Gold World News Flash |

- Koos Jansen: Did China Goose March Gold Imports to Prepare for April Smash?

- Breach: Man Defeats $300 Million Airport Perimeter Fence: “Substandard Security System”

- What Chinese Consumers Are Rushing To Buy This Christmas

- Goldbugs Will Have Their Revenge in 2014

- India Mulls Relaxing Import Duty on Gold Dore

- U.S. uses Exchange Stabilization Fund to rig major markets, Kirby tells USA Watchdog

- What Chinese Consumers Are Rushing To Buy This Christmas

- The Probability Of A Stock Market Crash Is Soaring

- Koos Jansen: Did China goose March gold imports to prepare for April smash?

- Some Themes To Watch In 2014

- 100 Years Of Success? - Fed 'Inflation' Style

- Gold Daily and Silver Weekly Charts - Tottering Into Year End

- Gold Daily and Silver Weekly Charts - Tottering Into Year End

- The 13 Most Popular Articles In 2013 On the Potential Collapse of the U.S. Dollar

- What Were the Reasons for Gold's 2013 Underperformance?

- Gold and Silver Sentiments Violently Diverged in 2013

- Just Gold & Silver: The Most Read Such Articles In 2013

- Lessons from the World’s Second Largest Gold Field

- India mulls relaxing import duty on gold dore

- Centerra Gold drafts deal with Kyrgyzstan on Kumtor mine

- Obamacare: A Parasite Intent on Killing Its Host

- These 13 Were the Most Read Economic/Financial/Investment Articles in 2013

- 2014 Gold Price Forecast - Where Will Gold Be By Year End? Short Squeeze Rally Or Crash?

- Gold Stocks Bear Market Cycle Bottom Forming Right Now!

- ANOTHER BUBBLE LOOKING FOR A PIN

- Lenin's Goelro And The Myth Of Total Electrification

- Platinum - Our Favorite Precious-Metals Trade Going Into 2014

- Making Friends with the U.S. Dollar

- Gold becoming scarce in Mexico too

- Minor blemishes aside, gold shone for Indians in 2013

- US Mint Discounts on 2014 Silver Coins and Annual Sets

| Koos Jansen: Did China Goose March Gold Imports to Prepare for April Smash? Posted: 27 Dec 2013 12:30 AM PST by Chris Powell, GATA:

Dear Friend of GATA and Gold: Gold researcher and GATA consultant Koos Jansen, perhaps the foremost expert on China’s gold market, tonight reports data suggesting, as your secretary/treasurer speculated a month ago to King World News – http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/11/14_A… – and directly to you – http://www.gata.org/node/13256 – that China helped arrange April’s gold price smashdown so that it could get a lot of gold a lot cheaper. |

| Breach: Man Defeats $300 Million Airport Perimeter Fence: “Substandard Security System” Posted: 26 Dec 2013 11:30 PM PST by Mac Slavo, SHTFPlan:

Every day hundreds of thousands of travelers are subjected to long lines and intrusive screenings by the Transportation Security Administration. Under the pretext of protecting Americans from terrorists the TSA, an agency which has never actually captured a terrorist in its ten year history, has spent billions of dollars on what they claim is a necessity in today's dangerous world. But with all the money being spent and a government control grid being implemented across the entire country, a cross-dressing fence jumper somehow managed to thwart a multi-million dollar impenetrable external perimeter defense system at Newark airport. |

| What Chinese Consumers Are Rushing To Buy This Christmas Posted: 26 Dec 2013 10:30 PM PST from ZeroHedge:

Google Translated from Chinanews: Gold price lower and lower end of the Christmas rush of people buying |

| Goldbugs Will Have Their Revenge in 2014 Posted: 26 Dec 2013 09:40 PM PST by Peter Cooper, Arabian Money:

On the contrary the New Year special edition of this popular store of investment advice (subscribe here, we can't give this exclusive content away) will be explaining to its readers how best to gear up for the next phase of the bull market in gold, albeit we might still have a few rough months ahead as the correction finds its true bottom. |

| India Mulls Relaxing Import Duty on Gold Dore Posted: 26 Dec 2013 08:36 PM PST by Shivom Seth, MineWeb.com

According to official sources, with India’s current account deficit compressed significantly, this can be seen as a first step in reducing the import duty on gold in a calibrated manner. |

| U.S. uses Exchange Stabilization Fund to rig major markets, Kirby tells USA Watchdog Posted: 26 Dec 2013 06:41 PM PST 9:40p ET Thursday, December 26, 2013 Dear Friend of GATA and Gold: Market analyst and GATA consultant Rob Kirby of Kirby Analytics in Toronto today tells Greg Hunter of USA Watchdog that the U.S. government, through its Exchange Stabilization Fund, is using derivatives to rig strategic markets and especially bond markets. The rigging ends, Kirby says, when China no longer can get gold from the West. The interview is 26 minutes long and can be viewed at USA Watchdog here: http://usawatchdog.com/colossal-fraud-there-are-no-free-markets-rob-kirb... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| What Chinese Consumers Are Rushing To Buy This Christmas Posted: 26 Dec 2013 06:02 PM PST While the US consumer is rushing to spend what little savings they have left and grab that last for 2013 "X% off" deal from the local inventory-clearance bin on plastic Made in China trinkets or marked-down clothing, Chinese consumers are likewise scrambling to buy products. Only, unlike in the US, the object of China's affection is not some gizmo that will end up in the local landfill within 3-6 months. China News Network shows what it is. Google Translated from Chinanews: Gold price lower and lower end of the Christmas rush of people buying Taiyuan a gold shop gold prices as low as 287 yuan / gram, people flocked buying gold jewelry. Western Christmas in China has gradually become the "Consumer Day", much of the gold market on this day after discounts, plus the price of gold hovering cheap Christmas discounts, and more gold has broken 300 yuan / gram mark. With the recent stumble endlessly international gold prices, gold investment income in 2013 or will be achieved for the first time in 13 years is negative. As for 2014, the price of gold, most institutions are still bearish. Publicly available data show that this year, gold prices fell more than 25%. The picture shows a gold shop in Taiyuan people flocked to buy. |

