saveyourassetsfirst3 |

- Silver Commitment of Traders

- Jim Willie: Forget a Taper, Fed to TRIPLE QE!

- Morgan Report: Prepare for Precious Metals to Lift Off

- Gold rises but tension builds ahead of US jobs data

- Jim Willie: Forget a Taper, Fed to TRIPLE QE!

- Can't-miss headlines: Gold muddles along, Labrador Trough M&A & more

- Late Session Selling coming back into Gold

- Circling back to silver fundamentals

- Doc & Turd: Gold Set to Rally Off Double Bottom As JPM Goes Massively Long!

- China's biggest jeweller sees gold in the masses

- Kyrgyzstan files ecology damage lawsuit against Centerra

- There Is Too Little Gold in the West

- Gold reverses sharp drop on strong U.S. jobs report, short-covering "now in the air”

- Sprott’s Thoughts On The Curious Case for Silver

- Bull market or bear market – where does gold stand now?

- Caption Contest Friday!

- Gold And Silver Are the Most Important Assets

- Price & Time: Important Cyclical Pivot Here In Gold

- Precious Metals Mining Company Managers: Your Job Includes Defending Your Industry Against Market Manipulation

- Back to the future? Hedging on agenda as gold prices fall - GFMS

- Precious Metals, Bitcoin and Freedom

- Gold Ricochets off of $1210

- What’s Next for Gold?

- Economists Warn Depositors May Be Burnt In Bail-Ins (Part III)

- Beware of the gold short-covering

- Where are the Stops?: Gold and Silver

- Intrinsic Value

- GOLD: Triggers Recovery But With Caution

- Taper On? NFP + 203k, Unemployment Rate Drops to 7%, Metals Plunge then Spike

- Economists Warn Depositors May Be Burnt In Bail-Ins (Part III)

- Economists Warn Depositors May Be Burnt In Bail-Ins (Part III)

- Swiss Refinery Report: Gold Supply Has Never Been Tighter

- Kyle Bass Warns When "Everyone Is 'Beggaring Thy Neighbor'... There Will Be Consequences"

- ECB's Mario Draghi denies Japanese-style deflation risk, drives euro even higher

- Three King World News Blogs

- Lawrence Williams: Bull market or bear market – where does gold stand now?

- China's biggest jeweller sees gold in the masses

- Sprott's Thoughts: The Curious Case for Silver

- Swiss refinery report: Gold supply has never been tighter

- CHARTS - Dollar Breaking Down

- DITTS -- Does it threaten the System?

- Eric Ben-Artzi: How Risky is Citigroup’s New, Improved Version of a Once-Toxic Type of Synthetic CDO?

- Bullion and Energy Market Commentary

- Gold Prices Forecast to Test 2013 Lows

- Gold Technicals – Stable Despite Additional QE Taper Fears

- Gold opens lower, but still above Thursday’s lows; 1172 technical target looms

- TECHNICAL Gold Does Serious Damage to Wednesday’s Advance

- Atlas Pulse Gold Investor Report goes all Crypto currency and Bitcoin mad this month

- Silver: Technical Outlook

- Producer/Merchant net long is not necessarily bullish

| Posted: 06 Dec 2013 12:54 PM PST By request: If you want to know why silver prices have gone nowhere lately, take one look at the chart and more specifically, the outlined ( IN YELLOW ) ellipse on the chart. That is the hedge funds' NET POSITION. They now have the largest net short position in the history of this particular disaggregated report. These big and powerful speculators are what drive our markets and they continue to sell rallies in Silver. Either they are going to have to be forced out by some concerted buying or the path of least resistance in silver is lower. My thinking is that it will take a definite shift in sentiment away from the current "economic growth is steady but slow" sentiment towards one of "economic growth is picking up speed and is increasing" in order to run these hedge funds out of their profitable short positions. From a technical standpoint, that means we need to see an upside violation of some key overhead chart resistance levels. My studies would indicate that this region which will begin to provide a bit of discomfort to the funds will begin just above the $21 level and extend towards $21.25. If the bulls can take prices up to those levels, and NOT FALTER, they will spark some serious short covering. Until then, rallies will continue to be sold. |

| Jim Willie: Forget a Taper, Fed to TRIPLE QE! Posted: 06 Dec 2013 12:30 PM PST

The USEconomy is in steady deterioration, the recession dreadful and relentless. The USFed is monetizing an amount equal to 150% of the official USGovt deficit. The Global Currency Reset is extremely complicated, thorny, and dangerous. The winner will be Gold. Click here for more from Jim Willie on why the Fed will be forced to TRIPLE QE in 2014: |

| Morgan Report: Prepare for Precious Metals to Lift Off Posted: 06 Dec 2013 12:15 PM PST

The end of the year is in sight, and many investors will soon be forced to take painful losses. David H. Smith, senior analyst at The Morgan Report, says that smart investors will take care to cull the weakest mining stocks from their portfolios and reinvest the proceeds in truly undervalued companies. In this interview [...] The post Morgan Report: Prepare for Precious Metals to Lift Off appeared first on Silver Doctors. |

| Gold rises but tension builds ahead of US jobs data Posted: 06 Dec 2013 12:02 PM PST Gold rose on Friday but was still on course for a weekly loss as investors focused on US jobs data that might lead to the curbing of monetary stimulus. |

| Jim Willie: Forget a Taper, Fed to TRIPLE QE! Posted: 06 Dec 2013 12:00 PM PST

The true volume of QE bond monetization purchases is much higher than reported. It is way over $100 billion per month, probably closer to $200 billion per month. The USFed recently relented, they blinked, and when they briefly told the truth, they admitted the QE volume would continue forever and a day. Given the political [...] The post Jim Willie: Forget a Taper, Fed to TRIPLE QE! appeared first on Silver Doctors. |

| Can't-miss headlines: Gold muddles along, Labrador Trough M&A & more Posted: 06 Dec 2013 11:58 AM PST The latest morning headlines, top junior developments and metal price movements. Today, gold picks up just a little and merger action in the Labrador Trough. |

| Late Session Selling coming back into Gold Posted: 06 Dec 2013 11:57 AM PST Both gold and silver have seen the return of sellers late in the session as the vigorous buying that marked the early part of the session has seemed to have runs its course for now. This is occurring while the mining shares are surrendering some of their gains. There still remains about an hour or so of trading in the equities before the bell rings so there is time for a last minute surge of short covering/fresh buying, but what started off looking like a very strong day in the mining sector appears to be fading. We'll see what happens on the close. As far as the metals go, the short covering that took place earlier today was nearly identical to what we experienced on Wednesday this week. In both cases price had dropped down to the $1210 level where it uncovered very strong buying. That reinforced this level as important chart support but what it also did was force some of the bears to once again cover after they sold the rally. The resultant short covering brought in some fresh bottom picking which scooted the market sharply higher but then the bulls disappeared. This leaves us with the downtrend still intact but with bears probably getting a bit nervous about just how much downside remains in the market. The gold shares MUST CONFIRM a bottom is in this market before I will feel comfortable that the worst is over for gold. If the shares cannot move higher, there is a good chance that bears are going to attempt another retest of that $1210 level once again. That level is now HUGELY important from a technical analysis standpoint. Silver could not regain the $20 level. It still remains a teenager. Price action in there is disappointing to say the least. It is going to be interesting to see the Asian response to all these theatrics come Sunday evening. |

| Circling back to silver fundamentals Posted: 06 Dec 2013 11:39 AM PST Beyond the typical underlying changes in money supply there are very important elements of demand that continue to push the price of physical silver higher and higher. This is despite the fact that silver has been money for much longer then gold. |

| Doc & Turd: Gold Set to Rally Off Double Bottom As JPM Goes Massively Long! Posted: 06 Dec 2013 11:00 AM PST

