully recovered by the mid-1930s. He instructed his son about the absolute necessity of keeping gold as the ultimate insurance policy. It is a good thing he did for the family was soon to need it again. As the Nazi persecution of Jews escalated, Nick's father was forced out of his business and had many of his financial assets seized but he still had his gold. Nick, his father, and sister decided that they had to escape if they were to survive. Nick was a teenager at the time. The family packed up everything they could carry with them and loaded it into their old Mercedes and made a desperate back road pilgrimage to a German port city on the Baltic Sea. They had to drive around many identification checkpoints along the way to avoid Nazi guards looking for escaping Jews. Finally arriving at their destination, Nick's father hid his children in a dilapidated rental house while he spent a week finally locating a Norwegian fishing captain whom he could bribe to take his family out of the country. The only thing that finally swayed the Norwegian was a very large payment in German gold coins. Once in Norway, Nick's family surreptitiously crossed into Sweden. Once there, Nick's father used all his remaining gold to secure passports, visas, and transportation to the United States. His dad had a contact in St. Louis who helped them relocate there. When they finally settled in St. Louis, they had less than $100 left of their savings, but they were ALIVE! Nick grew up, got married, raised a family and, incidentally, became a millionaire, but he never lost his gratitude or lost track of the lessons he had learned. I am very grateful that he shared them with me. If he hadn't, our company, Liberty Gold and Silver, would not exist. Now as I look back over my life and watch the criminal mismanagement of our fine country along with the unbridled greed and corruption within the banking and political environment that has stolen our nation's wealth, reduced over fifty million Americans to food stamps, eviscerated trillions in pension benefits for retirees, and eroded the US dollar's purchasing power by over 98% in the last century, I realize it is now more necessary than ever for all our citizens to quit worrying about how to get rich fast and to concern themselves with saving whatever is left of their financial assets. Last month, a computer glitch temporarily shut down food stamp cards in several southern states. What resulted was mass rioting and looting of various Walmarts and other grocery stores. When we simply consider the insanity that prevailed at the recent Black Friday shopping melees all across the country, where people were beating and shooting each other in an insane attempt to SPEND their hard earned money on Chinese junk, it should force us to ponder how bad it will be when this financial system completely blows up. And let me assure you, blow it will. Since the turn of the century, the United States has lost 58,000 manufacturing companies and has seen all forms of debt, government, corporate, and personal rise to $300 trillion, three times our gross domestic product. Ladies and gentlemen, we cannot borrow our way to prosperity. There is going to be a heavy price to pay for this foolishness. A great calamity is approaching day by day, make no mistake about it. It is time for all of us to reconsider our priorities. We strongly recommend that investment in gold and silver be part of them.

To learn more about the rewards of precious metals investing, including how to fund your existing IRA with gold or silver, please visit Liberty Gold and Silver. | ||||||||

| Swiss refinery report: Gold supply has never been tighter Posted: 05 Dec 2013 01:42 PM PST 4:40p ET Thursday, December 5, 2013 Dear Friend of GATA and Gold: Interviewed today by GATA consultant Koos Jansen, Anglo Far-East Bullion Co.'s Alex Stanczyk discusses his recent trip to a Swiss gold refinery whose managing director told of an unprecedented shortage of metal as China consumes it all. The interview is headlined "Alex Stanczyk: Physical Supply Has Never Been Tighter" and it's posted at Jansen's Internet site, In Gold We Trust, here: http://www.ingoldwetrust.ch/alex-stanczyk-physical-supply-never-been-tig... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | ||||||||

| David Morgan on QE, BitCoin and the Precious Metals Debt Card Posted: 05 Dec 2013 01:40 PM PST An Interview with David Morgan David Morgan of Silver-investor.com talks about QE, BitCoin and the Precious Metals Debt Card. [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||||||||