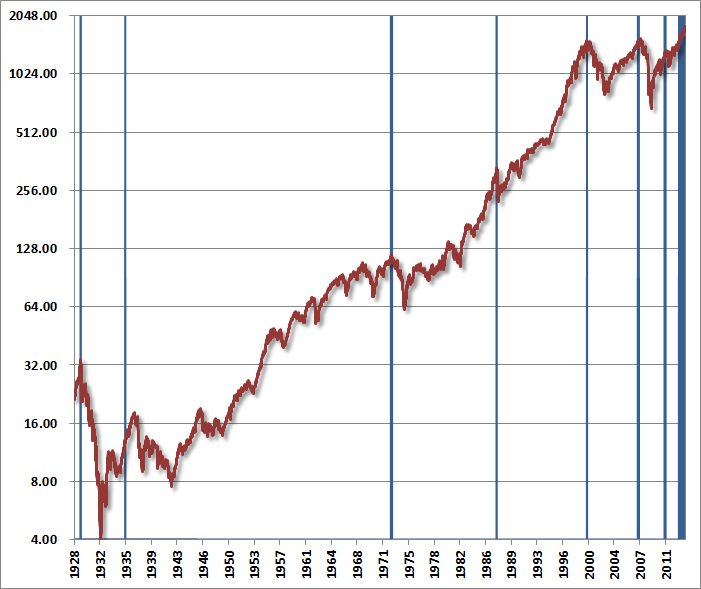

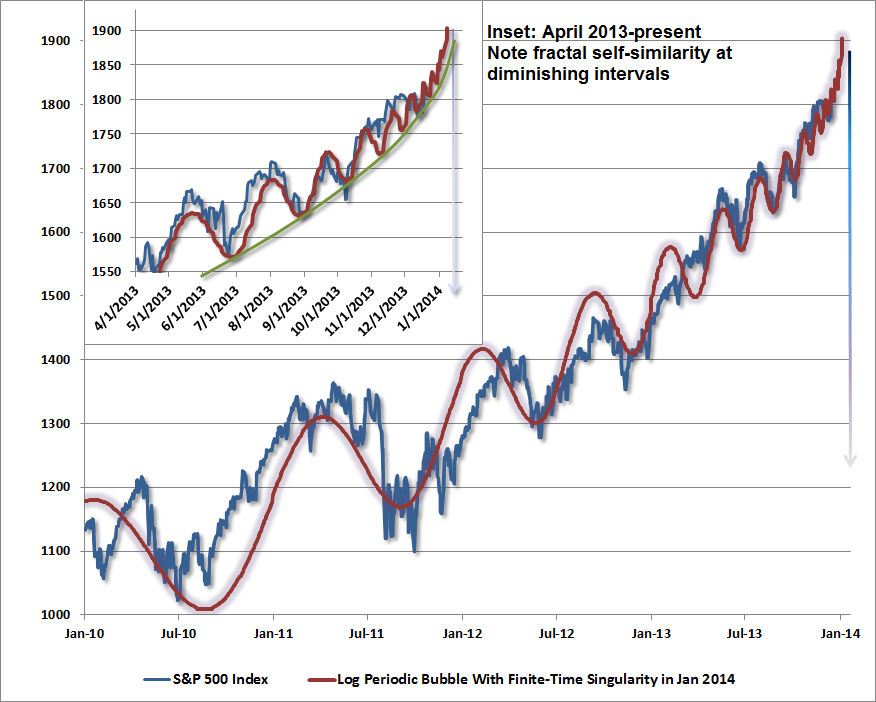

| The Probability Of A Stock Market Crash Is Soaring Posted: 26 Dec 2013 05:06 PM PST While some individual stocks (cough TWTR cough) may have reached irrational bubble territory, the US equity market is undergoing a seemingly 'rational' bubble. However, as John Hussman illustrates in the following chart, the probability of a stock market crash is growing extremely rapidly. Based on the this paper, Hussman simplifies the rational bubble as:

Regardless of last week’s slight tapering of the Federal Reserve’s policy of quantitative easing, speculators appear intent on completing the same bubble pattern that has attended a score of previous financial bubbles in equity markets, commodities, and other assets throughout history and across the globe. The chart below provides some indication of our broader concerns here. The blue lines indicate the points of similarly overvalued, overbought, overbullish, rising-yield conditions across history (specific definitions and variants of this syndrome can be found in numerous prior weekly comments). Sentiment figures prior to the 1960’s are imputed based on the relationship between sentiment and the extent and volatility of prior market fluctuations, which largely drive that data. Most of the prior instances of this syndrome were not as extreme as at present (for example, valuations are now about 35% above the overvaluation threshold for other instances, overbought conditions are more extended here, and with 58% bulls and only 14% bears, current sentiment is also far more extreme than necessary). So we can certainly tighten up the criteria to exclude some of these instances, but it’s fair to say that present conditions are among the most extreme on record. This chart also provides some indication of our more recent frustration, as even this variant of “overvalued, overbought, overbullish, rising-yield” conditions emerged as early as February of this year and has appeared several times in the past year without event. My view remains that this does not likely reflect a permanent change in market dynamics – only a temporary deferral of what we can expect to be quite negative consequences for the market over the completion of this cycle.

Narrowing our focus to the present advance, what concerns us isn’t simply the parabolic advance featuring increasingly immediate impulses to buy every dip – which is how we characterize the psychology behind log-periodic bubbles (described by Didier Sornette in Why Markets Crash). It’s that this parabola is attended by so many additional and historically regular hallmarks of late-phase speculative advances. Aside from strenuously overvalued, overbought, overbullish, rising-yield conditions, speculators are using record amounts of borrowed money to speculate in equities, with NYSE margin debt now close to 2.5% of GDP. This is a level seen only twice in history, briefly at the 2000 and 2007 market peaks. Margin debt is now at an amount equal to 26% of all commercial and industrial loans in the U.S. banking system. Meanwhile, we are again hearing chatter that the Federal Reserve has placed a “put option” or a “floor” under the stock market. As I observed at the 2007 peak, before the market plunged 55%, “Speculators hoping for a ‘Bernanke put’ to save their assets are likely to discover – too late – that the strike price is way out of the money.” The following chart is not a forecast, and certainly not something to be relied upon. It does, however, provide an indication of how Sornette-type bubbles have ended in numerous speculative episodes in history, in equities, commodities, and other assets, both in the U.S. and abroad. We are already well within the window of a “finite-time singularity” – the endpoint of such a bubble, but it is a feature of parabolas that small changes in the endpoint can significantly change the final value. The full litany of present conditions could almost be drawn from a textbook of pre-crash speculative advances. We observe the lowest bearish sentiment in over a quarter century, speculation in equities using record levels of margin debt, depressed mutual fund cash levels, heavy initial public offerings of stock, record issuance of low-grade “covenant lite” debt, strikingly rich valuations on a wide range of measures that closely correlate with subsequent market returns, faith that the Fed has put a “floor” under the market (oddly the same faith that investors relied on in 2007), and the proliferation of “this time is different” adjustments to historically reliable investment measures.

Even at 1818 on the S&P 500, we have to allow for the possibility that speculators have not entirely had their fill. In my view, the proper response is to maintain a historically-informed discipline, but with limited concessions (very small call option positions have a useful contingent profile) to at least reduce the temptation to capitulate out of undisciplined, price-driven frustration. Regardless of whether the market maintains its fidelity to a “log-periodic bubble,” we’ll continue to align our position with the expected return/risk profile as it shifts over time. That said, the “increasingly immediate impulses to buy every dip” that characterize market bubbles have now become so urgent that we have to allow for these waves to compress to a near-vertical finale. The present log-periodic bubble suggests that this speculative frenzy may very well have less than 5% to run between current levels and the third market collapse in just over a decade. As I advised in 2008 just before the market collapsed, be very alert to increasing volatility at 10-minute intervals. |