Jason Burack of Wall St for Main St was able to interview Turd Ferguson of TF Metals Report and The Doc of Silver Doctors for a 30+ minute round table discussion on gold, silver, inflation and the macroeconomic outlook for the US. To start off the interview, Jason asks Turd, a longtime veteran of working [...] The post Doc & Turd: Gold Set to Rally Off Double Bottom As JPM Goes Massively Long! appeared first on Silver Doctors. |

| China's biggest jeweller sees gold in the masses Posted: 06 Dec 2013 10:37 AM PST Chow Tai Fook faces the tough challenge of retaining its reputation for exclusive, luxury items while also appealing to the masses. |

| Kyrgyzstan files ecology damage lawsuit against Centerra Posted: 06 Dec 2013 10:23 AM PST Kyrgyzstan is suing Canada's Centerra Gold for $304 million over what the government says is ecological damage. |

| There Is Too Little Gold in the West Posted: 06 Dec 2013 10:04 AM PST Alasdair Macleod details out the reasons why the West is now in dangerously short supply of gold bullion stores. Accelerating the West to East flow is the current broken price discovery mechanism for the metal – Alasdair shows how gold is substantially undervalued and why that undervaluation is likely to correct itself spectacularly, precipitating a financial crisis. |

| Gold reverses sharp drop on strong U.S. jobs report, short-covering "now in the air” Posted: 06 Dec 2013 09:46 AM PST Wholesale gold in London reversed a sharp drop Friday lunchtime, recovering a $20 plunge on the release of U.S. jobs data to trade back above $1,230 per ounce, heading for a 1.7% drop on the week. |

| Sprott’s Thoughts On The Curious Case for Silver Posted: 06 Dec 2013 09:45 AM PST

It has been a difficult year for silver investors with the metal falling by 36% year-to-date. While the Federal Reserve balance sheet continues to expand, 'taper' discussions by the Federal Open Market Committee have weighed heavily on the price performance of all the precious metals this year. By our calculations, over the last five years [...] The post Sprott’s Thoughts On The Curious Case for Silver appeared first on Silver Doctors. |

| Bull market or bear market – where does gold stand now? Posted: 06 Dec 2013 09:35 AM PST As Lawrie Williams writes below, bank analysts appear to be totally reactive in their forecasts, therefore it is worth paying attention to those who have spent a long time not only analysing these markets but also been in them for significant periods. |

| Posted: 06 Dec 2013 09:00 AM PST

We’re not entirely positive if this is a photo of Kim Jong Un , or the latest Got Insurance? Obamacare advertisement, but regardless it should suffice for today’s Caption Contest Friday! The post Caption Contest Friday! appeared first on Silver Doctors. |

| Gold And Silver Are the Most Important Assets Posted: 06 Dec 2013 08:45 AM PST

I will keep it short today. We are having our Miles Franklin Holiday Party tonight. I picked up Bill Holter at the airport on Thursday afternoon and we spent the afternoon together and then my wife, Bill and I met Andy and Zhanna for dinner. I talk with Bill often, but this was the first time I met him in person. Bill's passion for gold and silver, his true patriotism and his unwavering belief in the necessity to own precious metals closely parallels mine – and Andy Hoffman's too. Very, very few people have our level of certainty, the basic understanding that gold and silver are the most important assets a person could own, now and going forward. The zigzags in price are normal and not at all indicative of the final destination. The short-term, day-to-day price is the journey, but we three focus on the destination. We have as much total belief in our analysis, causes and ultimate effect, as a truly religious man does in his belief that there is a God. We are true believers! What I find most interesting is not the degree of our belief, but it's that almost everyone else, clients, friends, family and even associates in our industry, have their doubts. They may not be "bearish" but they do not see the demise of the dollar and the tremendous rise in gold and silver with the same certainty that we do. They keep asking us, "Are you sure?" "What if you're wrong?" We are sure and we will not be wrong! How can we be so certain, you ask? There are some things that "you just know." Plus, it's a mathematical certainty. Check out Jim Sinclair's chart that says it all…

I believe that the launch date will occur in 2014 and before the year is over, new all-time highs will be reached in gold and silver will be close, although up a much greater percentage. Here is a great idea for you – sell your gold (or a large amount of it) now, for a tax loss, and reinvest the proceeds back into silver. Silver is way too cheap. The price ratio of silver to gold has risen to 63.138 to 1. That is way, way out of whack. Not only will you benefit from the tax loss, which is real for any gold purchased in the last two plus years, but you will switch into the undervalued of the two assets. Silver's rise, we believe, will be far greater than gold's. This is a very sensible idea. Don't leave the tax loss gains and future silver profits on the table now. According to Bill Holter, if you have your silver stored with us at Brinks in Canada, you can sell Silver Maple Leafs and replace them with Silver Eagles which also qualifies as a tax loss. It could be huge for you if you have a large amount of silver stored there – and many of our clients do. I am going to double check on this one, and verify this. First, speak with your tax professional regarding the tax loss, then call one of our brokers at 800-822-8080 if you are interested in selling your metals. -Business Management, June 16, 2012 In today's featured articles below, please check out the article on Zero Hedge. Zero Hedge discusses gold and silver manipulation. I love their site, but in the past, they have refused to embrace the possibility that the precious metals are manipulated. It drove Andy Hoffman nuts! He commented on this many times before. He probably will have an extra big smile on his face when I see him today, before the Holiday Party. Slowly, but surely, more and more of the doubters are coming around to what we see as so obvious. It makes absolutely no sense that gold and silver are the only commodities that the banks aren't manipulating. Frankly, they are the most logical commodities for them to manipulate. And there is no doubt in my mind that the Fed, the Treasury and a few of the biggest bullion banks are, and have been behind the leasing, naked shorting and daily price rigging that define the (paper) gold and silver markets. You read about it every day in this newsletter. When the manipulation comes to an end, and the new PHYSICAL ONLY exchanges start up in Singapore and Hong Kong in the near future, you will start to see what gold and silver are really worth, beyond the reach and the influence of the paper games being played on the Comex and LMBA. The bottom is now close and once hit; prices will turn up and leave $1100-$1200 gold and $19-$20 silver in the dust. Similar Posts: |

| Price & Time: Important Cyclical Pivot Here In Gold Posted: 06 Dec 2013 08:40 AM PST dailyfx |

| Posted: 06 Dec 2013 08:00 AM PST

It's high time to create a new industry trade organization. For less than $50,000 GATA sued the Federal Reserve in a freedom-of-information case and won. While that was not a market-manipulation case per se, Mr. Powell notes it "…demonstrated market manipulation and the monetary metals mining industry did nothing to publicize it and didn't even [...] The post Precious Metals Mining Company Managers: Your Job Includes Defending Your Industry Against Market Manipulation appeared first on Silver Doctors. |

| Back to the future? Hedging on agenda as gold prices fall - GFMS Posted: 06 Dec 2013 07:54 AM PST Thomson Reuters GFMS analyst William Tankard says this year's 26% drop in gold prices makes such a move a much more pressing consideration for miners. |

| Precious Metals, Bitcoin and Freedom Posted: 06 Dec 2013 07:30 AM PST Andy Hoffman speaks with Mike Krieger from libertyblitzkrieg.com on his weekly podcast to discuss the COMEX, Bitcoin, Fed, inflation and deflation, money printing, precious metals and gold and silver. To listen to the interview, please click below: Precious Metals, Bitcoin and Freedom Similar Posts: |