| Deutsche Bank exits commodities trading ... except for monetary metals Posted: 05 Dec 2013 01:26 PM PST Deutsche Bank Quits Commodities Under Regulatory Pressure By David Sheppard and Ron Bousso Deutsche Bank pulled the plug on its global commodities trading business on Thursday, cutting 200 jobs as it becomes the first major bank to exit the once lucrative sector due to toughening regulations and diminished profits. Germany's largest bank, which was one of the top-five financial players in commodities, will cease energy, agriculture, base metals, coal, and iron ore trading, it said in a statement, retaining only precious metals and a limited number of financial derivatives traders. The cuts are expected to largely fall on its main commodity desks in London and New York. ... ... For the full story: http://www.reuters.com/article/2013/12/05/deutsche-commodities-idUSL5N0J... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... | ||||||||

| Gold Daily and Silver Weekly Charts - Non-Farm Payrolls Tomorrow Posted: 05 Dec 2013 01:08 PM PST | ||||||||

| Gold Daily and Silver Weekly Charts - Non-Farm Payrolls Tomorrow Posted: 05 Dec 2013 01:08 PM PST | ||||||||

| China is mining gold at as much as $2,500 per ounce, Leeb tells KWN Posted: 05 Dec 2013 01:03 PM PST 4p ET Thursday, December 5, 2013 Dear Friend of GATA and Gold: Money manager Stephen Leeb tells King World News today that China is mining gold at a total cost of $2,000 to $2,500 per ounce, despite current futures prices of only half that, because China expects substantially higher prices. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/12/5_Ch... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair Plans Seminar in Boston on Dec. 7 Gold advocate and mining entrepreneur Jim Sinclair will hold his next seminar from 1 to 5 p.m. on Saturday, December 7, in the Boston suburb of Cambridge, Mass., at the Boston Marriott Cambridge at 50 Broadway in Cambridge. The admission fee will be $50. Details are posted at Sinclair's Internet site, JSMineSet, here: http://www.jsmineset.com/2013/11/14/boston-qa-session-announced/ Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||