| Koos Jansen: Did China goose March gold imports to prepare for April smash? Posted: 26 Dec 2013 05:02 PM PST 8:10p ET Thursday, December 26, 2013 Dear Friend of GATA and Gold: Gold researcher and GATA consultant Koos Jansen, perhaps the foremost expert on China's gold market, tonight reports data suggesting, as your secretary/treasurer speculated a month ago to King World News -- http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/11/14_A... -- and directly to you -- http://www.gata.org/node/13256 -- that China helped arrange April's gold price smashdown so that it could get a lot of gold a lot cheaper. Jansen discloses that there was "a huge spike" in gold imports by China from Hong Kong in March, "as if someone knew there was going to be immense demand for physical in April on the mainland." Jansen writes: Why would anybody import expensive gold in March to sell it for bottom prices in April? The answer: Chinese importing doesn't have to work like that. As I described in this article -- http://www.ingoldwetrust.ch/shanghai-gold-exchange-physical-delivery-equ... -- gold can be consigned by, for example, Hong Kong Shanghai Banking Corp. (HSBC) and Industrial and Commercial Bank of China (ICBC). This is how it works: The consigner HSBC can ship the gold to the mainland without selling it at this stage. On arrival it has to be registered within seven days at the Shanghai Gold Exchange and move into the vaults. The gold is now merely transported, not sold. The consignee ICBC will then ask HSBC for a quote in U.S. dollars per ounce (international spot) and then decide the offer price in renminbi at the Shanghai Gold Exchange. The Shanghai Gold Exchange premium is based upon freight costs, insurance costs, customs declaration fee, storage fee, ICBC's profit, etc. After the gold is sold on the Shanghai Gold Exchange, ICBC must pay HSBC in dollars within two days and needs to let the State Administration of Foreign Exchange verify the payment. I am aware that there was an arbitrage opportunity in early 2013 that could have explained some of the high volumes of gold trade between Hong Kong and the mainland. But this couldn't have explained the record net gold export just before the price dropped in April and the Shanghai Gold Exchange was stormed for physical gold. Of course HSBC is custodian of the gold of the exchange-traded fund GLD, whose metal, as Jansen notes, seems to have been transferred steadily to China this year as Western ETF investors sold their shares. Jansen's analysis is headlined "More on the West-to-East Gold Exodus" and it's posted at his Internet site, In Gold We Trust, here: http://www.ingoldwetrust.ch/shanghai-gold-exchange-physical-delivery-equ... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Posted: 26 Dec 2013 04:27 PM PST Submitted by Charles Hugh-Smith of OfTwoMinds blog, Propaganda, phony fixes and more debt can only cover the widening gap between fiscal reality and official fantasy for so long. So what else besides the potential for another global financial meltdown bears watching in 2014? Here are a few worthy prospects. Continuing our end-of-the-year tradition of exploring themes that have disruptive potential in the coming year, Gordon Long and I discuss a half-dozen such topics in 2014 Themes: CHS with Gordon T. Long(28 minutes).

My short list is centered not on one-time crises or potential black swans but on long-festering systemic problems that cannot be fixed within the current status quo, and thus they are destined to continue eroding systemic resilience. Kicking the can down the road and phony accounting "solutions" fix nothing, and so these systemic problems will eventually explode into crises that cannot be tamped down with the usual fiscal and monetary tricks. Student loans and the impossible-to-solve conflict between skyrocketing local government pension and healthcare costs and delivering services to taxpayers/residents are both prime examples. Something's got to give in both of these bubbling pressure cookers, and propaganda, phony fixes and more debt can only cover the widening gap between fiscal reality and official fantasy for so long. Five years of phony fixes have gotten us to 2013; I doubt the same illusions and tricks will get the global economy through 2014-2015 unscathed. |

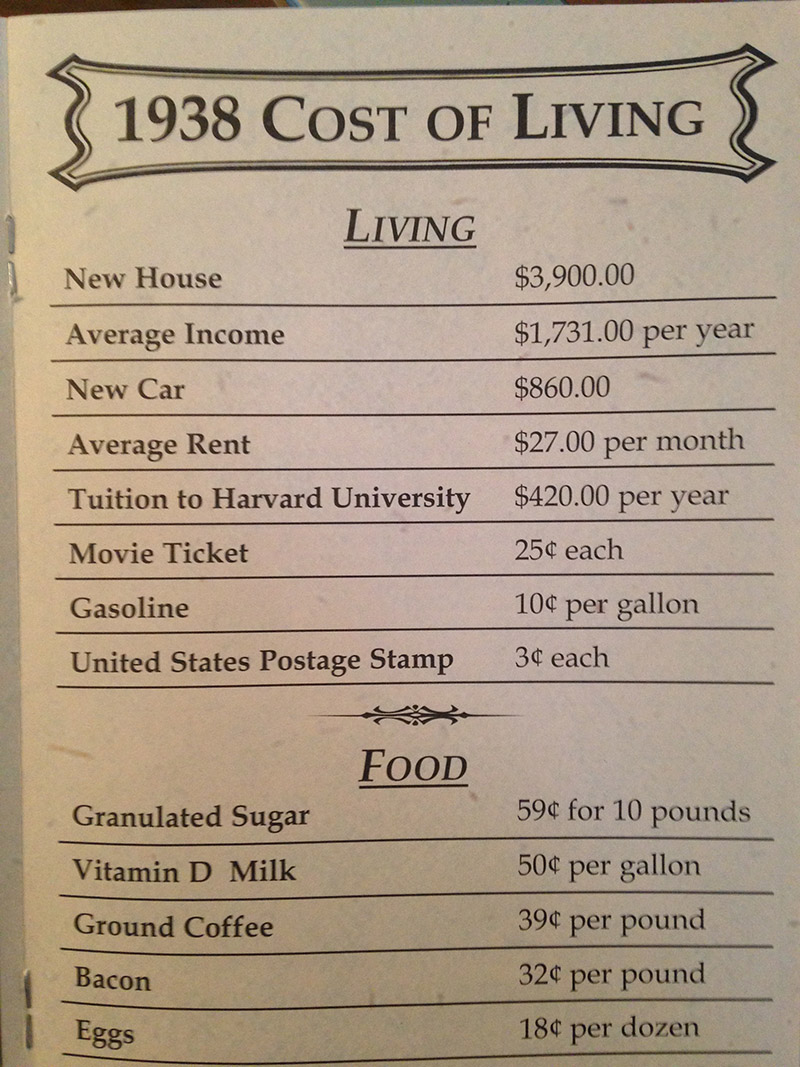

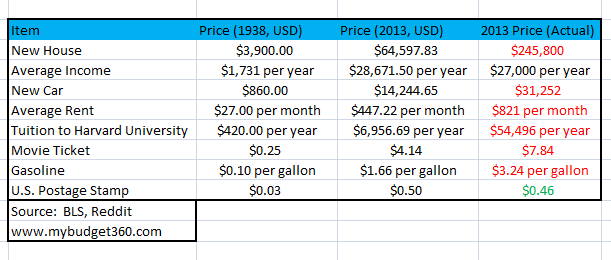

| 100 Years Of Success? - Fed 'Inflation' Style Posted: 26 Dec 2013 02:09 PM PST Money is only as useful as to what it can purchase. The Fed has created a system where debt is now equal to money. This is why big purchases like cars, housing, and even going to college are only feasible by mortgaging your future for many decades. Since the payments are broken down into tiny monthly installments many people pay little attention to the true cost of things over their lifetime. Yet, as MyBudget360 shows, over time, the U.S. dollar has lost a tremendous amount of purchasing power due to inflation. Inflation slowly eats away at your purchasing power yet having access to debt has given the middle class the false impression that they are still protected from the unraveling impacts of inflation. They are not... As MyBudget360.com goes on to note, Someone sent over a photo posted over on the popular Reddit website that shows the cost of living for people back in 1938. You would think that people in 2013 would have more purchasing power than those living through the Great Depression. Adjusting for inflation you would be surprised what has happened in the last 75 years.