| Posted: 06 Dec 2013 07:24 AM PST Earlier this week gold scored a low near $1210 before violently reversing on an "out of nowhere" short covering rally. Today, the initial reaction of the metal after the payrolls number was to plunge right back down towards $1210 again. However, it then staged another violent reversal higher on very strong volume. This action has gotten my attention. As a general rule of trading - a market that fails to move lower AND STAY LOWER on what is considered bearish news is a market that odds favor having bottomed - at least temporarily. Again, with so many computers running our markets nowadays, one has to be careful with generalizations but this sort of price action is noteworthy nonetheless. Another interesting thing - the mining shares are also moving higher along with the broader equity market this morning. They are not up by much but they are certainly not going down for a change. Yet another thing - the Japanese Yen is also sharply lower. That currency has tended to be a reflection of trader sentiments towards risk at times. During times of risk aversion; check that - during times in which traders are fearful of SLOWING ECONOMIC GROWTH - the Yen has been the recipient of strong money flows. The Yen is now moving lower. Another thing - Copper is moving higher. Another thing - the VIX just collapsed lower today with the index thus far down some 8% as I type this. The fear/concern/worry from earlier this week apparently just evaporated. Could it be that there are some incipient signs that the market sentiment is shifting towards one in which it really does believe that the economy is actually improving enough to see some actual stronger growth? The case is not yet clear. What is fogging it for me is the price action in the long end of theTreasury market. Were it not for that today, I would nod in the affirmative to the question I just posed; however, interest rates are moving lower ( not by much but they are lower) in today's session. That does not quite fit in with an increasing rate of growth sentiment. Putting in a temporary bottom does not necessarily also mean and uptrend is about to resume. Just take one look at the corn market as a recent example. It stopped moving lower, temporarily, but has not been able to develop any sort of lasting move higher. One thing I do know - gold has been an easy one way bet as far as a trade goes for some time now. Short rallies and make money as the price drops. The easy money might be over, at least for now... let's see how this thing closes today before getting too dogmatic however. By the way, JP Morgan continues to be the large stopper for December gold during its delivery period. They are gobbling up all the issues. One other item to note - silver is lagging gold today. That is not what one would expect to see if the "improving economy" theme was becoming much more widespread. Lots of variables to consider as traders. It is really unfortunate that the Commitment of Traders report due out later today will not include the price action from Wednesday and from today. Both days experienced these violent reversals. I would love to get a bit of a better look inside the market but sadly we will not get that until next week. By then it is too late to do us any good. This report really needs to be more timely but under the current setup the CFTC simply does not possess the financial resources/wherewithal to be able to generate something that up to date. Also, the brokerage firms do not have the manpower either to keep their reports to the CFTC that timely also. I will get something up later on today after the dust settles. We can take a look at the closes and go from there. |

| Posted: 06 Dec 2013 07:02 AM PST SunshineProfits |

| Economists Warn Depositors May Be Burnt In Bail-Ins (Part III) Posted: 06 Dec 2013 06:53 AM PST

Given that the euro area is moving toward a pro-forma inclusion of the depositors bail-ins in the standard toolbox for dealing with the financially distressed national banking systems, the case for gradual cost-minimising increase in long term share of these instruments in individual investors portfolios is being made not only by the market forces, but [...] The post Economists Warn Depositors May Be Burnt In Bail-Ins (Part III) appeared first on Silver Doctors. |

| Beware of the gold short-covering Posted: 06 Dec 2013 06:42 AM PST While the gold-backed ETP holdings have dropped 10 metric tons this week and 800 metric tons to 1,831 metric tons on Dec. 4, the number of short gold contracts by managed money is also approaching the high reached on July 9. |

| Where are the Stops?: Gold and Silver Posted: 06 Dec 2013 06:25 AM PST kitco |

| Posted: 06 Dec 2013 06:15 AM PST Amidst the recent Bitcoin surge, the (Cartel-administered) Precious Metals plunge and accelerated debauchery of countless fiat currencies, analysis of the term "intrinsic value" has seen a resurgence of its own. Not a day goes by without widespread commentary on what constitutes money – such as mine from Tuesday; which in my view, could not be a more positive development for the real money camp. Right now, I'm just happy to see active debate on the topic; albeit, for the time being, most commentators do not appear to truly understand its meaning. In today's Generation X-dominated financial environment, perhaps 80% of participants have never even heard of the gold standard; let alone, a monetary system based on anything but fiat currency. Frankly, I'd bet the vast majority, if quizzed directly, couldn't tell you the dollar is theoretically "backed" by the full faith and credit of the U.S. government. And thus, if that same quiz posed the question as to the definition of intrinsic value, the preponderance of respondents would undoubtedly concur, "the difference between an option's strike price and the actual market price." However, in truth, intrinsic value has an entirely different meaning. According to Wikipedia, it refers to the "value of an object, good, or service contained within itself." In other words, what worth does it have? In some ways, these measures are subjective; as indeed, some items have innate, intangible value. An originally signed Babe Ruth baseball, for example; given its uniqueness, historical significance, and universal recognition. Otherwise, it's just a worthless, used baseball. However, such outlying examples aside, intrinsic value can typically be calculated objectively; be it regarding stocks, bonds, or commodities. For financial assets, one can look to the underlying assets and/or earnings power of the issuing entity; while for commodities, the cost of production typically serves as an effective, self-correcting floor. And by self-correcting, I mean that when prices rise well above the cost of production, the market is typically flooded with supply – while conversely, when prices fall below the cost of production, supply typically dries up. This is not to say objective and subjective metrics cannot co-exist – as they often do; but instead, that the any rational investment decision-making process should start with intrinsic value. When it comes to money, there's a good reason why all 599 previous fiat currencies have failed; and thus, why the current 182 will as well. In a nutshell, they are backed by nothing but the aforementioned "full faith and credit" of issuing governments; or more accurately, in many cases privately-owned Central banks with keys to the printing press. In the absence of a gold standard, there are no limits on how many "currency units" are printed; and sadly, today's "Big Brother" world has become so secretive, there isn't even an effective method of accounting for how many exist. Objectively, the "intrinsic value" of a dollar bill is the cost of ink, paper, manufacturing, accounting, and transportation. However, the vast majority of "dollars" are now digital – connoting near zero material and production costs; with the only remaining "intrinsic value" being the value assigned to the "full faith and credit" of the issuer. In the real world, where creditworthiness is merit-based, "full faith and credit" is based on one's personal balance sheet, income statement, and cash flows. In other words, if you are over-indebted and cash poor – with a poor earnings outlook, to boot – it is unlikely one would accept your "IOU" as payment. This, by the way, is exactly what dollars, Euros, and Yen are – liabilities of the issuing government. When viewing sovereign issuers, the concept is no different; except that, in the absence of a gold standard, governments have zero restrictions on how much currency they print. In other words, it doesn't matter how much debt they incur, how weak their economic prospects, how negative their deficits, or how violent their foreign policy; as irrespective, they can print unlimited currency to monetize operations. To an extent, of course – as unfortunately, such unnatural policy has the unintended consequence of inflation. And given that fiat currency is a Ponzi scheme to begin with, hyperinflation inevitably rears its ugly head. From a pure investment standpoint, the only chance of sovereign "full faith and credit" having any real meaning is if the issuer has little debt, favorable demographics, strong growth prospects, positive trade and budgetary balances, and a track record of safeguarding monetary value. Unfortunately, given today's "final currency war" has only just begun, it's safe to say not a single nation would meet this criteria. In other words, "full faith and credit" is at best a hollow concept; and thus, no fiat currency has any intrinsic value to speak of. That said it's time to ask what inspired this particular topic, on this particular day. Actually, it's two events; starting with yet another egregiously negligent comment from the "Maestro" himself, Alan Greenspan. Just one day after grilling him in "No Bubbles Here" – for averring this year's equity surge is not a bubble; he deemed Bitcoin a bubble in this interview. This, from the man who on repeated occasions, over several decades – particularly after the 2000 and 2008 crashes his own policies created – claimed "it is impossible to identify a bubble until after it has burst." However, it's not the idiocy of him making yet another "uneducated guess" of the future that was my primary focus; but instead, his reasoning. To wit, his claim of a bubble in Bitcoin was predicated on its lack of intrinsic value; which in his words, you'd have to "stretch your imagination" to infer. Furthermore, when asked if Bitcoin can be the "new gold," he flat out answered, "No, it has no intrinsic value." Moving on, the original Money-Printer-in-Chief averred:

So here we have the man who managed the nation's currency operations for two decades admitting gold and silver have true intrinsic value; while at the same time, defining the dollar's intrinsic value as the "great credit standing" of the U.S. government. Tell me, objective reader; with $17 trillion of national debt, $5 trillion more "off balance sheet", $200 trillion of unfunded liabilities, $1 trillion annual deficits, a 35-year low Labor Participation Rate, stagnant real wages for four decades, a hollowed out manufacturing base – yielding a "New Employment Paradigm" of part-time, minimum wage service jobs – and an international reputation for warmongering, spying, and imperialism, how do you rate America's "credit standing?" Oh yeah, I forget to mention the Fed holding interest rates well below the inflation rate for five straight years, and overtly printing $85 billion each month to monetize toxic Treasury and mortgage-backed bonds. Conversely, what intangible premium would you add to gold and silvers' tangible intrinsic values of $1,200-$1,500/oz. and $22-$28/oz., respectively? Do their 5,000 year track records of monetary value hold any value? Or the fact that global Central banks are acquiring them hand over fist – particularly wealthy ones like China, Russia, and the Arab states? How about the fact that all the world's currencies have lost essentially all their purchasing power against Precious Metals; as well as the aforementioned 599, which ultimately collapsed?