| Biotech Breakthrough: The Age of Immunotherapy Posted: 05 Dec 2013 11:30 AM PST Cancer is moving up in the world lately. It’s the leading cause of death in the United Kingdom, and it will soon become the biggest killer in the United States. I had my own brush with this threat at the ripe old age of 20. Thankfully, I’m still alive, thanks to technology that became available by the 1990s. Only a few decades sooner and I’d just be a memory. Unfortunately, millions of lives are still prematurely ended by a disease caused by cells gone haywire. Today, I’m going to tell you one important way that will change — and how you will be able to profit in both wealth and health. It isn’t so much that cancer is deadlier than it used to be in times past, by the way. I’m living proof of that. We are constantly improving our ability to fight the disease, and we make progress every year as new diagnostic tests or therapies become available. The reason cancer is moving up the ranks is because of relative improvement compared with other life-enders — we’ve become much better at dealing with other big killers, like heart disease, than with cancer. Growing tumors would sometimes shrink after a bad fever caused by a systemic infectious disease. Overall, we live longer, of course. But the flip side of living longer is that cancer rates tend to rise as we age. Since we now escape cardiovascular ravages at greater rates than ever before, our cells reach ages where they become more prone to malignant mutation. Cancer is tough because it isn’t a single disease, but a group of diseases. The more we learn about it, the more complex it appears. In addition, cancer is highly adaptive. Like the Borg, that alien race of cybernetic aliens from Star Trek, it can quickly adjust and neutralize our most powerful weapons. Not only is cancer complex at the cellular level, but we are also learning that a tumor can contain different kinds of cancer cells, making it much like an organism in that sense. We may be able to develop a drug that can wipe out one kind of cancer cell, but others can survive and regrow a tumor — I’ll tell you more about that shortly. Some people think we’ll never vanquish this biological Borg. I believe they’re wrong and that we eventually will. Even if we don’t find a single magic bullet to end the relentless advance of mutant cells once they’ve appeared in the body, we can develop a suite of weapons that, if used in combination, can eventually slay the invaders in cases that are incurable today. We are now, in fact, in the early stages of a huge change in how we treat cancer. An arms race is on to upgrade our own naturally present immune cells to overcome the shifting defenses used by cancer to survive. Like nearly all new technologies, there have been false starts and reversals over the past years, but serious progress is now being made. The basic idea behind this technology isn’t new. Over 150 years ago, physicians began to notice how patients with cancer who also developed infections could get better. The infection did not even have to be at the same site as the tumor: Growing tumors would sometimes shrink after a bad fever caused by a systemic infectious disease. This led some early oncology pioneers to devise injectable bacterial cocktails that occasionally worked. These researchers hypothesized that the pathogens worked either by directly attacking cancer cells or by waking up a sleepy immune system. However, this form of therapy, which we’ve come to call immunotherapy, was eventually set aside in order to concentrate resources on other methods that were more promising with the technology of that time. Chemotherapy and radiation therapy became the principal weapons in the oncologists' arsenal. We found it was easier to create therapies using chemicals or electromagnetic waves, rather than finding ways to functionalize our body’s defenses to fend off cancer cells. As I mentioned, that’s now changing fast — and it’s the small biotechnology innovators that are leading the charge. We are reaching a turning point in immunotherapy research. With hundreds of programs under development, it is now a heavily researched oncology field. There are still plenty of skeptics regarding the promise of this technology, but I’m not one of them. In fact, I believe biotechnology investors who don’t participate in this new wave of cancer therapy will be missing out on historic profit opportunities. We’ve seen these epochal shifts in cancer technology before, so this isn’t something new. What is new is the rate of change, which is accelerating. Antibody-based therapies, for example, were almost science fiction-esque in the early 1980s. By the '90s, however, we began to see the first approvals for these antibody therapies against cancer. Now there are dozens of marketed mAbs (monoclonal antibodies), with many more on the way — and the market is vast. The immunotherapy market will also be enormous — and it is only just starting to take off. Citigroup analysts estimate that the market will generate $35 billion per year over the next 10 years as existing therapies grow market share and new therapies enter commercialization. The way Provenge works is radically different. As an active immunotherapy, it is a kind of cancer vaccine. There’s a lot of gold in those hills. Only two approved immunotherapies exist right now. One, marketed by Bristol-Myers Squibb, I discussed in my Breakthrough Technology Alert newsletter. This immunotherapy was originally developed by my former portfolio recommendation Medarex. The therapeutic agent itself is an antibody called ipilimumab (marketed as Yervoy). Unlike other antibody therapies, however, Yervoy works by activating immune system cells. It used existing antibody technology to do something new. (Medarex was subsequently purchased by Bristol-Myers Squibb in 2009, yielding our newsletter’s readers a 235% gain.) The other marketed therapy is Dendreon’s sipuleucel-T (Provenge) for prostate cancer. The way Provenge works is radically different. As an active immunotherapy, it is a kind of cancer vaccine. With Provenge, a type of white blood cell called an antigen-presenting cell (APC) is taken from a patient’s blood. It is then modified to present a single prostate cancer antigen to the rest of the immune system when it is later re-injected into the patient. While a great advance from a scientific standpoint, Provenge has faced real challenges in the marketplace. A blood draw must be processed in the lab for every dose, making it expensive from a cost-of-goods standpoint. In fact, most of Provenge’s hefty $90,000-per-course-of-therapy price tag is consumed by the cost of producing it. Furthermore, this therapy only delivers a survival benefit of about four months over not using it. Still, Provenge has shown the path toward a new form of cancer therapy. Next-generation active immunotherapies will be able to improve on Provenge. Sometimes, the advantage in the marketplace doesn’t go to the first mover, but to follow-on entrants who learn from the mistakes of their predecessors. Keep your eyes on this space! Ad lucrum per scientia (toward wealth through science), Ray Blanco Ed. Note: The future of cancer research is brighter than ever. And thanks to Ray, a few lucky investors are poised to take advantage of the next great breakthrough in these incredible technologies. Today’s Daily Reckoning email readers had a chance to join them. It’s just one small perk of subscribing to the FREE Daily Reckoning email edition. If you’re not currently receiving it, you can fix that right here. | ||||||||