The cost of living between 1938 and 2013 The picture in question has prices for living from 1938. It includes important items like a new home, income, new car, rent, and extreme purchasing examples like tuition for Harvard: Source: Reddit You can normalize costs over time through adjusting for inflation. Back in 1938 a new home cost about two times the annual average income. A new car was only about one-third the cost of the annual average income. These figures are important because back in 1938, using credit was only a small factor in purchasing goods. The middle class didn’t start blossoming until after World War II so you would expect that things were still tough for regular households. What we find though is that compared to the typical income, buying a new home or buying a car was relatively doable for most households. Now adjusting all these figures for inflation shows how much more expensive things have become and how dependent we now are to financing purchases with debt (created by the banking system):

This chart shows the impact of inflation and the declining purchasing power of the US dollar.

As Jim Quinn (of The Burning Platform blog) so eloquently sums up,

Know your enemy. |

| Gold Daily and Silver Weekly Charts - Tottering Into Year End Posted: 26 Dec 2013 01:31 PM PST |

| Gold Daily and Silver Weekly Charts - Tottering Into Year End Posted: 26 Dec 2013 01:31 PM PST |

| The 13 Most Popular Articles In 2013 On the Potential Collapse of the U.S. Dollar Posted: 26 Dec 2013 12:10 PM PST munKNEE.com will receive well over 1,000,000 visitors again in 2013 and is now a "go-to" destination for a diversified Below are introductions (with links) to the 13 most read such articles in 2013 in order of popularity. Interestingly, each article is as relevant today as the day they were posted so they are well worth taking the time to read. {Lorimer Wilson, editor of munKNEE.com (Your Key to Making Money!), encourages you to "Follow the munKNEE" via Facebook, Twitter, RSS feed or by registering to receive the bi-weekly Market Intelligence Report.) Here they are in descending rank (Go to the section at the very bottom of the page to express your comments on the selection): 1. Shift From U.S. Dollar As World Reserve Currency Underway – What Will This Mean for America? Today, more than 60% of all foreign currency reserves in the world are in U.S. dollars – but there are big changes on the horizon…Some of the biggest economies on earth have been making agreements with each other to move away from using the U.S. dollar in international trade…[and this shift] is going to have massive implications for the U.S. economy. [Let me explain what is underway.] Words: 1583 Read More » 2. Which Is the World's Safest Major Currency – You'll Be Surprised The term 'safe fiat currency’ is as intellectually disingenuous as terms like 'fair tax' or 'government innovation' but, as we've been exploring recently why modern central banking is completely dysfunctional, it does beg the question– is any currency 'safe'? Let's look at the numbers for some data-driven analysis. Words: 575 Read More » 3. China Converting U.S. Dollar Debt Holdings Into Gold At Accelerating Rate China, Russia and other nations are exiting their dollar-denominated holdings in favor of gold. This action should put pressure on the dollar and U.S. treasuries, pushing not only central banks, but mainstream investors towards the safety of precious metals and other tangible assets that cannot be defaulted on. There will be a rush out of dollars and into assets with no counter-party risk, it is just a matter of how soon it happens. Read More » 4. The U.S. Dollar Will Collapse When This Upcoming Event Happens If we want to better understand the answer to the elusive question of “When will the fiat US dollar collapse?”, we have to watch the petrodollar system and the factors affecting it. Read More » 5. What Would USD Collapse Mean for the World? I came to the conclusion several years ago that it was just a matter of time before the world realized that the relative functionality of the U.S. dollar was about to go belly up – to collapse. [Below is an explanation as to why I have come to that conclusion and what I think it would mean for the well-being of the world.] Words: 881 Read More » 6. China's Reining In of U.S. Treasury Purchases Will Precipitate U.S. Dollar Collapse The People's Bank of China is reported by Bloomberg to have said that it will rein in dollar purchases as the country no longer benefits from increases in its foreign-currency holdings…What implications will this have? I believe that we’ll see the start of a U.S. dollar collapse. Here’s why Read More » 7. The Collapse of the U.S. Dollar is Unavoidable! Here's Why The mother of all collapses is still in front of us. Below are my reasons why that is the case and how to protect yourself financially from such an eventuality. Read More » 8. Dollar's Days As Reserve Currency To End In 2 Years (10 Years Latest) – Here's Why The American dollar will be overthrown…in as short a period as 5 to 10 years says one analyst while another believes it will happen as early as 2015, 2016 latest. Here’s why. Read More » 9. This Proposed Law Would Ban Use or Possession of U.S. Dollar in Russia If the U.S. national debt continues to grow then the U.S. dollar system will collapse in 2017 suggests a Russian lawmaker in submitting a bill to the country's parliament that would ban the use or possession of the American currency. Read More » 10. Singapore – China Agreement Yet Another Sign of Ongoing Decline In U.S. Dollar Finance executives in Asia see the writing on the wall. They can see that the dollar is in a period of terminal decline, and that the Chinese renminbi is going to take tremendous market share away from the dollar – and they want a big piece of the action. To that end representatives of the Hong Kong Exchange and the Singapore Exchange, THE two dominant financial centers in Asia, have signed an agreement to combine their forces in rolling out more financial products denominated in Chinese renminbi. This has massive consequences for the global financial system – and the future of the U.S. dollar. Read More » 11. Gold Setting Up To Bottom; U.S. Dollar Setting Up to Crash The next black swan is already staring us in the face. It’s out of control currency debasement and it’s going to be a collapse in the purchasing power of the US dollar. [After all,] does anyone seriously think that we can print trillions of dollars out of thin air for five years and not eventually have something bad happen? Read More » 12. Continuing U.S. Dollar Strength Depends on Asia's Self-interests Continuing – Here's Why In an odd twist of fate the future of the U.S. dollar is in the hands of Asian governments [and particularly China and Japan. Let's hope they continue to put their own interests first.] Here's why. Read More » 13. The Next Fed-created Catastrophe – a Currency Crisis – Has Already Begun There is no escaping the inevitable – if you aggressively debase your currency eventually you are going to have a currency crisis. The first one has now begun. Words: 350; Charts: 2 Read More »