OK, I think you get my point. However, I wanted to add one more; as coincidentally, Gonzalo Lira published a fantastic piece today, regarding the various pitfalls associated with Bitcoin; which, by the way, I'll be discussing in detail in this afternoon's Miles Franklin Audioblog with Mike Krieger. Actually, I loved the article until the very end, when Lira made the following, counterintuitive statement.

For one, gold and silver indeed have intrinsic values, as described above. Moreover, gold and silver, "in and of themselves," have been used as money for millennia; not to mention, as ornaments, status symbols, and industrial components." More importantly, as Lira himself states, people have been trading both fiat currencies and items of real value for Precious Metals since time immemorial; in my view, de facto proof of their intrinsic value. Hopefully, the bastardized modern notions of "intrinsic value" in the currency, PM, and Bitcoin markets have been effectively refuted. If not, I urge you to do your own diligence; as ultimately, your financial survival depends on it. As for me, essentially my entire liquid net worth is held in the form of the only real money the world has ever known; which in my view, cannot be challenged by any incarnation of financial alchemy – or, for that matter, cyber-technology. Similar Posts: |

| GOLD: Triggers Recovery But With Caution Posted: 06 Dec 2013 05:50 AM PST forexcrunch |

| Taper On? NFP + 203k, Unemployment Rate Drops to 7%, Metals Plunge then Spike Posted: 06 Dec 2013 05:40 AM PST

Unemployment rate drops to 7% NFP +203k on expectations of +185k Typical post NFP metals smash has been mild, as both gold and silver are already bouncing Silver still well off the week’s lows near $18.80- Gold plunging towards the week’s lows and if $1210 fails to hold, $1200: Silver Buffalo As Low As [...] The post Taper On? NFP + 203k, Unemployment Rate Drops to 7%, Metals Plunge then Spike appeared first on Silver Doctors. |

| Economists Warn Depositors May Be Burnt In Bail-Ins (Part III) Posted: 06 Dec 2013 05:11 AM PST Below some leading economists and financial commentators give their perspective regarding the risks of bail-ins or deposit confiscation. If you manage money in any way, your own or others, it will be prudent to heed their warnings. Today's AM fix was USD 1,230.75, EUR 900.59 and GBP 752.38 per ounce. Gold fell $13.52 or 1.1% yesterday, closing at $1,229.69 /oz. Silver slipped $0.20 or 1.1% closing at $19.45/oz. Platinum dropped $11.51, or 0.8%, to $1,356.99/oz and palladium rose $6.00 or 0.8%, to $730.50/oz.

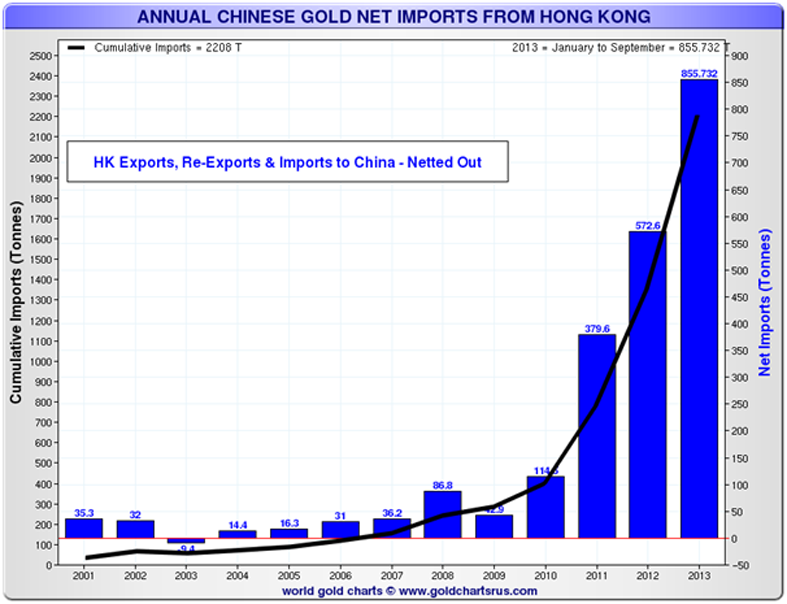

Premiums in China and India remained robust overnight and way over western premiums. Bullion premiums in western markets have seen little movement this week. Gold bullion bars (1 oz) are trading at $1,283.78/oz or premiums of between 3.75% and 4.5%, and gold gold bars (1 kilo) are trading at $40,899/oz or premiums of between 3% and 3.5%. Gold headed for a weekly drop of 1.9% as traders and more speculative investors await U.S. payrolls figures. Recent economic data boosted speculation the Federal Reserve may start trimming its $20 billion per week debt monetisation programme sooner than estimated. Although such speculation has been ongoing for a number of months now and has been proven incorrect. Prices fell as low as $1,211.75 on Wednesday the lowest since July 5, prior to a very sharp $40 rally brought gold to over $1,250/oz again. Then determined selling capped prices at that level and a seller or sellers seemed determined not to see gold turn positive on the week. This would have led to technical and momentum buying. As we noted yesterday, Chinese imports through Hong Kong alone are set to top 1,000 tonnes this year and this does not include other gold imports into China ex Hong Kong. Therefore, total Chinese gold demand could be as high as 2,000 tonnes. Total annual gold supply is expected to be around the 2,700 tonne mark. Therefore, China alone could swallow up nearly 75% of global gold mine supply this year.

It is important to note that the huge Chinese demand in tonnage terms, 1,000 tonnes and possibly as high as 2,000 tonnes, is only worth roughly $39 billion and $78 billion in dollar terms. This is nearly what the Federal Reserve is printing every single month since late 2012. Gold has tumbled 27% this year and is set for the first annual loss since 2000, as weak hands and hot money has exited the market on the recent price weakness. The majority of bullion buyers remain steadfast and demand remains robust, particularly in China and Asia. Even in western markets, while demand is lower than recent years, dealers, refineries and mints all report much more buyers than sellers which contradicts the notion that investors or gold buyers have "lost faith" in gold. It is worth noting that, while gold is down 27% this year, it remains up 63% in the last 5 years – since the financial crisis began. Thus, again proving its worth as a long term store of value. From a longer term perspective, it is also important to note that gold is now almost half of its record inflation adjusted high or real record high from 1980 at $2,400/oz (see chart). As we have said since 2003, we expect that number to be surpassed in the course of this secular bull market. Economists Warn Depositors May Be Burnt In Bail-Ins In it we detail, how bail-ins are a real risk not just to vulnerable countries like Greece, but to any countries in the EU, the UK, the U.S., Australia, New Zealand, Japan and most of the G20 countries. Below some leading economists and financial commentators in Ireland give their perspective regarding the risks of bail-ins. If you manage money in any way, your own or others, it will be prudent to heed their warnings.