| Posted: 05 Dec 2013 11:29 AM PST Today the Government released its second revision of Q3 GDP, which showed a big upward "revision" from 2.8% to 3.6%. These numbers are seasonally-adjusted, annualized figures which in and of themselves are highly problematic with how they are derived. Notwithstanding that, when you drill down beneath the headline reports, the components that make up GDP are downright ugly. The revised number was almost entirely from a massive upward revision in the size of the Q3 inventory build-up by businesses. As has been written about ad nauseum, we know that retailers and auto dealers have amassed a huge amount of inventory, waiting for a recovery in consumption that will never materialize. Speaking of consumption, that particular component of the GDP revision was revised down for a second time, 1.24% originally reported to .96% in the latest iteration. What this says is that consumption, which has been 70% of GDP for over a decade, has dropped below a 1% growth rate. If you strip out the inflation component of that growth number, it means that consumption actually declined on a real basis. In other words, unit volume sales to consumers declined. Think about that for a minute... As you can see, unless the consumer makes a miraculous spending recovery, the economy likely has hit a wall during November. The Thanksgiving weekend retail sales reports pretty much confirm this. Although the growth in online sales has been promoted as a big positive, e-commerce represents less than 6% of total retail sales. Retail sales declined over that weekend. The consumer is tapped and so is our economy. One last point about this, the release of today's factory orders report for October confirms my thesis here. Durables dropped 1.6% and non-durables dropped .2%. If you strip wholesale inflation out of the numbers, they are even worse. Note this: the inventory build-up that occurred in Q3 is likely going to turn into an inventory liquidation, which will negatively affect Q4 GDP. Also, this is consistent with my analysis posted yesterday which showed that the housing market is headed south. Finally, with the headline reports bullish as they were today, shouldn't the stock market be screaming higher? The Dow is down 60 pts as I write this and the SPX is down almost .5%. Even more interestingly, the dollar has tanked hard. Theoretically, with the taper promoters out in full force today, the dollar should be screaming higher. It's not. Qu'est-ce qui se passe? Today's action in the dollar - and this whole week for that matter - tells us the market is starting to perceive just how ugly the U.S. economic and financial situation is. No one is talking about the next budget/Treasury debt limit fight, but it's right around the corner. I think a lot of players at the dollar "poker table" are folding their cards and chairs and walking away from the game. The Fed has no hope of reducing QE and the market is perceiving that. That's why the dollar has sold off hard this week despite the parade of positive headline economic reports. Under the hood is a different matter. Be careful with your dollar-based assets. The stock market right now is more dangerously over-valued vs. the fundamentals than it was in early 2000. I'm not the only one saying this. Jim Rogers made this statement on yesterday: "Be prepared, be worried, and be careful...this is going to end badly." | ||||||||