The post The 13 Most Popular Articles In 2013 On the Potential Collapse of the U.S. Dollar appeared first on munKNEE dot.com. |

| What Were the Reasons for Gold's 2013 Underperformance? Posted: 26 Dec 2013 11:00 AM PST Economic improvement in the U.S., the Federal Reserve taper, central bank easing, and slow emerging markets growth are reasons for gold's poor performance in 2013. TheStreet's Jill Malandrino looks... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold and Silver Sentiments Violently Diverged in 2013 Posted: 26 Dec 2013 10:38 AM PST There are two reasons why people buy gold and silver. The first is that they're the monetary metals. Many people don't want more than a certain exposure to the risks of the banking system. They hold dollars for liquidity and beyond that ... Read More... |

| Just Gold & Silver: The Most Read Such Articles In 2013 Posted: 26 Dec 2013 09:57 AM PST munKNEE.com will receive well over 1,000,000 visitors again in 2013 and is now the "go-to" destination for diversified commentary and analyses on the current gold & silver doldrums and the future expectations for these precious metals. Below are introductions (with links) to the 13 most read such articles in 2013 in order of popularity. Interestingly, each of the 13 are as relevant today as the day they were posted so they are well worth taking the time to read. {Lorimer Wilson, editor of munKNEE.com (Your Key to Making Money!), encourages you to "Follow the munKNEE" via Facebook, Twitter, RSS feed or by registering to receive the bi-weekly Market Intelligence Report.) Here they are in descending rank (Go to the section at the very bottom of the page to express your comments on their popularity): 1. How Will the Price of Gold Evolve Into 2014 and Beyond? A Perspective How will the price of gold develop into 2014 and in the following years? [Read on as] we try a look into the future. Words: 2600 Read More » 2. Gold:Silver Ratio Suggests Much Higher Future Price for Silver – MUCH Higher! The majority of analysts maintain that gold will reach a parabolic peak price somewhere in excess of $5,000 per troy ounce in the next few years. Given the fact that the historical movement of silver is 90 – 95% correlated with that of gold suggests that a much higher price for silver can also be anticipated. Couple that with the fact that silver is currently greatly undervalued relative to its average long-term historical relationship with gold and it is realistic to expect that silver will eventually escalate dramatically in price. How much? This article applies the historical gold:silver ratios to come up with a range of prices based on specific price levels for gold being reached. Words: 691 Read More » 3. These Sites Are the BEST Places to Buy Gold & Silver Online – Here's Why Our review of the best places to buy gold online…[are] dependent on what your goal with the gold is — amassing physical bullion for financial security or to speculate on gold prices. Below are strategies and recommended dealers for each approach: Words: 532 Read More » 4. What's the Difference Between 1 Gold Karat, 1 Diamond Carat and 1 Troy Ounce? You have no doubt read countless articles on the price of gold costing “x dollars per ounce”, own a gold ring or some other piece of gold jewellery and/or wear or have bought/plan to buy a diamond ring but do you really understand exactly what you are buying? What’s the difference between 1 troy ounce of gold and 1 (regular) ounce? What’s the difference between 18 and 10 karat gold? What’s the difference between a .75 and a 1.0 carat diamond? Let me explain. Words: 1102 Read More » 5. A Direct Comparison Between Gold, Silver, Platinum and Copper In this article I would like to take a fresh look at physical gold, silver, platinum and copper regarding their respective versatility of use, durability, fungibility, store of value, liquidity and aesthetics with the hope that, for both old and new investors, my analysis will yield a new perspective on precious metals (including copper). Words: 878 Read More » 6. The Pros & Cons of Buying Gold Bars vs. Ingots vs. Coins It is during difficult times [such as these when] quantitative easing and currency wars have highlighted the volatility and vulnerability of currencies…that the true, safe value of gold really stands out. It is now easier for you to convert your savings into gold than ever before and this article outlines the reason for buying physical gold and the advantages and disadvantages of buying gold bars, ingots and/or coins. Read on! Words: 853 Read More » 7. Gold To Begin a Parabolic Rise In 2014 – Here's Why We are now starting the hyperinflationary phase in the USA and many other countries – and this will all start in 2014. What will be the trigger? The answer is simple – the fall of the U.S. dollar. Read More » 8. 12 Reasons Why Gold Should Bounce Sharply Higher in 2014 Is it time to throw in the towel? Is the bull market in precious metals really over? I don’t think so because my analyses suggest that nearly all of the fundamental factors that have been driving the gold price higher in the past decade have only strengthened in the past two years. Now that the correction has most likely run its course, I expect gold to rebound into the close of the year and bounce sharply higher in 2014. Here are the 12 reasons why. Read More » 9. We Told You So! Gold @ $1,200 & Silver @ $19 Is NO Surprise – Here's Why Don’t you just hate that gloating expression “I told you so!” Well, unfortunately some analysts had the foresight to forecast prices of $1,200 per troy ounce (or less!) and $19 silver several months ago. Read More » 10. Expect Gold to (Only) Drop to $1,150 by Mid-2014! Here's Why The gold price will likely decline to $1,150 next spring but should find enough buyer support from physical buyers and jewellery makers to prevent a fall below $1,000. Read More » 11. Noonan: "Gold Ain't Going Higher – At Least For the Short Term" – and Here's Why Does the fast-fading world reserve currency [the USD] look like it is collapsing? A look at the performance of the U.S. Dollar Index does not suggest that it is, weak as it is. If the fiat dollar is not in danger of imminent "collapse," or even breaking down, then gold does not have this event as an impetus for rallying higher. [Frankly speaking,] until that changes, gold ain't going higher, at least in the short term. Read More » 12. Gold Setting Up To Bottom; U.S. Dollar Setting Up to Crash The next black swan is already staring us in the face. It’s out of control currency debasement and it’s going to be a collapse in the purchasing power of the US dollar. [After all,] does anyone seriously think that we can print trillions of dollars out of thin air for five years and not eventually have something bad happen? Read More » 13. Future Demand For Gold Will NOT Be Met – Here's Why It is our belief that this is by far the most comprehensive report yet. That said, those that compare this report to 2012 will notice significant differences in the final metrics which suggest that, unless we have high-grade, high ounce deposits that are being fast tracked online, it will be very difficult to find a way to get supply to match demand. Read More » Honourable Mention: 1. Noonan: Here's Why Silver Is So Low & What To Do About It The demand for silver has grown exponentially in the past few years (record sales for American Eagle coins, record buying in India), but supply, on the other hand, keeps diminishing…Whenever there is a situation where demand rises sharply, while supply commensurately declines, it is a recipe for higher prices, and usually, much higher prices. This is true, unless one is talking about the silver market…[which] is at its lowest levels in the past three years. With talk of silver going anywhere from $150 to $500 higher, it currently struggles to hold $20. Why is this so? Read More » 2. The Internet's Most Unique Site for Financial Articles is Here There is no need to spend time searching the internet looking for articles worth reading. We do it for you and bring them to you each day on this the "internet's most unique site for financial articles" and in our newsletter, the " Market Intelligence Report" Read More » The post Just Gold & Silver: The Most Read Such Articles In 2013 appeared first on munKNEE dot.com. |

| Lessons from the World’s Second Largest Gold Field Posted: 26 Dec 2013 09:25 AM PST It was a long flight back. No meal service. But no turbulence, either. "Long flight" is a relative term, of course. 7 hours in a plane beats the 16 it takes to get to South Africa, that's for sure! I guess you and I are lucky we're rather close to the world's second largest gold field. Today we'll explore what this area has to offer. We'll start by outlining just where it is! Much to the surprise of many, the world's second largest gold field is right here in the U.S., in the mining-friendly state of Nevada. (My 7hr trip was thanks to a "stay on the plane" layover in California.) Simply put, Nevada's gold scene is booming. Years of geology (to make a very long story short) have placed a lot of gold throughout the state – mainly in what are called "carlin-style" gold formations. The Carlin Trend is found near Elko, NV. But there are plenty of other similar trends found throughout the state, mostly in the North. According to Science Daily, "Since the 1960s, geologists have found clusters of these 'Carlin-type' deposits throughout northern Nevada. They constitute, after South Africa, the second largest concentration of gold on Earth." Indeed, there's no doubt this area has gold. A quick look at the associated traffic on the desert roads and you'll see plenty of mine trucks hauling ore to nearby processing facilities. Below is an idea of what the trucks look like. We saw plenty!