This is the good news. In line with more normalised demand for gold and the precious metals, the risk hedging properties of these assets remain intact and require continued and structured approach to their inclusion when building a diversified, long-term focused investment portfolios. In addition, changes in the regulatory and policy responses to the financial crises, established in response to the Cypriot banking crisis, warrant longer-term re-weighting of optimal gold and other precious metals’ shares in defensive portfolios. Given that the euro area is moving toward a pro-forma inclusion of the depositors bail-ins in the standard toolbox for dealing with the financially distressed national banking systems, the case for gradual cost-minimising increase in long term share of these instruments in individual investors portfolios is being made not only by the market forces, but also by regulatory changes. Contrary to the short-term signals in the spot markets, gold and other precious metals role in delivering long-term risk management opportunities and tail risks hedging is becoming more important as the immediate volatility and short-term risks recede.” Dr Constantin Gurdgiev lectures in Finance in Trinity College, Dublin and in the Smurfit School of Business, UCD. He serves as the Chairman of Ireland Russia Business Association. In the past, he served as non-executive member on the Investment Committee of Goldcore. "In November 2012, it was reported by RTÉ's David Murphy that CRH, the building materials maker and the biggest company on the benchmark Irish stock index, "was mandated by its board not to leave cash in a bank in the euro zone during any weekend". The logic of CRH's stance only became fully clear after weekend decisions taken by Eurozone finance ministers had a severe and adverse effect on the financial claims of depositors in Cypriot banks in March 2013. Had ordinary retail and SME depositors in Cyprus's banks known in February of CRH's stance and of the logic behind it, does anyone seriously think that they would have left themselves so vulnerable in March? The lesson from Cyprus is that individual and business depositors (small, medium and large) need to show at least as much care in making their deposit decisions as large corporations such as CRH. If there is a significant possibility, even small, of capital loss, depositors should ask themselves the same question that corporate treasurers regularly ask themselves: am I being adequately compensated by the deposit rate for the risk I am now exposing my money to?" Cormac Lucey is a chartered accountant, financial analyst & lecturer at the Irish Management Institute (IMI). He was special advisor to Michael McDowell, former Attorney General of Ireland, from 2003 to 2007. He is a commentator on economics and politics. "The attempted bail-in of all deposits in the Cypriot banking crisis and the eventual decision to bail-in deposits in excess of €100,000 has drawn a line in the sand and has created a very dangerous and damaging precedent. A banking system has to be based on trust and confidence; the Cypriot decision and subsequent statements from European policy makers suggest that trust and confidence have been seriously, and possibly irredeemably, damaged. Any individual or any corporate treasurer would be taking an unacceptable risk in making a decision to leave deposits in excess of €100,000 in any single bank, unless one is convinced that the institution is 100% sound. The events of the past 5 years should have taught us that such a conviction would be dangerous. For investors, bank diversification is essential, but more broadly, asset diversification has to be the priority for anybody with any wealth. We still live in very dangerous and uncertain times and investors should do whatever it takes to manage risk and ensure that all of their eggs are not in a single basket that may be badly holed." Jim Power is a graduate of University College Dublin with a BA in Economics & Politics, and a Master of Economic Science Degree. He is Chief Economist at Friends First Group, a wholly owned subsidiary of Eureko, one of Europe's largest insurance groups. He teaches Finance and Economics on the Local Government MBA at Dublin City University, and Business Economics on the Executive MBA at the Michael Smurfit Graduate School of Business, University College Dublin. Download our Bail-In Guide: Protecting your Savings In The Coming Bail-In Era (11 pages)

|

| Economists Warn Depositors May Be Burnt In Bail-Ins (Part III) Posted: 06 Dec 2013 05:02 AM PST gold.ie |