| Posted: 05 Dec 2013 11:29 AM PST Today the Government released its second revision of Q3 GDP, which showed a big upward "revision" from 2.8% to 3.6%. These numbers are seasonally-adjusted, annualized figures which in and of themselves are highly problematic with how they are derived. Notwithstanding that, when you drill down beneath the headline reports, the components that make up GDP are downright ugly. The revised number was almost entirely from a massive upward revision in the size of the Q3 inventory build-up by businesses. As has been written about ad nauseum, we know that retailers and auto dealers have amassed a huge amount of inventory, waiting for a recovery in consumption that will never materialize. Speaking of consumption, that particular component of the GDP revision was revised down for a second time, 1.24% originally reported to .96% in the latest iteration. What this says is that consumption, which has been 70% of GDP for over a decade, has dropped below a 1% growth rate. If you strip out the inflation component of that growth number, it means that consumption actually declined on a real basis. In other words, unit volume sales to consumers declined. Think about that for a minute... As you can see, unless the consumer makes a miraculous spending recovery, the economy likely has hit a wall during November. The Thanksgiving weekend retail sales reports pretty much confirm this. Although the growth in online sales has been promoted as a big positive, e-commerce represents less than 6% of total retail sales. Retail sales declined over that weekend. The consumer is tapped and so is our economy. One last point about this, the release of today's factory orders report for October confirms my thesis here. Durables dropped 1.6% and non-durables dropped .2%. If you strip wholesale inflation out of the numbers, they are even worse. Note this: the inventory build-up that occurred in Q3 is likely going to turn into an inventory liquidation, which will negatively affect Q4 GDP. Also, this is consistent with my analysis posted yesterday which showed that the housing market is headed south. Finally, with the headline reports bullish as they were today, shouldn't the stock market be screaming higher? The Dow is down 60 pts as I write this and the SPX is down almost .5%. Even more interestingly, the dollar has tanked hard. Theoretically, with the taper promoters out in full force today, the dollar should be screaming higher. It's not. Qu'est-ce qui se passe? Today's action in the dollar - and this whole week for that matter - tells us the market is starting to perceive just how ugly the U.S. economic and financial situation is. No one is talking about the next budget/Treasury debt limit fight, but it's right around the corner. I think a lot of players at the dollar "poker table" are folding their cards and chairs and walking away from the game. The Fed has no hope of reducing QE and the market is perceiving that. That's why the dollar has sold off hard this week despite the parade of positive headline economic reports. Under the hood is a different matter. Be careful with your dollar-based assets. The stock market right now is more dangerously over-valued vs. the fundamentals than it was in early 2000. I'm not the only one saying this. Jim Rogers made this statement on yesterday: "Be prepared, be worried, and be careful...this is going to end badly." | ||||||||

| China Mining Some Gold For A Staggering $2,500 An Ounce Posted: 05 Dec 2013 11:08 AM PST  Today a man who has proven to be incredibly well-informed from his sources inside China about what is happening in that country stunned King World News when he said that China is actually mining some of its gold at projects inside of China at staggering "all-in cash costs in the $2,000 to $2,500 range." Acclaimed money manager Stephen Leeb believes this has incredibly important implications for what the Chinese believe the price of gold will be trading at in the future. Below is what Leeb had to say in his remarkable interview. Today a man who has proven to be incredibly well-informed from his sources inside China about what is happening in that country stunned King World News when he said that China is actually mining some of its gold at projects inside of China at staggering "all-in cash costs in the $2,000 to $2,500 range." Acclaimed money manager Stephen Leeb believes this has incredibly important implications for what the Chinese believe the price of gold will be trading at in the future. Below is what Leeb had to say in his remarkable interview.This posting includes an audio/video/photo media file: Download Now | ||||||||

| On-Sale in 2014: Silver to $16.76, $15.15, then $13.71 Posted: 05 Dec 2013 10:56 AM PST Are such low silver prices ever possible again? Technically, yes. Unless one was fortunate to have acquired the bulk of their physical silver allocation circa 2005 at an FRN price of under $6.00 per ounce ... Read More... | ||||||||

| Posted: 05 Dec 2013 10:28 AM PST Dear CIGAs, The war between bullish physical gold and bearish paper-gold will be entirely determined by the future of this chart. The dollar is too large for a government to manipulate where trend is concerned. The Exchange stabilization fund will try hit and run support, but that is not enough to change the trend. ... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. | ||||||||