That's a great sign when you're heading to a mine. After all, as our in-house geologist, Byron King, says: "gold is where you find it!" So if ore trucks are burning diesel heading to processing plants, you know you're in the right neighborhood. Onward we went! On this trip we were taking a look at an open pit mine. Unlike an underground mine – where you borough deep into the ground chasing veins – the open pit is a surface operation. Essentially, once the geologists outline the play, engineers blast and dig away on the surface grabbing all the mineralized rock they can.

From there, the ore is trucked to a crusher, crushed and taken to a processing facility. In this particular case the onsite processing facility was set to be a "heap leach" operation. Here's a very dumbed-down explanation (cause that's what your editor likes:) After the rock is crushed, it's put into massive piles. From there, the piles are continuously sprayed with acid – cyanide in this case – to dissolve the rock and release the gold. (Note, this is a closed system, the cyanide isn't ever in contact with the surrounding environment, after all, it's got the gold with it!) Once the gold is released it than travels in the acid solution through several column tanks to further concentrate it.

After running through a series of 2-story tanks, the concentrated solution is run through a carbon screen. Gold sticks to carbon. From there the carbon is burned away in an oven and you're left with relatively pure gold. If it sounds complicated, that's because it is! There's plenty of chemistry and engineering at work here. But it's all in a day's work for today's mine crews. That's one of my takeaways from the trip out west. In short, the "easy gold" is gone. Today's gold mine is infinitely high-tech, but also low grade. Sure, there are plenty of places around the globe, including some stuff here in North America that enjoy some higher-grade, bonanza-style deposits. And sure, in places like Alaska you can still reach out with your fingers and pluck a nugget or flake from the pile. But more and more the new start-ups (like those in Nevada), need to do a lot of work, for just a little gold. These days even a humble visitor like your editor, just wanting to see a spec of the shiny-yellowish stuff, is outta luck. The gold mine and operation I was privy to see was host to magnification-needed gold. In other words, ya can't see it! Here's a look at a higher-grade specimen from the mine site. This rock, for perspective, is about the size of my hand:

The rock I'm holding is called "jasperoid" – not to be confused with an asteroid, this stuff is from the bubbling stew of the earth's mantle. Up close you can see some shimmer, but that's not likely the gold you're seeing – it's just some other mineralization. I had a few rocks in my knapsack, a keepsake of the trip's take. But to be sure, I wouldn't likely be setting off any metal detectors with these hard rocks. (Heh, that didn't stop the TSA from searching my bag, though.) The jasperoid rock shown above holds approximately 0.04 ounces of gold per ton, along with 0.38 ounces per ton of silver. It may sound miniscule, but it's very minable. Here's the point, with today's gold prices miners can still make a buck. Open pit/heap leach operations are relatively low cost – in this case around $800 per ounce. But, my friend, the days of serendipitous gold falling into a miner's lap are all but gone. Instead the serendipity is found on a computer screen or in a core sample. That is, instead of seeing "0.04" ounces per ton on the screen, maybe an engineer or geologist will see "0.06" – in other words, more gold! Keep your boots muddy, Matt Insley Ed. Note: There's plenty more to the story. And readers of my Daily Resource Hunter get regular updates, including specific chances to learn about real, actionable investment opportunities. Learn more. Sign up for free, right here. Original article posted on Daily Resource Hunter |

| India mulls relaxing import duty on gold dore Posted: 26 Dec 2013 09:15 AM PST According to finance ministery officials, the government is looking to relax some of the conditions currently imposed on the import of gold dore by refiners |

| Centerra Gold drafts deal with Kyrgyzstan on Kumtor mine Posted: 26 Dec 2013 09:15 AM PST Centerra Gold says it has agreed to swap the govenrment's 32.7% stake in the Canadian miner for half the Kumtor mine. |

| Obamacare: A Parasite Intent on Killing Its Host Posted: 26 Dec 2013 09:00 AM PST [This article originally appeared in The Daily Reckoning on September 25, 2013] As the health care debate rages on, there is one reality that even the proponents of this hostile takeover of health care by government cannot ignore — and that is money. The government simply does not have the money for a new, expansive, public health care plan. The country is in a deep recession. The last thing we need is for government to increase and expand taxes to pay for another damaging, wasteful program. There are limits to how much government can tax before it kills the host. Foreigners are becoming less enthusiastic about buying our debt, and creating another open-ended welfare program when we cannot pay for what is already in place will not help. Champions of socialized medicine want to tax the rich, tax businesses that already cannot afford to provide health plans to employees and tax people who don't want to participate in the government's scheme by buying an approved health care plan. Presumably, all these taxes are to induce compliance. This is not freedom, nor will it improve health care. There are limits to how much government can tax before it kills the host. Even worse, when government attempts to subsidize prices, it has the net effect of inflating them instead. The economic reality is that you cannot distort natural market pressures without unintended consequences. Market forces would drive prices down. Government meddling negates these pressures, adds regulatory compliance costs and layers of bureaucracy and, in the end, drives prices up. The nonpartisan CBO estimates that the health care plan will cost almost a trillion dollars over the next 10 years. But government crystal balls always massively underestimate costs. It is not hard to imagine the final cost being two or three times the estimates, even though the estimates are bad enough. It is still surreal that in a free country, we are talking only about how government should fix health care, rather than why government should fix health care. This should be between doctors and patients. But this has been the discussion since the '60s and the inception of Medicare and Medicaid, when government first began intervening to keep costs down and make sure everyone had access. The result of Medicaid and Medicare price controls and regulatory burden has been to drive more doctors out of the system — making it more difficult for the poor and the elderly to receive quality care! Seemingly, there are no failed government programs, only underfunded ones. If we refuse to acknowledge common-sense economics, the prescription will always be the same: more government. Make no mistake, government control and micromanagement of health care will hurt, not help, health care in this country. However, if for a moment, we allowed the assumption that it really would accomplish all they claim, paying for it would still plunge the country into poverty. This solves nothing. The government, like any household struggling with bills to pay, should prioritize its budget. If the administration is serious about supporting health care without contributing to our skyrocketing deficits, they should fulfill promises to reduce our overseas commitments and use some of those savings to take care of Americans at home, instead of killing foreigners abroad. The leadership in Washington persists in a fantasy world of unlimited money to spend on unlimited programs and wars to garner unlimited control. But there is a fast-approaching limit to our ability to borrow, steal and print. Acknowledging this reality is not mean-spirited or cruel. On the contrary, it could be the only thing that saves us from complete and total economic meltdown. Democracy is majority rule at the expense of the minority. Our system has certain democratic elements, but the Founders never mentioned democracy in the Constitution, the Bill of Rights or the Declaration of Independence. In fact, our most important protections are decidedly undemocratic. For example, the First Amendment protects free speech. It doesn’t — or shouldn’t — matter if that speech is abhorrent to 51% or even 99% of the people. Speech is not subject to majority approval. Under our republican form of government, the individual, the smallest of minorities, is protected from the mob. Sadly, the Constitution and its protections are respected less and less as we have quietly allowed our constitutional republic to devolve into a militarist, corporatist social democracy. Laws are broken, quietly changed and ignored when inconvenient to those in power, while others in positions to check and balance do nothing. The protections the Founders put in place are more and more just an illusion. This is why increasing importance is placed on the beliefs and views of the president. The very narrow limitations on government power are clearly laid out in Article 1, Section 8 of the Constitution. Nowhere is there any reference to being able to force Americans to buy health insurance or face a tax or penalty, for example. Yet this power has been claimed by the executive and astonishingly affirmed by Congress and the Supreme Court. Because we are a constitutional republic, the mere popularity of a policy should not matter. If it is in clear violation of the limits of government and the people still want it, a constitutional amendment is the only appropriate way to proceed. However, rather than going through this arduous process, the Constitution was, in effect, ignored, and the insurance mandate was allowed anyway. Our system has certain democratic elements, but… our most important protections are decidedly undemocratic. This demonstrates how there is now a great deal of unhindered flexibility in the Oval Office to impose personal views and preferences on the country, so long as 51% of the people can be convinced to vote a certain way. The other 49%, on the other hand, have much to be angry about and protest under this system. We should not tolerate the fact that we have become a nation ruled by men, their whims and the mood of the day, and not laws. It cannot be emphasized enough that we are a republic, not a democracy and, as such, we should insist that the framework of the Constitution be respected and boundaries set by law are not crossed by our leaders. These legal limitations on government assure that other men do not impose their will over the individual, but rather, the individual is able to govern himself. When government is restrained, liberty thrives. Regards, Ron Paul Ed. Note: In today’s issue of The Daily Reckoning email edition, we offer more insight on the likely effects of Obamacare and the market movements that are likely to result from it. Get the full story by signing up for a FREE subscription to The Daily Reckoning, right here. [This essay is a compilation of Dr. Paul's writings during his time in Congress.] |