| Swiss Refinery Report: Gold Supply Has Never Been Tighter Posted: 06 Dec 2013 02:30 AM PST "We get the jobs report at 8:30 a.m. EST, and I expect that JPMorgan et al will do the dirty" ¤ Yesterday In Gold & SilverAs I mentioned in The Wrap in yesterday's column, once the big short covering rally in gold got capped during the New York lunch hour on Wednesday, it continued to get sold down almost with a break going into the London open yesterday morning. This trend continued until the low was in a hair after 10:30 a.m. EST. The subsequent rally lasted until shortly before noon, and then got sold down again starting around 2 p.m. in the New York electronic market. The high and low were recorded by the CME as $1,243.20 and $1,216.30 in the February contract. Gold closed in New York at $1,225.10 spot, down $18.20 from Wednesday, giving up virtually its entire gain from that day. Net volume was pretty hefty at 161,000 contracts. The chart pattern in silver was very similar, with the inflection points coming at the same time as the ones in gold. And after getting sold back down in electronic trading, the silver price didn't do much after that. The high and low in the March contract were reported as $19.60 and $19.27. Silver finished the Thursday trading session at $19.435 spot, which was down 28 cents from Wednesday's close. Net volume was a very healthy 47,000 contracts. The platinum price didn't do much yesterday, but for the second day in a row, palladium was the star of the day after it rallied briefly in mid-morning trading in New York. Here are the charts. The dollar index close late Wednesday afternoon in New York at 80.64, and then traded basically sideways until around 1 p.m. Hong Kong time. Then it dipped down to 80.40 during the next couple of hours, and then rallied back to around unchanged by shortly after 9 a.m. in London trading. The index spiked up to its high of the day [80.80] at 8:30 a.m. in New York, and then fell all the way down to 80.25 by 11:35 a.m. After that it traded flat for the remained of the Thursday session. The index finished the day at 80.26, which was down 38 basis points from Wednesday's close. There was zero correlation between the currencies and the precious metal price action yesterday. The gold stocks never got a sniff of positive territory. They gapped down at the open, rallied along with the gold price between 10:30 an 11:45 a.m. in New York, and then sold off for the rest of the day, as the gold price rolled over. The HUI finished down 2.74%, finishing on it's low of the day, and giving back everything it gained on Wednesday, plus a bit more. The daily HUI chart is M.IA., so here's the 5-day chart, and it's pretty ugly. It was a very similar chart pattern for the silver equities, but they only gave back about half of what they gained on Wednesday. Nick Laird's Intraday Silver Sentiment Index closed down 2.17%, and virtually on its low as well. Looking at these equity charts, you have to ask yourself one question, dear reader; and that is "whose buying all these precious metal shares that have been falling off the table for the last year or so", as somebody owns them. The CME's Daily Delivery Report for Day 5 of the December delivery month showed that 199 gold, along with 169 silver contracts were posted for delivery within the Comex-approved depositories on Monday. In gold, the short/issuers were of no particular importance. What was important, but no surprise, was the fact that the only long/stopper of note was JPMorgan Chase in its in-house [proprietary] trading account, with 193 of those contracts. In silver, the largest short/issuers of note were Jefferies and HSBC USA, with 82 and 75 contracts respectively. JPMorgan stopped 121 of those contracts, of which 116 contracts were for its in-house [proprietary] trading account. The link to yesterday's Issuers and Stopper Report is here. There were not reported changes in GLD yesterday, and as of 9:39 p.m. EST yesterday evening, there were no reported changes in SLV, either. Joshua Gibbons, the "Guru of the SLV Bar List", updated his website for the goings-on inside SLV for the past reporting week, and this is what he had to say -- "Analysis of the 04 December 2013 bar list, and comparison to the previous week's list: 819,078.4 troy ounces were removed (all from Brinks London), no bars were added or had a serial number change. "The bars removed were from: Doe Run (0.3M oz.), Met-Mex (0.2M oz.), and five others. As of the time that the bar list was produced, it was overallocated 737.6 troy ounces. All daily changes are reflected on the bar list." The link to Joshua's website is here. The U.S. Mint had another sales report yesterday. They sold another 8,500 troy ounces of gold eagles; and 1,000 one-ounce 24K gold buffaloes. It was rather quiet day for gold in the Comex-approved depositories on Wednesday. They reported receiving only 6,365 troy ounces, and didn't ship any out All of the activity was at Brink's, Inc., and here's the link. For a change, it was even quieter in silver, as nothing was reported received, and only 1,456 troy ounces were reported shipped out. The link to that activity is here. I have a decent number of stories again today and, as usual, the final edit is up to you. ¤ Critical ReadsHere is the "Growth" - Inventory Hoarding Accounts For Nearly 60% of GDP Increase in Past Year As we reported earlier, while on the surface the headline revised Q3 GDP number was a stunner coming at 3.6%, the reality is that more than 100% of the growth from the initial estimate came from a revised estimate of how many private Inventories were stockpiled in the quarter. The reality was that of the $230 billion in total increase in SAAR GDP, $146 billion of this, or over 63%, was due to inventory stockpiling. Treasury Chief to Declare Big Gains in Financial ReformTreasury Secretary Jacob J. Lew will assert on Thursday that the Obama administration’s vast overhaul of the financial system is close to accomplishing its goal of shielding society from the dangers posed by giant banks. In a broad policy speech intended to signal the administration’s views on financial regulations, Mr. Lew will also make it clear that more measures may be needed to strengthen the global system. In comments that will most likely upset foreign governments, he will call on overseas regulators to make their rules tougher. Earlier this year, I said if we could not with a straight face say we ended ‘too big to fail,’ we would have to look at other options,” he says. “Based on the totality of reforms we are putting in place, I believe we will meet that test, but to be clear, there is no precise point at which you can prove with certainty that we have done enough.” Mr. Lew’s comments come as regulators are scheduled to meet next week to finally approve the Volcker Rule, a cornerstone of the overhaul that tries to stop banks from speculatively trading with depositors’ money and other funds. In recent months, the Treasury Department has pressed the five agencies that worked on the rule to finish it before the end of the year. This article was posted on The New York Times website two minutes after midnight on Thursday morning in New York...and I thank Phil Barlett for finding it for us. It's worth reading. Volcker Rule to Scrap "Portfolio Hedging", Would Make Trillions in Excess Deposits Inert As we have been covering for the past year and a half, most explicitly in "A Record $2 Trillion In Deposits Over Loans - The Fed's Indirect Market Propping Pathway Exposed", when it comes to the pathway of the Fed's excess deposits propping up risk levels, it has nothing to do with reserves sitting on bank balance sheets as assets, and everything to do with excess deposits (of which there are now $2.4 trillion thanks to the Fed) which are used as Initial collateral by banks such as JPM and then funding such derivatives as IG9 in a failed attempt to cover a segment of the corporate bond market. These deposits originate at the Fed as a liability at the commercial banking sector to the excess reserve asset. The WSJ reports: "In a defeat for Wall Street, the "Volcker rule" won't allow banks to enter trades designed to protect against losses held in a broad portfolio of assets, according to people familiar with the rule. The practice, known as portfolio hedging, has become a focal point of regulators drafting the rule, a controversial plank of the 2010 Dodd-Frank financial law that seeks to prevent banks from putting their own capital at risk in pursuit of trading profits. But it won't contain language permitting portfolio hedging, which has been "expunged" from earlier drafts of the rule, according to a person familiar with the matter. Regulators decided to remove portfolio hedging from the rule after J.P. Morgan Chase disclosed billions of dollars in losses from its so-called London whale trades in 2012." This Zero Hedge piece from yesterday is a bit of heavy reading, but is definitely worth your time if you have it. It's the second offering of the day from Ulrike Marx. Wall Street trade groups challenge CFTC cross-border guidelinesThree Wall Street trade groups sued the U.S. Commodity Futures Trading Commission on Wednesday to stop tough overseas trading guidelines that they fear could hurt markets and reduce their profits. The groups accused the CFTC in their lawsuit of circumventing a more rigorous rule making process by issuing its cross-border regulations as "guidance.' They also said they filed the lawsuit to stop the CFTC from what they described as an "unceasing effort'' to regulate the global swaps market through unpredictable advisory documents instead of formal rules. This short article, along with an embedded 43 second video clip was posted on the cnbc.com Internet site on Wednesday shortly after the markets closed...and I thank West Virginia reader Elliot Simon for sending it our way. Jonathan Weil: The `GE Three' Go FreeIt wasn't long after three former General Electric Co. executives were convicted of rigging auctions for municipal-bond investment contracts that they received the ultimate sendoff: A 7,400-word torching in Rolling Stone magazine by Matt Taibbi, the writer who branded Goldman Sachs Group Inc. with the nickname "vampire squid." "Someday, it will go down in history as the first trial of the modern American mafia," Taibbi began his June 2012 opus about Dominick Carollo, Steven Goldberg and Peter Grimm. "Over 10 years in the making, the case allowed federal prosecutors to make public for the first time the astonishing inner workings of the reigning American crime syndicate, which now operates not out of Little Italy and Las Vegas, but out of Wall Street." Then came a surprise last week, right before Thanksgiving. A federal judge ordered the men released from prison. An appeals court had reversed their convictions the day before, without explanation. An opinion would be issued "in due course," it said. Bloomberg News ran a short story this week. The rest of the news media barely noticed. This rather short op-ed piece by Jonathan was posted on the Bloomberg website yesterday morning...and is definitely worth skimming. I thank Washington state reader S.A. for sending it along. Kyle Bass Warns When "Everyone Is 'Beggaring Thy Neighbor'... There Will Be Consequences""There are going to be consequences to central bank balance sheet expansion all over the world," Kyle Bass tells Steven Drobny in his new book, The New House of Money, adding "It’s a beggar-thy-neighbor policy, but everyone is beggaring thy neighbor." The Texan remains concerned at QE's effects on wealth inequality and worries that "at some point this is going to ignite and set cost pressures off." While Gold-in-JPY is his recommended trade for non-clients, his hugely convex trades on Japan's eventual collapse remain as he explains the endgame for his thesis, "won't buy back until JPY is at 350," and fears "the logical conclusion is war." This commentary by Kyle is embedded in another Zero Hedge story...and this one was filed on their website late yesterday afternoon EST. I thank Ulrike Marx for sending this one our way as well. It's Becoming Clear That The NSA's Nightmare Has Just BegunThe National Security Agency and its allies face a long, painful drip of classified documents relating to their intelligence operations. The quantity and range of leaks facilitated by Edward Snowden have become clear in recent news stories. First, The Australian reports that Edward Snowden stole as many as 20,000 Aussie signals intelligence files from the NSA's systems. Australia's attorney general called the disclosures the most damaging in the country's history. This news item was posted on the businessinsider.com Internet site yesterday morning EST...and I thank Roy Stephens for his first offering of the day. Autumn Statement 2013: Britain's AAA national grit as retirement at 70 accepted stoicallyThe Channel is getting ever wider. While George Osborne plans to push Britain's retirement age to 70, Europe's big two are going the other way. The German coalition deal has pencilled in a cut in the retirement age from 65 to 63, for those who have put in 45 years of contributions. (The overall plan to push the pension age gradually up to 67 remains in place.) President François Hollande has cut the reversed Nicolas Sarkozy's rise in the retirement age to 62 in France. Workers with 41 years of contributions can now retire at 60. This Ambrose Evans-Pritchard blog was posted on the telegraph.co.uk Internet site yesterday sometime...and it's the second contribution in a row from Roy Stephens. French unemployment hits 16-year high in third quarterFrance's unemployment rate rose to a 16-year high of 10.9 percent in the three months to September, the INSEE national statistics agency said Thursday, adding to pressure on President Francois Hollande in his battle to tackle France’s unemployment. The jobless rate rose 0.1 percentage points from the previous three months, the new data showed. The unemployment rate for metropolitan France, which excludes overseas territories and is more closely watched domestically, also rose by 0.1 percentage point in the same period to 10.5 percent. This story appeared on the france24.com Internet site yesterday sometime...and I thank Roy Stephens for sliding this into my in-box in the wee hours of this morning. Europe repeating all the errors of Japan as deflation draws closerEurope is one shock away from a deflation trap. A surprise anywhere in the world is all that it needs: an upset in China as the credit bubble pops, or a global bond shock as the US Federal Reserve winds down monetary stimulus. Producer price inflation (PPI) fell to -1.4pc in the eurozone in October. This is how deflation becomes lodged in the price chain. "Prices are sticky for a while as you approach zero inflation, but once you break through the ice into deflation things can move fast, as we've seen in Greece," said Julian Callow, global strategist at Barclays. "The European Central Bank needs to act before the horse has already bolted." This longish co |