| Turkish gold imports hit highest on record in 2013 Posted: 05 Dec 2013 10:27 AM PST 05-Dec (Reuters) — Turkey’s gold imports have surged to their highest on record so far this year after a hefty drop in bullion prices, with further progress signposted if restrictions on trade with Iran are formally eased. Turkey imported 270.7 tonnes of gold in the first 11 months of the year, data from Borsa Istanbul showed, more than double 2012′s full-year imports of 120.8 tonnes. …”Official coin demand has more than doubled, investment demand has also more than doubled, and jewellery demand has rebounded by around a fifth this year.” [source] | ||||||||

| Godu kopen tegen $100 korting? Posted: 05 Dec 2013 10:24 AM PST In mijn dagelijkse zoektocht naar interessante artikels kwam ik uit op het volgende: How to get $100 discount on an ounce of gold Commentary: Fund that trades below the value of its gold stake is worth a look http://www.marketwatch.com/story/how-to-get-100-discount-on-an-ounce-of-gold-2013-12-04?dist=lcountdown | ||||||||

| Time for Goldbugs to Admit Defeat? Posted: 05 Dec 2013 10:02 AM PST After a 12-year run, it looks like gold's wave has truly crested, and many bears are arguing that it's all downhill from here. A quick glance at a long-term gold price chart can certainly seem to confirm this impression. Read More... | ||||||||

| Comex Deliverable Gold Still Out On the Tails of Leverage at 57 to 1 Posted: 05 Dec 2013 09:48 AM PST | ||||||||

| Comex Deliverable Gold Still Out On the Tails of Leverage at 57 to 1 Posted: 05 Dec 2013 09:48 AM PST | ||||||||

| Not All Boats Are Rising For The SP500! Posted: 05 Dec 2013 09:45 AM PST There is no doubt that the S&P 500 has made new all-time highs. So has the Dow Jones Industrials (DJI) and the Dow Jones Transportations (DJT). The NASDAQ has not. Gold made new all-time highs back in September 2011. Read More... | ||||||||

| Lassonde - This Will Trigger Next Leg Of The Gold Bull Market Posted: 05 Dec 2013 08:49 AM PST  On the heels of continued volatility in the gold and silver markets, today legendary Pierre Lassonde told King World News exactly what is going to trigger the next leg higher in the gold bull market. Lassonde also spoke about the domination of the paper market over the physical market and how that will end. Lassonde is arguably the greatest company builder in the history of the mining sector. He is past President of Newmont Mining, past Chairman of the World Gold Council and current Chairman of Franco Nevada. On the heels of continued volatility in the gold and silver markets, today legendary Pierre Lassonde told King World News exactly what is going to trigger the next leg higher in the gold bull market. Lassonde also spoke about the domination of the paper market over the physical market and how that will end. Lassonde is arguably the greatest company builder in the history of the mining sector. He is past President of Newmont Mining, past Chairman of the World Gold Council and current Chairman of Franco Nevada. Lassonde is one of the wealthiest, most respected individuals in the gold world, and as always King World News would like to thank him for sharing his wisdom with our global readers during this critical period in these markets. This posting includes an audio/video/photo media file: Download Now | ||||||||

| Harmony Gold ordered to pay for water pollution Posted: 05 Dec 2013 08:39 AM PST The South African Court of Appeal has ordered Harmony to pay to clean up water pollution near mines west of Johannesburg, even after selling the land five years ago. | ||||||||

| Bull market or bear market – where does gold stand now? Posted: 05 Dec 2013 08:39 AM PST As might be expected most of the views on gold expressed at the Mines & Money Conference in London were positive, but nonetheless well worth listening to. | ||||||||

| Gold falls as market wakes up to Fed expectations Posted: 05 Dec 2013 08:39 AM PST Bullion saw its strongest gains in over a month on Wednesday as investors proved over-extended on bets for prices to fall further. | ||||||||

| Can’t-miss headlines: Gold, copper pop, high-grading & more Posted: 05 Dec 2013 08:39 AM PST The latest morning headlines, top junior developments and metal price movements. Today, gold was up, but copper shined even more, while one junior leaves behind low grades stopes. | ||||||||