| These 13 Were the Most Read Economic/Financial/Investment Articles in 2013 Posted: 26 Dec 2013 08:57 AM PST munKNEE.com will receive well over 1,000,000 visitors again in 2013 and is now a “go-to” destination for a diversified account of economic, financial and investment (gold, silver and the stock markets) analyses, opinion, advice and education. Below are introductions (with links) to the 13 most read such articles in 2013 in order of popularity. Interestingly, each article is as relevant today as the day they were posted so they are well worth taking the time to read. {Lorimer Wilson, editor of munKNEE.com (Your Key to Making Money!), encourages you to “Follow the munKNEE” via Facebook, Twitter, RSS feed or by registering to receive the bi-weekly Market Intelligence Report.) Here they are in descending rank (Go to the section at the very bottom of the page to express your comments on the selection): 1. How Will the Price of Gold Evolve Into 2014 and Beyond? A Perspective How will the price of gold develop into 2014 and in the following years? [Read on as] we try a look into the future. Words: 2600 Read More » 2. The 10 Best Places to Retire in Mexico As an artist who is neither a real estate salesperson nor a travel agent pushing an agenda, I feel it's time to look at the very best places in Mexico to retire with real pro's and con's so the reader can really make an informed decions on where to go that serves their needs, interests and ambitions. Read on! Read More » 3. Shift From U.S. Dollar As World Reserve Currency Underway – What Will This Mean for America? Today, more than 60% of all foreign currency reserves in the world are in U.S. dollars – but there are big changes on the horizon…Some of the biggest economies on earth have been making agreements with each other to move away from using the U.S. dollar in international trade…[and this shift] is going to have massive implications for the U.S. economy. [Let me explain what is underway.] Words: 1583 Read More » 4. 78% of NFL Players Go Bankrupt Within 5 Years & NBA Players In… The average professional athlete in the U.S. will make more in one season than most of us earn in our entire lives….[yet,] despite those staggering salaries, 78% of NFL players, 60% of NBA players and a very large percentage of MLB players (4x that of the average U.S. citizen) file bankruptcy within five years of retirement. [Let's take a look at] 5 possible reasons why the average athlete is destined to go (quickly) from fame to shame. Read More » 5. Gold:Silver Ratio Suggests Much Higher Future Price for Silver – MUCH Higher! The majority of analysts maintain that gold will reach a parabolic peak price somewhere in excess of $5,000 per troy ounce in the next few years. Given the fact that the historical movement of silver is 90 – 95% correlated with that of gold suggests that a much higher price for silver can also be anticipated. Couple that with the fact that silver is currently greatly undervalued relative to its average long-term historical relationship with gold and it is realistic to expect that silver will eventually escalate dramatically in price. How much? This article applies the historical gold:silver ratios to come up with a range of prices based on specific price levels for gold being reached. Words: 691 Read More » 6. These Sites Are the BEST Places to Buy Gold & Silver Online – Here's Why Our review of the best places to buy gold online…[are] dependent on what your goal with the gold is — amassing physical bullion for financial security or to speculate on gold prices. Below are strategies and recommended dealers for each approach: Words: 532 Read More » 7. The U.S. Dollar Will Collapse When This Upcoming Event Happens If we want to better understand the answer to the elusive question of “When will the fiat US dollar collapse?”, we have to watch the petrodollar system and the factors affecting it. Read More » 8. 5 Red Flags of Imminent Economic Collapse These 5 red flags will give you anywhere from a few days to a few months of warning that things are about to change drastically…and well before those around you grasp the full extent of what is going on. This is hopefully a scenario that never happens as this will truly be the end of the world as you knew it. Read More » 9. What's the Difference Between 1 Gold Karat, 1 Diamond Carat and 1 Troy Ounce? You have no doubt read countless articles on the price of gold costing “x dollars per ounce”, own a gold ring or some other piece of gold jewellery and/or wear or have bought/plan to buy a diamond ring but do you really understand exactly what you are buying? What’s the difference between 1 troy ounce of gold and 1 (regular) ounce? What’s the difference between 18 and 10 karat gold? What’s the difference between a .75 and a 1.0 carat diamond? Let me explain. Words: 1102 Read More » 10. Going Topless Is Legal In These U.S. States & Canadian Provinces Going topless for both men and women has come a long way over the last 77 years but still has much further to go as the map of the U.S. below illustrates. Read More » 11. The Major Imports & Exports Between the U.S. & Canada Are Surprising Canada and the United States are the world’s largest trading partners. The U.S. accounts for about three-quarters of Canada’s exports. Because of geography and the North American Free Trade Agreement, there are a number of products that the countries export to each other while at the same time importing from the other. [Take a look at the list. You might be very surprised.] Words: 712 Read More » 12. Yes, You Can Time the Market – Use These Trend Indicators Remember, the trend is your friend and now you have an arsenal of such indicators to make an extensive and in-depth assessment of whether you should be buying or selling. If ever there was a "cut and save" investment advisory this article is it. Words: 1579 Read More » 13. Which Is the World's Safest Major Currency – You'll Be Surprised The term 'safe fiat currency’ is as intellectually disingenuous as terms like 'fair tax' or 'government innovation' but, as we've been exploring recently why modern central banking is completely dysfunctional, it does beg the question– is any currency 'safe'? Let's look at the numbers for some data-driven analysis. Words: 575 Read More » Honourable Mention: The Internet's Most Unique Site for Financial Articles is Here There is no need to spend time searching the internet looking for articles worth reading. We do it for you and bring them to you each day on this the “internet’s most unique site for financial articles” and in our newsletter, the ” Market Intelligence Report” Read More »