| Kyle Bass Warns When "Everyone Is 'Beggaring Thy Neighbor'... There Will Be Consequences" Posted: 06 Dec 2013 02:30 AM PST "There are going to be consequences to central bank balance sheet expansion all over the world," Kyle Bass tells Steven Drobny in his new book, The New House of Money, adding "It’s a beggar-thy-neighbor policy, but everyone is beggaring thy neighbor." The Texan remains concerned at QE's effects on wealth inequality and worries that "at some point this is going to ignite and set cost pressures off." While Gold-in-JPY is his recommended trade for non-clients, his hugely convex trades on Japan's eventual collapse remain as he explains the endgame for his thesis, "won't buy back until JPY is at 350," and fears "the logical conclusion is war." This commentary by Kyle is embedded in another Zero Hedge story...and this one was filed on their website late yesterday afternoon EST. I thank Ulrike Marx for sending this one our way as well. |

| ECB's Mario Draghi denies Japanese-style deflation risk, drives euro even higher Posted: 06 Dec 2013 02:30 AM PST Mario Draghi said the ECB is studying what happened in Japan at the onset of its Lost Decade in the 1990s, insisting that Europe is unlikely to go the same way. The European Central Bank has cut its inflation forecast for the next two years and promised “powerful artillery” to boost the eurozone economy if necessary, but offered no concrete measures to halt the drift towards deflation. The euro punched to a five-week high of nearly $1.37 against the dollar and £0.84 against the pound as traders bet that the ECB’s governing council is too divided to take decisive action. Yields on 10-year Italian and Spanish bonds jumped seven basis points as credit tightened across the board. This is another offering from Ambrose Evans-Pritchard. This story was posted on the telegraph.co.uk Internet site very late yesterday afternoon GMT...and is the final contribution of the day from Roy Stephens. |

| Posted: 06 Dec 2013 02:30 AM PST 1. Pierre Lassonde: "This Will Trigger Next Leg of the Gold Bull Market". 2. Dr. Stephen Leeb: "China Mining Some Gold for a Staggering $2,500 an Ounce". 3. John Ing: "Shanghai Exchange Has Delivered More Gold Than Fort Knox!". [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests, to them, and not to me. Thank you. - Ed] |

| Lawrence Williams: Bull market or bear market – where does gold stand now? Posted: 06 Dec 2013 02:30 AM PST Is gold still in a bull market or a bear market? Opinions differ but in reality the answer to both questions could well be yes. It all depends where you start from! Over 12 years gold has risen from $250 to around $1,230 at the time of writing – definitely a bull market then? Over the past two and a bit years gold has fallen from around $1,900 to $1,220. That looks as though it may be a bear market then? Well yes – or is this just a major correction in a secular bull market? To an extent it depends on whether you are a gold bull or a gold bear as to which viewpoint you take. It was thus interesting to listen to some of the views expressed at the Mines & Money conference in London which has just ended. Speakers were perhaps more biased to the major correction in an ongoing bull market angle and they certainly had some strong historical evidence to support their viewpoints. Whether history will again repeat itself is obviously the major question here, but it does have the uncanny ability to repeat itself and one suspects it will do so yet again with the markets and gold – the only real question being how much further will gold fall before the market turns, and then how far and fast it will rise when it does. The question of "how far and fast" should be directed to JPMorgan Chase and two other U.S. bullion banks, as they are totally in command of the precious metal pricing structure in the Comex futures market...and until they say so, or are instructed to step aside, this price management scheme will continue unless the physical market dictates otherwise. This commentary by Lawrence was posted on the mineweb.com Internet site yesterday...and once again I thank Ulrike Marx for bringing this article to our attention. It's worth the read. |

| China's biggest jeweller sees gold in the masses Posted: 06 Dec 2013 02:30 AM PST The world's most valuable jewellery retailer Chow Tai Fook, which counts Cartier and Tiffany & Co as competitors, is on a quest to conquer the hearts of China's future big spenders. Its weapons of choice: Hello Kitty and Winnie the Pooh. Superman and the Angry Birds team also feature in Chow Tai Fook Jewellery Group's range of fashionable, and affordable, pieces which the company hopes will win over the millions of Chinese who live outside major cities but who are reaping the benefits of a rapidly growing economy and who remain enamoured by the gleam of gold. Chow Tai Fook's fashion jewellery, which costs between HK$200 and HK$2,000 ($26 and $260), is a far cry from the luxury offerings that have traditionally accounted for over 80 percent of sales, and which on average cost about 10 times as much. But the shift to expand mass-market retail is already paying off. Chow Tai Fook saw its net profit rise by a forecast-beating 92.3 percent in the six months ended September, with same-store sales growing 33.2 percent. Between the time I read this Reuters story yesterday afternoon...and then got around to posting in today's column at 3:02 a.m. EST this morning, the original link had become inactive. I did a Google search of the headline, and it's obviously had a "Page 1 rewrite" in the interim. That's what you're seeing here, and I have no idea what changes were made between the two stories. I thank Ulrike Marx for her final contribution to today's column. |

| Sprott's Thoughts: The Curious Case for Silver Posted: 06 Dec 2013 02:30 AM PST It has been a difficult year for silver investors with the metal falling by 36% year-to-date. While the Federal Reserve balance sheet continues to expand, ‘taper’ discussions by the Federal Open Market Committee have weighed heavily on the price performance of all the precious metals this year. By our calculations, over the last five years silver has a beta to the gold price of 1.5. This implies that price changes in gold are magnified in silver. Combine this with an 80% correlation in the price action between gold and silver over the same time frame and it’s easy to see that where the price of gold goes, the price of silver goes faster. As we break down the fundamentals for silver, market developments this year give rise to a curious conundrum – how can the case for silver be stronger while the price continues to languish? |

| Swiss refinery report: Gold supply has never been tighter Posted: 06 Dec 2013 02:30 AM PST Interviewed by GATA consultant Koos Jansen, Anglo Far-East Bullion Co.'s Alex Stanczyk discusses his recent trip to a Swiss gold refinery whose managing director told of an unprecedented shortage of metal as China consumes it all. |

| Posted: 06 Dec 2013 02:15 AM PST insidefutures |

| DITTS -- Does it threaten the System? Posted: 06 Dec 2013 02:09 AM PST Probably not yet. But the question never what it's doing now, it's always what it will be doing in the future. While gold and silver are bouncing along what may (or may not) be a bottom, BTC continues to assault its (parabolically arrived-at) all-time highs. A short piece on some simple, common-sense indicators that may reflect on BitCoin. |