| Gold Bull Over? Time for Goldbugs to Admit Defeat? Posted: 05 Dec 2013 08:25 AM PST After a 12-year run, it looks like gold's wave has truly crested, and many bears are arguing that it's all downhill from here. A quick glance at a long-term gold price chart can certainly seem to confirm this impression. | ||||||||

| Gold Prices Lose "Short-Covering Rally" After Strong US Jobs & GDP Data Posted: 05 Dec 2013 07:28 AM PST GOLD PRICES fell hard Thursday lunchtime in London, giving back all of yesterday's sudden 3.1% jump to trade back at $1223 per ounce after stronger-than-expected US economic and jobs data. European and US stockmarkets fell marginally after the Bureau for Economic Analysis revised its GDP estimate for the third quarter of this year up to 3.6% annual growth, well beating analysts' 3.0% forecast. Ahead of Friday's Non-Farm Payrolls data for November, last week's claims for initial jobless insurance then came in below 300,000 for only the second time since 1997. Gold prices had already ticked lower from Wednesday's jump to $1250 per ounce, but then fell swiftly. Silver held onto a chunk of yesterday's 5.1% gain, but also traded sharply lower with gold prices after the GDP data, falling to $19.30 per ounce. Neither the European Central Bank or Bank of England made any changes to their record-low interest rates, lending or quantitative easing at their December meetings today. UK chancellor George Osborne forecast to Parliament that the government will run a budge surplus as soon as 2019. The Pound fell towards 1-week lows. Gold prices in Sterling slipped to £747 per ounce, some 0.8% above Wednesday lunchtime's new 3-and-a-half-year low seen just before the jump. Wednesday's action "formed an outside day reversal warning," says ScotiaBank's technical analysis, with gold prices hitting a new 5-month low but ending US futures trading sharply higher. "However, as the daily trend remains bearish, the signal would have to be confirmed by an up day [on Thursday]." Following what Commerzbank's commodity team calls "a sharp reversal immediately" on the release of yesterday's much-better-than-expected US jobs data from the private ADP payrolls service, "a short covering rally ensued" it says, with bearish traders betting on lower gold prices forced to close their positions as the market rose. Ahead of Friday's official US jobs data, "The markets are still positioned quite short," reckons ANZ Bank analyst Victor Thianpiriya, quoted by Reuters. "There is going to be a bigger reaction to a weaker-than-expected nonfarm payrolls report than to stronger-than-expected numbers." Looking further ahead, "Tighter monetary policy in the US and rising rates are hanging over the market," said a note from Bank of America-Merrill Lynch analysts this week. "[That] could push gold prices towards $1100 per ounce in 2014," it believes. "Yet while the pause in the bull market may continue, we see several encouraging signs, most notably physical demand from emerging markets, that suggest...gold remains a sound medium-term investment." But "we are seeing continued outflow of gold investment holdings," counters one Singapore trading desk in a note, "and the physical demand from Asia seems insufficient to halt gold's decline." Gold prices achieving "a successful hold above $1180 would...be the best case scenario amidst mounting bearish pressure," it adds. Crude oil meantime rose to 5-week highs Thursday morning, with Brent crude touching $112 per barrel, after the US reported a sharper than expected drop in weekly stockpiles. The Opec oil cartel of 12 major producer nations yesterday maintained its 30 million barrels-per-day quota for 2014, but may have to cut output by 2.5% later next year to support prices, reckons Gareth Lewis-Davies, senior energy strategist at French investment bank BNP Paribas. India's DNA news-site says half-a-tonne of gold is being smuggled into the country each day, citing "top officials" at the Directorate of Revenue Intelligence. "Contrast this 15 tonnes per month with finance minister P.Chidambaram's target of 20-25 tonne [of legal] imports," says DNA. | ||||||||