The post These 13 Were the Most Read Economic/Financial/Investment Articles in 2013 appeared first on munKNEE dot.com. |

| 2014 Gold Price Forecast - Where Will Gold Be By Year End? Short Squeeze Rally Or Crash? Posted: 26 Dec 2013 08:56 AM PST This price prediction explains three reasons why gold could rally to $1,600 by the end of the year due to the current short squeeze, China & India's consumption & Fed monetary policies.... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Gold Stocks Bear Market Cycle Bottom Forming Right Now! Posted: 26 Dec 2013 08:03 AM PST Today we take a look at the Bullish Percent Index chart relative to Gold’s cycle and Gold Stocks. Essentially it tells you what percentage of Gold sector stocks are at or above a moving average, which normally would be 50 days. When 70% or more are above a 50 day moving average, sectors can be peaking out. If you look at our chart at the bottom, we have labeled various incidents with A, B, C, and D. |

| ANOTHER BUBBLE LOOKING FOR A PIN Posted: 26 Dec 2013 08:01 AM PST By Toby Connor, Gold Scents

Source: sentimentrader.com

Toby Connor A financial blog primarily focused on the analysis of the secular gold bull market. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions, email Toby. |

| Lenin's Goelro And The Myth Of Total Electrification Posted: 26 Dec 2013 05:35 AM PST LENIN AND THE GOELRO Announcing the Goelro plan on 21 February 1920, Vladimir Lenin said that communism was to politics what electricity is for the economy, saying: “Communism is Soviet power plus the electrification of the whole country”. Without total electrification “industry cannot be developed” and for Lenin, the plan was even a bulwark against barbarism, ignorance and disease, and a silver bullet for Russian recovery from the ravages of WWar I and the October Revolution. |

| Platinum - Our Favorite Precious-Metals Trade Going Into 2014 Posted: 26 Dec 2013 01:36 AM PST Brian Hunt writes: Among the most important financial decisions you'll ever make is the decision to buy precious metals like gold and silver. At Stansberry & Associates, we have been urging investors to buy precious metals for more than 10 years. We own precious metals ourselves. We've even published books on the right ways to invest in them. |

| Making Friends with the U.S. Dollar Posted: 25 Dec 2013 04:00 PM PST |

| Gold becoming scarce in Mexico too Posted: 25 Dec 2013 11:43 AM PST GATA 2:40p ET Wednesday, December 25, 2013 Dear Friend of GATA and Gold: Hugo Salinas Price, president of the Mexican Civic Association for Silver, reports that the Mexican Mint has run out of gold for minting coins as the metal flows in ever-increasing amounts from West to East. His report is posted at the association’s Internet site, La Plata, here: http://www.plata.com.mx/mplata/articulos/articlesFilt.asp?fiidarticulo=2… CHRIS POWELL, Secretary/Treasurer * * * Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Minor blemishes aside, gold shone for Indians in 2013 Posted: 25 Dec 2013 11:34 AM PST GATA From Indo-Asian News Service http://businesstoday.intoday.in/story/year-2013-roundup-demand-for-gold-… The World Bank and the International Monetary Fund may have written off gold as an investment option but the yellow metal shows no sign of losing its sheen in India. In 2013 not only did gold prices witness an upward march to touch Rs 34,600 per 10 grams, the demand also remained somewhat intact. Steady demand, despite import restrictions, saw gold prices swaying between Rs 26,440 per 10 grams in April to Rs 34,600 per 10 grams in August. “Gold will always remain an asset class in India. It will never fetch any negative return. Temporarily, there can be some reverses but in the long term it cannot fade away,” Bachharaj Bamalwa, director of the All India Gems and Jewellery Trade Federation, told the Indo-Asian News Service. Last year India imported around 960 tonnes of gold. High gold imports strained India’s current account deficit, which touched a high of 4.8 per cent of the country’s gross domestic product in 2012-13. India, being the world’s biggest buyer of bullion, imported a record 162 tonnes in May 2013. This shook the government, which was trying to rein in the huge current account deficit so as not to let the rupee depreciate any further. The government raised the import duty on gold to 15 pe cent. This rise in import duty somewhat stalled gold imports between end-July and mid-October. “This hiking of customs duty may help the economy in the short run but in the long run it does not because Indians will never stop buying gold. Thus the deficit in gold in the market, arising due to the hike in import duty, is filled by smuggled gold,” economist Siddharth Shankar told IANS. “Though the current account deficit looks a little better in the short run, in the long run the parallel economy is booming due to smuggled gold,” Shankar added. Somasundaram PR, managing director of the World Gold Council, said: “Gold is considered as a strong asset class and we believe policy direction should aim at easing the regulatory landscape for gold imports, viewing it as a strategic investment asset.” He said demand for gold in India, whether in the form of jewellery or investment (bars and coins), is predominantly retail and is driven by millions of individuals across rural and urban India. “They invest in gold as part of their household savings. It is important to understand that jewellery is considered an investment — not discretionary spending for consumption. It serves as a collateral for lending to a large class of borrowers in certain socio-economic segments,” Somasundaram added. “Look at the wedding and festive season in last quarter of 2013. This suggests that the demand outlook remains strong and the long-term fundamentals of the gold market are intact.” During April this year the price of gold fell to around Rs 26,440 per 10 grams. But later it again rose and now it is hovering around Rs 31,000 per 10 grams. “Over here, the 80-20 rule imposed by the government was a dampener for the industry,” said Bamalwa, alluding to a government stipulation that 20 percent of gold imported by retailers must be exported. “Initially there was no clarification on this issue, which stalled gold import for some time. This led to a rise in smuggling of gold across the country,” he said. As a result, Bamalwa said, 2013 was one of the worst years for the industry in terms of imports mainly due to restrictions on imports and the volatility in prices due to the steep depreciation of the rupee. Import duty on gold, which was 2 percent Jan 17, 2012 is now 15 percent. “This year even during Diwali or the festive season the business was not good,” Vipul Shah, chairman of the Gems and Jewellery Export Promotion Council, said. But he conceded that the situation was far from justifying the alarm bells being sounded. Yet the industry expects that overall demand for gold in India for 2013 is likely to end at around 900-1,000 tonnes against 960 tonnes last year. Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| US Mint Discounts on 2014 Silver Coins and Annual Sets Posted: 24 Dec 2013 03:51 PM PST This week the United States Mint announced it will offer 10% discounts for its most popular silver coins and annual sets. The bureau also said it would continue to sell it silver products at reduced prices in 2014. Additionally, the US Mint is promoting its new product schedule that includes prices and on-sale dates for […] No related posts. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

While the US consumer is rushing to spend what

While the US consumer is rushing to spend what  It's been a horrible year to be invested in gold but big corrections in long bull markets are pretty common and often preceed the final and greatest stage of the bull market. Once you actually can see this spike in prices then the ArabianMoney investment newsletter will be advising its readers to sell, but not this yuletide.

It's been a horrible year to be invested in gold but big corrections in long bull markets are pretty common and often preceed the final and greatest stage of the bull market. Once you actually can see this spike in prices then the ArabianMoney investment newsletter will be advising its readers to sell, but not this yuletide.

No comments:

Post a Comment