| Posted: 06 Dec 2013 01:20 AM PST By Eric Ben-Artzi, a former risk manager at Deustche Bank and Goldman, and SEC whistleblower We are all still paying the price for the stream of ever more leveraged credit derivatives that fueled the world's greatest credit bubble. It appears that some of these are attempting a comeback. Last week, the Financial Times reported that Citi is offering a new version of the now-infamous Leveraged Super Senior CDO ("LSS"). If it succeeds, the Bank could claim the benefit of insurance on a portfolio of corporate bonds, while the client (aka "counterparty") only deposits a small fraction of the insured amount. The purpose of the first synthetic CDO, created by JPMorgan in the '90s, was to relieve the bank of risky debt it actually owned. The riskier LSS deals arrived circa 2005, and were mostly arranged by trading desks which did not own the referenced bond portfolio. Rather, they simply turned around and sold insurance on the full amount of corporate debt, using regular CDS. The profit – the difference between the fees on the insurance sold and the cost of the insurance bought – was then claimed upfront and handed out in bonuses to the traders and salespeople at the end of the year. On a large scale, such transactions have the effect of lowering risk premiums (aka "spreads"). Ultimately, the borrowing costs of the corporations referenced in the portfolio go down, encouraging still more leverage. With bond yields decreasing, bond investors chase ever more leveraged instruments. These were some of the dynamics behind the last credit-fueled asset bubble, where borrowed money found its way to real estate and the stock market. In a recent interview with Der Spiegel, Nobel winning economist Robert Shiller warned: "… stock exchanges are at a high level and prices have risen sharply in some property markets… That could end badly”. A few days ago, the Financial Times reported that CMBS issuance has nearly doubled since last year to reach a post-crisis peak, as have CLO and CDO issuance. "US regulators have warned that banks are making riskier loans to companies in an effort to boost flat-lining profits and fight off competition from other types of lender" wrote the newspaper. As early as last February, in an article titled "Credit Super Nova!" Pimco's Bill Gross warned: "our credit-based financial markets and the economy it supports are levered, fragile and increasingly entropic – it is running out of energy and time." The leverage in previous LSS trades created a potential time-bomb, commonly known as "gap risk". It amounted to a "walk-away from the trade and cut your losses" option for the bank's counterparties. Such options must be valued as part of the trade, and increase in value dramatically in times of market distress. Now it appears that Citi's clever "structurers" have neutralized this bomb, by taking away the client's option to walk away when losses mount. Based on a description in Euromoney, if realized losses reach a very high threshold, the counterparty would now be contractually obligated to post additional collateral and cover Citi's losses. Market risk has now been transformed into credit risk. Compared to the old LSS structure, this is an improvement – but only if the credit risk is treated properly. The problem is that this is "wrong-way" tail-risk, which is hard to properly capture using common risk-measures such as VaR. The counterparty will need to pay Citi in an extreme scenario, when a large number of previously healthy companies default. Odds are the counterparty won't be in great shape either. Even in a less extreme scenario, Citi faces liquidity risk: the standard insurance contracts it can sell against these LSS trades typically require margin to be posted daily. It is precisely margin calls on such derivatives that hastened the collapse of Lehman Brothers (in fact, a margin call by a certain Bruno Iksil, who went on to become the London Whale). Since the LSS counterparty is not required to post simply because markets are stressed, Citi would have cash flying out one door, and none coming in the other. In the extreme scenario where losses do materialize, Citi's salesmen and their clients can tell themselves: "YBGIBG – You'll be gone I'll be gone". Those left to foot the bill will be Citi's stakeholders. Since Citi is still too big to fail, this means taxpayers. In the summer of 2007, LSS trades that had been sold to many Canadian investors blew up spectacularly. The Canadian government eventually stepped in and bailed out Deutsche Bank, the largest LSS dealer at the time. Let's hope that Tim Geithner's successors at the New York Fed are protecting us from a repeat performance. |

| Bullion and Energy Market Commentary Posted: 06 Dec 2013 01:10 AM PST oilngold |

| Gold Prices Forecast to Test 2013 Lows Posted: 06 Dec 2013 01:10 AM PST dailyfx |

| Gold Technicals – Stable Despite Additional QE Taper Fears Posted: 06 Dec 2013 01:05 AM PST forexnews |

| Gold opens lower, but still above Thursday’s lows; 1172 technical target looms Posted: 06 Dec 2013 01:00 AM PST fxstreet |

| TECHNICAL Gold Does Serious Damage to Wednesday’s Advance Posted: 06 Dec 2013 01:00 AM PST dailyfx |

| Atlas Pulse Gold Investor Report goes all Crypto currency and Bitcoin mad this month Posted: 06 Dec 2013 12:53 AM PST |

| Posted: 06 Dec 2013 12:45 AM PST fxempire |

| Producer/Merchant net long is not necessarily bullish Posted: 06 Dec 2013 12:28 AM PST Gene Arensberg has a good post up on the rare occurrence of COMEX Producer/Merchants category going net long. He sees it as a bullish sign but I would suggest another interpretation which could be more ambivalent. Gene notes that the producer/merchant "class of traders is dominated by actors who are hedging price risk of their own physical or financial exposure to precious metal, so they are usually more short than long futures" and that it includes "producers and miners, refiners, large jewelers, large bullion merchants". He also observes that for most of the time this group runs at around 160,000 contracts (circa 500 tonnes) short (see the chart below from Gene's site). Now the interesting this about this is that this group stays pretty much consistently short right through a huge bull run in gold, in pink. Don't you think that is unusual? As the losses mounted, wouldn't they have lightened up? How to account for this behaviour logically? The key is, as Gene says, that they are hedging their own physical. All of the types mentioned - miners, refiners, jewellers and bullion dealers - have a lot of gold in the working inventories of their businesses. They own this metal (are long) and thus go short to hedge themselves. Their business is about buying gold and transforming it into another more valuable product and then selling it. They are not interested in making money on the gold price itself. Indeed, if they weren't hedged then as a group holding around 16 million ounces they would have lost around $11 billion dollars in the drop from $1900 to $1200. I'm pretty sure you'll agree that they are unlikely to be making so much profit making coins/jewellery or as coin dealers to wear that sort of loss. So that is why we see a stable short position for this group, with smaller ups and downs as their sales and inventory fluctuate in response to changes in demand. If demand surges, then their inventory gets run down and they would take short hedges off and the short position would reduce. As they restock inventory, the short position should increase. We now have a basis on which to explain the 2008/2009 and 2013 divergences from the long run average of 160,000 contracts short. My explanation for the reduction in shorts from 160,000 to 27,000 in late 2008 is that the financial crisis caused an unprecedented surge in retail demand for gold. The industry was not geared up for that sort of volume so inventories were run down, resulting in a coin premiums surging. As the industry geared up and put on extra shifts etc the producer/merchants were able to restock and hence we see their short position increase again. Continuing with this inventory based analysis, it suggests the interpretation for the 2013 reduction in short positions to 6,000 long is that the industry is running down its inventory. In 2008/09 the inventory run down was due to a demand surge, but was only temporary. In 2013 the run down has persisted. An explanation for that is that demand and business has dried up - if you aren't selling as much product then you don't need to hold, and can't justify holding, as much working inventory as you used to. Consider that during 2006/2007 the producer/merchant short position hovered between 50,000 and 100,000 contracts (see this chart, which goes back a bit further than Gene's). The 160,000 average that Gene mentions is from 2009-2010-2011, which is the bull run in gold. An interpretation is that the extra demand during that bull run resulted in the industry needing to run higher inventories, so we see another 60,000+ shorts being added. With the $1900 bust, maybe the industry as a whole got stuck with higher than normal inventories so worked them down to their average of 75,000. What is interesting is that the rapid reduction from 75,000 short to 6,000 long started after the April 2013 price smash. That event certainly knocked sentiment from the market in the West. It resulted in cash for gold scrap business drying up (therefore less metal tied up in inventories by dealers and scrap merchants) and if you look at US Mint gold coin sales, they drop right off from that point as well, so again coin dealers etc have reduced inventory needs. To further back up this analysis, consider that US Mint silver coin sales have not reduced like gold and coincidentally the silver producer/merchant short silver position shows no reduction like gold as the silver market is still strong. So I'd argue that the producer/merchant position is just reflecting the lack of Western interest in physical gold investment (as also demonstrated in gold ETF reductions) rather than them "believe[ing] the path of least resistance is higher for gold." Having said that, I wouldn't say it is necessarily bearish, as Gene is right in that it is a rare signal so could indicate a turning point. I just don't see it as a slam dunk bullish sign either, as this lack of interest in gold is likely to continue until people realise that, no, the economy isn't on the mend and the problems fixed. Until that mainstream narrative changes, we could see speculators testing the gold market to the downside. Note: I have linked to a number of Nick's Sharelynx charts in this post. Just sign up for the free trial to get access to them, they are invaluable to understanding what is going on in the market, as hopefully this post demonstrates. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment